1. Introduction

In response to the interconnected challenges of climate change, sustainable development, and economic diversification, nations worldwide are re-evaluating their economic models. For Saudi Arabia, this global challenge coincides with an internal strategic vision: reduce long-standing reliance on hydrocarbons and create a new era of green innovation. This bold initiative is central to Vision 2030, which aims to build a resilient, inclusive, and environmentally responsible economy. At the heart of this change is green finance (GF), a key factor that can transform the national economy by promoting sustainable entrepreneurship, creating green jobs, and speeding up the shift to a circular economy (CE).

As the world’s largest oil exporter, Saudi Arabia presents a compelling research context due to its ambitious transition from a hydrocarbon-dependent economy [

1]. This transformation is supported by concrete financial mechanisms, including the national “Green Financing Framework”, which targets Net Zero Carbon emissions by 2060 and annual CO2 reductions of 278 million tons by 2030 [

1]. The framework adopts the G20-endorsed Circular Carbon Economy (CCE) approach, while the Public Investment Fund (PIF) drives implementation by investing USD 19.4 billion in green projects with the development of 70% of the Kingdom’s renewable energy capacity [

1]. Complementing this, the Saudi Green Initiative (SGI) has launched over 85 environmental projects with investments exceeding SAR 705 billion (USD 188 billion), establishing dedicated frameworks for green bonds, sukuk, and loans [

2,

3].

This study examines eight cities representing Saudi Arabia’s diverse economic geography under Vision 2030, including financial hubs (Riyadh), commercial gateways (Jeddah, Dammam), religious capitals (Mecca, Medina), and emerging regions (Tabuk, Taif, Hail). Hail serves as a critical case study, combining renewable energy and sustainable agriculture potential with persistent structural barriers, raising key questions about how green finance functions differently across regional contexts.

International research confirms green finance’s vital role in sustainable transitions, driving innovation through instruments like green bonds and sustainability-linked loans [

4,

5,

6]. However, challenges persist, including standardization issues and regulatory gaps [

7]. Effective circular transitions require integrated frameworks linking finance with innovation, as demonstrated in China’s green finance reform zones [

6]. This stands in contrast to the Saudi model, which is distinguished by its state-led, top-down approach, pivoting a hydrocarbon-dependent economy towards circularity, rather than greening an existing industrial base like China or navigating a complex supranational policy landscape like the European Union.

Green finance directly enables Vision 2030’s “Thriving Economy” pillar through renewable energy development and diversification [

8,

9]. While promoting inclusive growth when integrated with industrial policy [

10,

11], it requires careful implementation to address barriers like limited capital access in emerging regions [

8,

12,

13].

Despite extensive research, a significant gap persists. Most studies focus heavily on China, India, and Europe, resulting in a lack of understanding about the specific dynamics, challenges, and opportunities within the Gulf Cooperation Council (GCC) region. To our knowledge, no empirical research has simultaneously combined the four connected aspects of green finance, entrepreneurship, employment, and circularity into a single analytical framework. This gap is particularly significant because of Saudi Arabia’s Vision 2030, which seeks to actively promote all four pillars.

Our study, therefore, provides a novel contribution by developing the first integrated empirical framework that simultaneously analyzes these four interconnected pillars within the unique context of Saudi Arabia’s transformative Vision 2030. We intend to explore how green finance can act as a strategic driver to enhance green entrepreneurship, boost sustainable employment, and accelerate the shift to a circular economy in Saudi Arabia. This research takes a comparative and place-based approach across the eight key Saudi cities, with Hail serving as a focal point to reveal unique regional dynamics. While major urban centers typically reap the benefits of financial innovation, semi-peripheral regions like Hail illustrate the broader challenges and opportunities present; they have strong potential in sectors such as sustainable agriculture and renewable energy, but face serious financial access challenges. This represents a key test for the inclusive goals of Vision 2030.

To address these questions, we employ advanced machine learning techniques—XGBoost complemented by SHAP interpretation—to analyze non-linear relationships between green investment (IGF) and key outcomes: entrepreneurship (NBR), employment (EM), and circular economy indicators (CRW). This approach accounts for mediating factors like energy access (ATE, ANE) and Logarithm of Carbon Dioxide Emissions (LCDE), moving beyond correlation to provide actionable insights for policymakers supporting Saudi Arabia’s sustainable transition.

2. Literature Review

In this section, we focused on the most relevant research exploring how green finance can promote entrepreneurship, employment, and the circular economy in both emerging and developed markets. The selected studies were analyzed thematically to identify key challenges, opportunities, and contrasting perspectives. This qualitative approach highlights prevailing trends while also uncovering gaps and contradictions in the existing literature.

2.1. Green Finance and the Transition to a Circular Economy: A Review of Challenges and Opportunities

As environmental pressures and social inequalities intensify, moving toward a circular economy (CE) has become an essential pathway for sustainable development. Within this transition, green finance (GF) plays a central role—not only by providing capital for innovative projects but also by steering financial resources toward circular and sustainable production models. Yet, the alignment of GF with CE objectives remains complex, marked by both significant constraints and promising prospects.

2.1.1. Key Challenges in Aligning Green Finance with the Circular Economy

The integration of GF and CE faces a number of intertwined barriers that limit their practical implementation and long-term scalability.

Regulatory and Standardization Gaps: One persistent difficulty lies in the absence of a consistent global framework. Definitions of what counts as “green” or “circular” still vary widely across markets, creating confusion and heightening the risk of greenwashing [

7]. Without clear and harmonized criteria, investors face uncertainty when assessing which projects genuinely support circular outcomes.

Financial and Structural Barriers: Circular ventures—especially those initiated by small and medium enterprises (SMEs)—are often seen as high-risk because of their innovative but untested business models. This perception discourages lenders and limits access to capital. Moreover, conventional instruments like green bonds tend to favor large-scale renewable projects rather than smaller, circular initiatives that require more flexible funding mechanisms [

12,

13].

Technological and Infrastructural Hurdles: Shifting to a circular model demands substantial investment in recycling systems, remanufacturing facilities, and waste management technologies. However, many of these infrastructures remain underdeveloped or underfunded. The gap between pilot-stage innovations and commercial-scale implementation often creates a “valley of death” for promising circular solutions.

Market and Mindset Resistance: Deep-rooted habits tied to the linear “take-make-dispose” model persist among both producers and consumers. Firms may hesitate to alter profitable existing practices, and consumer awareness of circular products remains limited, slowing the diffusion of circular consumption patterns.

