1. Introduction

In the context of increasingly fierce global competition for resources, the strategic status of critical metals has become more prominent. Various countries have successively strengthened their research and planning of essential resources of metal to safeguard their own economic development and industrial security. Among them, antimony, as an important metal, due to its unique physical and chemical properties, has indispensable applications in multiple fields such as industrial production and high-tech industries, and has become an object of key concern in the resource layout of countries around the world [

1].

Antimony boasts numerous critical application scenarios, sustaining substantial demand. The industrial sector is its core demand area: flame retardants (primarily antimony trioxide) account for 70% of global antimony demand, while lead-acid batteries account for 15%. Approximately 50 tons of antimony are consumed per 1 GW of photovoltaic modules produced, and antimony is also used in wear-resistant alloys, semiconductor materials, and catalysts for PET resin production. The military sector highlights its strategic value: antimony is used as a hardener for armor-piercing projectiles, radiation shielding materials for armored vehicles and nuclear facilities, as well as in pyrotechnics like tracer rounds. It also serves as a key component in infrared detectors for night-vision devices and missile seekers. Emerging technologies drive new demand for growth: calcium-antimony batteries, antimony-based anodes for sodium-ion batteries, antimony-based solders/flame-retardant casings for AI servers, and antimony-based materials for quantum computing all rely on antimony. In other fields, antimony is used as a clarifier and colorant in glass and ceramics, as well as in catalysts for industrial exhaust denitrification and water pollution tracing, demonstrating its wide-ranging applications.

Globally, the reserves of antimony are limited and unevenly distributed. In 2022, the global production of antimony ore decreased to 110,000 tons, a drop of 34.1% compared to 2010. The main producing countries are China, Russia, and Tajikistan, with their production accounting for 54.5%, 18.2%, and 15.5%, respectively, in 2022. Russia is one of the major suppliers of antimony ore globally, but its production and export volume have been continuously declining. Its antimony ore exports mainly go to China, accounting for 65.9% in 2021, and a small portion is exported to countries such as Oman and Vietnam. Tajikistan, as the third-largest country in terms of antimony resources globally, has an annual production of 17,000 tons. The United States is a major importer of antimony. From 2019 to 2022, 63% of the antimony ore and its oxides imported by the United States came from China. Since 2009, China has gradually strengthened its supervision of antimony resource production, and its production has shown a downward trend. The production in 2022 decreased by 60% compared to 2010. China’s large-scale import of antimony ore has put other importing countries under certain competitive pressure when acquiring antimony resources, as they need to compete with China for the limited supply of antimony ore. For the exporting countries of antimony products, China’s huge import demand also makes it an important target market. All countries hope to meet the needs of the Chinese market to obtain economic benefits. China is a major country in terms of antimony resources, and its reserves and production once ranked first in the world. However, in recent years, the proportion of its reserves has decreased. In 2013, China’s reserve proportion was 52.78%, which had dropped to 24% in 2021 and was 19.4% in 2022. China is also an important exporter of antimony products. But after 2022, its export policy has been adjusted. The Ministry of Commerce and the General Administration of Customs of China issued a notice on 15 August 2024, implementing export controls on items such as antimony starting from 15 September. The implementation of this policy will affect the global supply pattern of antimony products. Other countries may correspondingly adjust their antimony industry policies and trade strategies to cope with the market changes brought about by China’s export controls, further intensifying the competition among countries in the field of antimony trade.

2. Literature Review

Due to the increased demand for antimony, such reserves of antimony have been rapidly depleted, thus affecting the sustainable supply of antimony resources. It is estimated that the gap between the supply and demand of antimony will exceed 10%. In the coming years, antimony will be more important than those rare earth elements [

2,

3,

4]. The European Union, the United States, China, and several other countries have listed antimony as one of the major mineral resources and formulated management strategies. However, the global antimony trade pattern remains unknown. Therefore, it is urgent to investigate the relationships among the participating trading countries in order to obtain valuable insights, which can help these policymakers make more appropriate preparations for the management strategies of antimony resources at the global level.

In academic research, some scholars have studied the distribution characteristics [

5,

6,

7], recycling [

2,

6,

8,

9], and supply risks of mineral resources [

10,

11,

12]. Meanwhile, other scholars have analyzed the evolutionary mechanisms of trade networks, but they have mainly focused on bulk mineral resources [

13], such as copper, iron, and zinc. Complex network theory has been widely applied in international trade [

14,

15,

16,

17]. In particular, centrality analysis, clustering coefficient, and average path length are used to evaluate the impacts of trade [

18,

19,

20,

21]. For example, Zhong et al. (2017) constructed a multi-energy network model to investigate the international fossil fuel trade and found that the natural gas trade network was the most stable [

22]. Tian et al. (2021) applied social network analysis to explore the characteristics and evolution patterns of the trade network of key resources for lithium-ion batteries, and discovered that these dominant countries tended to maintain their trade relationships [

23].

Scholars in related fields in the early stage mostly used the Quadratic Assignment Procedure model (QAP) and the Exponential Random Graph Model (ERGM) to study the influencing factors of the trade network. However, the QAP method cannot explain the dependence of the network because endogenous factors affect the evolution of the trade network. In addition, the formation of relationships and the structural evolution in the real international trade network are dynamic, but the ERGM is a static analysis, ignoring the correlations of the trade network in different periods. The core of this study is to examine how node attributes (national characteristics) influence trade flows (edge weights), rather than investigating the self-organization mechanisms of network structures—which is precisely where Exponential Random Graph Models (ERGMs) excel. The fixed-effects model can effectively control for time-invariant individual heterogeneity, a feature that constitutes a critical advantage for cross-country panel data analysis. Thus, this study adopts the fixed-effects model. Most scholars have applied the fixed effects model in the field of economics. For instance, Xiong et al. (2023) empirically explored the impact of the development of digital inclusive finance on the R&D innovation output of enterprises through a two-way fixed effects model and the instrumental variable method [

24]. Fischer et al. (2020) introduced a model that allows for network dependence in trade flows and conducted an analysis based on the structure of socio-cultural connectivity to avoid simultaneity bias [

25]. There are also scholars who have utilized the fixed effects model to identify the determinants influencing trade. Taining Wang et al. (2020) studied the impact of trade on the labor share [

26]. Abdoulganiour Almame Tinta (2017), based on the economic integration of the Economic Community of West African States (ECOWAS) region, employed a panel gravity model with fixed effects to analyze the role of participation in the Global Value Chain (GVC) in international trade and the relevant influencing factors [

27]. As can be seen from the above research, the fixed effects model has already been applied in international trade. Therefore, this study combines the complex network model with the fixed effects model to jointly explore the characteristics and influencing factors of the global antimony trade network.

Resource trade is influenced by the interplay of multiple dimensions: economy, politics, institutions, logistics, and the environment, and relevant classic literature has established a systematic explanatory framework. In the economic dimension, Ohlin’s Factor Endowment Theory points out that resource abundance is the foundation of trade. Trefler, however, modified this theory using data from 33 countries, emphasizing the key moderating role of differences in factor productivity in shaping trade flows. Ricardo’s Theory of Comparative Advantage reveals that relative efficiency drives the division of labor, while Dornbusch et al. introduced the “continuous goods spectrum,” expanding the logic of gradient advantages in resource industrial chains [

28]. In the political dimension, the Geopolitical Risk (GPR) Index constructed by Caldara et al. empirically shows that for every 1 standard deviation increase in geopolitical risk, energy trade decreases by 1.2% [

29]. Taking oil trade as an example, Ross notes that the “strategic nature” of resources tends to trigger political intervention, such as OPEC’s production regulation [

30]. In the institutional dimension, De Groot et al. found that for every 1 standard deviation increase in institutional quality, resource trade flows increase by 30–44% [

31]. Baldwin’s “Spaghetti Bowl” Theory, on the other hand, explains how Regional Trade Agreements (RTAs) reduce trade costs through rule coordination [

32]. In the logistics dimension, Krugman’s “Core-Periphery” Model reveals that transportation costs and agglomeration effects shape the trade pattern [

33]. The supply chain resilience theory proposed by Baldwin et al. emphasizes that diversification can reduce trade volatility by 30%. In the environmental dimension, the Pollution Haven Hypothesis by Copeland et al. points out that differences in environmental standards affect industrial location [

34]. Acemoglu et al. also confirmed that for every

$10 per ton increase in carbon tax, traditional energy exports decrease by 5%, and green technologies reshape the trade structure [

35].

To sum up, although existing studies have focused on the distribution and risks of mineral resources, no study has yet systematically depicted the trade pattern of the entire supply chain of antimony products using complex network methods, nor has there been quantitative identification of its multi-dimensional influencing factors. This study aims to fill this research gap.

3. Model Construction and Data Sources

3.1. Model Construction

In complex networks, there are two fundamental elements, namely “nodes” and “edges”. In this study, all countries participating in the global antimony trade are regarded as “nodes”, which are the main bodies in the network. The antimony trade relations between two countries are regarded as the “edges” of the global trade network, that is, the lines connecting the nodes [

36]. Among them, the direction of the flow of antimony in the process of global antimony trade is the “direction of the edges” in the antimony trade network. With import and export trade volumes as weights, the global antimony trade weighted network is finally constructed based on these two basic elements. The complex network of global antimony trade relations in this paper is represented by the adjacency matrix

. If there exists an antimony trade relationship between the

-th country and the

-th country in year N, then

in the adjacency matrix, an “edge” is established from node

to node

. If there is no antimony trade relationship at all between the

-th country and the

-th country in the year, then

in the adjacency matrix, there is no “edge” between node

and node

[

37].

Based on the establishment of the trade network, this study analyzes the evolution of the global antimony trade pattern through network indicators in two aspects: overall characteristics (network diameter, average path length, network density, average clustering coefficient) and individual characteristics (in-degree centrality, out-degree centrality, closeness centrality, betweenness centrality, eigenvector centrality) [

38].

3.1.1. Overall Characteristics

Network density is an indicator for measuring the overall tightness of a network. The larger the calculated value of the network density, the higher the tightness; conversely, the poorer the tightness [

39]. The value range of the network density is

between 0 and 1. When

, it indicates that all nodes in the trade network are completely connected. When the network density

, all nodes in the trade network are completely isolated. The expression of the network density is:

. In the formula,

represents the actual number of connections;

represents the number of nodes.

- 2.

Average Path Length

The average path length is the average value of the shortest paths between any two nodes [

40]. Therefore, the network diameter and the average path length measure the transmission performance and efficiency of the network, and they reflect the degree of smoothness of trade and trade efficiency in the trade network. The average path length refers to the average number of steps of the shortest paths between all the potentially connected nodes in the trade network. The shorter the average path length, the higher the transportation efficiency. Its expression is:

. In the formula,

represents the shortest path between node and node in the network.

- 3.

Network Diameter

The maximum value of the distance between any two nodes in the network is called the diameter of the network [

41], denoted as

, and its expression is:

.

- 4.

Average Clustering Coefficient

The clustering coefficient is an indicator of the degree of connection among nodes within a trade group [

42], with a value range of 0 to 1. The average value of the clustering coefficients of all nodes is called the average clustering coefficient

, and its expression is:

. In the formula,

represents the node degree of node i; e represents the number of edges between the

neighbors of

.

