Abstract

This article examines the growth threshold effect on renewable energy transition in eight Southeast Asian countries from 2000 to 2023. Utilizing panel data and threshold regression analysis, the study confirms the following established findings: (1) There is evidence of a significant impact of the moderating effect of growth/FDI on the nexus between access to clean energy and the renewable energy transition in Southeast Asian countries. (2) There is evidence of a significant impact of the moderating effect of growth/trade on the nexus between access to clean energy and the renewable energy transition in Southeast Asian countries. (3) There is evidence of a significant effect of the moderating effect of growth/R&D on the nexus between access to clean energy and the renewable energy transition in Southeast Asian countries. (4) Lastly, the complementary growth threshold of 1.68% is to be checked for access to clean energy and technologies and the renewable energy transition in Southeast Asian countries. Therefore, policies should promote sustained growth while ensuring investments in research and development, trade, and foreign direct investment (FDI), which are expected to benefit the region in the long term. In the short term, it may be necessary to reassess current policies to prevent misallocation of resources, ensuring progress towards SDG-7 before the 2030 deadline. Future research should investigate additional factors that could facilitate a sustained transition to renewable energy and examine the complex relationship between economic growth, access to clean energy, and renewable energy transition in Southeast Asian countries.

1. Introduction

Recently, the announcement by President Donald Trump on trade tariff policies, the so-called “reciprocal tariff” based on bilateral negotiations, has pushed markets and commodities beyond equilibrium and is intended to use tariffs not as weapons in a global context but to restrain competition and the rising Southeast Asian economies [1]. This policy has been narrowed to the imports from the region and could cause economic and political turbulence for Southeast Asian economies. Its impact may include diversifying trade partners, supply chain reconfiguration, fractured ASEAN unity, and the vulnerability of countries like Laos and Myanmar. The most immediate effect may likely come from the shifting goalposts of renewable energy transitions of the vulnerable countries, as transitions require structural transformation of the traditional energy to new energy and come with economic cost. The primary tools for mitigating the effects of climate change are energy transitions, which aim to enhance the resilience, sustainability, and productivity of a country’s energy system. When estimating energy transition pathways, each country and region has its own unique set of circumstances. Hence, addressing a research topic on the economic growth effects on energy transitions should provide a significant academic debate.

Southeast Asian economies have faced similar opportunities and difficulties in energy transitions. However, resource misalignment and energy demand also contribute to the region’s underdeveloped potential for renewable energy. Since the entire region has abundant renewable energy resources, the development of regional energy connections suggests a significant institutional advantage to further decarbonize the Southeast Asian energy sector beyond the efforts of individual countries. In terms of energy mix, Southeast Asia has achieved some early success in developing renewable energy sources, accompanied by advancements in energy efficiency. Despite its controversies, renewable energy has advanced significantly and continues to grow throughout Southeast Asia. Li et al. [2] affirmed the advancement of energy transition in Southeast Asia. Derouez and Ifa [3] found that in countries like Indonesia, Malaysia, Japan, and South Korea, CO2 emissions are mostly driven by GDP and non-renewable energy usage. However, mostly due to historical difficulties, the growth threshold in the energy mix has not been adequately addressed. In this study, the primary objective is to investigate the growth threshold effect on clean energy access and renewable energy transition in Southeast Asia.

The study most closely positioned to this article is by He and Huang [4], who investigated renewable energy’s growth effect using the Chinese time series data from 1990 to 2020. Chen et al. [5] investigated the renewable energy-growth threshold effect using a panel of 103 countries’ data from 1995 to 2015. Qi and Li [6] investigated the threshold effect of renewable energy on growth using panel data of 28 European Union members from 1990 to 2014. Abdulqadir [7] investigated the growth-energy threshold effect using panel data of 15 major oil-producing sub-Saharan African countries from 1990 to 2018. The present study differs from earlier research in that it concentrates on the policy syndrome at the intersection of the transition to renewable energy and growth. The current study differs from He and Huang [4], as it has addressed the threshold effect of growth on renewable energy transition. The current study differs from Qi and Li [6] and Chen et al. [5], as it is supplementary and SDG-focused on Southeast Asian economies. The current study differs from Abdulqadir [7], as it is the most recent and addresses different regions of the globe. From the preceding discussion, it is now clear that a comprehensive investigation of the nexus between the growth threshold effect and renewable energy transition in Southeast Asian economies is required to have a sustainable development outlook.