2.1.2. Emerging Opportunities and Synergies

Despite these challenges, numerous opportunities are emerging at the intersection of GF and CE, offering new routes for sustainable value creation and competitiveness.

Driving Technological Innovation and Competitiveness: Green finance provides the financial foundation for research and development in fields such as materials science, clean technologies, and resource efficiency. By supporting such innovation, GF stimulates new business models—like product-as-a-service or sharing platforms—that strengthen the resilience and market positioning of firms adopting circular principles [

4,

6].

Unlocking New Financial Instruments and Markets: The growing relevance of circular practices has encouraged the creation of novel financial tools. These include sustainability-linked loans tied to circular performance metrics and the securitization of circular assets. Integrating “circularity risk” into ESG assessments also helps investors identify firms that are better prepared for long-term environmental and regulatory changes [

14,

15].

Enhancing Transparency and Efficiency through Digitalization: Technologies such as blockchain, artificial intelligence, and FinTech applications are transforming how circular projects are monitored and financed [

5]. They enable traceability of materials along their life cycle, verify environmental claims, and optimize industrial symbiosis networks—reducing information asymmetries and improving investor confidence.

Creating Systemic Economic and Environmental Benefits: Experiences like China’s green finance reform pilot zones demonstrate how targeted policies can generate local co-benefits, including green job creation, energy efficiency gains, and lower pollution levels [

6]. In addition, promoting eco-friendly micro, small, and medium enterprises (MSMEs) through inclusive finance can contribute to a more diversified and resilient economic structure [

16].

In short, green finance is indispensable for enabling the circular transition, but its potential will only be realized if structural and institutional bottlenecks are effectively addressed. Strong governance frameworks, harmonized standards, and well-designed financial incentives—combined with the strategic use of digital tools—are essential to bridge existing gaps. Understanding how these challenges and opportunities interact remains a key priority for both research and policy aimed at aligning financial systems with circular economy principles.

2.2. Green Finance as a Driver of Sustainable Economic Transformation

Green finance goes beyond just environmental issues. It aims to reshape economic paths toward more inclusive and strong growth. Its power comes from its connection with industrial, social, and local strategies.

Wang, Shu, and Cui [

11] show that green finance reforms in China support urban green changes, especially through technological innovation and better carbon efficiency. This effect is stronger in less developed areas, which points to the need for local policies.

Similarly, Ref. [

10] highlights that green finance, when paired with environmental taxes and sustainable investments, leads to low-carbon, inclusive growth—especially when linked with educational and social policies.

Zhang et al. [

17] confirm that green finance boosts energy efficiency. However, they warn that its effectiveness relies on the quality of investments and their alignment with environmental goals.

In a related vein, Refs. [

18,

19] stress the importance of a comprehensive approach that links green finance, sustainability, and employment transformation. Liu [

18] especially points out the importance of green bonds, tax incentives, and focused support for renewable energy and sustainable agriculture.

In summary, green finance acts as a key tool for structural change, as long as it fits into a clear and coordinated plan for sustainable development.

2.3. Green Entrepreneurship, Digitalization, and Inclusion in Developing Economies

In low- and middle-income countries, the shift to a circular economy relies on integrating sustainable finance, entrepreneurial innovation, and digitalization effectively. Badjeena et al. [

12] find that green entrepreneurship mainly arises from economic opportunity but is limited by restricted access to finance, barriers in institutions, and gender inequality. Mondal, Singh, and Gupta [

20] show that for Indian SMEs, digitalization and improved dynamic capabilities are essential for effective circular business models. However, these advancements depend significantly on strong institutional support.

In this context, ref. [

13] emphasizes the importance of tools like green microfinance and social impact bonds in promoting financial inclusion and supporting circularity. Still, the global circularity rate of only 7.2% highlights the need for a comprehensive approach that combines blended finance, partnerships among various stakeholders, and customized local governance. Zhang and Cheung [

16] support this view by demonstrating that the relationship between green and inclusive finance depends on the context. It is beneficial for green SMEs but can be ineffective or even harmful for polluting companies. This detail requires careful targeting in financing policies.

Furthermore, empirical evidence from Saudi Arabia demonstrates that SME adoption of circular practices significantly improves business performance, indicating the practical relevance of green entrepreneurship initiatives [

21]. These findings align with trends in Saudi cities, where combining green investment, entrepreneurship, and energy access may play a crucial role in creating local circular economy models. Additionally, strategic national projects, such as NEOM and the Green Initiative, illustrate how green entrepreneurship is being supported within Saudi Arabia’s broader Vision 2030 framework, reinforcing both innovation and inclusion [

22].

2.4. Green Finance, Employment, and Territorial Transformation

One of the most compelling arguments for green finance is its power to create jobs—a vital ingredient for ensuring the shift to a sustainable economy is fair for everyone. We see this happen in a few key ways: it changes how things are made, moves jobs from old industries to new ones, and fuels initiatives to retrain workers for the future.

Real-world examples bring this to life. In China, special zones set up to test green finance policies have successfully boosted manufacturing jobs, especially in cleaner, privately owned companies [

23]. At the same time, there has been a noticeable shift in cities, with more people moving into jobs in sustainable service industries, marking a fundamental change in the economic landscape [

24].

But it is not all straightforward. There is a tricky balancing act at play. Some researchers note that while green policies increase the need for highly skilled experts, the costs can strain companies, sometimes making them hesitant to hire more people [

25]. The upside is that in eco-conscious firms, green lending directly helps create skilled jobs by combining new technology with human know-how [

26].

The potential is global. For instance, in Romania, experts highlight renewable energy—particularly hydropower—as a major driver of new green jobs [

27]. Yet, the flip side cannot be overlooked. This progress must be carefully managed, as job losses in traditional, polluting industries often demand strong support systems for affected workers [

28]. Moreover, while companies are increasingly tracking ESG metrics, a crucial element remains underdeveloped: genuinely engaging employees in green finance objectives, which represents a largely untapped opportunity [

29].

This brings us to a critical question for a country like Saudi Arabia. With national priorities squarely set on creating more jobs (EM) and diversifying the economy, understanding the precise impact of green investment (IGF) is essential. The real need is to figure out how these investments reshape the job market and different regions, specifically by looking at their effect on practical outcomes like access to electricity (ATE) and cutting emissions (CDE).