3.1.2. Individual Characteristics

In the adjacency matrix of a directed network, if there is a connection between node

and node

, then

, otherwise

. Among them, when country A exports antimony metal to country, it does not mean that country B will also export antimony metal to country i. The degree centrality is composed of the out-degree centrality and the in-degree centrality. The higher the node centrality, the greater the number of countries that have direct trade relations with this country, and the higher the degree of trade concentration [

43]. Its expression is:

.

- 2.

Closeness Centrality

Closeness centrality is an indicator for measuring the ability of a node to conduct trade independently [

44]. The lower the closeness centrality, the more likely the node will be restricted by the trade behaviors of other nodes when carrying out trade activities. The calculation formula is:

the formula,

represents the number of steps of the shortest path from node

to node

.

- 3.

Betweenness Centrality

The betweenness centrality is an important indicator reflecting a certain country’s ability to control the path of the overall trade network [

45]. In the global trade network, if a country is located on the intersecting path between two nodes, it can influence the trade of similar products carried out by other countries by controlling the transmission of information. The measurement formula for the betweenness centrality is:

. In the formula,

represents the number of shortcuts between country

and country k in the trade network, and g

represents the number of shortcuts between country

and country

that pass through country

.

- 4.

Eigenvector Centrality

Eigenvector centrality can be regarded as a weighted centrality with the influence of adjacent nodes as weights, which measures the importance of a country from the influence of its neighboring countries [

46]. The basic assumption is that a node with a high eigenvector implies that it is connected to many nodes that themselves have high eigenvectors. The larger the eigenvector centrality, the greater the influence of the participant in the entire network. The calculation formula is:

. In the formula,

represents the eigenvector centrality of country

;

and

are, respectively, the measurement values of the importance of country

and country

; c is a proportionality constant.

3.2. Data Sources

Antimony enters the supply chain mainly in two ways: as primary antimony ore and as recycled antimony recovered from raw materials such as used lead-acid batteries. The antimony industrial chain is divided into four stages. The first stage is the raw materials and primary industries, which include minerals such as senarmontite, stibnite, valentinite, and stibiconite. The second stage is the deep processing industries, encompassing compounds or metals such as antimony trioxide, antimony trisulfide, antimony alloys, and high-purity antimony. The third stage consists of application products, and the fourth stage is the application fields.

This study selects the trade data of antimony, a critical mineral, from 2007 to 2022 to construct a complex network. When establishing the trade network, this paper takes into account the trade volumes of imports and exports, and the data are sourced from the United Nations Commodity Trade Database (UN Comtrade). Antimony minerals (antimony ores and their concentrates), antimony metals (unwrought antimony), primary processed antimony products (antimony oxides, lead-antimony alloys, and other antimony products), and recycled antimony (antimony scrap) are chosen to establish the relevant global antimony trade network. Specifically, antimony ores and their concentrates (HS code 261710), unwrought antimony (HS code 811010), antimony oxides (HS code 282580), lead-antimony alloys (HS code 780191), other antimony products (HS code 811090), and antimony scrap (HS code 811020) are selected to establish the relevant global antimony trade network.

This study focuses on the period from 2007 to 2022 to reflect the most recent trends. Given that the inter-annual differences in the global antimony trade network may be relatively small, when conducting a visual analysis of the global antimony trade network, 2007 and 2022 are mainly selected as the key analysis time nodes. For the calculation of other indicators, the data of each year from 2007 to 2022 will all be processed, and the relevant data results will finally be obtained. (Note: During the data collection process, it was found that the trade volume of the Taiwan Province of China was relatively large. Therefore, in this study, Taiwan, China, Hong Kong, China, and Macao, China are listed separately for research and analysis.)

4. Characteristics of the Antimony Trade Network

4.1. Visualization Analysis

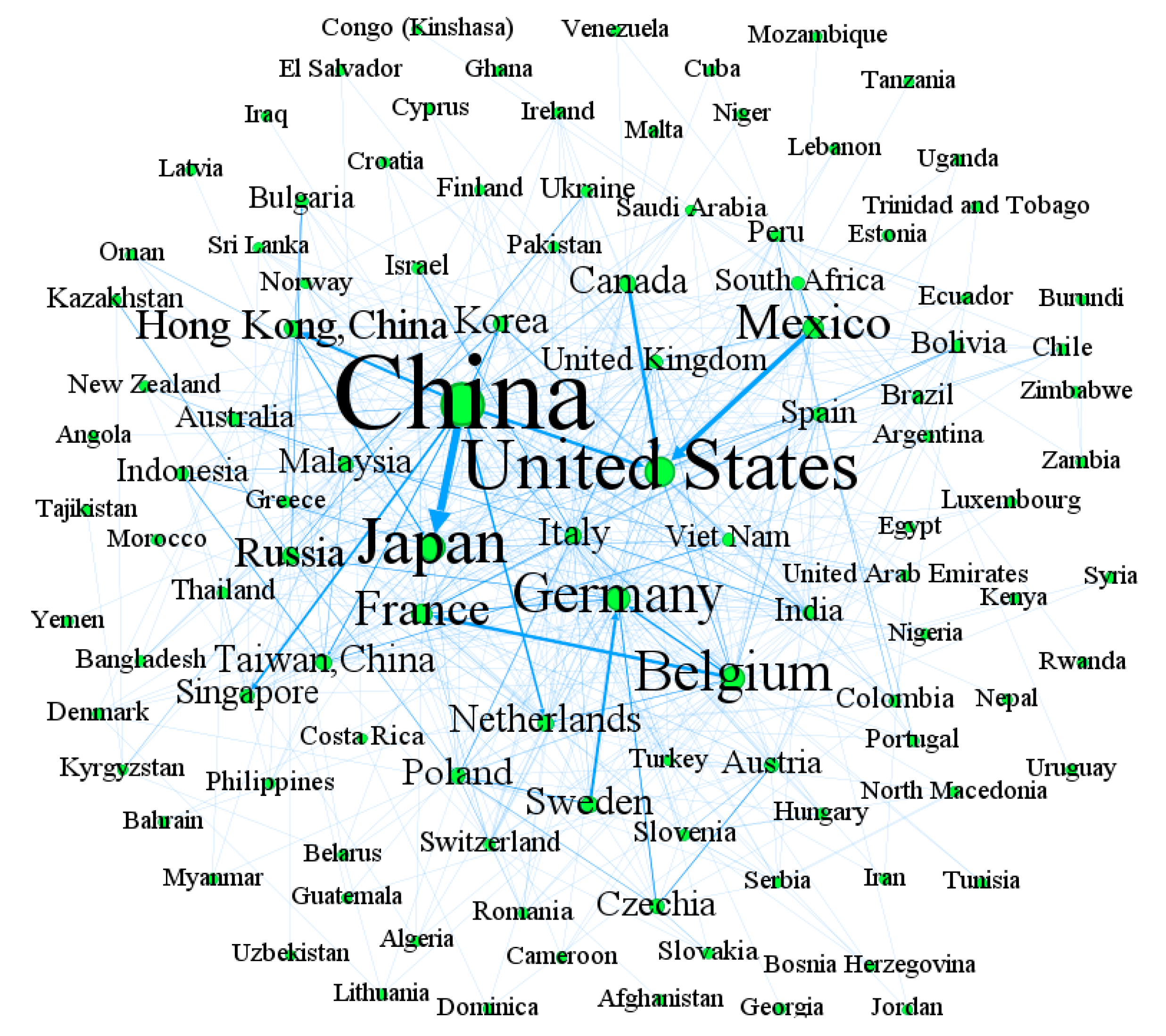

As shown in

Figure 1, China and the United States still occupy relatively core positions. China is connected to neighboring countries such as Japan, South Korea, and Russia, as well as European and American countries like the United Kingdom, France, and Germany by blue lines, demonstrating extensive trade connections. The United States also has trade relations with numerous countries, indicating that China and the United States are important nodes in the international trade network during this period, and a large number of countries have trade transactions with China and the United States.

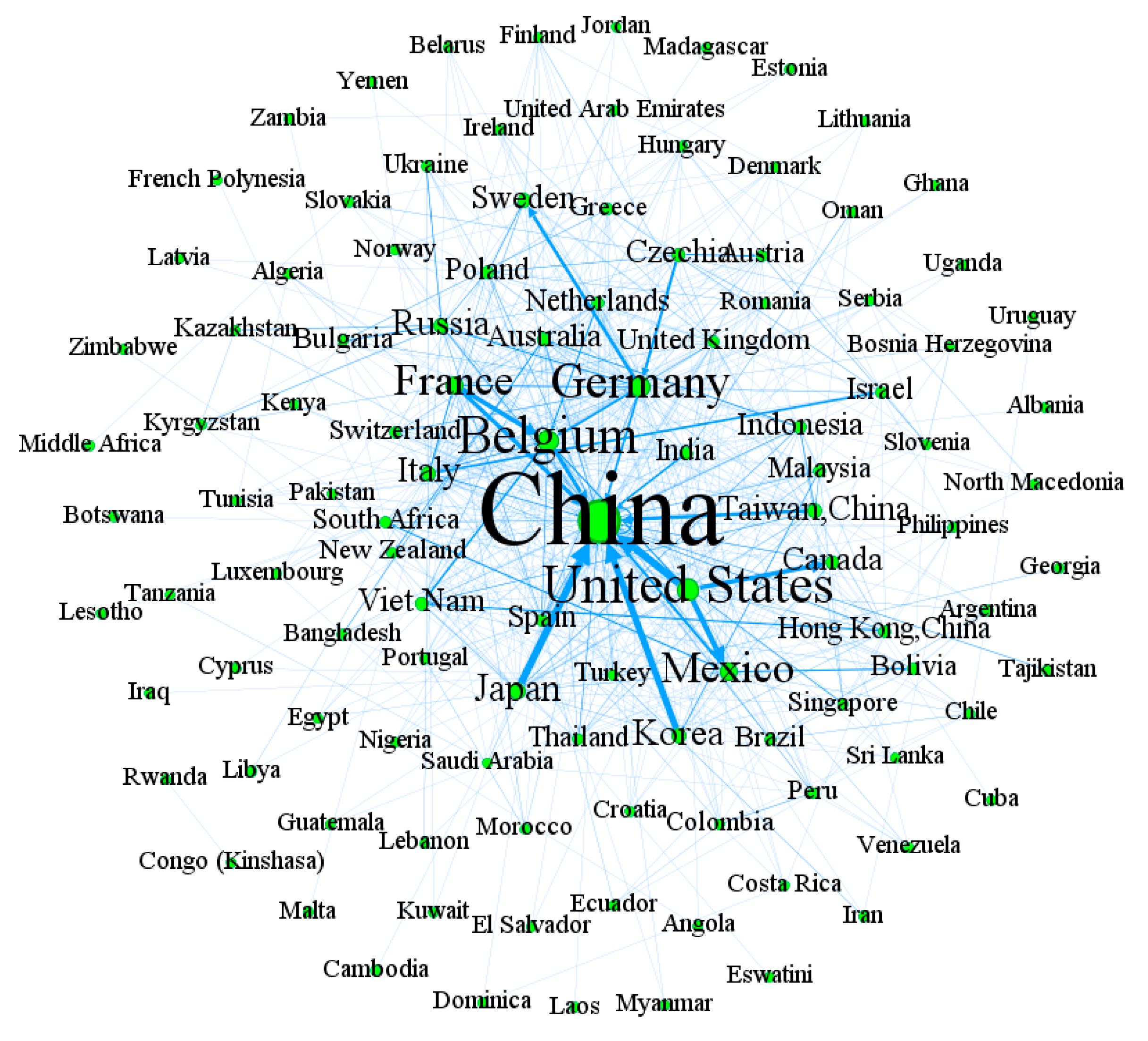

As shown in

Figure 2, China remains in the central position and is connected to many countries by blue lines. In addition to traditional trading partners, China has also established trade connections with more countries, covering countries from regions such as Asia, Europe, the Americas, and Africa. This indicates that China has further expanded its international trade map during this period, with more diversified trading partners, and its influence in the global trade network continues to grow.

