Director Network Stability and Corporate Green Innovation: Evidence from China’s A-Share Market

Abstract

1. Introduction

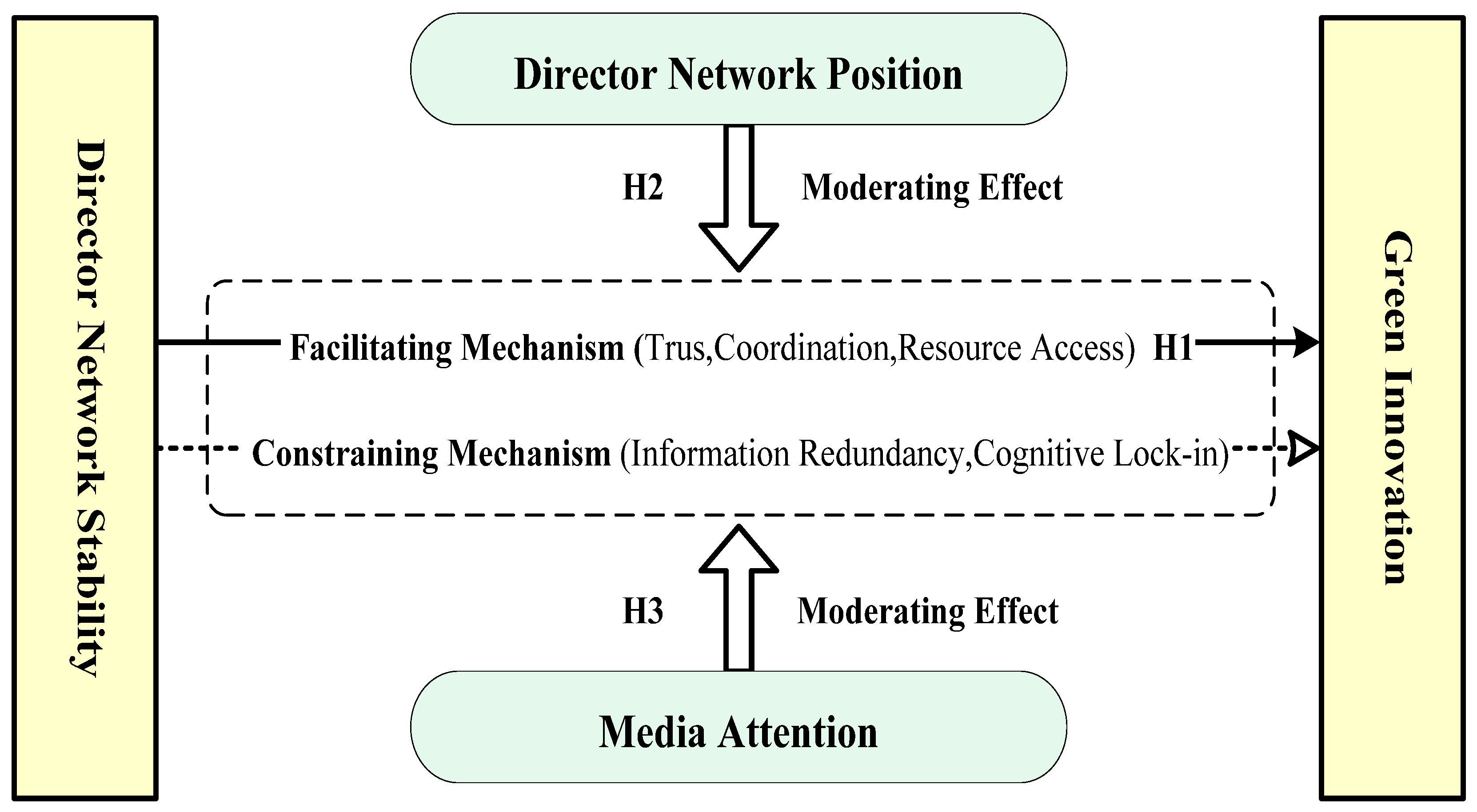

2. Theoretical Analysis and Hypothesis

2.1. Director Network Stability and Corporate Green Innovation

2.2. The Moderating Role of Director Network Position

2.3. The Moderating Role of Media Attention

3. Data and Methodology

3.1. Data and Sample Selection

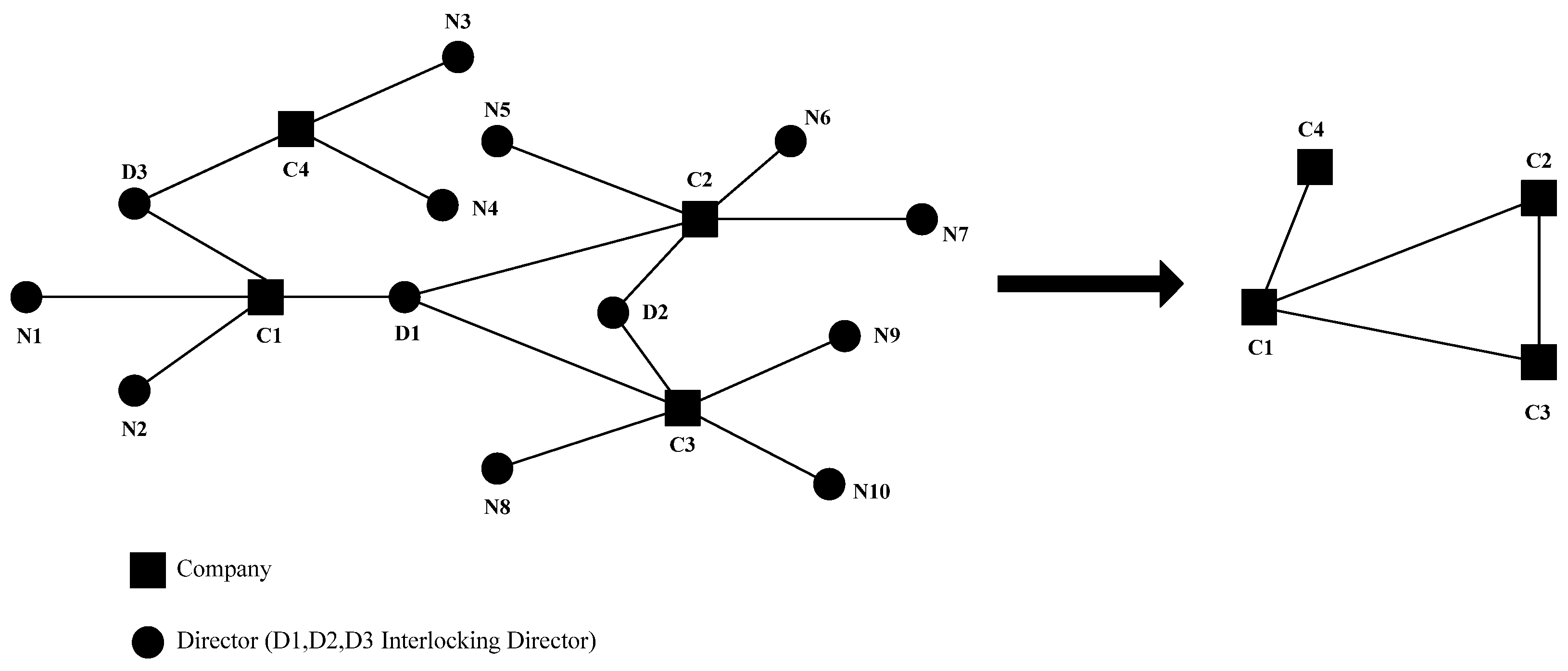

3.2. Variable Measurement

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Moderation Variables

- (1)

- Director Network Position

- (2)

- Media Attention

3.2.4. Control Variables

3.3. Model Setting

3.3.1. Basic Regression Model

3.3.2. Modelling the Moderating Effects of Director Network Position

3.3.3. Modelling the Moderating Effects of Media Attention

4. Empirical Analysis

4.1. Descriptive Statistics

4.2. Basic Regression Results

4.3. Moderation Effect Test

5. Endogeneity and Robustness Test

5.1. Endogeneity Test

- (1)

- To mitigate potential endogeneity concerns, this study employs the instrumental variable (IV) method and selects director tenure (IV) as an exogenous instrument for director network stability. Director tenure reflects the length of time a director continuously serves within a firm, which is closely related to the formation of stable inter-firm connections, thereby exhibiting a strong correlation with director network stability. At the same time, director tenure is primarily influenced by factors such as individual career planning, health conditions, and corporate personnel arrangements, and is unlikely to have a direct causal relationship with a firm’s green innovation output, thus meeting the exogeneity requirement for an instrumental variable. To verify the validity of the instrument, a weak instrument test is also conducted. Table 5 reports the regression results for both the first and second stages. In the first-stage regression, the coefficient of director tenure (IV) on director network stability (Stab) is 0.917, and is highly significant at the 1% level, indicating that the instrument has strong relevance to the endogenous variable and satisfies the relevance condition. In the second-stage regression, the coefficient of director network stability is 0.082, and remains significant at the 1% level, suggesting that even after controlling for endogeneity, the positive impact of director network stability on corporate green innovation remains robust, thereby further supporting the research hypothesis of this study.