2.5. Multi-Level Governance and Institutional Coordination

The effectiveness of green finance relies greatly on the quality of governance. Governance consistently emerges in the literature as a decisive factor shaping the impact of green finance. Financial instruments can only reach their full potential when they operate within institutional systems that are transparent, consistent, and inclusive.

Xu et al. [

6] demonstrate that green finance policies are most effective in regions with strong administrative capacities and clear environmental leadership. Liu [

18] emphasizes the value of proactive government strategies, supported by measures such as tax incentives, risk-sharing mechanisms, and a long-term vision. Other scholars highlight the need for collaboration between government bodies, the private sector, and civil society to create an ecosystem that supports a fair and sustainable transition.

This perspective is particularly significant for Saudi Arabia. Strengthening coordination among institutions can help ensure that green investments are allocated more effectively, resulting in real progress in entrepreneurship (NBR), employment (EM), and the circular economy (CRW). In this context, governance is not merely a backdrop, but a central force driving Saudi Arabia’s green transition.

2.6. Critical Synthesis, Academic Debates and Research Positioning

Scholarly work in green finance increasingly demonstrates its capacity to reshape economic systems through the advancement of circular practices, entrepreneurial development, and employment generation. Existing research outlines multiple mechanisms through which sustainable financial instruments can reorient capital flows, foster technological advancement, and produce environmental co-benefits, as evidenced in innovative policy experiments such as China’s green finance reform zones.

Nevertheless, this promising outlook is counterbalanced by significant scholarly discussions that scrutinize both the practical implementation and conceptual foundations of green finance. The academic community continues to debate several contentious aspects of the relationship between financial mechanisms and circular economic models. Concerns regarding greenwashing transcend mere definitional ambiguities to reveal a deeper incompatibility between conventional financial approaches and circular economy principles, with some researchers contending that prevailing systems naturally privilege incremental, measurable enhancements over radical circular transformations [

7,

12,

13].

Simultaneously, the prevalent enthusiasm for technological solutions faces scholarly pushback, as critics caution that digital tools like blockchain and artificial intelligence, despite improving supply chain visibility, fail to address entrenched institutional and behavioral patterns that sustain linear economic models. Questions of distributive justice further complicate the narrative, with research indicating that green finance allocations frequently cluster in developed economic centers, potentially widening regional disparities and prompting serious considerations about geographical equity within Saudi Arabia’s diversification strategy. Moreover, research on the Gulf context suggests that circular economy initiatives are strongly linked to resource management and sustainable development policies, emphasizing the strategic role of national energy and water governance [

30].

Most critically for this investigation, the viability of finance-led circular transitions in hydrocarbon-reliant nations remains academically disputed, with some analysts emphasizing the powerful “carbon lock-in” effects that might restrict green finance to marginal initiatives rather than enabling comprehensive economic restructuring. Evidence also indicates that Saudi Arabia’s circular economy transition produces spillover effects across the GCC, suggesting broader regional implications that are crucial to understanding policy scalability [

31].

These conceptual discussions converge with persistent empirical shortcomings in the current literature. The geographical focus of existing studies remains predominantly centered on China, India, and European contexts, providing a limited understanding of the distinctive circumstances characterizing Gulf economies. Additionally, scholarly work has yet to simultaneously investigate the interconnected dynamics between green finance, entrepreneurial activity, employment patterns, and circular economy indicators within a unified analytical framework. Traditional regression-based methodologies further prove inadequate for capturing the intricate, non-linear impacts of green financial interventions, especially when these effects demonstrate significant regional variation.

Our research seeks to bridge these theoretical discussions and empirical limitations. Employing XGBoost machine learning complemented by SHAP interpretation techniques, this investigation analyzes how green investment (IGF) influences entrepreneurial ventures (NBR), employment metrics (EM), and circular energy utilization (CRW), while controlling for crucial contextual factors including electricity availability (ATE, ANE) and carbon emission levels (LCDE).

The examination of eight strategically selected Saudi urban centers with varying socioeconomic and environmental characteristics enables a unique opportunity to evaluate propositions concerning regional equity and spatial development patterns, while simultaneously gauging the practicality of finance-mediated circular transitions in a resource-dependent economy. Ultimately, this research strives to deliver empirically grounded insights that can inform policy formulation for an equitable and geographically balanced sustainability transition in Saudi Arabia, while simultaneously advancing central theoretical discussions within the academic discourse.

