1. Introduction

Environmental, Social, and Governance (ESG) factors provide a framework for evaluating the sustainability performance of companies and their impact on broader society and the environment. ESG has become an important concept in the financial and business world, as investors, regulators, and consumers increasingly demand responsible business practices. The environmental aspect (E) focuses on companies’ impact on the natural environment, including greenhouse gas emissions, the use of natural resources, and pollution reduction strategies [

1]. The social aspect (S) includes issues such as working conditions, employee rights, diversity and inclusion, and the company’s impact on local communities [

2]. The governance aspect (G) encompasses corporate governance structure, business ethics, and the transparency and accountability of management [

3].

The ESG concept began to take shape in the early 2000s, when investors started recognizing the link between sustainable practices and companies’ long-term financial performance. A key milestone in ESG development was the launch of the Principles for Responsible Investment (PRI), which encouraged financial institutions to integrate ESG factors into their investment decisions [

4]. Certain studies suggest that companies with strong ESG performance often achieve better long-term financial results by mitigating risks related to environmental and social issues and by improving their reputation and appeal to investors [

5]. At the same time, ESG provides a framework for meeting stakeholder expectations, including those of regulators, customers, and employees, who are increasingly demanding responsible business behavior.

However, ESG remains a topic of debate and challenge, primarily due to the lack of uniform standards for assessment and impact measurement. Different rating agencies use different methodologies to calculate ESG scores, which can result in inconsistent outcomes and make company comparisons difficult [

6,

7]. Despite these challenges, regulations in this area are evolving rapidly—for instance, the EU has introduced the Corporate Sustainability Reporting Directive (CSRD), which will require more standardized and transparent ESG reporting [

8].

The growing importance of ESG is driven not only by the expectations of investors and regulators but also by increasing consumer pressure, as consumers more frequently support companies with clearly defined sustainability commitments. Companies that integrate ESG into their business strategies can gain a competitive advantage, enhance their reputation, and increase their long-term performance [

9].

One of the key aspects discussed in academic and practical debates is how ESG influences or correlates with business performance. Research shows that companies actively integrating sustainable practices into their operations often enjoy greater stakeholder trust, reduced regulatory risks, and increased attractiveness to investors. However, the relationship between ESG and the firm’s performance is not always straightforward and can vary depending on specific ESG components as well as sectoral and regional factors. A study finds that overall ESG performance is positively linked to a firm’s performance, although the individual components (environmental, social, and governance) do not always have a consistent impact [

10]. This suggests that certain ESG aspects may influence business performance more or less, depending on the specific sector, regulatory environment, and company strategy. For example, companies in the energy sector may face greater pressure regarding the environmental aspect of ESG, while in the tech industry, governance factors such as innovation and ethics may be more critical.

In our research, we will conduct a thorough review of existing studies that have examined the relationship between ESG and business performance, and we will compare their findings. Additionally, we will carry out an empirical analysis of companies listed on the NASDAQ and NYSE, comparing their performance and ESG ratings over time. This will contribute to a better understanding of the long-term effects of ESG on companies’ financial performance and provide insight into how investors and firms can optimally integrate ESG strategies into their business models. A key part of our research will involve the use of both traditional regression models and feedforward neural networks, allowing us to capture linear as well as nonlinear relationships between ESG ratings and financial performance. This dual approach enables a more comprehensive analysis, revealing complex patterns that may not be apparent through standard regression alone, and provides deeper insight into how ESG practices relate to ROA and ROE across different firms and contexts.

To conclude, we aim to investigate whether higher ESG ratings are associated with improved corporate financial performance, measured by ROA and ROE, and whether these effects follow linear or nonlinear patterns across different industries and firm characteristics.

Therefore, the structure of the research will include a literature review, where we will analyze existing studies and compare their findings. Next, we will describe the research methodology, including company selection, the time period of analysis, and the statistical methods used. In the empirical section, we will present the results of the analysis of NASDAQ–NYSE-listed companies and their ESG rating trends in relation to financial performance. In addition, we will use explainable artificial intelligence (XAI) methods to improve the transparency and interpretation of the results. The discussion will focus on interpreting the results and comparing them with existing studies, and the conclusion will summarize the key findings and provide suggestions for future research and practical implications.

