The Impact of Digital Economy on the Cost of Carbon Emission Reduction—A Theoretical and Empirical Study Based on a Carbon Market Framework

Abstract

1. Introduction

2. Literature Review and Research Hypothesis

2.1. Literature Review

2.2. Theoretical Analysis Framework and Research Hypotheses

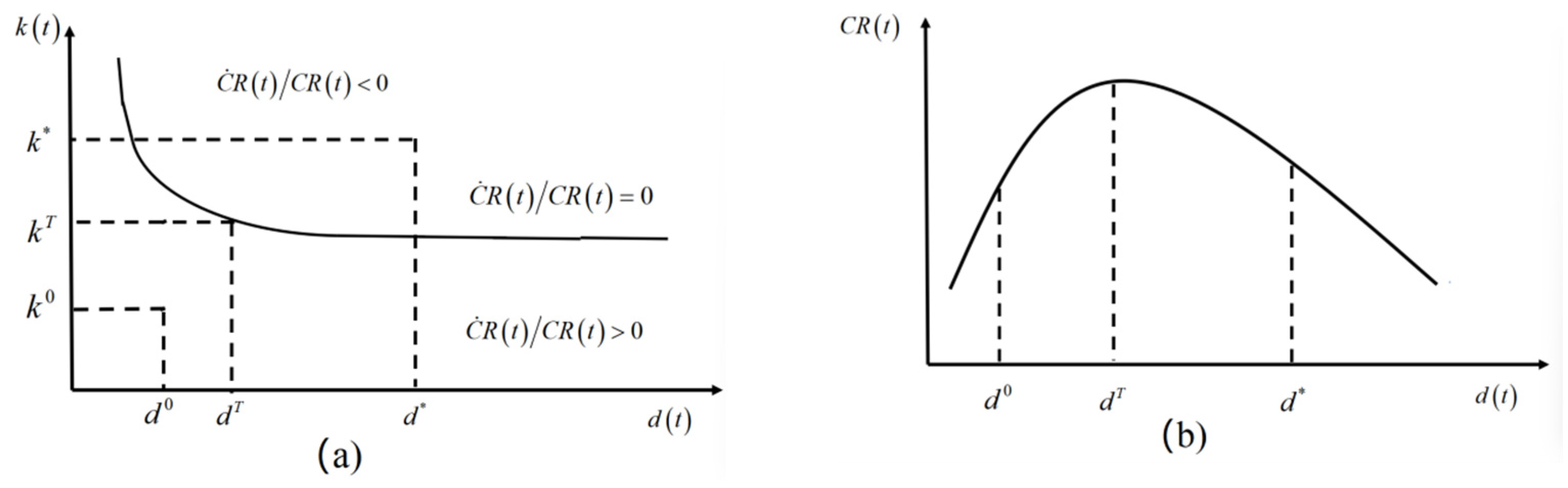

2.2.1. Theoretical Model

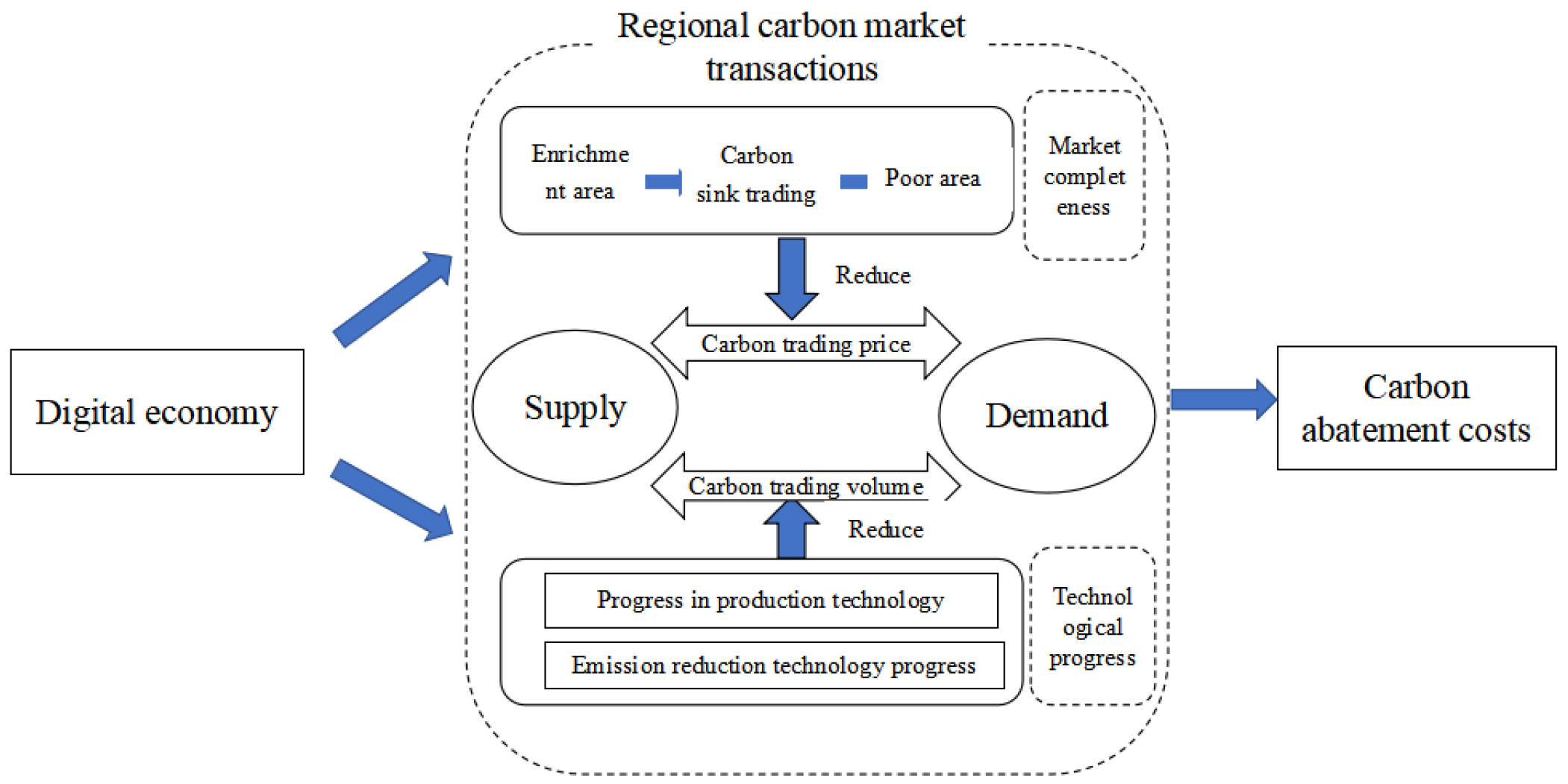

2.2.2. The Digital Economy Reduces Carbon Reduction Costs Through External Forces

2.2.3. Dig Contributes to the Cost of Carbon Reduction by Influencing Technological Progress

3. Research Methodology and Data Sources

3.1. Measurement Model

3.2. Measurement of Variables and Descriptive Statistics

3.2.1. Implicit Variable

3.2.2. Core Explanatory Variables

3.2.3. Mechanism Variables

3.2.4. Control Variable

3.3. Data Sources

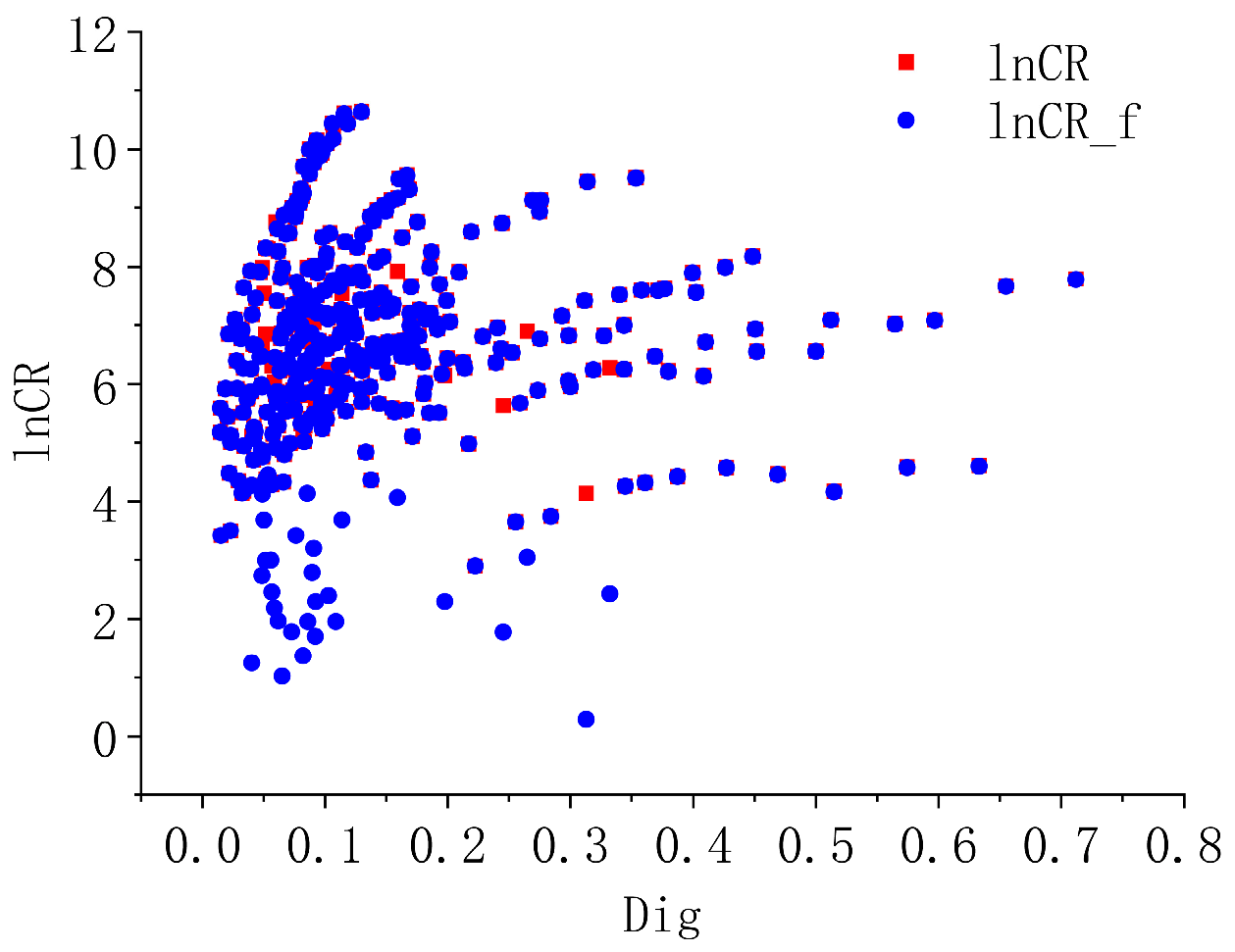

3.4. Characteristic Fact

4. Empirical Findings

4.1. Baseline Results

4.2. Robustness Check

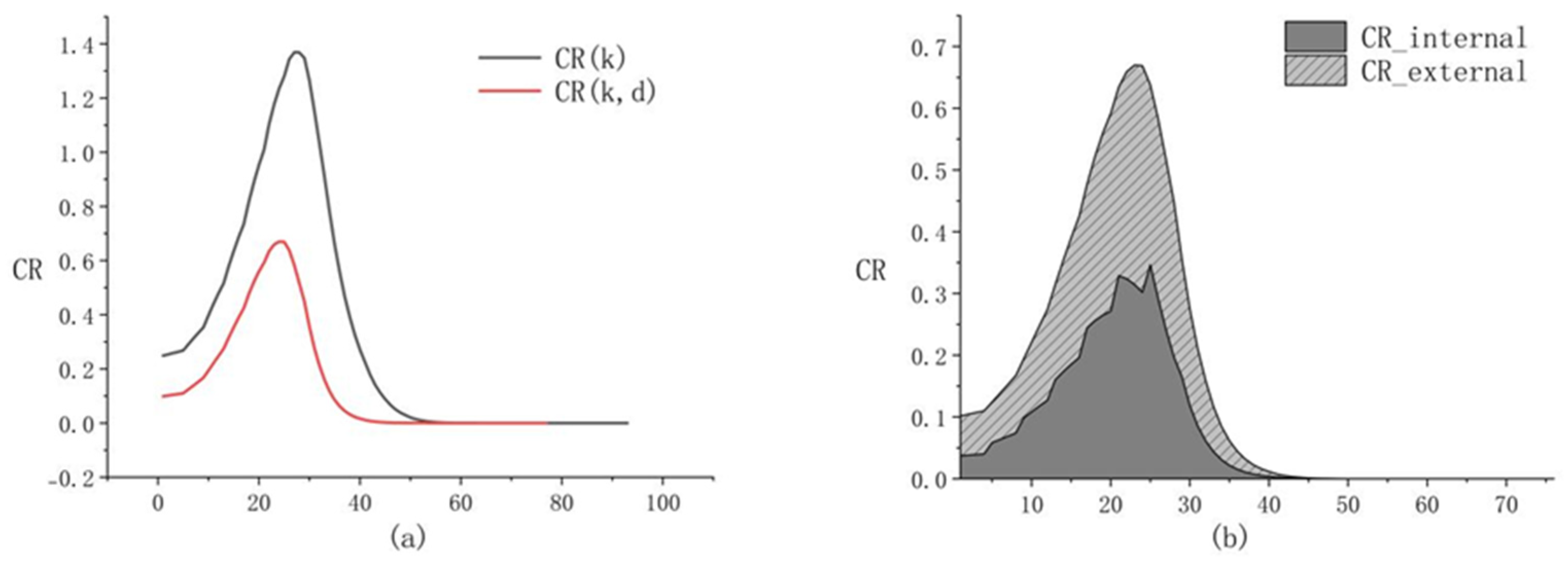

4.3. Numerical Simulation Validation

4.3.1. Solving the Steady-State Equations

4.3.2. Parameterization

5. Further Analysis

