Green Profit Optimization and Collaborative Innovation in Sustainable Maritime Supply Chains

Abstract

1. Introduction

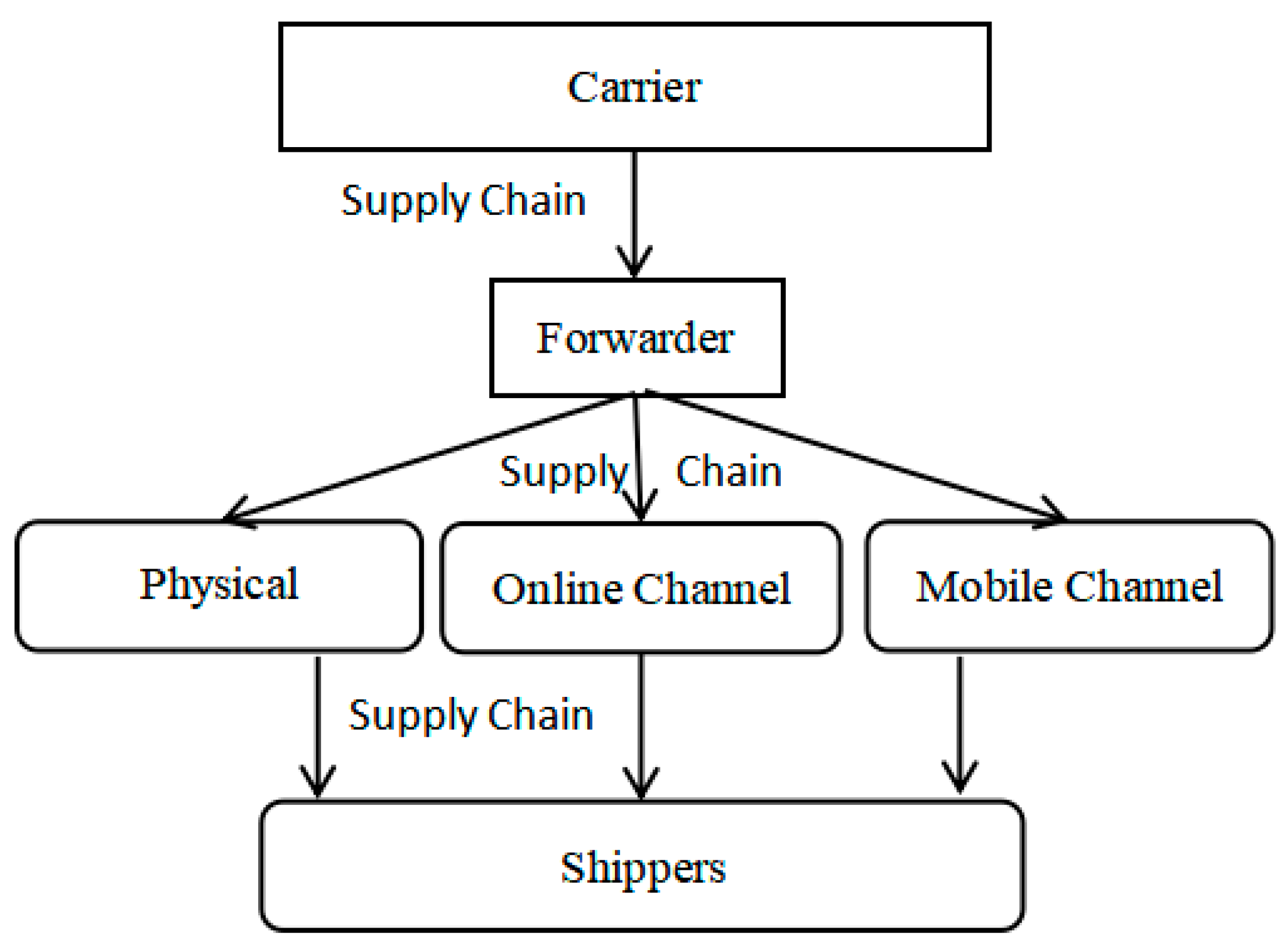

2. Construction of Profit Analysis Model for Sustainable Maritime Shipping Supply Chain

2.1. Basic Assumptions and Parameter Definitions of the Model

2.2. Construction of Profit Model for Sustainable Maritime Shipping Supply Chain

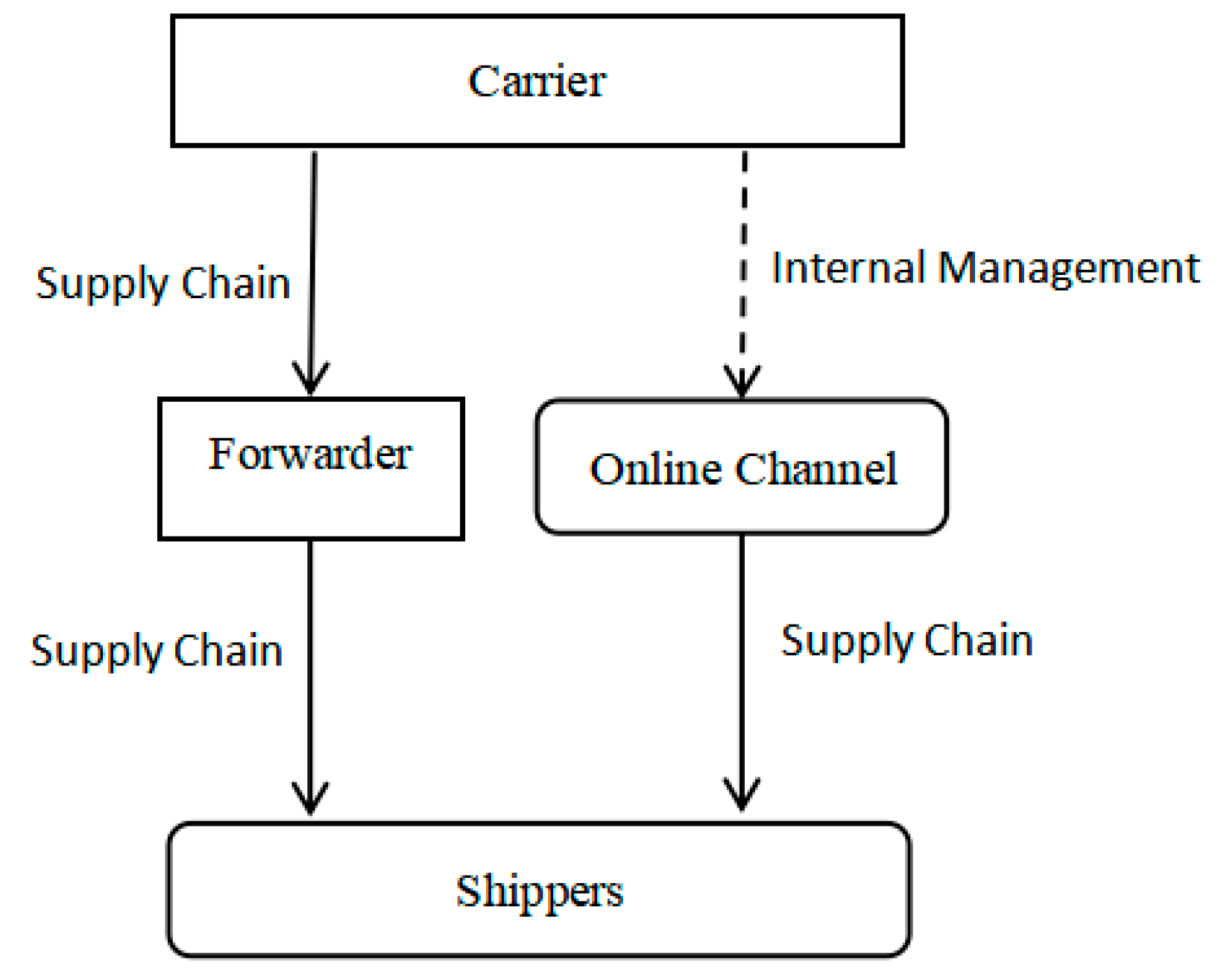

2.2.1. Construction and Solution of Dual-Channel Model for Carriers (Carriers)

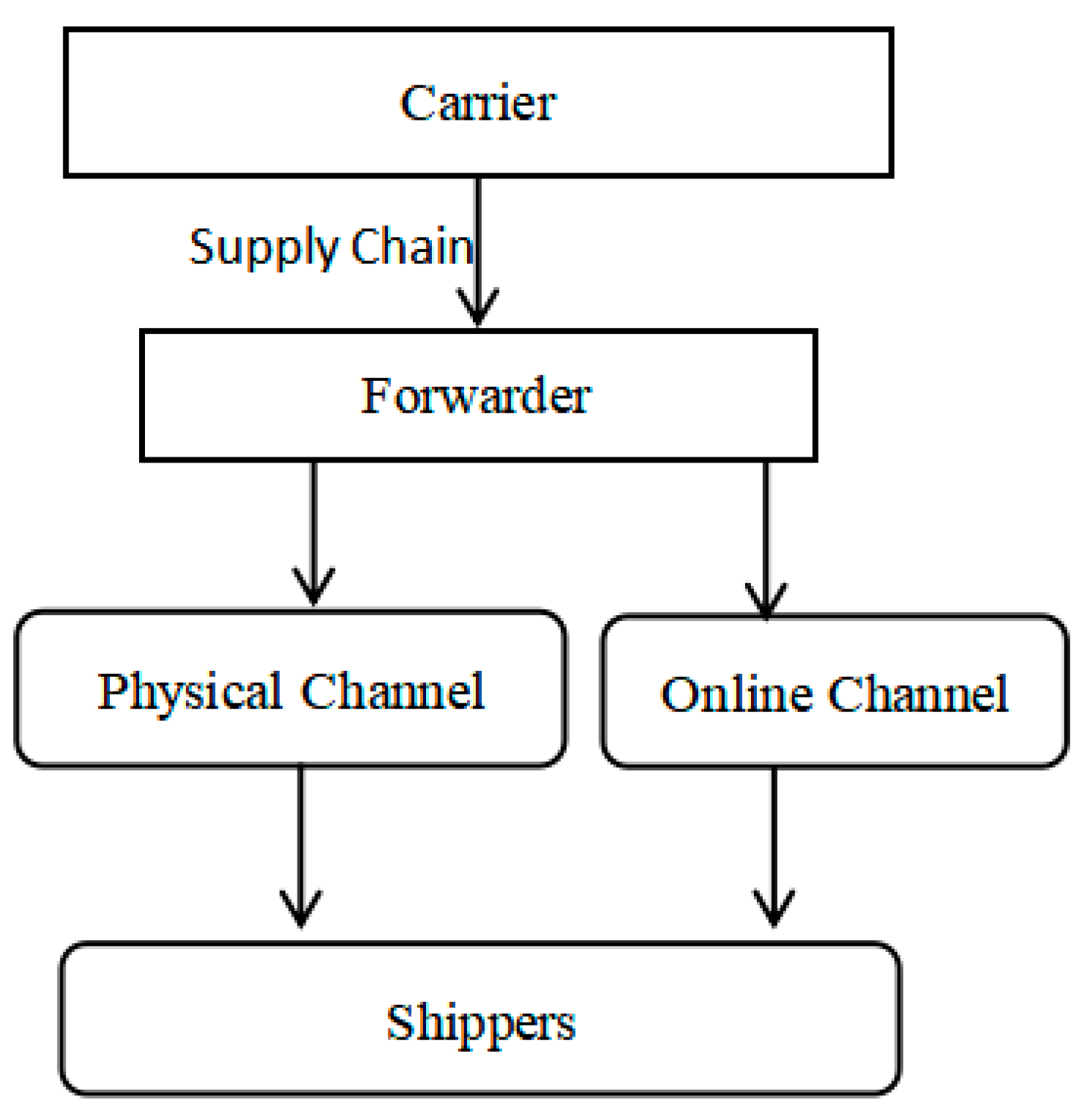

2.2.2. Construction and Solution of Dual-Channel Model for Forwarders

2.3. Profit Analysis and Comparison

3. Design of Collaborative Optimization and Benefit Sharing Mechanism for Sustainable Maritime Shipping Supply Chain

3.1. Model Basic Assumptions and Parameter Description

