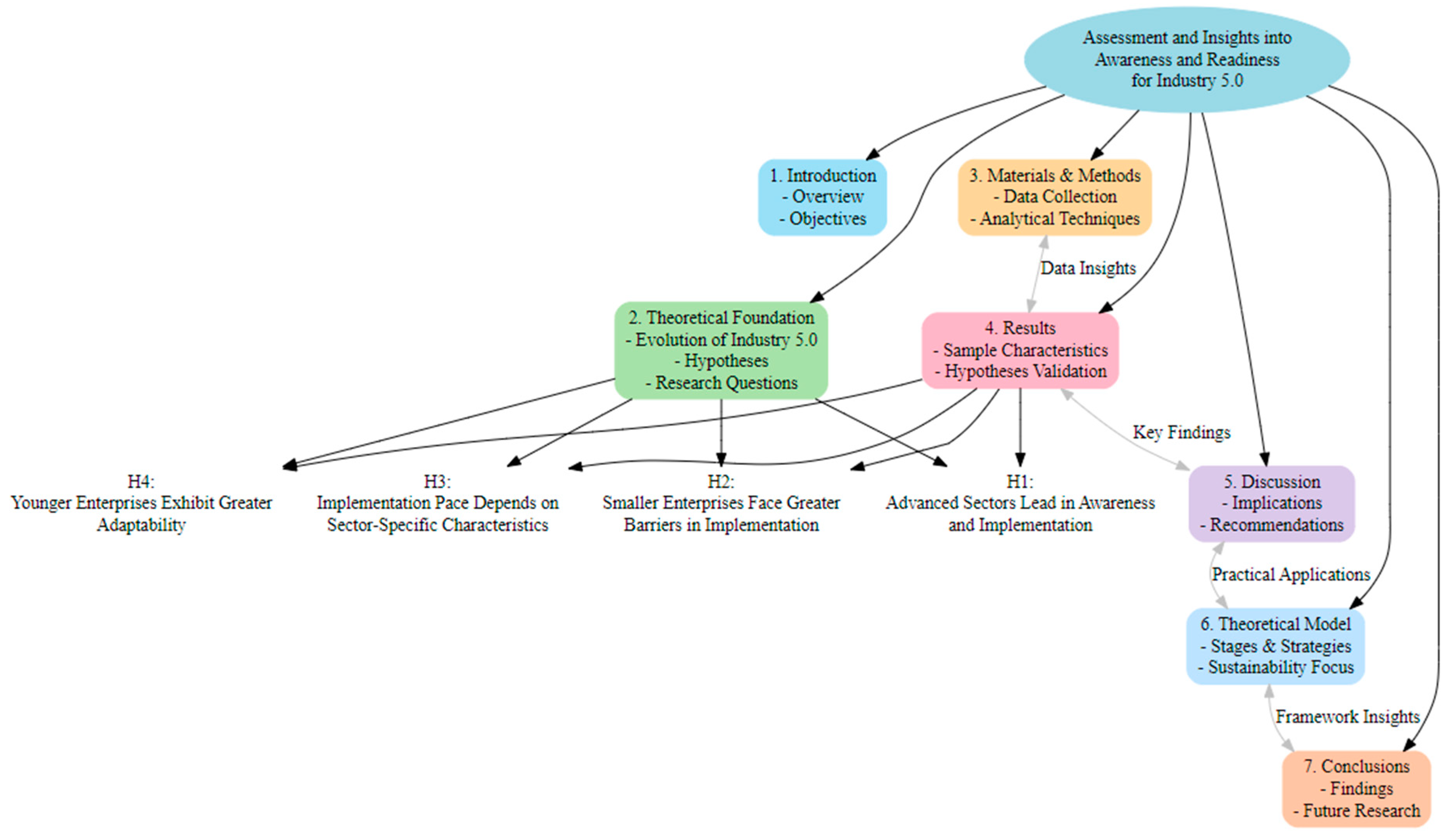

Assessment and Insights into the Awareness and Readiness of Organizations to Implement the Assumptions of Industry 5.0: An Examination of Five Polish Sectors

