Low-Carbon City Pilot Policy, Digitalization and Corporate Environmental and Social Responsibility Information Disclosure

Abstract

1. Introduction

2. Institutional Background and Theoretical Hypotheses

2.1. Policy Background

2.2. Theoretical Hypotheses

3. Research Design and Data

3.1. Samples and Data

3.2. Variable Specification

3.3. Model Specification

4. Analysis of Empirical Results

4.1. Descriptive Statistics

4.2. Main Results

4.3. Robust Test

4.3.1. Parallel Trend Test

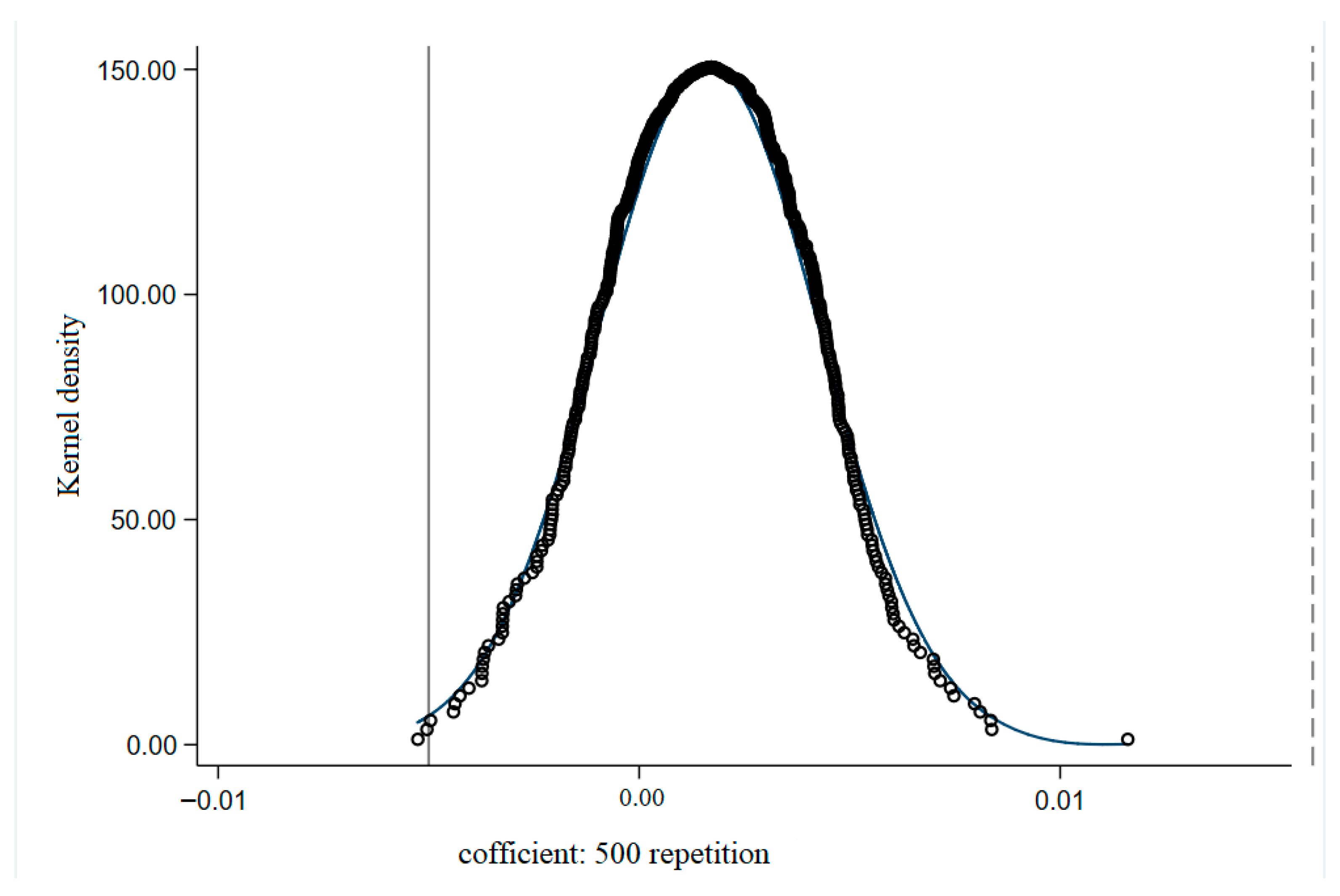

4.3.2. Placebo Test

4.4. Robustness Test

4.4.1. Sample Data Screening

4.4.2. Eliminate Other Policy Interference

4.4.3. Propensity Score Matching (PSM)

5. Results of Further Analysis

5.1. Mechanism Analysis

5.1.1. Environment Performance

5.1.2. Media Attention

5.2. Heterogeneity Analysis

5.2.1. Green Investors

5.2.2. Carbon Emissions

5.3. Impact on the Quality of Information Disclosure

6. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhuang, G.Y. The policy design logic of China’s low-carbon city pilot program. China Popul. Resour. Environ. 2020, 30, 19–28. [Google Scholar]

- Wang, J.X.; Sun, M.N. Green development and the “Porter Hypothesis Puzzle” in governance transformation—Evidence from corporate deleveraging under carbon risk. Econ. Manag. 2021, 43, 41–61. [Google Scholar]

- Hua, W.; Liu, C.; Li, C. Environmental Regulation, Government-business relations, and corporate green innovation: Evidence from low-carbon city pilot policy. Sustainability 2024, 16, 9949. [Google Scholar] [CrossRef]

- Zhang, H.F.; Li, R. Low-carbon pilot policy and performance of heavily polluting industrial enterprises. Econ. Rev. 2022, 2, 137–153. [Google Scholar]

- Dong, M. The net emission reduction effect of industrial pollutants under the low-carbon city pilot policy—Based on the synthetic control method. J. Beijing Inst. Technol. 2021, 23, 16–30. [Google Scholar]

- Wang, Y.F.; Tao, W.Q. The impact and effect of low-carbon city pilots on urban green total factor productivity growth. China Popul. Resour. Environ. 2021, 31, 78–89. [Google Scholar]

