1. Introduction

South African municipalities have been plagued by financial distress for decades. Resultantly, this level of dysfunctionality and collapse is mirrored in the poor municipal audit outcomes, as disclosed in the Auditor General of South Africa (AGSA) municipal audit reports [

1]. When municipalities are financially distressed, basic service delivery crumbles, and local communities are often tormented with water and electricity interruptions, dilapidated roads, and faltering emergency services [

2]. As per the Department of Cooperative Governance and Traditional Affairs (COGTA) [

3], interventions to alleviate financial distress have yielded inconsistent results, and many municipalities remain under provincial or national government administration for a protracted period of distress without adequate turnaround. Most of South Africa’s municipalities find themselves in a financial cul-de-sac, as neither national nor provincial government interventions have resulted in effective turnaround strategies that promptly and adequately resolve municipal financial distress.

In an attempt to help mitigate municipal financial distress, the AGSA stressed the importance of fiscal discipline and improved performance management in South African municipalities [

4]. The South African Constitution mandates the AGSA to express an audit opinion on whether the annual financial statements fairly represent the financial position, performance, and associated cash flows of municipalities [

5]. This audit opinion is disclosed in the AGSA’s annual audit report for each municipality, which reflects the results of regulatory audits, also referred to as audit outcomes. The Public Audit Act also mandates the AGSA must ascertain whether goods and services are being purchased at market-related prices by municipalities and utilized efficiently and effectively in executing municipal service delivery mandates [

6].

Furthermore, the AGSA must also evaluate whether municipal annual performance reports contain credible, reliable, and useful performance information regarding each municipality’s ability to meet its key performance indicators (KPIs) and targets for associated basic service delivery objectives and to determine whether or not each municipality has complied in all material aspects with legislation. Therefore, AGSA-issued audit reports are the only independent and credible measure to indicate whether a municipality’s annual financial statements are a reasonable reflection of its financial position, financial performance, and cash flows, as audit outcomes stem from a rigorous regulatory audit process [

7]. Audit reports also stipulate material instances of non-compliance with laws and regulations and disclose whether the achievement of municipal service delivery objectives is credible, relevant, and reasonable.

External audit reports empower all spheres of government and stakeholders to make effective decisions and are pivotal for improved accountability and transparency in municipalities. The audit reports of financially distressed municipalities often include adverse findings regarding municipal leadership’s inability to effectively oversee municipal finances and basic service delivery [

8]. In response to these audit report findings, municipalities must compile remedial audit action plans to resolve the audit findings raised in audit reports and management reports, as prescribed by the Municipal Financial Management Act (MFMA) [

9]. The purpose of audit action plans is to empower municipalities to develop their own adequate, effective, and appropriate internal and management controls to resolve audit findings [

10]. Progress in implementing audit action plans is monitored by municipal management teams, oversight committees, and provincial and national treasuries [

11].

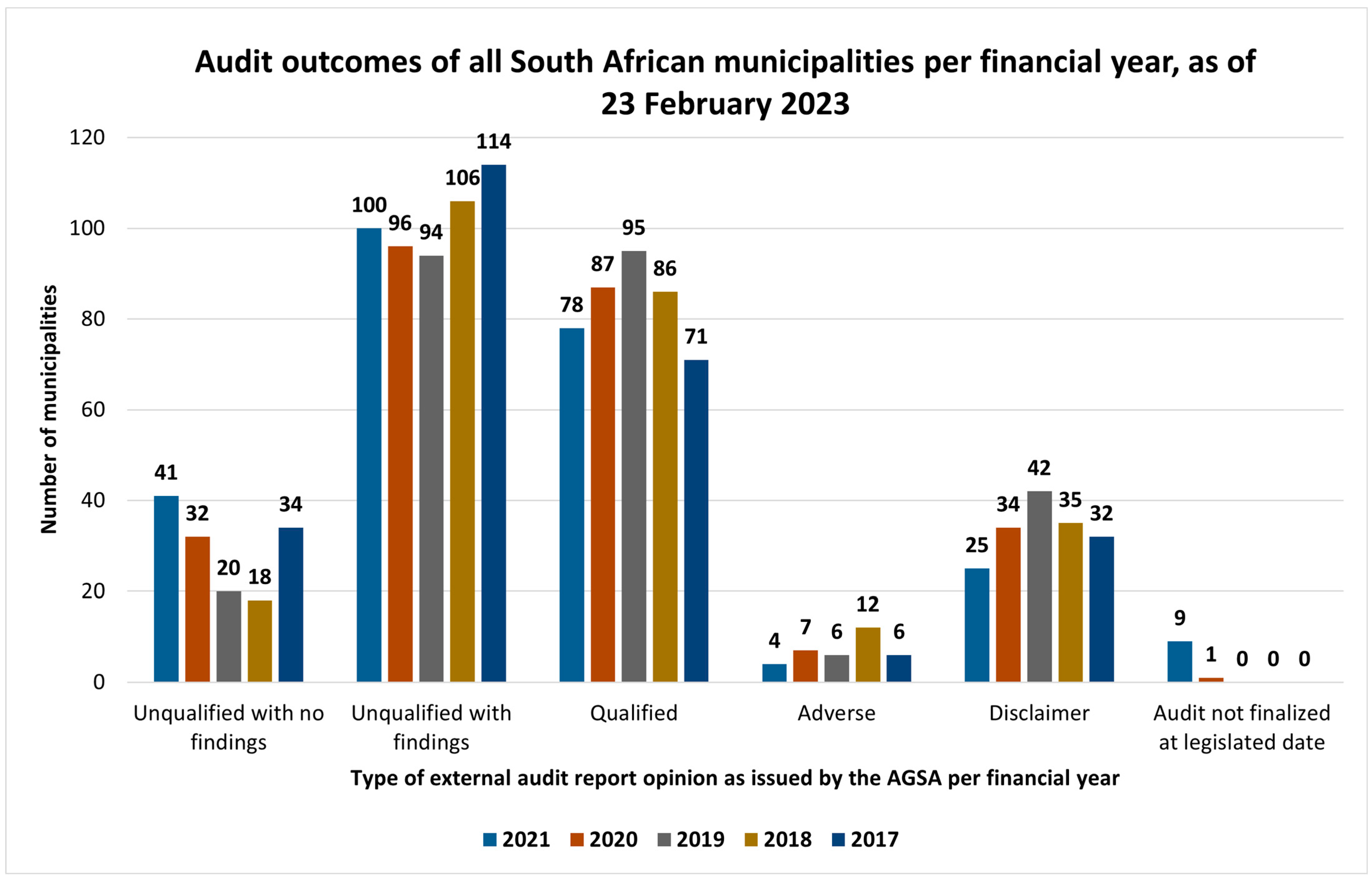

As evidenced in

Figure 1, 84% of South Africa’s municipalities received modified audit opinions during the 2021 financial year, whereas in 2017, 87% of all South African municipalities received modified audit opinions. This indicates a slight 3% improvement from 2017 to 2021. However, most South African municipalities still receive gloom-ridden audit outcomes due to material financial misstatements, unreliable and inaccurate performance information, and non-compliance with laws and regulations.

The primary objective of this study is to identify effectual turnaround strategies for financially distressed municipalities based on their audit outcomes. The findings of this study will equip financially distressed municipalities to improve their audit outcomes by executing turnaround strategies, which will improve the long-term sustainability and financial viability of these dysfunctional municipalities. Resultantly, residents will receive quality basic services, municipal fiscal discipline will improve, and public funds will be spent with cost containment in mind. This study contributes to the theory of financial distress resolution within the context of local democratic and governance theory, which revolves around the sustainable and equitable distribution of basic services and fair allocation of public funds within local communities.

