Navigating the Carbon Challenge: Strategic Integration of Hybrid Policies in Green Supply Chains

Abstract

1. Introduction

2. Literature Review

2.1. Research on Carbon Emission Trading Scheme

- (1)

- Efficiency and implications of Carbon Emission Trading Scheme

- (2)

- Mechanism Design of Carbon Markets

2.2. Impact of Carbon Tax Policies

- (1)

- Carbon Tax Emission Reduction Capacity and Impact

- (2)

- Political, Legal, and Policy Coordination Issues of Carbon Tax

2.3. Hybrid Policies in Emission Reduction Strategies

- (1)

- Typical National Practices

- (2)

- Policy Implementation Effects

3. Problem Formulation and Assumptions

3.1. Basic Assumptions

- (1)

- In this paper, the carbon trading price “k” is treated as an exogenous variable, jointly determined by the carbon trading market and governmental decisions [49].

- (2)

- Research and development (R&D) investment for carbon emission reduction is considered a one-time investment, and the emission reduction investment has no impact on the production cost of the product. A higher emission reduction investment coefficient indicates greater difficulty in achieving emission reduction [50].

- (3)

- (4)

- The carbon emissions per unit product are assumed to be constant, and the total carbon emissions of the enterprise form a linear function of production volume [52].

- (5)

- Market product demand is assumed to be a linear function of price [53].