2.7. Hypothesis Development

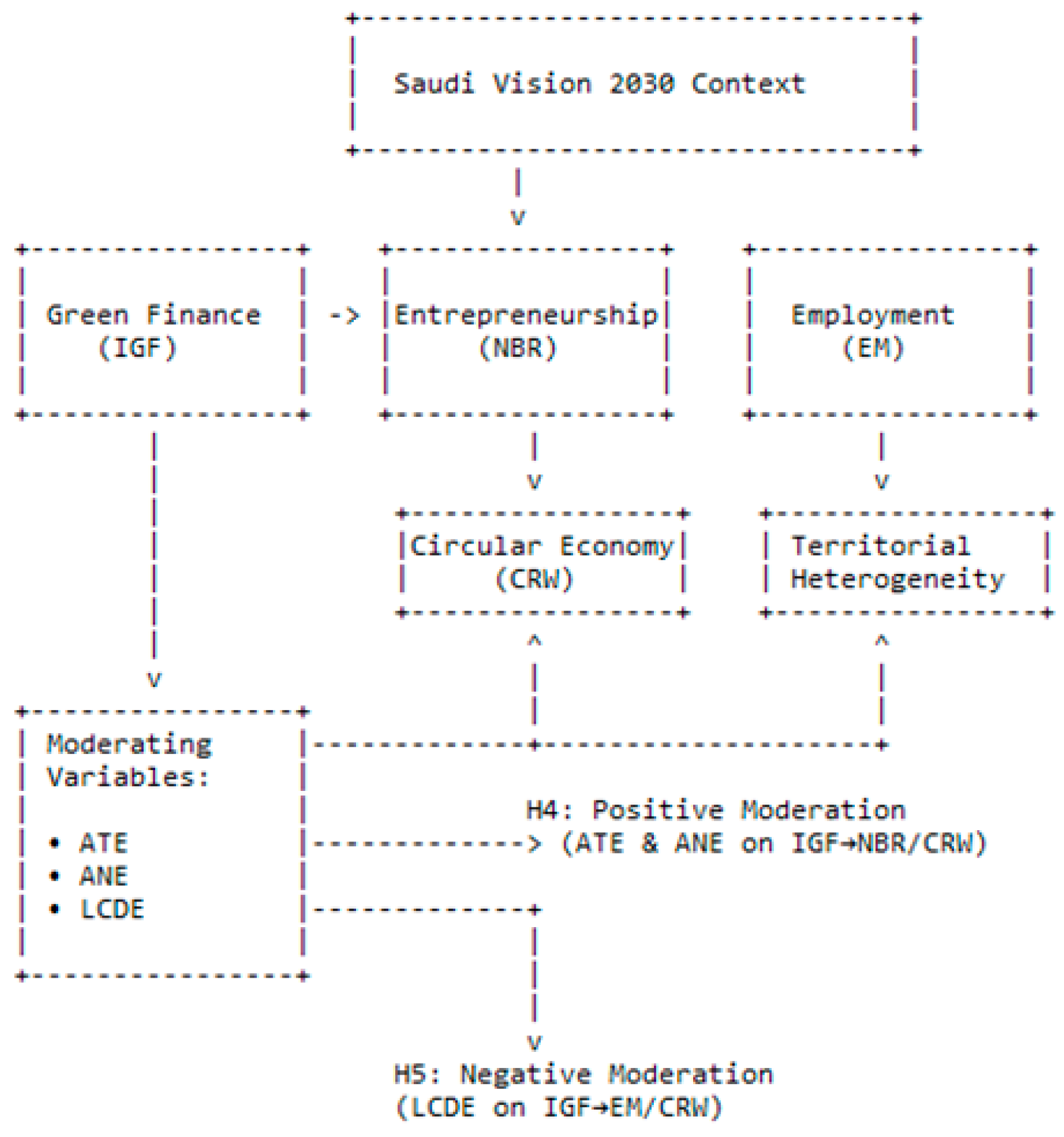

Building on prior research, addressing existing gaps, and drawing on the Saudi context outlined in the literature review, this study formulates several hypotheses to examine how green finance influences entrepreneurship (proxied by New Business Registrations–NBR), employment opportunities, and the development of the circular economy across Saudi Arabian cities. The conceptual framework guiding this research, illustrating the direct and moderating effects of Green Finance (IGF) on entrepreneurship, employment, and the circular economy within the Saudi Vision 2030 context, is presented in

Figure 1.

2.7.1. Green Finance and Entrepreneurship

Starting a business in the green economy is often a tough challenge. Entrepreneurs face high upfront costs and considerable technological uncertainty, which makes the path riskier than in many other sectors [

12]. Green finance helps to lower these barriers by providing not only the capital needed but also mechanisms that reduce financial risk. Through instruments like green bonds or targeted loans, start-ups and small firms gain the support required to design and scale circular solutions, whether in waste recycling, clean energy, or other sustainable activities. In the specific context of Saudi Arabia’s Vision 2030, which prioritizes economic diversification and private sector growth, green investments send a clear signal to the market: they validate new opportunities, boost confidence, and attract further interest. Taken together, these factors suggest that green finance can be a powerful driver of new business creation.

H1: Investment in Green Finance (IGF) has a positive effect on entrepreneurship, measured by the number of New Businesses Registered (NBR).

2.7.2. Green Finance and Employment

Green finance does not just create businesses—it also creates jobs. Funds from IGF directly support projects like building solar farms or recycling plants, which need workers to operate. They also push firms to combine technology and skills, raising the demand for trained labor [

26]. At the same time, there can be short-term pressures. For example, meeting new regulations or restructuring may slow hiring in some areas [

25]. Overall, though, the expectation is that green finance helps the economy move toward more sustainable industries and services, which is a critical objective for Saudi Arabia as it diversifies its economy under Vision 2030 and seeks to create employment for its growing population [

24].

H2: Investment in Green Finance (IGF) positively affects Employment (EM) levels.

2.7.3. Green Finance and the Circular Economy

Moving toward a circular economy requires money—lots of it. Significant investments are required to develop new technologies, build recycling and reverse logistics infrastructure, and redesign products so they are more durable and reusable. Green finance plays a crucial role in turning these ideas into reality. This is particularly relevant for Saudi Arabia, where national projects like NEOM and the Saudi Green Initiative explicitly aim to embed circular principles into the economy. Research from China shows that these kinds of policies can spark innovation and help make better use of resources [

6]. In our study, we track progress toward a circular economy by looking at factors like renewable energy use and levels of combustible waste (CRW). These measures reflect the influence of IGF-funded projects, such as waste-to-energy plants and renewable power generation. We therefore expect a strong positive link.

H3: Investment in Green Finance (IGF) positively affects the Use of Renewable Energy and Combustible Waste (CRW).

2.7.4. The Moderating Role of Energy Transition and Emissions

Green finance does not operate in a vacuum. To clarify the contextual mechanisms at play, we introduce two moderating hypotheses. Having dependable Access to Electricity (ATE) and a higher proportion of Alternative and Nuclear Energy (ANE) helps set the stage for green projects to succeed, making them more affordable and practical. We postulate that regions with robust electricity infrastructure and a cleaner energy mix can more effectively leverage green investments, thereby amplifying their impact on entrepreneurial and circular outcomes. Conversely, the level of Carbon Dioxide Emissions (LCDE) signals the extent of a region’s dependence on a carbon-intensive economy. We argue that in regions with lower emissions, the effectiveness of green investment in creating jobs and advancing circularity is enhanced, as the institutional and economic environment is more aligned with a sustainable transition. With all this in mind, we propose:

H4: Access to Electricity (ATE) and Alternative and Nuclear Energy (ANE) positively moderate the relationship between IGF and (a) NBR and (b) CRW, such that these relationships are stronger in regions with better electricity access and a cleaner energy mix.

H5: Carbon dioxide emissions (LCDE) negatively moderate the relationship between IGF and (a) EM and (b) CRW, such that these relationships are weaker in regions with higher emissions levels.

