Application of the Travel Cost Method to Estimate the Economic Value of Brasília National Park

Abstract

1. Introduction

- I.

- What is the direct use value of Brasília National Park for its visitors?

- II.

- How does travel cost influence the frequency of visits to the park?

- III.

- Does the current entrance fee reflect the recreational value perceived by visitors?

- IV.

- Is the price elasticity of demand for visits to Brasília National Park elastic or inelastic?

- I.

- The coefficient for travel cost is negative and statistically significant, reflecting its inverse relationship with visitation rates, meaning the frequency of visits to PNB decreases as the travel cost increases.

- II.

- The estimated consumer surplus per visit exceeds the current entrance fee, indicating underpricing.

- III.

- The price elasticity of demand for visits to Brasília National Park is inelastic, reflecting the unique importance of the park to its visitors and the lack of close substitutes. As a result, changes in travel cost will lead to relatively smaller changes in the quantity of visits demanded.

2. Materials and Methods

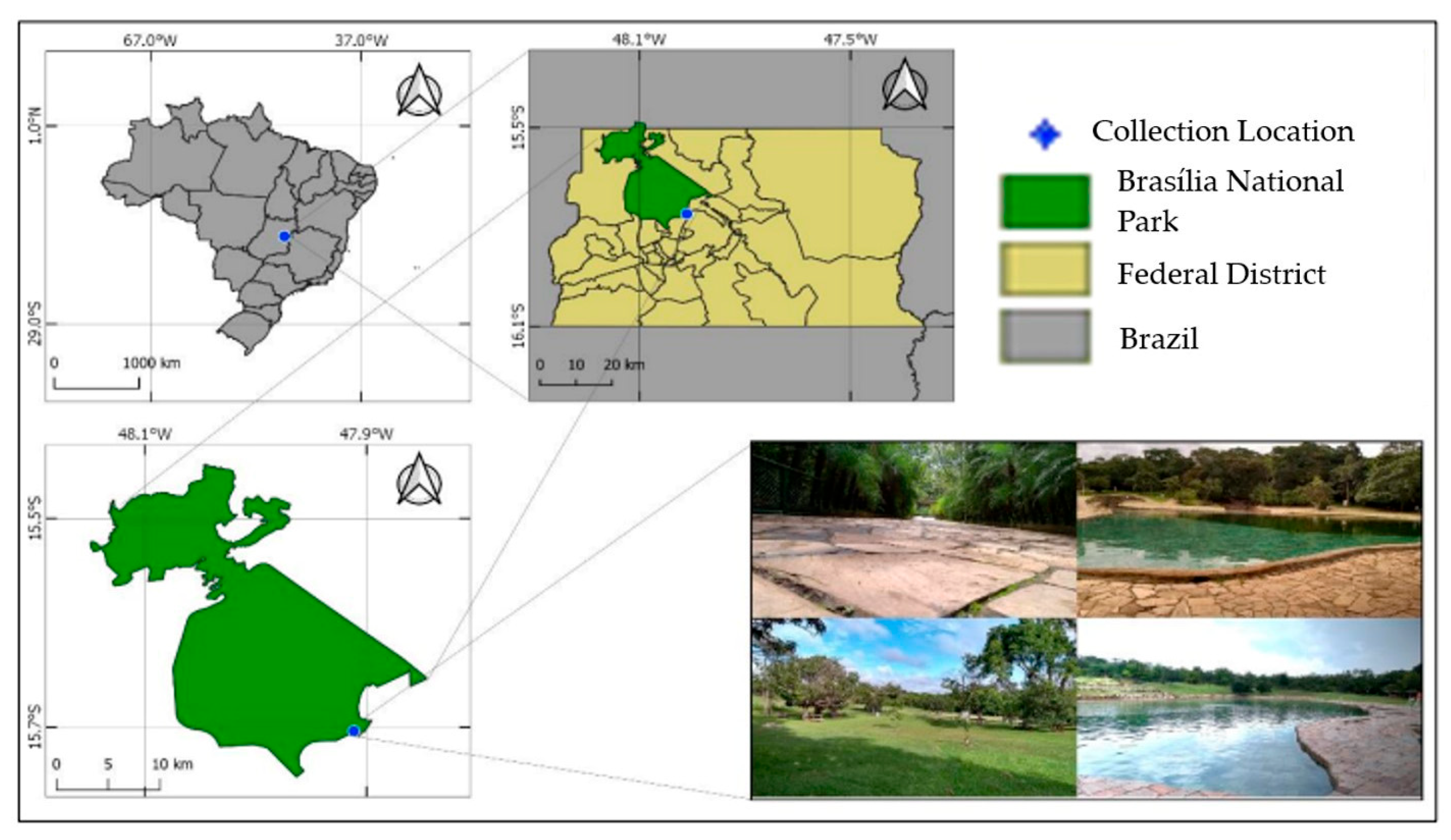

2.1. Study Area

2.2. Calculation and Sampling Method

