Impact of Venture Capital on Urban Carbon Emissions: Evidence from the Yangtze River Delta Urban Agglomeration in China

Abstract

1. Introduction

2. Literature Review and Research Hypotheses

2.1. Research on the Effects of Venture Capital

2.2. Research on the Influencing Factors of Carbon Emissions

2.3. Research Hypotheses

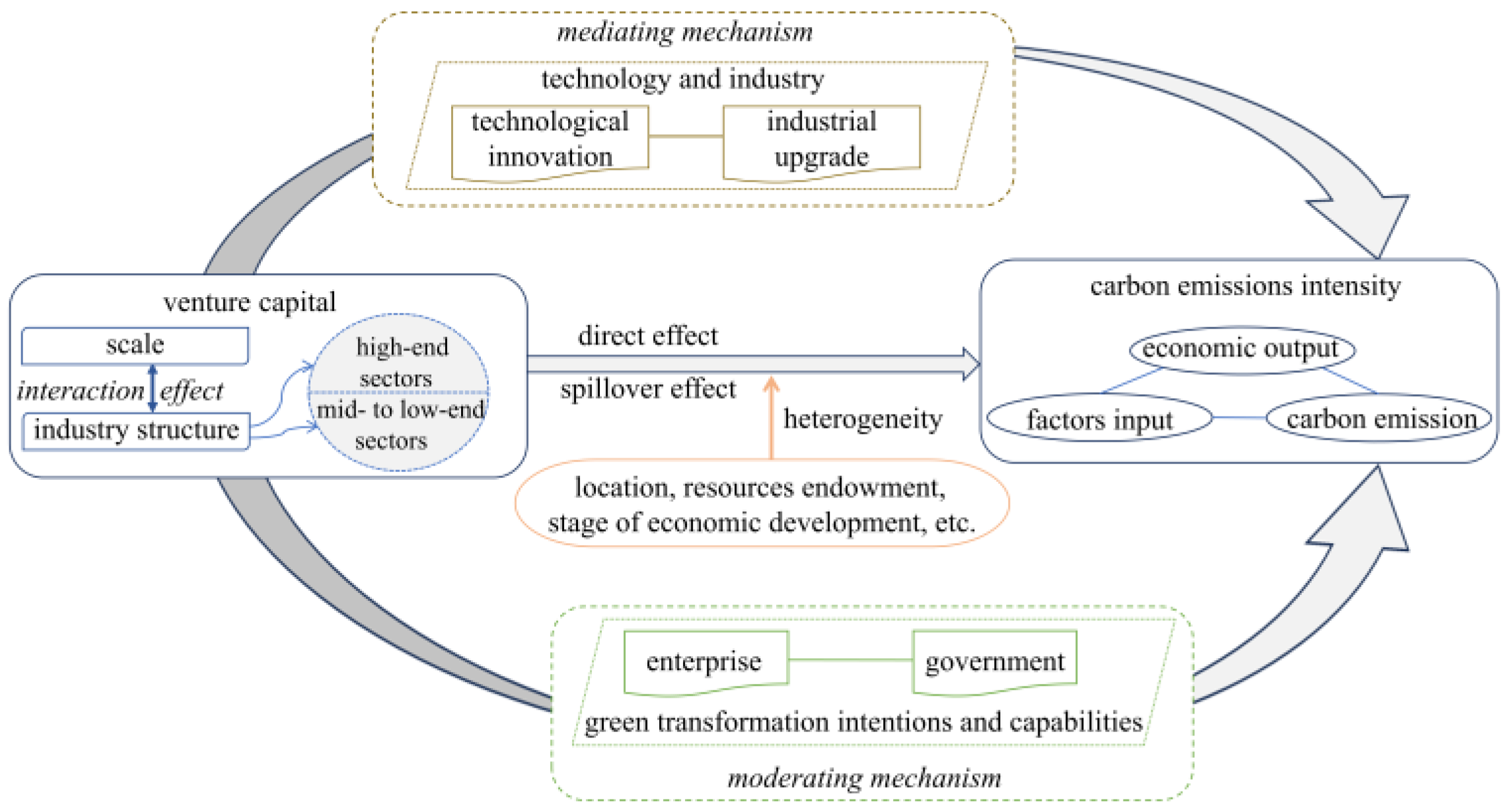

2.3.1. Venture Capital and Urban Carbon Emissions

2.3.2. The Mechanism of Venture Capital on Urban Carbon Emissions

2.3.3. The Regional Heterogeneity in the Effects of Venture Capital on Urban Carbon Emissions

3. Data and Methods

3.1. Model Construction

3.2. Variable Selection

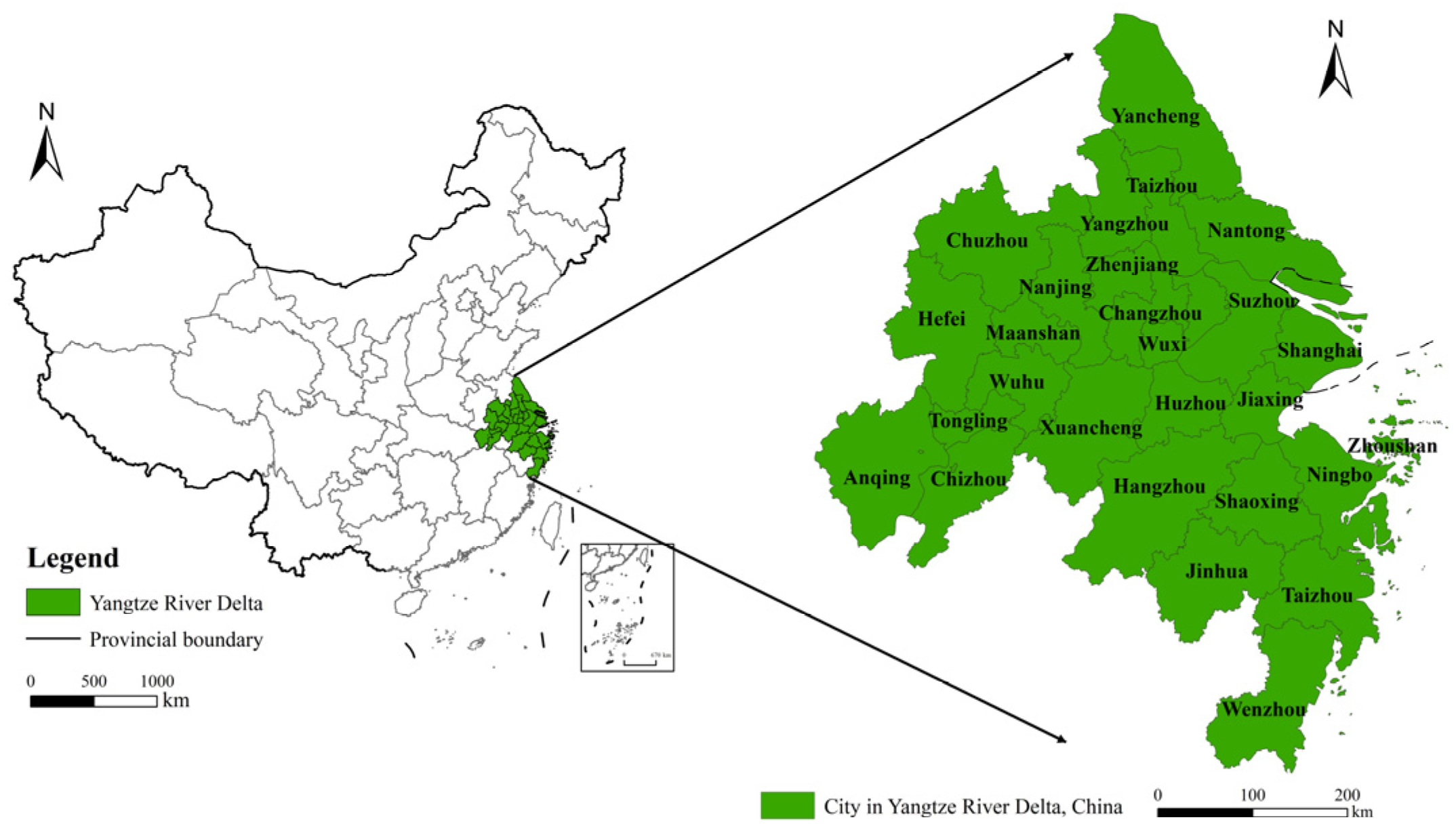

3.3. Study Area

3.4. Data Description

4. Empirical Results

4.1. Benchmark Regression

4.2. Robustness Test

4.3. Heterogeneity Analysis

4.3.1. Urban Pollution Emission Intensity Heterogeneity

4.3.2. Urban Geographical Location Heterogeneity

4.4. Analysis of Impact Mechanisms

4.4.1. Mediating Effect Test

4.4.2. Moderating Effect Test

5. Conclusions and Recommendations

5.1. Conclusions

- (1)

- Increasing the VCS significantly mitigates the rise in urban carbon emissions intensity, as confirmed by robustness tests.

- (2)

- There is heterogeneity in the carbon emissions reduction effects of venture capital across different industries, with more pronounced direct effects observed for investments directed towards mid- and low-end industries.

- (3)

- TECH serves as a key mechanism through which venture capital promotes carbon emissions reduction, although the mediating effect of IU has yet to become prominent.

- (4)

- ETI positively moderates the relationship between both venture capital scale and structure and carbon emissions reduction, while GTI exerts a significant positive moderating effect solely on the relationship between VCS and carbon emissions reduction.

- (5)

