Carbon-Aware Dispatch of Industrial Park Energy Systems with Demand Response and Ladder-Type Carbon Trading

Abstract

1. Introduction

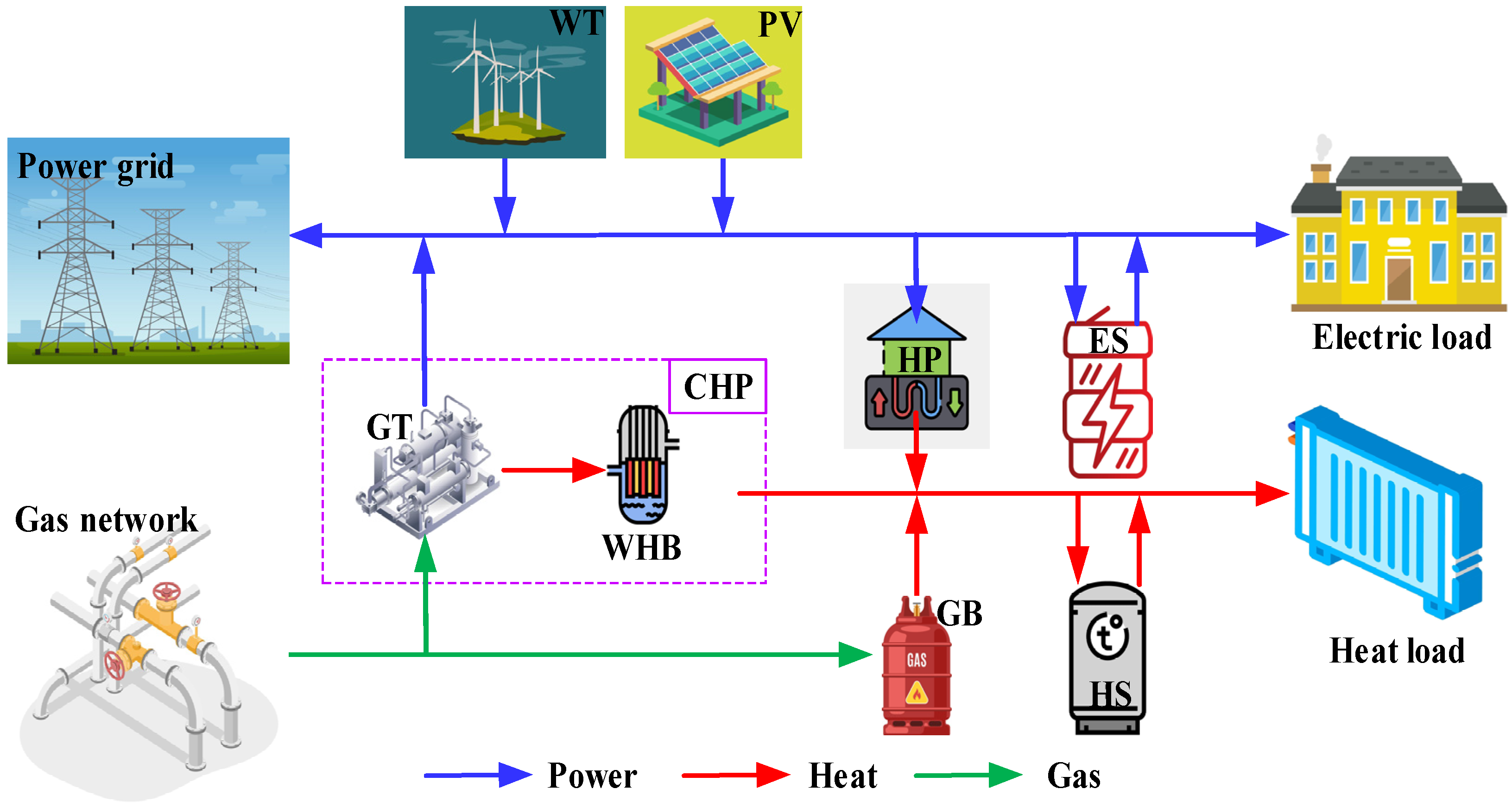

2. System Modeling

2.1. The IES Model

2.2. IES Equipment Model

- (1)

