Abstract

In recent years, China’s economic and social development has faced challenges such as urban-rural imbalance and ecological pressure. Digital inclusive finance and ecological resilience have become key concerns in academia and policymaking. This study empirically examines whether digital inclusive finance can enhance ecological resilience and its underlying mechanisms, drawing on quantitative evidence from provincial panel data covering 2011–2020. By providing robust empirical results, it contributes to understanding the role of digital finance in supporting high-quality growth and ecological civilization. While the findings align with national strategies such as the “dual carbon” goal and rural revitalization, the study’s primary contribution lies in advancing interdisciplinary exploration through rigorous evidence rather than solely at the policy level. By constructing a double fixed effects model and panel data from 30 Chinese provinces (2011–2020), the study finds that digital inclusive finance significantly enhances ecological resilience, both directly and indirectly through channels such as environmental regulation, artificial intelligence development, and green credit. Moreover, its ecological impact is moderated by regional economic levels and digital infrastructure, with stronger effects observed in eastern and digitally advanced regions. In summary, this study reveals the mechanisms through which digital inclusive finance promotes ecological resilience, offering a theoretical foundation and practical guidance for policy formulation. Its key contribution lies in systematically analyzing the link between digital inclusive finance and ecological resilience, enriching the theoretical framework and providing data support for policy optimization and financial institutions’ strategic adjustments. Future efforts should focus on strengthening policy coordination to enhance the ecological role of digital finance, promoting financial innovation to support resilience, and advancing regional coordination to narrow the digital divide and achieve shared ecological protection.

Keywords:

digital inclusive finance; ecological resilience; provincial panel; environmental regulations; green credit JEL Classification:

G20; O16; Q56; Q58; R11

1. Introduction

In recent years, as China’s economy and society transition toward high-quality development, issues related to urban–rural disparities and ecological pressures have become increasingly prominent. In this context, digital inclusive finance and ecological resilience have emerged as focal points. The former leverages technological advancements to optimize resource allocation and promote green development, while the latter constitutes a core component of ecological security. The national strategy advocating the integration of the digital economy with green development provides both policy support and a compelling rationale for academic inquiry.

While current research on digital inclusive finance has extensively focused on its role in economic benefits and economic resilience, among other aspects, the existing literature still lacks a systematic analysis of the relationship between digital inclusive finance and ecological resilience. Specifically, its underlying mechanisms and the role of financial factors remain underexplored. This study aims to fill this gap by thoroughly investigating whether and how digital inclusive finance can enhance ecological resilience. Employing both theoretical and empirical approaches, we will examine its direct effects and further analyze its indirect effects—through channels such as environmental regulation, artificial intelligence, and green credit—while also considering regional heterogeneity. This research aligns with national policy priorities and offers new perspectives for promoting high-quality economic development. It expands the scope of digital inclusive finance research into the ecological domain, enriches the theoretical framework, and opens new interdisciplinary avenues. Furthermore, it provides practical implications for policy refinement and strategic planning by financial institutions, thereby contributing to ecological civilization and fostering synergy between the digital economy and green development.

2. Materials and Methods

The research on the ecosystem and economic effects of digital inclusive finance has developed into a multidimensional framework. On one hand, studies consistently confirm the positive role of digital inclusive finance in economic activities. It significantly promotes the integrated development of primary, secondary, and tertiary industries in rural areas of China [1], and enhances the economic resilience of cities by improving technological innovation and consumption levels [2]. This positive effect is further validated in the practice of China’s green finance reform and innovation pilot zones, where the policy has notably improved the sustainability of cities by fostering technological innovation [3]. In developing countries, the effective operation of the digital small and medium-sized enterprise ecosystem also requires the collaborative support of governments, markets, and human capital [4]. More importantly, the effects of digital inclusive finance are not entirely positive. A study on 42 economies along the Belt and Road Initiative found that while it promotes economic growth, it also exacerbates CO2 emissions, revealing a potential severe trade-off between economic development and environmental sustainability [5].

The relationship between environmental regulation and ecological resilience is complex and contentious. Academics have not reached a unified conclusion regarding its impact; some studies suggest that environmental regulation may inhibit the improvement of ecological resilience by crowding out effects [6], while others have found that it exhibits non-linear threshold effects, or can enhance resilience at the micro-enterprise level by incentivizing technological innovation [7,8].These multiple effects highlight the importance of policy synergy. Notably, existing literature indicates that the combination of environmental regulation with tools such as digital technologies and green finance can effectively promote urban green efficiency and sustainable development, creating a “1 + 1 > 2” synergistic effect [3,9]. Therefore, this study hypothesizes that environmental regulation is one of the important channels through which digital inclusive finance affects ecological resilience, and we will investigate in subsequent analysis how digital inclusive finance operates through environmental regulation as a mediating mechanism.

The technological diffusion and social impact of artificial intelligence (AI) have raised concerns. AI, as a revolutionary technology, is widely regarded as a powerful tool for achieving environmental sustainability. Based on comprehensive bibliometric analysis, the application of AI in environmental monitoring is growing exponentially, combining with technologies like the Internet of Things (IoT) and remote sensing to provide unprecedented capabilities in monitoring air quality, water quality, biodiversity, and more [10]. Specifically, AI has proven to have significant potential in optimizing urban waste sorting policies, predicting and managing forest fires, and enhancing renewable energy efficiency [11]. In a broader framework, AI is seen as a key technology for achieving the United Nations Sustainable Development Goals (SDGs) and addressing climate change. It can support global environmental governance by improving modeling and prediction and optimizing resource management [12,13]. However, optimistic expectations for AI must be balanced with its social and ecological costs. The hidden ecological costs behind AI development have been systematically revealed, including the high energy consumption required to train large models, the dependence of data centers on non-renewable energy, the massive electronic waste generated by rapid hardware iterations, and the potential destruction of natural ecosystems by AI infrastructure [14]. This critical perspective reminds us that while using AI to address existing environmental issues, we must also face and manage the new environmental challenges brought by AI technology itself.

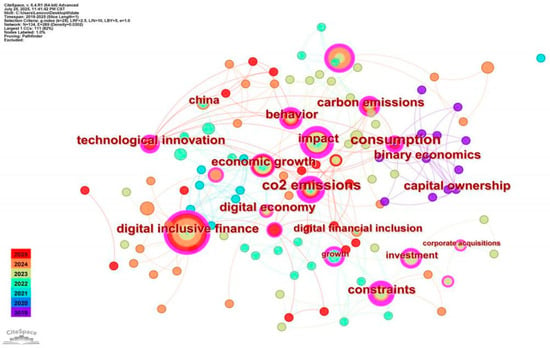

Regarding the policy coordination mechanisms for the agricultural economic transformation, existing research has uncovered profound political-economic logic and capital competition behind it. The idea of using finance as a tool to drive agricultural transformation is facing scrutiny from multiple levels. Theoretically, research on the geography of agricultural finance points out that credit and debt relationships in the Global South are not only embedded in local production and social reproduction networks but are increasingly shaped by the logic of global financial capital, which may exacerbate inequality [15]. Another study on European dairy companies found that green finance tends to flow into low-risk, easily quantifiable industrial processing sectors, rather than into the agricultural production sectors, which have significant climate impacts but are difficult to control. This exposes the inherent contradiction between capital logic and ecological needs [16]. In response to the limitations of these market- and capital-driven transformation plans, radical alternative solutions have also been proposed. Some scholars criticize the mainstream “Green New Deal” as being Eurocentric and advocate for a “People’s Green New Deal” based on agricultural ecology, climate debt settlements, and respect for the sovereignty of Global South countries, placing agriculture and farmers at the heart of climate solutions [17]. The co-occurrence analysis of keywords (Figure 1) illustrates the interconnectedness of core concepts in the existing literature, highlighting the research landscape surrounding digital inclusive finance and ecological resilience.