5.1. Mechanism Analysis

5.1.1. A Test of the Mediating Effect of Carbon Market Sophistication

5.1.2. A Test of the Mediating Effect of Technological Progress

5.2. Heterogeneity Analysis

6. Conclusions and Policy Implications

6.1. Main Findings

6.2. Discussions

6.3. Policy Implications

- (1)

- Digitally upgrade the ETS to raise market efficiency and transparency while advancing the energy transition and broader sustainability outcomes (air quality, resource efficiency, and environmental integrity). Accelerate the informatization and intelligentization of the carbon market by integrating blockchain registries, big-data MRV, and AI-driven anomaly detection to deliver real-time, auditable emissions data and fair price discovery with strengthened safeguards against greenwashing. Build interoperable carbon-accounting systems and an intelligent trading platform with open APIs to enable cross-regional linkage, higher liquidity, and lower transaction costs that also interoperate with corporate sustainability reporting. Couple ETS data with firms’ energy-management systems (IoT, SCADA/MES, digital twins) so that verified energy-efficiency gains and electrification/fuel-switching outcomes are reflected promptly in quota allocation and compliance—thereby reducing CR and improving market functioning.

- (2)

- Accelerate green technological innovation and shift the energy mix toward cleaner, more efficient supply and use. Increase R&D and demonstration for renewables integration, flexible grids, industrial electrification (e.g., heat pumps, electric kilns), hydrogen for hard-to-abate heat, and high-efficiency motor/drive systems. Resolve bottlenecks in key enabling technologies through university–industry consortia; expand public finance (grants, concessional loans) and targeted incentives (tax credits, contracts for difference, green PPAs). Embed energy-efficiency standards and ISO 50001 adoption, scale retrofit programs, and support demand-response and storage. Complement these with circular-economy and life-cycle design measures (materials efficiency, waste heat/use, reuse and recycling) to curb resource and water footprints, so that higher efficiency and cleaner energy supply lower marginal abatement costs, reduce CR, and deliver growth–environment co-benefits and climate resilience.

