1. Introduction

Saudi Arabia, a leading oil producer holding approximately 17 percent of the world’s proven petroleum reserves [

1], recognizes the critical need to diversify its revenue streams beyond oil dependency. The country aims to leverage oil and gas revenues to develop non-oil sectors including infrastructure, construction, education, tourism, and manufacturing [

2]. Vision 2030, unveiled on 25 April 2016, by Crown Prince Mohammed bin Salman, established two primary economic goals: increasing non-oil government revenue from SR163 billion to SR1 trillion, and raising foreign direct investment (FDI) from 3.8% to 5.7% of GDP—matching international standards [

2]. These objectives represent Saudi Arabia’s strategic shift toward a balanced, sustainable economic model while attracting international businesses to create a globally integrated investment landscape.

1.1. Saudi Arabia’s Investment Overview

Foreign direct investment has the potential to drive economic growth and facilitate the transfer of technology and knowledge [

3]. Saudi Arabia’s diversification efforts have significantly boosted both domestic and foreign investment, with FDI experiencing remarkable growth, tripling from under

$5 billion (18.7 billion SR) before Vision 2030’s announcement to approximately

$19 billion (72 billion SR) by 2021. According to data from Statista (2024), FDI values from 2007 to 2019 demonstrate this consistent upward trajectory. This growth stems from enhanced competitiveness across key sectors including business operations, infrastructure, cybersecurity, and education [

4]. The Kingdom has achieved notable global rankings improvements, ranking 36th globally in roads and transportation among 141 countries, 9th in Technical and Vocational Education Training among 154 countries (global-knowledge-index, 2020), and 41st in the Global Talent Competitiveness Index 2021 among 134 countries [

4]. Quality of life indicators show Saudi Arabia achieved 30th place in the World Happiness Index 2022 among 156 countries [

5] and 33rd in Travel and Tourism Competitiveness Index 2022 out of 117 countries [

6]. Economic strength is demonstrated through 6th ranking in foreign exchange reserves among G20 nations for 2021 [

4] and 3rd place in the Minority Investor Protection Ease Index for 2021 out of 132 countries, indicating strong institutional frameworks for international investors. According to data from the General Authority for Statistics, foreign direct investment [

7] FDI in Saudi Arabia rose markedly from less than USD 5 billion in 2007 to approximately USD 19 billion in 2019, reflecting the significant influence of economic reforms and an enhanced investment climate during this period.

1.2. Saudi Arabia’s Foreign Direct Investment Strategy and Challenges

Economic diversification and private sector expansion have taken center stage in Saudi Arabia’s policy agenda since the publication of Vision 2030 goals. A significant portion of this attention has been directed towards foreign direct investment (FDI) in the Saudi market. With a clear goal to boost FDI from its current standing of 3.8% of GDP to 5.7% by 2030, the country has instituted strategic programs aimed at attracting international companies. The Saudi Vision 2030 initiative, with central emphasis on empowering the private sector, contributes to an improved business environment and encourages international business engagement, ultimately leading to heightened competitiveness [

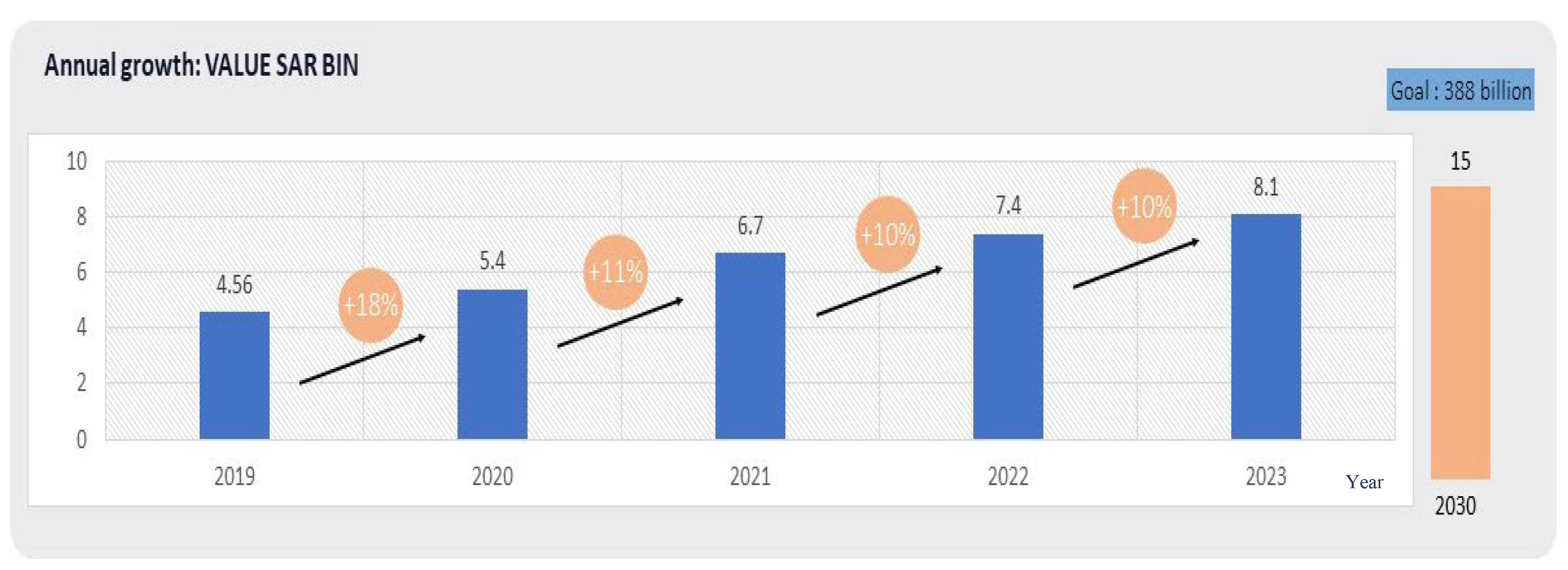

4]. The country is actively striving to attract greater numbers of international companies to invest in Saudi Arabia, with the fundamental objective of reaching an FDI target of 388 billion Saudi Riyal by 2030 [

8]. However, closer examination of data from the past three years reveals an average annual growth rate of approximately 10%. This growth trajectory has led to an FDI total of 8.1 billion by the first quarter of 2023. If this growth rate remains consistent, the projected FDI for 2030 would reach approximately 15 billion [

8]. This significant disparity between the established goal and actual FDI figures highlights a pressing concern requiring immediate attention. Examining this research matter is critical for identifying potential economic challenges preventing foreign businesses from entering the Saudi market as intended. It also involves crafting creative strategies to overcome the substantial disparity between projected economic goals and existing trajectory. This research addresses key questions regarding the primary economic challenges faced by international companies entering the Saudi market and the most effective strategies for attracting high-quality foreign direct investment. The study objectives focus on pinpointing primary economic challenges restricting foreign investor entry into the Saudi market and outlining strategic recommendations for maximizing annual growth rates within the Saudi market.

2. Literature Review

The literature review is organized into three main segments: Saudi Vision 2030, FDI from a global perspective, and key factors influencing FDI inflow globally and in the Saudi market. These segments encompass studies conducted from 2016 to 2023, providing updated insights with specific focus on Inward Foreign Direct Investment to facilitate comprehensive understanding of recent developments.

2.1. Saudi Vision 2030

On 25 April 2016, Crown Prince Mohammad bin Salman introduced Saudi Arabia’s Vision 2030, stating: “I am pleased to present Saudi Arabia’s Vision for the future, an ambitious yet attainable plan that embodies our long-term aspirations and expectations, showcasing the strengths and capabilities of our nation. Every success story originates from a vision, and robust visions are built on firm pillars” [

2]. Benefiting from its strategic geographical position at the crossroads of Asia, Africa, and Europe, the Kingdom leverages investment capabilities to foster a more sustainable and multifaceted economy. It holds the esteemed status as the heart of the Arab and Islamic world, serving as home to the two Holy Mosques. Vision 2030 represents a comprehensive, forward-thinking strategy aimed at unlocking the nation’s immense potential, establishing a diversified, innovative, and globally leading nation serving future generations [

2].