- (2)

- To further control for potential sample selection bias, this study employs the Heckman two-stage model for regression analysis, with the results reported in columns (5) and (6) of Table 5. Following the methodology of Yan et al. (2024) [73], in the first stage, we construct a dummy variable based on green innovation: if a firm files at least one green patent application in a given year, the variable takes the value of 1; otherwise, it is 0. This dummy variable is used as the dependent variable in the first stage and estimated using a Probit model, from which the inverse Mills ratio (IMR) is calculated to capture potential systematic bias in sample selection. In the second stage, the IMR is included as a control variable in the green innovation model to correct for estimation bias caused by non-random sample selection. As shown in the columns (5) and (6) of Table 5, the first-stage Probit regression results indicate that most variables significantly influence a firm’s decision to apply for green patents. The IMR coefficient is 3.871 with a t-value of 14.83, which is positive and significant at the 1% level, suggesting the existence of systematic selection bias in green patent applications. This finding underscores the necessity of applying the Heckman correction method. The second-stage regression results show that, after controlling for selection bias, the coefficient of director network stability (Stab) remains positive and significant at the 1% level, with its magnitude showing little change compared with the baseline regression results. This further confirms the robustness of the main conclusions.

- (3)

- To further mitigate potential endogeneity issues between the explanatory variable (Stab) and the dependent variable (GI), this study lags the green innovation variable by one year and employs a lagged dependent variable regression for robustness testing. As shown in column (1) of Table 6, when using lagged green innovation as the dependent variable, the coefficient of director network stability is 0.063 and remains significantly positive at the 1% level. This indicates that even when the observation period for green innovation is shifted one year earlier, the positive effect of director network stability on firms’ green innovation remains robust, providing additional validation of the baseline findings from a temporal perspective.

- (4)

- To effectively control for potential omitted variable bias, this study adopts a firm fixed-effects regression model. According to the results reported in column (3) of Table 6, the coefficient of director network stability (Stab) is 0.072 and is significant at the 1% level. This suggests that even after controlling for unobservable, time-invariant firm-specific effects, the positive impact of director network stability on green innovation remains robust, thereby further confirming the validity of the research hypothesis.

- (5)

- To address potential endogeneity problems caused by sample self-selection, this study further employs the Propensity Score Matching (PSM) method for robustness testing. The procedure is as follows: First, the annual median value of director network stability (Stab) is used as the threshold to divide the sample into a treatment group (stability above the median) and a control group (stability below the median). Second, nine covariates—return on assets (Roa), board size (Board), firm age (Age), firm size (Size), leverage (Lev), state ownership (SOE), institutional shareholding ratio (Indsh), largest shareholder’s ownership (Top1), and CEO duality (Dual)—are selected. With a caliper of 0.05, a 1:1 nearest-neighbor matching method with replacement is applied to match treatment group firms with control group firms of similar characteristics. Finally, the matched sample is re-estimated. The results in column (4) of Table 6 show that the coefficient of the key explanatory variable Stab is 0.063 and remains significant at the 1% level. This indicates that after effectively controlling for sample self-selection bias, the positive effect of director network stability on firms’ green innovation remains robust, further confirming the reliability and robustness of the study’s conclusions.

- (6)

- To further purge time-invariant firm-specific heterogeneity, we estimate a first-difference (FD) specification. As reported in Table 6, column (5), the coefficient on Stab is 0.072 and positive at the 1% significance level, indicating that the association between director network stability and green innovation persists under the FD design. The estimates are consistent with the baseline results, suggesting that our conclusions remain robust after leaving out time-invariant unobservables.

5.2. Robustness Test

- (1)

- Given the limitations of measuring corporate green innovation solely by the number of green patent applications, we employ two alternative indicators for robustness testing, following prior studies [78,79]. First, to capture the academic and technological impact of green innovation, we use the number of citations to green invention patents: GI1 is defined as the natural logarithm of 1 plus the number of citations, in year t, to the firm’s independently obtained green invention patents. Second, to reflect a broader scope of innovative output, we use the total number of independently obtained green patents: GI2 is defined as the natural logarithm of 1 plus the number of green patents (including invention, utility model, and design patents) independently obtained by the firm in year t. The corresponding regression results are reported in Table 7, which remain consistent with the baseline findings and further support the robustness of the study’s conclusions.

- (2)

- To further verify the robustness of the findings, we conduct a robustness examine by replacing the key explanatory variable. Following Kumar and Zaheer [32], we redefine director network stability (Stab1) as the degree to which a firm’s board network remains unchanged relative to the previous year. This measure captures the dynamic persistence of interlocking director ties by considering both newly added and exited interlocking firms. The calculation is expressed as follows:where denotes the number of newly added interlocking firms for firm in year compared with , represents the number of interlocking firms that exited during the same period, and is the total number of non-duplicated interlocking firms maintained between and . A smaller network churn implies greater network stability. The regression results based on this alternative measure remain consistent with the baseline estimates, providing further evidence of the robustness of our conclusions.

- (3)

- To further validate the robustness of the regression results, this paper replaced the measurement method of the moderator variable. We measure director network position using degree centrality in the “director -to- director” model director network and Media attention is measured by the total number of online news reports containing the company’s name. The regression results (columns (1) and (2) in Table 9) remain consistent with the baseline moderation findings.

- (4)

- In order to further verify the robustness of the regression results, this paper draws on the research method of Yan et al. (2024) [72] on the selection of green innovation model, and uses Poisson pseudo maximum likelihood regression (PPML) model instead of OLS model for estimation. Unlike the traditional Poisson regression, which requires the dependent variable to be count data, PPML relaxes this distributional assumption and only requires the dependent variable to be non-negative [80]. Therefore, it can be widely applied to various non-negative continuous variables, including green innovation (GI).

- (5)

- To further control for potential industry-specific effects on the empirical results, this study restricts the sample to annual observations of manufacturing-listed companies and re-estimates the regression models. The results, presented in columns (1) to (3) of Table 11, show that director network stability (Stab) continues to exert a significant positive effect on corporate green innovation within the manufacturing subsample, remaining robust at the 1% significance level. In columns (2) and (3), after introducing the moderating variables—director network position (Centrality) and media attention (Media)—and their interaction terms with director network stability, the interaction terms are consistently and significantly positive. This finding indicates that the moderating effects are also present in the manufacturing subsample. Therefore, even when restricting the analysis to manufacturing-listed companies, the positive impact of director network stability on corporate green innovation remains robust, further supporting the hypotheses of this study.

- (6)

- In the baseline analysis, we exclude financial firms and ST/*ST firms to improve estimation stability; however, this may tilt the sample toward healthier firms and potentially overstate the benefits of director network stability. We therefore re-estimate the models using a full sample that includes financial and ST/*ST listed firms. As reported in columns (4) to (6) of Table 11, the results are consistent with the baseline. This confirms that our main conclusion is robust to expanding the analysis to the full sample.

- (7)

- To eliminate potential interference of the COVID-19 pandemic on corporate green innovation activities, this study excludes sample data from 2020 to 2023 and reconstructs the research sample for the period from 2009 to 2019. The regression results are reported in Table 12. Specifically, the results in Column (1) show that the coefficient of director network stability (Stab) remains significantly positive at the 1% level, indicating that its positive effect on green innovation remains robust after removing the pandemic years. In Columns (2) and (3), moderation variables are added to the model. The results reveal that the coefficient of the interaction term is significantly positive at the 5% level in Column (2) and at the 1% level in Column (3), suggesting that the moderating variables further strengthen the positive impact of director network stability on green innovation. Therefore, even after excluding the influence of the COVID-19 pandemic, the research hypothesis of this paper remains valid.