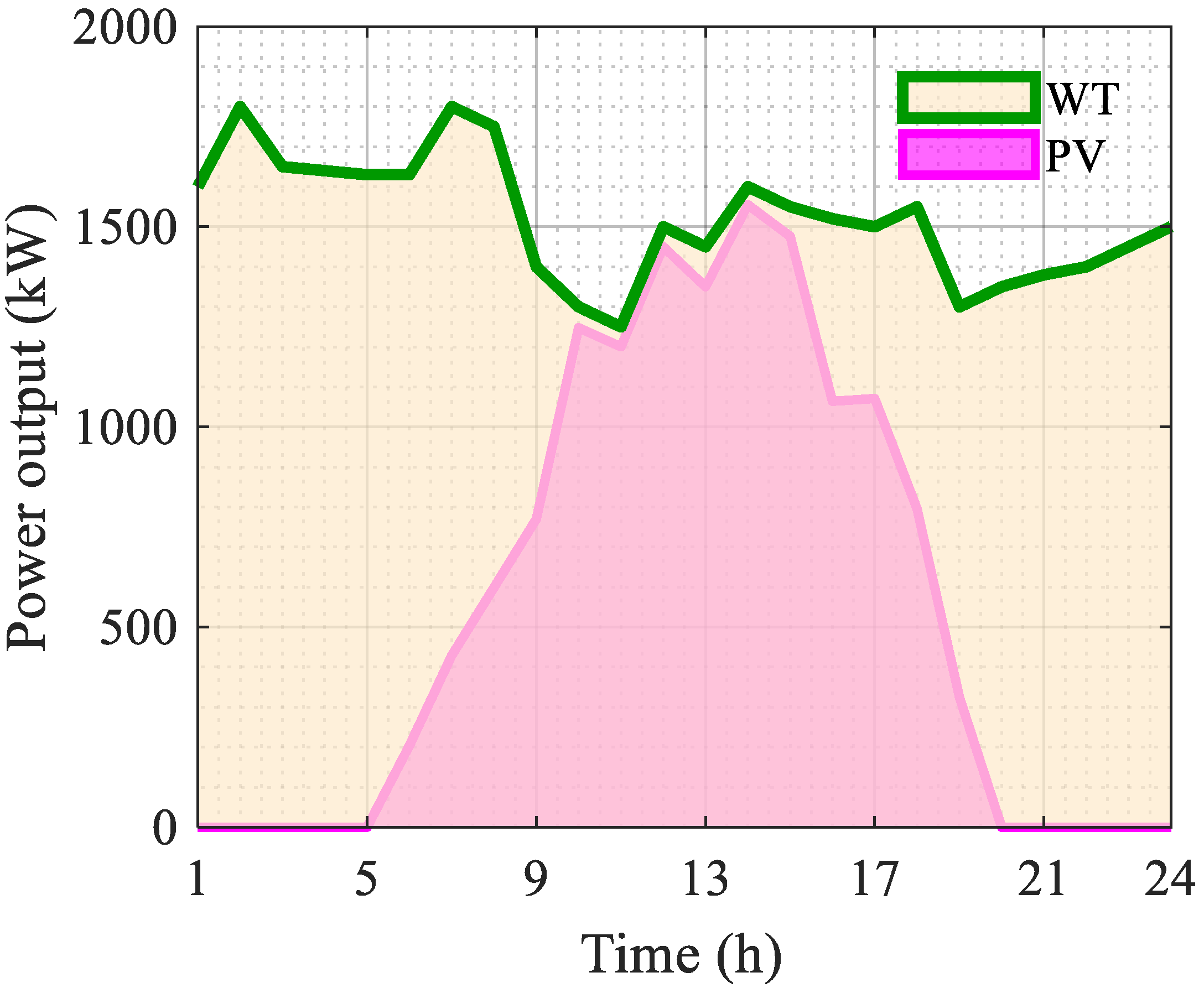

- PV and WT

- (2)

- GT model

- (3)

- WHB model

- (4)

- HP model

- (5)

- GB model

- (6)

- ES model

- (7)

- HS model

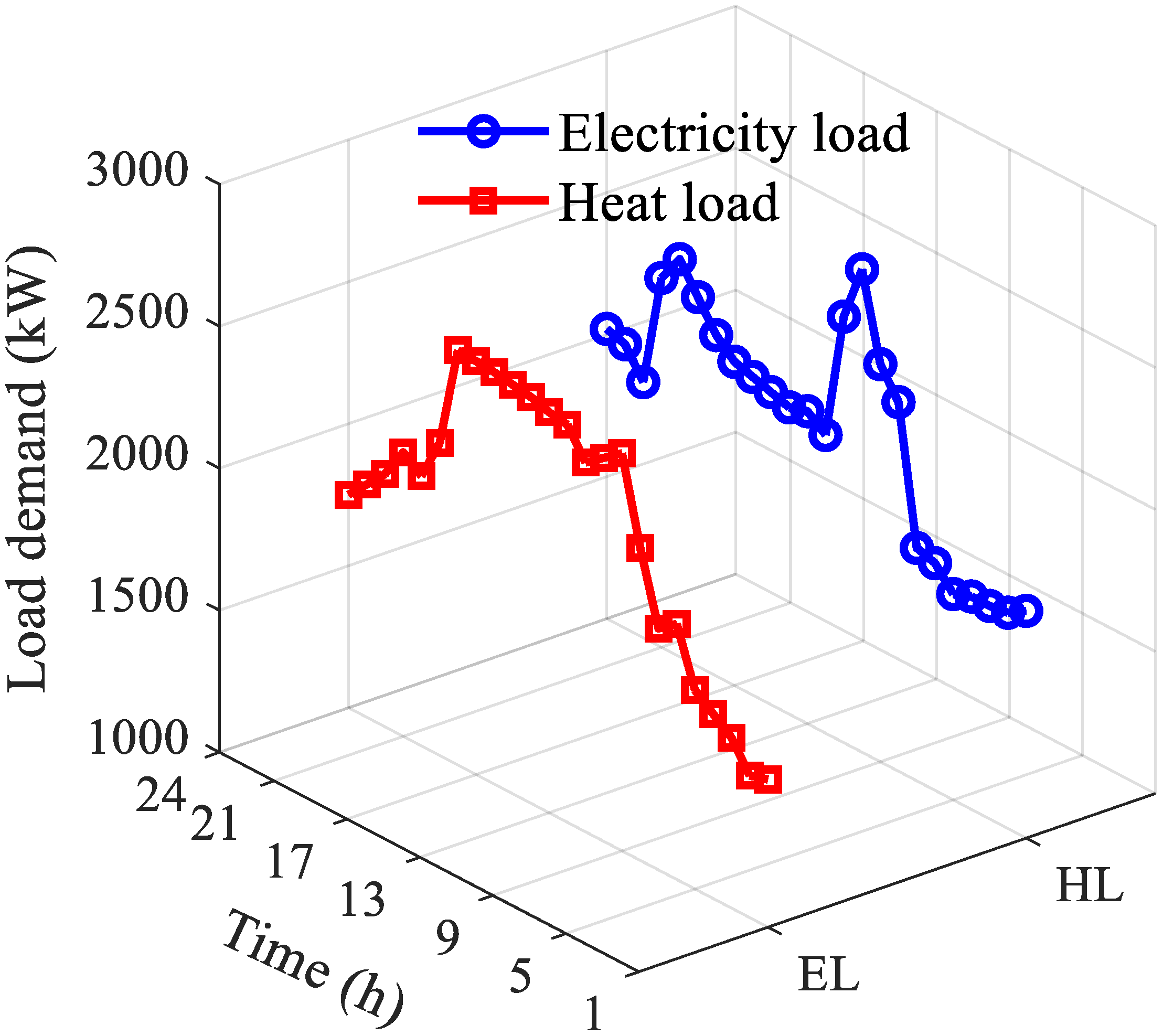

2.3. DR Modeling

- (1)