- The effectiveness of venture capital in curbing urban carbon emissions intensity demonstrates notable regional heterogeneity. The effects of VCS and VCR2 on carbon emissions reduction are particularly significant in cities with higher pollution levels, whereas VCR1 exhibits stronger effects in moderately polluted cities. Proximity to central cities enhances the carbon emissions reduction effect of VCS; however, VCR2 shows an initial increase followed by a decline in its impact.

5.2. Policy Implications

- (1)

- There is still a great potential for venture capital in urban carbon emissions reduction, which can be tapped through strengthening venture capital oversight and management and promoting the development of diversified venture capital entities. The inherent advantages of private venture capital, namely flexibility, sensitivity, and streamlined decision-making, should be fully leveraged. Concurrently, the management model for state-owned capital in venture investments should transition towards marketisation to maximise its incentive effects, corrective functions, and reputational benefits. However, it is important to note that the market-oriented transformation of state-owned venture capital may encounter multiple constraints, including institutional and mechanistic limitations, as well as the conflict between the requirement for stable preservation of state-owned assets and the high-risk nature of investment projects. As a key hub for domestic venture capital, the Yangtze River Delta Urban Agglomeration should take the lead in exploring reforms and improvements in assessment mechanisms, fault-tolerance and liability exemption frameworks, and performance evaluation systems of state-owned venture capital, thereby serving as a model and leader in this domain. This approach will facilitate the synergistic integration of the policy advantages associated with state-owned capital and the market strengths inherent in private venture capital, thereby enhancing the overall efficiency of the venture capital ecosystem, fostering a conducive innovation environment, and advancing industrial upgrading and economic transformation.