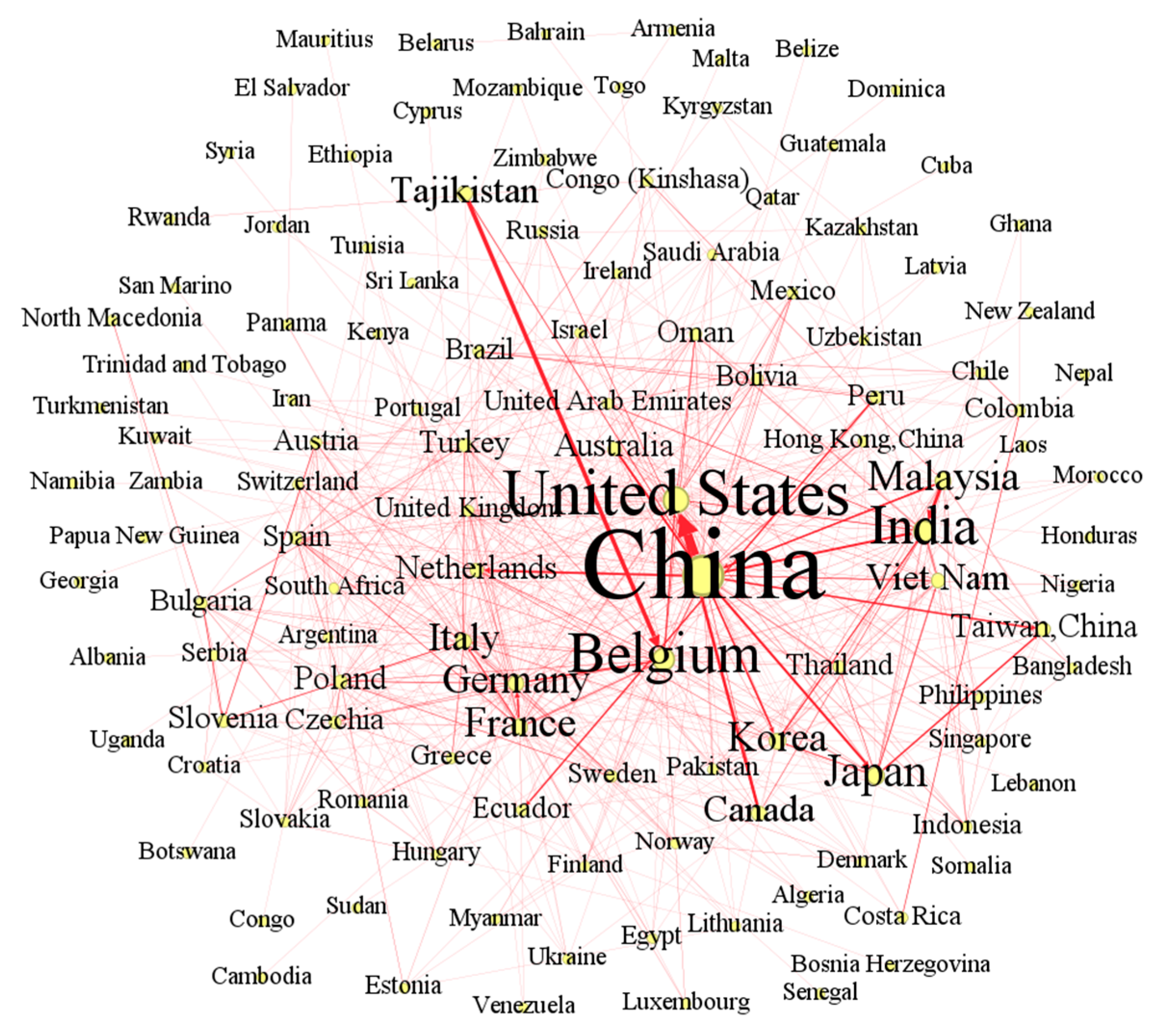

As shown in

Figure 3, during this period, China and the United States are still important focal points in the trade network. China is connected to numerous countries by red lines, with extensive trade connections involving countries from different continents. The United States also has trade relations with a large number of countries. In addition, countries such as India and Japan are also quite prominent in the trade network, indicating that, in the international trade pattern, apart from China and the United States, other countries also play important roles in trade, and the overall trade network is more complex and diverse.

As shown in

Figure 4, in the trade network during this period, China is in a relatively core position and is connected to many countries by red lines. It can be seen that China has significant trade connections with a large number of countries, such as the United States, France, Germany, and India. This indicates that China is a major trade-active country, possibly an important exporter or importer, playing a key role in the international trade network and having frequent trade exchanges with various countries.

4.2. Holistic Analysis

Figure 5 illustrates the evolution of the scale of the trade network from 2007 to 2022. By comprehensively analyzing the statistics of the number of nodes and edges, it can be found that both the participating entities and trade relationships in the import and export trade of antimony products show an increasing trend. This reflects the continuous development and expansion of the global antimony product trade market. However, there are certain fluctuations during this process.

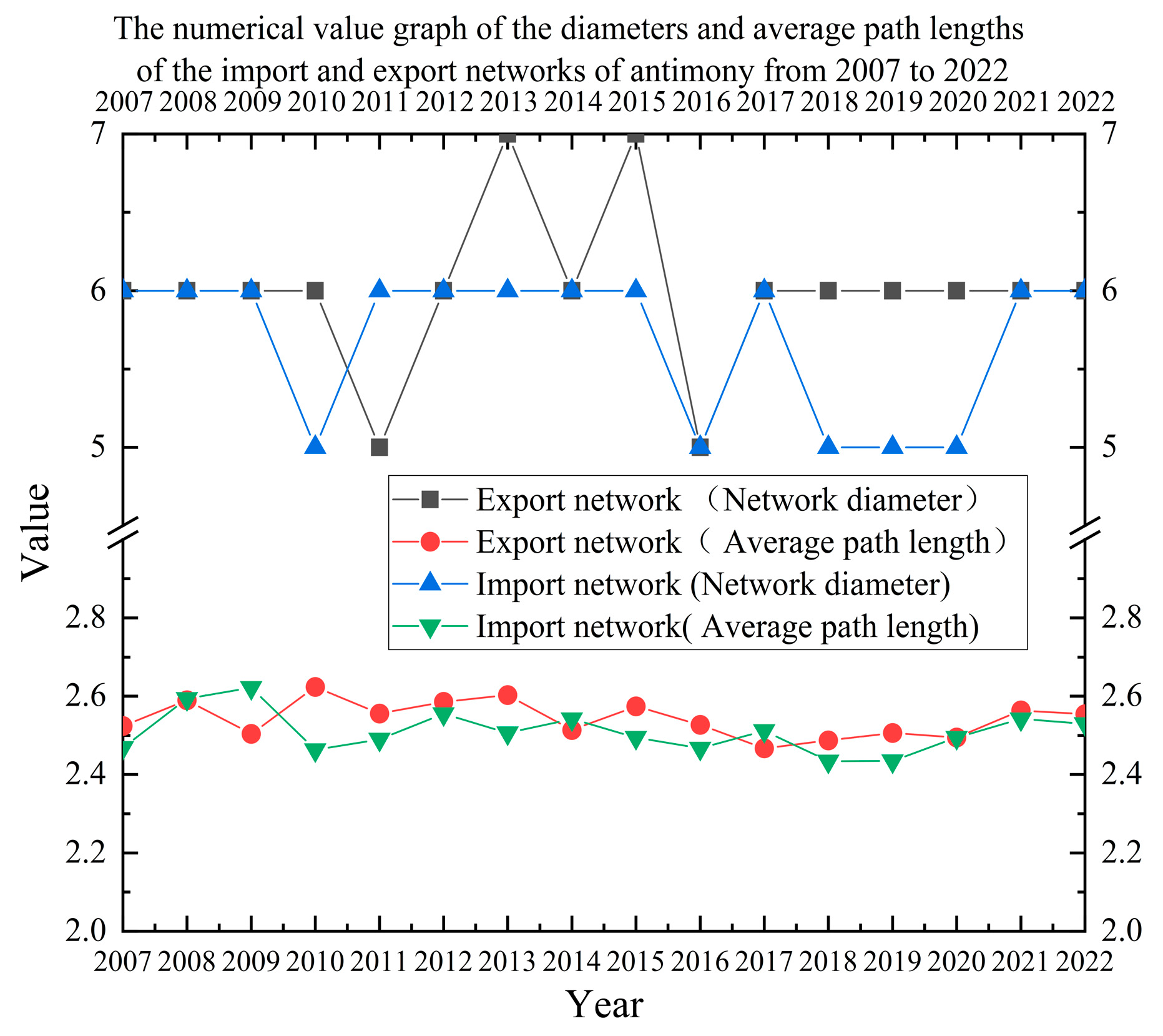

Figure 6 shows the numerical changes in the network diameter and average path length of antimony import and export trade from 2007 to 2022. In terms of the average path length, the average path length of the import and export networks is relatively stable. The average path length of the import network remains between 2.4 and 2.6, and the average path length of the export network is basically between 2.5 and 2.7. This means that, on average, there are 2.4 to 2.7 intermediate countries in the import and export trade chain, indicating that the transmission efficiency of the global antimony trade network is stable. Regarding the network diameter, the network diameters of the import and export networks fluctuate frequently. The network diameter of the import network fluctuates between 5 and 6, and the network diameter of the export network mainly fluctuates between 5 and 6, and occasionally reaches 7. That is, the number of countries involved between the two ends of the longest trade chain in the antimony trade network remains in the range of 5 to 7. These countries play the role of “bridges” in trade.

Figure 7 shows the numerical diagrams of the network density and average clustering coefficient of the antimony import and export trade network from 2007 to 2022. In terms of network density, the network density of the export network and that of the import network remain at a relatively low level, with the values fluctuating roughly between 0.05 and 0.06, and the range of variation is small. This indicates that the antimony import and export trade network is relatively loose, and the overall trade intensity is not high. In terms of the average clustering coefficient, the average clustering coefficient of the export network and that of the import network fluctuate between 0.35 and 0.45. Among them, the average clustering coefficient of the import network has certain fluctuations, and there is no obvious consistent upward or downward trend between the two.

