Abstract

Considering not only financial indicators but also ESG scores in assessing success provides an integrated approach in the performance evaluation of companies. The aim of this study is to analyze the performance of companies that are listed in the sustainability index of each E7 country according to their ESG scores and financial ratios, and to make comparisons at both micro and country levels. Utilizing a decision tree approach, this research investigates how ESG scores and key financial ratios influence corporate performance (ROA, ROE, and ROS) among firms in the E7 emerging economies for the year 2023. The reflection of the 2023 economic outlook on companies also supports the results of the study. India exhibited the most consistent and positive ESG-performance relationships for the three financial indicators examined. Among the countries where the ESG score created a difference, in ROA analysis, Türkiye had the greatest difference. ESG scores had a negative contribution to the ROE performance of the companies in Türkiye, China, and Mexico. In the ROS analysis, the first level of differentiation of the decision tree was the inventory turnover ratio. The findings aim to provide valuable information to companies in the E7 countries on developing their current situations to turn into sustainability-focused strategies and improving their corporate performance. It also highlights the importance of ESG integration for policymakers in achieving sustainable development goals.

1. Introduction

In recent years, investors and stakeholders have shown increasing interest in companies’ environmental and social impacts and governance practices, as well as their financial returns. This trend has brought sustainable investments based on Environmental, Social and Governance (ESG) criteria into the mainstream. In this context, ESG scores, considered an indicator of companies’ long-term value creation potential, have become a critical metric in terms of their relationship with financial performance. In the classical finance approach, the main responsibility of financial management is to find the financing source required for ensuring the continuity of the production process; while in the modern finance approach, it is to make decisions to maximize the market value of the company. Freeman [1] defined a stakeholder as any group or individual who can affect or is affected by the achievement of the organization’s objective, in stakeholder theory. Stakeholder theory is a managerial concept for examining how effectively a company manages its stakeholders to achieve its corporate performance goals. In the context of ESG, stakeholder theory suggests that sustainability practices can increase corporate value by meeting the expectations of stakeholders. According to stakeholder theory, investments should include ethical issues in addition to financial returns as a fundamental component of the decision-making process [2]. In this context, sustainability reporting is defined as a means of transparently communicating the organization’s performance from the perspective of various stakeholders. ESG scores emerged from the need to identify top performers by evaluating companies on environmental, social and governance factors [3]. With the sustainability reporting of Global Reporting Initiative (GRI) standards, companies’ ESG performances can be measured and reported through comparisons [4]. By reporting in accordance with these reporting standards at both global and local levels, companies see their current situation, make plans for the future, and enhance their national and international competitiveness. Integrated reporting is an approach used to measure, report, and share the sustainability performance of a company. This approach addresses the economic, environmental, and social dimensions of the business. It aims to present comprehensively the performance of the company to all stakeholders. There are indices on world stock exchanges where companies are listed according to their corporate sustainability performance.

Many countries have implemented regulations that hold companies accountable for their environmental and social impacts. According to the Sustainability Reporting Survey prepared by KPMG in 2024, it was determined that the percentage of the world’s largest 250 companies (G250) publishing sustainability audit reports increased from 63% to 69% compared to 2022. Meanwhile, the percentage of the largest 100 companies (N100) in the analyzed countries increased from 47% to 54%. The rate of those reporting sustainability within the N100 group was determined to be 79% [5]. All these statistical indicators suggest that companies, both nationally and internationally, have prioritized the creation of sustainability reports, similar in importance to financial reporting. When calculating the ESG scores of companies, the relevant data is provided through these sustainability reports. Global adoption of ESG policies improves innovation, value creation, and financial performance monitoring in companies. In general, social and environmental performance is positively correlated with economic stability. In developing countries, shareholders, managers, and human rights play important roles in determining ESG performance [6].

The task of the financial system is to ensure that funds are allocated in the most efficient way. In this context, finance can play an important role in accelerating the transition to a low-carbon and circular economy by directing investments to sustainable companies and projects. Sustainable finance examines how investment and credit processes interact with economic, social and environmental factors. In terms of fund allocation, finance, can contribute to making strategic decisions to ensure the balance between sustainable development goals. In addition, investors can influence the companies they provide capital to, encouraging them to turn to sustainable business models in the long term. In addition, the expertise of the financial system in risk pricing can also help manage environmental uncertainties. The targets determined with the sustainable finance approach have gone through important stages in recent years, evolving from being focused on short-term profit to a long-term value creation approach [7]. In this context, high sustainability performance facilitates companies’ access to more cost-effective financing sources. Companies that operate in accordance with ESG criteria are considered lower risk by credit institutions and therefore have the opportunity to benefit from more advantageous credit terms. Companies with high sustainability performance are seen as more reliable by investors and corporate customers, which contributes to the steady increase in stock prices. Another important effect of sustainability performance is the increase in market share, sales growth, revenue growth the strengthening of brand value and reputation. Companies that are committed to sustainability principles have a more positive image in the eyes of consumers and stakeholders, which increases customer loyalty and reinforces their competitive advantage.

The countries called the E7 countries, which stand out due to their increasing importance and catalytic role in the global economy, are China, Russia, India, Indonesia, Mexico, Brazil, and Türkiye. The E7 countries include the seven developing countries in the G20. The E7 countries provide unique and critical context for this research. These economies collectively represent more than 50% of the global population and contribute approximately 35% of world GDP growth. These countries face challenges where economic growth often conflicts with environmental and social goals, making them a focus for examining sustainable development. Over the last thirty years, these countries have been some of the main sources of global economic and production growth. However, this rapid growth process has also led to an increase in global energy consumption and CO2 emissions. The energy sector has become the fastest-growing sector in E7 countries. This has brought about problems such as excessive energy consumption and environmental pollution in the production of goods and services [8]. E7 countries are rich in natural resources, and it is expected that these resources will be managed responsibly. However, poorly managed natural resources can lead to slow economic growth and environmental degradation. On the other hand, a sustainable management approach can contribute to both environmentally sensitive practices and economic resilience. In addition, achieving sustainable development goals can be possible with strong institutional structures, transparent resource management, and good governance [9].

Companies that produce goods and services are the most important building blocks of the real economy. Therefore, the aim of this study is to analyze the performance of companies that are listed in the sustainability index of each country in the E7 according to their ESG scores and financial ratios, and to make comparisons on both micro and country levels. All companies cannot be indexed in sustainability index. There are some criteria for listed in sustainability index. These companies represent a certain standard in terms of sector diversity, company scale, and corporate transparency. Therefore, our study sample encompasses a group of companies that are somewhat homogenized in terms of company size and sectoral differences. Considering not only financial indicators but also ESG scores, for the assessment of success, has provided an integrated approach in the performance evaluation of companies. This study contributes to the literature by examining cross-regional comparisons of ESG practices and their outcomes, as well as the impact of ESG practices on financial performance, specifically in the case of E7 countries. Despite the increasing literature on ESG performance and financial indicators, critical gaps remain in understanding how these relationships play out in emerging economies. As indicated in the literature review, research has focused predominantly on developed markets or examined singular emerging economies, resulting in insufficiently comprehensive cross-country comparisons in similar communities of countries. The importance of this study lies in the sustainability practices implemented by the E7 countries today, which will determine their long-term competitive positions in global markets where ESG awareness is increasing. Companies’ ESG practices in these countries significantly affect global supply chains, resource consumption patterns, and international investment flows, making ESG performance patterns a matter of great interest for global stakeholders. Innovative methodological approaches are needed to understand the complex, non-linear relationships that traditional regression methods cannot capture.

Furthermore, cultural factors play a pivotal role in shaping ESG investment behavior in emerging economies, where shared societal norms and values influence corporate strategies and stakeholder expectations. There is also a need to explore the unobserved heterogeneity in ESG variables across different national contexts. Comparative research across emerging economies will be instrumental in uncovering these dynamics [10]. This study aims to examine the relationship between ESG performance and financial success in the E7 countries across three dimensions; it analyzes the non-linear and threshold-dependent effects of ESG scores on company performance. Second, it investigates how the unique economic and institutional structures of Brazil, China, Indonesia, India, Mexico, Russia, and Türkiye shape this relationship. This study thus contributes meaningfully to the discourse on sustainable investment by providing valuable insights for investors, companies, policymakers, and academics seeking to better understand the multifaceted nature of ESG in a globalized, yet culturally diverse, economic landscape.

