4.1. 2SLS Analysis Results

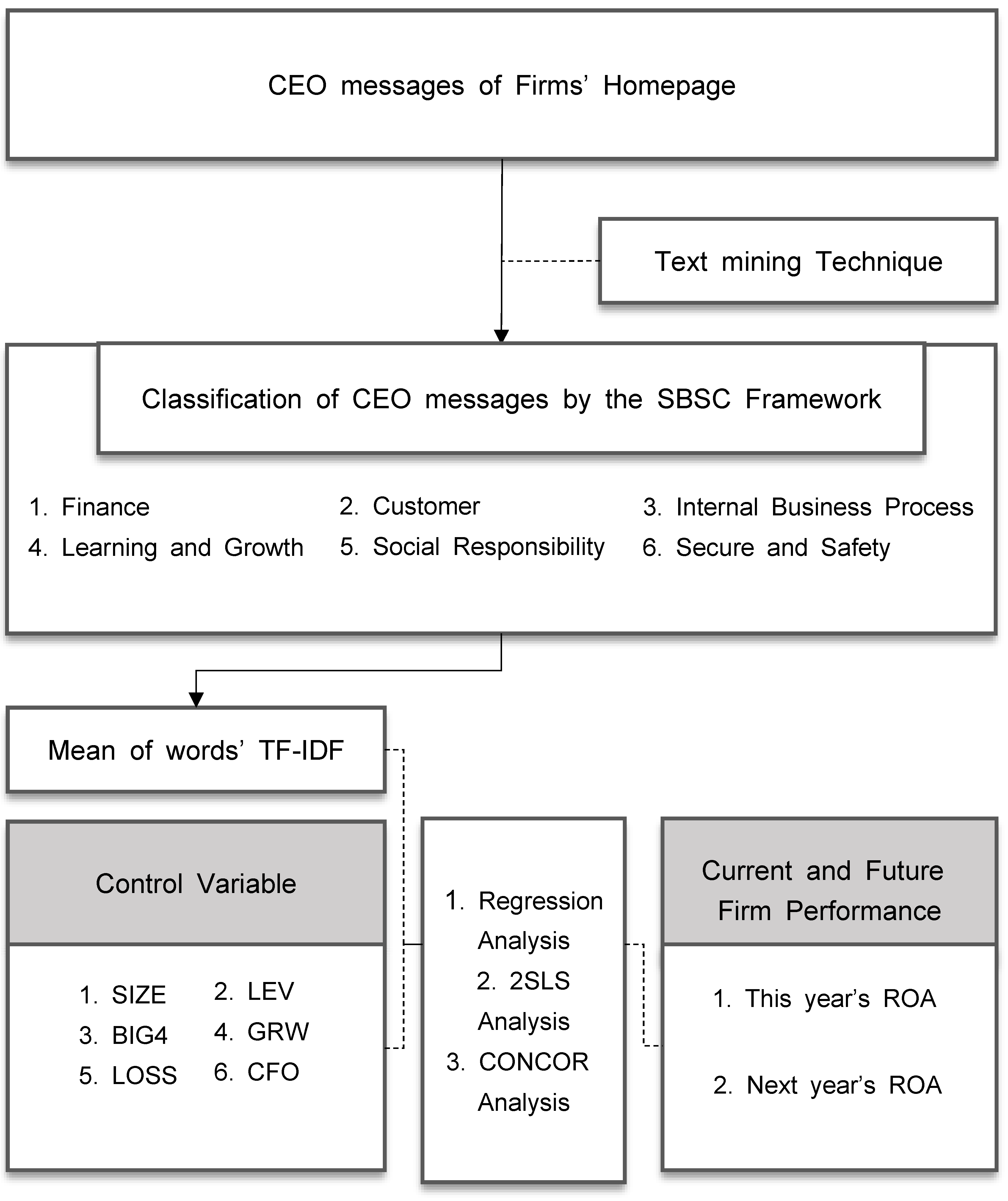

This paper presents the results of the study on how the factors strategically emphasized by companies in the hotel industry affect current and future corporate performance, respectively, through the website CEO message. The research model used the five elements of the SSC framework, finance, customers, internal business processes, learning and growth, and social responsibility, as independent variables. In addition, the secure and safety elements, which were classified separately among the internal business process elements, were also set as independent variables. The dependent variables in the research model are current and future corporate performance.