- (2)

- Implement context-specific strategies to direct venture capital towards industries with significant demand. In the long term, an increase in VCR1 can create beneficial synergy with the growth of VCS, thereby substantially enhancing carbon emissions reduction outcomes. However, for cities with smaller venture capital markets, higher pollution emission intensities, or greater distances from central urban areas, it is imperative to pay more attention to the financing needs of the general manufacturing and service sectors. It is essential to encourage venture capital investments in mid- and low-end industries to fully leverage their roles in screening, monitoring, and certification processes while accelerating the transition of traditional industries toward green and low-carbon development. Nevertheless, an information asymmetry between venture capital institutions and financing enterprises leads to capital misallocation and reduced efficiency. To address this issue, measures such as enhancing the quality and transparency of information disclosure and establishing a digital financing service platform should be implemented to improve the allocation efficiency of venture capital.

- (3)

- As micro-level entities, ETI plays a significant positive moderating role in the relationship between venture capital and carbon emissions reductions. Therefore, it is essential to strengthen the policy framework that supports green development for enterprises further and establish and enhance mechanisms for environmental, social, and governance (ESG) information disclosure as well as pricing strategies for green development. Additionally, leveraging the exemplary influence of leading firms and industry benchmarks is crucial for advancing green transformation across the entire industrial chain. Concurrently, GTI has not effectively influenced carbon emissions reduction in mid- and low-end industrial venture capital. It is necessary to develop a comprehensive fiscal and tax incentive mechanism aimed at promoting green innovation effect of mid- and low-end industrial venture capital to mitigate incentives for venture capital institutions to pursue superficial gains or financial exploitation, guiding invested enterprises in implementing green initiatives. To achieve this objective, local governments must establish a robust and scientific assessment framework for the transformation of manufacturing enterprises. Through systematic and regular evaluations, enterprises demonstrating strong transformation willingness, significant potential, and outstanding performance can be identified. Subsequently, through policy guidance, financial support, and information services, venture capital can be strategically directed towards these high-quality manufacturing enterprises.

5.3. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Fekete, H.; Kuramochi, T.; Roelfsema, M.; den Elzen, M.; Forsell, N.; Höhne, N.; Luna, L.; Hans, F.; Sterl, S.; Olivier, J.; et al. A review of successful climate change mitigation policies in major emitting economies and the potential of global replication. Renew. Sustain. Energy Rev. 2021, 137, 110602. [Google Scholar] [CrossRef]

- Gao, X.; Liu, N.; Hua, Y. Environmental Protection Tax Law on the Synergy of Pollution Reduction and Carbon Reduction in China: Evidence from a Panel Data of 107 Cities. Sustain. Prod. Consum. 2022, 33, 425–437. [Google Scholar] [CrossRef]

- Chen, Y.; Zhu, Z.; Cheng, S. Industrial Agglomeration and Haze Pollution: Evidence from China. Sci. Total Environ. 2022, 845, 157392. [Google Scholar] [CrossRef]

- Xu, L.X. Towards Green Innovation by China’s Industrial Policy: Evidence from Made in China 2025. Front. Environ. Sci. 2022, 10, 924250. [Google Scholar] [CrossRef]

- Wang, W.Z.; Hu, Y.; Lu, Y. Driving forces of China’s provincial bilateral carbon emissions and the redefinition of corresponding responsibilities. Sci. Total Environ. 2023, 857, 159404. [Google Scholar] [CrossRef]

- Kong, H.; Shi, L.; Da, D.; Li, Z.; Tang, D.; Xing, W. Simulation of China’s Carbon Emission based on Influencing Factors. Energies 2022, 15, 3272. [Google Scholar] [CrossRef]

- Chemmanur, T.J.; Loutskina, E.; Tian, X. Corporate venture capital, value creation, and innovation. Rev. Financ. Stud. 2014, 27, 2434–2473. [Google Scholar] [CrossRef]

- Maiti, M. Does development in venture capital investments influence green growth? Technol. Forecast. Soc. Chang. 2022, 182, 121878. [Google Scholar] [CrossRef]

- Yao, L.; Singleton, A.; Sun, P.; Dong, G. The Evolution Characteristics and Influence Mechanism of Chinese Venture Capital Spatial Agglomeration. Int. J. Environ. Res. Public Health 2021, 18, 2974. [Google Scholar] [CrossRef]

- Li, C.; Li, H.; Qin, X. Spatial Heterogeneity of Carbon Emissions and Its Influencing Factors in China: Evidence from 286 Prefecture-Level Cities. Int. J. Environ. Res. Public Health 2022, 19, 1226. [Google Scholar] [CrossRef]

- Barry, C.B.; Muscarella, C.J.; Peavy Iii, J.W.; Vetsuypens, M.R. The role of venture capital in the creation of public companies: Evidence from the going-public process. J. Financ. Econ. 1990, 27, 447–471. [Google Scholar] [CrossRef]

- Megginson, W.L.; Weiss, K.A. Venture capitalist certification in initial public offerings. J. Financ. 1991, 46, 879–903. [Google Scholar] [CrossRef]