2. Literature Review

The cumulative analysis of global studies on the impact of ESG activities on corporate financial performance reveals a complex, yet mostly positive, relationship between sustainable management and the firm’s financial performance. In one of the research [

11], authors explain that at the global level, ESG initiatives generally have a positive or neutral impact on operational efficiency, return on assets, and market value, with governance-related disclosures proving particularly important—though only up to a moderate level, suggesting the need for a balanced approach to ESG reporting. Some authors complement this picture with empirical evidence showing that firms with higher ESG performance achieve significantly better accounting indicators (ROE, ROA), with positive effects particularly evident in good governance practices and attention to internal stakeholders, while market response to defensive mechanisms such as anti-takeover measures is negative [

12]. Collectively, these studies confirm that when strategically integrated and transparently managed, ESG activities are not only an ethical imperative but also a significant driver of the firm’s financial performance for companies on a global scale.

In this context, another finding is also important, as it is built on earlier global analyses by focusing on 351 companies from the FTSE350 index, which includes firms from various countries, maintaining the study’s international comparability [

13]. Using a similar methodology, which also incorporates dynamic panel regression approaches, the authors found that overall ESG performance has a statistically significant positive effect on firms’ financial results during the 2002–2018 period. A familiar pattern reappears, as not all ESG components exert the same level of influence: some elements show positive effects, while others are not significant. The study’s key insight is that larger companies, similar to other findings [

14], derive more pronounced benefits from ESG strategies, indicating that company size and visibility play an important role in translating sustainable practices into financial performance.

Global research was conducted on publicly traded companies [

7], where authors examined ESG factors from an investor’s perspective. They highlight significant discrepancies in corporate ESG reporting and ratings, largely due to the subjective selection, weighting, and measurement of ESG topics. To explore the financial relevance of ESG performance, they conduct an econometric analysis using LSEG ESG scores from 2021 and 2022 for over 700 publicly traded companies listed on the NYSE. Preliminary findings indicate that ESG performance has a statistically significant and positive impact on financial outcomes.

The shift to European research further confirms the findings of global and FTSE-based studies, showing that the relationship between ESG performance and financial indicators such as ROE and ROA is also held in the European context. In a quantitative panel data analysis of 115 European companies between 2016 and 2020, authors found a statistically significant positive relationship between ESG scores and firms’ financial performance [

15]. Indicators such as levered free cash flow, return on equity, current ratio, and quick ratio were used. Other authors [

16], who analyzed 1038 public companies from 22 European countries over a shorter but data-rich period (2018–2019), also report a positive relationship between ESG indicators and return on equity and assets. Their study stands out, using machine learning methods combined with logistic regression to evaluate both the predictive power and potential causality of relationships. A notable contribution of this study is its emphasis on environmental innovation, diversity policies, and human capital investment, which were identified as key drivers of stronger financial outcomes. Both studies confirm that in the European environment, ESG performance is not only a social imperative but also a significant economic factor that can enhance profitability and long-term corporate stability.

Following the review of European studies confirming a positive relationship between ESG performance and corporate financial results, similar patterns emerge in the Asian context, where quantitative methods—often based on panel regressions—and indicators such as ROA and ROE also dominate. In South Korea, authors found that ESG practices positively influence firm performance, though the effects vary by industry and governance strength [

17]. Another study [

18], also on South Korea, found that ESG effects differ across industries—being most pronounced in the technology and environmental sectors, especially in competitive and fast-growing industries where ESG serves as a differentiation mechanism. These Asian studies collectively confirm that ESG practices also contribute to higher firms’ financial performance in rapidly developing markets, but their strategies must be tailored to the industrial characteristics of the environment.

So far, we have found that ESG factors generally have a positive impact on firm financial performance, but the effects are not uniform and often vary depending on the ESG component, industry, company size, and method of implementation. Some other studies point out that environmental measures often do not yield immediate results and may be less effective if not supported by actual changes [

10,

19]. Similarly, disclosures without proper implementation can lead to negative market reactions, raising questions about investor trust and the credibility of reporting. The issue of inconsistent ESG evaluations and the risk of “greenwashing,” which can seriously undermine trust in ESG initiatives if the quality of information is not ensured, was highlighted [

20]. Likewise, other authors find that ESG can improve financial performance only when adequate resources and capacities for implementation exist [

21]. These findings lead us to an increasingly prevalent question: Can ESG activities, despite good intentions, also become a source of negative effects on a company’s financial performance? In the following section, we will examine studies that specifically explore these negative aspects of ESG strategies and their potential impact on financial performance.

