Quality or Quantity? The Impact of Voluntary Environmental Regulation on Firm’s Green Technological Innovation: Evidence from Green Factory Certification in China

Abstract

1. Introduction

- (1)

- Can green factory certification promote GTI in enterprises?

- (2)

- If so, what are the key mechanisms through which certification affects innovation outcomes?

2. Policy Background, Literature Review and Theoretical Analysis

2.1. Policy Background

2.2. Literature Review

2.2.1. Related Literature on GTI

2.2.2. Related Literature on Voluntary Environmental Regulation

2.2.3. Related Literature on Green Factory Certification

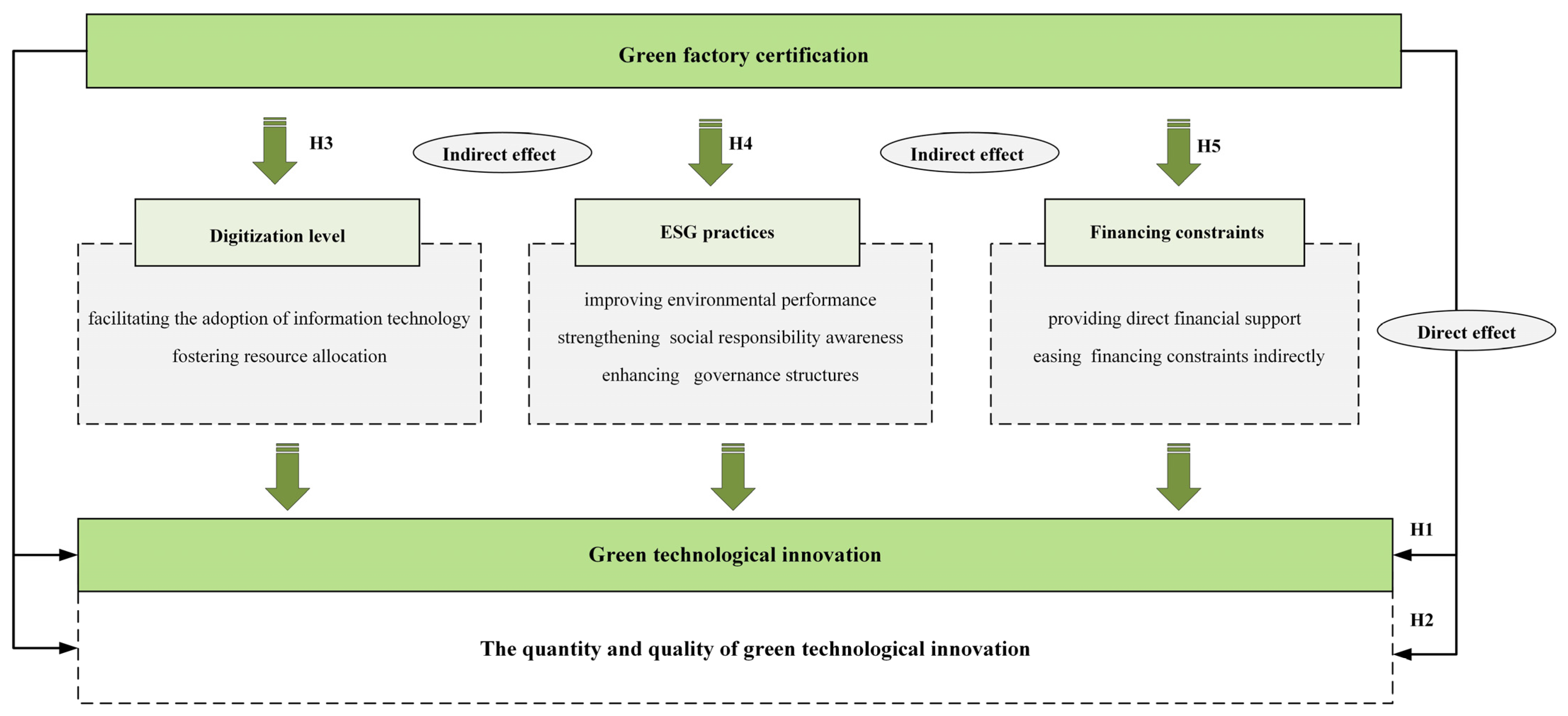

2.3. Theoretical Analysis

2.3.1. Green Factory Certification and GTI

2.3.2. The Underlying Mechanism of Digitalization Level

2.3.3. The Underlying Mechanism of ESG Practices

2.3.4. The Underlying Mechanism of Financing Constraint

3. Data and Research Method

3.1. Data Sources

3.2. Model Design

3.3. Variable Definitions

3.3.1. Dependent Variables

3.3.2. Independent Variable

3.3.3. Mechanism Variables

3.3.4. Control Variables

4. Empirical Results

4.1. Descriptive Statistics and Correlation Test

4.2. Baseline Regression

4.3. Parallel Trend Test

4.4. PSM-DID

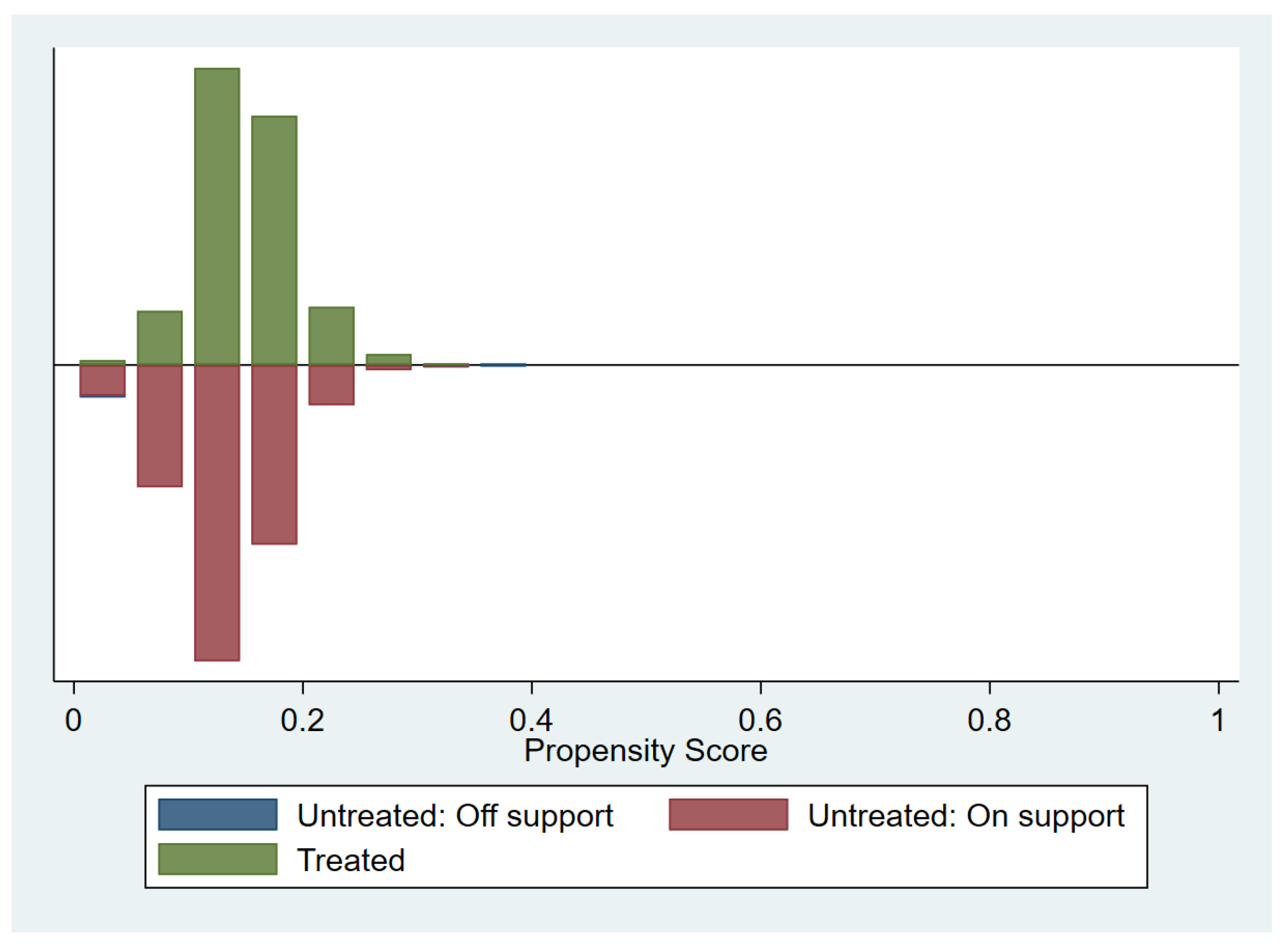

4.4.1. Common Support Domain Test

4.4.2. PSM-DID Balance Test

4.4.3. PSM-DID Regression Test

4.5. Robustness Tests

4.5.1. Placebo Test

4.5.2. Alternative Measurements of the Dependent Variables

4.5.3. Exclusion of Municipal Samples

4.5.4. Alternative Econometric Models

4.5.5. Entropy Balancing Method

4.5.6. Lagged Variable Test

4.5.7. Instrumental Variable Estimations

4.5.8. Inclusion of Multi-Dimensional Fixed Effects

5. Further Analysis

5.1. Mechanism Analysis

5.1.1. Digitalization Level

5.1.2. ESG Practices

5.1.3. Financing Constraints

5.2. Heterogeneity Analysis

5.2.1. Industry Heterogeneity

5.2.2. Firm Heterogeneity

5.2.3. Regional Heterogeneity

6. Discussion and Conclusions

6.1. Conclusions

- (1)

- After receiving green factory certification, there is a significant improvement in firms’ GTI capabilities, achieving dual breakthroughs in both the quantity and quality of GTI. The existing research suggests that voluntary environmental regulations create environmental incentive effects and promote GTI [11,36]. This study not only reinforces these findings, but also broadens the research perspective. Unlike previous studies that primarily examined non-governmental environmental certification tools, this study focuses on government-led green factory certification, a voluntary environmental regulation policy uniquely localized in China. These findings further confirm the effectiveness of voluntary environmental regulation within China’s institutional framework.