- Price-oriented DR program

- (2)

- Replaceable DR

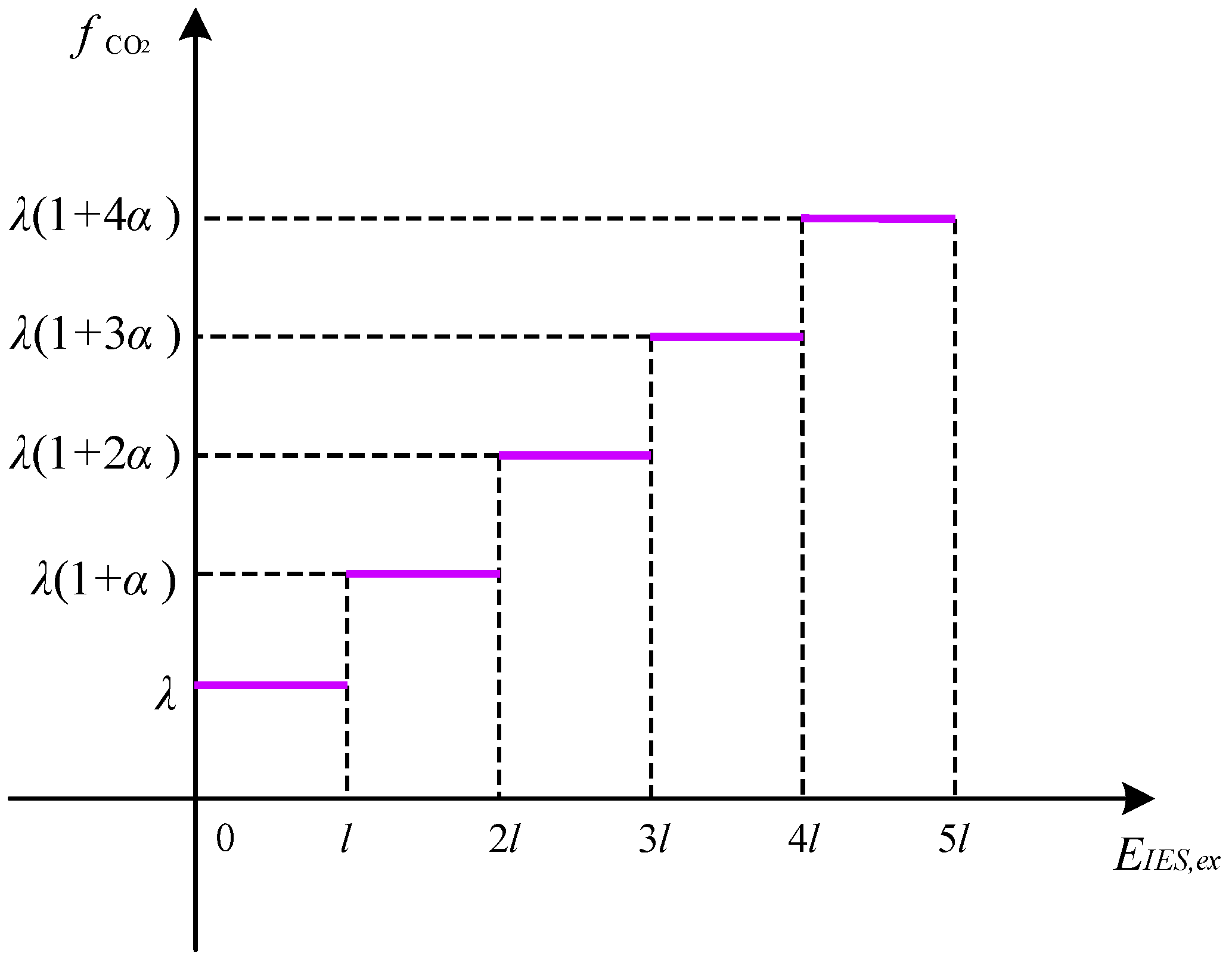

2.4. Laddered Carbon Trading Mechanism

- (1)

- Carbon emission allowance model

- (2)

- Actual carbon emission modeling

- (3)

- Stepped carbon trading framework

3. Optimization of the Operating Model

3.1. Objective Function

- (1)

- Energy purchase cost . The system can trade power with the higher-level grid, purchasing power from the higher-level grid when generation cannot meet its own demand and, accordingly, selling excess power to the higher-level grid when there is a surplus of generation. Moreover, natural gas procurement is required to support the operation of the CHP and GB.

- (2)

- Operation and maintenance costs

- (3)

- Carbon transaction cost. The carbon transaction cost of an operational cycle is the sum of all momentary costs, Equation (17).