2. Municipalities and the United Nations’ Sustainable Development Goals (SDGs)

Municipalities play an essential role in advancing the sustainable development of local residents [

12,

13]. The United Nations developed and published an idealistic citizen-centric Municipal Governance scorecard to empower municipalities to prioritize local community-based sustainable development, with the transformative mission of “leave-no-one-behind” [

14]. This scorecard specifically focuses on Sustainable Development Goal (SDG) 11, which relates to “Make cities and human settlements inclusive, safe, resilient and sustainable”. In this context, South African local governments aim to align themselves to the United Nations’ SDGs by being sustainable and resilient and delivering basic services to local communities which relate to SDG 6: “Clean water and sanitation”; SDG 7: “Affordable and clean energy”; SDG 12 “Responsible consumption and production” with regards to waste management; and SDG 13: “Life on land” with reference to climate change initiatives [

15]. These sustainable development goals are also based on the core functions of a municipality as stipulated in Schedules 4 and 5 of the South African Constitution, which stipulates that municipalities must provide the following basic services to residents:

Electricity and gas reticulation;

Cleaning and sustainable building regulations and reducing air pollution;

Refuse removal, landfill sites for solid waste disposal, and stormwater management systems;

Water and sanitation services [

5].

In South Africa, a sustainable municipality can be defined as a local government which utilizes its environmental resources appropriately to meet the demands of local residents and serves as the coalface of basic service delivery, which directly corresponds to the United Nations’ SDGs.

By contrast, the effective implementation of the SDGs has a significant impact on the financial capital and funds of municipalities, as the implementation of the SDGs hinges on extensive coordination between different spheres of government and requires substantial capital investment and human resources. Recently, Benito et al. [

16] found that the implementation of these SDGs had material repercussions on the financial health of Spanish municipalities, where SDG implementation resulted in reduced municipal surpluses and more budget deficits. Furthermore, Ribeiro et al. [

17] also highlighted the dilemma faced by Brazilian municipalities as they need to choose between carbon-based energy-intensive power stations, which lift residents out of poverty through job creation initiatives, and a reduction in carbon emissions, which limits pollution. Carbon emissions and air pollution can pollute ecosystems and damage the health of residents.

In South Africa, municipalities struggle to provide residents with electricity, water, and sanitation. Mamokhere [

18] argued that South African municipalities’ challenges regarding the implementation of SDGs 6 and 12 (water and sanitation) are mostly due to corruption; poor planning, monitoring, and evaluation of water infrastructure maintenance projects; and inadequate citizen participation in municipal strategic planning and budgeting processes. Financially distressed South African municipalities are plagued by mismanagement, financial irregularities, and wasteful expenditure due to inadequate internal controls and risk management practices, which threaten the sustainability of local governments [

4,

19,

20,

21,

22]. Mismanagement leads to an organizational culture where non-compliance with laws and regulations is tolerated, which resultantly empowers greedy politicians, officials, and municipal suppliers of goods and services to act unethically without fear of consequences [

4,

23]. The epitome of irregular expenditure is non-compliance with treasury regulations and ineffective municipal procurement practices [

24,

25,

26]. Sometimes, municipal tenders are intentionally awarded to close family members and business associates of municipal employees and local councilors, resulting in uncompetitive procurement practices. Consequently, nepotism is a leading cause of irregular and wasteful expenditure [

23,

27,

28]. Irregular expenditure ultimately renders municipalities incapable of delivering basic services to local communities due to mismanagement of public funds, which negatively affects the lives and livelihoods of residents. The SDGs are closely correlated to the quality of life of residents [

29]. Consequently, when municipalities are financially distressed, essential service delivery disintegrates, and local communities are often tormented with water and electricity interruptions, dilapidated roads, and faltering emergency services, which leave impoverished communities behind and stun local economic growth [

30].

3. An International Overview of Municipal Financial Distress Determinants

Municipal financial distress knows no borders and is not endemic to South Africa [

31,

32]. Across the world, local governments are experiencing financial distress as citizens are demanding effective and efficient essential service delivery in the context of the global financial crisis and an eroding tax base. Municipal financial distress had captured the attention of researchers and turnaround specialists since the 1960s, when some of the most famous metropolitan cities in the world started experiencing financial distress. The most infamous case study, according to Cohen et al. [

33], was New York’s financial troubles in 1975. Worldwide, municipalities are battling to remain financially viable and deliver essential services to residents, resulting in an international public financial crisis [

34,

35,

36]. Municipal financial distress has become a critical concern in the United States of America since the dawn of the 2008 Great Recession when the housing market crashed. Ever since then, the economy of the United States of America has shifted away from manufacturing to services and knowledge industries. This shift resulted in rising unemployment, which limited the ability of local governments to collect rates and taxes, as well as greater social demand for municipal housing and welfare assistance [

37]. Municipal fiscal distress is fueled mainly by financial and socio-economic pressures, changes in America’s ageing population demographics, and national policies that directly impact local governments. The fragility of local government finances was further impacted by the COVID-19 pandemic, which caused municipal revenue derived from rates and taxes to decline by

$155 billion (5.5%) in 2020 and was projected to cause a further

$167 billion (5.7%) decline in municipal revenue in 2021 and

$145 billion (4.7%) in 2022 [

38]. Maher, Oh, and Liao [

39] even argued that the United States of America was experiencing “an age of permanent fiscal crisis”, and that the COVID-19 pandemic had been the most severe financial crisis faced by local municipalities, which resulted in aggravating fiscal shocks and an enduring state of municipal financial distress.

South American metropolitan cities are especially exposed to natural disasters and hazards such as floods, earthquakes, extreme droughts and aridification, heat waves, cyclones, snow storms, and other weather calamities, which are increasing in magnitude and frequency due to the impact of climate change [

40,

41]. South America is projected to experience a 1.9 °C to 5.0 °C warming by 2100. As temperatures soar, the Andes glaciers are melting at an unprecedented speed, causing local communities to experience freshwater shortages, resulting in deforestation in the Amazon [

42]. Disasters usually strike 80% of the cities in South America and have a devasting impact on people experiencing poverty due to their unequal access to essential and emergency services because of sprawling, unregulated, informal settlements and slums [

43]. Since 1950, South American cities have experienced rapid urban growth, and 83% of the population now lives in urban areas, which places additional strain on existing and ageing municipal infrastructure, which is utilized for essential service delivery such as electricity, water supply, sanitation, as well as emergency services and results in municipal financial distress [

43].

Europe is facing the second significant refugee crisis in less than a decade. In 2015, European municipalities opened their doors to 3.6 million Syrian refugees, economic migrants, and asylum seekers, whereas more than 4.6 million Ukrainians fled their homes since the start of Russia’s military assault on neighboring Ukraine on 24 February 2022 [

44,

45,

46]. Similarly, Meer et al. [

45] and Demiroǧlu [

47] postulated that municipalities are the cornerstone of efforts to tackle the challenges posed by mass migrations of refugees. Municipalities are the front-line workers providing essential services and housing to refugees. Unfortunately, national governments do not always provide municipalities with the legal tools, infrastructure, and funding needed to empower these municipalities to play their distinctive role in refugee integration, settlement, and support, which results in faltering service delivery.

