Staying Competitive in Clean Manufacturing: Insights on Barriers from Industry Interviews

Abstract

1. Introduction

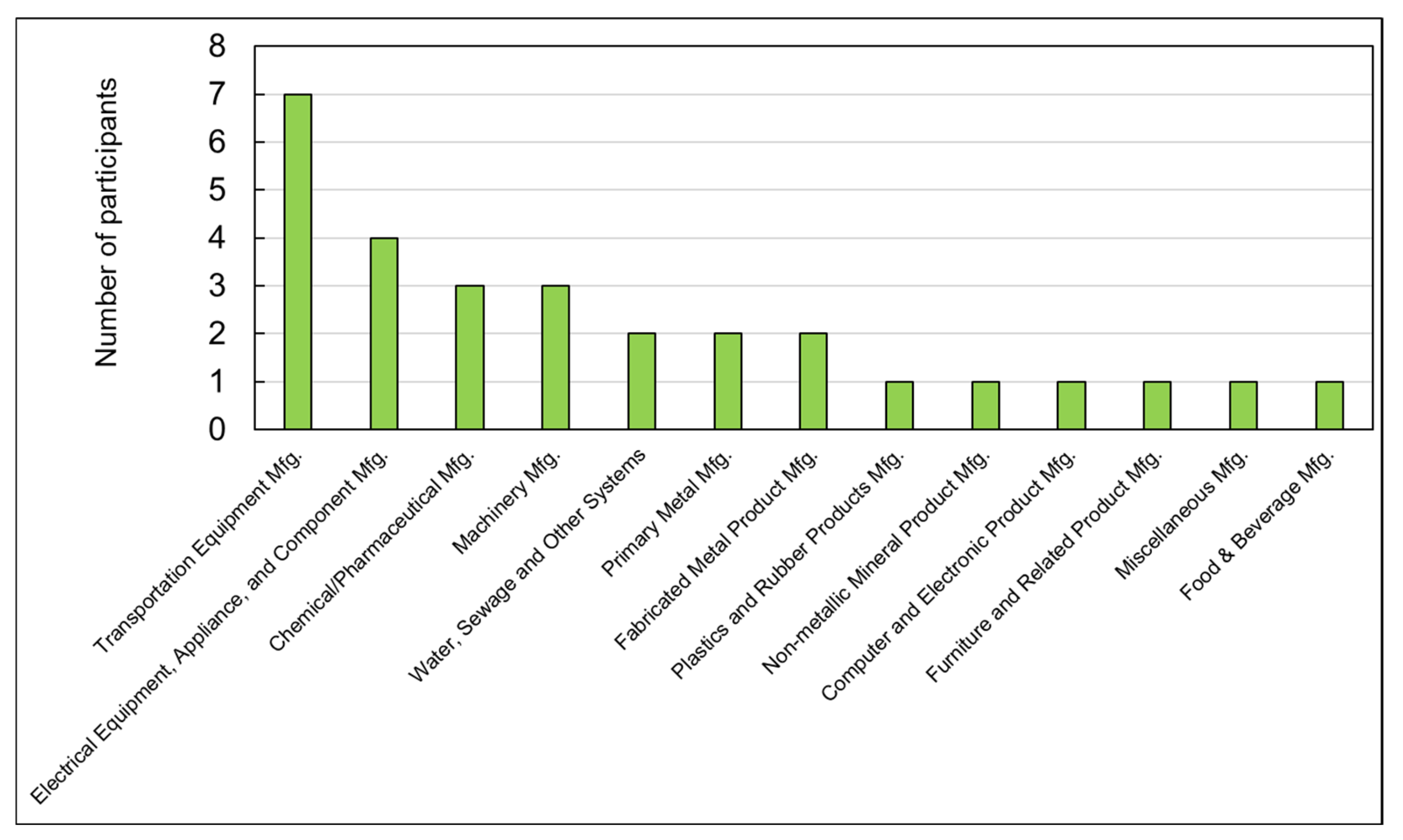

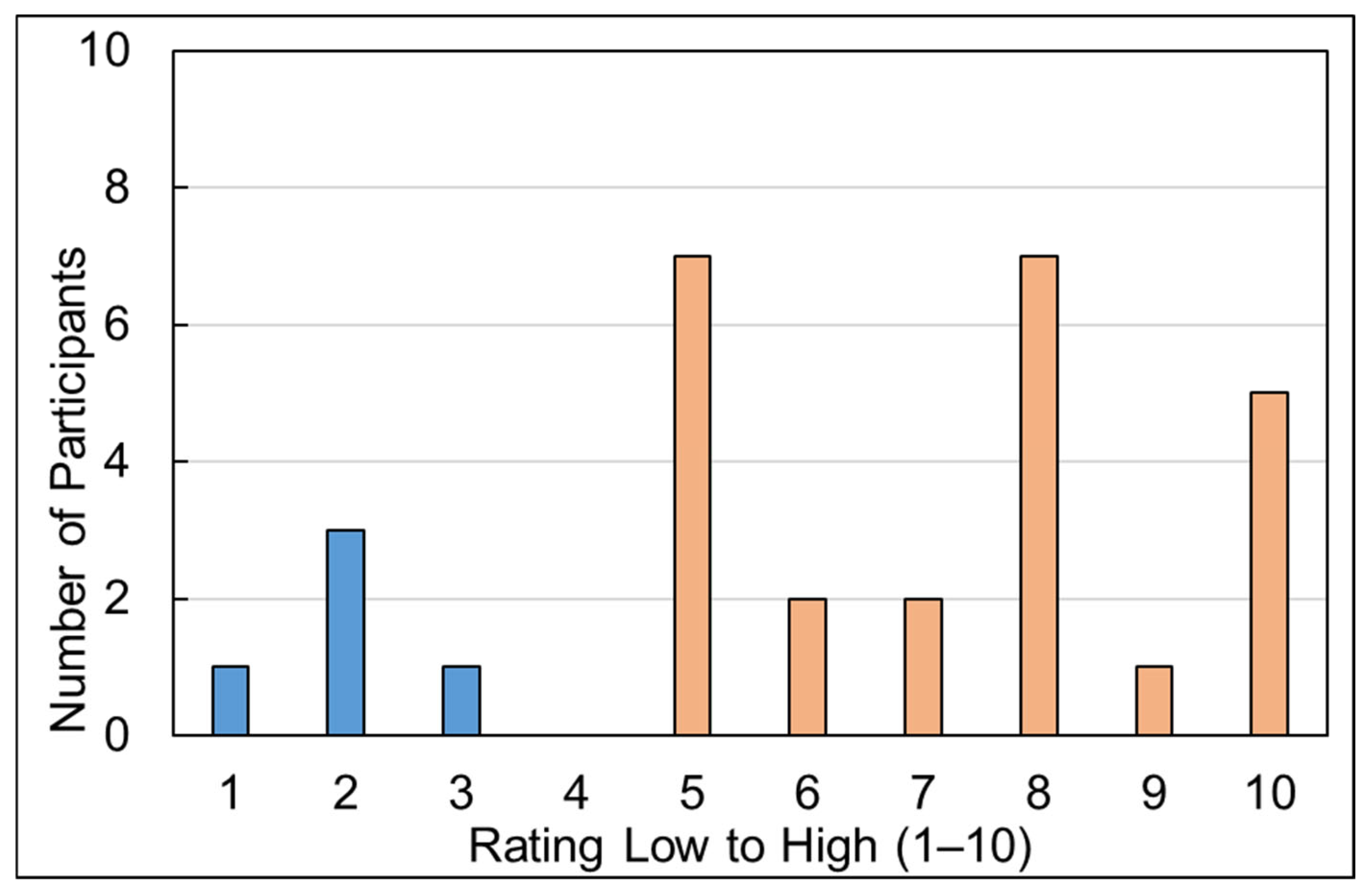

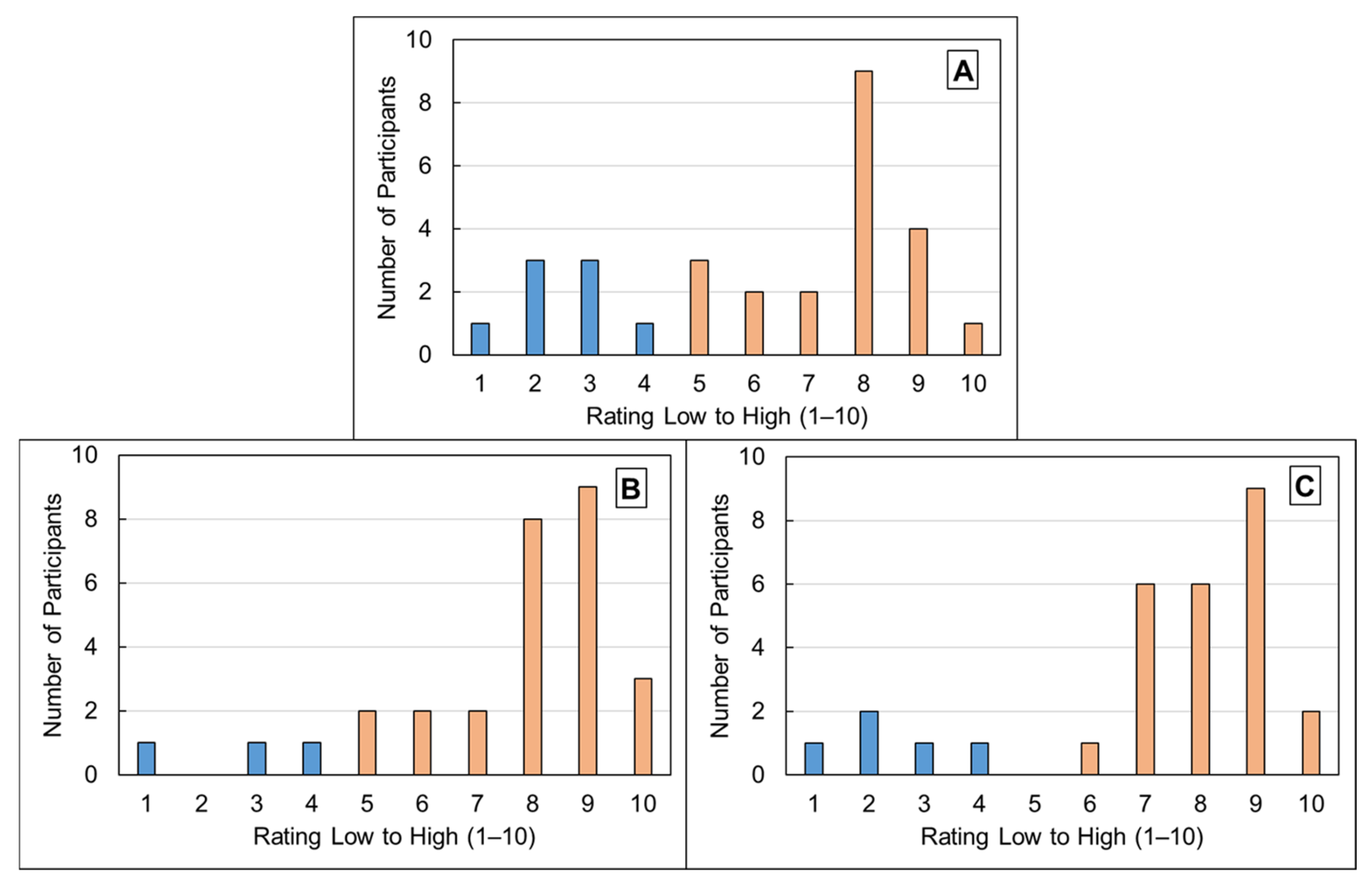

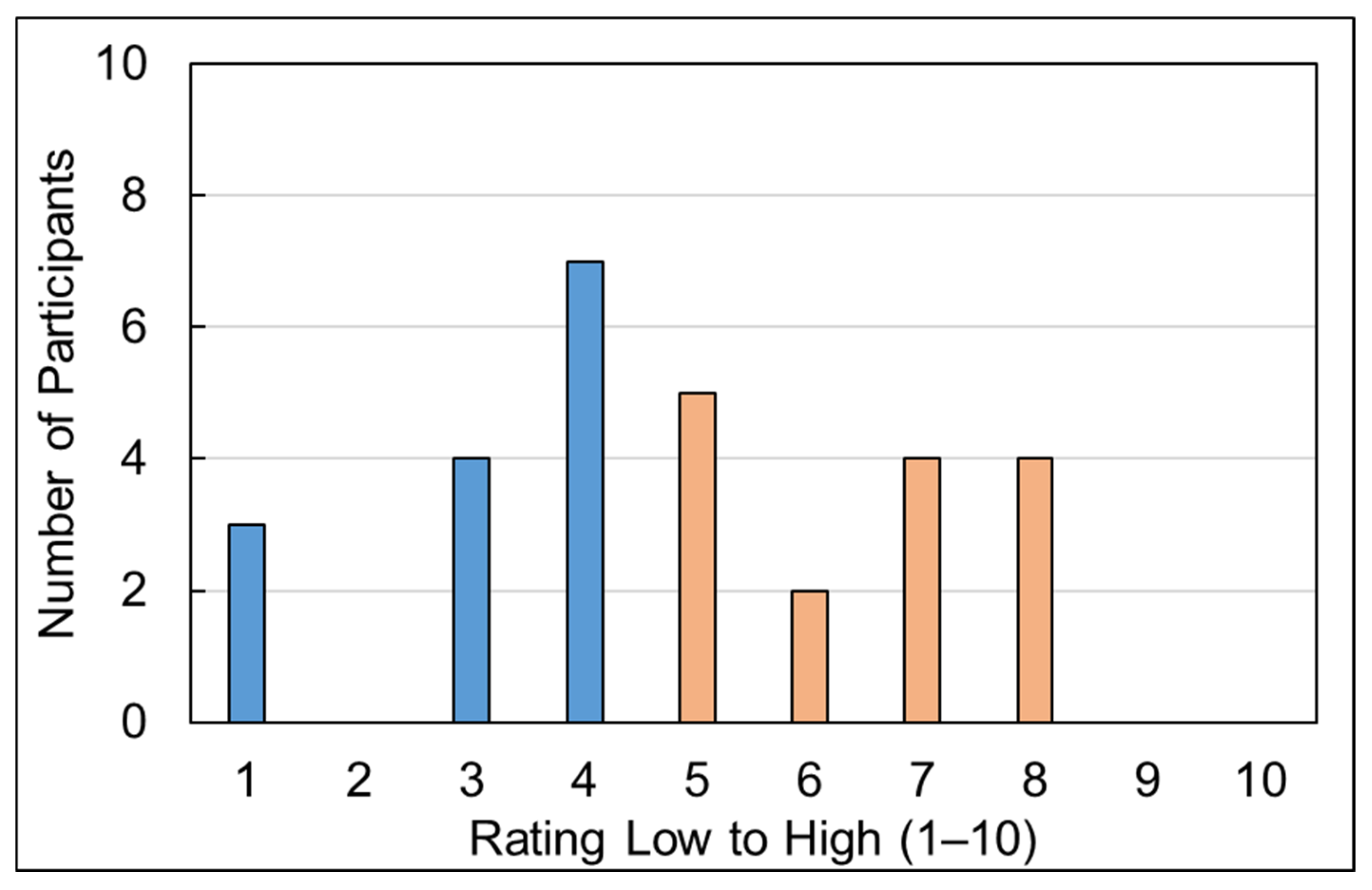

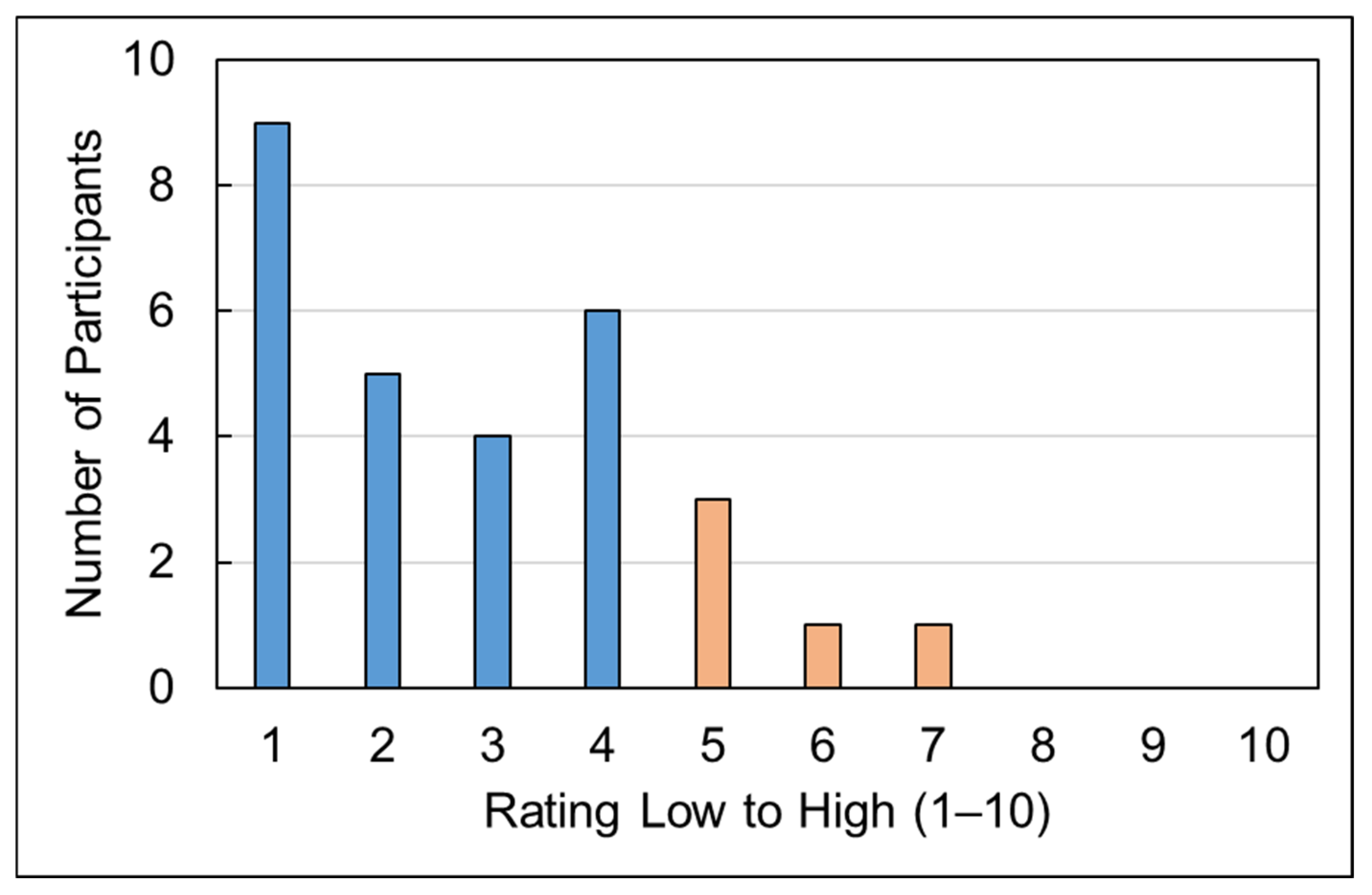

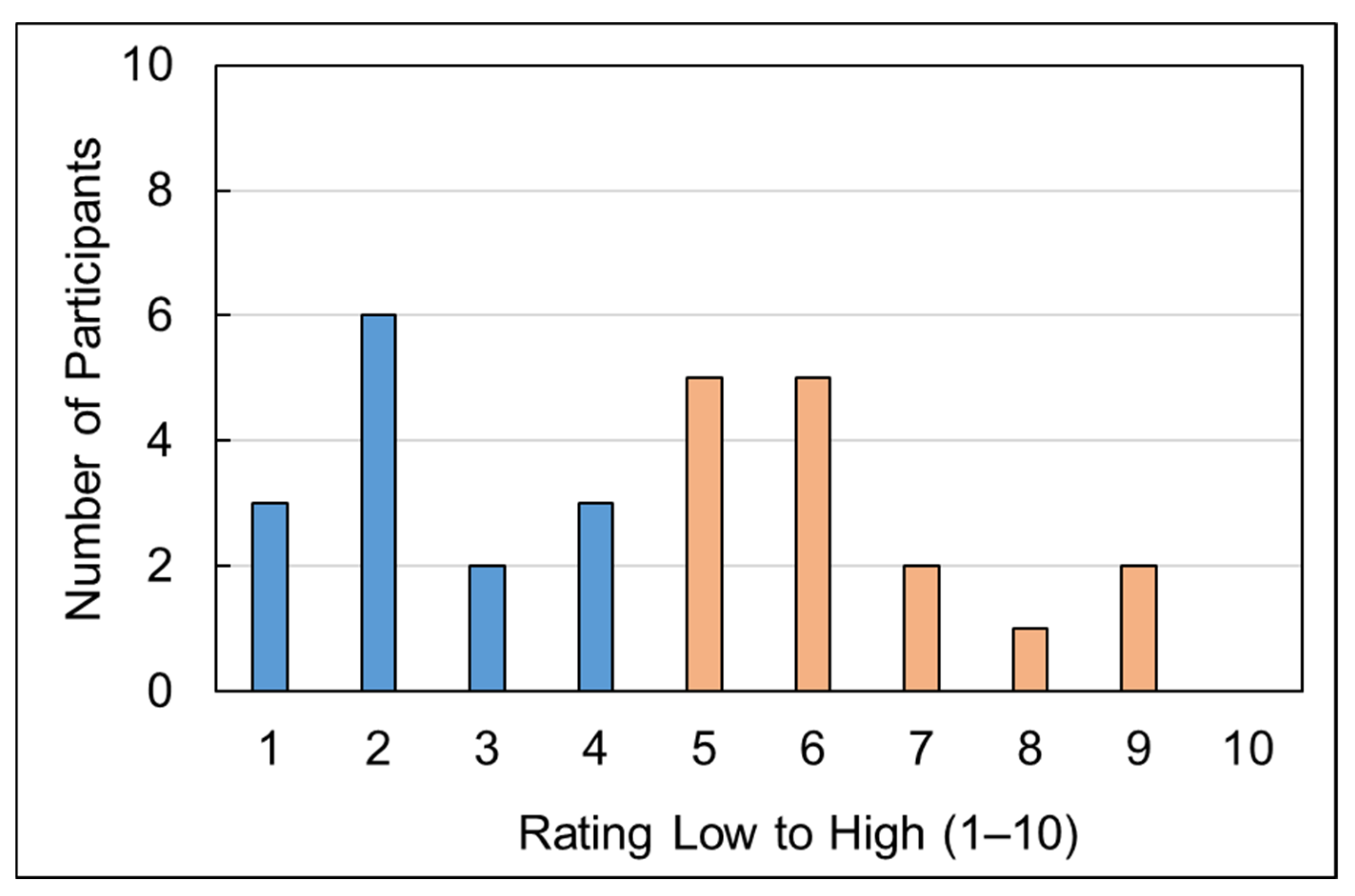

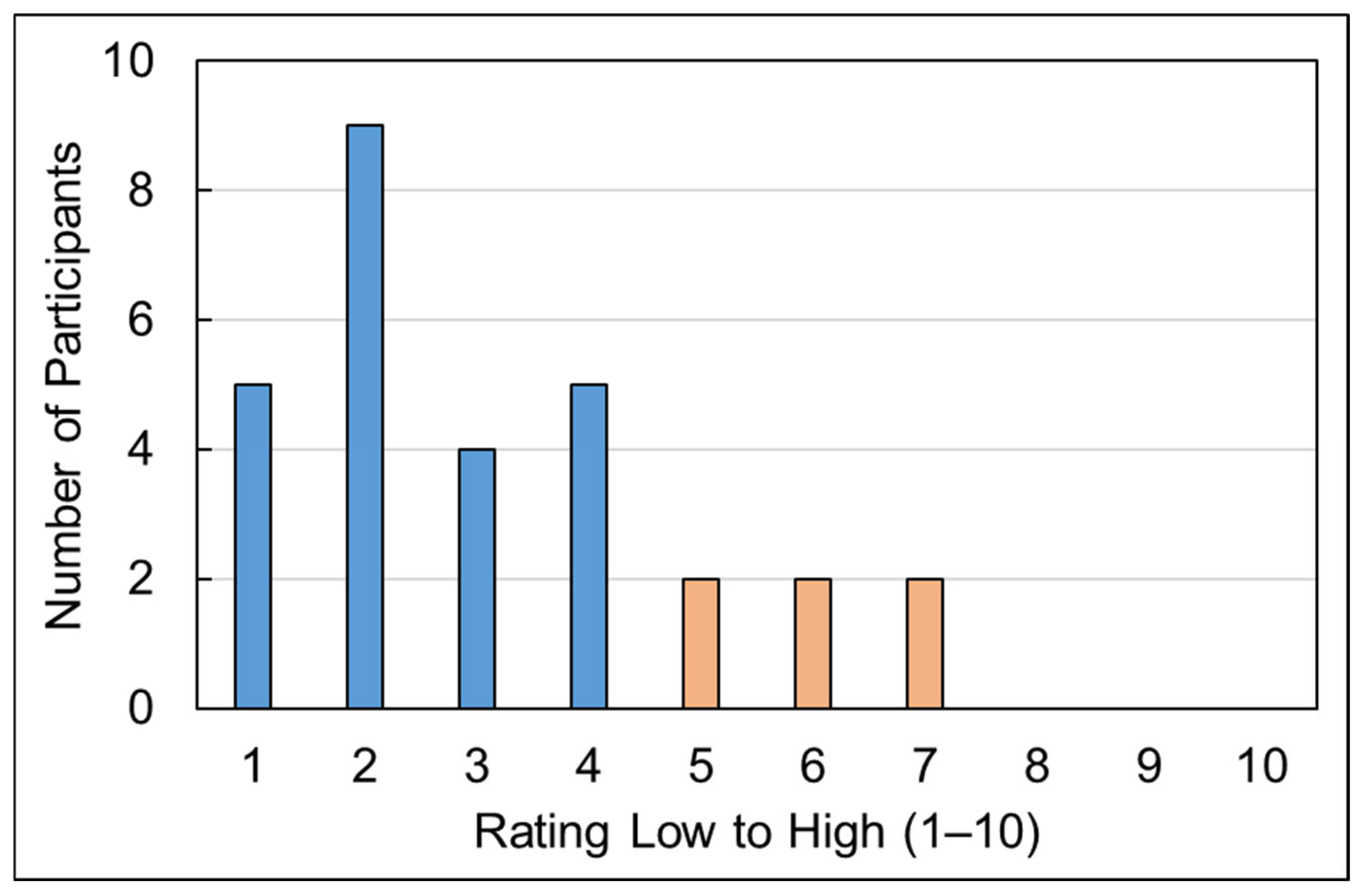

2. Data Collection

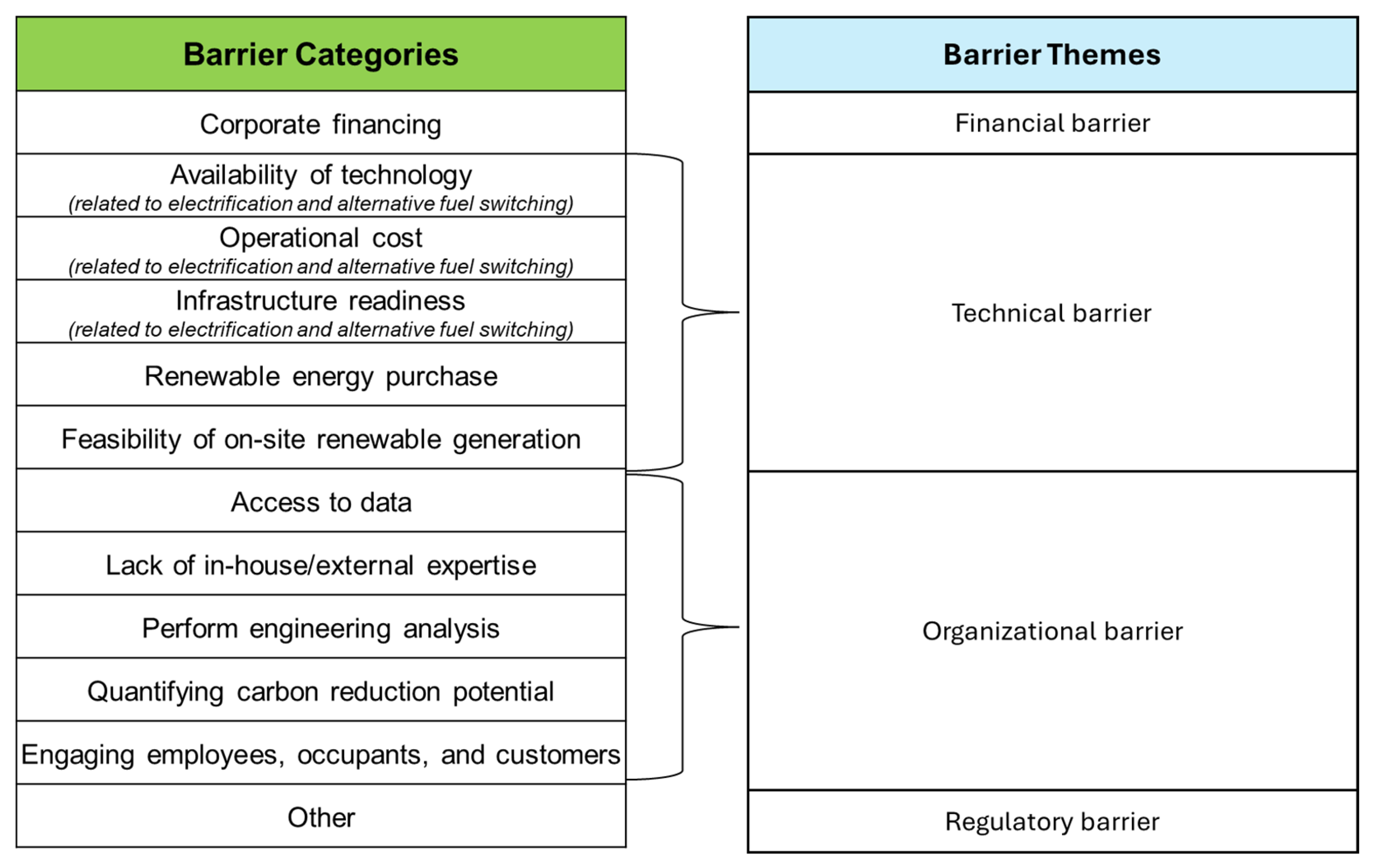