The study consists of six sections. Section 1 is an introduction that outlines the study’s purpose and significance. Section 2 provides a literature review, while Section 3 describes the research methodology and data. Section 4 presents the analysis results, followed by a discussion of these findings in Section 5. Finally, Section 6 offers a comprehensive conclusion and overall evaluation of the study.

2. Literature Review

In recent years, the impact of ESG scores on company performance has become an increasingly popular area of research among academics and professionals. This literature review aims to present current studies examining the impact of ESG scores and financial indicators on companies’ performances, particularly in the E7 countries. The literature can be organized into several key themes: (1) the impact of ESG on profitability measures, (2) ESG effects on cost of capital and company valuation, (3) regional and sectoral variations in ESG-performance relationships, and (4) the temporal dynamics of ESG impacts. This systematic review examines how these themes relate to emerging market contexts, particularly the E7 countries that form the focus of our study.

2.1. ESG Impact on Profitability Measures

Studies examining the relationship between ESG practices and traditional profitability metrics have yielded mixed results, with outcomes varying by geographic region and economic development level. Albitar et al. [11] investigated the effects of ESG disclosure on company performance before and after the introduction of integrated reporting on a sample of companies from the FTSE 350 index. Their findings demonstrate how regulatory frameworks can moderate ESG-performance relationships, providing insights relevant to understanding how institutional differences across E7 countries might influence ESG effectiveness. Alsayegh et al. [12] investigated the impact of ESG score on sustainability performance among Asian companies from 2005 to 2017. The results showed that environmental and social performance was significantly and positively related to economically sustainable performance. This positive relationship in Asian emerging markets provides a comparative framework for understanding ESG dynamics in other E7 economies, particularly given the inclusion of China and India in both studies. Duque-Grisales and Aguilera-Caracuel [13] examined the impact of ESG performance of multinational companies operating in Latin America on financial performance. The study was conducted using a panel dataset consisting of 520 observations, covering the period 2011–2015, with data from 104 companies operating in Brazil, Chile, Colombia, Mexico, and Peru. Return on assets (ROA) was used as a company performance indicator. The findings revealed that both the overall ESG and the environmental, social, and governance sub-dimension scores had a negative and statistically significant relationship with ROA. The study emphasizes that ESG investments had a negative impact on their performance in developing countries due to their high cost in the short term, but this effect could evolve into a positive one under favorable conditions. This finding is particularly relevant to our study of E7 countries, as it suggests that the short-term costs of ESG implementation in emerging markets may temporarily depress financial performance before yielding long-term benefits. The negative relationship observed in Latin American markets provides a comparative baseline for understanding ESG effects in other emerging economies. Bahadori et al. [14] researched companies’ financial performance in emerging markets with reference to ESG scores. They determined that higher ESG scores were associated with higher profitability. The contrasting findings between this study and the Latin American research highlight the heterogeneous nature of ESG-performance relationships across different emerging market regions, supporting our approach of examining E7 countries individually.

2.2. ESG Effects on Company Valuation Market Performance

Market-based performance measures, particularly Tobin’s Q, have been extensively used to assess how ESG practices influence investor perceptions and company valuation.

Behl et al. [15] researched causality and autoregression effects between ESG score and the company value of the Indian energy sector. They used the Tobin Q variable as a dependent to measure market-based performance. They determined that in the short run, the ESG score affected company value negatively. They examined whether better ESG scores do not guarantee higher financial performance in the short run, although ESG leads to better company value in the long run. The temporal distinction between short-term and long-term ESG effects identified in the Indian energy sector aligns with our research focus on understanding the current state of ESG-performance relationships in 2023, capturing a specific point in the ESG implementation cycle across E7 countries.

Saygili et al. [16] examined the effects of ESG practices on corporate financial performance indicators in Borsa Istanbul. They used ROA and Tobin Q as dependent variables in the study. Results showed that environmental disclosures had a negative effect on corporate financial performance. This finding from Türkiye, one of our E7 study countries, provides direct empirical evidence for the complex nature of ESG-performance relationships in emerging markets. Aydoğmuş et al. [17] examined relations between ESG scores and companies’ value and profitability. They used Tobin Q and ROA as dependent variables and the leverage ratio as a control variable. They found a positive relationship between ESG scores and company value. The inclusion of leverage as a control variable resonates with our methodological approach of considering multiple financial ratios alongside ESG scores.

2.3. Regional and Country-Specific ESG Performance Relationships

The heterogeneous nature of institutional frameworks, regulatory environments, and market structures across different countries has led to varying ESG-performance relationships, particularly between developed and emerging markets.

Moskovics et al. [18] investigated on Brazilian companies the cause–effect relationship among market structure, ESG performance, and company efficiency. Their focus on market structure variables provides insights into how competitive dynamics might moderate ESG effectiveness in emerging markets. Duan et al. [19] researched the relationship between ESG performance and company value in Chinese manufacturing companies for the period 2009–2021. They used the Tobin Q variable as a proxy for the company’s market value in the analysis. They found that improving ESG performance increased the company’s enterprise value. Additionally, they determined that investors should integrate corporate ESG performance into their investment strategies, which helps investors secure stable and sustainable investment returns. Possebon et al. [20] examined the impact of ESG scores on the cost of capital and ROA of publicly traded companies in Brazil. Panel and quantile regression analyses using data from the period 2018–2022 showed that companies with high ESG scores have lower costs of capital and higher operational performance. In particular, it was determined that environmental performance provided a significant reduction in the cost of capital, while environmental, social, and governance dimensions all positively and significantly impacted ROA.

Sinha Ray and Goel [21] researched the impacts of ESG scores on the financial variables that may affect the performance of Indian companies. They found that ESG scores influenced ROA, ROE, and Tobin Q indicators. In the study conducted by Deb et al. [22], the effects of ESG scores of companies in the Nifty 100 index in India on company performance were examined in the short and long term. The study found that ESG scores had negative effects on the operational and financial performance of companies in the long term, while they had positive effects on market performance (Tobin’s Q) in the short and long term. The authors stated that although ESG practices were a costly process for companies, they gained a reputation in the market.

Zhang [23] analyzed the effects of ESG scores of publicly traded companies included in the Chinese CSI 300 index, on company performance in his study. In the study covering the period 2015–2022, the relationship between ESG sub-component scores and companies’ ROA, financial performance and Tobin’s Q was examined. The findings reveal that the “social” dimension in particular had statistically significant and positive effects on company performance. On the other hand, the effects of “environmental” and “governance” scores on company performance were found to be more ambiguous, and it was stated that this situation was due to heterogeneity and sectoral differences in the level of ESG implementation among companies. Zhang [24] examined the impact of corporate ESG performance on financial performance in the Chinese market. ROA, ROE, and earnings per share were used as financial variables. The study found that corporate ESG performance significantly improves its financial performance. The positive ESG-performance relationships documented in Chinese manufacturing companies contrast with findings from other emerging markets, suggesting that institutional and economic factors specific to each E7 country may moderate the effectiveness of ESG practices. This heterogeneity underscores the need for country-specific analysis within the E7 framework.

Rahmaniati and Ekawati [25] researched the impacts of ESG performance on company value, and financial performance of Indonesian companies for the period of 2016–2022. They found a positive impact of ESG implementation on company values. Popov [26] examined the impact of ESG scores on the corporate financial performance of Russian companies. The results of the analysis showed that the correlation between ROA and ESG was minimal. Aslan Çetin et al. [27] investigated the effects of the ESG score on financial performance in the Borsa Istanbul Sustainability Index for the period 2018–2022. They found that ESG factors had a significant and positive effect on ROA, ROE, net profit margin, and asset growth, but had a negative effect on the market-to-book ratio. Bumin and Ertuğrul [28] analyzed the relation between the ESG scores and the company performance of the companies in BIST Sustainability Index for the year 2022 in their study. They used the net profit margin and earnings per share variables as performance measures. They found that there was a positive relationship between environmental score and profitability, whereas there was a negative relationship between social score and profitability.