The three pillars comprised six overarching level 1 objectives, cascading into twenty-seven branch objectives at level 2, and eventually spreading to ninety-six strategic objectives at level 3. According to the Vision 2030, this vision was systematically cascaded into strategic objectives to facilitate effective implementation through Vision Realization programs. As outlined on the Vision2030 website, eleven Vision Realization programs are strategically leading and overseeing the implementation of initiatives executed by public sector organizations, all directed toward the achievement of the goals set forth in Vision 2030. Engineer Khaled bin Abdulaziz Al Falih, 2023, the Minister of Investment, announced a new methodology for enhancing data quality and transparency in the Kingdom to empower investors and decision-makers. This initiative aligns with broader goals such as the National Investment Strategy, special economic zone development, global supply chain initiatives, and mega-project launches. The commitment to data enhancement supports the Kingdom’s objectives and strengthens its global investment position. Various strategies can encourage foreign companies to enter the Saudi Arabian market. Incentives and benefits, such as tax incentives, access to government contracts, and simplified visa processes, can attract foreign companies. Establishing special economic zones with relaxed regulations and attractive investment opportunities is another effective strategy [

9].

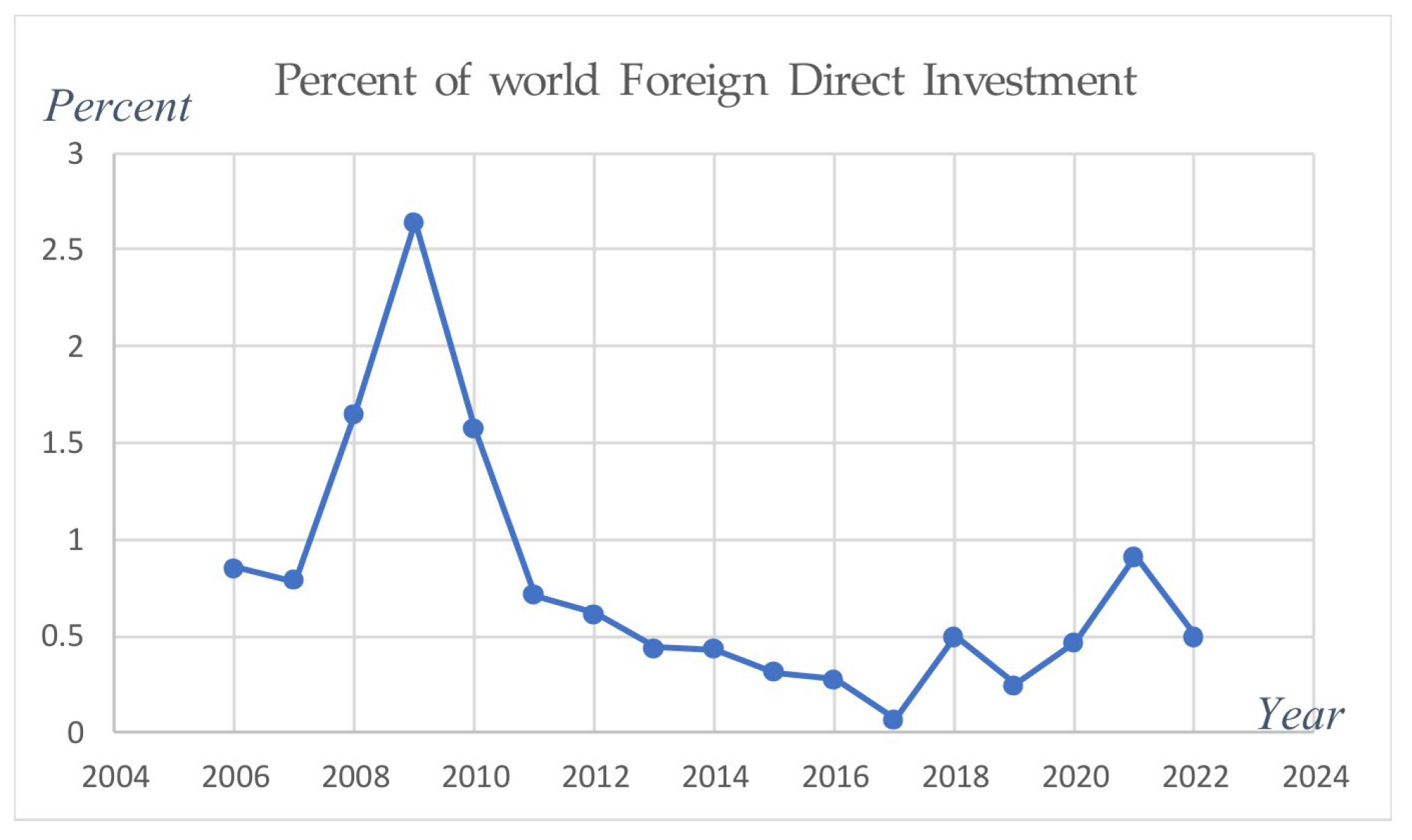

Figure 1 and

Figure 2 provide visual representation of Saudi Arabia’s economic growth rates from 2006 to 2022. Noteworthy is the noticeable impact of governmental policies and regulatory reforms, particularly post-2016, aligning with the inception of Saudi Vision 2030. This period witnessed significant increase in economic growth rates, rising from around 2% in 2016 to nearly 9% by 2022, underscoring tangible benefits from Vision 2030 strategic initiatives.

Figure 2 depicts the percentage of world Foreign Direct Investment in Saudi Arabia relative to GDP from 2006 to 2022, showing a discernible upward trend indicating increasing attractiveness of the Saudi market to foreign investors and growing appeal as an investment destination [

10].

2.2. Foreign Direct Investment from a Global Perspective

Foreign direct investment (FDI) represents investments made by companies or individuals from one country into another with the aim of establishing business operations or acquiring assets [

11]. FDI is a pivotal force driving economic growth globally, fostering job creation, and facilitating the exchange of technology and knowledge across nations. It is considered a key driver of globalization and international trade. Governments worldwide often employ incentives and policies to attract FDI, recognizing its potential to bring capital, expertise, and access to new markets [

11,

12,

13]. FDI can be broadly classified into two main forms: Inward FDI, which entails foreign capital investment in a host country, and outward FDI, which refers to host country investments in foreign markets. Inward FDI involves transferring tangible or intangible assets, making significant contributions to the host country’s economy [

14]. From a theoretical standpoint, FDI categorizes into Horizontal and Vertical types. Horizontal FDI involves companies investing in the same industry abroad as domestically, while Vertical FDI occurs when companies strategically distribute production processes across different countries [

15].

