Digital Finance and Green Technology Innovation: A Dual-Layer Analysis of Financing and Governance Mechanisms in China

Abstract

1. Introduction

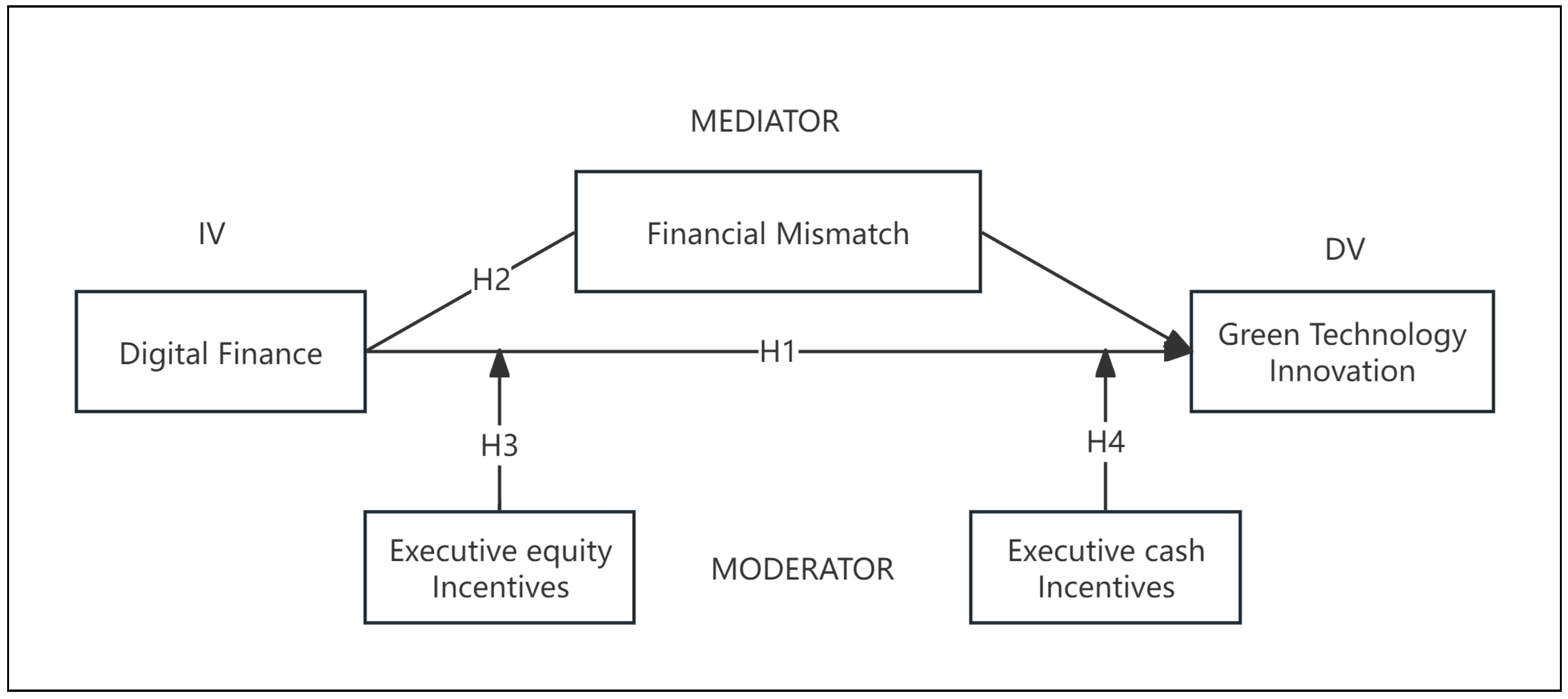

2. Literature Review and Hypothesis Development

2.1. Green Technology Innovation

2.2. Digital Finance

2.3. Theoretical Background

2.3.1. Resource Allocation Theory

2.3.2. Agency Theory

2.4. Hypothesis Development

3. Research Design

3.1. Sample and Data Sources

3.2. Variable Measurement

3.2.1. Dependent Variable: Green Technology Innovation (GTI)

3.2.2. Independent Variable: Digital Finance (DF)

3.2.3. Mediating Variables: Financial Mismatch (FM)

3.2.4. Moderating Variable: Executive Equity Incentive (EEI)

3.2.5. Moderating Variable: Executive Cash Incentive (ECI)

3.2.6. Control Variables

3.3. Empirical Models

- Model 1: Direct Effect

- Model 2: Mediation Analysis

- Model 3: Moderation by Executive Equity Incentive

- Model 4: Moderation by Executive Cash Incentive

4. Empirical Results

4.1. Descriptive Statistics

4.2. Baseline Results

4.3. Mediation Analysis

4.4. Moderation Analysis

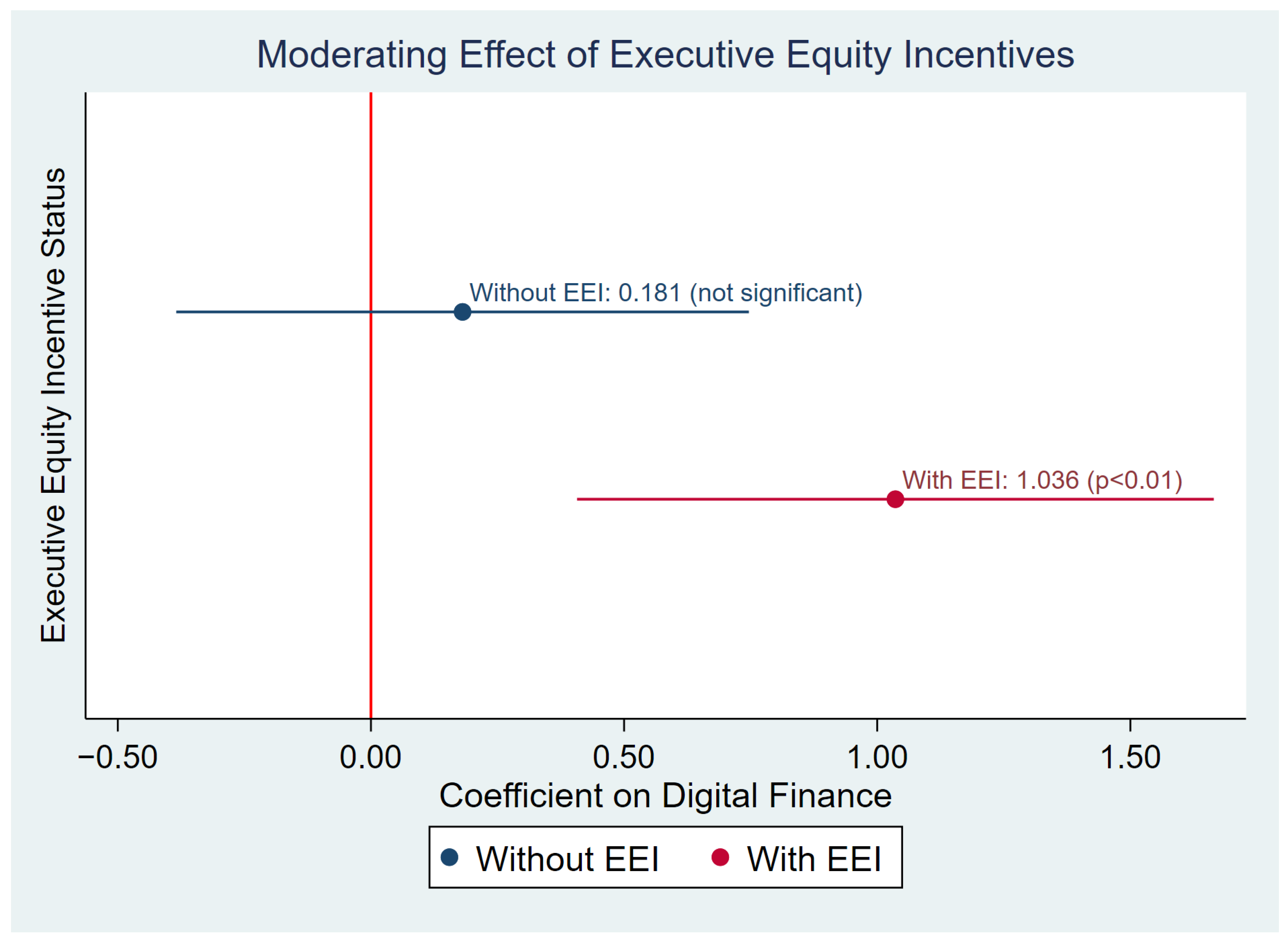

4.4.1. Executive Equity Incentives (EEI)

4.4.2. Executive Cash Incentives (ECI)

4.5. Robustness and Endogeneity Tests