2.4. ESG Effects on Cost of Capital and Financial Risk

The impact of ESG practices on companies’ cost of capital represents another crucial dimension of the ESG-performance relationship. Giannopoulos et al. [29] examined ESG and companies’ financial performance relationship. They used ROA and Tobin Q as financial performance measures in regression analysis. They found that ESG and ROA had a negative relationship. On the other hand, the variable Tobin Q increased when ESG increased. Moussa and Elmarzouky [30] researched the effects of ESG disclosure on the cost of capital for companies. They indicated in their study that ESG reporting was positively associated with the cost of capital. These findings suggest that ESG practices may simultaneously reduce financial risk while imposing short-term costs, creating complex trade-offs that our decision tree methodology is designed to capture.

The current literature reveals that the impact of ESG scores on companies’ performance varies depending on factors such as geographic region, industry dynamics, and time horizon. In some studies, Tobin Q and ROS performance measures are also included in the analysis, while ROA and ROE are used in almost all studies. In most studies, there is a positive statistical relationship between ROA and ESG scores, while the relationship with ROE is negative, due to the costs created by the capital requirements of sustainable investments.

The inconsistent findings across different studies and regions suggest that traditional linear models may be insufficient to capture the complex, conditional nature of ESG-performance relationships. This methodological limitation in existing literature supports our choice of decision tree algorithms, which can identify specific conditions under which ESG practices enhance or diminish financial performance.

Our study addresses these gaps by: (1) providing the first comprehensive cross-country analysis of ESG-performance relationships across all E7 countries using comparable methodology, (2) employing decision tree algorithms to identify threshold effects and non-linear relationships that traditional regression methods might miss. and (3) analyzing, within the emerging market context and at the company level, how ESG score, leverage ratio, current ratio, debt to equity ratio, inventory turnover ratio and accounts receivable turnover ratio affect the ESG-financial performance relationship.

3. Method and Variables

Methods and variables that were used in the analysis are described in this section.

3.1. Method

The decision tree is a classifier whose graphical structure analyzes samples based on a set of features and labels, classifies and regresses the samples, and presents the classification results in the form of a dendrogram [31]. In this study, the decision tree model was selected for the research. This is because the performance evaluation of companies is a relatively complex process. Many independent variables are difficult to model using linear regression, given the assumed performance criterion, and the normal distribution assumption is often difficult to meet. The study’s methodological approach distinguishes itself from traditional econometric models by employing the C5.0 Decision Tree model, a machine learning algorithm. This method aims to provide a deeper understanding of how ESG factors impact corporate performance by more effectively analyzing complex and non-linear relationships. The C5.0 Decision Tree model provides a clearer understanding of the thresholds in determining the role of ESG scores on companies’ financial performance metrics. The findings aim to provide valuable information to companies in the E7 countries on developing their current situations to turn into sustainability-focused strategies and improving their corporate performance. It also highlights the importance of ESG integration for policymakers in achieving sustainable development goals.

Traditional regression models tend to explain the relationship between variables with a single “average effect.” For example, a regression analysis might show that an increase in ESG scores has a statistically significant positive impact on ROA for companies overall. However, the C5.0 decision tree algorithm can reveal the conditional and heterogeneous relationships underlying this averaging. It makes a critical contribution to understanding the factors (such as country, sector, and company-specific characteristics) that moderate the link between ESG and financial performance in heterogeneous environments like emerging markets. Consequently, C5.0 provides a more nuanced and applicable perspective to the literature by answering the question “Under what conditions and for which companies is ESG most effective?” rather than “Does ESG always work everywhere ?”

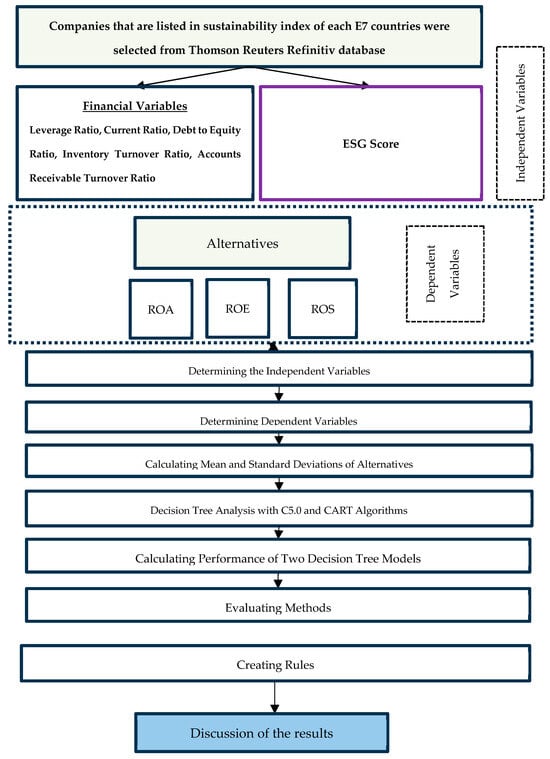

Figure 1 shows the flowchart of the proposed methodology:

Figure 1.

Flowchart of the proposed methodology.

The method evaluates all independent data (ESG scores and financial variables) simultaneously and selects the variable that provides the greatest information gain at each step. Instead of assuming a linear relationship between variables, the C5.0 algorithm determines the cut-off points for continuous variables (such as ESG scores and financial variables) that best separate company performance categories. These thresholds are not predetermined by the researcher but emerge directly from the data. The hierarchical structure of the decision trees, along with the determination of the rules, naturally captures the interactions between ESG scores and financial variables. In other words, it reveals how the impact of a company’s sustainability practices varies depending on its financial situation. Adding “country” as a category to the algorithm allows us to determine whether ESG impacts apply to all E7 economies or whether they vary systematically across countries. This provides important information about the role of institutional and economic context.

A decision tree is a method which assists with describing the decisions that will be made, the cases that might happen, and the results that are related to each of the events and decisions. Time-series forecasting predicts future trends based on provided feature data. Decision tree-based models have trouble extrapolating. A neural network or linear regression model can extrapolate the trend of a time series; decision tree-based models cannot, as they rely on decision boundaries derived from the training data [32]. In this study, there was not any analysis made to forecast, but rather the current situation was determined. The choice of the decision tree method in this research is based on three key advantages of this methodology. First, it facilitates the visualization and interpretation of complex and conditional relationships between ESG and financial performance. Second, unlike traditional econometric approaches, it can objectively identify critical decision points by considering variables. The third and most important advantage is the flexibility it offers to analyze both continuous financial indicators and categorical country variables within the same model. This methodological approach can clearly demonstrate the ESG score ranges at which companies achieve optimal financial performance, the importance of ESG in different country contexts, and the financial and institutional conditions under which managers should prioritize ESG strategies. Additionally, companies often prepare sustainability reports one year behind and disclose them to the public. The global financial crisis of 2008–2009 and the pandemic shock of 2020–2021 are important causes of the developments in the global economy in 2023. The inflationary effects of the expansionary monetary policies implemented during these periods became apparent in 2022; therefore, anti-inflationary monetary policies were implemented in 2023, particularly in developed countries. This resulted in a contraction of the money supply and an increase in interest rates. Thus, 2023 witnessed a slowdown in global growth and trade volume. While developed countries prioritized combating inflation, developing countries found it difficult to access external resources, which challenged them to both maintain their import capacity and increase their exports [33]. Based on all these reasons, the analysis was conducted only for the year 2023.

A C5.0-based decision tree works by splitting the sample based on variables that provide the highest information gain. Each sub-sample is defined by first splitting and then re-splitting, a process which is usually based on different variables, and the process will continue to repeat until the sub-sample cannot be split. The information gain measure is used to select test attributes at each node in the tree. The attribute with the highest information gain value will be selected as the parent for the next node [34].

