Policy-Driven Supply Chain Digitalization and Corporate Sustainability: Evidence from China’s Innovation Pilot

Abstract

1. Introduction

2. Literature Review

3. Institutional Background and Research Hypotheses

3.1. Institutional Background

3.2. Research Hypotheses

3.2.1. The Impact of SCD on Corporate ESG Performance

3.2.2. Financing Constraints Mechanism

3.2.3. Digital Technology Innovation Mechanism

3.2.4. Human Capital Structure Optimization Mechanism

4. Research Design

4.1. Model Design

4.2. Variable Definition

4.2.1. Dependent Variable

4.2.2. Explanatory Variables

4.2.3. Control Variables

4.3. Sample Selection and Data Sources

5. Empirical Findings and Analysis

5.1. Benchmark Regression Outcomes

5.2. Robustness Test

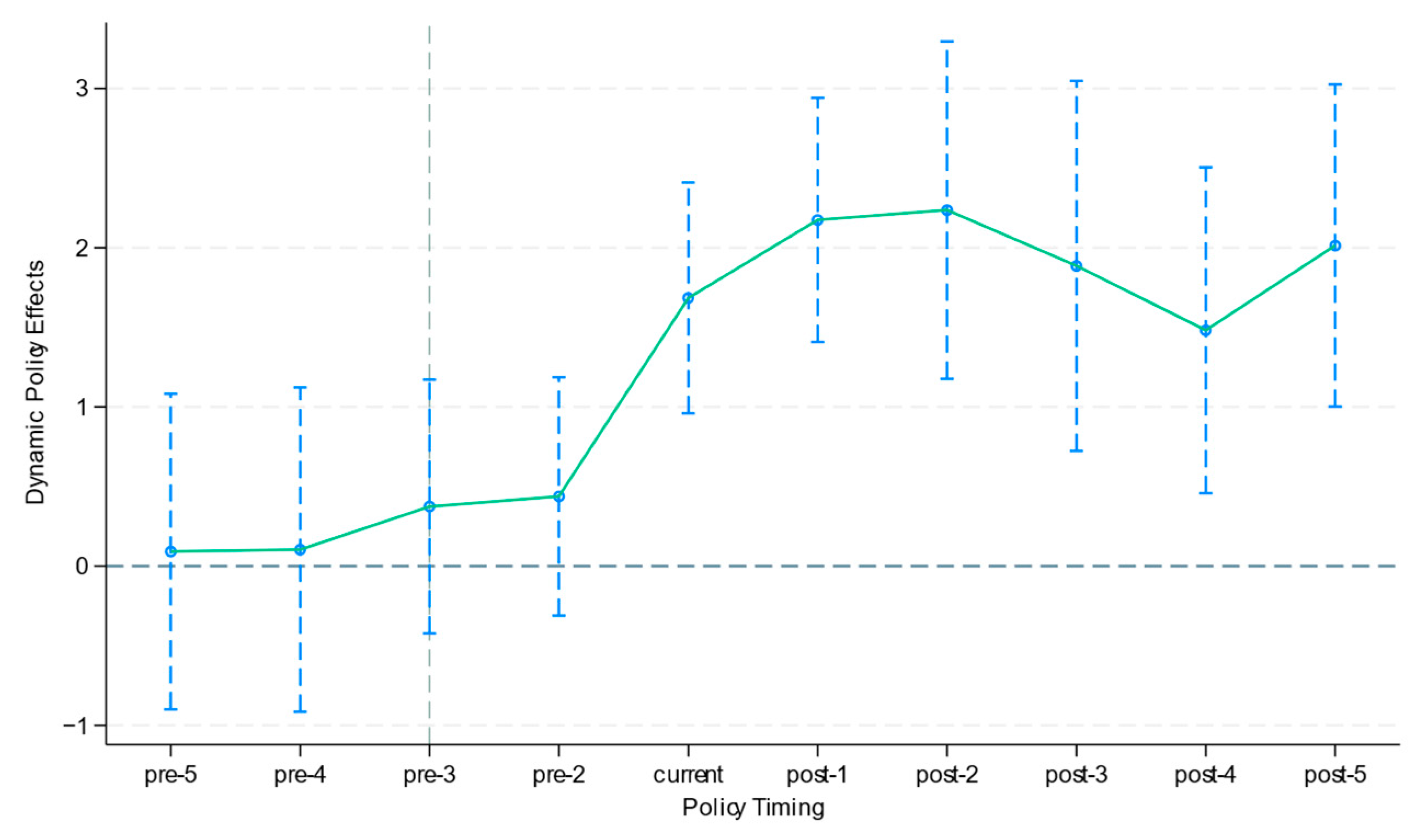

5.2.1. Pre-Trend Test

5.2.2. PSM-DID Test

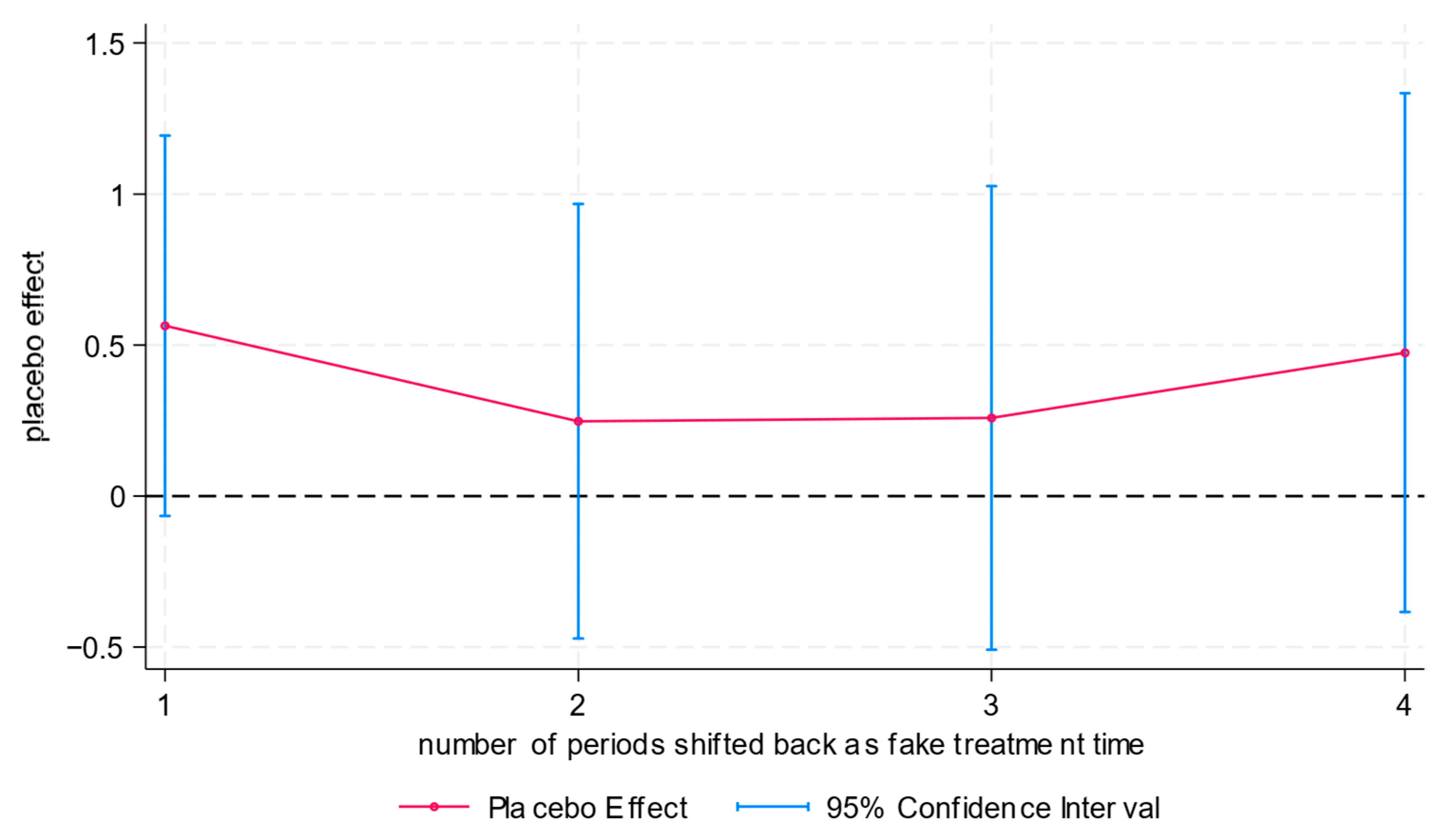

5.2.3. Placebo Test

5.2.4. Exclusion of Other Policy Interference

5.2.5. Replacement of the Dependent Variable

5.2.6. Adoption of Stricter Clustering Standards and Interactive Fixed Effects

5.3. Heterogeneity Analysis

5.3.1. Board Diversity and Corporate ESG Performance

5.3.2. CEO Duality and Corporate ESG Performance

5.3.3. Market Attention and ESG Performance

6. Mechanism Test

6.1. Mechanism Test from the Perspective of Financing Constraints

6.2. Mechanism Test from the Perspective of Digital Technology Innovation

6.3. Mechanism Test from the Perspective of Human Capital Structure Optimization

7. Discussion

8. Conclusions and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Chen, P.; Hao, Y. Digital Transformation and Corporate Environmental Performance: The Moderating Role of Board Characteristics. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1757–1767. [Google Scholar] [CrossRef]

- Baker, E.D.; Boulton, T.J.; Braga-Alves, M.V.; Morey, M.R. ESG Government Risk and International IPO Underpricing. J. Corp. Financ. 2021, 67, 101913. [Google Scholar] [CrossRef]

- Frank, A.G.; Dalenogare, L.S.; Ayala, N.F. Industry 4.0 Technologies: Implementation Patterns in Manufacturing Companies. Int. J. Prod. Econ. 2019, 210, 15–26. [Google Scholar] [CrossRef]