2.7.5. Territorial Heterogeneity

A central lesson from the literature is the weight of place-based policies and the spillover effects they create [

6,

11]. The socio-economic, industrial, and institutional profiles of Saudi cities differ widely. Riyadh, for example, as a metropolitan hub with dense financial services and a skilled workforce, can mobilize green finance in ways that are not directly comparable to Hail. The latter, while rich in agricultural and renewable energy potential, continues to face obstacles linked to infrastructure and financial inclusion. For this reason, we do not advance a single, uniform hypothesis. Instead, we argue that the relationships outlined in H1–H5 are likely to take different forms and strengths across the eight cities. Applying a machine learning approach allows us to capture these local specificities and to bring out the distinct challenges and opportunities faced by cities like Hail within the broader Vision 2030 agenda.

3. Methodology and Analysis

3.1. Research Design

This study employs a longitudinal, multi-city comparative design combining explanatory modeling with predictive analytics. The research follows a quasi-experimental framework leveraging natural variations in green finance deployment across eight strategically selected Saudi cities over a 25-year period (2000–2024). To test the proposed hypotheses and meet the research objectives, this study applies a quantitative approach that draws on machine learning techniques. This method is especially well-suited to uncovering complex, non-linear relationships while also accounting for regional differences among the eight Saudi cities examined.

3.2. Data Collection and Processing

3.2.1. Data Sources and City Selection

This study uses a balanced dataset covering eight major Saudi cities—Riyadh, Jeddah, Mecca, Medina, Dammam, Tabuk, Taif, and Hail—over the period 2000 to 2024.

These cities were chosen through stratified purposive sampling based on their strategic importance in Saudi Arabia’s economic landscape, as well as their representation of varied regional development trends. They account for more than 80% of the Kingdom’s non-oil economic activity, while also displaying diverse typologies: global financial hubs (Riyadh, Jeddah), industrial corridors (Dammam, Hail), emerging growth poles (Tabuk), and cultural-religious centers (Mecca, Medina). This stratified approach assures statistical representativeness and contextual diversity, making it suited for investigating different green finance pathways within the Vision 2030 framework.

The dataset was compiled from official Saudi institutional sources, including the General Authority for Statistics (GaStat), the Saudi Central Bank (SAMA), the Ministry of Energy, as well as annual reports published by leading financial institutions.

3.2.2. Data Cleaning and Preprocessing

A rigorous four-stage data cleaning protocol was implemented to ensure data quality and consistency:

- 1.

Data Integration: Harmonized data from multiple sources using city-year as the primary key, with cross-validation across sources to ensure consistency.

- 2.

Missing Data Treatment: Applied multiple imputation techniques using chained equations (MICE) for variables with <15% missing values. Variables with higher missing rates were excluded from analysis.

- 3.

Outlier Detection and Treatment: Identified outliers using the Interquartile Range (IQR) method. Winsorization was applied at the 1st and 99th percentiles to mitigate the influence of extreme values while preserving data integrity.

- 4.

Temporal Consistency Checks: We used verified consistent reporting methodologies across time periods, with adjustments for methodological changes, using bridge studies where available.

3.3. Variable Specification

Variable Definitions and Measurement

Investment in Green Finance (IGF) was operationalized as the total annual capital flow through verified green financial instruments, including green bonds, green sukuk, sustainability-linked loans, and dedicated green investment funds in each city. The classification followed the Saudi Green Finance Taxonomy (SAMA, 2022), with independent verification using the International Capital Market Association Green Bond Principles.

Green Employment Classification was constructed using a three-tier methodology:

Sector-based classification identifying employment in environmental protection and resource management activities;

Occupation-based approach mapping green-specific roles across all sectors using Saudi Standard Occupational Classification codes;

Establishment-level analysis of firms receiving green financing, with employment weighted by green revenue share.

This comprehensive approach aligns with both the ILO Guidelines on Green Jobs and Saudi Arabia’s National Green Jobs Strategy.

The variables used in the study are defined as follows:

- ○

Dependent Variables (Development Indicators):

New Businesses Registered (NBR): Yearly count of new business registrations in sectors identified as green or environmentally sustainable, such as renewable energy, waste management, and sustainable agriculture.

Employment (EM): Annual employment level, emphasizing changes in “green jobs” within sectors supported by green finance.

Use of Renewable Energy and Combustible Waste (CRW): An indicator of circular economy progress, measured as the share of total energy consumption from renewable sources and recycled combustible waste.

- ○

Independent Variable:

Investment in Green Finance (IGF): Total annual capital directed through green financial instruments, including green bonds, green sukuk, sustainability-linked loans, and dedicated green investment funds in each city.

- ○

Control and Moderating Variables:

Alternative and Nuclear Energy (ANE): The proportion of electricity generated from non-fossil fuel sources that reflects clean energy infrastructure.

Access to Electricity (ATE): The percentage of the population with reliable electricity access, serving as a proxy for foundational infrastructure.

Logarithm of Carbon Dioxide Emissions (LCDE): The natural log of total CO2 emissions (in kilotons), representing environmental pressure and carbon intensity of the economy.

3.4. Analytical Framework

3.4.1. Machine Learning Model: XGBoost

Given the anticipated non-linear and interactive relationships among variables, traditional linear regression was deemed inadequate. Instead, this research uses the eXtreme Gradient Boosting (XGBoost) algorithm, which was selected as the primary analytical tool due to several methodological advantages for this research context.

- ○

Theoretical Justification for XGBoost Selection:

Non-linear Capture: Effectively models complex, non-linear relationships expected in green finance-impact pathways;

Handling of Interaction Effects: Automatically detects and models interaction effects without pre-specification, crucial for testing moderation hypotheses;

Robustness to Multicollinearity: Handles correlated predictors better than traditional regression methods;

Missing Data Resilience: Maintains performance with sparse data patterns common in emerging green finance markets.

- ○

Comparative Algorithm Assessment:

Alternative methods were considered and rejected for specific limitations:

Random Forest: Less computationally efficient for large datasets and a tendency to overfit on noisy data;

Support Vector Machines: Poor scalability and difficulty in interpreting interaction effects;

Neural Networks: High data requirements and “black box” interpretability challenges;

Traditional Panel Regression: Inability to capture complex non-linear relationships central to our hypotheses.

XGBoost is an ensemble technique that constructs a powerful predictor by sequentially integrating multiple decision trees. Each subsequent tree addresses the shortcomings of the previous ones, resulting in a model that is both accurate and resilient. It effectively handles diverse data types and reduces the risk of overfitting.

In application, the dataset is divided into a training subset (80%) for model development and a testing subset (20%) for validation. Model accuracy is assessed using standard regression metrics, including Root Mean Squared Error (RMSE) and Mean Absolute Error (MAE). Hyperparameter optimization is performed via Bayesian Optimization with 5-fold cross-validation to enhance model performance.