3.2. Model Assumptions

4. Model Construction and Solution

4.1. Carbon Tax Policy Model (Model A)

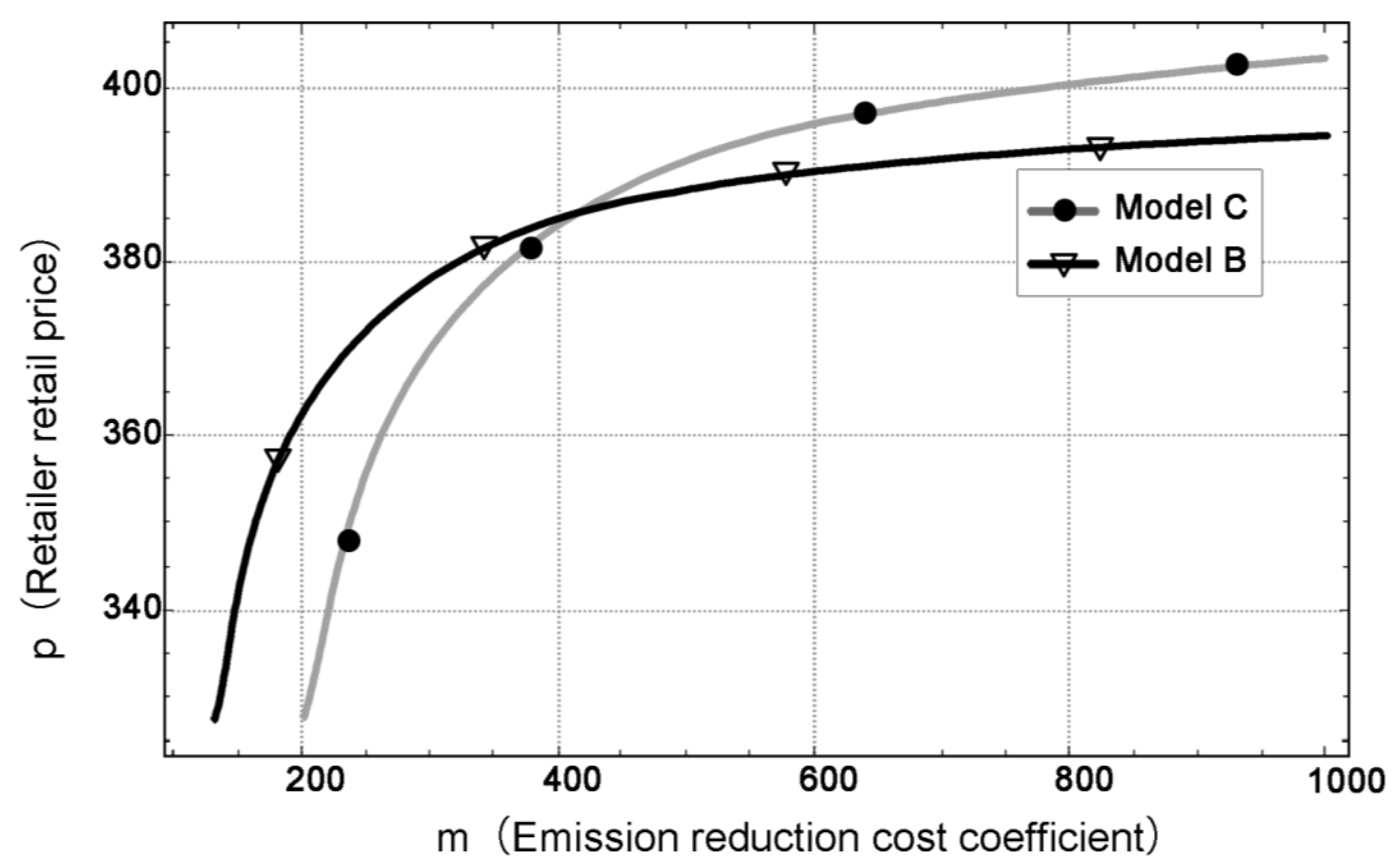

4.2. Carbon Emission Trading Scheme Model (Model B)

4.3. Hybrid Carbon Tax and Carbon Emission Trading Scheme (Model C)

5. Case Study Analysis

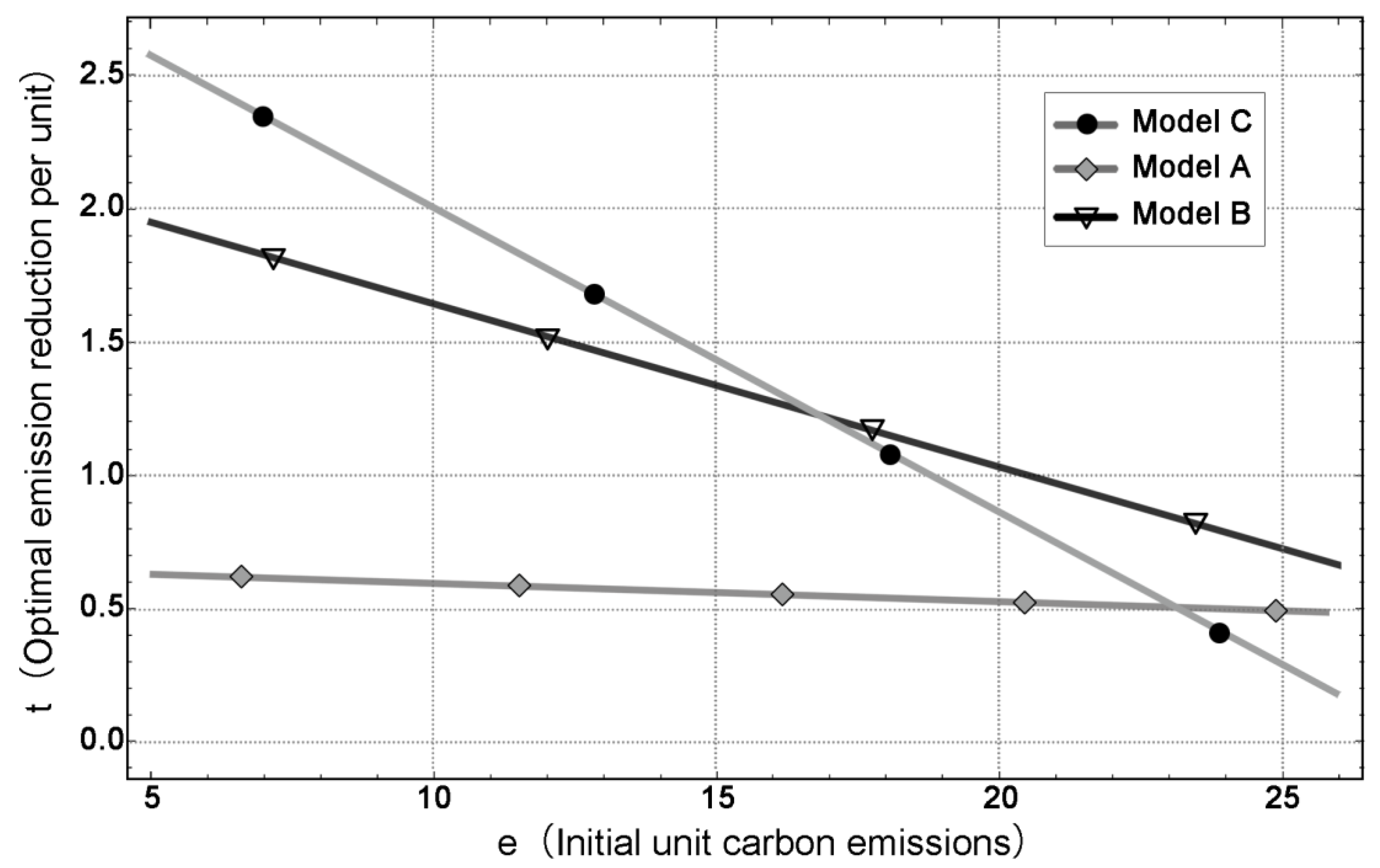

5.1. Impact of Initial Unit Carbon Emissions on Government Policy Selection