3.2. Construction of a Sustainable Maritime Shipping Service Demand Model Based on Consumer Utility

3.3. Construction of a Sustainable Maritime Shipping Supply Chain Model Under Centralized Decision-Making

3.4. Construction of a Sustainable Maritime Shipping Supply Chain Model Under Decentralized Decision-Making

4. Case Study

4.1. Background Description of the Case

4.2. Main Parameter Settings

4.3. Validation of Profit Analysis Model

- (1)

- Carrier (Company M) access to online channel mode: Based on the profit function and equilibrium solution formula of “Carrier Access to Online Channels” in Section 2, substitute all relevant parameters set in the table above to solve for the optimal price, optimal sustainability investment level, and respective profits and total supply chain profits of Company M (as the online channel access party) and the forwarder at this time.

- (2)

- Forwarder access to online channel mode: Based on the profit function and equilibrium solution formula of “Forwarder Access to Online Channels” in Section 2, substitute all relevant parameters set in the table above to solve for the optimal price, optimal sustainability investment level, and respective profits and total supply chain profits of the forwarder (as the online channel access party) and Company M at this time.

- (3)

- Summarize the profit results of the two online channel access modes mentioned above, visually compare them in Table 5, and compare key decision variables such as price and sustainability investment level under each mode to verify the impact of different online channel access strategies on the overall and member profits of the supply chain. The above parameters were substituted into the model, and the results are shown in the following table.