3. Analysis

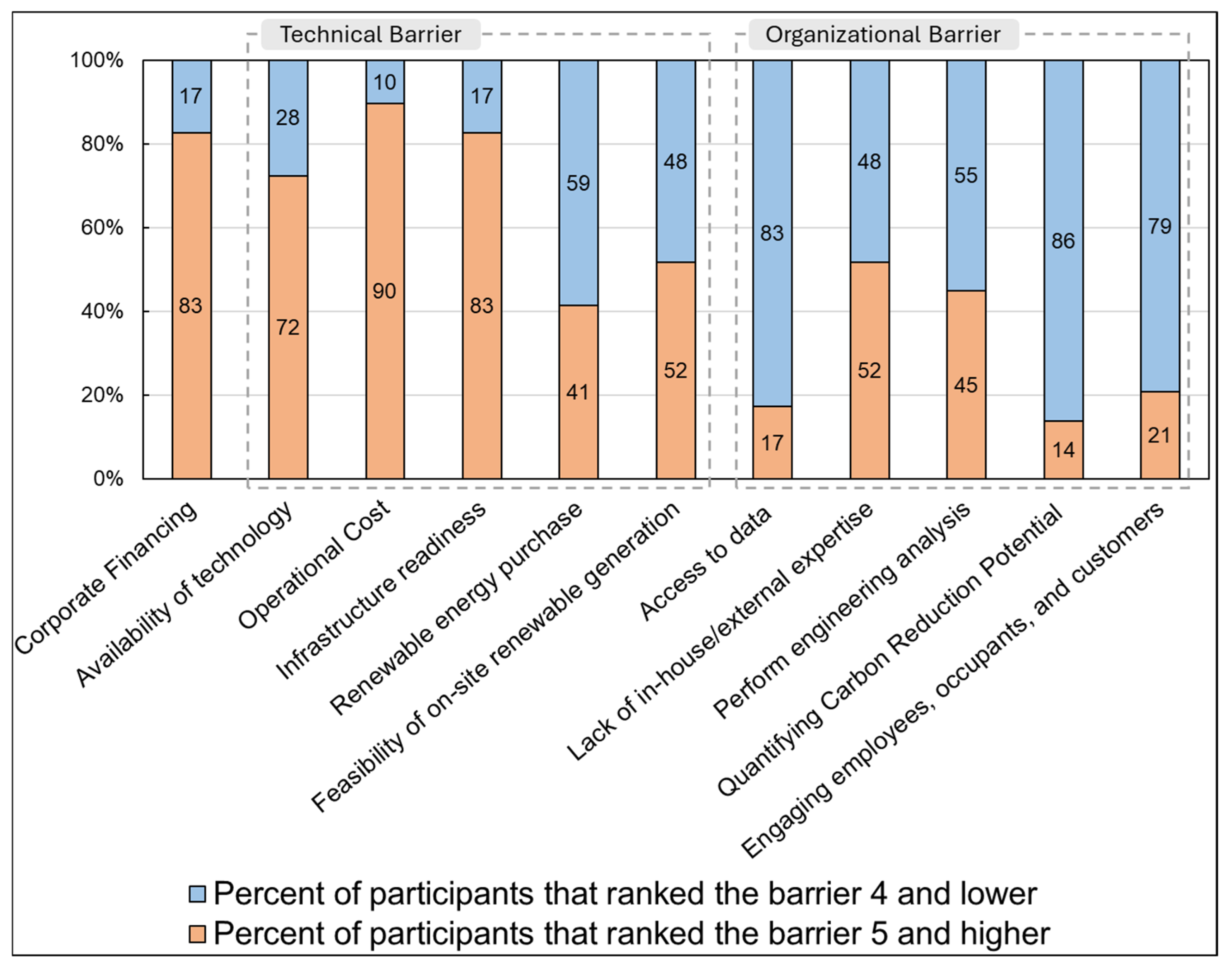

4. Results

4.1. Financial Barrier

4.1.1. Different Departments Competing for Capital

4.1.2. Investments Are Only Available for Projects with Quick Returns

4.1.3. Corporate Funding Approval Cycle and Project Prioritization Need to Align

4.1.4. Innovative Funding Mechanisms

4.1.5. Using the Internal Cost of Carbon to Make a Business Case

4.2. Technical Barrier

4.2.1. Barriers for Electrification Technology