4.5.1. Robustness Checks

4.5.2. Endogeneity Test

5. Discussion and Implications

5.1. Discussion

5.2. Implications

6. Limitations and Future Research Directions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| GTI | Green technology innovation |

| DF | Digital finance |

| FM | Financial mismatch |

| EEI | Executive equity incentive |

| ECI | Executive cash incentive |

| LEV | Leverage ratio |

| ROA | Return on assets |

| TQ | Tobin’s Q |

| GROWTH | Revenue growth rate |

| SIZE | Company size |

| AGE | Company age |

| SOE | State-owned enterprise |

| BOARD | Board size |

| INDBOARD | Independent board ratio |

References

- Wang, H.; Zhang, Z. Green Technology Innovation and Corporate Carbon Performance: Evidence from China. Sustainability 2025, 17, 5357. [Google Scholar] [CrossRef]

- Farooq, U.; Al-Gamrh, B.; Dai, J. Green Drives Greenbacks: The Impact of Sustainable Innovation on Corporate Cash Holdings in BRICS Nations. J. Clean. Prod. 2024, 140533. [Google Scholar] [CrossRef]

- Wen, J.; Ali, W.; Hussain, J.; Khan, N.A.; Hussain, H.; Ali, N.; Akhtar, R. Dynamics between Green Innovation and Environmental Quality: New Insights into South Asian Economies. Econ. Polit. 2022, 39, 543–565. [Google Scholar] [CrossRef]