Table 5 below is the result of a study verifying Hypothesis 1 and presents the results of an empirical analysis of how companies in the hotel industry affect current and future corporate performance when strategically emphasizing Finance factors. As a result of the 2SLS analysis, when the dependent variable is ROA

t, the regression coefficient β

1 of Finance, an independent variable, was 5.748, and the t-value was 1.264, which was not statistically significant. However, when the dependent variable is ROA

t+1, the regression coefficient β

1 of Finance, an independent variable, was 8.163, and the t-value was 2.356, indicating statistically significant analysis results at the 5% level.

The results presented in

Table 5 provide empirical evidence supporting the positive correlation between financial emphasis and future corporate performance. Specifically, the coefficient for the Finance variable in the second-stage regression for ROA

t+1 is 8.163, with a statistically significant t-value of 2.356 (

p < 0.05). This finding suggests that strategically prioritizing financial factors has a meaningful and positive impact on future performance, aligning with the hypothesis that financial emphasis contributes to long-term corporate success.

Furthermore, a comparison of the coefficients for ROAt and ROAt+1 further reinforces this observation. While the Finance coefficient for ROAt is 5.748 and statistically insignificant, the coefficient for ROAt+1 is 8.163 and statistically significant. This progression indicates that the effect of financial strategies strengthens over time, demonstrating an increasing influence on corporate performance as companies continue to implement financial initiatives.

To enhance the clarity of these findings, a notation or remark may be added to

Table 5 to explicitly highlight the positive correlation and the increasing impact of financial emphasis on future performance. Additionally, a statement will be incorporated into the main text to emphasize the observed trend, ensuring that the results are clearly interpreted within the broader context of the study.

These results imply that if a company in the hotel industry strategically emphasizes financial factors, there is no significant impact on current corporate performance. Still, there is a positive effect on improving future corporate performance. In other words, hotel companies that emphasize their financial perspective must pay much attention to financial performance while operating hotels. However, it is not expected that it would have been easy for hotel companies that suffered during COVID-19 to recover their financial conditions and improve their financial performance quickly. Nevertheless, hotel companies that emphasize financial perspectives will have improved their financial performance in the long run by continuously striving to increase profits and reduce costs.

Therefore, hotel companies that emphasize financial perspectives are inferred to have improved their future corporate performance in the long run, although their current corporate performance did not improve immediately.

We acknowledge that the financial perspective hypothesis presented in this study may appear contradictory to the observed results during the COVID-19 period, where most companies reported losses and negative sales growth. However, the hypothesis was framed to analyze whether emphasizing a financial perspective could serve as a foundational factor in predicting future corporate performance, even under adverse conditions. The significant impact observed during the COVID-19 period highlights the resilience and strategic importance of the financial perspective in mitigating crises.

That said, we agree that further analysis involving samples that distinguish between companies severely affected by COVID-19 and those less impacted could provide deeper insights. Such an approach would allow for a clearer understanding of the factors contributing to performance development under varying conditions and their implications for future corporate performance. This limitation is acknowledged in the study, and future research is recommended to refine this analysis with more targeted sample selection.

Table 6 shows the result of a study verifying Hypothesis 2 and presents the results of an empirical analysis of how companies in the hotel industry affect current and future corporate performance when strategically emphasizing Customer factors. As a result of the 2SLS analysis, as the dependent variable is ROA

t, the regression coefficient β

1 of Customer, an independent variable, was 2.461, and the t-value was 1.597, which was not statistically significant. Yet, as the dependent variable is ROA

t+1, the regression coefficient β

1 of Customer, an independent variable, was 2.795, and the t-value was 2.376, indicating statistically significant analysis results at the 5% level.

The results presented in

Table 6 provide empirical evidence supporting the positive correlation between customer emphasis and future corporate performance. Specifically, the coefficient for the Customer variable in the second-stage regression for ROA

t+1 is 2.795, with a statistically significant t-value of 2.376 (

p < 0.05). This finding suggests that a strategic focus on customer-related factors positively influences future corporate performance, aligning with the hypothesis that customer-centric strategies contribute to long-term business success.

Moreover, comparing the coefficients for ROAt and ROAt+1 highlights the increasing impact of customer emphasis over time. While the Customer coefficient for ROAt is 2.461 and statistically insignificant, the coefficient for ROAt+1 increases to 2.795 and becomes statistically significant. This progression indicates that customer-focused strategies may require time to manifest their full impact on financial performance, further reinforcing the long-term benefits of prioritizing customer engagement and satisfaction.