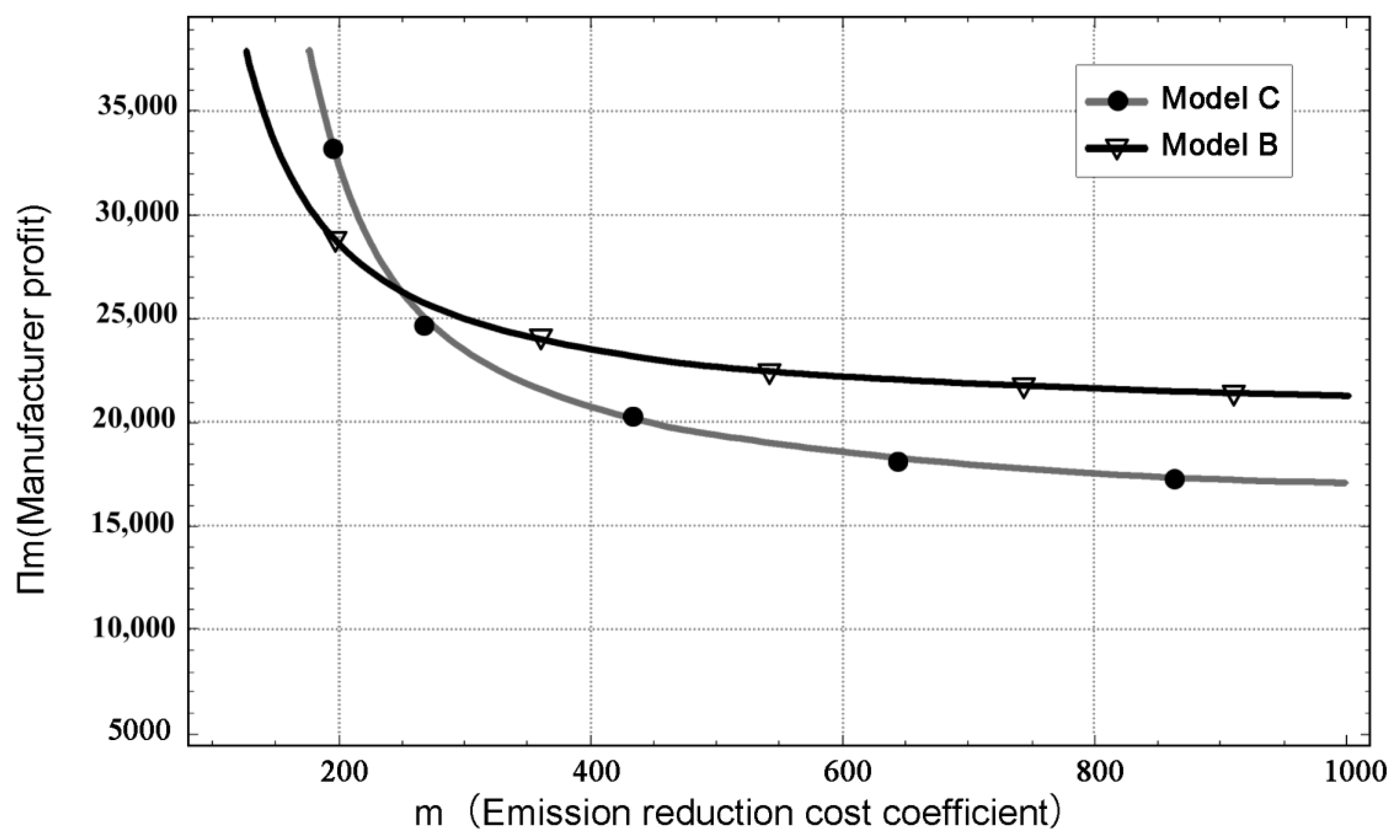

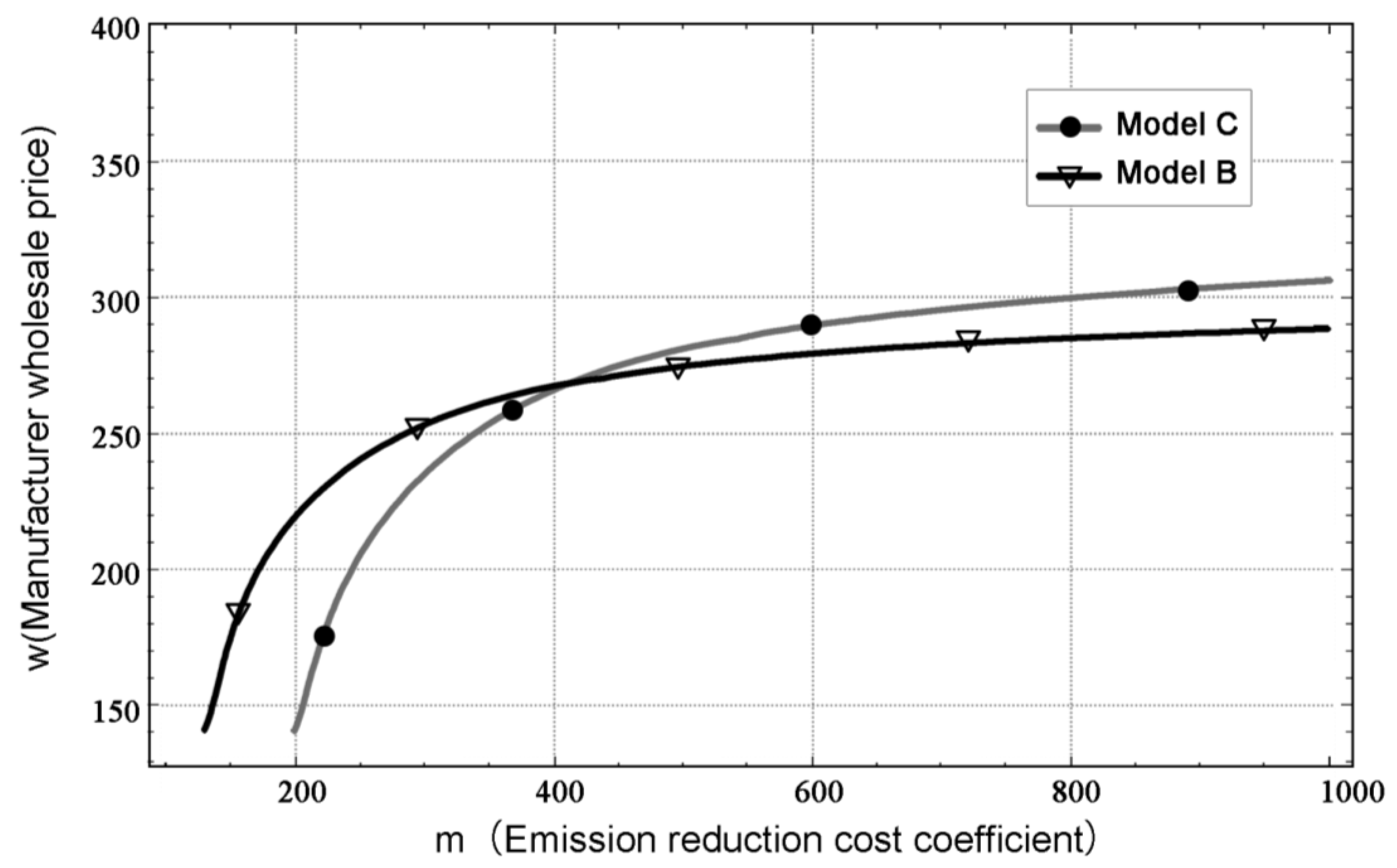

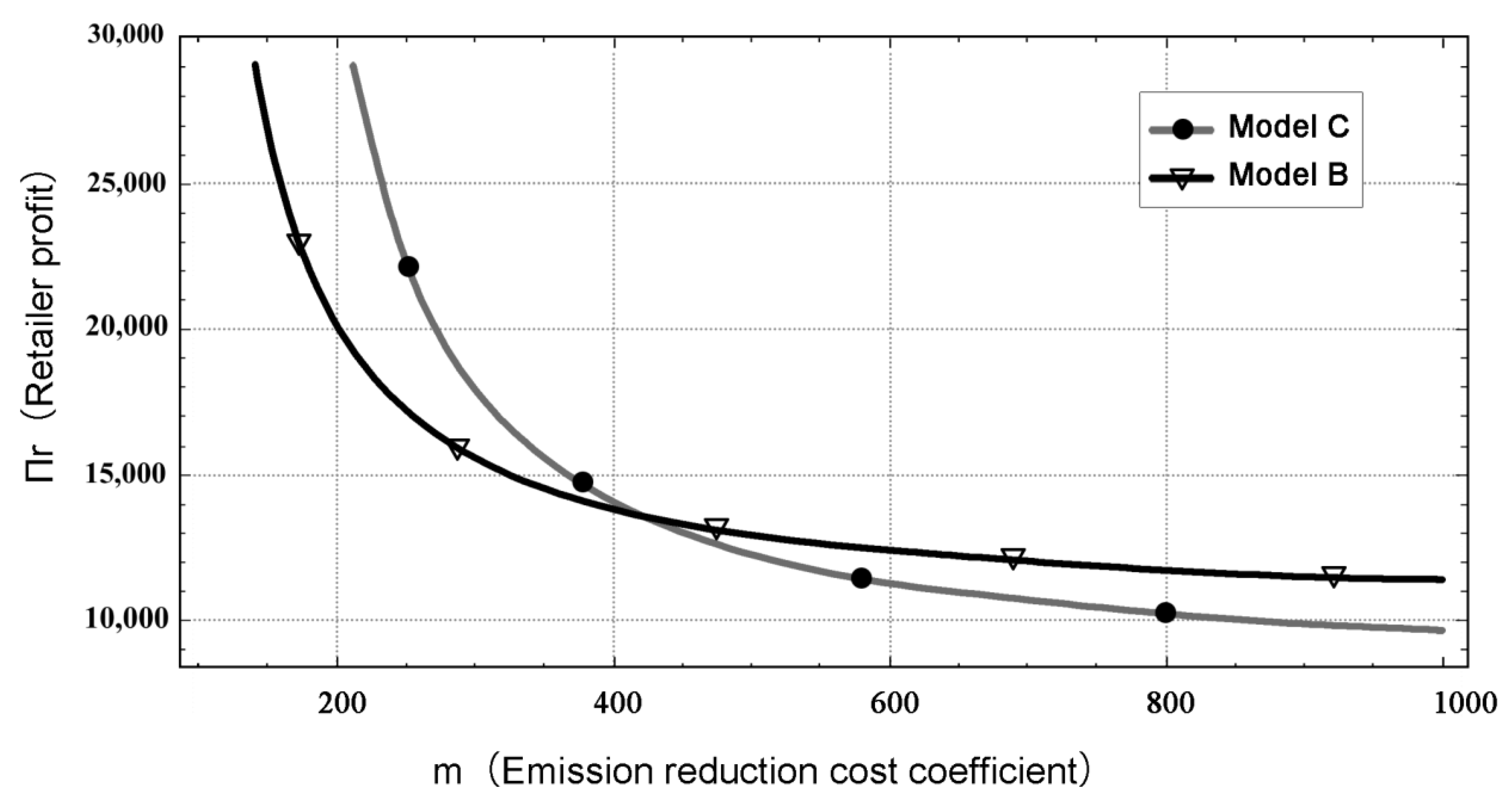

5.2. Comparative Analysis of Supply Chain Policies for Low-Pollution Enterprises

6. Conclusions and Discussion

6.1. Theoretical Contributions

6.2. Managerial Implications

7. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hák, T.; Janoušková, S.; Moldan, B. Sustainable Development Goals: A need for relevant indicators. Ecol. Indic. 2016, 60, 565–573. [Google Scholar] [CrossRef]

- Marron, D.B.; Toder, E.J. Tax policy issues in designing a carbon tax. Am. Econ. Rev. 2014, 104, 563–568. [Google Scholar] [CrossRef]

- Gilbertson, T.; Reyes, O.; Lohmann, L. Carbon Trading: How It Works and Why It Fails; Dag Hammarskjöld Foundation: Uppsala, Sweden, 2009; Volume 7. [Google Scholar]

- Guo, J.; Sun, L.; Yan, L.; Zhou, T. Analysis of The Evolutionary Game of Decisions to Reduce Carbon Emissions by Duopoly Manufacturers under Carbon Tax Policy. Environ. Eng. Manag. J. 2021, 20, 645–658. [Google Scholar]

- Tsai, W.-H. Carbon emission reduction—Carbon tax, carbon trading, and carbon offset. Energies 2020, 13, 6128. [Google Scholar] [CrossRef]