Despite the current debate advanced above, the contribution of the study to the existing literature is as follows: (1) The study delves into the impact of import restraints and responds to the Trump announcement of the so-called reciprocal tariffs on the Southeast Asian countries along the pursuit of renewable energy transitions. (2) The study investigates information asymmetry using the known dynamic panel threshold regression. (3) The study also utilized the interaction model to explore the moderating effect of economic growth in the nexus between access to clean energy innovation and renewable energy transition in Southeast Asian countries. The novelty of the study stems from applying this technique, which has the advantage of incorporating a robust approach that takes outlier incidence into account. The approach is more resilient to outcome variable variability and non-normal errors [8]. In light of the relationship between clean energy access and the transition to renewable energy in Southeast Asian economies, it is important to note that the current study differs from earlier studies in terms of viewpoints, perspectives, periodicity, and methodologies. The impact of information asymmetry in the relationship between clean energy access and the transition to renewable energy has not received the thorough scholarly attention it merits and has not been extensively covered in the literature; therefore, the topic is still up for debate. In this study, we have found evidence of a significant growth threshold effect on the relationship between clean energy access and the transition to renewable energy in Southeast Asian nations.

The paper is organized and divided into six sections. The theoretical support is presented in Section 2. The research methodology and data sources are described in Section 3. The results are shown in Section 4, while our findings are discussed in Section 5. The conclusions and policy implications of the article are presented in Section 6. Next, the theoretical underpinning and the hypothesis development supporting the findings of this article are presented in the forthcoming section.

2. Snippet of the Theoretical Underpinnings and Hypothesis Development

Abdulqadir [7] uncovered the impact of growth on the nexus between renewable energy consumption and energy intensity in major oil-producing sub-Saharan African (SSA) countries. Wang et al. [9] discovered a non-linear correlation between the development of renewable energy and official development assistance (ODA), suggesting the existence of a threshold effect using the SSA countries’ panel data from 2005 to 2015. Further, ODA would encourage the growth of renewable energy when urbanization and carbon dioxide intensity are below the threshold values.

2.1. Growth, FDI, Trade, R&D, CO2, and the Global Renewable Energy Transition

Initially, the investment in R&D, FDI inflows, trade, and innovation offers a great solution for achieving the renewable energy transition. Zhang et al. [10] found evidence that trade significantly enhances total factor renewable energy efficiency in a panel of 28 developed countries using panel data from 1996 to 2019. Guo et al. [11] discovered evidence that the digital economy effectively promoted energy transition in Chinese provinces using panel data from 2013 to 2022. Triki et al. [12] used time series analysis from 2002 to 2023 to uncover the link between renewable energy transition and long-term development in the Ha’il region. Raihan et al. [13] conducted a time series study from 1970 to 2022 to reveal the impact of FDI and globalization on Mexico’s renewable transition. Wang et al. [14] investigated the impact of renewable energy, urbanization, and trade on CO2 emissions and economic growth in a sample of 122 nations from 1998 to 2018. Osuma [15] showed that, using panel data from 20 EU nations from 2013 to 2023, technical innovation continually increases the use of renewable energy, whereas foreign direct investment harms the renewable energy transition. The study offers the following testable hypothesis in support of the study findings.

Hypothesis 1.

The level of trade plays a moderating role in the nexus between access to clean energy, innovations, and the transition to renewable energy in Southeast Asian economies.

2.2. Growth and the Global Renewable Energy Transition

Chen et al. [5] found evidence that if and only if developing or non-OECD nations cross a specific threshold of renewable energy consumption, the impact of renewable energy consumption on economic growth is positive and significant. Conversely, the use of renewable energy has a detrimental impact on economic growth if it falls below a certain threshold in developing nations. However, the authors also discovered that the use of renewable energy has a favorable and large impact on economic growth in OECD countries, while it has no discernible influence on such growth in developed nations. Imran et al. [16] discovered significant evidence of energy transition, resource curse, and economic development in Brazil, Russia, India, China, and South Africa (BRICS) countries from 1991 to 2022. Shu et al. [17] discovered the evidence that investment in R&D and renewable energy R&D exhibits a U-shaped influence on carbon emissions using G7 data from 1990–2020. Abd Alah and Ojekemi [18] found evidence from the Brazil-specific outcome of the role of growth, FDI, and infrastructure in sustainable energy transitions using quarterly data from 1990Q1 to 2020Q4. Hou et al. [19] unveiled the evidence in 38 OECD countries that the influence of FDI on energy transition significantly varies based on the stringency of environmental regulation. Xuan [20] found that FDI inflows and economic development have a significant positive correlation with environmental degradation, and innovation has a positive impact on carbon dioxide emissions in Vietnam, using annual data from 2000 to 2023. In another study, Xuan [21] discovered that R&D spending increases by 1%, significantly contributing to Germany’s GDP growth, demonstrating the large and positive long-term effects of innovation and renewable energy on economic growth. Additionally, the use of renewable energy has a significant positive impact, supporting the transition to a sustainable economy [22]. The study offers the following testable hypotheses in support of the study findings.

