Optimizing Supply Chain Financial Strategies Based on Data Elements in the China’s Retail Industry: Towards Sustainable Development

Abstract

1. Introduction

2. Problem Formulation

2.1. Problem Description

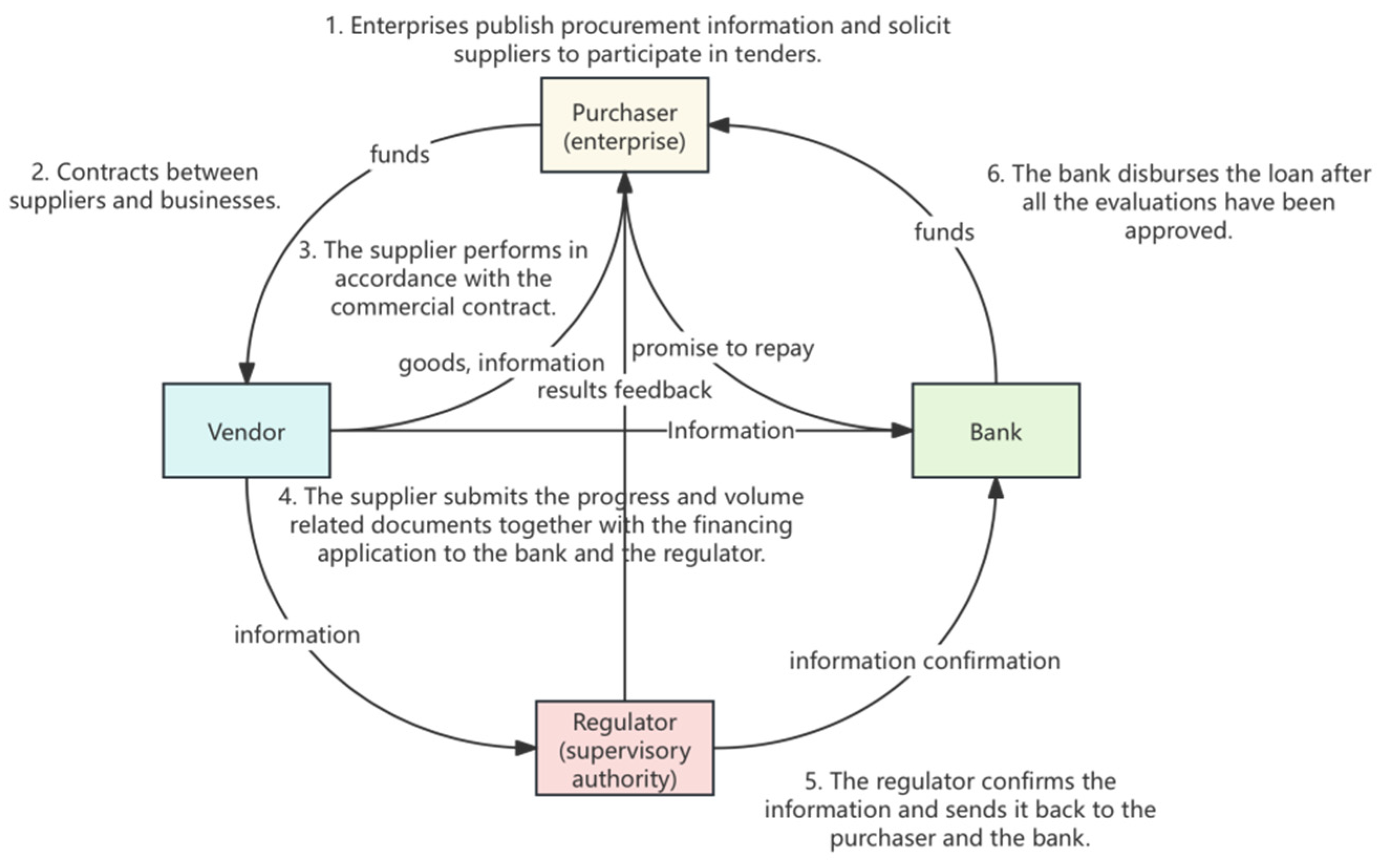

- Core Enterprises Announce Procurement Information: Upon project requirement determination, core enterprises disseminate comprehensive procurement details, including retail plans, necessary equipment and materials, and project timelines. A bidding date is set, allowing supply chain enterprises to understand their needs and prepare their bids. Enterprises submit detailed proposals based on the information published by the core enterprise, encompassing company profiles, experience with similar projects, implementation plans, cost and pricing quotations, and operational information. During this phase, regulatory bodies verify the authenticity of the information, conducting credit checks, performance reviews, and pricing audits on the bidding enterprises. Only enterprises confirmed to be authentic and compliant by the regulatory bodies proceed to the next bidding stage.