Figure 1.

Co-occurrence map of keywords.

3. Theoretical Analysis and Research Hypotheses

3.1. Direct Effects of Digital Inclusive Finance on Ecological Resilience

Digital inclusive finance exerts a significant and direct positive impact on ecological resilience. This direct effect stems from the technological attributes and inclusive functions of digital finance, which enhance the restoration capacity, adaptability, and resistance of ecological systems.

3.1.1. Correction of Resource Misallocation and Green Capital Allocation

By leveraging technologies such as big data and blockchain, digital inclusive finance reduces information asymmetries between the supply and demand sides of financial resources [18], thereby facilitating the direct flow of capital to ecological restoration projects and green industries, and mitigating the traditional financial system’s overreliance on high-pollution sectors. A case study by the Peking University Digital Finance Research Center shows that digital credit platforms, by using intelligent algorithms to identify financing needs of environmentally friendly enterprises, significantly improve the efficiency of capital allocation to green projects [19]. This optimization of resource allocation directly enhances the restoration capacity of ecological systems, as funding for ecological restoration projects can accelerate the natural recovery process of the environment.

3.1.2. Immediate Intervention in Consumer Behavior

Digital inclusive financial tools—such as carbon accounts and green consumption points—provide real-time feedback mechanisms that directly incentivize residents to choose low-carbon products and services, thereby reducing the overall ecological footprint of society. Beck et al. [20] indicate that the accessibility of inclusive finance can influence individual decision-making through behavioral economics mechanisms. For instance, Alipay’s “Ant Forest” encourages users to engage in low-carbon daily behaviors to accumulate green energy, which can be redeemed for tree planting. This initiative has directly engaged tens of millions of users in environmental protection, collectively reducing carbon emissions by over one million tons. Such interventions on the consumption side alleviate resource consumption pressures and enhance the adaptability of ecological systems.

3.1.3. Digital Enhancement of Environmental Governance Efficiency

Digital inclusive financial platforms integrate multidimensional environmental data (pollution emissions, energy consumption) to provide governments and enterprises with dynamic monitoring and decision-support tools. Guo and Liu [21] point out that digital technologies can strengthen the effectiveness of environmental regulations, such as by using smart contracts to automate the collection of pollution charges or by employing AI algorithms to optimize the allocation of resources for pollution control. This technology-enabled governance increases the resistance of ecological systems, enabling environmental policies to more effectively withstand the impact of sudden pollution events.

Therefore, the following research hypothesis is proposed:

H1:

DIF promotes ER by correcting resource misalignment, incentivizing low-carbon consumption, and improving efficiency of governance.

3.2. Indirect Effects of Digital Inclusive Finance on Ecological Resilience

Digital inclusive finance exerts an indirect influence on ecological resilience through mediating variables, specifically environmental regulation, the level of artificial intelligence development, and green credit.

3.2.1. Environmental Regulation

Digital inclusive finance enhances the bank ability of green projects, thereby compelling enterprises to adopt cleaner technologies and prompting governments to improve environmental policies, such as raising pollution charge standards. Meanwhile, the digitization of environmental complaint data can improve regulatory transparency, forming a transmission chain of “financial support–policy reinforcement—ecological improvement” [22].

3.2.2. Development of Artificial Intelligence

Digital financial platforms indirectly enhance ecological resilience by supporting the development of AI technologies, such as intelligent monitoring devices and resource optimization algorithms, which improve pollution forecasting accuracy and energy efficiency [23]. For example, AI-driven smart grids can optimize energy distribution and reduce dependence on fossil fuels, thereby strengthening the adaptive capacity of ecosystems.

3.2.3. Green Credit

Digital inclusive finance reduces the approval costs of green credit and expands credit supply to environmentally responsible enterprises, thereby fostering a virtuous cycle of “financial support—green investment—ecological restoration” [24]. Moreover, by restricting financing access for highly polluting firms, green credit exerts pressure for industrial transformation and reduces ecological stress.

Therefore, the following research hypothesis is proposed:

H2:

Digital inclusive finance indirectly promotes ecological resilience through the mediating effects of environmental regulation, artificial intelligence development, and green credit.

3.3. Heterogeneous Effects of Digital Inclusive Finance on Ecological Resilience

The ecological effects of digital inclusive finance are influenced by disparities in regional economic development and digital infrastructure.

3.3.1. Regional Heterogeneity

In economically developed eastern regions, where digital infrastructure is more advanced and financial resources are more readily directed toward green industries, the implementation of policies tends to be more effective. Consequently, the positive effects of digital inclusive finance on ecological resilience are more pronounced. In contrast, central and western regions—characterized by lower technology penetration and a more traditional industrial structure—experience comparatively weaker impacts [18].

3.3.2. Heterogeneity in Digital Economy Level

In regions with a high level of digital economy development, the integration of digital technologies and financial services is more advanced (e.g., higher 5G base station coverage, widespread adoption of smart devices), enabling more efficient promotion of green innovation and resource optimization, thereby amplifying the effects on ecological resilience. Conversely, in regions with lower levels of digital economy development, the “digital divide” limits the impact, resulting in more restricted effects [21].

Therefore, the following research hypothesis is proposed:

H3:

The positive effect of digital inclusive finance on ecological resilience is more pronounced in eastern regions, areas with a high level of digital economy development, and regions where ecological protection is prioritized.

4. Research Design

4.1. Model Construction

In empirical research, baseline regression can directly test the relationship between core variables. Introducing mediation effect analysis helps to uncover the transmission pathways and internal logic, extending the focus from “whether an effect exists” to “how it occurs,” thereby deepening the conclusions. To address potential endogeneity issues, methods such as instrumental variables and lagged terms are employed to enhance the reliability of the results. Robustness checks verify the consistency of conclusions under different conditions, strengthening their persuasiveness. Heterogeneity analysis, by contrast, reveals differential effects across regions or contexts, making the findings more comprehensive and targeted. The integration of these steps demonstrates the scientific rigor and methodological soundness of the research design.

4.1.1. Baseline Regression Model

To verify the impact of digital inclusive finance on ecological resilience, this study constructs a two-way fixed effects model as the baseline specification. To ensure the robustness and validity of the model analysis, a stepwise regression approach is employed. Control variables are added sequentially under the condition of statistical significance, aiming to improve the model’s explanatory power and goodness of fit. The specific model is formulated as follows:

The dependent variable ECRit represents the ecological resilience level of province i in year t. The independent variable DFit denotes the level of digital inclusive finance development. Cit refers to a set of control variables, including economic development level (PGDP), informatization level (ICT), degree of openness (TRADE), foreign direct investment (FDI), human capital level (EDU), and carbon intensity (CI). µi and λt represent region and year fixed effects, respectively, while εit is the random error term.