The overarching majority (75%) of Asians believe that their government’s inadequate commitment to perceived ethical behavior is the biggest challenge that their country faces, and 25% of all Asian citizens admittedly bribed public officials in 2021, which is the equivalent of 836 million residents in Asia participating in bribery [

48]. More than 50% of residents in Nepal, Thailand, Maldives, and Sri Lanka believe that corruption is on the rise, precisely due to government procurement irregularities, which involves tenders being allocated to politicians and bureaucrats, as well as their families and business associates, resulting in uncompetitive bidding and tenderpreneurship. There is also a pervasive lack of the implementation of anti-corruption legislation, which enables perpetrators to escape justice. Interestingly, 32% of Sri Lankan residents believe that all local government officials are corrupt without exception [

48]. Li, Tang, and Jaggi [

49] and Bastida et al. [

50] found that the risk of municipal default increases exponentially when municipalities are associated with fraud, corruption, and non-compliance with legislation.

Municipal financial distress is a global problem that threatens basic service delivery to local communities and hampers endeavors to achieve the SDGs. The risks faced by municipalities, which range from a declining revenue base to climate change and from assisting refugees to threats of corruption, are also transversal and may pose a threat to municipal financial viability worldwide. Furthermore, municipalities across the world have similar regulatory mandates to deliver basic services to their local communities, and, therefore, the effective turnaround strategies, which are proven to reduce financial distress in South Africa, may also help municipalities across the world to improve their financial viability.

4. Municipal Financial Distress Determinants in South Africa

Municipal financial distress is the result of a complex, multi-faceted combination of various root causes ranging from ineffective leadership to insufficient risk management and inadequate financial control [

51,

52]. Multiple diverse factors contribute to financial distress, and these factors are often interrelated [

33,

53]. Financial distress factors, as stipulated in municipal audit reports, include:

4.1. Ineffective and Inadequate Internal Controls

The AGSA regularly rebukes financially distressed municipalities for having ineffective and inadequate internal control and their inability to resolve audit findings [

54]. The accounting departments of municipalities often struggle with high employee turnover and vacancy rates, repetitive re-statements of prior year annual financial statements, incompetence, and high borrowing costs, which may culminate in a weak internal control environment and may lead to corruption and dishonesty [

55]. Faltering internal control systems also result in the misappropriation of municipal assets and a decline in revenue [

56,

57,

58]. An ineffective internal control environment may also be aggravated when municipal audit committees fail to meet and when the internal audit department is unable to execute high-quality internal audits [

21,

59]. To strengthen the internal control environment of municipalities, section 165 of the MFMA stipulates that each municipality must have an internal audit unit to advise the accounting officer of the effectiveness and adequacy of internal controls [

9].

Despite this legislative requirement to have a functioning municipal internal audit unit, municipal internal audit departments do not always report relevant information on the effective functioning of internal controls to their respective audit committees, which paralyzes both oversight functions [

60,

61]. Audit committees also tend to neglect to review the level of compliance with business ethics and codes of conduct in municipalities [

62]. This oversight omission by audit committees has caused some political analysts to call for establishing an independent “Internal Auditor-General” by consolidating the internal audit departments of all municipalities in South Africa and providing internal audit services from a centralized national government perspective [

63]. Improving the internal control environment of municipalities will improve the quality of accounting information provided and reduce manipulation of the annual financial statements [

64,

65,

66]. This will result in internal control weaknesses, which directly impact financial losses incurred by municipal taxpayers [

67].

4.2. Lack of Leadership and Governance

The political leadership of a municipality (municipal council) is responsible for appointing and delegating executive authority to the municipal manager. By contrast, the tension between the political leadership and the administration of a municipality, as well as the impact of cadre deployment, results in ineffective management and leadership, corruption, and wasteful expenditure [

68,

69,

70,

71,

72]. As such, several local municipalities lack the visionary leadership to economically develop their local communities and deliver on service delivery promises as proclaimed in election manifestos [

73,

74,

75,

76]. Administrative and political leadership is poor in most dysfunctional municipalities, resulting in indecisiveness and an inability to execute election promises made to the local residents [

70,

77,

78]. Councilors do not always have the technical skills and experience to thoroughly understand their fiduciary duties, resulting in paralysis and an inability to execute their duties [

79]. Regrettably, the self-enrichment motive of many councilors and administrators alike also contributes to the financial woes of municipalities, as councilors often fail to settle their own overdue municipal rates and taxes in a timely manner [

75,

80,

81,

82].

4.3. Non-Compliance with Laws and Regulations

Material non-compliance with financial laws and regulations is boldly disclosed in the external audit reports of municipalities for the voting public to view and to encourage electoral responsiveness to governance failures [

83,

84]. A high degree of compliance with municipal financial regulations is necessary to protect the credibility, usefulness, and reliability of accounting information and to enhance the decision usefulness of annual financial statements and annual performance reports [

85,

86]. Compliance with financial laws and regulations is also critically important for improving essential service delivery to local communities in South Africa [

87]. Trends in the AGSA’s audit reports for distressed municipalities indicate a regressive culture towards compliance with laws and regulations, which may indicate the absence of a sound ethical foundation [

75]. This absence of sound ethical principles is concerning as there is a direct relationship between the level of compliance with laws and regulations and the quality of basic service delivery in municipalities [

88].

4.4. Irregular Expenditure

Financially distressed municipalities reported a cumulative irregular expenditure of ZAR 6.3 billion during the 2021 financial year. Irregular, fruitless, wasteful, and unauthorized expenditure can be limited by ensuring that professionals fully capacitate municipal risk management divisions with the required technical competencies to recommend appropriate internal controls to mitigate risks [

19,

22]. Continuous professional development and training of finance professionals and accountants at municipalities is the cornerstone of limiting unwanted expenditure [

78,

89,

90,

91]. Kumar [

92] declared that an electronic web-based tender management system formed the foundation of the eThekwini Municipality’s strategy to ensure that its tender processes are fair, transparent, cost-effective, and competitive. In comparison, it is important to thoroughly investigate and report instances of irregular expenditure to the South African Police Service and other law enforcement agencies when fraud and corruption are suspected [

19,

89,

90]. Even though various interventions have been deemed effective in ensuring that tender processes of goods and services are fair and cost-effective, the foundation in the fight against fraud and corruption remains the establishment of a strong ethical organizational culture in municipalities [

21,

24,

25,

93,

94].

4.5. Lack of Accountability and the Willingness to Investigate Audit Findings

The AGSA reported that municipal audit report findings were often repeated from one year to the next [

8]. This pattern of repetitive audit findings continued in the 2019, 2020, and 2021 financial years for financially distressed municipalities. These repetitive audit findings may indicate that these municipalities’ audit action plans are ineffective and that governance and oversight structures cannot adequately enforce audit recommendations. Repetitive audit report findings indicate that municipalities may lack the financial and human capital resources and accountability to investigate significant audit findings issued by the AGSA and implement remedial action to resolve these findings.

4.6. Inadequate Consequences Management

Most municipal officials (58.6% of respondents) at a large district municipality in South Africa indicated the following response to a survey question: “I do things that have the best consequences for me, and it doesn’t matter if that involves lying or stealing” [

95]. Municipal officials may act unethically and fraudulently due to personal financial and lifestyle pressures and self-interest objectives [

94]. The long-term financial viability of a municipality can be severely threatened by employees’ inappropriate behavior and lack of adherence to ethical codes, standards, and norms [

96]. Most financially distressed municipalities did not enforce disciplinary action and consequence management in instances where municipal employees acted unethically [

97]. By contrast, disciplinary action in financial misconduct cases should be swift, transparent, just, and fair [

78]. In practice, though, consequence management tends to target vulnerable employees (junior employees, employees with physical and mental disabilities, and employees supporting a different political party) rather than senior managers; consequently, the fairness and effectiveness of consequence management may be in jeopardy [

98,

99]. The inability to enforce consequence management and to take disciplinary action at an executive management level may enhance the local community’s perception that their local government is failing to mitigate and adequately resolve incidents of fraud and corruption [

91].