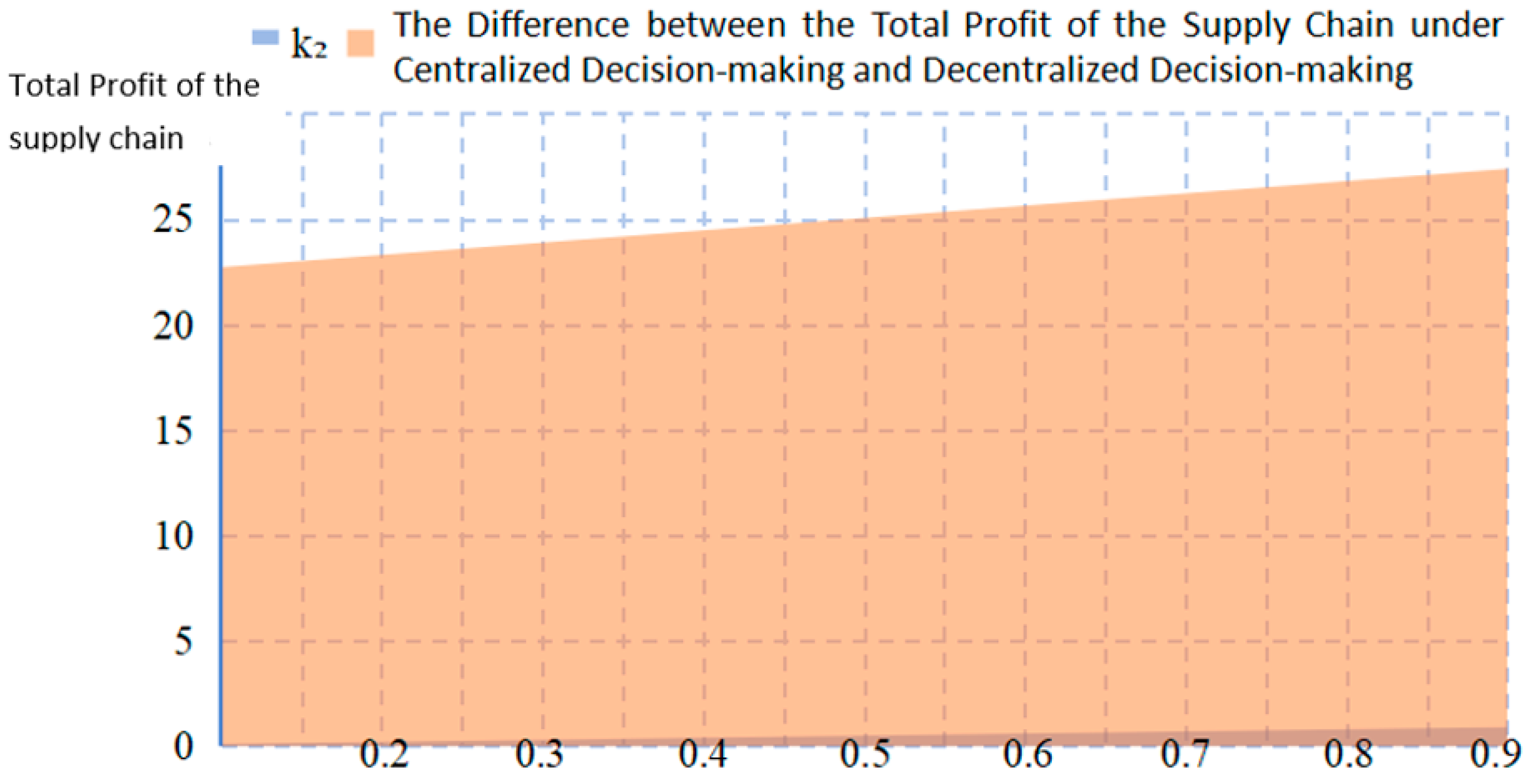

4.4. Analysis of the Effect of Decision Mode

4.5. Analysis of Collaborative Optimization Path for Revenue Sharing

5. Conclusions and Outlook

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wagner, N. Inventive Activity for Climate Change Mitigation: An Insight into the shipping Industry. Energies 2023, 16, 7403. [Google Scholar] [CrossRef]

- Sys, C.; Tei, A. Preface to This Special Issue: The Sustainable shipping Supply Chain. Sustainability 2024, 16, 9161. [Google Scholar] [CrossRef]

- Xiao, G.; Wang, Y.; Wu, R.; Li, J.; Cai, Z. Sustainable shipping transport: A review of intelligent shipping technology and green port construction applications. J. Mar. Sci. Eng. 2024, 12, 1728. [Google Scholar] [CrossRef]

- Liu, H.; Tian, Z.; Huang, A.; Yang, Z. Analysis of vulnerabilities in shipping supply chains. Reliab. Eng. Syst. Saf. 2018, 169, 475–484. [Google Scholar] [CrossRef]