- (2)

- Under the process of fostering corporate GTI, green factory certification exerts both direct and indirect effects. Beyond its immediate influence, it enhances GTI by improving firms’ digitalization levels, strengthening ESG practices, and alleviating financing constraints. These findings align with prior research emphasizing the critical role of digitalization, ESG performance, and financial accessibility in enhancing firms’ capacity and motivation for GTI [57,69,74].

- (3)

- Heterogeneity analysis exposes that green factory certification’s driving role in GTI demonstrates significant heterogeneity. Firms with better geographic locations, non-SOE firms, and those in light-polluting industries experience a more significant enhancement in GTI driven by green factory certification.

6.2. Theoretical Implications

6.3. Policy and Managerial Implications

6.4. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The environment and directed technical change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef]

- Tang, K.; Wang, Y.Y.; Wang, H.J. The impact of innovation capability on green development in China’s urban agglomerations. Technol. Forecast. Soc. Chang. 2024, 200, 123128. [Google Scholar] [CrossRef]

- Xie, X.; Huo, J.; Zou, H. Green process innovation, green product innovation, and corporate financial performance: A content analysis method. J. Bus. Res. 2019, 101, 697–706. [Google Scholar] [CrossRef]

- López-Gamero, M.D.; Molina-Azorín, J.F.; Claver-Cortés, E. The potential of environmental regulation to change managerial perception, environmental management, competitiveness and financial performance. J. Clean. Prod. 2010, 18, 963–974. [Google Scholar] [CrossRef]

- Cainelli, G.; De Marchi, V.; Grandinetti, R. Does the development of environmental innovation require different resources? Evidence from Spanish manufacturing firms. J. Clean. Prod. 2015, 94, 211–220. [Google Scholar] [CrossRef]

- Zhang, F.; Zhu, L. Enhancing corporate sustainable development: Stakeholder pressures, organizational learning, and green innovation. Bus. Strateg. Environ. 2019, 28, 1012–1026. [Google Scholar] [CrossRef]

- Lin, B.; Chen, X. Environmental regulation and energy-environmental performance—Empirical evidence from China’s non-ferrous metals industry. J. Environ. Manag. 2020, 269, 110722. [Google Scholar] [CrossRef]

