1. Introduction

As the airline industry continues to thrive, its environmental impact has become a pressing global concern, making the pursuit of sustainable development an urgent necessity. Nevertheless, in regions where the civil aviation sector is advanced, traditional fuel-powered aircraft (FPA) serve as significant contributors to local air pollution, thereby heightening the need for environmentally sustainable aircraft alternatives. To mitigate carbon emissions and move towards the sustainable development of the aviation sector, the International Civil Aviation Organization (ICAO) established a fresh regulatory objective for reducing greenhouse gases in the aviation industry by 2016, aiming to halve emissions by 2050 compared with the levels recorded in 2005 (International Air Transport Association (International Air Transport Association, 2023. Executive Summar Net Zero Roadmaps.

https://www.iata.org/en/programs/environment/roadmaps/, 9 October 2023). The current policy of exclusively relying on carbon taxes to augment fuel levies in the airline industry constrains the potential of conventional fuel-powered aircraft (FPA) to accomplish this objective [

1]. Consequently, Ref. [

2] argue for the urgent promotion of all-electric aircraft (AEA) development within the aviation sector.

In this context, digitalization emerges as a powerful engine driving the popularization of AEA and the sustainable transformation of aviation. Digital technologies are not only integral to the aircraft’s design and manufacturing, such as using digital twins for simulation and AI for optimizing battery management [

3], but also crucial for the supporting ecosystem. This includes the development of smart charging infrastructures and the use of big data for fleet management by airlines. The integration of these digital elements is essential for overcoming the challenges associated with AEA promotion.

In fact, in the studies of Refs. [

4,

5], it was pointed out that the battery structure of AEA is similar to that of new energy vehicles and is the most valuable part of the overall body of AEA. In the early stage of the development of new energy vehicles, the battery’s driving range, battery quality and safety, and cost issues were the main problems faced during promotion. The battery requirements for AEA are even higher. According to a report (Maintenance, Repair & Overhaul. (2019). How Batteries Need To Develop To Match Jet Fuel. Available at:

https://aviationweek.com/mro/aircraft-propulsion/how-batteries-need-develop-match-jet-fuel (accessed on 6 July 2025)), the current state-of-the-art lithium-ion battery exhibits a capacity ranging from 250 to 300 watt-hours per kilogram, rendering it suitable for powering compact AEA. However, achieving a comparable range to that of small-scale AEA in commercial AEA necessitates the utilization of a battery pack with an energy density of 500 Wh/kg. This presents significant challenges for battery technology research and development efforts undertaken by AEA manufacturers (hereinafter, as manufacturers). Moreover, promoting the development of AEA and expanding its market share in the digital context is a long-term, complex and continuous process. The development and market demand of AEA are mainly influenced by two aspects. The influence of the battery life level (referred to as the technical level) of AEA and consumer preferences. Because these two factors will evolve over time, thereby increasing the complexity of decision-making. Because the improvement of technological level and consumer preferences does not produce immediate effects, they usually have a delayed effect on the market [

6,

7]. These delay effects will have an impact on the decisions of manufacturers, airlines and governments. If these delay effects are ignored, it may lead to deviations in decision-making results and weaken the effectiveness of AEA promotion. To analyze the complex dynamic game decisions of manufacturers, airlines and governments in the process of promoting digital AEA, we have constructed a dynamic differential game model that simultaneously incorporates the delay effect and real-time changes. This model aims to solve the equilibrium solution to characterize the optimal strategies of each game participant in both competitive and cooperative environments. This equilibrium solution provides a crucial foundation for analyzing the development of AEA and its applications in the market [

8].

The lifecycle of lithium battery technology associated with All-Electric Aircraft (AEA) development presents multifaceted environmental risks [

1]. Research by Ref. [

9] identifies upstream hard-rock lithium mining as a critical source of environmental burden, where diesel-powered extraction and processing not only generate a significant carbon footprint but also pose toxic risks to terrestrial ecosystems and human health through polluted dust, tailings, and heavy metal leaching. Further amplifying these concerns [

10], in an empirical study of China’s largest lithium extraction area, demonstrated that lithium mining is the primary industrial source of riverine lithium pollution, leading to bioaccumulation in aquatic organisms and posing potential non-carcinogenic health risks to local residents through contaminated drinking water and vegetables. At the end-of-life stage, the disposal of spent batteries presents another significant challenge. As emphasized by Ref. [

11], recycling technologies are crucial for handling the impending wave of battery waste; they note that emerging direct recycling methods, which aim to rejuvenate rather than break down electrode materials, require a deep understanding of material failure mechanisms to prevent secondary pollution from improper handling. In summary, the entire lithium-ion battery industry chain, as reviewed by Ref. [

12], faces sustainability challenges across the entire material lifecycle, necessitating an integrated chemistry, environment, and policy framework for systematic risk assessment and management to ensure the truly green transition of AEA. Despite this, traditional aircraft still face more environmental and operational risks than electric aircraft during the manufacturing and operation process. According to research by Ref. [

2], traditional aircraft pose significant environmental risks due to their hydraulic and pneumatic systems, which are prone to leaks and require high maintenance, and their fossil fuel combustion, which emits large amounts of CO

2 and NO

x. Ref. [

13] further highlight, life cycle assessments confirm their high global warming potential and ecotoxicity. In contrast, electric aircraft produce zero direct emissions during operation. Their life cycle carbon emissions can be about 55% lower, with substantial reductions in other pollutants. Their electric propulsion systems are more reliable, and they exhibit better life cycle cost economics. In conclusion, electric aircraft demonstrate superior environmental performance, reliability, and cost-effectiveness, making them a more suitable and promising solution for greening the aviation industry.

The promotion of AEA presents a complex landscape of risks and rewards for stakeholders. Manufacturers face significant costs when driving research and development (R&D) and implementing core AEA technology. As AEA emerges, immature key R&D technologies may lead to frequent operational failures in aviation, thereby reducing AEA utilization. Therefore, intensifying R&D efforts is crucial. Ongoing innovation and breakthroughs in R&D technology require substantial investments. However, Ref. [

14] argue that excessive spending can inflate the initial cost of AEA, potentially dampening the short-term investment enthusiasm of manufacturers and airlines. The study conducted by Ref. [

15] concurrently demonstrates that lithium-ion batteries are widely recognized as the optimal energy source for electric aircraft due to their exceptional energy density and extended lifespan. However, potential safety concerns may arise during battery utilization due to variations in operational temperature and charging status. Although Ref. [

16] suggests that increasing the utilization of AEA has the potential to contribute towards mitigating greenhouse gas emissions and noise pollution, thereby assisting the airline industry in achieving their carbon reduction targets, it is imperative to acknowledge that conventional fuel-powered aircraft still offer superior short-term economic advantages. Based on the study conducted by Ref. [

17], it is suggested that achieving long-term economic sustainability with AEA would require battery costs to reach or fall below

$100 per kilowatt-hour. With immature core technology and low consumer preference, hasty implementation poses risks to operational safety and revenue stability. Airlines have adopted a cautious approach to AEA. As the government holds operational and ownership rights over most airports, it plays a pivotal role in promoting AEA adoption. Ref. [

18] contend that to ensure the endurance level of AEA, it is imperative for the government to allocate investments towards bolstering airport charging infrastructure and optimizing existing power grids. This mitigates the variable operational costs and encourages airline and consumer adoption. Manufacturers must enhance battery technology R&D to optimize endurance, reduce costs, and boost consumer preferences. The government must formulate effective incentive policies while balancing its fiscal budget with necessary investments in charging infrastructure.