In Europe—despite the common perception that it is sustainability-oriented—numerous studies reveal complex and often contradictory relationships between ESG performance and financial indicators. In Italy, research analyzed 54 listed companies and found that ESG scores had no positive effect on abnormal stock returns [

22]. On the contrary, they detected a negative relationship between ESG performance and financial results. Similarly diverse findings come in Norway, where ESG performance positively affects Tobin’s Q—a market valuation metric—but negatively affects return on assets (ROA) [

23]. This underlines the importance of distinguishing between different financial indicators and recognizing that ESG strategies may yield benefits with a delay, not necessarily reflected in short-term accounting metrics. In the UK, authors find that firms with lower social ratings achieved higher market returns compared to those with high social performance, especially in the environmental domain [

24]. This raises questions about the perception of ESG as a cost rather than an investment with immediate returns, a viewpoint that may also prevail in developed capital markets.

We conclude with the study, which focuses on whether financial performance is linked to higher environmental, social, and governance (ESG) scores in emerging markets, specifically for multinationals in Latin America [

25]. Their study tested hypotheses using linear regression on data from 104 multinational companies from Brazil, Chile, Colombia, Mexico, and Peru during the 2011–2015 period. Results show that the relationship between ESG scores and firm financial performance is significantly negative. They also separately analyzed environmental, social, and governance dimensions and found a negative relationship between each of these components and financial performance. Additionally, the empirical analysis provides evidence of a moderating effect of financial slack and geographic international diversification on this relationship.

To summarize, key findings from numerous global, European, and Asian studies indicate that ESG performance and its impact on financial outcomes depend on multiple factors, with no uniform pattern. Positive effects of ESG on the firm’s financial performance, measured with financial indicators like return on equity (ROE) and return on assets (ROA), are more common among larger, high-profile companies with balanced and transparent ESG reporting, especially when emphasizing effective governance and internal stakeholders. Industry is also critical—competitive sectors often show more positive effects. Additionally, individual ESG components vary in effectiveness: governance generally has the most positive influence, while environmental and social effects depend on actual implementation and perceived credibility. Negative effects tend to occur when ESG activities are not strategically planned, are largely symbolic (e.g., greenwashing), or impose costs without clear benefits—highlighting the importance of high-quality execution and tailoring ESG approaches to the specific circumstances of the firm.

In addition to examining the direct relationship between ESG performance and financial outcomes, recent research emphasizes that risk plays a crucial mediating role in understanding the ESG–performance nexus. Several studies highlight that ESG engagement not only influences profitability but also reshapes firms’ and investors’ exposure to various forms of risk. For example, in a study, an author presents an ESG-constrained portfolio optimization model showing that investors’ differing preferences toward environmental, social, and governance dimensions alter their effective risk aversion and portfolio allocation, especially when considering tail-value-at-risk [

26]. Similarly, in another research authors demonstrate that sustainability-oriented portfolios can maintain or even improve risk-adjusted performance compared to conventional ones, with higher ESG scores often associated with superior risk–return profiles when screening levels are appropriately defined. These findings suggest that ESG integration can enhance portfolio resilience, linking sustainability with efficient risk management [

27]. Furthermore, there is a finding that ESG scores are key determinants of firms’ market betas, indicating a strong connection between sustainability practices and systematic risk across industries [

28]. Together, these studies underscore that ESG should not be analyzed solely in terms of financial performance indicators like ROA and ROE but also through its capacity to mitigate credit, market, and systemic risks—reinforcing the need for a more comprehensive and risk-aware understanding of ESG’s role in corporate and investment performance.

3. Materials and Methods

3.1. Data

The dataset used in this study was obtained through private access from a data provider, FMP (

https://site.financialmodelingprep.com/developer/docs/stable, accessed on 28 August 2025), utilizing API connections to retrieve the required data. This approach ensured both efficiency and consistency in data collection and enabled access to a comprehensive set of financial and ESG-related information.

The sample includes companies listed on the NASDAQ and NYSE. For these firms, we collected the relevant financial indicators and other variables necessary for empirical analysis, following the principles of economic theory and a thorough review of the existing literature.

The dependent variables used in the analysis are Return on Assets (ROA) and Return on Equity (ROE), which represent two key measures of firm-level financial performance. The explanatory variables were grouped into several categories: (1) ESG indicators—representing environmental, social, and governance scores assigned to each firm, (2) demographic variables—including the firm’s sector classification, continent, and the number of employees, (3) lagged values of the dependent variables, and (4) lagged values of financial indicators—these were selected across six thematic groups: (i) growth, (ii) profitability, (iii) capital expenditures and investment, (iv) cash flow and liquidity, (v) debt and financial structure, and (vi) operational efficiency and cycles.