3.2. Constraints

- (1)

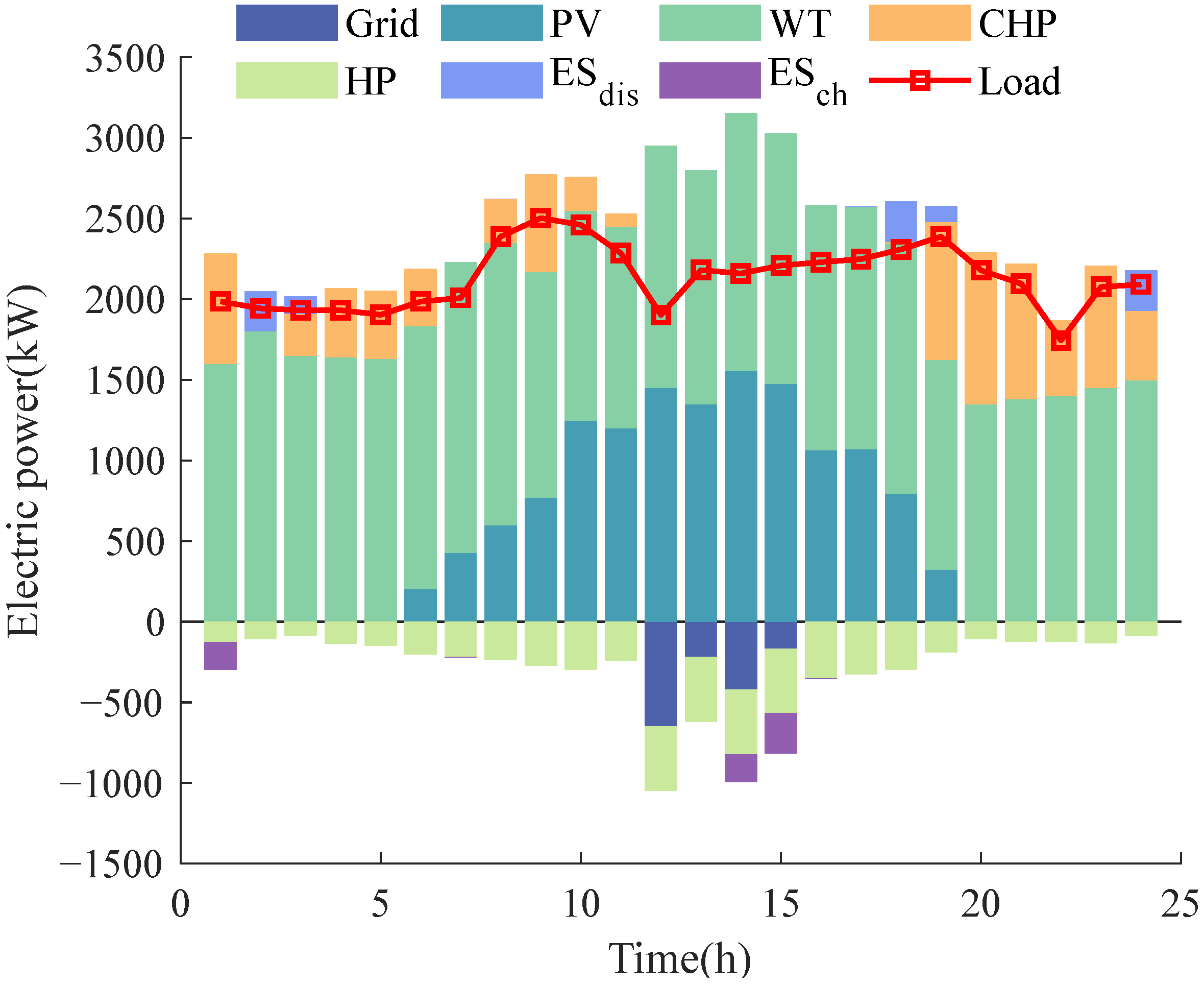

- Electric power balance

- (2)