4.3. Individual Analysis

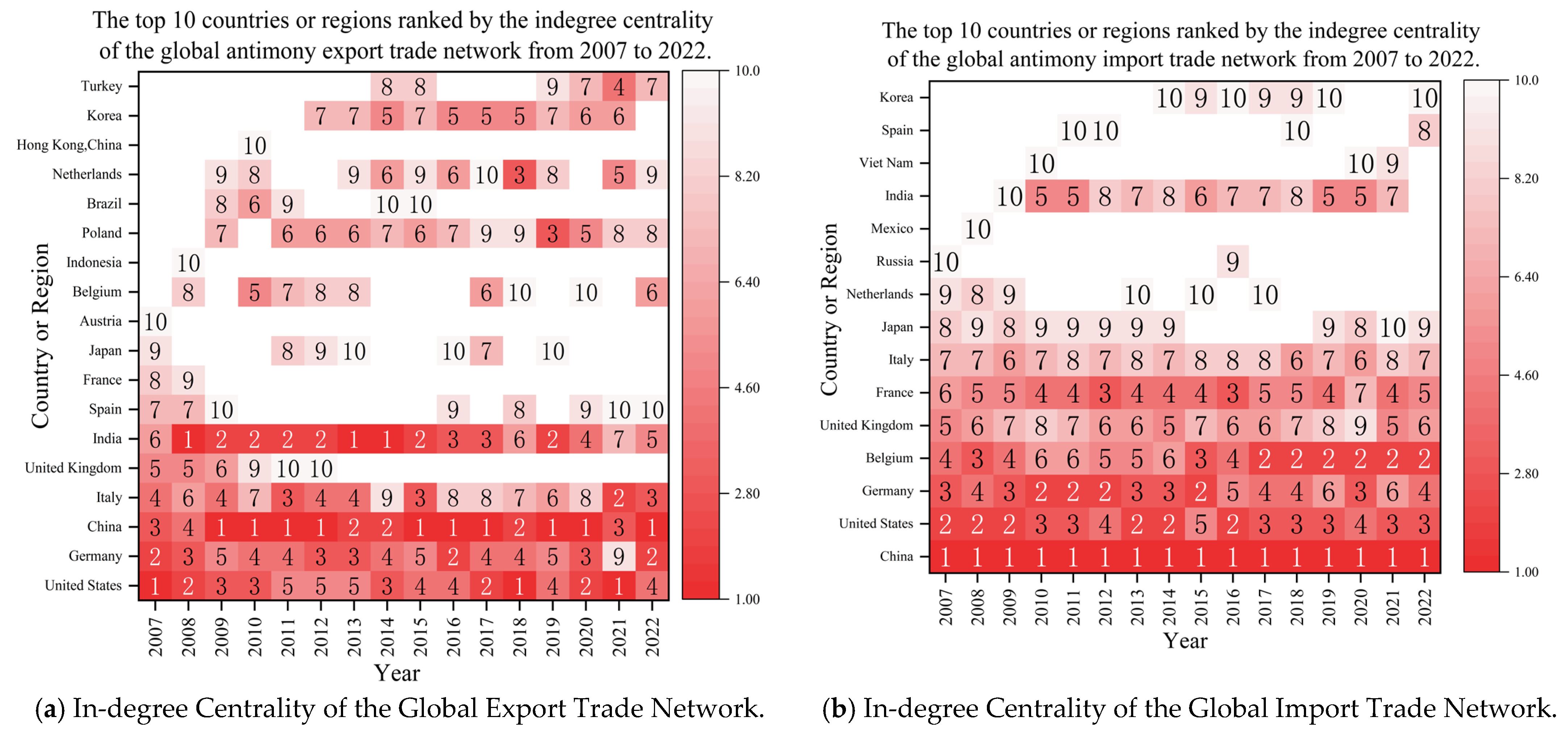

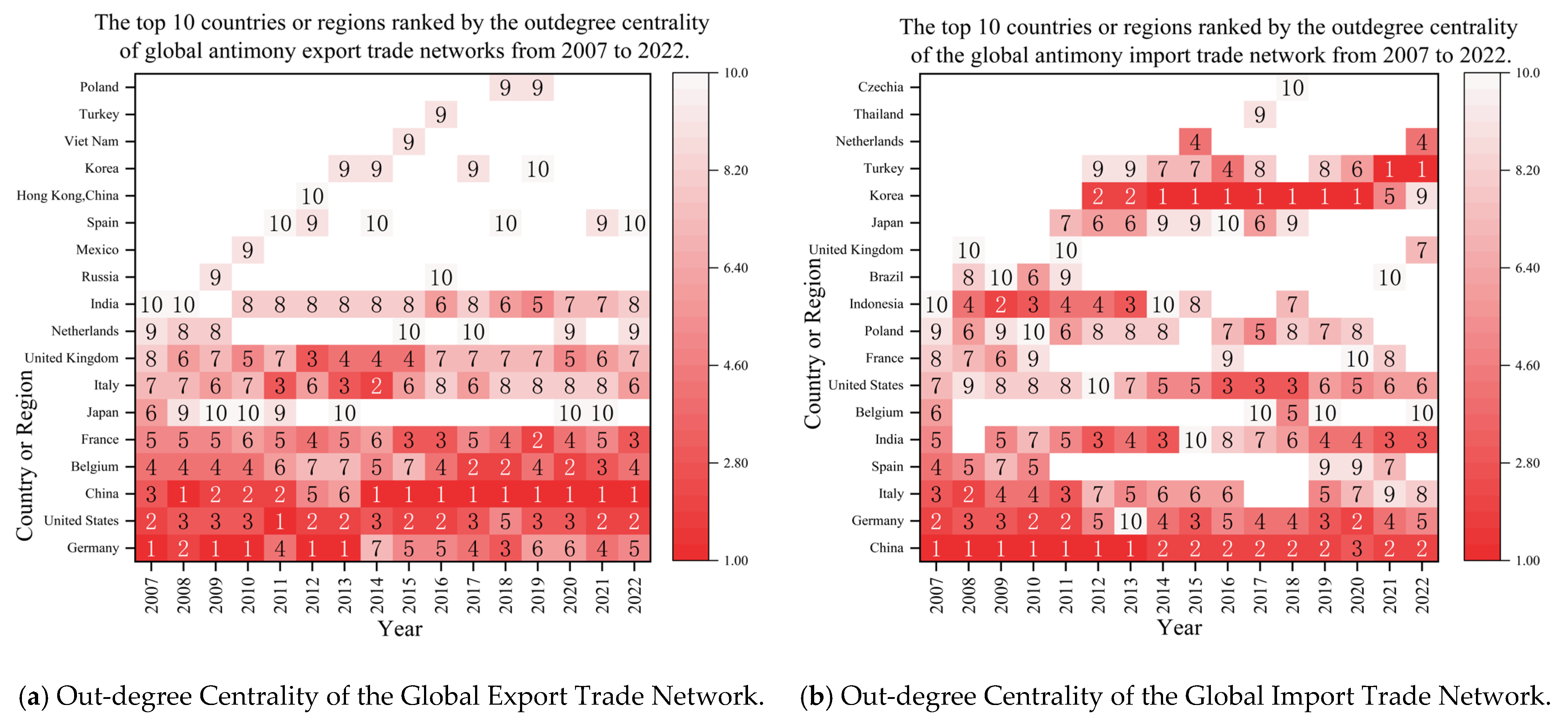

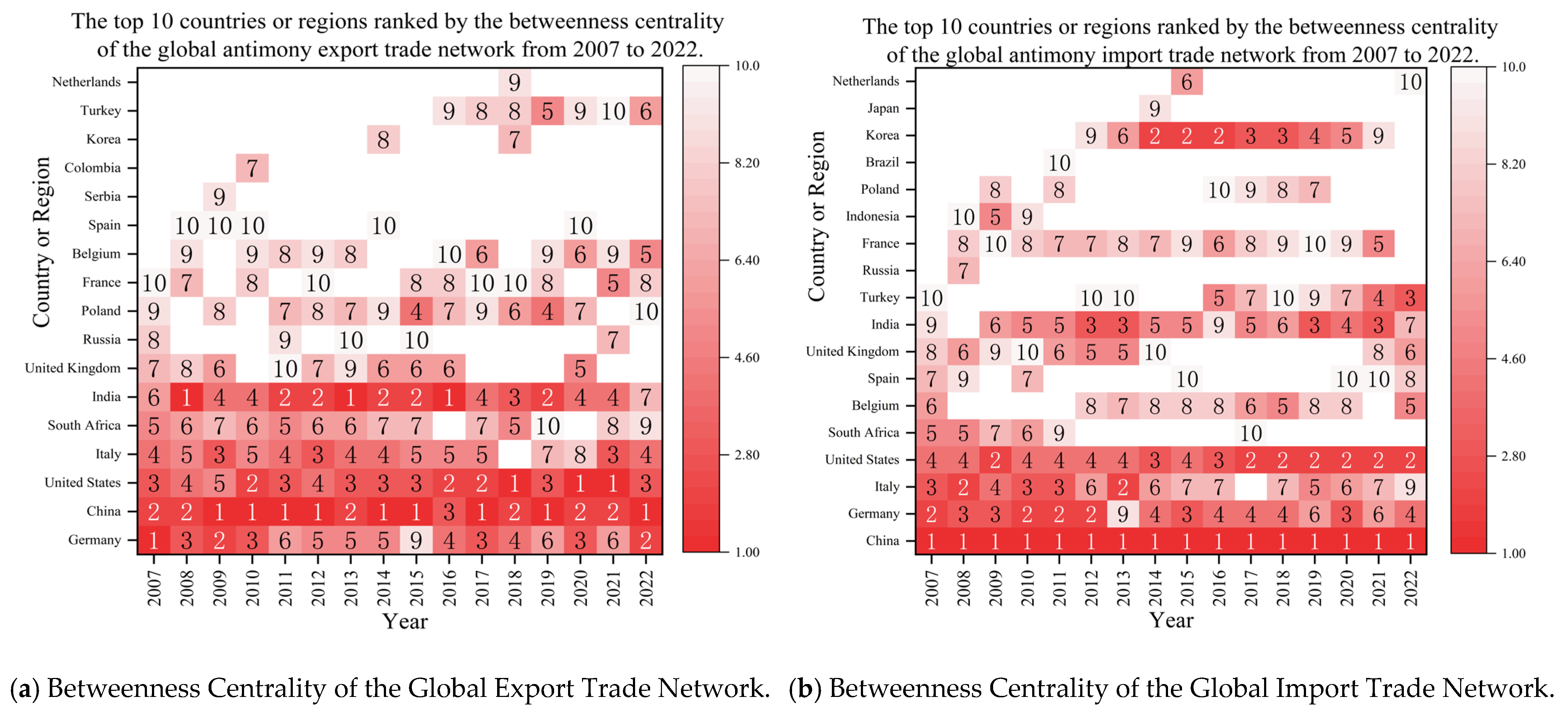

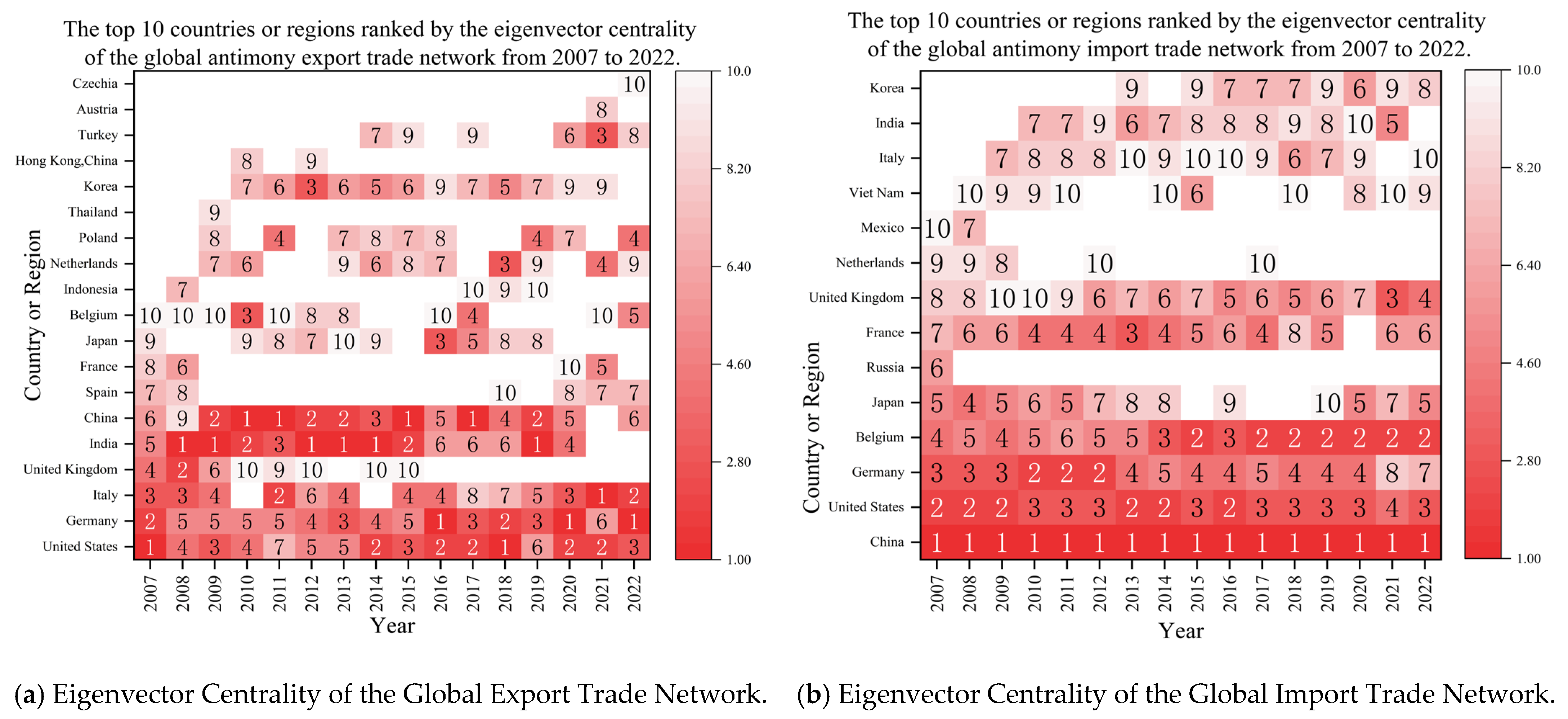

This paper depicts the characteristics of individual networks from five dimensions: in-degree centrality, out-degree centrality, closeness centrality, betweenness centrality, and eigenvector centrality. The results are shown in

Figure 8,

Figure 9,

Figure 10,

Figure 11 and

Figure 12 as follows:

Figure 8,

Figure 9,

Figure 10,

Figure 11 and

Figure 12 show the top 10 countries or regions ranked according to different centrality indicators in the global antimony trade network from 2007 to 2022, involving out-degree centrality, closeness centrality, in-degree centrality, eigenvector centrality, and betweenness centrality, covering both the export and import trade networks. The following is the analysis combined with the charts:

Export Trade Network: ① In-degree Centrality: It reflects the extent to which a country or region receives external connections in the global antimony export trade network. The values of the United States and Germany were relatively low in some years, and the degree of receiving external connections varied. In contrast, countries such as Turkey and South Korea ranked high in some years and received more external connections. ② Out-degree Centrality: It reflects the extent of external connections of a country or region in the global antimony export trade network. China ranked high in the early stage, but its value was low in the later stage, indicating that the breadth of export connections has changed. The rankings of Germany, the United States, etc., fluctuated, and their values were low in some years. In contrast, countries such as Spain and South Korea ranked high in some years, with extensive export connections. ③ Closeness Centrality: It measures the degree to which a country or region is close to other nodes in the trade network. China, Germany, the United States, etc., had certain rankings in most years, indicating that their distances to other nodes in the network were in a relatively stable state. In some years, such as from 2011 to 2013, countries like India and Spain ranked high, showing a high degree of closeness to other nodes. ④ Betweenness Centrality: It represents the ability of a country or region to control the flow of resources in the trade network. China, Germany, and the United States had relatively stable rankings in most years, and their control abilities in the trade network were relatively stable. Countries such as the Netherlands and Turkey ranked high in some years, with strong abilities to control the flow of resources. ⑤ Eigenvector Centrality: It comprehensively considers the connection situation of a node itself and the importance of the nodes connected to it. China, Germany, the United States, etc., had certain rankings in most years, indicating that their comprehensive influence in the network was in a relatively stable state. Countries such as Belgium and Japan ranked high in some years, with strong comprehensive influence.

Import Trade Network: ① In-degree Centrality: It reflects the extent of receiving external connections. China’s values were generally low over the years, and the degree of receiving external connections was limited. Countries such as South Korea and Spain ranked high in some years and received more external connections. ② Out-degree Centrality: It reflects the breadth of external connections of a country or region in the global antimony import trade network. China’s values were low in most years, and the breadth of external connections was limited. In contrast, countries such as the Czech Republic and