Current Challenges to Achieving Mass-Market Hydrogen Mobility from the Perspective of Early Adopters in South Korea

Abstract

1. Introduction

2. Literature Review

2.1. Previous Studies on FCVs

2.2. Current Status of FCVs in South Korea

2.2.1. Vehicles

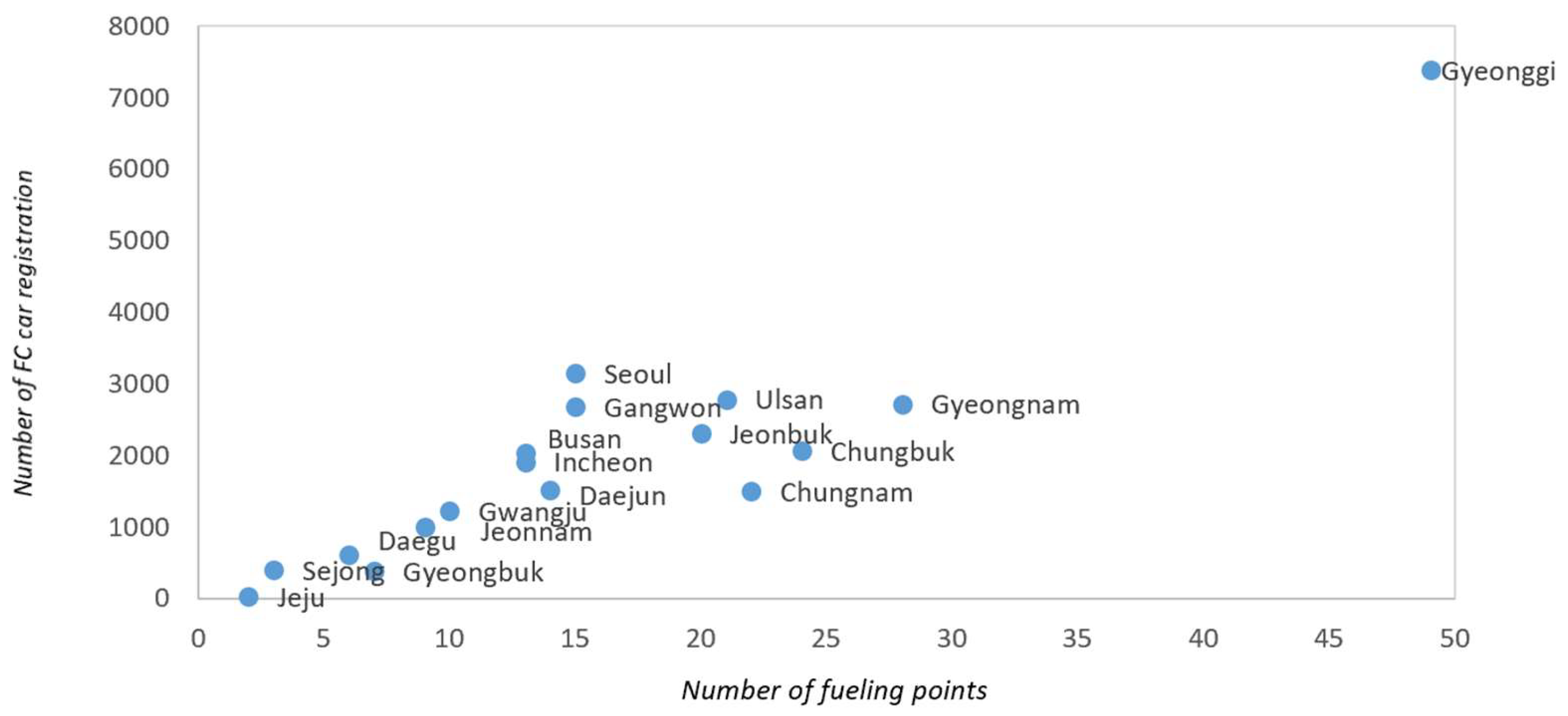

2.2.2. Infrastructure

2.2.3. Government Policy

2.3. Scope of the Study

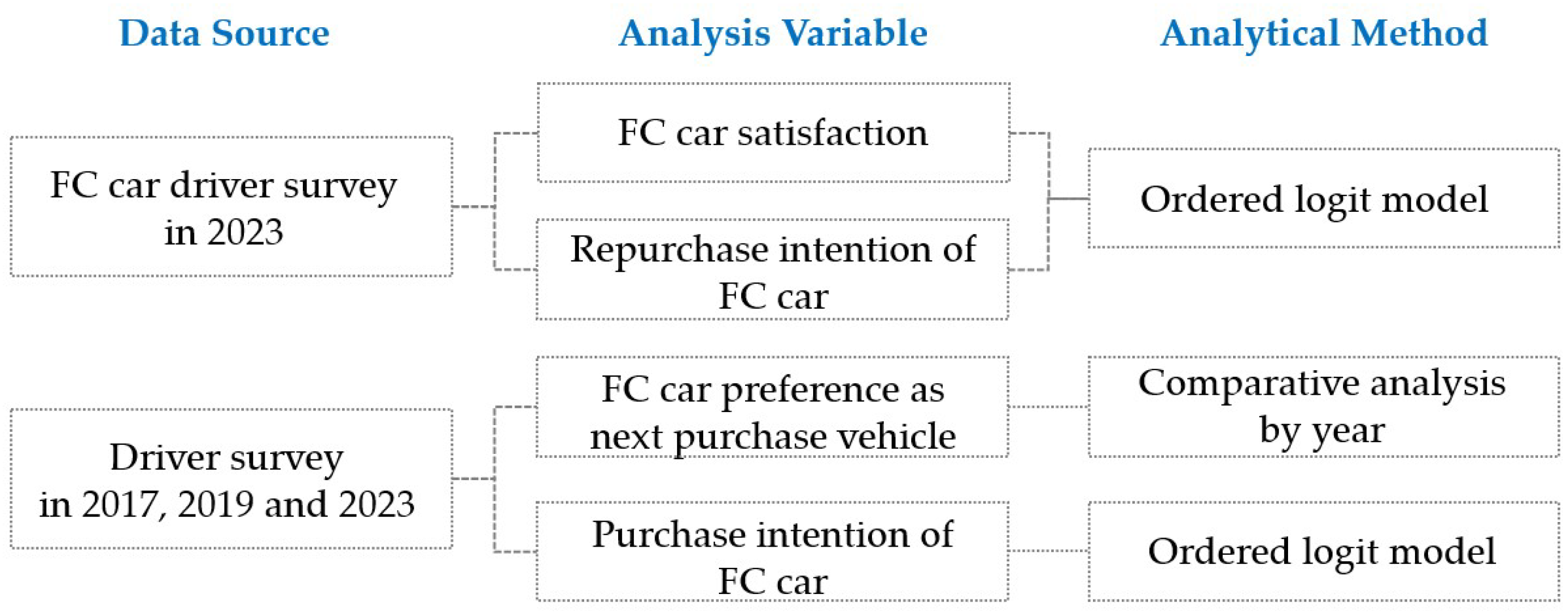

3. Data and Methods

3.1. Data

3.2. Analysis Methods

4. Results

4.1. Perspective of Early Adopters

4.1.1. Factors Affecting FC Car Satisfaction

4.1.2. Factors on Repurchase Intention

4.2. Analysis of Potential Adopters

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- IPCC. IPCC Sixth Assessment Report. Chapter 10: Transport. Available online: https://www.ipcc.ch/report/ar6/wg3/chapter/chapter-10/ (accessed on 1 August 2024).

- Ministry of Land, Infrastructure and Transport of Korea. Automotive Registration Status. Available online: https://www.index.go.kr/unity/potal/main/EachDtlPageDetail.do?idx_cd=1257 (accessed on 1 August 2024).

- Patil, G.; Pode, G.; Diouf, B.; Pode, R. Sustainable Decarbonization of Road Transport: Policies, Current Status, and Challenges of Electric Vehicles. Sustainability 2024, 16, 8058. [Google Scholar] [CrossRef]

- California Air Resource Board, Zero-Emission Terms to Know|ZEV TruckStop|California Air Resources Board. Available online: https://ww2.arb.ca.gov/our-work/programs/truckstop-resources/zev-truckstop/zev-101/zero-emission-terms-know-zev-truckstop (accessed on 10 February 2025).