Hypothesis 2.

The level of FDI does play a moderating role in the nexus between access to clean energy, innovations, and the transition to renewable energy in Southeast Asian economies.

Hypothesis 3.

The level of R&D plays a moderating role in the nexus between access to clean energy, innovations, and the transition to renewable energy in Southeast Asian economies.

2.3. Growth and Renewable Energy Transition in Southeast Asia

Cong et al. [23] discovered how the digital economy and sustainable elements—economic, social, and environmental—affected Southeast Asia’s use of renewable energy between 2004 and 2021. The aim is to underline how crucial it is to the creation and transformation of sustainable green energy. Zhong et al. [24] revealed many avenues through the strategic pursuit of cross-border transmission, carbon capture and sequestration, and renewable energy in ASEAN countries. He and Huang [4] discovered that renewable energy has a favorable impact on economic growth, using China’s data from 1990 to 2020. Furthermore, the renewable energy transition can also have an indirect impact on economic growth through trade openness, foreign direct investment, labor force participation, gross capital formation, and R&D spending. Guo and Yan [25] found that their heterogeneity analysis of the transition reveals that the emission reduction effects of industrial upgrading intensified in downstream regions, while energy transition was crucial for mid-upstream mitigation across YREB provinces from 2005 to 2021. Furthermore, a U-shaped relationship exists between industrial upgrading and both energy intensity and energy structure decarbonization, while it significantly lowers regional emissions.

On the contrary, Asisifa and Pratomo [26] revealed that greenhouse gases and renewable energy transition do not have a significant influence on the level of growth in Southeast Asian countries. Li et al. [2] discovered that, primarily due to legacy difficulties, the dominance of coal in the energy mix has a mismatch between energy demand and available resources; the region’s potential for renewable energy transition is similarly underdeveloped. On the other hand, in Southeast Asian nations, the relationship between clean energy access and the renewable energy transition is impacted by economic growth. Regardless of whether this effect was seen or not, it would not give economists and policymakers the right policy tools until they suggested a turning point in the nexus under investigation. Using a dynamic threshold regression technique, we have discovered a gap in the literature and substantial evidence of the existence of an inflection point along the nexus between clean energy access and renewable energy transition in Southeast Asian countries. The study offers the following testable hypothesis in support of the main study findings, taking into account the gap in the literature, as follows:

Hypothesis 4.

The impact of economic growth on clean energy, innovations, and the transition to renewable energy in Southeast Asian economies may shift from positive to negative, or vice versa, when it falls below or above a particular threshold.

3. Data and Methods

3.1. Data

In this study, panel data from the World Bank Development Indicators (WDI) covering eight Southeast Asian countries (China, Indonesia, Japan, South Korea, Malaysia, Singapore, Thailand, and Vietnam) for the period 2000–2023 are employed; Laos and Myanmar are excluded from the sample due to data unavailability. This exclusion is motivated by the empirical strategy requirements of the balanced panel dataset, as including the two would result in an unbalanced panel dataset. The theoretical underpinnings of our models come from the endogenous growth theory, which describes balanced growth as the result of information spillover [27,28]. Such a theoretical stance is also consistent with the New Theory of Economic Growth, which holds that trade openness, energy, foreign direct investment, and R&D investment are among the factors that contribute to economic growth. Therefore, these factors can be used as conduits for energy transition and economic growth. All of the variables are described in detail in Appendix A Table A1.

3.1.1. Dependent Variable

Renewable energy consumption (transition). The study employs renewable energy consumption as the share of renewable energy in total final energy consumption as a dependent variable. The choice of this variable was motivated by the literature [4,29,30].

3.1.2. Independent Variable

Access to clean fuels and technologies for cooking (access). The choice of this variable was motivated by a gap in the literature.

3.1.3. Threshold Variable

Economic prosperity (economic growth): The study adopts a constant annual growth rate of gross domestic product as an indicator of economic growth. This variable is supported by the previous studies [31,32,33].