- Kato, A.I.; Tsoka, G.E. Impact of venture capital financing on small-and medium-sized enterprises’ performance in Uganda. S. Afr. J. Entrep. Small Bus. Manag. 2020, 12, 11. [Google Scholar] [CrossRef]

- Jiang, P.; Cai, C.X.; Keasey, K.; Wright, M.; Zhang, Q. The role of venture capitalists in small and medium-sized enterprise initial public offerings: Evidence from China. Int. Small Bus. J. 2014, 32, 619–643. [Google Scholar] [CrossRef]

- Otchere, I.; Vong, A.P.I. Venture capitalist participation and the performance of Chinese IPOs. Emerg. Mark. Rev. 2016, 29, 226–245. [Google Scholar] [CrossRef]

- Amit, R.; Glosten, L.; Muller, E. Does venture capital foster the most promising entrepreneurial firms? Calif. Manag. Rev. 1990, 32, 102–111. [Google Scholar] [CrossRef]

- Ber, H.; Yafeh, Y. Can venture capital funds pick winners? Evidence from pre-IPO survival rates and post-IPO performance. Isr. Econ. Rev. 2007, 5, 23–46. [Google Scholar]

- Tan, Y.; Huang, H.; Lu, H. The Effect of Venture Capital Investment—Evidence from China’s Small and Medium-Sized Enterprises Board. J. Small Bus. Manag. 2013, 51, 138–157. [Google Scholar] [CrossRef]

- Huang, F.; Zhang, X.; Peng, T. Chinese Venture Capital, Management Support and Firms’ Growth: Survey on Private SMEs. China J. Manag. 2015, 12, 207–214. (In Chinese) [Google Scholar]

- Kortum, S.S.; Lerner, J. Assessing the contribution of venture capital to Innovation. RAND J. Econ. 2000, 31, 674–692. [Google Scholar] [CrossRef]

- Yi, R.; Wang, H.; Lyu, B.; Xia, Q. Does venture capital help to promote open innovation practice?. Evidence from China. Eur. J. Innov. Manag. 2023, 26, 0161. [Google Scholar] [CrossRef]

- Arvanitis, S.; Stucki, T. The impact of venture capital on the persistence of innovation activities of start-ups. Small Bus. Econ. 2014, 42, 849–870. [Google Scholar] [CrossRef]

- Wen, J.; Yang, D.; Feng, G.F.; Dong, M.; Chang, C.P. Venture capital and innovation in China: The non-linear evidence. Struct. Chang. Econ. Dyn. 2018, 46, 148–162. [Google Scholar] [CrossRef]

- Chary, T.S. Role of Venture Capital in Promotion of New Enterprises1. Financ. India 2005, 19, 1003–1011. [Google Scholar]

- Yao, L.; Lu, J.; Sun, P. Venture capital and industrial structure upgrading from the perspective of spatial spillover. Sustainability 2019, 11, 6698. [Google Scholar] [CrossRef]

- Cao, Y.; Cao, Y. Venture Capital, Non-performing Loans and Industrial Upgrading—Empirical Research based on Chinese Provincial Panel Data. J. Beijing Inst. Technol. (Soc. Sci. Ed.) 2020, 22, 76–87. (In Chinese) [Google Scholar]

- Romain, A.; Van Pottelsberghe, B. The economic impact of venture capital. In Discussion Paper Series 1; Deutsche Bundesbank: Frankfurt am Main, Germany, 2004; Volume 18. [Google Scholar]

- Cha, B.; Song, G. Influence of Venture Capital to Clean Technology on Economic Green Growth: Dynamic Analysis Based on Chinese Data. Sci. Technol. Manag. Res. 2023, 43, 223–234. (In Chinese) [Google Scholar]

- Yang, S.; Feng, D.; Lu, J.; Wang, C. The effect of venture capital on green innovation: Is environmental regulation an institutional guarantee? J. Environ. Manage. 2022, 318, 115641. [Google Scholar] [CrossRef] [PubMed]

- Gaddy, B.E.; Sivaram, V.; Jones, T.B.; Wayman, L. Venture capital and cleantech: The wrong model for energy innovation. Energy Policy 2017, 102, 385–395. [Google Scholar] [CrossRef]

- Dong, W.; Li, Y.; Lv, X.; Yu, C. How does venture capital spur the innovation of environmentally friendly firms?. Evidence from China. Energy Econ. 2021, 103, 105582. [Google Scholar] [CrossRef]

- Lee, J.W. The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 2023, 55, 483–489. [Google Scholar] [CrossRef]

- Zhu, H.; Duan, L.; Guo, Y.; Yu, K. The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: Evidence from panel quantile regression. Econ. Model. 2016, 58, 237–248. [Google Scholar] [CrossRef]

- Grimes, P.; Kentor, J. Exporting the greenhouse: Foreign capital penetration and CO2 Emissions 1980–1996. J. World Syst. Res. 2003, 9, 261–275. [Google Scholar] [CrossRef]

- Nie, Y.; Liu, Q.; Ren, D. Does the FDI Inflows in Countries along “the Belt and Road” Aggravate Carbon Emissions?. Does the FDI Inflows in Countries along “the Belt and Road” Aggravate Carbon Emissions? Ecol. Econ. 2022, 38, 29–37. [Google Scholar]

- Apergis, N.; Pinar, M.; Unlu, E. How do foreign direct investment flows affect carbon emissions in BRICS countries?. Revisiting the pollution haven hypothesis using bilateral FDI flows from OECD to BRICS countries. Environ. Sci. Pollut. Res. 2023, 30, 14680–14692. [Google Scholar] [CrossRef]