- Kim, Y.; Lim, H.; Lee, J. Decarbonizing Road Transport in Korea: Role of electric vehicle transition policies. Transp. Res. Part D 2024, 128, 104084. [Google Scholar] [CrossRef]

- Laghlimi, C.; Moutcine, A.; Ziat, Y.; Belkhanchi, H.; Koufi, A.; Bouyassan, S. Hydrogen, Chronology and Electrochemical Production. Sol. Energy Sustain. Dev. J. 2024, 14, 22–37. [Google Scholar] [CrossRef]

- Li, X.; Ye, T.; Meng, X.; He, D.; Li, L.; Song, K.; Jiang, J.; Sun, C. Advances in the Application of Sulfonated Poly(Ether Ether Ketone) (SPEEK) and Its Organic Composite Membranes for Proton Exchange Membrane Fuel Cells (PEMFCs). Polymers 2024, 16, 2840. [Google Scholar] [CrossRef]

- Joint Ministries of Korea. A National Basic Plan for Carbon Neutrality and Green Growth. Available online: https://www.2050cnc.go.kr/flexer/view/BOARD_ATTACH?storageNo=1936 (accessed on 1 August 2024).

- Bethoux, O. Hydrogen Fuel Cell Road Vehicles: State of the Art and Perspectives. Energies 2020, 13, 5843. [Google Scholar] [CrossRef]

- Ajanovic, A.; Haas, R. Prospects and impediments for hydrogen and fuel cell vehicles in the transport sector. Int. J. Hydrogen Energy 2021, 46, 10049–10058. [Google Scholar] [CrossRef]

- International Energy Agency. Global EV Outlook 2024. Available online: https://iea.blob.core.windows.net/assets/a9e3544b-0b12-4e15-b407-65f5c8ce1b5f/GlobalEVOutlook2024.pdf (accessed on 1 August 2024).

- Ministry of Trade, Industry and Energy of Korea. Hydrogen Economy Roadmap. Available online: https://www.motie.go.kr/kor/article/ATCLf724eb567/210222/view (accessed on 1 August 2024).