3.1.4. Control Variable

The specific control variables include foreign direct investment inflow share of GDP (FDI), trade openness (TOP), R&D expenditure share of GDP, and labor force participation rate. These variables are supported by the previous studies [4,5,6,34].

3.2. Methods

To explore the premises of the testable hypotheses, the study applied an interaction model approach by Brambor et al. [35] and panel threshold analysis by Hansen [36] to investigate the growth threshold effect on renewable transition for Southeast Asian countries over the period 2000–2023. The study utilized panel data with a model specified as follows.

where t denotes year; denotes constant; [,] denotes estimated coefficients; and denotes a random term. Introducing the threshold investigation in the pertinent model above, we employ the threshold effect test following the approach in Hansen [15,16,36,37,38]. To build a two-regime structural equation in a threshold model, the study proposes . Therefore, where is the threshold variable of interest, the model is respecified as follows:

where denotes constant; [,] denotes estimated coefficients; denotes a random term; and is the indicator function representing the sample splitting.

Equally, the models (1–2) presented above are utilized as an empirical strategy for modeling the nexuses between renewable energy transition in Southeast Asia. The next section will present the results from the above testable empirical models.

4. Results

This section will examine and provide the main conclusions drawn from the hypothesis, taking into account its structure and the models covered in the previous sections. To meet the statistical requirement, we first provide the initial data analysis. We next go on to explore the moderating effect of growth in the nexuses investigated. Third, the results of the threshold estimation and dynamic panel threshold effect test for the benchmark models are shown.

4.1. Preliminary Data Analysis

Table 1 Panel A shows the renewable energy transition and access to clean energy and technology in Southeast Asian countries. The trend presentation was strongly supported by their estimated means and standard deviations [3.241; 2.724] and [1.501; 1.549], respectively. Summarily, other variables also exhibit parallel trends, as trade, R&D, labor, and FDI have mean and standard deviations of [4.552; 2.878; 4.288 and 0.846] and [0.772; 1.950; 0.073 and1.296], respectively. In Table 1, Panel B, the pairwise correlation test results revealed a positive and statistically significant correlation with access to clean energy and technology, and a negative and significant correlation between transition, trade, and FDI, respectively.

Table 1.

Preliminary data analysis.

4.2. Endogeneity Test

In order to thoroughly investigate the potential endogeneity issues that may arise between access to clean energy and the renewable energy transition, this study has chosen to use an instrumental variable method. The information in Table 2 shows that (L.access), the instrumental variable of choice, is appropriate and effective. The expected value of access (accesshat) continues to show a strong positive link with the shift to renewable energy, according to the results of the second stage. According to this research, continued access to clean energy and technology continuously raises the regional level of the renewable energy transition, even after carefully accounting for the intricate endogeneity considerations.

Table 2.

Endogeneity test.

4.3. Moderating Effects Analysis

As presented in Table 3, column 1, the coefficients of access to clean energy, innovation, and R&D display a significant positive coefficient at the 1% level, suggesting that these variables contribute to advancing the renewable energy transition. However, the coefficient of the interaction term (Growth × FDI) presented in column 2 is [0.152] and positive, statistically significant at the 10% level. This estimate revealed that the level of FDI inflow has a significant moderating effect on access to clean energy and the renewable energy transition, thus validating Hypothesis 1.

Table 3.

Moderation analysis.

Similarly, the coefficient of the interaction term (Growth × trade) presented in column 3 is [0.227] and is positive and statistically significant at the 5% level. This finding indicates that trade has a significant moderating effect on access to clean energy and the renewable energy transition, thereby validating Hypothesis 2. Furthermore, the coefficient of the interaction term (Growth × R&D) presented in column 4 is [−0.281] and is statistically significant at the 1% level. This shows that the role of R&D has a significant moderating effect on access to clean energy and the renewable energy transition, validating Hypothesis 3.

4.4. Threshold Effect Test and Estimations

As presented in Table 4, the results of both the threshold effect test and threshold estimation are disclosed. The threshold effect test for the level of the growth variable is presented. It is observed that there is strong evidence of a significant growth threshold effect [Growth = 1.68%] on the nexus between access to clean energy and the renewable energy transition, respectively.

Table 4.

Threshold effect test and estimation.