- Contract Signing: After bid evaluation, core enterprises select the supply chain enterprise best meeting the project needs and sign a contract detailing project requirements, schedules, payment methods, and responsibilities.

- Supplier Contract Fulfillment: Suppliers commence the project plan implementation as per contract stipulations, submitting retail progress and product lists to the regulatory body at specific milestones.

- Supplier Progress Feedback: Suppliers submit progress and workload-related vouchers along with financing applications to banks and regulatory bodies. Upon receipt and verification of this information, the regulatory body provides feedback to the core enterprise.

- Regulatory Body Information Submission to Banks: Post-verification, the regulatory body forwards performance reports and audit findings to banks, encompassing compliance checks, project progress, and financial details.

- Bank and Core Enterprise Disbursement: Upon confirmation of the information, the bank verifies and disburses funds directly to suppliers in accordance with the contract and performance. Suppliers then deliver goods as per the contract and project progress. Upon project completion, the core enterprise makes the final payment to the bank, concluding the cooperation process.

2.2. Meaning of Data-Element Warranties

2.3. Problem Solving Methods (Stackelberg Game)

3. Establishment of Supply Chain Financing Model for Retail Industry Based on Data Elements and Stackelberg Game

3.1. Descriptions and Notations

3.2. Model Assumptions

- Information symmetry: All supply chain participants have access to the same data elements. This assumption of information symmetry is critical for the effective implementation of data-driven financing strategies and the mitigation of potential risks arising from information asymmetry.

- Rational decision-making: Parties involved aim to maximize their respective profits. This assumption allows for the application of game-theoretic approaches, such as the Stackelberg game, to model and analyze the strategic interactions among the participants.

3.3. Modelling

3.3.1. Traditional Supply Chain Financing Model (T-Model)

3.3.2. Data-Element Secured Financing Model (Model G)

- Basic model

- 2.

- Consideration of risk assessment value and risk appetite

- 3.

- Considering the supplier delivery level

- 4.