When creating a C5.0-based decision tree, if all the examples in the subset belong to the same class, a leaf node is created directly for this subset. If all the attributes in the subset have been processed and there is no other attribute that can be used to separate the dataset, the classification is made based on the class to which the majority of the examples in this subset belong, and a leaf node is created [35]. Fundamental methods in C5.0 decision tree algorithm are as follows [36]:

Entropy is a metric that measures the disorder and uncertainty of information in a dataset. It calculates the uncertainty among the possible outcomes of a random variable. Information gain measures the decrease in entropy resulting from partitioning by a feature. It indicates how informative a feature is for classification. Overfitting occurs when a model adapts too closely to the training data and therefore generalizes poorly on new data. C5.0 implements techniques such as pruning and boosting to prevent overfitting. Boosting is a method of creating a stronger classifier by sequentially training weak classifiers. C5.0 implements a method based on the AdaBoost algorithm. The weights of misclassified examples are increased, allowing the model to pay more attention to these examples.

The C5.0 decision tree algorithm’s performance was compared to the classification and regression (CART) decision tree algorithm in the study. The CART decision tree can model the relationship between dependent variables and independent variables for homogeneous subclasses and show this relationship in the form of a tree structure. CART uses the Gini index to determine which attribute should generate the branch. The strategy is to choose the attribute whose GINI Index is the minimal after splitting [37].

It is important to examine which types of errors caused incorrect classifications. Table 1 presents the confusion matrix. The confusion matrix reveals the strengths and weaknesses of the model through its components, thus providing the necessary information for optimization of the model. As shown in Table 1, if a researcher rejects a null hypothesis that is indeed true in the population, a type I error (false positive) occurs, and if the researcher cannot reject a null hypothesis that is actually false in the population, a type II error (false negative) occurs. Errors between types I and II can never be avoided. The F1 score is calculated as the harmonic mean of precision and sensitivity. F1 score, has the capacity to evaluate the performance of the model and is used to accurately reflect the effectiveness of the model, especially in imbalanced data sets. Accuracy is the simplest evaluation score and is defined as the ratio of correctly predicted observations to the total number of observations. Precision is the ratio of correctly predicted positive cases to all positive cases predicted by the model. This measure is used to estimate whether the model is reliable. Sensitivity shows the proportion of positive classes that the model correctly predicted. In other words, it shows how many of the true positive cases were correctly predicted. Specificity refers to the rate at which the model correctly predicts the negative class. This is the rate at which the model correctly predicts a class as negative among all true negative examples.

Table 1.

Confusion matrix and classification performance metrics.

3.2. Variables of the Study

Variables in the analysis and their definitions can be seen in Table 2. ESG scores of companies and financial ratios were taken from Thomson Reuters Refinitiv Eikon database. In the study, 477 companies operating in Brazil, China, Russia, India, Indonesia, Mexico, and Türkiye, referred to as E7 countries, were analyzed for the year 2023.

Table 2.

Variables and their definitions in the study.

ROA, ROE and ROS variables were categorized as “low,” “medium,” and “high” in the decision tree analysis. Thresholds were determined by taking three-year sectoral average values. According to the three-year sectoral average value, values below 0.90 were determined as “low”, values above 1.10 as “high” and values between these two values as “medium”.

4. Analysis Results

Table 3 shows the mean statistics of company variables in E7 countries for the analysis. According to Table 3, Russia, Mexico, and Brazil had higher averages in leverage ratios compared to other countries. This indicated that companies in these countries used debt relatively more intensively. Indonesia and China had the highest averages in terms of current ratio, as their liquidity status was stronger than other countries. Russia and Mexico were above the average in terms of debt-to-equity ratio, while Indonesia and India remained at lower levels. In terms of inventory turnover ratio, Türkiye and China presented quite high average values, compared to other countries, which indicated that inventory turns over faster in these countries, or, alternatively, this may be due to differences in sector structure. China and Türkiye stand out in their accounts receivable turnover ratio averages, which shows that there are significant differences in the collection speed of receivables.

Table 3.

Mean (M) and standard deviation (SD) statistics for variables in E7 countries.

In ESG scores, the averages of all countries are close to each other and range between 60 and 80; this shows that their sustainability performance was generally at similar levels. In terms of profitability indicators, ROA, ROE, and ROS achieved the highest average values in Türkiye. It was seen that companies generally exhibit improved profitability.

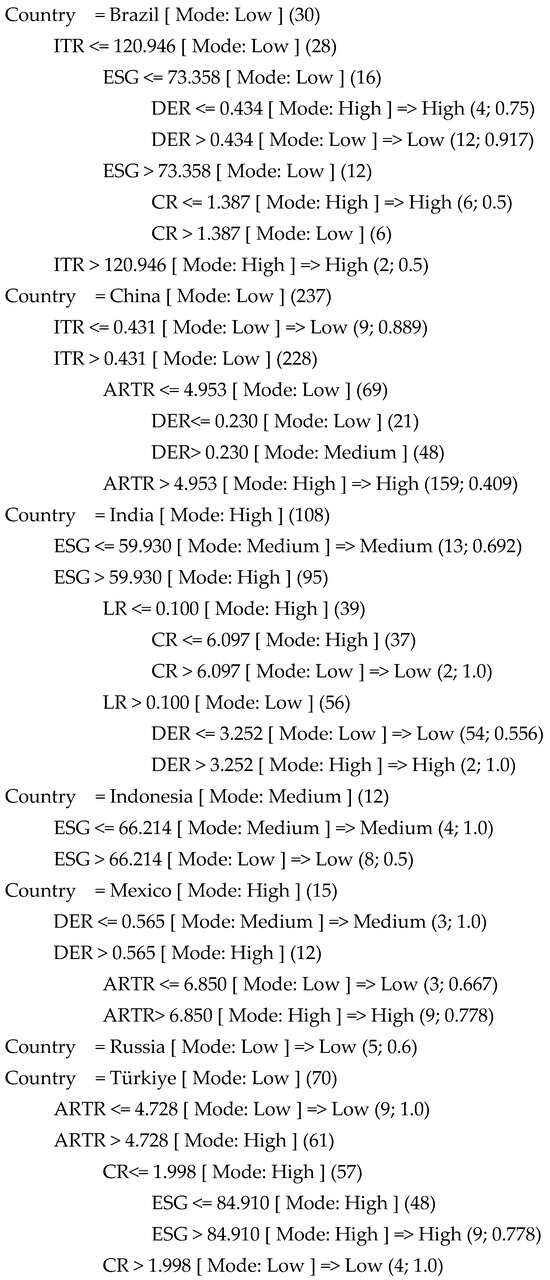

In the performance analysis of companies in E7 countries in terms of ROA, ESG scores and five financial ratios were used as independent variables, and, as a result of the analysis, the accuracy rate was found to be 62.5% with the C5.0 algorithm and 51.3% with the CART algorithm. Decision tree results for ROA can be seen in Figure 2:

Figure 2.

Text of decision tree results for ROA analysis.

