The Role of the Built Environment in Achieving Sustainable Development: A Life Cycle Cost Perspective

Abstract

1. Introduction

- Synthesize existing knowledge on LCC practices and their application to coastal and marina facilities.

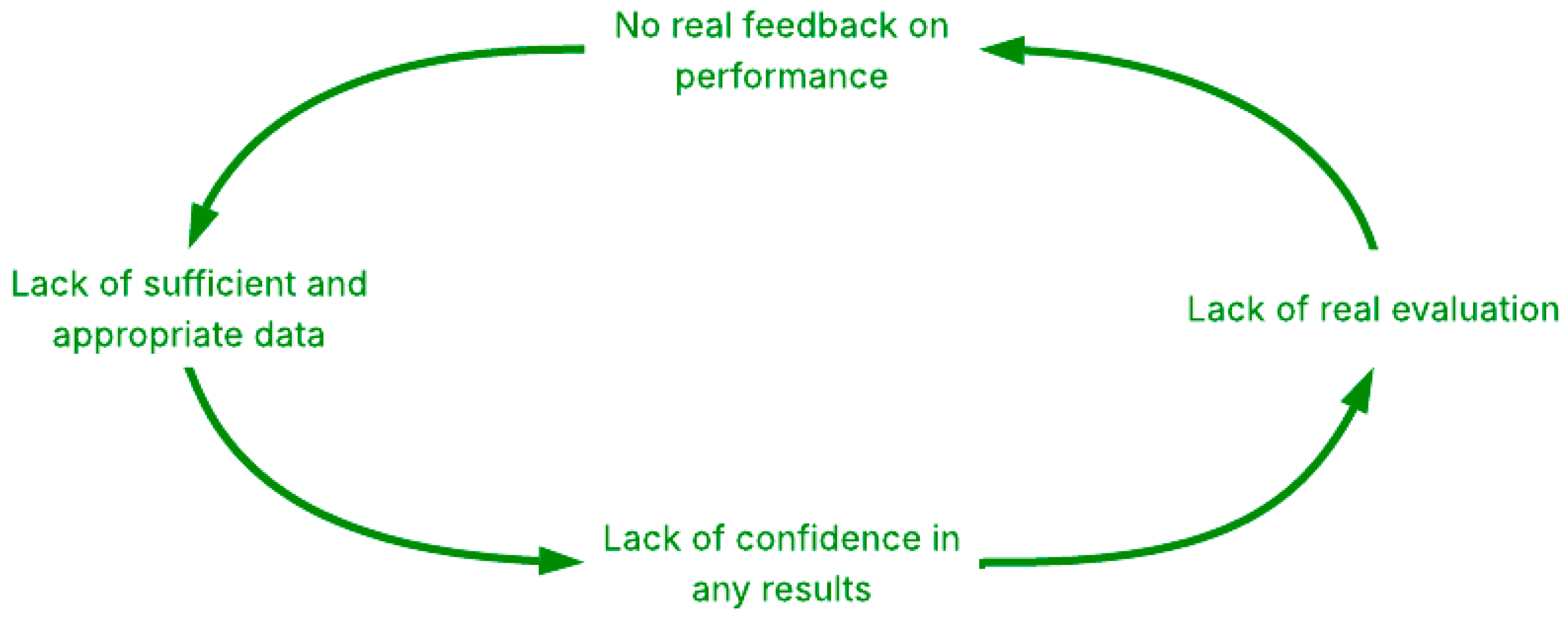

- Identify barriers and gaps in current approaches, including regulatory, methodological, and data-related challenges.

- Explore stakeholder perspectives on the practical limitations of existing models.

- Introduce a marina-specific LCC framework that provides both scientific and practical value in supporting sustainable investment and management.

- RQ1: How have LCC methodologies been applied in the context of marina infrastructure, and what gaps remain?

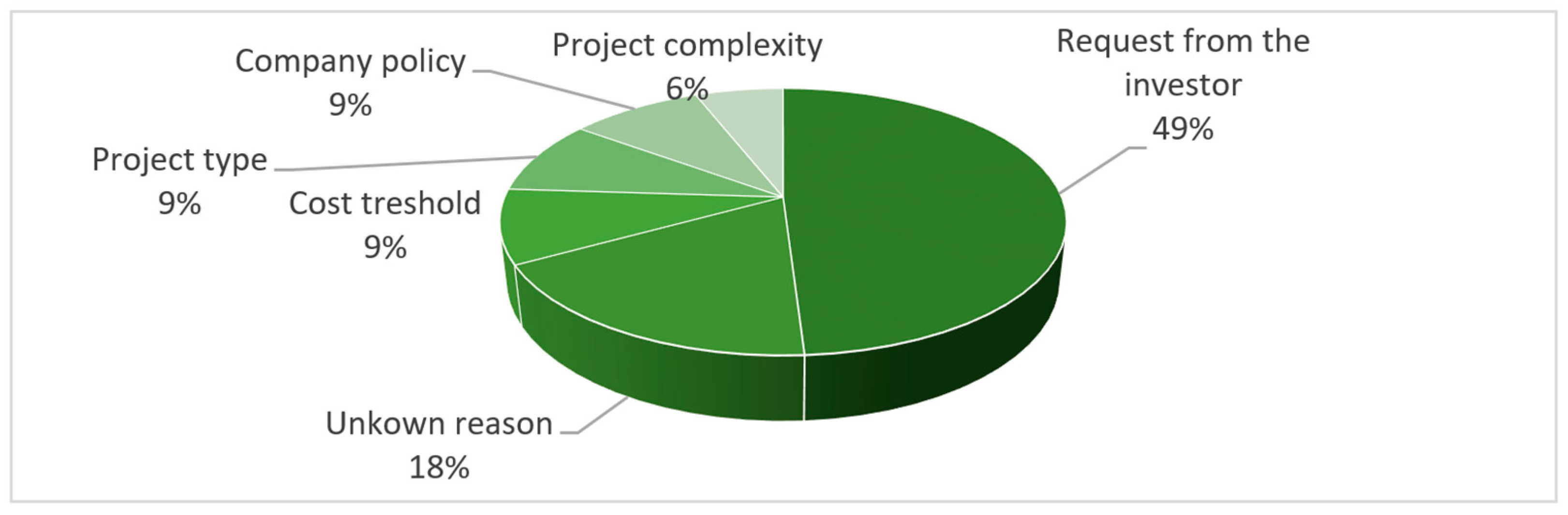

- RQ2: What barriers and enablers shape the adoption of LCC in marina management and procurement?

- RQ3: What design considerations are necessary for developing an LCC framework tailored to marinas?

2. Methods

2.1. Literature Review

2.2. Stakeholder Interviews

- General marina characteristics (ownership, year of construction, concession area, length of pontoons, number of berths by vessel length).

- Maintenance planning (strategies, upgrades, and reconstruction plans).

- Pontoon and anchoring system details (pontoon type, decking material, anchoring system).

- Marina usage (number of users, staff, operational profile).

- Life cycle cost categories, including

- inspection costs;

- replacement of worn elements;

- periodic works and repairs;

- operating costs.

