Do Executives with IT Backgrounds Influence the Selection of Corporate Auditors in the Context of Digital Innovation?—An Examination from a Sustainability Perspective

Abstract

1. Introduction

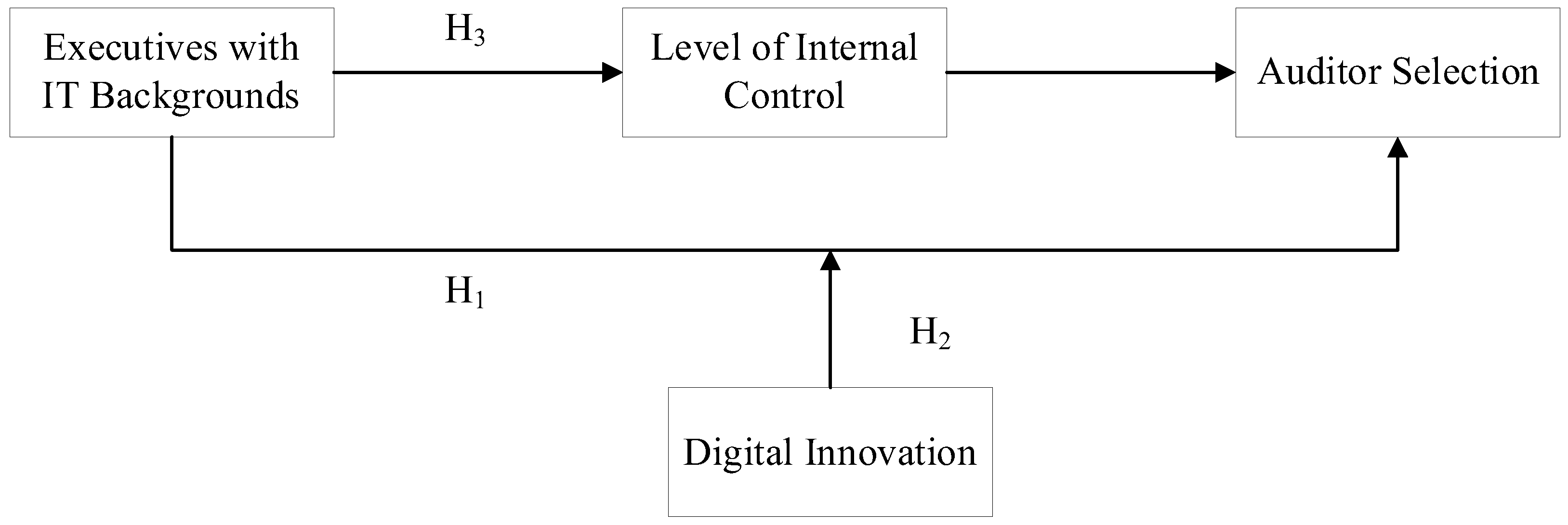

2. Theoretical Analysis and Research Hypotheses

2.1. Literature Review

2.2. Theoretical Analysis and Research Hypothesis

3. Research Design

3.1. Sample Selection and Data Sources

3.2. Model Design and Definition of Variables

3.2.1. Modeling

3.2.2. Definition of Variables

Explained Variable

Explanatory Variables

Moderating Variable

Mediating Variable

Control Variables

4. Empirical Results and Analysis

4.1. Descriptive Statistics

4.2. Research Hypothesis Testing

4.3. Further Analysis

4.3.1. Robustness and Endogeneity Tests

Replacement of Key Explanatory Variables

The Selection of Auditors Serves as an Important Proxy Variable Reflecting Audit Quality

Instrumental Variables Approach

4.3.2. Heterogeneity Analysis

Nature of Ownership Rights

Enterprise Size

Term of Office of Executives

Industry Classification

5. Conclusions and Implications of the Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Oh, K.S.; Cho, M.H.; Park, B.I. The Comparative Impact of Conventional and Digital Innovations on Driving Corporate Sustainability: The Case of Venture Firms in South Korea. Sustainability 2025, 17, 3226. [Google Scholar] [CrossRef]