To enhance the clarity of these findings, we will consider adding a notation or remark to

Table 6 to explicitly highlight the positive correlation and the growing influence of customer emphasis on future performance. Additionally, a statement will be incorporated into the main text to emphasize this observed trend, ensuring that the results are clearly interpreted within the broader context of the study.

These results mean that if a company in the hotel industry strategically emphasizes customer elements, there is no significant effect on current firm performance but a positive impact on increasing future firm performance. Namely, hotel companies that value customer perspective will focus on customer satisfaction and make company-wide efforts. In particular, the hotel industry is a C2C industry that directly contacts customers due to its nature, so it will make relatively more effort for customers than other industries.

Hotel companies that value customer perspective will not be able to show good corporate performance in the short term due to improved customer service quality, the cost of continuous customer management, and facility replacement for customer satisfaction. However, this continuous effort for customers helps attract customers in the long run because it is promoted to potential customers in terms of marketing, which can lead to positive results for future corporate performance in the long run.

Table 7 is the result of a study verifying Hypothesis 3 and shows the results of an empirical analysis of how companies in the hotel industry affect current and future corporate performance when strategically emphasizing Internal Business Process factors. As a result of the 2SLS analysis, when the dependent variable is ROA

t, the regression coefficient β

1 of Internal Business Process, an independent variable, was 1.507, and the t-value was 0.640, which was not statistically significant. Also, when the dependent variable is ROA

t+1, the regression coefficient β

1 of Internal Business Process, an independent variable, was 0.819, and the t-value was 0.452, which was not statistically significant.

The empirical results presented in

Table 7 provide insight into the relationship between an emphasis on Internal Business Process and corporate performance. The coefficient for the Internal Business Process variable in the second-stage regression for ROA

t+1 is 0.819, but its t-value (0.452) is statistically insignificant. This suggests that an emphasis on internal business processes does not have a strong or statistically significant direct impact on future corporate performance.

However, in the second-stage regression for ROAt, the coefficient for Internal Business Process is 1.507, with a t-value of 0.640, also indicating an insignificant effect on current corporate performance. This implies that, unlike financial and customer-related strategies, focusing on internal business processes does not immediately translate into performance improvements, at least based on the sample and model used in this study. On the other hand, GRW demonstrates a statistically significant positive impact on ROAt+1 (β = 0.059, t = 2.158, p < 0.05), suggesting that growth-related factors may moderate or interact with internal processes in shaping long-term corporate performance. These findings imply that hotel companies that emphasize internal business processes do not significantly improve their current and future corporate performance. Hotel companies that emphasize internal business processes will strive to introduce an efficient and effective hotel operation and management system. Of course, improving the internal business process is necessary to improve the sustainability of hotel companies and successfully manage them.

However, introducing a new internal business process system or improving the internal business process system is time-consuming and expensive. Therefore, even if hotel companies try to improve their internal business processes, it may be difficult to confirm that these efforts lead to financial performance.

Table 8 indicates the result of a study verifying Hypothesis 4 and presents the results of an empirical analysis of how companies in the hotel industry affect current and future corporate performance when strategically emphasizing employees’ Learning and Growth factors. As a result of the 2SLS analysis, as the dependent variable is ROA

t, the regression coefficient β

1 of Learning and Growth, an independent variable, was 17.153 and the t-value was 1.453, which was not statistically significant. Also, when the dependent variable is ROA

t+1, the regression coefficient β

1 of Internal Business Process, an independent variable, was 5.545, and the t-value was 0.608, which was not statistically significant.

Hotel companies that emphasize the perspective of learning and growth intend to ultimately improve employee satisfaction by encouraging employee growth through active support. Active support for employees leads to improved employee satisfaction, which can positively affect customers as well, thereby improving corporate performance.

However, since there is no direct causal relationship between emphasizing learning and sexual orientation and improving corporate performance, no significant relationship has been derived. Based on employee satisfaction, it is expected that support for employee learning and growth has a positive effect on hotel companies’ financial performance.

Table 9 is the result of a study verifying Hypothesis 5 and presents the results of an empirical analysis of how companies in the hotel industry affect current and future corporate performance when strategically emphasizing Social Responsibility factors. As a result of the 2SLS analysis, when the dependent variable is ROA

t, the regression coefficient β

1 of Social Responsibility, an independent variable, was 7.749, and the t-value was 1.799, which was statistically significant at a 10% level. Yet, when the dependent variable is ROA

t+1, the regression coefficient β

1 of Social Responsibility, an independent variable, was 5.111, and the t-value was 1.540, which was not statistically significant.