- Sun, D.; Zeng, S.; Chen, H.; Meng, X.; Jin, Z. Monitoring effect of transparency: How does government environmental disclosure facilitate corporate environmentalism? Bus. Strateg. Environ. 2019, 28, 1594–1607. [Google Scholar] [CrossRef]

- Carrión-Flores, C.E.; Innes, R.; Sam, A.G. Do voluntary pollution reduction programs (VPRs) spur or deter environmental innovation? Evidence from 33/50. J. Environ. Econ. Manag. 2013, 66, 444–459. [Google Scholar] [CrossRef]

- Lin, B.; Huang, C. Analysis of emission reduction effects of carbon trading: Market mechanism or government intervention? Sustain. Prod. Consump. 2022, 33, 28–37. [Google Scholar] [CrossRef]

- Ma, H.; Dong, Y.; Zhou, M.; Fang, N. Impact of voluntary environmental regulation on green innovation from the perspective of enterprise life cycle: Evidence from China. Environ. Res. Commun. 2024, 6, 095012. [Google Scholar] [CrossRef]

- Sun, H.; Liu, C.; Guo, J. Environmental incentive effect and spillover effect of the government′s green certification system on manufacturing enterprises. China Popul. Resour. Environ. 2024, 34, 76–87. [Google Scholar]

- Wang, W.; Zhang, Q.; Hao, J. How Does Green Factory Certification Affect Corporate Sustainability Performance: Evidence from China. Sustainability 2025, 17, 61. [Google Scholar] [CrossRef]

- Arocena, P.; Orcos, R.; Zouaghi, F. The impact of ISO 14001 on firm environmental and economic performance: The moderating role of size and environmental awareness. Bus. Strategy Environ. 2021, 30, 955–967. [Google Scholar] [CrossRef]

- Heras-Saizarbitoria, I.; Boiral, O.; Díaz de Junguitu, A. Environmental management certification and environmental performance: Greening or greenwashing? Bus. Strategy Environ. 2020, 29, 2829–2841. [Google Scholar] [CrossRef]

- Qiu, Y.; Kahn, M.E. Impact of voluntary green certification on building energy performance. Energy Econ. 2019, 80, 461–475. [Google Scholar] [CrossRef]

- Chen, Y.; Singhal, V.; Zhu, Q. Environmental policies and financial performance: Stock market reaction to firms for their proactive environmental practices recognized by governmental programs. Bus. Strategy Environ. 2021, 30, 1548–1562. [Google Scholar] [CrossRef]

- GB/T 36132-2018; General Principles for Assessment of Green Factory. Standardization Administration of China: Beijing, China, 2018.

- Wei, X.; Jiang, F.; Su, Y. More green, less labor gains? Green factory and labor income share in China. Energy Econ. 2024, 133, 107481. [Google Scholar] [CrossRef]

- Zou, X.; Min, J.; Meng, S. The green development effect of science and technology financial policy in China. Front. Environ. Sci. 2024, 12, 1463679. [Google Scholar] [CrossRef]

- Liao, Y.; Zhou, X. Real green or fake green? Impact of green credit policy on corporate ESG performance. Humanit. Soc. Sci. Commun. 2024, 11, 1097. [Google Scholar] [CrossRef]

- Cai, W.; Ye, P. Local-neighborhood effects of different environmental regulations on green innovation: Evidence from prefecture level cities of China. Environ. Dev. Sustain. 2022, 24, 4810–4834. [Google Scholar] [CrossRef]

- Li, S.; Chen, L.; Xu, P. Quantity or quality? The impact of financial geo-density on firms’ green innovation. Environ. Sci. Pollut. Res. 2023, 30, 54073–54094. [Google Scholar] [CrossRef]

- Huang, M.; Li, M.; Liao, Z. Do politically connected CEOs promote Chinese listed industrial firms’ green innovation? The mediating role of external governance environments. J. Clean. Prod. 2021, 278, 123634. [Google Scholar] [CrossRef]

- Yin, H.; Zhang, L.; Cai, C.; Zhang, Z.; Zhu, Q. Fiscal & tax incentives, ESG responsibility fulfillments, and corporate green innovation performance. Int. Rev. Econ. Financ. 2025, 98, 103838. [Google Scholar]

- Qi, G.; Zeng, S.; Tam, C.; Yin, H.; Zou, H. Stakeholders’ Influences on Corporate Green Innovation Strategy: A Case Study of Manufacturing Firms in China. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 1–14. [Google Scholar] [CrossRef]

- Adnan, M.; Zhu, N.; Abdullah; Bilal, M. The nexus between female CEOs, government subsidies and green innovation: Probing board diversity dynamics. Total Qual. Manag. Bus. Excell. 2025. [Google Scholar] [CrossRef]

- Wang, H.; Yang, J.; Zhu, N. Does Tax Incentives Matter to Enterprises’ Green Technology Innovation? The Mediating Role on R&D Investment. Sustainability 2024, 16, 5902. [Google Scholar] [CrossRef]

- Zhang, J.; Kang, L.; Li, H.; Ballesteros-Pérez, P.; Skitmore, M.; Zuo, J. The impact of environmental regulations on urban Green innovation efficiency: The case of Xi’an. Sustain. Cities Soc. 2020, 57, 102123. [Google Scholar] [CrossRef]

- Bu, M.; Qiao, Z.; Liu, B. Voluntary environmental regulation and firm innovation in China. Econ. Model. 2020, 89, 10–18. [Google Scholar] [CrossRef]

- Johnstone, L.; Hallberg, P. ISO 14001 adoption and environmental performance in small to medium sized enterprises. J. Environ. Manag. 2020, 266, 110592. [Google Scholar] [CrossRef]

- Li, R.; Ramanathan, R. Exploring the relationships between different types of environmental regulations and environmental performance: Evidence from China. J. Clean. Prod. 2018, 196, 1329–1340. [Google Scholar] [CrossRef]

- Yang, X.; Yao, Y. Environmental compliance and firm performance: Evidence from China. Oxf. Bull. Econ. Stat. 2012, 74, 397–424. [Google Scholar] [CrossRef]

- Lim, S.; Prakash, A. Voluntary regulations and innovation: The case of ISO 14001. Public Adm. Rev. 2014, 74, 233–244. [Google Scholar] [CrossRef]

- Hu, S.; Wang, M.; Wu, M.; Wang, A. Voluntary environmental regulations, greenwashing and green innovation: Empirical study of China’s ISO14001 certification. Environ. Impact Assess. Rev. 2023, 102, 107224. [Google Scholar] [CrossRef]

- Li, D.; Tang, F.; Jiang, J. Does environmental management system foster corporate green innovation? The moderating effect of environmental regulation. Technol. Anal. Strateg. Manag. 2019, 31, 1242–1256. [Google Scholar] [CrossRef]

- ISO 14001; Environmental Management Systems—Requirements with Guidance for Use. International Organization for Standardization (ISO): Geneva, Switzerland, 2015.