Lagged values of the dependent variables are included to capture dynamic effects and allow for the persistence of financial performance over time, which tends to exhibit path-dependence, and past performance often influences current performance. Including lagged dependent variables improves the model’s ability to reflect this dynamic behavior. The use of lagged financial variables is crucial for mitigating issues of endogeneity and reverse causality. By using past values, we aim to ensure that the explanatory variables are determined before the realization of the current performance outcomes (ROA and ROE), thus reducing the risk of simultaneity bias. Moreover, special care was taken to exclude financial indicators that are directly or indirectly derived from or highly correlated with the dependent variables. This decision is grounded in the need to maintain the analytical integrity of the model and avoid multicollinearity, which could distort the interpretation of results and reduce the explanatory power of individual variables.

After constructing the raw dataset, we proceeded with a series of data cleaning steps to ensure the integrity and reliability of the empirical analysis. First, we excluded all observational units with missing values or inconsistent data entries. This step was essential to avoid biased estimates and computational errors that may arise due to incomplete information or data anomalies. Subsequently, we applied a value-based filtering procedure focused on the two dependent variables, ROA and ROE. Specifically, we retained only those observations where ROA and ROE values fall within the interval [−1,1]. This range was chosen to remove extreme outliers that could distort statistical estimates and undermine the generalizability of the findings. While values beyond this range are theoretically possible, they are typically associated with either data quality issues or extraordinary, non-representative financial events. Additionally, it is important to emphasize that the selected bounds are still relatively wide, allowing for substantial variability in firm performance. However, in order to maintain a sufficiently large sample size, we opted for moderately conservative thresholds rather than more aggressive outlier exclusion. This trade-off ensures a balance between data quality and the statistical power of our models, enabling robust inference without sacrificing general representativeness.

This final dataset of 6681 rows of observations, refined through systematic filtering, serves as the foundation for the empirical analysis presented in the following sections. The inclusion of all the variables is presented in

Table 1.

3.2. Methods

To analyze the relationship between ESG factors and firm performance, we employed a dual-method approach combining traditional econometric analysis, regression, and modern machine learning techniques, a feed-forward neural network. Before applying the models, we made several important adjustments to the explanatory variables to improve interpretability and ensure suitability for both linear and nonlinear modeling approaches.

Specifically, the continuous ESG score was transformed into a categorical variable with three levels: (1) class 1 represents firms with low ESG scores, (2) class 2 includes firms with medium ESG scores, and (3) class 3 consists of firms with high ESG scores. This transformation allows for clearer comparisons across distinct ESG performance tiers and facilitates the identification of potential threshold effects that may not be captured by continuous specifications. In addition, the number of employees was converted into a relative measure, where each firm’s value was divided by the overall average number of employees across the full sample. This standardization helps mitigate size-related distortions and ensures that the variable reflects relative scale rather than absolute magnitude, which may vary greatly between sectors and would otherwise dominate the model purely due to numerical size. Furthermore, sectoral and continental dummy variables were introduced to control structural differences across industries and regions. However, due to the overwhelming dominance of North American firms in the sample, we excluded the minority of firms located outside of North America. This step reduced regional heterogeneity and improved comparability across observations.

3.2.1. Regression

As a first step, we applied regression analysis to assess the statistical significance and explanatory power of ESG when considered alongside other control variables. The goal was to determine whether ESG classification remains a relevant predictor of the firm’s financial performance when accounting for a broader set of financial and demographic characteristics.

We constructed two separate regression models, one for each dependent variable, ROA and ROE. Each model included the lagged value of the respective dependent variable (i.e., lagged ROA when modeling ROA, and lagged ROE when modeling ROE) to capture persistence and dynamic effects in firm performance over time. This specification allows each model to reflect the underlying behavior of its specific performance indicator more accurately.

To identify the most relevant predictors, we employed a stepwise regression approach with an intercept, which iteratively adds or removes explanatory variables based on predefined statistical criteria (e.g., significance levels). Stepwise selection is particularly useful in high-dimensional settings with many potential predictors, as it reduces the risk of overfitting while retaining variables that offer genuine explanatory power. By starting with a constant and allowing variables to enter or exit the model based on their incremental contribution, this method balances model simplicity and robustness.

