Asymmetric Effects of Fiscal Policy and Foreign Direct Investment Inflows on CO2 Emissions—An Application of Nonlinear ARDL

Abstract

1. Introduction

2. Literature Review

2.1. Fiscal Policy and Environmental Quality

2.2. FDI and Environmental Quality

2.3. Other Factors Responsible for Carbon Emissions

2.3.1. Financial Development and Carbon Emissions

2.3.2. Trade Openness and Carbon Emissions

2.3.3. Economic Growth and Carbon Emissions

3. Model and Methodology

4. Results and Discussion

4.1. Preliminary Analysis

4.2. Results of NARDL Bound Test

4.3. Long-Run Results

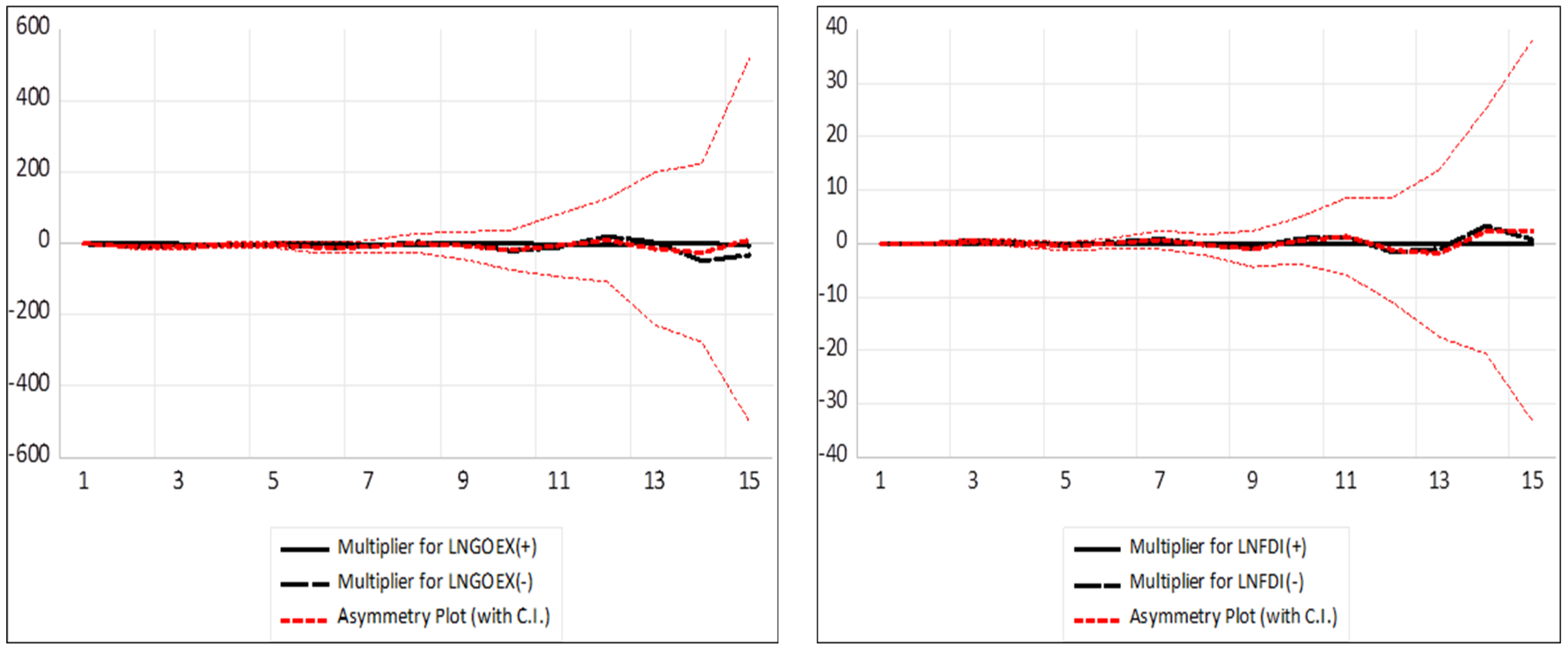

4.4. Short-Run Findings

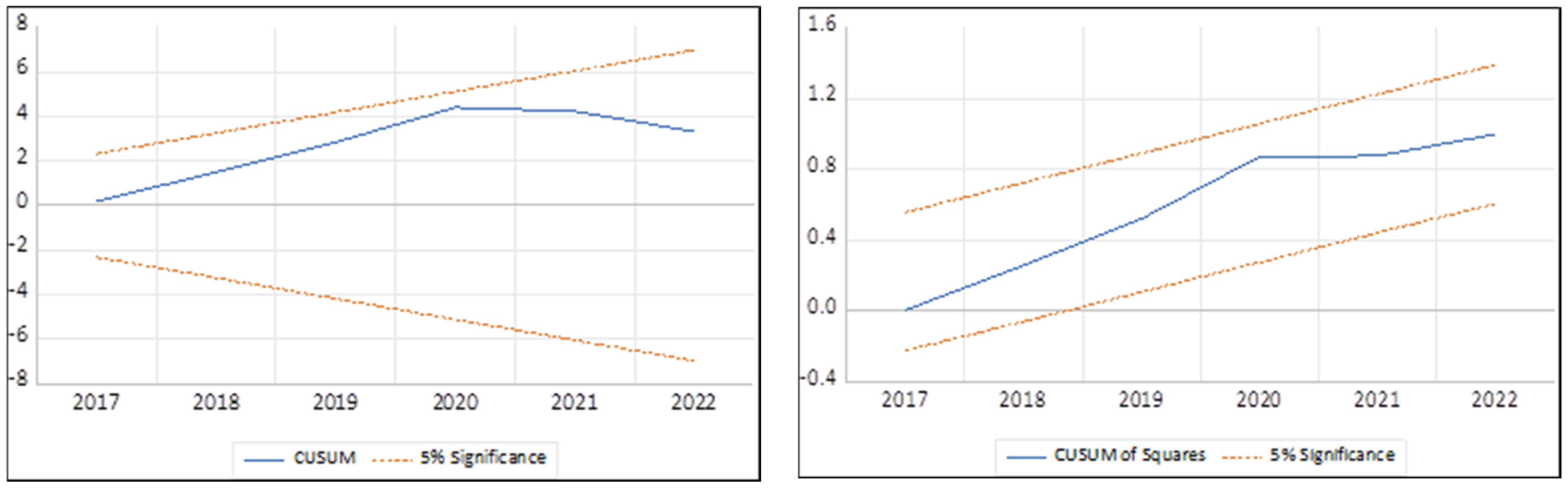

4.5. Stability Diagnostic Test

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Intergovernmental Panel on Climate Change, Climate Change 2022: Impacts, Adaptation, and Vulnerability; Intergovernmental Panel on Climate Change (IPCC): Geneva, Switzerland, 2022.

- Hussain, M.; Wang, W.; Wang, Y. Natural resources, consumer prices and financial development in China: Measures to control carbon emissions and ecological footprints. Resour. Policy 2022, 78, 102880. [Google Scholar]

- Mishra, B.R.; Arjun; Tiwari, A.K. Exploring the asymmetric effect of fiscal decentralization on economic growth and environmental quality: Evidence from India. Environ. Sci. Pollut. Res. 2023, 30, 80192–80209. [Google Scholar]

- Luo, R.; Ullah, S.; Ali, K. Pathway towards sustainability in selected Asian countries: Influence of green investment, technology innovations, and economic growth on CO2 emission. Sustainability 2021, 13, 12873. [Google Scholar] [CrossRef]

- Nguyen, T.P.; Tran, T.N.; Dinh, T.T.H.; Hoang, T.M.; Duong Thi Thuy, T. Drivers of climate change in selected emerging countries: The ecological effects of monetary restrictions and expansions. Cogent Econ. Financ. 2022, 10, 2114658. [Google Scholar]

- Chaturvedi, A.; Saluja, M.S.; Banerjee, A.; Arora, R. Environmental fiscal reforms. IIMB Manag. Rev. 2014, 26, 193–205. [Google Scholar] [CrossRef][Green Version]