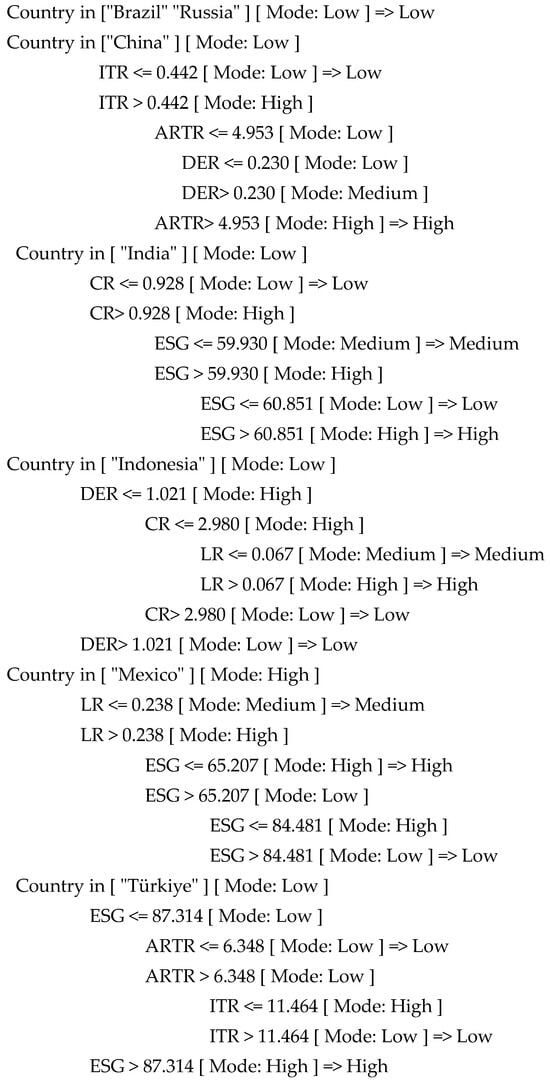

The same independent variables were used in the performance analysis of the companies in the E7 countries in terms of ROE, and as a result of the analysis, the accuracy rate was found to be 56.80% with the C5.0 algorithm and 54.90% with the CART algorithm. Decision tree results for ROE can be seen in Figure 3.

Figure 3.

Text of decision tree results for ROE analysis.

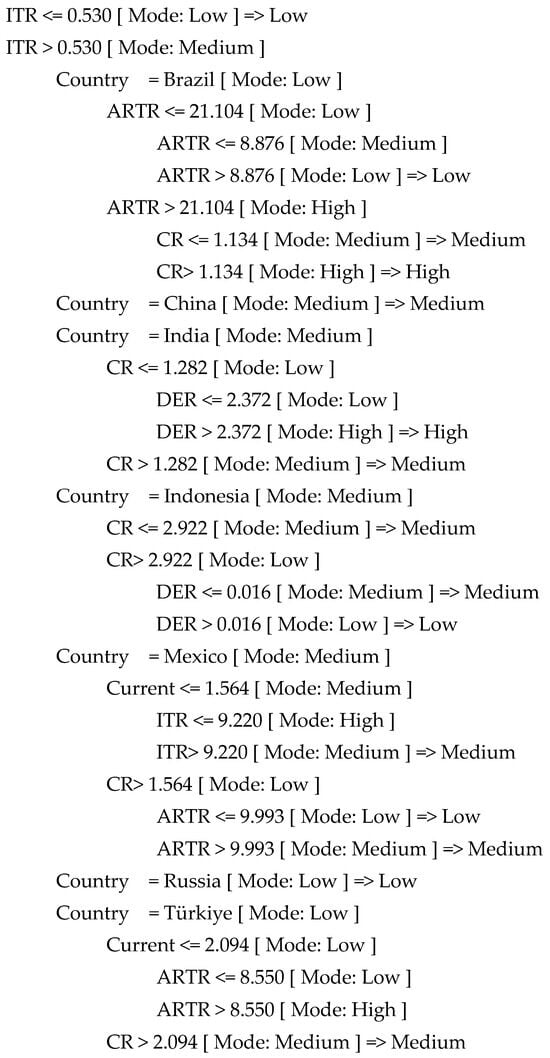

The same independent variables were used in the performance analysis of the companies in the E7 countries to assess profit margin before interest and tax (Return on Sales, ROS). As a result of the analysis, the accuracy rate was found to be 59.70% with the C5.0 algorithm and 52.40% with the CART algorithm. Decision tree results for ROS can be seen in Figure 4.

Figure 4.

Text of Decision Tree Results for ROS Analysis.

C5.0 decision tree algorithm’s performance metrics were compared to CART decision tree algorithm in Table 4.

Table 4.

Classification-based performance metrics in C5.0 and CART algorithms.

Accuracy rate is useful for performance measurement. The C5.0 algorithm had higher accuracy for all dependent variables than the CART algorithm in the study. In machine learning, 60–70% accuracy is expected, especially in heterogeneous data sets (different countries, sectors) due to the non-linear characteristics of financial variables. Excessive data sizes across countries and non-linear relationships in financial variables cause the model’s accuracy rate to decrease moderately. The reasons the accuracy rate was around 60% can be examined under three headings: (1) The complexity and heterogeneity of emerging market data inherently limit predictive accuracy, (2) The cross-sectional nature of our 2023 data captures a specific economic climate that may not be fully generalizable, and (3) Financial performance is influenced by numerous factors beyond ESG scores and the financial ratios included in our model. In addition to the accuracy rate, other performance metrics that form the confusion matrix were used to check the general performance of the classification model. The ROE and ROS variables were categorized as “low,” “medium,” and “high” in the decision tree analysis. Thus, the multiclass confusion matrix was prepared as a 3 × 3 setup. In multiclass classification, the average values are calculated instead of finding metrics for each class. Calculating averages can be carried out using micro or macro averaging methods. Table 4 shows micro-averaged values, which give the performance of the model across all classes. Precision is used to assess the reliability of the model. C5.0 algorithm’s reliability was determined to be higher than CART algorithm for ROA, ROE, and ROS analysis. The sensitivity rate was determined to be lower than the precision rate for all dependent variables across both algorithms, except for the ROS analysis with the C5.0 algorithm.

These empirical findings reveal distinct patterns of ESG effectiveness across E7 countries, with accuracy rates of 56.80–62.5% for the C5.0 algorithm indicating moderate but meaningful predictive power. The variation in model performance across ROA, ROE, and ROS metrics suggests that ESG impacts operate differently depending on the specific performance measure, highlighting the need for nuanced policy approaches rather than uniform ESG mandates across all financial indicators.

5. Discussion

57% of Brazilian companies operated with low ROA in 2023. The distinguishing financial variables influencing low ROA were the debt-to-equity ratio and inventory turnover ratio. 61% of companies operating with a low inventory turnover ratio had low ROA. The low turnover ratio indicated that there was difficulty in converting products into cash through sales. 75% of companies with a low inventory turnover and an ESG score below 73 achieved a low ROA. 91% of companies with a low inventory turnover ratio, scoring below a 73 ESG score, and having a debt-to-equity ratio above 0.43 achieved low ROA. In summary, the situation of the Brazilian companies in the sample in 2023 was that debts were more prevalent in the financial resource composition. They operated with a low inventory turnover ratio and they had a good ESG score, and ROA was low, which was a performance measure. As in the studies of Saygili et al. [16] and Duque-Grisales and Aguilera-Caracuel [13], a negative relationship was found between ESG score and ROA for Brazilian companies in the year 2023. Here, one might think that financial variables rather than ESG scores predominantly determined low ROA.

While 61% of Chinese companies operated with either medium or high ROA in 2023, 39% achieved low ROA. It was observed that the ESG scores of Chinese companies were not a distinguishing variable. 63% of companies with a high inventory turnover ratio operated with a medium-high ROA. 65% of companies with a high inventory turnover ratio and high receivables turnover ratio operated with a medium to high ROA. In terms of turnover rates used in measuring the performance of activities, high inventory and accounts receivable turnover ratios indicated that products were sold and accounts receivable were collected quickly, implying no collection problem.

65% of Indian companies operated with medium to high ROA in 2023. It was observed that the contribution of ESG score to ROA was positive. As in the studies of Alsayegh et al. [12], Bahadori et al. [14], Possebon et al. [20] and Aslan Çetin et al. [27] a positive relationship was found between ESG score and ROA for Indian companies in the year 2023. However, when companies prefer to finance their investments with debt, it can be said that they cannot fully benefit from the tax deduction created by the interest payments of the debt if the debt-to-equity ratio is low. This situation resulted in low ROA. The current ratio is a variable used to interpret the solvency of the business. Although the low current ratio was insignificant when companies used low levels of debt, the effect of ESG scores on ROA in Indian companies was distinctive and positive due to the reputation created by the ESG score and the trust it provides to investors.

41% of Indonesian companies operated with a medium ROA in 2023. 50% of companies with an ESG score higher than 66 achieved low ROA, while 50% achieved medium and high ROA. It was also noteworthy that despite the small number of companies, the distinguishing factor in the interpretation of ROA was the ESG score rather than financial variables.