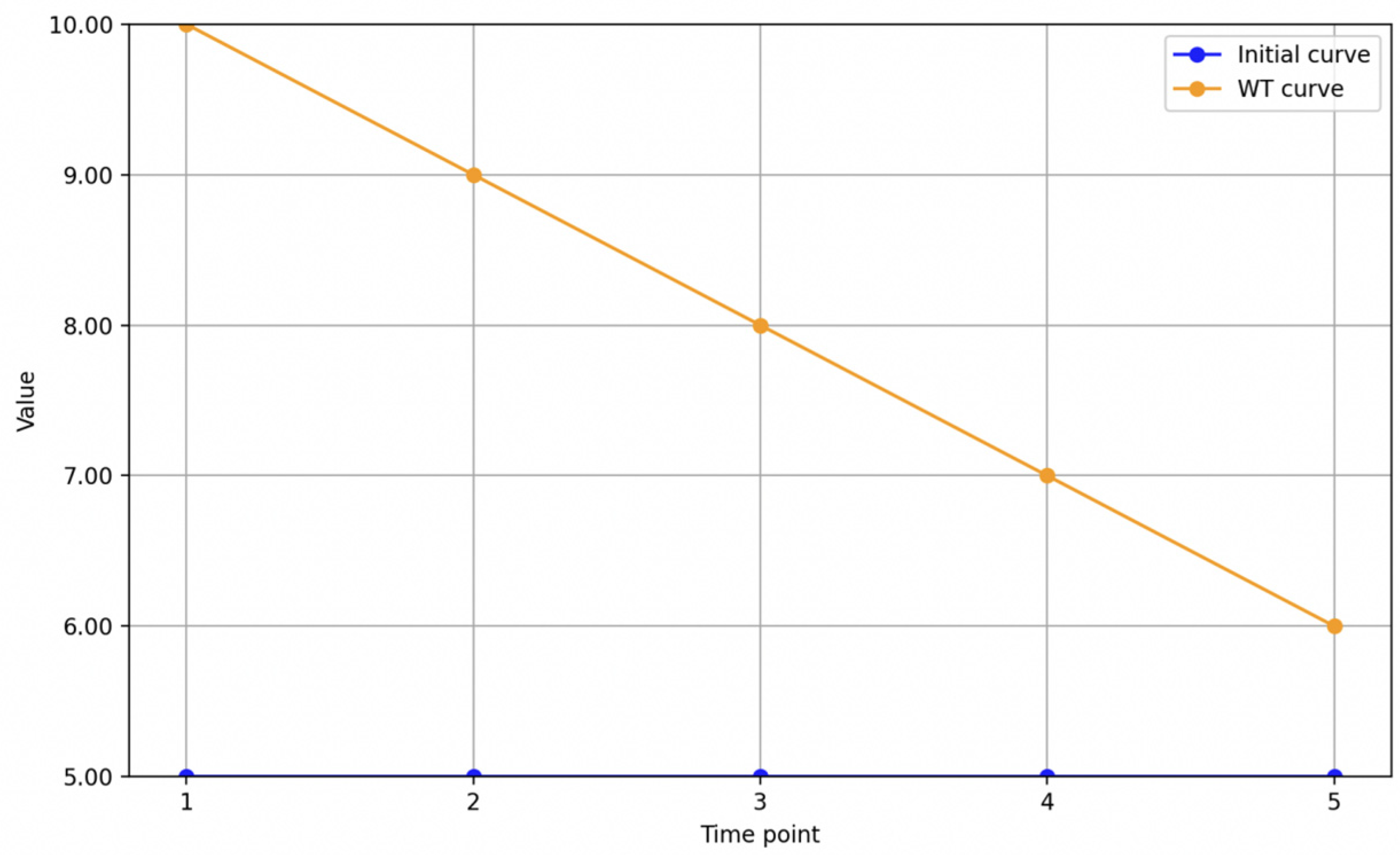

- A multi-stage financing model considering the transience of the supply chain

4. Numerical Analysis of Retail Industry Supply Chain Financing Model Based on Data Elements and Stackelberg Game

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Cai, X.; Chen, J.; Xiao, Y.; Xu, X. Fresh-product supply chain management with logistics outsourcing. Omega 2013, 41, 752–765. [Google Scholar] [CrossRef]

- Busch, L.; Gray, D. Supply chain finance: The next big opportunity. Supply Chain. Manag. Rev. 2014, 12, 57–60. [Google Scholar]

- Gullien, G.; Badell, M.; Puigjaner, L. A holistic frame work for short-term supply chain management integrating corporate production financial planning. Int. J. Prod. Econ. 2007, 106, 288–306. [Google Scholar] [CrossRef]

- Gupta, D.; Wang, L. A stochastic inventory model with trade credit. Manuf. Serv. Oper. Manag. 2009, 11, 4–18. [Google Scholar] [CrossRef]

- Hofmann, E.; Zumsteg, S. Win-win and No-win situations in supply chain finance; The case of accounts receivable programs. Supply Chain. Forum Int. J. 2015, 16, 30–50. [Google Scholar] [CrossRef]

- Wu, C.; Zhao, Q.; Xi, M. A retailer-supplier supply chain model with trade credit default risk in a supplier-Stackelberg game. Comput. Ind. Eng. 2017, 112, 568–575. [Google Scholar] [CrossRef]

- Yang, A.S.; Birge, R.J. Trade credit, risk sharing, and inventory financing portfolios. Manag. Sci. 2017, 64, 3667–3689. [Google Scholar] [CrossRef]

- Raghavan NR, S.; Mishra, V.K. Short-term financing in a cash-constrained supply chain. Int. J. Prod. Econ. 2011, 134, 407–412. [Google Scholar] [CrossRef]

- Chen, Y.; Weiguo, F.; Baofeng, Z. Financing a risk-averse manufacturer in a pull contract: Early payment versus retailer investment. Int. Trans. Oper. Res. 2020, 28, 2548–2580. [Google Scholar]

- Huang, S.; Fan, Z.; Wang, X. The impact of transportation fee on the performance of capital-constrained supply chain under 3PL financing service. Comput. Ind. Eng. 2019, 130, 358–369. [Google Scholar] [CrossRef]

- Zhao, J.; Duan, Y. The coordination mechanism of supply chain finance based on tripartite game theory. J. Shanghai Jiaotong Univ. (Sci.) 2016, 21, 370–373. [Google Scholar] [CrossRef]

- Zeng, J.; Glaister, K.W. Value creation from big data: Looking inside the black box. Strateg. Organ. 2017, 16, 105–140. [Google Scholar] [CrossRef]

- Yan, N.; Sun, B.; Zhang, H.; Liu, C. A partial credit guarantee contract in a capital-constrained supply chain: Financing equilibrium and coordinating strategy. Int. J. Prod. Econ. 2016, 173, 122–133. [Google Scholar] [CrossRef]

- Zong, S.; Huang, N. Optimal financing decision with financial constraints for a manufacturer in a low-carbon supply chain. Environ. Sci. Pollut. Res. 2023, 30, 86998–87015. [Google Scholar] [CrossRef]

- Qiangqiang, W.; Bin, Z. Financing and equilibrium decision of capital constrained supply chain under asymmetric information. Oper. Res. Manag. Sci. 2024, 33, 23. [Google Scholar]