4.1.2. Mediation Effect Model

To examine whether the development of digital inclusive finance influences ecological resilience through environmental regulation, artificial intelligence development, and green credit, the following mediation effect models are constructed:

where Mit denotes the mediating variables: environmental regulation (ER), artificial intelligence development level (DLAI), and green credit (GC).

The mediation effect model testing procedure is as follows: First, test the coefficient α1, which represents the direct effect of digital inclusive finance on ecological resilience. If α1 is not statistically significant, stop the mediation effect analysis. If α1 is significant, further test the impact of digital inclusive finance on environmental regulation, artificial intelligence development, and green credit by examining the significance of coefficient β1.

If both α1 and β1 are significant, proceed to test the influence of digital inclusive finance, environmental regulation, artificial intelligence development, and green credit on ecological resilience, with coefficients γ1 and γ2 respectively. If α1, β1, and γ2 are all significant, test γ1. If γ1 is significant, it indicates a partial mediation effect. If γ1 is not significant, this indicates a full mediation effect. If either β1 or γ2 is not significant, continue with an endogeneity test to determine whether the mediation effect is significant.

4.2. Variable Selection

4.2.1. Dependent Variable: Ecological Resilience (ER)

In this study, ecological resilience is defined as the capacity of regional ecosystems to resist, recover, and adapt when confronted with resource constraints, environmental pressures, and external shocks. Following the research of Zhang M. [18], based on the multidimensional connotation of ecological resilience, a comprehensive evaluation index system is constructed using the entropy method, focusing on three dimensions: restorative capacity, adaptive capacity, and resistance capacity. The results are shown in Table 1. Restorative capacity emphasizes the ability of the ecosystem to restore its original functions after disturbance, measured by green space resources and fiscal investment. Adaptive capacity reflects the system’s ability to respond to external changes through structural adjustments, with pollution treatment efficiency as the core indicator. Resistance capacity represents the stability of the ecosystem in withstanding external shocks, inversely measured by pollutant emissions.

Table 1.

Ecological restoration capacity evaluation indicators (horizontal table).

4.2.2. Core Explanatory Variable: Digital Inclusive Finance (DF)

The core explanatory variable in this study is the Digital Inclusive Finance Index, which is published by the Digital Finance Research Center of Peking University. This index was constructed by Guo Feng and other scholars based on microtransaction data from platforms such as Ant Financial. The index covers three dimensions: breadth of coverage (mobile payment account penetration rate), depth of usage (per capita digital credit limit), and level of digitalization (blockchain technology adoption rate). It provides a comprehensive reflection of the penetration and innovative effectiveness of digital financial services across provinces [12] (Guo et al., 2020).

To facilitate the understanding of variables and the interpretation of model coefficients, this study normalizes the Digital Inclusive Finance (DIF) index by dividing it by 100. This approach maintains the original linear structure of the DIF index, making its numerical range more manageable, while avoiding potential issues with zero values and alterations to the linear relationship assumption that logarithm transformation might introduce. We believe this normalization method more intuitively reflects the impact of changes in the absolute level of DIF on ecological resilience; specifically, it shows the precise extent to which ecological resilience is affected when the standardized DIF increases by one unit (corresponding to an increase of 100 units in the original DIF). Unlike logarithm transformation, which typically aims to capture percentage changes or address highly skewed data characteristics, this study focuses more on explaining the policy effects in terms of the absolute magnitude of DIF.

In terms of indicator selection, this study uses provincial administrative regions as the unit of analysis and constructs a panel dataset covering the years 2011 to 2020 (with 30 provinces included; Tibet, Hong Kong, Macao, and Taiwan are excluded due to data unavailability). Since the original index has a large range of values, direct regression might lead to very small coefficients that are difficult to interpret. To address this, the raw index is standardized by dividing it by 100, making the regression coefficients more intuitive. This allows for clearer interpretation of the marginal effect of each 1-unit increase in digital inclusive finance on ecological resilience. For example, if the regression coefficient is 0.05, it means that for every 100-unit increase in DF, ecological resilience increases by 0.05 units.

4.2.3. Mediating Variables

This study selects environmental regulation (ENR), artificial intelligence development (AI), and green credit (GC) as mediating variables to analyze the pathways through which digital inclusive finance impacts ecological resilience. The selection of these variables is based on the following reasoning: Environmental regulation reflects the direct intervention of policy constraints in ecological protection [18]; artificial intelligence represents the driving force of technological innovation in resource optimization [23]; and green credit indicates the directional allocation of financial resources to green industries [5].

Environmental Regulation (ENR) based on the work of Zhang Mingdou et al. (2022) [18], an integrated index is constructed using industrial wastewater/air pollutant treatment costs (as a percentage of GDP) and the number of environmental complaints (per unit GDP). The index is weighted using the entropy method to quantify the intensity of policy implementation and the effectiveness of social supervision.

Artificial Intelligence Development (AI), following Xu Xiaodan and Hui Ning (2024) [23], the development level of artificial intelligence is measured across three dimensions: technological research and development (number of AI patents), industrial application (density of industrial robots), and infrastructure (number of 5G base stations per 10,000 people). Data is collected for these dimensions and a composite index is synthesized using principal component analysis.

Green Credit (GC) based on the work of Chen Na and Chen Jiang (2024) [24], the green credit index is constructed with the proportion of green credit balance as the core indicator, complemented by the frequency of keywords in policy texts (quantified using the TF-IDF method). The entropy weight method is then applied to construct the final index.

The measurement methods above integrate multidimensional data (from statistical year- books, patent databases, and policy texts), ensuring both the scientific rigor and empirical robustness of the indicators.

4.2.4. Control Variables

This study selects several control variables to account for potential confounding factors that could influence ecological resilience. These variables include the level of economic development (per capita GDP), the level of informatization (the ratio of postal and telecommunications services to GDP), the degree of openness (the ratio of total imports and exports to GDP), foreign direct investment (the ratio of foreign direct investment to regional GDP), human capital (the ratio of university students to total population), carbon intensity (the ratio of CO emissions to GDP), population density (the ratio of the total population to administrative area at the end of the year), industrialization level (the ratio of secondary industry value added to GDP), and industrial structure (the ratio of tertiary industry value added to secondary industry value added).

These variables are selected to represent regional characteristics from multiple dimensions, including economic, technological, social, and environmental factors. Specific measurement methods include the ratio of key economic indicators to GDP and the proportion of specific resource elements (such as university students and import/export volume). The purpose is to control for regional differences that could potentially affect ecological resilience, ensuring the robustness of the research conclusions.

Economic development and industrialization level influence resource consumption patterns and environmental pressure, while informatization and openness levels alter ecological governance efficiency through technological diffusion and external shocks. Human capital and population density reflect the dynamic relationship between social resource allocation and ecological carrying capacity.

4.3. Data Sources and Descriptive Statistics

4.3.1. Data Sources

The core explanatory variable, the Digital Inclusive Finance Index, is derived from the authoritative report published by the Digital Finance Research Center of Peking University (2011–2022). This index systematically measures the penetration level of digital financial services in each province across three dimensions: breadth of coverage, depth of usage, and level of digitalization. The index reflects the degree to which digital financial services have been integrated into regional economies.