- López, R.; Galinato, G.I.; Islam, A. Fiscal spending and the environment: Theory and empirics. J. Environ. Econ. Manag. 2011, 62, 180–198. [Google Scholar] [CrossRef]

- Halkos, G.E.; Paizanos, E.A. The effects of fiscal policy on CO2 emissions: Evidence from the USA. Energy Policy 2016, 88, 317–328. [Google Scholar] [CrossRef]

- Adewuyi, A.O. Effects of public and private expenditures on environmental pollution: A dynamic heterogeneous panel data analysis. Renew. Sustain. Energy Rev. 2016, 65, 489–506. [Google Scholar] [CrossRef]

- Katircioglu, S.; Katircioglu, S. Testing the role of fiscal policy in the environmental degradation: The case of Turkey. Environ. Sci. Pollut. Res. 2018, 25, 5616–5630. [Google Scholar] [CrossRef]

- Ullah, S.; Majeed, M.T.; Chishti, M.Z. Examining the asymmetric effects of fiscal policy instruments on environmental quality in Asian economies. Environ. Sci. Pollut. Res. 2020, 27, 38287–38299. [Google Scholar]

- Yuelan, P.; Akbar, M.W.; Hafeez, M.; Ahmad, M.; Zia, Z.; Ullah, S. The nexus of fiscal policy instruments and environmental degradation in China. Environ. Sci. Pollut. Res. 2019, 26, 28919–28932. [Google Scholar]

- Abbass, K.; Song, H.; Khan, F.; Begum, H.; Asif, M. Fresh insight through the VAR approach to investigate the effects of fiscal policy on environmental pollution in Pakistan. In Environmental Science and Pollution Research; Springer: Berlin/Heidelberg, Germany, 2022; pp. 1–14. [Google Scholar]

- Ike, G.N.; Usman, O.; Sarkodie, S.A. Fiscal policy and CO2 emissions from heterogeneous fuel sources in Thailand: Evidence from multiple structural breaks cointegration test. Sci. Total Environ. 2020, 702, 134711. [Google Scholar]

- McAusland, C. Trade, politics, and the environment: Tailpipe vs. smokestack. J. Environ. Econ. Manag. 2008, 55, 52–71. [Google Scholar]

- Lopez, R.E.; Palacios, A. Have Government Spending and Energy Tax Policies Contributed to Make Europe Environmentally Cleaner? 2010. Available online: https://ageconsearch.umn.edu/record/94795 (accessed on 21 January 2025).