Considering current AEA R&D maturity and consumer preferences, a critical question emerges: Which model should AEA market promotion underline? Because the battery—the core component of AEA directly determines performance, its R&D is highly dynamic and costly. Therefore, battery innovation is pivotal to AEA’s widespread diffusion and long-term profitability. This poses a shared challenge for manufacturers, airlines, and the government. Airlines must carefully evaluate AEA endurance, safety, and market demand. They must also consider the availability of airport charging infrastructure. Inadequate facilities can cause operational delays, erode consumer confidence, and suppress demand. Accordingly, before selecting a collaboration model, manufacturers, airlines, and the government should comprehensively assess AEA endurance and the current state of airport infrastructure. Given current market conditions, an important choice arises: should stakeholders share costs or act independently? For independent decision-making, we model behavior using the Nash non-cooperative framework. If the manufacturer’s R&D capability falls short of the minimum requirements for commercial AEA, airlines and the government should proceed cautiously and avoid immediate collaboration. This situation yields a Nash non-cooperative equilibrium, in which each stakeholder acts independently to maximize its own utility. Under cost-sharing arrangements, as the manufacturer’s R&D level improves, airline–manufacturer willingness to cooperate increases, which stimulates AEA procurement. This, in turn, raises demand for airport charging infrastructure and incentivizes government investment. The high operating costs of first-generation AEA may dampen airline and government enthusiasm. Large manufacturers often pursue cost-sharing arrangements with airlines and the government to set standards and strengthen market influence. This manufacturer-led approach protects airline and government interests but increases the manufacturer’s burden. Once technical and cost challenges are resolved, airlines and the government can proactively advance emissions reduction and infrastructure development, enabling closer collaboration. Within a collaborative framework, we analyze a model in which decision-makers share information and resources and jointly optimize decisions. Although idealized in practice, this model serves as a benchmark. Accordingly, we study three game models for AEA promotion: Nash non-cooperative, cost-sharing, and collaborative cooperation. To analyze AEA promotion, we develop a dynamic game model that incorporates delay effects and real-time adjustments. The model identifies optimal strategies for all parties and supports long-term, stable AEA deployment.

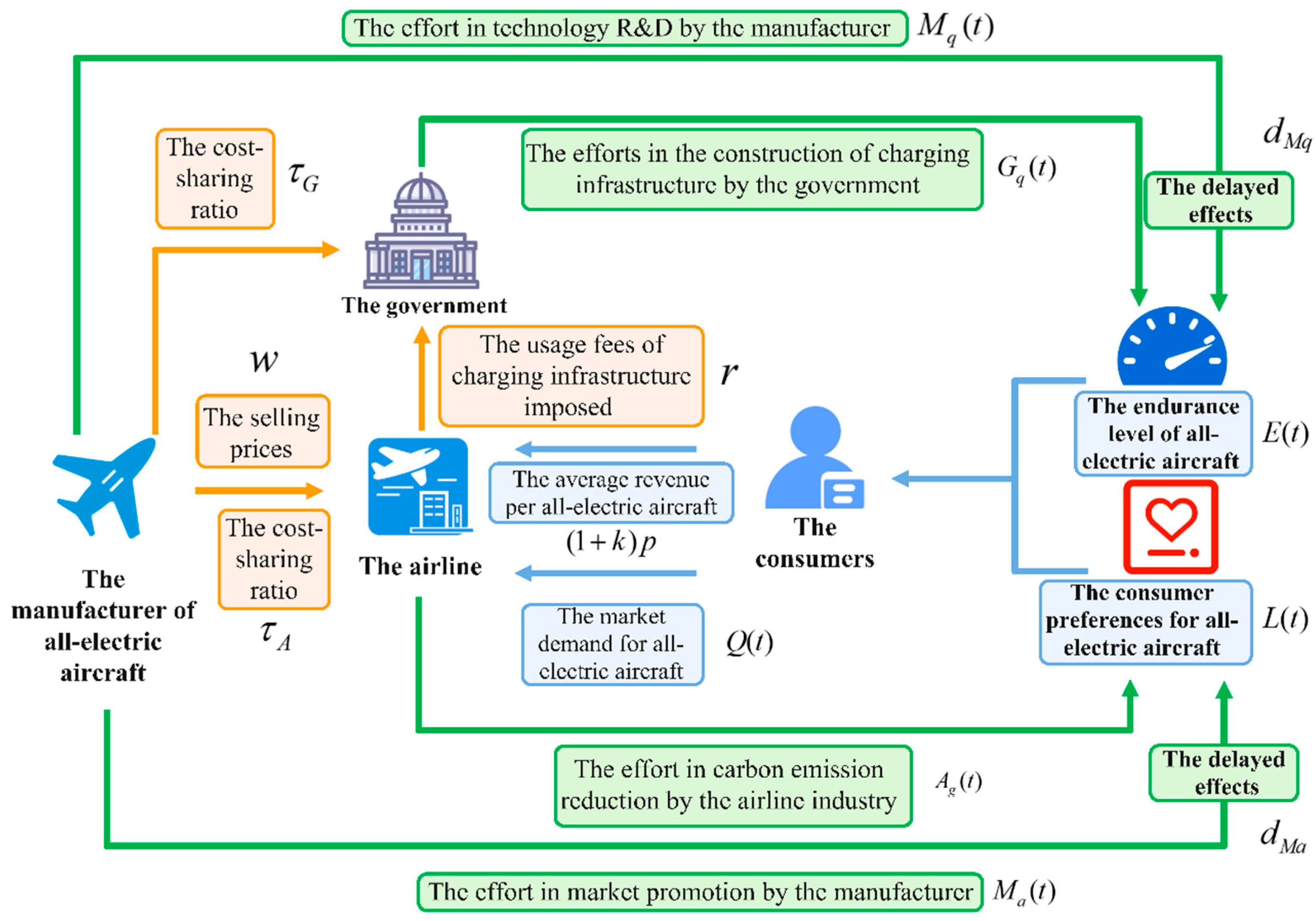

Draw on the similarities between AEA and the research on the promotion of new energy vehicles. This paper employs dynamic optimal control and a differential game model including delay effects. Under the NASH non-cooperative mode, cost-sharing mode and collaborative mode, respectively. Study the optimal decision-making paths for manufacturers, airlines and the government in terms of enhancing technological levels and increasing consumer investment strategies. This study primarily addresses the following four aspects: (1) The extent of the influence exerted by different cost coefficients on the selection of popularization models for AEA. (2) The reciprocal impact of the chosen promotion model on technological advancement and consumer preferences for AEA. (3) How government initiatives in charging infrastructure, manufacturers’ efforts in digitalized R&D, and the airline’s marketing promotion dynamically popularize the all-electric aircraft. (4) The influence of varying delayed effects on the optimal strategic decisions made by the manufacturer, airline, and government.