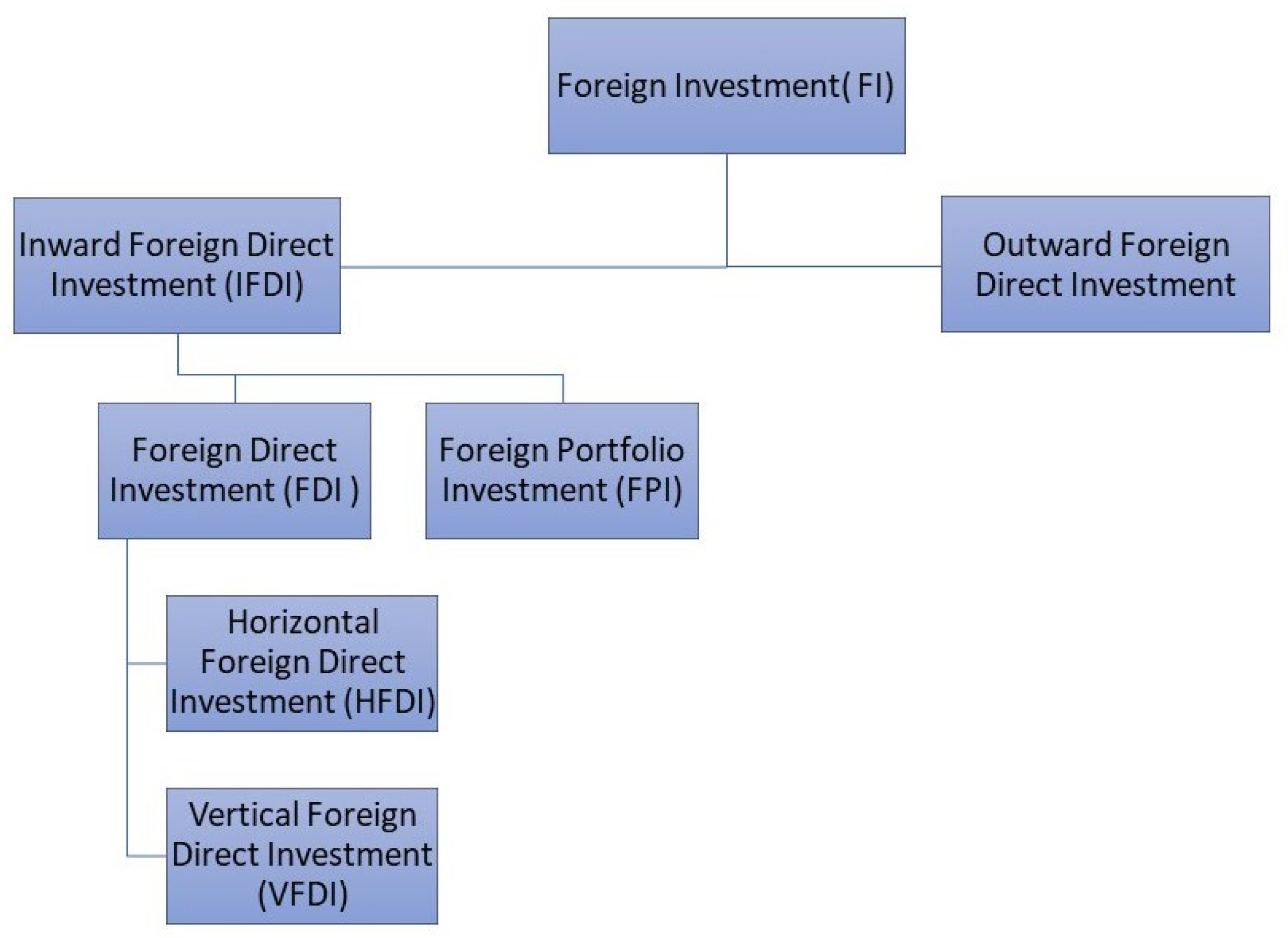

Figure 3 illustrates Foreign Direct Investment breakdown based on previous studies.

2.3. Key Factors Influencing FDI Inflow

As the relationship between foreign direct investment (FDI) and economic growth unfolds, it becomes evident that contrasting viewpoints emerge from extensive research. While some studies suggest a positive correlation between FDI and economic growth, others indicate potential adverse effects in certain countries [

11,

12,

13,

16]. Haudi [

17] outline benefits for investors, including global expansion and cost minimization. Simultaneously, advantages for host countries involve attracting FDI, fostering economic growth, integrating technology, and promoting innovative ideas. However, potential drawbacks include the creation of dependency and prioritization of profit over host state development [

18].

Table 1 outlined a tabular presentation summarizing the advantages and disadvantages associated with key factors influencing Foreign Direct Investment (FDI), as identified by [

17,

19].

The study conducted by Samargandi [

20] sheds light on the challenges influencing Foreign Direct Investment (FDI) dynamics in Saudi Arabia. Key elements include substantial oil revenues and government involvement in crucial industries. Despite initial challenges with negative FDI inflows until 2004, strategic policies, such as joining the World Trade Organization (WTO), led to a significant increase in FDI since 2005, even amid the global financial crisis. Furthermore, the unveiling of Saudi Arabia’s Vision 2030 in 2016, articulated by Crown Prince Mohammed bin Salman Bin Abdulaziz, set ambitious goals to raise FDI from 3.8% to 5.7% of gross domestic product (GDP) to reach international standards [

9]. It defines GDP as “the sum of values added by the domestic producers to the product price, plus customs tariffs.” Alternatively, it is the sum of all outputs, less the sum of intermediate consumption plus the indirect taxes on products (taxes, subsidies, etc.) not included in the output’s values”. Also, in the 2014 World Investment Report by the United Nations Conference on Trade and Development (UNCTAD), Saudi Arabia ranked third in terms of the highest number of Foreign Direct Investments (FDI) in Western Asia [

21]. Binkhamis indicated [

22] that despite lagging in moving forward to attract foreign investments to the Saudi market, returns have recorded promising numbers in recent years; the latest data from the General Authority for Statistics in 2023 highlights FDI Inflows of approximately 17 billion SAR and Outflows of around 5 billion SAR during Q3 2023, resulting in a net FDI flow of 11 billion towards ‘sustainable FDI.’ The data report highlights prioritizing the following criteria, i.e., low carbon footprint, strict adherence to human rights, maintaining workplace safety, preventing discrimination, and upholding transparency standards. The increasing recognition of the importance of environmental, social, and governance factors in investment decision-making drives the strategic shift towards ESG investing. ESG investing considers companies’ sustainability and ethical practices, aiming to generate long-term value while considering the impact on the environment, society, and corporate governance. This shift aligns with broader goals related to sustainable development and responsible investment practices, as emphasized by the (Columbia Center on Sustainable Investment).

2.4. The Key Factors and Challenges Influencing the Inflow of Foreign Direct Investment (FDI) Globally and in Saudi Arabia

In today’s global economy, foreign direct investment (FDI) faces various challenges. For developing and underdeveloped nations, FDI remains a vital engine of growth and a preferred strategy for economic advancement [

17]. These countries actively seek to attract investors by leveraging key influencing factors. Nguyen [

23] found that trade liberalization and human resource quality positively impact FDI in Southeast Asia, while urbanization, population size, and tourism have limited effects. Djokoto and Wongnaa [

24] analyzed FDI inflows based on economic growth, government policy, labor markets, inflation, trade openness, foreign reserves, and natural resources. Abdel-Rahman [

25] highlighted market size as a major consideration for investors, while foreign investment also boosts local capital availability [

26]. Aljbory [

27] stressed the importance of GDP growth and inflation in shaping the investment environment but noted that political and security risks were not included in the model. In Africa, Johnson [

28] identified infrastructure gaps, low savings, and inflation as barriers to FDI from 1970 to 2021. Khan [

29,

30] advocated inflation targeting to improve governance and macroeconomic stability, with countries adopting this strategy seeing a 3% increase in FDI.

In Saudi Arabia, FDI has historically supported oil exploration and major firms like ARAMCO and SABIC, and also contributed to infrastructure and banking [

25]. Regulatory reforms in 2000 revised corporate and trade laws to attract more investors [

31]. Key factors now include Vision 2030, strategic location, real estate prospects, and a strong financial sector [

32].

2.5. Foreign Direct Investment (FDI) in GCC Countries

Foreign Direct Investment (FDI) has become a pivotal component for economic growth and diversification in the Gulf Cooperation Council (GCC) countries. The GCC, comprising Saudi Arabia, the United Arab Emirates (UAE), Qatar, Kuwait, Oman, and Bahrain, is strategically focused on reducing reliance on oil revenues and fostering sustainable economic development. The GCC nations have recognized the need for economic diversification to counteract the volatility of oil prices. As noted by Abdel-Rahman [

25], FDI is crucial for the growth of non-oil sectors such as tourism, finance, and technology, which can significantly contribute to the region’s economic sustainability. The implementation of policies aimed at encouraging FDI is evident in Saudi Arabia’s Vision 2030 and similar strategic frameworks across other GCC nations [

2].

Various factors influence FDI in the GCC countries, including favorable government policies, strategic geographical positioning, and the availability of natural resources. According to Binkhamis [

22], employment of open investment policies and regulatory reforms in Saudi Arabia has been instrumental in attracting FDI, nearly tripling inflows since the announcement of Vision 2030. In the UAE, its established infrastructure and business-friendly environment have also led to substantial foreign investments in sectors such as real estate and finance [

9]. Despite the positive outlook on FDI in the GCC, challenges remain. Regulatory complexities, bureaucratic inefficiencies, and concerns regarding political stability are some barriers identified [

32].

The impact of FDI on GCC economies has multifaceted approach. On one hand, it has stimulated economic growth and job creation; on the other hand, concerns regarding dependency on foreign capital have emerged. As highlighted by Samargandi [

20], while FDI has historically supported vital sectors, it is essential for GCC nations to ensure that indigenous development is not compromised in the pursuit of foreign investments. The GCC countries continue to position themselves as attractive destinations for FDI through strategic initiatives and regulatory reforms.

In 2023, the Minister of Investment introduced a new data transparency initiative aligned with the National Investment Strategy, special economic zones, global supply chains, and mega-projects. Strategies to attract FDI include tax incentives, access to government contracts, simplified visas, and support for licensing and compliance. Special economic zones and partnerships between foreign and local firms further facilitate investment and knowledge exchange [

33]. El-Awady [

32] also emphasized GDP growth, domestic investment, and natural gas reserves as critical factors.