- (3)

- Promote place-based digitalization to leverage complementary regional advantages and support a just energy transition. Pursue differentiated Dig pathways: the eastern region should focus on frontier R&D, advanced analytics, and scaling of low-carbon process innovations; the central and western regions should prioritize digital and power infrastructure (fiber, 5G, industrial IoT), expand the “East-to-West computing power” initiative with energy- and water-efficient green data centers co-located with renewables, and develop platforms that enable traditional industries to digitize operations and improve energy efficiency. Pair investment with worker reskilling/SME support and community co-benefits to ensure an equitable, just transition. Strengthen talent and investment attraction to western hubs, foster interregional data and carbon-market connectivity, and share best practices. Narrowing digital gaps will align external ETS incentives with internal energy-efficiency upgrades nationwide, amplifying CR reductions and accelerating green transformation while safeguarding local environmental quality and ecosystem health.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| ETS | Carbon emissions trading |

| CR | Regional carbon abatement costs |

| Y | Total Output |

| Total Consumption-based Output | |

| K | Total Physical Capital |

| D | Total Data Capital |

| L | Labor Force |

| R | Proportion of Carbon Emission Reduction |

| P | Carbon Trading Price |

| Carbon Emission Cap | |

| n | Population Growth Rate |

| g | Technological Progress Growth Rate |

| Depreciation Rate of Physical Capital | |

| Depreciation Rate of Data Capital | |

| Investment Ratio of Physical Capital | |

| Proportion of Emission Reduction Investment | |

| Growth Rate of Emission Reduction Technology | |

| Output Elasticity of Physical Capital | |

| Dig | Digital economy |

| y | Output per Capita |

| A | Technological Progress |

| k | Physical Capital per Capita |

| d | Data Capital per Capita |

| E | Carbon Emissions |

| C | Total Regional Carbon Reduction Cost |

| Q | Carbon Trading Volume |

| F | Number of Emission Reduction Compliance by Regulated Enterprises |

| Output Elasticity of Data Capital | |

| s | Savings Rate |

| Marginal Carbon Reduction Cost | |

| Growth Rate of Carbon Trading Market Maturity | |

| Initial Technological Progress | |

| Initial Labor Force | |

| Initial Pollution per Unit Output | |

| Initial Irreducible Carbon Emission Proportion |

Appendix A

Appendix A.1

Appendix A.2

- (1)

- Calculation of power growth rateInternal growth rate (measured by total carbon emissions):External growth rate (measured by carbon price changes):

- (2)

- Extreme difference normalization treatment: To eliminate the influence of dimensions, the two types of power are standardized to the 0–1 interval for convenient weight distribution:

- (1)

- Weight allocation and decompositionSum of normalized drivers:Share of internal vs. external drivers:

- (2)

- Decomposition of carbon abatement costs

Appendix B

| Level 1 Indicators | Level 2 Indicators | Level 3 Indicators | Indicator Properties |

|---|---|---|---|

| Dig | Infrastructure for Dig | Number of domain names (ten thousand) | + |

| Number of IPv4 (ten thousand) | + | ||

| Number of Internet access ports (ten thousand) | + | ||

| Cell phone penetration rate (units/100 people) | + | ||

| Length of long-distance fiber optic cables per unit area (km/km2) | + | ||

| Digital industrialization | Number of Informatization Enterprises (number) | + | |

| Software business revenue (billion yuan) | + | ||

| Digital Finance Coverage Breadth Index | + | ||

| Digital Finance Depth of Use Index | + | ||

| Digital Finance Digitization Degree | + | ||

| Industrial digitization | Number of websites per 100 enterprises (number) | + | |

| E-commerce transaction volume (billion yuan) | + | ||

| Share of enterprises with e-commerce trading activities (%) | + |

References

- Wang, Z.; Wu, J.; Zhao, C. Multi-product pricing and carbon allocations under cap-and-trade regulation and uncertain carbon market. Int. J. Prod. Res. 2025, 1–21. [Google Scholar] [CrossRef]

- Venmans, F.M.J. The effect of allocation above emissions and price uncertainty on abatement investments under the EU ETS. J. Clean. Prod. 2016, 126, 595–606. [Google Scholar] [CrossRef]

- An, Q.; Shi, Y. Does enterprise digitization reduce carbon emissions? Evidence from China. Chin. J. Popul. Resour. Environ. 2023, 21, 219–230. [Google Scholar] [CrossRef]

- Xu, Q.; Li, X.; Guo, F. Digital transformation and environmental performance: Evidence from Chinese resource-based enterprises. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1816–1840. [Google Scholar] [CrossRef]

- Lyu, Y.; Bai, Y.; Zhang, J. Digital transformation and enterprise low-carbon innovation: A new perspective from innovation motivation. J. Environ. Manag. 2024, 365, 121663. [Google Scholar] [CrossRef]

- Zhang, N.; Huang, X.; Qi, C. The effect of environmental regulation on the marginal abatement cost of industrial firms: Evidence from the 11th Five-Year Plan in China. Energy Econ. 2022, 112, 106147. [Google Scholar] [CrossRef]

