1. Introduction

The report of the 19th National Congress of the Communist Party of China formally declared that China has entered a stage of high-quality development. This strategic shift emphasizes the shift in China’s economy from high-speed growth to high-quality development. Economic data from the National Bureau of Statistics of China indicates that, from 2013 to 2022, China’s total factor productivity grew by an average annual rate of 1.3% and scientific and technological progress contributed 58.3% to economic growth. The quality of development has continuously improved. Promoting high-quality economic development is a fundamental requirement for thoroughly implementing the new development philosophy. On the one hand, as the main body of the real economy, the manufacturing industry, is the lifeline of the country’s economic development and an indispensable material guarantee for the stable operation and healthy development of the economy and society. Its development quality is also an important support for the improvement of the country’s comprehensive strength and international competitiveness. Especially in the context of the new round of global industrial transformation, the manufacturing industry is the core carrier of national scientific and technological innovation and should make greater contributions to innovation and high-quality development. The state of development in the manufacturing industry is not only a direct indicator of a country’s production prowess, but also of paramount importance in leading its economy toward high-quality growth. At present, the manufacturing industry is in a critical period of transformation, but it is currently facing the dual pressure of “external worries” and “internal driving forces”. The manufacturing industry urgently needs to explore new structural transformation drivers, improve the level of value creation, and release new development potential to promote high-quality development.

As the basic project and pillar of national governance and comprehensive deepening of reform, fiscal and taxation policies have always played a key role in the process of China’s economic system reform [

1]. The country has continuously introduced tax support policies for the high-quality development of the manufacturing industry. These policies, which have impacted manufacturing micro-entities through multiple channels, have not only alleviated the tax burden on manufacturing enterprises, but have also played a positive role in guiding policy. Following the business tax to value-added tax (VAT) reform, the country has continued to introduce preferential tax policies for the manufacturing sector, and, in 2019, a new round of large-scale tax and fee reductions began. Among these, the policy of additional deductions for R&D expenditure, a core tax tool for incentivizing corporate innovation, has seen its preferential strength and scope of application continuously expand, becoming a key tool for precisely enabling innovation in the manufacturing industry.

Therefore, an in-depth investigation of the impact of additional deductions for research and development expenditures on advancement in modern manufacturing enterprises can not only demonstrate the effectiveness of current tax policies, but also provide empirical evidence for optimizing tax incentives to promote quality development in the manufacturing industry. On this basis, this paper uses listed modern manufacturing enterprises to examine the fundamental question of whether additional deductions for research and development expenditures promote quality development in modern manufacturing enterprises and the mechanisms through which this influences this quality development. It also examines the mediating role of research and development investment and innovation performance in this process and clarifies the overall chain logic that explains the influence of policy measures on quality development in modern manufacturing. Ultimately, it provides empirical evidence for optimizing policy design and enhancing the innovation effectiveness of the advanced manufacturing industry. The potential marginal contributions of this article are as follows: First, by focusing on advanced manufacturing, a key sector that is technology-intensive and highly innovation-dependent, this article deeply analyzes the inherent mechanism through which the R&D super-deduction policy enhances quality-driven enterprise development by mediating the effects of R&D investment and innovation performance. By focusing on the unique attributes of advanced manufacturing, this study deepens our understanding of the micro-effects of the policy, especially for additional-deductions for R&D fees, enriches the research on the policy transmission mechanism in technology-intensive industries, and provides new empirical evidence for understanding the micro-effects of policies in specific industries. Second, by incorporating R&D input and innovation output into a unified chain mediation framework, this article systematically examines the sequence and synergy between the two in policy transmission. Compared with existing research that focuses on a single mediator or a simple parallel mediation perspective, this framework improves the “policy-innovation factor-development quality” correlation theory, more fully reveals the full chain logic of how policies affect the high-quality development of advanced manufacturing, and provides a new analytical paradigm and perspective for the study of the synergistic effect of multiple mediating variables. Third, combining the industry characteristics of advanced manufacturing with the heterogeneous characteristics of policy implementation, this study’s conclusions can provide a precise basis for the government to optimize the design of such an incentive tax policy; at the same time, it can provide practical guidance for enterprises to efficiently allocate R&D resources and accelerate the transformation of innovative results, helping the advanced manufacturing industry to effectively transform policy dividends into core competitiveness, and has strong practical significance for promoting the improvement of policy effectiveness.

2. Literature Review

2.1. Research on Tax Incentives and Innovation Investment

The extant literature explores the role of tax incentives in boosting corporate innovation, with consistent empirical findings. Tax incentives cut innovation costs and redirect internal capital, thereby promoting corporate R&D investment [

2,

3]. For manufacturers, tax incentives correlate positively with innovation input; this effect is especially strong for high-tech firms [

4]. Using data from Chinese A-share manufacturing enterprises, studies show R&D expense additional deduction policies directly drive R&D investment by easing financing constraints, with more notable effects on non-state-owned enterprises (non-SOEs) and small- and medium-sized enterprises (SMEs) [

5]. Specifically, such policies enhance firms’ R&D intensity by optimizing cash flow, signaling to external stakeholders, and reducing financial pressure [

6,

7,

8]. Comparative research indicates tax incentives outperform government subsidies in stimulating corporate innovation [

9]. Raising R&D additional deduction rates and optimizing deductible items also effectively boost enterprises’ R&D investment [

10]. Additionally, tax incentives significantly increase R&D intensity, although their impact varies by tax category [

9,

10,

11], industry, and firm size, with stronger effects in high-tech sectors and SMEs [

12].

2.2. Research on Effects of Tax Incentives on Innovation Output

Research on this impact has garnered widespread academic attention. Using corporate innovation performance as a proxy for overall firm value, studies find that tax-incentivized enterprises generate more new products and patents [

11]. Tax reduction measures—including R&D expense additional deductions—promote green technological innovation in manufacturing, increase green patent applications, and drive high-quality development by enhancing production efficiency [

13]. When converted into patents and technological achievements, tax-supported R&D investments boost product added value and market competitiveness; high-tech firms, in particular, commercialize innovative products more efficiently [

14,

15]. The R&D expense additional deduction policy is designed to help enterprises focus on core-business innovation and facilitate new technology commercialization [

16]. Moreover, in regions with robust intellectual property protection, the market value of innovative products is more readily realized, amplifying the policy’s effect. From the lens of innovation quality and sustainability, tax incentives not only raise enterprises’ patent application volumes, but also improve patent quality—fostering sustained corporate development and quality enhancement [

11,

17].