Abstract

1. Introduction

2. Theoretical Foundation and Hypotheses

2.1. The Essence and Concept of Industry 5.0

2.2. The Level of Awareness Among Enterprises Regarding the Implementation of Industry 5.0 Principles

2.3. Hypotheses

3. Methodology

3.1. Data Collection and Sample

3.2. Data Analysis

4. Results

4.1. Sample Characteristics

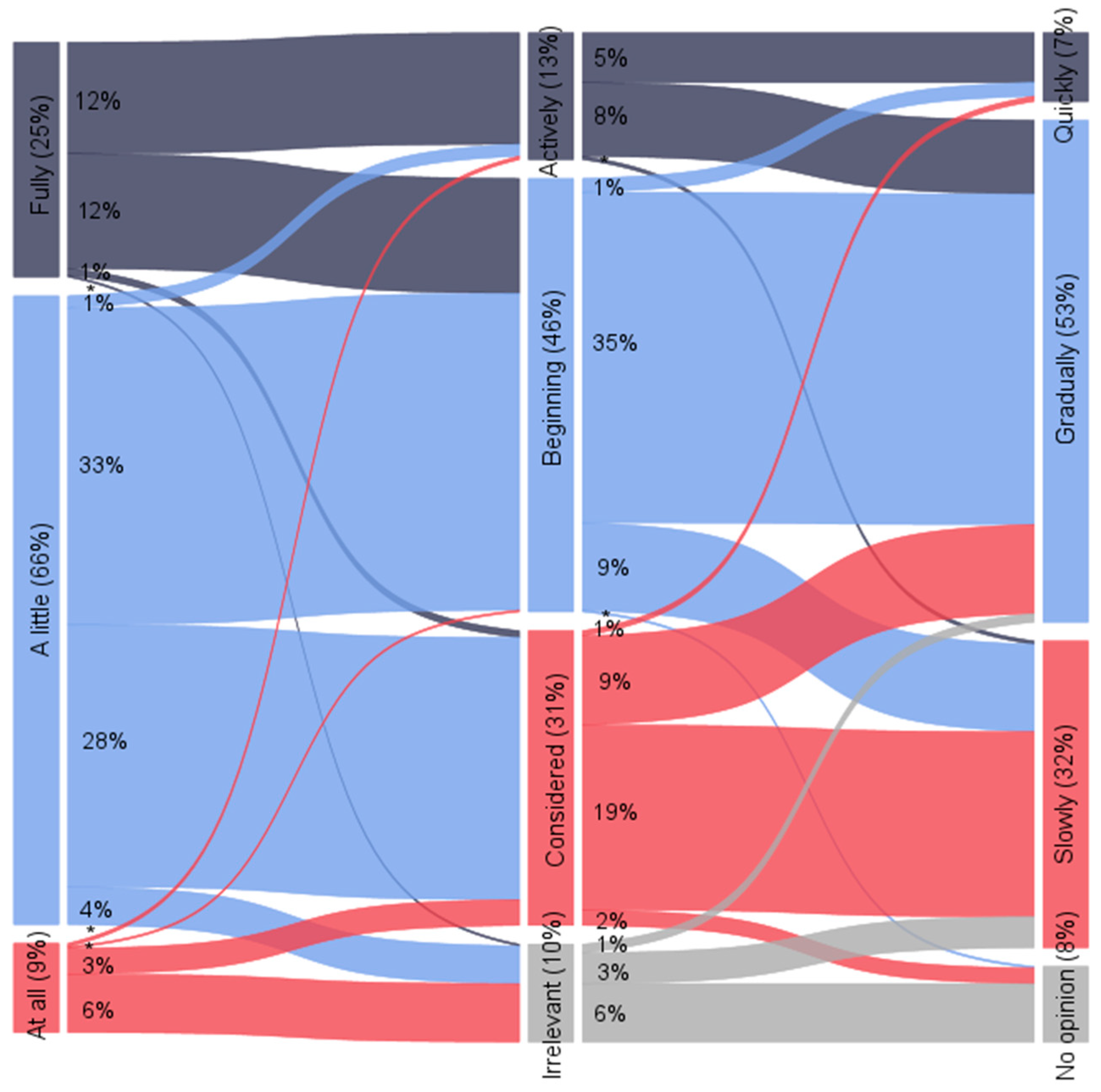

4.2. Awareness, Commitment, and Pace of Implementation of Industry 5.0

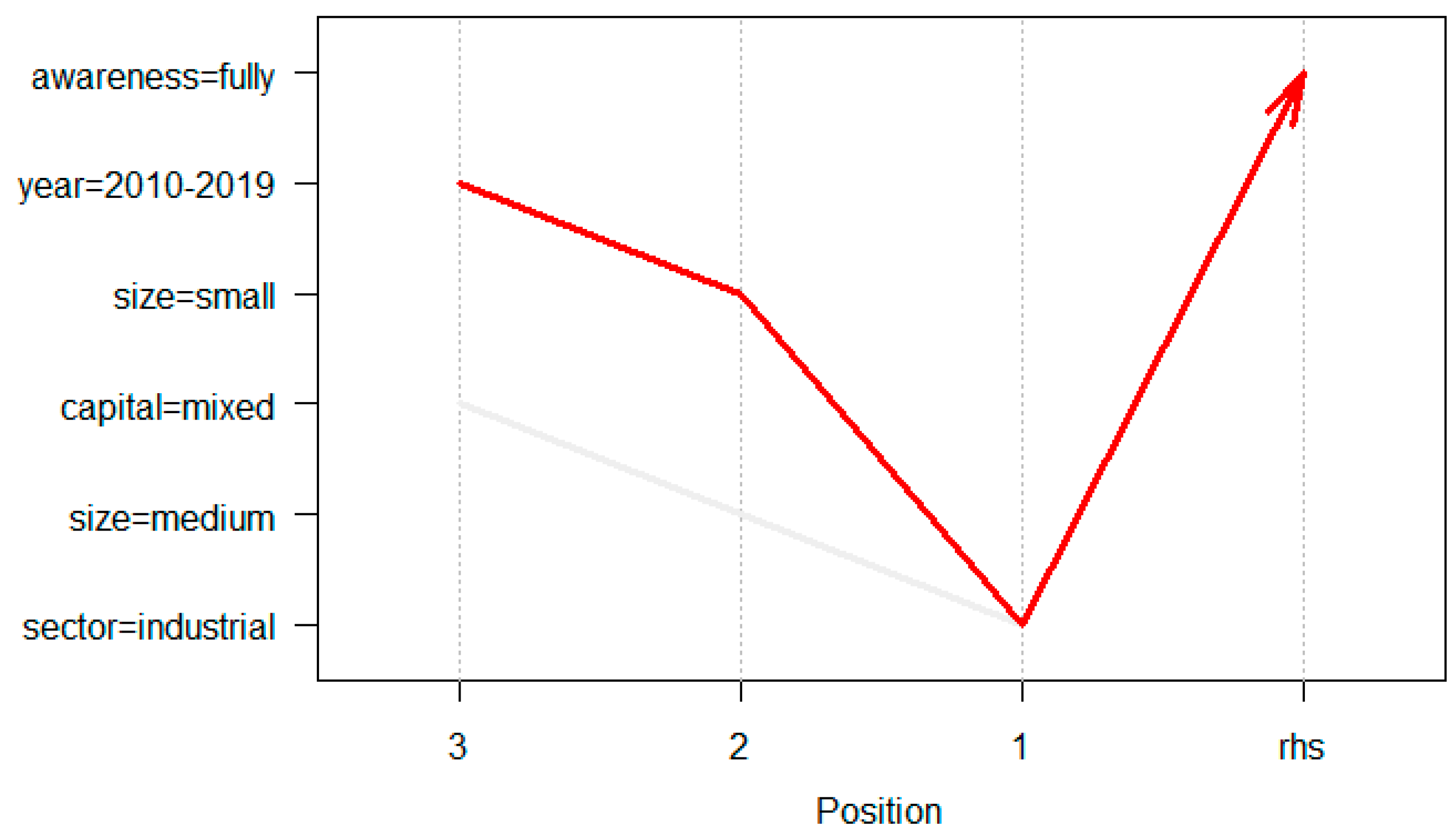

- Rule 1: If sector = industrial, size = small, year = 2010–2019, then the probability of full awareness is 66.67% (lift = 2.71).

- Rule 2: If sector = industrial, size = medium, capital = mixed, then the probability of full awareness is 60% (lift = 2.44).

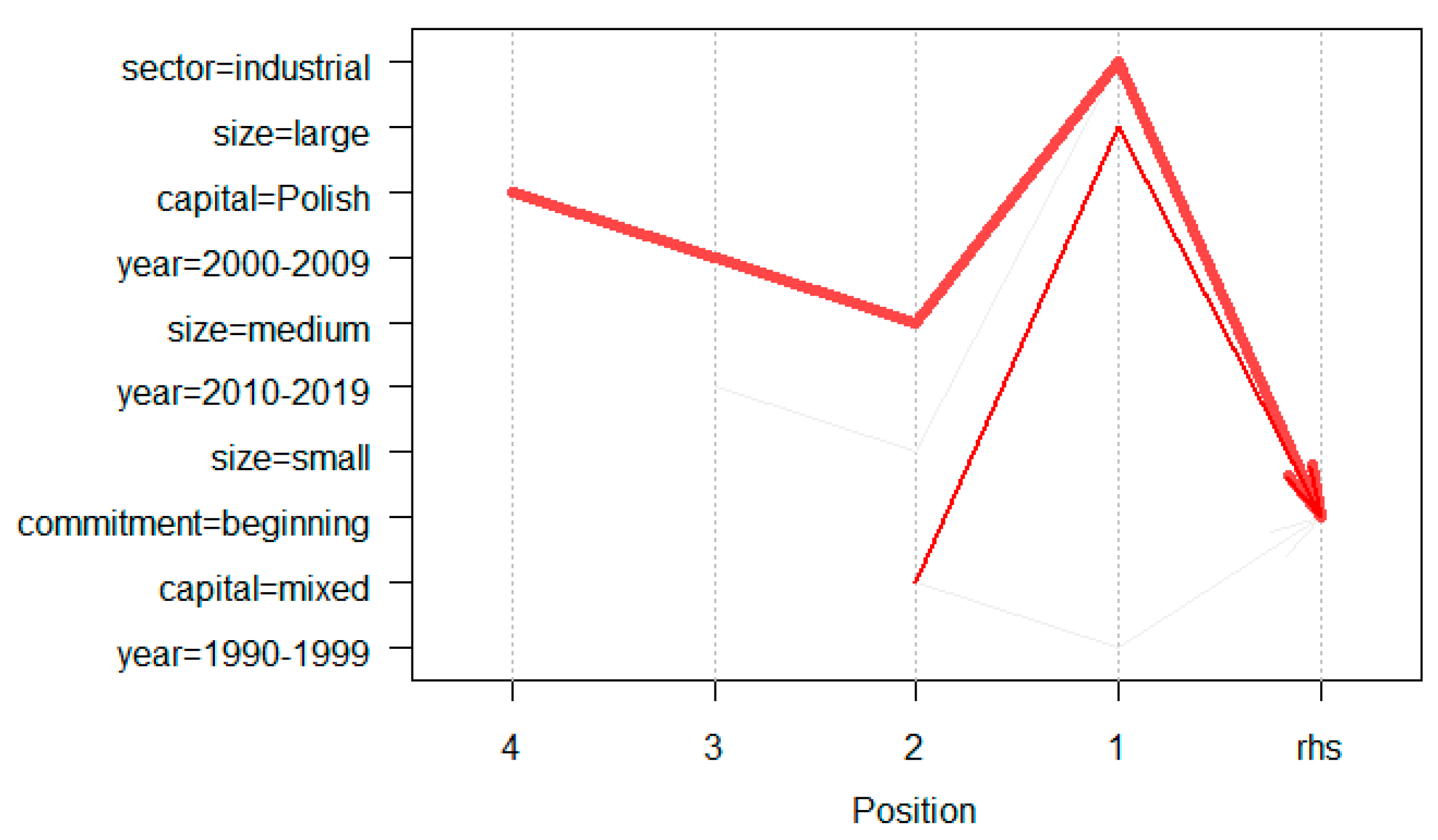

- Rule 1: If size = large, capital = mixed, then the probability of active/starting commitment is 70% (lift = 1.54).

- Rule 2: If sector = industrial, size = medium, year = 2000–2009, capital = Polish, then the probability of active/starting commitment is 69.23% (lift = 1.52).

- Rule 3: If year = 1990–1999, capital = mixed, then the probability of active/starting commitment is 66.67% (lift = 1.47).

- Rule 4: If sector = industrial, size = small, year = 2010–2019, then the probability of active/starting commitment is 66.67% (lift = 1.47).