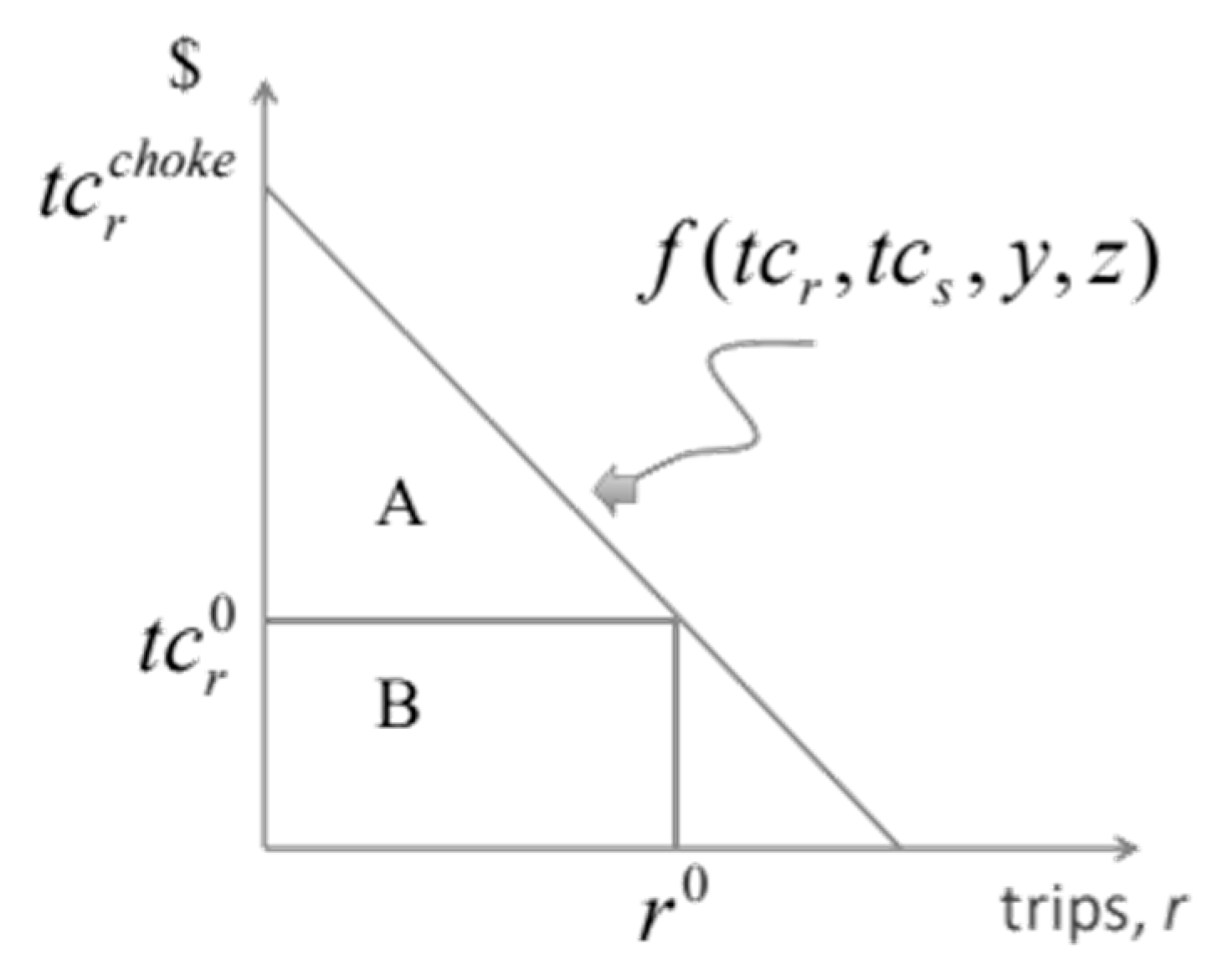

2.3. Travel Cost Method

2.4. Research Design

3. Results and Discussion

3.1. Sample Description

3.2. The Economic Value of Recreational Use of the National Park of Brasília

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Brazil Ministry of the Environment. Fauna and Flora. Brasília. 2021. Available online: www.gov.br/mma/pt-br/assuntos/biodiversidade/fauna-e-flora (accessed on 6 March 2024).

- Souza, M.F.R. Public Policy for Conservation Units in Brazil: Diagnosis and Proposals for a Review; Federal University of Paraná: Curitiba, Brazil, 2012. [Google Scholar]

- Gomes, G.H. Olhos D’água Multi-Use Ecological Park: Current Situation and Importance for the Community’s Leisure; Monograph (Post-Graduation in Ecotourism)—University of Brasília: Brasília, Brazil, 2004. [Google Scholar]

- de Almeida, A.N.; de Oliveira Versiani, R.; Soares, P.R.C.; Angelo, H. Avaliação Ambiental Do Parque Olhos D’Água: Aplicação do Método da Disposição a Pagar. Floresta Ambiente 2017, 24, e00094714. [Google Scholar] [CrossRef]

- González, R.M.; Marrero, Á.S.; Navarro-Ibáñez, M. Tourists’ Travel Time Values Using Discrete Choice Models: The Recreational Value of the Teide National Park. J. Sustain. Tour. 2018, 26, 2021–2042. [Google Scholar] [CrossRef]