The remaining part of this article is arranged as follows: In

Section 2 provides a review of the relevant literature. In

Section 3, the construction of a differential game model is discussed that considers the delayed effects of technology R&D and consumer preferences for AEA. Subsequently, equilibrium strategies under various game models are compared and analyzed. In

Section 4, numerical simulations are carried out to demonstrate the impact of various factors on AEA promotion.

Section 5 summarizes the study and proposes future research directions.

4. Numerical Analysis

At present, the parameters used in this paper are derived from existing literature and reports, or derived from them. The influence coefficient in the cost decision variable is

,

,

,

[

50]. The coefficient in the influence on the state variable

,

,

,

[

51]. The default values of the remaining parameters are set to

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

, and

. More detailed parameter sources and Settings are shown in

Table 2. The remaining parameters are randomly initialized within the preset reasonable range to ensure the validity of the Settings and the relative stability of the results. The following analysis will simulate how stakeholders choose the optimal cooperation mode to promote digitalized AEA, thereby advancing the sustainable development of the aviation industry.

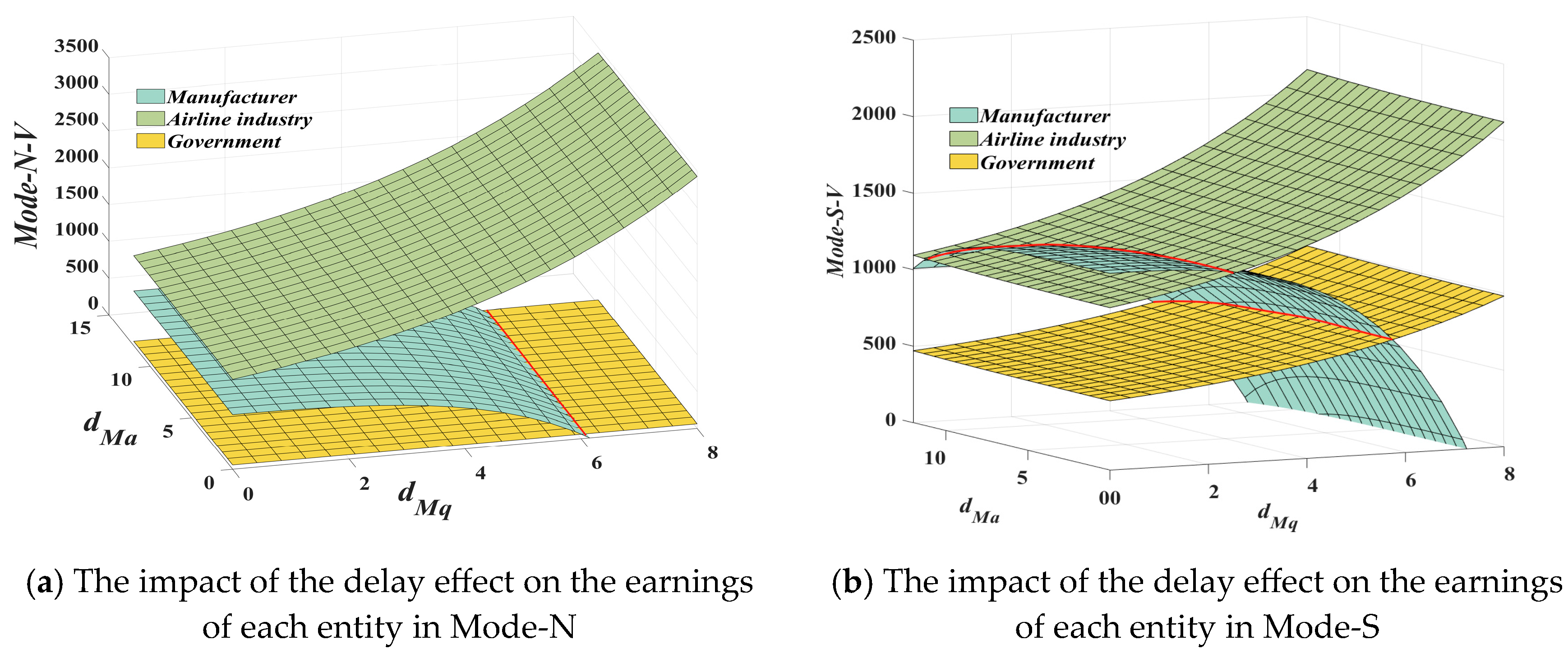

Figure 2 describes how the overall benefits to the manufacturer, airline, and government vary with the delayed effects in different game modes (For the sake of convenience, in this chapter, Mode-N represents the Nash non-cooperative mode in the graph, Mode-S denotes the cost-sharing mode, and Mode-C signifies the collaborative cooperation mode.). These benefits are a direct result of their respective investments in digitalized R&D, sustainable operations, and smart infrastructure. The overall gain in the Nash non-cooperative and cost-sharing modes exhibits a negative correlation with the delayed effects

,

. As

,

increases, both the gain in the Nash non-cooperative mode and the gain in the cost-sharing mode gradually decrease. Meanwhile, the rate of decrease is higher for the gain in the cost-sharing mode, resulting in a smaller gain than that of the Nash non-cooperative mode. Conversely, in the collaborative cooperation mode, the overall gain gradually increases as

and

increase. However, the overall benefits of the Nash non-cooperative and cost-sharing modes are strictly higher than those of the collaborative cooperation mode. Therefore, the manufacturer, airline, and government make various optimal decisions at different delay ranges. When

,

is small, and the cost-sharing mode is the best choice. When

,

is large, and the Nash non-cooperative mode is the best choice.

According to

Figure 1 and the previous deduction, the delayed effects have threshold values. When there are delays in technological upgrading by the manufacturer

and delays in promotion by the manufacturer

, the airline and government are increasingly inclined to adopt a cost-sharing mode to alleviate cost pressures, foster collaboration with manufacturers, facilitate promotion of AEA, and maximize overall revenue. Prior to finalizing the commencement of cooperation, the manufacturer must fully clarify the delayed effects of its technology development and marketing to ensure that it is within the minimum threshold range. When

and

are used, although the cost-sharing mode can maintain higher revenues compared to the collaborative cooperation mode, the manufacturer is unable to assist the airline and the government in sharing additional costs owing to the difficulties associated with technology development and promotion. At this point, implementing a cost-sharing mechanism cannot enhance overall revenues but instead results in losses. Therefore, the manufacturer, airline, and government are inclined to prefer the Nash non-cooperative mode. In conclusion, the manufacturer, airline, and government should choose either a cost-sharing mode or a Nash non-cooperative mode based on different delayed effects. This decision is crucial as it determines the collective capacity to fund and sustain the long-term digital R&D and infrastructure investments necessary for a successful transition.