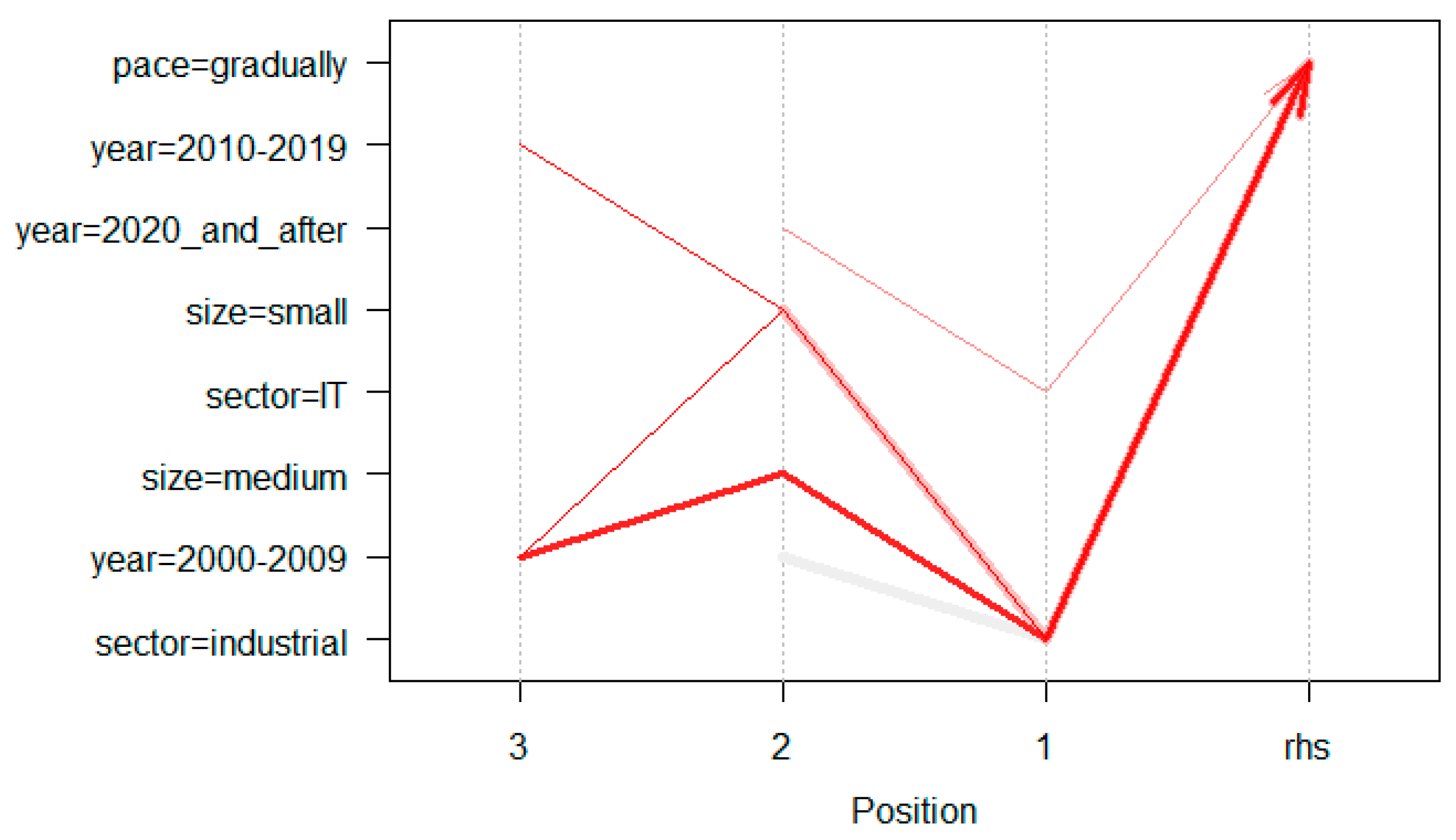

- Rule 1: If sector = IT, year = 2020_and_after, then the probability of quick/gradual pace of implementation of Industry 5.0 is 85.71% (lift = 1.63).

- Rule 2: If sector = industrial, size = small, then the probability of quick/gradual pace of implementation of Industry 5.0 is 83.33% (lift = 1.58).

- Rule 3: If sector = industrial, year = 2000–2009, then the probability of quick/gradual pace of implementation of Industry 5.0 is 80.65% (lift = 1.53).

- Rule 4: If sector = industrial, size = medium, year = 2000–2009, then the probability of quick/gradual pace of implementation of Industry 5.0 is 88.89% (lift = 1.69).

- Rule 5: If sector = industrial, size = small, year = 2000–2009, then the probability of quick/gradual pace of implementation of Industry 5.0 is 90% (lift = 1.71).

- Rule 6: If sector = industrial, size = small, year = 2010–2019, then the probability of quick/gradual pace of implementation of Industry 5.0 is 88.89% (lift = 1.69).