Table 2 summarizes the key determinants—positive and negative—affecting FDI in Saudi Arabia, based on the reviewed literature.

Table 2 outlines the pivotal factors influencing the positive or negative aspects of attracting foreign direct investment in the Saudi market, providing a comprehensive overview of the key determinants discussed in the literature review.

Research in the field of Foreign Direct Investment (FDI) in Saudi Arabia has predominantly centered around the examination of strategies designed to attract investors. However, after a comprehensive review of existing literature, a notable research gap emerges. Specifically, there is a dearth of assessments regarding the strategies employed to enhance FDI in Saudi Arabia and their direct and indirect impacts within the framework of the economic goals outlined in the Vision 2030 initiative. While previous studies acknowledge the importance of diversifying economic incomes, there is a crucial need to investigate the implementation of these strategies and their tangible outcomes in terms of achieving the targeted FDI objectives. This research gap underscores the necessity for a more nuanced exploration of strategy execution and its measurable impact on meeting the envisioned FDI goals.

Figure 4 shows the annual growth rate year-on-year in Saudi Arabia from 2019 to the first quarter of 2023 [

37]. It should also be mentioned that some published data indicates a figure of 19.29 billion SAR in 2021 [

10], due to Saudi Aramco’s infrastructure deal being concluded [

37].

The proactive efforts of the Saudi government to improve the quality of life for all its residents are unmistakably evident in the year-on-year growth observed. This progress instills optimism for the future, as evidenced from the announcement in 2023 until the present day.

3. Methodology

This section presents the methodological framework adopted in the study. Building on the comprehensive literature review of key economic factors affecting Foreign Direct Investment (FDI) in Saudi Arabia, a mixed-methods approach was employed. Quantitative analysis was conducted using a standard model and simple regression to evaluate the impact of each identified factor on FDI inflows. Complementing this, qualitative insights were gathered through Delphi interviews with eight experts in economics, finance, construction industry and investment, aimed at identifying the most effective strategies for improving the investment climate. By combining both quantitative and qualitative methods, this integrated approach provides a thorough and multidimensional assessment of the forces shaping FDI trends in the Saudi market.

3.1. Statistical Quantitative Analysis Method: Multiple Linear Regression Model

3.1.1. Key Economic Factors Influencing Foreign Investment Based on Previous Researchers

The literature review extensively examined previous studies, with a specific focus on understanding the primary factors influencing the decisions of foreign investors to either increase or reduce their investments globally, with a particular emphasis on Saudi Arabia.

Table 3 presents a compilation of these economic factors, synthesizing key findings from the array of previous research.

While there are additional economic factors beyond this list, we curated these based on several reasons:

- -

These factors have been extensively researched across various studies.

- -

Researchers have approached these factors from diverse perspectives.

- -

They are subjective and quantifiable.

- -

The studies originate from reputable academic institutions.

- -

These factors have shown consistent relevance and impact across different economic environments.

- -

They represent both internal and external influences on investment decisions.

- -

Their inclusion allows for a comprehensive understanding of the economic landscape affecting foreign investment.

In light of the most influential economic factors on FDI, seven key variables were chosen for analysis spanning the last 18 years, from 2006 to 2023. These variables encompass population growth rate, gross savings and spending, trade openness, inflation rate Gross Domestic Product (GDP), and world oil reserve. Their selection was prompted by the researcher’s hypothesis regarding their substantial impact on FDI. Moreover, there has been no comprehensive study examining these factors collectively within the specified period. These factors are widely recognized in economic theory as fundamental drivers of economic growth and investment attraction. Analyzing them allows us to test theoretical assumptions against empirical data. To be more determined, here is the direct reason behind the chosen for each factor from our perspective:

- -

Population Growth Rate: Population growth directly impacts the size of the labor force and consumer base, influencing market demand and investment opportunities.

- -

Gross Savings and Spending: The level of savings and spending reflects the economic health and consumer confidence within a country, which are key determinants for attracting foreign investment.

- -

Trade Openness: Trade openness measures the extent to which a country engages in international trade. Higher levels of trade openness often correlate with increased foreign investment opportunities and market accessibility.

- -

Inflation Rate: Inflation affects the purchasing power of consumers and the cost of doing business. Understanding inflation trends is crucial for foreign investors to assess the stability and profitability of investments.

- -

Gross Domestic Product (GDP): Changes in GDP can reflect shifts in consumer spending, investment, and government expenditure, all of which can impact FDI. Analyzing GDP alongside other factors provides a comprehensive view of the economic landscape and its influence on foreign investment.

- -

World Oil Reserves: Given Saudi Arabia’s significant role as a major oil-producing nation, world oil reserves are a crucial factor influencing its economy and foreign investment. Fluctuations in oil prices and production levels can have ripple effects on various economic indicators, including FDI.

- -

Limited Existing Research: While each of these factors has been studied individually in relation to FDI, there is a gap in comprehensive research that examines their collective impact over a specific time period. Therefore, analyzing these factors together provides a more holistic understanding of their influence on FDI inflows.

- -

Data Availability and Reliability: Data on population growth, savings, spending, trade openness, and inflation rate are typically well-documented and available from reputable sources such as national statistical agencies and international organizations, ensuring the reliability of our analysis.

3.1.2. Multiple Linear Regression Mode

The Multiple Linear Regression Model is a statistical method used to analyze the relationship between multiple independent variables and a single dependent variable. It was first formulated by Francis Galton, a British polymath, in the late 19th century, around the 1880s. Galton developed this model to understand the relationship between the heights of parents and their offspring, pioneering the field of regression analysis. Since Galton’s pioneering work, the Multiple Linear Regression Model has become a fundamental tool in statistics, economics, social sciences, and various other fields. It allows researchers to examine the complex relationships between multiple variables and make predictions or infer causal relationships based on empirical data. The quantitative methodology employed in this research encompasses a comprehensive data analysis approach, utilizing datasets sourced from reputable sources such as the Global Economy, Business and Economic Data, and the World Bank. The dataset covers the period from 2006 to 2023 in the Saudi Arabia and includes key economic factors as independent variables, which influence the dependent variable, Foreign Direct Investment (FDI). The selected independent factors consist of population growth, savings as a percentage of GDP, gross spending, trade openness, inflation rate, and Gross Domestic Product (GDP). To analyze the relationship between these independent variables and FDI, a simple regression model was implemented using Stata 17, the statistics and data science software and DATAlab platform. This methodology facilitates a rigorous examination of the impact of various economic factors on FDI inflows, providing valuable insights that pinpoint areas requiring improvement to enhance FDI inflows.

Table 4 presents year-on-year assessments for various factors, each denoted by its respective abbreviation. These factors include:

- -

FDI: Foreign Direct Investment (measured in billion USD) encompasses direct investment equity flows into the reporting economy, including equity capital, reinvestment of earnings, and other capital.

- -

gPOP: Population growth rate (percentage). Population is measured based on the de facto definition, including all residents regardless of legal status or citizenship.

- -

SY: Gross savings as a percentage of GDP, calculated as gross national income less total consumption, plus net transfers.

- -

GY: Government spending as a percentage of GDP, includes all government current expenditures for purchases of goods and services (including compensation of employees). It also includes most expenditures on national defense and security, but excludes government military expenditures that are part of government capital formation.

- -

EXY: Trade openness, represented by exports plus imports as a percentage of GDP.

- -

CPI: Inflation rate, as measured by the consumer price index (CPI), reflects the annual percentage change in the cost of a fixed basket of goods and services for the average consumer.

- -

Y: Gross Domestic Product (GDP), measured in billion USD, represents the total value of goods and services produced within a country’s borders. This includes taxes on products but excludes subsidies.

- -

ORWOR: Percentage of world oil reserves, calculated as the proven oil reserves of a country as a percent of the total proven oil reserves for the world.

We forecasted these values by calculating the average of the preceding three years, as highlighted in green in the table. For instance, to forecast the Gross Saving (SY) of 2023, we summed the numbers for the years 2022, 2021, and 2020, then divided by 3 to obtain the average, following the equation: (24.58 + 30.52 + 40.29)/3.