- Baştürk, M.F. Does Green Finance Reduce Carbon Emissions?. Global Evidence Based on System Generalized Method of Moments. Sustainability 2024, 16, 8210. [Google Scholar] [CrossRef]

- Khan, M.A.; Riaz, H.; Ahmed, M.; Saeed, A. Does green finance really deliver what is expected?. An empirical perspective. Borsa Istanb. Rev. 2022, 22, 586–593. [Google Scholar] [CrossRef]

- Zhao, X.; Zhang, S.; Ahmad, N.; Wang, S.; Zhao, J. Unlocking Sustainable Growth: The Transformative Impact of Green Finance on Industrial Carbon Emissions in China. Sustainability 2024, 16, 8253. [Google Scholar] [CrossRef]

- Wang, J.; Tian, J.; Kang, Y.; Guo, K. Can green finance development abate carbon emissions: Evidence from China. Int. Rev. Econ. Financ. 2023, 88, 73–91. [Google Scholar] [CrossRef]

- Lu, Z. A Study on the Influence on the Carbon Finance to the Low-Carbon in Resources Industries: An Empirical Analysis Based on CDM. Financ. Pract. Theory 2020, 11, 57–62. (In Chinese) [Google Scholar]

- Zhou, K.; Li, Y. Carbon finance and carbon market in China: Progress and challenges. J. Clean. Prod. 2019, 214, 536–549. [Google Scholar] [CrossRef]

- Khan, K.; Luo, T.; Ullah, S.; Rasheed, H.M.W.; Li, P.H. Does digital financial inclusion affect CO2 emissions?. Evidence from 76 emerging markets and developing economies (EMDE’s). J. Clean. Prod. 2023, 420, 138313. [Google Scholar] [CrossRef]

- Schmitz, A.; Kamiński, J.; Scalet, B.M.; Soria, A. Energy consumption and CO2 emissions of the European glass industry. Energy Policy 2011, 39, 142–155. [Google Scholar] [CrossRef]

- Alves, M.R.; Moutinho, V. Decomposition analysis and Innovative Accounting Approach for energy-related CO2 (carbon dioxide) emissions intensity over 1996–2009 in Portugal. Energy 2013, 57, 775–787. [Google Scholar] [CrossRef]

- Fisher-Vanden, K.; Jefferson, G.H.; Ma, J.; Xu, J. Technology development and energy productivity in China. Energ Econ. 2006, 28, 690–705. [Google Scholar] [CrossRef]

- Zhang, H.; Feng, C.; Zhou, X. Going carbon-neutral in China: Does the low-carbon city pilot policy improve carbon emission efficiency? Sustain. Prod. Consum. 2022, 33, 312–329. [Google Scholar] [CrossRef]

- Bano, S.; Zhao, Y.; Ahmad, A.; Wang, S.; Liu, Y. Identifying the impacts of human capital on carbon emissions in Pakistan. J. Clean. Prod. 2018, 183, 1082–1092. [Google Scholar] [CrossRef]

- Cappellari, T.; Gucciardi, G. Equity Investments and Environmental Pressure: The Role of Venture Capital. Sustainability 2023, 16, 241. [Google Scholar] [CrossRef]

- Hochberg, Y.V.; Ljungqvist, A.; Lu, Y. Whom you know matters: Venture capital networks and investment performance. J. Financ. 2007, 62, 251–301. [Google Scholar] [CrossRef]

- Lin, B.; Xie, Y. Driving green technology innovation in renewable energy: Does venture capital matter? IEEE Trans. Eng. Manag. 2023, 71, 6784–6795. [Google Scholar] [CrossRef]

- Belloc, F. Innovation in state-owned enterprises: Reconsidering the conventional wisdom. J. Econ. Issues. 2014, 48, 821–848. [Google Scholar] [CrossRef]

- Yang, Y.; Wei, X.; Wei, J.; Gao, X. Industrial structure upgrading, green total factor productivity and carbon emissions. Sustainability 2022, 14, 1009. [Google Scholar] [CrossRef]

- Caselli, S.; Gatti, S.; Perrini, F. Are venture capitalists a catalyst for innovation? Eur. Financ. Manage. 2009, 15, 92–111. [Google Scholar] [CrossRef]

- Adewuyi, A.O. Effects of public and private expenditures on environmental pollution: A dynamic heterogeneous panel data analysis. Renew. Sustain. Energy. Rev. 2016, 65, 489–506. [Google Scholar] [CrossRef]

- Matloob, A.; Sarif, M.O.; Um, J.S. Exploring correlation between OCO-2 XCO2 and DMSP/OLS nightlight imagery signature in four selected locations in India. Spat. Inf. Res. 2021, 29, 123–135. [Google Scholar] [CrossRef]