- Huang, Y.; He, P.; Cheng, T.; Xu, S.; Pang, C.; Tang, H. Optimal strategies for carbon emissions policies in competitive closed-loop supply chains: A comparative analysis of carbon tax and cap-and-trade policies. Comput. Ind. Eng. 2024, 195, 110423. [Google Scholar] [CrossRef]

- Shen, L.; Lin, F.; Cheng, T. Low-carbon transition models of high carbon supply chains under the mixed carbon cap-and-trade and carbon tax policy in the carbon neutrality era. Int. J. Environ. Res. Public Health 2022, 19, 11150. [Google Scholar] [CrossRef]

- Qi, S.; Cheng, S. China’s national emissions trading scheme: Integrating cap, coverage and allocation. Clim. Policy 2018, 18, 45–59. [Google Scholar] [CrossRef]

- Tan, X.; Liu, Y.; Cui, J.; Su, B. Assessment of carbon leakage by channels: An approach combining CGE model and decomposition analysis. Energy Econ. 2018, 74, 535–545. [Google Scholar] [CrossRef]

- Zech, K.M.; Schneider, U.A. Carbon leakage and limited efficiency of greenhouse gas taxes on food products. J. Clean. Prod. 2019, 213, 99–103. [Google Scholar] [CrossRef]

- Ranson, M.; Stavins, R.N. Linkage of greenhouse gas emissions trading systems: Learning from experience. Clim. Policy 2016, 16, 284–300. [Google Scholar] [CrossRef]

- Andersson, F.N. International trade and carbon emissions: The role of Chinese institutional and policy reforms. J. Environ. Manag. 2018, 205, 29–39. [Google Scholar] [CrossRef]

- Rose, A.; Wei, D.; Miller, N.; Vandyck, T.; Flachsland, C. Policy brief—Achieving Paris climate agreement pledges: Alternative designs for linking emissions trading systems. Rev. Environ. Econ. Policy 2018, 12, 170–182. [Google Scholar] [CrossRef]

- Kanamura, T. Role of carbon swap trading and energy prices in price correlations and volatilities between carbon markets. Energy Econ. 2016, 54, 204–212. [Google Scholar] [CrossRef]

- Fouré, J.; Guimbard, H.; Monjon, S. Border carbon adjustment and trade retaliation: What would be the cost for the European Union? Energy Econ. 2016, 54, 349–362. [Google Scholar] [CrossRef]

- Sousa, R.; Álvarez-Espinosa, A.C.; Rojas Pardo, N.; Melo Leon, S.F.; Romero Otalora, G.; Calderon Diaz, S.; Vazão, C.; Barata, P.M.; Salcedo, L.R. Emissions trading in the development model of Colombia. Clim. Policy 2020, 20, 1161–1174. [Google Scholar] [CrossRef]

- Nong, D.; Nguyen, T.H.; Wang, C.; Van Khuc, Q. The environmental and economic impact of the emissions trading scheme (ETS) in Vietnam. Energy Policy 2020, 140, 111362. [Google Scholar] [CrossRef]

- Wen, Y.; Hu, P.; Li, J.; Liu, Q.; Shi, L.; Ewing, J.; Ma, Z. Does China’s carbon emissions trading scheme really work? A case study of the hubei pilot. J. Clean. Prod. 2020, 277, 124151. [Google Scholar] [CrossRef]

- Xuan, D.; Ma, X.; Shang, Y. Can China’s policy of carbon emission trading promote carbon emission reduction? J. Clean. Prod. 2020, 270, 122383. [Google Scholar] [CrossRef]

- Gao, Y.; Li, M.; Xue, J.; Liu, Y. Evaluation of effectiveness of China’s carbon emissions trading scheme in carbon mitigation. Energy Econ. 2020, 90, 104872. [Google Scholar] [CrossRef]

- Hu, J.; Pan, X.; Huang, Q. Quantity or quality? The impacts of environmental regulation on firms’ innovation–Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol. Forecast. Soc. Change 2020, 158, 120122. [Google Scholar] [CrossRef]

- Ren, S.; Hu, Y.; Zheng, J.; Wang, Y. Emissions trading and firm innovation: Evidence from a natural experiment in China. Technol. Forecast. Soc. Change 2020, 155, 119989. [Google Scholar] [CrossRef]

- Yang, X.; Jiang, P.; Pan, Y. Does China’s carbon emission trading policy have an employment double dividend and a Porter effect? Energy Policy 2020, 142, 111492. [Google Scholar] [CrossRef]

- Jarke-Neuert, J.; Perino, G. Energy efficiency promotion backfires under cap-and-trade. Resour. Energy Econ. 2020, 62, 101189. [Google Scholar] [CrossRef]