After collecting and organizing the data into a table, the analysis was conducted using a standard model in the Stata software. Equation (1) of multiple linear regression formulated as follows [

37]:

Equation (1): Regression Model

This Equation (1) demonstrates a regression model that includes multiple independent variables to predict the dependent variable, making it a standard model, specifically a multiple linear regression model. Where

- 1.

FDIt represents the dependent variable (Foreign Direct Investment) at time t.

- 2.

gPOPt, SYt, GYt, EXYt, CPIt, Yt, and ORWORt represent independent variables (population growth rate, gross savings as a percentage of GDP, government spending as a percentage of GDP, trade openness, inflation rate, GDP, and percentage of world oil reserves, respectively) at time t.

- 3.

β0, β1, β2, β3, β4, β5, β6, and β7 are the coefficients or parameters associated with each independent. The coefficients are numerical values that quantify the relationship between each independent variable and the dependent variable (FDI) variable, These values are determined through the regression analysis process and represent the strength and direction of the relationship between each independent variable and FDI as follows:

β0 (Intercept): This represents the expected value of FDI when all the independent variables are equal to zero. It is the baseline level of FDI in the absence of the influence of the independent variables.

β1\beta_1β1 (Coefficient for Population Growth Rate, This coefficient indicates the change in FDI for a one-unit increase in the population growth rate, holding all other variables constant. A positive β1\beta_1β1 suggests that higher population growth rates are associated with increased FDI.

β2\beta_2β2 (Coefficient for Gross Saving: This coefficient reflects the change in FDI for a one-unit increase in gross savings as a percentage of GDP, holding all other variables constant. A positive β2\beta_2β2 indicates that higher gross savings rates are associated with higher FDI.

β3\beta_3β3 (Coefficient for Government Spending: This coefficient shows the change in FDI for a one-unit increase in government spending as a percentage of GDP, holding all other variables constant. A positive β3\beta_3β3 suggests that increased government spending is positively correlated with FDI.

β4\beta_4β4 (Coefficient for Trade Openness: This coefficient indicates the change in FDI for a one-unit increase in trade openness, holding all other variables constant. A positive β4\beta_4β4 suggests that greater trade openness leads to higher FDI.

β5\beta_5β5 (Coefficient for Inflation Rate: This coefficient reflects the change in FDI for a one-unit increase in the inflation rate, holding all other variables constant. A negative β5\beta_5β5 indicates that higher inflation rates are associated with lower FDI.

β6\beta_6β6 (Coefficient for GDP: This coefficient shows the change in FDI for a one-unit increase in GDP, holding all other variables constant. A positive β6\beta_6β6 suggests that higher GDP levels are positively correlated with FDI.

β7\beta_7β7: This coefficient indicates the change in FDI for a one-unit increase in the percentage of world oil reserves, holding all other variables constant. A positive β7\beta_7β7 suggests that a higher percentage of world oil reserves is associated with increased FDI.

εt represents the error term.

3.2. Qualitative Analysis Method: The Delphi Method

The Delphi method is a research technique that uses a series of questionnaires to gather opinions from experts without face-to-face discussions. It allows for anonymous participation and aims to reach a consensus on a particular topic.

3.2.1. Importance of Effective FDI Policies

As previously stated, the impact of FDI can have on the host nation is largely dependent on the quality of related policies. An inward FDI policy must successfully facilitate entry and operation of foreign countries and must strive to provide an equilibrium that maximizes the benefits and minimizes the risks. Higher rates of return on investment tend to attract more investors, and thus an effective FDI strategy and policy must convince the investor of potential and profitability. This is not limited to economic stability and satisfactory return on investment, any increases in efficiency due to factors or technology movement are potential pull factors for FDI. The final kicker for FDI is potential market size and an FDI strategy and policy is often created with the expressed purpose of increasing the size of the country’s market. This, however, should be consolidated with long-term development of the workforce and the country as to avoid market seeking behavior by the investor, and dependency by the host. As previously highlighted, the impact of Foreign Direct Investment (FDI) on a host nation greatly hinges on the quality of its associated policies. A proactive inward FDI policy should adeptly facilitate the entry and operations of foreign entities, striving to establish an equilibrium that maximizes benefits while minimizing risks. The allure of higher returns on investment naturally attracts more investors, emphasizing the need for FDI strategies and policies that convincingly showcase the potential for profitability. This extends beyond mere economic stability and satisfactory returns, encompassing enhancements in efficiency through the movement of factors or technology, which serve as attractive factors for FDI. Additionally, the allure of a sizable market plays a pivotal role in attracting FDI, prompting policies geared towards expanding the country’s market size. However, this expansion should be complemented by long-term workforce development initiatives to deter short-term market-seeking behavior and foster self-sufficiency.

The Saudi Government is actively striving to transform its approach. Efforts are underway to streamline foreign investment processes, ensuring equitable treatment for both local and foreign investors. These endeavors include offering various incentives and liberalization measures to catalyze investment growth. The evolution of FDI policies in Saudi Arabia since the inception of the regulatory Foreign Investment Law (FIL) in 2000 underscores the nation’s commitment to fostering a conducive investment climate. Recent policy initiatives aimed at bolstering FDI are a testament to Saudi Arabia’s proactive stance in adapting to evolving economic dynamics. Driven by the imperative need for financial diversification amidst fluctuating oil prices, coupled with the transformative objectives of Vision 2030 and the National Transformation Program, the government is actively fostering an environment ripe for investment. These initiatives not only aim to attract foreign capital but also prioritize the development of local talent and job creation. In the global arena, both developed and developing nations are recognizing the pivotal role of FDI in driving economic growth and comprehensive development. Saudi Arabia’s strategic focus on aligning its policies with Vision 2030 and fostering an investor-friendly environment underscores its commitment to harnessing the transformative potential of FDI. By leveraging additional capital resources, technological advancements, managerial expertise, and job opportunities, Saudi Arabia is poised to accelerate its journey towards robust economic development and global competitiveness.

3.2.2. Ranking of the Strategies and Policies

Delphi is a qualitative research method that involves collecting data through questionnaires and conducting multiple rounds of review and feedback by a panel of experts. To use Delphi in research, the following steps followed:

- 1.

Identify the research topic or problem that requires expert opinions or insights.

- 2.

Develop a questionnaire that captures the key aspects of the research topic. The questionnaire designed to gather qualitative data.

- 3.

Distribute the questionnaire to a selected group of experts in the field. These experts have knowledge and experience relevant to the research topic.

- 4.

Collect the responses from the experts and analyze them to identify common themes, patterns, and areas of agreement or disagreement.

- 5.

Based on the analysis, revise and refine the questionnaire for the next round of data collection.

- 6.

Repeat the process of distributing the questionnaire, collecting responses, and analyzing the data for multiple rounds. The number of rounds can vary depending on the research objectives and the level of consensus desired, in our research we do two rounds.

- 7.

Each round of data collection and analysis helps in narrowing down the focus, identifying emerging trends, and reaching a consensus on the research topic.

- 8.

The results of the Delphi process used to inform decision-making, policy development, or further research in the chosen field.

The survey is divided into two sections, with the first section focusing on collecting biographical information. The second section is dedicated to ranking the policies, allowing you as an expert to share your opinion on the most crucial measures in the short to medium terms. Eight experts from different industries are chosen

- -

Industrial

- -

Finance

- -

Construction

- -

Investment

- -

Tourism

The six policies from the literature ranked by experts in terms of their importance in attracting quality foreign investors are as follows:

- 1.

Entry and stay conditions: This policy focuses on creating favorable conditions for foreign investors to enter and stay in the country. It includes visa regulations, residency permits, and other related requirements [

39]

- 2.

Tax incentives and concessions: This policy aims to provide tax incentives and concessions to foreign investors, reducing their tax burden and encouraging investment [

40].

- 3.

FDI promotion agencies: This policy emphasizes the establishment of effective FDI promotion agencies that provide support and assistance to foreign investors throughout the investment process [

40].

- 4.

Pre-investment screening: This policy involves screening and reviewing foreign investments to ensure national security and protect strategic sectors of the economy [

41].

- 5.

Investment protection agreements: This policy involves signing bilateral or multilateral investment protection agreements to provide legal protection and guarantees for foreign investors [

41].

- 6.

Investor-friendly legal framework: This policy focuses on creating an investor-friendly legal framework by implementing transparent and predictable investment regulations [

39,

41].

After meticulously selecting and compiling the data, we proceeded with two rounds of expert consultations. Following this, we synthesized the acquired insights into charts and analyses, enriching our comprehension of the experts’ viewpoints, as outlined in the results.