3.2.2. Feed-Forward Neural Network

Given our assumption that the relationship between ESG scores and a firm’s financial performance may be nonlinear in nature—both in how ESG ratings are determined and how they interact with financial indicators—we also employed a Feedforward Neural Network (FFNN) as a complementary modeling approach. Traditional linear models may fail to capture complex, layered dependencies between variables, especially when threshold effects, interactions, or diminishing returns are present. For this reason, FFNNs offer a valuable alternative, as they are capable of modeling nonlinear relationships without requiring a priori specification of functional forms.

FFNNs are particularly effective in this context because of their ability to approximate virtually any continuous function, given sufficient complexity and training data. This makes them well-suited for detecting subtle patterns or interactions among ESG-related variables and financial characteristics that could influence firm performance in ways not easily captured by standard regression models.

As in the regression analysis, we constructed two separate neural network models—one for predicting ROA and another for ROE. This separation allowed each network to be optimized specifically for its target variable, taking into account its unique distributional properties and relevant explanatory factors.

Each FFNN followed a three-layer architecture: (1) the input layer contained as many nodes as there were explanatory variables in the model, (2) the hidden layer served as the core computational structure, where we experimented with different numbers of hidden neurons to identify the optimal architecture, and (3) the output layer consisted of a single neuron producing a continuous prediction for either ROA or ROE, depending on the specific model.

This architecture strikes a balance between complexity and interpretability, allowing the model to uncover non-obvious interactions while maintaining a manageable structure suitable for explainability techniques in subsequent analysis.

To ensure optimal performance of the FFNN models, we scaled all input variables prior to training. This preprocessing step is crucial for neural networks, as it prevents variables with larger numerical ranges from dominating the learning process and ensures more stable and efficient convergence during optimization. Without proper scaling, the network might become biased toward features with larger magnitudes, which could distort the learning dynamics and reduce predictive accuracy.

4. Results and Discussion

4.1. Regression

As previously outlined in the

Section 3.2, we constructed separate regression models for each dependent variable, namely ROA and ROE, to account for their distinct dynamics and relevant lag structures. The results for the ROA regression model are summarized below and shown in

Table 2.

The final model for ROA includes 21 statistically significant explanatory variables at conventional significance levels. Notably, the ESG categorical variable emerged as statistically significant, with a positive regression coefficient, indicating that firms in higher ESG categories tend to exhibit better financial performance as measured by ROA. This suggests that stronger ESG performance is associated with improved operational efficiency or risk mitigation, translating into higher asset returns.

Among the demographic variables, the relative number of employees was significant, suggesting that firm size (when changed to a relative measure) has a meaningful impact on ROA. In addition, several interaction terms between ESG category and specific sectors were also retained in the model, highlighting that the effect of ESG performance on ROA may differ by industry. This aligns with the idea that ESG relevance is context-dependent, with certain sectors (e.g., communication services, technology, real estate, healthcare) being more sensitive to ESG practices than others.

As expected, the lagged value of ROA was significant with a positive regression coefficient, indicating persistence in firm-level profitability in a positive direction. This validates the decision to include dynamic effects in the regression framework and confirms that past performance influences current outcomes.

Importantly, the final model includes at least one significant variable from each of the six financial indicator groups—growth, profitability, capital expenditures and investment, cash flow and liquidity, debt and financial structure, and operational efficiency and cycles. This breadth ensures that the model captures a well-rounded view of the financial dimensions influencing ROA, rather than being overly reliant on a single category. It also reflects the complex nature of firm performance, which is driven by multiple, interrelated factors.

The R2 of the model is 25.6%, which, although not particularly high, is acceptable and expected in the context of economic and financial modeling, where firm performance is inherently influenced by a multitude of unobservable or external factors. The relatively modest R2 reflects the high variability typical of real-world financial data and underscores the challenge of achieving strong predictive accuracy in such settings. Nevertheless, the primary objective of this analysis was not to maximize predictive power, but rather to assess the statistical significance and relevance of ESG performance when controlling for other financial and demographic variables. In this respect, the model succeeds in demonstrating that ESG is a robust and meaningful determinant of ROA, while also confirming the complementary explanatory roles of additional variables.

