Research on the Mechanism of Digital Skills for Enhancing Farmers’ Participation in Formal Financial Markets

Abstract

1. Introduction

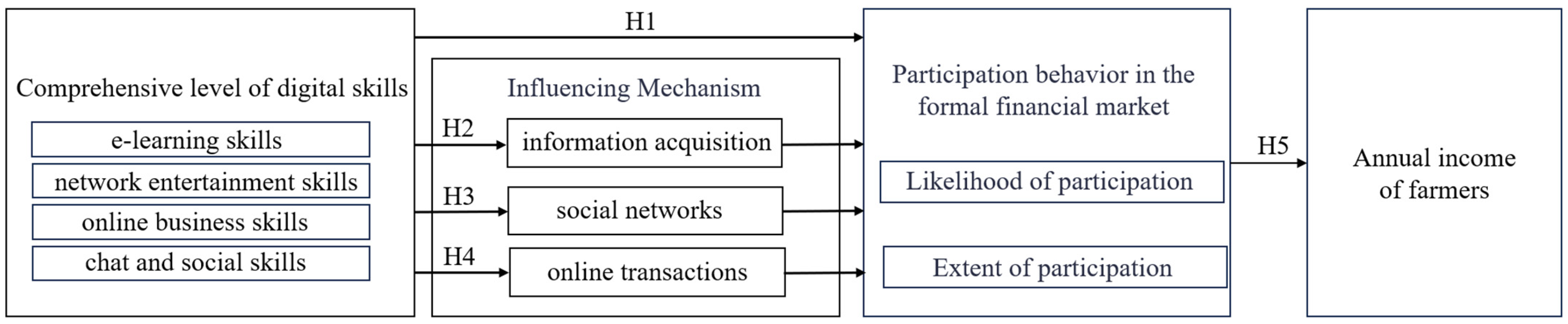

2. Theoretical Analysis and Research Hypothesis

2.1. Digital Skills and Farmers’ Participation in Formal Financial Markets

2.2. The Mechanism of Digital Skills in Enhancing Farmers’ Participation in Formal Financial Markets

2.3. Economic Effects of Digital Skills on Farmers’ Participation in Formal Financial Markets

3. Research Design

3.1. Data Sources

3.2. Model Specification

3.3. Variable Selection

3.3.1. Explained Variable

3.3.2. Explanatory Variable

3.3.3. Mechanism Variables

3.3.4. Control Variables

4. Empirical Analysis Results

4.1. Analysis of the Impact of Digital Skills on Farmers’ Participation in Formal Financial Markets

4.2. Endogeneity Analysis

4.3. Robustness Tests

4.4. Mechanism Analysis

4.5. Heterogeneity Analysis

4.5.1. Heterogeneity Analysis Across Educational Levels

4.5.2. Heterogeneity Analysis Across Age

4.5.3. Heterogeneity Analysis Across Annual Income Levels

5. Further Analysis

6. Discussion

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Zhang, M.; Liu, X.; Wu, W. College Student Village Officials and Rural Family Financial Market Participation. Res. Financ. Econ. Iss. 2024, 49–61. [Google Scholar] [CrossRef]

- Zhou, Y.; He, G. The Effect of Digital Inclusive Finance Development on Farmer’s Household Financial Assets Allocation. Mod. Econ. Sci. 2020, 42, 92–105. [Google Scholar]

- Wang, X.; Liu, Y.; Song, M. Digital Capability and Household Risk Financial Assets Allocation. Chin. Rural Econ. 2023, 102–121. [Google Scholar] [CrossRef]

- State Council. The Implementation Opinions on Promoting High-Quality Development of Inclusive Finance. 2023. Available online: https://www.mee.gov.cn/zcwj/gwywj/202310/t20231012_1042898.shtml (accessed on 25 September 2023).