3.2.3. Relative Importance Index

The expert analysis gathered through the Delphi survey utilized a specific scale to rank the relative relevance of various Key Performance Indicators (KPIs). Prioritizing these signals based on their Relative Relevance Index (RII) was a widely accepted method in research [

42]. The RII was calculated using the formula:

Equation (2): Relative Relevance Index (RII)

- -

W represents the weight or score assigned to each factor.

- -

A represents the highest possible score that can be assigned to a factor, typically based on the number of response options or levels for each factor.

- -

N represents the total number of respondents or observations.

In this study, the Delphi methodology was employed to assess the relative importance of various investment-related factors. Initially, a panel of experts was selected to provide their insights and opinions on a set of predefined factors critical to investment decisions. The Delphi process was structured in iterative rounds, where each round involved the experts ranking the factors based on their perceived significance. In the first round, participants were asked to rank each factor on a scale from 1 to 5, with 1 being the most important and 5 being the least important. The rankings were then collected and analyzed to compute the Relative Importance Index (RII) for each factor.

4. Results and Discussions

The results of the statistical quantitative analysis method, specifically the Multiple Linear Regression Model, are presented in this section. The model was used to analyze the data collected from the surveys administered to the participants of the study. The section provides an in-depth analysis of the factors that contribute to the success of Saudi Arabian expatriates working in various sectors of different countries. It highlights the key factors identified through the regression analysis and their impact on the success of expatriates. The results provide valuable insights into the characteristics, skills, and experiences that are associated with successful expatriate careers. Additionally, this section discusses the implications of these findings for organizations and individuals involved in managing expatriate assignments. It concludes by summarizing the key findings and their implications for future research and practice.

4.1. Result of Statistical Quantitative Analysis Method: Multiple Linear Regression Model

In this section, we elaborate on the results obtained through Stata software after entering the data of various economic factors. We demonstrate the impact of each of these factors on Foreign Direct Investment (FDI) in Saudi Arabia from 2006 to 2023. This analytical framework serves two primary purposes: it assesses the impact of various economic factors on FDI and provides valuable insights into the characteristics influencing expatriate success in different sectors. The Multiple Linear Regression Model is utilized to establish relationships between multiple independent variables, such as population growth, government spending, and inflation rates, and a dependent variable, which, in this context, is FDI. The model quantifies how changes in each independent variable correlate with changes in FDI over the years from 2006 to 2023. This method enables researchers to identify significant factors that affect FDI and to draw conclusions that can inform policy and investment strategies.

Table 5 represents the effect of various economic variables on (FDI) Foreign Direct Investment in the Saudi Arabia over the period 2006 to 2023. Each economic variable is represented by a coefficient, which indicates the magnitude and direction of its impact on foreign direct investment (FDI).

To determine the significant variables at the 5% level, we consider those with a p-value less than or equal to 0.05 From the provided regression results, the variables meeting this criterion are:

- -

gPOP (Population growth): Coefficient = −5.495233, p-value = 0.018

- -

SY (Share of youth population): Coefficient = −1.96316, p-value = 0.001

- -

GY (Government effectiveness): Coefficient = −2.765139, p-value = 0.004

- -

EXY (Exchange rate volatility): Coefficient = 1.056012, p-value = 0.002

- -

CPI (Consumer Price Index): Coefficient = 1.267367, p-value = 0.029

- -

ORWOR (Political stability): Coefficient = 6.125285, p-value = 0.006

These variables are statistically significant at the 0.05 level, suggesting they have an impact on explaining variations in FDI.

4.1.1. Significant Level: p > |t|

The significance level represented by the “

p > |t|” column in the regression result in

Table 6. In statistical analysis, a commonly chosen significance level is 0.05. This threshold indicates that if the

p-value associated with a coefficient estimate is less than 0.05, the coefficient is considered statistically significant., implying a meaningful relationship between the independent variable and FDI.

4.1.2. Effect of Economic Factors on FDI

- 1.

Population Growth (gPOP): The coefficient estimate for population growth is −5.495233, with a p-value of 0.018. This indicates that population growth has a statistically significant negative effect on FDI. For every one-unit increase in population growth, FDI is expected to decrease by approximately 5.50 billion USD, holding other factors constant. A one-unit increase in population growth” refers to an increase in the population growth rate by one percentage point. For example, if the population growth rate increases from 2% to 3%, this represents a one-unit increase.

- 2.

Gross Savings (SY): The coefficient estimate for gross savings is −1.96316, with a highly significant p-value of 0.001. This suggests that gross savings have a statistically significant negative impact on FDI. For every one-unit increase in gross savings, FDI is expected to decrease by around 1.96 billion USD, all else being equal.

While A one-unit increase in gross savings means an increase in gross savings as a percentage of GDP by one percentage point. For example, if gross savings as a percentage of GDP increases from 20% to 21%, this represents a one-unit increase. This increase is expected to decrease FDI by approximately 1.96 billion USD, holding other factors constant.

- 3.

Government Spending (GY): Government spending also exhibits a statistically significant negative effect on FDI, as indicated by a coefficient estimate of −2.765139 and a p-value of 0.004. This suggests that higher government spending is associated with lower levels of FDI in Saudi Arabia. A one-unit increase in government spending means an increase in government spending as a percentage of GDP by one percentage point. For example, if government spending as a percentage of GDP increases from 15% to 16%, this represents a one-unit increase. This increase is expected to decrease FDI by approximately 2.77 billion USD, holding other factors constant.

- 4.

Trade Openness (EXY): Trade openness, represented by exports plus imports as a percentage of GDP, has a statistically significant positive effect on FDI. The coefficient estimate is 1.056012, with a p-value of 0.002. This implies that higher trade openness is associated with higher levels of FDI. A one-unit increase in trade openness means an increase in trade openness by one percentage point. For example, if trade openness increases from 50% to 51%, this represents a one-unit increase. This increase is expected to increase FDI by approximately 1.06 billion USD, holding other factors constant.

- 5.

Inflation Rate (CPI): The coefficient estimate for the inflation rate is 1.267367, with a p-value of 0.029. This indicates a statistically significant positive relationship between inflation and FDI. Higher inflation rates are associated with higher levels of FDI inflows. A one-unit increase in the inflation rate means an increase in the inflation rate by one percentage point. For example, if the inflation rate increases from 2% to 3%, this represents a one-unit increase. This increase is expected to increase FDI by approximately 1.27 billion USD, holding other factors constant.

- 6.

Gross Domestic Product (Y): The coefficient estimate for GDP is 0.0218353, with a p-value of 0.150. This suggests that GDP does not have a statistically significant effect on FDI at the 0.05 level. A one-unit increase in GDP means an increase in GDP by one billion USD. This increase is expected to increase FDI by approximately 0.022 billion USD, holding other factors constant. However, the effect is not statistically significant at the 0.05 level.

- 7.

Percentage of World Oil Reserves (ORWOR): The coefficient estimate for the percentage of world oil reserves is 6.125285, with a p-value of 0.006, indicating a statistically significant positive relationship with FDI. Higher percentages of world oil reserves are associated with higher levels of FDI in Saudi Arabia. A one-unit increase in world oil reserves means an increase in the percentage of world oil reserves by one percentage point. For example, if the percentage of world oil reserves increases from 10% to 11%, this represents a one-unit increase. This increase is expected to increase FDI by approximately 6.13 billion USD, holding other factors constant.

4.2. Result of Qualitative Analysis Method: The Delphi Method

The rankings obtained, from most to least important according to expert results, are as follows:

- 1.

Investment protection agreements

- 2.

Pre-investment screening

- 3.

FDI promotion agencies

- 4.

Entry and stay conditions

- 5.

Tax incentives and concessions and

- 6.

Investor-friendly legal framework

To apply the RII equation with 8 respondents, we assigned weights (W) to each factor based on their rankings and calculated the RII:

4.2.1. Assign the Weights Based on Ranks

- -

Rank 1: Weight = 5

- -

Rank 2: Weight = 4

- -

Rank 3: Weight = 3

- -

Rank 4: Weight = 2

- -

Rank 5: Weight = 1

4.2.2. Summary of RII Values

Table 7 provides a clear overview of the relative importance index (RII) values for various factors related to foreign direct investment (FDI).