- Guo, J.; Gu, F.; Liu, Y.; Liang, X.; Mo, J.; Fan, Y. Assessing the impact of ETS trading profit on emission abatements based on firm-level transactions. Nat. Commun. 2020, 11, 2078. [Google Scholar] [CrossRef]

- Beck, U.; Kruse-Andersen, P.K. Endogenizing the cap in a cap-and-trade system: Assessing the agreement on EU ETS phase 4. Environ. Resour. Econ. 2020, 77, 781–811. [Google Scholar] [CrossRef]

- Bruninx, K.; Ovaere, M.; Delarue, E. The long-term impact of the market stability reserve on the EU emission trading system. Energy Econ. 2020, 89, 104746. [Google Scholar] [CrossRef]

- Olner, D.; Mitchell, G.; Heppenstall, A.; Pryce, G. The spatial economics of energy justice: Modelling the trade impacts of increased transport costs in a low carbon transition and the implications for UK regional inequality. Energy Policy 2020, 140, 111378. [Google Scholar] [CrossRef]

- Zhu, L.; Cui, L.; Schleich, J. Designing a globally acceptable carbon tax scheme to address competitiveness and leakage concerns. Clim. Change Econ. 2020, 11, 2050008. [Google Scholar] [CrossRef]

- Labandeira, X.; Labeaga, J. Combining input-output analysis and micro-simulation to assess the effects of carbon taxation on Spanish households. Fisc. Stud. 1999, 20, 305–320. [Google Scholar] [CrossRef]

- Caillavet, F.; Fadhuile, A.; Nichèle, V. Assessing the distributional effects of carbon taxes on food: Inequalities and nutritional insights in France. Ecol. Econ. 2019, 163, 20–31. [Google Scholar] [CrossRef]

- Runst, P.; Thonipara, A. Dosis facit effectum why the size of the carbon tax matters: Evidence from the Swedish residential sector. Energy Econ. 2020, 91, 104898. [Google Scholar] [CrossRef]

- Adetutu, M.O.; Odusanya, K.A.; Weyman-Jones, T.G. Carbon tax and energy intensity: Assessing the channels of impact using UK microdata. Energy J. 2020, 41, 143–166. [Google Scholar] [CrossRef]

- Marz, W.; Pfeiffer, J. Petrodollar recycling, oil monopoly, and carbon taxes. J. Environ. Econ. Manag. 2020, 100, 102263. [Google Scholar] [CrossRef]

- McLaughlin, C.; Elamer, A.A.; Glen, T.; AlHares, A.; Gaber, H.R. Accounting society’s acceptability of carbon taxes: Expectations and reality. Energy Policy 2019, 131, 302–311. [Google Scholar] [CrossRef]

- Umit, R.; Schaffer, L.M. Attitudes towards carbon taxes across Europe: The role of perceived uncertainty and self-interest. Energy Policy 2020, 140, 111385. [Google Scholar] [CrossRef]

- Kaushal, K.R.; Rosendahl, K.E. Taxing consumption to mitigate carbon leakage. Environ. Resour. Econ. 2020, 75, 151–181. [Google Scholar] [CrossRef]

- Brown, M.A.; Li, Y.; Soni, A. Are all jobs created equal? Regional employment impacts of a US carbon tax. Appl. Energy 2020, 262, 114354. [Google Scholar] [CrossRef]

- Reaños, M.A.T. Initial incidence of carbon taxes and environmental liability. A vehicle ownership approach. Energy Policy 2020, 143, 111579. [Google Scholar] [CrossRef]

- Xin-gang, Z.; Ling, W.; Ying, Z. How to achieve incentive regulation under renewable portfolio standards and carbon tax policy? A China’s power market perspective. Energy Policy 2020, 143, 111576. [Google Scholar] [CrossRef]

- Li, X.; Yao, X. Can energy supply-side and demand-side policies for energy saving and emission reduction be synergistic?—A simulated study on China’s coal capacity cut and carbon tax. Energy Policy 2020, 138, 111232. [Google Scholar] [CrossRef]

- Ghazouani, A.; Xia, W.; Ben Jebli, M.; Shahzad, U. Exploring the role of carbon taxation policies on CO2 emissions: Contextual evidence from tax implementation and non-implementation European Countries. Sustainability 2020, 12, 8680. [Google Scholar] [CrossRef]

- Pocklington, D. The UK Climate Change Levy–Innovative, but Flawed. Eur. Energy Environ. Law Rev. 2001, 10, 220–227. [Google Scholar] [CrossRef]