2.3. Research on the Impact of R&D Investment and Innovation Output

Numerous studies confirm a significant positive association between R&D investment and innovation outcomes. A chain mediation analysis indicates that accumulated R&D investment drives substantial technological progress, generates innovation outputs, and thereby enhances firm value [

5]. The advanced manufacturing sector exhibits relatively higher efficiency in converting R&D investment into innovation outcomes. As a core focus in research on its digital transformation, studies reveal that R&D investment spurs technological iteration, yields innovation outputs, and ultimately achieves transformation goals—validating the “R&D investment-innovation outcome” conversion chain [

6]. For high-tech firms, increased R&D investment directly boosts innovation capability, which in turn fuels patent growth and technological breakthroughs [

18]. Research on the structure and efficiency of innovation investment allocation further shows that the proportion of R&D investment enterprises allocate to different stages influences the quantity and quality of innovation outputs. A rational R&D investment structure can improve innovation output efficiency and strengthen enterprises’ innovative development [

19].

2.4. The Role of Tax Incentives in Fostering High-Quality Development

Scholars have examined the link between tax incentives and firms’ high-quality development from diverse perspectives. From the firm performance lens, tax incentives are widely held to boost economic performance [

20]. Studies confirm that R&D expense additional deduction policies drive capital reallocation from the virtual to the real economy, raise total factor productivity (TFP), and exert a stronger effect on non-state-owned enterprises and high-tech firms [

16]. Further analysis shows current fiscal and budgetary tools promote manufacturing growth and structural upgrading, but lack efficacy in advancing the commercialization of scientific and technological achievements [

21]. For small- and medium-sized manufacturing enterprises, tax and fee cuts foster high-quality development by lifting TFP, though this effect can be weakened by local debt reduction [

22]. A comparison of tax incentives and government subsidies reveals tax incentives are more effective in economic upturns than downturns and better support enterprises’ long-term development [

23,

24]. From the perspective of firms’ sustainable development capacity, tax incentives enhance such capacity and improve enterprises’ social image and long-term competitiveness by spurring green innovation and socially responsible investment [

25].

2.5. Research on Tax Incentives, R&D Investment, Innovation Output, and High-Quality Development

Some have developed a framework of “tax incentives-R&D investment-innovation performance-high-quality development,” demonstrating that R&D expense additional deduction policies boost R&D investment by easing financing constraints. This, in turn, enhances innovation performance and increases firm value, with a significant chain mediation effect [

5]. Other studies note that tax incentives improve innovation performance via stimulating innovation investment to enable high-quality development, with this transmission chain varying across firms’ life-cycle stages [

26]. For high-tech enterprises, tax funds and technology-related tax incentives exert a synergistic effect: by spurring R&D investment and accelerating commercialization of innovative achievements, they significantly enhance firms’ innovation capability, profitability, and operational growth—forming a “policy-input-output-quality” closed loop [

27]. Studies also address the coordination between macroeconomic environments and policies. For instance, amid severe economic downward pressure, combining tax incentives with subsidies and financial support more effectively stimulates firm innovation and facilitates high-quality development [

28].

In summary, the existing literature has established a foundational understanding of how tax incentives—particularly R&D expense additional deduction policies—shape corporate R&D investment, innovation outputs, and high-quality development: studies consistently confirm that tax incentives drive R&D investment by cutting costs, easing financing constraints, and optimizing cash flow, that these investments boost innovation outputs like patents and green technologies while enhancing firm value, and that tax incentives directly foster high-quality development by improving TFP, redirecting capital to the real economy, and supporting sustainable capabilities. Recent work further explores multi-link mechanisms such as the “tax incentives—R&D-innovation—high-quality development” chain and “policy-input-output-quality” closed loop, highlighting the mediating role of R&D and innovation. However, three critical gaps remain: first, most research focuses on binary or partial multi-variable relationships rather than unpacking the systematic synergy between tax policies, R&D investment, innovation outputs, and high-quality development—especially overlooking the dynamic chain synergy of R&D-innovation conversion efficiency in policy implementation, which limits insights into full-process policy mechanisms. Second, existing studies either aggregate manufacturing firms or focus on high-tech industries, but neglect advanced manufacturing—a sector with unique traits that differ from traditional manufacturing and high-tech enterprises, failing to explore sector-specific policy mechanisms or heterogeneity, leaving recommendations without targeting for this strategically critical field. Third, measurements of high-quality development rarely align with R&D-innovation transmission channels, ignoring dimensions like value chain upgrading or industrial transformation key to advanced manufacturing, and no study has built a comprehensive “policy incentives-input transformation-quality improvement” framework for the sector, leaving micro-mechanisms of how innovation drives quality improvement unaddressed. To fill these gaps, this study focuses on advanced manufacturing enterprises, integrates the four core variables into a unified analytical framework, and examines the mediating roles of R&D investment and innovation outputs along the logical chain “R&D expense additional deduction policy→R&D investment→innovation outputs→high-quality development,” aiming to provide empirical support for targeted tax policies promoting advanced manufacturing’s high-quality development.