- Guo, R.; Xiao, G.; Zhang, C.; Li, Q. A Study on Influencing Factors of Port Cargo Throughput Based on Multi-scale Geographically Weighted Regression. Front. Mar. Sci. 2025, 12, 1637660. [Google Scholar] [CrossRef]

- Ding, H.; Huang, H.; Tang, O. Sustainable supply chain collaboration with outsourcing pollutant-reduction service in power industry. J. Clean. Prod. 2018, 186, 215–228. [Google Scholar] [CrossRef]

- Kusumawati, E.D.; Punomo, B. Technological Transformation and Innovation Strategy as a Key Pillar in Improving Sustainability Efficiency in the shipping Industry. IITE Proceeding Int. Inov. Technol. Proceeding 2024, 2, 65–76. [Google Scholar]

- Wang, K.; Liang, H.; Liu, X.; Li, Z.; Jing, Z.; Chi, Y.; Ma, R.; Cao, J.; Huang, L. Investigations and applications of carbon control technology: The roadmap to zero-carbon shipping. Ocean Eng. 2025, 339, 121898. [Google Scholar] [CrossRef]

- IMO. IMO 2020-Cutting Sulphur Oxide Emissions. Available online: https://www.imo.org/en/mediacentre/hottopics/pages/sulphur-2020.aspx (accessed on 26 October 2025).