- Kohli, R.; Melville, N.P. Digital innovation: A review and synthesis. Inf. Syst. J. 2019, 29, 200–223. [Google Scholar] [CrossRef]

- Menten, S.; Smits, A.; Kok, R.A.W.; Lauche, K.; van Gils, M. External resourcing for digital innovation in manufacturing SMEs. Technovation 2025, 140, 103142. [Google Scholar] [CrossRef]

- Cao, S.; Wu, Y. Executives’ IT background and corporate digital technology innovation: Evidence from Chinese microenterprises. PLoS ONE 2025, 20, e0320844. [Google Scholar] [CrossRef]

- Wang, H.; Li, B. Research on the influence mechanism of digital innovation in high-tech enterprises—An inter-organizational perspective. Manag. Decis. Econ. 2024, 45, 2988–3001. [Google Scholar] [CrossRef]

- Zhao, S.; Guan, Y.; Zhou, H.; Hu, F. Making digital technology innovation happen: The role of the CEO’s information technology backgrounds. Econ. Model. 2024, 140, 106866. [Google Scholar] [CrossRef]

- Liang, R. How does the Chinese digital transformation of enterprises affect the auditor switch? PLoS ONE 2024, 19, e0302013. [Google Scholar] [CrossRef]

- Peng, Y.; Jin, H. Effects of information and technology application in audits and digital economy on enterprise risk management level. Financ. Res. Lett. 2025, 73, 106593. [Google Scholar] [CrossRef]

- Dong, X.H.; Jiang, Y.W. Does enterprise digital transformation affect audit opinion type?—Based on business evidence of Chinese listed companies. Econ. Politics 2024, 36, 1143–1163. [Google Scholar] [CrossRef]

- Luo, Y.; Cui, R.; Ma, J.; Jin, Y.; Li, M.; Lin, S. Impact of CEO’s Scientific Research Background on the Enterprise Digital Level. Humanit. Soc. Sci. Commun. 2024, 11, 832. [Google Scholar] [CrossRef]

- Bley, J.; Saad, M.; Samet, A. Auditor choice and bank risk taking. Int. Rev. Financ. Anal. 2019, 61, 37–52. [Google Scholar] [CrossRef]

- Li, L.; Monroe, G.S.; Coulton, J. Managerial litigation risk and auditor choice. Int. J. Audit. 2024, 28, 142–169. [Google Scholar] [CrossRef]

- Jiang, H.; Jiang, Q. How regulatory media information disclosure affects auditor selection–Empirical evidence based on the interaction platform between investors and listed companies. Financ. Res. Lett. 2024, 67, 105826. [Google Scholar] [CrossRef]

- Yu, J.; Kwak, B.; Park, M.S.; Zang, Y. The Impact of CEO/CFO Outside Directorships on Auditor Selection and Audit Quality. Eur. Account. Rev. 2021, 30, 611–643. [Google Scholar] [CrossRef]

- Acar, M.; Şendurur, U. What affects auditor choice in emerging markets? New evidence on the role of cultural distance. Manag. Audit. J. 2023, 38, 1082–1111. [Google Scholar] [CrossRef]

- Chen, S.; Yang, Y. Impact of executive overseas backgrounds on corporate tax–avoidance behaviors. Financ. Res. Lett. 2024, 67, 105955. [Google Scholar] [CrossRef]

- Kalelkar, R.; Khan, S. CEO financial background and audit pricing. Account. Horiz. 2016, 30, 325–339. [Google Scholar] [CrossRef]

- Hernández-Pérez, J.; Cruz Rambaud, S.; Lorenzana de la Varga, T. Economic situation, the key to understanding the links between CEOs’ personal traits and the financial structure of large private companies. PLoS ONE 2019, 14, e0218853. [Google Scholar] [CrossRef]

- Hoang, N.V.; Dang, H.V.; Nguyen, H.T.; Pham, M.H. Upholding integrity: The influence of executives’ backgrounds on corporate information environment. J. Behav. Exp. Financ. 2025, 46, 101050. [Google Scholar] [CrossRef]

- Sunder, J.; Sunder, S.V.; Zhang, J. Pilot CEOs and corporate innovation. J. Financ. Econ. 2017, 123, 209–224. [Google Scholar] [CrossRef]