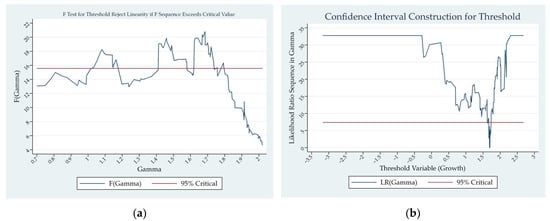

Considering the level of economic growth as a threshold variable, its impact on the level of access to clean energy can either be negative or positive on the renewable energy transition. The result from the threshold effect test revealed the existence of a significant threshold estimate of [Growth = 1.68%]. Table 4 above presents the threshold impact estimations of the variables at regime 1 (below the threshold) and regime 2 (above the threshold), respectively. Below the threshold, the impact of growth on access to clean energy and renewable energy transition in Southeast Asian countries is a positive 0.548 and statistically significant at the 1% level, and the impact further declines to a positive 0.209 above the threshold and is statistically significant at the 1% level. Figure 1 presents a diagrammatic portrayal of the asymptotic critical values construction for the estimated threshold. The process is utilized to establish consistency in the investigation of the true estimates for the best fit.

Figure 1.

The graph depicts the likelihood ratio function for the level of growth in the nexus between access to clean energy and the renewable energy transition. In (a), the graph shows the F-statistic test for threshold reject linearity if the sequence exceeds the critical value. In (b), the graph shows the meticulous confidence interval construction for the estimated threshold and is presented in Table 4, above.

5. Discussion

In this section, the major findings of this article are discussed, using the joint interaction term and dynamic panel threshold regression approach to investigate the nexus between access to clean energy and technology and the transition to renewable energy in Southeast Asian countries, and specifically, the effect of FDI and growth on the outcome variable, renewable energy transition. This implies that the impact of FDI on both development and energy transition is significant. The findings reveal the significant impact of the moderating effect of growth/FDI (Growth × FDI) on the nexus between access to clean energy and the renewable energy transition in Southeast Asian countries. Consequently, Hypothesis 1 is confirmed.

Second, the effect of trade and growth on the outcome variable, renewable energy transition, is investigated. This implies that the impact of trade on both growth and energy transition is significant. The findings show the significant impact of the moderating effect of growth/trade (growth × trade) on the nexus between access to clean energy and the renewable energy transition in Southeast Asian countries. Consequently, Hypothesis 2 is confirmed.

Third, the effect of investment in R&D and growth on the outcome variable, renewable energy transition, is investigated. This implies that the impact of investment in R&D on both growth and energy transition is significant. The findings reveal the significant impact of the moderating effect of growth/R&D (Growth × R&D) on the nexus between access to clean energy and the renewable energy transition in Southeast Asian countries. Consequently, Hypothesis 3 is confirmed.

When the critical threshold of growth is below 1.68%, the impact of the estimated coefficient of access to clean energy is 0.548, and the effect on renewable energy transition in Southeast Asia is positive and statistically significant at the 1% level. However, when this critical level of the growth threshold exceeds 1.68%, the impact of the estimated coefficient on access to clean energy and transition in Southeast Asian countries declines to 0.209 and is statistically significant at the 1% level. The implied decreasing magnitude of access to clean energy is referred to as the underutilized or underdeveloped stage of renewable energy development. This implies the growth threshold should be promoted to enhance access to clean energy and innovation for the sustainable economic growth of Southeast Asian countries over the period 2000–2023. Consequently, Hypothesis 4 is confirmed.

6. Conclusions

In conclusion, this article investigates the impact of the growth threshold on access to clean energy and renewable energy, covering eight Southeast Asian countries, including China, Indonesia, Japan, South Korea, Malaysia, Singapore, Thailand, and Vietnam, for the period 2000–2023. Using panel data and threshold regression analysis as an empirical strategy, we have found overwhelming evidence to support and respond to the fundamental testable research hypotheses in this article.

The findings are established: (1) There is evidence of a significant moderating effect of growth/FDI on the nexus between access to clean energy and the renewable energy transition in Southeast Asian countries. (2) There is evidence of a significant moderating effect of growth/trade on the nexus between access to clean energy and the renewable energy transition in Southeast Asian countries. (3) There is evidence of a significant moderating effect of growth/R&D on the nexus between access to clean energy and the renewable energy transition in Southeast Asian countries. (4) Lastly, the complementary growth threshold of 1.68% is to be checked for access to clean energy and technologies and the renewable energy transition in South Asian countries. This result aligns with research conducted by Zhang et al. [10], Raihan et al. [13], Hou et al. [19], Xuan [21], and He and Huang [4], who investigated renewable energy’s growth effect using the Chinese time series data from 1990 to 2020, and as discussed in the theoretical underpinnings section of this article.