- Horbach, J.; Rammer, C.; Rennings, K. Determinants of Eco-Innovations by Type of Environmental Impact: The Role of Regulatory Push/Pull, Technology Push and Market Pull. Ecol. Econ. 2012, 78, 112–122. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of Digital Finance on Financial Inclusion and Stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Tang, Y.; Geng, B. Digital Finance Development Level and Corporate Debt Financing Cost. Financ. Res. Lett. 2024, 60, 104825. [Google Scholar] [CrossRef]

- Yao, L.; Yang, X. Can Digital Finance Boost SME Innovation by Easing Financing Constraints?: Evidence from Chinese GEM-Listed Companies. PLoS ONE 2022, 17, e0264647. [Google Scholar] [CrossRef]

- Li, X.; Shao, X.; Chang, T.; Albu, L.L. Does Digital Finance Promote the Green Innovation of China’s Listed Companies? Energy Econ. 2022, 114, 106254. [Google Scholar] [CrossRef]

- Xue, Q.; Liu, X. Can Digital Finance Boost Corporate Green Innovation. Financ. Res. Lett. 2024, 62, 105224. [Google Scholar] [CrossRef]

- Zhang, Q.; Mao, Z. Digital Finance, Financing Constraints, and Green Innovation in Chinese Firms: The Roles of Management Power and CSR. Sustainability 2025, 17, 7110. [Google Scholar] [CrossRef]

- Bai, J.; Gong, X.; Zhao, X. Credit Mismatch and Non-Financial Firms’ Shadow Banking Activities—Evidence Based on Entrusted Loan Activities. China J. Account. Stud. 2020, 8, 249–271. [Google Scholar] [CrossRef]

- Li, X.; Zhao, Z. Corporate Internal Control, Financial Mismatch Mitigation and Innovation Performance. PLoS ONE 2022, 17, e0278633. [Google Scholar] [CrossRef]

- Zhu, W. Digital Finance, Capital Misallocation and Corporate Innovation. Int. Rev. Econ. Financ. 2024, 96, 103696. [Google Scholar] [CrossRef]

- Wu, J.; Liu, B.; Zeng, Y.; Luo, H. Good for the Firm, Good for the Society? Causal Evidence of the Impact of Equity Incentives on a Firm’s Green Investment. Int. Rev. Econ. Financ. 2022, 77, 435–449. [Google Scholar] [CrossRef]

- Zeng, Y.; Zhao, X.; Zhu, Y. Equity Incentives and ESG Performance: Evidence from China. Financ. Res. Lett. 2023, 58, 104592. [Google Scholar] [CrossRef]

- Rennings, K. Redefining Innovation—Eco-Innovation Research and the Contribution from Ecological Economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Chen, S.; Gao, D.; Tan, L. Smarter and Greener: How Does Intelligent Manufacturing Empower Enterprises’ Green Innovation? Sustainability 2025, 17, 7230. [Google Scholar] [CrossRef]

- Zang, J.; Teruki, N.; Ong, S.Y.Y.; Wang, Y. Can Enterprise Digitalization Promote Green Technological Innovation? Evidence from China’s Manufacturing Sector. Sustainability 2025, 17, 1222. [Google Scholar] [CrossRef]

- Chen, M.; Liu, S.; Gao, L. Digital Finance, Financial Flexibility and Corporate Green Innovation. Financ. Res. Lett. 2024, 70, 106313. [Google Scholar] [CrossRef]

- Yang, J.; Hui, N. How Digital Finance Affects the Sustainability of Corporate Green Innovation. Financ. Res. Lett. 2024, 63, 105314. [Google Scholar] [CrossRef]

- Popp, D. Lessons from Patents: Using Patents to Measure Technological Change in Environmental Models. Ecol. Econ. 2005, 54, 209–226. [Google Scholar] [CrossRef]

- Du, K.; Cheng, Y.; Yao, X. Environmental Regulation, Green Technology Innovation, and Industrial Structure Upgrading: The Road to the Green Transformation of Chinese Cities. Energy Econ. 2021, 98, 105247. [Google Scholar] [CrossRef]

- Hu, G.; Wang, X.; Wang, Y. Can the Green Credit Policy Stimulate Green Innovation in Heavily Polluting Enterprises? Evidence from a Quasi-Natural Experiment in China. Energy Econ. 2021, 98, 105134. [Google Scholar] [CrossRef]

- Amore, M.D.; Bennedsen, M. Corporate Governance and Green Innovation. J. Environ. Econ. Manag. 2016, 75, 54–72. [Google Scholar] [CrossRef]

- Guo, J.; Lv, J. Media Attention, Green Technology Innovation and Industrial Enterprises’ Sustainable Development: The Moderating Effect of Environmental Regulation. Econ. Anal. Policy 2023, 79, 873–889. [Google Scholar] [CrossRef]

- Lv, C.; Shao, C.; Lee, C.-C. Green Technology Innovation and Financial Development: Do Environmental Regulation and Innovation Output Matter? Energy Econ. 2021, 98, 105237. [Google Scholar] [CrossRef]