4.7. High Vacancy Rates

Municipalities cannot execute their basic service delivery mandates without adequate human resources to execute tasks successfully [

68,

75,

80,

91]. Municipalities must fill key vacancies with competent individuals and prevent a high vacancy rate from negatively impacting the audit outcomes of municipalities [

75,

97]. Municipal Managers, Chief Financial Officers, and Supply Chain Managers are critical positions to fill in order to maintain the financial stability of a municipality. It is worrisome that municipal officials usually occupy management positions for less than two years due to high staff turnover and vacancy rates [

75]. It is a proven fact that there is a direct correlation between the duration of the employment terms of the Municipal Manager and Chief Financial Officer and the audit outcomes of the municipality [

100]. During the 2018 financial year, 27% of all South African municipalities reported that either one or all of the following key positions were vacant: Head of Supply Chain Management, Chief Financial Officer, or Municipal Manager. These key management officials serve as gatekeepers of financial and internal control, and associated vacancies may result in increased tender irregularities as management control diminishes [

101,

102]. Having a fully capacitated senior municipal management team improves the efficiency and effectiveness of the municipality, which resultantly improves service delivery and limits tender irregularities [

102,

103]. In addition, vacancies are habitual in the internal audit departments of municipalities, which causes additional constraints and limitations on internal control and governance [

91,

104]. Internal audit vacancies lead to reduced audit coverage and limit the ability of the audit committee and other oversight committees to identify internal control weaknesses [

105].

5. Municipal Financial Distress Turnaround Strategies

The AGSA’s regulatory audit results are reflected in municipal audit reports and management reports, which contain audit opinions and detailed descriptions of audit findings, as stipulated by International Auditing Standards [

106]. In response, the municipal management teams compiled their own audit action plans to strategize how remedial action would be executed to resolve audit findings. Usually, municipal management teams face a dilemma regarding competing priorities, capacity constraints, and budget deficits, which may prevent management teams from fully implementing all the audit recommendations raised by the external auditors within the agreed-upon time frames [

107]. The primary benefit of implementing audit action plans is that the internal control environments of auditees will be more effective in mitigating audit risks, and therefore, control risk will be lower. Shohihah, Djamhuri, and Purwanti [

108] issued a severe warning that audit reports and management reports will have little or no value if audit action plans are not adequately and promptly implemented.

The successful implementation of audit action plans hinges on the ability of entities to review their collapsing situation by reflecting on the historic strategic options and decisions that have culminated in their financial distress. Stutz, Ainamo, and Lamberg [

109] postulated that entities in financial distress need to look back at the point in time when the downturn began by recommending that managers should be “approaching a past-related but distinctly new activity domain by imagining what could have been ‘possible’ in the past, seen from actual present, to trigger a brighter future”. Once the starting point of the downturn has been identified, then management teams should critically assess the root causes of dysfunctionality to develop and implement successful turnaround strategies and incorporate these strategies into audit action plans [

110].

The compilation and implementation of effective turnaround strategies are complex, as municipal management teams often integrate a kaleidoscope of diverse turnaround strategies in their plans to resolve financial distress [

111]. Municipal management teams may opt to incorporate several elements of the following in their audit action plans:

5.1. Strategic Responses

Strategy, in the form of policy pronouncements, is omnipresent in the public sector. Strategy assists public sector entities in achieving their performance objectives and creating value for the public through effective and efficient service delivery [

112]. By contrast, numerous research studies have indicated that public sector entities fail because of their inability to plan for the future proactively. Consequently, adequate planning empowers local governments to exploit opportunities and mitigate risks so that municipalities can respond to demands and challenges experienced by their local communities in a sustainable manner [

113]. Therefore, the strategic objective of any municipal turnaround strategy should be to resolve financial distress by focusing on improving municipal financial viability and institutional sustainability.

The AGSA assesses executive management restructurings as part of their audit program on “Understanding the entity and its environment”. Should the auditors identify audit risks associated with managerial restructurings and organizational changes, then these risks are transferred to the risk registers of regulatory audit engagements as part of the AGSA’s assessment and response to risks of material misstatements. Typical audit responses to risks associated with managerial restructurings may include audit procedures such as “The auditors were advised to apply professional scepticism throughout the audit” or “More supervision will be provided on the audit” [

114]. Significant management and strategy changes will be classified as an inherent risk factor affecting the overall reasonable presentation of the annual financial statements and annual performance reports.

5.2. Financial Responses

Financial restructuring strategies are designed to improve cash flow, liquidity, and revenue generation to significantly reduce an organization’s debt in order to prevent bankruptcy [

115]. Financial responses pinpoint and concentrate on achieving expedited revenue growth and improved debtors’ collection while building positive stakeholder partnerships. Municipal financial restructuring strategies focus mainly on debt restructuring and the protection of municipal assets from creditors while carefully balancing the interest of creditors with the interest of residents [

116]. Financially distressed South African municipalities have the option to submit an application to the High Court for a stay of legal proceedings from creditors and debt collectors, as specified in the MFMA [

1]. Resultantly, South African creditors prefer proactive workout plans as soon as the slightest municipal financial decline is detected instead of prolonged reactive legal interventions later on when municipalities are severely distressed.

The AGSA carefully audits compliance with laws and regulations regarding municipal debt management as legislated. Therefore, significant non-compliance with laws and regulations regarding debt restructurings will be disclosed in municipal audit reports [

114]. Any deterioration of municipal audit outcomes regarding financial restructurings can be carefully monitored, and remedial action to resolve related audit findings should be described in detail in audit action plans.

5.3. Operational Responses

The operational efficiency of any entity will be smothered if such an entity has implemented numerous duplicated processes and procedures, when internal controls are ineffective and inadequate, or if the entity has insufficient segregation of duties. Optimizing operational processes and standard operating procedures will improve efficiency and financial viability, resulting in rapid performance improvement [

117]. Hammer and Champy [

118] stated that re-engineering organizational processes and procedures should reduce operational costs and quickly improve service delivery. Operational turnaround strategies should focus on current processes and procedures at municipalities to establish how these processes can be optimized [

119].

It is pivotal for South African municipalities to implement successful turnaround strategies to resolve financial distress by mitigating the root causes of audit findings as disclosed in external audit reports. Municipalities should formulate and disclose their turnaround strategy for each audit finding in their audit action plan, as prescribed [

9]. Audit action plans should also contain the names of municipal officials responsible for the effective implementation of each remedial action item, and strict timelines should be defined for when each audit finding should be resolved. Municipal management teams and other oversight bodies should monitor the municipality’s progress regarding implementing remedial action [

9]. Should municipalities report insufficient progress in terms of their audit action plan, then planned remedial action and set timelines may have to be re-assessed by the management teams and oversight bodies, and consequently, audit action plans should be amended accordingly.

6. Theoretical Analysis

Municipalities are an integral part of democracy and enable the mass participation of residents in government decision making, which directly impacts local communities. Municipalities are prerequisites for any political system to be classified as democratic. Furthermore, municipalities have been perceived as the most crucial vehicle for alleviating poverty, as municipal infrastructure development and maintenance create job opportunities for local residents and stimulate local economic development [

120]. Municipalities also represent the sphere of government that ordinary citizens can relate to most, as residents will be acquainted with their elected councilors.

South African local government democracy is threatened due to voter apathy and inadequate municipal service delivery. In November 2021, South Africans voted to elect new local governments. According to the Independent Electoral Commission, only 46% of registered voters cast their ballots. The low voter turnout is significant, as only 62% of the voting public are registered voters [

121]. Stokes [

122] stated: “A central claim to democratic theory is that democracy induces governments to be responsive to the preference of the people”. Therefore, the 2021 local government election results indicate that voters have lost faith in South Africa’s political parties and their abilities to deliver basic municipal services on behalf of residents.