2.3. Cost Breakdown Structure

3. Life Cycle Costs in Sustainable Development

3.1. The Strategic Role of Facility Management in Sustainable Development

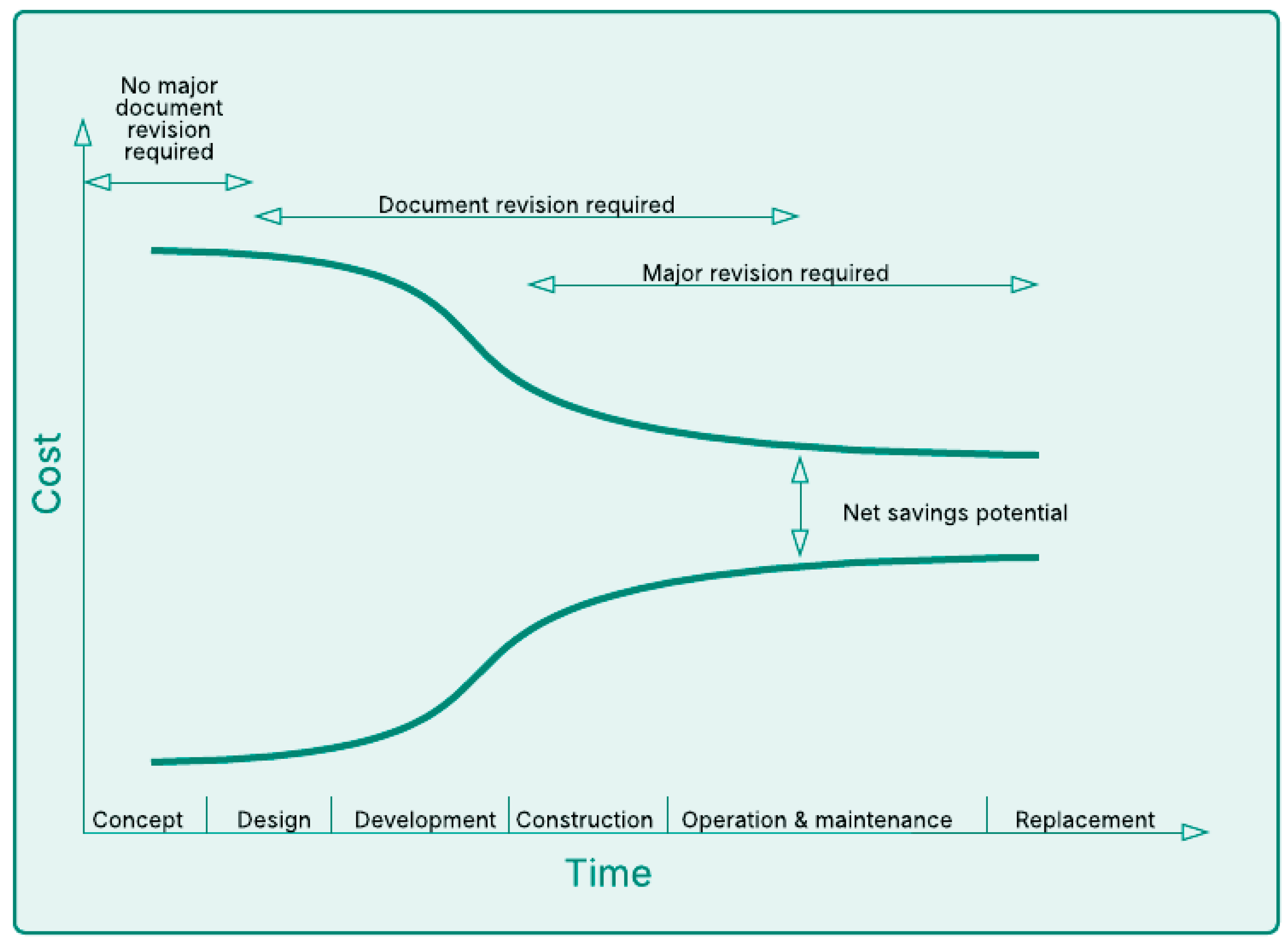

3.2. The Role of Life Cycle Costing in Early Design and Decision-Making

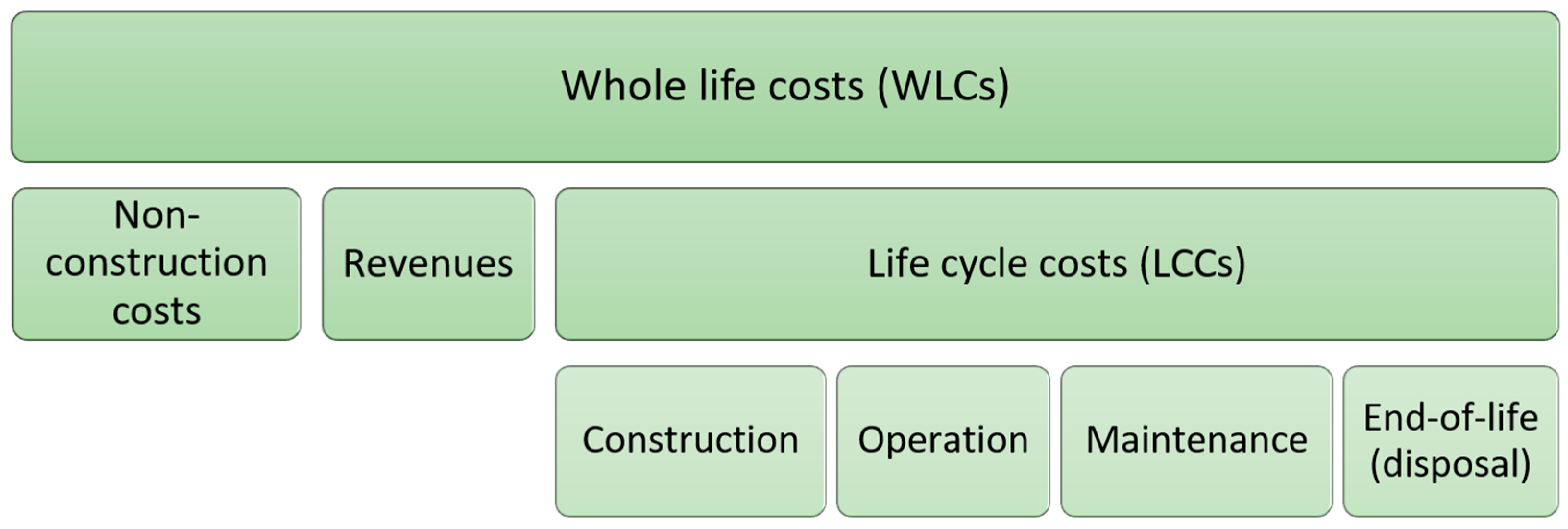

3.3. Terminology, Standards, and Cost Categories in LCC

- the method should be applied at all decision-making stages throughout the design process;

- it must account for the operational costs of the building;

- the logical process must encompass all factors influencing the decision-making process.

3.4. A Framework for Sustainable Decision-Making and Long-Term Cost Optimization

4. Existing Life Cycle Cost Estimation Models

- Engineering estimation;

- Analogous estimation;

- Parametric estimation.

- Defining the problem and objectives of the analysis;

- Establishing rules, constraints, and criteria;

- Defining system requirements and maintenance policies;

- Temporal scheduling of activities;

- Cost estimation (from both the producer’s and the user’s perspectives);

- Cost breakdown and development (or adaptation) of cost models and design variants;

- Temporal allocation of activities;

- Discounting future building-related costs;

- Determination of total life cycle costs;

- Result analysis and evaluation of design variants;

- Sensitivity analysis of the model with respect to input data;

- Recommendation of the optimal design variant;

- Use of feedback and control mechanisms for continuous system improvement.