- Zhang, S.; Gu, H. How Can the Application of the Internet and Information Technologies Alleviate Rural Residents’ Risk Aversion Attitude? An Analysis Based on the Micro Data of China Family Panel Studies. Chin. Rural Econ. 2020, 33–51. [Google Scholar]

- Stango, V.; Zinman, J. Exponential Growth Bias and Household Finance. J. Financ. 2024, 64, 2807–28409. [Google Scholar] [CrossRef]

- Agarwal, S.; Chua, Y.H. FinTech and household finance: A review of the empirical literature. China Financ. Rev. Int. 2020, 10, 361–376. [Google Scholar] [CrossRef]

- Coibion, O.; Georgarakos, D.; Gorodnichenko, Y.; Kenny, G.; Weber, M. The Effect of Macroeconomic Uncertainty on Household Spending. Amer. Econ. Rev. 2024, 114, 645–677. [Google Scholar] [CrossRef]

- Yin, Z.; Song, Q.; Wu, Y. Financial Literacy, Trading Experience and Household Portfolio Choice. Econ. Res. J. 2014, 49, 62–75. [Google Scholar]

- Zeng, Z.; He, Q.; Wu, Y.; Yin, Z. Financial knowledge and the diversity of family portfolio. Economist 2015, 6, 86–94. [Google Scholar] [CrossRef]

- Yang, H.; Zhang, K. Cognitive Ability, Social Interaction Mode and Household Asset Allocation: An Empirical Analysis Based on CFPS Data. Rev. Invest Stud. 2020, 39, 67–81. [Google Scholar]

- Hong, H.; Kubik, J.D.; Stein, J.C. Social Interaction and Stock-Market Participation. J. Financ. 2004, 59, 137–163. [Google Scholar] [CrossRef]

- Wei, Z.; Jiang, J.; Yang, Y.; Song, X. Social Networks, Financial Market Participation and Family Assets Selection: An Empirical Study Based on CHFS Data. Financ. Econ. 2018, 28–42. [Google Scholar]

- Gutsche, G.; Wetzel, H.; Ziegler, A. Determinants of individual sustainable investment behavior—A framed field experiment. J. Econ. Behav. Organ. 2023, 209, 491–508. [Google Scholar] [CrossRef]

- Qi, W.; Li, M.; Li, J. Digital Rural Empowerment and Farmers’ Income Growth: Mechanism and Empirical Test: A Study on the Moderating Effect of Farmers’ Entrepreneurial Activity. J. Southeast Univ. 2021, 23, 116–125. [Google Scholar] [CrossRef]

- Wu, F.; Cui, F.; Liu, T. The influence of digital inclusive finance on household wealth: A study based on CHFS data. Financ. Res. Lett. 2023, 58, 104460. [Google Scholar] [CrossRef]

- Feng, M. Digital Inclusive Finance, Rural Entrepreneurship, and Increasing Income and Wealth for Farmers. Stat. Decis. 2024, 40, 138–143. [Google Scholar] [CrossRef]

- Yang, S.; Kong, R. Has Participation in Digital Financial Markets Improved Farmers’ Income? J. Huazhong Agric. Univ. 2021, 180–190+200. [Google Scholar] [CrossRef]

- Tang, W. Digital Technology Driving High-Quality Development of Agriculture and Rural Areas: Theoretical Interpretation and Practical Path. J. Nanjing Agric. Univ. 2022, 22, 1–9. [Google Scholar] [CrossRef]

- Fu, C.; Sun, X.; Guo, M.; Yu, C. Can digital inclusive finance facilitate productive investment in rural households?–An empirical study based on the China Household Finance Survey. Financ. Res. Lett. 2024, 61, 105034. [Google Scholar] [CrossRef]

- Wu, Y.; Li, X.; Li, J.; Zhou, L. Digital Finance and Household Portfolio Efficiency. J. Manag. World 2021, 37, 92–104+107. [Google Scholar] [CrossRef]

- Wanzala, R.W.; Obokoh, L.O. Financial inclusion of the informal sector of marginalized counties in Kenya. Cogent Soc. Sci. 2025, 11, 2522291. [Google Scholar] [CrossRef]

- Saeed, U.F.; Klugah, G.E. Driving inclusive growth through financial systems and technology adoption: A global analysis of synergistic pathways using structural equation modeling. Cogent Econ. Financ. 2025, 13, 2523955. [Google Scholar] [CrossRef]