4.2.2. Barrier for Alternate Fuel-Switching Technology

4.2.3. Lack of Volume of Equipment Availability

4.2.4. Need for Facility Layout Change or Legacy Infrastructure Upgrade

4.2.5. Barriers for On-Site Renewable Energy

4.2.6. Barriers to Renewable Contracts

4.3. Organizational Barrier

4.3.1. Inaccuracies in Data Collection from Traditional Spreadsheet Tools

4.3.2. Lack of Dedicated Staff

4.3.3. Recognition to Drive Sustainability Initiatives

4.3.4. Lack of Skilled Workforce

4.3.5. Lack of Understanding of the Emerging Technology and Energy Market and the Need for C-Suite Education

4.4. Regulatory Barrier

Uncertainty Around Carbon Accounting

5. Future Work

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- U.S. Energy Information Administration. Use of Energy Explained: Energy Use in Industry. Available online: https://www.eia.gov/energyexplained/use-of-energy/industry.php (accessed on 15 April 2025).

- U.S. Department of Energy. Industrial Decarbonization Roadmap; U.S. Department of Energy: Washington, DC, USA, 2022. [Google Scholar]

- United States Department of State and Executive Office of the President. The Long-Term Strategy of the United States; United States Department of State and Executive Office of the President: Washington, DC, USA, 2021. [Google Scholar]

- Sandbag Climate Campaign. Barriers to Industrial Decarbonisation; Sandbag Climate Campaign: Brussels, Belgium, 2018. [Google Scholar]

- Gross, S. The Challenge of Decarbonizing Heavy Industry; Brookings Institute: Washington, DC, USA, 2021. [Google Scholar]

- U.S. Department of Energy. Barriers to Industrial Energy Efficiency: Report to Congress; U.S. Department of Energy: Washington, DC, USA, 2015.

- U.S. Department of Energy. Pathways Analysis Summary: Decarbonization Potential for Industrial Subsectors; U.S. Department of Energy: Washington, DC, USA, 2024.