Additionally, there are statistics such as Log-Likelihood, AIC, and BIC values that were used as additional criteria when optimizing the regression models. The Durbin–Watson statistic was applied to verify the correct specification of the model. In our case, the Durbin–Watson value was approximately 1.5, which is within the generally acceptable range of 1.5 to 2.5, indicating no significant autocorrelation in the residuals. Finally, the p-value of the Jarque–Bera test is 0.000, indicating statistical significance and confirming that the residuals are not normally distributed. This implies that the ordinary least squares estimator may not fully satisfy its assumptions. For this reason, we did not further optimize the regression model, as it primarily served as a benchmark and reference point for the subsequent feedforward neural network (FFNN) analysis. Since both the residuals and the dependent variable deviate from normality, the regression results should be interpreted with some caution. However, given the large sample size, the potential bias is expected to be minimal, and the overall findings remain robust and informative.

The second regression model was developed to explain Return on Equity (ROE) using the same methodological framework as the ROA model. This model yielded 19 statistically significant explanatory variables, reflecting a similarly rich structure of relevant predictors. The results are shown in

Table 3.

Consistent with the ROA results, the categorical ESG variable was again statistically significant, with a positive regression coefficient. This finding reinforces the conclusion that firms with stronger ESG performance tend to achieve superior financial outcomes. In the context of ROE, this may reflect enhanced investor confidence, better governance practices, or improved access to capital, all of which can contribute to higher returns on equity.

Among the demographic variables, the relative number of employees again proved significant, indicating that relative firm size plays an important role in shaping financial performance. In addition, the same interaction terms between ESG categories and industry sectors that were found significant in the ROA model also appear in the ROE model. This suggests that the moderating effect of industry context on ESG’s impact is stable across performance metrics, highlighting the robustness of the ESG-sector interaction.

As in the ROA model, the lagged value of ROE was statistically significant and positively associated with the dependent variable. This result confirms the persistence of equity-based performance and supports the inclusion of dynamic terms in the model. Furthermore, the model also includes at least one significant variable from each of the six financial indicator groups. This comprehensive representation ensures that the model captures the multi-dimensional nature of firm performance, consistent with the principles of financial analysis and corporate valuation. The R2 of the ROE model is 16.6%, for which a similar explanation as before is valid.

The interpretation of the statistical indicators presented in this table follows the same rationale as discussed for

Table 2. The Log-Likelihood, AIC, and BIC values were used as supporting criteria for model optimization, and the Durbin–Watson statistic confirmed an acceptable model specification. The Jarque–Bera test again showed significant non-normality of the residuals, indicating that the results should be interpreted with some caution; however, given the large sample size, the potential bias is expected to be minimal. As before, certain automatically generated statistics are reported for completeness but are not central to our analysis.

4.2. Feed-Forward Neural Network

The primary purpose of applying FFNN in our analysis was not to achieve superior predictive accuracy, but rather to explore the nonlinear relationships—particularly between ESG performance and financial performance indicators (ROA and ROE). Traditional linear regression models are limited in their ability to capture such complex interactions. FFNNs, on the other hand, are well-suited to this task due to their flexible architecture and capacity to approximate arbitrary nonlinear functions.

Two separate FFNN models were constructed—one for each dependent variable. For the ROA model, a structure with three hidden layers was found to offer an optimal balance between model complexity and interpretability. In contrast, the ROE model required a deeper architecture with ten hidden layers to sufficiently capture the relevant patterns in the data. This difference may be attributed to the greater volatility and noisier signal typically associated with equity-based returns, which often demand more complex modeling frameworks to identify meaningful relationships.

While prediction was not the primary goal, we still assessed the predictive performance of the FFNNs to better understand how well the nonlinear structure fits the data. To do this, we estimated a simple linear regression model in which the actual value of the dependent variable was regressed on the predicted values generated by the FFNN.

For the ROA model, this yielded an R2 of 27.4%, slightly higher than the 25.6% achieved in the classical regression framework. For the ROE model, the R2 remained exactly 16.6%, equal to the result from the regression model. These outcomes suggest that FFNNs can offer marginal gains in predictive power—especially when the underlying relationships are nonlinear, as appears to be the case for ROA. However, the identical R2 for ROE across both models implies that, in this instance, the structure of the data does not permit improved learning beyond what was already captured linearly.

To gain further insights into the nonlinear influence of ESG performance on firm financial outcomes, we conducted a sensitivity analysis using the trained FFNN models. The goal was to isolate and visualize the effect of ESG scores on predicted ROA and ROE, while keeping all other explanatory variables constant.