The impact of delayed effects on the revenue of the manufacturer, airlines, and government entities in the Nash non-cooperative and cost-sharing modes is illustrated in

Figure 3a,b. As depicted in

Figure 3a, the airline consistently generates higher revenue than both the manufacturer and the government. Moreover, as the delayed effects increase, there is a gradual decrease in the revenue of the manufacturer relative to that of the government. The cost-sharing mode, illustrated in

Figure 3b, demonstrates that the manufacturer garners the greatest benefit, followed by the airline; whereas the government achieves the least. Initially, this mode enables the manufacturer to attain optimal profitability when faced with minimal delayed effects. However, as the delayed effects increase, their revenues start to decline and fall below those of airlines, before gradually dropping even further below government revenues. These findings depicted in

Figure 3a,b, demonstrate that an increase in delayed effects benefits airlines and the government, while adversely affecting the manufacturer. Moreover, it is evident that the benefits to the manufacturer diminish as the delayed effects increase.

The above analysis, combined with the previous formula derivation, reveals the existence of a threshold for delayed effects in the Nash non-cooperative mode. When and occur, the revenue of the manufacturer is lower than that of the airline but higher than that of the government; whereas and demonstrate that manufacturers earn less than the airline and the government. This is because an increase in the delayed effects will increase the efforts of electric aircraft manufacturers in technology development and marketing to mitigate the adverse impacts, which will have a positive effect on the revenue of airlines and governments. This implies that longer R&D cycles for complex digital technologies might, counter-intuitively, benefit other stakeholders in the short term. In cost-sharing mode, appropriate delayed effects are beneficial for the electric aircraft to improve its endurance level and promotion. However, prolonged delays can adversely affect manufacturer revenue. When and are used, the revenue of the manufacturer is lower than that of airlines, but higher than that of governments. However, when and are used, the manufacturer gains relatively less than the government. This is because the delayed effects in implementation allow manufacturers to enhance their technological R&D and marketing efforts. However, the benefits of excessively long delayed effects cannot compensate for the costs incurred by the manufacturer to support airlines and the government regarding energy conservation, emissions reduction, and infrastructure construction. Consequently, returns decrease persistently.

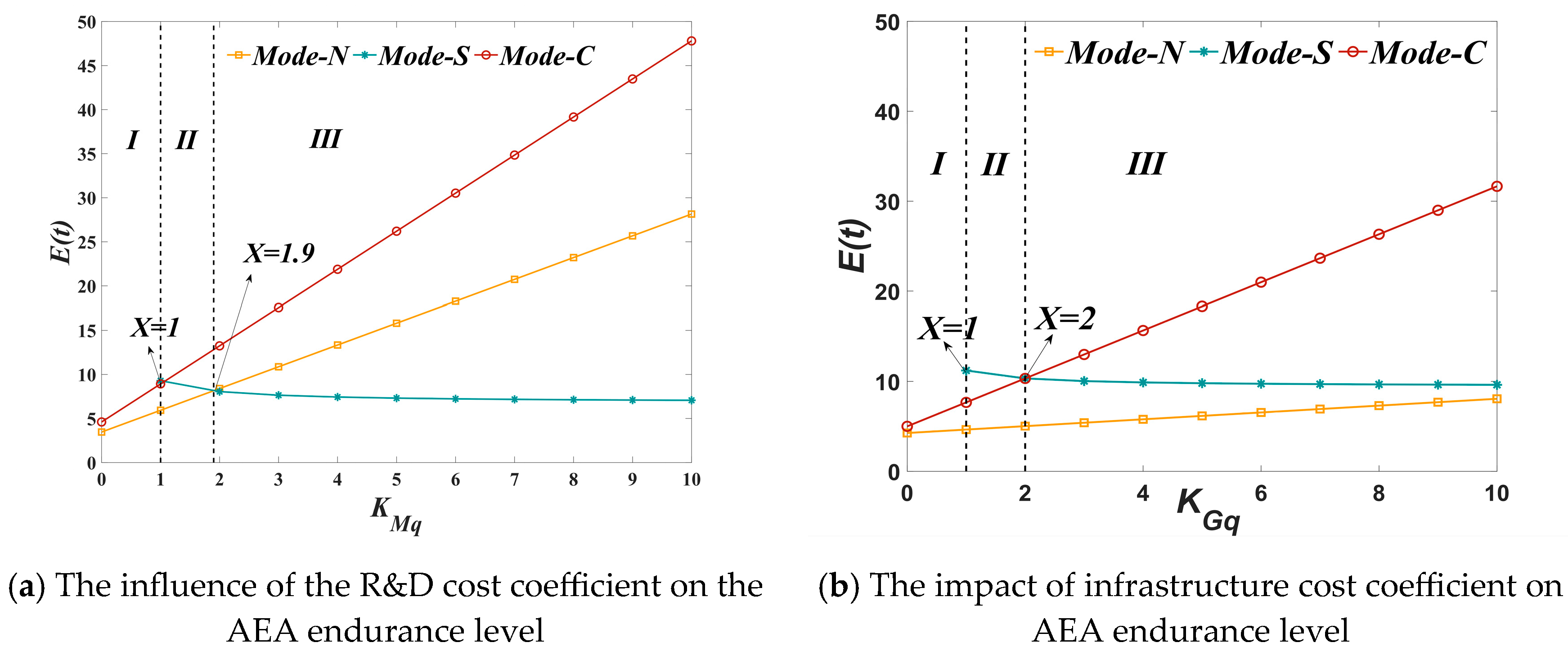

Figure 4a,b are divided into three regions respectively (Region I indicates that the manufacturer does not undertake cost-sharing.), describing the trend of the endurance level of AEA

change with the increase in the cost coefficient of the charging infrastructure by the government

and the cost coefficient of promotion for the manufacturer

. Due to the cost-sharing mode, the manufacturer should bear a portion of the airline and government costs; the initial value in this mode is determined by factors denoted as

and

. Consequently, with the increase of

and

,

showed a steady upward trend in both Nash non-cooperative mode and collaborative mode. Moreover,

in the collaborative cooperation mode is always higher than Nash non-cooperative mode. Although

decays in the collaborative cooperation mode, in region II of

Figure 3a (entering region II when

), it is higher than the Nash non-cooperative mode and the cost-sharing mode, while in region III (entering region III when

), it is lower than both. In

Figure 3b, when

is in region II, the cost-sharing mode is higher than the cooperative mode and the Nash non-cooperative mode. When

(entering region III), the cooperative mode still maintains its advantage. It can be seen that the cost-sharing mode has a high

in the early stage of cooperation, but it needs to help the airline and the government share part of the cost; the high research and development cost leads to the negative return of the mode to

.

