Ambidextrous Alliances, Complementary Assets, and Firms’ Breakthrough Innovations: Evidence from High-Tech Firms in China

Abstract

1. Introduction

2. Theoretical Background and Hypotheses

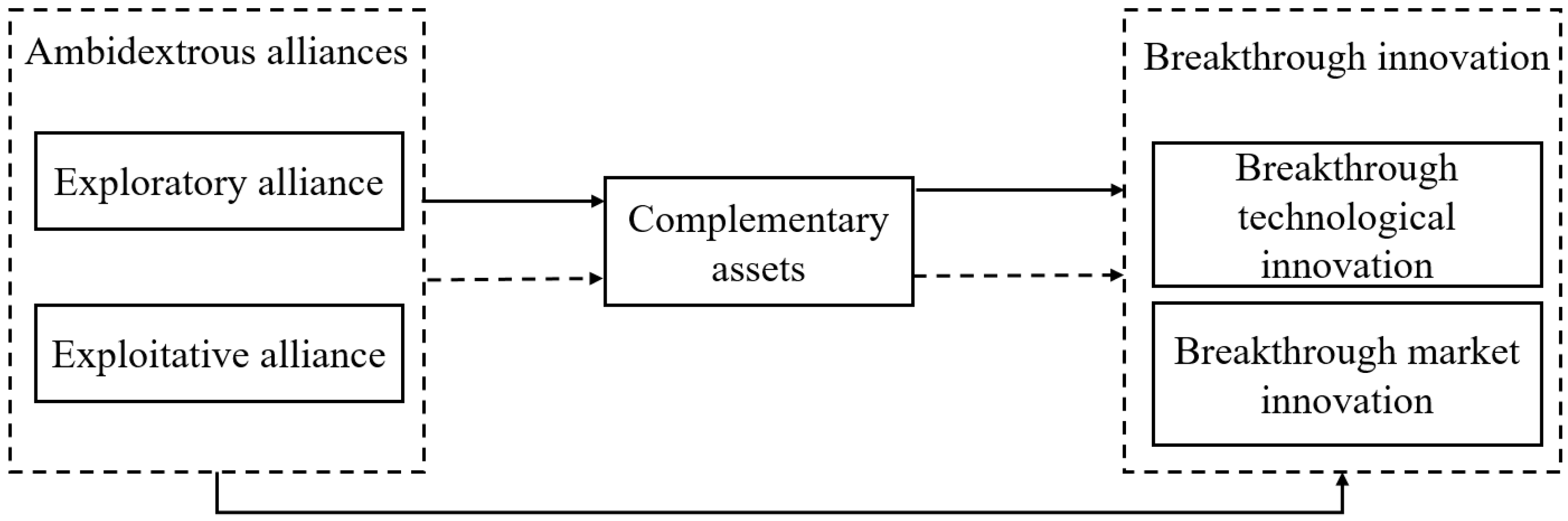

2.1. Ambidextrous Alliances

2.2. Complementary Assets

2.3. Breakthrough Innovations

2.4. Ambidextrous Alliances and Breakthrough Innovations

2.5. Ambidextrous Alliances and Complementary Assets

2.6. Complementary Assets and Breakthrough Innovations

2.7. The Mediating Roles of Complementary Assets

3. Research Methodology

3.1. Sample and Data Background

3.2. Variables and Measures

3.3. Reliability, Validity, and Common Method Bias (CMB)

4. Results

4.1. Correlation Analyses

4.2. Hypotheses Test

4.3. Robustness Test

5. Discussion

6. Conclusions

6.1. Theoretical Contributions

6.2. Implementation Suggestions

6.3. Limitations and Future Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Huang, K.G.; Su, Y.-S.; Chen, J.; Kajikawa, Y. Shaping the future through developing and managing breakthrough innovations: A new conceptual framework. Technol. Forecast. Soc. Chang. 2025, 214, 124039. [Google Scholar]

- Fleming, L. Breakthroughs and the “Long tail” of innovation. MIT Sloan Manag. Rev. 2007, 49, 69. [Google Scholar]

- Zhang, Y.; Wang, D.; Xu, L. Knowledge search, knowledge integration and enterprise breakthrough innovation under the characteristics of innovation ecosystem network: The empirical evidence from enterprises in Beijing-Tianjin-Hebei region. PLoS ONE 2021, 16, e0261558. [Google Scholar]

- Shi, Y. Digital finance and corporate breakthrough innovation: Evidence from China. PLoS ONE 2024, 19, e0307737. [Google Scholar]