- Beal, D.J. A travel cost analysis of the value of Carnarvon Gorge National Park for recreational use. Rev. Mark. Agric. Econ. 1995, 63, 292–303. [Google Scholar] [CrossRef]

- Carpio, C.E.; Wohlgenant, M.K.; Boonsaeng, T. The demand for agritourism in the United States. J. Agric. Resour. Econ. 2008, 33, 254–269. [Google Scholar]

- Maia, A.G.; Romeiro, A.R. Validade e Confiabilidade do Método de Custo de Viagem: Um Estudo Aplicado ao Parque Nacional da Serra Geral. Econ. Apl. 2008, 12, 103–123. [Google Scholar] [CrossRef]

- Prayaga, P.; Rolfe, J.; Stoeckl, N. The value of recreational fishing in the Great Barrier Reef, Australia: A pooled revealed preference and contingent behaviour model. Mar. Policy 2010, 34, 244–251. [Google Scholar] [CrossRef]

- Bhat, M.Y.; Bhatt, M.S. Economic valuation of biodiversity in South Asia: The case of Dachigam National Park in Jammu and Kashmir (India). Asia Pac. Policy Stud. 2018, 6, 59–72. [Google Scholar] [CrossRef]

- Dong, C.M.; Lin, C.C.; Lin, S.P. Study on the appraisal of tourism demands and recreation benefits for Nanwan Beach, Kenting, Taiwan. Environments 2018, 5, 97. [Google Scholar] [CrossRef]