- Luo, Q.; Zhao, Q.; Qiu, H. Digital Skills and Property Income of Farmers: Based on CRRS Data. Contemp. Econ. Manag. 2023, 45, 54–62. [Google Scholar] [CrossRef]

- Jiang, J.; Qing, P.; Cai, W.; Huang, F. How do digital skills affect farmers’ e-commerce participation behavior? A mediation effect based on information acquisition. J. China Agric. Univ. 2024, 29, 81–93. [Google Scholar]

- Li, M.; Yang, L. Impact and Mechanisms of Residents’ Digital Literacy on Financial Market Participation. Rev. Invest Stud. 2024, 43, 22–34. [Google Scholar]

- Wen, T.; Liu, Y. Digital Literacy, Financial Knowledge With Farmers’ Response to Digital Financial Behavior. Res. Financ. Econ. Iss. 2023, 50–64. [Google Scholar] [CrossRef]

- Liu, H.; Ma, W. Social Interaction in the Internet Age and Family Capital Market Participation Behavior. Stud. Int. Financ. 2017, 55–66. [Google Scholar] [CrossRef]

- Wozniak, G.D. Joint Information Acquisition and New Technology Adoption: Late Versus Early Adoption. Rev. Econ. Stat. 1993, 75, 438–445. [Google Scholar] [CrossRef]

- Dong, X.; Yu, W.; Zhu, M. Financial Market Participants and Asset Choice among Rural and Urban Household under Different Information. Chan. Financ. Trade Res. 2017, 28, 33–42. [Google Scholar] [CrossRef]

- Dong, X.; Shi, X. Information Channel, Financial Literacy and the Willingness to Accept the Internet Financial Products of Household in Urban and Rural Areas. J. Nanjing Agric. Univ. 2018, 18, 109–118+159. [Google Scholar]

- Wang, T. Social Change and Social Research in the Digital Age. Soc. Sci. China 2021, 12, 73–88+200–201. [Google Scholar]

- Qi, Y.; Chu, X. The Employment Effect of Digital Life: The Internal Mechanism and Micro Evidence. Financ. Trade Econ. 2021, 42, 98–114. [Google Scholar] [CrossRef]

- Yao, J.; Zang, X.; Zhou, B. Social Networks and Household Financial Vulnerability in China. J. Financ. Res. 2024, 526, 151–168. [Google Scholar]

- He, J.; Wang, A.; Yu, H. Social Capital and Family Participation in Financial Markets. Financ. Econ. Res. 2018, 33, 104–116. [Google Scholar]

- Yin, Z.; Yang, H.; Zhang, C. The Impact of Social Networks on Family Financial Exclusion. Stud. Int. Financ. 2023, 22–23. [Google Scholar] [CrossRef]

- Wu, S.; Yao, Z. Online Social Interaction and Financial Market Participation: Evidence from an Online Securities Trading Platform. Manag. Rev. 2022, 34, 3–15. [Google Scholar] [CrossRef]

- Yin, Z.; Li, H.; Wu, Z. Effects of Digital Inclusive Finance on Fluctuations in Household Income in China. Econ. Rev. 2024, 83–92. [Google Scholar] [CrossRef]

- Jiang, J.; Wang, Z.; Liao, L. Rural Experience and Stock Market Participation. Econ. Res. J. 2018, 53, 84–99. [Google Scholar]

- Xiang, Y.; Wu, X. How Does Financial Literacy Alleviate Farmers’ Digital Financial Exclusion? Analysis Based on CHFS Data. Sci. Decis. Mak. 2024, 38–58. [Google Scholar]

- Jin, R.; Li, S.; Nan, L. Have Environmental Regulations Been Adopted to Promote Farmers’ Clean Heating? J. Northw. A&F Univ. 2022, 22, 130–140. [Google Scholar] [CrossRef]

- Dong, X.; Xu, H. Empirical Analysis of the Influencing Factors of Rural Financial Exclusion in China: A Perspective Based on the Distribution of Financial Institution Outlets in County Areas. J. Financ. Res. 2012, 115–126. [Google Scholar]