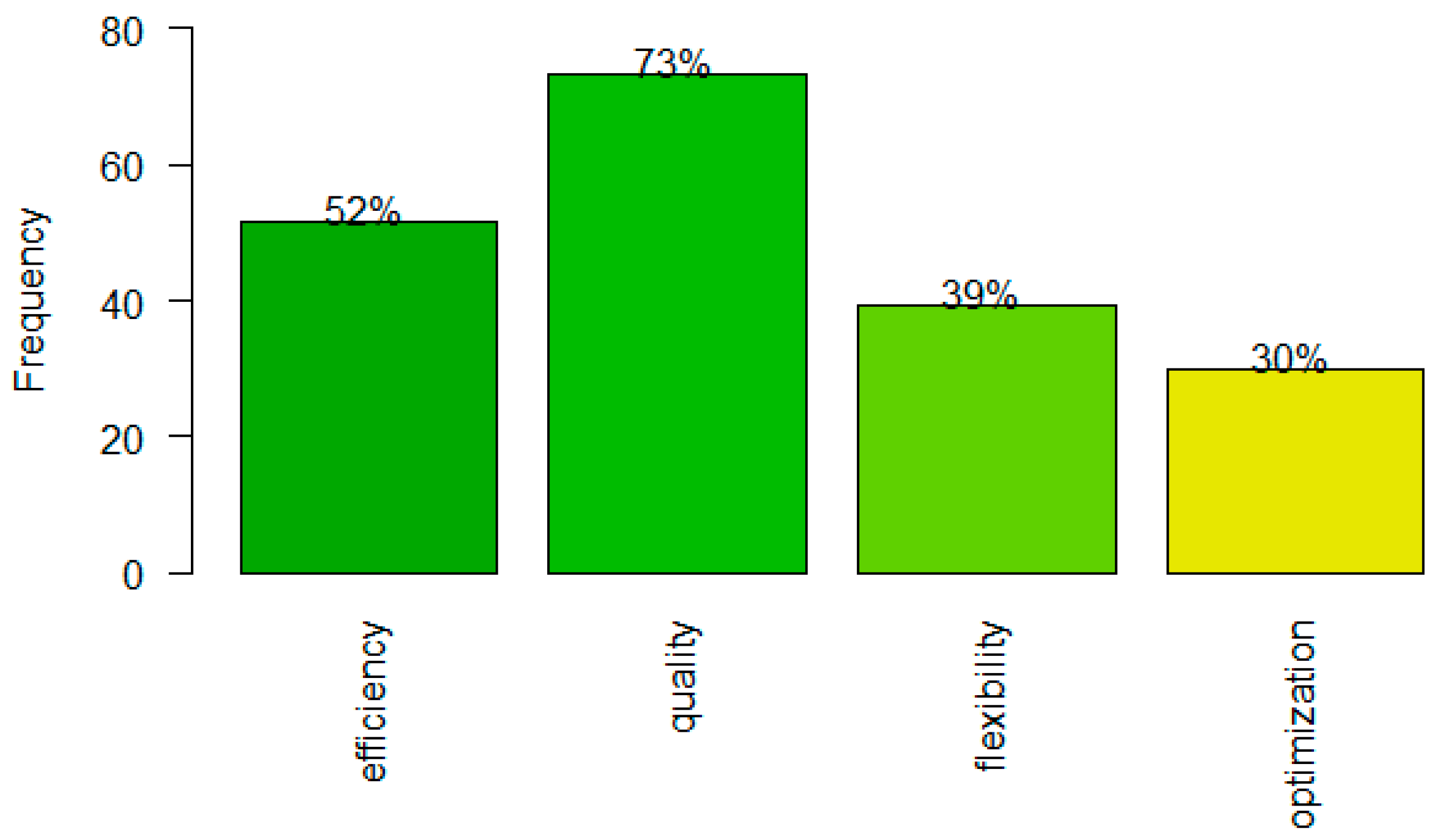

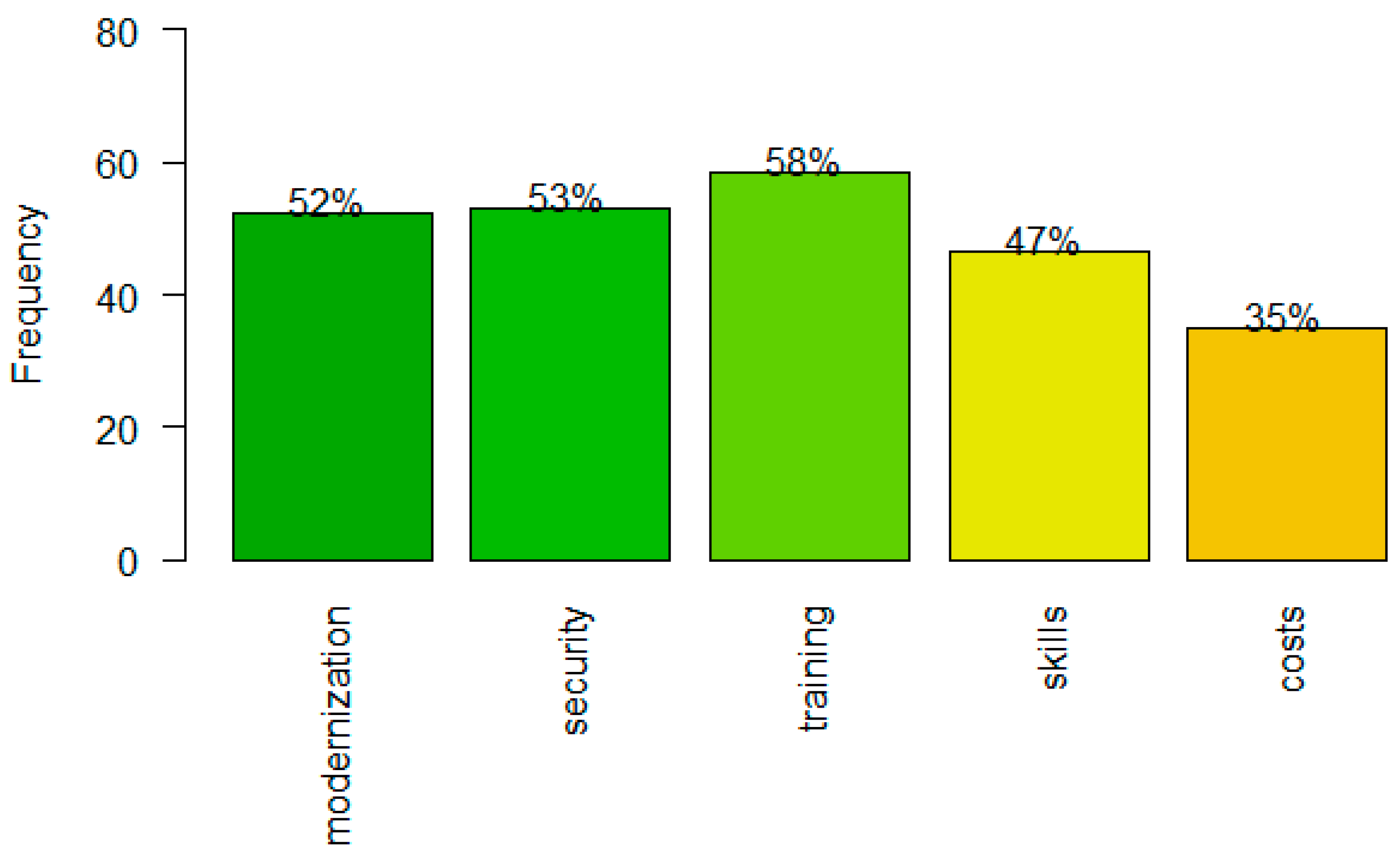

4.3. Benefits and Challenges

5. Discussion

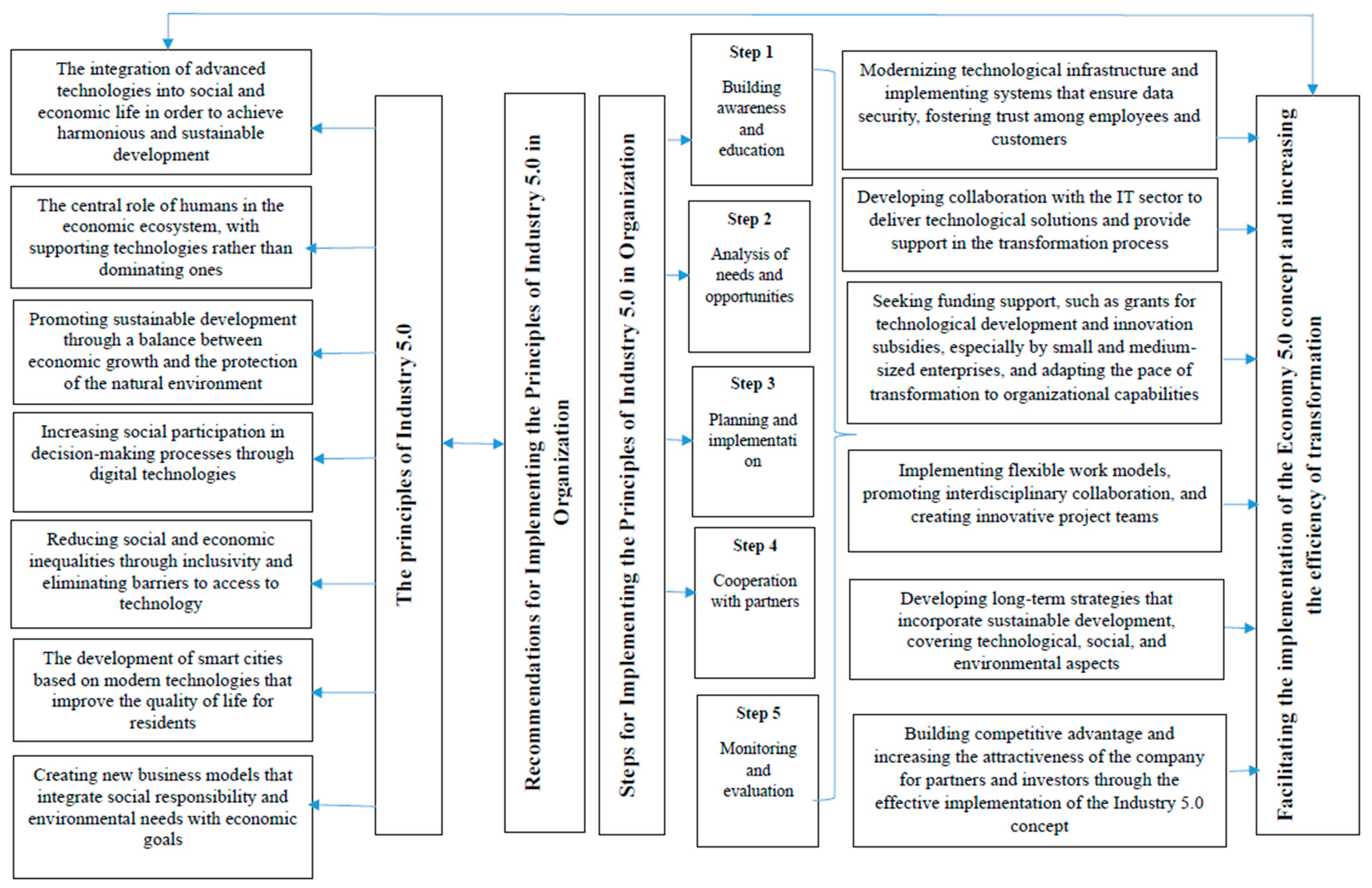

5.1. Implications

5.2. Theoretical Model

5.3. Limitations

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Maciejewski, R.; Knast, P. Podstawy Teoretyczne i Praktyczne Rewolucji Przemysłowej 4.0 i 5.0; Fundacja na Rzecz Czystej Energii: Poznań, Poland, 2024. [Google Scholar]

- Li, X.; Kim, Y. Technologiczne innowacje i transformacje społeczne w kontekście Gospodarki 5.0. In Nowe Horyzonty: Perspektywy na Przyszłość Gospodarki; Park, S., Ed.; Wydawnictwo Alfa: Katowice, Poland, 2024; pp. 87–102. [Google Scholar]

- Schwab, K. The Fourth Industrial Revolution; Crown Currency: Hoofddorp, The Netherlands, 2017. [Google Scholar]

- Fukuyama, F. Identity: The Demand for Dignity and the Politics of Resentment. Farrar, Straus and Giroux. 2018. Available online: https://psipp.itb-ad.ac.id/wp-content/uploads/2020/10/Francis-Fukuyama-Identity_-The-Demand-for-Dignity-and-the-Politics-of-Resentment-0-Farrar-Straus-and-Giroux.pdf (accessed on 20 October 2024).