6. Further Analysis

6.1. Mediating Effect of Corporate Social Responsibility

6.2. Mediating Effect of R&D Investment

7. Conclusions and Implications

7.1. Conclusions

7.2. Theoretical Contributions

7.3. Theoretical Reflection on Competing Perspectives and Contradictory Dynamics

7.4. Recommendations

8. Research Limitations and Future Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Chen, F.; Zeng, X.; Guo, X. Green finance, climate change, and green innovation: Evidence from China. Financ. Res. Lett. 2024, 63, 105283. [Google Scholar] [CrossRef]

- Wang, H.; Feng, Z.; Yuan, L. Green R&D Intervention of Public Research Institutions and Green Innovation of Enterprises: From the Perspective of Environmental Externalities. China Ind. Econ. 2024, 9, 81–99. [Google Scholar]

- Wang, T.; Liu, X.; Wang, H. Green bonds, financing constraints, and green innovation. J. Clean. Prod. 2022, 381, 135134. [Google Scholar] [CrossRef]

- Wang, Z.W.; Zhu, Y.Z.; Zhang, H. The Spillover Effects of Environmental Punishment on Firm-level Productivity. J. Financ. Res. 2024, 2, 113–130. [Google Scholar]

- Zhou, X.X.; Jia, M.Y.; Zhao, X. An empirical study and evolutionary game analysis of green finance promoting enterprise green technology innovation. China Ind. Econ. 2023, 6, 43–61. [Google Scholar]

- Lin, T.; Wu, W.; Du, M.; Ren, S.; Huang, Y.; Cifuentes-Faura, J. Does green credit really increase green technology innovation? Sci. Prog. 2023, 106, 00368504231191985. [Google Scholar] [CrossRef]

- Guo, J.J.; Fang, Y.; Guo, Y. Environmental regulation, short-term failure tolerance and firm green innovation: Evidence from the practice of green credit policy. Econ. Res. 2024, 59, 112–129. [Google Scholar]

- Zhai, H.Y.; Gao, W.R.; Li, D.L. Local Environmental Legislation, Environmental Justice and Corporate Green Innovation: Based on the Synergistic Perspective of Legislation and Justice. J. Audit. Econ. 2024, 39, 106–116. [Google Scholar]

- Zhou, Z.; Wang, S.; Zhang, Y. Micro-policy effects of green tax: Evidence based on data of environmental news text sentiment of enterprises. China Ind. Econ. 2023, 7, 103–121. [Google Scholar]

- Zhang, X.; Li, H.; Ma, Y. Environmental Protection Tax, Government Innovation Subsidy and Enterprises’ Green Innovation. Public Financ. Res. 2024, 2, 98–113. [Google Scholar]

- Li, Y.H.; Li, P.Q. The impact of environmental protection tax on the level of green technology innovation of enterprises-Based on the analysis of Shanghai and Shenzhen A-share listed industrial enterprises. Tax. Res. 2022, 11, 52–58. [Google Scholar]

- Leng, C.; Ben, F. Executives’ overseas backgrounds and green innovation in manufacturing enterprises. Financ. Res. Lett. 2025, 72, 106585. [Google Scholar] [CrossRef]

- Zhang, X.; Sun, W. The role of interlocking directorates and managerial characteristics on corporate green innovation. Financ. Res. Lett. 2025, 74, 106818. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, X.; Gao, J.; Tan, H. Media attention and green technology innovation of heavily polluting enterprises. China Soft Sci. 2023, 9, 30–40. [Google Scholar]

- Zhao, J.; Zhao, L.; Yan, T. Does Interlocking Directors’ Green Experience Richness Enhance the Green Innovation Efficiency of Chinese Listed Companies? Sustainability 2025, 17, 2122. [Google Scholar] [CrossRef]

- Wang, L.; Zhou, X.; Chen, M. From “cultivator” to “influencer”: How does digital transformation drive green innovation: Longitudinal case study based on Inspur. J. China Soft Sci. 2023, 10, 146–163. [Google Scholar]

- Ye, B.; Xu, H.; Li, X. Government environmental audit, attention allocation and green innovation quality of state-owned enterprises. J. Audit. Econ. 2023, 38, 1–10. [Google Scholar]

- Ji, H.; Yang, L.; Lian, C. CEO Power and Green Innovation: Evidence from China. Sustainability 2025, 17, 3660. [Google Scholar] [CrossRef]

- Javed, M.; Wang, F.; Usman, M.; Gull, A.A.; Zaman, Q.U. Female CEOs and green innovation. J. Bus. Res. 2023, 157, 113515. [Google Scholar] [CrossRef]

- Zhang, X.; Shan, Y.G.; Li, J.; Zhang, Y. The greening power of networks: Spillover effect of environmental penalties in director networks. J. Environ. Manag. 2025, 375, 124367. [Google Scholar] [CrossRef]

- Zhao, X.; Wang, S.; Wu, X. Leveraging Board Experience Diversity to Enhance Corporate Green Technological Innovation. Sustainability 2025, 17, 3351. [Google Scholar] [CrossRef]

- Gong, J.; Song, J.; Zhou, J. Can audit committees’ environmental background promote corporate green innovation? Evidence from China. Appl. Econ. 2025, 57, 2161–2174. [Google Scholar] [CrossRef]

- Al-Hajaya, K.; Almahameed, E.; Sawan, N.; Altarawneh, M.; Eltweri, A.; Salem, R. Audit Committees and the Quality of Standalone Sustainability Reporting, Considering the Moderating Role of External Assurance: Evidence from the Global Chemical Industry. Bus. Strategy Environ. 2025, 34, 6210–6228. [Google Scholar] [CrossRef]

- Lin, Z.G.; Xin, M.X. Directors’ Network Position and Efficiency of Financial Asset Investment. China J. Account. Stud. 2023, 2, 79–95. [Google Scholar]

- Wang, F.; He, J.; Chen, L. Will Interlocking directors with green experience promote quantity increase and quality improvement of enterprise green innovation. China Ind. Econ. 2023, 10, 155–173. [Google Scholar]

- Wang, S.; Lv, J. Director Network Centrality and Firm Green Innovation: Moderating Effect of Absorptive Capacity. Bus. Ethics Environ. Responsib. 2025. [Google Scholar] [CrossRef]

- Qiu, Q.; Yu, J. Impact of independent director network on corporate green innovation: Evidence from Chinese listed companies. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 3271–3293. [Google Scholar] [CrossRef]

- Burt, R.S. Reinforced structural holes. J. Soc. Netw. 2015, 43, 149–161. [Google Scholar] [CrossRef]

- Larcker, D.F.; So, E.C.; Wang, C.C.Y. Boardroom centrality and firm performance. Account. Econ. 2013, 55, 225–250. [Google Scholar] [CrossRef]

- Soda, G.; Stea, D.; Pedersen, T. Network Structure, Collaborative Context, and Individual Creativity. J. Manag. 2019, 45, 1739–1765. [Google Scholar] [CrossRef]

- Wu, S.; Li, Y. Is enterprise’ alliance network diversity helpful for cooperative innovation? A model of moderated mediator. J. Nankai Bus. Rev. 2014, 17, 152–160. [Google Scholar]

- Kumar, P.; Zaheer, A. Ego-network stability and innovation in alliances. Acad. Manag. J. 2019, 62, 691–716. [Google Scholar] [CrossRef]

- Sun, Z.F.; Wang, H.R.; Zhang, W.H. Synergizing independent and cooperative R&D activities: The effect of absorptive capacity. Sci. Res. Manag. 2016, 37, 11. [Google Scholar]

- Abernethy, M.A.; Kuang, Y.F.; Qin, B. The Relation Between Strategy, CEO Selection, and Firm Performance. Contemp. Account. Res. 2019, 36, 1575–1606. [Google Scholar] [CrossRef]

- Li, H.; Wu, X.Y. Social capital, knowledge redundancy and innovation performance: An empirical test of knowledge-intensive service firms. Enterp. Econ. 2015, 6, 32–39. [Google Scholar]

- Hwang, D.B.; Golemon, P.L.; Chen, Y.; Wang, T.-S.; Hung, W.-S. Guanxi and Business Ethics in Confucian Society Today: An Empirical Case Study in Taiwan. Bus. Ethics 2009, 89, 235–250. [Google Scholar] [CrossRef]

- Yang, X.; Li, F.; Zhao, Y. Research on the Internal Control Spillover Effect of Interlocking Directorates—From the perspective of internal control deficiencies. Audit. Res. 2022, 3, 117–128. [Google Scholar]

- Syverson, C. What Determines Productivity? Econ. Lit. 2011, 49, 326–365. [Google Scholar] [CrossRef]

- Zhao, T. Board network, investment efficiency, and the mediating role of CSR: Evidence from China. Int. Rev. Econ. Financ. 2021, 76, 897–919. [Google Scholar] [CrossRef]

- Hu, Y.; Li, Z.; Guo, J. Does independent directors’ interlocking network position affect green innovation? Sustainability 2024, 16, 1089. [Google Scholar] [CrossRef]