- Tang, L.; Luo, X.; Zhang, J. Has the Purchase of Agricultural Machinery Services Increased Farmers’ Income? J. Agrotech. Econ. 2021, 46. [Google Scholar] [CrossRef]

- Wang, Q.; Liu, C.; Lan, S. Digital literacy and financial market participation of middle-aged and elderly adults in China. Econ. Polit. Stud. 2023, 11, 441–468. [Google Scholar] [CrossRef]

- Hsueh, S.C.; Zhang, S.; Hou, L. Mitigating Financial Investment Polarization: The Role of Digital Payments in Enhancing Household Participation. Emerg. Mark. Financ. Trade. 2025, 61, 154–170. [Google Scholar] [CrossRef]

- Parvin, S.M.R.; Panakaje, N.; Madhura, K.; Irfana, S.; Kulal, A. Socialization: Exploring the intervening Business Studies role of financial well-being. South Asian J. Bus. Stud. 2025. [Google Scholar] [CrossRef]

- Rooj, D.; Sengupta, R. E-wallets and stock market participation—A joint copula regression analysis. Rev. Behav. Financ. 2025, 17, 624–663. [Google Scholar] [CrossRef]

| Variable Names | Variable Definitions and Assignments | Mean | Standard Deviation |

|---|---|---|---|

| Explained variables | |||

| Likelihood of participation in formal financial market | Whether to participate in formal financial markets, 0 = No, 1 = Yes. | 0.023 | 0.151 |

| Extent of participation in formal financial market | The ratio of financial assets to household assets | 0.009 | 0.073 |

| Explanatory variable | |||

| Digital skills | Comprehensive level of digital skills | 1.285 | 0.769 |

| Mechanism variables | |||

| Information acquisition | Acquisition situation: 1 = relatively difficult, 2 = sometimes possible, 3 = completely possible | 2.319 | 0.801 |

| Social networks | Number of relatives and friends from whom one can borrow 5000 yuan or more | 7.524 | 13.652 |

| Online transactions | Whether one operates products through online transactions, 0 = No, 1 = Yes. | 0.073 | 0.260 |

| Control variables | |||

| Gender | 0 = Male, 1 = Female | 0.069 | 0.253 |

| Age | Age | 54.075 | 10.554 |

| Age Squared | The square of the age divided by 100 | 30.355 | 11.505 |

| Education level | 1 = Never attended school, 2 = Primary school, 3 = Junior high school, 4 = Senior high school, 5 = Secondary technical school, 6 = Vocational high school, 7 = Junior college, 8 = Bachelor’s degree or above. | 2.853 | 1.101 |

| Health status | 1 = Very poor, 2 = Poor, 3 = Average, 4 = Good, 5 = Very good. | 3.616 | 0.996 |

| Party membership | Whether a Party member: 0 = No, 1 = Yes | 0.238 | 0.426 |

| Cadre status | 0 = Non-village cadre, 1 = Village cadre | 0.165 | 0.371 |

| Training experience | Parameter for skills training: 0 = No, 1 = Yes | 0.110 | 0.313 |

| Household size | Number of people | 4.136 | 1.505 |

| Paved roads | Whether the road between the village and the group (the internal units of a village) is paved, 0 = No, 1 = Yes | 0.941 | 0.235 |

| Number of households with broadband | Number of households with broadband in the entire village | 558.187 | 1060.931 |

| Village economic conditions | Logarithm of per capita disposable income of the village in 2019 | 9.421 | 0.721 |

| Village transportation conditions | Distance from the village committee to the county government (kilometers) | 23.843 | 17.263 |