- Mujtaba, A.; Jena, P.K. Analyzing asymmetric impact of economic growth, energy use, FDI inflows, and oil prices on CO2 emissions through NARDL approach. Environ. Sci. Pollut. Res. 2021, 28, 30873–30886. [Google Scholar]

- Ali, K.; Bakhsh, S.; Ullah, S.; Ullah, A.; Ullah, S. Industrial growth and CO2 emissions in Vietnam: The key role of financial development and fossil fuel consumption. Environ. Sci. Pollut. Res. 2021, 28, 7515–7527. [Google Scholar]

- Nam, P.X.; Thanh, T.T. Effects of bribery on firms’ environmental innovation adoption in Vietnam: Mediating roles of firms’ bargaining power and credit and institutional constraints. Ecol. Econ. 2021, 185, 107042. [Google Scholar]

- Le, T.H. Connectedness between nonrenewable and renewable energy consumption, economic growth and CO2 emission in Vietnam: New evidence from a wavelet analysis. Renew. Energy 2022, 195, 442–454. [Google Scholar]

- Nguyen, D.X.; Nguyen, T.D. The Relationship of Fiscal Policy and Economic Cycle: Is Vietnam Different? J. Risk Financ. Manag. 2023, 16, 281. [Google Scholar]

- Joshi, P.; Beck, K. Democracy and carbon dioxide emissions: Assessing the interactions of political and economic freedom and the environmental Kuznets curve. Energy Res. Soc. Sci. 2018, 39, 46–54. [Google Scholar]

- Halkos, G.E.; Paizanos, E.A. The effect of government expenditure on the environment: An empirical investigation. Ecol. Econ. 2013, 91, 48–56. [Google Scholar]

- Gerlagh, R.; Van Den Bijgaart, I.; Nijland, H.; Michielsen, T. Fiscal policy and CO2 emissions of new passenger cars in the EU. Environ. Resour. Econ. 2018, 69, 103–134. [Google Scholar] [CrossRef]

- Mughal, N.; Kashif, M.; Arif, A.; Guerrero, J.W.G.; Nabua, W.C.; Niedbała, G. Dynamic effects of fiscal and monetary policy instruments on environmental pollution in ASEAN. Environ. Sci. Pollut. Res. 2021, 28, 65116–65126. [Google Scholar] [CrossRef]

- Walter, I.; Ugelow, J.L. Environmental policies in developing countries. Ambio 1979, 8, 102–109. [Google Scholar]

- Shahbaz, M.; Nasreen, S.; Abbas, F.; Anis, O. Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ. 2015, 51, 275–287. [Google Scholar] [CrossRef]

- Yaşar, N.; Telatar, M. The relationship between foreign direct investment and CO2 emissions across a panel of countries. In Energy Economy, Finance and Geostrategy; Springer: Berlin/Heidelberg, Germany, 2018; pp. 157–169. [Google Scholar]

- Bakhsh, K.; Rose, S.; Ali, M.F.; Ahmad, N.; Shahbaz, M. Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: New evidences from 3SLS. J. Environ. Manag. 2017, 196, 627–632. [Google Scholar] [CrossRef] [PubMed]

- Cai, X.; Che, X.; Zhu, B.; Zhao, J.; Xie, R. Will developing countries become pollution havens for developed countries? An empirical investigation in the Belt and Road. J. Clean. Prod. 2018, 198, 624–632. [Google Scholar] [CrossRef]

- Dou, J.; Han, X. How does the industry mobility affect pollution industry transfer in China: Empirical test on Pollution Haven Hypothesis and Porter Hypothesis. J. Clean. Prod. 2019, 217, 105–115. [Google Scholar] [CrossRef]

- Duan, Y.; Jiang, X. Pollution haven or pollution halo? A Re-evaluation on the role of multinational enterprises in global CO2 emissions. Energy Econ. 2021, 97, 105181. [Google Scholar] [CrossRef]

- Singhania, M.; Saini, N. Demystifying pollution haven hypothesis: Role of FDI. J. Bus. Res. 2021, 123, 516–528. [Google Scholar] [CrossRef]

- Birdsall, N.; Wheeler, D. Trade policy and industrial pollution in Latin America: Where are the pollution havens? J. Environ. Dev. 1993, 2, 137–149. [Google Scholar] [CrossRef]

- Antweiler, W.; Copeland, B.R.; Taylor, M.S. Is free trade good for the environment? Am. Econ. Rev. 2001, 91, 877–908. [Google Scholar] [CrossRef]

- Aust, V.; Morais, A.I.; Pinto, I. How does foreign direct investment contribute to Sustainable Development Goals? Evidence from African countries. J. Clean. Prod. 2020, 245, 118823. [Google Scholar] [CrossRef]

- Wang, X.; Luo, Y. Has technological innovation capability addressed environmental pollution from the dual perspective of FDI quantity and quality? Evidence from China. J. Clean. Prod. 2020, 258, 120941. [Google Scholar] [CrossRef]

- Sarkodie, S.A. Failure to control economic sectoral inefficiencies through policy stringency disrupts environmental performance. Sci. Total Environ. 2021, 772, 145603. [Google Scholar] [CrossRef]