3.4.2. Model Interpretability: SHAP Analysis

Although machine learning models like XGBoost are very powerful, their complexity can make them seem like mysterious “black boxes”, leaving us uncertain about the factors influencing their predictions.

To address this issue and truly test our hypotheses, we used a technique called SHapley Additive Explanations (SHAP).

Drawing on concepts from game theory, SHAP fairly assigns credit to each feature, illustrating how it pushes the prediction above or below a simple benchmark, such as the average outcome. This approach gives us a clear and intuitive idea of the impact of each variable, allowing us to explore the “black box” to understand what truly influences the results.

We applied SHAP in three ways:

Global Interpretation: Summary plots display the average impact of each variable (e.g., IGF, ANE, ATE) on the outcomes (NBR, EM, CRW), helping evaluate hypotheses H1–H3 by determining whether IGF is a key predictor.

Local Interpretation: Dependency plots illustrate how changes in a variable like IGF affect model predictions, clarifying whether the relationship is linear, positive, or exhibits diminishing returns.

Interaction Analysis: SHAP interaction values assess the moderating effects proposed in H4 and H5. For example, they indicate if the effect of IGF is stronger when alternative energy (ANE) levels are high.

3.4.3. Territorial Heterogeneity Analysis

The analysis employed a multi-level SHAP approach to examine spatial variations:

Global SHAP values for overall variable importance;

City-specific SHAP analysis to identify regional patterns;

Cluster-based analysis grouping cities by development characteristics.

A key question for our research was the following: do these effects play out the same way in every city? This is where machine learning, combined with SHAP, comes in. This powerful combination allows us to go beyond averages and compare specific drivers of outcomes in each urban area.

The model is trained on the full dataset to capture broad patterns.

City-specific SHAP analyses are then conducted by calculating SHAP values for all observations from each city.

By comparing SHAP value distributions across cities, we can assess:

- ○

The relative influence of IGF on entrepreneurship (NBR) in smaller cities like Hail versus larger ones like Riyadh.

- ○

Whether the connection between CO2 emissions (LCDE) and renewable energy use (CRW) differs in industrial centers such as Dammam.

- ○

Unique regional drivers and constraints, enabling tailored policy recommendations.

This approach offers more than a simple regional fixed effect; it quantifies the distinct impact of each factor by location, yielding insights that can inform targeted, place-based policy decisions.

3.5. Empirical Model Specification

To make the analysis both robust and easier to interpret, we use XGBoost [

32] for predictive modeling, along with SHAP values [

33] to explain the model’s results. This approach allows us to see, in detail, how each explanatory variable contributes to the outcomes. For each sustainable development indicator—New Businesses Registered (NBR), Employment (EM), and Circular Renewable Waste use (CRW)—the basic relationship with green finance investment (IGF) and the control/moderating variables (ANE, ATE, LCDE) can still be represented using a classical panel data model:

where

Yit ∈ {NBRit, EMit, CRWit} denotes the dependent variable for city i in year t;

α is the intercept;

μi captures unobserved city-specific heterogeneity;

λt represents time-fixed effects;

εit is the idiosyncratic error term.

3.5.1. Model with Moderating Effects

To test the moderating roles of ANE, ATE, and LCDE, interaction terms are introduced:

where

γ1 and γ2 test whether the effect of green finance is amplified by clean energy infrastructure (ANE, ATE).

γ3 captures whether high emission levels (LCDE) alter the effectiveness of green finance.

3.5.2. Integration with XGBoost

Because the data may exhibit non-linear relationships and city-specific differences, the classical panel equations serve mainly as a conceptual benchmark before applying the XGBoost framework. In this framework, the empirical model can be expressed as follows:

where f

θ is a non-linear function learned by an ensemble of K decision trees.

Tk(X) is the k-th decision tree;

wk is the weight assigned to that tree;

θ denotes the set of optimized parameters and hyperparameters (tree depth, learning rate, regularization, etc.).

3.5.3. Interpretability via SHAP

To ensure interpretability, SHAP (SHapley Additive exPlanations) values are computed:

where

ϕj is the marginal contribution of feature j (e.g., IGF);

F is the set of all explanatory variables;

S is a subset of variables;

f(S) is the model prediction when only variables in S are included.

SHAP values offer insights at both the global level—showing the overall importance of each feature—and the local level—revealing how individual observations are affected—helping us understand how IGF, ANE, ATE, and LCDE drive sustainable development outcomes across Saudi cities.

4. Results

4.1. Data Analysis

The preliminary data analysis provides a national overview of the key variables supporting Saudi Arabia’s Vision 2030 objectives, highlighting their main characteristics and linear relationships.

Table 1 presents these details, with Panel A showing descriptive statistics and Panel B the correlation matrix, providing a strong foundation for further analysis.

The dataset shows considerable heterogeneity, providing a robust basis for analyzing differentiated economic pathways. As indicated in Panel A, the distributional characteristics reveal important trends and economic insights. Investment in Green Finance (IGF) and New Businesses Registered (NBR) exhibit pronounced right skewness (1.331 and 3.851, respectively) with high kurtosis (4.278 and 20.699). Their standard deviations are similar to or higher than their means, indicating that certain periods or entities account for disproportionately high levels of investment and entrepreneurial activity, pointing to emerging hubs of green economic dynamism.

Access to Electricity (ATE) is very high nationally, reflecting a mature and stable electricity sector that ensures a consistent energy supply across regions. This near-universal access provides a solid foundation for economic development and energy transition initiatives.

Alternative and Nuclear Energy (ANE) shows moderate negative skewness (−0.855) with mesokurtic characteristics (2.178), suggesting early-stage but growing adoption in selected areas.

The Low-Carbon Development Indicator (LCDE), representing the natural logarithm of total CO2 emissions, and the Employment rate (EM) display relatively symmetric distributions with slight negative skewness (−0.731 and −0.463) and moderate kurtosis, reflecting generally balanced performance across regions.

Use of Renewable and Combustible Waste (CRW) exhibits strong positive skewness (2.111) and exceptionally high kurtosis (20.291), revealing substantial variability and uneven adoption patterns, highlighting areas where circular economy policies may be prioritized.

The minimum and maximum values of LCDE and EM further illustrate regional disparities in carbon intensity and labor market performance, while the variability of IGF and NBR highlights periods or regions with high economic activity. Collectively, these statistics provide important context for interpreting the panel’s heterogeneity.