- Zhou, K.Z.; Yim, C.K.; Tse, D.K. The effects of strategic orientations on technology and market based breakthrough innovations. J. Mark. 2005, 69, 42–60. [Google Scholar] [CrossRef]

- Kaplan, S.; Vakili, K. The double-edged sword of recombination in breakthrough innovation. Strateg. Manag. J. 2015, 36, 1435–1457. [Google Scholar] [CrossRef]

- Capponi, G.; Martinelli, A.; Nuvolari, A. Breakthrough innovations and where to find them. Res. Policy 2022, 51, 104376. [Google Scholar]

- Hu, J.; Huo, D.; Wu, D.; Yang, C. The effect of corporate agglomeration networks on breakthrough innovation—Evidence from China. Technol. Forecast. Soc. Chang. 2025, 212, 123980. [Google Scholar]

- Kraft, P.S.; Dickler, T.A.; Withers, M.C. When do firms benefit from overconfident CEOs? The role of board expertise and power for technological breakthrough innovation. Strateg. Manag. J. 2025, 46, 381–410. [Google Scholar]

- Russo, A.; Schena, R. Ambidexterity in the context of SME alliances: Does sustainability have a role? Corp. Soc. Responsib. Environ. Manag. 2021, 28, 606–615. [Google Scholar]

- Hughes, J.; Weiss, J. Simple rules for making alliances work. Harv. Bus. Rev. 2007, 85, 122–126. [Google Scholar] [PubMed]

- Jung, Y.R.; Lee, J.; Hwang, J.; Gava, N.L. Knowledge spillovers and innovation performance of the originator: The moderating effect of technological alliances. J. Innov. Knowl. 2024, 9, 100540. [Google Scholar]

- Jin, Y.; Shao, Y.F. Power-leveraging paradox and firm innovation: The influence of network power, knowledge integration and breakthrough innovation. Ind. Mark. Manag. 2022, 102, 205–215. [Google Scholar]

- Kauppila, O.-P. Alliance management capability and firm performance: Using resource-based theory to look inside the process black box. Long Range Plan. 2015, 48, 151–167. [Google Scholar]

- Pan, X.; Xu, G.; Meng, L. Drifting toward alliance innovation: Patent collaboration relationships and development in China’s hydrogen energy industry from a network perspective. Sustainability 2024, 16, 2101. [Google Scholar] [CrossRef]

- Zahoor, N.; Khan, Z.; Marinova, S.; Cui, L. Ambidexterity in strategic alliances: An integrative review of the literature. Int. J. Manag. Rev. 2024, 26, 82–109. [Google Scholar]

- Yang, H.; Zheng, Y.; Zhao, X. Exploration or exploitation? small firms’ alliance strategies with large firms. Strateg. Manag. J. 2014, 35, 146–157. [Google Scholar]

- Rothaermel, F.T.; Deeds, D.L. Exploration and exploitation alliances in biotechnology: A system of new product development. Strateg. Manag. J. 2004, 25, 201–221. [Google Scholar]

- Ferreira, J.; Coelho, A.; Moutinho, L. The influence of strategic alliances on innovation and new product development through the effects of exploration and exploitation. Manag. Decis. 2021, 59, 524–567. [Google Scholar]

- Teece, D.J. Profiting from technological innovation—Implications for integration, collaboration, licensing and public-policy. Res. Policy 1986, 15, 285–305. [Google Scholar]

- Ryan-Charleton, T.; Galavan, R.J. Multimarket contact between partners and strategic alliance survival. Strateg. Manag. J. 2024, 45, 1988–2017. [Google Scholar]

- Bockelmann, T.; Werder, K.; Recker, J.; Lehmann, J.; Bendig, D. Configuring alliance portfolios for digital innovation. J. Strateg. Inf. Syst. 2024, 33, 101808. [Google Scholar]

- Lavie, D.; Rosenkopf, L. Balancing exploration and exploitation in alliance formation. Acad. Manag. J. 2006, 49, 797–818. [Google Scholar]

- Hoang, H.; Rothaermel, F.T. Leveraging internal and external experience: Exploration, exploitation, and R&D project performance. Strateg. Manag. J. 2010, 31, 734–758. [Google Scholar]

- Moreira, S.; Klueter, T.M.; Asija, A. Market for technology 2.0? Reassessing the role of complementary assets on licensing decisions. Res. Policy 2023, 52, 104787. [Google Scholar]