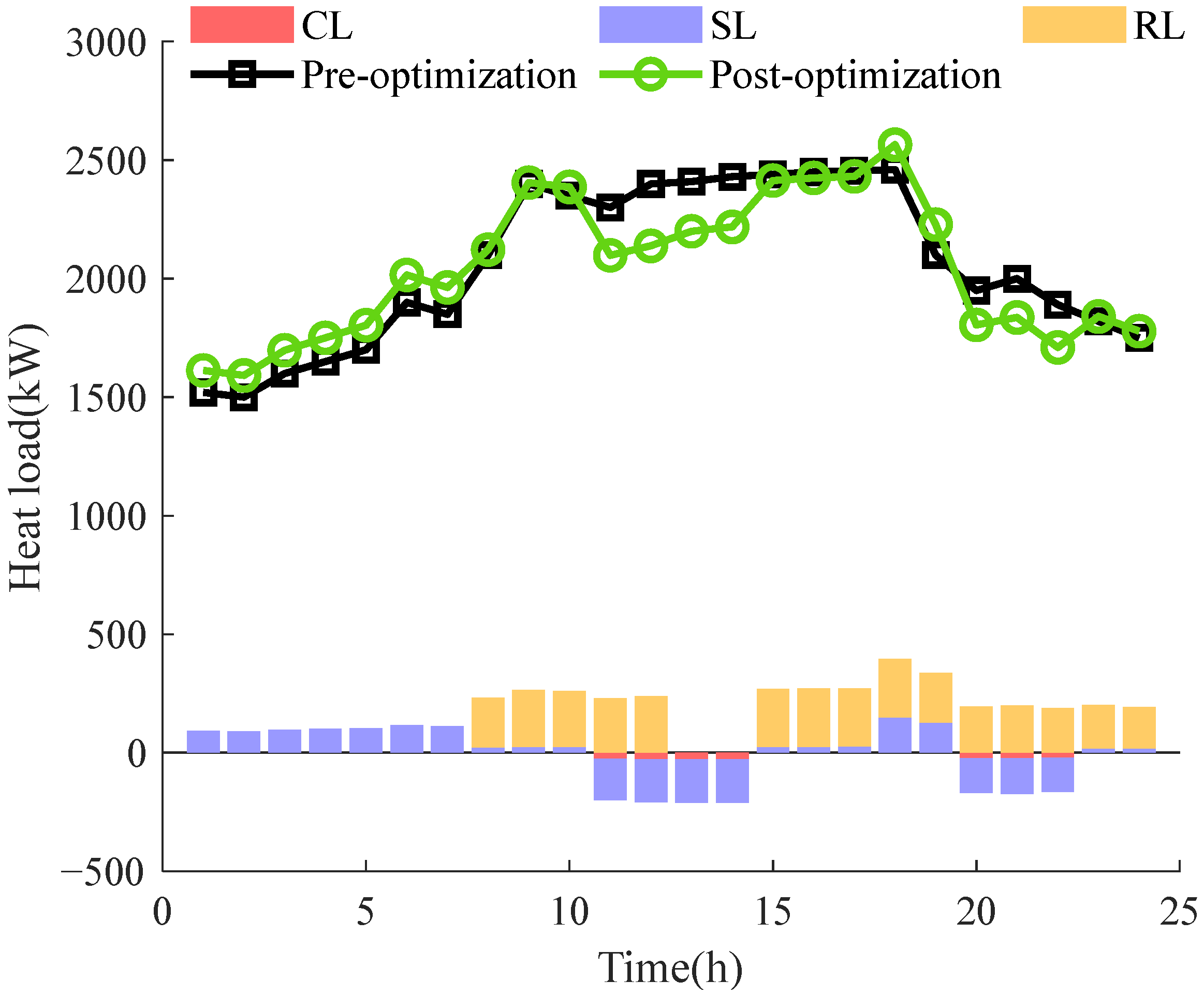

- Thermal power balance

- (3)

- Gas power balance

- (4)

- Customer satisfaction constraints on electricity usage

4. Case Study

4.1. Parameter Setting

4.2. Different Scenarios Comparison

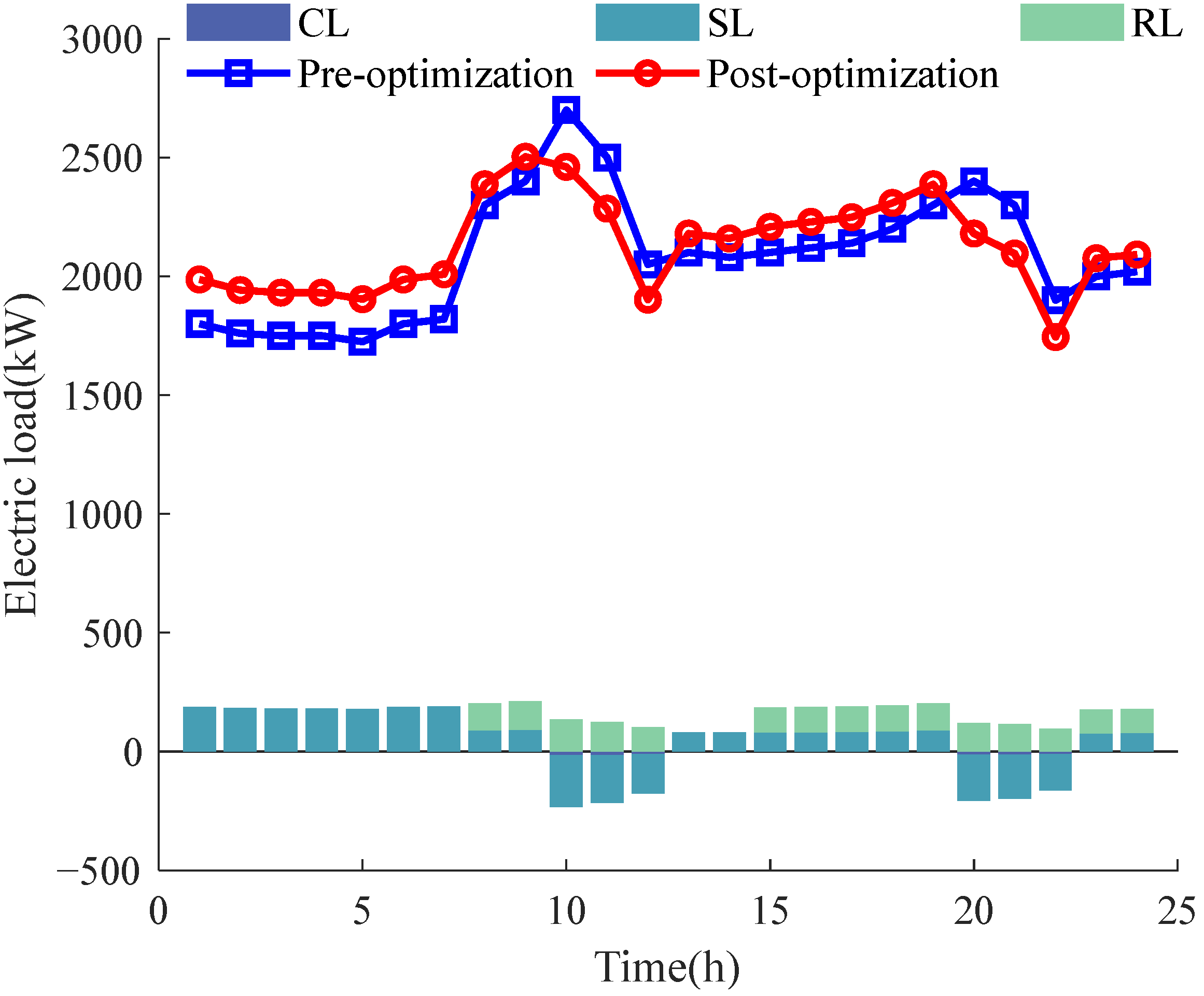

4.3. Different DR Strategy Analysis

4.4. Limitations and Future Research

5. Conclusions

- (1)

- The introduction of the stepped carbon trading mechanism alongside DR strategies significantly reduces carbon emission costs by 44.45%, actual carbon emissions by 9.85%, and total system costs by 10.62% compared to scenarios without this mechanism. This demonstrates the mechanism’s effectiveness in providing an initial carbon emission allowance, achieving a dual optimization of economic and environmental benefits. This finding contributes to the existing literature by offering a novel perspective on how carbon trading mechanisms can be practically applied in IES to balance economic efficiency and environmental goals.