- IMO. New Sulphur Emission Limits Enter into Effect in the Mediterranean. Available online: https://www.imo.org/en/mediacentre/pages/whatsnew-2254.aspx (accessed on 26 October 2025).

- NanHua Research. Fuel Cost Illustration-The Most Important Changeable Cost in Maritime Industry. Available online: https://baijiahao.baidu.com/s?id=1676272976463990889&wfr=spider&for=pc.2025-10-4 (accessed on 26 October 2025).

- Liu, J.; Zhang, H.; Zhen, L. Blockchain technology in shipping supply chains: Applications, architecture and challenges. Int. J. Prod. Res. 2023, 61, 3547–3563. [Google Scholar] [CrossRef]

- Xiao, G.; Caleb, A.; Wang, T.; Li, Q.; Biancardo, S.A. Evaluating the impact of ECA policy on sulfur emissions from the five busiest ports in America based on difference in difference model. Front. Mar. Sci. 2025, 12, 1609261. [Google Scholar] [CrossRef]

- Mar-Ortiz, J.; Gracia, M.D.; Castillo-García, N. Challenges in the design of decision support systems for port and shipping supply chains. In Exploring Intelligent Decision Support Systems: Current State and New Trends; Springer International Publishing: Berlin/Heidelberg, Germany, 2018; pp. 49–71. [Google Scholar]

- Zore, Ž.; Čuček, L.; Kravanja, Z. Synthesis of sustainable production systems using an upgraded concept of sustainability profit and circularity. J. Clean. Prod. 2018, 201, 1138–1154. [Google Scholar] [CrossRef]

- Oh, J.; Jeong, B. Profit analysis and supply chain planning model for closed-loop supply chain in fashion industry. Sustainability 2014, 6, 9027–9056. [Google Scholar] [CrossRef]

- New, S.J. A framework for analysing supply chain improvement. Int. J. Oper. Prod. Manag. 1996, 16, 19–34. [Google Scholar] [CrossRef]

- Cuong, T.N.; Kim, H.S.; Long, L.N.B.; You, S.S. Seaport profit analysis and efficient management strategies under stochastic disruptions. Marit. Econ. Logist. 2024, 26, 212–240. [Google Scholar] [CrossRef]

- Zhao, L.; Xu, J. Contract Design for Dual Channel Conflict and Coordination in Supply Chain Based on Electronic Market. Chin. J. Manag. Sci. 2014, 22, 61–68. [Google Scholar]

- Janssen, M.; Shelegia, S. Consumer search and double marginalization. Am. Econ. Rev. 2015, 105, 1683–1710. [Google Scholar] [CrossRef]

- McCarthy, T.M.; Golicic, S.L. Implementing collaborative forecasting to improve supply chain performance. Int. J. Phys. Distrib. Logist. Manag. 2002, 32, 431–454. [Google Scholar] [CrossRef]

- Staring, R.J. Cross-Project Collaboration in the Construction Sector: A 4C Control Tower for Construction Supply Chains. Master’s Thesis, University of Twente, Enschede, The Netherlands, 2019. [Google Scholar]

- Tsay, A.A.; Nahmias, S.; Agrawal, N. Modeling supply chain contracts: A review. In Quantitative Models for Supply Chain Management; Springer: Berlin/Heidelberg, Germany, 1999; pp. 299–336. [Google Scholar]

- Raj, A.; Biswas, I.; Srivastava, S.K. Designing supply contracts for the sustainable supply chain using game theory. J. Clean. Prod. 2018, 185, 275–284. [Google Scholar] [CrossRef]

- Nagariya, R.; Kumar, D.; Kumar, I. Sustainable service supply chain management: From a systematic literature review to a conceptual framework for performance evaluation of service only supply chain. Benchmarking Int. J. 2022, 29, 1332–1361. [Google Scholar] [CrossRef]