- Zhou, Y.; Huo, W.; Bo, L.; Chen, X. Impact and Mechanism Analysis of ESG Ratings on the Efficiency of Green Technology Innovation. Financ. Res. Lett. 2023, 58, 104591. [Google Scholar] [CrossRef]

- Khan, A.N.; Mehmood, K.; Kwan, H.K. Green Knowledge Management: A Key Driver of Green Technology Innovation and Sustainable Performance in the Construction Organizations. J. Innov. Knowl. 2024, 9, 100455. [Google Scholar] [CrossRef]

- Lee, C.-C.; Qin, S.; Li, Y. Does Industrial Robot Application Promote Green Technology Innovation in the Manufacturing Industry? Technol. Forecast. Soc. Chang. 2022, 183, 121893. [Google Scholar] [CrossRef]

- Zhang, W.; Zhang, S.; Chen, F.; Wang, Y.; Zhang, Y. Does Chinese Companies’ OFDI Enhance Their Own Green Technology Innovation? Financ. Res. Lett. 2023, 56, 104113. [Google Scholar] [CrossRef]

- Acharya, V.; Xu, Z. Financial Dependence and Innovation: The Case of Public versus Private Firms. J. Financ. Econ. 2017, 124, 223–243. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Guo, J.; Fang, H.; Liu, X.; Wang, C.; Wang, Y. FinTech and Financing Constraints of Enterprises: Evidence from China. J. Int. Financ. Mark. Inst. Money 2023, 82, 101713. [Google Scholar] [CrossRef]

- Jin, L.; Dai, J.; Jiang, W.; Cao, K. Digital Finance and Misallocation of Resources among Firms: Evidence from China. N. Am. J. Econ. Financ. 2023, 66, 101911. [Google Scholar] [CrossRef]

- Zhang, Z.; Mao, R.; Zhou, Z.; Zeng, Z. How Does Digital Finance Affect Green Innovation? City-Level Evidence from China. Financ. Res. Lett. 2023, 58, 104424. [Google Scholar] [CrossRef]

- Tang, D.; Chen, W.; Zhang, Q.; Zhang, J. Impact of Digital Finance on Green Technology Innovation: The Mediating Effect of Financial Constraints. Sustainability 2023, 15, 3393. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Weiss, A. Credit Rationing in Markets with Imperfect Information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Stiglitz, J.E. The Contributions of the Economics of Information to Twentieth Century Economics. Q. J. Econ. 2000, 115, 1441–1478. [Google Scholar] [CrossRef]

- Zhu, Y.; Huang, W. The Impact of Fintech Development on Green Transformation of Private Enterprises—Empirical Evidence from China. Sustainability 2025, 17, 3789. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Li, B.; Du, J.; Yao, T.; Wang, Q. FinTech and Corporate Green Innovation: An External Attention Perspective. Financ. Res. Lett. 2023, 58, 104661. [Google Scholar] [CrossRef]

- Hu, B.; Hong, G. Management Equity Incentives, R&D Investment on Corporate Green Innovation. Financ. Res. Lett. 2023, 58, 104533. [Google Scholar]

- Li, Q.; Chen, H.; Chen, Y.; Xiao, T.; Wang, L. Digital Economy, Financing Constraints, and Corporate Innovation. Pac.-Basin Financ. J. 2023, 80, 102081. [Google Scholar] [CrossRef]

- Wang, W. Digital Finance and Firm Green Innovation: The Role of Media and Executives. Financ. Res. Lett. 2025, 74, 106794. [Google Scholar] [CrossRef]

- Wang, M.; Yu, X.; Hong, X.; Yang, X. Can Digital Finance Promote Green Innovation Collaboration in Enterprises? Glob. Financ. J. 2025, 65, 101109. [Google Scholar] [CrossRef]

- Che, S.; Tao, M.; Silva, E.; Sheng, M.S.; Zhao, C.; Wang, J. Financial Misallocation and Green Innovation Efficiency: China’s Firm-Level Evidence. Energy Econ. 2024, 136, 107697. [Google Scholar] [CrossRef]

- Li, W.; Pang, W. Digital Inclusive Finance, Financial Mismatch and the Innovation Capacity of Small and Medium-Sized Enterprises: Evidence from Chinese Listed Companies. Heliyon 2023, 9, e13792. [Google Scholar] [CrossRef] [PubMed]

- Wang, S.; Yong, Y.; Liu, X.; Wang, Y. How Fintech Mitigates Credit Mismatches to Promote Green Innovation: Evidence from Chinese Listed Enterprises. Int. Rev. Financ. Anal. 2024, 96, 103740. [Google Scholar] [CrossRef]

- Yang, Y.; Han, X.; Wang, X.; Yu, J. Research on Executive Equity Incentives and Corporate Innovation Performance: The Role of Corporate Social Responsibility. Chin. Manag. Stud. 2022, 17, 1014–1030. [Google Scholar] [CrossRef]

- Tao, A.; Wang, C.; Zhang, S.; Kuai, P. Does Enterprise Digital Transformation Contribute to Green Innovation? Micro-Level Evidence from China. J. Environ. Manag. 2024, 370, 122609. [Google Scholar] [CrossRef]