- Dong, Y.; Shao, S.; Zhang, Y. Does FDI have energy-saving spillover effect in China? A perspective of energy-biased technical change. J. Clean. Prod. 2019, 234, 436–450. [Google Scholar] [CrossRef]

- Xin-gang, Z.; Yuan-feng, Z.; Yan-bin, L. The spillovers of foreign direct investment and the convergence of energy intensity. J. Clean. Prod. 2019, 206, 611–621. [Google Scholar] [CrossRef]

- Tariq, G.; Sun, H.; Ali, I.; Pasha, A.A.; Khan, M.S.; Rahman, M.M.; Mohamed, A.; Shah, Q. Influence of green technology, green energy consumption, energy efficiency, trade, economic development and FDI on climate change in South Asia. Sci. Rep. 2022, 12, 16376. [Google Scholar] [CrossRef] [PubMed]

- Abdouli, M.; Hammami, S. Economic growth, FDI inflows and their impact on the environment: An empirical study for the MENA countries. Qual. Quant. 2017, 51, 121–146. [Google Scholar] [CrossRef]

- Seker, F.; Ertugrul, H.M.; Cetin, M. The impact of foreign direct investment on environmental quality: A bounds testing and causality analysis for Turkey. Renew. Sustain. Energy Rev. 2015, 52, 347–356. [Google Scholar] [CrossRef]

- Ben-David, I.; Jang, Y.; Kleimeier, S.; Viehs, M. Exporting pollution: Where do multinational firms emit CO2? Econ. Policy 2021, 36, 377–437. [Google Scholar] [CrossRef]

- Zhuang, Y.; Yang, S.; Razzaq, A.; Khan, Z. Environmental impact of infrastructure-led Chinese outward FDI, tourism development and technology innovation: A regional country analysis. J. Environ. Plan. Manag. 2022, 66, 367–399. [Google Scholar] [CrossRef]

- Othman, N.; Wahab, S.N.; Hewage, R.S.; Ismail, F.R.; Chindo, S. Validating the Environmental Kuznets Curve: Evidence from ASEAN’s Economic Growth, Renewable Energy, and Carbon Emissions; BIO Web of Conferences, 2024; EDP Sciences: Les Ulis, France, 2024; p. 02007. [Google Scholar]

- Ridzuan, A.R.; Kumaran, V.V.; Fianto, B.A.; Shaari, M.S.; Esquivias, M.A.; Albani, A. Reinvestigating the presence of environmental kuznets curve in Malaysia: The role of foreign direct investment. Int. J. Energy Econ. Policy 2022, 12, 217–225. [Google Scholar] [CrossRef]

- Shabir, M.; Gill, A.R.; Ali, M. The impact of transport energy consumption and foreign direct investment on CO2 emissions in ASEAN countries. Front. Energy Res. 2022, 10, 994062. [Google Scholar] [CrossRef]

- Bi, K.; Masud, M.M.; Akhtar, R.; Md Noman, A.H.; Zhao, Y.; Al-Mamun, A. Decoding Climate Change Dynamics in Malaysia: Analysing Energy, Economic Growth, Foreign Direct Investment, and Oil Prices Interplay, Natural Resources Forum, 2024; Wiley Online Library: Hoboken, NJ, USA, 2024. [Google Scholar]

- Vinh, C.T.H. The Two-Way Linkage Between Foreign Direct Investment and Environment in Vietnam–From Sectoral Perspectives; Foreign Trade University: Hanoi, Vietnam, 2015. [Google Scholar]

- Saini, N.; Sighania, M. Environmental impact of economic growth, emission and FDI: Systematic review of reviews. Qual. Res. Financ. Mark. 2019, 11, 81–134. [Google Scholar] [CrossRef]

- Jakob, M.; Flachsland, C.; Steckel, J.C.; Urpelainen, J. Actors, objectives, context: A framework of the political economy of energy and climate policy applied to India, Indonesia, and Vietnam. Energy Res. Soc. Sci. 2020, 70, 101775. [Google Scholar] [CrossRef]

- Saqib, N.; Dincă, G. Exploring the asymmetric impact of economic complexity, FDI, and green technology on carbon emissions: Policy stringency for clean-energy investing countries. Geosci. Front. 2024, 15, 101671. [Google Scholar] [CrossRef]

- Di Tommaso, M.R.; Angelino, A. Vietnamese industrial development: Following Washington on the road to Beijing. Int. J. Emerg. Mark. 2021, 16, 241–263. [Google Scholar] [CrossRef]

- Li, Q.; Qamruzzaman, M. Innovation-led environmental sustainability in Vietnam—Towards a green future. Sustainability 2023, 15, 12109. [Google Scholar] [CrossRef]

- Qamruzzaman, M. Do environmental and institutional quality attribute to inflows of FDI in Lower-Middle income Nations? Evidences from asymmetric investigation. GSC Adv. Res. Rev. 2023, 15, 079–104. [Google Scholar] [CrossRef]

- Korutaro Nkundabanyanga, S.; Kasozi, D.; Nalukenge, I.; Tauringana, V. Lending terms, financial literacy and formal credit accessibility. Int. J. Soc. Econ. 2014, 41, 342–361. [Google Scholar] [CrossRef]