- Kempken, T.; Hauck, T.; De Santis, M.; Queipo Rodriguez, P.; Miranda, M.; Gonzalez, D.; Simonelli, F.; Vu, H.; Szulc, W.; Croon, D.; et al. Collection of Possible Decarbonisation Barriers; Green Steel for Europe Consortium: Brussels, Belgium, 2021. [Google Scholar]

- Renewable Thermal Collaborative. Industrial Thermal Decarbonization Package; Renewable Thermal Collaborative: Washington, DC, USA, 2023. [Google Scholar]

- Erb, T.; Perciasepe, B.; Radulovic, V.; Niland, M. Corporate Climate Commitments: The Trend Towards Net Zero. In Handbook of Climate Change Mitigation and Adaptation; Lackner, M., Sajjadi, B., Chen, W.-Y., Eds.; Springer: New York, NY, USA, 2020; pp. 1–34. [Google Scholar]

- Christiansen, K.L.; Hajdu, F.; Planting Mollaoglu, E.; Andrews, A.; Carton, W.; Fischer, K. “Our burgers eat carbon”: Investigating the discourses of corporate net-zero commitments. Environ. Sci. Policy 2023, 142, 79–88. [Google Scholar] [CrossRef]

- Colesanti Senni, C.; Reidt, N. Transport policies in a two-sided market. Econ. Work. Pap. Ser. 2018, 18/306. [Google Scholar] [CrossRef]

- Caritte, V.; Acha, S.; Shah, N. Enhancing Corporate Environmental Performance Through Reporting and Roadmaps. Bus. Strategy Environ. 2015, 24, 289–308. [Google Scholar] [CrossRef]

- Gomes, S.; Lopes, J.M.; Nogueira, S. Willingness to pay more for green products: A critical challenge for Gen Z. J. Clean. Prod. 2023, 390, 136092. [Google Scholar] [CrossRef]

- Sharma, M.; Antony, R.; Vadalkar, S.; Ishizaka, A. Role of industry 4.0 technologies and human-machine interaction for de-carbonization of food supply chains. J. Clean. Prod. 2024, 468, 142922. [Google Scholar] [CrossRef]

- Ferreira, A.; Pinheiro, M.D.; de Brito, J.; Mateus, R. Decarbonizing strategies of the retail sector following the Paris Agreement. Energy Policy 2019, 135, 110999. [Google Scholar] [CrossRef]

- Ajayi, V.; Reiner, D. Are Consumers Willing to Pay for Industrial Decarbonisation? Evidence from a Discrete Choice Experiment on Green Plastics; Energy Policy Research Group, University of Cambridge: Cambridge, UK, 2020. [Google Scholar]

- Larrea, I.; Correa, J.M.; López, R.; Giménez, L.; Solaun, K. A Multicriteria Methodology to Evaluate Climate Neutrality Claims—A Case Study with Spanish Firms. Sustainability 2022, 14, 4310. [Google Scholar] [CrossRef]

- Hong, P.; Jeong, J. Supply chain management practices of SMEs: From a business growth perspective. J. Enterp. Inf. Manag. 2006, 19, 292. [Google Scholar] [CrossRef]

- Diezinger, S.; Dennhardt, B. Electrification in Industry: The Most Efficient Way Towards Decarbonization. In Proceedings of the ADIPEC, Abu Dhabi, United Arab Emirates, 31 October–3 November 2022. [Google Scholar]

- Gailani, A.; Cooper, S.; Allen, S.; Pimm, A.; Taylor, P.; Gross, R. Assessing the potential of decarbonization options for industrial sectors. Joule 2024, 8, 576–603. [Google Scholar] [CrossRef]

- Stephens, P.; Vairamohan, B. Low-carbon Fuel Pathway to Decarbonize Hard to Electrify Industries Case Study: Cement and Glass Industries. In Proceedings of the 2023 ACEEE Summer Study on Industry, Detroit, MI, USA, 11–13 July 2023; American Council for an Energy-Efficient Economy (ACEEE): Washington, DC, USA, 2023. [Google Scholar]

- Wesseling, J.H.; Van der Vooren, A. Lock-in of mature innovation systems: The transformation toward clean concrete in the Netherlands. J. Clean. Prod. 2017, 155, 114–124. [Google Scholar] [CrossRef]

- Svensson, O.; Khan, J.; Hildingsson, R. Studying Industrial Decarbonisation: Developing an Interdisciplinary Understanding of the Conditions for Transformation in Energy-Intensive Natural Resource-Based Industry. Sustainability 2020, 12, 2129. [Google Scholar] [CrossRef]

- Chidolue, O.; Ngozichukwu, B.; Ibekwe, K.I.; Illojianya, V.I.; Fafure, A.V.; Daudu, C.D. Decarbonization Strategies in Energy-Intensive Industries: Cases from Canada, USA, and Africa. Int. J. Sci. Res. Arch. 2024, 11, 361–370. [Google Scholar] [CrossRef]

- Wei, M.; McMillan, C.A.; De La Rue Du Can, S. Electrification of Industry: Potential, Challenges and Outlook. Curr. Sustain./Renew. Energy Rep. 2019, 6, 140–148. [Google Scholar] [CrossRef]

- Ha, N.M.; Nguyen, P.A.; Luan, N.V.; Tam, N.M. Impact of green innovation on environmental performance and financial performance. Environ. Dev. Sustain. 2023, 26, 17083–17104. [Google Scholar] [CrossRef]

- Alkadi, N.E. Energy and Productivity, Two Sides of a Coin in the U.S. Auto Industry; SAE International: Warrendale, PA, USA, 2006. [Google Scholar]

- Shah Mehmood, W.; Muhammad Usman, A.; Xinli, Z.; Sidra, S. Green innovation and firm performance: An empirical analysis of operational efficiency, environmental commitment and technological capability. World J. Adv. Res. Rev. 2025, 25, 1148–1160. [Google Scholar] [CrossRef]

- Hameed, T.; Alemayehu, F.K.; Kumbhakar, S.C. Green innovation in Norwegian firms: Navigating the complexity of productivity and performance. Technol. Forecast. Soc. Change 2024, 209, 123786. [Google Scholar] [CrossRef]

- National Renewable Energy Laboratory (NREL). Non-Energy Benefits: Reducing Payback and Improving Performance; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2025. [Google Scholar]

- Jalo, N.; Johansson, I.; Kanchiralla, F.M.; Thollander, P. Do energy efficiency networks help reduce barriers to energy efficiency? -A case study of a regional Swedish policy program for industrial SMEs. Renew. Sustain. Energy Rev. 2021, 151, 111579. [Google Scholar] [CrossRef]

- Nehler, T. Non-Energy Benefits of Industrial Energy Efficiency: Roles and Potentials. Ph.D. Thesis, Linköping University, Linköping, Sweden, 2019. [Google Scholar]

- Feng, S.; Wareewanich, T. The effects of corporate carbon performance on financing cost—Evidence from S&P 500. J. Infrastruct. Policy Dev. 2024, 8, 7997. [Google Scholar]

- Better Buildings Solution Center. Celanese Corporation: Sustainability Checklist for Capital Projects. Available online: https://betterbuildingssolutioncenter.energy.gov/implementation-models/celanese-corporation-sustainability-checklist-capital-projects (accessed on 16 April 2025).