- Ghobakhloo, M. Industry 4.0, Digitization, and Opportunities for Sustainability. J. Clean. Prod. 2020, 252, 119869. [Google Scholar] [CrossRef]

- Dubey, R. Unleashing the Potential of Digital Technologies in Emergency Supply Chain: The Moderating Effect of Crisis Leadership. Ind. Manag. Data Syst. 2023, 123, 112–132. [Google Scholar] [CrossRef]

- Lerman, L.; Benitez, G.B.; Muller, J.M.; de Sousa, P.R.; Frank, A.G. Smart Green Supply Chain Management: A Configurational Approach to Enhance Green Performance through Digital Transformation. Supply Chain. Manag. Int. J. 2022, 27, 147–176. [Google Scholar] [CrossRef]

- Minculete, G.; Stan, S.E.; Ispas, L.; Virca, I.; Stanciu, L.; Milandru, M.; Mănescu, G.; Bădilă, M.-I. Relational Approaches Related to Digital Supply Chain Management Consolidation. Sustainability 2022, 14, 10727. [Google Scholar] [CrossRef]

- Rauniyar, K.; Wu, X.; Gupta, S.; Modgil, S.; Jabbour, A.B.L.d.S. Risk Management of Supply Chains in the Digital Transformation Era: Contribution and Challenges of Blockchain Technology. Ind. Manag. Data Syst. 2023, 123, 253–277. [Google Scholar] [CrossRef]

- Fu, S.; Liu, J.; Tian, J.; Peng, J.; Wu, C. Impact of Digital Economy on Energy Supply Chain Efficiency: Evidence from Chinese Energy Enterprises. Energies 2023, 16, 568. [Google Scholar] [CrossRef]

- Oubrahim, I.; Sefiani, N.; Happonen, A. The Influence of Digital Transformation and Supply Chain Integration on Overall Sustainable Supply Chain Performance: An Empirical Analysis from Manufacturing Companies in Morocco. Energies 2023, 16, 1004. [Google Scholar] [CrossRef]

- Colombo, J.; Boffelli, A.; Kalchschmidt, M.; Legenvre, H. Navigating the Socio-Technical Impacts of Purchasing Digitalisation: A Multiple-Case Study. J. Purch. Supply Manag. 2023, 29, 100849. [Google Scholar] [CrossRef]

- Gao, J.; Hua, G.; Huo, B. Green Finance Policies, Financing Constraints and Corporate ESG Performance: Insights from Supply Chain Management. Oper. Manag. Res. 2024, 17, 1345–1359. [Google Scholar] [CrossRef]