- Mahmoud, A.; Albadry, O.; Mohamed, M.; El-Khozondar, H.J.; Nassar, Y.F.; Hafez, A.A. Charging systems/techniques of electric vehicle: A comprehensive review. J. Sol. Energy Sustain. Dev. 2024, 13, 18–44. [Google Scholar] [CrossRef]

- Eberle, U.; Von Helmolt, R. Sustainable transportation based on electric vehicle concepts: A brief overview. Energy Environ. Sci. 2010, 3, 689–699. [Google Scholar] [CrossRef]

- Dash, S.K.; Chakraborty, S.; Roccotelli, M.; Sahu, U.K. Hydrogen Fuel for Future Mobility: Challenges and Future Aspects. Sustainability 2022, 14, 8285. [Google Scholar] [CrossRef]

- Geene, D.L.; Ogden, J.M.; Lin, Z. Challenges in the designing, planning and deployment of hydrogen refueling infrastructure for fuel cell electric vehicles. eTransportation 2020, 6, 100086. [Google Scholar] [CrossRef]

- Hassan, Q.; Azzawi, I.D.J.; Sameen, A.Z.; Salman, H.M. Hydrogen Fuel Cell Vehicles: Opportunities and Challenges. Sustainability 2023, 15, 11501. [Google Scholar] [CrossRef]

- Hienuki, S.; Mitoma, H.; Ogata, M.; Uchida, I.; Kagawa, S. Environmental and energy life cycle analyses of passenger vehicle systems using fossil fuel-derived hydrogen. Int. J. Hydrogen Energy 2021, 46, 36569–36580. [Google Scholar] [CrossRef]

- Liu, X.; Reddi, K.; Elgowainy, A.; Lohse-Busch, H.; Wang, M.; Rustagi, N. Comparison of well-to-wheels energy use and emissions of a hydrogen fuel cell electric vehicle relative to a conventional gasoline-powered internal combustion engine vehicle. Int. J. Hydrogen Energy 2020, 45, 972–983. [Google Scholar] [CrossRef]

- Ogden, J.M. Prospects for Hydrogen in the Future Energy System; Research Report—UCD-ITS-RR-18-07; University of California: Davis, CA, USA, 2018; p. 22. [Google Scholar]

- Watabe, A.; Leaver, J. Comparative economic and environmental benefits of ownership of both new and used light duty hydrogen fuel cell vehicles in Japan. Int. J. Hydrogen Energy 2021, 46, 26582–26593. [Google Scholar] [CrossRef]

- Asif, U.; Schmidt, K. Fuel Cell Electric Vehicles (FCEV): Policy Advances to Enhance Commercial Success. Sustainability 2021, 13, 5149. [Google Scholar] [CrossRef]

- Zhao, F.; Mu, Z.; Hao, H.; Liu, Z.; He, X.; Przesmitzki, S.V.; Amer, A.A. Hydrogen Fuel Cell Vehicle Development in China: An Industry Chain Perspective. Energy Technol. 2020, 8, 2000179. [Google Scholar] [CrossRef]

- Ala, G.; Filippo, G.D.; Viola, F.; Giglia, G.; Imburgia, A.; Romano, P.; Castiglia, V.; Pellitteri, F.; Schettino, G.; Miceli, R. Different Scenarios of Electric Mobility: Current Situation and Possible Future Developments of Fuel Cell Vehicles in Italy. Sustainability 2020, 12, 564. [Google Scholar] [CrossRef]

- Andújar, J.M.; Segura, F.; Rey, J.; Vivas, F.J. Batteries and Hydrogen Storage: Technical Analysis and Commercial Revision to Select the Best Option. Energies 2022, 15, 6196. [Google Scholar] [CrossRef]

- Khan, U.; Yamamoto, T.; Sato, H. Consumer preferences for hydrogen fuel cell vehicles in Japan. Transp. Res. Part D 2020, 87, 102542. [Google Scholar] [CrossRef]

- Guo, X.; Li, W.; Ren, D.; Chu, J. Prospects for the development of hydrogen fuel cell vehicles in China. Renew. Energy 2025, 240, 122231. [Google Scholar] [CrossRef]

- Burke, A.F.; Zhao, J.; Miller, M.R.; Fulton, L.M. Vehicle choice modeling for emerging zero-emission light-duty vehicle markets in California. Heliyon 2024, 10, e32823. [Google Scholar] [CrossRef]

- Meng, X.; Sun, C.; Mei, J.; Tang, X.; Hasanien, H.M.; Jiang, J.; Song, K. Fuel cell life prediction considering the recovery phenomenon of reversible voltage loss. J. Power Sources 2025, 625, 235634. [Google Scholar] [CrossRef]

- Li, Z.; Wang, W.; Ye, M.; Liang, X. The impact of hydrogen refueling station subsidy strategy on China’s hydrogen fuel cell vehicle market diffusion. Int. J. Hydrogen Energy 2021, 46, 18453–18465. [Google Scholar] [CrossRef]

- Qudrat-Ullah, H. Adoption and Growth of Fuel Cell Vehicles in China: The Case of BYD. Sustainability 2022, 14, 12695. [Google Scholar] [CrossRef]

- Wu, Y.; Liu, F.; He, J.; Wu, M.; Ke, Y. Obstacle identification, analysis and solutions of hydrogen fuel cell vehicles for application in China under the carbon neutrality target. Energy Policy 2021, 159, 112643. [Google Scholar] [CrossRef]

- Trencher, G.; Edianto, A. Drivers and Barriers to the Adoption of Fuel Cell Passenger Vehicles and Buses in Germany. Energies 2021, 14, 833. [Google Scholar] [CrossRef]

- Trencher, G. Strategies to accelerate the production and diffusion of fuel cell electric vehicles: Experiences from California. Energy Rep. 2020, 6, 2503–2519. [Google Scholar] [CrossRef]

- Hardman, S. Understanding the impact of reoccurring and non-financial incentives on plug-in electric vehicle adoption—A review. Transp. Res. Part A Policy Pract. 2019, 119, 1–14. [Google Scholar] [CrossRef]