- Zhang, B.; Wan, K. The Effect of Energy Rights Trading Pilot Policies on Urban Carbon Emissions: Empirical Analysis Based on PSM-DID. Sustainability 2024, 16, 8357. [Google Scholar] [CrossRef]

| Industry Category | Specific Sector |

|---|---|

| high-end sectors | automobile manufacturing, machinery manufacturing, semiconductor and electronic equipment manufacturing, biotechnology, clean technology, information technology, finance, Internet |

| mid- to low-end sectors | agriculture, energy and mining, paper and printing, food and beverage manufacturing, chemical process, textile and garment manufacturing, construction, chain and retail, education and training, radio and television, logistic, real estate, telecommunications and value-added services, entertainment and media |

| Variable | Mean | Standard Deviation | MIN | MAX |

|---|---|---|---|---|

| CI | 1.285 | 1.038 | 0.216 | 5.709 |

| VCS | 2264.399 | 6696.261 | 0.343 | 45,764.993 |

| VCR1 | 0.6243 | 0.255 | 0.0245 | 1.000 |

| VCR2 | 0.376 | 0.255 | 0.000 | 0.975 |

| FP | 1.505 | 0.487 | 0.913 | 3.316 |

| ROAD | 9.678 | 3.582 | 4.032 | 21.752 |

| EDU | 2.257 | 1.877 | 0.225 | 9.888 |

| ER | 5464.833 | 712.091 | 3281.000 | 7685.000 |

| URBAN | 0.671 | 0.102 | 0.396 | 0.894 |

| FDI | 0.501 | 0.380 | 0.060 | 2.390 |

| TECH | 3313.344 | 4637.637 | 56.000 | 28,534.000 |

| IU | 1.039 | 0.389 | 0.334 | 2.802 |

| ETI | 77.143 | 131.957 | 0.000 | 666.667 |

| GTI | 22.695 | 29.526 | 2.204 | 214.063 |

| PEI | 43.620 | 28.869 | 18.586 | 127.651 |

| GL | 102.056 | 68.574 | 0 | 258.8 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| LLC | p-Value | IPS | p-Value | VIF | VIF | |

| CI | −10.3252 | 0.0000 | −1.5088 | 0.0657 | - | - |

| VCS | −10.8455 | 0.0000 | −3.3352 | 0.0004 | 4.58 | 7.45 |

| VCR1 | −11.0399 | 0.0000 | −2.7905 | 0.0026 | 8.11 | - |

| VCR2 | −12.4409 | 0.0000 | −4.3267 | 0.0000 | - | 4 |

| VCS×VCR1 | −8.5352 | 0.0000 | −1.2543 | 0.1049 | 7.11 | - |

| VCS×VCR2 | −9.0899 | 0.0000 | −2.8452 | 0.0022 | - | 5.59 |

| URBAN | −14.4282 | 0.0000 | −2.9473 | 0.0016 | 3.9 | 4.01 |

| FDI | −3.4403 | 0.0003 | −5.1363 | 0.0000 | 1.35 | 1.3 |

| FP | −18.7170 | 0.0000 | −4.9562 | 0.0000 | 2.58 | 2.58 |

| ROAD | −7.5997 | 0.0000 | −0.1825 | 0.4276 | 1.73 | 1.73 |

| ER | −13.9771 | 0.0000 | −2.8594 | 0.0021 | 1.34 | 1.34 |

| EDU | −8.7709 | 0.0000 | −0.8217 | 0.2056 | 2.21 | 2.21 |

| Sequence of Window Periods | Time Window | Moran’s I | Z | p-Value |

|---|---|---|---|---|

| 1 | 2011–2013 | −0.121 | −2.908 | 0.002 |

| 2 | 2012–2014 | −0.120 | −2.858 | 0.002 |

| 3 | 2013–2015 | −0.117 | −2.737 | 0.003 |

| 4 | 2014–2016 | −0.116 | −2.706 | 0.003 |

| 5 | 2015–2017 | −0.120 | −2.841 | 0.002 |

| 6 | 2016–2018 | −0.120 | −2.857 | 0.002 |

| 7 | 2017–2019 | −0.108 | −2.438 | 0.007 |

| 8 | 2018–2020 | −0.096 | −2.004 | 0.023 |

| 9 | 2019–2021 | −0.086 | −1.680 | 0.046 |

| 10 | 2020–2022 | −0.086 | −1.655 | 0.049 |

| Test | Statistic | p-Value |

|---|---|---|

| LM error | 244.02 *** | 0.000 |

| R-LM error | 133.05 *** | 0.000 |

| LM lag | 93.97 *** | 0.000 |

| R-LM lag | 3.01 *** | 0.083 |

| LR-SDM/SAR | 31.62 *** | 0.000 |

| LR-SDM/SEM | 28.24 *** | 0.001 |

| Wald-SDM/SAR | 34.95 *** | 0.000 |

| Wald-SDM/SEM | 27.30 *** | 0.001 |

| Hausman | 824.3 *** | 0.000 |

| Lrtest both ind | 39.61 *** | 0.006 |

| Lrtest both time | 1147.27 *** | 0.000 |

| Variable | SDM | SAR | SEM | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| VCS | −0.0229 *** (0.0075) | −0.0104 (0.0081) | −0.0109 (0.0071) | −0.0049 (0.0077) | −0.0159 ** (0.0074) | −0.0063 (0.0078) |

| VCR1 | 0.0324 * (0.0186) | 0.0170 (0.0178) | 0.0243 (0.0184) | |||

| VCS×VCR1 | −0.0244 ** (0.0098) | −0.0151 (0.0092) | −0.0205 ** (0.0097) | |||

| VCR2 | −0.0128 ** (0.0057) | −0.0080 (0.0054) | −0.0103 * (0.0056) | |||

| VCS×VCR2 | 0.0057 (0.0038) | 0.0023 (0.0036) | 0.0043 (0.0038) | |||

| W×VCS | 0.0096 (0.1146) | 0.0083 (0.1254) | ||||

| W×VCR1 | 0.3050 * (0.1811) | |||||

| W×VCS×VCR1 | −0.0389 (0.0946) | |||||

| W×VCR2 | −0.1005 (0.0625) | |||||

| W×VCS×VCR2 | 0.0433 (0.0450) | |||||

| Controls | YES | YES | YES | YES | YES | YES |

| City fixed effect | YES | YES | YES | YES | YES | YES |

| Time fixed effect | YES | YES | YES | YES | YES | YES |

| Observations | 270 | 270 | 270 | 270 | 270 | 270 |

| R-squared | 0.7666 | 0.7460 | 0.1992 | 0.1924 | 0.1360 | 0.1376 |

| All Variables Are One-Period Lagged | Replace the Measure of the VCS | Transform Weight Matrix | |||||