- Navrud, S.; Mungatana, E.D. Environmental Valuation in Developing Countries: The Recreational Value of Wildlife Viewing. Ecol. Econ. 1994, 11, 135–151. [Google Scholar] [CrossRef]

- Torres-Ortega, S.; Pérez-Álvarez, R.; Díaz-Simal, P.; de Luis-Ruiz, J.; Piña-García, F. Economic valuation of cultural heritage: Application of travel cost method to the National Museum and Research Center of Altamira. Sustainability 2018, 10, 2550. [Google Scholar] [CrossRef]

- Farr, M.; Stoeckl, N.; Beg, R.A. The efficiency of the environmental management charge in the Cairns management area of the Great Barrier Reef Marine Park. Aust. J. Agric. Resour. Econ. 2011, 55, 322–341. [Google Scholar] [CrossRef]

- Angelo, H.; Almeida, A.N.; Vasconcelos, P.G.A.; Gaspar, R.O.; Paula, M.F.; Matricardi, E.A.T. Economic valuation of the National Park of Brasilia. Rev. Eletrônica Gestão Educ. Tecnol. Ambient. Santa Maria 2020, 24, e8. [Google Scholar] [CrossRef]

- Roussel, S.; Salles, J.M.; Tardieu, L. Recreation Demand Analysis of Sensitive Natural Areas from an On-Site Survey. Rev. D’économie Régionale Urbaine 2016, 2, 355–384. [Google Scholar] [CrossRef]

- de Carvalho Júnior, L.C.; de Mendonça Marques, M.; de Souza Freire, F. Mensuração de ativos culturais: Aplicação do método do custo de viagem e método de valoração contingente no Memorial Darcy Ribeiro. Rev. Bras. Pesqui. Tur. 2016, 10, 394–413. [Google Scholar] [CrossRef]

- Mendonça Marques, M.; Souza Freire, F. Mensuração de ativos culturais: Uma aplicação do método do custo de viagem na Catedral de Brasília. PASOS Rev. Tur. Patrim. Cult. 2015, 13, 1047–1066. [Google Scholar] [CrossRef]

- Muñoz Muñoz, J.P. Valoração Econômica do Parque Nacional de Brasília. Ph.D. Thesis, Universidade de Brasília, Brasília, Brazil, 2015. [Google Scholar]

- de Almeida, A.N.; da Silva, J.C.G.L.; Gonçalves, A.O.; Angelo, H. Determinants of environmental behavior in Brasília. J. Environ. Manag. Sustain. 2015, 4, 46–56. [Google Scholar]

- Fonseca, S.; Rebelo, J. Economic valuation of cultural heritage: Application to a museum located in the Alto Douro Wine Region: World Heritage Site. PASOS Rev. Tur. Patrim. Cult. 2010, 8, 339–350. [Google Scholar] [CrossRef]

- Afonso, A.C.B. O Consumidor Verde: Perfil e Comportamento de Compra. Master’s Thesis, Universidade Tecnica de Lisboa, Lisboa, Portugal, 2010. [Google Scholar]

- Marques, M.M. Mensuração de Ativos Culturais: Uma Aplicação do Método do Custo de Viagem Em Bens Públicos Culturais do Distrito Federal. Master’s Thesis, Universidade de Brasília, Brasília, Brazil, 2012. [Google Scholar]

- Loomis, J.; Tadjion, O.; Watson, P.; Wilson, J.; Davies, S.; Thilmany, D. A hybrid individual-zonal travel cost model for estimating the consumer surplus of golfing in Colorado. J. Sports Econ. 2009, 10, 155–167. [Google Scholar] [CrossRef]

- Loomis, J.; Yorizane, S.; Larson, D. Testing significance of multi-destination and multi-purpose trip effects in a travel cost method demand model for whale watching trips. Agric. Resour. Econ. Rev. 2000, 29, 183–191. [Google Scholar] [CrossRef]