- (2)

- The implementation of DR strategies leads to a 10.44% reduction in energy purchase costs. By reducing peak loads and increasing valley loads, the system can optimize energy procurement based on time-varying energy prices and availability. This approach decreases expenses while simultaneously improving the system’s versatility and resilience. The study extends prior research by examining the specific impacts of different DR types on IES operations, providing deeper insights into demand-side management.

- (3)

- When both the stepped carbon trading mechanism and DR are considered, the total operating costs, energy purchase costs, carbon trading costs, and actual carbon emissions are all lower than in scenarios considering only carbon trading. DR not only shifts and cuts loads but also enables the mutual substitution of electricity and heat energy, smoothing the load curve. The system can accurately compare the costs of electricity and gas procurement and the outputs of gas turbines and gas boilers across different periods. This facilitates choosing an operational strategy that is both cost-efficient and environmentally friendly, achieving an effective balance between economic benefits and carbon reduction. This research advances the field by developing a comprehensive model that integrates carbon trading and DR, offering a more holistic approach to IES operation.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| Abbreviation | |

| CHP | Combined heat and power |

| CL | Curtailable load |

| DR | Demand response |

| ES | Electric storage |

| GB | Gas boiler |

| GT | Gas turbine |

| HP | Heat pump |

| HS | Heat storage |

| IES | Integrated energy system |

| MILP | Mixed-integer linear programming |

| PV | Photovoltaic |

| RL | Replaceable load |

| SL | Shiftable load |

| WT | Wind turbines |

| WHB | Waste heat boiler |

| Sets and indices | |

| Scheduling cycle | |

| Index of time | |

| Parameters and constants | |

| Carbon emission right allowances for IES | |

| Actual carbon emissions from IES | |

| Carbon credits exchanged in the market | |

| Minimum value of ES charging and discharging power | |

| Maximum value of ES charging and discharging power | |

| Minimum value of thermal energy storage and heat release power | |

| Maximum value of thermal energy storage and heat release power | |

| Maximum value of PV output | |

| Maximum value of WT output | |

| Upper input power limits of GB | |

| Lower input power limits of GB | |

| Initial charge state of the ES during the charging and discharging cycle | |

| Final charge state of the ES during the charging and discharging cycle | |

| Minimum state-of-charge of the ES | |

| Maximum state-of-charge of the ES | |

| Initial charge state of the HS during the charging and discharging cycle | |

| Final charge state of the HS during the charging and discharging cycle | |

| Minimum state-of-charge of the HS | |

| Maximum state-of-charge of the HS | |

| Minimum substitutions for the replaceable electrical/heat loads | |

| Maximum substitutions for the replaceable electrical/heat loads | |

| Upper limits of the GB’s climb | |

| Lower limits of the GB’s climb | |

| Emission factors of coal-fired generation | |

| Emission factors of gas-fueled equipment | |

| Emission intensities of unit electricity from coal plants | |

| Emission intensities of unit gas consumption of gas-fired units | |

| Gas-to-electricity efficiency of GT | |

| Gas-to-thermal efficiency of GT | |

| Heat recovery efficiency of the WHB | |

| Electrical transfer efficiency of the HP | |

| Energy conversion efficiency of GB | |

| Charging efficiency of the ES | |

| Discharging efficiency of the ES | |

| Charging efficiency of the HS | |

| Discharging efficiency of the HS | |

| Energy utilization rates of electric energy | |

| Energy utilization rates of thermal energy | |

| Unit calorific value of electric energy | |

| Unit calorific value of natural gas | |

| Unit calorific value of thermal energy | |

| Initial carbon price | |

| Width of the emission allowance interval | |

| Carbon price increase rate | |

| Energy purchase cost | |

| Operation and maintenance cost | |

| Carbon trading cost | |

| System total cost | |

| PV unit operation cost | |

| WT unit operation cost | |

| GT unit operation cost | |

| WHB unit operation cost | |

| HP unit operation cost | |

| GB unit operation cost | |

| ES unit operation cost | |

| HS unit operation cost | |

| Customer satisfaction index | |

| Minimum satisfaction threshold | |

| Upper and lower bounds of load deviation range ratio | |

| Variables | |

| Thermal power generated by GT at time t | |

| Power input to GB at time t | |

| Thermal power output of GT at time t | |

| Thermal power output from the HP at time t | |

| Thermal power input to the WHB at time t | |

| Power purchased from the grid at time t | |

| Electric power generated by GT at time t | |

| Practical load demand at time t | |

| Baseline load at time t | |

| Charging power of the ES at time t | |

| Discharging power of the ES at time t | |

| Electrical power output from the GT at time t | |

| Electrical power input to the HP at time t | |

| Storage power of thermal energy storage at time t | |

| Release power of thermal energy storage at time t | |

| PV power output at time t | |

| Power sold to the grid at time t | |

| Combined output power of CHP and GB at time t | |

| Heat power recovered by the WHB at time t | |

| WT power output at time t | |

| Initial amount of load that can be curtailed at time t | |

| Initial transferable load quantity at time t | |

| Purchased gas consumption at time t | |

| CHP gas consumption at time t | |

| GB gas consumption at time t | |

| Charge state of ES at time t | |

| Charge state of HS at time t | |

| Amount of curtailable load at time t | |

| Amount of replaceable electrical load at time t | |

| Amount of replaceable heat loads at time t | |

| Amount of shiftable load at time t | |

| The electrical load elasticity coefficient at time t | |

| Practical electricity price at time t | |

| Baseline electricity price at time t | |

| Electricity purchased price at time t | |

| Electricity sold price at time t | |

| Gas purchased price at time t | |

| Charging state of the ES at time t | |

| Discharging state of the ES at time t | |

| Storage state of the thermal energy storage at time t | |

| Release state of the thermal energy storage at time t | |

References

- Wang, P.; Li, H.; Wang, L.; Huang, Z. The impact of teleconnections of built-up land on regional carbon burden under the shared socio-economic pathways. Sci. Total Environ. 2024, 906, 167589. [Google Scholar] [CrossRef]