- Lipman, T.E.; Elke, M.; Lidicker, J. Hydrogen fuel cell electric vehicle performance and user-response assessment: Results of an extended driver study. Int. J. Hydrogen Energy 2018, 43, 12442–12454. [Google Scholar] [CrossRef]

- Khan, U.; Yamamoto, T.; Sato, H. An insight into potential early adopters of hydrogen fuel-cell vehicles in Japan. Int. J. Hydrogen Energy 2021, 46, 10589–10607. [Google Scholar] [CrossRef]

- Dua, R.; Hardman, S.; Bhatt, Y.; Suneja, D. Enablers and disablers to plug-in electric vehicle adoption in India: Insights from a survey of experts. Energy Rep. 2021, 7, 3171–3188. [Google Scholar] [CrossRef]

- Rosales-Tristancho, A.; Brey, R.; Carazo, A.F.; Brey, J.J. Analysis of the barriers to the adoption of zero-emission vehicles in Spain. Transp. Res. Part A 2022, 158, 19–43. [Google Scholar] [CrossRef]

- Apostolou, D.; Welcher, S.N. Prospects of the hydrogen-based mobility in the private vehicle market. A social perspective in Denmark. Int. J. Hydrogen Energy 2021, 46, 6885–6900. [Google Scholar] [CrossRef]

- Trencher, G.; Wesseling, J. Roadblocks to fuel-cell electric vehicle diffusion: Evidence from Germany, Japan and California. Transp. Res. Part D 2022, 112, 103458. [Google Scholar] [CrossRef]

- Dijk, M.; Iversen, E.; Klitkou, A.; Kemp, R.; Bolwig, S.; Borup, M.; Møllgaard, P. Forks in the Road to E-Mobility: An Evaluation of Instrument Interaction in National Policy Mixes in Northwest Europe. Energies 2020, 13, 475. [Google Scholar] [CrossRef]

- Hwang, H.; Lee, Y.; Seo, I.; Chung, Y. Successful pathway for locally driven fuel cell electric vehicle adoption: Early evidence from South Korea. Int. J. Hydrogen Energy 2021, 46, 21764–21776. [Google Scholar] [CrossRef]

- Yang, H.; Cho, Y.; Yoo, S. Public willingness to pay for hydrogen stations expansion policy in Korea: Results of a contingent valuation survey. Int. J. Hydrogen Energy 2017, 42, 10739–10746. [Google Scholar] [CrossRef]

- Shin, J.-E. Hydrogen Technology Development and Policy Status by Value Chain in South Korea. Energies 2022, 15, 8983. [Google Scholar] [CrossRef]

- Lopez Jaramillo, O.; Stotts, R.; Kelley, S.; Kuby, M. Content Analysis of Interviews with Hydrogen Fuel Cell Vehicle Drivers in Los Angeles. Transp. Res Rec. 2019, 2673, 377–388. [Google Scholar] [CrossRef]

- Hardman, S.; Shiu, E.; Steinberger-Wilckens, R.; Turrentine, T. Barriers to the adoption of fuel cell vehicles: A qualitative investigation into early adopters attitudes. Transp. Res. Part A 2017, 95, 166–182. [Google Scholar] [CrossRef]

- Kim, E.; Heo, E. Key Drivers behind the Adoption of Electric Vehicle in Korea: An Analysis of the Revealed Preferences. Sustainability 2019, 11, 6854. [Google Scholar] [CrossRef]

- Kim, J.H.; Lee, G.; Park, J.; Hong, J.; Park, J. Consumer intentions to purchase battery electric vehicles in Korea. Energy Policy 2019, 132, 736–743. [Google Scholar] [CrossRef]

- Jung, J.; Yeo, S.; Lee, Y.; Moon, S.; Lee, D.-J. Factors affecting consumers’ preferences for electric vehicle: A Korean case. Res. Transp. Bus. Manag. 2021, 41, 100666. [Google Scholar] [CrossRef]

- Kwon, Y.; Son, S.; Jang, K. User satisfaction with battery electric vehicles in South Korea. Transp. Res. Part D 2020, 82, 102306. [Google Scholar] [CrossRef]

- Lashari, Z.A.; Ko, J.; Jung, S.; Choi, S. Choices of Potential Car Buyers Regarding Alternative Fuel Vehicles in South Korea: A Discrete Choice Modeling Approach. Sustainability 2022, 14, 5360. [Google Scholar] [CrossRef]

- Total Registered Motor Vehicles, Car Registration Statistics for December 2023. Available online: https://stat.molit.go.kr/portal/cate/statMetaView.do?hRsId=58&hFormId=1244&hSelectId=1244&hPoint=00&hAppr=1&hDivEng=&oFileName=&rFileName=&midpath=&sFormId=1244&sStart=2024&sEnd=2024&sStyleNum=562&settingRadio=xlsx (accessed on 1 August 2024).

- Ministry of Environment of Korea. Status of Distribution of Zero-Emission Vehicles and Construction of Charging Infrastructure in 2023. Available online: https://me.go.kr/home/web/public_info/read.do?pagerOffset=0&maxPageItems=10&maxIndexPages=10&searchKey=&searchValue=&menuId=10357&orgCd=&condition.publicInfoMasterId=13&condition.deleteYn=N&publicInfoId=1209&menuId=10357 (accessed on 1 August 2024).