This finding is consistent with the nonlinear regression studies by Qi and Li [6] on the threshold impacts of renewable energy use on economic expansion under energy transformation, and by Abdulqadir [7] on the growth threshold effect on the use of renewable energy in the sub-Saharan African oil-producing nations. Chen et al. [5] used a threshold model on a sample of 103 countries from 1995 to 2015 to examine the relationship between economic growth and renewable energy transformations, and Abdulqadir [38] on how sub-Saharan Africa may achieve the Sustainable Development Goals (SDGs) through urbanization, renewable energy, and reductions in carbon dioxide emissions. To achieve SDG-7 in the pursuit of affordable access to clean energy in Southeast Asian countries, the transition to renewable energy often results in certain economic cost implications. Rarely, an enhanced transition to renewable energy may likely result in a negative impact on these economies when some fundamental growth indicators are below a certain threshold, as predicted from the outcome of this study.

Consistent with the findings from this study, it is recommended that the Southeast Asian region should promote access to clean energy and innovation as a matter of policy relevance. The policy implications of accelerated transition to renewable energy promote sustained growth, at least below certain thresholds. Considering the findings from this article, we believe that promoting investment in R&D, trade, and FDI would have a positive impact on the region in the long run. In the short run, revisiting some of the existing policies could possibly distort the optimal allocation of resources to achieve its desired SDG-7 trajectory before the deadline, 2030.

Despite the contributions of this study, several limitations should be acknowledged. First, the analysis primarily focuses on Southeast Asian countries due to data availability constraints, which may limit the generalizability of findings to developing economies with distinct investment in R&D, FDI, trade, and renewable energy policy landscapes. Second, while the study employs instrumental variables to mitigate endogeneity concerns, unobserved factors such as geopolitical shifts or cultural attitudes toward access to clean energy and innovation could still bias the results. Third, the threshold modeling framework may overlook dynamic interactions between investment in R&D, FDI, trade, and renewable energy adoption over time.

Future research should focus on other fundamental factors that could likely promote sustained economic growth and the renewable energy transition while controlling the effect of access to clean fuels and technologies. Given considerable concern about exploring the asymmetric impact of economic growth in the nexus between access to clean energy and renewable energy transition in Southeast Asian countries and beyond, this will be a significant topic for future research. Future studies might benefit from including a wider range of issues, particularly the recent Donald Trump reciprocal tariffs and how they affect economic growth and renewable transformations in Southeast Asian countries. Emphasis should focus on such policy indices and technical breakthroughs to provide a more comprehensive picture of the factors driving economic growth and energy transition. In order to properly capture the intricate interactions and potential threshold effects between renewable energy and economic results, researchers could also investigate nonlinear or machine learning models.

Author Contributions

Conceptualization, I.A.A. and M.M.; methodology, I.A.A.; software, I.A.A.; validation, I.A.A. and M.M.; investigation, I.A.A.; resources, M.M.; data curation, I.A.A.; writing—original draft preparation, I.A.A.; writing—review and editing, M.M.; visualization, I.A.A.; supervision, M.M.; project administration, I.A.A.; funding acquisition, M.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the projects of talent recruitment of GDUPT under the Grant no. XJ2022000901.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| ASEAN | Association of Southeast Asian Nations |

| SSA | Sub-Saharan Africa |

| SDG | Sustainable Development Goal |

| R&D | Research and Development |

| FDI | Foreign Direct Investment |

Appendix A

Table A1.

Data definitions and sources.

Table A1.

Data definitions and sources.

| Variables | Symbols | Definition | Source |

|---|---|---|---|

| Renewable energy | Transitions | Renewable energy consumption is the share of renewable energy in total final energy consumption. | WDI |

| Economic growth | Growth | Annual % growth rate of GDP constant 2015 | WDI |

| Access to clean energy | Access | Access to clean fuels and technologies for cooking (% of population) | WDI |

| Trade openness | Trade | Trade (% of GDP) | WDI |

| Foreign direct investment | FDI | Net inflows (% of GDP) | WDI |

| Research and development expenditure | R&D | Research and development expenditure (% of GDP) | WDI |

| Labor force | Labor | Labor force participation rate, total (% of total population ages 15–64) | WDI |

References

- Regilme, S.S. Oligarchic Rivalry: US–China Tariffs and the Global Politics of Inequality. 2025. Available online: https://hdl.handle.net/1887/4252628 (accessed on 27 August 2025).