This study also falls within the ambit of governance theory, as governance theory aims to find solutions for collective problems relating to public policy and essential service delivery [

123]. Governance refers directly to leadership and management as it stems from the Greek word “kybernesis”, which refers to stewardship of public funds and assets and is as old as human civilization [

124]. Municipal governance failures often result in public trust deficits, voter apathy, an absence of public participation in decision making, and further weakening municipal oversight [

125,

126]. The research findings of this study will improve stewardship of public funds and assets, enhance the financial viability of distressed municipalities so that local communities receive essential services sustainably, reduce voter apathy, and strengthen local democracy.

7. Materials and Methods

7.1. Inductive Interpretive Content Analysis

Qualitative research aims to locate the root cause of problems and explore reasons for these occurrences. Qualitative research methods explore phenomena and determine the meaning of these events during and after their occurrence [

127]. Qualitative research consists of interpretive practices that help people understand their world through an observed naturalistic approach [

128]. Qualitative researchers, therefore, tend to document notes and memos as they participate in and interpret fieldwork in a real-life and practical setting [

129].

The primary aim of this study is to identify successful turnaround strategies that have resulted in municipal financial distress resolution from an interpretive exploratory perspective. Interpretivism’s central concern is “to obtain an understanding of what is happening through the eyes and minds of the people involved in the situation under study” [

128]. Meredith [

130] explained that interpretivism “allows the much more meaningful question of “why”, rather than just the “what” and “ how”, to be answered with a relatively full understanding of the nature and complexity of the complete phenomenon”. This research paradigm proclaims that knowledge is constructed by analyzing the practical consequences of the research enquiry by focusing on “what works” in a question-driven research context. Interpretivism as a research paradigm has several advantages, such as:

Researchers obtain a deep and relevant understanding of the social context in which a phenomenon occurs in a natural setting [

130,

131,

132,

133].

It enables the researcher to investigate unobservable factors such as the research participants’ thoughts, values, perceptions, perspectives, feelings, and emotions [

131,

132,

133].

Interpretivism as a research paradigm has several limitations, such as:

Research results relate to complexity within a particular context of the phenomenon. Therefore, research findings cannot be generalized and made applicable to other contexts and people [

131].

The researcher’s ontological view is subjective, as opposed to being objective, resulting in potential bias on behalf of the researcher [

131,

134].

Interpretive research is time-consuming, and the research process may lack rigor and controls. In addition, researchers may be unfamiliar with the research procedures and may neglect the burden of proof in the research process [

130].

Some academics regard this research paradigm “as an assembly of anecdotes and personal impressions” [

135].

As a result, this study endeavors to identify turnaround strategies that work to resolve municipal service delivery challenges through the “eyes and minds” of municipalities that have achieved improved audit outcomes.

As indicated in

Figure 2, this study consisted of an analysis of audit reports and audit action plans of municipalities that have achieved improved audit outcomes in order to identify turnaround strategies deployed to facilitate distress resolution.

7.2. Municipal Sample Selection

The Minister of COGTA published a list of 87 municipalities that were officially declared as “financially distressed” on 15 May 2018 [

136]. The list of 87 financially distressed municipalities is included in

Appendix B. Audit and annual reports for the financial years ending on 30 June 2018, 30 June 2019, and 30 June 2020 were obtained from the National Treasury’s MFMA database for the financially distressed municipalities selected as part of this study. The MFMA database can be accessed by clicking on the following web link:

http://mfma.treasury.gov.za (accessed on 22 April 2023). Annual reports and audit reports for the financial year ending on 30 June 2021 were obtained from the National Treasury’s GoMuni portal by clicking on this link:

https://lg.treasury.gov.za/ibi_apps/signin (accessed on 22 April 2023). The public can access both the GoMuni portal and the MFMA database. Audit reports and annual reports of financially distressed municipalities were downloaded from these websites from 7 February 2023 to 13 March 2023. These municipalities represent the sample selected for this research study. The audit reports and audit action plans of these selected municipalities were analyzed for the ensuing three financial years to identify which municipalities had improved and then, subsequently, to identify successful turnaround strategies that resulted in improved financial viability for these particular municipalities. The study’s cutoff date was 30 May 2023. The audit reports for the financial year ending on 30 June 2022 were excluded from this study as the National Treasury and AGSA had not published these reports as of 30 May 2023.

If the AGSA’s audit opinion for a particular municipality in the financial year ending on 30 June 2018 was disclaimed, and if in the financial year ending on 30 June 2021, the audit opinion improved to an adverse, qualified, or unqualified opinion, then the financially distressed municipality was classified as having “Improved”. Likewise, if the AGSA’s audit opinion was adverse, and the audit opinion improved to a qualified or unqualified opinion subsequently, then an improvement was recorded as well. Moreover, if the AGSA’s audit opinion was qualified, and this audit opinion improved to an unqualified opinion subsequently, then the municipality was improved (refer to

Appendix C). Only 24 of the original 87 financially distressed municipalities achieved improved audit outcomes during the 2021 financial year, as disclosed in

Appendix D.

7.3. Content Analysis Procedure

The qualitative findings were derived from implementing an inductive conceptual coding scheme of turnaround strategies utilizing ATLAS.ti version 23. A conceptual content analysis indicates the existence and frequency of references to turnaround strategies in the text of audit action plans. Numerous audit report qualification paragraphs can be resolved through the effective implementation of a particular turnaround strategy, such as adequate records management, and vice versa. A particular turnaround strategy can also form part of a kaleidoscope of different turnaround strategies to resolve a particular audit report qualification. Consequently, the exact number of turnaround strategies does not directly correspond to the precise number of audit report qualification paragraphs resolved. Resultantly, the number of codes utilized in ATLAS.ti only reflects the number of references to a particular turnaround strategy in the audit action plans of municipalities. For example, 14 municipalities that achieved improved audit outcomes resolved their 14 audit report qualification paragraphs relating to property, plants, and equipment. These municipalities managed to resolve this particular audit report qualification by implementing the following turnaround strategies, inter alia:

Adequate records management: Municipalities maintained a complete and accurate asset register of all their assets.

Asset management: Municipalities ensured that capital assets were only disposed of if these assets were no longer utilized to deliver basic services to residents.

Internal controls: The municipalities conducted assets verification annually, and the conditions and existence of all assets were confirmed.

Credible annual financial statements: The value of municipal assets was reconciled from the fixed asset register to the general ledger and the annual financial statements.

Procurement and contract management: Municipalities strictly complied with procurement regulations when new assets were procured or constructed to ensure that assets were purchased at market prices (and that prices were not over-inflated).

Resultantly, these 14 municipalities made 153 references to turnaround strategies in their audit action plans, which were implemented to resolve their 14 audit report paragraphs associated with misstatements or limitations regarding property, plants, and equipment. Vice versa, a particular turnaround strategy, such as implementing effective and adequate internal controls, assisted 22 municipalities in resolving 138 different audit report qualifications ranging from property, plants, and equipment to revenue from non-exchange transactions to irregular expenditure and even general expenses. Municipalities generally have several audit report qualification paragraphs and non-compliance findings listed in their audit reports. The coding scheme in ATLAS.ti, therefore, reflects the total number of references to a particular turnaround strategy in the audit action plans of municipalities that improved their audit outcomes. The frequency of references to a particular turnaround strategy indicates how often the strategy was utilized to resolve audit report qualifications and indicates the significance and effectiveness of this turnaround strategy in the context of municipalities that achieved improved audit outcomes.