Other data for the study, including economic development, environmental governance, and industrial structure, are primarily sourced from official publications such as the National Bureau of Statistics database, the China Urban Construction Statistical Yearbook, and the China Environmental Statistics Yearbook. These sources ensure the authority and comparability of the data used.

For missing values in certain years or provinces (industrial pollution control expenditures for some provinces in 2015), this study employs a linear interpolation method to impute the missing data, thereby preserving the integrity of the sample to the greatest extent possible.

4.3.2. Descriptive Statistics

Table 2 presents the descriptive statistics of the variables.

Table 2.

Descriptive statistical analysis result.

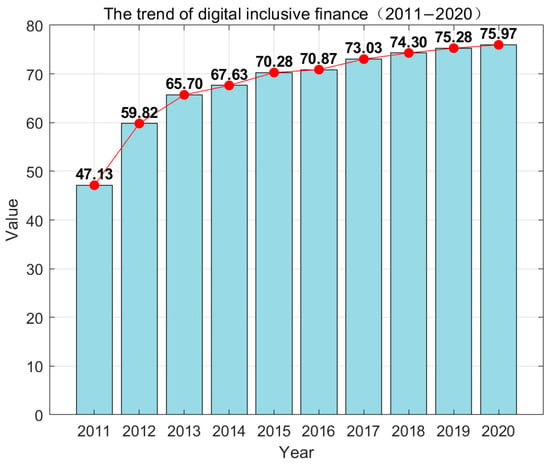

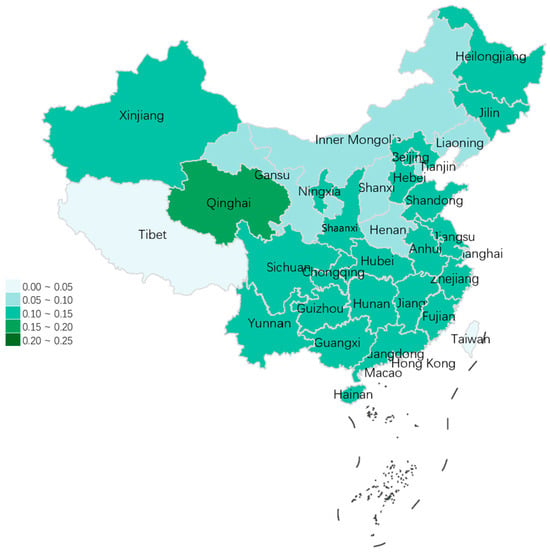

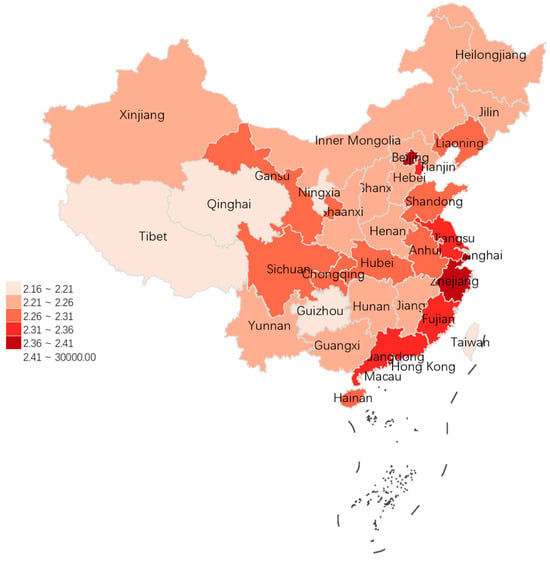

This study uses panel data from 30 provinces in China from 2011 to 2020 (excluding Tibet, Hong Kong, Macao, and Taiwan) to effectively capture the long-term trends of the co-evolution of digital inclusive finance and ecological resilience. Figure 2 provides a visual presentation of the upward trend of the digital inclusive finance index during the sample period. The spatial distribution of provincial ecological resilience levels (Figure 3) reveals significant regional disparities, which motivates the subsequent heterogeneity analysis.

Figure 2.

Trend of digital inclusive finance.

Figure 3.

Provincial ecological resilience.

5. Empirical Analysis

5.1. Baseline Regression

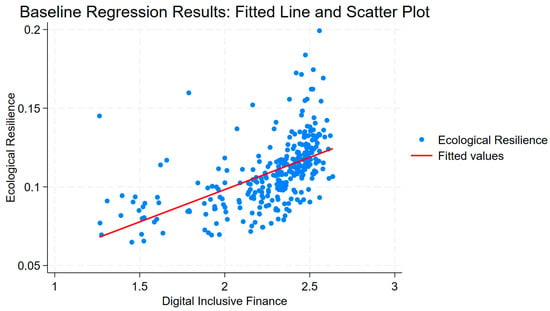

The estimation results of the baseline regression model for the impact of digital inclusive finance on ecological resilience are presented in Table 3. All models use a two-way fixed effects approach for regression analysis. The regression result (1) shows that without control variables, there is a significant positive correlation between carbon emissions and digital inclusive finance. Specifically, a one-unit increase in the standardized digital inclusive finance index is associated with a 0.0429% increase in ecological resilience, significant at the 1% level. Regression results (2)–(7) analyze the regression results when control variables are included. The results indicate that both economic development level and informatization level are significant at the 1% level, while the degree of openness is significant at the 5% level. Economic development and informatization can effectively promote ecological resilience. However, the regression coefficient for the degree of openness is −0.0314, suggesting that it has a suppressive effect on ecological resilience. This may be due to the fact that while economic development and informatization enhance ecological resilience through funding support, technological innovation, and scientific decision-making, the introduction of external technologies and management models through openness may not necessarily improve ecological resilience. In particular, when ecological protection awareness is weak and regulation is insufficient, openness may actually increase the risk of ecological degradation due to differences in regional policies, institutional frameworks, and ecological conditions.

Table 3.

Regression results.

Foreign direct investment, human capital level, and carbon intensity do not pass the significance level test. This may be because the relationships between these factors and ecological resilience are not strong enough, or there are confounding factors that affect the relationships. Additionally, the model may not have accounted for other important factors.

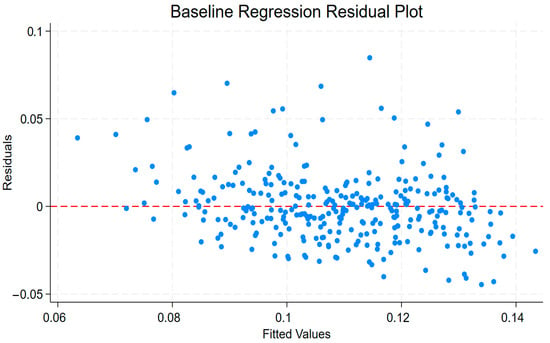

From the model’s fitted regression plot (Figure 4) and residual plot (Figure 5), it can be observed that most of the residuals are within 0.05, indicating that the model has a small error between the predicted and actual values, with a high fit accuracy. The scatter plot of ecological resilience shows that the data points are distributed near the regression equation, further confirming that the regression model can capture the trend of data changes well. In the residual plot, the distribution of residuals indicates no obvious systematic bias, and most residual values are concentrated within 0.05, suggesting that the model does not exhibit significant overfitting or underfitting. Therefore, it can be concluded that the regression model has a high fit quality and is suitable for further analysis and prediction of ecological resilience.

Figure 4.

Baseline regression results: fitted line and scatter plot.