- Fang, A.H.; Ge, H.Y. Social Network Stability, Information Flow and Enterprise Innovation Performance. Ind. Technol. Econ. 2020, 39, 39–47. [Google Scholar]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Granovetter, M. Economic action and social structure: The problem of embeddedness. Am. J. Sociol. 1985, 91, 481–510. [Google Scholar] [CrossRef]

- Rodan, S.; Galunic, C. More than network structure: How knowledge heterogeneity influences managerial performance and innovativeness. Strateg. Manag. J. 2004, 25, 541–562. [Google Scholar] [CrossRef]

- Landry, R.; Amara, N.; Lamari, M. Does social capital determine innovation? To what extent? Technol. Forecast. Soc. Change 2002, 69, 681–701. [Google Scholar] [CrossRef]

- Rusanen, H.; Halinen, A.; Jaakkola, E. Accessing resources for service innovation–the critical role of network relationships. J. Serv. Manag. 2014, 25, 2–29. [Google Scholar] [CrossRef]

- Darnall, N.; Edwards, D.J. Predicting the cost of environmental management system adoption: The role of capabilities, resources and ownership structure. Strateg. Manag. 2006, 27, 301–320. [Google Scholar] [CrossRef]

- Dyer, J.H. Effective interim collaboration: How firms minimize transaction costs and maximise transaction value. Strateg. Manag. J. 1997, 18, 535–556. [Google Scholar] [CrossRef]

- Li, W.; Zheng, M. Is it substantive innovation or strategic innovation? Impact of macroeconomic policies on micro-enterprises’ innovation. Econ. Res. 2016, 51, 60–73. [Google Scholar]

- Wassmer, U.; Dussauge, P. Network resource stocks and flows: How do alliance portfolios affect the value of new alliance formations? Strateg. Manag. 2012, 33, 871–883. [Google Scholar] [CrossRef]

- Shropshire, C. The role of the interlocking director and board receptivity in the diffusion of practices. Acad. Manag. Rev. 2010, 35, 246–264. [Google Scholar]

- Kim, H.S. How a firm’s position in a whole network affects innovation performance. Technol. Anal. Strateg. Manag. 2019, 31, 155–168. [Google Scholar] [CrossRef]

- Mazzla, E.; Perrone, G. A strategic needs perspective on operations outsourcing and other inter-firm relationships. Int. J. Prod. Econ. 2013, 144, 256–267. [Google Scholar] [CrossRef]

- Gonzalea, M.A.; Triguero, A.; Saez-Martinez, F.J. Many or trusted partners for eco-innovation? The influence of breadth and depth of firms’ knowledge network in the food sector. Technol. Forecast. Soc. Change 2019, 147, 51–62. [Google Scholar]

- Shao, Y.M.; Li, J.L.; Zhang, X.L. Outward foreign direct investment and green technology innovation: A company and host country perspective. Technol. Forecast. Soc. Change 2024, 203, 123379. [Google Scholar] [CrossRef]

- Ren, X.; Li, W.; Li, Y. Climate risk, digital transformation and corporate green innovation efficiency: Evidence from China. Technol. Forecast. Soc. Change 2024, 209, 123777. [Google Scholar] [CrossRef]

- Nicoletti, B.; Appolloni, A. Green logistics 5.0: A review of sustainability-oriented innovation with foundation models in logistics. Eur. J. Innov. Manag. 2024, 27, 542–561. [Google Scholar] [CrossRef]

- Yang, T.; Tsang, Y.P.; Wu, C.H.; Chung, K.T.; Lee, C.K.M.; Yuen, S.S.M. Mixed reality-based online 3D pallet loading problem to achieve augmented intelligence in e-fulfilment processes. Oper. Manag. Res. 2023, 18, 612–627. [Google Scholar] [CrossRef]

- Wu, B.H.; Zhu, P.H.; Yin, H.; Wen, F.H. The risk spillover of high carbon enterprises in China: Evidence from the stock market. Energy Econ. 2023, 126, 106939. [Google Scholar] [CrossRef]

- Lyu, K.; Cai, D.X.; Hao, M. Dynamic innovation collaboration based on complex network analysis: Evidence from the “Belt and Road” Initiative. Knowl. Econ. 2024, 15, 19157–19182. [Google Scholar] [CrossRef]

- Davi-Arderius, D.; Schittekatte, T. Carbon emissions impacts of operational network constraints: The case of Spain during the COVID-19 crisis. Energy Econ. 2023, 128, 107164. [Google Scholar] [CrossRef]

- Xie, X.; Wang, H. The impact mechanism of network embeddedness on firm innovation performance: A moderated mediation model based on non-R&D innovation. J. Ind. Eng./Eng. Manag. 2020, 34, 13–28. [Google Scholar]

- Zheng, Y.; Yang, H. Does familiarity foster innovation? The impact of alliance partner repeatedness on breakthrough innovations. J. Manag. Stud. 2015, 52, 213–230. [Google Scholar] [CrossRef]

- Chen, S.H.; Jiang, G.S.; Lu, C.C. The board ties, the selection of the target company, and acquisition performance: A study from the perspective based on the information asymmetry between the acquirer and the target. Manag. World 2013, 12, 117–132. [Google Scholar]

- McLeod, J.M.; Glynn, C.J.; Griffin, R.J. Communication and energy conservation. J. Environ. Educ. 1987, 18, 29–37. [Google Scholar] [CrossRef]

- Campa, P. Press and leaks: Do newspapers reduce toxic emissions? J. Environ. Econ. Manag. 2018, 91, 184–202. [Google Scholar] [CrossRef]

- Chan, K. Mass communication and pro-environmental behavior: Waste recycling in Hong Kong. J. Environ. Manag. 1998, 52, 317–325. [Google Scholar] [CrossRef]

- Craven, B.M.; Marston, C.L. Investor relations and corporate governance in large UK companies. Corp. Gov. Int. Rev. 1997, 3, 137–151. [Google Scholar]

- Lin, S.Y.; Chen, J.B.; Shi, L. Impact of environmental taxes on small and micro businesses—An empirical research in Hunan Province. J. China Environ. Sci. 2016, 36, 2212–2218. [Google Scholar]

- Wen, S.B.; Zhou, L.L. The Influencing Mechanism of Carbon Disclosure on Financial Performance—“Inverted U-shaped” Moderating Role of Media Governance. Manag. Rev. 2017, 29, 183. [Google Scholar]

- Liu, B.B.; Yu, Q.Q.; Bi, J.; Zhang, Y.L. The driving force of improving corporate environmental performance based on the stakeholder theory. Zhongguo Renkou Ziyuan Yu Huan Jing/China Popul. Resour. Environ. 2009, 19, 80–84. [Google Scholar]

- Zhang, J.J.; Yu, L.; Bi, Q.; Pan, J. Media supervision, environmental regulation and firm green investment. Shanghai Univ Financ. Econ. 2016, 18, 91–102. [Google Scholar]

- Yan, B.; Cheng, M.; Wang, N.H. ESG green spillover, supply chain transmission and corporate green innovation. Econ. Res. 2024, 59, 72–91. [Google Scholar]

- Li, Y.; Wang, P.; Wang, Q.J. Can Board Interlocks Inhibit Compensation Stickiness?—Based on the Mediating Effect of Managerial Power. Res. Econ. Manag. 2019, 40, 128–144. [Google Scholar]

- Schabus, M. Do Director Networks Help Managers Forecast Better? Account. Rev. 2022, 97, 397–426. [Google Scholar] [CrossRef]

- Zhang, Y.; Huang, K.N. Board Network Distance and the “Adjacency Bias” for Company Stock Investment. China Econ. Q. 2023, 23, 335–352. [Google Scholar]

- Zeng, S.; Xiao, L.; Jiang, X.; Huang, Y.; Li, Y.; Yuan, C. Do Directors’ Network Positions Affect Corporate Fraud? Sustainability 2024, 16, 6675. [Google Scholar] [CrossRef]

- Takalo, S.K.; Tooranloo, H.S. Green innovation: A systematic literature review. J. Clean. Prod. 2021, 279, 122474. [Google Scholar] [CrossRef]

- Wang, L.; Zeng, T.; Li, C. Behavior decision of top management team and enterprise green technology innovation. J. Clean. Prod. 2022, 367, 133120. [Google Scholar] [CrossRef]

- Gourieroux, C.; Monfort, A.; Trognon, A. Pseudo maximum likelihood methods: Theory. Econometrica 1984, 52, 681–700. [Google Scholar] [CrossRef]