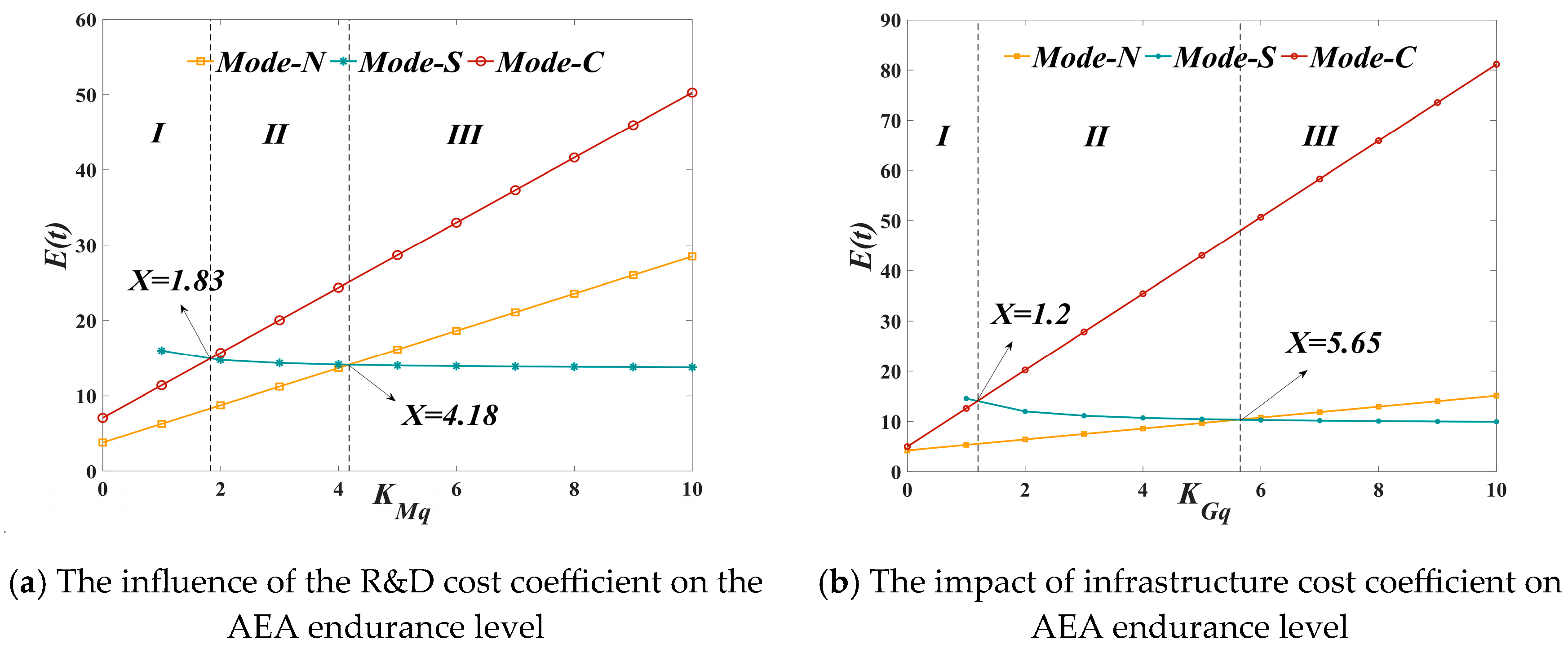

Figure 5a,b are obtained by adjusting the impact of the government’s efforts on the endurance of AEA (change

to

). By comparing

Figure 4a,b, it can be observed that the cost-sharing mode is more effective in enhancing the research and development level of AEA when the promotion cost pressure is low (when

and

, in region I). However, as the promotion cost increases to a threshold and exceeds (

and

in region III), Nash non-cooperative mode and collaborative cooperation mode will exceed the cost-sharing mode. The cost threshold will move backward with the increase in the impact of the government’s efforts on the endurance of all-electric aircraft

, thus expanding the advantage range of cost-sharing mode.

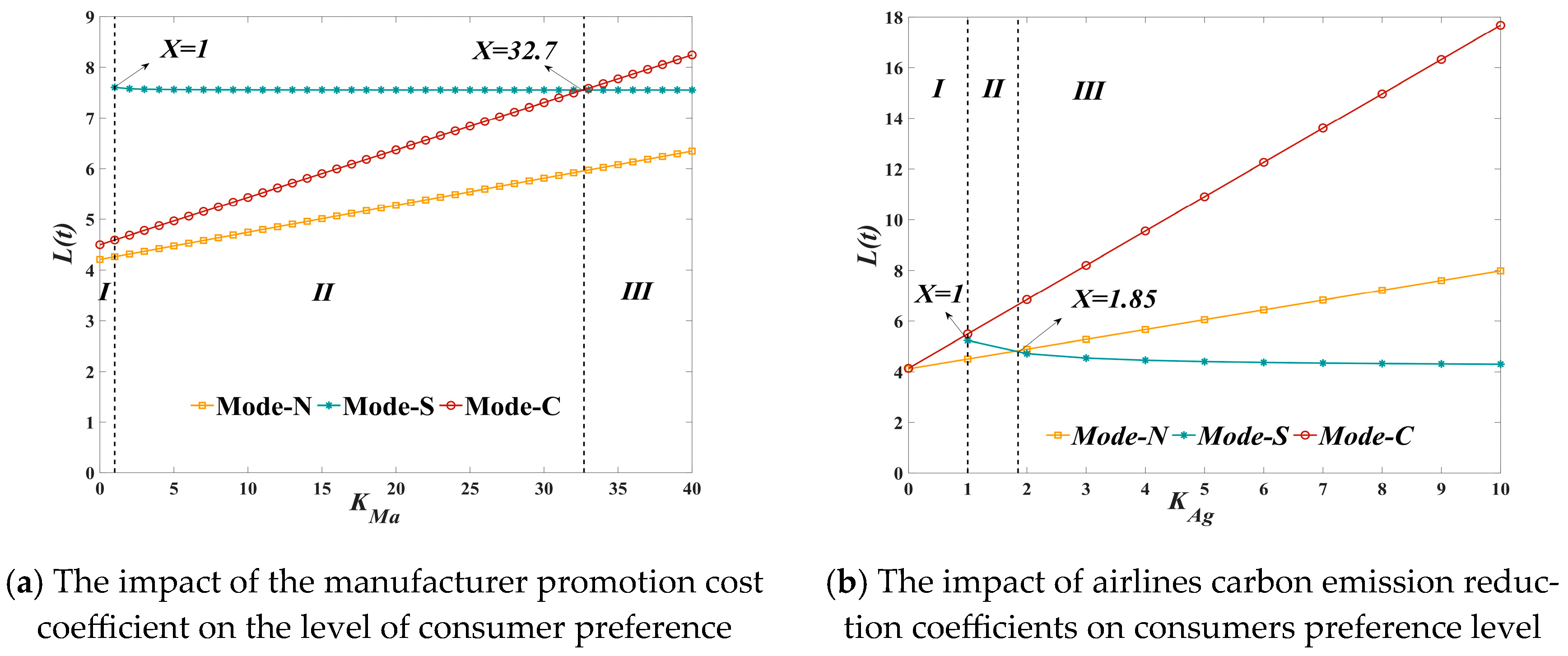

Figure 6a is partitioned into four distinct regions, whereas

Figure 6b can be divided into three regions (Region I indicates that the manufacturer does not undertake cost-sharing), as shown in