- Wang, F.; Ge, X. Does the low-carbon transition shock employment? Empirical evidence from low-carbon city pilots. China Ind. Econ. 2022, 5, 81–99. [Google Scholar]

- Shi, F.; Wang, Y. Corporate Social Responsibility, Carbon information disclosure, and enterprise value: A study of listed companies in China’s highly polluting industries. Int. J. Financ. Stud. 2024, 12, 66. [Google Scholar] [CrossRef]

- Richardson, A.J.; Welker, M. Social disclosure, financial disclosure and the cost of equity capital. Account. Organ. Soc. 2001, 26, 597–616. [Google Scholar] [CrossRef]

- Li, Z.; Li, S.; Huo, Z.; Liu, Y.; Zhang, H. Does CSR information disclosure improve investment efficiency? The moderating role of analyst attention. Sustainability 2023, 15, 12310. [Google Scholar] [CrossRef]

- Fan, Q.; Chun, D.; Ban, Q.; Jiang, Y.; Li, H.; Xu, L. Mandatory disclosure of corporate social responsibility and the quality of earnings management. Sustainability 2023, 15, 13026. [Google Scholar] [CrossRef]

- Zhao, Z.Z.; Cheng, Z.; Lv, D.S. Did the national low-carbon strategy improve corporate total factor productivity?—A quasi-natural experiment based on the low-carbon city pilot program. Ind. Econ. Res. 2021, 6, 101–115. [Google Scholar]

- Chen, S.; Mao, H.; Sun, J. Low-carbon city construction and corporate carbon reduction performance: Evidence from a quasi-natural experiment in China. J. Bus. Ethics 2022, 180, 125–143. [Google Scholar] [CrossRef]

- Du, M.; Feng, R.; Chen, Z. Blue sky defense in low-carbon pilot cities: A spatial spillover perspective of carbon emission efficiency. Sci. Total Environ. 2022, 846, 10. [Google Scholar] [CrossRef] [PubMed]

- Li, X.; Hu, J.; Lyu, X.; Bhuiyan, M.A. Are low-carbon city pilot policies conducive to carbon reduction? An analysis of experiences from China. Environ. Dev. Sustain. 2025, 1, 25. [Google Scholar] [CrossRef]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations: A Resource Dependence Perspective; Harper & Row: New York, NY, USA, 1978. [Google Scholar]