- Amoako-Tuffour, J.; Martínez-Espiñeira, R. Leisure and the Opportunity Cost of Travel Time in Recreation Demand Analysis; St. Francis Xavier University: Antigonish, NS, Canada, 2008; Manuscrito não Publicado. [Google Scholar]

- Romeiro, M.D.C. Um Estudo Sobre o Comportamento do Consumidor Ambientalmente Favorável: Uma Verificação na Região do ABC Paulista. Ph.D. Thesis, Faculdade de Economia, Administração e Contabilidade, Universidade de São Paulo, São Paulo, Brazil, 2006; 358p. [Google Scholar]

- May, P.H.; Lustosa, M.C.; da Vinha, V. Economia do Meio Ambiente; Elsevier: Rio de Janeiro, Brazil, 2003. [Google Scholar]

- Straughan, R.D.; Roberts, J.A. Environmental segmentation alternatives: A look at green consumer behavior in the new millennium. J. Consum. Mark. 1999, 16, 558–575. [Google Scholar] [CrossRef]

- Parsons, G.R.; Wilson, A.J. Incidental and joint consumption in recreation demand. Agric. Resour. Econ. Rev. 1997, 26, 1–6. [Google Scholar] [CrossRef]

- Mohammadi Limaei, S.; Ghesmati, H.; Rashidi, R.; Yamini, N. Economic Evaluation of Natural Forest Park Using the Travel Cost Method (Case Study; Masouleh Forest Park, North of Iran). J. Forensic Sci. 2014, 60, 254–261. [Google Scholar] [CrossRef]

- Yamane, T. Statistics: An Introductory Analysis; Harper and Row: New York, NY, USA, 1967. [Google Scholar]

- Molina, J.R.; González-Cabán, A.; Rodríguez y Silva, F. Wildfires Impact on the Economic Susceptibility of Recreation Activities: Application in a Mediterranean Protected Area. J. Environ. Manag. 2019, 245, 454–463. [Google Scholar] [CrossRef]

- Pindyck, R.S.; Rubinfeld, D.L. Microeconomia; Makron Books: São Paulo, Brazil, 1994. [Google Scholar]

- Federal District. Planning Company of the Federal District. District Household Sample Survey—PDAD. Brasília. 2018. Available online: http://www.codeplan.df.gov.br/pdad-2018/ (accessed on 10 May 2020).

- Jones, T.E.; Yang, Y.; Yamamoto, K. Assessing the Recreational Value of World Heritage Site Inscription: A Longitudinal Travel Cost Analysis of Mount Fuji Climbers. Tour. Manag. 2017, 60, 67–78. [Google Scholar] [CrossRef]

- Blakemore, F.; Williams, A. British tourists’ valuation of a Turkish beach using contingent valuation and travel cost methods. J. Coast. Res. 2008, 25, 1469–1480. [Google Scholar] [CrossRef]

- Freire, C.R.F.; de Cerqueira, C.A.; Casimiro Filho, F.; de Souza Guimarães Júnior, G. Valor de uso e Valor de Opção do Litoral do Município de Canavieiras, Estado da Bahia (Brasil); Revista Observatorio de la Economía Latinoamericana: Curitiba, Brazil, 2009. [Google Scholar]

- Hakim, A.R.; Subanti, S.; Tambunan, M. Economic valuation of nature-based tourism object in Rawapening, Indonesia: An application of travel cost and contingent valuation method. J. Sustain. Dev. 2011, 4, 91–102. [Google Scholar] [CrossRef]

- Vicente, E.; de Frutos, P. Application of the travel cost method to estimate the economic value of cultural goods: Blockbuster art exhibitions. Rev. Econ. Pública 2011, 196, 37–63. [Google Scholar]

- Gujarati, D.N.; Porter, D.C. Basic Econometrics; AMGH: Porto Alegre, Brazil, 2011. [Google Scholar]

- Chotikapanich, D.; Griffiths, W.E. Carnarvon Gorge: A Comment on the Sensitivity of Consumer Surplus Estimation. Aust. J. Agric. Resour. Econ. 1998, 42, 249–261. [Google Scholar] [CrossRef]