|---|---|---|---|---|---|---|---|

| Variable | (1) L.CI | (2) L.CI | Variable | (3) CI | (4) CI | (5) CI | (6) CI |

| L.VCS | −0.0213 *** (0.0076) | −0.0105 (0.0083) | VCS | −0.0351 ** (0.0139) | −0.0317 ** (0.0146) | −0.0137 * (0.0073) | −0.0054 (0.0076) |

| L.VCR1 | 0.0279 (0.0189) | VCR1 | 0.0205 (0.0180) | 0.0229 (0.0204) | |||

| L.VCS×L.VCR1 | −0.0204 ** (0.0101) | VCS*VCR1 | −0.0174 * (0.0095) | −0.0186 * (0.0103) | |||

| L.VCR2 | −0.0115 ** (0.0058) | VCR2 | −0.0134 ** (0.0053) | −0.0105 * (0.0054) | |||

| L.VCS×L.VCR2 | 0.0050 (0.0039) | VCS*VCR2 | 0.0059 * (0.0036) | 0.0023 (0.0036) | |||

| L.Controls | YES | YES | Controls | YES | YES | YES | YES |

| City fixed effect | YES | YES | City fixed effect | YES | YES | YES | YES |

| Time fixed effect | YES | YES | Time fixed effect | YES | YES | YES | YES |

| Observations | 189 | 189 | Observations | 270 | 270 | 270 | 270 |

| R-squared | 0.5822 | 0.5906 | R-squared | 0.7521 | 0.6254 | 0.6926 | 0.4314 |

| Variable | Low Level in PEI | Medium Level in PEI | High Level in PEI | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| VCS | 0.0294 *** (0.0109) | 0.0461 *** (0.0125) | 0.0087 (0.0139) | −0.0153 (0.0131) | −0.0147 (0.0112) | −0.0134 (0.0092) |

| VCR1 | 0.0436 (0.0711) | −0.1933 *** (0.0749) | 0.0238 (0.0165) | |||

| VCS×VCR1 | −0.0309 (0.0294) | 0.0749 ** (0.0306) | −0.0163 (0.0102) | |||

| VCR2 | −0.0391 (0.0322) | −0.0119 (0.0672) | −0.0138 ** (0.0058) | |||

| VCS×VCR2 | 0.0191 (0.0119) | −0.0057 (0.0224) | 0.0050 (0.0049) | |||

| Controls | YES | YES | YES | YES | YES | YES |

| City fixed effect | YES | YES | YES | YES | YES | YES |

| Time fixed effect | YES | YES | YES | YES | YES | YES |

| Observations | 90 | 90 | 90 | 90 | 90 | 90 |

| R-squared | 0.4321 | 0.4799 | 0.8653 | 0.8727 | 0.6944 | 0.5009 |

| Variable | Short Distance | Medium Distance | Far Distance | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| VCS | 0.0294 *** (0.0109) | 0.0461 *** (0.0125) | 0.0087 (0.0139) | −0.0153 (0.0131) | −0.0147 (0.0112) | −0.0134 (0.0092) |

| VCR1 | 0.0436 (0.0711) | −0.1933 *** (0.0749) | 0.0238 (0.0165) | |||

| VCS×VCR1 | −0.0309 (0.0294) | 0.0749 ** (0.0306) | −0.0163 (0.0102) | |||

| VCR2 | −0.0391 (0.0322) | −0.0119 (0.0672) | −0.0138 ** (0.0058) | |||

| VCS×VCR2 | 0.0191 (0.0119) | −0.0057 (0.0224) | 0.0050 (0.0049) | |||

| Controls | YES | YES | YES | YES | YES | YES |

| City fixed effect | YES | YES | YES | YES | YES | YES |

| Time fixed effect | YES | YES | YES | YES | YES | YES |

| Observations | 90 | 90 | 90 | 90 | 90 | 90 |

| R-squared | 0.4321 | 0.4799 | 0.8653 | 0.8727 | 0.6944 | 0.5009 |

| Variable | (1) TECH | (2) TECH | (3) IU | (4) IU | (5) CI | (6) CI | (7) CI | (8) CI |

|---|---|---|---|---|---|---|---|---|

| VCS | 0.0678 ** (0.0285) | 0.0015 (0.0310) | −0.0421 *** (0.0100) | −0.0321 *** (0.0105) | −0.0189 ** (0.0074) | −0.0101 (0.0079) | −0.0215 *** (0.0079) | −0.0093 (0.0081) |