- Monica, A.Z.; Gerald, J.Z. Beyond survival: Achieving New Venture Growth by building legitimacy. Acad. Manag. Rev. 2002, 27, 414–431. [Google Scholar] [PubMed]

- Klassen, R.D.; Whybark, D.C. The impact of environmental technologies on manufacturing performance. Acad. Manag. J. 1999, 42, 6. [Google Scholar] [CrossRef]

- Kong, H.G.; Tang, W. The impact factors of environmental information disclosure quality from a stakeholder perspective. Manag. Rev. 2016, 28, 182–193. [Google Scholar]

- Kang, L.Q.; Liu, H.M. The mechanism and effectiveness of corporate social capital participation in corporate governance: Theoretical analysis and empirical test. Nankai Bus. Rev. 2015, 18, 72–81. [Google Scholar]

- Zhao, Y.H.; Ma, Z.; Feng, T.W. Big data development, institutional environment, and government governance efficiency. Manag. World 2019, 35, 119–132. [Google Scholar]

- Xu, J.H.; Li, S.M. Zhang Dong, Family involvement, institutional environment, and corporate voluntary social responsibility—Empirical study based on the tenth national private enterprise survey. Econ. Manag. 2018, 40, 37–53. [Google Scholar]

- Wang, Y.; Li, Y.X.; Ma, Z.; Song, J.B. Can environmental administrative penalties act as a deterrent?—The deterrent effect of environmental regulation from the perspective of peer influence. J. Manag. Sci. 2020, 23, 77–95. [Google Scholar]

- Liu, Z.Y.; Zhuang, X.H. The impact of organizational logic hybridity on social enterprise mission drift: A perspective from the Yin-Yang balance view. J. Manag. Eng. 2022, 36, 35–48. [Google Scholar]

- Yan, H.Z.; Chen, B.Z. Climate change, environmental regulation, and the value of corporate carbon emission information disclosure. Financ. Res. 2017, 6, 142–158. [Google Scholar]

- Chen, F.Y.; Zhong, T.Y. Low-carbon city pilot, media attention, and corporate environmental investment—From the perspective of the “dual-carbon” strategy. Financ. Account. Mon. 2022, 4, 65–69. [Google Scholar]

- Thomas, C.; David, S.; David, T. The Collateral Channel: How Real Estate Shocks Affect Corporate Investment. Am. Econ. Rev. 2012, 102, 2381–2409. [Google Scholar] [CrossRef]

- Randy, A.B. Local environmental regulation and plant-level productivity. Ecol. Econ. 2011, 70, 2516–2522. [Google Scholar] [CrossRef]

- Song, H.; Sun, Y.J.; Chen, D.K. Government air pollution control effect evaluation—An empirical study from China’s low-carbon city construction. Manag. World 2019, 35, 95–108, 195. [Google Scholar]

- Sun, G. “Technology Recognition”, agency costs, and innovation performance—Preliminary evidence from patent applications of listed companies. Stud. Sci. Sci. 2018, 36, 249–263. [Google Scholar]

- Chen, W.L.; Srinivasan, S. Going digital: Implications for firm value and performance. Rev. Account. Stud. 2024, 29, 1619–1665. [Google Scholar] [CrossRef]

- He, G.; Li, Z.C.; Yu, L.; Zhou, Z.Q. Does commercial reform embracing digital technologies mitigate stock price crash risk? J. Corp. Financ. 2025, 91, 102741. [Google Scholar] [CrossRef]

- Baker, A.C.; Larcker, D.F.; Wang, C.C.Y. How much should we trust staggered difference-in-differences estimates? J. Financ. Econ. 2022, 144, 370–395. [Google Scholar] [CrossRef]

- Tang, G.P.; Sun, H.F. Environmental regulation, risk compensation, and executive compensation—Empirical evidence from the implementation of the new Environmental Protection Law. Econ. Manag. 2022, 44, 140–158. [Google Scholar]

- Khurram, M.U.; Abbassi, W.; Chen, Y.; Chen, L. Outward foreign investment performance, digital transformation, and ESG performance: Evidence from China. Glob. Financ. J. 2024, 60, 100963. [Google Scholar] [CrossRef]