A thematic assessment of successful municipal turnaround strategies was utilized to evaluate the efficacy of turnaround strategies, as disclosed in the audit action plans, using ATLAS.ti version 23. ATLAS.ti is a well-developed coding program popular with qualitative researchers [

137]. This study aimed to identify effective turnaround strategies instead of merely counting words, as using words only results in decreased reliability and a meaningless research result; therefore, a thematic analysis was conducted. Initially, the first author performed manual coding as part of this analysis of the municipal audit action plans of municipalities.

A single coder performed all the coding to ensure the coding instrument was reliable and consistent instead of using multiple coders. We enhanced the reliability of this study by ensuring that content categories were selected from well-grounded literature. In addition, the completeness and effectiveness of turnaround strategies were confirmed by the provincial treasuries and the National Treasury of South Africa, which are mandated by legislation to monitor and support financially distressed municipalities. A pilot study was also conducted to evaluate the reliability of the coding instrument. Subsequently, ATLAS.ti’s auto-coding was utilized to enhance the completeness of identified turnaround strategies and ensure that no turnaround strategy was missed due to manual coding errors. Other potential turnaround strategies included using the automated Regular Expression Search function for words relating to “distress resolution”, “remedial action”, “strategy”, “strategies”, and “turnaround”. Therefore, a comprehensive list of successful turnaround strategies was identified from the municipal audit action plans, which are disclosed in

Appendix A of this study.

7.4. An Example of the Content Analysis Performed on a Financially Distressed Municipality That Achieved an Audit Outcome Improvement

On 30 November 2018, the AGSA issued a qualified audit report for the Alfred Duma Local Municipality for the financial year ending on 30 June 2018. The basis for the qualified audit opinion, as per the audit report, was indicated as follows:

Property, plants, and equipment: The municipality did not recognize and correctly account for property, plants, and equipment. Estimates used in the measurements of property, plants, and equipment were not adequately supported because the municipality failed to implement an adequate asset management system.

Investment property: The municipality did not recognize all property held for capital appreciation as investment property due to the status of accounting records.

Revenue and receivables from non-exchange transactions—fines: Included in revenue and receivables from non-exchange transactions was an amount of ZAR 9.9 million and ZAR 35.08 million, respectively, related to fines. The AGSA was unable to obtain sufficient appropriate audit evidence that these amounts were properly accounted for due to the status of accounting records.

On 31 January 2022, the AGSA issued the Alfred Duma Local Municipality’s audit report for the financial year ending on 30 June 2021. None of the disclosed audit report qualification paragraphs, as indicated above, were observed in the audit report of this particular municipality for the financial year ending on 30 June 2021. Consequently, an improvement in the audit outcomes was observed.

Furthermore, the annual report for the Alfred Duma Local Municipality for the same financial year was inspected. The annual reports of local municipalities contain the audit action plans. The following specific remedial action to resolve audit findings was observed in the audit action plan of the Alfred Duma Local Municipality by conducting an analysis of the content of this plan. The following quotes from the Alfred Duma Local Municipality’s audit action plan were observed:

“Furthermore, the municipality has put in place very effective oversight mechanisms through the establishment of the Municipal Public Accounts Committee and the Performance and Audit Committees, which to date has carried out its oversight function very successfully”.

“Be well governed and demonstrate good governance and administration by cutting wastage, spending public monies prudently, hiring competent staff, ensuring transparency and accountability. Ensure sound financial management and accounting and prudently manage resources so as to sustainably deliver services and bring development to communities. Build and maintain sound institutional and administrative capabilities, administered and managed by dedicated and skilled personnel at all levels”.

“Alfred Duma Local Municipality in discharging their responsibilities relating to the safeguarding of assets and the operation of adequate and effective systems. The Municipality has an effective performance management system implemented at the top and middle management levels”.

“Ensure that the AFS agrees to the Trial balance and General Ledger—Perform review of financial statements for validity, accuracy and completeness—Review working paper file and ensure that it agrees to information on the AFS, TB and GL”.

“Audit Asset Management—Review monthly asset reconciliations—Ensure asset reconciliation balances to general ledger and trial balance—Review fixed asset register—Test for existence of assets—Review depreciation calculations—Review compliance with GRAP” (Standards of Generally Recognised Accounting Practices).

“The Asset Section no longer uses the services of consultants for financial, which has contributed largely to the minimizing of spending on consulting fees. We have reviewed and amended the organogram in an attempt to ensure that we have enough resources in terms capacity and human resources. Two (2) Senior Accountants have been appointed as well as an assets accountant to ensure a smooth transition from dependence on consultants on our plan to minimize or reduce such spending and this has been achieved”.

“We are further responsible for generating controls to ensure the safeguarding of assets but still every year we experience theft, losses and vandalism of Councils assets where all departmental Heads need to play their oversight roles. Disposal Management is also one of the key areas that we are focused on, to ensure that all necessary processes are adhered to as per the requirement of Section 14 of the MFMA. There have been some inefficiencies but to mitigate the Municipality has appointed an independent auctioneer to curb thefts and to increase our revenue base, and we have also seen an improvement in this regard as compared to the previous financial years. The Asset Management Section works closely with the Internal Audit Section”.

“The municipality keeps up to date with GRAP statements and finance officials are regularly sent on GRAP update courses”.

“Audit Debtors and Revenue Management—Review debit raising processes for main services rendered (rates, electricity, refuse)—Review debit raising processes for sundry services rendered—Review Debtors Age Analysis—Review Indigent Database”.

The audit report findings of this municipality were resolved by improving governance and oversight through the establishment of municipal public accounts committees and audit committees. Furthermore, the municipality employed competent employees to ensure that the municipality can deliver services to their community through the introduction of “sound financial management” practices. In addition, the municipality introduced a performance management system for managers and ensured that municipal accountants receive adequate training on the implementation of accounting standards, which are indicators of effective human resources management. The municipality also introduced security measures to safeguard its property, plants, equipment, and investment properties and reconciled underlying accounting records such as the Annual Financial Statements (AFS) to the Trial Balance (TB) and General Ledger (GL). Subsequently, the municipality ensured that accounting records are adequately reviewed by financial managers, which are all indicators of adequate and effective internal controls, asset management, and adequate records management. All the above constitute effective turnaround strategies to resolve audit findings and improve the financial sustainability of a financially distressed municipality.

8. Cumulative Results and Discussion

The purpose of this study is to identify successful turnaround strategies with the potential to resolve municipal financial distress based on the turnaround strategies as disclosed in the audit action plans of municipalities (which were previously classified as financially distressed in May 2018) that had achieved improved audit outcomes. This analysis indicates the existence and frequency of references to particular turnaround strategies, as disclosed in the text of audit action plans, which resulted in resolved audit report findings.

As per

Figure 3, the most frequently used effective turnaround strategies are further critically evaluated next.

8.1. Internal Controls

As indicated in

Section 4.1 of this study, financially distressed municipalities often have inadequate and ineffective controls. Effective and adequate internal controls can assist municipalities in reducing the impact and the likelihood of unfavorable incidents and calamities by introducing rigorous risk management processes and controls to respond to risks, which inform control activities [

138]. Effective and adequate internal controls were implemented in 22 out of the 24 municipalities (92%) that reported improved audit outcomes. A total of 138 audit report qualification paragraphs were successfully resolved by implementing adequate and effective internal controls at these 22 municipalities. Furthermore, 122 references regarding the implementation of adequate and effective internal controls were noticed in the audit action plans of municipalities that achieved improved audit outcomes.