- Aktan, A.C.; Castellucci, F. Top management teams hierarchical structures: An exploration of multi-level determinants. Long Range Plan. 2025, 58, 102515. [Google Scholar] [CrossRef]

- Cai, Y.; Luo, N.; Xie, X.; Gong, Y. Chairman’ s IT background and enterprise digital transformation: Evidence from China. Pac. Basin Financ. J. 2024, 83, 102220. [Google Scholar] [CrossRef]

- Plekhanov, D.; Franke, H.; Netland, T.H. Digital transformation: A review and research agenda. Eur. Manag. J. 2023, 41, 821–844. [Google Scholar] [CrossRef]

- Zhang, K.; Bu, C. Top managers with information technology backgrounds and digital transformation: Evidence from small and medium companies. Econ. Model. 2024, 132, 106629. [Google Scholar] [CrossRef]

- Nagahi, M.; Hossain, N.U.I.; Jaradat, R.; Dayarathna, V.; Keating, C.; Goerger, S.; Hamilton, M. Classification of Individual Managers’ Systems Thinking Skills Based on Different Organizational Ownership Structures. Syst. Res. Behav. Sci. 2021, 39, 258–273. [Google Scholar] [CrossRef]

- Rayburn, S.; Patel, J.; Kaleta, J.P. The Influence of Firm’s Top Management Team Characteristics on Big Data Analytics Capability and Competitive Advantage. Inf. Syst. Manag. 2024, 41, 265–281. [Google Scholar] [CrossRef]

- Huang, X.; Gao, Q.; Wang, D. The impact of top management team tenure heterogeneity on innovation efficiency of declining firms. PLoS ONE 2025, 20, e0313624. [Google Scholar] [CrossRef]

- Yang, L.; Liu, J.; Fan, Z.; Yang, D. Governance of executive personal characteristics and corporate performance based on empirical evidence based on machine learning. J. Ambient. Intell. Humaniz. Comput. 2023, 14, 8655–8665. [Google Scholar] [CrossRef]

- Nassani, A.A.; Yousaf, Z.; Grigorescu, A.; Oprisan, O.; Haffar, M. Accounting Information Systems as Mediator for Digital Technology and Strategic Performance Interplay. Electronics 2023, 12, 1866. [Google Scholar] [CrossRef]

- Manita, R.; Elommal, N.; Baudier, P.; Hikkerova, L. The Digital Transformation of External Audit and Its Impact on Corporate Governance. Technol. Forecast. Soc. Change 2020, 150, 119751. [Google Scholar] [CrossRef]

- Gong, Q.; Gu, J.; Kong, Z.; Shen, S.; Dong, X.; Li, Y.; Li, C. The Impact of ESG Ratings on Corporate Sustainability: Evidence from Chinese Listed Firms. Sustainability 2025, 17, 5942. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, Q.; Wei, Y. Digital finance, internal control, and audit quality. Financ. Res. Lett. 2025, 76, 107033. [Google Scholar] [CrossRef]

- Zhang, K.; Wang, Y.; Cui, X.; Yue, H. Can the academic experience of senior leadership improve corporate internal control quality? Asian Bus. Manag. 2022, 21, 231–260. [Google Scholar] [CrossRef]

- Gebrayel, E.; Jarrar, H.; Salloum, C.; Lefebvre, Q. Effective association between audit committees and the internal audit function and its impact on financial reporting quality: Empirical evidence from Omani listed firms. Int. J. Audit. 2018, 22, 197–213. [Google Scholar] [CrossRef]

- Hu, Z.; Zeng, W.; Zhang, Y. Confucian culture and the choice of high-quality auditors. Manag. Audit. J. 2025, 40, 761–797. [Google Scholar] [CrossRef]

- Wang, X.; Sun, M. Enhancing SMEs resilience through digital innovation: A stage-based analysis. Eur. J. Innov. Manag. 2025, 28, 2607–2629. [Google Scholar] [CrossRef]

- Wang, R.; Zhang, G. Does optimising the business environment enhance enterprise resilience? The role of digital innovation and entrepreneurial spirit. Humanit. Soc. Sci. Commun. 2025, 12, 469. [Google Scholar] [CrossRef]