- Wen, Z.L.; Zhang, L.; Hou, J.T.; Liu, H.Y. Mediation effect testing procedures and their applications. Acta Psychol. Sin. 2004, 5, 614–620. [Google Scholar]

- Wang, C.Y.; Wu, J.W. Media tone, investor sentiment, and IPO pricing. Financ. Res. 2015, 9, 174–189. [Google Scholar]

- Xu, A.T.; Dai, Y.J.; Hu, Z.Y.; Qiu, K.A. Can green finance policy promote inclusive green growth?—Based on the quasi-natural experiment of China’s green finance reform and innovation pilot zone. Int. Rev. Econ. Financ. 2025, 100, 104090. [Google Scholar] [CrossRef]

- Rjiba, H. Annual report readability and the cost of equity capital. J. Corp. Financ. 2021, 67, 101866. [Google Scholar] [CrossRef]

- Li, P.G.; Shen, Y.F. Executive compensation, sensational news, and the corporate governance role of the media. J. Manag. Sci. China 2013, 16, 63–80. [Google Scholar]

- Jiang, G.S.; Lu, J.C.; Li, W.A. Do green investors play a role?—An empirical study on corporate participation in green governance. Financ. Res. 2021, 5, 117–134. [Google Scholar]

- Chi, Y.; Hu, N.; Lu, D.; Yang, Y. Green investment funds and corporate green innovation: From the logic of social value. Energy Econ. 2023, 119, 106532. [Google Scholar] [CrossRef]

- Hu, J.F.; Huang, Q.H.; Pan, X.X. Carbon emission trading system and corporate innovation quality: Suppression or promotion, China Population. Resour. Environ. 2020, 30, 49–59. [Google Scholar]

- Kong, D.M.; Wei, Y.X.; Ji, M.M. The impact of environmental protection fee-to-tax policy on the green information disclosure of enterprises. Secur. Mark. Her. 2021, 8, 13. [Google Scholar]

| Variables | Variable Definition |

|---|---|

| ECSR | If a listed company publishes a social responsibility report, it is marked as 1; 0 otherwise |

| PilotPost | If the region where the listed company is located implements the low-carbon city pilot policy in the year, it is marked as 1; 0 otherwise |

| Dig | The degree of digital transformation of listed companies |

| lnpgdp | Logarithm of GDP per capita at the city level |

| Size | The natural logarithm of the company’s total assets at the end of the period |

| Lev | The company’s total debt-to-asset ratio at the end of the period |

| ROA | Net profit/total assets at the end of the period |

| Board | The natural logarithm of the total number of board members |

| Indep | The number of independent directors/total number of board members |

| TobinQ | The ratio of the company’s market value to the company’s total assets at the end of the period |

| Top1 | The ratio of the number of shares held by the largest shareholder to the total share capital |

| Firmage | The natural logarithm of the number of years the company has been listed plus 1 |

| SOE | When the company’s equity nature is a state-owned enterprise, the value is 1, 0 otherwise |

| Banlance | The ratio of the second largest shareholder’s shareholding ratio to the largest shareholder’s shareholding ratio |

| Year | Year dummy variable |

| Firm | Firm dummy variable |

| Variable | N | Mean | Sd | Min | Max |

|---|---|---|---|---|---|

| ECSR | 29,206 | 0.274 | 0.446 | 0.0000 | 1.0000 |

| Pilot × Post | 29,206 | 0.562 | 0.496 | 0.0000 | 1.0000 |

| Dig | 29,206 | 9.390 | 5.814 | −3.0000 | 22.0000 |

| lnpgdp | 29,206 | 11.55 | 0.552 | −1.763 | 14.19 |

| Size | 29,206 | 22.14 | 1.305 | 19.41 | 26.45 |

| Lev | 29,206 | 0.418 | 0.209 | 0.0270 | 0.925 |

| ROA | 29,206 | 0.045 | 0.064 | −0.398 | 0.255 |

| Board | 29,206 | 2.135 | 0.198 | 1.609 | 2.708 |

| Indep | 29,206 | 0.374 | 0.0530 | 0.250 | 0.600 |

| Top1 | 29,206 | 0.352 | 0.150 | 0.0810 | 0.758 |

| TobinQ | 29,206 | 2.039 | 1.376 | 0.802 | 17.73 |

| FirmAge | 29,206 | 2.834 | 0.365 | 0.693 | 3.611 |

| SOE | 29,206 | 0.374 | 0.484 | 0.0000 | 1.0000 |

| Balance | 29,206 | 0.724 | 0.612 | 0.0160 | 2.961 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| ECSR | ECSR | ECSR | |