- Liu, Q.; Wu, F.; Chen, W. The Interaction between Industry-Talent Integration and Two-Phase Green Innovation in Pharmaceutical Manufacturing Companies: Moderating Effects of Corporate Financing Constraints and Executive Short-Term Compensation Incentives. J. Environ. Manag. 2024, 372, 123199. [Google Scholar] [CrossRef]

- Ye, R.; Chen, Y.; Kelly, K.A. The Effects of Firm Performance on CEO Compensation and CEO Pay Ratio before and during COVID-19. Res. Econ. 2023, 77, 453–458. [Google Scholar] [CrossRef]

- Manso, G. Motivating Innovation. J. Financ. 2011, 66, 1823–1860. [Google Scholar] [CrossRef]

- Jensen, M.C. Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. Am. Econ. Rev. 1986, 76, 323–329. [Google Scholar]

- Driver, C.; Grosman, A.; Scaramozzino, P. Dividend Policy and Investor Pressure. Econ. Model. 2020, 89, 559–576. [Google Scholar] [CrossRef]

- Ren, H.; Zhou, L.; Wang, N.; He, Z. Digital Transformation and Green Technology Innovation in Chinese Semiconductor Industry: A Fixed Effects Regression Analysis Considering Media Coverage, Ownership Type, Compensation Incentives, Managerial Myopia. Int. J. Prod. Econ. 2024, 277, 109400. [Google Scholar] [CrossRef]

- Guo, F.; Wnag, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring the Development of Digital Inclusive Finance in China: Index Compilation and Spatial Characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar]

- Yang, R.; Li, R.; Ge, X. Digital Finance Development, Financial Mismatches, and Corporate Shadow Banking Activities. China Econ. Rev. 2025, 93, 102495. [Google Scholar] [CrossRef]

- Kuo, C.-S.; Li, M.-Y.L.; Yu, S.-E. Non-Uniform Effects of CEO Equity-Based Compensation on Firm Performance—An Application of a Panel Threshold Regression Model. Br. Account. Rev. 2013, 45, 203–214. [Google Scholar] [CrossRef]

- He, L.; Jiang, M. CSR Performance, Executive Compensation Incentive and Innovation Investment of Chinese Private Enterprises under Dynamic Perspective. Sci. Program. 2022, 2022, 1–16. [Google Scholar] [CrossRef]

- Liu, M.; Zhao, J.; Liu, H. Digital Transformation, Employee and Executive Compensation, and Sustained Green Innovation. Int. Rev. Financ. Anal. 2025, 97, 103873. [Google Scholar] [CrossRef]

- Cameron, A.C.; Miller, D.L. A Practitioner’s Guide to Cluster-Robust Inference. J. Hum. Resour. 2015, 50, 317–372. [Google Scholar] [CrossRef]

- Zhao, X.; Lynch, J.G., Jr.; Chen, Q. Reconsidering Baron and Kenny: Myths and Truths about Mediation Analysis. J. Consum. Res. 2010, 37, 197–206. [Google Scholar] [CrossRef]

- Shao, Y.; Chen, Z. Can Government Subsidies Promote the Green Technology Innovation Transformation? Evidence from Chinese Listed Companies. Econ. Anal. Policy 2022, 74, 716–727. [Google Scholar] [CrossRef]

- Hu, S.; Zhao, Z.; Wu, L.; Zhang, Z. Does Public Procurement Promote Renewable Energy Innovation? Firm-Level Evidence from China. J. Clean. Prod. 2025, 486, 144574. [Google Scholar] [CrossRef]

- Lai, H.; Quan, L.; Wu, F.; Tang, S.; Guo, C.; Lai, X. Corporate Environmental Publicity and Green Innovation: Are Words Consistent with Actions? Humanit. Soc. Sci. Commun. 2025, 12, 514. [Google Scholar] [CrossRef]

- Miao, Y.; Fei, X.; Sun, J.; Yang, H. The Impact of the US-China Trade War on Chinese Firms’ Investment. Int. Econ. J. 2023, 37, 485–510. [Google Scholar] [CrossRef]

- Pan, L.; Lei, L. International Trade Friction and Firm Cash Holdings. Financ. Res. Lett. 2023, 55, 103976. [Google Scholar] [CrossRef]

- Wang, Z.; Li, X.; Xue, X.; Liu, Y. More Government Subsidies, More Green Innovation? The Evidence from Chinese New Energy Vehicle Enterprises. Renew. Energy 2022, 197, 11–21. [Google Scholar] [CrossRef]

- Bedford, A.; Bugeja, M.; Ghannam, S.; Jeganathan, D.; Ma, N. Were CEO Pay Cuts during the COVID-19 Pandemic Merely Symbolic? Shareholders’ Reaction and Outrage. Pac.-Basin Financ. J. 2023, 79, 101993. [Google Scholar] [CrossRef]