- Schneider, R.; Smith, J. Gospodarka 5.0: Nowy paradygmat zarządzania zasobami w erze cyfrowej. J. Econ. Stud. 2023, 10, 45–58. [Google Scholar]

- Tawalbeh, L.A.; Muheidat, F.; Tawalbeh, M.; Quwaider, M. IoT privacy and security: Challenges and solutions. Appl. Sci. 2020, 10, 4102. [Google Scholar] [CrossRef]

- Moczydłowska, J.M. Przemysł 4.0-Ludzie i Technologie; Difin: Warszawa, Poland, 2023. [Google Scholar]

- Graczyk, M.; Stec, A. Blockchain technology in logistics and supply chain management. In Advances in Intelligent Systems and Computing; Borzemski, L., Grzech, A., Świątek, J., Eds.; Springer: Berlin/Heidelberg, Germany, 2018; Volume 722. [Google Scholar]

- Chesbrough, H.; Vanhaverbeke, W.; West, J. (Eds.) New Frontiers in Open Innovation; Oxford University Press: Oxford, UK, 2020. [Google Scholar]

- Mahmud, K.; Makaju, S.; Ibrahim, R.; Missaoui, A. Current progress in nitrogen fixing plants and microbiome research. Plants 2020, 9, 97. [Google Scholar] [CrossRef]

- Polski Fundusz Rozwoju. Usługi w Gospodarce i Handlu Zagranicznym Polski. 2021. Available online: https://pfr.pl/artykul/raport-specjalny-uslugi-w-gospodarce-i-handlu-zagranicznym-polski (accessed on 15 January 2025).

- Główny Urząd Statystyczny. Produkt Krajowy Brutto i Wartość Dodana Brutto w Przekroju Regionów w 2021 r. 2023. Available online: https://stat.gov.pl/obszary-tematyczne/rachunki-narodowe/rachunki-regionalne/produkt-krajowy-brutto-i-wartosc-dodana-brutto-w-przekroju-regionow-w-2021-r-,7,6.html (accessed on 16 January 2025).

- Instytut Finansów Publicznych. 20 Lat Polskiego Rolnictwa w UE. Perspektywa Makroekonomiczna. Wybrane Fakty. 2024. Available online: https://www.ifp.org.pl/20-lat-polskiego-rolnictwa-w-ue-perspektywa-makroekonomiczna-wybrane-fakty/ (accessed on 16 January 2025).

- Główny Urząd Statystyczny. Bank Danych Lokalnych. 2024. Available online: https://stat.gov.pl/ (accessed on 16 January 2025).

- Polish Investment & Trade Agency. The Automotive & Electromobility Sector. 2023. Available online: https://www.paih.gov.pl/wp-content/uploads/0/149501/149567.pdf (accessed on 17 January 2025).

- Polska Agencja Inwestycji i Handlu. Sektor ICT. 2024. Available online: https://www.paih.gov.pl/dlaczego_polska/sektory/ict/ (accessed on 16 January 2025).

- Urząd Komisji Nadzoru Finansowego. Informacja na Temat Sytuacji Sektora Bankowego w 2023 Roku. 2024. Available online: https://www.knf.gov.pl/?articleId=91100&p_id=18 (accessed on 17 January 2025).

- MGBI. Ile Lat Działa Przeciętny Polski Przedsiębiorca? 2023. Available online: https://www.mgbi.pl/blog/ile-lat-dziala-przecietny-polski-przedsiebiorca/ (accessed on 16 January 2025).

- Główny Urząd Statystyczny. Działalność Gospodarcza Przedsiębiorstw z Kapitałem Zagranicznym w 2022 Roku. 2023. Available online: https://stat.gov.pl/obszary-tematyczne/podmioty-gospodarcze-wyniki-finansowe/przedsiebiorstwa-niefinansowe/dzialalnosc-gospodarcza-przedsiebiorstw-z-kapitalem-zagranicznym-w-2022-roku,26,6.html (accessed on 17 January 2025).

- Główny Urząd Statystyczny. Działalność Gospodarcza Przedsiębiorstw z Kapitałem Zagranicznym w 2020 Roku. 2021. Available online: https://stat.gov.pl/obszary-tematyczne/podmioty-gospodarcze-wyniki-finansowe/przedsiebiorstwa-niefinansowe/dzialalnosc-gospodarcza-przedsiebiorstw-z-kapitalem-zagranicznym-w-2020-roku,4,16.html (accessed on 17 January 2025).

- ABSL. Sektor Nowoczesnych Usług Biznesowych w Polsce. 2024. Available online: https://absl.pl/pl/sektor-w-liczbach (accessed on 16 January 2025).

- Angelini, P. Financial decisions based on zero-sum games: New conceptual and mathematical outcomes. Int. J. Financ. Stud. 2024, 12, 56. [Google Scholar] [CrossRef]

- Livingston, V.; Jackson-Nevels, B.; Reddy, V.V. Social, cultural, and economic determinants of well-being. Encyclopedia 2022, 2, 1183–1199. [Google Scholar] [CrossRef]

- Jin, Y.; Jeong, S.; Moon, M.; Kim, D. Analysis of the dynamic behavior of multi-layered soil grounds. Appl. Sci. 2024, 14, 5256. [Google Scholar] [CrossRef]

- Keidanren, N. Toward Realization of the New Economy and Society. Reform of the Economy and Society by the Deepening of Society. 2016, 5. Available online: https://www.keidanren.or.jp/en/policy/2016/029_outline.pdf (accessed on 25 October 2024).

- Lasi, H.; Fettke, P.; Kemper, H.-G.; Feld, T.; Hoffmann, M. Industry 4.0. Bus. Inf. Syst. Eng. 2014, 6, 239–242. [Google Scholar] [CrossRef]

- Rojko, A. Industry 4.0 concept: Background and overview. Int. J. Interact. Mob. Technol. 2017, 11, 77–90. [Google Scholar] [CrossRef]

- Xu, L.D.; Xu, E.L.; Li, L. Industry 4.0: State of the art and future trends. Int. J. Prod. Res. 2018, 56, 2941–2962. [Google Scholar] [CrossRef]

- Lu, Y. Industry 4.0: A survey on technologies, applications and open research issues. J. Ind. Inf. Integr. 2017, 6, 1–10. [Google Scholar] [CrossRef]

- Ciucu-Durnoi, A.N.; Delcea, C.; Stănescu, A.; Teodorescu, C.A.; Vargas, V.M. Beyond Industry 4.0: Tracing the Path to Industry 5.0 through Bibliometric Analysis. Sustainability 2024, 16, 5251. [Google Scholar] [CrossRef]

- Zizic, M.C.; Mladineo, M.; Gjeldum, N.; Celent, L. From Industry 4.0 towards Industry 5.0: A Review and Analysis of Paradigm Shift for the People, Organization and Technology. Energies 2022, 15, 5221. [Google Scholar] [CrossRef]

- Madsen, D.Ø.; Slåtten, K. Comparing the Evolutionary Trajectories of Industry 4.0 and 5.0: A Management Fashion Perspective. Appl. Syst. Innov. 2023, 6, 48. [Google Scholar] [CrossRef]

- Raja Santhi, A.; Muthuswamy, P. Industry 5.0 or industry 4.0S? Introduction to industry 4.0 and a peek into the prospective industry 5.0 technologies. Int. J. Interact. Des. Manuf. 2023, 17, 947–979. [Google Scholar] [CrossRef]

- Nahavandi, S. Industry 5.0—A Human-Centric Solution. Sustainability 2019, 11, 4371. [Google Scholar] [CrossRef]

- Aheleroff, S.; Huang, H.; Xu, X.; Zhong, R.Y. Toward sustainability and resilience with Industry 4.0 and Industry 5.0. Front. Manuf. Technol. 2022, 2, 951643. [Google Scholar] [CrossRef]

- Ghobakhloo, M.; Iranmanesh, M.; Fathi, M.; Rejeb, A.; Foroughi, B.; Nikbin, D. Beyond Industry 4.0: A systematic review of Industry 5.0 technologies and implications for social, environmental and economic sustainability. Asia-Pac. J. Bus. Adm. 2024; ahead-of-print. [Google Scholar] [CrossRef]

- Vlacic, L.; Huang, H.; Dotoli, M.; Wang, Y.; Ioannou, P.A.; Fan, L.; Wang, X.; Carli, R.; Lv, C.; Li, L.; et al. Automation 5.0: The key to systems intelligence and Industry 5.0. IEEE/CAA J. Autom. Sin. 2024, 11, 1723–1727. [Google Scholar] [CrossRef]