- Korea Automotive and Mobility Association. Korean Automobile Industry; Korea Automotive and Mobility Association: Seoul, Republic of Korea, 2024; pp. 12–19. [Google Scholar]

- Jeju Special Self-Governing Province. Available online: https://www.jeju.go.kr/news/bodo/list.htm?act=view&seq=1484090 (accessed on 1 January 2025).

- Joint Ministries of Korea. Hydrogen Infrastructure and Charging Station Construction Plan. Available online: https://www.korea.kr/common/download.do?fileId=197053853&tblKey=GMN (accessed on 1 August 2024).

- Ministry of Environment of Korea. 2024 Hydrogen Electric Vehicle Distribution Project Subsidy Processing Guidelines; Ministry of Environment of Korea: Sejong City, Republic of Korea, 2024. [Google Scholar]

- Ministry of Environment of Korea. 2024 Hydrogen Charging Station Installation and Fuel Cost Support Project Subsidy Processing Guidelines; Ministry of Environment of Korea: Sejong City, Republic of Korea, 2024. [Google Scholar]

- Park, S.; Park, J. 2050 Support Project of Sustainable Transportation Policy; Korea Transport Institute: Sejong, Republic of Korea, 2023; pp. 161–211. [Google Scholar]

- Park, J.; Heo, S.; Kim, J. Advanced Vehicle Technologies and Implications for Future Transport Systems; Korea Transport Institute: Sejong, Republic of Korea, 2019; pp. 85–129. [Google Scholar]

- Park, J. Research on Activating the Spread of Electric Vehicles Through Survey and Analysis of Actual Purchaser Usage Status; Korea Transport Institute: Sejong, Republic of Korea, 2017; pp. 111–132. [Google Scholar]

- StataCorp. Ordered Logistics Regression. Available online: https://www.stata.com/manuals/rologit.pdf (accessed on 1 October 2024).

- Vilchez, J.J.G.; Smyth, A.; Kelleher, L.; Lu, H.; Rohr, C.; Harrison, G.; Thiel, C. Electric Car Purchase Price as a Factor Determining Consumers’ Choice and their Views on Incentives in Europe. Sustainability 2019, 11, 6357. [Google Scholar] [CrossRef]

- Li, W.; Long, R.; Chen, H.; Chen, F.; Zheng, X.; He, X.; Zhang, L. Willingness to pay for hydrogen fuel cell electric vehicles in China: A choice experiment analysis. Int. J. Hydrogen Energy 2020, 45, 34346–34353. [Google Scholar] [CrossRef]

- Lin, B.; Wu, W. Why people want to buy electric vehicle: An empirical study in first-tier cities of China. Energy Policy 2018, 112, 233–241. [Google Scholar] [CrossRef]

- Kelley, S.; Gulati, S.; Hiatt, J.; Kuby, M. Do early adopters pass on convenience? Access to and intention to use geographically convenient hydrogen stations in California. Int. J. Hydrogen Energy 2022, 47, 2708–2722. [Google Scholar] [CrossRef]

- Kim, C.; Cho, S.H.; Park, S.H.; Kim, M.; Lee, G.; Kim, S.; Kim, D.K. Failure analysis and maintenance of hydrogen refueling stations. J. Mech. Sci. Technol. 2024, 38, 3829–3836. [Google Scholar] [CrossRef]

- Joint Ministries of Korea. Plan to Expand the Supply of Hydrogen Electric Vehicles. Available online: https://www.opm.go.kr/opm/news/press-release.do?mode=download&articleNo=155804&attachNo=140171 (accessed on 10 February 2025).

| By 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Total | 5102 | 5843 | 8532 | 10,256 | 4673 |

| FC car | 5085 | 5783 | 8473 | 10,104 | 4294 |

| FC bus | 17 | 60 | 54 | 152 | 367 |

| FC truck | none | None | 5 | none | 11 |

| By 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Production volume | 6020 | 6459 | 9438 | 10,606 | 5594 |

| Domestic sales | 4194 | 5786 | 8502 | 10,164 | 4328 |

| Export sales | 788 | 995 | 1119 | 361 | 224 |

| By 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Total refueling points | 36 | 70 | 170 | 229 | 300 |

| Total FCVs | 5102 | 10,945 | 19,477 | 29,733 | 34,406 |

| Ratio of FCVs to refueling points | 142 | 156 | 115 | 130 | 115 |

| FC Car (Nexo) | Gasoline Car (G70) | ||

|---|---|---|---|

| Purchase cost | Sticker price | KRW 69,500,000 | KRW 53,800,000 |

| Sales tax | KRW 3,022,727 | KRW 3,604,640 | |

| Subsidy | KRW 32,500,000 | ||

| Final purchase cost | KRW 40,022,727 | KRW 57,444,640 | |

| Fuel cost | Fuel cost per unit | KRW 9900 per kilogram | 1548 won per liter |

| Average fuel economy | 96.2 km per kilogram | 10.7 km per liter | |

| Fuel cost per year | KRW 1,154,644 | KRW 1,540,931 |

| Variables | Description | Units |

|---|---|---|

| Gender | Gender | 1 = male, 2 = female |

| Age | Age | Age |

| Driving experience | Total number of years of driving experience | Year |

| Number of family members | Number of household members | People |

| Occupation | Respondent’s occupation | 1 = office worker, 0 = others |

| Monthly income | Average monthly income of the respondent’s household | KRW 10,000 Korean |

| Number of cars | Total number of cars owned by the respondent’s household | Cars |

| Region | Region where the respondent lives | 1 = metropolitan area, 0 = others |