- Hamdy, A. Supply Chain Capabilities Matter: Digital Transformation and Green Supply Chain Management in Post-Pandemic Emerging Economies: A Case from Egypt. Oper. Manag. Res. 2024, 17, 963–981. [Google Scholar] [CrossRef]

- Seshadrinathan, S.; Chandra, S. Trusting the Trustless Blockchain for Its Adoption in Accounting: Theorizing the Mediating Role of Technology-Organization-Environment Framework. Financ. Innov. 2025, 11, 44. [Google Scholar] [CrossRef]

- Yadav, V.S.; Majumdar, A. What Impedes Digital Twin from Revolutionizing Agro-Food Supply Chain? Analysis of Barriers and Strategy Development for Mitigation. Oper. Manag. Res. 2024, 17, 711–727. [Google Scholar] [CrossRef]

- Zhang, M.; Yang, W.; Zhao, Z.; Pratap, S.; Wu, W.; Huang, G.Q. Correction: Is Digital Twin a Better Solution to Improve ESG Evaluation for Vaccine Logistics Supply Chain: An Evolutionary Game Analysis. Oper. Manag. Res. 2024, 17, 387. [Google Scholar] [CrossRef]

- Zou, T.; Xiong, F.; Li, S.; Zhang, W. Understanding the Determinants of Firms’ Usage of A/B Testing: A Technology–Organization–Environment Framework. IEEE Trans. Eng. Manag. 2025, 72, 378–400. [Google Scholar] [CrossRef]

- Li, F.; Nucciarelli, A.; Roden, S.; Graham, G. How Smart Cities Transform Operations Models: A New Research Agenda for Operations Management in the Digital Economy. Prod. Plan. Control 2016, 27, 514–528. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Qi Dong, J.; Fabian, N.; Haenlein, M. Digital Transformation: A Multidisciplinary Reflection and Research Agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Pagani, M.; Pardo, C. The impact of digital technology on relationships in a business network. Ind. Mark. Manag. 2017, 67, 185–192. [Google Scholar] [CrossRef]

- Ronchini, A.; Guida, M.; Moretto, A.; Caniato, F. The Role of Artificial Intelligence in the Supply Chain Finance Innovation Process. Oper. Manag. Res. 2024, 17, 1213–1243. [Google Scholar] [CrossRef]

- Wang, S.; Zhang, H. Green Entrepreneurship Success in the Age of Generative Artificial Intelligence: The Interplay of Technology Adoption, Knowledge Management, and Government Support. Technol. Soc. 2024, 79, 102744. [Google Scholar] [CrossRef]

- Singh, P.K.; Maheswaran, R. Analysis of Social Barriers to Sustainable Innovation and Digitisation in Supply Chain. Environ. Dev. Sustain. 2024, 26, 5223–5248. [Google Scholar] [CrossRef]

- Jiang, S.; Chen, K. Multidirectional Analysis for Sustainable Development: An Examination of Sustainable Policies, Corporate Social Responsibility, and Organizational Performance. Sustain. Dev. 2024, 32, 4385–4396. [Google Scholar] [CrossRef]

- Singhal, V.; Maiyar, L.M.; Roy, I. Environmental Sustainability Consideration with Just-in-Time Practices in Industry 4.0 Era—A State of the Art. Oper. Manag. Res. 2025, 18, 437–460. [Google Scholar] [CrossRef]

- Yuan, Y.; Tan, H.; Liu, L. The Effects of Digital Transformation on Supply Chain Resilience: A Moderated and Mediated Model. J. Enterp. Inf. Manag. 2023, 37, 488–510. [Google Scholar] [CrossRef]

- Wang, L.; Qi, J.; Zhuang, H. Monitoring or Collusion? Multiple Large Shareholders and Corporate ESG Performance: Evidence from China. Financ. Res. Lett. 2023, 53, 103673. [Google Scholar] [CrossRef]

- Gregory, R.P. The Influence of Firm Size on ESG Score Controlling for Ratings Agency and Industrial Sector. J. Sustain. Financ. Invest. 2024, 14, 86–99. [Google Scholar] [CrossRef]

- Jeyhunov, A.; Kim, J.D.; Bae, S.M. The Effects of Board Diversity on Korean Companies’ ESG Performance. Sustainability 2025, 17, 787. [Google Scholar] [CrossRef]

- Huang, W.; Luo, Y.; Wang, X.; Xiao, L. Controlling Shareholder Pledging and Corporate ESG Behavior. Res. Int. Bus. Financ. 2022, 61, 101655. [Google Scholar] [CrossRef]

- Jiang, F.; Ma, J.; Zheng, X. Multiple Large Shareholders and ESG Performance: Evidence from the Cost-Sharing and Resource-Provision View. Account. Financ. 2025, 65, 1309–1346. [Google Scholar] [CrossRef]

- Baek, K.-J.; Yeo, Y.-J. The Impact of a De Facto CEO on Environmental, Social, and Governance Activities and Firm Value: Evidence from Korea. Sustainability 2023, 15, 15308. [Google Scholar] [CrossRef]

- Fan, R.; Ren, Z. Effects of CEO inside Debt on Corporate ESG Behavior: Role of Major Shareholders. Financ. Res. Lett. 2025, 81, 107462. [Google Scholar] [CrossRef]

- Aabo, T.; Giorici, I.C. Do Female CEOs Matter for ESG Scores? Glob. Financ. J. 2023, 56, 100722. [Google Scholar] [CrossRef]

- Kim, K.; Kim, T.-N. CEO Career Concerns and ESG Investments. Financ. Res. Lett. 2023, 55, 103819. [Google Scholar] [CrossRef]

- Welch, K.; Yoon, A. Do High-Ability Managers Choose ESG Projects That Create Shareholder Value? Evidence from Employee Opinions. Rev. Account. Stud. 2023, 28, 2448–2475. [Google Scholar] [CrossRef]

- Lopez-de-Silanes, F.; McCahery, J.A.; Pudschedl, P.C. Institutional Investors and ESG Preferences. Corp. Gov. Int. Rev. 2024, 32, 1060–1086. [Google Scholar] [CrossRef]