- Chen, Q.; Liu, S. Internal Control Quality and Leverage Manipulation: Evidence from Chinese State-Owned Listed Companies. Sustainability 2025, 17, 2905. [Google Scholar] [CrossRef]

- He, W.; He, S.; Hou, H. Digital economy, technological innovation, and sustainable development. PLoS ONE 2024, 19, e0305520. [Google Scholar] [CrossRef] [PubMed]

- Tsao, S.M.; Lu, H.T.; Keung, E.C. Internationalization and auditor choice. J. Int. Financ. Manag. Account. 2017, 28, 235–273. [Google Scholar] [CrossRef]

- Chen, S.; Yang, J. Intelligent manufacturing, auditor selection and audit quality. Manag. Decis. 2025, 63, 964–997. [Google Scholar] [CrossRef]

- Yu, D.; Zhu, Y. Executives with digital backgrounds and corporate ESG performance: Evidence from China. Res. Int. Bus. Financ. 2025, 75, 102765. [Google Scholar] [CrossRef]

- Corten, M.; Steijvers, T.; Lybaert, N.; Coeckelbergs, C. The Influence of the CEO on Auditor Choice in Private Firms: An Interplay of Willingness and Ability. Sustainability 2021, 13, 6710. [Google Scholar] [CrossRef]

- Bills, K.L.; Cobabe, M.; Pittman, J.; Stein, S.E. To share or not to share: The importance of peer firm similarity to auditor choice. Account. Organ. Soc. 2020, 83, 101115. [Google Scholar] [CrossRef]

- Qi, B.; Yang, R.; Tian, G. Do social ties between individual auditors and client CEOs/CFOs matter to audit quality? Asia-Pac. J. Account. Econ. 2017, 24, 440–463. [Google Scholar] [CrossRef]

- He, X.X.; Xie, D.C.; Hu, Z.M.; Bao, X.L.; Li, L. Impact of managerial overconfidence on abnormal audit fee: From the perspective of balance mechanism of shareholders. PLoS ONE 2020, 15, e0238450. [Google Scholar] [CrossRef] [PubMed]

- Cao, X.; Im, J.; Syed, I. A Meta-Analysis of the Relationship Between Chief Executive Officer Tenure and Firm Financial Performance: The Moderating Effects of Chief Executive Officer Pay and Board Monitoring. Group Organ. Manag. 2021, 46, 530–563. [Google Scholar] [CrossRef]

- Zhao, M.; Fu, X.; Sun, J.; Wang, Z.Z.; Wang, H.J.; Lu, S.; Cui, L. Optimal strategy of artificial intelligence on low-carbon energy transformation: Perspective from enterprise green technology innovation efficiency. Energy 2025, 319, 135035. [Google Scholar] [CrossRef]

- Zhang, L.; Zhang, X. Impact of digital government construction on the intelligent transformation of enterprises: Evidence from China. Technol. Forecast. Soc. Change 2025, 210, 123787. [Google Scholar] [CrossRef]

| Category | Name | Symbol | Definition |

|---|---|---|---|

| Explained Variables | Auditor Selection | If the firm chosen by the company is “Top 10”, then = 1; otherwise, = 0. | |

| Explanatory Variables | Executives with IT Backgrounds | Number of executives with IT backgrounds/total number of executive team members | |

| Moderating Variable | Digital Innovation | (Number of patent applications for digital innovation inventions + 1) | |

| Mediating Variables | Internal Control Level | (Internal control index + 1) | |

| Control Variable | Company Size | (Total assets at the end of the year) | |

| Company Growth | Revenue growth rate | ||

| Gearing Ratio | Total liabilities/total assets | ||

| Return on Assets | Year-end net profit/average total assets | ||

| Current Ratio | Current assets/current liabilities | ||

| Fixed Assets Ratio | Fixed assets/total assets | ||

| Intangible Assets Ratio | Intangible assets/total assets | ||

| Shareholding Ratio of Top Shareholders | Number of shares held by the largest shareholder/ (total number of shares) | ||

| Shareholding Ratio of Top Ten Shareholders | Number of shares held by top ten shareholders/total number of shares | ||