4.1. Theoretical Foundations of Life Cycle Cost Calculation

- Inflation—When expenditures occur at different points in the past or future, they are measured in differing values due to price changes. The general trend of rising prices over time is called inflation, while a trend of falling prices is called deflation. Monetary units that include the effects of inflation or deflation over time are called nominal units or current/data year units. Units that exclude inflation or deflation components—thus maintaining constant purchasing power—are called real units or base year units.

- Discounting—Adjusting for the time value of money. Costs or benefits (expressed in constant monetary units) occurring at different time points are not comparable without accounting for their temporal value. The time value of money reflects two things: the return funds could earn in their next-best use, or the compensation required to delay current consumption.

4.2. Discounting Costs in Life Cycle Cost Analysis

- Time shifting: A single value can be adjusted forward or backward in time without changing its actual (present) value.

- Annualization: A lump sum can be converted into an equivalent annual stream (e.g., a capital investment).

- Present value: Any combination of cash flows (finite or infinite) and lump sums can be aggregated into a single present value at a specific point in time.

- d = real discount rate;

- D = nominal discount rate;

- l = inflation rate.

- = initial investment cost of design alternative i;

- = sum of discounted operational costs over time t;

- = sum of discounted maintenance costs over time t;

- = discounted terminal (salvage) value, calculated as

- = discounted residual value at the end of the analysis period;

- = discounted removal (decommissioning) costs;

- T = analysis period expressed in years.

- = present value;

- = value of the one-time cost at time t;

- d = real discount rate;

- t = time expressed in years.

- = present value;

- = value of the recurring costs;

- d = real discount rate;

- t = time expressed in years.

- = annualized cost at the end of the year;

- = present value as calculated in Equation (6);

- d = discount rate;

- t = time (expressed in years) from the start of the analysis to the end of the evaluation period.

4.3. Uncertainty and Selection of Model Input Parameters

- The Confidence Index (CI) method, and

- Monte Carlo simulation.

- CI < 0.15: low confidence (<60% probability);

- 0.15 ≤ CI ≤ 0.5: moderate confidence (60–67%);

- CI > 0.5: high confidence (>67%).

- Assigning specific values to the input parameter;

- Calculating the corresponding values of the output variable;

- Analyzing the relationship between input and output values.

4.4. Summary Overview of Existing Models

- = initial capital investment cost;

- = reconstruction costs;

- = residual (salvage) value at the end of the analysis period;

- = annual recurring costs for use, maintenance, and repair (excluding energy costs);

- = other recurring costs for use, maintenance, and repair (excluding energy costs);

- = energy costs.

- = procurement cost at time t = 0, including development, design, and construction costs, holding costs, and other initial costs associated with asset acquisition;

- = annual cost at time t (0 ≤ t ≤ T) for support function i (0 ≤ i ≤ n), such as maintenance, cleaning, energy, and security, which can be considered continuous over time;

- = non-annual cost at time t for discontinuous support function j (0 ≤ j ≤ m), such as repainting or component replacement at a specific point in time;

- = discount rates applicable to support functions i and j, respectively;

- = asset value at the time of disposal, reduced by removal costs;

- = discount rate applied to the disposal value of the asset.

- = present discounted costs of use over period T measured from the acquisition time;

- = cost model factor (constant for different building categories);

- = cost-significant items such as interior finishing, roof repairs, cleaning, energy costs, management costs, rates, insurance, and joinery.

- = total lifecycle costs of the building;

- = capital (investment) costs of the building;

- = other investment costs (land acquisition, design, etc.);

- = building management costs during the design phase;

- = building management costs related to building elements (insurance costs, electricity costs, etc.);

- = building removal costs during the design phase.

- = total operating costs;

- = cost model factor, equal to 0.87;

- = time period expressed in years;

- = c1: indoor cleaning costs, c2: laundry costs;

- = e1: gas, e2: electricity, e3: fuel;

- = o1: rates, o2: insurance;

- = a1: management fees, a2: security and protection;

- = m1: interior finishing, m2: roof repairs.

- = average annual nominal maintenance and operation costs;

- = floor area of communication spaces (corridors, hallways).

- = average annual nominal maintenance and operation costs;

- = nominal discount rate;

- = year in which the costs occur;

- = total number of time periods (years) for which the discounted operation costs are calculated.

- C1: cost of concept development and product definition, independent of geographical location (k);

- C2: design cost, also independent of location (k);

- C3 (k): manufacturing cost, dependent on location (k);

- C4 (k): installation and assembly cost, location-dependent (k);

- C5 (k): operation cost, location-dependent (k);

- C6 (k): decommissioning cost at end of life, location-dependent (k).

5. Discussion

- Sector-specific synthesis: Previous LCC studies in construction often overlook the unique operational and environmental conditions of marinas. By consolidating scattered literature, this review establishes a baseline of knowledge specific to pontoons, mooring systems, and marina facilities.

- Stakeholder perspectives: Through interviews, this study captures practical insights into the challenges of applying generalized LCC models in marinas. Stakeholders emphasized the need for validated maintenance guidelines and cost breakdown structures tailored to harsh marine conditions—an aspect not well documented in prior research.

- Framework development priorities: The review identifies design principles for a marina-specific LCC framework, including standardized data collection, risk-based maintenance strategies, and integration of sustainability indicators. These priorities address current gaps and create pathways for more reliable, sector-relevant decision-support tools.

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| LCC | Life cycle cost |

| WLC | Whole life costing |

| PV | Present value |

| NPV | Net present value |

| EUAC | Equivalent uniform annual cost |

| IRR | Internal rate of return |

| CI | Confidence Index |

| CBS | Cost breakdown structure |

| FOWF | Floating offshore wind farm |

References

- Alwaer, H.; Clements-Croome, D.J. Key performance indicators (KPIs) and priority setting in using the multi-attribute approach for assessing sustainable intelligent buildings. Build. Environ. 2010, 45, 799–807. [Google Scholar] [CrossRef]

- Government of Croatia. Public Procurement Law; Narodne Novine; Government of Croatia: Zagreb, Croatia, 2016.

- HRN ISO 15686-5:2023; Buildings and Constructed Assets—Service Life Planning, Part 5: Whole Life Costing. HZN Glasilo: Zagreb, Croatia, 2023.

- NATO Research and Technology Organization. NORTH ATLANTIC TREATY Code of Practice for Life Cycle Costing; NATO Research and Technology Organization: La Spezia, Italy, 2009. [Google Scholar]

- EUR-Lex. Directive 2014/24/EU of the European Parliament and of the Council of 26 February 2014 on Public Procurement and Repealing Directive 2004/18/EC; EUR-Lex: Luxembourg, 2023. [Google Scholar]

- EUR-Lex. Directive 2014/25/EU of the European Parliament and of the Council in Respect of the Thresholds for Supply, Service and Works Contracts, and Design Contests; EUR-Lex: Luxembourg, 2023. [Google Scholar]

- The Spanish Government. Ley 9/2017, de 8 de Noviembre, de Contratos del Sector Público, por la que se Transponen al Ordenamiento Jurídico Español las Directivas del Parlamento Europeo y del Consejo 2014/23/UE y 2014/24/UE, de 26 de Febrero de 2014; The Spanish Government: Madrid, Spain, 2025.

- The French National Assembly. Law No. 2020-105 of February 10, 2020 Relating to the Fight Against Waste and the Circular Economy; The French National Assembly: Paris, France, 2020.