| Technology interest | Level of interest in cutting-edge technologies assessed on a 5-point Likert scale | 1 = extremely uninterested, 2 = somewhat uninterested, 3 = neutral, 4 = somewhat interested, 5 = extremely interested |

| Eco-friendliness | Level of interest in environmental protection activities assessed on a 5-point Likert scale | Same as above |

| Period of ownership | Total number of months the respondent drove an FC car | Months |

| Repairs and recalls | Total frequency of recalls or repairs during the ownership of an FC car | Counts |

| Driving days | Average number of days FC car used per month | Days |

| HRS in use | Total number of refueling stations used in the past month | Stations |

| Fueling frequency | Total number of refueling sessions in the past month | Times |

| Fueling failure | Experience fueling failure due to unexpected stoppage and breakdowns of refueling facilities | 1 = never, 2 = almost none, 3 = sometimes, 4 = very often |

| Importance of purchase price | Level of agreement that the price of an FC car is an important barrier to its diffusion | 1 = extremely disagree, 2 = somewhat disagree, 3 = neutral, 4 = somewhat agree, 5 = extremely agree |

| Importance of maintenance and repair (M&R) cost | Level of agreement that the M&R cost of an FC car is an important barrier to its diffusion | Same as above |

| Importance of fuel cost | Level of agreement that the hydrogen cost is an important barrier to FC car diffusion | Same as above |

| Importance of durability | Level of agreement that the durability of FCs and their critical components are an important barrier to FC car diffusion | Same as above |

| Importance of an HRS network | Level of agreement that the number of accessible HRSs is an important barrier to FC car diffusion | Same as above |

| Importance of refueling time | Level of agreement that the refueling time of HRSs is an important barrier to FC car diffusion | Same as above |

| Satisfaction with performance | Level of satisfaction with the vehicle performance of FC cars | 1 = extremely dissatisfied, 2 = somewhat dissatisfied, 3 = neutral, 4 = somewhat satisfied, 5 = extremely satisfied |

| Satisfaction with range | Level of satisfaction with the driving range of FC cars | Same as above |

| Satisfaction with design | Level of satisfaction with the FC car design | Same as above |

| Satisfaction with fueling | Level of satisfaction with the convenience of hydrogen refueling | Same as above |

| Satisfaction with fuel cost | Level of satisfaction with the hydrogen cost | Same as above |

| Variables | Description | Units |

|---|---|---|

| Gender | Gender | 1 = male, 2 = female |

| Age | Age | age |

| Occupation | Respondent’s occupation | 1 = office worker, 0 = others |

| Monthly income | Average monthly income of the respondent’s household | KRW 10,000 Korean |

| Number of cars | Total number of cars owned by the respondent’s household | cars |

| Region | Region where the respondent lives | 1 = metropolitan area, 0 = others |

| Technology interest | Level of interest in cutting-edge technologies assessed on a 5-point Likert scale | 1 = extremely uninterested, 2 = somewhat uninterested, 3 = neutral, 4 = somewhat interested, 5 = extremely interested |

| Eco-friendliness | Level of interest in environmental protection activities assessed on a 5-point Likert scale | Same as above |

| Average mileage | Average annual mileage of the respondent | kilometer |

| Average fuel cost | The average monthly fuel cost of the respondent | 10,000 Korean won |

| Vehicle choice | The most important attribute to consider when buying a car | 1 = economic factor, 0 = others |

| Next purchase | How many years from now does the respondent expect to buy a new car? | Year |

| Factor 1 | Level of awareness of the major attributes of FC cars | 1–5 |

| FC car experience | Level of experience with FC cars | 1 = never drove an FC car, 2 = never drove an FC car but saw one, 3 = drove an FC car before, 4 = owned an FC car before |

| HRS accessibility | Whether an HRS is located near the respondent’s home | 1 = more than one HRS, 0 = none |

| Motivation for buying an FC car | Main motivation if the respondent is buying an FC car | 1 = economic motivation, 0 = others |

| Importance of purchase price | Level of agreement that the price of an FC car is an important barrier to its diffusion | 1 = extremely disagree, 2 = somewhat disagree, 3 = neutral, 4 = somewhat agree, 5 = extremely agree |

| Importance of maintenance and repair (M&R) cost | Level of agreement that the M&R cost of an FC car is an important barrier to its diffusion | Same as above |

| Importance of fuel cost | Level of agreement that the hydrogen cost is an important barrier to FC car diffusion | Same as above |

| Importance of durability | Level of agreement that the durability of FC and critical components is an important barrier to FC car diffusion | Same as above |

| Importance of an HRS network | Level of agreement that the number of accessible HRSs is an important barrier to FC car diffusion | Same as above |

| Importance of refueling time | Level of agreement that refueling time at HRSs is an important barrier to FC car diffusion | Same as above |

| Eco-friendliness of FC cars | Level of agreement that an FC car can reduce carbon emissions and mitigate air pollution | Same as above |

| Pride in FC cars | Level of agreement that an FC car driver would feel proud | Same as above |

| Safety concerns with FC cars | Level of agreement that an FC car has safety issues, such as fire hazards and explosion risks, compared with an Internal Combustion Engine (ICE) car | Same as above |

| Societal needs of FC cars | Level of agreement that there should be more hydrogen mobility adopted for the mitigation of climate change and air pollution | Same as above |

| Prospects for FC cars | Level of agreement that we will eventually buy FC cars in the long run | Same as above |