3. Analytical and Conceptual Framework

3.1. A Review of Tax Incentives for the Manufacturing Industries

Between 2010 and 2024, the policy regarding additional deductions for R&D expenses was adjusted several times. From 2010 to 2016, the additional deduction rate remained unchanged at 50%. According to the Enterprise Income Tax Law of China and its implementing regulations, which came into effect in 2008, eligible R&D expenditures incurred by enterprises that are not capitalised as intangible assets and are charged against current-year taxable income qualify for an extra 50% tax deduction beyond standard statutory deductions, in addition to actual statutory deductions. In 2017, the Ministry of Finance, the State Administration of Taxation, and the Ministry of Science and Technology jointly issued a notice increasing in the super-deduction rate for R&D expenses of technology SMEs from 50% to 75%. In 2018, the Ministry of Finance, the State Administration of Taxation, and the Ministry of Science and Technology jointly issued a notice stating that from 1 January 2018, to 31 December 2020, actual R&D expenses incurred by an enterprise that do not result in intangible assets being included in the current period’s profit or loss are eligible for a 75% super-deduction on the pre-tax actual amount, in addition to the deductions stipulated by law. In 2021, the additional deduction for R&D expenses of manufacturing enterprises increased from 75% to 100%. In 2023, the Ministry of Finance and the State Administration of Taxation jointly issued a notice increasing the additional deduction for pre-tax R&D expenses of enterprises in eligible industries from 75% to 100%. This increase was implemented through a long-term institutional agreement. For manufacturing companies, adjustments were made mainly in 2018 and 2020, increasing the deduction percentage and expanding insurance coverage.

3.2. Analysis of the Mechanism of the R&D Expenses Additional Deduction Policy and the High-Quality Development of Advanced Manufacturing Enterprises

The additional deduction for R&D expenditures is increasingly being used by companies, and its scope is expanding. According to statistics, the supplementary deductions for research and development expenses included in the advance corporate income tax data for manufacturing enterprises in 2023 amounted to 1.1 trillion yuan, accounting for nearly 60%. This effectively compensates for the revenue losses of innovative enterprises caused by technological spillovers, strengthens their innovation capacity, and significantly stimulates corporate investment and innovation. On the one hand, the government has introduced a series of tax incentives to reduce the tax burden on companies, ease their financial pressure, and ease their short-term financing constraints. This allows for manufacturing companies to invest more heavily in promoting high-quality development. On the other hand, tax incentives play a guiding role in the development of manufacturing companies.

Specifically, the additional deduction for R&D expenditures facilitates the qualitative growth of advanced manufacturing companies by tax reduction, resource release, and strategic alignment. From a financial perspective, by increasing the input tax deduction rate for R&D expenditures, the policy directly reduces companies’ taxable income and increases their free cash flow [

5]. This effect is particularly crucial for advanced manufacturing industries with long production cycles and high capital intensity, as it alleviates financing constraints in the development of core technologies and the acquisition of high-end equipment. From a signaling perspective, the policy signals government support for innovation in advanced manufacturing, strengthens investors’ confidence in the long-term development of companies, and encourages them to focus on technological upgrading and industrial transformation [

16]. For example, the policy encourages companies to prioritize resources on high-value development areas such as digital transformation and green production, thus improving production efficiency and product added value [

6]. From a governance perspective, this policy, by standardizing the accounting and reporting of R&D expenditures, requires companies to optimize their internal management processes, reduce the waste of R&D resources, and indirectly improve total factor productivity (TFP) [

29]. This is in line with the modern manufacturing industry’s need for sophisticated management.

In summary, the policy of additional deductions for R&D expenditures can promote the high-quality development of manufacturing companies by increasing cash flow, stimulating innovation, and improving governance effectiveness. Based on this, this article proposes Hypothesis 1:

H1. The policy of additional deductions for R&D expenses can significantly enhance the high-quality development of manufacturing enterprises.

3.3. Analysis of the Mechanism by Which the R&D Expenses Additional Deduction Policy Promotes High-Quality Development of Advanced Manufacturing Enterprises Through R&D Investment

The high costs and risks of the innovation process often hinder enterprises or even deprive them of their motivation to innovate. Therefore, it is essential for the government to regulate the efficiency of enterprise innovation through tax incentives. On the one hand, the tax policy which provide an additional- deduction for R&D costs encourages enterprises to increase their R&D costs by reducing unit R&D costs. This policy provides a proportional additional deduction for R&D costs and essentially distributes R&D risks between the government and enterprises [

30]. This alleviates the cost pressure of enterprises’ innovation activities and encourages them to actively participate in various innovation activities. This policy provides “protection” for high-risk basic research and cutting-edge technology development in advanced manufacturing, encouraging enterprises to hire more research personnel, purchase equipment, and acquire technologies [

6]. In addition, tax incentives can improve enterprises’ innovation financing capacity. By reducing innovation costs and increasing returns, they can alleviate internal financial pressure to a certain extent. Tax incentives for enterprises also have a positive impact on investors, attracting more financial support and strengthening their external financing capabilities. Innovation activities can also help enterprises achieve high-quality development. Enterprise innovation activities can generate more new products and technologies. Product innovations can strengthen competitiveness, and technological innovations can improve production efficiency and ultimately promote high-quality development. Increasing R&D investment also directly strengthens the innovation capacity of advanced manufacturing enterprises. Advanced manufacturing is characterized by high technology intensity. The continuous accumulation of R&D investment motivates enterprises to make breakthroughs in key technologies such as chip manufacturing and high-end device development, thereby creating a differentiated competitive advantage [

14]. For example, increasing the proportion of R&D personnel can accelerate technological iteration, and upgrading R&D equipment can improve the accuracy of the production process, which ultimately results in enhancing both product quality and operational productivity and fostering sustainable and high-value growth [

5].

In summary, this policy can promote R&D investment by reducing unit R&D costs, sharing R&D risks, and improving financing options. By strengthening the innovation capacity of enterprises, promoting key technological advances, accelerating technological iteration, and improving the precision of production processes, R&D investment can lead to improved product quality and production efficiency, create a differentiated competitive advantage, and thus promote the high-quality development. On this basis, so proposed Hypothesis 2:

H2. R&D investment mediates the relationship between the additional deduction policy for R&D expenses and the high-quality development of advanced manufacturing enterprises.

3.4. Analysis of the Mechanism by Which the Policy of Additional Deductions for R&D Expenses Promotes High-Quality Development of Advanced Manufacturing Enterprises Through Innovation Output

Innovation performance serves as an another critical mediating mechanism through which policy interventions influence high-quality development and its transmission channel is “policy incentives-scientific research performance transformation-market feedback”. On the one hand, policies promote the accumulation of innovation performance by increasing R&D investment. The policy not only directly stimulates R&D investment, but also indirectly supports the pilot and transformation of innovative achievements by improving corporate cash flow [

13]. In advanced manufacturing, this effect is reflected in the increase in the number of patents such as invention patents and the industrialization of new technologies [

14]. On the other hand, innovation performance promotes high-quality development through the realization of market value. The innovation performance of advanced manufacturing has the characteristics of high added value. For example, core technology patents can increase product premiums, new processes can reduce unit energy consumption, and new products can increase market share [

16]; in addition, the brand image and industry influence generated by innovative products can attract greater resource aggregation, forming a virtuous cycle of “innovative products-market expansion-reinvestment” [

21].