- Ren, S.; Li, X.; Yuan, B.; Li, D.; Chen, X. The effects of three types of environmental regulation on eco-efficiency: A cross-region analysis in China. J. Clean. Prod. 2018, 173, 245–255. [Google Scholar] [CrossRef]

- Li, P.; Yao, S.; Fan, L.; Yin, S.; Du, H. Government certified environmental labels and trade credit: Evidence from green factories. Econ. Lett. 2024, 244, 112008. [Google Scholar] [CrossRef]

- Wang, M.; Ye, T.; Kong, D. Green Manufacturing and Corporate Environmental Information Disclosure:Evidence from the Policy Experiment of “Creation of Green Factories” in China. Econ. Res. J. 2024, 59, 116–134. [Google Scholar]

- Li, Z.; Shao, Q.; Song, J. The efforts of manufacturing enterprises toward sustainable development under voluntary environmental policy: The roles of external pressure, attraction, and internal attributes. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 2315–2329. [Google Scholar] [CrossRef]

- Jiang, Z.; Wang, Z.; Zeng, Y. Can voluntary environmental regulation promote corporate technological innovation? Bus Strateg Environ 2020, 29, 390–406. [Google Scholar] [CrossRef]

- Ni, H.; Liu, W.; Yang, Z. Training investment, human capital upgrading and firm innovation: The role of government training subsidies. Kybernetes 2024, 53, 2934–2966. [Google Scholar] [CrossRef]

- Ahmad, M.F.; Ismail, S.N.; Hassan, M.F.; Chan, S.W.; Abdul Hamid, N.; Ahmad, A.N.A.; Mohd Nawi, M.N.; Abdul Rahman, N.A. A study of green factory practices in Malaysia manufacturing industry. Int. J. Supply Chain Manag. 2019, 8, 772–776. [Google Scholar]

- Yang, M.; Li, H.; Li, J. The Theory and Practice of Evaluating Green Factories in China. S. Asian J. Soc. Stud. Econ. 2021, 10, 24–33. [Google Scholar] [CrossRef]

- Wei, X.; Jiang, F.; Chen, Y. The value of “green label”: Green factory and corporate ESG performance. Appl. Econ. Lett. 2024. [Google Scholar] [CrossRef]

- Awan, A.; Hussain, K.; Zafar, M.; Butt, M.J.; Yaghmour, S. Impact of nations’ green behavior on green growth by considering the moderating role of environmental policy stringency. Manag. Environ. Qual. Int. J. 2024, 36, 309–328. [Google Scholar] [CrossRef]

- Wang, Z.; Chen, J.; Xue, X. Assessing the efficacy of green credit policy in fostering green innovation in heavily polluting industries. Clean Technol. Environ. Policy 2024, 27, 309–325. [Google Scholar] [CrossRef]

- Su, Y.; Lee, C.C. Green finance, environmental quality and technological innovation in China. Int. J. Financ. Econ. 2023, 30, 405–425. [Google Scholar] [CrossRef]

- Vargas-Hernández, J.G.; Vargas-González, O.C. Organizational Innovation Approach to Green Technological Innovation. In Intellectual Capital as a Precursor to Sustainable Corporate Social Responsibility; IGI Global: Hershey, PA, USA, 2023; pp. 181–199. [Google Scholar]

- Bi, S.; Kang, C.; Bai, T.; Yi, X. The effect of green fiscal policy on green technological innovation: Evidence from energy saving and emission reduction fiscal policy. Environ. Sci. Pollut. Res. 2024, 31, 10483–10500. [Google Scholar] [CrossRef]

- Al Koliby, I.S.; Al-Hakimi, M.A.; Zaid, M.A.K.; Khan, M.F.; Hasan, M.B.; Alshadadi, M.A. Green entrepreneurial orientation and technological green innovation: Does resources orchestration capability matter? Bottom Line 2024, 37, 45–70. [Google Scholar] [CrossRef]

- Upadhayay, N.B.; Rocchetta, S.; Gupta, S.; Kamble, S.; Stekelorum, R. Blazing the trail: The role of digital and green servitization on technological innovation. Technovation 2024, 130, 102922. [Google Scholar] [CrossRef]

- Bai, Y.; Song, S.; Jiao, J.; Yang, R. The impacts of government R&D subsidies on green innovation: Evidence from Chinese energy-intensive firms. J. Clean. Prod. 2019, 233, 819–829. [Google Scholar] [CrossRef]

- Ma, D.; Zhu, Q. Innovation in emerging economies: Research on the digital economy driving high-quality green development. J. Bus. Res. 2022, 145, 801–813. [Google Scholar] [CrossRef]

- Teece, D. Profiting from innovation in the digital economy: Enabling technologies, standards, and licensing models in the wireless world. Res. Policy 2018, 47, 1367–1387. [Google Scholar] [CrossRef]

- Lai, A.; Li, Z.; Hu, X.; Wang, Q. Does digital economy improve city-level eco-efficiency in China? Econ. Anal. Policy 2024, 81, 1198–1213. [Google Scholar] [CrossRef]

- Goldfarb, A.; Tucker, C. Digital economics. J. Econ. Lit. 2019, 57, 3–43. [Google Scholar] [CrossRef]

- Liu, W.; Wang, Z.; Shi, Q.; Bao, S. Impact of the digital transformation of Chinese new energy vehicle enterprises on innovation performance. Humanit. Soc. Sci. Commun. 2024, 11, 1–11. [Google Scholar] [CrossRef]