| Driving performance | Comparative evaluation of vehicle performance of an FC car compared with an ICE car | 1 = ICE car is much superior, 2 = ICE car is somewhat superior, 3 = same, 4 = FC car is somewhat superior, 5 = FC car is much superior |

| Driving range | Comparative evaluation of the driving range of an FC car compared with an ICE car | Same as above |

| Design | Comparative evaluation between the FC car design and ICE car design | Same as above |

| Fueling convenience | Comparative evaluation of fueling convenience between FC cars and ICE cars | Same as above |

| Variables | Coefficient | Standard Error | z | P > |z| |

|---|---|---|---|---|

| Gender | 0.1793 | 0.5735 | 0.31 | 0.755 |

| Age | −0.0720 (*) | 0.0433 | −1.66 | 0.096 |

| Driving experience | 0.0769 (*) | 0.0457 | 1.68 | 0.093 |

| Number of family members | −0.0166 | 0.2159 | −0.08 | 0.939 |

| Occupation | 0.0844 | 0.4308 | 0.2 | 0.845 |

| Monthly income | −0.0088 | 0.0523 | −0.17 | 0.867 |

| Number of cars | 0.1943 | 0.2891 | 0.67 | 0.502 |

| Region | −0.7003 | 0.4476 | −1.56 | 0.118 |

| Technology Interest | 0.3195 | 0.2980 | 1.07 | 0.284 |

| Eco-friendliness | −0.2004 | 0.3317 | −0.6 | 0.546 |

| Period of ownership | 0.0000 | 0.0000 | 1.29 | 0.197 |

| Repairs and recalls | −0.4553 (**) | 0.2290 | −1.98 | 0.048 |

| Driving days | 0.1518 | 0.3336 | 0.45 | 0.65 |

| HRS in use | 0.3142 | 0.2567 | 1.22 | 0.221 |

| Fueling frequency | −0.0679 | 0.1165 | −0.58 | 0.56 |

| Fueling failure | −0.7125 (**) | 0.2852 | 2.5 | 0.012 |

| Importance of purchase price | 0.1904 | 0.2755 | 0.69 | 0.49 |

| Importance of M&R cost | −0.1658 | 0.3612 | −0.46 | 0.646 |

| Importance of fuel cost | 0.2293 | 0.3483 | 0.66 | 0.51 |

| Importance of durability | −0.5126 | 0.4746 | −1.08 | 0.28 |

| Importance of HRS network | 0.8604 (**) | 0.3976 | 2.16 | 0.03 |

| Importance of refueling time | −0.8741 (***) | 0.3042 | −2.87 | 0.004 |

| Satisfaction with performance | 0.7821 (**) | 0.3608 | 2.17 | 0.03 |

| Satisfaction with range | 0.3561 | 0.2491 | 1.43 | 0.153 |

| Satisfaction rate with design | 0.2413 | 0.2636 | 0.92 | 0.36 |

| Satisfaction with fueling | −0.2099 | 0.2154 | −0.97 | 0.33 |

| Satisfaction with fuel cost | 0.1696 | 0.2154 | 0.79 | 0.431 |

| /cut1 | 0.5246 | 2.3042 | ||

| /cut2 | 2.98206 | 2.3024 | ||

| /cut3 | 4.7561 | 2.3433 | ||

| /cut4 | 7.6896 | 2.4214 | ||

| Number of observations = 100; Log likelihood = −111.82914; LR chi2 (27) = 58.12; Prob > chi2 = 0.0005; Pseudo R2 = 0.20630 | ||||