In summary, the policy of additional R&D deductions can stimulate R&D investment and improve corporate cash flow to support pilot testing and the implementation of innovative results. This promotes patent growth and the commercialization of new technologies in advanced manufacturing enterprises. Thanks to their high added value, innovative products can pool resources by increasing product premiums, reducing unit energy consumption, expanding market share, and enhancing brand image and industrial influence. This creates a virtuous cycle of “innovative products—market expansion—reinvestment” that promotes the quality-oriented growth of manufacturing enterprises. Thus, this article proposes Hypothesis 3:

H3. Innovation output plays a mediating role between the additional deductions for R&D expenses and the high-quality development of advanced manufacturing enterprises.

3.5. Analysis of the Chain Mediating Effect of R&D Investment and Innovation Output in Policy-Driven High-Quality Development of Advanced Manufacturing Enterprises

R&D investment and innovation performance act as mediating variables within the input-transformation-outcome chain, collectively shaping how policy interventions drive high-quality development. Policy initially encourages enterprises to increase their R&D investment through tax incentives, thus promoting the development of innovative products. The monetization of such innovative offerings ultimately translates into greater profitability and a strengthened competitive position for enterprises [

5]. Taking the high-end equipment manufacturing industry as an example, the policy of additional R&D expenditure deduction encourages enterprises to invest more in intelligent control systems, promotes the generation of relevant technical patents, and ultimately leads to intelligent upgrading of production lines, reduces failure rates and energy consumption, and promotes high-quality development [

6]. This chain reflects the development logic of advanced manufacturing. The policy links R&D investments with innovative products, thus providing a sustainable driver for high-quality development. In summary, the additional R&D expenditure deduction policy encourages advanced manufacturing enterprises to increase their R&D investments through tax incentives and promotes the development of innovative results, such as technical patents. The implementation of these innovative results ultimately leads to better economic benefits and improved competitiveness for enterprises, thus promoting the intelligent upgrading of production lines and high-quality development. This “input-transformation-profit” chain has an intermediate effect: additional R&D expenditure deduction policy—R&D investment—innovation results—high-quality development, which provides a sustainable impetus. So Hypothesis 4 is proposed:

H4. R&D investment and innovation output play a chain mediating role between the additional deductions for R&D expenses and the high-quality development of advanced manufacturing companies.

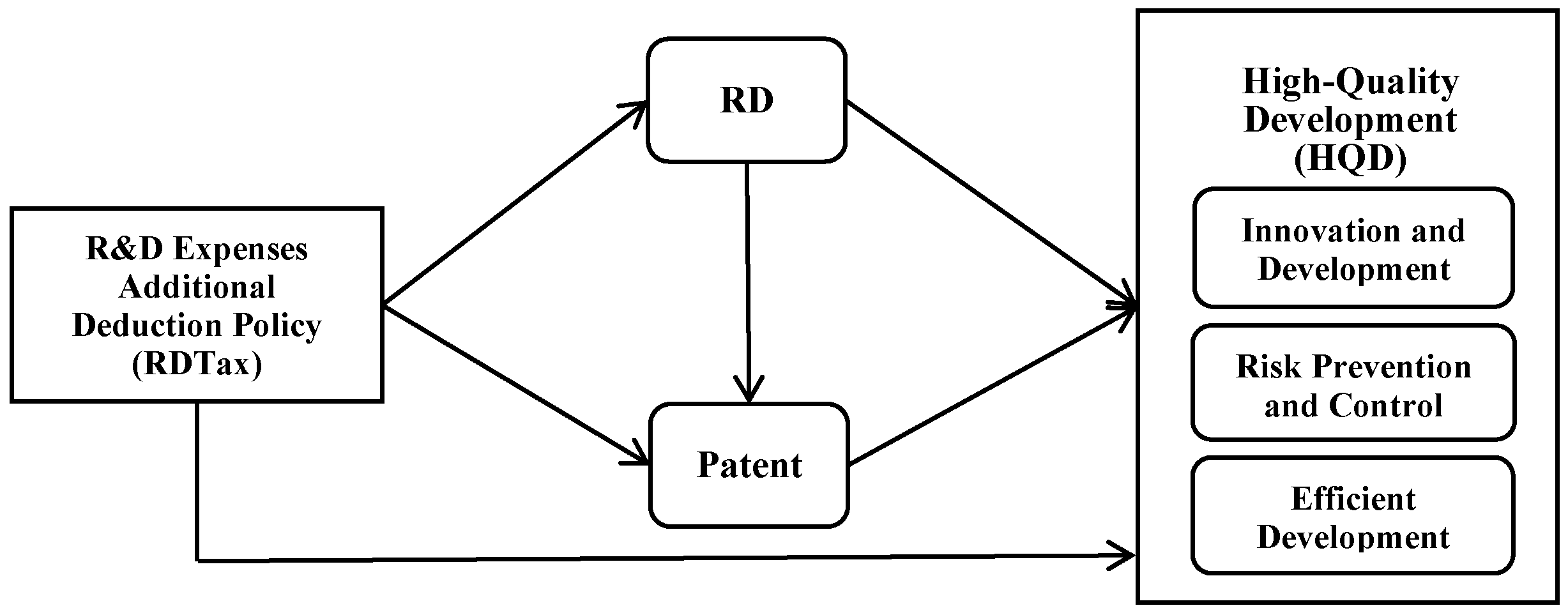

Above all, this study constructs the conceptual framework shown in

Figure 1.