Most Important Factor: Investment Protection Agreements (RII = 0.825) is ranked highest, highlighting its critical importance. Least Important Factor: FDI Promotion Agencies (RII = 0.300) is ranked lowest, signifying its lower level of importance. The application of the Delphi methodology revealed significant insights into the relative importance of various investment-related factors. The results indicated that Investment Protection Agreements emerged as the most crucial factor, with the highest Relative Importance Index (RII) of 0.825. This suggests that experts consider robust legal frameworks and guarantees against expropriation or unfair treatment as critical for attracting and securing investments. This high ranking underscores the importance of ensuring that investment agreements provide strong protection to foster investor confidence by enhancing the legal frameworks surrounding investment protection agreements is essential. In contrast, FDI Promotion Agencies was identified as the least important factor, with the lowest RII of 0.300. This finding implies that while these agencies play a role in facilitating foreign direct investment, their perceived impact on investment decisions is relatively lower compared to other factors. This could indicate that investors prioritize more tangible aspects of the investment environment, such as legal protections and market conditions, over promotional efforts by agencies.

Pre-Investment Screening and Tax Incentives and Concessions both had moderate RII values (0.475 and 0.475, respectively), suggesting that while these factors are relevant, they do not hold as much weight as Investment Protection Agreements. This balance reflects that investors do value screening processes and tax incentives, but these are secondary to the foundational security provided by investment agreements. Entry and Stay Conditions and Investor-Friendly Legal Framework both shared a similar RII of 0.450. These results highlight that while these factors are important, they are not as critical as investment protection agreements. They reflect the necessary but less prioritized aspects of the investment environment, such as the ease of market entry and ongoing legal support.

Overall, the Delphi methodology provided a nuanced view of the factors influencing investment decisions, emphasizing the centrality of legal protections while highlighting the comparatively lower impact of promotional activities. These findings suggest that policymakers and investment facilitators should focus on enhancing investment protection frameworks to attract and retain investors effectively, while also considering the roles of other factors to create a comprehensive investment climate. The Delphi methodology reveals a clear need for policymakers and investment facilitators to enhance investment protection frameworks. Such efforts should focus on creating strong legal protections that reassure investors, while still considering the supporting factors to formulate a comprehensive investment strategy. By prioritizing and strengthening investment protection agreements, countries can effectively create a more attractive environment for potential investors, balancing the various factors that influence their decisions. In summary, the statistical outcomes of the multiple linear regression analysis and the six policies are rooted in the need for enhancing the investment climate in Saudi Arabia. By aligning these policies with the insights of economic effects from the quantitative analysis, stakeholders can effectively address the factors impacting FDI, thereby creating a more attractive environment for foreign investors.

The regression analysis revealed that population growth and government effectiveness both have significant negative impacts on FDI in Saudi Arabia, indicating that rapid population increases and weak governance may deter foreign investors. In contrast, inflation and the country’s share of world oil reserves showed significant positive effects, suggesting that resource wealth and certain economic conditions can attract investment.

The Delphi analysis reinforced the importance of strong legal protections, with Investment Protection Agreements ranked as the most critical factor for investor confidence, while FDI Promotion Agencies were seen as less influential. Together, these findings highlight the need for a balanced FDI strategy that strengthens legal frameworks, improves governance, and leverages natural resource advantages, in alignment with Vision 2030’s economic diversification goals.

5. Conclusions

This study critically evaluated the effectiveness of Foreign Direct Investment (FDI) attraction strategies in Saudi Arabia within the framework of Vision 2030. Using the Delphi methodology, Investment Protection Agreements emerged as the most influential determinant (RII = 0.825), underscoring the central role of robust legal frameworks that safeguard against expropriation and unfair treatment in fostering investor confidence. In contrast, FDI Promotion Agencies ranked lowest (RII = 0.300), reflecting a prevailing investor preference for substantive legal protections over promotional activities. Other factors—such as Pre-Investment Screening and Tax Incentives—were recognized as relevant but secondary, while Entry and Stay Conditions and Investor-Friendly Legal Frameworks received moderate attention yet lacked the critical weight of protective agreements. These findings highlight the need for policymakers to prioritize strengthening investment protection mechanisms as a cornerstone of FDI strategy. Such measures would not only enhance investor trust but also contribute to a more comprehensive and competitive investment climate. The analysis further revealed substantial variation in the relative impact of different determinants, as indicated by RII values. Investor preferences are shaped by conditions including investment promotion measures, entry requirements, fiscal incentives, and the strength of legal frameworks, with tax incentives and concessions emerging as particularly influential. These results align with established economic theory, which emphasizes that predictable regulatory environments and fiscal advantages reduce perceived risk and stimulate capital inflows. In conclusion, enhancing legal protections, supported by targeted fiscal incentives and complementary measures, is essential to optimizing Saudi Arabia’s investment attractiveness. Continuous, systematic evaluation of these factors will be critical to achieving Vision 2030’s objectives, fostering a stable and appealing environment for foreign investors, and driving sustainable economic growth. The recommendations for further research are as follows:

Application Across Industries: It is recommended to implement the statistical quantitative analysis method of multiple linear regression models across various industries. This approach would allow researchers to analyze different datasets relevant to specific industries.

Sector-Specific Studies: Investigating specific sectors for FDI attraction will allow for a deeper understanding of unique challenges and opportunities within those sectors, enhancing tailored policy recommendations.

Comparative Analysis: Researchers should conduct comparative analyses across different countries with varying FDI success rates and legal frameworks to identify best practices and factors contributing to a favorable investment climate.

Longitudinal Studies: Future research should involve longitudinal studies to monitor changes in FDI patterns and investor perceptions over time, particularly after the implementation of new investment protection laws or agreements.

Impact Assessment of Legal Reforms: Evaluating the effectiveness of newly implemented legal reforms or changes in government policy, specifically related to FDI protection, will provide valuable feedback on their efficacy and areas for improvement.

By addressing these recommendations, future research efforts can contribute significantly to the investment landscape, ultimately enhancing the effectiveness of strategies aimed at attracting and retaining foreign investors in Saudi Arabia and similar economies. One limitation of this study is that it relies on the Delphi methodology, which may introduce biases based on expert selection. To mitigate biases from expert selection and assumptions associated with the Delphi methodology and Multiple Linear Regression Model, future studies should incorporate a diverse pool of experts and utilize additional quantitative methods to cross-validate findings regarding economic factors and Foreign Direct Investment (FDI).

Author Contributions

Conceptualization, B.S. and M.A.; methodology, B.S. and M.A.; formal analysis, B.S. and M.A.; investigation, M.A.; resources, B.S. and M.A.; writing—original draft preparation, B.S.; writing—review and editing, B.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

This study is waived for ethical review due to the Prince Sultan University Institutional Review Board (PSU IRB) policy, in alignment with the National Committee of Bioethics (NCBE) guidelines under Royal Decree No. (M/59), which stipulate that research not involving identifiable personal data, medical procedures, or vulnerable populations is exempt from formal ethical review.

Informed Consent Statement

Informed consent for participation is not required as per the Prince Sultan University Institutional Review Board (PSU IRB) policy, in alignment with the National Committee of Bioethics (NCBE) guidelines under Royal Decree No. (M/59), which stipulate that studies not involving identifiable personal data, medical procedures, or vulnerable populations are exempt from this requirement.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Acknowledgments

The authors would like to acknowledge the support of Prince Sultan University for paying the Article Processing Charges [APC] of this publication. Also would like to thank N. Khan for his academic input.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Energy Information Administration (EIA). Country Analysis Brief: Saudi Arabia. In Last Updated: 4 October 2024; 2024. Available online: https://www.eia.gov/international/content/analysis/countries_long/Saudi_Arabia/pdf/Saudi-Arabia.pdf (accessed on 17 April 2023).

- Vision 2030. A Story of Transformation. 2022. Available online: https://www.vision2030.gov.sa/en/explore/story-of-transformation (accessed on 20 June 2023).

- Brimble, P.; Sherman, J. The Broader Impacts of Foreign Direct Investment on Economic Development in Thailand: Corporate Responses. In Foreign Direct Investment and Poverty Reduction, Proceedings of the High Level Roundtable on FDI and Its Impact on Poverty Alleviation 1998, Geneva, Switzerland, December 1998; Klein, M., Aaron, C., Hadjimichael, B., Eds.; WB Policy Research Working Paper 2613. World Bank: Washington, DC, USA, 2002. [Google Scholar]

- Ministry of Economy & Planning MEP. Last Visited 2024. Available online: https://mep.gov.sa/ar/knowledge-base/economic-reports (accessed on 11 November 2023).