- Zhang, Z.; Qian, Z.; Chen, M.; Zhu, R.; Zhang, F.; Zhong, T.; Lin, J.; Ning, L.; Xie, W.; Creutzig, F. Worldwide rooftop photovoltaic electricity generation may mitigate global warming. Nat. Clim. Change 2025, 15, 393–402. [Google Scholar] [CrossRef]

- Zhang, S.; Chen, W.; Zhang, Q.; Krey, V.; Byers, E.; Rafaj, P.; Nguyen, B.; Awais, M.; Riahi, K. Targeting net-zero emissions while advancing other sustainable development goals in China. Nat. Sustain. 2024, 7, 1107–1119. [Google Scholar] [CrossRef]

- Zhou, W.; Chi, Y.; Tang, S.; Hu, Y.; Wang, Z.; Zhang, X. The evolution analysis of low-carbon power transition strategies and carbon emission decoupling based on carbon neutrality target. Energy 2024, 311, 133298. [Google Scholar] [CrossRef]

- Zhang, J.; Ding, S.; Lu, Z.; Kong, X.; Guo, X.; Zhang, J. Towards net-zero: Coupling carbon mineralization with seasonal energy storage in integrated energy systems planning. Appl. Energy 2025, 393, 126065. [Google Scholar] [CrossRef]

- Morris, J.; Gurgel, A.; Mignone, B.K.; Kheshgi, H.; Paltsev, S. Mutual reinforcement of land-based carbon dioxide removal and international emissions trading in deep decarbonization scenarios. Nat. Commun. 2024, 15, 7160. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, J.; Zhao, Z.; Ren, J.; Chen, X. Research on carbon emission reduction effect of China’s regional digital trade under the “double carbon” target--combination of the regulatory role of industrial agglomeration and carbon emissions trading mechanism. J. Clean. Prod. 2023, 405, 137049. [Google Scholar] [CrossRef]

- Han, Y.; Tan, S.; Zhu, C.; Liu, Y. Research on the emission reduction effects of carbon trading mechanism on power industry: Plant-level evidence from China. Int. J. Clim. Change Strateg. Manag. 2022, 15, 212–231. [Google Scholar] [CrossRef]

- Li, F.; Wang, D.; Guo, H.; Zhang, J. Distributionally Robust Optimization for integrated energy system accounting for refinement utilization of hydrogen and ladder-type carbon trading mechanism. Appl. Energy 2024, 367, 123391. [Google Scholar] [CrossRef]

- Chen, J.; Tang, Z.; Huang, Y.; Qiao, A.; Liu, J. Asymmetric Nash bargaining-based cooperative energy trading of multi-park integrated energy system under carbon trading mechanism. Electr. Power Syst. Res. 2024, 228, 110033. [Google Scholar] [CrossRef]

- Wang, L.; Yang, C.; Xu, Z.; Yuan, G.; Tang, L.; Bai, Y.; Wang, X. Analysis of carbon electricity coupled market modeling method based on carbon credit trading mechanism. Int. J. Electr. Power Energy Syst. 2024, 156, 109707. [Google Scholar] [CrossRef]

- Wang, L.; Ren, X.; Ma, Y.; Liu, Z.; Dong, W.; Ni, L. Optimal low-carbon scheduling of integrated energy systems considering stepped carbon trading and source-load side resources. Energy Rep. 2024, 12, 3145–3154. [Google Scholar] [CrossRef]

- Zhou, W.; Lai, J.; Li, X.; Zeng, Z. Dynamic Vertical Peer-to-Peer Carbon Right Sharing Management for Microgrid Clusters with Multiple Structural Demand Response. IEEE Trans. Ind. Inform. 2025, 21, 6038–6048. [Google Scholar] [CrossRef]

- Wang, Y.; Dong, P.; Xu, M.; Li, Y.; Zhou, D.; Liu, X. Research on collaborative operation optimization of multi-energy stations in regional integrated energy system considering joint demand response. Int. J. Electr. Power Energy Syst. 2024, 155, 109507. [Google Scholar] [CrossRef]

- Xiong, Z.; Zhang, D.; Wang, Y. Optimal operation of integrated energy systems considering energy trading and integrated demand response. Energy Rep. 2024, 11, 3307–3316. [Google Scholar] [CrossRef]

- Wang, Y.; Li, Y.; Zhang, Y.; Xu, M.; Li, D. Optimized operation of integrated energy systems accounting for synergistic electricity and heat demand response under heat load flexibility. Appl. Therm. Eng. 2024, 243, 122640. [Google Scholar] [CrossRef]

- Ma, C.; Hu, Z. Low-Carbon Economic Scheduling of Integrated Energy System Considering Flexible Supply–Demand Response and Diversified Utilization of Hydrogen. Sustainability 2025, 17, 1749. [Google Scholar] [CrossRef]

- Yang, M.; Liu, Y. Research on multi-energy collaborative operation optimization of integrated energy system considering carbon trading and demand response. Energy 2023, 283, 129117. [Google Scholar] [CrossRef]