4. Research Design

4.1. Sample Selection and Variable Sources

This paper uses data from A-share listed companies in the advanced manufacturing sector from 2010 to 2024 as an empirical sample. The data comes from a list of 45 national-level advanced manufacturing clusters covering 19 provinces (autonomous regions, and municipalities) published by the Ministry of Industry and Information Technology. Based on the “Made in China 2025” plan and the National Bureau of Statistics’ “Three New” statistical classifications, 15 industries from the CSMAR (China Securities Market and Accounting Research Database) were used as representative sectors of the advanced manufacturing sector. The data for this paper, primarily sourced from platforms such as CSMAR, covers indicators such as tax incentives and corporate innovation. After excluding companies with incomplete data or special circumstances (ST and *ST companies), continuous variables were winsorized at a 1% to 99% margin to avoid extreme values and outliers in the sample data and ensure the accuracy of the research results. After screening, a total of 13,851 valid company sample data were obtained. STATA 18.0 was used for data processing and calculations.

4.2. Variable Selection

4.2.1. Dependent Variable

Currently, a standardized framework for assessing high-quality development (abbreviated as HQD hereafter) in manufacturing has yet to be established. Based on the connotation of high-quality development, this paper uses the “five development concepts” as the basis for measuring the high-quality development of manufacturing. Taking into account the availability of specific indicators, based on the research results of Zhang et al. [

31] and the assessment framework for quality development in manufacturing proposed by Zhao et al. [

32,

33], which is finally measured from three dimensions: innovation development, efficiency development, and risk control. Taking into account the available data, an evaluation system with 10 specific indicators was established: the first is the Innovation and Development Index, which uses enterprise innovation funding intensity, enterprise innovation driving capability, and innovation output as evaluation indicators. The second is the Efficiency Development Index, which takes business asset operation efficiency, business inventory operation efficiency, and business profit efficiency as benchmarks. The third is the Risk Control Index, which uses the Enterprise Credit Risk Control Index, Enterprise Operational Risk Control Index, Enterprise Policy Risk Prevention Index, and business operating sustainability as benchmarks. Based on this, the weighting of each indicator is determined using the entropy weighting method, thereby obtaining the measurement index for high-quality manufacturing development. This index provides a comprehensive, objective, and scientific evaluation tool for measuring the quality development (HQD) level of manufacturing enterprises. The specific calculation steps are as follows:

(1) Standardize the raw data Xij of each manufacturing enterprise to solve the calculation problem caused by the different ranges of the enterprise’s various indicators. The calculation formula is as follows:

When the indicator is a positive indicator, its standardized formula is

When the indicator is a negative indicator, its standardized formula is

where max(x

ij) represents the maximum value of the j-th indicator of the i-th sample, x

ij represents the data of the jth indicator of the i-th sample in the original data, and X

ij represents the data of the jth indicator of the i-th sample in the standardized data.

(2) According to Formulas (1) and (2), the weight p

ij of the data of the same indicator in each sample data is calculated. The calculation formula is as follows:

According to Formula (3), the entropy value e(j) of each indicator is determined as Formula (4). Before calculating the entropy value, it is necessary to calculate the entropy constant k according to Formula (4) based on the given data sample:

Based on the calculated entropy values, the information entropy redundancy of each indicator is determined using Formula (5):

Normalize according to Formula (6) to determine the weight of each indicator in the high quality level of manufacturing industry:

On this basis, the weights of each indicator are determined (see the fifth column of

Table 1). Finally, the standardized data of the indicator are multiplied by the corresponding weights obtained by the entropy method to obtain the specific values used to determine the qualitative development of each company (Formula (7)). This article uses this indicator as the dependent variable in the empirical analysis.

4.2.2. Independent Variable

This article is based on the research method of Liu et al. [

34] and uses the intensity of R&D expenditure deduction as the main explanatory variable. For the R&D expenditure deduction, we calculate the tax benefits received by the firm based on the deduction intensity and take the logarithm ln(R&D investment × deduction rate + 1). During the study period, the deduction rate was 50% before 2018, 75% from 2018 (inclusive) to 2020, and 100% for intangible assets not yet formed in 2021 (inclusive).

R&D intensity: Based on the previous analysis and the approach of Li et al. [

35], we use the firm’s current-year R&D investment as a mediating variable and measure it as the ratio of the firm’s R&D investment to its operating revenue to eliminate the influence of firm size. Data at the 1% and 99% percentiles are winsorized to reduce the influence of outliers on the regression results.

R&D Intensity = Total R&D Investment/Main Business Revenue

Following Xu et al. [

36], this article uses the number of citations of granted patents as a measure of innovation output. The calculation formula is as follows:

Patent = ln(citation count of granted patent + 1)

This paper draws on the research of Chen & Liu [

37] and introduces a series of control variables (CVs) into the empirical analysis. Since the development of a high-quality firm is also influenced by other factors, it is necessary to control for these factors in the model. The control variables selected in this paper include cash flow intensity, debt-to-equity ratio, labor intensity, whether both positions are combined, firm value, firm size, firm profitability, the degree of market power of the firm, return on assets, equity concentration, and firm age.

See

Table 2 below for detailed variable definitions:

4.3. Model Construction

This article examines the role of R&D additional-deduction tax policy in promoting high-value developments in the manufacturing sector, this paper conducts empirical analysis by constructing three regression test models as shown in Formulas (8)–(11).

4.3.1. Benchmark Regression Model

Based on the research paradigm of Qi & Xiao et al. [

38], a dynamic panel regression model on the impact of additional deduction policy for R&D expenses on the HQD of enterprises is constructed. To test hypothesis H1, we construct model (8) as follows:

The dependent variable is high-quality enterprise development of the manufacturing industry(HQD). The core independent variable is additional deduction policy for R&D expenses (RDTax). CVs represents a set of control variables, covering key factors such as firm size and debt-to-asset ratio. To mitigate endogenous disturbances, two dummy variables, time (Year) and firm (Firm), are introduced into the regression model to reduce the interference of unobservable factors at the year and individual levels. i represents the individual listed company (corresponding to the stock code), t is the observation year, and ε is the random error term.

4.3.2. Mediation Effect Model

In order to test the effect of R&D investment on enterprise’s high-quality development through mediating variables, we refer to the research of the same as above to construct a mediating effect test model. To test hypothesis H2, we construct Formulas (9) and (10) as follows:

The mediating variable is RD, and the meanings of the other variables are identical to those described above.