- Sun, Y.; Zhou, Y. Specialized complementary assets and disruptive innovation: Digital capability and ecosystem embeddedness. Manag. Decis. 2024, 62, 3704–3730. [Google Scholar]

- Stieglitz, N.; Heine, K. Innovations and the role of complementarities in a strategic theory of the firm. Strateg. Manag. J. 2007, 28, 1–15. [Google Scholar]

- Roy, R.; Cohen, S.K. Stock of downstream complementary assets as a catalyst for product innovation during technological change in the US machine tool industry. Strateg. Manag. J. 2017, 38, 1253–1267. [Google Scholar]

- Wu, B.; Wan, Z.X.; Levinthal, D.A. Complementary assets as pipes and prisms: Innovation incentives and trajectory choices. Strateg. Manag. J. 2014, 35, 1257–1278. [Google Scholar]

- Jin, Y.; Shao, Y.F.; Wu, Y.B. Routine replication and breakthrough innovation: The moderating role of knowledge power. Technol. Anal. Strateg. Manag. 2021, 33, 426–438. [Google Scholar]

- Un, C.A.; Cuervo-Cazurra, A.; Asakawa, K. R&D collaborations and product innovation. J. Prod. Innov. Manag. 2010, 27, 673–689. [Google Scholar]

- Cui, V.; Yang, H.; Vertinsky, I. Attacking your partners: Strategic alliances and competition between partners in product markets. Strateg. Manag. J. 2018, 39, 3116–3139. [Google Scholar]

- Zhong, C.; Huang, R.; Duan, Y.; Sunguo, T.; Strologo, A.D. Exploring the impacts of knowledge recombination on firms’ breakthrough innovation: The moderating effect of environmental dynamism. J. Knowl. Manag. 2024, 28, 698–723. [Google Scholar]

- Zhu, X.; Yang, N.; Zhang, M.; Wang, Y. Firm innovation: Technological boundary-spanning search and knowledge base and distance. Manag. Decis. 2024, 62, 326–351. [Google Scholar]

- Wang, Q.; Jiang, Q.; Yu, H. Analysis of the influence of entrepreneurial apprehension and entrepreneurial strategic orientation on breakthrough innovation. Sustainability 2023, 15, 7320. [Google Scholar] [CrossRef]

- Datta, A.; Srivastava, S. (Re)conceptualizing technological breakthrough innovation: A systematic review of the literature and proposed framework. Technol. Forecast. Soc. Chang. 2023, 194, 122740. [Google Scholar]

- Gerbing, D.W.; Anderson, J.C. An updated paradigm for scale development incorporating unidimensionality and its assessment. J. Mark. Res. 1988, 25, 186–192. [Google Scholar]

- Werner, O.; Campbell, D.T. Translating, working through interpreters, and the problem of decentering. In A Handbook of Method in Cultural Anthropology; American Museum of Natural History: New York, NY, USA, 1970; pp. 398–420. [Google Scholar]

- Christmann, P. Effects of “best practices” of environmental management on cost advantage: The role of complementary assets. Acad. Manag. J. 2000, 43, 663–680. [Google Scholar]

- Podsakoff, P.M.; MacKenzie, S.B.; Podsakoff, N.P. Sources of method bias in social science research and recommendations on how to control it. Annu. Rev. Psychol. 2012, 63, 539–569. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The moderator mediator variable distinction in social psychological-research—Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar]

- Hayes, A.F. Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach; Guilford Press: New York, NY, USA, 2017. [Google Scholar]

- Luger, J.; Raisch, S.; Schimmer, M. Dynamic balancing of exploration and exploitation: The contingent benefits of ambidexterity. Organ. Sci. 2018, 29, 449–470. [Google Scholar]

- Bohnsack, R.; Rennings, M.; Block, C.; Broering, S. Profiting from innovation when digital business ecosystems emerge: A control point perspective. Res. Policy 2024, 53, 104961. [Google Scholar]