We first constructed an average input vector, where each explanatory variable was set to its mean value across the full dataset. This serves as a representative or “baseline” firm. In order to perform sensitivity analysis, we selected a single variable to vary systematically—the ESG score, which is the primary focus of this study. Since all variables, including ESG, were scaled to the 0,1 range, we varied the ESG value from 0 to 1 in increments of 0.1, resulting in 11 distinct values. For each of these ESG scores, we kept all other input variables fixed at their average values and recorded the corresponding predicted values of the dependent variable (ROA or ROE) from the FFNN model.

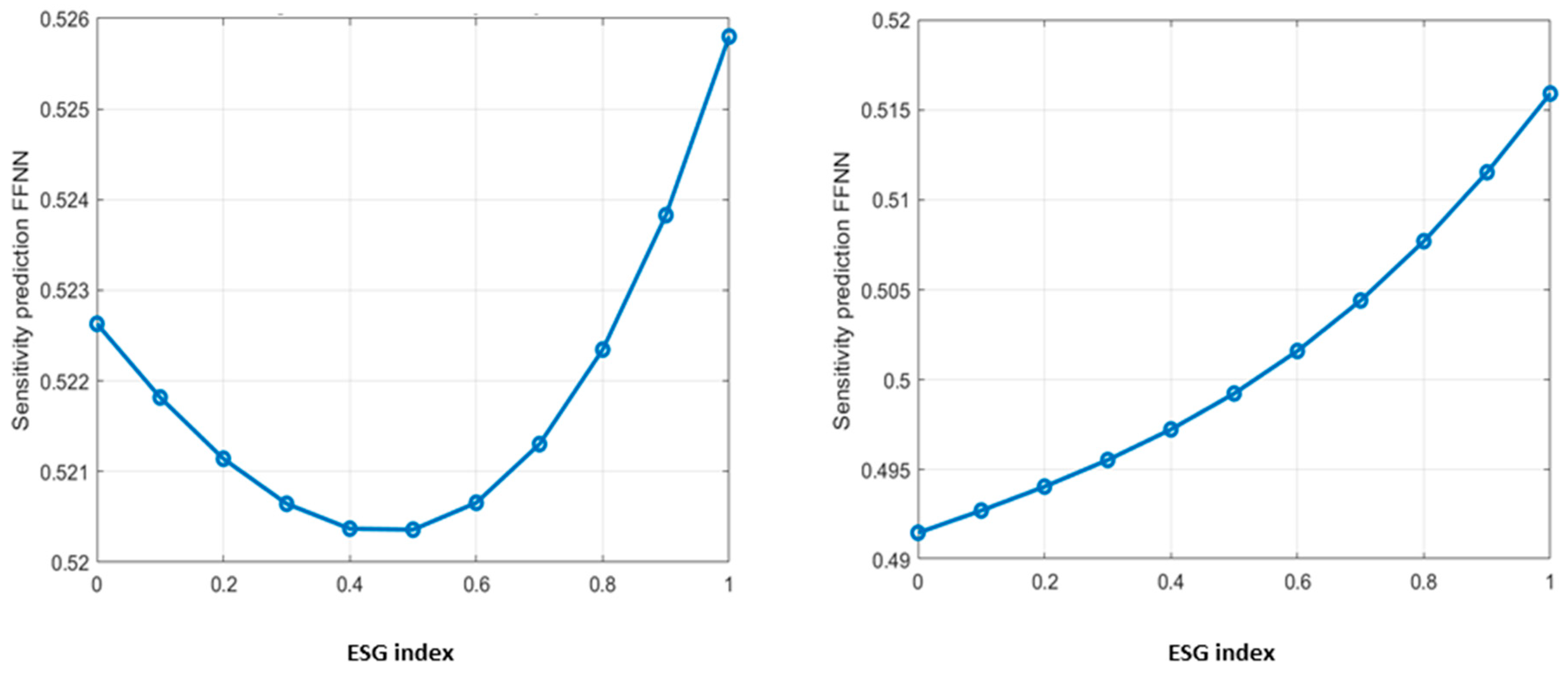

The results are presented graphically in

Figure 1 for ROA (left) and ROE (right). These plots illustrate the nonlinear response of the firm’s financial performance to changes in ESG performance. This approach allows us to visualize the marginal effect of ESG while holding other factors constant and provides an intuitive understanding of how improvements (or declines) in ESG scores might translate into expected financial outcomes. Furthermore, the sensitivity curves highlight any thresholds, helping us determine whether ESG effects exhibit diminishing returns, or whether they become impactful only beyond a certain level—insights that are often inaccessible via linear modeling approaches.