- Goel, R.; Gupta, P. Robotics and Industry 4.0. In A Roadmap to Industry 4.0: Smart Production, Sharp Business and Sustainable Development. Advances in Science, Technology & Innovation; Nayyar, A., Kumar, A., Eds.; Springer: Cham, Switzerland, 2020. [Google Scholar] [CrossRef]

- Borboni, A.; Reddy, K.V.V.; Elamvazuthi, I.; AL-Quraishi, M.S.; Natarajan, E.; Azhar Ali, S.S. The Expanding Role of Artificial Intelligence in Collaborative Robots for Industrial Applications: A Systematic Review of Recent Works. Machines 2023, 11, 111. [Google Scholar] [CrossRef]

- Haidegger, T.; Mai, V.; Mörch, C.M.; Boesl, D.O.; Jacobs, A.; Rao, R.B.; Khamis, A.; Lach, L.; Vanderborght, B. Robotics: Enabler and inhibitor of the Sustainable Development Goals. Sustain. Prod. Consum. 2023, 43, 422–434. [Google Scholar] [CrossRef]

- Dalal, S.; Seth, B.; Radulescu, M. Driving Technologies of Industry 5.0 in the Medical Field. In Digitalization, Sustainable Development, and Industry 5.0; Akkaya, B., Apostu, S.A., Hysa, E., Panait, M., Eds.; Emerald Publishing Limited: Leeds, UK, 2023; pp. 267–292. [Google Scholar] [CrossRef]

- Gandhi, N.; Mishra, S. Applications of Reinforcement learning for Medical Decision Making. In Proceedings of the International Conference on Recent Trends and Applications in Computer Science and Information Technology, Tirana, Albania, 21–22 May 2021; pp. 164–168. [Google Scholar]

- Galizia, F.G.; Bortolini, M.; Calabrese, F. A cross-sectorial review of industrial best practices and case histories on Industry 4.0 technologies. Syst. Eng. 2023, 26, 908–924. [Google Scholar] [CrossRef]

- Gomez, R. Driving Sustainability and Innovation through Design. In Research Journeys to Net Zero; Sung, K., Isherwood, P., Moalosi, R., Eds.; Taylor Francis Publishing: London, UK, 2024; pp. 43–56. [Google Scholar]

- Polymeni, S.; Plastras, S.; Skoutas, D.N.; Kormentzas, G.; Skianis, C. The impact of 6G-IoT technologies on the development of agriculture 5.0: A review. Electronics 2023, 12, 2651. [Google Scholar] [CrossRef]

- Cesco, S.; Sambo, P.; Borin, M.; Basso, B.; Orzes, G.; Mazzetto, F. Smart agriculture and digital twins: Applications and challenges in a vision of sustainability. Eur. J. Agron. 2023, 146, 126809. [Google Scholar] [CrossRef]

- Bissadu, K.D.; Sonko, S.; Hossain, G. Society 5.0 enabled agriculture: Drivers, enabling technologies, architectures, opportunities, and challenges. Inf. Process. Agric. 2024. [Google Scholar] [CrossRef]

- Concepcion, R.; Josh Ramirez, T.; Alejandrino, J.; Janairo, A.G.; Jahara Baun, J.; Francisco, K.; Relano, R.-J.; Enriquez, M.L.; Grace Bautista, M.; Vicerra, R.R.; et al. A look at the near future: Industry 5.0 boosts the potential of sustainable space agriculture. In Proceedings of the IEEE 14th International Conference on Humanoid, Nanotechnology, Information Technology, Communication and Control, Environment, and Management (HNICEM), Boracay Island, Philippines, 1–4 December 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Lu, B.; Wang, X.; Hu, C.; Li, X. Rapid and high-performance analysis of total nitrogen in coco-peat substrate by coupling laser-induced breakdown spectroscopy with multi-chemometrics. Agriculture 2024, 14, 946. [Google Scholar] [CrossRef]

- Abdel-Basset, M.; Mohamed, R.; Chang, V. A Multi-Criteria Decision-Making Framework to Evaluate the Impact of Industry 5.0 Technologies: Case Study, Lessons Learned, Challenges and Future Directions. Inf. Syst. Front. 2024. [Google Scholar] [CrossRef]

- Li, L.; Quintero, J.C.; Yang, Z.; Ono, K. Assessment of user preferences for in-car display combinations during non-driving tasks: An experimental study using a virtual reality head-mounted display prototype. World Electr. Veh. J. 2024, 15, 264. [Google Scholar] [CrossRef]

- Agrawal, R.; Imieliński, T.; Swami, A. Mining Association Rules Between Sets of Items in Large Databases; SIGMOD Rec.: New York, NY, USA, 1993; Volume 22, pp. 207–216. [Google Scholar] [CrossRef]

- Bayardo, R.J.; Agrawal, R.; Gunopulos, D. Constraint-Based Rule Mining in Large, Dense Databases. Data Min. Knowl. Discov. 2010, 4, 217–240. [Google Scholar] [CrossRef]

- Husson, F.; Josse, J.; Pagès, J. Principal Component Methods Hierarchical Clustering Partitional Clustering: Why Would We Need to Choose for Visualizing Data? Appl. Math. Dep. 2010, 17. [Google Scholar]

- R Core Team. R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2024; Available online: https://www.R-project.org/ (accessed on 15 October 2024).

- Hahsler, M.; Buchta, C.; Gruen, B.; Hornik, K. Arules: Mining Association Rules and Frequent Itemsets. R Package Version 1.7-8, 2024. Available online: https://CRAN.R-project.org/package=arules (accessed on 15 October 2024).

- Hahsler, M. ArulesViz: Visualizing Association Rules and Frequent Itemsets. R Package Version 1.5.3. 2024. Available online: https://CRAN.R-project.org/package=arulesViz (accessed on 15 October 2024).

- Iannone, R.; Roy, O. DiagrammeR: Graph/Network Visualization. R Package Version 1.0.11. 2024. Available online: https://CRAN.R-project.org/package=DiagrammeR (accessed on 15 October 2024).

- IBM Corporation. IBM SPSS Statistics for Windows, Version 29.0.2.0; IBM Corporation: Armonk, NY, USA, 2023. [Google Scholar]

- SAP Polska. Jakie Trendy Będą Napędzać Biznes w 2024 Roku? 2024. Available online: https://news.sap.com/poland/2024/01/jakie-trendy-beda-napedzac-biznes-w-2024-roku-dane-i-prognozy-sap/ (accessed on 28 October 2024).

- Grabowska, S.; Sługocki, W.; Saniuk, A. Industry 5.0—Directions of Business Action and Knowledge of Technology in the Context of Surveys of Employees of Manufacturing Companies. In Scientific Papers of Silesian University of Technology. Organization & Management/Zeszyty Naukowe Politechniki Slaskiej. Seria Organizacja i Zarzadzanie; Silesian University of Technology: Gliwice, Poland, 2024; Volume 202, pp. 139–152. [Google Scholar] [CrossRef]

- Forbes, P. Przemysł 4.0 i Przemysł 5.0 Zmieniają Polską Gospodarkę. 2024. Available online: https://www.forbes.pl/technologie/przemysl-40-i-przemysl-50-zmieniaja-polska-gospodarka/xzqbjmy (accessed on 1 November 2024).

- Ghoujdam, M.E.K.; Chaabita, R.; Khalfi, O.E.; Zehraoui, K.; Alaoui, H.E. Exploring the Technologies of Industry 5.0, Benefits and Applications: A Systematic Review. In Industry 5.0 and Emerging Technologies: Transformation Through Technology and Innovations; Springer: Berlin/Heidelberg, Germany, 2024; pp. 23–37. [Google Scholar] [CrossRef]

- ElektroOnline. Przemysł 5.0 w Polsce—Czy Dogonimy Europę? 2024. Available online: https://elektroonline.pl/news/12402%2CPrzemysl-50-w-Polsce-czy-dogonimy-Europe (accessed on 3 November 2024).

- Saniuk, S.; Grabowska, S.; Straka, M. Identification of Social and Economic Expectations: Contextual Reasons for the Transformation Process of Industry 4.0 into the Industry 5.0 Concept. Sustainability 2022, 14, 1391. [Google Scholar] [CrossRef]

- Polska, E.Y. Business 5.0—Następny Krok w Biznesowej Transformacji Firm. 2024. Available online: https://www.ey.com/pl_pl/insights/consulting/business-5-0-nastepny-krok (accessed on 1 November 2024).