Hotel companies that emphasize the perspective of corporate social activities can be said to actively engage in ESG activities of companies that have recently attracted worldwide attention. In the past, it was thought that corporate ESG activities did not help improve financial performance; only costs were spent. It was also known that it takes a long time for corporate social activities to lead to improved financial performance.

However, the results of this study mean that, unlike in the past, customers are very favorable to companies that are active in ESG activities in the present, and the response immediately leads to improved corporate performance, unlike in the past. Companies are also aware of customer changes in response to these ESG activities, so the cost of ESG activities is often regarded as marketing costs. In recent years, it can be said that the promotional effect of such corporate social activities is more reliable than commercial advertising, so it can be said that it has immediate good results in improving corporate performance.

Table 10 shows the result of a study verifying Hypothesis 6 and presents the results of an empirical analysis of how companies in the hotel industry affect current and future corporate performance when strategically emphasizing Security and Safety. As a result of the 2SLS analysis, as the dependent variable is ROA

t, the regression coefficient β

1 of Security and Safety, an independent variable, was −5.435, and the t-value was −1.674, a statistically significant result at a 10% level. Also, as the dependent variable is ROA

t+1, the regression coefficient β1 of Security and Safety, an independent variable, was −4.854, and the t-value was −1.948, now a statistically significant analysis result.

The findings presented in

Table 10 demonstrate that the impact of Security and Safety on corporate performance is not consistently positive. Specifically, in the short term (ROA

t), the coefficient for Security and Safety is −5.435, with a negative t-value (−1.674,

p < 0.10). This result suggests that increased expenditures on security and safety measures do not immediately translate into improved financial performance. Instead, such expenditures may impose a financial burden on hotel operations, potentially leading to negative short-term outcomes due to increased operational costs. Furthermore, the negative coefficients for control variables such as LEV (−0.145,

p < 0.01) and BIG4 (−0.092,

p < 0.01) suggest that additional financial pressures, such as leverage levels and external audit requirements, could further hinder the immediate benefits of security and safety investments.

In the long term (ROAt+1), the coefficient for Security and Safety remains negative at −4.854, with a t-value of −1.948 (p < 0.10), indicating that even over time, increased emphasis on security and safety does not necessarily contribute to financial growth. These results imply that while security and safety measures are essential for maintaining operational stability and customer confidence, their financial benefits may not be directly reflected in improved profitability. However, certain structural factors appear to have a more positive influence on performance. For example, SIZE (β = 0.003, t = 0.426) and GRW (β = 0.047, t = 2.146, p < 0.05) suggest that larger hotel companies and those experiencing growth trends may benefit more from security and safety investments compared to smaller or stagnant businesses.

These findings highlight the complex nature of security and safety expenditures in the hospitality industry. While these measures are critical for risk management and ensuring guest satisfaction, they may not directly lead to improved financial performance, particularly in the short term.

The empirical analysis results of this study can be interpreted as follows: hotel companies that are highly interested in security and safety negatively affect corporate performance in the short and long term due to the costs required to strengthen security and safety.

As a result of hotel companies strengthening security and safety during the Corona period, there are several main reasons for the decline in corporate performance. First, it is an excessive cost burden. Since the hotel industry was already in a difficult situation due to a decrease in sales and customers, additional expenditures such as the introduction of quarantine equipment and the establishment of a non-face-to-face system were a big burden. Second, it is the limitation of service provision. Customer satisfaction decreased as customer experience was limited or public facility operation was reduced due to the reinforced safety measures, which led to a decrease in the revisit rate. Third, it is a problem of customer reliability. Excessive quarantine measures caused inconvenience to some customers, which negatively affected corporate image and brand value. Fourth, it is a problem of adaptation to technological changes. The introduction of non-face-to-face services and mobile check-in systems initially put a burden on companies, and there were cases where it was difficult for customers to fully adapt to the new system. Finally, it is a loss of competitiveness. Some companies that focused too much on strengthening security and safety failed to meet various demands of customers or fell behind in competition. Overall, strengthening security and safety during the COVID-19 period was essential, but it can be seen that a combination of factors such as cost, service restrictions, and customer inconvenience negatively affected corporate performance.

4.2. Additional Test Results (CONCOR Analysis)

Among the empirical analysis results of this paper, the verification of Hypothesis 6 shows that among hotel companies, firms that emphasize security and safety tend to significantly decrease their current and future corporate performance. Apart from improving corporate performance, hotel security and safety is an essential and fundamental factor for a hotel to run its business, even though corporate performance decreases in the short and long term due to the hotel’s spending to secure security and safety.