| Variable Names | Model 1 | Model 2 |

|---|---|---|

| Digital skills | 0.207 *** (0.072) | 0.180 *** (0.062) |

| Gender | 0.237 (0.173) | 0.186 (0.147) |

| Age | 0.054 (0.041) | 0.047 (0.036) |

| Age squared | −0.050 (0.040) | −0.044 (0.035) |

| Education level | 0.139 *** (0.044) | 0.130 *** (0.040) |

| Health status | 0.055 (0.055) | 0.037 (0.048) |

| Party membership | 0.045 (0.138) | 0.048 (0.120) |

| Cadre status | −0.285 (0.176) | −0.250 (0.159) |

| Training experience | 0.450 *** (0.134) | 0.343 *** (0.107) |

| Household size | 0.018 (0.036) | 0.018 (0.033) |

| Paved roads | −0.175 (0.290) | −0.230 (0.269) |

| Number of households with broadband | 0.0001 * (0.0001) | 0.0001 * (0.00003) |

| Village economic conditions | 0.409 *** (0.084) | 0.363 *** (0.076) |

| Village transportation conditions | −0.0002 (0.004) | −0.0001 (0.003) |

| Constant term | −8.287 *** | −7.202 *** |

| Pseudo R2 | 0.1271 | 0.1224 |

| Log pseudolikelihood | −271.48749 | −272.59037 |

| Observation | 2895 | 2895 |

| Variable Names | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|

| Digital Skills | Likelihood of Participation in Formal Financial Markets | Digital Skills | Extent of Participation in Formal Financial Markets | |

| First-Stage | Second-Stage | First-Stage | Second-Stage | |

| Digital skills | 0.072 ** (0.032) | 0.031 ** (0.151) | ||

| Instrumental variables for digital skills | 0.191 *** (0.328) | 0.191 ** (0.029) | ||

| Control variables | Yes | Yes | Yes | Yes |

| Constant term | 0.799 *** | −0.289 *** | 0.799 *** | −0.106 *** |

| One stage F statistic | 28.76 (p = 0.0000) | 28.76 (p = 0.0000) | ||

| Wald test | 87.39 (p = 0.0000) | 55.99 (p = 0.0000) | ||

| Observation | 2895 | 2895 | 2895 | 2895 |

| Variable Names | Model 7 | Model 8 | Model 9 | Model 10 |

|---|---|---|---|---|

| Digital Skills | Likelihood of Participation in Formal Financial Markets | Digital Skills | Extent of Participation in Formal Financial Markets | |

| First-Stage | Second-Stage | First-Stage | Second-Stage | |

| Digital skills | 1.257 ** (0.628) | 1.099 ** (0.559) | ||

| Instrumental variables for digital skills | 0.191 *** (0.029) | 0.191 *** (0.029) | ||

| Control variables | Yes | Yes | Yes | Yes |

| Constant term | 0.799 *** | −9.338 *** | 0.799 ** | −8.066 *** |

| One stage F statistic | 28.76 (p = 0.0000) | 28.76 (p = 0.0000) | ||

| Wald test | 67.40 (p = 0.0000) | 38.15 (p = 0.0005) | ||

| Observation | 2895 | 2895 | 2895 | 2895 |

| Variable Names | Sample | Treated | Controls | Difference | S.E. | T-Stat |

|---|---|---|---|---|---|---|

| Likelihood of participation in formal financial markets | Unmatched | 0.026 | 0.004 | 0.022 | 0.007 | 2.98 *** |

| ATT | 0.026 | 0.007 | 0.019 | 0.006 | 3.31 *** |

| Variable Names | Sample | Treated | Controls | Difference | S.E. | T-Stat |

|---|---|---|---|---|---|---|

| Extent of participation in formal financial markets | Unmatched | 0.010 | 0.002 | 0.007 | 0.003 | 2.12 ** |

| ATT | 0.010 | 0.004 | 0.006 | 0.003 | 1.84 * |

| Variables and Statistical Parameters | Model 11 | Model 12 | ||

|---|---|---|---|---|

| Select Model Dummy Variables for Digital Skills | Regression Model Likelihood of Participation in Formal Financial Markets | Select Model Dummy Variable for Digital Skills | Regression Model Extent of Participation in Formal Financial Markets | |