Thailand ranked high in some years, with extensive external connections. ③ Betweenness Centrality: It represents the ability to control the flow of resources. China’s values were low in most years, and its ability to control the flow of resources was limited. Countries such as the Netherlands and Japan ranked high in some years, with strong abilities to control the flow of resources. ④ Closeness Centrality: It measures the degree of closeness to other nodes in the import trade network. Germany, China, Italy, etc., had certain rankings in most years, and their distances to other nodes were relatively stable. In some years, such as from 2011 to 2013, countries like Brazil and the United States ranked high, showing a high degree of closeness to other nodes. ⑤ Eigenvector Centrality: It comprehensively considers one’s connections and the importance of connected nodes. China, Germany, the United States, etc., had certain rankings in most years, and their comprehensive influence in the network was relatively stable. Countries such as South Korea and India ranked high in some years, with strong comprehensive influence.

Overall, the rankings of countries or regions under different centrality indicators show dynamic changes. China ranked high in the early stage under some indicators, but there were fluctuations in the later stage. Countries such as the United States and Germany have maintained certain ranking positions for many years in multiple indicators, playing a relatively stable role in the global antimony trade network. In different years, some countries or regions have performed outstandingly under specific centrality indicators, reflecting the complexity and dynamics of the structure of the global antimony trade network and the roles of various countries.

4.4. Analysis Summary

1. Global antimony-related trade can facilitate the free flow of antimony resources among all relevant countries. However, the major antimony-related trade activities occur between developed and developing countries and are rarely seen between countries with similar levels of economic development. Although this supply chain is based on resource endowments and reflects the genuine supply and demand relationship, it may lead to the depletion of antimony resources and ultimately affect the development of the global antimony industry.

2. Judging from the overall characteristics of global antimony trade, the trade activities among the trading partner countries of global antimony tend to be closer. The antimony trade routes between various countries are continuously shortening, and the total volume of global antimony trade is on the rise. In the global antimony trade network, most of the countries in the core and semi-peripheral countries are in a state of constant flux, indicating that there is a certain degree of substitutability in the antimony trade among core countries, peripheral countries, and semi-peripheral countries. However, generally speaking, it remains relatively stable.

3. Regarding the characteristics of the world’s major trading countries, regions in the European Union, mainly including Germany, France, Belgium, the Netherlands, and other countries, are the core areas of antimony import and export trade. China, Tajikistan, and Vietnam rank among the top three in global antimony trade, and their export trade accounts for approximately 62% of the global trade value. More countries have trade transactions with China and Vietnam, but the transaction volumes vary. Tajikistan only conducts trade exchanges with France, Belgium, Russia and several European countries. Other countries participating in global antimony trade also have stable trading partners, but the number is relatively small.