In 2023, 47% of Mexican companies in the sample operated with high ROA. 58% of companies with a high debt-to-equity ratio and 78% of companies with a high accounts receivable turnover ratio achieved a high ROA. It was determined that Mexican companies benefited from the tax advantage of debt in 2023 and did not experience any problems in collecting receivables.

For the year 2023, 53% of Turkish companies achieved a medium or high ROA. 50% of companies with a high accounts receivable turnover ratio and a low current ratio, achieved a high ROA. The ESG score of the relevant companies was below 84, while 51% of these companies with a high inventory turnover ratio achieved a high ROA. ESG scores in Türkiye were higher than those of countries with significant ESG variables. While the ESG distinction score in Brazil was 73, in contrast, it in India was 64. The financial variables that were effective in ROA performance analysis in Turkish companies were accounts receivable turnover ratio and inventory turnover ratio, similar to those used in China. Although the efficient collection of receivables did not resolve the issue of low liquidity concerning solvency, the high speed of conversion of inventory into cash made a positive contribution to ROA.

While 63% of Chinese companies operated with medium and high ROE in the year 2023, 37% achieved low ROE. It was determined that 65% of Chinese companies operating with a high inventory turnover ratio and 68% of companies with a high accounts receivable turnover ratio achieved medium to high ROE. It was seen that the same financial variables in the ROA analysis were also distinguishing variables in the ROE analysis. It was determined that ROE decreased or remained stable on average for Chinese companies in the lower classifications, where the ESG score influenced the results. Here, it can be interpreted that ESG scores had a negative effect on ROE, especially since there were investments that needed to be made to ensure environmental sustainability and digital transformation expenses.

In the year 2023, 59% of Indonesian companies achieved either medium or high ROE. Unlike the ROA analysis, it was determined that the ESG score did not make a difference for Indonesian companies in 2023. However, only the debt-to-equity ratio among financial variables created a significant difference in the classification in terms of ROE.

It was seen that the ESG score, which positively affects ROA in Indian companies, was also effective in ROE. In the year 2023, 40% of Indian companies achieved low ROE, and 60% achieved medium and high ROE. 62% of companies with a high current ratio and an ESG score above 59 attained medium to high ROE.

For the year 2023, 40% of Mexican companies achieved low ROE, 20% had medium ROE, and 40% had high ROE. Equality continued to be maintained in companies with high debt financing ratios. 46% of these companies had low ROE, 8% had medium ROE, and the remaining 46% had high ROE. The equivalence between low and high ROE was broken by the ESG score. Among companies with a high leverage ratio and an ESG score above 65, 54% had low ROE and 46% had high ROE. Here, the effect of ESG on ROE was determined to be negative.

For the year 2023, 57% of companies in Türkiye operated with low ROE, 7% with medium ROE, and 36% with high ROE. 61% of these companies, with an ESG score below 87, achieved low ROE. Among companies with an ESG score below 87, 52% of those operating with a high accounts receivable turnover ratio achieved low ROE. The next step of the decision tree reveals which variable affects those achieving high ROE. The study is significant because 52% of companies operating with a low inventory turnover rate achieved high ROE.

The C5.0 algorithm excludes Russia and China from its scope of analysis for measuring the ROS performance of companies. In contrast to the ROA and ROE analyses, the first level of differentiation, of the decision tree in the ROS performance analysis was the inventory turnover ratio, rather than the country. Forty percent of the companies were classified at a high inventory turnover ratio above 0.530 and achieved a medium ROS in 2023. While the companies with low ROS were 37%, the companies with high ROS were 23%. All five countries were included in the second-stage classification, and the analysis results were shared.

In the lower-level classifications of the decision tree in the Brazilian sample, it was determined that the dominant distinguishing variable among the companies was the accounts receivable turnover ratio. 53% of Brazilian companies with a high inventory turnover ratio achieved low Return on Sales (ROS) in 2023. 61% of companies with a low accounts receivable turnover ratio reported low ROS. In Brazilian companies, although the rate of conversion of inventory into cash was high in the year 2023, they made sales on credit, had problems in collecting receivables, and the income they obtained from their main activities was low.

43% of Indian companies with high inventory turnover achieved low return on sales in 2023. Among Indian companies with a high inventory turnover ratio, 38% of these companies with a high current ratio had medium ROS. Among Indian companies with a high inventory turnover ratio, 62% with a low current ratio, and a low debt to equity ratio achieved low ROS. When the leverage ratio of these companies was high, meaning they financed their investments with more debt, 67% of the companies achieved low ROS. When the ESG score of these companies was below 72, the proportion of companies that achieved low ROS rose to 68%. Therefore, the distinguishing variable in the ROS performance analysis of Indian companies in 2023 was the current ratio, or solvency ratio. Having high solvency means that the company has sufficient liquidity to make payments at any time. The EBITDA margin of these companies was moderate. Low ROS was the dominant result that started with a low current ratio and continued as the variables remained at lower levels.

66% of Indonesian companies with high inventory turnover ratios achieved medium Return on Sales (ROS) in 2023. Among Indonesian companies with a high inventory turnover ratio, 85% of companies with a low current ratio achieved medium ROS. Forty-six percent of Mexican companies with a high inventory turnover ratio achieved a medium Return on Sales (ROS) in the year 2023. Among Mexican companies with a high inventory turnover ratio, 55% of companies with a low current ratio achieved a medium ROS, while 6% of companies with a high current ratio achieved a low ROS. 44% of Turkish companies with a high inventory turnover ratio achieved low ROS in 2023. While 36% of Turkish companies with high inventory turnover ratio, low current ratio, and high accounts receivable turnover ratio achieved high ROS, 39% of these companies with low leverage ratios achieved medium ROS in 2023.

6. Conclusions

Corporate financing constraints reached a record level on a global scale in the year 2023. Due to the slowdown in economic growth and increasing operating and financing costs, the global Working Capital Requirement (WCR) reached 76 days of turnover. Therefore, payment terms increased further, especially in Asia and North America, and receivable terms increased to 59 days. The proportion of companies with receivables terms exceeding 60 days of turnover was 42% globally at the end of 2023. This indicates that companies are waiting longer to receive payments and that there are risks related to cash flow problems. India exhibited the most consistent and positive ESG-performance relationships for the three financial indicators examined. However, these findings must be interpreted in the context of India’s unique institutional and economic conditions in 2023. The reforms and regulations made for ESG in India have led companies to prioritize ESG scores. This also attracts the attention of international investors who invest according to ESG scores. Therefore, the reflection of the 2023 economic outlook [34] on companies also supports the results of this analysis. India’s Business Responsibility and Sustainability Report (BRSR), a framework for ESG reporting, came into effect in 2023. The increase in bank lending and rising capital spending by companies in India, coupled with improving conditions, suggests that economic growth in India will accelerate. The high leverage ratio and debt ratio also confirm that Indian businesses were in an economic climate with strong borrowing opportunities. The Reserve Bank of India’s target of maintaining an average inflation rate of 2–6% by 2030 also provides incentives for companies to invest. India is making investments, particularly in renewable energy technologies, to achieve its net-zero carbon target by 2070 [38].

These empirical patterns suggest that successful ESG policy implementation requires country-specific institutional frameworks rather than standardized global approaches. The conditional relationships identified through our decision tree analysis indicate that policymakers should consider company-level financial health and sector characteristics when designing ESG regulations and incentives.

ROA was low only in Brazil for the companies evaluated within the sample for the year 2023. Russia was excluded from the analysis, and China, India, Indonesia, Mexico, and Türkiye were the remaining countries that received medium and above values. Only the ESG score variable was the distinguishing factor in performance classification in Indonesia. Financial variables did not affect ROA classification in Indonesia. In the ROA analysis, the ESG score did not affect the countries of China and Mexico. In May 2024, China published draft regulations to unify corporate sustainability disclosures with a phased implementation plan. Therefore, China aims for a phased implementation for companies rather than a uniform approach, starting with larger, publicly listed companies and then expanding to medium and small companies [39]. Among the countries where the ESG score created a difference in ROA analysis, Türkiye had the highest ESG score difference. High inflation in Türkiye in 2023 was the primary factor affecting companies, regardless of their ESG performance. Legal regulations regarding ESG have been implemented, and the publication of sustainability reports has become mandatory for companies. Brazil was the country where the ESG score created a difference in ROA analysis. However, its effect was not as high as financial variables. In contrast, India was the country where the ESG score had a more significant effect than financial variables.