- Bikmetova, N.; Pirinsky, C.A. Do ESG Rating Agencies Improve ESG Performance? J. Bus. Ethics 2025, 1–31. [Google Scholar] [CrossRef]

- Cao, L.; Lau, W.; Shaharuddin, S.S. Customer ESG Preferences and Firms’ ESG Performance: A Stakeholder Theory Perspective. Singap. Econ. Rev. 2025, 1–30. Available online: https://www.worldscientific.com/doi/10.1142/S0217590825500018 (accessed on 1 September 2025). [CrossRef]

- Shi, D.; Li, Z.; Huang, Y.; Tan, H.; Ling, Y.; Liu, Y.; Tu, Y. Market Competition and ESG Performance-Based on the Mediating Role of Board Independence. Int. Rev. Financ. Anal. 2024, 96, 103620. [Google Scholar] [CrossRef]

- Li, C.; Li, Y. Market Competition, Resource Allocation and Corporate ESG Performance. Eurasian Bus. Rev. 2025, 1–36. Available online: https://link.springer.com/article/10.1007/s40821-025-00311-z (accessed on 1 September 2025). [CrossRef]

- Huang, H.; Yang, J.; Ren, C. Unlocking ESG Performance Through Intelligent Manufacturing: The Roles of Transparency, Green Innovation, and Supply Chain Collaboration. Sustainability 2024, 16, 10724. [Google Scholar] [CrossRef]

- Zhang, W.; Li, H.; Qian, L.; Wang, X. How Intelligent Manufacturing Improves Corporate ESG Performance: A Three-Dimensional Analysis Based on “Environment,” “Society,” and “Governance”. J. Environ. Manag. 2025, 380, 125171. [Google Scholar] [CrossRef]

- Chen, Y.; Ren, J. How Does Digital Transformation Improve ESG Performance? Empirical Research from 396 Enterprises. Int. Entrep. Manag. J. 2025, 21, 27. [Google Scholar] [CrossRef]

- Zhou, Z.; Yuan, Z.; He, C. Can Digital Transformation Promote Firms’ Sustainable Development? Evidence Based on ESG Performance. Int. Rev. Financ. Anal. 2025, 105, 104434. [Google Scholar] [CrossRef]

- Schilling, L.; Seuring, S. Linking the Digital and Sustainable Transformation with Supply Chain Practices. Int. J. Prod. Res. 2024, 62, 949–973. [Google Scholar] [CrossRef]

- Ngo, V.M.; Pham, H.C.; Nguyen, H.H. Drivers of Digital Supply Chain Transformation in SMEs and Large Enterprises—A Case of COVID-19 Disruption Risk. Int. J. Emerg. Mark. 2023, 18, 1355–1377. [Google Scholar] [CrossRef]

- Xu, B.; Guo, Q.; Chen, L. The Influence of Supply Chain Digitalization on Enterprise ESG Performance: A Quasi-Natural Experiment Based on Pilot Policies for Supply Chain Innovation and Application. Econ. Anal. Policy 2025, 87, 1058–1072. [Google Scholar] [CrossRef]

- Tian, L.; Tian, W.; Guo, M. Can Supply Chain Digitalization Open the Way to Sustainable Development? Evidence from Corporate ESG Performance. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 2332–2346. [Google Scholar] [CrossRef]

- Zhong, T.; Duan, Y.; Du, D.; Wu, D. How Does Digital Supply Chain Innovation Affect Corporate ESG Performance?—Empirical Evidence Based on Supply Chain Innovation and Application Pilot in China. Emerg. Mark. Financ. Trade 2025, 1–30. Available online: https://www.tandfonline.com/doi/full/10.1080/1540496X.2025.2492771 (accessed on 1 September 2025). [CrossRef]

- Chen, S.; Leng, X.; Luo, K. Supply Chain Digitalization and Corporate ESG Performance. Am. J. Econ. Sociol. 2024, 83, 855–881. [Google Scholar] [CrossRef]

- Ivanov, D. Digital Supply Chain Management and Technology to Enhance Resilience by Building and Using End-to-End Visibility During the COVID-19 Pandemic. IEEE Trans. Eng. Manag. 2024, 71, 10485–10495. [Google Scholar] [CrossRef]

- Vachon, S.; Klassen, R.D. Environmental Management and Manufacturing Performance: The Role of Collaboration in the Supply Chain. Int. J. Prod. Econ. 2008, 111, 299–315. [Google Scholar] [CrossRef]

- Lee, C.-C.; Wang, F. How Does Digital Inclusive Finance Affect Carbon Intensity? Econ. Anal. Policy 2022, 75, 174–190. [Google Scholar] [CrossRef]

- Luo, S.; Xiong, Z.; Liu, J. How Does Supply Chain Digitization Affect Green Innovation? Evidence from a Quasi-Natural Experiment in China. Energy Econ. 2024, 136, 107745. [Google Scholar] [CrossRef]

- Meng, C.; Lin, Y. The Impact of Supply Chain Digitization on the Carbon Emissions of Listed Companies-A Quasi-Natural Experiment in China. Struct. Change Econ. Dyn. 2025, 73, 392–406. [Google Scholar] [CrossRef]

- Shen, Y.; Tian, Z.; Chen, X.-L.; Wang, H.; Song, M. Unpacking the Green Potential: How Does Supply Chain Digitalization Affect Corporate Carbon Emissions?—Evidence from Supply Chain Innovation and Application Pilots in China. J. Environ. Manag. 2025, 374, 124147. [Google Scholar] [CrossRef]

- Stank, T.; Esper, T.; Goldsby, T.J.; Zinn, W.; Autry, C. Toward a Digitally Dominant Paradigm for Twenty-First Century Supply Chain Scholarship. Int. J. Phys. Distrib. Logist. Manag. 2019, 49, 956–971. [Google Scholar] [CrossRef]

- Xue, L.; Zhang, C.; Ling, H.; Zhao, X. Risk Mitigation in Supply Chain Digitization: System Modularity and Information Technology Governance. J. Manag. Inf. Syst. 2013, 30, 325–352. [Google Scholar] [CrossRef]

- Zhang, Y.; Wan, D.; Zhang, L. Green Credit, Supply Chain Transparency and Corporate ESG Performance: Evidence from China. Financ. Res. Lett. 2024, 59, 104769. [Google Scholar] [CrossRef]