- The Royal Norwegian Ministry of Children and Families. Review of the Effects of the Norwegian Transparency Act; The Royal Norwegian Ministry of Children and Families: Oslo, Norway, 2024.

- The Dutch Secretary of State for Infrastructure and Water Management. Manifesto for Socially Responsible Contracting and Procurement. Available online: https://hollandcircularhotspot.nl/wp-content/uploads/2023/05/ManifestoSustainableProcurement.pdf (accessed on 2 September 2025).

- Orfanidou, V.S.; Rachaniotis, N.P.; Tsoulfas, G.T.; Chondrokoukis, G.P. Life Cycle Costing Implementation in Green Public Procurement: A Case Study from the Greek Public Sector. Sustainability 2023, 15, 2817. [Google Scholar] [CrossRef]

- European Boating Industry. EBI and NMMA to Develop First Globally Aligned Recreational Marine Life Cycle Assessment. Available online: https://europeanboatingindustry.eu/newsroom/latest-news/item/1052-icomia-ebi-and-nmma-to-develop-first-globally-aligned-recreational-marine-life-cycle-assessment (accessed on 2 September 2025).

- Perera, O.; Morton, B.; Perfrement, T. Life Cycle Costing: A Question of Value; International Institute for Sustainable Development: Winnipeg, MB, Canada, 2009. [Google Scholar]

- Boussabaine, A.H.; Kirkham, R.J. Whole Life-Cycle Costing: Risk and Risk Responses; Blackwell: Oxford, UK, 2004. [Google Scholar]

- Krstić, H.; Marenjak, S. Analysis of buildings operation and maintenance costs. Građevinar 2012, 64, 293–303. [Google Scholar]

- Sun, Y.; Carmichael, D.G. Uncertainties related to financial variables within infrastructure life cycle costing: A literature review. Struct. Infrastruct. Eng. 2018, 14, 1233–1243. [Google Scholar] [CrossRef]

- Schmid, P. Towards Sustainable Building; Springer: Dordrecht, The Netherlands, 2001. [Google Scholar]

- Government of Croatia. Maritime Code; Government of Croatia: Zagreb, Croatia, 2019.

- Elmualim, A.; Valle, R.; Kwawu, W. Discerning policy and drivers for sustainable facilities management practice. Int. J. Sustain. Built Environ. 2012, 1, 16–25. [Google Scholar] [CrossRef]

- Haapio, A.; Viitamiemi, P. Environmental effect of structural solutions and building materials. Environ. Impact Assess. Rev. 2008, 28, 587–600. [Google Scholar] [CrossRef]

- Wan-Hamdan, W.S.Z.; Hamid, M.Y.; Mohd-Radzuan, N.A. Contribution of Facilities Management Processes in Supporting Malaysia National Higher Education Strategic Plan. Procedia Eng. 2011, 20, 180–187. [Google Scholar] [CrossRef]

- Ross, N.W. Marinas & Public access. In Proceedings of the Ports and Harbors: Our Link to the Water: Proceedings of the Eleventh International Conference, Boston, MA, USA, 22–26 October 1988. [Google Scholar]

- International Consulting Group Within Engineering, Economics and Environmental Science. Available online: http://www.publications.cowi.com/cowi/79/html5/ (accessed on 3 September 2018).

- Marović, I. Sustav za Podršku Odlučivanju u Upravljanju Vrijednostima Nekretnina. Ph.D. Thesis, Faculty of Civil Engineering, University of Zagreb, Zagreb, Croatia, 2013. [Google Scholar]

- Lavy, S. Facility management practices in higher education buildings. J. Facil. Manag. 2008, 6, 303–315. [Google Scholar] [CrossRef]

- Amaratunga, D.; Baldry, D.; Sarshar, M. Assessment of facilities management performance—What next? Facilities 2000, 18, 66–75. [Google Scholar] [CrossRef]

- Nik-Mat, N.E.M.; Kamaruzzaman, S.N.; Pitt, M. Assessing the Maintenance Aspect of Facilities Management through a Performance Measurement System: A Malaysian Case Study. Procedia Eng. 2011, 20, 329–338. [Google Scholar] [CrossRef]

- Lepkova, N.; Uselis, R. Development of a Quality Criteria System for Facilities Management Services in Lithuania. Procedia Eng. 2013, 57, 697–706. [Google Scholar] [CrossRef]

- Singh, D.; Tiong, R.L.K. A Fuzzy Decision Framework for Contractor Selection. J. Constr. Eng. Manag. 2005, 131, 62–70. [Google Scholar] [CrossRef]

- Lindholm, A.; Suomala, P. Present and future of life cycle costing: Reflections from Finnish companies. Finn. J. Bus. Econ. 2005, 2, 282–292. [Google Scholar]

- Utama, W.P.; Chan, A.P.C.; Zahoor, H.; Gao, R.; Jumas, D.Y. Making decision toward overseas construction projects. Eng. Constr. Archit. Manag. 2019, 26, 285–302. [Google Scholar] [CrossRef]

- Kirk, S.J.; Dell’Isola, A.J. Life Cycle Costing for Design Professionals, 2nd ed.; McGrawHill Book Co. Inc.: New York, NY, USA, 1995. [Google Scholar]

- Kishk, M.; Al-Hajj, A.; Pollock, R.; Aouad, G.; Bakis, N.; Sun, M. Whole Life Costing In Construction: A State of the Art Review. Available online: https://www.researchgate.net/publication/28579031_Whole_life_costing_in_construction_A_state_of_the_art_review (accessed on 2 September 2025).

- Aouad, G.; Bakis, N.; Amaratunga, D.; Osbaldiston, S.; Sun, M.; Kishk, M.; Al-Hajj, A.; Pollock, R. An Integrated Life Cycle Costing Database: A Conceptual Framework. In Proceedings of the 17th Annual ARCOM Conference, University of Salford, Salford, UK, 5–7 September 2001. [Google Scholar]

- Ozsariyildiz, S.; Tolman, F. IT support for the very early design of buildings and civil engineering works. In The life-Cycle of Construction IT Innovations.—Technology Transfer from Research to Practice; Björk, B.C., Jägbeck, A., Eds.; Royal Institute of Technology: Stockholm, Sweden, 1998. [Google Scholar]

- Wahidi, S.I.; Pribadi, T.W.; Firdausi, M.I.; Santosa, B. Technical and Economic Analysis of a Conversion on a Single Pontoon to a Multi Pontoon Floating Dock. Naše More Znan. Časopis More Pomor. 2022, 69, 114–122. [Google Scholar] [CrossRef]

- Clemons, S.K.C.; Salloum, C.R.; Herdegen, K.G.; Kamens, R.M.; Gheewala, S.H. Life cycle assessment of a floating photovoltaic system and feasibility for application in Thailand. Renew. Energy 2021, 168, 448–462. [Google Scholar] [CrossRef]

- Ahmed, N.U. A design and implementation model for life cycle cost management system. Inf. Manag. 1995, 28, 261–269. [Google Scholar] [CrossRef]

- Ammar, M.; Zayed, T.; Moselhi, O. Fuzzy-Based Life-Cycle Cost Model for Decision Making under Subjectivity. J. Constr. Eng. Manag. 2013, 139, 556–563. [Google Scholar] [CrossRef]

- Emblemsvåg, J. Life-Cycle Costing: Using Activity-Based Costing and Monte Carlo Methods to Manage Future Costs and Risks; Wiley: Hoboken, NJ, USA, 2003. [Google Scholar]