- Better Buildings Solution Center. Coining a Cleaner Future: Slides. Available online: https://betterbuildingssolutioncenter.energy.gov/sites/default/files/2023-12/Coining%20a%20Cleaner%20Future%20-%20Slides.pdf (accessed on 22 May 2025).

- Cummins Inc. 2024-25: Cummins Sustainability Progress Report; Cummins Inc.: Columbus, IN, USA, 2025. [Google Scholar]

- Colgate-Palmolive Company. 2023 Climate Transition & Net Zero Action Plan. Available online: https://www.colgatepalmolive.com/content/dam/cp-sites/corporate/corporate/common/pdf/2023-climate-transition-net-zero-action-plan.pdf (accessed on 21 May 2025).

- Better Buildings Solution Center. General Motors Funds Energy Conservation Projects Through Energy Performance. Available online: https://betterbuildingssolutioncenter.energy.gov/implementation-models/general-motors-funds-energy-conservation-projects-through-energy-performance (accessed on 21 May 2025).

- Better Buildings Solution Center. Bentley Mills: Reducing Risk and Liability in Energy Upgrades Through Efficiency. Available online: https://betterbuildingssolutioncenter.energy.gov/implementation-models/bentley-mills-reducing-risk-and-liability-energy-upgrades-through-efficiency (accessed on 21 May 2025).

- Cochelin, P.; Popoola, B.; Ornelas, A.; Volland, E.F. Sustainable Bond Issuance To Approach $1 Trillion in 2024; U.S. Public Finance: New York, NY, USA, 2024. [Google Scholar]

- Electrolux Group. Green Financing Impact Report 2023; Electrolux Group: Stockholm, Sweden, 2023. [Google Scholar]

- Kingspan Group plc. Planet Passionate Report 2023; Kingspan Group plc: Kingscourt, Ireland, 2023. [Google Scholar]

- Barata, P.M.; Mukherjee, M.; Silitonga, A.; Jones, D.; Jaspal, M.; Hanafi, A.; Pearen, H. Navigating Carbon Pricing: The G20 Experience and Global South Prospects; Observer Research Foundation: New Delhi, India; New York, NY, USA, 2024. [Google Scholar]

- Bowler, L. A Beginner’s Guide to Internal Carbon Pricing. Available online: https://www.ramboll.com/en-us/insights/decarbonise-for-net-zero/a-beginner-s-guide-to-internal-carbon-pricing (accessed on 21 May 2025).

- Better Buildings Solution Center. Paying the Price: How Internal Carbon Pricing Supports Emissions Reduction. Available online: https://betterbuildingssolutioncenter.energy.gov/webinars/paying-price-how-internal-carbon-pricing-supports-emissions-reduction (accessed on 16 April 2025).

- Saint-Gobain Half-Year 2023 Financial Report. Available online: https://www.saint-gobain.com/sites/saint-gobain.com/files/media/document/Half%20Year%202023%20Financial%20Report.pdf (accessed on 21 May 2025).

- Saint-Gobain. CDP Climate Change 2022 Questionnaire Response; Saint-Gobain: Courbevoie, France, 2022. [Google Scholar]

- Cummins Inc. 2024 CDP Climate Change Questionnaire Response; Cummins Inc.: Columbus, IN, USA, 2024. [Google Scholar]

- Better Buildings Solution Center. Paying the Price: Internal Carbon Pricing Strategies. Available online: https://betterbuildingssolutioncenter.energy.gov/sites/default/files/slides/Paying%20the%20Price%20-%20Slides.pdf (accessed on 22 May 2025).

- Renewable Thermal Collaborative. MVR Heat Pumps & Thermal Efficiency at Chivas Brothers Distillery; Renewable Thermal Collaborative: Arlington, VA, USA, 2024. [Google Scholar]

- Renewable Thermal Collaborative. AstraZeneca and Vanguard Renewables U.S. RNG Agreement; Renewable Thermal Collaborative: Arlington, VA, USA, 2024. [Google Scholar]

- Better Building Solutions Center. Lockheed Martin: Transforming a Parking Lot into an Energy-Generating Solar Carport. Available online: https://betterbuildingssolutioncenter.energy.gov/showcase-projects/lockheed-martin-transforming-parking-lot-energy-generating-solar-carport (accessed on 21 May 2025).

- Renewable Thermal Collaborative. Solar Thermal at Colgate-Palmolive Factory; Renewable Thermal Collaborative: Arlington, VA, USA, 2023. [Google Scholar]

- Better Buildings Solution Center. ArcelorMittal USA: Power of 1 Contest Increases Employee Engagement and Generates Low- and No-Cost Project Ideas. Available online: https://betterbuildingssolutioncenter.energy.gov/implementation-models/arcelormittal-usa-power-1-contest-increases-employee-engagement-and-generates (accessed on 16 April 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nandy, P.; Wenning, T.; Botts, A.; Kansara, H.J. Staying Competitive in Clean Manufacturing: Insights on Barriers from Industry Interviews. Sustainability 2025, 17, 9233. https://doi.org/10.3390/su17209233

Nandy P, Wenning T, Botts A, Kansara HJ. Staying Competitive in Clean Manufacturing: Insights on Barriers from Industry Interviews. Sustainability. 2025; 17(20):9233. https://doi.org/10.3390/su17209233

Chicago/Turabian StyleNandy, Paulomi, Thomas Wenning, Alex Botts, and Harshal J. Kansara. 2025. "Staying Competitive in Clean Manufacturing: Insights on Barriers from Industry Interviews" Sustainability 17, no. 20: 9233. https://doi.org/10.3390/su17209233

APA StyleNandy, P., Wenning, T., Botts, A., & Kansara, H. J. (2025). Staying Competitive in Clean Manufacturing: Insights on Barriers from Industry Interviews. Sustainability, 17(20), 9233. https://doi.org/10.3390/su17209233