- Perrenoud, M.A. Environmental Valuation of the Serra Do Mar State Park—Santa Virgínia Nucleus. Master’s Thesis, University of Taubaté, Taubaté, Brazil, 2010. [Google Scholar]

- Enyew, S. Valuation of the Benefits of Out-Door Recreation Using the Travel Cost Method: The Case of Wabi-Shebele Langano Recreation Site; Addis Ababa University: Addis Ababa, Ethiopia, 2003. [Google Scholar]

- Nillesen, E.; Wesseler, J.; Cook, A. Estimating the Recreational-Use Value for Hiking in Bellenden Ker National Park, Australia. Environ. Manag. 2005, 36, 311–316. [Google Scholar] [CrossRef]

- Fleming, C.M.; Cook, A. The Recreational Value of Lake McKenzie, Fraser Island: An Application of the Travel Cost Method. Tour. Manag. 2008, 29, 1197–1205. [Google Scholar] [CrossRef]

- Herman, M.A.S.; Ahmad, S.; Ramachandran, S.; Rusli, Y.M. Recreational Economic Value of the Perlis State Park, Malaysia: An Application of Zonal Travel Cost Model. Trop. Agric. Sci. 2013, 36, 295–310. [Google Scholar]

- Tourkolias, C.; Skiada, T.; Mirasgedis, S.; Diakoulaki, D. Application of the Travel Cost Method for the Valuation of the Poseidon Temple in Sounio, Greece. J. Cult. Herit. 2015, 16, 567–574. [Google Scholar] [CrossRef]

- Knapman, B.; Stoeckl, N. Recreation User Fees: An Australian Empirical Investigation. Tour. Econ. 1995, 1, 5–15. [Google Scholar] [CrossRef]

- Phaneuf, D.J. Recreation Demand Models. In Handbook of Environmental Economics; Elsevier: Amsterdam, The Netherlands, 2004; pp. 671–751. [Google Scholar]

- Sebold, S.; Silva, A. Uma aplicação do método dos custos de viagem para valoração de um parque ambiental. Rev. Produção Online 2004, 4. [Google Scholar] [CrossRef]

- Clara, I.; Dyack, B.; Rolfe, J.; Newton, A.; Borg, D.; Povilanskas, R.; Brito, A.C. The Value of Coastal Lagoons: Case Study of Recreation at the Ria de Aveiro, Portugal in Comparison to the Coorong, Australia. J. Nat. Conserv. 2018, 43, 190–200. [Google Scholar] [CrossRef]

- Rolfe, J.; Dyack, B. Testing for Convergent Validity between Travel Cost and Contingent Valuation Estimates of Recreation Values in the Coorong, Australia. Aust. J. Agric. Resour. Econ. 2010, 54, 583–599. [Google Scholar] [CrossRef]

- Amirnejad, H.; Jahanifar, K. Comparison of contingent valuation and travel cost method in estimating the recreational values of a forest park. J. Environ. Sci. Manag. 2018, 21, 36–44. [Google Scholar] [CrossRef]

- Jaung, W.; Carrasco, L.R. Travel Cost Analysis of an Urban Protected Area and Parks in Singapore: A Mobile Phone Data Application. J. Environ. Manag. 2020, 261, 110238. [Google Scholar] [CrossRef]

- Ng, W.-S.; Mendelsohn, R. The economic impact of sea-level rise on nonmarket lands in Singapore. AMBIO J. Hum. Environ. 2006, 35, 289–297. [Google Scholar] [CrossRef] [PubMed]

- Ashim, Y.; Shete, M. Valuation of Awash National Park, Ethiopia: An application of travel cost and choice experiment methods. J. Dev. Areas 2022, 56, 157–173. [Google Scholar] [CrossRef]