5. Analysis of Influencing Factors

5.1. Selection of Variables

5.1.1. Sample Selection

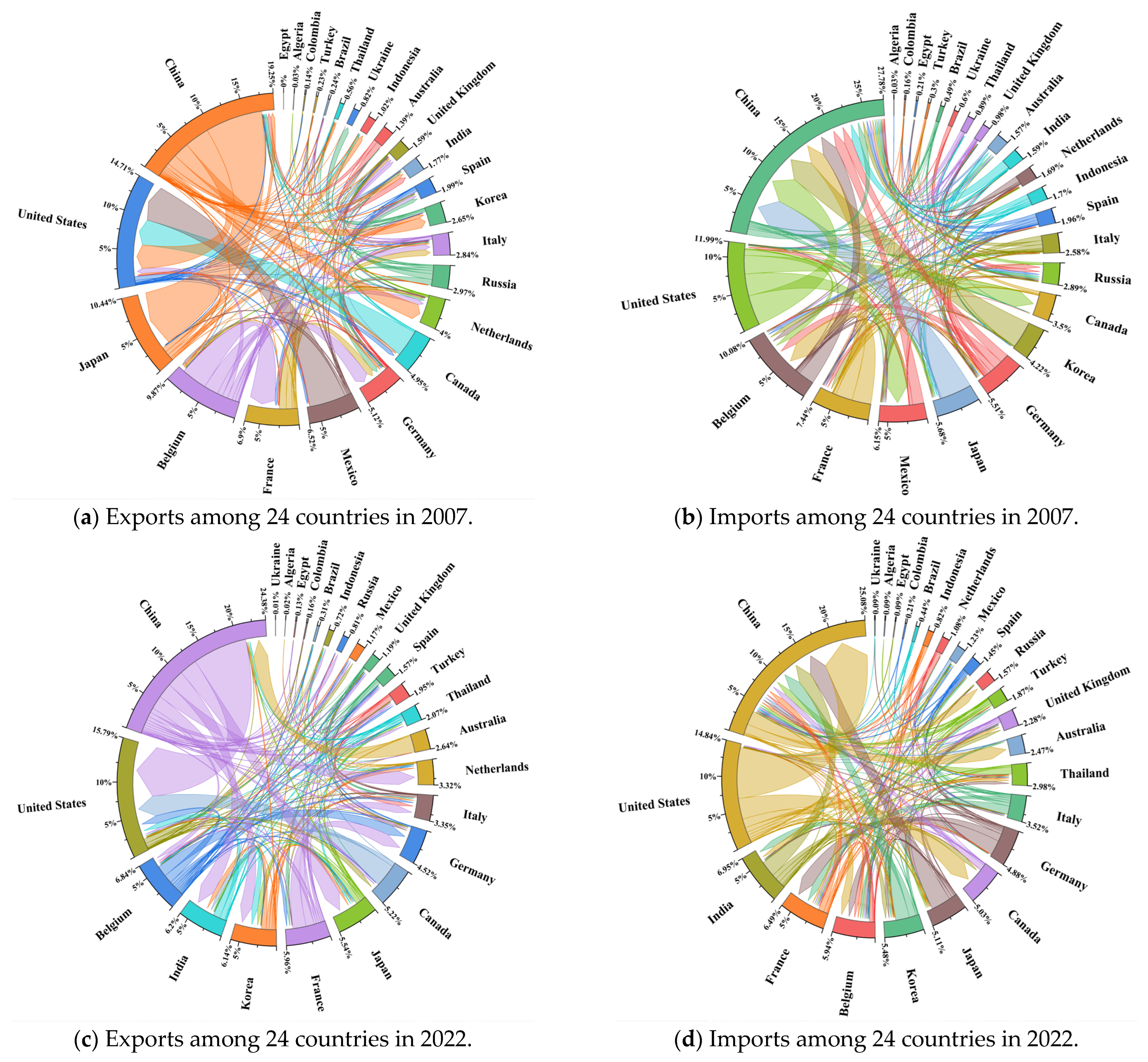

Considering the data availability and the realizability of the model, 24 countries (regions) with high node degrees and node strengths, namely Algeria, Australia, Belgium, Brazil, Canada, China, Colombia, Egypt, France, Germany, India, Indonesia, Italy, Japan, Mexico, the Netherlands, South Korea, Russia, Spain, Thailand, Turkey, Ukraine, the United Kingdom, and the United States, are selected to represent the core network of the global antimony trade. The impacts of different factors on the trade network from 2007 to 2022 are investigated.

The antimony trade situation among the selected 24 countries is shown in

Figure 13 as follows:

5.1.2. Variable Selection

The antimony trade connections among various countries are influenced by a combination of multiple factors. In this paper, factors influencing the antimony trade network are selected from five aspects: political management factors, economic development levels, differences in trade policies, transportation and traffic conditions, and legal system factors, and a model of influencing factors for each country is constructed [

47]. The specific explanations of the influencing factors are as follows (

Table 1):

First, political management factors [

48].Taking into account that the institutional environment of a country can affect its foreign trade, variables representing politics are selected, including the political stability of a country’s government, foreign policies, administrative efficiency, democratic fairness, and the investment environment. The government stability index, political effectiveness index, corruption control index, and regulatory governance index are selected from the Global Political Governance Indicators Network Database. The above data are sourced from the Global Political Governance Indicators Network Database.

Second, the level of economic development. ① Gross Domestic Product (GDP). The classical gravity model theory posits that there is a positive correlation between the volume of trade between two countries and the economic scale of those countries. The difference in the level of economic development between the two countries is an important factor influencing their antimony trade relationship. ② Consumer Price Index (CPI). The CPI is a macro indicator reflecting the level of price changes in a country. An increase in the CPI will lead to an increase in costs, which has an adverse impact on the import and export trade of antimony. ③ Exchange rate. Antimony is priced in US dollars in the international market, and changes in the exchange rate will affect its actual cost in the importing country. Exchange rate fluctuations may influence the trade policies and agreements between the two parties, thereby affecting the stability and predictability of antimony trade. At the same time, when importing enterprises purchase antimony, they need to assess the impact of the exchange rate on costs, and exchange rate fluctuations may prompt them to adjust their purchasing strategies [

49].

Third, differences in trade policies. The tariff rate is the main manifestation of a country’s trade policy. The tariff rate is the proportion used to calculate the tax amount when imposing tariffs, and the imposition of tariffs affects the import price of antimony. The difference in tariff rates between the two countries is an important factor influencing antimony trade. The smaller the difference in tariff rates, the closer the antimony trade exchanges between the two countries will be [

50].

Fourth, transportation factors. The comprehensive score of the Logistics Performance Index (LPI) reflects the perception of a country’s logistics established based on the efficiency of customs clearance procedures, the quality of infrastructure related to trade and transportation quality, the ease of arranging competitively priced freight, the quality of logistics services, the ability to track and trace goods, and the frequency of goods reaching the consignee within the scheduled time. The Logistics Performance Index involves the following seven aspects of indicators: ① The efficiency of customs clearance and the work efficiency of other border agencies; ② The quality of information technology equipment for cargo transportation and logistics; ③ The convenience and affordability of arranging international cargo transportation; ④ The competitiveness of the local logistics industry; ⑤ The ability to track international cargo transportation; ⑥ The timeliness of cargo transportation arriving at the destination [

51].

Fifth, legal system factors. Considering that a country’s legal safeguard system can affect its foreign trade, the legal system index of each country is selected from the Global Political Governance Indicators Network Database for measurement [

52].

5.2. Model Construction

In order to explore the impact of a country’s (region’s) external factors on its antimony product trade, this paper selects 24 countries (regions) that participated in the trade of strategically key metals every year during the period from 2007 to 2022 as samples [

53]. After conducting unit root tests and cointegration tests on the data, the selection of the specific model is determined through the Hausman test. According to the results of the Hausman test, the hypothesis of “the existence of random effects” is rejected; that is, a fixed effects model should be selected. Drawing on the model specifications of Nunn [

54], a panel regression model is constructed. The econometric model constructed is as follows:

Among them:

represents the country; j represents the time;

is national antimony trade import or export value;

represents the constant term;

represents the regression coefficients of their respective independent variables;

represents the time effect. The regression and testing processes of the model were all completed using StataMP 18. At the same time, to ensure that the model is more reasonable in setting and to reduce the possibility of the existence of heteroscedasticity, the natural logarithms are taken for the above variable sequences with relatively large values, which are denoted as lntrade, lncpi, corruption, lngdp, lngovernment, logistics, tariff, nomocracy, regulatory, lncurrency, and stability, respectively. The following research is all based on these logarithmic values [

55].

5.3. Empirical Analysis

In view of the significant impacts exerted by the global financial crisis in 2008 and the COVID-19 pandemic in 2019 on world trade, respectively, this paper specifically excludes the data from 2009 and 2020 that were directly affected by them to ensure the stability of the research results analysis and stability tests were conducted on the global export and import trade networks of antimony products [

56], with the results presented in

Table 2 and

Table 3 as follows:

5.4. Analysis of Results

Based on the analysis of the contents in

Table 2 and

Table 3, it can be concluded that:

5.4.1. Analysis of Key Influencing Factors on Export Trade

① lngdp: The coefficient is 0.567 *** (0.558 *** in robustness test), significant at the 1% level. The economic implication is that for every 1% increase in a country’s GDP, the export trade linkage intensity (lntrade) will significantly increase by approximately 0.56%. For example, during China’s period of rapid economic growth, the expansion of manufacturing capacity drove the large-scale export of goods such as mechanical and electrical products, textiles, etc., making GDP growth a core support for robust exports.

② lngovernment: The coefficient is 4.303 ** (4.156 * in robustness test), significant at the 5% and 10% levels, respectively. The economic implication is that for every 1% increase in government expenditure, the export trade linkage intensity significantly increases by approximately 4.3%. China supports export industries through fiscal subsidies, export tax rebates, and infrastructure investment (such as ports and cross-border logistics). A typical example is the policy support for the photovoltaic and new energy vehicle industries, which directly promotes the expansion of their export scale.

③ logistics: The coefficient is 1.259 *** (1.266 *** in robustness test), significant at the 1% level. The economic implication is that for every 1% improvement in logistics level, the export trade linkage intensity significantly increases by approximately 1.26%. China’s logistics infrastructure such as the China-Europe Railway Express and port automation upgrades have significantly reduced the transportation costs and time of exported goods. For example, small commodities from Yiwu are exported to the world through an efficient logistics network, reflecting the key enabling role of logistics in exports.

④ tariff: The coefficient is −0.119 *** (−0.131 *** in robustness test), significant at the 1% level. The economic implication is that for every 1% increase in tariff, the export trade linkage intensity significantly decreases by approximately 0.12–0.13%. During the China-US trade war, the United States imposed additional tariffs on Chinese goods exported to the US, directly leading to a sharp decline in China’s exports of mechanical and electrical products, furniture, etc., to the US, intuitively reflecting the inhibitory effect of tariffs on exports.

⑤ regulatory: The coefficient is −21.608 *** (−22.032 *** in robustness test), significant at the 1% level. The economic implication is that for every 1 unit increase in regulatory stringency, the export trade linkage intensity significantly decreases by approximately 21.6–22.0%. Technical trade barriers such as environmental protection and labor standards in the EU have forced Chinese export enterprises to invest a lot of costs to upgrade their processes to meet compliance requirements, which has restricted the export scale to a certain extent.

5.4.2. Analysis of Key Influencing Factors on Import Trade

① lngdp: The coefficient is 0.651 *** (0.653 *** in robustness test), significant at the 1% level. The economic implication is that for every 1% increase in GDP, the import trade linkage intensity significantly increases by approximately 0.65%. China’s economic growth has driven the expansion of import demand for crude oil, chips, high-end equipment, etc. For example, the dependence on imports of lithium mines and photovoltaic equipment during the outbreak period of the new energy industry reflects the pull of GDP growth on imports.

② logistics: The coefficient is 1.171 *** (1.216 *** in robustness test), significant at the 1% level. The economic implication is that for every 1% improvement in logistics level, the import trade linkage intensity significantly increases by approximately 1.17–1.22%. The efficient customs clearance capabilities of Shanghai Port and Ningbo Port ensure that imported bulk commodities (such as iron ore and soybeans) quickly enter the domestic industrial chain, supporting the needs of manufacturing and agriculture.

③ tariff: The coefficient is −0.106 *** (−0.111 *** in robustness test), significant at the 1% level. The economic implication is that for every 1% increase in tariff, the import trade linkage intensity significantly decreases by approximately 0.11%. After China reduced import tariffs on agricultural products (such as beef and fruits), the import volume of related goods increased significantly; while the additional tariffs imposed on US agricultural products during the China-US trade war led to a contraction in import scale, reflecting the two-way impact of tariffs on imports.

④ regulatory: The coefficient is −19.283 *** (−21.868 *** in robustness test), significant at the 1% level. The economic implication is that for every 1 unit increase in regulatory stringency, the import trade linkage intensity significantly decreases by approximately 19.3–21.9%. China’s quarantine standards for imported food and technical certification requirements for high-end equipment, while ensuring domestic safety and quality, also increase the compliance costs for import enterprises. For example, imported infant formula needs to go through strict quarantine procedures.