To test the influence of innovation on the development of corporate quality using mediating variables, we draw on the above-mentioned research to construct a model to test the mediating effect. To test hypothesis H3, we construct Formulas (11) and (12) as follows:

The mediating variable is clear, and the meanings of the other variables are the same as above.

Finally, using the multiple mediation effect analysis method, a chain mediation model was constructed to test hypothesis H4, as shown in Equations (13) and (14).

4.4. Empirical Analysis Results

4.4.1. Descriptive Statistics

As is shown in

Table 3, the maximum tax incentive for advanced manufacturing enterprises is 21.88, the minimum is 0, the mean is 11.82, and the median is 17.55. This indicates significant variation in the level of tax incentives among advanced manufacturing enterprises. Judging from the mean and median values of the HQD for the manufacturing industry, the development level of most manufacturing enterprises still needs to be improved.

4.4.2. Benchmark Regression Test

Showing in

Table 4, the impact of the RDTax on HQD of advanced manufacturing enterprises is empirically tested using ordinary least squares (OLS) and fixed effect (FE) models. By controlling for firm fixed effects (FE firm) and year fixed effects (FE year), the regression results provide empirical evidence for the economic consequences of the R&D expense deduction policy. As shown in

Table 4, RDTax exerts a pronounced and robust effect on the HQD of advanced manufacturing enterprises: In OLS model, the coefficient of RDTax in column (1) without the control variable is 0.0029, which is significant at 1%, indicating that the policy is a significant driver of HQD; after adding the control variables in column (2), the coefficient decreases, but the significance remains unchanged. This eliminates the interference of factors such as cash flow constraints and leverage pressure, and more purely reflects the mechanism through which the policy enables enterprises to achieve high-quality growth by reducing innovation costs and releasing cash flow. In the FE model, the RDTax coefficient in column (3) without control variables is 0.0018, which is significant at 1%. The coefficient in column (4) after adding control variables is 0.0017. The FE model has slightly attenuated the coefficient due to the fixed effects of enterprise and year, but it is still significant, and the FE model is more effective. Therefore, from an economic perspective, this policy has eased the constraints on innovation funds by reducing R&D-related taxes and fees, prompting enterprises to use cash flow for technological upgrades and releasing “innovation-oriented” market signals to ensure the optimization of resource allocation, thus forming a positive cycle of HQD of enterprises. In summary, the verification confirms the stable promotion effect of RDTax on the HQD of advanced manufacturing, verifies Hypothesis 1, and lays an empirical foundation for subsequent mechanism testing.

4.4.3. Endogeneity Test

To mitigate the endogeneity of the baseline regression, we incorporate the one-period lagged R&D expense deduction intensity (L.RDTax) as an instrumental variable, using a two-stage 2SLS estimation method. The regression results show that: ① In the first stage, the regression coefficient of the one-period lagged R&D expense deduction intensity (L.RDTax) is significantly positive (coefficient 0.8145 ***,

t-value 118.5385), indicating that the instrumental variable passes the test; ② In the second stage, the regression coefficient of the R&D expense deduction intensity (RDTax) remains significantly positive (coefficient 0.0008 ***,

t-value 50.6863), indicating that the conclusions of the baseline regression model hold even after controlling for endogeneity. Showing in

Table 5.

4.4.4. Robustness Test

To test the robustness of these results, we validated them by replacing the independent variable with RDTax1. According to Liu et al. [

34], which defines the preferential policy intensity for R&D expenditure deduction as “R&D investment × supplementary deduction rate * corporate tax rate/total assets.” Then, this paper calculates the preferential policy intensity for R&D expenditure deduction from 2010 to 2024 using ln(R&D expenditure * supplementary deduction rate * corporate tax rate)/total assets). The corresponding estimation outcomes are displayed in column (1) of

Table 6. After replacing the independent variable, it is found that the result is significant and positive.

Since the uncertainty of the economic environment during the 2020–2021 COVID-19 epidemic affected manufacturing production and operations, capital supply, and market circulation, which may have affected the accuracy of the empirical results, this paper retested the model by excluding the data of manufacturing enterprises for this period (column (2) of

Table 6). The regression results show that after excluding the samples during the epidemic period, the policy of additional deduction of R&D expenditures remains significantly and positively associated with enhanced quality development in advanced manufacturing enterprises. This demonstrates that the role of policy in promoting HQD remains stable even after excluding disruptions caused by the epidemic, further confirming the reliability of the baseline regression conclusion and suggesting that the basic logic of tax incentives promoting HQD of advanced manufacturing is not affected by sharp fluctuations in the short-term external environment.

Previous studies have shown that tax subsidies have a significant positive impact on the R&D investment of manufacturing enterprises and enhancement of total factor productivity [

39]. This means that there may be an overlapping effect with the policy of R&D super-deduction policy, which may affect the identification of the independent effect of tax incentives. In order to mitigate potential confounding from tax subsidy policies, a robustness test was conducted, and tax subsidies were included as an additional control variable in the regression analysis (see column (3) of

Table 6). A statistically significant positive correlation is observed between tax subsidies and HQD in advanced manufacturing enterprises at the 1% level. The key R&D expense additional deduction policy as an explanatory variable is consistent with the original benchmark test significance, confirming its independent driving role. This shows that even after controlling for the overlapping effect of tax subsidies, the R&D expense additional deduction policy still has a strong influence, further confirming the accuracy and reliability of the research results.

To further verify the robustness, this paper conducts a one-period lagged regression (L.RDTax) on the core explanatory variables to address potential endogeneity problems and capture the lagged characteristics of policy effects (results are shown in column (4) of

Table 6). Due to the characteristic time lag in how tax incentives affect high-quality corporate development, on the one hand, the R&D activities of enterprises are cyclical, and a considerable duration is required for policy-induced increases in R&D investment to translate into technological achievements, enhance production efficiency, and ultimately realize HQD; on the other hand, the cash flow released by tax incentives is often used for long-term innovation projects, and its influence is difficult to fully reflect in the current period. The regression results of the one-period lagged regression are more consistent with the actual transmission effect of the policy effect.