The sensitivity analysis reveals clear nonlinear relationships between ESG performance and a firm’s financial performance, with notable differences between ROA and ROE as dependent variables.

The ROA curve (left) exhibits a pronounced nonlinear pattern, which is consistent with the higher explanatory power of the FFNN model for ROA (R2 of 27.4%) compared to ROE (R2 of 16.6%). This suggests that ESG effects on ROA are more complex and better captured through a nonlinear modeling approach, whereas the relationship with ROE appears to be less intricate. Additionally, for ROA, the curve shows an initial decline in predicted profitability as ESG scores increase from 0 to approximately 0.5. This may reflect that firms with lower to mid-range ESG scores could be investing in ESG initiatives without yet seeing positive returns, possibly due to initial adjustment of costs, reallocation of resources, or reputational lag in financial performance. However, beyond a score of 0.5, the curve starts to rise more sharply, suggesting that firms with strong ESG performance may begin to realize tangible benefits that translate into higher profitability. This turning point highlights a potential threshold effect, where only sufficiently high ESG engagement yields measurable financial gains in terms of ROA.

The ROE curve (right), in contrast, demonstrates a monotonic increasing pattern. While the increase is more gradual for ESG values below 0.5, the slope becomes steeper beyond this midpoint, indicating an accelerated positive effect of ESG on equity returns at higher ESG levels. This smoother shape with fewer nonlinear fluctuations aligns with the lower predictive power of the FFNN model for ROE, implying that ESG performance explains ROE less intricately than it does for ROA. Nevertheless, the curve still reflects a positive and economically meaningful relationship, supporting the idea that high ESG performance contributes to better returns for shareholders—albeit in a more linear or delayed fashion.

Together, these results support the notion that ESG impacts both accounting-based (ROA) and market-based (ROE) measures of financial performance, but in different ways. ROA seems to be more sensitive to ESG investment thresholds, while ROE responds steadily but more conservatively to ESG improvements. This underscores the value of using nonlinear modeling techniques, such as FFNN, to uncover latent patterns in the ESG–performance relationship that may not be visible through traditional regression analysis.

5. Conclusions

This study set out to explore the relationship between ESG ratings and corporate financial performance, focusing specifically on two key profitability indicators: Return on Assets (ROA) and Return on Equity (ROE). Given the growing relevance of sustainability in business practices, understanding whether higher ESG scores translate into superior financial outcomes—and whether such effects are linear or more complex—is of substantial importance.

Methodologically, we employed a dual approach by combining traditional regression models with feedforward neural networks (FFNN), allowing us to assess both linear and nonlinear patterns. Our results demonstrate that ESG is a statistically significant predictor of financial performance, with a consistently positive relationship observed in both ROA and ROE models. Importantly, interaction effects with demographic and sectoral characteristics revealed that the impact of ESG is not universal—it varies depending on firm-specific and environmental factors.

The use of FFNNs further confirmed that the relationship between ESG and financial outcomes is not purely linear. Especially for ROA, we observed pronounced nonlinearities, suggesting the existence of threshold effects, where ESG benefits become more apparent beyond a certain point. In the case of ROE, although the nonlinear pattern was more subdued, a clear upward trend was still present.

While this study provides valuable insights, several limitations should be acknowledged. First, the analysis is based on data from firms listed on NASDAQ and NYSE, with a strong concentration of observations from North America. As a result, the findings may not generalize to firms operating in other regulatory, cultural, or market environments, particularly in emerging markets or under different corporate governance structures.

Moreover, although ESG was found to be significant, our analysis relied on static ESG scores at specific time points. ESG ratings themselves can be inconsistent across providers and may not fully capture forward-looking or qualitative aspects of sustainability.

Nevertheless, these findings contribute to a more nuanced understanding of the role of ESG in corporate financial performance. They indicate that strong ESG practices can be associated with improved financial outcomes, particularly when embedded within the broader operational and structural context of the firm. This has important implications for both investors and corporate decision-makers, as it suggests that sustainability efforts are not merely a regulatory or reputational necessity, but potentially a strategic lever for long-term value creation.

Future research could extend this analysis by incorporating longitudinal ESG data, examining firms from other regions, or exploring additional performance metrics to further validate and generalize the observed relationships. Moreover, the nonlinear effect suggests that modeling ESG in a more complex way within the regression framework could provide a more robust and interpretable econometric assessment of ESG’s impact on financial performance.