Figure 5.

Baseline regression residual plot.

5.2. Endogeneity Test

In the baseline regression of this paper, a considerable number of control variables have been introduced and the effects of time and individual factors have been controlled. However, there may still be a bidirectional causality or common influence from omitted variables between digital inclusive finance and ecological resilience, which could lead to biased results in the study. The endogeneity test helps confirm whether the causal relationship between the two is genuine, thus avoiding incorrect causal inference. By eliminating endogeneity issues, it becomes possible to more accurately analyze how digital inclusive finance truly affects ecological resilience, ensuring the reliability of the research conclusions.

In this study, an endogeneity test is conducted to examine whether the impact of digital inclusive finance on ecological resilience changes. We employ the two-stage least squares method (2SLS) and follow the research approach of Meng Weifu et al. [25], selecting the lagged one-period digital inclusive finance index as the instrumental variable to conduct an IV regression analysis. The results, as shown in Table 4, reveal that the regression coefficient for digital inclusive finance is 0.0465, which is a small change from the baseline regression result of 0.0429. Furthermore, the coefficient is statistically significant at the 1% level, indicating that the previous conclusions are robust.

Table 4.

Endogeneity test.

Considering that the impact of digital inclusive finance on ecological resilience may have a lag effect, and to avoid the mutual causality between digital inclusive finance and ecological resilience, this paper refers to the research of Hu Shanshan et al. [26] and uses the lagged one-period, two-period, and three-period digital inclusive finance index as instrumental variables for the endogeneity test. The regression results in Table 4 show that after alleviating the endogeneity problem through lagging variables, the impact effect of digital inclusive finance on ecological resilience remains significantly positive, proving that the baseline regression conclusion is robust.

5.3. Robustness Check

To further validate the robustness and reliability of the above regression results, this study employs three additional methods for robustness checks, with the results presented in Table 4.

5.3.1. Trimming of Extreme Values

In the data selection process, extreme or outlier values may significantly affect the regression analysis results. leading to biased regression coefficients and undermining the reliability of the model. Therefore, addressing these extreme values is crucial for ensuring the accuracy of the regression results.

To minimize the impact of extreme values, a 1% two-sided trimming method is employed, which involves adjusting the extreme values of all continuous variables to ensure a more uniform distribution of the data. This method limits the extreme values to between the 1st and 99th percentiles, reducing the impact of outliers on the regression model.

After the trimming procedure, the regression results in Table 3. Column (2) are consistent with the baseline regression results, indicating that the regression effect is robust.

5.3.2. Adding Control Variables

To prevent the regression results from being biased by omitted variables, this study further incorporates control variables, including population density (PD), industrialization level (LI), and industrial structure (IS). These control variables help eliminate potential external factors that may influence ecological resilience, thereby enhancing the accuracy and reliability of the regression model.

The regression results in Table 5, Column (3) show that, after adding the control variables, the positive impact of digital inclusive finance on ecological resilience remains significant, and the effect size is consistent with the baseline regression results. This indicates that, even after controlling for variables such as population density, industrialization level. and industrial structure, digital inclusive finance continues to have a positive effect on ecological resilience. This result further validates the robust relationship between digital inclusive finance and ecological resilience.

Table 5.

Endogeneity and robustness tests.

5.3.3. Modifying the Time Period

To eliminate the direct impact of policy release and consider the lag of policy effects, this study shortens the sample window to 2017–2020. This adjustment aims to eliminate the interference brought by the “Guiding Opinions on Building a Green Financial System” issued by the People’s Bank of China and six other ministries. According to the regression results in column (4) of Table 5, digital inclusive finance still has a significant positive impact on ecological resilience in the new sample window, and it still passes the test at the 10% significance level. This result indicates that after shortening the sample window, the development of digital inclusive finance still has a stable positive effect on ecological resilience.

5.3.4. Changing the Sample Range

Due to the significant differences in data characteristics and development levels between the four direct-controlled municipalities (Beijing. Tianjin. Chongqing. and Shanghai) and other provinces, this study excludes the data from these municipalities to ensure higher accuracy and representativeness in the regression analysis. This treatment helps eliminate potential biases caused by differences in economic, Social, and policy environments between the municipalities and other provinces.

Based on the regression results in Column (5), after excluding the direct-controlled municipalities, the baseline regression analysis shows that digital inclusive finance still has a significant positive impact on ecological resilience, with the results passing the 1% significance level test. This indicates that the regression results are robust.

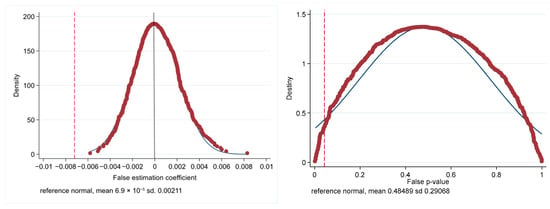

5.4. Placebo Test

Among the above test results, the relationship between green inclusive finance and ecological resilience might merely be a natural reflection of the trend over time or caused by other accidental factors. To rule out this possibility, this paper conducts a placebo test by randomly constructing explanatory variables—digital financial inclusion indicators. As shown in Figure 6, The results of the placebo test show that the positive effect of green inclusive finance on ecological resilience in the main test is indeed valid, to a certain extent, ruling out the influence of time variables and other unknown factors.

Figure 6.

Placebo test.

6. Further Analysis

6.1. Mediation Mechanism Analysis

This study primarily tests the mediation effects of environmental regulation, artificial intelligence development, and green credit on the relationship between digital inclusive finance and ecological resilience. The results indicate the presence of mediation effects.

6.1.1. Environmental Regulation as a Mediator in Ecological Resilience

Column (1) of Table 5 shows that digital inclusive finance significantly improves environmental regulation at the 1% significance level, with a coefficient of 0.0849. This indicates that digital inclusive finance has a significant positive impact on environmental regulation. This may be because digital inclusive finance, by promoting information dissemination, broadening financial service coverage, and efficiently allocating financial resources, can drive businesses and local governments to increase their attention to environmental protection.

Column (2) shows that environmental regulation has a positive impact on ecological resilience at the 1% significance level. with a coefficient of 0.679. This is because stringent environmental protection policies effectively reduce pressure on ecosystems, enhance their ability to adapt to external environmental changes, and increase their resilience. After controlling for environmental regulation as a mediating variable, digital inclusive finance still has a significant positive effect on ecological resilience at the 10% significance level. with a coefficient of 0.0121. This suggests that digital inclusive finance promotes investments in ecological protection and sustainable development projects, indirectly improving ecological resilience. However, compared to the coefficient of 0.0429 and significance level from the baseline regression without environmental regulation, the effect is weaker. This indicates that environmental regulation itself has already significantly improved ecological resilience, reducing the additional contribution of digital inclusive finance.

6.1.2. Artificial Intelligence Development as a Mediator in Ecological Resilience

Columns (3) and (4) of Table 5 show that digital inclusive finance has a suppressive effect on artificial intelligence development at the 1% significance level. with a coefficient of −2.388. The negative impact of digital inclusive finance on the development level of artificial intelligence (β = −2.388. p < 0.01) may be related to the development stage and resource allocation structure of both. Digital inclusive finance mainly serves small and medium-sized enterprises and low-income groups [27], and its capital flow is more inclined towards consumer finance and microcredit rather than long-term and high-risk artificial intelligence technology research and development [28]. Moreover, the current AI development index mainly measures technological output (such as the number of patents) and infrastructure (such as 5G base stations), while digital inclusive finance may not have fully penetrated into the core technologies of AI, resulting in a “crowding-out effect” in the short term. Future research can further refine the composition of AI indicators. distinguish between basic research and application promotion, and more accurately capture the interaction mechanism between digital finance and AI development.