- Carter, M.E.; Lynch, L.J.; Peng, X. COVID-19-Motivated Changes to Executive Compensation. J. Manag. Account. Res. 2024, 36, 115–133. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Initials | Measurement | Refs. |

|---|---|---|---|---|

| Dependent variable | Green technology innovation | GTI | ln(Green Patent Applications + 1) | [19,20] |

| Independent variable | Digital finance | DF | ln(Digital Financial Inclusion Index/100) | [19,57] |

| Mediating variable | Financialmismatch | FM | (Firm level Interest Rate − Industry Average Interest Rate)/Industry Average Interest Rate | [47,58] |

| Moderating variable | Executive equity incentive | EEI | Equity Value/(Equity Value + Cash Compensation) | [59] |

| Executive cashincentive | ECI | ln (Total Executive Cash Compensation) | [60,61] | |

| Control variable | Leverage ratio | LEV | Total Liabilities/Total Assets | [8,9,45] |

| Return on assets | ROA | Net Income/Total Assets | ||

| Tobin’s Q | TQ | Market Value/Book Value of Assets | ||

| Revenue growth rate | GROWTH | Year-over-year change in operating revenue | ||

| Company size | SIZE | ln (Total Assets) | ||

| Company age | AGE | Number of years since establishment | ||

| State-owned enterprise | SOE | Binary indicator (1 if state-controlled, 0 if privately-owned) | ||

| Board size | BOARD | ln (Total number of directors) | ||

| Independent board ratio | INDBOARD | Proportion of independent directors relative to total board members |