- Idarraga, D.A.M.; Gonzalez, J.M.H.; Medina, C.C.; Sabidussi, A. Ambidexterity and innovation: A systematic and meta-analytic approach to mediating effects on performance. Technol. Anal. Strateg. Manag. 2025, 1–18. [Google Scholar] [CrossRef]

| Variables | Categories | Samples | % | Variables | Categories | Samples | % |

|---|---|---|---|---|---|---|---|

| Industry | ICT | 94 | 33.7 | Firm year (year) | <5 | 67 | 24 |

| Biomedicine | 30 | 10.8 | 5~10 | 54 | 19.4 | ||

| Aerospace | 38 | 13.6 | 10~20 | 74 | 26.5 | ||

| Advanced materials | 41 | 14.7 | >20 | 84 | 30.1 | ||

| Advanced manufacturing | 48 | 17.2 | Firm assets (million yuan) | <3 | 7 | 2.5 | |

| Others | 28 | 10 | 3~20 | 36 | 12.9 | ||

| R&D | <1% | 18 | 6.5 | 20~400 | 106 | 38 | |

| 1%~3% | 28 | 10 | >400 | 130 | 46.6 | ||

| 3%~5% | 42 | 15.1 | Ownership | State-owned | 68 | 24.4 | |

| 5%~8% | 37 | 13.3 | Private-owned | 147 | 52.7 | ||

| >8% | 154 | 55.2 | Joint venture | 44 | 15.8 | ||

| Others | 20 | 7.2 |

| Items | Loadings |

|---|---|

| Exploratory alliance (ERA) Cronbach’s α: 0.838; CR: 0.834; AVE: 0.561 | |

| We will seek cooperation with universities, research institutes, and other relevant departments in conducting innovation activities. | 0.849 |

| The purpose for our firms to form alliances is to carry out pioneering work. | 0.850 |

| The main motivation for our firms to form alliances is to find new opportunities. | 0.657 |

| Through inter-organizational cooperation, we have realized innovative activities that we cannot carry out on our own. | 0.609 |

| Exploitative alliance (EIA) Cronbach’s α: 0.800; CR: 0.800; AVE: 0.501 | |

| We simplify or optimize business operations through subcontracting cooperation with alliance partners. | 0.720 |

| Suppliers play an important role in developing new products or providing new services. | 0.745 |

| By cooperating with the alliance, we have improved the cooperation efficiency among organizations. | 0.696 |

| The main motivation for our firms to form alliances is to obtain complementary resources. | 0.667 |

| Complementary assets (CA) Cronbach’s α: 0.891; CR: 0.878; AVE: 0.596 | |

| Compared with competitors, we are more concerned about taking the lead in trying new methods and technologies in the industry. | 0.846 |

| Compared with our competitors, we pay more attention to using the latest production technology. | 0.890 |

| Compared with our competitors, we are more concerned about investing in new equipment and mechanical equipment. | 0.816 |

| In the past three years, we have been a leader in product innovation. | 0.589 |

| In the past three years, we have been a leader in process innovation. | 0.679 |

| Breakthrough technological innovation (BTI) Cronbach’s α: 0.796; CR: 0.806; AVE: 0.583 | |

| Our products are highly innovative and have replaced inferior substitutes. | 0.798 |

| Our products incorporate brand new technical knowledge. | 0.835 |

| Our technology/products are completely different from those of our main competitors. | 0.645 |

| Breakthrough market innovation (BMI) Cronbach’s α: 0.859; CR: 0.861; AVE: 0.608 | |

| Our product/technology concept is difficult for mainstream customers to evaluate or understand. | 0.704 |

| Our products involve higher switching costs for mainstream customers. | 0.806 |

| Our products need mainstream customers to learn how to use them. | 0.816 |

| It takes a long time for mainstream customers to understand the full benefits of our products. | 0.787 |