- Islam, F.; Shahbaz, M.; Ahmed, A.U.; Alam, M.M. Financial development and energy consumption nexus in Malaysia: A multivariate time series analysis. Econ. Model. 2013, 30, 435–441. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Ozturk, I.; Lean, H.H. The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe. Nat. Hazards 2015, 79, 621–644. [Google Scholar] [CrossRef]

- Salahuddin, M.; Alam, K.; Ozturk, I.; Sohag, K. The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew. Sustain. Energy Rev. 2018, 81, 2002–2010. [Google Scholar] [CrossRef]

- Sadorsky, P. Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 2011, 39, 999–1006. [Google Scholar] [CrossRef]

- Nasir, M.A.; Huynh, T.L.D.; Tram, H.T.X. Role of financial development, economic growth & foreign direct investment in driving climate change: A case of emerging ASEAN. J. Environ. Manag. 2019, 242, 131–141. [Google Scholar]

- Cetin, M.; Ecevit, E.; Yucel, A.G. The impact of economic growth, energy consumption, trade openness, and financial development on carbon emissions: Empirical evidence from Turkey. Environ. Sci. Pollut. Res. 2018, 25, 36589–36603. [Google Scholar] [CrossRef]

- Frankel, J.A.; Romer, D. Does trade cause growth? In Global Trade; Routledge: Oxfordshire, UK, 2017; pp. 255–276. [Google Scholar]

- Pata, U.K. Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: Testing EKC hypothesis with structural breaks. J. Clean. Prod. 2018, 187, 770–779. [Google Scholar] [CrossRef]

- Le, T.-H.; Chang, Y.; Park, D. Trade openness and environmental quality: International evidence. Energy Policy 2016, 92, 45–55. [Google Scholar] [CrossRef]

- Li, R.; Wang, Q.; Liu, Y.; Jiang, R. Per-capita carbon emissions in 147 countries: The effect of economic, energy, social, and trade structural changes. Sustain. Prod. Consum. 2021, 27, 1149–1164. [Google Scholar] [CrossRef]

- Tariq, M.; Xu, Y.; Ullah, K.; Dong, B. Toward low-carbon emissions and green growth for sustainable development in emerging economies: Do green trade openness, eco-innovation, and carbon price matter? Sustain. Dev. 2024, 32, 959–978. [Google Scholar] [CrossRef]

- Haisheng, Y.; Jia, J.; Yongzhang, Z.; Shugong, W. The impact on environmental Kuznets curve by trade and foreign direct investment in China. Chin. J. Popul. Resour. Environ. 2005, 3, 14–19. [Google Scholar] [CrossRef]

- Jiang, R.; Liu, B. How to achieve carbon neutrality while maintaining economic vitality: An exploration from the perspective of technological innovation and trade openness. Sci. Total Environ. 2023, 868, 161490. [Google Scholar] [CrossRef] [PubMed]

- Hu, J.; Wu, H.; Ying, S.X. Environmental regulation, market forces, and corporate environmental responsibility: Evidence from the implementation of cleaner production standards in China. J. Bus. Res. 2022, 150, 606–622. [Google Scholar] [CrossRef]

- Cobbold, E.Y.; Li, Y.; Obobisa, E.S. Technology transfer and innovation through trade; assessing the role of low carbon technologies imports on domestic green innovation. In The Journal of Technology Transfer; Springer: Berlin/Heidelberg, Germany, 2024; pp. 1–30. [Google Scholar]

- Wang, Q.; Sun, J.; Pata, U.K.; Li, R.; Kartal, M.T. Digital economy and carbon dioxide emissions: Examining the role of threshold variables. Geosci. Front. 2024, 15, 101644. [Google Scholar] [CrossRef]

- Wang, Q.; Ren, F.; Li, R. Exploring the impact of geopolitics on the environmental Kuznets curve research. Sustain. Dev. 2024, 32, 1700–1722. [Google Scholar] [CrossRef]

- Lopez, R. The environment as a factor of production: The effects of economic growth and trade liberalization 1. In International Trade and the Environment; Routledge: Oxfordshire, UK, 2017; pp. 239–260. [Google Scholar]

- Wang, Q.; Zhang, F.; Li, R. Free trade and carbon emissions revisited: The asymmetric impacts of trade diversification and trade openness. Sustain. Dev. 2024, 32, 876–901. [Google Scholar] [CrossRef]

- Odugbesan, J.A.; Rjoub, H. Relationship among economic growth, energy consumption, CO2 emission, and urbanization: Evidence from MINT countries. Sage Open 2020, 10, 2158244020914648. [Google Scholar] [CrossRef]

- Teng, J.-Z.; Khan, M.K.; Khan, M.I.; Chishti, M.Z.; Khan, M.O. Effect of foreign direct investment on CO2 emission with the role of globalization, institutional quality with pooled mean group panel ARDL. Environ. Sci. Pollut. Res. 2021, 28, 5271–5282. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Beton Kalmaz, D. Determinants of CO2 emissions: Empirical evidence from Egypt. Environ. Ecol. Stat. 2021, 28, 239–262. [Google Scholar] [CrossRef]