Figure 6. In the cost-sharing mode, the manufacturer assumes a portion of the costs incurred by both the airline and government entities; thus, the initial value of the mode commences at

and

. In

Figure 6a, despite a high level of consumer preferences

in the cost-sharing mode, an increase in the cost coefficient of promotion for the manufacturer

leads to a gradual decline in consumer preferences

(when

enters area II). This decline is slower compared to the collaborative cooperation mode in region III (when

), but greater than that observed in the Nash non-cooperative mode. Eventually, it reaches its lowest level in region IV (when

). In

Figure 6b,

in cost-sharing mode exhibits a gradual decrease in region II (when

), which is less pronounced than that observed in collaborative cooperation mode. Furthermore, the level of

continuously decreases in region III (when

), albeit at a slower rate compared with the Nash non-cooperative mode. This is attributed to the imperative for manufacturers to actively promote their products, as the impact on

remains relatively gradual despite potential increases in

. However, if the cost coefficient of carbon emission reduction for the airline

continues to escalate, it will exert greater cost pressure on the manufacturer. In cost-sharing mode,

declines faster. Under the collaborative cooperation mode, the three parties form a community of shared interests, enabling them to bear costs collectively and leverage resources and information. This collaboration facilitates economies of scale and scope, enhances product R&D efficiency, and boosts market competitiveness, even in scenarios with increasing cost coefficients.

The influence coefficient of airline carbon reduction efforts on consumer preferences for AEA (adjusted from

to

) is shown in

Figure 7. By comparing it with

Figure 6, we observe that the selection rate of the collaborative cooperation mode and Nash non-cooperative mode is influenced by this coefficient. As the coefficient increases, the evolution rates of both modes accelerate. However, the cost-sharing mode mitigates the interference effect caused by an increase in this coefficient and exhibits the greatest stability among the three modes.

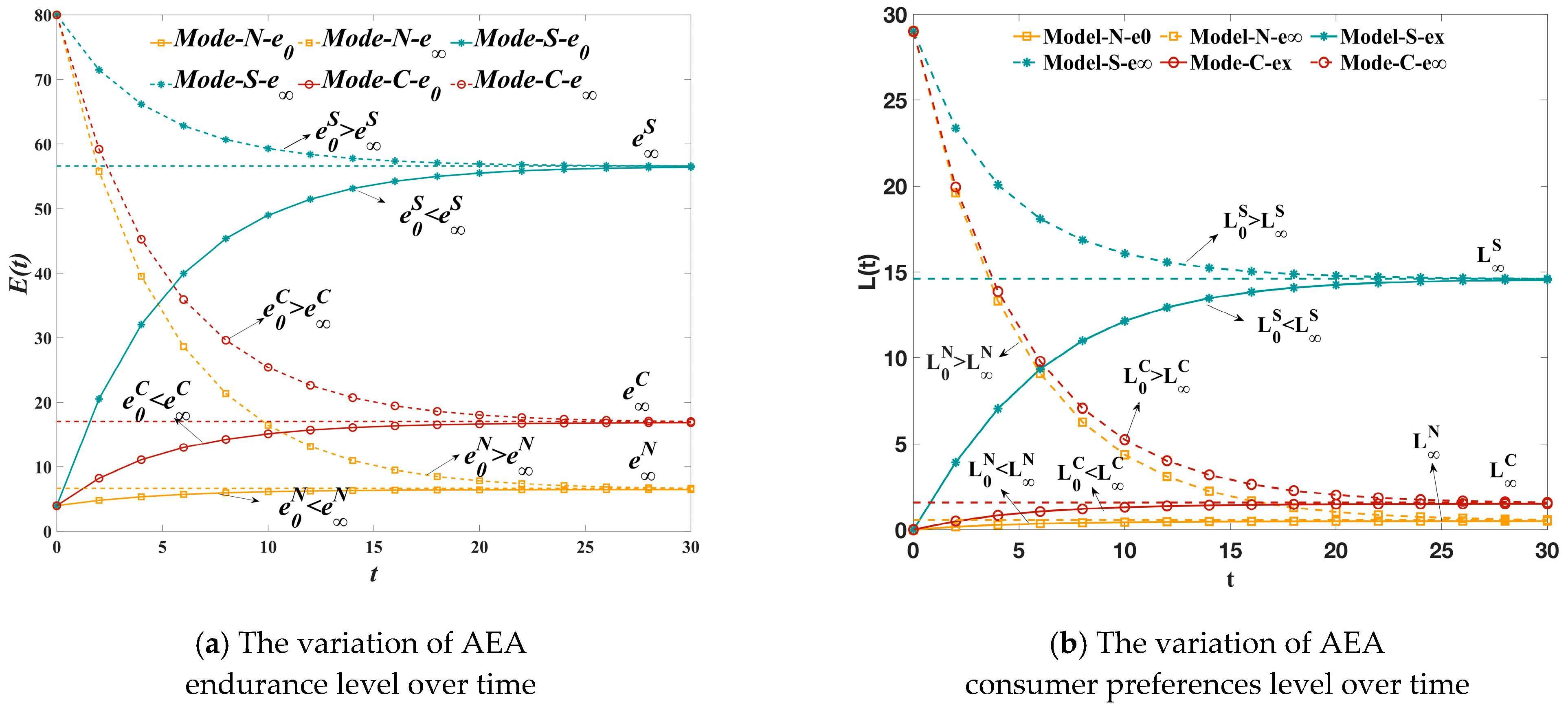

The results presented in

Figure 8 demonstrate that across various cooperative modes, the AEA exhibits optimal steady-state values for both the endurance level of the AEA

and consumer preferences of the AEA

. Notably, the cost-sharing mode exhibits higher optimal steady-state values than both the Nash non-cooperative and collaborative cooperation modes. The decay rate of the cost-sharing mode exhibited a significantly lower magnitude than that of the Nash non-cooperative mode before reaching the steady state. The evolution trend of

and

over time, under the three modes, was influenced by the initial values of

and

, as depicted in

Figure 8. Higher values of

and

exhibited a decay with time, whereas lower values increased over time, eventually converging to the steady-state level. The steady-state values of

and

are independent of their initial values

and

, but solely determined by the cooperative mode. Specifically, in the cost-sharing mode, the steady-state values of

and

reach their maximum, whereas in the Nash non-cooperative mode, they reach their minimum. Compared with the cost-sharing mode,

and

of electric aircraft in the Nash non-cooperative and collaborative cooperation modes declined the fastest and grew the slowest. The lack of formal commercial use, coupled with uncertain safety and market demand, has led airlines and governments to adopt a cautious approach towards AEA adoption and airport infrastructure redevelopment. Within the framework of the Nash non-cooperative mode, manufacturers, airlines, and governments prioritize their own interests without establishing trust or effective communication channels, resulting in a prisoner’s dilemma. In the collaborative cooperation mode, although these three parties can be considered part of the same department, their costs and revenues differ, leading to a free-rider mentality. However, by implementing the cost-sharing mode, in which the manufacturer provides subsidies to the airline and the government as followers while assuming leadership roles, the investment risks for both parties are reduced to some extent. This approach also enhances the motivation of airlines and governments to promote green emission-reduction initiatives and the development of charging infrastructure.