Therefore, this study additionally conducts network analysis using text mining techniques to identify the relationship between safety and security elements and the factors strategically emphasized by hotel companies. For further analysis, this study directly collected CEO messages posted on the websites of companies belonging to the hotel industry and extracted keywords through text mining analysis. The top 50 keywords were selected in the order of the highest TF-IDF values among the keywords, and a CONCOR analysis was performed among the techniques to confirm the connection between these keywords.

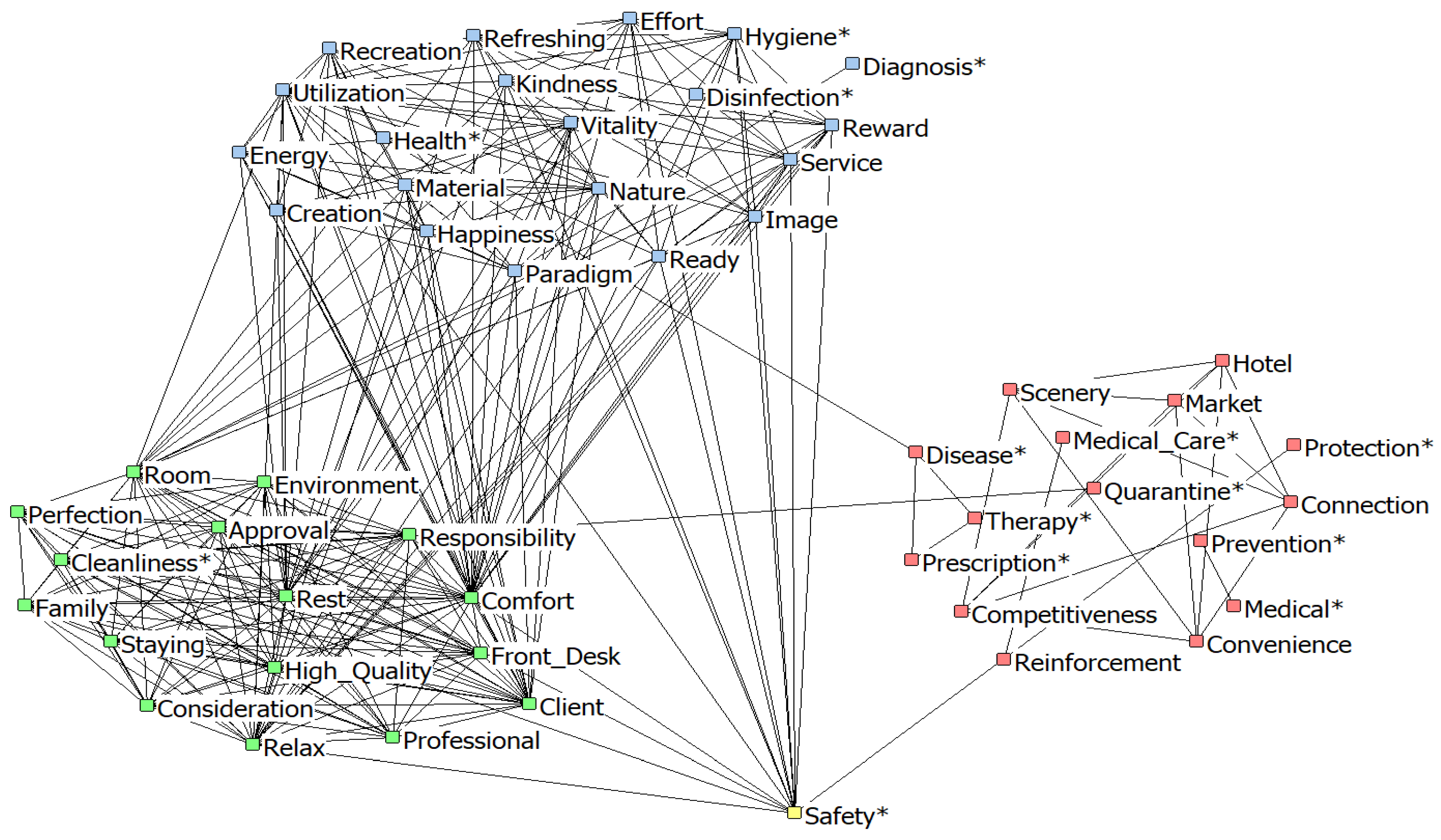

Figure 2 below presents the results of the CONCOR analysis of this study. The keywords marked * in

Figure 2 are related to Security and Safety factors.