- Shahbaz, M.; Tiwari, A.K.; Nasir, M. The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 2013, 61, 1452–1459. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Kalmaz, D.B. Testing the moderating role of urbanization on the environmental Kuznets curve: Empirical evidence from an emerging market. Environ. Sci. Pollut. Res. 2020, 27, 38169–38180. [Google Scholar] [CrossRef] [PubMed]

- Liu, X.; Bae, J. Urbanization and industrialization impact of CO2 emissions in China. J. Clean. Prod. 2018, 172, 178–186. [Google Scholar] [CrossRef]

- Raheem, I.D.; Ogebe, J.O. CO2 emissions, urbanization and industrialization: Evidence from a direct and indirect heterogeneous panel analysis. Manag. Environ. Qual. Int. J. 2017, 28, 851–867. [Google Scholar] [CrossRef]

- Zmami, M.; Ben-Salha, O. An empirical analysis of the determinants of CO2 emissions in GCC countries. Int. J. Sustain. Dev. World Ecol. 2020, 27, 469–480. [Google Scholar] [CrossRef]

- Arjun; Mishra, B.R.; Tiwari, A.K. Exploring the asymmetric effect of fiscal policy instruments in encountering environmental degradation: Proposing an SDG framework for India. Environ. Sci. Pollut. Res. 2024, 31, 25907–25928. [Google Scholar] [CrossRef]

- Nathaniel, S.; Anyanwu, O.; Shah, M. Renewable energy, urbanization, and ecological footprint in the Middle East and North Africa region. Environ. Sci. Pollut. Res. 2020, 27, 14601–14613. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Perron, P.; Phillips, P.C. Does GNP have a unit root?: A re-evaluation. Econ. Lett. 1987, 23, 139–145. [Google Scholar] [CrossRef]

- Broock, W.A.; Scheinkman, J.A.; Dechert, W.D.; LeBaron, B. A test for independence based on the correlation dimension. Econom. Rev. 1996, 15, 197–235. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Worrell, E.; Van Berkel, R.; Fengqi, Z.; Menke, C.; Schaeffer, R.; Williams, R.O. Technology transfer of energy efficient technologies in industry: A review of trends and policy issues. Energy Policy 2001, 29, 29–43. [Google Scholar] [CrossRef]

- Nath, S.D.; Eweje, G.; Bathurst, R. The invisible side of managing sustainability in global supply chains: Evidence from multitier apparel suppliers. J. Bus. Logist. 2021, 42, 207–232. [Google Scholar] [CrossRef]

- Mai Tan Việt Nam Đang ở vị Thế Tốt Hút “Làn Sóng” Mới Đầu tư Vào Ngành Công Nghiệp Giá Trị Cao. Available online: https://thoibaotaichinhvietnam.vn/viet-nam-dang-o-vi-the-tot-hut-lan-song-moi-dau-tu-vao-nganh-cong-nghiep-gia-tri-cao-163642.html#:~:text=Trong%209%20th%C3%A1ng%20n%C4%83m%202024,ngh%E1%BB%87%20cao%2C%20gi%C3%A1%20tr%E1%BB%8B%20cao (accessed on 11 December 2024).

- Do, T.N.; Burke, P.J.; Nguyen, H.N.; Overland, I.; Suryadi, B.; Swandaru, A.; Yurnaidi, Z. Vietnam’s solar and wind power success: Policy implications for the other ASEAN countries. Energy Sustain. Dev. 2021, 65, 1–11. [Google Scholar] [CrossRef]

- Nong, D.; Wang, C.; Al-Amin, A.Q. A critical review of energy resources, policies and scientific studies towards a cleaner and more sustainable economy in Vietnam. Renew. Sustain. Energy Rev. 2020, 134, 110117. [Google Scholar] [CrossRef]

- Odugbesan, J.A.; Adebayo, T.S. The symmetrical and asymmetrical effects of foreign direct investment and financial development on carbon emission: Evidence from Nigeria. SN Appl. Sci. 2020, 2, 1982. [Google Scholar] [CrossRef]

- Nhuong, B.H.; Hang, L.T.T.; Thuy, D.T.T.; Quang, P.T.; Anh, K.T. Investigating the Nexus Between Foreign Direct Investment and Sustainable Energy Transition: The Case of Vietnam. J. Environ. Assess. Policy Manag. 2024, 26, 2350023. [Google Scholar] [CrossRef]

- Minh, T.B.; Ngoc, T.N.; Van, H.B. Relationship between carbon emissions, economic growth, renewable energy consumption, foreign direct investment, and urban population in Vietnam. Heliyon 2023, 9, e17544. [Google Scholar] [CrossRef]

- Thuy Dung Samsung Viet Nam Works to Contribute to Viet Nam’s Net-Zero Emissions Target. Available online: https://en.baochinhphu.vn/samsung-viet-nam-works-to-contribute-to-viet-nams-net-zero-emissions-target-111240813095855541.htm (accessed on 26 December 2024).

- VNA Bac Lieu Plans to Become Renewable Energy Export Hub. Available online: https://en.vietnamplus.vn/bac-lieu-plans-to-become-renewable-energy-export-hub-post296771.vnp (accessed on 26 December 2024).