| Pilot × Post | 0.0209 *** | 0.0215 *** | 0.0145 |

| (0.0079) | (0.0078) | (0.0160) | |

| Dig | −0.0010 | ||

| (0.0049) | |||

| PilotPost *Dig | 0.0085 * | ||

| (0.0049) | |||

| lnpgdp | −0.0153 | −0.0185 | |

| (0.0142) | (0.0171) | ||

| Size | 0.0996 *** | 0.0971 *** | |

| (0.0082) | (0.0091) | ||

| Lev | −0.1162 *** | −0.1270 *** | |

| (0.0248) | (0.0253) | ||

| ROA | −0.0207 | −0.0073 | |

| (0.0388) | (0.0392) | ||

| Board | −0.0214 | −0.0045 | |

| (0.0236) | (0.0250) | ||

| Indep | −0.0562 | −0.0312 | |

| (0.0654) | (0.0713) | ||

| Top1 | −0.0430 | −0.0381 | |

| (0.0591) | (0.0630) | ||

| TobinQ | 0.0107 *** | 0.0118 *** | |

| (0.0022) | (0.0023) | ||

| FirmAge | −0.0155 | 0.0421 | |

| (0.0418) | (0.0470) | ||

| SOE | −0.0043 | 0.0010 | |

| (0.0186) | (0.0191) | ||

| Balance | −0.0215 ** | −0.0010 | |

| (0.0106) | (0.0049) | ||

| Constant | 0.3775 *** | −1.3982 *** | −1.7140 *** |

| (0.0155) | (0.2668) | (0.3127) | |

| Firm FE/Year FE | Yes | Yes | Yes |

| Observations | 29,206 | 29,206 | 23,996 |

| R-squared | 0.0465 | 0.0775 | 0.0683 |

| Variables | 1% Reduction in Tail | 5% Reduction in Tail | Other Policies | psm1:3 | psm1:5 |