In the companies evaluated within the sample for the year 2023, ROE was found to be low only in Türkiye and Mexico. Russia and Brazil were excluded from the analysis scope by a decision tree, while the remaining countries, China, India, and Indonesia, received medium or above values. While the ESG score had a negative contribution to the ROE of the companies in Türkiye, China, and Mexico, it contributed positively to ROE in India. Mexico is North America’s second-largest economy. Its geopolitical location is heavily influenced by its manufacturing sector. NAFTA has had a positive impact on Mexico’s manufacturing industry. Mexico’s transformation into an international logistics powerhouse, while positively impacting the country’s economy, has also led to further environmental degradation. Consequently, the country is now increasingly focusing on sustainability measures and environmental regulations [40]. In Indonesia, unlike ROA, the ESG score did not contribute to ROE significantly. In China, the financial variables that had a distinctive effect on ROE performance were the same as those for ROA. In contrast, in Indonesia, the debt-to-equity ratio, and in Türkiye, the inventory turnover ratio, had distinctive impacts. The necessity for companies to incur environmental investment expenditures to implement the circular economy approach will create a financial requirement in the short term. This may cause a decrease in return on equity for the shareholders. However, in the long term, these investments made for environmental improvement will increase the demand for the business’s products and services by enhancing the business’s brand reputation, especially among its customers and potential shareholders [41].

The companies evaluated within the sample for the year 2023 had only medium ROS values in Indonesia and Mexico. Russia and China were excluded from the analysis scope by a decision tree; the remaining countries of Brazil, India, and Türkiye received low ROS values. In the ROS analysis, the first level of differentiation of the decision tree was the inventory turnover ratio. In the ROA and ROE analysis, the first differentiation began at the country level. While the ESG score had a negative impact on the ROS performance of companies in India, it did not contribute significantly to ROE in Brazil, Indonesia, Mexico, and Türkiye. The financial variables that had a distinctive effect on ROS performance were the accounts receivable turnover ratio for Brazil and the current ratio for India, Indonesia, and Mexico.

The variable relationships between ESG criteria and performance in E7 countries highlight the critical importance of alignment with local conditions to achieve the desired benefits from policies. For instance, countries like India, where ESG scores consistently create a positive impact on various performance indicators, represent successful models of this alignment. On the other hand, the mixed results observed in Türkiye, China, and Mexico point to an area of opportunity, indicating that existing policies should be reviewed and refined by taking specific market inefficiencies and structural gaps into account.

Policymakers recognize the critical importance of standardized and reliable data to fully realize the potential of ESG investments. This need indicates that for companies, investing in technological innovations for capturing, processing, and reporting big data represents a priority opportunity area. The role of energy and digital transformation-oriented policies and incentives is set to become increasingly decisive. For instance, artificial intelligence technologies have the potential to make tangible contributions to environmental sustainability by simultaneously optimizing energy demand forecasting and energy efficiency. The primary role of policymakers in this process is to encourage companies to integrate sustainability performance into the core of their main management strategies, while establishing transparent and mandatory ESG reporting frameworks. From a policy design perspective, these findings suggest that the effectiveness of ESG regulation would be enhanced by one that considers the conditional nature of sustainability benefits and adopts threshold-based approaches. Ultimately, systematic frameworks, such as the decision tree methodology, will enable policymakers to identify critical intervention points and design targeted, effective policy measures.

A review of the literature shows that the majority of the studies on E7 countries include comparisons of macro variables. In this study, the financial data and ESG scores of companies listed on the stock exchanges of each E7 country, where ESG scores are accessible, were taken into consideration integratively, and the company performances were compared between countries. With the C5.0 and CART algorithms, the ROA, ROE, and ROS performance values were considered and classified according to countries, financial variables and ESG scores of companies. Some limitations of the study should also be considered. The availability of ESG data limited the scope of the analysis. In future studies, the results can be tested against different financial and performance variables. The differentiation in how global and local economic developments are reflected, first in countries and then in companies, can be examined by varying the analysis timeframe during the specified year. Furthermore, the dataset was limited to only one year of performance indicators. Future studies could expand on these limitations, include sector-based differentiation, and investigate the long-term impact of ESG factors on performance through time-series analysis. However, even among the companies included in the index, differences in sectoral structure and company scale can exist. These factors were not included as separate control variables in this study. ESG score can be analyzed into its separate components and more detailed analyses can be performed in terms of its subcomponents.

Author Contributions

Conceptualization, S.F. and S.A.; methodology, S.F. and B.O.T.; software, S.F.; validation, S.F. and S.A.; formal analysis, S.F. and B.O.T.; investigation, S.F. and S.A.; resources, S.F. and S.A.; data curation, S.A.; writing—original draft preparation, S.F.; writing—review and editing, S.F., S.A. and B.O.T.; visualization, S.F. and B.O.T.; supervision, S.F. and B.O.T.; project administration, S.F.; funding acquisition, S.F. and S.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data set was taken from Thomson Reuters Refinitiv Eikon database.

Conflicts of Interest

The authors have no competing interests to declare relevant to this article’s content.

References

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Talan, G.; Sharma, G.D.; Pereira, V.; Muschert, G.W. From ESG to Holistic Value Addition: Rethinking Sustainable Investment from the Lens of Stakeholder Theory. Int. Rev. Econ. Financ. 2024, 96, 103530. [Google Scholar] [CrossRef]

- Clément, A.; Robinot, É.; Trespeuch, L. Improving ESG Scores with Sustainability Concepts. Sustainability 2022, 14, 13154. [Google Scholar] [CrossRef]

- Global Reporting. Available online: https://www.globalreporting.org (accessed on 10 March 2025).

- KPMG, The Move to Mandatory Reporting: Survey of Sustainability Reporting 2024. Available online: https://kpmg.com/xx/en/our-insights/esg/the-move-to-mandatory-reporting.html (accessed on 15 April 2025).

- Ahmad, H.; Yaqub, M.; Lee, S.H. Environmental-, Social-, and Governance-Related Factors for Business Investment and Sustainability: A Scientometric Review of Global Trends. Environ. Dev. Sustain. 2024, 26, 2965–2987. [Google Scholar] [CrossRef]

- Schoenmaker, D.; Schramade, W. Principles of Sustainable Finance; Oxford University Press: Oxford, UK, 2019. [Google Scholar]

- Liang, Y.; Rahman, S.U.; Shafaqat, A.; Ali, A.; Ali, M.S.E.; Khan, H. Assessing Sustainable Development in E-7 Countries: Technology Innovation, and Energy Consumption Drivers of Green Growth and Environment. Sci. Rep. 2024, 14, 28636. [Google Scholar] [CrossRef]

- Dai, X.; Wu, J.; Fan, S.; Zhou, Y. Advancing Economic Sustainability in E7 Economies: The Impact of Green Finance, Environmental Benefits, and Natural Resource Management. Front. Environ. Sci. 2025, 12, 1509564. [Google Scholar] [CrossRef]

- Rooh, S.; El-Gohary, H.; Khan, I.; Alam, S.; Shah, S.M.A. An Attempt to Understand Stock Market Investors’ Behaviour: The Case of Environmental, Social, and Governance (ESG) Forces in the Pakistani Stock Market. J. Risk Financ. Manag. 2023, 16, 500. [Google Scholar] [CrossRef]

- Albitar, K.; Hussainey, K.; Kolade, N.; Gerged, A.M. ESG Disclosure and Firm Performance before and after IR: The Moderating Role of Governance Mechanisms. Int. J. Account. Inf. Manag. 2020, 28, 429–444. [Google Scholar] [CrossRef]