- Gao, L.; Fei, F.; Jia, Y.; Wen, P.; Zhao, X.; Shao, H.; Feng, T.; Huo, L. Optimal dispatching of integrated agricultural energy system considering ladder-type carbon trading mechanism and demand response. Int. J. Electr. Power Energy Syst. 2024, 156, 109693. [Google Scholar] [CrossRef]

- Cui, Y.; Xu, Y.; Huang, T.; Wang, Y.; Cheng, D.; Zhao, Y. Low-carbon economic dispatch of integrated energy systems that incorporate CCPP-P2G and PDR considering dynamic carbon trading price. J. Clean. Prod. 2023, 423, 138812. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, L.; Hu, W. An Integrated Energy Demand Response Model Considering Source-Load Synergy and Stepped Carbon Trading Mechanism. Eng. Lett. 2024, 32, 614. [Google Scholar]

- Fan, W.; Ju, L.; Tan, Z.; Li, X.; Zhang, A.; Li, X.; Wang, Y. Two-stage distributionally robust optimization model of integrated energy system group considering energy sharing and carbon transfer. Appl. Energy 2023, 331, 120426. [Google Scholar] [CrossRef]

- Wang, J.; Zhao, Y.; Li, H.; Xu, X. Enhanced photovoltaic-powered distribution network resilience aided by electric vehicle emergency response with willingness and reward. Appl. Energy 2025, 389, 125619. [Google Scholar] [CrossRef]

- Hu, J.; Wang, Y.; Dong, L. Low carbon-oriented planning of shared energy storage station for multiple integrated energy systems considering energy-carbon flow and carbon emission reduction. Energy 2024, 290, 130139. [Google Scholar] [CrossRef]

- Sadeq, A.M. Energy Storage Systems: A Comprehensive Guide. 2023. Available online: https://www.researchgate.net/publication/374133294_Energy_Storage_Systems_A_Comprehensive_Guide (accessed on 1 July 2025).

- Maghami, M.R.; Pasupuleti, J.; Ekanayake, J. Energy storage and demand response as hybrid mitigation technique for photovoltaic grid connection: Challenges and future trends. J. Energy Storage 2024, 88, 111680. [Google Scholar] [CrossRef]

- Wang, J.; Meng, J.; Li, H.; Xu, X. Analysis of regional electric vehicle aggregation response behavior in the coupling electricity and carbon markets. Energy 2025, 326, 135914. [Google Scholar] [CrossRef]

- Wei, Z.; Ma, X.; Guo, Y.; Wei, P.; Lu, B.; Zhang, H. Optimized operation of integrated energy system considering demand response under carbon trading mechanism. Electr. Power Constr. 2022, 43, 1–9. [Google Scholar]

| Equipment Type | Parameters | Value |

|---|---|---|

| GT | Installed capacity/kW | 4000 |

| Electrical efficiencies | 0.3 | |

| Thermal efficiency | 0.4 | |

| GB | Installed capacity/kW | 1000 |

| Efficiency | 0.9 | |

| WHB | Efficiency | 0.8 |

| HP | Installed capacity/kW | 400 |

| Efficiency | 4.4 | |

| HS | Maximum capacity/kWh | 400 |

| Initial heat storage/kWh | 50 | |

| Charge/discharge thermal efficiency | 0.95/0.9 | |

| Maximum charging and discharging power/kW | 250 | |

| ES | Maximum capacity/kWh | 400 |

| Initial power/kWh | 70 | |

| Charge/discharge efficiency | 0.95/0.9 | |

| Maximum charge/discharge power/kW | 250 |

| Time | Price (CNY/kWh) | Time | Price (CNY/kWh) |

|---|---|---|---|

| 01:00–07:00 | 0.38 | 15:00–18:00 | 0.68 |

| 08:00–11:00 | 0.68 | 19:00–22:00 | 1.2 |

| 12:00–14:00 | 1.2 | 23:00–24:00 | 0.38 |

| Case | /CNY | /CNY | /CNY | /CNY | /kg |

|---|---|---|---|---|---|

| 1 | 22,438.1 | 19,886.6 | 1721.1 | 830.4 | 39,664.3 |

| 2 | 21,169.5 | 18,584.2 | 1790.1 | 795.2 | 38,364.2 |

| 3 | 21,723.5 | 18,383.8 | 1803.9 | 1535.8 | 41,418.3 |

| 4 | 23,684.5 | 20,527.8 | 1725.2 | 1431.5 | 42,554.7 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yan, C.; Xu, J.; Li, C.; Han, Q.; Li, H.; Wang, J. Carbon-Aware Dispatch of Industrial Park Energy Systems with Demand Response and Ladder-Type Carbon Trading. Sustainability 2025, 17, 9472. https://doi.org/10.3390/su17219472

Yan C, Xu J, Li C, Han Q, Li H, Wang J. Carbon-Aware Dispatch of Industrial Park Energy Systems with Demand Response and Ladder-Type Carbon Trading. Sustainability. 2025; 17(21):9472. https://doi.org/10.3390/su17219472

Chicago/Turabian StyleYan, Chao, Jianyun Xu, Chunrui Li, Qilin Han, Hongwei Li, and Jun Wang. 2025. "Carbon-Aware Dispatch of Industrial Park Energy Systems with Demand Response and Ladder-Type Carbon Trading" Sustainability 17, no. 21: 9472. https://doi.org/10.3390/su17219472

APA StyleYan, C., Xu, J., Li, C., Han, Q., Li, H., & Wang, J. (2025). Carbon-Aware Dispatch of Industrial Park Energy Systems with Demand Response and Ladder-Type Carbon Trading. Sustainability, 17(21), 9472. https://doi.org/10.3390/su17219472