⑤ lncurrency: The coefficient is 0.171 *** (0.172 *** in robustness test), significant at the 1% level. The economic implication is that for every 1% depreciation of the local currency (if the indicator reflects the value of the local currency relative to foreign currencies), the import trade linkage intensity significantly increases by approximately 0.17%. During the period of RMB depreciation, the import of rigid demand goods such as chips and energy in China did not shrink significantly. Instead, the import scale increased due to enterprises’ strategies such as “advance order locking”, reflecting the rigidity of import demand and the complex impact of exchange rates.

⑥ stability: The coefficient is 7.867 * (9.719 ** in robustness test), significant at the 10% and 5% levels, respectively. The economic implication is that for every 1 unit increase in economic stability, the import trade linkage intensity significantly increases by approximately 7.9–9.8%. With China’s long-term stable economic development, enterprises have more sustainable plans for importing advanced equipment (such as industrial robots) and technologies. For example, new energy vehicle companies steadily import battery raw materials, supporting industrial expansion.

5.4.3. Comparative Analysis of Export and Import

- (1)

Common Significant Factors

① lngdp: It is significantly positive at the 1% level in both export and import. This indicates that the expansion of economic scale has a two-way driving effect on imports and exports—it not only promotes the upgrading of domestic production capacity to expand exports but also drives domestic consumption and production demand to expand imports. For example, China’s GDP growth simultaneously drives the export of mechanical and electrical products and the import of chips and energy.

② logistics: It is significantly positive at the 1% level in both export and import. Logistics is the “infrastructure” of international trade. Efficient logistics not only ensures the global distribution of exported goods but also ensures the domestic circulation of imported goods. A typical example is the efficiency support of China’s port cluster for both imports and exports.

③ tariff: It is significantly negative at the 1% level in both export and import. Tariff is the core embodiment of trade costs. Whether for export or import, an increase in tariff will directly increase transaction costs and weaken price competitiveness. During the China-US trade war, the mutual imposition of tariffs by both sides led to a simultaneous contraction in bilateral import and export scales, intuitively verifying this conclusion.

④ regulatory: It is significantly negative at the 1% level in both export and import. Excessive or unreasonable regulations (such as technical trade barriers and quarantine standards) will increase the compliance costs of enterprises’ import and export, thereby restraining the trade scale. For example, the constraints of EU environmental standards on China’s exports and the threshold effect of China’s import quarantine on foreign exporters are essentially the impact of regulation on trade.

- (2)

Differential Factors

- ①

Export-Specific Significant Factor

Government expenditure is significantly positive in export but not significant in import. This indicates that the direct promotion effect of government policies on exports is more prominent—through means such as fiscal subsidies, industrial support, and infrastructure investment, export competitiveness can be effectively enhanced (for example, China’s policy support for the photovoltaic industry directly promotes its global export); while imports are more driven by market demand, and the direct pulling effect of government expenditure is relatively weak.

- ②

Import-Specific Significant Factors: lncurrency and stability

- (a)

lncurrency: It is significantly positive in import but not significant in export. Import demand is more sensitive to exchange rate fluctuations (especially for rigid demand goods), while exports are relatively less directly sensitive to exchange rates due to enterprises’ pricing strategies and diversified market layouts.

- (b)

stability: It is significantly positive in import but not significant in export. When the domestic economy is stable, enterprises have more confidence in long-term imports (such as equipment and raw materials), while exports are more affected by external factors such as international market demand and trade policies, and the direct impact of domestic economic stability is relatively weak.

6. Policy Recommendations

Antimony is a critical raw material for semiconductors and new energy alloys (e.g., alloy materials for lithium battery anodes). Countries can optimize their industrial structures and increase investment in the R&D and application of antimony-based new materials while developing high-end manufacturing industries (such as semiconductor chips and new energy equipment). Taking China as an example, as GDP growth drives the expansion of the semiconductor and new energy industries, it will not only boost the import demand for high-purity antimony and antimony alloys (for high-end manufacturing processes) but also expand the export scale of domestically produced antimony-based flame retardants and high-value-added antimony alloy products. This will bidirectionally stimulate the technological added value and market vitality of antimony trade.

- 2.

Improve the Cross-Border Logistics and Warehousing System for Antimony Trade to Ensure the Efficient Circulation of Strategic Resources.

As a strategic metal, the transportation of antimony requires both safety and timeliness. Countries should upgrade logistics infrastructure for antimony trade. For instance, establish specialized metal warehousing centers at ports in Hunan, China (a major antimony-producing region), optimize dedicated transportation routes for antimony products on the China-Europe Railway Express, and promote “smart customs clearance” systems to shorten the customs clearance time for antimony raw materials and products. Meanwhile, improve global standards for cold chain transportation (required for temperature control of some antimony-based materials) and anti-corrosion transportation for antimony trade, reduce the constraints of logistics losses on the scale of antimony trade, and ensure the efficient circulation of antimony from production areas to downstream industries worldwide.

- 3.

Promote Tariff Liberalization in Antimony Trade and Eliminate Market Access Barriers.

In antimony trade, the tariff policies of various countries directly affect its market competitiveness. For example, if China faces high tariffs when exporting antimony-based flame retardants to the EU, its price advantage will be significantly weakened. Countries should actively participate in free trade agreement negotiations related to antimony trade, reduce unreasonable tariff tiers, and optimize tariff structures for strategic resources like antimony (e.g., appropriately lowering tariffs on antimony raw material imports to ensure upstream supply for the industrial chain, and offering tariff preferences for exports of high-value-added antimony products). This will reduce the inhibitory effect of tariffs on the bidirectional flow of antimony trade and promote the market-oriented allocation of global antimony resources.

- 4.

Strengthen the Government’s Strategic Support for the Antimony Industry to Enhance Global Discourse Power in Antimony Trade.

As a major producer and exporter of antimony, China can provide targeted policy support for the antimony industry. For example, offer financial subsidies for the R&D of green antimony mining technologies and antimony-based new materials (e.g., antimony compounds for semiconductors), implement tax rebate policies for exports of high-value-added antimony products, and build national-level antimony industrial parks to aggregate industrial chain resources. Such support will drive the transformation of China’s antimony industry from “resource export” to “technology + product export,” strengthen its pricing power and competitiveness in global antimony trade, and simultaneously ensure the strategic security of domestic antimony resources.

- 5.

Maintain Macroeconomic Stability and Flexibly Manage Exchange Rates to Safeguard the Resilience of Antimony Trade.

As a rigid industrial raw material, antimony trade is significantly affected by global macroeconomic stability and exchange rate fluctuations. When the economies of importing countries (e.g., the EU and U.S. semiconductor and flame retardant industries) are stable, their demand for antimony becomes more sustainable. As a major exporter, China needs to maintain macroeconomic stability to ensure long-term planning for the antimony industry (such as antimony ore exploration and production capacity layout). Meanwhile, it should flexibly use exchange rate tools and guide antimony trade enterprises to implement exchange rate hedging. For example, when the RMB exchange rate fluctuates, lock in the export prices of antimony products through financial instruments to safeguard the profit margins and scale stability of antimony trade.

7. Future Scope

Strengthening Robustness Tests

It is suggested to add the following robustness tests: replace core explanatory variables (e.g., using per capita GDP instead of GDP); adopt different standard error clustering methods (e.g., country-level clustering); and if conditions permit, introduce instrumental variables to alleviate potential endogeneity issues.

Author Contributions

Conceptualization, L.X.; methodology, L.X.; software, J.T.; validation, L.X. and J.T.; formal analysis, J.T.; investigation, L.X.; resources, L.X.; data curation, J.T.; writing—original draft preparation, J.T.; writing—review and editing, Y.Z.; visualization, X.G.; supervision, X.G.; project administration, Y.Z.; funding acquisition, L.X. All authors have read and agreed to the published version of the manuscript.

Funding

This study was supported by the National Social Science Foundation of China under Grant No. 23XGL013, the Key Research Base Project for Humanities and Social Sciences at Higher Education Institutions in Jiangxi Province under Grant No. JD24033 and 2024 Postgraduate Innovation Special Fund Project of Jiangxi Province. Project Number: YC2024-S576.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Nomenclature

| Symbol | Meaning |

| Network Density |

| the actual number of connections |

| the number of nodes. |

| Average Path Length |

| Network Diameter |

| Average Clustering Coefficient |

| Degree Centrality |

| Closeness Centrality |

| Betweenness Centrality |

| Eigenvector Centrality |

References

- Zhao, G.; Li, W.; Geng, Y.; Bleischwitz, R. Measuring Trade Efficiency of Antimony Products in China. J. Clean. Prod. 2025, 486, 144440. [Google Scholar] [CrossRef]

- Dupont, D.; Arnout, S.; Jones, P.T.; Binnemans, K. Antimony Recovery from End-of-Life Products and Industrial Process Residues: A Critical Review. J. Sustain. Metall. 2016, 2, 79–103. [Google Scholar] [CrossRef]

- Henckens, M.L.C.M.; Driessen, P.P.J.; Worrell, E. How Can We Adapt to Geological Scarcity of Antimony? Investigation of Antimony’s Substitutability and of Other Measures to Achieve a Sustainable Use. Resour. Conserv. Recycl. 2016, 108, 54–62. [Google Scholar] [CrossRef]

- Li, J.; Xu, D.; Zhu, Y. Global Antimony Supply Risk Assessment through the Industry Chain. Front. Energy Res. 2022, 10, 1007260. [Google Scholar] [CrossRef]

- Ding, J.; Zhang, Y.; Ma, Y.; Wang, Y.; Zhang, J.; Zhang, T. Metallogenic Characteristics and Resource Potential of Antimony in China. J. Geochem. Explor. 2021, 230, 106834. [Google Scholar] [CrossRef]

- He, P.; Feng, H.; Hu, G.; Hewage, K.; Achari, G.; Wang, C.; Sadiq, R. Life Cycle Cost Analysis for Recycling High-Tech Minerals from Waste Mobile Phones in China. J. Clean. Prod. 2020, 251, 119498. [Google Scholar] [CrossRef]

- Wang, X.; He, M.; Xi, J.; Lu, X. Antimony Distribution and Mobility in Rivers around the World’s Largest Antimony Mine of Xikuangshan, Hunan Province, China. Microchem. J. 2011, 97, 4–11. [Google Scholar] [CrossRef]

- Habib, K.; Hamelin, L.; Wenzel, H. A Dynamic Perspective of the Geopolitical Supply Risk of Metals. J. Clean. Prod. 2016, 133, 850–858. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, Y.; Ju, N.; Ai, Y.; Liu, Y.; Liang, J.; Hu, Z.-N.; Guo, R.; Xu, W.; Zhang, W.; et al. Ultimate Resourcization of Waste: Crab Shell-Derived Biochar for Antimony Removal and Sequential Utilization as an Anode for a Li-Ion Battery. ACS Sustain. Chem. Eng. 2021, 9, 8813–8823. [Google Scholar] [CrossRef]

- Brink, S.V.D.; Kleijn, R.; Sprecher, B.; Mancheri, N.; Tukker, A. Resilience in the Antimony Supply Chain. Resour. Conserv. Recycl. 2022, 186, 106586. [Google Scholar] [CrossRef]