- Pelzeter, A. Building optimisation with life cycle costs—The influence of calculation methods. J. Facil. Manag. 2007, 5, 115–128. [Google Scholar] [CrossRef]

- Singh, D.; Tiong, R.L.K. Development of life cycle costing framework for highway bridges in Myanmar. Int. J. Proj. Manag. 2005, 23, 37–44. [Google Scholar] [CrossRef]

- Gluch, P.; Baumann, H. The life cycle costing (LCC) approach: A conceptual discussion of its usefulness for environmental decision-making. Build. Environ. 2004, 39, 571–580. [Google Scholar] [CrossRef]

- Her Majesty’s Stationery Office. Life Cycle Costing; Her Majesty’s Stationery Office: Norwich, UK, 1992. [Google Scholar]

- Ferens, D.V. Software Parametric Cost Estimation: Wave of the Future. Eng. Cost Prod. Econ. 1988, 14, 157–164. [Google Scholar] [CrossRef]

- Bryan, N.S.; Rosen, J.J.; Marland, N.T. A New Life Cycle Cost Model: Flexible, Interactive and Controversia. Def. Manag. J. 1980, 16, 2–7. [Google Scholar]

- Wilson, R.L. Operations and support cost model for new product concept development. Comput. Ind. Eng. 1986, 11, 128–131. [Google Scholar] [CrossRef]

- Wierda, L.S. Product Cost-Estimation by the Designer. Eng. Costs Prod. Econ. 1988, 13, 189–198. [Google Scholar] [CrossRef]

- Baccarini, D. Estimating project cost continency—A model and exploration of research questions. In Proceedings of the ARCOM 20th Annual Conference, The Heriot-Watt University, Edinburgh, UK, 1–3 September 2004. [Google Scholar]

- Paulson, B.C. Designing to reduce construction costs. J. Constr. Devision ASCE 1976, 102, 587–592. [Google Scholar] [CrossRef]

- Fabrycky, W.J.; Blanchard, B.S. Life-Cycle Cost and Economic Analysis; Printice-Hall, Inc.: Saddle River, NJ, USA, 1991. [Google Scholar]

- Flanagan, R.; Norman, G.; Meadows, J.; Robinson, G. Life Cycle Costing Theory and Practice; BSP Professional Books: Oxford, UK, 1989. [Google Scholar]

- Shil, N.C.; Parvez, M. Life cycle costing: An alternative selection tool. J. Bus. Res. 2007, 9, 49–68. [Google Scholar]

- Onukwube, H. Whole—Life Costing and Cost Management Framework for Construction Projects in Nigeria; McDermott, P., Khalfan, M.M.A., Eds.; University of Salford: Salford, UK, 2006. [Google Scholar]

- Ferry, D.J.O.; Flanagan, R. Life Cycle Costing—A Radical Approach; Construction Industry Research and Information Association: London, UK, 1991. [Google Scholar]

- Bakis, N.; Kagiousglou, M.; Aouad, G.; Amaratunga, D. An Integrated Environment for Life Cycle Costing in Construction. CIB Rep. 2003, 284, 15. [Google Scholar]

- Kirkham, R.J. Re-engineering the whole life cycle costing process. Constr. Manag. Econ. 2005, 23, 9–14. [Google Scholar] [CrossRef]

- ISO/DIS 15686:2017; Buildings and Constructed Assets—Service Life Planning, Part 5: Whole Life Costing. British Standards Institution: London, UK, 2017.

- Yilmazlar, K. Integrated Design and LCOE Minimization of Floating Wind Turbines. Ph.D. Thesis, Politecnico di Milano, Milan, Italy, 2024. [Google Scholar]

- Castro-Santos, L.; Filgueira-Vizoso, A.; Lamas-Galdo, I.; Carral-Couce, L. Methodology to calculate the installation costs of offshore wind farms located in deep waters. J. Clean. Prod. 2018, 170, 1124–1135. [Google Scholar] [CrossRef]

- Sacks, A.; Nisbet, A.; Ross, J.; Harinarain, N. Life cycle cost analysis: A case study of Lincoln on the Lake. J. Eng. Des. Technol. 2012, 10, 228–254. [Google Scholar] [CrossRef]

- El-Haram, M.A.; Marenjak, S.; Horner, M.W. Development of a generic framework for collecting whole life cost data for the building industry. J. Qual. Maint. Eng. 2002, 8, 144–151. [Google Scholar] [CrossRef]

- Krstić, H. Model Procjene Troškova Održavanja i Uporabe Građevina na Primjeru Građevina Sveučilišta Josipa Jurja Strossmayera u Osijeku. Ph.D. Thesis, University of Osijek, Osijek, Croatia, 2011. [Google Scholar]

- Kirkham, R.J.; Alisa, M.; Pimenta da Silva, A.; Grindley, T.; Brøndsted, J. Rethinking Whole Life Cycle Cost Based Design Decision-Making. In Proceedings of the 20th Annual Conference and Annual Meeting—The Hariot-Watt University, Edinburgh, UK, 1–3 September 2004. [Google Scholar]

- Potts, K.; Ankrah, N. Construction Cost Management—Learning from Case Studies, 2nd ed.; Routledge: Oxon, UK, 2013. [Google Scholar]

- Oduyemi, O.I. Life Cycle Costing Methodology for Sustainable Commercial Office Buildings. Ph.D. Thesis, University of Derby, Derby, UK, 2015. [Google Scholar]

- Fuller, S.K.; Petersen, S.R. Life-Cycle Costing Manual for the Federal Energy Management Program; U.S. Government Printing Office: Washington, DC, USA, 1996.

- Ellis, B. Life Cycle Cost. In Proceedings of the International Conference of Maintenance Societies, Melbourne, Australia, 22–25 May 2007. [Google Scholar]

- Kishk, M.; Al-Hajj, A.; Pollock, R. Handling Uncertain Information in Whole-Life Costing: A Comparative Study. Risk Manag. 2002, 4, 59–70. [Google Scholar] [CrossRef]

- Arja, M.; Sauce, G.; Souyri, B. External uncertainty factors and LCC: A case study. Build. Res. Inf. 2009, 37, 325–334. [Google Scholar] [CrossRef]

- Peças, P.; Ribeiro, I.; Silva, A.; Henriques, E. Comprehensive approach for informed life cycle-based materials selection. Mater. Des. 2013, 43, 220–232. [Google Scholar] [CrossRef]

- Asiedu, Y.; Gu, P. Product life cycle cost analysis: State of the art review. Int. J. Prod. Res. 1998, 36, 883–908. [Google Scholar] [CrossRef]

- Hodges, N.W. The Economic Management of Physical Assets; Wiley: London, UK, 1996. [Google Scholar]

- Seeley, I.H. Building Economics, 3rd ed.; Palgrave Macmillan: Basingstoke, UK, 1996. [Google Scholar]

- Edwards, S.; Bartlett, E.; Dickie, I. Whole Life Costing and Life-Cycle Assessment for Sustainable Building Design; BRE Electronic Publications: Watford Herts, UK, 2000. [Google Scholar]

- Schade, J. Life cycle cost calculation models for buildings. In Proceedings of the 4th Nordic Conference on Construction Economics and Organisation: Development Processes in Construction Mangement, Luleå, Sweden, 14–15 June 2007. [Google Scholar]

- Dhillon, B.S. Life Cycle Costing for Engineers; CRC Press, Taylor & Francis Group: Boca Raton, FL, USA, 2010. [Google Scholar]

- Flanagan, R.; Jewell, C. Whole Life Appraisal for Construction; Blackwell Publishing Ltd.: Oxford, UK, 2005. [Google Scholar]

- Stone, P.A. Economics of building design. J. R. Stat. Soc. 1960, 123, 237–273. [Google Scholar] [CrossRef]

- BS3811; British Standard Glossary of Maintenance of Physical Resources. Department of Industry: Canberra, Australia, 1974.