- Ehsan, S.; Douwe, S.F. Analyzing the Structure of Closed-Loop Supply Chains: A Game Theory Perspective. Sustainability 2021, 13, 1397. [Google Scholar] [CrossRef]

| Subscript at the Lower Right Corner of the Parameters | Meaning of the Subscripts |

|---|---|

| “r” | Offline physical service channels used by the forwarder in the supply chain |

| “n” | Online service channels used by the forwarder in the supply chain |

| “m” | Mobile service channels used by the forwarder in the supply chain |

| Superscripts in the Upper Right Corner of the Parameters | Meaning of the Superscripts |

| “C” | The decision-making behavior of the supply chain under centralized decision-making models |

| “D” | The decision-making behavior of the supply chain under decentralized decision-making models |

| “S” | The decision-making behavior of the supply chain under revenue-sharing models |

| Variable | Carrier Access to Online Channels | Forwarder Access to Online Channels |

|---|---|---|

| Wholesale Price | ||

| Retail Price | ||

| Retailer Profit | ||

| Manufacturer Profit | ||

| Profit of the Supply Chain |

| Centralized Decision-Making Mode | Decentralized Decision-Making Mode | ||

|---|---|---|---|

| Retail Price | |||

| Wholesale Price | |||

| Retail Profit | |||

| Profit of the Carrier | |||

| Total Profit of the Supply Chain | |||

| Parameter Symbol | Meaning of Parameter | Numerical Value |

|---|---|---|

| m | Total Market Volume | 1000 |

| b | Price-Sensitive Coefficient | 1 |

| cm | Operating Costs of the Forwarder’s Unit | 10 |

| cr | Unit Operating Costs of Carriers (Company M) | 0 |

| c | Comprehensive Cost between Forwarders and Carriers | 7.5 |

| t | Market Share of the Product | 0.8 |

| φ | Shippers’ Recognition/Acceptance of Online Channels | 0.8 |

| ψ | Shippers’ Recognition/Acceptance of Mobile Channels | 0.7 |

| α | Market Share Expanded by the Carrier (Company M) after Accessing Online Channels | 0.1 |

| β | Market Share Expanded by the Forwarder after Accessing Online Channels | 0.2 |

| Channel Access Mode | Total Profit of Supply Chain () | Profit of Forwarder () | Profit of Company M | Final Price of Shipping Service |

|---|---|---|---|---|

| Carrier (Company M) Access to Online Channels | 140,000 | 67,500 | 72,500 | 550 |

| Forwarder Access to Online Channels | 97,537.5 | 65,025 | 32,512.5 | 3060 |

| Decision Mode | Total Profit of the Supply Chain ) | Final Price of Ocean Freight (P*) |

|---|---|---|

| Decentralized Decision-Making | 4.5 | |

| Centralized Decision-Making | 4 | |

| Perform Differential Analysis | −0.5 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, Y.; Kuang, Z.; Xiao, G. Green Profit Optimization and Collaborative Innovation in Sustainable Maritime Supply Chains. Sustainability 2025, 17, 9845. https://doi.org/10.3390/su17219845

Yu Y, Kuang Z, Xiao G. Green Profit Optimization and Collaborative Innovation in Sustainable Maritime Supply Chains. Sustainability. 2025; 17(21):9845. https://doi.org/10.3390/su17219845

Chicago/Turabian StyleYu, Yiping, Zengjie Kuang, and Guangnian Xiao. 2025. "Green Profit Optimization and Collaborative Innovation in Sustainable Maritime Supply Chains" Sustainability 17, no. 21: 9845. https://doi.org/10.3390/su17219845

APA StyleYu, Y., Kuang, Z., & Xiao, G. (2025). Green Profit Optimization and Collaborative Innovation in Sustainable Maritime Supply Chains. Sustainability, 17(21), 9845. https://doi.org/10.3390/su17219845