- World Happiness Report. The World Happiness Report. 2023. Available online: https://www.worldhappiness.report/ed/2023/ (accessed on 12 September 2023).

- The World Economic Forum. The Global Competitiveness Report 2020. World Economic Forum. 2020. Available online: https://www.weforum.org/publications/the-global-competitiveness-report-2020/ (accessed on 21 July 2023).

- The General Authority for Statistics. Last Visited 2023. Available online: https://www.stats.gov.sa/ (accessed on 11 May 2023).

- Argaam. Here Is What You Need to Know About 44 MNCs Moving Regional HQs to Riyadh. 2021. Available online: https://www.argaam.com/en/article/articledetail/id/1507250 (accessed on 16 January 2024).

- General Authority for Statistics. Saudi Arabia Adopts New Methodology for Calculating FDI Data. Available online: https://www.stats.gov.sa/en/w/saudi-arabia-adopts-new-methodology-for-calculating-fdi-data (accessed on 1 November 2023).

- The Global Economy. GDP Growth, Inflation, and Other Indicators. Available online: https://www.theglobaleconomy.com/download-data.php (accessed on 3 May 2023).

- Hussain, E.M.; Haque, M. Foreign Direct Investment, Trade, and Economic Growth: An Empirical Analysis of Bangladesh. Economies 2016, 4, 7. [Google Scholar] [CrossRef]

- Choi, Y.J.; Baek, J. Does FDI Really Matter to Economic Growth in India? Economies 2017, 5, 20. [Google Scholar] [CrossRef]

- Ridzuan, A.; Ismail, N.; Che Hamat, A. Does Foreign Direct Investment Successfully Lead to Sustainable Development in Singapore? Economies 2017, 5, 29. [Google Scholar] [CrossRef]

- Alenezi, A. Improving the Saudi Arabian Foreign Direct Investment Framework and Promoting Diversification. Ph.D. Thesis, University of Manchester, Manchester, UK, 2020. [Google Scholar]

- Haile, G.A.; Assefa, H. Determinants of Foreign Direct Investment in Ethiopia: A time-series analysis. In Proceedings of the 4th International Conference on the Ethiopian Economy, Addis Ababa, Ethiopia, 10–12 June 2006. [Google Scholar]

- Adams, S. Foreign Direct investment, domestic investment, and economic growth in Sub-Saharan Africa. J. Policy Model. 2009, 31, 939–949. [Google Scholar] [CrossRef]

- Haudi, H.; Wijoyo, H.; Cahyono, Y. Analysis of Most Influential Factors to Attract Foreign Direct Investment. J. Crit. Rev. 2020, 7, 4128–4135. [Google Scholar]

- Fox, G. A Future for International Investment? Modifying BITs to Drive Economic Development. Geo. J. Int’l L. 2014, 46, 229–259. [Google Scholar]

- Lohith, J. FDI in Indian Media Industry: Boon or Bane? Int. J. Multidiscip. Approach Stud. 2016, 3, 34–36. [Google Scholar]

- Samargandi, N.A.; Alghfais, M.; AlHuthail, H.M. Factors in Saudi FDI inflow. SAGE Open 2022, 12, 215824402110672. [Google Scholar] [CrossRef]

- United Nations Conference on Trade and Development (UNCTAD). World Investment Report 2014: Investing in the SDGs: An Action Plan. 2014. Available online: https://unctad.org/system/files/official-document/wir2014_en.pdf (accessed on 7 July 2024).

- Binkhamis, M. Barriers and Threats to Foreign Direct Investment (FDI) in Saudi Arabia: A Study of Regulatory, Political and Economic Factors. Ph.D. Thesis, De Montfort University, Leicester, UK, October 2016. [Google Scholar]

- Nguyen, V.C. Monetary Policy and Foreign Direct Investment—Empirical Evidence. Economies 2023, 11, 234. [Google Scholar] [CrossRef]

- Djokoto, J.G.; Wongnaa, C.A. Does the level of development distinguish the impacts of foreign direct investment on the stages of human development? Sustain. Futures 2023, 5, 100111. [Google Scholar] [CrossRef]

- Abdel-Rahman, A. Determinants of Foreign Direct Investment in the Kingdom of Saudi Arabia. 2010. Available online: https://erf.org.eg/app/uploads/2017/05/0238.pdf (accessed on 10 February 2023).

- Sauvant, K.P.; Mann, H. Sustainable FDI for Sustainable Development; Columbia FDI Perspectives No. 221; Columbia Center on Sustainable Investment: New York, NY, USA, 2018. [Google Scholar]

- Aljbory, A. The impact of the investment environment in attracting foreign direct investment on Iraq model for the period (2003–2013). Al-Qadisiyah J. Qadisiya Adm. Econ. Sci. 2016, 18, 144–163. [Google Scholar]

- Adelakun, J.; Ogujiuba, K. A Comparative Analysis of the Determinants of Foreign Direct Investment: The Case of Top Ten Recipients of Foreign Direct Investment in Africa. Economies 2023, 11, 244. [Google Scholar] [CrossRef]

- Khan, N. Does Inflation Targeting Really Promote Economic Growth? Rev. Political Econ. 2022, 34, 564–584. [Google Scholar] [CrossRef]

- Khan, N. Analyzing the Impact of Inflation Targeting Adoption on FDI Inflows. Acad. Strateg. Manag. J. 2021, 20, 1–11, ISSN 1544–1458; Online ISSN: 1939–6104. [Google Scholar]

- Khathlan, K.A. Foreign Direct Investment Inflows and Economic Growth in Saudi Arabia: A Co-integration Analysis. Rev. Econ. Financ. 2013, 4, 70–80. [Google Scholar]

- El-Awady, S.; Al-Mushayqih, S.; Al-Oudah, E. An analytical study of the determinants of foreign investment in Saudi Arabia “Saudi Vision 2030”. Bus. Manag. Rev. 2020, 11. [Google Scholar] [CrossRef]

- Hoekman, B.M.; Maskus, K.E.; Saggi, K. Transfer of Technology to Developing Countries: Unilateral and Multilateral Policy Options. World Dev. 2005, 33, 1587–1602. [Google Scholar] [CrossRef]

- World Bank Group. World Development Indicators. 2016. Available online: https://documents.worldbank.org/en/publication/documents-reports/documentdetail/805371467990952829/world-development-indicators-2016 (accessed on 1 February 2024).

- Belloumi, M.; Alshehry, A. The Impacts of Domestic and Foreign Direct Investments on Economic Growth in Saudi Arabia. Economies 2018, 6, 18. [Google Scholar] [CrossRef]

- Alregab, H. The Role of Environmental, Social, and Governance Performance on Attracting Foreign Ownership: Evidence from Saudi Arabia. Sustainability 2022, 14, 15626. [Google Scholar] [CrossRef]

- Lai, T.L.; Robbins, H.; Wei, C.Z. Strong consistency of least squares estimates in multiple regression II. J. Multivar. Anal. 1979, 9, 343–361. [Google Scholar] [CrossRef]

- Argaam. FDIs in Saudi Arabia Rise to SAR 8.1 bln in Q1 2023. 2023. Available online: https://www.argaam.com/en/article/articledetail/id/1659594 (accessed on 8 May 2023).

- Albassam, B.A. Does Saudi Arabia’s economy benefit from foreign investments? Benchmarking Int. J. 2015, 22, 1214–1228. [Google Scholar] [CrossRef]

- Ramady, M.A.; Saee, J. Foreign direct investment: A strategic move toward sustainable free enterprise and economic development in Saudi Arabia. Thunderbird Int. Bus. Rev. 2007, 49, 37–56. [Google Scholar] [CrossRef]

- Alkahtani, F. Legal Protection of Foreign Direct Investment in Saudi Arabia. Ph.D. Thesis, Newcastle University, Newcastle upon Tyne, UK, 2010. Available online: https://theses.ncl.ac.uk/jspui/handle/10443/2254 (accessed on 10 July 2023).

- Rooshdi, R.M.; Abd Majid, M.Z.; Sahamir, S.R.; Ismail, N.A.A. Relative importance index of sustainable design and construction activities criteria for green highway. Chem. Eng. Trans. 2018, 63, 151–156. [Google Scholar]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).