Municipalities that managed to safeguard and maintain their assets relied on improving the effectiveness and adequacy of the following internal controls to resolve audit report qualifications:

Each divisional municipal manager was personally responsible for the physical security of divisional operational assets, such as equipment, vehicles, and consumables. Municipalities aimed to ensure that assets were safeguarded through the use of fences, burglar bars, and other physical security measures to protect assets against theft.

Regular physical asset verifications were conducted to ensure that assets were in good working condition. These physical asset verifications were then used to update fixed asset registers, which were reconciled to the general ledger and annual financial statements. Should any discrepancies be identified during the asset verification and review processes, then the Chief Financial Officer or delegated financial official approved adjusting journal entries after reviewing supporting evidence.

Municipalities used independent accounting consultants to assist them in updating their fixed asset registers by confirming the valuation of assets in order to disclose assets adequately in annual financial statements.

Accounting policies relating to assets were also reviewed to confirm that these policies complied with prescribed accounting standards, such as the Standards of Generally Recognised Accounting Practices (GRAP), as stipulated in the MFMA.

Municipalities stressed the importance of ensuring that internal audit divisions were adequately capacitated with skilled and experienced internal auditors and that internal audit vacancies were filled promptly.

The significant impact of implementing effective and adequate internal controls as a turnaround strategy was also highlighted in the works of Spatacean, Ann Riney, and Akomea-Frimpong et al. [

56,

57,

58].

Municipalities that failed to improve their financial affairs experienced the following barriers with regard to internal controls:

Municipalities had outdated accounting and operational policies and standard operating procedures, and these municipalities also failed to review policies and procedures on a regular basis.

A lack of segregation of duties.

No formal delegation of authority from the council to the executive management team was in place.

8.2. Governance and Oversight

Municipalities function autonomously from other spheres of government but are still subjected to various governance and oversight structures to ensure that municipalities maintain fiscal discipline and avoid irregularities [

9]. The effectiveness of governance mechanisms is directly related to the probability that a municipality may experience financial distress [

139,

140,

141]. Trustworthy governance and oversight are essential for promoting sustainability, accountability, integrity, and compliance with laws and regulations, as most municipalities are susceptible to fraud and corruption because of the inherent risks associated with public procurement practices [

142]. Therefore, municipalities with weak governance and oversight bodies are more likely to experience financial distress and may experience repetitive audit findings due to a lack of accountability, as indicated in

Section 4.2 and

Section 4.5 of this study. The primary objective of effective governance and oversight is to guarantee that municipalities can adequately respond to the basic service demands of local communities and can be held accountable for service delivery failures [

143]. Municipalities should justify management decisions regarding how public taxpayers’ funds are spent to ensure that residents receive adequate basic services in their local communities. The AGSA evaluates the governance and oversight structures of municipalities and may conclude on the effectiveness of governance and oversight committees in their audit reports by indicating the following: “The audit committee and internal audit was not effective in the financial year even though it was appointed in the year”, as in the case of the Joe Morolong Municipality [

114].

Good governance and effective oversight measures were implemented in 21 out of the 24 municipalities (88%) that achieved improved audit outcomes. A total of 100 audit report qualification paragraphs were successfully resolved by implementing effective governance and oversight at these 21 municipalities. Furthermore, 102 references regarding the implementation of effective governance and oversight were noticed in the audit action plans of municipalities that achieved improved audit outcomes. Good governance and effective oversight were achieved through the implementation of the following:

The establishment of functional municipal oversight committees, which may include audit and risk committees and municipal public accounts committees (MPACs), which all contributed to the level of assurance provided regarding the reasonable representation of the financial affairs of these municipalities, as prescribed in legislation as well as the King IV report on corporate governance [

9,

144].

Utilizing a stakeholder-inclusive approach to decision making through collaborative governance, as emphasized by Van der Merwe [

145]. Improved municipalities used participatory forums such as mayoral community meetings (“imbizos”) and bilateral meetings to address basic service delivery challenges and account for how public funds were spent. These community meetings increased transparency and public trust.

Municipalities ensured that interruptions to the provisioning of basic services were addressed and resolved through the customer care system, regular ward committee meetings, and monthly timeous financial reporting.

The Mahikeng Municipality aptly concluded on the importance of governance and oversight by stating that good leadership underpins good governance with the main aim of enhancing accountability, fairness, and transparency.

In contrast, it was observed that municipalities that failed to improve their financial affairs experienced the following barriers with regard to governance and oversight:

Municipalities failed to appoint members to their audit committee, or the audit committee failed to meet at least once on a quarterly basis.

Municipalities failed to implement internal audit recommendations promptly.

Instances where irregular, unauthorized, and wasteful expenditure were written off without an investigation being conducted by the municipal public accounts committee.

8.3. Human Resources Management

Even though there is an abundance of consequences associated with financial distress, one of the most destructive consequences is the impact of impending financial distress on employee turnover intention, productivity, and morale. The early onset of financial distress causes talented and skilled employees to resign [

146]. In addition, Pedersen [

147] postulated that employees would also demand higher remuneration at organizations with a perceived risk of financial distress as they attempt to protect themselves against declining job security, possible reductions in working hours, and salary losses if their employers are no longer addressing concerns. Financial distress consequently increases expenses such as salaries and wages. Financially distressed municipalities often struggle with high vacancy rates and a lack of performance management systems, as indicated in

Section 4.6 and

Section 4.7 of this study.

Effective human resources management aims to ensure that municipalities have an effective performance evaluation system, as prescribed by the Municipal Systems Act [

9]. Municipal Managers must disclose all financial interests within 60 days of appointment. Furthermore, all employees should have a job description within the approved organogram of the municipality. Material non-compliance deviations regarding any of these prescripts should be reported in the audit reports of affected municipalities. Effective human resources management assists municipalities with resolving several other audit report qualifications by ensuring that skilled and experienced employees are recruited and appointed for suitable positions in municipalities and that employees receive sufficiently appropriate training to execute their duties as required [

148]. Effective human resource management was implemented in 21 out of the 24 municipalities (88%) that achieved improved audit outcomes. Implementing effective human resources management processes and procedures successfully resolved 84 audit report qualification paragraphs at these 21 municipalities. Furthermore, 67 references regarding the implementation of effective human resources management processes were noticed in the audit action plans of municipalities that achieved improved audit outcomes. Effective human resources management was achieved by implementing the following processes and procedures:

Improved municipalities had an organizational structure in place, which was approved by their municipal councils.

Municipal officials were appointed to all critical positions, and vacancies were filled promptly.

Employees participated in regular training workshops to enhance professional competencies and technical skills.

Performance management systems were implemented, which required employees to set and achieve their own key performance targets that were aligned with each municipality’s overall service delivery strategy. Municipal officials submitted a portfolio of evidence supporting their key performance targets.

Improved municipalities achieved excellent person–job matches by ensuring employees had adequate skills and competencies to execute their duties.

Effective human resources management contributed to municipalities resolving audit report findings regarding material uncertainty relating to ongoing concerns.

In contrast, it was observed that municipalities that failed to improve their financial affairs experienced the following barriers with regard to human resources management:

Municipal councilors, mayors, and officials did not have the minimum competency levels required to execute their jobs appropriately.

Municipal management teams failed to implement a performance management system for employees.

Members of the municipal bid evaluation committees and bid adjudication committees did not receive training on procurement regulations and practices, and consequently, tender irregularities and financial misconduct were incurred.

High staff turnover rates, as well as high vacancy rates, were observed.

8.4. Records Management

The South African public sector, which includes municipalities, is generally plagued by poor records management, which results in disclaimers and adverse audit opinions [

149]. Repetitive disclaimer audit opinions are determinants of financial distress as municipalities suffer significant harm due to inadequate records management, which leads to material irregularities and financial distress. Inefficient and poor records management creates a breeding ground enabling endemic fraud and corruption, as poor records management results in miscommunications and data losses [

150]. Resultantly, non-compliance with laws and regulations is often observed in financially distressed municipalities, as indicated in

Section 4.3 of this study.