The regression results show that the one-period lagged R&D expense additional deduction policy (L.RDTax) is still significantly positive, and the correlation coefficient is basically consistent with the baseline regression model. This result shows that the promotion effect of the policy is not only effective in the current period, but also has persistence in the next period, further confirming its continued driving effect on HQD. In addition, the significant lag period alleviates the endogeneity concerns of “reverse causality” that enterprises with HQD are more likely to receive tax incentives. In summary, the policy exerts a sustained positive influence on high-quality growth within the advanced manufacturing sector, which enhances the credibility of conclusions.

To further test the robustness and account for the strong persistence of high—quality development (where past performance influences current outcomes), we incorporate the one—period lag of HQD (L.HQD) into the model for a dynamic panel analysis. The results in Column (5) of

Table 6 show that the coefficient of L.HQD is significantly positive (0.0029 ***), indicating that past high—quality development has a positive impact on current high—quality development. Meanwhile, the coefficient of RDTax remains significantly positive (0.0010 ***), which confirms that the positive promotion effect of R&D tax deduction on the high—quality development of advanced manufacturing enterprises is robust even after considering the dynamic persistence of high—quality development.

To further verify the robustness of our results and mitigate the influence of extreme value treatment on the conclusions, we re-ran the regression analysis using the original variables before winsoring. The results are shown in column 6 of

Table 6. The regression results show that the coefficient of the core explanatory variable, RDTax, remains significantly positive (consistent in direction and significance with the baseline regression and winsoring results). This result demonstrates that even without winsoring to preserve the distribution characteristics of the original data, the role of the R&D expense deduction in promoting high-quality development of advanced manufacturing enterprises remains robust, indicating that the baseline conclusions are not driven by extreme value treatment, further confirming the reliability of our findings.

To further rule out potential interference from industry factors and regional policies, this study includes industry- and province-specific fixed effects for robustness testing. Industry-specific fixed effects effectively isolate inherent differences in technological iteration and innovation resource endowments across manufacturing subsectors, while province-specific fixed effects mitigate exogenous interference from regional policy preferences and the institutional environment. The results show that the RDTax policy coefficient (0.0017) is significant at the 1% level when accounting for industry-specific fixed effects (results are shown in column (7) of

Table 6). When accounting for both industry- and province-specific fixed effects (column 8), the RDTax coefficient remains significant at the 1% level at 0.0017. This confirms that the policy’s stimulatory effect is not due to industry-specific technological characteristics or random regional policy overlaps. This not only underlines the influence of industry-specific technological characteristics and the regional institutional environment on firm performance, but also reinforces the robustness of RDTax as a universal policy instrument across tested industries and regions.

4.4.5. Mediation Mechanism Test

Based on the mediation effect analysis paradigm of Wen & Ye [

40], this section investigates the transmission mechanism through which the R&D tax deduction policy (RDTax) affects HQD of advanced manufacturing enterprises through research and development (R&D) investment.

As is shown in

Table 7, column (1) and (2) of list the results of the independent mediating effect of R&D investment (RD): Column (1) shows that the coefficient of R&D expense deduction (RDTax) on RD is significantly positive, and Column (2) shows that the coefficient of RD on HQD is also significantly positive, indicating that RDTax promotes corporate R&D investment and thus supports the HQD of advanced manufacturing enterprises, verifying Hypothesis 2. Columns (3) and (4) show the results of the independent mediating effect of innovation output: In Column (3), the coefficient of RDTax on patents is significantly positive, and Column (4) shows that the coefficient of innovation output (Patent) on HQD is significantly positive, indicating that RDTax promotes corporate innovation output and transforms rich innovation results into the driving force of HQD, thereby verifying Hypothesis 3. Columns (1), (5) and (6) show the results of the chain mediation effect test: Column (1) confirms the significant positive correlation coefficient of RDTax on R&D investment, Column (5) shows that R&D investment promotes high-quality innovation output, highlighting that RD is the key link between RDTax and Patent, and Column (6) shows that the R&D expense additional deduction policy (RDTax) ultimately promotes the HQD of advanced manufacturing through the above two mediating effects. The chain mediation effect is established, which verifies Hypothesis 4.

4.4.6. Heterogeneity Analysis

To further examine the heterogeneous effects of the R&D tax deduction (RDTax) policies on HQD of advanced manufacturing, this study, based on the “Statistical Classification Method for Large, Medium, Small, and Micro Enterprises (2017)” and considering the characteristics of the manufacturing industry, categorizes the surveyed enterprises into large, medium, and micro enterprises according to total assets and operating income. The regression results of the heterogeneity tests by enterprise size are presented in

Table 8. For large enterprises column (1), the estimated coefficient for RDTax is 0.0017, which is positive and statistically significant at the 1% level. Large enterprises have resource advantages such as sufficient cash flows and mature research and development systems, which enable them to better respond to policy measures. For medium-sized enterprises column (2), the regression results are insignificant. This may be due to the dual pressures created by the displacement of large firms and the flexible competition of small firms, which hamper the use of policy tools to address bottlenecks in resource allocation. The results are also insignificant for micro and small enterprises. This could be because small firms, due to their asset size and operating turnover, have limited reserves for innovation financing and low risk tolerance. Tax incentives are therefore insufficient to offset their high R&D costs and long-term risks. These results therefore confirm the scale differences in policy effects and offer opportunities for their optimization.

To further explore the heterogeneous impact, this study investigates the heterogeneity of the impact over different periods. For manufacturing enterprises, the additional deduction policy for R&D expenditure was mainly adjusted in 2018 and 2020. Since the sample data for each year before and after the adjustment are sufficient, this paper conducts a group analysis before 2018, 2018–2020, and after 2020, and conducts a group test of the samples using Model (9). The results in

Table 8 column (4) to (6) show that the implementation of the additional deduction policy for R&D expenditure before 2018, during the implementation period, had no significant impact on promoting the HQD of enterprises. However, after 2018, the implementation of this policy served as a key mechanism for promoting HQD at the enterprise level. This shows that by increasing the deduction rate under the additional deduction policy, enterprises can more easily access innovation resources, reduce the cost of acquiring innovation resources, and this is conducive to the HQD of enterprises.