The correlation matrix in Panel B highlights several significant relationships. Interpreting these correlations in terms of explained variance, the correlation between IGF and NBR is 0.647, indicating that approximately 41.8% of the variation in new business registrations is associated with IGF. Similarly, IGF accounts for 27.3% of the variability in EM, 17.9% of the variability in LCDE, and 38.6% of the variability in ANE. These values demonstrate the substantial role of green finance in promoting entrepreneurship, employment, decarbonization, and alternative energy adoption, while acknowledging that other factors contribute to the remaining unexplained variance.

The correlation matrix in Panel B highlights several significant relationships. IGF emerges as a synergistic driver, with strong positive correlations with NBR (0.647 ***), EM (0.522 ***), LCDE (0.423 ***), and ANE (0.621 ***), suggesting its potential role in simultaneously promoting green entrepreneurship, job creation, and decarbonization.

Positive correlations between EM and LCDE (0.537 ***) and between NBR and LCDE (0.517 ***) and EM (0.519 ***) indicate that economic and environmental goals may reinforce one another, supporting the emergence of a green entrepreneurial ecosystem. ANE stands out as a key driver of multidimensional growth, while CRW shows moderate but significant correlations with NBR, EM, and LCDE, suggesting that circular economy initiatives contribute to economic development through complex mechanisms.

These patterns align with the strategic goals of Vision 2030 and corroborate international evidence on the effectiveness of green finance [

4,

6]. Investments in energy transition are recognized as economic catalysts, promoting multiple objectives simultaneously [

27].

Although these national-level correlations highlight promising synergies between sustainability and economic outcomes, they may mask non-linear effects and regional disparities. The following sections apply advanced machine learning techniques to explore these complex dynamics at the city level across Saudi Arabia’s diverse economic landscape.

4.2. Empirical Analysis Using XGBoost and SHAP

To understand the complex, often non-linear relationships among our variables, we applied the XGBoost algorithm [

32]. This approach goes beyond simple correlations and allows us to capture patterns that might otherwise be overlooked. The predictive performance of the models, measured with Root Mean Square Error (RMSE), is summarized in

Table 2.

To make the results more interpretable, we also calculated SHAP (SHapley Additive exPlanations) values. These values help pinpoint which factors—such as green investment—have the greatest impact on outcomes like entrepreneurship, providing a clear, data-informed guide for policy decisions.

The SHAP analysis highlights that each city has unique drivers shaping its economic outcomes. For instance, predictions of new business registrations (NBR) are most accurate in Hail and Tabuk, with RMSE values of 58.97 and 111.48. This suggests that entrepreneurship in these cities is influenced by a small set of key factors. By contrast, larger cities like Riyadh and Jeddah show higher RMSE values (424.58 and 433.86), indicating that entrepreneurial activity is affected by a wider and more complex set of influences, including knowledge flows and international investment. These results are consistent with research emphasizing the complexity of urban innovation ecosystems [

20].

Across all cities, Alternative and Nuclear Energy (ANE) emerges as the strongest predictor of employment (EM), with SHAP values ranging from 76.9% to 96.6%. This reinforces the idea that the energy transition can drive substantial job creation [

26,

27], particularly in the Saudi context. Investments in energy infrastructure and related supply chains appear to have significant local employment effects.

When looking at circular economy development (CRW), two distinct patterns emerge. In industrial centers like Dammam, Medina, and Taif, circular economy practices are closely tied to existing industrial activity (high SHAP for LCDE), indicating that modernization of current industries drives sustainability. In cities such as Jeddah, Tabuk, Hail, and Mecca, CRW correlates more with green finance (high SHAP for IGF), suggesting that new investments are actively fostering circular economy capacity from the ground up. This supports the dual pathway framework, where green finance both modernizes existing industries and encourages new green ventures [

10,

17].

The analysis also reveals notable differences across cities, pointing to the importance of region-specific policies. Cities can be grouped into three main types based on their primary drivers of entrepreneurship:

ANE-Led Hubs (Riyadh, Jeddah, Mecca), where energy-related projects dominate entrepreneurial activity.

Industry-Led Hubs (Dammam, Hail, Taif, Medina), where established industrial activity drives new business creation.

Finance-Led Developments (Tabuk), where green capital is the main driver of new ventures.

These distinctions suggest that one-size-fits-all policies are unlikely to be effective; interventions must align with local economic realities.

Overall, Saudi Arabia’s economy consists of diverse regional systems, linked by national priorities. ANE investment consistently supports employment, while green finance (IGF) influences growth differently depending on the city. Circularity (CRW) acts as a bridge between sustainability and industrial transformation, either through modernizing existing industries or creating new green ventures.

These findings indicate that policies tailored to regional contexts, while keeping national goals in mind, can enhance the success of Vision 2030. By understanding local drivers of growth, Saudi Arabia can pursue a green transition that is both economically strong and socially inclusive.

5. Discussion

This study explored how green finance contributes to sustainable development across Saudi cities. Overall, the evidence supports the proposed framework while showing meaningful regional differences that reflect the country’s diverse economic and institutional landscapes.

5.1. Managerial and Policy Implications

The results suggest that green finance investments (IGF) play an important role in stimulating entrepreneurship, confirming H1. In finance-oriented cities like Tabuk, IGF appears to be the most influential factor in the creation of new firms, while in industrial or energy-based regions, its impact remains positive but less pronounced. This finding resonates with earlier studies arguing that green finance helps lower financial barriers for eco-innovative start-ups and builds confidence among entrepreneurs [

12,

16]. However, the fact that its intensity varies from one city to another highlights the influence of local financial maturity and institutional support [

11,

20].

The employment results (H2) are more nuanced. IGF indirectly supports job creation—particularly in smaller or finance-led areas—whereas Alternative and Nuclear Energy (ANE) remains the most decisive factor across cities, explaining a large share of the employment variation (SHAP values between 76.9% and 96.6%). These results suggest that the combination of energy transition projects and green financial initiatives strengthens local labor markets, a pattern also observed in earlier works that linked renewable investments to job creation through both direct hiring and supply-chain effects [

16,

24,

27].