- Hamari, J.; Sjöklint, M.; Ukkonen, A. The sharing economy: Why people participate in collaborative consumption. J. Assoc. Inf. Sci. Technol. 2016, 67, 2047–2059. [Google Scholar] [CrossRef]

- Gao, H.; Wang, H.; Wen, H. Corporate ESG Performance Guided by Environmental Rule of Law: Evidence from the Establishment of Intermediate Environmental Courts in China. J. Financ. Econ. 2025, 50, 77–92. [Google Scholar] [CrossRef]

- Zhou, C.; Wang, H.; Shu, Y. The Spillover Effects of Green Industry Policies from the Perspective of Common Shareholders——A Quasi Natural Experiment Based on Green Factory Evaluation. Financ. Res. 2024, 78–92. [Google Scholar] [CrossRef]

- Zhou, Y.; Huo, W.; Bo, L.; Chen, X. Impact and mechanism analysis of ESG ratings on the efficiency of green technology innovation. Financ. Res. Lett. 2023, 58, 104591. [Google Scholar] [CrossRef]

- Zhou, J.; Lei, X.; Yu, J. ESG rating divergence and corporate green innovation. Bus Strateg Environ 2024, 33, 2911–2930. [Google Scholar] [CrossRef]

- Wang, M.; Li, Y.; Wang, Z. A nonlinear relationship between corporate environmental performance and economic performance of green technology innovation: Moderating effect of government market-based regulations. Bus. Strateg. Environ. 2023, 32, 3119–3138. [Google Scholar] [CrossRef]

- Abdullah; Zhu, N.; Hashmi, M.A.; Shah, M.H. CEO power, board features and ESG performance: An extensive novel moderation analysis. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 5627–5655. [Google Scholar] [CrossRef]

- Laguir, I.; Stekelorum, R.; El Baz, J. Proactive environmental strategy and performances of third party logistics providers (TPLs): Investigating the role of eco-control systems. Int. J. Prod. Econ. 2021, 240, 108249. [Google Scholar] [CrossRef]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Zhang, D.; Rong, Z.; Ji, Q. Green innovation and firm performance: Evidence from listed companies in China. Resour. Conserv. Recycl. 2019, 144, 48–55. [Google Scholar] [CrossRef]

- Liu, H.-j.; Hu, H.-g. “From Point to Area” Effect of Government Environmental Governance: A Non-Binding Perspective on Voluntary Environmental Regulation. China Ind. Econ. 2024, 80–98. [Google Scholar] [CrossRef]

- Flammer, C. Corporate green bonds. J. Financ. Econ. 2021, 142, 499–516. [Google Scholar] [CrossRef]

- Ghoul, S.E.; Guedhami, O.; Kim, Y. Country-level institutions, firm value, and the role of corporate social responsibility initiatives. J. Int. Bus. Stud. 2017, 48, 360–385. [Google Scholar] [CrossRef]

- Adams, R.; Jeanrenaud, S.; Bessant, J.; Denyer, D.; Overy, P. Sustainability-oriented Innovation: A Systematic Review. Int. J. Manag. Rev. 2016, 18, 180–205. [Google Scholar] [CrossRef]

- Chen, F.; Zeng, X.; Guo, X. Green finance, climate change, and green innovation: Evidence from China. Financ. Res. Lett. 2024, 63, 105283. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Levkov, A. Big bad banks? The winners and losers from bank deregulation in the United States. J. Financ. 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- Lv, D.; Liu, X.; Cao, G. The impact of enterprise digital transformation on green technology innovation in manufacturing: A factor flow perspective. Singap. Econ. Rev. 2024, 1–36. [Google Scholar] [CrossRef]

- Liao, X.; Zhang, Y.; Wang, X.; Yuan, R. Digitalization Level and Green-Oriented Transition Development of Highly Energy-Intensive Enterprises Based on Carbon Reduction Perspective. Sustainability 2023, 15, 15549. [Google Scholar] [CrossRef]

- Feng, H.; Zhang, Z.; Wang, Q.; Yang, L. Does a Company’s Position within the Interlocking Director Network Influence Its ESG Performance?—Empirical Evidence from Chinese Listed Companies. Sustainability 2024, 16, 4190. [Google Scholar] [CrossRef]

- Gao, Y.; Yang, H.; Sun, X.; Tian, X.; Xu, J. Corporate Digital Transformation and Financing Constraints: The Moderating Effect of Institutional Investors. Heliyon 2024, 10, e33199. [Google Scholar] [CrossRef]

- Ai, M.; Luo, F.; Bu, Y. Green innovation and corporate financial performance: Insights from operating risks. J. Clean. Prod. 2024, 456, 142353. [Google Scholar] [CrossRef]

- Ferrara, E.L.; Chong, A.; Duryea, S. Soap operas and fertility: Evidence from Brazil. Am. Econ. J. Appl. Econ. 2012, 4, 1–31. [Google Scholar] [CrossRef]

- Kong, H.; Sun, L.; Zhang, W. Digitization and Green Technology Innovation of Chinese Firms Under Government Subsidy Policies. Systems 2024, 12, 447. [Google Scholar] [CrossRef]

- Cao, S.; Fang, Z.; Pu, W.; Ruan, Y.-Y. Vertical interlock and firm value: The role of corporate innovation. Emerg. Mark. Financ. Trade 2022, 58, 1061–1077. [Google Scholar] [CrossRef]

- Wu, K.; Kong, D.; Yang, W. Does Environmental, Social, and Governance Rating Affect Firms’ Real Earnings Management—Evidence from China. Financ. Res. Lett. 2024, 67, 105764. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef] [PubMed]

- Xu, P.; Ye, P.; Zhao, F.; Jahanger, A. Technology spillover and market competitiveness in green credit induced corporate green innovation: An evolutionary game theory and empirical study. Technol. Forecast. Soc. Chang. 2024, 207, 123622. [Google Scholar] [CrossRef]

- Zhang, Q.; Wang, Y.; Chen, Q. Green Bond Issuance and the Spillover Effect of Green Technology Innovation from the Perspective of Market Attention: Evidence from China. Systems 2024, 12, 399. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Wang, W. How does China’s carbon emissions trading (CET) policy affect the investment of CET-covered enterprises? Energy Econ. 2021, 98, 105224. [Google Scholar] [CrossRef]