|---|---|---|---|---|---|

| (1) ECSR | (2) ECSR | (3) ECSR | (4) ECSR | (5) ECSR | |

| Pilot × Post | 0.0215 *** | 0.2532 *** | 0.0215 *** | 0.0232 *** | 0.0201 ** |

| (0.0078) | (0.0811) | (0.0078) | (0.0086) | (0.0082) | |

| Newpost | −0.1386 *** | ||||

| (0.0404) | |||||

| lnpgdp | −0.0153 | 0.0215 *** | −0.0153 | −0.0103 | −0.0051 |

| (0.0142) | (0.0078) | (0.0142) | (0.0171) | (0.0163) | |

| Size | 0.0996 *** | −0.0153 | 0.0996 *** | 0.1014 *** | 0.1028 *** |

| (0.0082) | (0.0142) | (0.0082) | (0.0100) | (0.0096) | |

| Lev | −0.1162 *** | 0.0996 *** | −0.1162 *** | −0.1089 *** | −0.1022 *** |

| (0.0248) | (0.0082) | (0.0248) | (0.0301) | (0.0283) | |

| ROA | −0.0207 | −0.1162 *** | −0.0207 | −0.0487 | −0.0248 |

| (0.0388) | (0.0248) | (0.0388) | (0.0508) | (0.0489) | |

| Board | −0.0214 | −0.0207 | −0.0214 | −0.0109 | −0.0099 |

| (0.0236) | (0.0388) | (0.0236) | (0.0281) | (0.0275) | |

| Indep | −0.0562 | −0.0214 | −0.0562 | −0.0674 | −0.0474 |

| (0.0654) | (0.0236) | (0.0654) | (0.0793) | (0.0775) | |

| Top1 | −0.0430 | −0.0562 | −0.0430 | −0.0390 | −0.0631 |

| (0.0591) | (0.0654) | (0.0591) | (0.0697) | (0.0654) | |

| TobinQ | 0.0107 *** | −0.0430 | 0.0107 *** | 0.0069 ** | 0.0074 ** |

| (0.0022) | (0.0591) | (0.0022) | (0.0029) | (0.0029) | |

| FirmAge | −0.0155 | 0.0107 *** | −0.0155 | −0.0309 | −0.0208 |

| (0.0418) | (0.0022) | (0.0418) | (0.0485) | (0.0460) | |

| SOE | −0.0043 | −0.0155 | −0.0043 | −0.0028 | 0.0006 |

| (0.0186) | (0.0418) | (0.0186) | (0.0220) | (0.0213) | |

| Balance | −0.0215 ** | −0.0043 | −0.0215 ** | −0.0240 * | −0.0276 ** |

| (0.0106) | (0.0186) | (0.0106) | (0.0129) | (0.0123) | |

| Constant | −1.4002 *** | −1.4002 *** | −1.3982 *** | −1.4422 *** | −1.5620 *** |

| (0.2666) | (0.2666) | (0.2668) | (0.3186) | (0.3037) | |

| Firm FE/Year FE | Yes | Yes | Yes | Yes | Yes |

| Observations | 29,206 | 29,206 | 28,816 | 19,617 | 21,029 |

| R-squared | 0.0775 | 0.0775 | 0.0485 | 0.0465 | 0.0426 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| E | ECSR | Media | ECSR | |

| E | 0.0718 *** | |||

| (0.0036) | ||||

| Media | 0.0000 ** | |||

| (0.0000) | ||||

| Pilot × Post | 0.0530 ** | 0.0177 ** | 48.6211 *** | 0.0210 *** |

| (0.0269) | (0.0072) | (15.8198) | (0.0078) | |

| lnpgdp | 0.0420 | −0.0203 * | −13.4883 | −0.0153 |

| (0.0551) | (0.0123) | (15.2874) | (0.0143) | |

| Size | 0.1794 *** | 0.0878 *** | 67.1765 *** | 0.0984 *** |

| (0.0220) | (0.0076) | (16.4493) | (0.0083) | |

| Lev | −0.5568 *** | −0.0771 *** | 50.2947 | −0.1169 *** |

| (0.0814) | (0.0226) | (56.8584) | (0.0249) | |

| ROA | 0.7344 *** | −0.0752 ** | 48.0675 | −0.0196 |

| (0.1479) | (0.0362) | (55.4165) | (0.0390) | |

| Board | −0.0885 | −0.0144 | −25.7034 | −0.0209 |

| (0.0827) | (0.0221) | (44.5726) | (0.0237) | |

| Indep | −0.4387 * | −0.0189 | 134.7706 | −0.0576 |

| (0.2326) | (0.0628) | (137.8074) | (0.0657) | |

| Top1 | 0.3411 ** | −0.0679 | 32.2960 | −0.0464 |

| (0.1656) | (0.0544) | (145.4460) | (0.0592) | |

| TobinQ | −0.0001 | 0.0111 *** | 25.0555 *** | 0.0098 *** |

| (0.0069) | (0.0021) | (3.5619) | (0.0023) | |

| FirmAge | −0.1056 | −0.0006 | −91.1909 * | −0.0150 |

| (0.1285) | (0.0398) | (51.9086) | (0.0418) | |

| SOE | 0.0019 | −0.0030 | −5.7286 | −0.0042 |

| (0.0557) | (0.0173) | (34.0529) | (0.0186) | |

| Balance | −0.0091 | 0.0718 *** | 41.3094 | −0.0222 ** |

| (0.0319) | (0.0036) | (52.5212) | (0.0106) | |

| Constant | 2.5664 *** | −1.8119 *** | −1285.7468 *** | −1.3667 *** |

| (0.8114) | (0.2477) | (292.0556) | (0.2674) | |

| Firm FE/Year FE | Yes | Yes | Yes | Yes |

| Observations | 28,068 | 28,068 | 28,386 | 28,386 |

| R-squared | 0.0483 | 0.1391 | 0.0640 | 0.0780 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| ECSR (GI = 1) | ECSR (GI = 0) | ECSR (Indu = 1) | ECSR (Indu = 0) | Equal | |