- Li, B.; Nian, V.; Shi, X.; Li, H.; Boey, A. Perspectives of energy transitions in East and Southeast Asia. WIREs Energy Environ. 2020, 9, e364. [Google Scholar] [CrossRef]

- Derouez, F.; Ifa, A. Assessing the Sustainability of Southeast Asia’s Energy Transition: A Comparative Analysis. Energies 2025, 18, 287. [Google Scholar] [CrossRef]

- He, Y.; Huang, P. Exploring the Forms of the Economic Effects of Renewable Energy Consumption: Evidence from China. Sustainability 2022, 14, 8212. [Google Scholar] [CrossRef]

- Chen, C.; Pinar, M.; Stengos, T. Renewable energy consumption and economic growth nexus: Evidence from a threshold model. Energy Policy 2020, 139, 111295. [Google Scholar] [CrossRef]

- Qi, S.; Li, Y. Threshold effects of renewable energy consumption on economic growth under energy transformation. Chin. J. Popul. Resour. Environ. 2017, 15, 312–321. [Google Scholar] [CrossRef]

- Abdulqadir, I.A. Growth threshold-effect on renewable energy consumption in major oil-producing countries in sub-Saharan Africa: A dynamic panel threshold regression estimation. Int. J. Energy Sect. Manag. 2021, 15, 496–522. [Google Scholar] [CrossRef]

- Abdulqadir, I.A.; Asongu, S.A. The asymmetric effect of Internet access on economic growth in sub-Saharan Africa. Econ. Anal. Policy 2022, 73, 44–61. [Google Scholar] [CrossRef]

- Wang, Q.; Guo, J.; Dong, Z. The positive impact of official development assistance (ODA) on renewable energy development: Evidence from 34 Sub-Saharan Africa Countries. Sustain. Prod. Consum. 2021, 28, 532–542. [Google Scholar] [CrossRef]

- Zhang, L.; Xie, L.; Mu, X.; Hu, G. Trade and the Sustainable Energy Transition: Exploring the Impact of Trade on Total Factor Renewable Energy Efficiency. Sustainability 2025, 17, 1566. [Google Scholar] [CrossRef]

- Guo, L.; Du, F.; Tang, M. Will the Development of the Digital Economy Impact the Clean Energy Transition? An Intermediary Utility Analysis Based on Technological Innovation and Industrial Structure. Sustainability 2025, 17, 4917. [Google Scholar] [CrossRef]

- Triki, R.; Mahmoud, S.M.; Bahou, Y.; Boudabous, M.M. Assessing Renewable Energy Adoption to Achieve Sustainable Development Goals in Ha’il Region. Sustainability 2025, 17, 6097. [Google Scholar] [CrossRef]

- Raihan, A.; Ridwan, M.; Zimon, G.; Rahman, J.; Tanchangya, T.; Bari, A.M.; Atasoy, F.G.; Chowdhury, A.I.; Akter, R. Dynamic effects of foreign direct investment, globalization, economic growth, and energy consumption on carbon emissions in Mexico: An ARDL approach. Innov. Green Dev. 2025, 4, 100207. [Google Scholar] [CrossRef]

- Wang, Q.; Li, C.; Li, R. How does renewable energy consumption and trade openness affect economic growth and carbon emissions? International evidence of 122 countries. Energy Environ. 2025, 36, 187–211. [Google Scholar] [CrossRef]

- Osuma, G.; Bonga-Bonga, L. The Effects of Foreign Direct Investment and Technological Innovation on Renewable Energy Consumption Under Varying Market Conditions in the EU. Energies 2025, 18, 1353. [Google Scholar] [CrossRef]

- Imran, M.; Alam, M.S.; Jijian, Z.; Ozturk, I.; Wahab, S.; Doğan, M. From resource curse to green growth: Exploring the role of energy utilization and natural resource abundance in economic development. Nat. Resour. Forum 2024, 49, 2025–2047. [Google Scholar] [CrossRef]

- Shu, H.; Wang, Y.; Umar, M.; Zhong, Y. Dynamics of renewable energy research, investment in EnvoTech and environmental quality in the context of G7 countries. Energy Econ. 2023, 120, 106582. [Google Scholar] [CrossRef]

- Abd Alah, F.F.M.B.; Ojekemi, O.S. Quantile Analysis of Economic Growth, Foreign Direct Investment, and Renewable Energy on CO2 Emissions in Brazil: Insights for Sustainable Development. Energies 2025, 18, 2256. [Google Scholar] [CrossRef]