5. Discussion

This study empirically examines the impact of the R&D expenditure additional deduction policy on high-quality development (HQD) of Chinese A-share-listed advanced manufacturing enterprises (2010–2024), with findings that align with existing research, extend theoretical insights, and clarify policy trade-offs, while also identifying key limitations.

The core result that the R&D tax deduction significantly promotes HQD echoes international evidence [

2], confirming such incentives drive quality-oriented growth. This reflects China’s maturing innovation framework: 2018 reforms explained the policy’s strengthened HQD effect [

10,

12], verifying intensity as a key lever. Heterogeneity analysis shows that large enterprises benefit more [

5], due to their mature R&D systems and stable cash flows, addressing a gap in linking size to advanced manufacturing’s high R&D intensity. Most notably, the study identifies a chain mediation mechanism, moving beyond isolated pathways to clarify how tax incentives first ease funding constraints and then enable conversion of investment into outputs to drive HQD, extending Luo et al.’s [

16] single-mediator work.

Contextualizing the policy against alternatives reveals its strengths and weaknesses. Tax incentives outperform subsidies by avoiding administrative delays/rent-seeking, allowing for enterprises to autonomously shape R&D and offering stability for long-cycle projects. However, they depend on tax liabilities, leaving loss-making SMEs with little benefit and fail to solve “innovation conversion” without robust IPP.

International comparisons add context, OECD policies also drive HQD, but China’s deductions are more central to SME HQD. The EU’s green-linked deductions suggest China could add similar “directional clauses” to align with “double carbon” goals.

This study has limitations. First, aggregated data overlooks sub-sector heterogeneity. Second, it does not explore synergies between deductions and other policies. Third, the listed-firm sample excludes unlisted SMEs, restricting generalizability. Future research could address these via sub-sector analysis, policy synergy testing, and expanded samples.

6. Conclusions

Using data from advanced manufacturing companies listed on the Chinese A-share market between 2010 and 2024, this study empirically examines the relationship between the R&D expenditure allowance deduction policy and these companies’ high-quality development. The key results are summarized below.

First, this policy is instrumental in fostering high-quality development within advanced manufacturing. This confirms its role as a catalyst in motivating companies to improve the quality of their development and facilitate their transformation and upgrading. This finding is confirmed by a series of robustness tests. Second, from a heterogeneous perspective, the effects of the policy vary depending on company size and year of implementation: In terms of scope, the policy has a stronger impact on large advanced manufacturing companies, and its influence on promoting high-quality development has increased year-on-year since 2018, in line with the trend of reforms that have intensified since 2018 and expanded the policy’s scope. Third, R&D investment plays a mediating role, confirming the transmission path of “additional deductions for R&D expenditure→R&D investment→high-quality development of advanced manufacturing.” Fourth, innovation performance also plays a mediating role, forming a transmission mechanism: “additional deductions for R&D expenditure→innovation performance→high-quality development of advanced manufacturing.” Fifth, it plays a mediating role between R&D investment and innovation performance: the policy first encourages enterprises to increase their R&D investment, then promotes innovation performance, and finally high-quality development. This establishes a chain of “additional deductions for R&D expenditure→R&D investment→innovation performance→high-quality development of advanced manufacturing,” clarifying the mediating role of R&D investment and innovation performance, especially the internal mechanism of its chain mediation role.

7. Suggestions

To address the limitations of the policy and enhance its practical significance, we propose specific and feasible measures based on the research results:

7.1. Develop Scale-Differentiated Deduction Rates and Eligibility Requirements

For loss-making SMEs, introduce loss carry-forward and extend the carry-forward period to ensure that unused deductions are preserved, thereby resolving the problem that SMEs cannot immediately enjoy deductions due to lack of taxable income, enabling them to apply for tax reductions after they become profitable. Further simplify the policy application process and establish a “one-stop online portal” for SMEs to reduce administrative burdens and improve policy accessibility. For large enterprises, implement a “performance-based additional deduction” policy. Increase the additional deduction ratio for enterprises that meet the following two innovation quality standards: (1) invention patents account for more than 30% of the total number of patent applications; and (2) green R&D investment accounts for more than 20% of the total R&D expenditure. This move avoids duplicate R&D expenditure and guides large enterprises to carry out high-impact, sustainable innovation.

7.2. Develop Industry-Differentiated Additional Deduction Policies

Develop policies based on the characteristics of each sub-sector of advanced manufacturing to support industrial upgrading and the “dual low-carbon” goals. For green-focused sub-sectors, a 150% “super green additional deduction” will be implemented for R&D expenses related to carbon emission reduction to accelerate the adoption of green technologies. A 100% deduction will be granted for “pre-feasibility study expenses” in technology-intensive sub-sectors, such as technology route verification and prototype testing, which is crucial for mitigating high-risk early-stage projects in these sectors.

7.3. Strengthening Policy Coordination to Promote the Transformation of R&D Input and Output

To strengthen the established chain intermediary mechanism, the R&D expense deduction policy will be linked to the commercialization of innovative achievements. Strengthening guidance on R&D investment will require that at least 60% of the income tax deduction benefits be used for core R&D activities. A quarterly reporting system will be established for large enterprises to track fund utilization and ensure that policy benefits effectively drive tangible investment. Strengthening incentives for innovative output will provide an additional percentage of deductions to enterprises that commercialize within 12 months of patent authorization to address the “innovation transformation gap” and reward market-oriented R&D activities.

7.4. Optimizing the Implementation Environment and Policy Coordination

Enhancing policy awareness and compliance, developing industry training programs, and publishing a “policy manual” containing case studies will enhance enterprises’ ability to utilize deductions, formulate synergistic and complementary policies, and integrate R&D deductions with science and technology finance instruments. Small- and medium-sized enterprises (SMEs) should be offered preferential loans when using R&D deductions to fund collaborative projects with universities and research institutes. For large enterprises, deduction eligibility should be linked to participation in industrial chain innovation alliances to promote systemic innovation.

In summary, the R&D expense deduction policy is a powerful tool for promoting high-quality development in advanced manufacturing, but its full potential lies in targeted, locally adapted design. These recommendations aim to address scale and industry inequalities, strengthen input–output linkages, and leverage policy synergies, providing practical guidance for policymakers to refine policies and support China’s industrial modernization.