- Alsayegh, M.; Abdul Rahman, R.; Homayoun, S. Corporate Economic, Environmental, and Social Sustainability Performance Transformation through ESG Disclosure. Sustainability 2020, 12, 3910. [Google Scholar] [CrossRef]

- Duque-Grisales, E.; Aguilera-Caracuel, J. Environmental, Social and Governance (ESG) Scores and Financial Performance of Multilatinas: Moderating Effects of Geographic International Diversification and Financial Slack. J. Bus. Ethics 2021, 168, 315–334. [Google Scholar] [CrossRef]

- Bahadori, N.; Kaymak, T.; Seraj, M. Environmental, Social, and Governance Factors in Emerging Markets: The Impact on Firm Performance. Bus. Strategy Dev. 2021, 4, 411–422. [Google Scholar] [CrossRef]

- Behl, A.; Kumari, P.S.R.; Makhija, H.; Sharma, D. Exploring the Relationship of ESG Score and Firm Value Using Cross-Lagged Panel Analyses: Case of the Indian Energy Sector. Ann. Oper. Res. 2022, 313, 231–256. [Google Scholar] [CrossRef]

- Saygili, E.; Arslan, S.; Birkan, A.O. ESG Practices and Corporate Financial Performance: Evidence from Borsa Istanbul. Borsa Istanb. Rev. 2022, 22, 525–533. [Google Scholar] [CrossRef]

- Aydogmus, M.; Gülay, G.; Ergun, K. Impact of ESG Performance on Firm Value and Profitability. Borsa Istanb. Rev. 2022, 22, S119–S127. [Google Scholar] [CrossRef]

- Moskovics, P.; Wanke, P.; Tan, Y.; Gerged, A.M. Market Structure, ESG Performance, and Corporate Efficiency: Insights from Brazilian Publicly Traded Companies. Bus. Strategy Environ. 2023, 33, 241–262. [Google Scholar] [CrossRef]

- Duan, Y.; Yang, F.; Xiong, L. Environmental, Social, and Governance (ESG) Performance and Firm Value: Evidence from Chinese Manufacturing Firms. Sustainability 2023, 15, 12858. [Google Scholar] [CrossRef]

- Possebon, E.A.G.; Cippiciani, F.A.; Savoia, J.R.F.; de Mariz, F. ESG Scores and Performance in Brazilian Public Companies. Sustainability 2024, 16, 5650. [Google Scholar] [CrossRef]

- Sinha Ray, R.; Goel, S. Impact of ESG Score on Financial Performance of Indian Firms: Static and Dynamic Panel Regression Analyses. Appl. Econ. 2022, 55, 1742–1755. [Google Scholar] [CrossRef]

- Deb, R.; Behra, A.; Dusmanta, K. ESG Scores and Its Impact on Firm Performance: Study from Nifty100 Firms. IIM Kozhikode Soc. Manag. Rev. 2024, 19, 1–13. [Google Scholar] [CrossRef]

- Zhang, J. An empirical Analysis of ESG Scores and Firm Performance Based on the CSI 300 Index. In Proceedings of the 2024 2nd International Conference on Financial Mathematics, Investment and Business Management (FMIBM 2024), Phoenix, AZ, USA, 25–26 May 2024. [Google Scholar] [CrossRef]

- Zhang, L.S. The Impact of ESG Performance on the Financial Performance of Companies: Evidence from China’s Shanghai and Shenzhen A-share Listed Companies. Front. Environ. Sci. 2025, 13, 1507151. [Google Scholar] [CrossRef]

- Rahmaniati, N.P.G.; Ekawati, E. The Role of Indonesian Regulators on the Effectiveness of ESG Implementation in Improving Firms’ Non-Financial Performance. Cogent. Bus. Manag. 2024, 11, 2293302. [Google Scholar] [CrossRef]

- Popov, E. The Impact of ESG Ratings on the Corporate Financial Performance of Russian Companies. In Proceedings of the International Scientific Forestry Forum (Forestry Forum 2024), Voronezh, Russia, 15–18 October 2024. [Google Scholar] [CrossRef]

- Aslan Çetin, F.; Öztürk, S.; Akarsu, O.N. The Effect of ESG Data of Companies on Financial Performance: A Panel Data Analysis on The BIST Sustainability Index. Sosyoekonomi 2024, 32, 125–146. [Google Scholar] [CrossRef]

- Bumin, M.; Ertuğrul, A. Effect of ESG Scores on Firm Performance: Evidence from Borsa Istanbul Sustainability Index. Int. J. Acad. Res. Bus. Soc. Sci. 2024, 14, 1033–1047. [Google Scholar] [CrossRef]

- Giannopoulos, G.; Kihle Fagernes, R.V.; Elmarzouky, M.; Afzal Hossain, K.A.B.M. The ESG Disclosure and the Financial Performance of Norwegian Listed Firms. J. Risk Financ. Manag. 2022, 15, 237. [Google Scholar] [CrossRef]

- Moussa, A.S.; Elmarzouky, M. Beyond Compliance: How ESG Reporting Influences the Cost of Capital in UK Firms. J. Risk Financ. Manag. 2024, 17, 326. [Google Scholar] [CrossRef]

- Chen, H. An ESG-Modified Credit Risk Assessment Model Based on Decision Tree Model. In Proceedings of the 2022 2nd International Conference on Economic Development and Business Culture (ICEDBC 2022), Dali, China, 24–26 June 2022; Available online: https://www.atlantis-press.com/proceedings/icedbc-22/125983566 (accessed on 15 April 2025).

- Ali, M.; Alqahtani, A.; Jones, M.W.; Xie, X. Clustering and Classification for Time Series Data in Visual Analytics: A Survey. IEEE Access 2019, 7, 181314–181338. [Google Scholar] [CrossRef]

- Aegean Region Chamber of Industry, Annual Economic Reports 2023. Available online: https://static.ebso.org.tr/documents/yayinlar/yillik-ekonomi-raporlari/2023-yilinda-dunya-ve-turkiye-ekonomisi-2024-yilina-bakis-restorasyon-mu-yoksa-yeniden-insa-mi-449.pdf (accessed on 1 August 2025).

- Cirgon, B.Z. Comparison of C4.5 and C5.0 Methods for Classification of Bad Credit and Good Credit. Formosa J. Sci. Technol. 2025, 4, 789–808. [Google Scholar] [CrossRef]

- Pang, S.L.; Gong, J.Z. C5.0 Classification Algorithm and Application on Individual Credit Evaluation of Banks. Syst. Eng. Theory Pract. 2009, 29, 94–104. [Google Scholar] [CrossRef]

- Jansson, J. Decision Tree Classification of Products Using C5.0 and Prediction of Workload Using Time Series Analysis. Master’s Thesis, KTH, School of Electrical Engineering, Stockholm, Sweden, 2016. Available online: https://www.diva-portal.org/smash/get/diva2:1072186/FULLTEXT01.pdf (accessed on 22 March 2025).

- Patil, N.; Lathi, R.; Chitre, V. Comparison of C5.0 & CART Classification Algorithms Using Pruning Technique. Int. J. Eng. Res. Technol. 2012, 1, 1–5. [Google Scholar]

- Allianz Trade, Ödeme Sürelerinin Uzamasının Bedeli. Available online: https://www.allianz-trade.com/tr_TR/ekonomik-arastirmalar/ekonomik-gorunum-raporlari/odeme-surelerinin-uzamasinin-bedeli.html (accessed on 6 February 2025).

- MS Advisory, China ESG. Available online: https://msadvisory.com/china-esg/ (accessed on 10 February 2025).

- SIX Mexico, Mexico Sustainability Measures and Environmental Regulation. Available online: https://sixmexico.com/blog/mexico-sustainability-measures-and-environmental-regulation (accessed on 5 April 2025).

- Kucharska, W. Employee Commitment Matters for CSR Practice, Reputation and Corporate Brand Performance—European Model. Sustainability 2020, 12, 940. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).