- Liu, S.; Chen, Y.; Zhang, J. Supply Chain Digitalization and ESG Rating Divergence: Based on the Perspective of Digital Empowerment. Ind. Technol. Econ. 2024, 43, 124–133. [Google Scholar]

- Yu, C.-H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for Green Finance: Resolving Financing Constraints on Green Innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Ma, J.; Li, Q.; Zhao, Q.; Liou, J.; Li, C. From Bytes to Green: The Impact of Supply Chain Digitization on Corporate Green Innovation. Energy Econ. 2024, 139, 107942. [Google Scholar] [CrossRef]

- Chan, C.-Y.; Chou, D.-W.; Lo, H.-C. Do Financial Constraints Matter When Firms Engage in CSR? N. Am. J. Econ. Financ. 2017, 39, 241–259. [Google Scholar] [CrossRef]

- Wang, L.; Yang, H. Digital Technology Innovation and Corporate ESG Performance: Evidence from China. Econ. Chang. Restruct. 2024, 57, 207. [Google Scholar] [CrossRef]

- Yoo, Y.; Henfridsson, O.; Lyytinen, K. Research Commentary—The New Organizing Logic of Digital Innovation: An Agenda for Information Systems Research. Inf. Syst. Res. 2010, 21, 724–735. [Google Scholar] [CrossRef]

- Zobel, A.-K.; Lokshin, B.; Hagedoorn, J. Formal and Informal Appropriation Mechanisms: The Role of Openness and Innovativeness. Technovation 2017, 59, 44–54. [Google Scholar] [CrossRef]

- Wu, C.K.; Tsang, K.F.; Liu, Y.; Zhu, H.; Wei, Y.; Wang, H.; Yu, T.T. Supply Chain of Things: A Connected Solution to Enhance Supply Chain Productivity. IEEE Commun. Mag. 2019, 57, 78–83. [Google Scholar] [CrossRef]

- Hao, X.; Wang, X.; Wu, H.; Hao, Y. Path to Sustainable Development: Does Digital Economy Matter in Manufacturing Green Total Factor Productivity? Sustain. Dev. 2023, 31, 360–378. [Google Scholar] [CrossRef]

- Nagwal, R.; Rohit, K.; Pathak, R. Insights from Circular Supply Chain Implementation Prospects Employing Industry 4.0 Technologies: A Study Based on Applied Methodologies of SLR and Content Analysis. Oper. Manag. Res. 2025, 18, 461–474. [Google Scholar] [CrossRef]

- Carpenter, M.A. The Price of Change: The Role of CEO Compensation in Strategic Variation and Deviation from Industry Strategy Norms. J. Manag. 2000, 26, 1179–1198. [Google Scholar] [CrossRef]

- Hu, S.; Wang, L.; Zhu, L. Is there a human capital improvement effect in the application of industrial robots? J. Financ. Econ. 2021, 47, 61–75+91. [Google Scholar] [CrossRef]

- Graetz, G.; Michaels, G. Robots at Work. Rev. Econ. Stat. 2018, 100, 753–768. [Google Scholar] [CrossRef]

- Acemoglu, D.; Lelarge, C.; Restrepo, P. Competing with Robots: Firm-Level Evidence from France. AEA Pap. Proc. 2020, 110, 383–388. [Google Scholar] [CrossRef]

- Banalieva, E.R.; Dhanaraj, C. Internalization Theory for the Digital Economy. J. Int. Bus. Stud. 2019, 50, 1372–1387. [Google Scholar] [CrossRef]

- Wang, Z. Research on the Intensity of Artificial Intelligence Technology and the Transformation of Internal Labor Structure in Enterprises. Econ. Perspect. 2020, 11, 67–83. [Google Scholar]

- Binder, A.J.; Bound, J. The Declining Labor Market Prospects of Less-Educated Men. J. Econ. Perspect. 2019, 33, 163–190. [Google Scholar] [CrossRef]

- Wang, M.; Xu, M.; Ma, S. The Effect of the Spatial Heterogeneity of Human Capital Structure on Regional Green Total Factor Productivity. Struct. Change Econ. Dyn. 2021, 59, 427–441. [Google Scholar] [CrossRef]

- Wang, Z.; Yin, Q.E.; Yu, L. Real Effects of Share Repurchases Legalization on Corporate Behaviors. J. Financ. Econ. 2021, 140, 197–219. [Google Scholar] [CrossRef]

- He, X.; Chen, W. Digital Transformation and Environmental, Social, and Governance Performance from a Human Capital Perspective. Sustainability 2024, 16, 4737. [Google Scholar] [CrossRef]

- Yu, G. Digital Transformation, Human Capital Upgrading, and Enterprise ESG Performance: Evidence from Chinese Listed Enterprises. Oeconomia Copernic. 2024, 15, 1465–1508. [Google Scholar] [CrossRef]

- Hong, Y.; Jiang, X.; Xu, H.; Yu, C. The Impacts of China’s Dual Carbon Policy on Green Innovation: Evidence from Chinese Heavy-Polluting Enterprises. J. Environ. Manag. 2024, 350, 119620. [Google Scholar] [CrossRef]

- Chen, Q.; Qi, J.; Yan, G. Placebo test of double difference method: A guide to practice. Manag. World 2025, 41, 181–220. [Google Scholar] [CrossRef]

- Kang, Y.; Zhu, D.H.; Zhang, Y.A. Being Extraordinary: How CEOS’ Uncommon Names Explain Strategic Distinctiveness. Strateg. Manag. J. 2021, 42, 462–488. [Google Scholar] [CrossRef]

- Pan, Y.; Guo, M. Corporate ESG performance under air pollution pressure. Quant. Econ. Technol. Econ. Res. 2023, 40, 112–132. [Google Scholar] [CrossRef]

- Baron, R.; Kenny, D. The Moderator Mediator Variable Distinction in Social Psychological-Research—Conceptual, Strategic, and Statistical Considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Jiang, T. Mediating and moderating effects in the study of causal inference experience. China Ind. Econ. 2022, 5, 100–120. [Google Scholar] [CrossRef]