- Treasury, H.M. Appraisal and Evaluation in Central Government. In The Green Book; HM Treasury: London, UK, 2003. [Google Scholar]

- Treasury, H.M. The Green Book; H. M. Treasury: London, UK, 2018. [Google Scholar]

- S. C. I. Network: Working Group on Whole Life Costing. Sustainable Construction & Innovation through Procurement. Whole Life Costing—Preliminary Report on: Available Tools and Guidance, Barriers to Implementing WLC, Income Streams, Future Forecasting of Energy, 2011.

- Latham, M. Constucting the Team: Joint Review of Procurement and Contractual Arrangements in the United Kingdom Construction Industry; HMSO Publications Centre: London, UK, 1994. [Google Scholar]

- Blyth, A.; Worthington, J. Managing the Brief for Better Design, 2nd ed.; Routledge: Oxon, UK, 2010. [Google Scholar]

- Norris, G.A. Integrating life cycle cost analysis and LCA. Int. J. Life Cycle Assess. 2001, 6, 118–120. [Google Scholar] [CrossRef]

- Hunkeler, D.; Rebitzer, G. Life cycle costing—Paving the road to sustainable development? Int. J. Life Cycle Assess. 2003, 8, 109–110. [Google Scholar] [CrossRef]

- Kloepffer, W. Life cycle sustainability assessment of products (with Comments by Helias A. Udo de Haes, p. 95). Int. J. Life Cycle Assess. 2008, 13, 89–94. [Google Scholar] [CrossRef]

- Swarr, T.E.; Hunkeler, D.; Klöpffer, W.; Pesonen, H.L.; Ciroth, A.; Brent, A.C.; Pagan, R. Environmental life-cycle costing: A code of practice. Int. J. Life Cycle Assess. 2011, 16, 389–391. [Google Scholar] [CrossRef]

- El-Haram, M.A.; Marenjak, S.; Horner, R.M.W. Whole Life Costing in the Building Industry: A Case Study. In Proceedings of the Construction in the XXI Century: Local and Global Challenges (CIB Symposium), Rome, Italy, 17–20 October 2006. [Google Scholar]

- Sterner, E. Life-cycle costing and its use in the Swedish building sector. Build. Res. Inf. 2000, 28, 387–393. [Google Scholar] [CrossRef]

- Abraham, D.; Dickinson, R. Disposal costs for environmentally regulated facilities: LCC approach. J. Constr. Eng. Manag. 1998, 124, 146–154. [Google Scholar] [CrossRef]

- Bull, J.W. Life Cycle Costing for Construction; Taylor & Francis e-Library: London, UK, 2003. [Google Scholar]

- Clift, M. Life-cycle costing in the construction sector. UNEP Ind. Environ. 2003, April-September, 37–41. [Google Scholar]

- McGeorge, J.F. The Quality Approach to Design And Life Cycle Costing in The Health Service; Blackie Academic & Professional: Glasgow, UK, 1992. [Google Scholar]

- Ludvig, K.; Gluch, P. Life Cycle Costing in Construction Projects—A Case Study of a Municipal Construction Client. In Proceedings of the Third International World of Construction Project Management Conference, Coventry, UK, 20–22 October 2010. [Google Scholar]

- Hunter, K.; Hari, S.; Kelly, J. A whole life costing input tool for surveyors in UK local government. Struct. Surv. 2005, 23, 346–358. [Google Scholar] [CrossRef]

- Boussabaine, A.H. Cost Planning of PFI and PPP Building Projects; Taylor & Francis: Routledge, UK, 2007. [Google Scholar]

- Chiurugwi, T.; Udeaja, C.; Babatunde, S.; Ekundayo, D. Life cycle costing in construction projects: Professional quantity surveyors’ perspective. In Going North for Sustainability: Leveraging Knowledge and Innovation for Sustainable Construction and Development; Egbu, C., Ed.; London South Bank University: London, UK, 2015. [Google Scholar]

- Griffin, J.J. Life cycle cost analysis: A decision aid. In Life Cycle Costing for Construction; Bull, J.W., Ed.; Blackie Academic & Professional: Glasgow, UK, 1993; pp. 135–146. [Google Scholar]

- Olubodun, F.; Kangwa, J.; Oladapo, A.; Thompson, J. An appraisal of the level of application of life cycle costing within the construction industry in the UK. Struct. Surv. 2010, 28, 254–265. [Google Scholar] [CrossRef]

- Frangopol, D.M.; Lin, K.-Y.; Estes, A.C. Life-Cycle Cost Design of Deteriorating Structures. J. Struct. Eng. 1997, 123, 1390–1401. [Google Scholar] [CrossRef]

- Vorster, M.C.; Bafna, T.; Weyers, R.E. Model for determining the optimum rehabilitation cycle for concrete bridge decks. Bridge Hydrol. Res. Transp. Res. Rec. 1991, 1319, 62–71. [Google Scholar]

- Blank, L.; Tarquin, A. Engineering Economy, 7th ed.; McGraw-Hill: New York, NY, USA, 2011. [Google Scholar]

- Diamantoulaki, I.; Angelides, D.C. Risk-based maintenance scheduling using monitoring data for moored floating breakwaters. Struct. Saf. 2013, 41, 107–118. [Google Scholar] [CrossRef]

- EUR-Lex. Directive 2014/25/EU of the European Parliament and of the Council; EUR-Lex: Luxembourg, 2014. [Google Scholar]

- Korpi, E.; Ala-Risku, T. Life cycle costing: A review of published case studies. Manag. Audit. J. 2008, 23, 240–261. [Google Scholar] [CrossRef]

- Estes, A.C.; Frangopol, D.M. Minimum expected cost-oriented optimal maintenance planning for deteriorating structures: Application to concrete bridge decks. Reliab. Eng. Syst. Saf. 2001, 73, 281–291. [Google Scholar] [CrossRef]

- Kamyk, Z.; Śliwiński, C. Impact of Life Cycle Cost Analysis on the Pontoon. Szybkie Pojazdy Gąsienicowe Fast Tracked Veh. 2016, 40, 61–76. [Google Scholar]

- Duyan, Ö.; Ciroth, A. Life Cycle Costing Quick Explanation Two Different Methods to Perform Life Cycle Costing in openLCA; GreenDelta: Berlin, Germany, 2013. [Google Scholar]

- Potnik Galić, K.; Budić, H. Model analize troškova životnog ciklusa proizvoda. Računovodstvo Financ. 2013, 10, 142–148. [Google Scholar]

- Arshad, A. Net Present Value is better than Internal Rate of Return. Interdiscip. J. Contemp. Res. Bus. 2012, 4, 211–219. [Google Scholar]

- U.S. Department of Transportation. Life-Cycle Cost Analysis Primer; U. S. Department of Transportation: Washington, DC, USA, 2002.