Artificial intelligence development has a positive impact on ecological resilience at the 1% significance level, with a coefficient of 0.00167. This is because AI, through the analysis of large environmental datasets, can identify potential environmental issues and ecological risks, as well as predict ecosystem changes. By making accurate predictions. AI can help decision-makers take proactive measures to enhance ecological resilience. After introducing artificial intelligence as a mediating variable, digital inclusive finance still has a significant positive effect on ecological resilience at the 5% significance level, with a coefficient of 0.0178. This is because digital inclusive finance, through intelligent financial services, can provide funding support for green and environmental protection projects, promoting the adoption of AI technologies to improve management efficiency and ecological protection outcomes. However, compared to the coefficient of 0.0429 and significance level of 1% when no mediating variables were included, the effect is weaker. This suggests that when artificial intelligence is introduced as a mediator, the direct impact of digital inclusive finance on ecological resilience is suppressed or shifted through the development process of artificial intelligence. In other words, some of the effects of digital inclusive finance are indirectly channeled through artificial intelligence, reducing its direct impact.

6.1.3. Green Credit as a Mediator in Ecological Resilience

Columns (5) and (6) of Table 6 show that digital inclusive finance significantly promotes the growth of green credit at the 1% level, with a coefficient of 0.00580. This may be because digital inclusive finance, by providing convenient and low-barrier financial services, allows more enterprises, especially small and medium-sized green businesses, to access financial support, thereby fostering the growth of green credit.

Table 6.

Mediation mechanism results.

Green credit positively influences ecological resilience at the 10% significance level, with a coefficient of 0.551. This suggests that green credit plays a positive role in enhancing ecological resilience, likely because it funds environmental protection and sustainable development projects, directly promoting the protection and restoration of ecosystems. The investments can be used for ecological restoration, natural resource conservation, and pollution control, all of which improve ecosystems’ self-restoration capacity and their ability to adapt to external shocks, thereby enhancing ecological resilience.

After controlling for green credit as the mediating variable, digital inclusive finance still has a positive effect on ecological resilience at the 10% significance level, with a coefficient of 0.0120. The financing support provided by digital inclusive finance helps businesses develop green technologies such as renewable energy, green buildings and ecological agriculture. These technologies not only improve production efficiency but also contribute to enhancing ecosystems’ adaptive and restorative capacities, further strengthening ecological resilience. However, when green credit is introduced as a mediating variable, the effect is weaker than when no mediating variables were included. This indicates that while green credit promotes ecological Resilience, the direct positive impact of digital inclusive finance on ecological resilience is somewhat diminished.

6.2. Heterogeneity Analysis

6.2.1. Regional Heterogeneity Analysis

In the study of how digital inclusive finance promotes ecological resilience, regional heterogeneity is a key factor. This is because differences in economic development levels, environmental policies, social culture, and ecological environments across regions may affect the role of digital inclusive finance. Therefore, to explore this issue in depth, this paper selects 31 provinces in China as the research sample, and, following the classification standards of the National Bureau of Statistics, divides them into three distinct regions: eastern, central, and western, for analysis.

(1) Preliminary Regional Analysis

As shown in Figure 7, there are significant regional differences in the development of digital inclusive finance in China, generally following a decreasing trend from the eastern region to the central and western regions. The eastern region demonstrates the highest level of digital inclusive finance development, primarily concentrated in the eastern coastal areas. The central region exhibits a higher level of digital inclusive finance than the western region, but its distribution is uneven. In contrast, the western region generally has a lower level of digital inclusive finance development. These results indicate that the effects of digital inclusive finance vary across regions, with the eastern region, due to its stronger economic and financial foundations, being better able to enhance ecological resilience.

Figure 7.

Digital inclusive finance heatmap.

(2) Heterogeneity Analysis

According to the heterogeneity analysis in Table 6, the coefficient for the eastern region is significant, indicating that digital inclusive finance has a positive and significant impact on ecological resilience in eastern China. The eastern region typically features a more mature economy and well-developed financial infrastructure. Digital inclusive finance can promote efficient resource allocation and green investment, thereby supporting environmental protection and sustainable development projects, which in turn enhance the adaptability and resilience of the ecosystem.

In the central region, the coefficient is −0.00147, suggesting that the development of digital inclusive finance has a negative but insignificant effect on ecological resilience. This indicates that, although digital inclusive finance may have improved the accessibility of financial services to some extent, its contribution to enhancing ecological resilience remains limited and may even be somewhat inhibitory.

The negative or insignificant impact of digital inclusive finance on ecological resilience in Central China stems from the region’s unique stage of development and a series of deep-rooted structural challenges. The local economy remains relatively underdeveloped, with an industrial structure still dominated by high energy consumption and heavy pollution. This has created a severe industrial lock-in effect, where traditional industries generate strong path dependence and entrenched interests, thereby imposing substantial barriers to green transformation. Against this backdrop, although digital inclusive finance has improved financial accessibility, in the absence of a clear green orientation and rigorous screening mechanisms, capital may inadvertently flow into the maintenance or expansion of traditional industries rather than supporting structural transformation, thereby exacerbating rather than alleviating environmental pressures.

Moreover, the generally weak environmental governance in the region further undermines the positive role of digital inclusive finance. This is reflected in inadequate stringency in policy formulation and enforcement, insufficient regulatory oversight, low transparency of environmental information, and the tacit acquiescence of some local governments in sacrificing environmental protection under economic growth pressures. Without effective external constraints and internal incentives, even green projects that obtain digital financial support are prone to “greenwashing”, where funds fail to generate genuine environmental benefits and may even be diverted or wasted.

The relatively weak financial infrastructure, limited supply of green financial products and services, low levels of environmental awareness among the public and enterprises, as well as the still insufficient coverage and depth of application of digital inclusive finance, all constitute further constraints. The interplay of these factors explains why digital inclusive finance in Central China has not fully realized its potential in enhancing ecological resilience. Instead, due to misallocation of funds and deficiencies in governance systems, its contribution appears limited or even suppressive.

For the western region, the coefficient is 0.0018, but it does not pass the significance test. suggesting that the impact of digital inclusive finance on ecological resilience in this region is not significant. Although the coefficient is positive. indicating a potential positive effect, the lack of statistical significance suggests that the influence of digital inclusive finance on ecological resilience is relatively weak or possibly affected by other uncontrolled factors.

The relatively underdeveloped economic level serves as a fundamental constraint. This means that local governments, enterprises, and residents tend to prioritize fulfilling basic survival and development needs in their financial investments, leading to a relatively insufficient proactive engagement and investment capacity in ecological environmental protection and restoration. Although digital inclusive finance can encourage green investment by lowering transaction costs and enhancing financial accessibility, its potential guiding role is difficult to translate into concrete action in a context of weak economic foundations, insufficient credit demand, and a scarcity of high-quality green projects. Similarly, small businesses might find it challenging to invest in green transformation due to profit pressures, thus limiting the effectiveness of digital financial services.