- Xu, J.; Lu, J.; Chai, L.; Zhang, B.; Qiao, D.; Li, S. Untangling the Impact of ESG Performance on Financing and Value in the Supply Chain: A Congruence Theory Perspective. Bus. Strategy Environ. 2025, 34, 2190–2206. [Google Scholar] [CrossRef]

- Eichholtz, P.; Kok, N.; Quigley, J.M. Doing Well by Doing Good? Green Office Buildings. Am. Econ. Rev. 2010, 100, 2492–2509. [Google Scholar] [CrossRef]

- Li, X.; Zheng, Z.; Han, X. Multiplying “Numbers” Up: Government Data Governance Empowers Enterprise Digital Innovation. Res. Quant. Econ. Technol. Econ. 2024, 41, 68–88. [Google Scholar] [CrossRef]

- Wang, Z.; Tang, P. Substantive Digital Innovation or Symbolic Digital Innovation: Which Type of Digital Innovation Is More Conducive to Corporate ESG Performance? Int. Rev. Econ. Financ. 2024, 93, 1212–1228. [Google Scholar] [CrossRef]

- Xiao, T.; Sun, R.; Yuan, C.; Sun, J. Digital transformation of enterprises, human capital restructuring and labor income share. Manag. World 2022, 38, 220–237. [Google Scholar] [CrossRef]

- Fulmer, I.S.; Ployhart, R.E. Our Most Important Asset. J. Manag. 2013, 40, 161–192. [Google Scholar] [CrossRef]

- Liu, X.; Wang, L. Digital Transformation, ESG Performance and Enterprise Innovation. Sci. Rep. 2025, 15, 23874. [Google Scholar] [CrossRef]

- Wang, J. Digital Transformation, Environmental Regulation and Enterprises’ ESG Performance: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 1567–1582. [Google Scholar] [CrossRef]

- Qian, S.; Yu, W. Green Finance and Environmental, Social, and Governance Performance. Int. Rev. Econ. Financ. 2024, 89, 1185–1202. [Google Scholar] [CrossRef]

- Chen, H.X.; Zhao, X.; Smutka, L.; Henry, J.T.; Barut, A.; Shahzad, U. Exploring the impact of China’s low carbon energy technology trade on alleviating energy poverty in Belt and Road Initiative countries. Energy 2025, 318, 134604. [Google Scholar] [CrossRef]

- Shi, Y.; Li, Z.; Lin, L.; Chen, H.; Feng, L.; Lu, W. From awareness to Action: How climate attention drives the low-carbon transition in Chinese agriculture. J. Environ. Manag. 2025, 392, 126700. [Google Scholar] [CrossRef]

- Zhu, Y.; Zhang, Z. Supply Chain Digitalization and Corporate ESG Performance: Evidence from Supply Chain Innovation and Application Pilot Policy. Financ. Res. Lett. 2024, 67, 105818. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Variable Symbol | Variable Declaration |

|---|---|---|---|

| Dependent Variable | Corporate ESG performance | ESG | Huazheng’s comprehensive score on environment, society and governance |

| Explanatory Variables | SCD | DID_Enterprise | The enterprise is located in a pilot city and has a value of 1 for the year 2018 and beyond, otherwise it is 0 |

| Control variables | Shareholding Ratio of the Largest Shareholder | Top1 | Number of shares held by the largest shareholder/total number of shares |

| Board Size | Board | Number of directors on the board | |

| Proportion of Independent Directors | Indpe | Number of independent directors/Board Size | |

| Asset/Liability Ratio | Lev | Total liabilities/Total assets | |

| Fixed Assets Ratio | Fixed | Fixed assets/Total assets | |

| Return on Total Assets | Rota | Retained profits/Total assets balance |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| DID_Enterprise | 41,129 | 0.0140 | 0.1175 | 0 | 1 |