- Saha, N.; Mukul, S.A. Visitor’s Willingness to Pay for Cultural Ecosystem Services in Bangladesh: An Assessment for Lawachara National Park, a Biodiversity Hotspot. Small-Scale For. 2022, 21, 185–201. [Google Scholar] [CrossRef]

- Champ, P.A.; Boyle, K.J.; Brown, T.C. A Primer on Nonmarket Valuation; Springer: Berlin/Heidelberg, Germany, 2017; Volume 13. [Google Scholar] [CrossRef]

- Belcher, R.N.; Chisholm, R.A. Tropical vegetation and residential property value: A hedonic pricing analysis in Singapore. Ecol. Econ. 2018, 149, 149–159. [Google Scholar] [CrossRef]

- Kong, F.; Yin, H.; Nakagoshi, N. Using GIS and landscape metrics in the hedonic price modeling of the amenity value of urban green space: A case study in Jinan City, China. Landsc. Urban Plan. 2007, 79, 240–252. [Google Scholar] [CrossRef]

- Schläpfer, F.; Waltert, F.; Segura, L.; Kienast, F. Valuation of landscape amenities: A hedonic pricing analysis of housing rents in urban, suburban and periurban Switzerland. Landsc. Urban Plan. 2015, 141, 24–40. [Google Scholar] [CrossRef]

- Quah, E.; Tan, K.C. Pricing a scenic view: The case of Singapore’s East Coast Park. Impact Assess. Proj. Apprais. 1999, 17, 295–303. [Google Scholar] [CrossRef]

- Ward, F.A.; Beal, D. Valuing Nature with Travel Cost Models; Edward Elgar Publishing: Cheltenham, UK, 2000. [Google Scholar]

| Source Zones | Distance | Administrative Regions and Neighborhoods of the Plano Piloto |

|---|---|---|

| I | 0–5 km | Northwest (neighborhood); SIA. |

| II | 5–10 km | Asa Norte (neighborhood); Asa Sul (neighborhood); Varjão; North Lake; Cruise; Southwest/Octagonal; SCIA/Structural. |

| III | 10–15 km | Guará I and II; Park Way; Vicente Pires; Candangolândia; Sout Lake. |

| IV | 15–20 km | Bandeirante Nucleus; Riacho Fundo; Águas Claras; Taguatinga; Botanical garden; Itapoã; Paranoá; Sobradinho I, Sobradinho II, Fercal. |

| V | 20–25 km | Riacho Fundo II; Ceilândia; Fern. |

| SAW | 25–35 km | Recanto das Emas; Range; Brazlândia; São Sebastião; Planaltina; Santa Maria. |

| Models | Price–Demand Elasticity |

|---|---|

| Linear: | |

| Lin-Log: | |

| Log-Lin: | |

| Log-Log: |

| Socioeconomic Data | Number of Visitors | Percentage (%) | |

|---|---|---|---|

| Sex | |||

| Male | 175 | 58.3 | |

| Female | 125 | 41.7 | |

| Age group | |||

| Under 19 years old | 10 | 3.3 | |

| 19–29 years old | 67 | 22.3 | |

| 30–39 years old | 78 | 26.0 | |

| 40–49 years old | 54 | 18.0 | |

| 50–60 years old | 52 | 17.3 | |

| Over 60 years old | 39 | 13.0 | |

| Labor market situation | |||

| Retired | 40 | 13.3 | |

| Unemployed | 22 | 7.3 | |

| Student | 30 | 10.0 | |

| Working | 197 | 65.7 | |

| Education level | |||

| No education | 1 | 0.3 | |

| Incomplete elementary school | 3 | 1.0 | |

| Complete elementary school | 8 | 2.7 | |

| Incomplete high school | 10 | 3.3 | |

| Complete high school | 47 | 15.7 | |

| Incomplete higher education | 34 | 11.3 | |

| Complete higher education | 197 | 65.7 | |

| Monthly income | |||

| Up to 1 minimum wage—minimum wage in 2020: BRL 1045.00 (USD 190.00) | 35 | 11.7 | |