- Huang, Z.; Liao, G.; Li, Z. Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Change 2019, 144, 148–156. [Google Scholar] [CrossRef]

- Du, L.; Zhang, Z.; Feng, T. Linking green customer and supplier integration with green innovation performance: The role of internal integration. Bus. Strategy Environ. 2018, 27, 1583–1595. [Google Scholar] [CrossRef]

- Xu, N.; Zhang, D.; Li, Y.; Bai, Y. Research on the heterogeneity of executives’ nonsalary incentives on corporate green technology innovation. Chin. Manag. Stud. 2024, 18, 1583–1609. [Google Scholar] [CrossRef]

- Su, C.; Deng, J.; Li, X.; Huang, W.; Ma, j.; Wang, C.; Wang, X. Investment in enhancing resilience safety of chemical parks under blockchain technology: From the perspective of dynamic reward and punishment mechanisms. J. Loss Prev. Process Ind. 2025, 94, 105523. [Google Scholar] [CrossRef]

| Variable Type | Variables | Code | Measurement |

|---|---|---|---|

| Dependent Variables | Green Technological Innovation (GTI) | GTI | Natural logarithm of 1 plus the number of green invention patents and green utility model patent applications. |

| Quality of GTI | GTI_Inv | Natural logarithm of 1 plus the number of green invention patent applications. | |

| Quantity of GTI | GTI_Uti | Natural logarithm of 1 plus the number of green utility model patent applications. | |

| Independent Variable | Green Factory Certification | GP | Whether a listed company is certified as a Green Factory in a given year is coded as 1 if certified, and 0 otherwise. If the certification is revoked in that year, the company is coded as 0 for that year. |

| Mechanism Variables | Digitalization level | Dig | The composite index values for the six dimensions—artificial intelligence technology, big data, cloud computing, blockchain, digital technology utilization, and digital transformation. |

| ESG practices | ESG | The Huazheng ESG rating. | |

| Financing constraints | SA | The SA index. | |

| Control Variables | Profitability | Roa | The ratio of net profit to total assets. |

| Leverage Ratio | Lev | The ratio of total liabilities to total assets. | |

| Enterprise Value Multiple | Evm | The ratio of enterprise value to EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). | |

| Firm Size | Size | Natural logarithm of total assets. | |

| Board Size | BoardSize | Total number of board members. | |

| Shareholding Ratio of the Largest Shareholder | Top1 | The proportion of shares held by the largest shareholder relative to the total shares outstanding. | |

| CEO Duality | Dual | Assumes a value of 1 if the CEO concurrently holds the position of chairman of the board, and 0 otherwise. | |

| Number of Independent Directors | Indp | Total number of independent directors on the board. | |

| Tobin’s Q | Tobinq | The ratio of market value to book value. | |

| years listed | Age | The duration of the enterprise’s listing in years. |

| Variable | N | Mean | Std. Dev | Min | Median | Max |

|---|---|---|---|---|---|---|

| GTI | 22,720 | 0.414 | 0.849 | 0.000 | 0.000 | 7.060 |

| GTI_Inv | 22,720 | 0.295 | 0.712 | 0.000 | 0.000 | 6.620 |

| GTI_Uti | 22,720 | 0.226 | 0.594 | 0.000 | 0.000 | 6.080 |

| GP | 22,720 | 0.041 | 0.198 | 0.000 | 0.000 | 1.000 |

| Roa | 22,720 | 0.076 | 0.258 | 0.000 | 0.060 | 22.010 |

| Lev | 22,720 | 0.902 | 0.133 | 0.000 | 0.950 | 1.000 |

| Size | 22,720 | 21.748 | 1.162 | 15.720 | 21.600 | 28.100 |

| Evm | 22,720 | 3.2997 | 0.715 | 0.48 | 3.20 | 7.74 |

| BoardSize | 22,720 | 8.374 | 1.591 | 4.000 | 9.000 | 18.000 |

| Top1 | 22,720 | 35.430 | 15.037 | 3.890 | 33.880 | 89.090 |

| Indp | 22,720 | 3.105 | 0.534 | 1.000 | 3.000 | 8.000 |

| Dual | 22,720 | 4.646 | 7.328 | 0.000 | 0.000 | 63.810 |

| Tobinq | 22,720 | 0.531 | 0.239 | 0.010 | 0.520 | 1.460 |

| Age | 22,720 | 1.608 | 1.060 | 0.000 | 1.610 | 3.470 |

| Variables | GTI | GP | Roa | Lev | Size | Evm | BoardSize | Top1 | Indp | Dual | Tobinq | Age |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GTI | 1.000 | |||||||||||

| GP | 0.054 *** | 1.000 | ||||||||||

| Roa | −0.012 | 0.000 | 1.000 | |||||||||

| Lev | −0.039 *** | −0.042 *** | −0.058 *** | 1.000 | ||||||||

| Size | 0.007 | 0.009 | 0.087 *** | −0.302 *** | 1.000 | |||||||

| Evm | 0.276 *** | 0.144 *** | −0.023 ** | −0.229 *** | 0.086 *** | 1.000 | ||||||

| BoardSize | 0.053 *** | 0.011 | −0.009 | −0.060 *** | 0.034 *** | 0.262 *** | 1.000 | |||||

| Top1 | −0.010 | −0.002 | −0.001 | −0.115 *** | 0.026 *** | 0.169 *** | 0.022 * | 1.000 | ||||

| Indp | 0.049 *** | −0.012 | −0.002 | −0.048 *** | 0.017 * | 0.293 *** | 0.721 *** | 0.078 *** | 1.000 | |||

| Dual | 0.038 *** | 0.037 *** | 0.003 | −0.002 | 0.015 | 0.058 *** | 0.037 *** | 0.171 *** | −0.008 | 1.000 | ||

| Tobinq | 0.066 *** | 0.060 *** | −0.085 *** | −0.299 *** | −0.121 *** | 0.312 *** | 0.113 *** | 0.157 *** | 0.086 *** | 0.011 | 1.000 | |