| Variables | Coefficient | Standard Error | z | P > |z| |

|---|---|---|---|---|

| Gender | −0.6788 | 0.5724 | −1.19 | 0.236 |

| Age | 0.0016 | 0.0428 | 0.04 | 0.97 |

| Driving experience | 0.0452 | 0.0454 | 1 | 0.319 |

| Number of family members | −0.2197 | 0.2026 | −1.08 | 0.278 |

| Occupation | −0.2885 | 0.4176 | −0.69 | 0.49 |

| Monthly income | −0.0187 | 0.0537 | −0.35 | 0.727 |

| Number of cars | 0.1164 | 0.2910 | 0.4 | 0.689 |

| Region | 0.8238 (*) | 0.4336 | 1.9 | 0.057 |

| Technology interest | 0.6234 (**) | 0.3109 | 2.01 | 0.045 |

| Eco-friendliness | −0.4206 | 0.3276 | −1.28 | 0.199 |

| Period of ownership | 0.0000 | 0.0000 | 0.07 | 0.945 |

| Repairs and recalls | −0.2419 | 0.2180 | −1.11 | 0.267 |

| Driving days | 0.5842 (*) | 0.3366 | 1.74 | 0.083 |

| HRS in use | 0.8148 (***) | 0.2672 | 3.05 | 0.002 |

| Fueling frequency | −0.0570 | 0.1177 | −0.48 | 0.628 |

| Fueling failure | −0.4383 (*) | 0.2652 | 1.65 | 0.098 |

| Importance of purchase price | 0.2237 | 0.2888 | 0.77 | 0.439 |

| Importance of M&R cost | −0.6295 (*) | 0.3718 | −1.69 | 0.09 |

| Importance of fuel cost | 0.2244 | 0.3395 | 0.66 | 0.509 |

| Importance of durability | 0.4459 | 0.4229 | 1.05 | 0.292 |

| Importance of HRS network | −0.0623 | 0.3956 | −0.16 | 0.875 |

| Importance of refueling time | −0.3561 | 0.2895 | −1.23 | 0.219 |

| Satisfaction with performance | 0.0453 | 0.3665 | 0.12 | 0.902 |

| Satisfaction with range | 0.3146 | 0.2538 | 1.24 | 0.215 |

| Satisfaction with design | 0.7542 (***) | 0.2714 | 2.78 | 0.005 |

| Satisfaction with fueling | 0.2278 | 0.2074 | 1.1 | 0.272 |

| Satisfaction with fuel cost | 0.4637 (**) | 0.2100 | 2.21 | 0.027 |

| /cut1 | 4.7776 | 2.32478 | ||

| /cut2 | 6.7814 | 2.3590 | ||

| /cut3 | 8.3464 | 2.4048 | ||

| /cut4 | 10.5730 | 2.5124 | ||

| Number of observations = 100; Log likelihood = −123.963; LR chi2 (27) = 61.70; Prob > chi2 = 0.0002; Pseudo R2 = 0.1993 | ||||

| FCV | BEV | Hybrid | |

|---|---|---|---|

| 2017 | 0.4% | 22.3% | 20.7% |

| 2019 | 4.5% | 24.2% | 28.2% |

| 2023 | 1.5% | 28.0% | 37.2% |

| Variables | Coefficient | Standard Error | z | P > |z| |

|---|---|---|---|---|

| Gender | 0.2510 (*) | 0.1407 | 1.78 | 0.075 |

| Age | 0.0103 (*) | 0.0062 | 1.66 | 0.098 |

| Occupation | −0.0500 | 0.1388 | −0.36 | 0.719 |

| Monthly income | −0.0080 | 0.0147 | −0.54 | 0.589 |

| Number of cars | −0.0368 | 0.1120 | −0.33 | 0.742 |

| Region | −0.0621 | 0.1259 | −0.49 | 0.622 |

| Technology interest | 0.5955 (***) | 0.0803 | 7.42 | 0.000 |

| Eco-friendliness | 0.1011 | 0.0908 | 1.11 | 0.266 |

| Average mileage | 0.0000 | 0.0000 | −0.99 | 0.323 |

| Average fuel cost | −0.0010 | 0.0064 | −0.16 | 0.873 |

| Vehicle choice | −0.0927 | 0.1301 | −0.71 | 0.476 |

| Next purchase | 0.0010 | 0.0256 | 0.04 | 0.968 |

| Factor 1 | 0.3838 (***) | 0.0802 | 4.79 | 0.000 |

| FC car experience | 0.3396 (***) | 0.1297 | −2.62 | 0.009 |

| HRS accessibility | 0.1101 | 0.1463 | 0.75 | 0.451 |

| Motivation for buying an FC car | 0.2779 (**) | 0.1243 | 2.24 | 0.025 |

| Importance of purchase price | 0.0679 | 0.1008 | 0.67 | 0.5 |

| Importance of M&R cost | −0.0797 | 0.1013 | −0.79 | 0.432 |

| Importance of fuel cost | 0.0802 | 0.1127 | 0.71 | 0.477 |

| Importance of durability | −0.0168 | 0.0971 | −0.17 | 0.863 |

| Importance of HRS network | −0.2852 (**) | 0.1128 | −2.53 | 0.011 |

| Importance of refueling time | −0.0572 | 0.0936 | −0.61 | 0.541 |

| Eco-friendliness of FC cars | 0.0595 | 0.0975 | 0.61 | 0.542 |

| Pride in FC cars | 0.2258 (***) | 0.0764 | 2.96 | 0.003 |

| Safety concerns with FC cars | −0.2247 (***) | 0.0738 | −3.05 | 0.002 |

| Societal needs for FC cars | 0.0721 | 0.0953 | 0.76 | 0.449 |

| Prospects for FC cars | 0.6519 (***) | 0.0841 | 7.75 | 0.000 |

| Driving performance | 0.1126 | 0.0960 | 1.17 | 0.241 |

| Driving range | 0.2132 (***) | 0.0688 | 3.1 | 0.002 |

| Design | 0.2050 (**) | 0.0826 | 2.48 | 0.013 |

| Fueling convenience | 0.0751 | 0.0758 | 0.99 | 0.322 |

| /cut1 | 3.3471 | 0.8809 | ||

| /cut2 | 5.4848 | 0.8902 | ||

| /cut3 | 6.8420 | 0.8985 | ||

| /cut4 | 9.3804 | 0.9248 | ||

| Number of observations = 1000 Log likelihood = −193.1262; LR chi2 (31) = 623.66; Prob > chi2 = 0.0000 Pseudo R2 = 0.2072 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Park, J.; Kim, C. Current Challenges to Achieving Mass-Market Hydrogen Mobility from the Perspective of Early Adopters in South Korea. Sustainability 2025, 17, 2507. https://doi.org/10.3390/su17062507

Park J, Kim C. Current Challenges to Achieving Mass-Market Hydrogen Mobility from the Perspective of Early Adopters in South Korea. Sustainability. 2025; 17(6):2507. https://doi.org/10.3390/su17062507

Chicago/Turabian StylePark, Jiyoung, and Chansung Kim. 2025. "Current Challenges to Achieving Mass-Market Hydrogen Mobility from the Perspective of Early Adopters in South Korea" Sustainability 17, no. 6: 2507. https://doi.org/10.3390/su17062507

APA StylePark, J., & Kim, C. (2025). Current Challenges to Achieving Mass-Market Hydrogen Mobility from the Perspective of Early Adopters in South Korea. Sustainability, 17(6), 2507. https://doi.org/10.3390/su17062507