| ESG | 41,129 | 73.0432 | 4.5408 | 63.19 | 81.38 |

| Top1 | 41,129 | 34.1067 | 14.8913 | 1.84 | 89.99 |

| Board | 41,129 | 8.4998 | 1.6981 | 2 | 18 |

| Indpe | 41,129 | 37.5301 | 4.9630 | 33.33 | 50 |

| Lev | 41,129 | 43.2687 | 19.8488 | 10.8735 | 78.8377 |

| Fixed | 41,129 | 20.9224 | 14.8673 | 1.27 | 53.15 |

| Rota | 41,129 | 0.0352 | 0.0481 | −0.0791 | 0.1258 |

| Variable | ESG | |

|---|---|---|

| (1) | (2) | |

| DID_Enterprise | 0.9280 *** (2.75) | 0.9302 *** (2.80) |

| Top1 | 0.0126 *** (2.84) | |

| Board | 0.1189 *** (3.53) | |

| Indpe | 0.0655 *** (7.32) | |

| Lev | −0.0238 *** (−8.96) | |

| Fixed | −0.0146 *** (−3.71) | |

| Rota | 3.7714 *** (5.60) | |

| Enterprise fixed effect | YES | YES |

| Year fixed effect | YES | YES |

| Obs | 41,129 | 41,129 |

| R2 | 0.5281 | 0.5353 |

| Time | Coefficient | [95% Conf. Interval] | |

|---|---|---|---|

| pre-5 | 0.1568 (0.30) | −0.8762 | 1.1898 |

| pre-4 | 0.1621 (0.30) | −0.9113 | 1.2355 |

| pre-3 | 0.3453 (0.87) | −0.4357 | 1.1263 |

| pre-2 | 0.4134 (1.14) | −0.3002 | 1.1270 |

| current | 1.6876 *** (4.60) | 0.9684 | 2.4068 |

| post-1 | 2.1714 *** (5.79) | 1.4376 | 2.9052 |

| post-2 | 2.2866 *** (4.04) | 1.1781 | 3.3951 |

| post-3 | 1.8517 *** (3.05) | 0.6617 | 3.0417 |

| post-4 | 1.4897 *** (2.84) | 0.4629 | 2.5165 |

| post-5 | 2.0013 *** (3.92) | 1.0012 | 3.0014 |

| Variable | Unmatched Matched | Mean | %Bias | %Reduct |Bias| | t-Test | ||

|---|---|---|---|---|---|---|---|

| Treated | Control | t | p | ||||

| Top1 | Unmatched | 35.354 | 34.07 | 8.8 | 73.6 | 2.93 | 0.003 |

| Matched | 35.354 | 35.693 | −2.3 | −0.54 | 0.589 | ||

| Board | Unmatched | 9.0979 | 8.4821 | 32.3 | 97.2 | 12.32 | 0.000 |

| Matched | 9.0979 | 9.0808 | 0.9 | 0.20 | 0.841 | ||

| Indpe | Unmatched | 37.503 | 37.531 | −0.5 | 94.0 | −0.19 | 0.851 |

| Matched | 37.503 | 37.505 | 0.0 | −0.01 | 0.994 | ||

| Lev | Unmatched | 52.988 | 42.98 | 51.9 | 98.2 | 17.17 | 0.000 |

| Matched | 52.988 | 53.168 | −0.9 | −0.23 | 0.815 | ||

| Fixed | Unmatched | 19.774 | 20.956 | −7.7 | 96.5 | −2.70 | 0.007 |

| Matched | 19.774 | 19.815 | −0.3 | −0.06 | 0.949 | ||

| Rota | Unmatched | 0.0426 | 0.0350 | 16.1 | 96.3 | 5.36 | 0.000 |

| Matched | 0.0426 | 0.0423 | 0.6 | 0.15 | 0.880 | ||

| Variable | ESG |

|---|---|

| DID_Enterprise | 0.7102 ** (1.96) |

| Top1 | 0.0063 (0.60) |

| Board | 0.0707 (1.13) |

| Indpe | 0.0654 *** (3.21) |

| Lev | −0.0358 *** (−4.68) |

| Fixed | −0.0147 (−1.32) |

| Rota | 2.2282 (0.98) |

| Enterprise fixed effect | YES |

| Year fixed effect | YES |

| Obs | 6436 |

| R2 | 0.7083 |

| DID_Enterprise Number of Lags | Pseudo-Processing Time | Coefficient | Std. Err. | p-Value | [95% Conf. Interval] | |

|---|---|---|---|---|---|---|

| 1 | 2017 | 0.5639 | 0.6883 | 0.103 | −0.0662 | 1.1940 |

| 2 | 2016 | 0.2478 | 0.6232 | 0.499 | −0.4714 | 0.9670 |

| 3 | 2015 | 0.2587 | 0.6133 | 0.509 | −0.5092 | 1.0266 |

| 4 | 2014 | 0.4747 | 0.6375 | 0.279 | −0.3844 | 1.3337 |

| Variable | ESG | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| DID_Enterprise | 0.7658 ** (2.29) | 0.9153 *** (2.80) | 0.9197 *** (2.84) | 0.7762 ** (2.32) |

| Intelligent Manufacturing Pilot policy | 1.5523 *** (4.14) | 1.5948 *** (4.23) | ||

| Data Factor Marketization policy | 0.2874 *** (2.67) | 0.1805 (1.60) | ||

| Big Data Comprehensive Pilot Zone policy | 0.4221 *** (3.33) | 0.3748 *** (2.81) | ||

| Top1 | 0.0090 ** (2.00) | 0.0084 ** (1.87) | 0.0088 ** (1.96) | 0.0092 ** (2.05) |

| Board | 0.0908 *** (2.71) | 0.0901 *** (2.69) | 0.0910 *** (2.72) | 0.0924 *** (2.77) |

| Indpe | 0.0638 *** (7.08) | 0.0640 *** (7.09) | 0.0636 *** (7.05) | 0.0632 *** (7.02) |

| Lev | −0.0210 *** (−7.85) | −0.0213 *** (−7.90) | −0.0214 *** (−7.96) | −0.0215 *** (−8.01) |

| Fixed | −0.0140 *** (−3.53) | −0.0140 ** (−3.52) | −0.0138 *** (−3.47) | −0.0137 *** (−3.46) |

| Rota | 4.5734 *** (6.47) | 4.6044 *** (6.50) | 4.6360 *** (6.56) | 4.6745 *** (6.63) |

| Enterprise fixed effect | YES | YES | YES | YES |

| Year fixed effect | YES | YES | YES | YES |

| Obs | 39,271 | 39,271 | 39,271 | 39,271 |

| R2 | 0.5262 | 0.5257 | 0.5259 | 0.5267 |

| Variable | ESG_PB | |

|---|---|---|

| (1) | (2) | |

| DID_Enterprise | 3.2133 *** (3.78) | 3.2334 *** (3.82) |

| Top1 | −0.0088 (−0.69) | |

| Board | 0.1597 ** (2.08) | |

| Indpe | 0.0644 *** (2.79) | |

| Lev | −0.0036 (−0.45) | |

| Fixed | 0.0089 (0.81) | |

| Rota | 8.9412 *** (4.72) | |

| Enterprise fixed effect | YES | YES |

| Year fixed effect | YES | YES |

| Obs | 13089 | 13,089 |

| R2 | 0.8178 | 0.8190 |

| Variable | ESG | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| DID_Enterprise | 1.0283 *** (3.05) | 0.8003 ** (2.12) | 0.8582 *** (2.60) | 0.8529 ** (2.25) |

| Top1 | 0.0145 *** (3.32) | 0.0116 ** (2.34) | 0.0138 *** (3.12) | 0.0154 *** (3.27) |

| Board | 0.1208 *** (3.70) | 0.1055 *** (2.84) | 0.1130 *** (3.40) | 0.1026 *** (2.90) |

| Indpe | 0.0627 *** (7.20) | 0.0641 *** (6.63) | 0.0630 *** (7.09) | 0.0580455 *** (6.26) |

| Lev | −0.0252 *** (−9.74) | −0.0240 *** (−8.31) | −0.0252 *** (−9.47) | −0.0256 *** (−9.28) |

| Fixed | −0.0174 *** (−4.54) | −0.0116 *** (−2.72) | −0.0134 *** (−3.44) | −0.0149 *** (−3.63) |

| Rota | 3.8672 *** (5.76) | 4.4201 *** (5.97) | 4.1662 *** (6.22) | 3.8071 *** (5.18) |