- Lee, S.; Bi, X. Can embedded knowledge in pollution prevention techniques reduce greenhouse gas emissions? A case of the power generating industry in the United States. Environ. Res. Lett. 2020, 15, 124033. [Google Scholar] [CrossRef]

- Hao, X.; Miao, E.; Wen, S.; Wu, H.; Xue, Y. Executive green cognition on corporate greenwashing behavior: Evidence from a-share listed companies in China. Bus. Strategy Environ. 2025, 34, 2012–2034. [Google Scholar] [CrossRef]

- Chen, P.; Chu, Z. Mere facade? Is greenwashing behaviour lower in low-carbon corporates? Bus. Strategy Environ. 2024, 33, 4162–4174. [Google Scholar] [CrossRef]

- Colmer, J.; Martin, R.; Muûls, M.; Wagner, U.J. Does pricing carbon mitigate climate change? Firm-level evidence from the european union emissions trading system. Rev. Econ. Stud. 2025, 92, 1625–1660. [Google Scholar] [CrossRef]

- Hong, Q.; Cui, L.; Hong, P. The impact of carbon emissions trading on energy efficiency: Evidence from quasi-experiment in China’s carbon emissions trading pilot. Energy Econ. 2022, 110, 106025. [Google Scholar] [CrossRef]

- Lessmann, C.; Kramer, N. The effect of cap-and-trade on sectoral emissions: Evidence from California. Energy Policy 2024, 188, 114066. [Google Scholar] [CrossRef]

- Chen, X.; Lloyd, A.D. Understanding the challenges of blockchain technology adoption: Evidence from China’s developing carbon markets. Inf. Technol. People 2025, 38, 1328–1362. [Google Scholar] [CrossRef]

- Wang, B.; Gong, S.; Yang, Y. Unveiling the relation between digital technology and low-carbon innovation: Carbon emission trading policy as an antecedent. Technol. Forecast. Soc. Change 2024, 205, 123522. [Google Scholar] [CrossRef]

- Zhao, Z.; Li, Y.; Su, X. Beggar-thy-neighbor: Carbon leakage within China’s pilot emissions trading schemes. Sustain. Prod. Consum. 2024, 47, 208–221. [Google Scholar] [CrossRef]

- Ferdaus, M.M.; Dam, T.; Anavatti, S.; Das, S. Digital technologies for a net-zero energy future: A comprehensive review. Renew. Sustain. Energy Rev. 2024, 202, 114681. [Google Scholar] [CrossRef]

- Lin, B.; Ge, J. Valued forest carbon sinks: How much emissions abatement costs could be reduced in China. J. Clean. Prod. 2019, 224, 455–464. [Google Scholar] [CrossRef]

- Tol, R.S. An emission intensity protocol for climate change: An application of FUND. Clim. Policy 2004, 4, 269–287. [Google Scholar] [CrossRef]

- Brock, W.A.; Taylor, M.S. The green Solow model. J. Econ. Growth 2010, 15, 127–153. [Google Scholar] [CrossRef]

- Wang, L.; Zhao, Z.; Xu, X. The Impact and Mechanism of Digital Economy on Carbon Emissions. J. Hebei Univ. Econ. Bus. 2024, 45, 45–59. [Google Scholar] [CrossRef]

- Qiu, H.; Zhang, H.; Lei, K.; Zhang, H.; Hu, X. Forest digital twin: A new tool for forest management practices based on Spatio-Temporal Data, 3D simulation Engine, and intelligent interactive environment. Comput. Electron. Agric. 2023, 215, 108416. [Google Scholar] [CrossRef]

- Romer, P.M. Increasing returns and long-run growth. J. Political Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Zuo, S.; Zhao, Y.; Zheng, L.; Zhao, Z.; Fan, S.; Wang, J. Assessing the influence of the digital economy on carbon emissions: Evidence at the global level. Sci. Total Environ. 2024, 946, 174242. [Google Scholar] [CrossRef] [PubMed]

- Wang, T.; Li, R.; Zhang, Q.; Sun, S. Digitalization and urban carbon emissions: Unraveling the mechanisms of agglomeration economics. J. Environ. Manag. 2025, 387, 125855. [Google Scholar] [CrossRef] [PubMed]

- Xia, D.; Zhang, L.; Zhou, D.; Pian, Q. Continuous allocation of carbon emission quota considering different paths to carbon peak: Based on multi-objective optimization. Energy Policy 2023, 178, 113622. [Google Scholar] [CrossRef]

- Han, Y.; Wu, F.; Zhang, L.; Pang, Q.; Wang, W.; Li, F. Synergistic allocation of carbon emission and energy quotas: A balancing act under carbon peaking constraints. J. Environ. Manag. 2025, 373, 123544. [Google Scholar] [CrossRef]

- Li, C.; Wu, J.; Zhang, F.; Huang, X. Forest Carbon Sinks in Chinese Provinces and Their Impact on Sustainable Development Goals. Forests 2025, 16, 83. [Google Scholar] [CrossRef]

- Lai, S.; Chen, H.; Zhao, Y. Measurement and prediction of the development level of China’s digital economy. Humanit. Soc. Sci. Commun. 2024, 11, 1–14. [Google Scholar] [CrossRef]