- Siemiński, M.; Oliński, M. Readiness of Polish SMEs for the challenges of Industry 4.0/5.0 from the perspective of organizational culture. In Scientific Papers of Silesian University of Technology. Organization & Management/Zeszyty Naukowe Politechniki Slaskiej. Seria Organizacji i Zarzadzanie; Silesian University of Technology: Gliwice, Poland, 2024; Volume 197, pp. 493–513. [Google Scholar] [CrossRef]

- PARP. Startupy w Polsce. Raport 2019. 2019. Available online: https://www.parp.gov.pl/storage/publications/pdf/Startupy-w-Polsce---raport-2019_200117.pdf (accessed on 17 January 2025).

- Pawlicz, A.; Molski, A.; Liszka, W. Wpływ wieku i wielkości przedsiębiorstw turystycznych na ich innowacyjność. Stud. Oeconomica Posnaniensia 2017, 5, 231. [Google Scholar]

- Morton, E. Legacy Business Programs: Emerging Directions. PAS Memo 2022, 109. Available online: https://www.planning.org/publications/document/9227404/ (accessed on 17 January 2025).

- Fundacja Platforma Przemysłu Przyszłości. Strategia Rozwoju Platformy Przemysłu Przyszłości na Lata 2022–2025. 2022. Available online: https://przemyslprzyszlosci.gov.pl/uploads/2022/01/Strategia-rozwoju-Platformy-Przemyslu-Przyszlosci-na-lata-2022-2025.pdf (accessed on 2 November 2024).

- Politechnika Śląska. O Przemyśle 5.0 na Konferencji Nowy Przemysł 4.0 w Katowicach. 2024. Available online: https://www.polsl.pl (accessed on 28 October 2024).

- Platforma Przemysłu Przyszłości. Przemysł 5.0? 2021. Available online: https://przemyslprzyszlosci.gov.pl/przemysl-5-0/ (accessed on 2 November 2024).