The endurance level of the AEA in the three modes gradually increases over time and eventually stabilizes at a consistent value, as shown in

Figure 9a (Mode-N = 15.17, Mode-C = 31.30, Mode-S = 107.13). The endurance level of AEA gradually increased as the delayed effects were extended. Compared to the impact of delay, there was an improvement in the final stability value of the endurance level of the AEA. In

Figure 9b, the level of consumer preference in both the Nash non-cooperative mode and cost-sharing mode gradually decreases and approaches a stable value (Mode-N = 1.38, Mode-C = 2.65, Mode-S = 15.26). As shown in

Figure 8, the level of consumer preference exhibits an upward trend only in the cost-sharing mode. Consistent with the conclusions, the superiority of cost-sharing mode was confirmed. Moreover, as the delayed effects of consumer preference increases, its degree shows a slowly increasing trend.

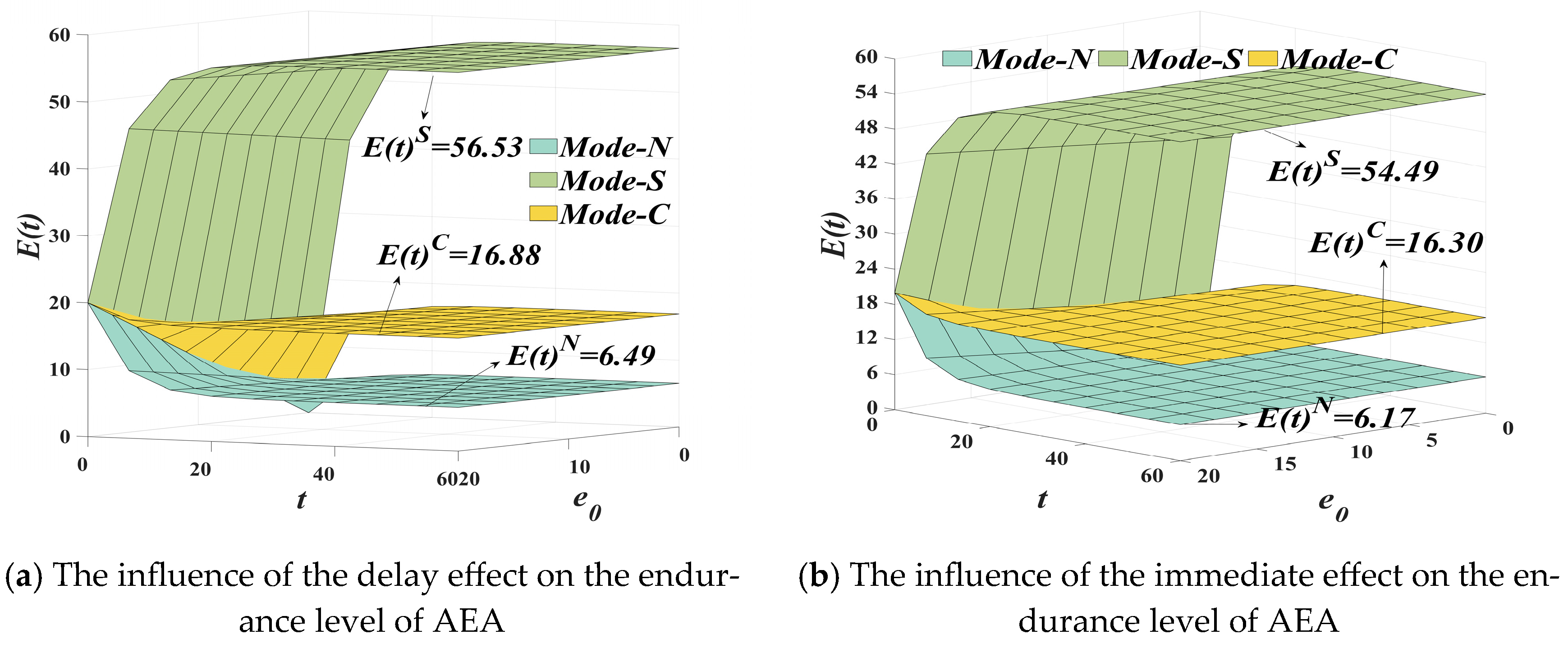

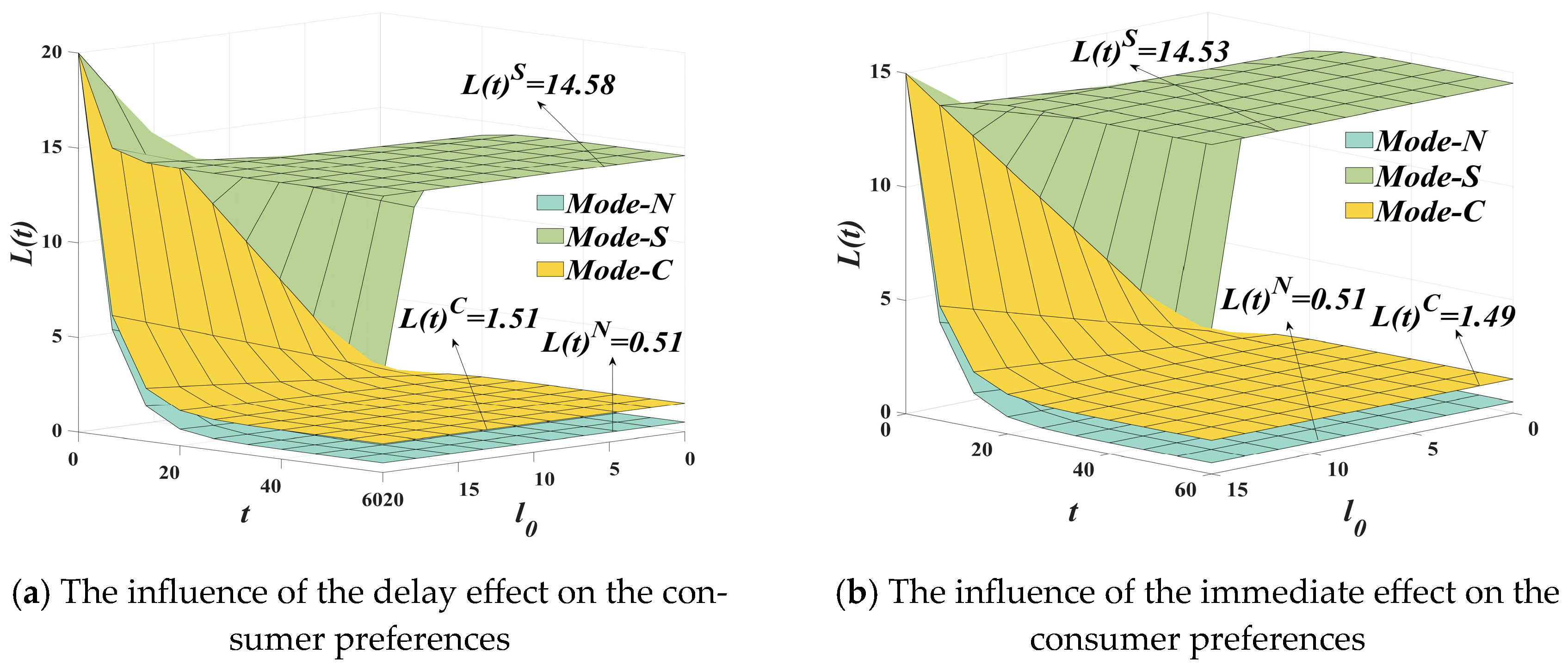

The evolution trend of the endurance level of AEA

with the initial value

and time

under delay and immediate effects is illustrated in

Figure 10a,b. Similarly, the evolution trends of

with

and

under delay and immediate effects are shown in

Figure 11b. This can be observed in

Figure 10 and

Figure 11; across all three modes, when

falls below the equilibrium value,

initially increases before stabilizing over time. Conversely, when

exceeded the equilibrium value, it first decreased before reaching a stable state at the equilibrium value. Furthermore, a larger gap between the initial and equilibrium values results in faster growth (or decline).