- Fu, Y.; Yi, Z. Multi-province comparisons of digital financial inclusion performance in China: A group ranking method with preference analysis. China Econ. Rev. 2023, 80, 102014. [Google Scholar] [CrossRef]

- Liu, Y.; Deng, W.; Wen, H.; Li, S. Promoting green technology innovation through policy synergy: Evidence from the dual pilot policy of low-carbon city and innovative city. Econ. Anal. Policy 2024, 84, 957–977. [Google Scholar] [CrossRef]

- Addis, A.K. Sustainability and efficiency analysis of 42 countries: Super SBM-DEA model and the GML productivity index with undesirable outputs. Ecol. Indic. 2025, 177, 113767. [Google Scholar] [CrossRef]

- Zhou, L.; Fan, J.; Hu, M.; Yu, X. Clean air policy and green total factor productivity: Evidence from Chinese prefecture-level cities. Energy Econ. 2024, 133, 107512. [Google Scholar] [CrossRef]

- Zheng, Y.; Wang, M.; Ma, X.; Zhu, C.; Gao, Q. The Dynamic Relationship Between Industrial Structure Upgrading and Carbon Emissions: New Evidence from Chinese Provincial Data. Sustainability 2024, 16, 10118. [Google Scholar] [CrossRef]

- Ran, C.; Zhang, Y. The driving force of carbon emissions reduction in China: Does green finance work. J. Clean. Prod. 2023, 421, 138502. [Google Scholar] [CrossRef]

- Chen, W.; Wang, G.; Xu, N.; Ji, M.; Zeng, J. Promoting or inhibiting? New-type urbanization and urban carbon emissions efficiency in China. Cities 2023, 140, 104429. [Google Scholar] [CrossRef]

- Liu, J.; Ma, X.; Zhang, J.; Zhang, S. New-type urbanization construction, shift-share of employment, and CO2 emissions: Evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 26472–26495. [Google Scholar] [CrossRef]

- Zhang, W.; Liu, X.; Wang, D.; Zhou, J. Digital economy and carbon emission performance: Evidence at China’s city level. Energy Policy 2022, 165, 112927. [Google Scholar] [CrossRef]

- Yang, S.; Li, H.; Liu, X.; Wei, Y.; Shen, J.; Cheng, B. Spatial analysis of the digital economy’s influence on urban sustainable development: A decade-long study of Chinese prefecture-level cities. Ecol. Indic. 2024, 166, 112338. [Google Scholar] [CrossRef]

- Su, T.; Li, C. Has the Digital Economy Boosted Carbon Reduction in Livestock Farming in China? Agriculture 2024, 14, 1494. [Google Scholar] [CrossRef]

- Lyu, Y.; Xiao, X.; Zhang, J. Does the digital economy enhance green total factor productivity in China? The evidence from a national big data comprehensive pilot zone. Struct. Change Econ. Dyn. 2024, 69, 183–196. [Google Scholar] [CrossRef]

- Tao, Z.; Zhang, Z.; Shangkun, L. Digital economy, entrepreneurship, and high-quality economic development: Empirical evidence from urban China. Front. Econ. China 2022, 17, 393. [Google Scholar] [CrossRef]

- Zou, T.; Yin, W. Postponed Retirement, Grandparenting and Youth Employment. J. Quant. Technol. Econ. 2023, 40, 157–177. [Google Scholar] [CrossRef]

- Wang, D. A dynamic optimization on economic energy efficiency in development: A numerical case of China. Energy 2014, 66, 181–188. [Google Scholar] [CrossRef]

- Luo, F.; Chen, F.; Yang, D.; Yang, S. Assessing the total factor productivity growth decomposition: The transformation of economic growth momentum and policy choice in China. Environ. Sci. Pollut. Res. 2023, 30, 34503–34517. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.; Li, F. Estimation of industry-level basic digital capital services in China: A variable depreciation rate estimation method based on DSGE. China Econ. Rev. 2024, 86, 102199. [Google Scholar] [CrossRef]

- Liu, Z.; Deng, Z.; He, G.; Wang, H.; Zhang, X.; Lin, J.; Qi, Y.; Liang, X. Challenges and opportunities for carbon neutrality in China. Nat. Rev. Earth Environ. 2022, 3, 141–155. [Google Scholar] [CrossRef]

- Zhou, B.; Zeng, X.; Jiang, L.; Xue, B. High-quality economic growth under the influence of technological innovation preference in China: A numerical simulation from the government financial perspective. Struct. Change Econ. Dyn. 2020, 54, 163–172. [Google Scholar] [CrossRef]

- Lyu, J.; Cao, M.; Wu, K.; Li, H. Price volatility in the carbon market in China. J. Clean. Prod. 2020, 255, 120171. [Google Scholar] [CrossRef]

- Wang, B.; Duan, M. Have China’s emissions trading systems reduced carbon emissions? Firm-level evidence from the power sector. Appl. Energy 2025, 378, 124802. [Google Scholar] [CrossRef]

- Xu, Q.; Zhong, M.; Li, X. How does digitalization affect energy? International evidence. Energy Econ. 2022, 107, 105879. [Google Scholar] [CrossRef]

- Matthess, M.; Kunkel, S.; Dachrodt, M.F.; Beier, G. The impact of digitalization on energy intensity in manufacturing sectors—A panel data analysis for Europe. J. Clean. Prod. 2023, 397, 136598. [Google Scholar] [CrossRef]