- Altarawneh, H.; Al-Hajaya, K.; Eltweri, A.; Alrawashdeh, W.; Sawan, N. Green accounting disclosure and firm market value: Evidence from Jordan. Manag. Sustain. Arab. Rev. 2025. [Google Scholar] [CrossRef]

- Liu, Y. Corporate Social Responsibility, Managerial Competence and Director’s Network Peer Effect. Commer. Res. 2023, 3, 127–135. [Google Scholar]

- Li, X.Q.; Fung, H.G.; Zhu, Q.X. Interlocking Directorate Networks, Financial Constraints and the Social Responsibility of Private Enterprises. J. Manag. Sci. 2020, 17, 1208–1217. [Google Scholar]

- Zou, P. Disclosure of corporate social responsibility and actual tax burden: Walking the talk or logging rolling. J. Bus. Manag. 2018, 40, 159–177. [Google Scholar]

- Inkpen, A.C.; Tsang, E.W.K. Social capital, networks, and knowledge transfer. J. Acad. Manag. Rev. 2005, 30, 146–165. [Google Scholar] [CrossRef]

- Feng, G.; Wang, J. The peer effect of corporate innovation in social network. Chin. J. Manag. 2019, 16, 1809–1819. [Google Scholar]

- Wong, S.S.; Boh, W.F. The contingent effects of social network sparseness and centrality on managerial innovativeness. J. Manag. Stud. 2014, 51, 1180–1203. [Google Scholar] [CrossRef]

- De, S.D.; Gabriele, C.; Antonella, Z. Resource-based local development and networked core-competencies for tourism excellence. J. Tour. Manag. 2010, 31, 260–266. [Google Scholar]

- Chen, S.Y.; Ma, B. Wenzhou Folk Chamber of Commerce: Institutional Analysis of Self-governance-A Typical Study of Wenzhou Clothing Chamber of Commerce. J. Manag. World 2004, 12, 31–49, 155. [Google Scholar]

- Wu, H.J.; Liu, Q.R.; Wu, S.N. Corporate environmental disclosure and financing constraints. J. World Econ. 2017, 40, 124–147. [Google Scholar]

- Sun, L.Y.; Miao, C.L.; Yang, L. Ecological-economic efficiency evaluation of green technology innovation in strategic emerging industries based on entropy weighted TOPSIS method. Ecol. Indic. 2017, 73, 554–558. [Google Scholar] [CrossRef]

- Griliches, Z. Productivity, R&D and basic research at the firm level in the 1970s. J. Am. Econ. Rev. 1986, 76, 141–154. [Google Scholar]

- Hall, R.E.; Jones, C.I. Why do some countries produce so much more output per worker than others? Q. J. Econ. 1999, 114, 83–116. [Google Scholar] [CrossRef]

- Bronzini, R.; Piselli, P. Determinants of long-run regional productivity with geographical spillovers: The role of R&D, human capital and public infrastructure. Reg. Sci. Urban Econ. 2009, 39, 187–199. [Google Scholar]

| Type | Name | Symbol | Definitions |

|---|---|---|---|

| Dependent Variable | Green Innovation | GI | Log of 1 plus the sum of green invention patents and green utility model patents independently applied for by the firm in a given year. |

| Independent Variable | Director network stability | Stab | Log of 1 plus the average duration of all edges associated with the firm’s node. |

| Moderator Variable | Director Network Position | Centrality | Firm’s degree centrality within the director network. |

| Media Attention | Media | Log of 1 plus the total number of news headlines in mainstream newspapers containing the firm’s name. | |

| Control Variable | Return on Assets | Roa | Ratio of net profit to average total assets. |

| Board Size | Board | Total number of board members. | |

| Enterprise Age | Age | The number of years from the firm’s establishment to the observation year. | |

| Company Size | Size | The natural logarithm of the company’s total assets. | |

| Leverage Ratio | Lev | The ratio of total liabilities at the end of the year to total assets at the end of the year. | |

| State Ownership | SOE | The value of state-owned enterprises is 1, and the value of non-state-owned enterprises is 0. | |

| Institutional Investor Ownership | Indsh | Shareholding ratio of institutional investors at year-end. | |

| Ownership Concentration | Top 1 | Largest shareholder’s shareholding ratio at year-end. | |

| CEO duality | Dual | A dummy variable equal to 1 if the CEO and board chair are the same person. | |

| Industry Dummy Variables | Ind | A set of dummy variables for industry classification. | |

| Year Dummy Variables | Year | A set of dummy variables for each year to control for time effects. |

| Variable | N | Mean | Std. Dev. | Min | P25 | Median | P75 | Max | VIF |

|---|---|---|---|---|---|---|---|---|---|

| GI | 43,696 | 0.340 | 0.776 | 0.000 | 0.000 | 0.000 | 0.000 | 6.848 | |

| Stab | 43,696 | 4.307 | 2.097 | 1.000 | 2.720 | 4.136 | 5.688 | 15.000 | 1.16 |

| Roa | 43,696 | 0.048 | 0.095 | −4.803 | 0.025 | 0.050 | 0.081 | 0.831 | 1.13 |

| Board | 43,696 | 9.000 | 1.687 | 5.000 | 7.000 | 9.000 | 9.000 | 15.000 | 1.15 |

| Age | 43,696 | 2.920 | 0.358 | 0.693 | 2.708 | 2.944 | 3.178 | 4.248 | 1.10 |

| Size | 43,696 | 22.117 | 1.342 | 14.942 | 21.245 | 21.987 | 22.925 | 28.644 | 1.07 |

| Lev | 43,696 | 0.422 | 0.214 | 0.007 | 0.253 | 0.412 | 0.576 | 4.026 | 1.29 |

| SOE | 43,696 | 0.334 | 0.474 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 | 1.44 |

| Indsh | 43,696 | 43.844 | 24.812 | 0.000 | 23.163 | 45.122 | 63.847 | 101.140 | 1.63 |

| Top 1 | 43,696 | 34.120 | 15.067 | 0.290 | 22.510 | 31.890 | 44.085 | 89.990 | 1.42 |

| Dual | 43,696 | 0.293 | 0.454 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 | 1.14 |

| Centrality | 43,696 | 3.582 | 1.207 | 0.000 | 3.219 | 3.871 | 4.357 | 6.061 | 1.10 |

| Media | 43,696 | 0.366 | 0.488 | 0.010 | 0.086 | 0.199 | 0.438 | 6.610 | 1.05 |

| Variable | GI | GI |

|---|---|---|

| (1) | (2) | |

| Stab | 0.082 *** | 0.057 *** |

| (12.90) | (8.62) | |

| Roa | 0.437 *** | |

| (12.07) | ||

| Board | 0.024 *** | |

| (9.20) | ||

| Age | −0.008 *** | |

| (−11.92) | ||

| Size | 0.001 *** | |

| (10.69) | ||

| Lev | 0.324 *** | |

| (17.37) | ||

| SOE | 0.059 *** | |

| (6.35) | ||

| Indsh | 0.001 *** | |

| (7.06) | ||

| Top 1 | −0.001 | |

| (−0.63) | ||

| Dual | 0.026 *** | |

| (3.11) | ||

| Year | Control | Control |

| Industry | Control | Control |

| Constant | −0.160 | −0.519 |

| (−6.88) | (−14.14) | |

| R2 | 0.132 | 0.169 |

| Observations | 43,696 | 43,696 |

| Variable | GI | GI |

|---|---|---|

| (1) | (2) | |

| Stab | 0.003 | 0.011 |

| (0.23) | (0.66) | |

| Centrality | −0.005 | |

| (−0.78) | ||

| Stab × Centrality | 0.015 *** | |

| (3.48) | ||

| Media | 0.065 *** | |

| (8.55) | ||

| Stab × Media | 0.016 *** | |

| (2.99) | ||

| Roa | 0.430 *** | 0.297 *** |

| (11.98) | (9.12) | |

| Board | 0.022 *** | 0.019 *** |

| (8.49) | (7.36) | |

| Age | −0.008 *** | −0.007 *** |

| (−11.92) | (−11.28) | |

| Size | 0.001 *** | 0.001 *** |

| (10.68) | (8.50) | |

| Lev | 0.320 *** | 0.229 *** |

| (17.20) | (12.75) | |

| SOE | 0.056 *** | 0.058 *** |

| (6.01) | (6.39) | |

| Indsh | 0.001 *** | 0.001 *** |

| (6.80) | (2.53) | |

| Top 1 | −0.001 | 0.001 |

| (−0.56) | (0.53) | |

| Dual | 0.025 *** | 0.022 *** |

| (3.04) | (2.70) | |

| Year | Control | Control |

| Industry | Control | Control |

| Constant | −0.473 | −0.671 |

| (−11.79) | (−15.81) | |

| R2 | 0.170 | 0.188 |

| Observations | 43,696 | 43,696 |

| Variable | IV-2SLS | Heckman | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| IV | GI | IV | GI | GI | GI | |