| VCR1 | −0.3384 *** (0.0704) | 0.0497 ** (0.0246) | 0.0129 (0.0189) | 0.0311 * (0.0187) | ||||

| VCS×VCR1 | 0.1544 *** (0.0373) | −0.0250 * (0.0130) | −0.0156 (0.0099) | −0.0238 ** (0.0099) | ||||

| VCR2 | 0.0586 *** (0.0218) | −0.0131 * (0.0074) | −0.0095 * (0.0056) | −0.0127 ** (0.0057) | ||||

| VCS×VCR2 | −0.0248 * (0.0147) | 0.0008 (0.0050) | 0.0043 (0.0038) | 0.0066 * (0.0038) | ||||

| TECH | −0.0574 *** (0.0164) | −0.0571 *** (0.0161) | ||||||

| IU | 0.0599 (0.0477) | 0.0571 (0.0481) | ||||||

| Controls | YES | YES | YES | YES | YES | YES | YES | YES |

| City fixed effect | YES | YES | YES | YES | YES | YES | YES | YES |

| Time fixed effect | YES | YES | YES | YES | YES | YES | YES | YES |

| Observations | 270 | 270 | 270 | 270 | 270 | 270 | 270 | 270 |

| R-squared | 0.7666 | 0.8291 | 0.8272 | 0.4349 | 0.4686 | 0.7615 | 0.7238 | 0.7635 |

| Variable | Earlier Development Stage (2011–2016) | Later Development Stage (2017–2022) | ||

|---|---|---|---|---|

| (1) IU | (2) CI | (3) IU | (4) CI | |

| VCS | −0.0031 (0.0076) | −0.0049 (0.0076) | −0.0208 (0.0168) | 0.0006 (0.0140) |

| VCR1 | −0.0064 (0.0163) | 0.0305 * (0.0156) | 0.1307 ** (0.0549) | −0.0155 (0.0463) |

| VCS×VCR1 | −0.0105 (0.0093) | −0.0160 * (0.0090) | −0.0510 * (0.0260) | 0.0024 (0.0219) |

| IU | 0.4058 *** (0.0857) | −0.2073 *** (0.0768) | ||

| Controls | YES | YES | YES | YES |

| City fixed effect | YES | YES | YES | YES |

| Time fixed effect | YES | YES | YES | YES |

| Observations | 135 | 135 | 135 | 135 |

| R-squared | 0.6676 | 0.6061 | 0.2627 | 0.5200 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| VCS | −0.0126 (0.0087) | −0.0213 *** (0.0078) | −0.0014 (0.0088) | −0.0081 (0.0081) | −0.0139 (0.0092) | −0.0228 *** (0.0075) | 0.0018 (0.0097) | −0.0161 ** (0.0082) |

| VCR1 | 0.0259 (0.0187) | 0.0310 * (0.0186) | 0.0343 * (0.0184) | 0.0353 * (0.0185) | ||||

| VCS×VCR1 | −0.0190 * (0.0100) | −0.0188 * (0.0111) | −0.0242 ** (0.0098) | −0.0227 ** (0.0105) | ||||

| VCR2 | −0.0121 ** (0.0057) | −0.0153 *** (0.0058) | −0.0145 *** (0.0056) | −0.0083 (0.0060) | ||||

| VCS×VCR2 | 0.0053 (0.0038) | 0.0115 ** (0.0049) | 0.0065 * (0.0038) | −0.0017 (0.0047) | ||||

| ETI | 0.0379 *** (0.0142) | 0.0026 (0.0059) | 0.0416 *** (0.0140) | −0.0003 (0.0066) | ||||

| VCS×ETI | −0.0146 ** (0.0061) | −0.0157 *** (0.0061) | ||||||

| VCR1×ETI | −0.0166 (0.0152) | |||||||

| VCR2×ETI | −0.0129 * (0.0074) | |||||||

| GTI | 0.0319 ** (0.0147) | 0.0045 (0.0055) | 0.0375 ** (0.0147) | 0.0183 *** (0.0053) | ||||

| VCS×GTI | −0.0104 * (0.0061) | −0.0127 ** (0.0061) | ||||||

| VCR1×GTI | −0.0084 (0.0109) | |||||||

| VCR2×GTI | 0.0231 *** (0.0078) | |||||||

| Controls | YES | YES | YES | YES | YES | YES | YES | YES |

| City fixed effect | YES | YES | YES | YES | YES | YES | YES | YES |

| Time fixed effect | YES | YES | YES | YES | YES | YES | YES | YES |

| Observations | 270 | 270 | 270 | 270 | 270 | 270 | 270 | 270 |

| R-squared | 0.7666 | 0.8291 | 0.8272 | 0.4349 | 0.4686 | 0.7615 | 0.7238 | 0.7635 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, L.; Wang, X.; Sheng, Y.; Zhao, J. Impact of Venture Capital on Urban Carbon Emissions: Evidence from the Yangtze River Delta Urban Agglomeration in China. Sustainability 2025, 17, 546. https://doi.org/10.3390/su17020546

Huang L, Wang X, Sheng Y, Zhao J. Impact of Venture Capital on Urban Carbon Emissions: Evidence from the Yangtze River Delta Urban Agglomeration in China. Sustainability. 2025; 17(2):546. https://doi.org/10.3390/su17020546

Chicago/Turabian StyleHuang, Lijiali, Xueqiong Wang, Yanwen Sheng, and Jinli Zhao. 2025. "Impact of Venture Capital on Urban Carbon Emissions: Evidence from the Yangtze River Delta Urban Agglomeration in China" Sustainability 17, no. 2: 546. https://doi.org/10.3390/su17020546

APA StyleHuang, L., Wang, X., Sheng, Y., & Zhao, J. (2025). Impact of Venture Capital on Urban Carbon Emissions: Evidence from the Yangtze River Delta Urban Agglomeration in China. Sustainability, 17(2), 546. https://doi.org/10.3390/su17020546