| Nature of Ownership | If the firm is state-controlled, = 1; otherwise, = 0. | ||

| Age of Executives | Average age of executives |

| Variable | Sample | Mean | S.D. | Min | Max |

|---|---|---|---|---|---|

| 25,967 | 0.572 | 0.495 | 0.000 | 1.000 | |

| 25,967 | 0.121 | 0.216 | 0.000 | 1.000 | |

| 25,967 | 0.110 | 0.416 | 0.000 | 2.565 | |

| 25,967 | 6.467 | 0.135 | 5.732 | 6.697 | |

| 25,967 | 22.408 | 1.306 | 20.094 | 26.440 | |

| 25,967 | 2.379 | 2.123 | 0.340 | 13.131 | |

| 25,967 | 0.419 | 0.196 | 0.063 | 0.880 | |

| 25,967 | 0.035 | 0.061 | −0.230 | 0.197 | |

| 25,967 | 0.147 | 0.366 | −0.542 | 2.100 | |

| 25,967 | 0.203 | 0.153 | 0.002 | 0.672 | |

| 25,967 | 0.046 | 0.052 | 0.000 | 0.348 | |

| 25,967 | 33.145 | 14.559 | 8.320 | 72.840 | |

| 25,967 | 57.748 | 15.048 | 23.460 | 90.480 | |

| 25,967 | 0.340 | 0.474 | 0.000 | 1.000 | |

| 25,967 | 49.833 | 3.136 | 42.000 | 57.182 |

| Variable | (1) | (2) | Variable | (1) | (2) |

|---|---|---|---|---|---|

| 0.043 *** | 0.065 *** | 0.115 ** | |||

| (3.134) | (4.731) | (1.992) | |||

| 0.038 *** | 0.001 *** | ||||

| (12.879) | (2.333) | ||||

| 0.004 ** | 0.003 *** | ||||

| (2.200) | (10.011) | ||||

| −0.027 | −0.005 | ||||

| (−1.113) | (−0.709) | ||||

| 0.303 *** | 0.003 *** | ||||

| (5.381) | (2.980) | ||||

| 0.001 | 0.673 *** | −0.552 *** | |||

| (0.090) | (62.248) | (−7.771) | |||

| 0.078 *** | Fixed | Fixed | |||

| (3.719) | 25,967 | 25,967 | |||

| 0.067 | 0.095 |

| Variable | (1) | (2) | Variable | (1) | (2) |

|---|---|---|---|---|---|

| 0.059 *** | 0.057 *** | 0.086 *** | 0.087 *** | ||

| (4.295) | (4.105) | (4.122) | (4.150) | ||

| 0.036 *** | 0.030 *** | 0.121 ** | 0.120 ** | ||

| (5.016) | (4.036) | (2.100) | (2.076) | ||

| 0.076 *** | 0.001 ** | 0.001 ** | |||

| (2.657) | (2.479) | (2.474) | |||

| 0.037 *** | 0.037 *** | 0.003 *** | 0.003 *** | ||

| (12.262) | (12.227) | (10.270) | (10.329) | ||

| 0.005 ** | 0.005 ** | −0.005 | −0.005 | ||

| (2.294) | (2.310) | (−0.649) | (−0.682) | ||

| −0.023 | −0.022 | 0.003 *** | 0.003 *** | ||

| (−0.954) | (−0.920) | (3.022) | (3.033) | ||

| 0.301 *** | 0.301 *** | −0.529 *** | −0.528 *** | ||

| (5.339) | (5.356) | (−7.429) | (−7.423) | ||

| 0.001 | 0.001 | Fixed | Fixed | ||

| (0.139) | (0.138) | 25,967 | 25,967 | ||

| 0.096 | 0.096 |

| Variable | (1) | (2) | Variable | (1) | (2) |

|---|---|---|---|---|---|

| 0.065 *** | 0.010 *** | 0.115 ** | −0.074 *** | ||

| (4.731) | (2.676) | (1.992) | (−4.862) | ||

| 0.038 *** | 0.013 *** | 0.001 *** | 0.000 *** | ||

| (12.879) | (16.952) | (2.333) | (4.925) | ||

| 0.004 ** | −0.003 *** | 0.003 *** | 0.000 *** | ||

| (2.200) | (−4.987) | (10.011) | (4.200) | ||

| −0.027 | −0.026 *** | −0.005 | 0.009 *** | ||

| (−1.113) | (−4.196) | (−0.709) | (4.693) | ||

| 0.303 *** | 0.586 *** | 0.003 *** | 0.002 *** | ||

| (5.381) | (39.659) | (2.980) | (5.642) | ||