| Age | 0.020 ** | 0.065 *** | 0.005 | 0.112 *** | 0.020 ** | 0.392 *** | 0.158 *** | −0.054 *** | 0.158 *** | 0.088 *** | −0.040 *** | 1.000 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| GTI | GTI | GTI_Inv | GTI_Inv | GTI_Uti | GTI_Uti | |

| GP | 0.114 *** | 0.107 *** | 0.096 *** | 0.101 *** | 0.068 *** | 0.061 *** |

| (6.059) | (4.694) | (6.018) | (5.167) | (4.595) | (3.463) | |

| Roa | −0.009 | −0.003 | −0.004 | |||

| (−0.416) | (−0.192) | (−0.268) | ||||

| Evm | −0.000 | −0.000 | −0.000 | |||

| (−0.467) | (−0.406) | (−0.196) | ||||

| Lev | 0.000 | −0.000 | 0.000 | |||

| (0.806) | (−1.282) | (1.536) | ||||

| Size | 0.055 *** | 0.049 *** | 0.023 *** | |||

| (6.300) | (6.553) | (3.364) | ||||

| BoardSize | 0.004 | −0.003 | 0.011 *** | |||

| (0.820) | (−0.640) | (2.712) | ||||

| Top1 | −0.001 ** | −0.001 ** | −0.001 | |||

| (−2.225) | (−2.057) | (−1.390) | ||||

| Indp | −0.014 | −0.005 | −0.019 * | |||

| (−1.048) | (−0.435) | (−1.747) | ||||

| Dual | −0.000 | −0.000 | −0.000 | |||

| (−0.132) | (−0.122) | (−0.171) | ||||

| Tobinq | 0.020 | −0.006 | 0.044 ** | |||

| (0.718) | (−0.239) | (2.048) | ||||

| Age | −0.022 * | −0.025 ** | 0.007 | |||

| (−1.909) | (−2.554) | (0.806) | ||||

| Constant | 0.401 *** | −0.701 *** | 0.278 *** | −0.658 *** | 0.236 *** | −0.308 ** |

| (148.867) | (−3.753) | (121.418) | (−4.092) | (111.815) | (−2.111) | |

| Firm | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 22,720 | 22,720 | 22,720 | 22,720 | 22,720 | 22,720 |

| adj. R2 | 0.676 | 0.694 | 0.657 | 0.677 | 0.616 | 0.636 |

| Variables | Matching Status | Mean (Treatment Group) | Mean (Control Group) | Standardized Bias (%) | T-Value | p-Value |

|---|---|---|---|---|---|---|

| Roa | Before | 1.894 | 1.972 | −8.5 | −4.35 | 0.000 |

| After | 1.891 | 1.892 | 0.2 | 0.08 | 0.940 | |

| Evm | Before | 22.459 | 34.76 | −4.9 | −1.96 | 0.050 |

| After | 22.455 | 22.28 | 0.1 | 0.37 | 0.712 | |

| Lev | Before | 1.429 | 1.658 | −1.9 | −0.76 | 0.448 |

| After | 1.422 | 1.399 | 0.2 | 0.58 | 0.564 | |

| Size | Before | 8.782 | 8.559 | 13.0 | 6.85 | 0.000 |

| After | 8.782 | 8.763 | 1.1 | 0.42 | 0.674 | |

| BoardSize | Before | 3.225 | 3.167 | 9.6 | 5.17 | 0.000 |

| After | 3.224 | 3.220 | 0.8 | 0.29 | 0.768 | |

| Top1 | Before | 0.058 | 0.055 | 4.8 | 2.02 | 0.043 |

| After | 0.053 | 0.060 | −1.5 | −0.47 | 0.640 | |

| Indp | Before | 22.475 | 22.238 | 18.9 | 9.51 | 0.000 |

| After | 22.442 | 22.46 | 1.0 | 0.39 | 0.693 | |

| Dual | Before | 6.777 | 6.752 | 2.9 | 1.43 | 0.152 |

| After | 6.733 | 6.778 | −0.3 | −0.11 | 0.910 | |

| Tobinq | Before | −3.807 | −3.794 | −4.4 | −2.29 | 0.022 |

| After | −3.816 | −3.808 | 0.7 | 0.29 | 0.773 | |

| Age | Before | 1.634 | 1.342 | 2.9 | 2.10 | 0.036 |

| After | 1.651 | 1.571 | 0.7 | 0.28 | 0.776 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| GTI | GTI_Inv | GTI_Uti | |

| GP | 0.113 *** | 0.068 * | 0.113 *** |

| (2.824) | (1.912) | (3.767) | |

| Controls | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| Constant | 0.414 *** | 0.296 *** | 0.224 *** |

| (75.077) | (60.574) | (54.167) | |

| N | 7284 | 7284 | 7284 |

| adj. R2 | 0.692 | 0.656 | 0.649 |

| Variables | Alternative Measurement of Dependent Variables | Exclusion of Municipal Samples | Logit Model | Entropy Balancing Method | ||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| GTI | GTI_Inv | GTI_Uti | GTI | GTI | GTI | |

| GP | 0.113 *** | 0.105 *** | 0.084 * | 0.122 *** | 0.404 *** | 0.198 *** |

| (5.368) | (5.842) | (1.648) | (5.170) | (3.383) | (10.729) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −0.350 ** | −0.309 ** | −1.593 *** | −0.973 *** | −17.844 *** | −8.256 *** |

| (−2.014) | (−2.084) | (−2.743) | (−4.790) | (−21.077) | (−29.891) | |

| N | 22,720 | 22,720 | 22,720 | 18,124 | 22,720 | 22,720 |

| adj. R2 | 0.667 | 0.646 | 0.639 | 0.673 | 0.205 | |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| GTI | GTI_Inv | GTI_Uti | |