The primary objective of effective records management is to ensure that source documents, informative financial data, and an audit trail of transactions are readily available to improve accountability and enhance management decision making. Poor records management hinders municipalities from delivering basic quality services to their local communities due to ineffective management decisions and will result in repetitive disclaimed audit opinions [

149]. Effective records management was implemented in 20 out of the 24 municipalities (83%) that achieved improved audit outcomes. Implementing effective records management processes and procedures successfully resolved 75 audit report qualification paragraphs at these 20 municipalities. Furthermore, 63 references regarding the implementation of effective records management processes were noticed in the audit action plans of municipalities that achieved improved audit outcomes.

Maintaining adequate records and source documentation, such as traffic fine book registers, valuation rolls, and billings reports, is necessary to ensure that the annual financial statements are a fair and reasonable representation of the financial affairs of municipalities [

151]. Insufficient source documentation often leads to financial distress and results in disclaimed audit opinions and material irregularities due to the significant harm that inadequate records management may cause a public institution if no audit trail of transactions exists [

152]. Preferably, records management systems should also allow for documentation to be stored in a digital format. The Modimolle-Mookgophong Municipality implemented a digital record-keeping system that assisted them in resolving several audit report findings and limiting instances of fraud and corruption in this municipality.

It was observed that municipalities that failed to improve their financial affairs experienced the following barriers with regard to records management:

Valuation rolls were incomplete and inaccurate. Consequently, financially distressed municipalities were unable to bill all residents’ rates and taxes, as some residents’ names were omitted from the valuation roll, which resulted in revenue leakage.

Municipalities with paper-based documentation and files often lost vital source documents required to maintain an audit trail of transactions.

8.5. Asset Management

Infrastructure assets are crucial, and they empower municipalities to deliver essential services. However, South African infrastructure assets are ageing at an alarming rate and require regular maintenance to deliver essential services to local communities [

153]. The maintenance and replacement of infrastructure assets should be a top municipal priority, as capital investment reduces infrastructure breakdowns, prevents service delivery collapses, and negates the patchwork approach to infrastructure maintenance [

15]. The procurement of infrastructure assets and the maintenance thereof in financially distressed municipalities is often coupled with irregular expenditure, as indicated in

Section 4.3 and

Section 4.4 of this study.

The MFMA stipulates that municipalities must take reasonable steps to account for municipal assets [

9]. The MFMA’s definition of asset management includes, among other things, infrastructure assets, investment properties, receivables, investments, and loans to directors of these municipalities. Effective asset management was implemented in 18 out of the 24 municipalities (75%) that achieved improved audit outcomes. Implementing effective asset management processes and procedures successfully resolved 50 audit report qualification paragraphs at these 18 municipalities. Furthermore, 59 references regarding the implementation of effective asset management processes were noticed in the audit action plans of municipalities that achieved improved audit outcomes. Municipalities achieved success by:

The planning, budgeting, and reporting of assets was integrated to ensure adequate funding was set aside for repairing infrastructure, community, and heritage assets.

The Asset Directorate enforced clear segregation of duties regarding the custody and oversight of municipal assets.

The working conditions of assets were carefully and regularly monitored to reduce excessive maintenance costs, as assets were repaired as soon as any breakdowns were observed. Strategic plans were implemented to maintain municipal assets, and budgets adequately provided for repairs and maintenance-related expenses.

New assets were received and recorded in fixed asset registers within 24 h after the acquisition date.

When assets were no longer in good working condition, a policy was in place to dispose of these assets and utilize the proceeds from asset disposals to replace assets at the end of their useful lives.

Loss control committees were established to monitor, review, and report on all asset losses and disposals. Audit committees carefully monitored the loss control committee reports following the principles of good governance.

In contrast, it was observed that municipalities that failed to improve their financial affairs experienced the following barriers regarding asset management:

Municipal assets were not adequately maintained due to ineffective project management practices and unreliable planning regarding scheduled maintenance. If municipal assets are not adequately maintained, then they cannot be used effectively to deliver services to communities.

Fixed asset registers were not credible and reliable, and therefore, municipal management teams either did not have a complete record of their assets or had assets listed in their fixed asset registers, but the existence of these assets could not be confirmed as the location of these assets was unknown.

Municipalities tended to appoint asset management consultants and auctioneers indefinitely to provide them with the required skills that these municipalities did not have, without requiring external consultants to transfer the necessary skills and know-how to municipal officials to empower the municipality to perform these functions themselves. In this regard, ZAR 1.26 billion was spent on external consultants during the 2021 financial year.

9. Summative Findings

Local governments that achieved improved audit outcomes implemented various turnaround strategies to improve their financial viability, sustainability, and audit outcomes. Due to the significance of public funds invested in infrastructure assets, municipalities achieved success by focusing on effective asset management, adequate records management, and effective internal controls to ensure that these assets were adequately safeguarded and that the values of these assets were fairly stated in annual financial statements, which resolved the majority of audit qualifications. Furthermore, improved municipalities attributed their success to prioritizing effective human resources management where municipalities had an approved organizational structure, and all critical vacancies were filled with officials with the required skills, experience, and knowledge to execute their duties with due care. All of the above assisted financially distressed municipalities in reducing the occurrence of ongoing concerns in audit report paragraphs.

Effective turnaround strategies were identified based on the results of an inductive interpretive content analysis of the audit action plans of municipalities, which were classified as financially distressed in May 2018 and subsequently achieved improved audit outcomes. The credibility and reliability of these turnaround strategies were corroborated by inspecting the related external audit reports of these municipalities to ensure that each turnaround strategy, as disclosed in the audit action plans, resulted in audit report qualification paragraphs being resolved in subsequent external audit reports. The AGSA conducted external audits based on a rigorous regulatory auditing process as prescribed by the International Standards on Auditing. Consequently, the most effective turnaround strategies were identified based on the number of audit report qualification paragraphs, which were subsequently resolved as a direct result of implementing each turnaround strategy and the frequency of references to this particular strategy in the audit action plans of these municipalities.

As per

Figure 4, most municipalities, which were previously classified as financially distressed, improved due to the implementation of effective and adequate internal controls. The implementation of effective and adequate internal controls resulted in most external audit report qualification paragraphs being resolved and were most frequently referenced in audit action plans. This turnaround strategy is therefore deemed to be pivotal in helping financially distressed municipalities to turn around.

Financially distressed municipalities across the world may be able to reduce their financial distress by implementing similar turnaround strategies to those which have proven effective in a South African context. The turnaround strategies identified in this study are transversal, impacting local governments globally, as financially distressed municipalities worldwide will be impacted by internal controls, governance and oversight, human resources, records management, and asset management practices.

10. Conclusions

Many of South Africa’s local communities are frustrated with their municipalities due to inadequate and ineffective basic service delivery. This study focuses attention on the importance of implementing successful turnaround strategies to resolve municipal financial distress in order to improve municipal financial viability and sustainability and, as a result, the quality of basic services provided to local communities. The full extent of the financial and operational problems experienced at financially distressed municipalities are reflected in the AGSA’s audit report, which serves as an independent barometer of the reasonable representation of a municipality’s annual financial statements and annual performance reports. Furthermore, audit outcomes can also be utilized to measure the implementation of audit action plans, which are drafted in response to audit findings. Moreover, these turnaround strategies can also serve as checklists for any municipality to improve the effectiveness and adequacy of their control activities, which may result in improved audit outcomes.