- World Bank. Vietnam Public Expenditure Review: Fiscal Policies Towards Sustainability, Efficiency, and Equity; Vietnam, G.O., Ed.; World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Hoa, P.X.; Xuan, V.N.; Thu, N.T.P. Nexus of innovation, foreign direct investment, economic growth and renewable energy: New insights from 60 countries. Energy Rep. 2024, 11, 1834–1845. [Google Scholar] [CrossRef]

- Fahy, K.; Alexiou, A.; Daras, K.; Mason, K.; Bennett, D.; Taylor-Robinson, D.; Barr, B. Mental health impact of cuts to local government spending on cultural, environmental and planning services in England: A longitudinal ecological study. BMC Public Health 2023, 23, 1441. [Google Scholar] [CrossRef]

- Ahmad, M.; Satrovic, E. How do fiscal policy, technological innovation, and economic openness expedite environmental sustainability? Gondwana Res. 2023, 124, 143–164. [Google Scholar] [CrossRef]

- Pata, U.K. Renewable and non-renewable energy consumption, economic complexity, CO2 emissions, and ecological footprint in the USA: Testing the EKC hypothesis with a structural break. Environ. Sci. Pollut. Res. 2021, 28, 846–861. [Google Scholar] [CrossRef] [PubMed]

- Fei, L.; Dong, S.; Xue, L.; Liang, Q.; Yang, W. Energy consumption-economic growth relationship and carbon dioxide emissions in China. Energy Policy 2011, 39, 568–574. [Google Scholar] [CrossRef]

- Sadorsky, P. The effect of urbanization on CO2 emissions in emerging economies. Energy Econ. 2014, 41, 147–153. [Google Scholar] [CrossRef]

- Brown, R.L.; Durbin, J.; Evans, J.M. Techniques for testing the constancy of regression relationships over time. J. R. Stat. Soc. Ser. B Stat. Methodol. 1975, 37, 149–163. [Google Scholar] [CrossRef]

| Symbol | Variables | Definition | Sources |

|---|---|---|---|

| CO2 | Per capita carbon dioxide | Kt of CO2 emissions | WDI |

| TRADE | Trade openness | The sum of import and export (% of GDP) | WDI |

| CREDIT | Financial development | The volume of domestic credit to private sector (% of GDP) | WDI |

| FDI | Foreign direct investment inflow | Foreign direct investment inflows (% of GDP) | WDI |

| GOEX | Fiscal policy | Government expenditure (% of GDP) | WDI |

| GDPPC | Economic development | GDP per capita (constant USD 2010) | WDI |

| Variables | Mean | Median | Maximum | Minimum | Std. Dev. | Skewness | Kurtosis | Jarque–Bera | Prob. |