The relationship between green finance and the circular economy (H3) also shows strong territorial contrasts. In industrial centers such as Dammam, Medina, and Taif, progress in circularity (CRW) depends more on reductions in carbon intensity (LCDE) than on IGF, suggesting that local firms prioritize technological modernization of their existing industries (e.g., petrochemicals in Dammam). In contrast, in a city like Hail—a region with recognized potential in sustainable agriculture and renewable energy but facing persistent structural barriers like limited SME access to finance—IGF emerges as the key driver of circular practices. This reveals its crucial role in bridging investment gaps and fostering innovation and sustainable entrepreneurship within emerging economic ecosystems. Hail’s dual responsiveness to both LCDE (for entrepreneurship) and IGF (for the circular economy) illustrates this duality: a necessary industrial modernization coupled with new, finance-catalyzed development. This dual mechanism—revitalizing traditional industries while nurturing new green sectors—is consistent with observations from other emerging economies where green finance adapts to local industrial structures [

6,

10,

17].

Moderating effects further refine this understanding. The influence of IGF is stronger in areas with better access to electricity (ATE) and a higher share of clean energy (ANE), confirming H4. This indicates that robust infrastructure makes financial resources more productive, a point well established in the literature on sustainable development [

11,

13]. As for H5, carbon emissions (LCDE) act as a mixed moderator: in heavily industrialized cities, higher emissions are associated with more active circular responses—probably because environmental pressure accelerates adaptation—while in other areas, this connection remains weaker. Such variability echoes international evidence showing that emissions can either hinder or motivate green innovation depending on local contexts [

6,

16].

Interestingly, compared with the European Union and China, Saudi cities display greater heterogeneity in the link between green finance and employment. This difference can be attributed to disparities in institutional maturity and governance capacity. As a result, local authorities should avoid uniform approaches and instead design city-specific financial strategies.

These conclusions directly support the objectives of Saudi Vision 2030, which seeks to diversify the economy, foster sustainable investment, and encourage innovation in urban development. Policymakers can build on these findings to guide the allocation of green financial resources, promote clean energy adoption, and strengthen institutional mechanisms that improve the long-term effectiveness of sustainability initiatives.

5.2. Limitations and Future Research Directions

This study provides new insights into the role of green finance across eight major Saudi cities while recognizing several limitations that open avenues for future research.

Several methodological considerations deserve attention. First, the analysis relies on city-level data, which effectively captures regional trends but may obscure internal variations within cities—such as differences among districts, firms, or socioeconomic groups. Second, cities such as Riyadh and Jeddah, with more advanced entrepreneurial ecosystems, may naturally attract greater inflows of green finance, independent of the causal effect of finance on entrepreneurship.

Moreover, the exclusive focus on Saudi cities limits the generalizability of the findings. Expanding the analysis to other Gulf countries or emerging economies could help reveal how institutional frameworks and financial maturity influence the effectiveness of green finance initiatives.

The study also does not account for certain potentially influential factors, including local governance quality and innovation capacity, which could further explain how green finance fosters entrepreneurship, employment, and the development of a circular economy. Future research could address these limitations through several promising directions: conducting micro-level case studies within cities; applying instrumental variable approaches or natural experiments to better address causal identification challenges; extending cross-country comparisons to economies with similar characteristics; and incorporating governance and innovation indicators into the analytical framework.

Despite these limitations, this study represents one of the first city-level assessments of green finance in Saudi Arabia. Its findings provide a practical foundation for policymakers seeking to align financial strategies with broader environmental and economic objectives, while guiding future research toward a more comprehensive understanding of sustainable development dynamics in urban contexts.

6. Conclusions

This study provides compelling evidence that green finance serves as a crucial catalyst for advancing Saudi Arabia’s Vision 2030 objectives while addressing significant geographical and methodological gaps in the sustainable finance literature. Our investigation yields robust empirical support for all research hypotheses (H1-H5), revealing both the transformative potential and important contextual nuances of sustainable financial mechanisms.

The analysis demonstrates that green finance initiatives achieve optimal impact when implemented alongside developed clean energy infrastructure (ANE), with SHAP values confirming ANE as the dominant employment driver across all cities (76.9–96.6%). This finding proves particularly significant for resource-dependent economies, underscoring the complementary relationship between financial and energy policies. Concurrently, carbon emission levels (LCDE) exhibit more subtle, context-dependent moderating effects, especially in industrial centers, where higher emissions correlate with stronger circular economy responses.

Methodologically, the integrated XGBoost-SHAP approach successfully captured intricate non-linear relationships and regional variations that conventional econometric methods might overlook. The strong predictive performance, with RMSE values as low as 58.97 for new business registrations in Hail, confirms the robustness of our machine learning framework in analyzing complex urban sustainability dynamics.

The SHAP-driven urban classification—ANE-Led Hubs (Riyadh, Jeddah, Mecca), Industry-Led Hubs (Dammam, Hail, Taif, Medina), and Finance-Led Developments (Tabuk)—provides policymakers with a practical diagnostic tool for designing tailored green finance strategies. This typology enables precisely targeted interventions:

ANE-Led Hubs should prioritize large-scale alternative energy projects and innovation networks, leveraging their demonstrated synergistic benefits on employment (89.7–96.6% SHAP values) and business creation

Industry-Led Hubs like Hail benefit most from strategies supporting industrial modernization, where green financing accelerates sustainable transformations of existing industries, while specifically targeting SMEs and start-ups active in sustainable agricultural value chains and renewable energy to overcome the identified structural barriers. This is evidenced by LCDE’s strong influence (45.0% SHAP for new business registrations in Hail), which reflects efficiency drives and innovation within a pre-existing economic fabric, such as its agro-industrial and logistics sectors.

Financial Developments require specialized support for eco-friendly startups through dedicated funding mechanisms, capitalizing on IGF’s prominent role (39.5% SHAP for new business registrations in Tabuk).

The case of Hail exemplifies these refined dynamics, functioning as an Industrial Center while demonstrating notable responsiveness to green financing (IGF showing 37.3% importance for circular economy advancement). This dual reactivity underscores how green finance can strategically modernize conventional industries through enhancement rather than replacement.

In practical terms, implementing these evidence-based, differentiated strategies enables Saudi Arabia to achieve its national sustainability targets while positioning itself as an international reference for sustainable transitions in resource-dependent economies. The findings ultimately confirm that regionally adapted green finance represents a viable and effective pathway toward realizing Vision 2030’s ambitious goals, establishing a replicable paradigm for similar economies worldwide seeking to balance economic growth, social equity, and environmental protection through tailored financial mechanisms.