- Blackman, I.D.; Holland, C.P.; Westcott, T. Motorola’s global financial supply chain strategy. Supply Chain. Manag. Int. J. 2013, 18, 132–147. [Google Scholar] [CrossRef]

- Dada, M.; Hu, Q. Financing newsvendor inventory. Oper. Res. Lett. 2008, 36, 569–573. [Google Scholar] [CrossRef]

- Jiang, L.; Hao, Z. Alleviating supplier’s capital restriction by two-order arrangement. Oper. Res. Lett. 2014, 42, 444–449. [Google Scholar] [CrossRef]

- Leora, K. The Role of “Reverse Factoring” in Supplier Financing of Small and Medium Sized Enterprises; World Bank: Washington, DC, USA, 2004; pp. 102–103. [Google Scholar]

- Zhen, X.; Shi, D.; Li, Y.; Zhang, C. Manufacturer’s financing strategy in a dual-channel supply chain: Third-party platform, bank, and retailer credit financing. Transp. Res. Part E 2020, 133, 101820. [Google Scholar] [CrossRef]

- Wang, F.; Yang, X.; Zhuo, X.; Xiong, M. Joint logistics and financial services by a 3PL firm: Effects of risk preference and demand volatility. Transp. Res. Part E 2019, 130, 312–328. [Google Scholar] [CrossRef]

- Tahi Hamonangan Tambunan, T. Development of small and medium enterprises in a developing country: The Indonesian case. J. Enterprising Communities People Places Glob. Econ. 2011, 5, 68–82. [Google Scholar]

- Martins, A.; Branco, M.C.; Melo, P.N.; Machado, C. Sustainability in small and medium-sized enterprises: A systematic literature review and future research agenda. Sustainability 2022, 14, 6493. [Google Scholar] [CrossRef]

- Sun, K.; Ooi, K.B.; Wei-Han Tan, G.; Lee, V.H. Small and medium-sized enterprises’ path to sustainable supply chains: Exploring the role of supply chain finance and risk management. Supply Chain. Manag. Int. J. 2024, 30, 1–18. [Google Scholar] [CrossRef]

- Bancilhon, C.; Karge, C.; Norton, T. Win-Win-Win: The Sustainable Supply Chain Finance Opportunity; Report BSR: Paris, France, 2018. [Google Scholar]

- Guo, J.; Jia, F.; Yan, F.; Chen, L. E-commerce supply chain finance for SMEs: The role of green innovation. Int. J. Logist. Res. Appl. 2024, 27, 1596–1615. [Google Scholar] [CrossRef]

- Lu, Q.; Wang, Y.; Yang, Y. How SMEs’ supply chain specific investment impacts supply chain financing performance: Insights from signaling theory. J. Bus. Ind. Mark. 2025, 40, 495–510. [Google Scholar] [CrossRef]

| Notation | Description |

|---|---|

| Sold price of goods | |

| Wholesale prices offered by suppliers to purchasers | |

| Production cost per unit of product | |

| Residual value per unit of product | |

| Quantity purchased | |

| Purchaser’s initial funding | |

| Contractor out-of-stock losses due to material shortages | |

| Average material demand | |

| Expected material usage by core businesses | |

| Product recovery rate | |

| Bank loan interest rate | |

| Standard Bank Loan Interest Rate | |

| Profit | |

| Composite score of data elements | |

| The project material demand, whose probability density function satisfies , the probability distribution function satisfies | |

| Supply chain financing risks | |

| Risk attitudes of decision-makers in the supply chain () | |

| Current workload and progress | |

| Utility function | |

| e | Supplier delivery level |

| h | Supplier effort cost factor |

| t | Decision phase |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, H.; Jiang, W.; Mu, J.; Cheng, X. Optimizing Supply Chain Financial Strategies Based on Data Elements in the China’s Retail Industry: Towards Sustainable Development. Sustainability 2025, 17, 2207. https://doi.org/10.3390/su17052207

Zhang H, Jiang W, Mu J, Cheng X. Optimizing Supply Chain Financial Strategies Based on Data Elements in the China’s Retail Industry: Towards Sustainable Development. Sustainability. 2025; 17(5):2207. https://doi.org/10.3390/su17052207

Chicago/Turabian StyleZhang, Hong, Weiwei Jiang, Jianbin Mu, and Xirong Cheng. 2025. "Optimizing Supply Chain Financial Strategies Based on Data Elements in the China’s Retail Industry: Towards Sustainable Development" Sustainability 17, no. 5: 2207. https://doi.org/10.3390/su17052207

APA StyleZhang, H., Jiang, W., Mu, J., & Cheng, X. (2025). Optimizing Supply Chain Financial Strategies Based on Data Elements in the China’s Retail Industry: Towards Sustainable Development. Sustainability, 17(5), 2207. https://doi.org/10.3390/su17052207