| Variable | Category | % |

|---|---|---|

| Sector | Banking/financial | 18.5 |

| IT | 21.9 | |

| Automotive | 20.0 | |

| Industrial | 18.3 | |

| Service | 21.2 | |

| Size | 10–49 employees (small) | 69.6 |

| 50–249 employees (medium) | 21.2 | |

| 250 and more employees (large) | 9.2 | |

| 1989 and before | 8.1 | |

| Year | 1990–1999 | 18.0 |

| 2000–2009 | 31.3 | |

| 2010–2019 | 36.0 | |

| 2020 and after | 6.7 | |

| Capital | Polish | 89.4 |

| Foreign | 4.0 | |

| Mixed | 6.7 |

| Variables | p-Value | df |

|---|---|---|

| Sector | <0.001 | 8 |

| Size | <0.001 | 4 |

| Efficiency | <0.001 | 2 |

| Capital | <0.001 | 4 |

| Year | <0.001 | 8 |

| Optimization | <0.001 | 2 |

| Quality | <0.001 | 2 |

| Flexibility | <0.001 | 2 |

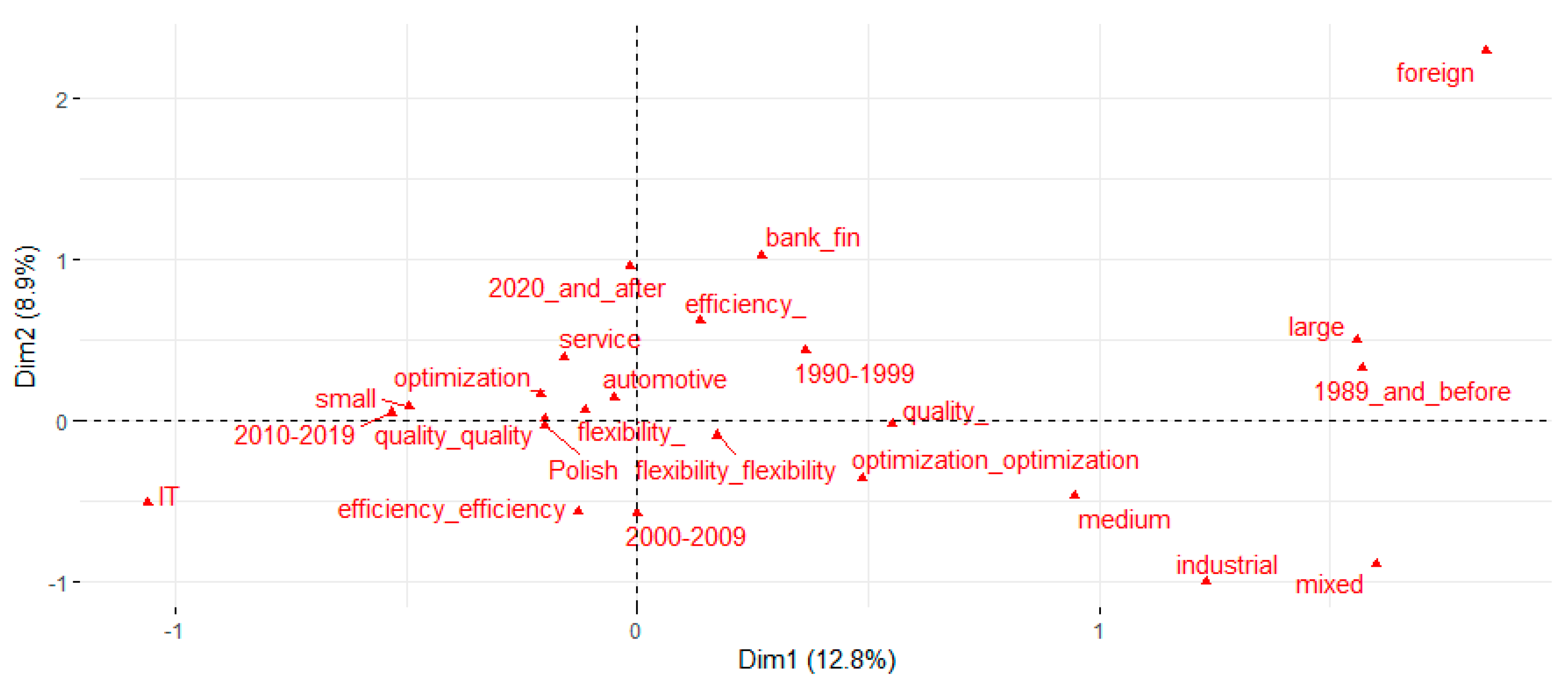

| Cluster | Cla/ Mod | Mod/ Cla | p-Value | v-Test |

|---|---|---|---|---|

| Cluster 1 | ||||

| sector = IT | 91.803 | 82.353 | <0.001 | 18.975 |

| size = small | 34.884 | 99.265 | <0.001 | 10.125 |

| efficiency = efficiency_efficiency | 40.070 | 84.559 | <0.001 | 9.152 |

| optimization = optimization_ | 34.134 | 91.912 | <0.001 | 6.935 |

| year = 2010–2019 | 41.000 | 60.294 | <0.001 | 6.668 |

| capital = Polish | 27.364 | 100.000 | <0.001 | 5.596 |

| quality = quality_quality | 28.922 | 86.765 | <0.001 | 4.233 |

| flexibility = flexibility_ | 29.080 | 72.059 | 0.002 | 3.172 |

| Cluster 2 | ||||

| sector = service | 95.763 | 40.357 | <0.001 | 12.028 |

| efficiency = efficiency_ | 73.234 | 70.357 | <0.001 | 10.591 |

| sector = automotive | 79.279 | 31.426 | <0.001 | 6.952 |

| size = small | 58.398 | 80.714 | <0.001 | 5.759 |

| capital = Polish | 54.125 | 96.071 | <0.001 | 5.266 |

| sector = bank_fin | 67.961 | 25.000 | <0.001 | 3.970 |

| year = 1990–1999 | 62.000 | 22.143 | 0.010 | 2.564 |

| Cluster 3 | ||||

| sector = industrial | 92.157 | 67.143 | <0.001 | 16.445 |

| size = large | 86.275 | 31.429 | <0.001 | 9.679 |

| size = medium | 59.322 | 50.000 | <0.001 | 9.076 |

| capital = mixed | 89.190 | 23.571 | <0.001 | 8.488 |

| year = 1989_and_before | 73.333 | 23.571 | <0.001 | 7.065 |

| optimization = optimization_optimization | 38.922 | 46.429 | <0.001 | 4.759 |

| capital = foreign | 68.182 | 10.714 | <0.001 | 4.264 |

| flexibility = flexibility_flexibility | 32.877 | 51.429 | <0.001 | 3.331 |

| efficiency = efficieny_efficiency | 31.010 | 63.571 | 0.001 | 3.272 |

| quality = quality_ | 33.108 | 35.000 | 0.011 | 2.540 |

| Variables | p-Value | df |

|---|---|---|

| Sector | <0.001 | 12 |

| Size | <0.001 | 6 |

| Capital | <0.001 | 6 |

| Modernization | <0.001 | 3 |

| Skills | <0.001 | 3 |

| Costs | <0.001 | 3 |

| Year | <0.001 | 12 |

| Security | <0.001 | 3 |

| Training | <0.001 | 3 |

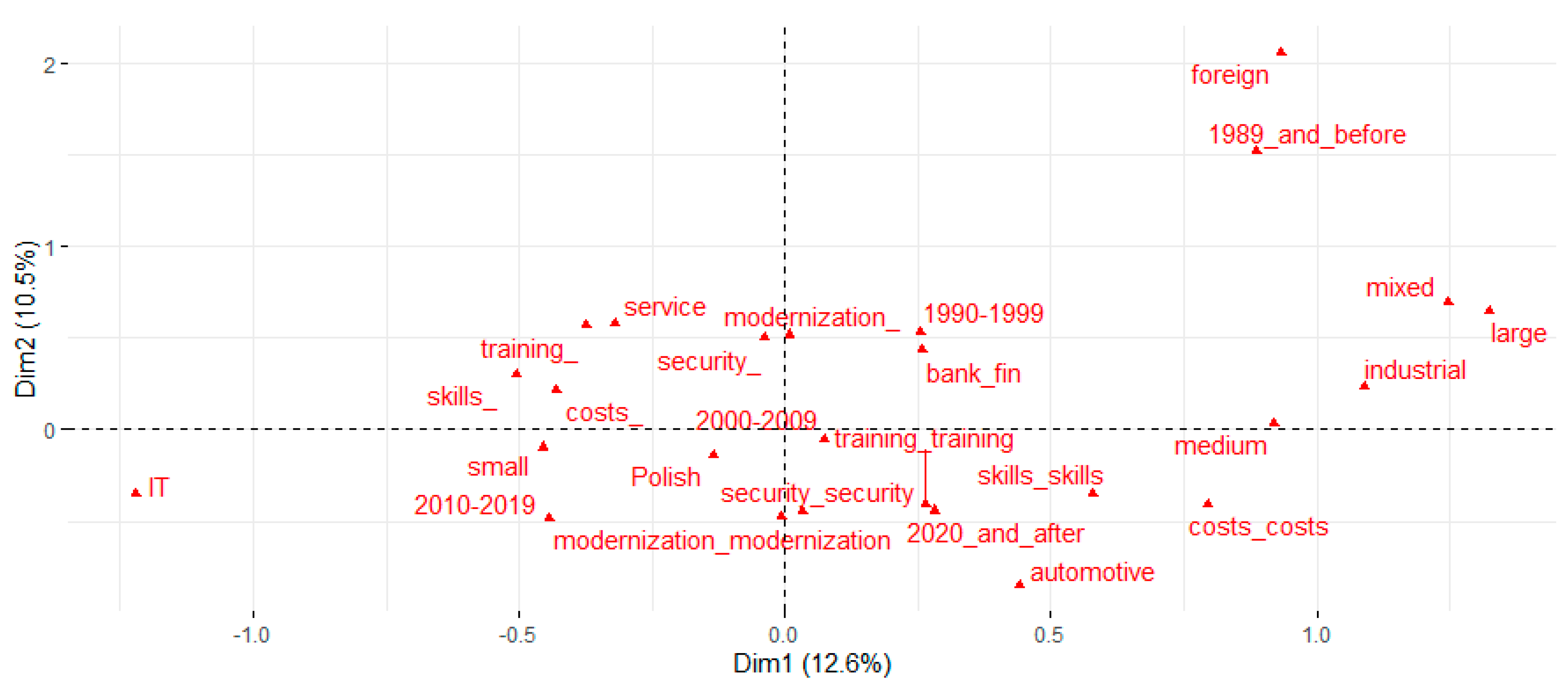

| Cluster | Cla/ Mod | Mod/ Cla | p-Value | v-Test |

|---|---|---|---|---|

| Cluster 1 | ||||

| sector = IT | 81.148 | 81.818 | <0.001 | 16.955 |

| skills = skills_ | 40.067 | 98.347 | <0.001 | 12.488 |

| costs = costs_ | 33.518 | 100.000 | <0.001 | 10.802 |

| modernization = modernization_modernization | 37.113 | 89.256 | <0.001 | 9.677 |

| size = small | 30.749 | 98.347 | <0.001 | 8.984 |

| year = 2010–2019 | 36.000 | 59.504 | <0.001 | 5.966 |

| capital = Polish | 24.346 | 100.000 | <0.001 | 5.197 |

| security = security_security | 29.492 | 71.901 | <0.001 | 4.742 |

| training = training_ | 27.707 | 52.893 | 0.005 | 2.834 |

| Cluster 2 | ||||

| modernization = modernization_ | 67.170 | 82.028 | <0.001 | 13.328 |

| sector = service | 88.983 | 48.387 | <0.001 | 12.729 |

| security = security_ | 59.387 | 71.429 | <0.001 | 9.337 |

| size = small | 49.612 | 88.479 | <0.001 | 8.056 |

| capital = Polish | 42.455 | 97.235 | <0.001 | 5.143 |

| year = 1990–1999 | 59.000 | 27.189 | <0.001 | 4.443 |

| training = training_ | 47.186 | 50.230 | <0.001 | 3.307 |

| sector = bank_fin | 51.456 | 24.424 | 0.005 | 2.823 |

| costs = costs_ | 42.659 | 70.968 | 0.017 | 2.390 |

| Cluster 3 | ||||

| costs = costs_costs | 57.949 | 80.142 | <0.001 | 12.878 |

| skills = skills_skills | 47.876 | 87.943 | <0.001 | 11.802 |

| training = training_training | 39.385 | 90.780 | <0.001 | 9.618 |

| modernization = modernization_modernization | 38.488 | 79.433 | <0.001 | 7.626 |

| sector = automotive | 54.054 | 42.553 | <0.001 | 7.331 |

| size = medium | 51.395 | 43.262 | <0.001 | 7.023 |

| security = security_security | 37.288 | 78.014 | <0.001 | 7.013 |

| sector = industrial | 52.941 | 38.298 | <0.001 | 6.675 |

| capital = Polish | 26.962 | 95.035 | 0.008 | 2.635 |

| Cluster 4 | ||||

| year = 1989_and_before | 73.333 | 42.857 | <0.001 | 9.673 |

| size = large | 60.784 | 40.260 | <0.001 | 8.352 |

| capital = foreign | 90.909 | 25.974 | <0.001 | 8.283 |

| capital = mixed | 70.270 | 33.766 | <0.001 | 8.212 |

| sector = industrial | 38.235 | 50.649 | <0.001 | 7.052 |

| size = medium | 28.814 | 44.156 | <0.001 | 4.904 |

| sector = bank_fin | 28.155 | 37.662 | <0.001 | 4.291 |

| training = training_ | 19.481 | 58.442 | 0.001 | 3.194 |

| skills = skills_ | 17.172 | 66.234 | 0.015 | 2.430 |

| costs = costs_ | 16.066 | 75.325 | 0.038 | 2.080 |

| modernization = modernization_ | 16.981 | 58.442 | 0.043 | 2.026 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bartuś, K.; Kocot, M.; Sączewska-Piotrowska, A. Assessment and Insights into the Awareness and Readiness of Organizations to Implement the Assumptions of Industry 5.0: An Examination of Five Polish Sectors. Sustainability 2025, 17, 903. https://doi.org/10.3390/su17030903

Bartuś K, Kocot M, Sączewska-Piotrowska A. Assessment and Insights into the Awareness and Readiness of Organizations to Implement the Assumptions of Industry 5.0: An Examination of Five Polish Sectors. Sustainability. 2025; 17(3):903. https://doi.org/10.3390/su17030903

Chicago/Turabian StyleBartuś, Kamila, Maria Kocot, and Anna Sączewska-Piotrowska. 2025. "Assessment and Insights into the Awareness and Readiness of Organizations to Implement the Assumptions of Industry 5.0: An Examination of Five Polish Sectors" Sustainability 17, no. 3: 903. https://doi.org/10.3390/su17030903

APA StyleBartuś, K., Kocot, M., & Sączewska-Piotrowska, A. (2025). Assessment and Insights into the Awareness and Readiness of Organizations to Implement the Assumptions of Industry 5.0: An Examination of Five Polish Sectors. Sustainability, 17(3), 903. https://doi.org/10.3390/su17030903