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|

| 1. Firm age | - | ||||||||

| 2. Firm assets | 0.422 ** | - | |||||||

| 3. R&D | −0.044 | 0.164 ** | - | ||||||

| 4. Alliance number | 0.119 * | 0.275 ** | 0.084 | - | |||||

| 5. ERA | −0.072 | 0.082 | 0.174 ** | 0.151 * | 0.749 | ||||

| 6. EIA | −0.046 | 0.087 | 0.120 * | −0.022 | 0.286 ** | 0.708 | |||

| 7. CA | −0.03 | 0.075 | 0.273 ** | 0.161 * | 0.656 ** | 0.370 ** | 0.772 | ||

| 8. BTI | −0.118 * | 0.036 | 0.169 ** | 0.079 | 0.497 ** | 0.451 ** | 0.485 ** | 0.764 | |

| 9. BMI | −0.047 | 0.083 | −0.018 | 0.036 | 0.276 ** | 0.324 ** | 0.308 ** | 0.301 ** | 0.78 |

| Mean | 2.630 | 3.290 | 4.010 | 2.920 | 5.772 | 4.933 | 5.493 | 5.012 | 4.229 |

| S.D. | 1.149 | 0.784 | 1.300 | 1.357 | 1.054 | 1.048 | 1.081 | 1.072 | 1.388 |

| Min | 1 | 1 | 1 | 2 | 1 | 1 | 1 | 1 | 1 |

| Max | 4 | 4 | 5 | 6 | 7 | 7 | 7 | 7 | 7 |

| Variables | BTI | BMI | CA | |||||

|---|---|---|---|---|---|---|---|---|

| Model1 | Model2 | Model3 | Model4 | Model5 | Model6 | Model7 | Model8 | |

| Firm age | −0.142 * | −0.071 | −0.078 | −0.106 | −0.061 | −0.068 | −0.041 | 0.039 |

| Firm assets | 0.052 | −0.014 | −0.005 | 0.131 | 0.084 | 0.094 | 0.012 | −0.051 |

| R&D | 0.149 * | 0.059 | 0.032 | −0.045 | −0.102 | −0.131 | 0.257 *** | 0.154 ** |

| Alliance Number | 0.069 | 0.036 | 0.023 | 0.016 | 0.003 | −0.011 | 0.141 * | 0.076 |

| ERA | 0.382 *** | 0.282 *** | 0.205 ** | 0.100 | 0.568 *** | |||

| EIA | 0.333 *** | 0.298 *** | 0.267 *** | 0.231 *** | 0.197 *** | |||

| CA | 0.175 * | 0.185 * | ||||||

| R2 | 0.049 | 0.360 | 0.376 | 0.017 | 0.155 | 0.172 | 0.095 | 0.495 |

| adj-R2 | 0.035 | 0.346 | 0.36 | 0.003 | 0.136 | 0.151 | 0.082 | 0.484 |

| F | 3.550 * | 25.536 *** | 23.310 *** | 1.204 | 8.306 *** | 8.053 *** | 7.189 *** | 44.442 *** |

| Paths | Type | Effects | S.E. | Bootstrap (95% CI) | |

|---|---|---|---|---|---|

| Lower | Upper | ||||

| Path1: | Total effect | 0.482 | 0.055 | 0.375 | 0.59 |

| ERA→CA→BTI | Indirect effect | 0.173 | 0.058 | 0.059 | 0.288 |

| Direct effect | 0.309 | 0.069 | 0.173 | 0.445 | |

| Path2: | Total effect | 0.368 | 0.078 | 0.213 | 0.522 |

| ERA→CA→BMI | Indirect effect | 0.214 | 0.060 | 0.099 | 0.333 |

| Direct effect | 0.153 | 0.100 | −0.043 | 0.349 | |

| Path3: | Total effect | 0.446 | 0.055 | 0.337 | 0.554 |

| EIA→CA→BTI | Indirect effect | 0.126 | 0.042 | 0.048 | 0.211 |

| Direct effect | 0.319 | 0.055 | 0.211 | 0.428 | |

| Path4: | Total effect | 0.427 | 0.076 | 0.277 | 0.577 |

| EIA→CA→BMI | Indirect effect | 0.115 | 0.035 | 0.051 | 0.191 |

| Direct effect | 0.312 | 0.080 | 0.155 | 0.469 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fan, B.; Shao, Y.; Dong, Z.; Zhou, X. Ambidextrous Alliances, Complementary Assets, and Firms’ Breakthrough Innovations: Evidence from High-Tech Firms in China. Sustainability 2025, 17, 2812. https://doi.org/10.3390/su17072812

Fan B, Shao Y, Dong Z, Zhou X. Ambidextrous Alliances, Complementary Assets, and Firms’ Breakthrough Innovations: Evidence from High-Tech Firms in China. Sustainability. 2025; 17(7):2812. https://doi.org/10.3390/su17072812

Chicago/Turabian StyleFan, Bo, Yunfei Shao, Zhichun Dong, and Xiangrong Zhou. 2025. "Ambidextrous Alliances, Complementary Assets, and Firms’ Breakthrough Innovations: Evidence from High-Tech Firms in China" Sustainability 17, no. 7: 2812. https://doi.org/10.3390/su17072812

APA StyleFan, B., Shao, Y., Dong, Z., & Zhou, X. (2025). Ambidextrous Alliances, Complementary Assets, and Firms’ Breakthrough Innovations: Evidence from High-Tech Firms in China. Sustainability, 17(7), 2812. https://doi.org/10.3390/su17072812