| Stab | 0.082 *** | 8.907 *** | 0.058 *** | |||

| (10.32) | (11.91) | (8.84) | ||||

| IV | 0.917 *** | 0.623 *** | ||||

| (347.15) | (11.99) | |||||

| Roa | −0.012 | 0.436 *** | 0.005 | 0.072 | 1.150 *** | 4.066 *** |

| (−0.87) | (11.33) | (0.20) | (0.3) | (10.83) | (16.18) | |

| Board | 0.004 *** | 0.024 *** | 0.002 | −0.019 | 0.05 *** | 0.175 *** |

| (5.24) | (10.86) | (1.53) | (−1.34) | (10.47) | (16.35) | |

| Age | −0.002 *** | −0.008 *** | 0.009 *** | −0.163 *** | −0.015 *** | −0.054 *** |

| (−8.23) | (−12.51) | (10.35) | (−11.88) | (−11.05) | (−16.48) | |

| Size | 0.001 | 0.001 *** | 0.001 *** | −0.001 | 0.001 *** | 0.001 *** |

| (1.34) | (27.53) | (3.18) | (−1.32) | (7.11) | (14.36) | |

| Lev | 0.027 *** | 0.312 *** | 0.235 | −3.831 *** | 0.636 ** | 2.272 *** |

| (3.81) | (16.03) | (9.93) | (−10.32) | (15.14) | (16.84) | |

| SOE | −0.024 *** | 0.055 *** | 0.083 *** | −1.327 *** | 0.132 *** | 0.456 *** |

| (−7.18) | (6.03) | (9.52) | (−10.2) | (6.64) | (15.69) | |

| Indsh | −0.001 | 0.001 *** | −0.001 | 0.003 *** | 0.001 ** | 0.004 *** |

| (−0.47) | (6.97) | (−0.68) | (2.64) | (2.45) | (15.93) | |

| Top 1 | 0.001 ** | −0.001 | −0.002 *** | 0.037 *** | 0.001 * | 0.004 *** |

| (2.38) | (−0.25) | (−8.01) | (10.35) | (1.90) | (9.75) | |

| Dual | −0.007 ** | 0.028 *** | −0.044 ** | 0.891 *** | −0.005 | 0.017 ** |

| (−2.30) | (3.51) | (−6.20) | (10.04) | (−0.27) | (2.02) | |

| IMR | 3.871 *** | |||||

| (14.83) | ||||||

| Year | Control | Control | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control | Control | Control |

| Constant | −0.340 | −0.544 | 0.998 | −9.496 | −2.550 | −11.260 |

| (6.54) | (−9.40) | (24.90) | (11.31) | (16.86) | (−15.48) | |

| R2 | 0.800 | 0.169 | 0.242 | 0.164 | 0.157 | 0.180 |

| Observations | 43,696 | 43,696 | 43,696 | 43,696 | 43,696 | 43,696 |

| Variable | GI | GI | GI | GI | GI |

|---|---|---|---|---|---|

| Lag One Phase | Lag Two Phase | Fixed Effect | PSM | FD | |

| (1) | (2) | (3) | (4) | (5) | |

| Stab | 0.063 *** | 0.068 *** | 0.072 *** | 0.063 *** | 0.072 *** |

| (7.43) | (7.09) | (30.22) | (7.84) | (7.51) | |

| Roa | 0.375 *** | 0.285 *** | 0.011 *** | 0.465 *** | 0.05 * |

| (10.36) | (7.83) | (5.67) | (10.84) | (1.67) | |

| Board | 0.023 *** | 0.020 *** | 0.000 | 0.025 *** | 0.001 |

| (8.11) | (6.85) | (0.68) | (8.60) | (0.77) | |

| Age | −0.007 *** | −0.007 *** | −0.002 *** | −0.008 *** | 0.001 |

| (−9.87) | (−9.10) | (−13.32) | (−11.19) | (−0.49) | |

| Size | 0.001 *** | 0.001 *** | −0.001 *** | 0.001 *** | 0.001 |

| (10.90) | (11.27) | (−3.43) | (10.32) | (−1.13) | |

| Lev | 0.340 *** | 0.316 *** | −0.000 *** | 0.317 *** | −0.006 |

| (16.77) | (14.94) | (−5.85) | (15.30) | (−0.37) | |

| SOE | 0.060 *** | 0.061 *** | 0.005 *** | 0.063 *** | 0.012 * |

| (6.04) | (5.95) | (17.13) | (6.33) | (1.72) | |

| Indsh | 0.001 *** | 0.001 *** | 0.030 *** | 0.001 *** | 0.001 |

| (6.48) | (5.15) | (36.99) | (6.91) | (0.61) | |

| Top 1 | −0.001 | −0.001 | −0.112 *** | −0.001 | 0.001 |

| (−1.04) | (−0.68) | (−21.30) | (−0.72) | (−0.09) | |

| Dual | 0.025 *** | 0.020 ** | −0.001 *** | 0.026 *** | −0.002 |

| (2.76) | (2.11) | (−7.25) | (2.62) | (−0.37) | |

| Year | Control | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control | |

| Firm | Control | ||||

| Constant | −0.535 | −0.490 | −0.322 | −0.578 | −0.004 |

| (−13.52) | (−11.66) | (−5.84) | (−14.28) | (−0.08) | |

| R2 | 0.177 | 0.179 | 0.160 | 0.179 | 0.100 |

| Observations | 37,630 | 33,075 | 43,696 | 35,314 | 37,630 |

| Variable | GI1 | GI2 | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Stab | 10.062 *** | −2.489 | −4.474 | 0.160 *** | 0.065 ** | 0.122 *** |

| (3.97) | (−0.38) | (−1.47) | (12.97) | (2.04) | (8.32) | |

| Centrality | −1.114 | −0.001 | ||||

| (−0.43) | (−0.10) | |||||

| Stab × Centrality | 3.527 ** | 0.026 *** | ||||

| (1.98) | (3.04) | |||||

| Media | −5.963 | 0.352 *** | ||||

| (−0.83) | (10.16) | |||||

| Stab × Media | 38.447 *** | 0.090 *** | ||||

| (8.25) | (4.00) | |||||

| Roa | 10.312 | 8.554 | −10.42 | 0.982 *** | 0.967 *** | 0.788 *** |

| (0.72) | (0.60) | (−0.73) | (14.12) | (13.89) | (11.43) | |

| Board | 2.111 *** | 1.704 ** | 1.309 | 0.055 *** | 0.051 ** | 0.047 *** |

| (2.62) | (2.09) | (1.63) | (13.98) | (12.89) | (12.15) | |

| Age | 1.128 *** | 1.128 ** | 1.185 *** | −0.022 *** | −0.021 ** | −0.021 *** |

| (4.68) | (4.68) | (4.94) | (−18.56) | (−18.57) | (−18.25) | |

| Size | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** |

| (67.22) | (67.11) | (58.92) | (19.74) | (19.58) | (8.77) | |

| Lev | 16.711 *** | 15.715 ** | 3.262 | 0.171 *** | 0.163 *** | 0.040 |

| (2.33) | (2.19) | (0.45) | (4.95) | (4.67) | (1.16) | |

| SOE | 12.397 *** | 11.691 *** | 11.808 *** | −0.045 *** | −0.049 *** | −0.048 *** |

| (3.59) | (3.47) | (3.53) | (−2.59) | (−2.97) | (−2.97) | |

| Indsh | 0.101 | 0.091 | −0.013 | 0.001 *** | 0.091 *** | 0.001 |

| (1.55) | (1.38) | (−0.19) | (3.60) | (3.21) | (0.05) | |

| Top 1 | −0.037 | −0.032 | 0.005 | 0.003 *** | 0.003 *** | 0.004 *** |

| (−0.36) | (−0.32) | (0.05) | (6.64) | (6.74) | (7.33) | |

| Dual | 0.827 | 0.690 | −0.519 | 0.037 *** | 0.035 *** | 0.026 * |

| (0.28) | (0.23) | (−0.17) | (2.51) | (2.43) | (1.85) | |

| Year | Control | Control | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control | Control | Control |

| Constant | −85.923 | −75.435 | −71.369 | −0.816 | −0.749 | −0.818 |

| (−4.02) | (−3.29) | (−3.33) | (−7.82) | (−6.70) | (−7.89) | |

| R2 | 0.185 | 0.186 | 0.191 | 0.309 | 0.310 | 0.326 |

| Observations | 43,696 | 43,696 | 43,696 | 43,696 | 43,696 | 43,696 |

| Variable | GI | GI | GI | GI | GI | GI |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Stab1 | 0.038 ** | −0.092 | 0.060 | |||