The results of the additional analysis are summarized and presented as follows. The word safety was found to be related to words such as Image, Service, Reward, Ready, Paradigm, Utilization, Comfort, High Quality, Relax, and Reinforcement etc. Health relates to words such as Energy, Recreation, Vitality, Nature, Refresh, and Room. Quarantine was found to be related to words such as Protection, Market, Competitiveness, and Responsibility. Disinfection was related to words such as Hygiene, Refresh, Nature, Ready, Image, Reward, and Service.

These imply that hotel companies’ security and safety are complementarily connected to various factors. In other words, the results of the CONCOR analysis show that even though the hotel company’s security and safety directly negatively affect the company’s short-term and long-term corporate performance, as in Hypothesis 6, it is indirectly related to many important factors of hotel companies, so hotel companies should pay attention to and manage security and safety elements.

The results of the CONCOR analysis, as illustrated in

Figure 2, provide a comprehensive understanding of the connections between security and safety elements and other strategic priorities emphasized in CEO messages within the hotel industry. This analysis is particularly significant in validating Hypothesis 6, which posits that a focus on security and safety measures negatively impacts both current and future corporate performance due to the associated financial burden and operational challenges.

The CONCOR analysis reveals that keywords such as “Safety”, “Quarantine”, “Disinfection”, and “Protection” are central to the discussion and form a distinct cluster. These keywords are interconnected with terms like “Hygiene”, “Convenience”, “Medical Care”, and “Prevention”, highlighting the strategic emphasis placed on health and safety, particularly during the COVID-19 pandemic. This cluster reflects the critical need for hotels to address customer concerns about hygiene and safety to rebuild trust and confidence during a period of heightened health awareness.

The analysis confirms the findings of Hypothesis 6, indicating that while security and safety measures are essential, they incur significant costs that negatively affect both short-term and long-term financial performance. The implementation of enhanced sanitation protocols, quarantine systems, and non-contact service technologies imposes a substantial financial burden on hotel operations. Moreover, these measures often disrupt standard operational processes, further limiting short-term profitability and growth potential.

Although the direct financial impact of security and safety measures is negative, the CONCOR analysis highlights their indirect strategic contributions. Security-related keywords are closely linked to terms such as “Service”, “Comfort”, and “Responsibility”, suggesting that these measures play a critical role in building customer trust and enhancing the overall reputation of hotels. For instance, the connection between “Disinfection” and “Service” or “Hygiene” and “Comfort” indicates that customers perceive safety measures as integral to an enhanced service experience, even if these measures do not result in immediate financial gains.

The analysis also reveals connections between “Quarantine” and terms like “Competitiveness”, “Convenience”, and “Medical Care”, emphasizing the evolving expectations of customers in the post-pandemic hospitality market. These findings suggest that while costly, safety measures are now considered a baseline requirement for competitiveness in the industry. Hotels that fail to prioritize these elements may risk losing market share and customer loyalty.

While safety measures negatively impact profitability in the short term, the analysis underscores their importance as a foundation for customer satisfaction and long-term brand loyalty. Keywords like “Comfort” and “Responsibility” demonstrate that customers increasingly expect hotels to integrate safety measures as part of their broader CSR efforts. This shift in customer expectations positions safety initiatives not only as operational necessities but also as strategic investments in the hotel’s reputation and trustworthiness.

The results of the CONCOR analysis support Hypothesis 6 by confirming that security and safety measures entail significant costs, resulting in direct negative effects on corporate performance. However, the analysis also highlights the indirect strategic benefits of these measures, which include. First, customer trust and safety measures help establish and maintain trust, which is critical for fostering long-term customer loyalty and repeat business. Second, market competitiveness: in the post-pandemic era, prioritizing health and safety is essential for staying competitive in a rapidly changing hospitality landscape. Third, reputation management, by demonstrating a commitment to safety, hotels can reinforce their image as responsible and customer-focused organizations, thereby enhancing brand equity and appeal.

The findings of the CONCOR analysis emphasize the dual nature of security and safety measures in the hotel industry. While these measures pose immediate financial challenges, their indirect benefits, such as enhancing customer trust, improving service quality, and aligning with CSR priorities, cannot be overlooked. These results suggest that hotel managers must carefully balance the financial costs of implementing safety measures with their long-term strategic importance. Integrating safety initiatives into broader strategic goals will ensure that hotels remain resilient, competitive, and aligned with evolving customer expectations, as emphasized in the study’s objectives and the validation of Hypothesis 6.