- Pearson, A.J.; Ashmore, E. Risk Assessment of Antimony, Barium, Beryllium, Boron, Bromine, Lithium, Nickel, Strontium, Thallium and Uranium Concentrations in the New Zealand Diet. Food Addit. Contam. Part A 2020, 37, 451–464. [Google Scholar] [CrossRef] [PubMed]

- Yu, S.; Duan, H.; Cheng, J. An Evaluation of the Supply Risk for China’s Strategic Metallic Mineral Resources. Resour. Policy 2021, 70, 101891. [Google Scholar] [CrossRef]

- Wang, C.; Zhong, W.; Wang, A.; Sun, X.; Li, T.; Wang, X. Mapping the Evolution of International Antimony Ores Trade Pattern Based on Complex Network. Resour. Policy 2021, 74, 102421. [Google Scholar] [CrossRef]

- Ercsey-Ravasz, M.; Toroczkai, Z.; Lakner, Z.; Baranyi, J. Complexity of the International Agro-Food Trade Network and Its Impact on Food Safety. PLoS ONE 2012, 7, e37810, Erratum in PLoS ONE 2012, 7, 10-1371. [Google Scholar] [CrossRef]

- Ge, J.; Wang, X.; Guan, Q.; Li, W.; Zhu, H.; Yao, M. World Rare Earths Trade Network: Patterns, Relations and Role Characteristics. Resour. Policy 2016, 50, 119–130. [Google Scholar] [CrossRef]

- Wang, X.; Li, H.; Yao, H.; Chen, Z.; Guan, Q. Network Feature and Influence Factors of Global Nature Graphite Trade Competition. Resour. Policy 2019, 60, 153–161. [Google Scholar] [CrossRef]

- Wang, W.; Fan, L.; Li, Z.; Zhou, P.; Chen, X. Measuring Dynamic Competitive Relationship and Intensity among the Global Coal Importing Trade. Appl. Energy 2021, 303, 117611. [Google Scholar] [CrossRef]

- Peng, P.; Lu, F.; Cheng, S.; Yang, Y. Mapping the Global Liquefied Natural Gas Trade Network: A Perspective of Maritime Transportation. J. Clean. Prod. 2021, 283, 124640. [Google Scholar] [CrossRef]

- Bai, X.; Hu, X.; Wang, C.; Lim, M.K.; Vilela, A.L.M.; Ghadimi, P.; Yao, C.; Stanley, H.E.; Xu, H. Most Influential Countries in the International Medical Device Trade: Network-Based Analysis. Phys. A Stat. Mech. Its Appl. 2022, 604, 127889. [Google Scholar] [CrossRef]

- De Benedictis, L.; Tajoli, L. The World Trade Network. World Econ. 2011, 34, 1417–1454. [Google Scholar] [CrossRef]

- Kang, X.; Wang, M.; Wang, T.; Luo, F.; Lin, J.; Li, X. Trade Trends and Competition Intensity of International Copper Flow Based on Complex Network: From the Perspective of Industry Chain. Resour. Policy 2022, 79, 103060. [Google Scholar] [CrossRef]

- Zhong, W.; An, H.; Shen, L.; Dai, T.; Fang, W.; Gao, X.; Dong, D. Global Pattern of the International Fossil Fuel Trade: The Evolution of Communities. Energy 2017, 123, 260–270. [Google Scholar] [CrossRef]

- Tian, X.; Geng, Y.; Sarkis, J.; Gao, C.; Sun, X.; Micic, T.; Hao, H.; Wang, X. Features of Critical Resource Trade Networks of Lithium-Ion Batteries. Resour. Policy 2021, 73, 102177. [Google Scholar] [CrossRef]

- Xiong, M.; Li, W.; Xian, B.T.S.; Yang, A. Digital Inclusive Finance and Enterprise Innovation—Empirical Evidence from Chinese Listed Companies. J. Innov. Knowl. 2023, 8, 100321. [Google Scholar] [CrossRef]

- Fischer, M.M.; LeSage, J.P. Network Dependence in Multi-Indexed Data on International Trade Flows. J. Spat. Econom. 2020, 1, 4. [Google Scholar] [CrossRef]

- Wang, T.; Tian, J. Recasting the Trade Impact on Labor Share: A Fixed-Effect Semiparametric Estimation Study. Empir. Econ. 2020, 58, 2465–2511. [Google Scholar] [CrossRef]

- Tinta, A.A. The Determinants of Participation in Global Value Chains: The Case of ECOWAS. Cogent Econ. Financ. 2017, 5, 1389252. [Google Scholar] [CrossRef]

- Dornbusch, R.; Fischer, S.; Samuelson, P.A. Comparative Advantage, Trade, and Payments in a Ricardian Model with a Continuum of Goods. Am. Econ. Rev. 1977, 67, 823–839. [Google Scholar] [CrossRef]

- Caldara, D.; Iacoviello, M. Measuring Geopolitical Risk. Am. Econ. Rev. 2022, 112, 1194–1225. [Google Scholar] [CrossRef]

- Carmody, P. The Oil Curse: How Petroleum Wealth Shapes the Development of Nations. Afr. Aff. 2013, 112, 688–689. [Google Scholar] [CrossRef]

- De Groot, H.L.F.; Linders, G.; Rietveld, P.; Subramanian, U. The Institutional Determinants of Bilateral Trade Patterns. Kyklos 2004, 57, 103–123. [Google Scholar] [CrossRef]

- Baldwin, R.E. Multilateralising Regionalism: Spaghetti Bowls as Building Blocs on the Path to Global Free Trade. World Econ. 2006, 29, 1451–1518. [Google Scholar] [CrossRef]

- Krugman, P. Increasing Returns and Economic Geography. J. Political Econ. 1991, 99, 483–499. [Google Scholar] [CrossRef]

- Copeland, B.R.; Taylor, M.S. North-South Trade and the Environment. Q. J. Econ. 1994, 109, 755–787. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef]

- Chini, C.M.; Peer, R.A.M. The Traded Water Footprint of Global Energy from 2010 to 2018. Sci. Data 2021, 8, 7. [Google Scholar] [CrossRef]

- Alhussam, M.I.; Ren, J.; Yao, H.; Abu Risha, O. Food Trade Network and Food Security: From the Perspective of Belt and Road Initiative. Agriculture 2023, 13, 1571. [Google Scholar] [CrossRef]

- Wang, X.-Y.; Chen, B.; Song, Y. Dynamic Change of International Arms Trade Network Structure and Its Influence Mechanism. Int. J. Emerg. Mark. 2025, 20, 660–677. [Google Scholar] [CrossRef]

- Ma, J.; Li, M.; Niu, J. Risk Countermeasures of International Wheat Trade under the Network Reconstruction. Int. J. Mod. Phys. C 2023, 34, 2350145. [Google Scholar] [CrossRef]

- Bartesaghi, P.; Clemente, G.P.; Grassi, R. Clustering Coefficients as Measures of the Complex Interactions in a Directed Weighted Multilayer Network. Phys. A Stat. Mech. Its Appl. 2023, 610, 128413. [Google Scholar] [CrossRef]

- Dong, C.V.; Truong, H.Q. Impacts of the COVID-19 Pandemic on International Trade in Developing Countries: Evidence from Vietnam. Int. J. Emerg. Mark. 2024, 19, 1113–1134. [Google Scholar] [CrossRef]

- Shi, C.; Qi, J.; Zhi, J.; Zhang, C.; Chen, Q.; Na, X. Study on the Pattern and Driving Factors of Water Scarcity Risk Transfer Networks in China from the Perspective of Transfer Value—Based on Complex Network Methods. Environ. Impact Assess. Rev. 2025, 112, 107752. [Google Scholar] [CrossRef]

- Gallotti, R.; Barthelemy, M. The Multilayer Temporal Network of Public Transport in Great Britain. Sci. Data 2015, 2, 140056. [Google Scholar] [CrossRef] [PubMed]

- Zhong, Y.; Chen, Y.; Qiu, J. Study on the Spatial Structure of the Complex Network of Population Migration in the Poyang Lake Urban Agglomeration. Sustainability 2023, 15, 14789. [Google Scholar] [CrossRef]

- Xue, L.; Huang, X.; Wu, Y.; Yan, X.; Zheng, Y. Grade Setting of a Timber Logistics Center Based on a Complex Network: A Case Study of 47 Timber Trading Markets in China. Information 2020, 11, 107. [Google Scholar] [CrossRef]

- Prabheesh, K.P.; Vidya, C.T. Interconnected Horizons: ASEAN’s Journey in the Global Semiconductor Trade Network Amidst the COVID-19 Pandemic and Supply Chain Realignments. Emerg. Mark. Financ. Trade 2025, 61, 2185–2205. [Google Scholar] [CrossRef]

- Sullivan, A.; Kim, S.; Lee, D. Applying Organizational Density to Local Public Service Performance: Separating Homeless Service Outcomes from Outputs. Public Manag. Rev. 2023, 25, 262–285. [Google Scholar] [CrossRef]

- Kang, M.M.; Park, S.; Sorensen, L.C. Empowering the Frontline: Internal and External Organizational Antecedents of Teacher Empowerment. Public Manag. Rev. 2022, 24, 1705–1726. [Google Scholar] [CrossRef]

- Kuznets, S. Quantitative Aspects of the Economic Growth of Nations: X. Level and Structure of Foreign Trade: Long-Term Trends. Econ. Dev. Cult. Chang. 1967, 15, 1–140. [Google Scholar] [CrossRef]

- Fagiolo, G.; Mastrorillo, M. Does Human Migration Affect International Trade? A Complex-Network Perspective. PLoS ONE 2014, 9, e97331. [Google Scholar] [CrossRef]

- Cui, Q.; Li, Y. An Empirical Study on the Influencing Factors of Transportation Carbon Efficiency: Evidences from Fifteen Countries. Appl. Energy 2015, 141, 209–217. [Google Scholar] [CrossRef]

- Czinkota, M.R.; Skuba, C.J. Contextual Analysis of Legal Systems and Their Impact on Trade and Foreign Direct Investment. J. Bus. Res. 2014, 67, 2207–2211. [Google Scholar] [CrossRef]

- Ramirez-Madrid, J.P.; Escobar-Sierra, M.; Lans-Vargas, I.; Montes Hincapie, J.M. Factors Influencing Citizens’ Adoption of e-Government: An Empirical Validation in a Developing Latin American Country. Public Manag. Rev. 2024, 26, 185–218. [Google Scholar] [CrossRef]

- Nunn, N. Relationship-Specificity, Incomplete Contracts, and the Pattern of Trade. Q. J. Econ. 2007, 122, 569–600. [Google Scholar] [CrossRef]

- Tebecis, T.; Crespo Cuaresma, J. A Dataset of Structural Breaks in Greenhouse Gas Emissions for Climate Policy Evaluation. Sci. Data 2025, 12, 42. [Google Scholar] [CrossRef]

- Zhao, M.; Yuan, F. The Top Management Team and Enterprise Innovation: An Empirical Study from Growth Enterprise Market Listed Companies in China. Manag. Decis. Econ. 2022, 43, 2066–2082. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).