| (2.21) | (−1.28) | (1.19) | ||||

| Stab2 | 0.023 *** | 0.003 | 0.001 | |||

| (5.40) | (0.29) | (0.09) | ||||

| Centrality | 0.016 | 0.004 | ||||

| (1.64) | (0.63) | |||||

| Stab1/2 × Centrality | 0.034 * | 0.005 ** | ||||

| (1.69) | (2.15) | |||||

| Media | 0.099 *** | 0.070 *** | ||||

| (12.19) | (10.02) | |||||

| Stab1/2 × Media | −0.004 | 0.008 ** | ||||

| (−0.27) | (2.54) | |||||

| Roa | 0.45 *** | 0.443 *** | 0.302 *** | 0.442 *** | 0.436 *** | 0.302 *** |

| (11.68) | (11.57) | (8.75) | (12.21) | (12.13) | (9.26) | |

| Board | 0.025 *** | 0.023 *** | 0.02 *** | 0.023 *** | 0.022 *** | 0.018 *** |

| (8.87) | (8.1) | (7.12) | (9.04) | (8.4) | (7.18) | |

| Age | −0.006 *** | −0.007 *** | −0.006 *** | −0.007 *** | −0.007 *** | −0.007 *** |

| (−9.59) | (−9.78) | (−9.05) | (−11.19) | (−11.18) | (−10.55) | |

| Size | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** |

| (10.48) | (10.51) | (8.19) | (10.73) | (10.72) | (8.61) | |

| Lev | 0.358 *** | 0.351 *** | 0.257 *** | 0.332 *** | 0.329 *** | 0.237 *** |

| (17.76) | (17.49) | (13.31) | (17.74) | (17.59) | (13.12) | |

| SOE | 0.069 *** | 0.066 *** | 0.071 *** | 0.062 *** | 0.059 *** | 0.061 *** |

| (7.02) | (6.64) | (7.28) | (6.65) | (6.33) | (6.66) | |

| Indsh | 0.001 *** | 0.001 *** | 0.001 * | 0.001 *** | 0.001 *** | 0.001 ** |

| (6.48) | (6.06) | (1.91) | (6.99) | (6.72) | (2.49) | |

| Top 1 | −0.001 | −0.001 | 0.001 | −0.001 | −0.001 | 0.001 |

| (−1.04) | (−0.88) | (−0.05) | (−1.03) | (−0.97) | (0.11) | |

| Dual | 0.02 ** | 0.021 ** | 0.016 * | 0.024 *** | 0.023 *** | 0.020 ** |

| (2.27) | (2.33) | (1.85) | (2.87) | (2.79) | (2.47) | |

| Year | Control | Control | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control | Control | Control |

| Constant | −0.463 | −0.487 | −0.728 | −0.497 | −0.668 | −0.481 |

| (−11.69) | (−9.64) | (−15.65) | (−13.57) | (−16.07) | (−12.06) | |

| Pseudo R2 | 0.169 | 0.170 | 0.188 | 0.169 | 0.187 | 0.169 |

| Observations | 39,317 | 39,317 | 39,317 | 43,696 | 43,696 | 43,696 |

| Variable | GI | GI | GI | GI | GI | GI |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Stab | 0.012 | −0.043 | 0.004 | 0.040 *** | −0.048 | −0.013 |

| (0.67) | (−1.05) | (0.28) | (3.67) | (−1.63) | (−0.53) | |

| Degree | 0.001 | |||||

| (0.40) | ||||||

| Stab × Degree | 0.002 ** | |||||

| (2.34) | ||||||

| Media | 0.084 *** | 0.060 *** | 0.074 *** | 0.083 *** | 0.070 *** | |

| (7.34) | (6.85) | (7.97) | (7.71) | (7.07) | ||

| Stab × Media | 0.018 ** | 0.020 *** | 0.013 ** | 0.024 *** | 0.020 *** | |

| (2.26) | (3.35) | (2.01) | (3.19) | (2.84) | ||

| Roa | 0.434 *** | 0.458 *** | 0.379 *** | 0.369 *** | 0.287 *** | 0.427 *** |

| (12.02) | (9.15) | (7.56) | (10.66) | (5.64) | (11.71) | |

| Board | 0.019 *** | 0.018 *** | 0.016 *** | 0.021 *** | 0.016 *** | 0.021 *** |

| (7.14) | (7.03) | (6.24) | (8.11) | (6.52) | (8.39) | |

| Age | −0.008 *** | −0.007 *** | −0.007 *** | −0.008 *** | −0.007 *** | −0.007 *** |

| (−12.02) | (−10.74) | (−10.7) | (−11.67) | (−10.26) | (−11.36) | |

| Size | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** |

| (10.67) | (12.82) | (12.81) | (8.85) | (12.09) | (8.66) | |

| Lev | 0.317 *** | 0.201 *** | 0.199 *** | 0.248 *** | 0.194 *** | 0.244 *** |

| (17.07) | (10.47) | (10.41) | (13.61) | (10.16) | (13.37) | |

| SOE | 0.055 *** | 0.076 *** | 0.055 *** | 0.061 *** | 0.071 *** | 0.072 *** |

| (5.93) | (8.29) | (6.06) | (6.63) | (7.86) | (7.86) | |

| Indsh | 0.001 *** | 0.001 | −0.001 | 0.001 *** | 0.001 | 0.001 *** |

| (6.68) | (1.02) | (−0.14) | (3.76) | (0.03) | (4.20) | |

| Top 1 | −0.001 | 0.001 | 0.001 | 0.001 | 0.001 | 0.001 |

| (−0.52) | (1.30) | (0.51) | (0.13) | (1.32) | (1.08) | |

| Dual | 0.024 *** | 0.017 ** | 0.019 ** | 0.022 *** | 0.016 ** | 0.02 ** |

| (2.90) | (2.10) | (2.41) | (2.64) | (2.00) | (2.41) | |

| Year | Control | Control | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control | Control | Control |

| Constant | −0.441 | −0.744 | −0.515 | −0.613 | −0.621 | −0.662 |

| (−10.68) | (−11.12) | (−12.87) | (−15.84) | (−11.58) | (−13.54) | |

| R2 | 0.170 | 0.191 | 0.195 | 0.182 | 0.195 | 0.182 |

| Observations | 43,696 | 43,696 | 43,696 | 43,696 | 43,696 | 43,696 |

| Variable | GI | GI | GI |

|---|---|---|---|

| (1) | (2) | (3) | |

| Stab | 0.185 *** | −0.021 | 0.130 *** |

| (8.85) | (−0.38) | (5.48) | |

| Centrality | −0.02 | ||

| (−0.94) | |||

| Stab × Centrality | 0.055 *** | ||

| (3.72) | |||

| Media | 0.370 *** | ||

| (6.62) | |||

| Stab × Media | 0.069 ** | ||

| (2.13) | |||

| Roa | 1.985 *** | 1.940 *** | 1.680 *** |

| (13.39) | (13.09) | (11.83) | |

| Board | 0.075 *** | 0.068 *** | 0.065 *** |

| (11.07) | (10.01) | (10.22) | |

| Age | −0.024 *** | −0.024 *** | −0.022 *** |

| (−12.32) | (−12.43) | (−11.63) | |

| Size | 0.001 *** | 0.001 *** | 0.001 *** |

| (11.15) | (11.70) | (5.35) | |

| Lev | 1.156 *** | 1.140 *** | 0.936 *** |

| (19.82) | (19.58) | (16.01) | |

| SOE | 0.169 *** | 0.160 *** | 0.157 *** |

| (6.51) | (5.81) | (5.92) | |

| Indsh | 0.004 *** | 0.003 *** | 0.002 *** |

| (7.20) | (6.75) | (4.59) | |

| Top 1 | 0.001 | 0.001 | 0.001 |

| (0.27) | (0.47) | (0.80) | |

| Dual | 0.095 *** | 0.093 *** | 0.064 *** |

| (4.00) | (3.93) | (2.80) | |

| Year | Control | Control | Control |

| Industry | Control | Control | Control |

| Constant | −4.901 | −4.714 | −4.860 |

| (−17.86) | (−16.72) | (−17.72) | |

| Pseudo R2 | 0.178 | 0.179 | 0.193 |

| Observations | 43,635 | 43,635 | 43,635 |

| Variable | GI | GI | GI | GI | GI | GI |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Stab | 0.046 *** | −0.019 | −0.017 | 0.061 *** | 0.002 | 0.004 |