According to

Figure 10a and

Figure 11a, in the Nash non-cooperative mode,

and

reach equilibrium at 6.49 and 0.51, respectively. In the cost-sharing mode, the equilibrium values increase to 56.53 for

and 14.58 for

, whereas in the collaborative cooperation mode, they stabilize around 16.88 for

and 1.51 for

. It is evident that when both

and

are low, adopting the Nash non-cooperative mode can enhance these factors. When

and

are at moderate levels, the adoption of a collaborative cooperation mode can effectively facilitate the enhancement of both

and

. This suggests that collaborative cooperation can moderately incentivize manufacturers, airlines, and governments to make concerted efforts. When the initial values for

and

are high, it is imperative to implement a cost-sharing mode to further elevate both

and

. As depicted in

Figure 10b and

Figure 11b, the immediate impact leads to the attainment of equilibrium between

and

in Nash non-cooperative mode, with values stabilizing at 6.17 and 0.51, respectively; similarly, in cost-sharing mode, their equilibrium values converge at 54.49 and 14.53. The state of equilibrium is achieved at levels of 16.30 and 1.49.

By comparing

Figure 10 and

Figure 11, it can be seen that compared with the immediate effect, the existence of a delayed effects can promote

and

, but the

is less than the

of an electric aircraft. This is because the delayed effects may have allowed the manufacturer to achieve technological breakthroughs, thereby enhancing

. Consumer acceptance of AEA is determined by factors such as safety, endurance, cost-effectiveness, and environmental awareness. After a prolonged observation period, the consumer preference

shows a slight increase owing to the influence of delayed effects. In summary, compared to the immediate effects, although the improvement brought about by the delayed effects has a small degree of improvement in consumer preferences, it can also help the promotion of the manufacturer and the effort to reduce carbon emissions of airlines to a certain extent, expand market demand, and help the promotion of AEA.

5. Conclusions

With the continuous advancement of airlines and the subsequent expansion of transportation, the widespread utilization of FPA has significantly increased greenhouse gas emissions. In the face of global warming and the urgent need for sustainable development, mitigating these emissions within the airline sector has become a shared challenge for AEA manufacturers, airlines, and governments. This study argues that digitalization is a key enabler in this transition, while acknowledging that the popularization of digitalized AEA is a complex game-theoretic process. The endurance and performance of AEA, as well as the decision-making changes in stakeholders, are significantly influenced by the level of R&D undertaken by manufacturers in this field. The endurance of AEA and market preference towards AEA are determined by factors such as the level of digitalized R&D, carbon emission reduction efforts, and improvements in charging infrastructure. This study established a dynamic differential game model with delayed effects, the game process of a manufacturer, airline, and government is numerically simulated in Nash non-cooperative, cost-sharing, and collaborative cooperation modes. The results highlight the critical impact of time delays, inherent in digital technology development and market adoption, on the strategic choices of all parties. In our simulation results, the cost-sharing mode achieved the highest level of battery life and the steady-state value of consumer preference. They were 107.13 and 15.26, respectively, significantly higher than 31.30 and 2.65 of the collaborative cooperation model or 15.17 and 1.38 in the non-cooperative mode with NASH. Correspondingly, the battery life is approximately 7.06 times higher than that of the NASH non-cooperative mode. It is approximately 3.42 times higher than the collaborative mode. Consumer preferences have increased by approximately 11.06 times compared to the NASH non-cooperative model. It is approximately 5.76 times higher than the collaborative cooperation model. Based on the above results, this study further clarifies the optimal mode selection under different scenarios: When the delay effect is small and the government’s willingness to invest in infrastructure construction is high, the adoption of the cost-sharing model can effectively increase the steady-state values of the endurance level and consumer preference level of AEA, and improve the overall performance of AEA promotion. When the delay effect is high, the coordination cost of cooperation is high, and the uncertainty of returns is large, the NASH non-cooperative model is actually the best decision-making model, and in the short term, airlines will be the biggest beneficiaries. Furthermore, when the three parties do not have the conditions for cost-sharing due to their respective decision-making choices, the collaborative model can make the benefits of all parties more balanced and is suitable as a transitional choice towards a collaborative cooperation model.

For manufacturers of AEA, the adoption of a cost-sharing mode can effectively capitalize on their market dominance. In contrast, airlines can ensure stable profits by embracing the Nash non-cooperative mode. However, the government can achieve stable revenue growth by choosing any promotional model, but it cannot ensure their optimal benefits in the process of promoting AEA. Without considering the delayed effects of strategy implementation, the cost-sharing mode is the most preferred option. However, the Nash non-cooperative mode would become more advantageous when the delay time is significant.

The introduction of the delayed effects led to a gradual increase in the overall revenue generated under the Nash non-cooperative mode. When the marketing and R&D delays exceed approximately 4.58 and 5.49 model-time units, respectively (under the benchmark setting), the Nash non-cooperative mode becomes the optimal choice for AEA promotion; under smaller delays, the cost-sharing mode remains superior. The increase in delayed effects, although detrimental to the interests of the manufacturer, can enhance the endurance capabilities of AEA—potentially due to more mature digital technologies after a longer R&D period—and improve the steady-state value of consumer preferences. Moreover, it can also facilitate expeditious decision-making processes for both airlines and government entities. In Nash non-cooperation mode, airlines emerge as primary beneficiaries, whereas in cost-sharing mode with minimal delayed effects, manufacturers reap greater benefits.

This research carries out thorough deductions and simulation experiments under various scenarios; however, certain limitations that require further exploration should be noted. The model proposed in this study encompasses a business ecosystem that includes the manufacturer, airline, and government. However, the resistance arising from competition among the AEA, FPA and high-speed rail is not considered. Furthermore, AEA manufacturers could establish strategic alliances with companies or institutions other than the airlines, which may also have significant impacts on promoting AEA. Future research should also investigate the role of data as a strategic asset within this game, as digitalized aircraft will generate vast amounts of operational data that could create new value and influence stakeholder bargaining power. Future research should further investigate the collaborative optimization of digital R&D investment and market pricing of AEA with more intricate market competition and policy environments to enhance the applicability of the model in the context of the industry’s digital and sustainable transformation.