| Variable | N | Mean | SD | Min | P25 | Median | P75 | Max |

|---|---|---|---|---|---|---|---|---|

| GTI | 23,486 | 0.329 | 0.745 | 0 | 0 | 0 | 0 | 3.611 |

| DF | 23,486 | 1.169 | 0.261 | 0.442 | 1.026 | 1.233 | 1.368 | 1.507 |

| COST | 23,038 | 0.02 | 0.015 | 0 | 0.008 | 0.018 | 0.029 | 0.062 |

| FM | 23,486 | −0.335 | 1.201 | −13.154 | −0.751 | −0.04 | 0.403 | 2.682 |

| IC | 22,531 | 6.475 | 0.164 | 5.424 | 6.436 | 6.504 | 6.554 | 6.733 |

| EEI | 23,486 | 0.228 | 0.326 | 0 | 0 | 0.015 | 0.444 | 0.962 |

| ECI | 23,486 | 14.992 | 0.774 | 13.170 | 14.478 | 14.959 | 15.478 | 17.150 |

| LEV | 23,486 | 0.407 | 0.195 | 0.007 | 0.251 | 0.401 | 0.552 | 1.501 |

| ROA | 23,486 | 0.041 | 0.055 | −0.191 | 0.016 | 0.039 | 0.068 | 0.193 |

| AGE | 23,486 | 18.252 | 5.979 | 1 | 14 | 18 | 22 | 55 |

| SIZE | 23,486 | 22.289 | 1.296 | 20.05 | 21.356 | 22.108 | 23.036 | 26.477 |

| TQ | 23,022 | 0.568 | 0.48 | −0.471 | 0.211 | 0.477 | 0.838 | 3.447 |

| SOE | 23,486 | 0.37 | 0.483 | 0 | 0 | 0 | 1 | 1 |

| BOARD | 23,485 | 2.131 | 0.197 | 1.099 | 1.946 | 2.197 | 2.197 | 2.89 |

| INDBOARD | 23,485 | 0.376 | 0.056 | 0.167 | 0.333 | 0.353 | 0.429 | 0.8 |

| GROWTH | 22,689 | 0.143 | 0.281 | −0.392 | −0.017 | 0.103 | 0.247 | 1.175 |

| Variables | GTI | GTI |

|---|---|---|

| (1) | (2) | |

| DF | 0.7455 *** | 0.7842 *** |

| (0.2540) | (0.2292) | |

| LEV | 0.2661 *** | |

| (0.0723) | ||

| ROA | 0.1496 | |

| (0.1443) | ||

| AGE | −0.0070 * | |

| (0.0037) | ||

| SIZE | 0.1316 *** | |

| (0.0123) | ||

| TQ | 0.0424 * | |

| (0.0253) | ||

| SOE | 0.0271 | |

| (0.0439) | ||

| BOARD | 0.0928 | |

| (0.0814) | ||

| INDBOARD | 0.0653 | |

| (0.2398) | ||

| GROWTH | −0.0304 | |

| (0.0222) | ||

| Constant | −0.5150 * | −3.7402 *** |

| (0.2847) | (0.3246) | |

| Industry FE | Yes | Yes |

| Year FE | Yes | Yes |

| Observations | 21,009 | 21,009 |

| R-squared | 0.0653 | 0.1234 |

| Adjusted R-squared | 0.0641 | 0.1219 |

| Within R-squared | 0.0042 | 0.0662 |

| Number of clusters | 309 | 309 |

| Variables | (1) | (2) |

|---|---|---|

| FM | GTI | |

| DF | −1.1131 *** | 0.7424 *** |

| (0.2658) | (0.2341) | |

| FM | – | −0.0376 *** |

| (0.0082) | ||

| LEV | 1.8936 *** | 0.3372 *** |

| (0.1308) | (0.0788) | |

| ROA | −3.0630 *** | 0.0346 |

| (0.3049) | (0.1405) | |

| AGE | 0.0084 *** | −0.0067 * |

| (0.0029) | (0.0037) | |

| SIZE | −0.0108 | 0.1312 *** |

| (0.0198) | (0.0123) | |

| TQ | 0.1318 *** | 0.0375 |

| (0.0491) | (0.0262) | |

| SOE | −0.3202 *** | 0.0150 |

| (0.0365) | (0.0430) | |

| BOARD | −0.0532 | 0.0908 |

| (0.1224) | (0.0799) | |

| INDBOARD | 0.0086 | 0.0656 |

| (0.3542) | (0.2411) | |

| GROWTH | 0.0108 | −0.0300 |

| (0.0326) | (0.0221) | |

| Constant | 0.6544 | −3.7156 *** |

| (0.5504) | (0.3261) | |

| Industry FE | Yes | Yes |

| Year FE | Yes | Yes |

| Observations | 21,009 | 21,009 |

| R-squared | 0.1456 | 0.1265 |

| Clusters (city level) | 309 | 309 |

| Variables | (1) | (2) |

|---|---|---|

| Without EEI | With EEI | |

| DF | 0.1810 | 1.0360 *** |

| (0.2871) | (0.3195) | |

| LEV | 0.0400 | 0.3637 *** |

| (0.1123) | (0.0728) | |

| ROA | −0.5484 ** | 0.3820 ** |

| (0.2491) | (0.1703) | |

| AGE | −0.0072 | −0.0063 |

| (0.0048) | (0.0040) | |

| SIZE | 0.1486 *** | 0.1240 *** |

| (0.0249) | (0.0167) | |

| TQ | 0.0195 | 0.0581 * |

| (0.0403) | (0.0311) | |

| SOE | 0.0707 | 0.0407 |

| (0.0437) | (0.0494) | |

| BOARD | 0.1323 | 0.0525 |

| (0.1524) | (0.1004) | |

| INDBOARD | 0.4824 | −0.1686 |

| (0.4378) | (0.3185) | |

| GROWTH | −0.0467 | −0.029 |

| (0.0376) | (0.0266) | |

| Constant | −3.6464 *** | −3.7375 *** |

| (0.5548) | (0.4969) | |

| Industry FE | Yes | Yes |

| Year FE | Yes | Yes |

| Observations | 6556 | 14,453 |

| R-squared | 0.151 | 0.127 |

| Clusters (city level) | 243 | 282 |

| Coefficient Difference () | 0.855 | |

| Bootstrap 95% CI | [0.5348, 1.1751] | |

| Variables | GTI |

|---|---|

| DF | 1.1979 |

| (0.4050) | |

| ECI | 0.1322 *** |

| (0.0408) | |

| DF × ECI | −0.0381 |

| (0.0323) | |

| LEV | 0.2730 *** |

| (0.0757) | |

| ROA | 0.0261 |

| (0.1510) | |

| AGE | −0.0073 ** |

| (0.0035) | |

| SIZE | 0.1021 *** |

| (0.0140) | |

| TQ | 0.0234 |

| (0.0264) | |

| SOE | 0.0296 |

| (0.0437) | |

| BOARD | 0.0632 |

| (0.0799) | |

| INDBOARD | 0.0422 |

| (0.2448) | |

| GROWTH | −0.0085 |

| (0.0251) | |

| Constant | −4.7918 *** |

| (0.6845) | |

| Industry FE | Yes |

| Year FE | Yes |

| Observations | 20,860 |

| R-squared | 0.128 |

| Clusters (city level) | 309 |

| Variables | (1) | (2) |