- Zhu, Y.; Lan, M. Digital economy and carbon rebound effect: Evidence from Chinese cities. Energy Econ. 2023, 126, 106957. [Google Scholar] [CrossRef]

- Cui, J.; Wang, C.; Zhang, J.; Zheng, Y. The effectiveness of China’s regional carbon market pilots in reducing firm emissions. Proc. Natl. Acad. Sci. USA 2021, 118, e2109912118. [Google Scholar] [CrossRef]

- Suo, X.; Zhang, L.; Guo, R.; Lin, H.; Yu, M.; Du, X. The inverted U-shaped association between digital economy and corporate total factor productivity: A knowledge-based perspective. Technol. Forecast. Soc. Change 2024, 203, 123364. [Google Scholar] [CrossRef]

- Ren, S.; Bao, R.; Gao, Z. Arrival of distant power: The impact of ultra-high voltage transmission projects on energy structure in China. Energy 2025, 316, 134527. [Google Scholar] [CrossRef]

| Parameter | Symbol | Value |

|---|---|---|

| Carbon Conversion Coefficient of Understory Plants | 0.195 | |

| Forest Carbon Conversion Coefficient | 1.244 | |

| Biomass expansion factor | δ | 1.9 |

| Bulk density | ρ | 0.5 |

| Carbon content | r | 0.5 |

| Variable | Measurement Method | Mean | Standard | Min | Max |

|---|---|---|---|---|---|

| Ln (Carbon abatement costs) | lnCR | 6.834 | 1.433 | 2.900 | 10.646 |

| Ln (the digital economy) | lnDig | −2.210 | 0.733 | −4.226 | −0.340 |

| Ln (the digital economy)2 | (lnDig)2 | 5.419 | 3.329 | 0.115 | 17.862 |

| Ln (Industrial structure) | lnIS | 0.014 | 0.421 | −0.704 | 1.667 |

| Ln (Financial development level) | lnFDL | 1.189 | 0.289 | 0.517 | 2.029 |

| Ln (Urbanization level) | lnUL | −0.528 | 0.196 | −1.049 | −0.110 |

| Ln (Level of human capital) | lnHCL | −3.901 | 0.277 | −4.822 | −3.132 |

| Ln (Labor force level) | lnLFL | 2.023 | 0.106 | 1.713 | 2.182 |

| Ln (Level of technology market development) | lnTMDL | −4.928 | 1.389 | −8.592 | −1.656 |

| Ln (Informatization level) | lnIL | −3.093 | 0.729 | −4.223 | 0.921 |

| Number of green patents authorized per 10,000 people | GP | 0.925 | 1.217 | 0.029 | 8.681 |

| Emission Reduction Technology Progress | ERTP | 0.187 | 0.126 | 0 | 1.058 |

| Production Technology Progress | PTP | 1.337 | 0.303 | 0.924 | 2.454 |

| (1) lnCR | (2) lnCR | (3) lnCR | |

|---|---|---|---|

| lnDig | −1.645 *** | −2.286 *** | −2.231 *** |

| (0.553) | (0.256) | (0.264) | |

| (lnDig)2 | −0.461 *** | −0.247 *** | −0.271 *** |

| (0.122) | (0.027) | (0.032) | |

| _cons | 5.371 *** | 0.492 | 3.336 |

| (0.607) | (0.570) | (3.501) | |

| Time FE | NO | YES | YES |

| Provinces FE | NO | YES | YES |

| Controls | NO | NO | YES |

| N | 360 | 360 | 360 |

| R 2 | 0.062 | 0.981 | 0.982 |

| Instrumental Variable | Instrumental Variable | |||

|---|---|---|---|---|

| First | Second | First | Second | |

| lnDig | lnCR | lnDig | lnCR | |

| Instrumental variable | 0.035 *** | |||

| (0.006) | ||||

| Instrumental variable1 | 0.037 *** | |||

| (0.006) | ||||

| lnDig | −5.933 *** | −5.460 *** | ||

| (1.148) | (1.010) | |||

| (lnDig)2 | −0.100 *** | −0.651 *** | −0.602 *** | |

| (0.004) | (0.120) | (0.106) | ||

| _cons | −4.383 *** | −15.50 ** | −4.386 *** | −13.10 ** |

| (0.678) | (7.158) | (0.671) | (6.476) | |

| Time FE | YES | YES | YES | YES |

| Province FE | YES | YES | YES | YES |

| Controls | YES | YES | YES | YES |

| Kleibergen-Paap rk LM | 31.08 (0.000) | 36.41 (0.000) | ||

| Cragg-Donald Wald F | 29.29 (16.38) | 34.89 (16.38) | ||

| N | 360 | 360 | 360 | 360 |

| R2 | 0.992 | 0.971 | 0.992 | 0.973 |

| Dig Policy Shock | TES Policy Shock | Remove Provinces | Substitution of Explanatory Variables | Replacement of Core Explanatory Variables | |