| (5.58) | (−1.00) | (−0.85) | (9.73) | (0.17) | (0.25) | |

| Centrality | −0.019 ** | −0.004 | ||||

| (−2.49) | (−0.66) | |||||

| Stab × Centrality | 0.019 *** | 0.016 *** | ||||

| (3.51) | (3.94) | |||||

| Media | 0.063 *** | 0.074 *** | ||||

| (6.59) | (9.11) | |||||

| Stab × Media | 0.023 *** | 0.019 *** | ||||

| (3.40) | (3.38) | |||||

| Roa | 0.478 *** | 0.473 *** | 0.305 *** | 0.006 *** | 0.008 | 0.005 |

| (9.27) | (9.24) | (6.70) | (0.98) | (0.96) | (0.76) | |

| Board | 0.031 *** | 0.030 *** | 0.026 *** | 0.019 *** | 0.024 *** | 0.020 *** |

| (8.74) | (8.49) | (7.37) | (9.17) | (9.69) | (7.98) | |

| Age | −0.009 *** | −0.009 *** | −0.009 *** | −0.004 *** | −0.007 *** | −0.007 *** |

| (−10.53) | (−10.54) | (−10.52) | (−8.64) | (−11.20) | (−10.38) | |

| Size | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** |

| (14.13) | (14.06) | (12.58) | (11.67) | (11.33) | (8.69) | |

| Lev | 0.371 | 0.371 *** | 0.268 *** | 0.003 | 0.004 | 0.002 |

| (14.46) | (14.49) | (10.85) | (1.01) | (0.96) | (0.64) | |

| SOE | 0.043 *** | 0.043 *** | 0.043 *** | 0.071 *** | 0.063 *** | 0.063 *** |

| (3.45) | (3.39) | (3.45) | (9.64) | (7.19) | (7.26) | |

| Indsh | 0.001 *** | 0.001 *** | 0.001 | 0.001 *** | 0.001 *** | 0.001 *** |

| (4.87) | (4.80) | (1.29) | (9.96) | (8.91) | (3.32) | |

| Top 1 | −0.001 * | −0.001 * | −0.001 | 0.001 * | 0.001 | 0.001 |

| (−1.77) | (−1.75) | (−0.74) | (−1.79) | (0.01) | (1.22) | |

| Dual | 0.031 *** | 0.031 *** | 0.030 *** | 0.028 *** | 0.025 *** | 0.023 *** |

| (3.16) | (3.14) | (3.11) | (4.35) | (3.19) | (2.87) | |

| Year | Control | Control | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control | Control | Control |

| Constant | −0.416 | −0.340 | −0.568 | −0.262 | −0.269 | −0.530 |

| (−8.79) | (−6.68) | (−10.56) | (−8.50) | (−6.81) | (−12.07) | |

| R2 | 0.178 | 0.178 | 0.196 | 0.137 | 0.158 | 0.183 |

| Observations | 43,696 | 43,696 | 43,696 | 47,628 | 47,628 | 47,628 |

| Variable | GI | GI | GI |

|---|---|---|---|

| (1) | (2) | (3) | |

| Stab | 0.050 *** | 0.012 | 0.024 |

| (6.32) | (0.97) | (−1.02) | |

| Centrality | −0.001 | ||

| (−0.18) | |||

| Stab × Centrality | 0.009 ** | ||

| (2.45) | |||

| Media | 0.052 *** | ||

| (5.02) | |||

| Stab × Media | 0.021 *** | ||

| (2.97) | |||

| Roa | 0.381 *** | 0.281 *** | 0.261 *** |

| (9.15) | (8.37) | (6.97) | |

| Board | 0.024 *** | 0.017 *** | 0.019 *** |

| (7.72) | (6.19) | (6.31) | |

| Age | −0.007 *** | −0.004 *** | −0.007 *** |

| (−8.83) | (−6.33) | (−8.89) | |

| Size | 0.001 *** | 0.001 *** | 0.001 *** |

| (12.53) | (12.73) | (10.35) | |

| Lev | 0.262 *** | 0.180 *** | 0.166 *** |

| (12.19) | (10.37) | (7.99) | |

| SOE | 0.047 *** | 0.049 *** | 0.049 *** |

| (4.39) | (5.44) | (4.59) | |

| Indsh | 0.001 *** | 0.001 *** | 0.001 |

| (4.07) | (4.85) | (0.99) | |

| Top 1 | −0.001 | −0.001 * | 0.001 |

| (−0.63) | (−1.87) | (0.31) | |

| Dual | 0.032 *** | 0.033 *** | 0.026 *** |

| (3.14) | (3.99) | (2.68) | |

| Year | Control | Control | Control |

| Industry | Control | Control | Control |

| Constant | −0.463 | −0.347 | −0.552 |

| (−11.34) | (−9.68) | (−10.72) | |

| R2 | 0.173 | 0.158 | 0.190 |

| Observations | 27,854 | 27,854 | 27,854 |

| Variable | CSR | GI |

|---|---|---|

| (1) | (2) | |

| CSR | 0.173 *** | |

| (12.61) | ||

| Stab | 0.043 *** | 0.050 *** |

| (19.50) | (7.50) | |

| Roa | 0.178 | 0.406 *** |

| (12.93) | (11.43) | |

| Board | 0.007 *** | 0.023 *** |

| (9.87) | (8.75) | |

| Age | −0.001 *** | −0.008 *** |

| (−5.65) | (−11.62) | |

| Size | 0.001 *** | 0.001 *** |

| (15.45) | (10.34) | |

| Lev | 0.046 *** | 0.316 *** |

| (7.20) | (17.03) | |

| SOE | 0.031 *** | 0.053 *** |

| (10.27) | (5.78) | |

| Indsh | 0.001 *** | 0.001 *** |

| (16.41) | (6.13) | |

| Top 1 | −0.001 *** | −0.001 |

| (−2.58) | (0.48) | |

| Dual | 0.008 *** | 0.024 *** |

| (3.25) | (2.94) | |

| Year | Control | Control |

| Industry | Control | Control |

| Constant | −0.080 | −0.505 |

| (−3.98) | (−13.86) | |

| R2 | 0.255 | 0.172 |

| Observations | 43,696 | 43,696 |

| Variable | Investment | GI |

|---|---|---|

| (1) | (2) | |

| Investment | 0.109 *** | |

| (32.71) | ||

| Stab | 0.396 *** | 0.013 * |

| (32.12) | (1.71) | |

| Roa | 3.518 | 0.324 *** |

| (30.93) | (5.66) | |

| Board | 0.055 *** | 0.018 *** |

| (12.41) | (6.01) | |

| Age | −0.007 *** | −0.008 *** |

| (−5.70) | (−10.12) | |

| Size | 0.001 *** | 0.001 *** |

| (61.09) | (8.59) | |

| Lev | 1.027 ** | 0.237 *** |

| (24.87) | (10.28) | |

| SOE | 0.026 | 0.058 *** |

| (1.37) | (5.14) | |

| Indsh | 0.008 *** | −0.001 * |

| (27.27) | (−1.81) | |

| Top 1 | −0.002 *** | −0.001 |

| (−4.75) | (0.47) | |

| Dual | 0.020 | 0.023 *** |

| (1.57) | (2.59) | |

| Year | Control | Control |

| Industry | Control | Control |

| Constant | 13.660 | −1.967 |

| (114.36) | (−28.71) | |

| R2 | 0.481 | 0.188 |

| Observations | 35,884 | 35,884 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zeng, S.; Chen, Y.; Gao, Y.; Li, Y.; Yuan, C.; Yang, H. Director Network Stability and Corporate Green Innovation: Evidence from China’s A-Share Market. Sustainability 2025, 17, 10607. https://doi.org/10.3390/su172310607

Zeng S, Chen Y, Gao Y, Li Y, Yuan C, Yang H. Director Network Stability and Corporate Green Innovation: Evidence from China’s A-Share Market. Sustainability. 2025; 17(23):10607. https://doi.org/10.3390/su172310607

Chicago/Turabian StyleZeng, Sen, Yuanhong Chen, Yan Gao, Yanru Li, Cao Yuan, and Hanming Yang. 2025. "Director Network Stability and Corporate Green Innovation: Evidence from China’s A-Share Market" Sustainability 17, no. 23: 10607. https://doi.org/10.3390/su172310607

APA StyleZeng, S., Chen, Y., Gao, Y., Li, Y., Yuan, C., & Yang, H. (2025). Director Network Stability and Corporate Green Innovation: Evidence from China’s A-Share Market. Sustainability, 17(23), 10607. https://doi.org/10.3390/su172310607