|---|---|---|

| 2011–2018 | 2019–2022 | |

| DF | −1.0119 * | 7.5528 *** |

| (0.5816) | (2.5704) | |

| ECI | 0.0003 | 0.6732 *** |

| (0.0445) | (0.2430) | |

| DF × ECI | 0.1082 ** | −0.4505 ** |

| (0.0455) | (0.1754) | |

| LEV | 0.2656 *** | 0.2908 *** |

| (0.0924) | (0.0709) | |

| ROA | 0.0617 | 0.0708 |

| (0.2173) | (0.1436) | |

| AGE | −0.0086 ** | −0.0057 ** |

| (0.0044) | (0.0027) | |

| SIZE | 0.1161 *** | 0.0891 *** |

| (0.0177) | (0.0122) | |

| TQ | 0.0416 | 0.0174 |

| (0.0307) | (0.0283) | |

| SOE | 0.0121 | 0.0521 |

| (0.0504) | (0.0381) | |

| BOARD | 0.0767 | 0.0350 |

| (0.1008) | (0.0801) | |

| INDBOARD | 0.0473 | 0.0090 |

| (0.2887) | (0.2788) | |

| GROWTH | −0.0076 | −0.0107 |

| (0.0349) | (0.0267) | |

| Constant | −2.9991 *** | −12.9912 *** |

| (0.7607) | (3.6654) | |

| Industry FE | Yes | Yes |

| Year FE | Yes | Yes |

| Observations | 12,346 | 8514 |

| R-squared | 0.1213 | 0.1464 |

| Clusters (city level) | 308 | 304 |

| Variables | Province | Province FE | Patent | Pre-Pandemic |

|---|---|---|---|---|

| Clustering | Grants | |||

| (1) | (2) | (3) | (4) | |

| DF | 0.7842 *** | 1.1119 *** | 0.7478 *** | 0.6182 *** |

| (0.2485) | (0.2451) | (0.2272) | (0.2275) | |

| LEV | 0.2661 *** | 0.2540 *** | 0.2031 *** | 0.2699 *** |

| (0.0647) | (0.0707) | (0.0676) | (0.0924) | |

| ROA | 0.1496 | 0.0818 | 0.0565 | 0.2382 |

| (0.1670) | (0.1374) | (0.1383) | (0.1954) | |

| AGE | −0.0070 * | −0.0071 ** | −0.0071 ** | −0.0078 * |

| (0.0036) | (0.0036) | (0.0036) | (0.0045) | |

| SIZE | 0.1316 *** | 0.1345 *** | 0.1250 *** | 0.1517 *** |

| (0.0126) | (0.0120) | (0.0112) | (0.0153) | |

| TQ | 0.0424 * | 0.0545 ** | 0.0168 | 0.0607 ** |

| (0.0242) | (0.0244) | (0.0232) | (0.0298) | |

| SOE | 0.0271 | 0.0355 | 0.0006 | 0.0219 |

| (0.0539) | (0.0449) | (0.0376) | (0.0495) | |

| BOARD | 0.0928 | 0.0865 | 0.0917 | 0.1062 |

| (0.0739) | (0.0820) | (0.0689) | (0.0942) | |

| INDBOARD | 0.0653 | 0.0425 | 0.1335 | 0.0814 |

| (0.2503) | (0.2585) | (0.2176) | (0.2756) | |

| GROWTH | −0.0304 | −0.0326 | −0.0268 | −0.0292 |

| (0.0230) | (0.0235) | (0.0216) | (0.0285) | |

| Constant | −3.7402 *** | −4.1575 *** | −3.5520 *** | −3.9116 *** |

| (0.3447) | (0.4299) | (0.2994) | (0.3677) | |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Province FE | No | Yes | No | No |

| Observations | 21,009 | 21,009 | 21,009 | 14,587 |

| R-squared | 0.1234 | 0.1388 | 0.1148 | 0.1130 |

| Number of clusters | 31 | 309 | 309 | 309 |

| Variables | First Stage | Second Stage |

|---|---|---|

| (1) | (2) | |

| Internet Penetration (L1) | 0.0890 *** | |

| (0.0137) | ||

| DF | 0.9808 *** | |

| (0.3729) | ||

| LEV | 0.0156 | 0.2840 *** |

| (0.0101) | (0.0770) | |

| ROA | 0.0542 | 0.1575 |

| (0.0421) | (0.1551) | |

| AGE | −0.0008 | −0.0065 |

| (0.0011) | (0.0041) | |

| SIZE | 0.0124 *** | 0.1321 *** |

| (0.0034) | (0.0133) | |

| TQ | 0.0098 | 0.0404 |

| (0.0068) | (0.0268) | |

| SOE | −0.0037 | 0.0157 |

| (0.0121) | (0.0475) | |

| BOARD | 0.0435 * | 0.1084 |

| (0.0221) | (0.0848) | |

| INDBOARD | 0.0077 | 0.1132 |

| (0.0659) | (0.2675) | |

| GROWTH | −0.0056 | −0.0307 |

| (0.0061) | (0.0236) | |

| Constant | 0.7123 *** | Absorbed by FE |

| (0.0893) | ||

| Industry FE | Yes | Yes |

| Year FE | Yes | Yes |

| Observations | 19,010 | 19,010 |

| R-squared | 0.4062 | 0.0653 |

| Number of clusters | 216 | 216 |

| Kleibergen–Paap rk LM | 29.395 *** | |

| Kleibergen–Paap rk Wald F | 41.9940 | |

| Stock-Yogo 10% critical value | 16.3800 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, Y.; Mahmood, R.; Nassir, A.M.; Zhang, L. Digital Finance and Green Technology Innovation: A Dual-Layer Analysis of Financing and Governance Mechanisms in China. Sustainability 2025, 17, 8982. https://doi.org/10.3390/su17208982

Ma Y, Mahmood R, Nassir AM, Zhang L. Digital Finance and Green Technology Innovation: A Dual-Layer Analysis of Financing and Governance Mechanisms in China. Sustainability. 2025; 17(20):8982. https://doi.org/10.3390/su17208982

Chicago/Turabian StyleMa, Yongpeng, Rosli Mahmood, Annuar Md Nassir, and Leyi Zhang. 2025. "Digital Finance and Green Technology Innovation: A Dual-Layer Analysis of Financing and Governance Mechanisms in China" Sustainability 17, no. 20: 8982. https://doi.org/10.3390/su17208982

APA StyleMa, Y., Mahmood, R., Nassir, A. M., & Zhang, L. (2025). Digital Finance and Green Technology Innovation: A Dual-Layer Analysis of Financing and Governance Mechanisms in China. Sustainability, 17(20), 8982. https://doi.org/10.3390/su17208982