- Hou, H.; Wu, D.; Wang, X.; Kong, D. Foreign direct investment, environmental regulation, and energy transition—An empirical study based on data from 38 OECD countries worldwide. Manag. Decis. Econ. 2025, 46, 573–589. [Google Scholar] [CrossRef]

- Xuan, V.N. The nexus between innovation, renewable energy consumption, foreign direct investment, GDP, and CO2 emissions in the context of Vietnam: New evidence from the ARDL approach. Energy Environ. 2025. [Google Scholar] [CrossRef]

- Xuan, V.N. Nexus of innovation, renewable energy, FDI, trade openness, and economic growth in Germany: New insights from ARDL method. Renew. Energy 2025, 247, 123060. [Google Scholar] [CrossRef]

- Xuan, V.N. Relationship between GDP, FDI, renewable energy, and open innovation in Germany: New insights from ARDL method. Environ. Sustain. Indic. 2025, 25, 100592. [Google Scholar] [CrossRef]

- Cong, N.T.; Truc, H.T.; Nhut, N.M.; Ngoc, T.T. The Role of the Digital Economy and Sustainable Factors: Economic, Social, Environmental in Renewable Energy Consumption in Southeast Asia; Springer Nature: Cham, Switzerland, 2025; Volume 2, ISBN 9783031938900. [Google Scholar]

- Zhong, S.; Yang, L.; Papageorgiou, D.J.; Su, B.; Ng, T.S.; Abubakar, S. Accelerating ASEAN’s energy transition in the power sector through cross-border transmission and a net-zero 2050 view. iScience 2025, 28, 111547. [Google Scholar] [CrossRef]

- Guo, S.; Yan, X. Investigation of Industrial Structure Upgrading, Energy Consumption Transition, and Carbon Emissions: Evidence from the Yangtze River Economic Belt in China. Sustainability 2025, 17, 4383. [Google Scholar] [CrossRef]

- Asisifa, M.; Pratomo, W.A. Analysis of the Impact of Green Economy on Economic Growth in ASEAN Countries. In TALENTA Conference Series: Local Wisdom, Social, and Arts; Universitas Sumatera Utara: Kota Medan, Indonesia, 2025; Volume 8. [Google Scholar]

- Romer, P.M. Endogenous Technological Change. J. Political Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef]

- Romer, P.M. Increasing returns and long-run growth. J. Political Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Han, S.; Peng, D.; Guo, Y.; Aslam, M.U.; Xu, R. Harnessing technological innovation and renewable energy and their impact on environmental pollution in G-20 countries. Sci. Rep. 2025, 15, 2236. [Google Scholar] [CrossRef]

- Shi, X.; Shi, D. Impact of Green Finance on Renewable Energy Technology Innovation: Empirical Evidence from China. Sustainability 2025, 17, 2201. [Google Scholar] [CrossRef]

- Wang, J.; Tan, Z.; Zuo, Y. Digital inclusive finance and common prosperity: The threshold effect based on rural revitalization. Int. Rev. Econ. Financ. 2025, 100, 104096. [Google Scholar] [CrossRef]

- Wen, C.; Xiao, Y.; Hu, B. Digital financial inclusion, industrial structure and urban–Rural income disparity: Evidence from Zhejiang Province, China. PLoS ONE 2024, 19, e0303666. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, K.; Pang, Y.; Coyte, P.C. The role of digital financial inclusion in China on urban—Rural disparities in healthcare expenditures. Front. Public Health 2024, 12, 1397560. [Google Scholar] [CrossRef]

- Wu, S.; Yang, D.; Xia, F.; Zhang, X.; Huo, J.; Cai, T.; Sun, J. The Effect of Labor Reallocation and Economic Growth in China. Sustainability 2022, 14, 4312. [Google Scholar] [CrossRef]

- Brambor, T.; Clark, W.R.; Golder, M. Understanding interaction models: Improving empirical analyses. Political Anal. 2006, 14, 63–82. [Google Scholar] [CrossRef]

- Hansen, B. Sample Splitting and Threshold Estimation. Econometrica 2000, 68, 575–603. [Google Scholar] [CrossRef]

- Abdulqadir, I.A. CO2 emissions policy thresholds for renewable energy consumption on economic growth in OPEC member countries. Int. J. Energy Sect. Manag. 2023, 17, 1074–1091. [Google Scholar] [CrossRef]

- Abdulqadir, I.A. Urbanization, renewable energy, and carbon dioxide emissions: A pathway to achieving sustainable development goals (SDGs) in sub-Saharan Africa. Int. J. Energy Sect. Manag. 2024, 18, 248–270. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).