| L.GP | 0.075 *** | 0.064 *** | 0.045 ** |

| (2.855) | (2.832) | (2.182) | |

| L.Roa | −0.019 | −0.017 | 0.001 |

| (−0.469) | (−0.495) | (0.045) | |

| L.Evm | −0.000 | −0.000 | −0.000 |

| (−0.259) | (−0.365) | (−0.006) | |

| L.Lev | −0.000 | 0.000 | −0.000 |

| (−0.216) | (0.382) | (−1.065) | |

| L.Size | 0.055 *** | 0.052 *** | 0.021 *** |

| (5.880) | (6.419) | (2.868) | |

| L.Boardsize | 0.008 | 0.005 | 0.009 ** |

| (1.563) | (1.062) | (2.205) | |

| L.Top1 | −0.000 | −0.000 | −0.001 |

| (−0.704) | (−0.279) | (−1.145) | |

| L.Indp | −0.018 | −0.018 | −0.013 |

| (−1.254) | (−1.454) | (−1.123) | |

| L.Dual | −0.001 | −0.001 | 0.000 |

| (−0.983) | (−0.742) | (0.198) | |

| L.Tobinq | −0.086 *** | −0.059 ** | −0.043 * |

| (−2.896) | (−2.284) | (−1.841) | |

| L.Age | −0.027 ** | −0.022 ** | −0.005 |

| (−2.176) | (−2.047) | (−0.528) | |

| Constant | −0.664 *** | −0.731 *** | −0.193 |

| (−3.319) | (−4.233) | (−1.224) | |

| N | 22,720 | 22,720 | 22,720 |

| adj. R2 | 0.708 | 0.692 | 0.647 |

| Variable | First Stage | Second Stage |

|---|---|---|

| GP | GTI | |

| GP | 0.787 *** | |

| (2.692) | ||

| AQ | 0.671 *** | |

| (2.991) | ||

| K-P LM Statistic | 12.197 *** | |

| C-D F Statistic | 18.932 | |

| K-P F Statistic | 12.200 | |

| Controls | Yes | Yes |

| Firm | Yes | Yes |

| Year | Yes | Yes |

| N | 17,832 | 17,832 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| GTI | GTI_Inv | GTI_Uti | |

| GP | 0.104 *** | 0.100 *** | 0.061 *** |

| (4.577) | (5.085) | (3.400) | |

| Constant | −0.806 *** | −0.748 *** | −0.362 ** |

| (−4.218) | (−4.546) | (−2.420) | |

| Controls | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| Province | Yes | Yes | Yes |

| City | Yes | Yes | Yes |

| N | 22,662 | 22,662 | 22,662 |

| adj. R2 | 0.695 | 0.677 | 0.636 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| GTI | Dig | GTI | |

| GP | 0.107 *** | 2.542 *** | 0.078 *** |

| (4.694) | (3.544) | (3.452) | |

| Dig | 0.001 ** | ||

| (2.554) | |||

| Controls | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| Constant | −0.701 *** | 328.417 *** | −0.892 *** |

| (−3.753) | (49.640) | (−3.912) | |

| N | 22,720 | 22,720 | 22,720 |

| adj. R2 | 0.694 | 0.983 | 0.714 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| GTI | ESG | GTI | |

| GP | 0.107 *** | 0.168 *** | 0.094 *** |

| (4.694) | (5.580) | (4.110) | |

| ESG | 0.027 *** | ||

| (4.827) | |||

| Controls | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| Constant | −0.701 *** | 0.043 | −0.694 *** |

| (−3.753) | (0.164) | (−3.499) | |

| N | 22,720 | 22,720 | 22,720 |

| adj. R2 | 0.694 | 0.520 | 0.702 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| GTI | SA | GTI | |

| GP | 0.107 *** | −0.012 *** | 0.096 *** |

| (4.694) | (−4.389) | (4.242) | |

| SA | −0.092 *** | ||

| (−15.398) | |||

| Controls | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| Constant | −0.701 *** | −3.374 *** | 2.415 *** |

| (−3.753) | (−150) | (8.796) | |

| N | 22,720 | 22,720 | 22,720 |

| adj. R2 | 0.694 | 0.953 | 0.698 |

| Variables | (1) | (2) |

|---|---|---|

| Heavy-Polluting Industries | Light-Polluting Industries | |

| GP | −0.002 | 0.175 *** |

| (−0.045) | (5.834) | |

| Controls | Yes | Yes |

| Firm | Yes | Yes |

| Year | Yes | Yes |

| Constant | −0.017 | −1.192 *** |

| (−0.047) | (−5.043) | |

| N | 7098 | 15,622 |

| adj. R2 | 0.652 | 0.708 |

| Variables | (1) | (2) |

|---|---|---|

| State-Owned Enterprises | Non-State-Owned Enterprises | |

| GP | 0.040 | 0.140 *** |

| (0.820) | (5.457) | |

| Controls | Yes | Yes |

| Firm | Yes | Yes |

| Year | Yes | Yes |

| Constant | −0.326 | −1.264 *** |

| (−0.822) | (−5.704) | |

| N | 8050 | 14,670 |

| adj. R2 | 0.734 | 0.666 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| Eastern Region | Central Region | Western Region | |

| GP | 0.087 *** | 0.168 *** | 0.105 |

| (3.195) | (3.138) | (1.626) | |

| Controls | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| Constant | −0.841 *** | −1.836 *** | −1.105 ** |

| (−3.684) | (−3.265) | (−2.108) | |

| N | 17,822 | 3145 | 1753 |

| adj. R2 | 0.705 | 0.672 | 0.648 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, Y.; Li, W.; Zeng, L.; Chen, M. Quality or Quantity? The Impact of Voluntary Environmental Regulation on Firm’s Green Technological Innovation: Evidence from Green Factory Certification in China. Sustainability 2025, 17, 2498. https://doi.org/10.3390/su17062498

Chen Y, Li W, Zeng L, Chen M. Quality or Quantity? The Impact of Voluntary Environmental Regulation on Firm’s Green Technological Innovation: Evidence from Green Factory Certification in China. Sustainability. 2025; 17(6):2498. https://doi.org/10.3390/su17062498

Chicago/Turabian StyleChen, Yongjun, Wei Li, Longji Zeng, and Min Chen. 2025. "Quality or Quantity? The Impact of Voluntary Environmental Regulation on Firm’s Green Technological Innovation: Evidence from Green Factory Certification in China" Sustainability 17, no. 6: 2498. https://doi.org/10.3390/su17062498

APA StyleChen, Y., Li, W., Zeng, L., & Chen, M. (2025). Quality or Quantity? The Impact of Voluntary Environmental Regulation on Firm’s Green Technological Innovation: Evidence from Green Factory Certification in China. Sustainability, 17(6), 2498. https://doi.org/10.3390/su17062498