- Anderson, T.; Brandt, E. The use of performance and durability data in assessment of life time serviceability. In Proceedings of the Eighth International Conference on Durability of Building Materials and Components, Vancouver, BC, Canada, 30 May–3 June 1999. [Google Scholar]

- Hermans, M.H. Building performance starts at Hand-Over: The importance of life span information. In Proceedings of the Eighth International Conference on Durability of Building Materials and Components, Vancouver, BC, Canada, 30 May–3 June 1999. [Google Scholar]

- Ashworth, A.; Perera, S. Cost Studies of Buildings, 6th ed.; Routledge: Oxon, UK, 2015. [Google Scholar]

- Levander, E.; Schade, J.; Stehn, L. Life Cycle Cost Calculation Models for Buildings & Addressing Uncertainties About Timber Housing by Whole Life Costing Life Cycle Costing for Buildings: Theory and Suitability for Addressing Uncertainties About Timber Housing; Luleå University of Technology: Luleå, Sweden, 2017. [Google Scholar]

- Mearig, T.; Coffee, N.; Morgan, M. Life Cycle Cost Analysis Handbook; State of Alaska—Department of Education & Early Development: Juneau, AK, USA, 1999. [Google Scholar]

- Öberg, M. Integrated Life Cycle Design—Applied to Concrete Multi-Dwelling Buildings. Bachelor’s Thesis, Lund University, Lund, Sweden, 2005. [Google Scholar]

- Law, J.; Smullen, J. A Dictionary of Finance and Banking, 3rd ed.; Oxford University Press: Oxford, UK, 2005. [Google Scholar]

- ISO/DIS 15686-5; Buildings and Constructed Assets—Service Life Planning, Part 5: Whole Life Costing. British Standards Institution: London, UK, 2004.

- Deb, K. Multi-Objective Optimization Using Evolutionary Algorithms; John Wiley & Sons, Ltd.: Chichester, UK, 2001. [Google Scholar]

- Neves, L.A.C.; Frangopol, D.M.; Cruz, P.J.S. Probabilistic Lifetime-Oriented Multiobjective Optimization of Bridge Maintenance: Single Maintenance Type. J. Struct. Eng. 2006, 132, 991–1005. [Google Scholar] [CrossRef]

- Frangopol, D.M.; Liu, M. Maintenance and management of civil infrastructure based on condition, safety, optimization, and life-cycle cost. Struct. Infrastruct. Eng. 2007, 3, 29–41. [Google Scholar] [CrossRef]

- Hoar, D.; Norman, G. Life cycle cost management. In Quantity Surveying Techniques—New Directions; Brandon, P.S., Ed.; BSP Professional Books: Oxford, UK, 1977. [Google Scholar]

- Kelly, J.; Male, S. Value Management in Design and Construction; Taylor & Francis e-Library: London, UK, 2005. [Google Scholar]

- Finch, E.F. The uncertain role of life cycle costing in the renewable energy debate. Renew. Energy 1994, 5, 1436–1443. [Google Scholar] [CrossRef]

- Keoleian, G.A.; Kendall, A.; Chandler, R.; Helfand, G.E.; Lepech, M.; Li, V.C. Life-cycle cost model for evaluating the sustainability of bridge decks. In Proceedings of the International Workshop on Life-Cycle Cost Analysis and Design of Civil Infrastructure Systems, Cocoa Beach, FL, USA, 8–11 May 2005. [Google Scholar]

- European Comission. Official Journal of the European Union; European Comission: Brussels, Belgium, 2008. [Google Scholar]

- Government of Croatia. Rules for the Determination of the Reference and Discount Rate; Government of Croatia: Zagreb, Croatia, 2008.

- Rahman, S.; Vanier, D. Life cycle cost analysis as a decision support tool for managing municipal infrastructure. In Proceedings of the Building for the Future: The 16th CIB World Building Congress, Rotterdam, The Netherlands, 1–7 May 2004. [Google Scholar]

- Flanagan, R.; Kendell, A.; Norman, G.; Robinson, G. Life Cycle Costing and Risk Management. Constr. Manag. Econ. 1987, 5, 53–71. [Google Scholar] [CrossRef]

- Ko, W.I.; Choi, J.W.; Kang, C.H.; Lee, J.S. Nuclear fuel cycle cost analysis using a probabilistic simulation technique. Ann. Nucl. Energy 1998, 25, 771–789. [Google Scholar] [CrossRef]

- Goumas, M.G.; Lygerou, V.A.; Papayannakis, L.E. Computational methods for planning and evaluating geothermal energy projects. Energy Policy 1999, 27, 147–154. [Google Scholar] [CrossRef]

- Byrne, P.; Fuzzy, D.C.F. a Contradiction in Terms, or a Way to Better Investment Appraisal? In Proceedings of the Cutting Edge ‘97, London, UK, 5–6 September 1997.

- Edwards, P.J.; Bowen, P.A. Practices, barriers and benefits of risk management process in building services cost estimation: Comment. Constr. Manag. Econ. 1998, 16, 105–108. [Google Scholar] [CrossRef]

- Jovanović, P. Application of sensitivity analysis in investment project evaluation under uncertainty and risk. Int. J. Proj. Manag. 1999, 17, 217–222. [Google Scholar] [CrossRef]

- Flanagan, R.; Norman, G. Risk Management and Construction; Wiley-Blackwell: Oxford, UK, 1993. [Google Scholar]

- Woodward, D.G. Use of sensitivity analysis in build-own-operate-transfer project evaluation. Int. J. Proj. Manag. 1995, 13, 239–246. [Google Scholar] [CrossRef]

- Bromilow, F.J.; Pawsey, M.R. Life cycle cost of university buildings. Constr. Manag. Econ. 1987, 5, S3–S22. [Google Scholar] [CrossRef]

- Al-Hajj, A.N.; Horner, M.W. Modelling the Running Costs of Buildings. Constr. Manag. Econ. 1998, 16, 459–770. [Google Scholar] [CrossRef]

- Marenjak, S.; El-haram, M.A.; Horner, R.M.W. Procjena ukupnih troškova projekata u visokogradnji. Građevinar 2002, 54, 393–401. [Google Scholar]

- Castro-Santos, L.; Prado, G.; Diaz-Casas, V. Methodology to study the life cycle cost of floating offshore wind farms. In Proceedings of the 10th Deep Sea Wind R&D Conference, Trondheim, Norway, 24–25 January 2013. [Google Scholar]

- Engelhardt, M.; Savic, D.; Skipworth, P.; Cashman, A.; Saul, A.; Walters, G. Whole life costing: Application to water distribution network. Water Sci. Technol. Water Supply 2003, 3, 87–93. [Google Scholar] [CrossRef]

- Podofillini, L.; Zio, E.; Vatn, J. Risk-informed optimisation of railway tracks inspection and maintenance procedures. Reliab. Eng. Syst. Saf. 2006, 91, 20–35. [Google Scholar] [CrossRef]

- Yang, S.I.; Frangopol, D.M.; Kawakami, Y.; Neves, L.C. The use of lifetime functions in the optimization of interventions on existing bridges considering maintenance and failure costs. Reliab. Eng. Syst. Saf. 2006, 91, 698–705. [Google Scholar] [CrossRef]

- Okasha, N.M.; Frangopol, D.M. Lifetime-oriented multi-objective optimization of structural maintenance considering system reliability, redundancy and life-cycle cost using GA. Struct. Saf. 2009, 31, 460–474. [Google Scholar] [CrossRef]