| ECSR | 0.9862 *** | ||||

| (0.0317) | |||||

| Pilot × Post | 0.0119 | 0.0273 *** | 0.0123 | 0.0249 * | −0.0515 ** |

| (0.0137) | (0.0089) | (0.0088) | (0.0148) | (0.0229) | |

| lnpgdp | −0.0098 | −0.0147 | −0.0173 | 0.0011 | −0.0891 ** |

| (0.0260) | (0.0171) | (0.0159) | (0.0266) | (0.0346) | |

| Size | 0.1343 *** | 0.0727 *** | 0.0954 *** | 0.0935 *** | 0.0721 *** |

| (0.0136) | (0.0094) | (0.0104) | (0.0138) | (0.0177) | |

| Lev | −0.1024 ** | −0.1115 *** | −0.1534 *** | −0.0679 | 0.0531 |

| (0.0446) | (0.0289) | (0.0273) | (0.0466) | (0.0655) | |

| ROA | −0.1249 | −0.0136 | −0.0311 | −0.0789 | 0.0303 |

| (0.0814) | (0.0366) | (0.0428) | (0.0728) | (0.1001) | |

| Board | −0.0065 | −0.0405 | −0.0152 | −0.0208 | −0.0347 |

| (0.0373) | (0.0291) | (0.0257) | (0.0475) | (0.0648) | |

| Indep | −0.1026 | −0.0431 | −0.0508 | −0.0786 | −0.0780 |

| (0.1081) | (0.0850) | (0.0686) | (0.1210) | (0.1811) | |

| Top1 | −0.0476 | −0.0108 | −0.0549 | −0.0700 | −0.2244 * |

| (0.0959) | (0.0673) | (0.0717) | (0.0969) | (0.1318) | |

| TobinQ | 0.0158 *** | 0.0025 | 0.0132 *** | 0.0033 | −0.0058 |

| (0.0037) | (0.0024) | (0.0025) | (0.0042) | (0.0055) | |

| FirmAge | 0.0276 | −0.0770 | −0.0027 | 0.0346 | 0.2731 *** |

| (0.0672) | (0.0484) | (0.0474) | (0.0897) | (0.0909) | |

| SOE | −0.0003 | 0.0038 | −0.0060 | −0.0204 | 0.0004 |

| (0.0391) | (0.0190) | (0.0237) | (0.0293) | (0.0433) | |

| Balance | −0.0283 * | −0.0161 | −0.0265 ** | −0.0054 | −0.0550 ** |

| (0.0164) | (0.0127) | (0.0113) | (0.0227) | (0.0244) | |

| Constant | −2.3244 *** | −0.6712 ** | −1.3283 *** | −1.5599 *** | 0.0893 |

| (0.4373) | (0.3135) | (0.3157) | (0.4939) | (0.5823) | |

| Firm FE/Year FE | Yes | Yes | Yes | Yes | Yes |

| Observations | 11,834 | 15,704 | 20,249 | 8496 | 29,206 |

| R-squared | 0.0995 | 0.0634 | 0.0427 | 0.0425 | 0.6829 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, Z.; Li, H. Low-Carbon City Pilot Policy, Digitalization and Corporate Environmental and Social Responsibility Information Disclosure. Sustainability 2025, 17, 8689. https://doi.org/10.3390/su17198689

Yu Z, Li H. Low-Carbon City Pilot Policy, Digitalization and Corporate Environmental and Social Responsibility Information Disclosure. Sustainability. 2025; 17(19):8689. https://doi.org/10.3390/su17198689

Chicago/Turabian StyleYu, Zhijing, and Hao Li. 2025. "Low-Carbon City Pilot Policy, Digitalization and Corporate Environmental and Social Responsibility Information Disclosure" Sustainability 17, no. 19: 8689. https://doi.org/10.3390/su17198689

APA StyleYu, Z., & Li, H. (2025). Low-Carbon City Pilot Policy, Digitalization and Corporate Environmental and Social Responsibility Information Disclosure. Sustainability, 17(19), 8689. https://doi.org/10.3390/su17198689