| Digital skills | 0.00889 * (0.00379) | 0.178 ** (0.0623) | ||

| Average level of digital skills | 0.327 *** (0.0676) | 0.327 *** (0.0676) | ||

| IMR1 | −0.0278 (0.0616) | |||

| IMR2 | 0.253 (1.053) | |||

| Control variables | Yes | Yes | Yes | Yes |

| Constant term | 0.550 | −0.208 ** | 0.550 | −7.275 *** |

| R2/Pseudo R2 | 0.1353 | 0.0321 | 0.1353 | 0.1225 |

| Observation | 2895 | 2895 | ||

| Variable Names | Model 13 | Model 14 | Model 15 |

|---|---|---|---|

| Information Acquisition | Social Networks | Online Transactions | |

| Digital skills | 0.244 *** (0.192) | 0.629 ** (0.274) | 0.026 *** (0.006) |

| Control variables | Yes | Yes | Yes |

| Constant term | 1.138 *** | −10.019 *** | −0.158 *** |

| R2 | 0.2358 | 0.0310 | 0.0364 |

| Observation | 2895 | 2895 | 2895 |

| Variable Names | Model 16 | Model 17 | Model 18 | |||

|---|---|---|---|---|---|---|

| Regression Results Across Different Educational Levels for Grouping | Regression Results Across Different Age Groups | Regression Results Across Different Income Levels Groups | ||||

| Low Educational Level | High Educational Level | Young Group | Middle-Aged and Elderly Group | Low-Income Level | High-Income Level | |

| Digital skills | 0.289 *** (0.078) | −0.111 (0.178) | 0.054 (0.240) | 2.40 *** (0.069) | 0.311 *** (0.107) | 0.129 (0.101) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant term | −9.264 *** | −14.378 *** | −10.225 *** | −6.565 *** | −8.710 *** | −7.905 *** |

| Pseudo R2 | 0.1238 | 0.2327 | 0.2006 | 0.1191 | 0.1972 | 0.0698 |

| Observation | 2415 | 480 | 283 | 2612 | 2094 | 801 |

| Variable Names | Model 19 | Model 20 | Model 21 | |||

|---|---|---|---|---|---|---|

| Regression Results Across Different Educational Levels for Grouping | Regression Results Across Different Age Groups | Regression Results Across Different Income Levels Groups | ||||

| Low Educational Level | High Educational Level | Young Group | Middle-Aged and Elderly Group | Low-Income Level | High-Income Level | |

| Digital skills | 0.248 *** (0.071) | −0.071 (0.133) | 0.078 (0.193) | 0.208 *** (0.060) | 0.370 *** (0.125) | 0.074 (0.069) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant term | −7.869 *** | −12.925 *** | −9.261 *** | −5.789 *** | −10.353 *** | −4.864 *** |

| Pseudo R2 | 0.1127 | 0.2223 | 0.2006 | 0.1115 | 0.1834 | 0.0868 |

| Observation | 2415 | 480 | 283 | 2612 | 2094 | 801 |

| Variable Names | Farmers’ Annual Income | |

|---|---|---|

| Model 22 | Model 23 | |

| Likelihood of Participation in formal financial markets | 0.632 *** (0.115) | |

| Extent of participation in formal financial markets | 0.763 *** (0.260) | |

| Control variable | Yes | Yes |

| Constant term | 5.592 *** | 5.515 *** |

| R2 | 0.1283 | 0.1255 |

| Observation | 2895 | 2895 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, J.; Zhang, C.; Yang, H. Research on the Mechanism of Digital Skills for Enhancing Farmers’ Participation in Formal Financial Markets. Sustainability 2025, 17, 8927. https://doi.org/10.3390/su17198927

Zhang J, Zhang C, Yang H. Research on the Mechanism of Digital Skills for Enhancing Farmers’ Participation in Formal Financial Markets. Sustainability. 2025; 17(19):8927. https://doi.org/10.3390/su17198927

Chicago/Turabian StyleZhang, Jiayan, Chenxi Zhang, and Huilian Yang. 2025. "Research on the Mechanism of Digital Skills for Enhancing Farmers’ Participation in Formal Financial Markets" Sustainability 17, no. 19: 8927. https://doi.org/10.3390/su17198927

APA StyleZhang, J., Zhang, C., & Yang, H. (2025). Research on the Mechanism of Digital Skills for Enhancing Farmers’ Participation in Formal Financial Markets. Sustainability, 17(19), 8927. https://doi.org/10.3390/su17198927