| 0.001 | 0.050 *** | −0.552 *** | 6.070 *** | ||

| (0.090) | (22.047) | (−7.771) | (323.977) | ||

| 0.078 *** | −0.033 *** | Fixed | Fixed | ||

| (3.719) | (−5.943) | 25,967 | 25,967 | ||

| 0.095 | 0.165 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| 0.921 *** | ||||

| (46.508) | ||||

| 0.010 *** | 0.532 *** | |||

| (8.348) | (10.532) | |||

| 0.045 *** | ||||

| (7.137) | ||||

| Control variable | Control | Control | Control | Control |

| −0.548 *** | −0.089 *** | 0.055 * | −0.743 *** | |

| (−7.736) | (−14.754) | (1.732) | (−9.884) | |

| Fixed | Fixed | Fixed | Fixed | |

| 25,967 | 25,967 | 25,967 | 25,967 | |

| 0.096 | 0.074 | 0.103 | 0.056 |

| Variable | (1) State-Owned Enterprises | (2) Non-State-Owned Enterprises | (3) Small-Scale Enterprises | (4) Large-Scale Enterprises |

|---|---|---|---|---|

| 0.030 | 0.057 *** | 0.017 | 0.072 *** | |

| (1.081) | (3.604) | (0.670) | (4.298) | |

| Control variable | Control | Control | Control | Control |

| −0.971 *** | −0.293 *** | −0.783 ** | −0.645 *** | |

| (−7.948) | (−3.077) | (−2.220) | (−7.500) | |

| Fixed | Fixed | Fixed | Fixed | |

| 8825 | 17,142 | 6491 | 19,476 | |

| 0.137 | 0.092 | 0.081 | 0.106 |

| Variable | (1) Longer Terms | (2) Shorter Terms | (3) Capital-Intensive Enterprises | (4) Labor-Intensive Enterprises |

|---|---|---|---|---|

| 0.012 | 0.061 *** | 0.012 | 0.053 *** | |

| (0.619) | (3.027) | (0.569) | (2.857) | |

| Control variable | Control | Control | Control | Control |

| −0.417 *** | −0.703 *** | −0.710 *** | −0.549 *** | |

| (−3.923) | (−7.135) | (−7.113) | (−5.070) | |

| Fixed | Fixed | Fixed | Fixed | |

| 12,971 | 12,980 | 12,983 | 12,983 | |

| 0.101 | 0.108 | 0.119 | 0.092 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, J.; Li, J.; Wang, S. Do Executives with IT Backgrounds Influence the Selection of Corporate Auditors in the Context of Digital Innovation?—An Examination from a Sustainability Perspective. Sustainability 2025, 17, 8911. https://doi.org/10.3390/su17198911

Liu J, Li J, Wang S. Do Executives with IT Backgrounds Influence the Selection of Corporate Auditors in the Context of Digital Innovation?—An Examination from a Sustainability Perspective. Sustainability. 2025; 17(19):8911. https://doi.org/10.3390/su17198911

Chicago/Turabian StyleLiu, Jia, Jingyao Li, and Shuwei Wang. 2025. "Do Executives with IT Backgrounds Influence the Selection of Corporate Auditors in the Context of Digital Innovation?—An Examination from a Sustainability Perspective" Sustainability 17, no. 19: 8911. https://doi.org/10.3390/su17198911

APA StyleLiu, J., Li, J., & Wang, S. (2025). Do Executives with IT Backgrounds Influence the Selection of Corporate Auditors in the Context of Digital Innovation?—An Examination from a Sustainability Perspective. Sustainability, 17(19), 8911. https://doi.org/10.3390/su17198911