Secondly, underdeveloped infrastructure is a critical factor limiting the effective functioning of digital inclusive finance. This refers not only to the information and communication networks essential for digital finance (such as internet penetration and bandwidth stability), but also to physical infrastructure like electricity supply, transportation, and logistics. These deficiencies directly and significantly compromise the accessibility, convenience, and user experience of digital financial tools. In areas with poor network coverage or unstable power supply, even if digital financial products are available, users struggle to access and utilize them consistently, which greatly reduces their efficiency and breadth of application. Furthermore, the generally low level of digital literacy also makes it difficult for the public to effectively utilize these tools, further weakening their impact. The absence of such infrastructure prevents digital inclusive finance from becoming an effective “conduit” for supporting ecological resilience building.

More importantly, lower financial service penetration rate (encompassing both traditional and digital finance) restricts the realization of the potential effects of digital inclusive finance. This is manifested not only in low financial literacy and insufficient trust or acceptance of new financial tools among the populace, but also in the lack of a sound credit system and diverse green financial products specifically tailored for ecological protection. In such an environment, digital inclusive finance struggles to effectively aggregate and match funds, and to incentivize environmentally friendly behaviors. Even if digital platforms exist, they may fail to achieve economies of scale due to a small user base, limited product offerings, or insufficient risk management capabilities, thereby weakening their transmission mechanism for enhancing ecological resilience. For example, if there is a lack of digital credit products specifically designed for ecological agriculture or water resource conservation in a given area, even the presence of digital financial platforms cannot accurately meet the needs of ecological protection.

6.2.2. Digital Economy Development Levels Heterogeneity Analysis

Heterogeneity analysis of digital economy development levels helps to deepen the understanding of the differentiated roles that digital inclusive finance plays across various regions or markets. There are significant disparities in the development levels of the digital economy among different regions. Regions with higher levels of digital economy development typically possess more advanced infrastructure and technological applications. which can better promote green technological innovation and improve the efficiency of resource allocation, thereby enhancing ecological resilience. In contrast, in regions with lower levels of digital economy development, the limited penetration of technology and financial services may constrain the role of digital inclusive finance, resulting in a weaker effect on ecological resilience.

According to the heterogeneity analysis results presented in Table 7, when the digital economy is at a high level, the coefficient is 0.0202 and passes the 5% significance test, indicating that a high level of digital economy development has a significant positive impact on the improvement of ecological resilience. This suggests that in environments where the digital economy is highly developed, the widespread adoption of digital technologies and financial services can effectively enhance resource allocation efficiency, foster the application and innovation of green technologies, and thereby strengthen the adaptability and resilience of ecosystems. High levels of digital economy development are usually accompanied by more advanced infrastructure, greater technological application, and stronger policy support, allowing digital inclusive finance to play a more prominent role in promoting green development, environmental protection projects, and ecological resilience.

Table 7.

Heterogeneity analysis.

When the digital economy is at a low level, the result does not pass the significance test. This indicates that in regions with lower levels of digital economy development, the role of digital inclusive finance in improving ecological resilience is not significant and the impact is relatively limited. A low level of digital economy typically means that infrastructure and technological applications are less developed, and financial services are less accessible and available, thus the potential of digital inclusive finance is not fully realized. Therefore, although the digital economy at a low level may still exert some positive effect on ecological resilience, this effect is not statistically significant.

7. Conclusions and Recommendations

7.1. Conclusions

This study empirically examines the impact of digital inclusive finance on ecological resilience. The findings demonstrate that digital inclusive finance significantly enhances ecological resilience, indicating its notable role in improving the capacity of ecosystems to withstand shocks and self-recover. Baseline regression results show that a 1% increase in digital inclusive finance leads to a corresponding 0.0429% increase in ecological resilience, and this result remains robust at the 1% significance level. The findings are further validated through tests for endogeneity, robustness, and multiple empirical methods.

Mechanism analysis reveals that digital inclusive finance not only directly optimizes resource allocation, stimulates green consumption, and improves the efficiency of environmental governance, but also indirectly affects ecological resilience through channels such as environmental regulation, the development of artificial intelligence, and green credit. Regional heterogeneity analysis shows that the effect of digital inclusive finance is more pronounced in the eastern region, due to its advanced economy and well-developed financial infrastructure. In contrast, the effect is weaker in the central and western regions, which are limited by lower technology penetration and more traditional industrial structures. The ecological effect of digital inclusive finance is also stronger in regions with a higher level of digital economy development, whereas regions with lower levels are constrained by the “digital divide.”

Based on these empirical findings and analyses, the government should adopt proactive policy measures to fully leverage the role of digital inclusive finance in promoting ecological resilience.

7.2. Recommendations

To begin with, the government should increase investment in digital infrastructure, particularly by enhancing the quality of network coverage, the penetration of digital terminals, and the application level of smart devices in the central and western regions. This will effectively reduce the digital divide and provide a solid foundation for the balanced development of digital inclusive finance. Initiatives such as the “Broadband China” strategy, accelerating the deployment of 5G base stations and expanding internet access to remote rural areas, should be implemented. In parallel, the government could support the development of regionally customized digital financial tools. For instance, promoting mobile payment systems that directly link subsidies or green credits to household or enterprise carbon accounts could enhance accessibility and strengthen the behavioral incentives for green consumption.

In addition, preferential policies should be introduced to guide financial institutions in channeling more resources toward green projects, including ecological restoration, clean energy development, and pollution control. Establishing dedicated green credit risk compensation funds, which provide partial risk-sharing for loans directed toward ecological projects, can effectively reduce the risk exposure of financial institutions. Tax incentives, such as reductions in corporate income tax and value-added tax for institutions actively engaged in green lending, would further encourage participation. To make this more effective, policymakers could prioritize support for innovative instruments such as blockchain-based green bonds, carbon credit pledge loans, or digital platforms for carbon trading, which are particularly suited to addressing the financing and verification challenges of ecological resilience.

Financial institutions also play a pivotal role and should actively pursue financial innovation. Leveraging the advantages of digital platforms, institutions can design diversified green financial products that meet the heterogeneous financing needs of ecological projects. For projects with high upfront costs and long payback periods, such as ecological restoration, long-term, low-interest digital credit products should be developed. For enterprises with measurable carbon reduction outcomes, tools such as performance-based carbon futures contracts or AI-driven carbon footprint loans can be introduced. Furthermore, collaboration with technology companies should be deepened to develop integrated risk assessment systems using big data, blockchain, and artificial intelligence. Big data analytics can merge financial, environmental, and credit information to form comprehensive risk profiles, while blockchain ensures the transparency and traceability of transactions. effectively reducing greenwashing risks.

At the regional level, interregional cooperation should be strengthened to promote the coordinated development of digital inclusive finance and ecological resilience. The eastern region, with its first-mover advantage, can promote the diffusion of advanced technologies such as digital carbon accounts and smart-contract-enabled green supply chain finance, transferring experience to the central and western regions through technology spillovers, talent exchange, and industrial relocation. Meanwhile, the central and western regions should exploit their resource endowments to design regionally tailored digital finance models. For example, rural areas could employ digital agricultural supply chain finance platforms that integrate production and transaction data to support ecological agriculture. Minority areas could integrate ecological tourism with digital inclusive finance by creating mobile-based eco-tourism financing products, facilitating the combined development of ecological conservation and cultural tourism.