- Bruvoll, A.; Larsen, B.M. Greenhouse gas emissions in Norway: Do carbon taxes work? In Environmental Taxation in Practice; Routledge: London, UK, 2017; pp. 545–557. [Google Scholar]

- Dresner, S.; Jackson, T.; Gilbert, N. History and social responses to environmental tax reform in the United Kingdom. Energy Policy 2006, 34, 930–939. [Google Scholar] [CrossRef]

- Tamura, H.; Teraoka, R. Assessing hybrid policy of carbon tax and emissions trading under uncertainty for preserving global environment. IFAC Proc. Vol. 2011, 44, 12916–12921. [Google Scholar] [CrossRef]

- Jeffrey, C.; Perkins, J.D. The association between energy taxation, participation in an emissions trading system, and the intensity of carbon dioxide emissions in the European Union. Int. J. Account. 2015, 50, 397–417. [Google Scholar] [CrossRef]

- Kiss, T.; Popovics, S. Evaluation on the effectiveness of energy policies–Evidence from the carbon reductions in 25 countries. Renew. Sustain. Energy Rev. 2021, 149, 111348. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. What are the main factors affecting carbon price in Emission Trading Scheme? A case study in China. Sci. Total Environ. 2019, 654, 525–534. [Google Scholar] [CrossRef] [PubMed]

- Ji, L.; Huang, G.; Niu, D.; Cai, Y.; Yin, J. A Stochastic Optimization Model for Carbon-Emission Reduction Investment and Sustainable Energy Planning under Cost-Risk Control. J. Environ. Inform. 2020, 36, 107–118. [Google Scholar] [CrossRef]

- Yu, F.; Han, F.; Cui, Z. Reducing carbon emissions through industrial symbiosis: A case study of a large enterprise group in China. J. Clean. Prod. 2015, 103, 811–818. [Google Scholar] [CrossRef]

- Xu, X.; Zhang, W.; He, P.; Xu, X. Production and pricing problems in make-to-order supply chain with cap-and-trade regulation. Omega 2017, 66, 248–257. [Google Scholar] [CrossRef]

- Shafer, W.; Sonnenschein, H. Market demand and excess demand functions. Handb. Math. Econ. 1982, 2, 671–693. [Google Scholar]

- Li, B.; Zhu, M.; Jiang, Y.; Li, Z. Pricing policies of a competitive dual-channel green supply chain. J. Clean. Prod. 2016, 112, 2029–2042. [Google Scholar] [CrossRef]

- Mesagan, E.P.; Isola, W.A.; Ajide, K.B. The capital investment channel of environmental improvement: Evidence from BRICS. Environ. Dev. Sustain. 2019, 21, 1561–1582. [Google Scholar] [CrossRef]

| Non-Decision Variables | Meanings |

|---|---|

| D | Market demand |

| Q | Potential market demand for green products |

| β | Consumer price sensitivity coefficient |

| Consumer sensitivity coefficient to the carbon emission reduction rate | |

| r | Tax on unit carbon emissions |

| k | Unit carbon trading price |

| c | Unit production cost of a green product |

| m | Emission reduction cost coefficient |

| g | Initial free carbon quota for the green manufacturer |

| e | Unit carbon emissions when the manufacturer does not take emission reduction measures |

| Decision Variables | Meanings |

| P | Retailer’s selling price, as determined by the retailer |

| w | Manufacturer’s wholesale price, as determined by the manufacturer |

| t | Manufacturer’s carbon emission reduction rate, as determined by the manufacturer |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tang, R.; Yu, D.; Tan, Y. Navigating the Carbon Challenge: Strategic Integration of Hybrid Policies in Green Supply Chains. Sustainability 2025, 17, 2390. https://doi.org/10.3390/su17062390

Tang R, Yu D, Tan Y. Navigating the Carbon Challenge: Strategic Integration of Hybrid Policies in Green Supply Chains. Sustainability. 2025; 17(6):2390. https://doi.org/10.3390/su17062390

Chicago/Turabian StyleTang, Rui, Dingyao Yu, and Yongbo Tan. 2025. "Navigating the Carbon Challenge: Strategic Integration of Hybrid Policies in Green Supply Chains" Sustainability 17, no. 6: 2390. https://doi.org/10.3390/su17062390

APA StyleTang, R., Yu, D., & Tan, Y. (2025). Navigating the Carbon Challenge: Strategic Integration of Hybrid Policies in Green Supply Chains. Sustainability, 17(6), 2390. https://doi.org/10.3390/su17062390