|---|---|---|---|---|---|---|---|---|---|

| CO2 | 11.427 | 11.460 | 13.027 | 9.869 | 0.943 | −0.074 | 1.912 | 1.657 | 0.437 |

| TRADE | 4.778 | 4.830 | 5.229 | 4.193 | 0.293 | −0.515 | 2.290 | 2.151 | 0.341 |

| CREDIT | 3.900 | 4.180 | 4.836 | 2.500 | 0.774 | −0.527 | 1.759 | 3.646 | 0.162 |

| FDI | 1.631 | 1.569 | 2.480 | 1.023 | 0.352 | 0.792 | 2.768 | 3.520 | 0.172 |

| GOEX | 23.376 | 23.323 | 24.245 | 22.561 | 0.561 | 0.125 | 1.539 | 3.020 | 0.221 |

| GDPPC | 7.390 | 7.417 | 8.205 | 6.512 | 0.514 | −0.089 | 1.824 | 1.945 | 0.378 |

| Variables | ADF (p-Value) | PP (p-Value) | ||||||

|---|---|---|---|---|---|---|---|---|

| Intercept | Intercept and Trend | Intercept | Intercept and Trend | |||||

| Level | ||||||||

| CO2 | 0.078 | 0.959 | −2.114 | 0.519 | 0.110 | 0.962 | −2.228 | 0.459 |

| TRADE | −0.683 | 0.837 | −2.270 | 0.437 | −0.497 | 0.879 | −2.231 | 0.457 |

| CREDIT | −1.706 | 0.419 | −0.961 | 0.936 | −1.706 | 0.419 | −1.023 | 0.926 |

| FDI | −3.057 ** | 0.041 | −3.342 * | 0.078 | −2.807 * | 0.069 | −2.969 | 0.156 |

| GOEX | 0.324 | 0.976 | −3.763 ** | 0.036 | 0.194 | 0.968 | −1.814 | 0.674 |

| GDPPC | −1.330 | 0.602 | −3.758 ** | 0.034 | −2.257 | 0.192 | −1.280 | 0.875 |

| First differences | ||||||||

| CO2 | −5.501 *** | 0.000 | −5.395 *** | 0.001 | −5.542 *** | 0.000 | −5.429 *** | 0.001 |

| TRADE | −7.665 *** | 0.000 | −7.522 *** | 0.000 | −7.510 *** | 0.000 | −7.523 *** | 0.000 |

| CREDIT | −4.800 *** | 0.001 | −5.036 *** | 0.002 | −4.794 *** | 0.001 | −5.036 *** | 0.002 |

| FDI | −4.204 *** | 0.003 | −4.129 ** | 0.014 | −4.099 *** | 0.003 | −4.007 ** | 0.019 |

| GOEX | −4.424 *** | 0.001 | −4.364 *** | 0.008 | −4.507 *** | 0.001 | −4.456 *** | 0.007 |

| GDPPC | −4.887 *** | 0.000 | −5.026 *** | 0.002 | −3.671 ** | 0.010 | −4.181 ** | 0.013 |

| Series | Dimension 2 | Dimension 3 | Dimension 4 | Dimension 5 | Dimension 6 |

|---|---|---|---|---|---|

| CO2 | 0.195 *** | 0.327 *** | 0.423 *** | 0.488 *** | 0.540 *** |

| TRADE | 0.161 *** | 0.285 *** | 0.384 *** | 0.456 *** | 0.505 *** |

| CREDIT | 0.202 *** | 0.339 *** | 0.433 *** | 0.495 *** | 0.535 *** |

| FDI | 0.103 *** | 0.160 *** | 0.181 *** | 0.200 *** | 0.206 *** |

| GOEX | 0.191 *** | 0.317 *** | 0.399 *** | 0.454 *** | 0.491 *** |

| GDPPC | 0.199 *** | 0.336 *** | 0.431 *** | 0.499 *** | 0.549 *** |

| F-Bounds Test | Null Hypothesis: No Levels Relationship | |||

| Test Statistic | Value | Signif. | I(0) | I(1) |

| F-statistic | 3.90 ** | 10% | 2.03 | 3.13 |

| k | 7 | 5% | 2.32 | 3.50 |

| 2.50% | 2.60 | 3.84 | ||

| 1% | 2.96 | 4.26 | ||

| Long-run estimation | ||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| FDI+ | −0.124 *** | 0.029 | −4.294 | 0.005 |

| FDI− | −0.125 | 0.088 | −1.418 | 0.206 |

| GOEX+ | −1.275 ** | 0.354 | −3.604 | 0.011 |

| GOEX− | 5.627 ** | 2.022 | 2.783 | 0.032 |

| TRADE | −0.487 ** | 0.162 | −3.009 | 0.024 |

| CREDIT | 0.357 ** | 0.112 | 3.188 | 0.019 |

| GDPPC | 3.197 *** | 0.362 | 8.823 | 0.000 |

| Short-run estimation | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| Δ (FDI+) | −0.128 ** | 0.041 | −3.158 | 0.020 |

| Δ (FDI−) | 0.018 | 0.070 | 0.259 | 0.804 |

| Δ (GOEX+) | −0.719 ** | 0.273 | −2.632 | 0.039 |

| Δ (GOEX−) | 7.678 *** | 1.164 | 6.597 | 0.001 |

| Δ (TRADE) | −0.608 *** | 0.113 | −5.358 | 0.002 |

| Δ (CREDIT) | 0.491 *** | 0.106 | 4.648 | 0.004 |

| Δ (GDPPC) | 1.209 * | 0.494 | 2.446 | 0.050 |

| C | −23.875 *** | 3.378 | −7.068 | 0.000 |

| ECM (−1) | −2.456 *** | 0.347 | −7.088 | 0.000 |

| R-squared | 0.882 | Adjusted R-squared | 0.736 | |

| F-statistic | 6.054 | Prob (F-statistic) | 0.001 |

| Diagnostic Tests | F-Statistic | p-Value |

|---|---|---|

| Model misspecification: RESET test | 0.376 | 0.566 |

| Serial correlation: Breusch–Godfrey LM test | 3.340 | 0.140 |

| Heteroskedasticity test: Breusch–Pagan–Godfrey | 0.486 | 0.902 |

| Heteroskedasticity test: ARCH | 0.779 | 0.385 |

| Normality test: Jarque–Bera test | 2.147 | 0.342 |

| Long-run asymmetries based on Wald test | F-statistics | Prob. |

| FDI | 0.552 | 0.486 |

| GOEX | 5.053 * | 0.066 |

| Short-run asymmetries based on Wald test | F-statistics | Prob. |

| FDI | 0.663 | 0.425 |

| GOEX | 1.327 | 0.262 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen, T.P.; Duong, T.T.-T. Asymmetric Effects of Fiscal Policy and Foreign Direct Investment Inflows on CO2 Emissions—An Application of Nonlinear ARDL. Sustainability 2025, 17, 2503. https://doi.org/10.3390/su17062503

Nguyen TP, Duong TT-T. Asymmetric Effects of Fiscal Policy and Foreign Direct Investment Inflows on CO2 Emissions—An Application of Nonlinear ARDL. Sustainability. 2025; 17(6):2503. https://doi.org/10.3390/su17062503

Chicago/Turabian StyleNguyen, Thanh Phuc, and Trang Thi-Thuy Duong. 2025. "Asymmetric Effects of Fiscal Policy and Foreign Direct Investment Inflows on CO2 Emissions—An Application of Nonlinear ARDL" Sustainability 17, no. 6: 2503. https://doi.org/10.3390/su17062503

APA StyleNguyen, T. P., & Duong, T. T.-T. (2025). Asymmetric Effects of Fiscal Policy and Foreign Direct Investment Inflows on CO2 Emissions—An Application of Nonlinear ARDL. Sustainability, 17(6), 2503. https://doi.org/10.3390/su17062503