| Between 1 and 2 minimum wages | 45 | 15.0 | |

| Between 2 and 5 minimum wages | 70 | 23.3 | |

| Between 5 and 10 minimum wages | 82 | 27.3 | |

| Between 10 and 20 minimum wages | 49 | 16.3 | |

| More than 20 minimum wages | 19 | 6.3 | |

| R2 | PBIAS | CE | |

| AWY efficiency | 0.64 | −11.11 | −0.14 |

| Zones | Distance (km) | Population | Visits in % | Visitation Rate (Visitors Per Thousand Inhabitants) | Average Travel Cost (USD/Zone) | Average Yield (USD/Zone) | Mean Age |

|---|---|---|---|---|---|---|---|

| I | 0–5 | 12.420 | 7.2 | 67.1 | 3.43 | 1763.7 | 46.3 |

| II | 5–10 | 356.617 | 58.1 | 18.9 | 5.81 | 1638.9 | 43.7 |

| III | 10–15 | 267.247 | 16.3 | 7.1 | 5.99 | 1270.3 | 40.2 |

| IV | 15–20 | 740.307 | 14.2 | 2.2 | 9.44 | 1053.1 | 37.2 |

| V | 20–25 | 751.478 | 2.9 | 0.5 | 12.77 | 592.6 | 32.4 |

| SAW | 25–35 | 737.673 | 1.3 | 0.2 | 13.15 | 745.4 | 32.5 |

| Linear | Lin-Log | Log-Lin | Log-Log | |

|---|---|---|---|---|

| Intercept | 57.82 * | 175.52 ** | 5.86 *** | 16.68 *** |

| CVm | −0.90 ** | −42.87 ** | −0.10 *** | −4.14 *** |

| R2 | 58.34% | 74.71% | 97.18% | 95.65% |

| BIC | 55.15 | 52.15 | 9.49 | 12.08 |

| AIC | 55.77 | 52.78 | 10.11 | 12.70 |

| Tests | Linear | Lin–Log | Log–Lin | Log–Log |

|---|---|---|---|---|

| Shapiro–Wilk | 0.96 (0.81) | 0.97 (0.91) | 0.85 (0.16) | 0.93 (0.60) |

| Durbin–Watson | 1.29 (0.03) * | 1.30 (0.03) * | 2.47 (0.53) | 2.50 (0.55) |

| Breusch–Pagan | 3.80 (0.05) | 3.09 (0.08) | 0.26 (0.61) | 0.07 (0.79) |

| F-Test (p-value) | 5.60 (0.08) | 11.82 (0.03) | 137.6 (0.00) | 87.98 (0.00) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Angelo, H.; dos Santos Ferreira, A.; de Almeida, A.N.; de Rezende Alvares, M.; dos Santos, J.A. Application of the Travel Cost Method to Estimate the Economic Value of Brasília National Park. Sustainability 2025, 17, 8932. https://doi.org/10.3390/su17198932

Angelo H, dos Santos Ferreira A, de Almeida AN, de Rezende Alvares M, dos Santos JA. Application of the Travel Cost Method to Estimate the Economic Value of Brasília National Park. Sustainability. 2025; 17(19):8932. https://doi.org/10.3390/su17198932

Chicago/Turabian StyleAngelo, Humberto, Alexandre dos Santos Ferreira, Alexandre Nascimento de Almeida, Manuella de Rezende Alvares, and Juscelina Arcanjo dos Santos. 2025. "Application of the Travel Cost Method to Estimate the Economic Value of Brasília National Park" Sustainability 17, no. 19: 8932. https://doi.org/10.3390/su17198932

APA StyleAngelo, H., dos Santos Ferreira, A., de Almeida, A. N., de Rezende Alvares, M., & dos Santos, J. A. (2025). Application of the Travel Cost Method to Estimate the Economic Value of Brasília National Park. Sustainability, 17(19), 8932. https://doi.org/10.3390/su17198932