Author Contributions

Conceptualization, X.L.; methodology, H.J. and X.L.; software, H.J. and X.L.; validation, H.J. and X.L.; formal analysis, H.J. and X.L.; investigation, H.J. and X.L.; resources, H.J. and X.L.; data curation, X.L.; writing—original draft preparation, X.L.; writing—review and editing, H.J. and X.L.; visualization, H.J. and X.L.; supervision, X.L.; project administration, H.J. and X.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author due to confidentiality agreements and the need to protect sensitive information.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ge, H.; Li, B.; Tang, D.; Xu, H.; Boamah, V. Research on Digital Inclusive Finance Promoting the Integration of Rural Three-Industry. Int. J. Environ. Res. Public Health 2022, 19, 3363. [Google Scholar] [CrossRef] [PubMed]

- Du, Y.; Wang, Q.; Zhou, J. How does digital inclusive finance affect economic resilience: Evidence from 285 cities in China. Int. Rev. Financ. Anal. 2023, 88, 102709. [Google Scholar] [CrossRef]

- Liu, Y.; Dong, K.; Wang, K.; Taghizadeh-Hesary, F. Moving towards sustainable city: Can China’s green finance policy lead to sustainable development of cities? Sustain. Cities Soc. 2024, 102, 105242. [Google Scholar] [CrossRef]

- Aminullah, E.; Fizzanty, T.; Nawawi, N.; Suryanto, J.; Pranata, N.; Maulana, I.; Ariyani, L.; Wicaksono, A.; Suardi, I.; Azis, N.L.L.; et al. Interactive Components of Digital MSMEs Ecosystem for Inclusive Digital Economy in Indonesia. J. Knowl. Econ. 2022, 15, 487–517. [Google Scholar] [CrossRef]

- Ozturk, I.; Ullah, S. Does digital financial inclusion matter for economic growth and environmental sustainability in OBRI economies? An empirical analysis. Resour. Conserv. Recycl. 2022, 185, 106489. [Google Scholar] [CrossRef]

- Lan, C.; Li, X.; Peng, B.; Li, X. Unlocking Urban Ecological Resilience: The Dual Role of Environmental Regulation and Green Technology Innovation. Sustain. Cities Soc. 2025, 106, 106466. [Google Scholar] [CrossRef]

- Wu, N.; Zhou, Y.; Yin, S.; Gong, H.; Zhang, C. Revealing the nonlinear impact of environmental regulation on ecological resilience using the XGBoost-SHAP model: Evidence from the Yangtze River Delta region, China. J. Clean. Prod. 2025, 514, 145700. [Google Scholar] [CrossRef]

- Wu, Y.; Tham, J. The impact of environmental regulation. Environment. Social and Government Performance. and technological innovation on enterprise resilience under a green recovery. Heliyon 2023, 9, e20338. [Google Scholar] [CrossRef] [PubMed]

- Zhang, X.; Shi, Y.; Meng, L. Research on the mechanism and path of the coupling of digital technology and environmental regulation to promote urban green efficiency. Sustain. Cities Soc. 2024, 116, 105906. [Google Scholar] [CrossRef]

- Alotaibi, E.; Nassif, N. Artificial intelligence in environmental monitoring: In-depth analysis. Discov. Artif. Intell. 2024, 4, 84. [Google Scholar] [CrossRef]

- Taghikhah, F.; Erfani, E.; Bakhshayeshi, I.; Tayari, S.; Karatopouzis, A.; Hanna, B. Artificial intelligence and sustainability: Solutions to social and environmental challenges. In Artificial Intelligence and Data Science in Environmental Sensing; Elsevier: Amsterdam, The Netherlands, 2022; pp. 93–108. [Google Scholar]

- Habila, M.A.; Ouladsmane, M.; Alothman, Z.A. Role of artificial intelligence in environmental sustainability. In Visualization Techniques for Climate Change with Machine Learning and Artificial Intelligence; Elsevier: Amsterdam, The Netherlands, 2023; pp. 449–469. [Google Scholar]

- Kumari, N.; Pandey, S. Application of artificial intelligence in environmental sustainability and climate change. In Visualization Techniques for Climate Change with Machine Learning and Artificial Intelligence; Elsevier: Amsterdam, The Netherlands, 2023; pp. 293–316. [Google Scholar]

- Zhuk, A. Artificial intelligence impact on the environment: Hidden ecological costs and ethical-legal issues. J. Digit. Technol. Law 2023, 1, 932–954. [Google Scholar] [CrossRef]

- Green, W.N. Financing agrarian change: Geographies of credit and debt in the global south. Prog. Hum. Geogr. 2022, 46, 849–869. [Google Scholar] [CrossRef]

- Van Veelen, B. Cash cows? Assembling low-carbon agriculture through green finance. Geoforum 2021, 118, 130–139. [Google Scholar] [CrossRef]

- Ajl, M. A people’s green new deal: Obstacles and prospects. Agrar. South J. Political Econ. 2021, 10, 371–390. [Google Scholar]

- Zhang, M.; Ren, Y. Impact of environmental regulation on ecological resilience: A perspective of “Local-neighborhood” effect. J. Beijing Inst. Technol. (Soc. Sci. Ed.) 2022, 24, 16–29. [Google Scholar]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring China’s digital financial inclusion: Index compilation and spatial characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar]

- Beck, T.; Demirgüç-Kunt, A.; Maksimovic, V. Financing patterns around the world: Are small firms different? J. Financ. Econ. 2008, 89, 467–487. [Google Scholar] [CrossRef]

- Guo, W.W.; Liu, Y.D. Green Credit. Cost-Benefit Effects and the Profitability of Commercial Banks. South. Financ. 2019, 9, 40–50. [Google Scholar]

- Xia, J.H.; Liu, S.; Ding, C.F.; Tao, X.Q. Environmental Regulation and Green Total Factor Productivity: Promoting or Suppressing. Econ. Probl. 2024, 4, 60–67. [Google Scholar]

- Xu, X.D.; Hui, N. The Impact of Artificial Intelligence on the Green and Low-Carbon Development of Industry. J. Shaanxi Norm. Univ. (Philos. Soc. Sci. Ed.) 2024, 53, 74–86. [Google Scholar]

- Chen, N.; Chen, J. Digital Inclusive Finance and Corporate Green Innovation: The Mediating Role of Green Credit Policy. Sci. Technol. Entrep. 2024, 37, 133–138. [Google Scholar]

- Meng, W.F.; Li, S.; Liu, J.H. Research on the Impact Mechanism of Digital Inclusive Finance on Rural Revitalization. Econ. Issues 2023, 3, 102–111. [Google Scholar]

- Hu, S.; Zhao, L. Can digital inclusive finance promote common prosperity?—An empirical study based on rural micro-enterprises’ credit. Econ. Issues 2025, 9, 46–54. [Google Scholar]

- Cumming, D.J.; Schwienbacher, A. Fintech venture capital. Corp. Gov. Int. Rev. 2018, 26, 374–389. [Google Scholar] [CrossRef]

- Buchanan, B.G.; Yang, T. The impact of artificial intelligence on innovation: Evidence from venture capital. Res. Policy 2023, 52, 104673. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).