|---|---|---|---|---|---|

| lnCR | lnCR | lnCR | lnCR_F | lnCR | |

| Did_Dig | −0.102 ** | ||||

| (0.050) | |||||

| Did_TES | −0.372 *** | ||||

| (0.082) | |||||

| lnDig | −2.148 *** | −2.064 *** | −1.690 *** | −2.231 *** | |

| (0.265) | (0.258) | (0.350) | (0.264) | ||

| (lnDig)2 | −0.261 *** | −0.244 *** | −0.233 *** | −0.271 *** | |

| (0.032) | (0.032) | (0.039) | (0.032) | ||

| lnDig_pca | −13.035 *** | ||||

| (1.716) | |||||

| (lnDig_pca)2 | −6.431 *** | ||||

| (1.623) | |||||

| _cons | 3.216 | 1.166 | −3.693 | 3.336 | 1.934 |

| (3.484) | (3.429) | (4.030) | (3.501) | (3.781) | |

| Time FE | YES | YES | YES | YES | YES |

| Province FE | YES | YES | YES | YES | YES |

| Controls | YES | YES | YES | YES | YES |

| N | 360 | 360 | 288 | 360 | 360 |

| R2 | 0.982 | 0.983 | 0.985 | 0.945 | 0.982 |

| Parameter | Baseline | Literature | Parameter | Baseline | Literature |

|---|---|---|---|---|---|

| n | 0.0053 | Zou and Yin [42] | 0.2 | Wang et al. [43] | |

| 0.5 | Wang et al. [43] | s | 0.4719 | Wang et al. [43] | |

| g | 0.02 | Luo et al. [44] | a | 1.57 | Appendix A.1 |

| 0.1 | Liu et al. [45] | 0.02 | This paper assumes | ||

| 0.1 | Liu et al. [45] | 1 | This paper assumes | ||

| 0.05 | Brock and Taylor [19] | 1 | This paper assumes | ||

| 0.041 | Liu et al. [46] | 1 | This paper assumes | ||

| 35 | Brock and Taylor [19] | 1 | This paper assumes | ||

| 0.4 | Zhou et al. [47] |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| GP | lnCR | ERTP | lnCR | PTP | lnCR | |

| lnDig | 2.383 *** | −1.924 *** | 0.419 *** | −1.665 *** | 0.228 *** | −2.283 *** |

| (0.443) | (0.270) | (0.057) | (0.274) | (0.087) | (0.266) | |

| (lnDig)2 | 0.324 *** | −0.229 *** | 0.036 *** | −0.223 *** | 0.023 ** | −0.276 *** |

| (0.054) | (0.033) | (0.007) | (0.032) | (0.011) | (0.032) | |

| GP | −0.129*** | |||||

| (0.033) | ||||||

| ERTP | −1.350 *** | |||||

| (0.254) | ||||||

| PTP | 0.229 | |||||

| (0.172) | ||||||

| _cons | −15.097 ** | 1.393 | −0.747 | 2.327 | 9.723 *** | 1.113 |

| (5.878) | (3.461) | (0.751) | (3.362) | (1.154) | (3.877) | |

| Time FE | YES | YES | YES | YES | YES | YES |

| Province FE | YES | YES | YES | YES | YES | YES |

| Controls | YES | YES | YES | YES | YES | YES |

| N | 360 | 360 | 360 | 360 | 360 | 360 |

| R2 | 0.811 | 0.983 | 0.685 | 0.984 | 0.953 | 0.982 |

| East | Central | West | Low Dig Region | High Dig Region | |

|---|---|---|---|---|---|

| lnCR | lnCR | lnCR | lnCR | lnCR | |

| lnDig | −0.542 ** | −2.501 ** | −4.810 *** | −3.283 *** | −0.894 ** |

| (0.273) | (1.166) | (0.379) | (0.892) | (0.382) | |

| (lnDig)2 | −0.060 * | −0.477 *** | −0.515 *** | −0.381 *** | −0.087 |

| (0.036) | (0.174) | (0.046) | (0.101) | (0.085) | |

| _cons | 18.755 *** | 14.003 * | −21.239 *** | −24.528 *** | 11.946 *** |

| (3.824) | (7.404) | (6.648) | (5.528) | (4.364) | |

| Time Fe | YES | YES | YES | YES | YES |

| Province FE | YES | YES | YES | YES | YES |

| Controls | YES | YES | YES | YES | YES |

| N | 132 | 96 | 132 | 175 | 185 |

| R2 | 0.991 | 0.991 | 0.991 | 0.989 | 0.981 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ji, Y.; Pang, X.; Yang, Y. The Impact of Digital Economy on the Cost of Carbon Emission Reduction—A Theoretical and Empirical Study Based on a Carbon Market Framework. Sustainability 2025, 17, 9771. https://doi.org/10.3390/su17219771

Ji Y, Pang X, Yang Y. The Impact of Digital Economy on the Cost of Carbon Emission Reduction—A Theoretical and Empirical Study Based on a Carbon Market Framework. Sustainability. 2025; 17(21):9771. https://doi.org/10.3390/su17219771

Chicago/Turabian StyleJi, Yuguo, Xinsheng Pang, and Yu Yang. 2025. "The Impact of Digital Economy on the Cost of Carbon Emission Reduction—A Theoretical and Empirical Study Based on a Carbon Market Framework" Sustainability 17, no. 21: 9771. https://doi.org/10.3390/su17219771

APA StyleJi, Y., Pang, X., & Yang, Y. (2025). The Impact of Digital Economy on the Cost of Carbon Emission Reduction—A Theoretical and Empirical Study Based on a Carbon Market Framework. Sustainability, 17(21), 9771. https://doi.org/10.3390/su17219771