- Ruegg, R.T.; Marshall, H.E. Building Economics: Theory and Practice; Van Nostrand Reinhold: New York, NY, USA, 1990. [Google Scholar]

- Kirkham, R.J.; Boussabaine, A.H.; Grew, R.G.; Sinclair, S.P. Forecasting the Running Costs of Sport and Leisure. In Proceedings of the Eighth International Conference on Durability of Building Materials and Components, Vancouver, BC, Canada, 30 May–3 June 1999. [Google Scholar]

- Taylor, W.B. The Use of Life Cycle Costing Acquiring Physical Assets. Long Range Plan. 1981, 14, 32–43. [Google Scholar] [CrossRef]

- Stewart, M.G. Reliability-based assessment of ageing bridges using risk ranking and life cycle cost decision analyses. Reliab. Eng. Syst. Saf. 2001, 74, 263–273. [Google Scholar] [CrossRef]

| Main Category | Subcategory | Typical Elements (Marina-Specific) | Notes/Examples |

|---|---|---|---|

| C—Acquisition/Construction Costs | C1—Pre-construction | Design, project documentation, permits, tendering | EUR/project, % of capital cost |

| C2—Construction | Pontoons (modules, fingers), anchoring blocks/chains/ropes, piles, breakwaters, dredging, utilities (electrical pedestals, water, IT) | EUR/m pontoon, EUR/berth, EUR/m3 dredged | |

| C3—Commissioning | Testing, certification, opening procedures | % of construction cost | |

| A—Operation Costs | A1—Energy and Water | Electricity, fuel, water supply | EUR/berth/year |

| A2—Waste Management | Wastewater, bilge water, solid waste, recycling services | EUR/t handled | |

| A3—Staff and Administration | Salaries, training, insurance, IT systems | Annual fixed costs | |

| M—Maintenance Costs | M1—Preventive (Planned) | Inspections (safety, structural), scheduled replacements (chains, ropes, decking), surface treatment | EUR/inspection, EUR/cycle |

| M2—Corrective (Reactive) | Emergency repairs (pontoon damage, anchor failure), storm/flood repairs, unplanned dredging | EUR/incident, % of capital value | |

| R—Renewal/Upgrades | R1—Modernization | Pontoon extension, electrification for e-boats, utilities retrofits, structural reinforcement | EUR/project |

| R2—Regulatory Compliance | Environmental upgrades, safety retrofits | EUR/compliance cycle | |

| E—Energy Costs (specific) | E1—Energy Use | Lighting, shore power to vessels, pumps | Often modeled separately for sensitivity analysis |

| S—End-of-Life/Residual Value | S1—Decommissioning | Removal of pontoons, anchors, utilities, dredged materials | EUR/m pontoon removed |

| S2—Disposal and Recycling | Demolition, disposal, recycling of steel, concrete, composites | Recovery value %, EUR/t | |

| S3—Residual Value | Salvage of usable materials, resale of assets | Deducted from total LCC |

| Term | Definition | Notes on Usage in This Paper |

|---|---|---|

| Life Cycle Cost (LCC) | The total cost of ownership of an asset over its lifetime, including acquisition, operation, maintenance, and disposal. | Primary term used throughout this paper. |

| Whole Life Cost (WLC) | Similar to LCC but may also include non-construction costs (e.g., land, financing, user costs) and potential revenues. | Considered broader than LCC; used in some UK and EU contexts. |

| Total Ownership Cost (TOC) | Term used in defense/industrial procurement, focused on long-term ownership costs including training, support, and disposal. | Conceptually overlaps with LCC; less common in construction. |

| Model/Approach | Main Components | Assumptions | Applicability to Marina Infrastructure | Key Limitations |

|---|---|---|---|---|

| NPV | Capital cost, O&M costs, residual value, discount rate | Costs discounted to present value using fixed rate | Widely applicable (e.g., pontoons, dredging, breakwaters) | Sensitive to discount rate; assumes stable forecasts |

| EUAC | Annualized version of NPV | Converts total costs into equal annual amounts | Useful for comparing alternatives with different lifespans (e.g., piles vs. pontoons) | Can obscure year-to-year cost variability |

| IRR | Discount rate at which NPV = 0 | Assumes revenue-generating project | Limited applicability (most marina assets are cost centers, not revenue streams) | Less suitable for non-revenue infrastructure |

| Probabilistic Models (Monte Carlo, CI method) | Cost variables expressed as distributions | Requires probability distributions for inputs | Strong potential for marina LCC (uncertain maintenance costs, weather impacts) | Data-intensive; requires simulation capacity |

| Deterministic + Sensitivity Analysis | Fixed input values with one-variable variation | Simple, transparent | Useful for early-stage marina design | Oversimplifies multi-factor uncertainty |

| Period | Years | Discount Rate |

|---|---|---|

| Immediate future | 1–5 | 4% |

| Near future | 6–25 | 3% |

| Distant future | 26–75 | 2% |

| Variable | Description | Unit of Measure |

|---|---|---|

| v1 | Sea temperature | Scale 1–5 |

| v2 | Wind impact | Scale 1–5 |

| v3 | Tidal influence | Scale 1–5 |

| v4 | Concession sea area | m2 |

| v5 | Number of pontoon piers | count |

| v6 | Length of pontoon piers | m |

| v7 | Wooden walking surface | yes/no |

| v8 | Total number of berths | count |

| v9 | Berths for vessels 5–8 m | count |

| v10 | Berths for vessels 8–10 m | count |

| v11 | Berths for vessels 10–12 m | count |

| v12 | Berths for vessels 12–15 m | count |

| v13 | Berths for vessels 15–19 m | count |

| v14 | Berths for vessels >19 m | count |

| v15 | Average number of users | count |

| v16 | Inspections in 10 years | count |

| v17 | Concession costs | EUR |

| Cost Category (EUR per Berth/Year) | Mean | Median | Min | Max | Std. Dev. |

|---|---|---|---|---|---|

| Inspections and mandatory testing | 42 | 40 | 20 | 75 | 15 |

| Replacement of materials/elements | 115 | 110 | 60 | 180 | 35 |

| Periodic works and repairs | 98 | 95 | 45 | 150 | 28 |

| Operation and utilities | 155 | 160 | 90 | 220 | 40 |

| Total LCC (annualized) | 410 | 405 | 280 | 560 | 75 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gudac Hodanić, I.; Krstić, H.; Marović, I.; Gudac Cvelic, M. The Role of the Built Environment in Achieving Sustainable Development: A Life Cycle Cost Perspective. Sustainability 2025, 17, 8996. https://doi.org/10.3390/su17208996

Gudac Hodanić I, Krstić H, Marović I, Gudac Cvelic M. The Role of the Built Environment in Achieving Sustainable Development: A Life Cycle Cost Perspective. Sustainability. 2025; 17(20):8996. https://doi.org/10.3390/su17208996

Chicago/Turabian StyleGudac Hodanić, Ivona, Hrvoje Krstić, Ivan Marović, and Martina Gudac Cvelic. 2025. "The Role of the Built Environment in Achieving Sustainable Development: A Life Cycle Cost Perspective" Sustainability 17, no. 20: 8996. https://doi.org/10.3390/su17208996

APA StyleGudac Hodanić, I., Krstić, H., Marović, I., & Gudac Cvelic, M. (2025). The Role of the Built Environment in Achieving Sustainable Development: A Life Cycle Cost Perspective. Sustainability, 17(20), 8996. https://doi.org/10.3390/su17208996