| Enterprise fixed effect | YES | YES | YES | YES |

| Year fixed effect | YES | YES | YES | YES |

| Industry#year | YES | NO | NO | YES |

| City#year | NO | YES | NO | YES |

| Province#year | NO | NO | YES | YES |

| Obs | 41,129 | 41,129 | 41,129 | 41,129 |

| R2 | 0.5900 | 0.6107 | 0.5479 | 0.6607 |

| Variable | (1) Boa_High ESG | (2) Boa_Low ESG |

|---|---|---|

| DID_Enterprise | 1.1510 *** (2.74) | 0.5750 (1.01) |

| Top1 | 0.0080 (1.11) | 0.0056 (2.41) |

| Board | 0.0110 (0.22) | 0.1546 *** (-8.75) |

| Indpe | 0.0549 *** (4.19) | 0.0639 *** (5.65) |

| Lev | −0.0276 *** (−7.20) | −0.0243 *** (−7.75) |

| Fixed | −0.0176 *** (−3.03) | −0.01270 *** (−2.91) |

| Rota | 3.8201 *** (3.85) | 1.7274 * (3.08) |

| Enterprise fixed effect | YES | YES |

| Year fixed effect | YES | YES |

| Obs | 18,289 | 19,158 |

| R2 | 0.5655 | 0.5786 |

| Adj-R2 | 0.4907 | 0.5059 |

| Fisher’s Permutation test | −0.576 * | |

| Variable | (1) CEO Duality_High ESG | (2) CEO Duality_Low ESG |

|---|---|---|

| DID_Enterprise | 1.4781 ** (1.82) | 0.6369 (1.65) |

| Top1 | −0.0075 (−0.62) | 0.0095 * (1.80) |

| Board | 0.1243 (1.54) | 0.1208 *** (3.15) |

| Indpe | 0.0648 *** (3.30) | 0.0736 *** (6.71) |

| Lev | −0.0397 *** (−7.50) | −0.0213 *** (−6.69) |

| Fixed | −0.0170 ** (−2.28) | −0.0155 *** (−3.27) |

| Rota | 1.6698 (1.24) | 3.5902 *** (4.19) |

| Enterprise fixed effect | YES | YES |

| Year fixed effect | YES | YES |

| Obs | 10,246 | 26,220 |

| R2 | 0.6119 | 0.5619 |

| Adj-R2 | 0.5150 | 0.5000 |

| Fisher’s Permutation test | −0.841 * | |

| Variable | (1) An_High ESG | (2) An_Low ESG |

|---|---|---|

| DID_Enterprise | 0.9701 ** (2.33) | −0.6915 (−1.07) |

| Top1 | −0.0077 (−0.76) | 0.0019 (0.27) |

| Board | 0.0645 (1.16) | 0.0871 (1.64) |

| Indpe | 0.0874 *** (5.49) | 0.0584 *** (4.14) |

| Lev | −0.0164 *** (−2.98) | −0.0271 *** (−6.32) |

| Fixed | −0.0168 ** (−2.05) | −0.0069 (−1.19) |

| Rota | −0.7492 (−0.46) | 0.5329 (0.44) |

| Enterprise fixed effect | YES | YES |

| Year fixed effect | YES | YES |

| Obs | 11,163 | 13,277 |

| R2 | 0.5644 | 0.5855 |

| Adj-R2 | 0.4677 | 0.4742 |

| Fisher’s Permutation test | −1.662 *** | |

| Variable | SA | |

|---|---|---|

| (1) | (2) | |

| DID_Enterprise | −0.0862 *** (−6.67) | −0.0005 *** (−2.88) |

| Top1 | −0.0003 (−1.47) | |

| Board | 0.003 ** (2.41) | |

| Indpe | −0.0001 (−0.54) | |

| Lev | 0.0004 *** (4.21) | |

| Fixed | −0.0002 (−1.53) | |

| Rota | 0.019 (1.10) | |

| Enterprise fixed effect | YES | YES |

| Year fixed effect | YES | YES |

| Obs | 41,129 | 41,129 |

| R2 | 0.9518 | 0.9516 |

| Variable | Digital Technology Innovation | |

|---|---|---|

| (1) | (2) | |

| DID_Enterprise | 0.3276 ** (2.34) | 0.3251 ** (2.30) |

| Top1 | 0.0014 (0.61) | |

| Board | 0.0257 ** (2.04) | |

| Indpe | 0.0002 (0.07) | |

| Lev | 0.0028 ** (2.47) | |

| Fixed | −0.0007 (−0.45) | |

| Rota | 0.386 (1.60) | |

| Enterprise fixed effect | YES | YES |

| Year fixed effect | YES | YES |

| Obs | 19,906 | 19,906 |

| R2 | 0.7308 | 0.7313 |

| Variable | Human Capital Structure Optimization | |

|---|---|---|

| (1) | (2) | |

| DID_Enterprise | 0.0048 ** (2.45) | 0.0044 ** (2.40) |

| Top1 | 0.0002 *** (5.75) | |

| Board | 0.0004 (1.46) | |

| Indpe | 0.00009 (1.51) | |

| Lev | −0.0001 *** (−6.68) | |

| Fixed | −0.0001 *** (−3.36) | |

| Rota | 0.0221 *** (4.69) | |

| Enterprise fixed effect | YES | YES |

| Year fixed effect | YES | YES |

| Obs | 27,662 | 27,662 |

| R2 | 0.7003 | 0.7056 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, L.; Huang, H.; Chen, N.; Chen, H. Policy-Driven Supply Chain Digitalization and Corporate Sustainability: Evidence from China’s Innovation Pilot. Sustainability 2025, 17, 8762. https://doi.org/10.3390/su17198762

Zhang L, Huang H, Chen N, Chen H. Policy-Driven Supply Chain Digitalization and Corporate Sustainability: Evidence from China’s Innovation Pilot. Sustainability. 2025; 17(19):8762. https://doi.org/10.3390/su17198762

Chicago/Turabian StyleZhang, Lingwei, Hui Huang, Na Chen, and Huangxin Chen. 2025. "Policy-Driven Supply Chain Digitalization and Corporate Sustainability: Evidence from China’s Innovation Pilot" Sustainability 17, no. 19: 8762. https://doi.org/10.3390/su17198762

APA StyleZhang, L., Huang, H., Chen, N., & Chen, H. (2025). Policy-Driven Supply Chain Digitalization and Corporate Sustainability: Evidence from China’s Innovation Pilot. Sustainability, 17(19), 8762. https://doi.org/10.3390/su17198762