Abstract

With the surge in global maritime trade of new energy vehicles (NEVs), the roll-on/roll-off (Ro-Ro) shipping market faces a severe supply–demand imbalance, pushing shipping rates to persistently high levels. To tackle this challenge, NEV manufacturers and other automakers have begun establishing their own Ro-Ro fleets, creating an urgent need for optimized operational scheduling of these proprietary fleets. Against this context, this study focuses on optimizing the operational scheduling of automakers’ self-owned Ro-Ro fleets. Under the premise of deterministic automobile export transportation demands, a mixed-integer programming model is developed to minimize total fleet operational costs, with decision variables covering vessel port call sequence/selection, port loading and unloading quantities, and voyage speeds. A genetic algorithm is designed to solve the model, and the effectiveness of the proposed approach is validated through a real-world case study. The results demonstrate that the optimization method generates clear, actionable scheduling schemes for self-owned Ro-Ro fleets, effectively helping automakers refine their maritime logistics strategies for proprietary fleets. This study contributes to the field by focusing on automaker-owned Ro-Ro fleets and filling the research gap in cargo-owner-centric scheduling, providing a practical tool for automakers’ overseas logistics operations.

1. Introduction

As global efforts to address climate change deepen and green concepts gain worldwide popularity, new energy vehicles (NEVs), with their distinct advantages of zero emissions and high energy efficiency, have transitioned from niche products to mainstream options. This shift is driven mainly by three key enablers, including technological advancements, declining costs and robust government support for NEV adoption. This evolution is further manifested in a global trend of rapid market expansion, characterized by record-breaking sales and market share. According to the International Energy Agency (IEA), global NEV sales surged to 17 million in 2024, with their share of total global auto sales surpassing 20% for the first time; meanwhile, the global NEV stock reached 58 million, more than triple the total NEV fleet in 2021 [1].

This rapid NEV market expansion has not only driven a surge in cross-border transportation demand but also accentuated regional disparities in trade patterns. As the world’s largest NEV producer and exporter, China produced 13.168 million NEVs in 2024, accounting for over 60% of the global total. More notably, its NEV exports reached 1.28 million, taking the largest share (40%) of global NEV exports, with shipments primarily destined for key markets including Europe (35%), Southeast Asia (30%), and Latin America (20%). In Europe, NEV sales stagnated in 2024 due to weakened subsidy policies, yet the region still maintained a roughly 20% NEV market share. Notably, the European Union (EU) remained a net exporter of NEVs: its NEV exports exceeded 0.8 million, mostly flowing to other European countries (e.g., the United Kingdom) and North America, while imports stood below 0.7 million, 60% of which were sourced from China [1]. The U.S. recorded an approximately 10% year-on-year growth in NEV sales in 2024, with NEVs accounting for over one-tenth of its total auto sales. In terms of trade, the U.S. exported USD 5.52 billion worth of NEVs in 2024, with top destinations including Canada (USD 2.28 B) and Germany (USD 1.05 B); meanwhile, its NEV imports totaled USD 22.8 billion, primarily from Mexico (USD 8.21 B), Germany (USD 5.61 B), South Korea (USD 4.51 B) and Japan (USD 2.56 B) [2]. Emerging markets in Southeast Asia and Latin America, led by Thailand and Brazil, have become new growth engine for the global NEV sector. Thailand, as Southeast Asia’s largest NEV market, saw its NEV sales surge by nearly 50%, with Chinese imports accounting for 85% of local NEV sales. Brazil leads Latin America, recording nearly 125,000 NEV sales in 2024, more than double 2023’s figure; its NEV sales share rose to 6.5%, and over 85% of its NEVs that year were imported from China [1].

This expansion of the global NEV market and cross-regional trade has placed higher demands on cross-border logistics. As the primary mode for international NEV trade, maritime transport plays a crucial role in long-distance, large-volume shipments. In this field, roll-on/roll-off (Ro-Ro) vessels, as efficient and conventional carriers for global ocean-going vehicle transportation, boast advantages such as high loading and unloading efficiency, low reliance on port equipment, stable transportation quality, and low cargo damage rates. They have thus become a key logistics guarantee for supporting the export of NEVs.

While Ro-Ro vessels meet the efficiency needs of NEV logistics, the sector still faces notable environmental challenges, particularly from traditional shipping practices. These vessels primarily use heavy fuel oil, emitting significant carbon dioxide (CO2). A single China–Europe Ro-Ro voyage carrying 5000 NEVs, for example, emits roughly 15 thousand tons of CO2, while port and inland transport add further emissions, undermining NEVs’ inherent green attributes.

Amid growing NEV demand and mounting environmental concerns, government policies have become a key driver in shaping both NEV adoption and logistics practices. For NEV adoption, countries have rolled out diverse incentives. For example, China offers purchase subsidies, tax exemptions, and relaxed traffic restrictions for NEVs; the U.S. provides IRA tax credits and reduced registration fees; the EU mandates zero-emission sales targets, while relatively high fossil fuel prices in many regions also drive NEV demand. For green logistics, the International Maritime Organization (IMO) requires 40% lower shipping CO2 emissions by 2030; China subsidizes LNG-powered Ro-Ro vessels, and the EU enforces stricter fuel standards, all guiding the optimization of NEV cross-border transportation.

This policy-driven growth in NEV trade, however, has exacerbated a mismatch between global Ro-Ro shipping supply and demand. Over the past decade, Ro-Ro capacity has grown slowly due to limited new vessel deliveries. As of the end of 2023, only 765 operational Ro-Ro vessels existed worldwide, with a total capacity of 4.0702 million Car Equivalent Units (CEUs) and a mere 3.56% year-on-year capacity growth. In contrast, demand for automobile maritime transportation led by NEVs—has surged rapidly. The global seaborne trade volume of automobiles increased by 17% year-on-year in 2023, reaching a record high of 28.84 million. Ro-Ro shipping capacity thus increasingly fails to keep pace with the soaring demand for automobile maritime transportation.

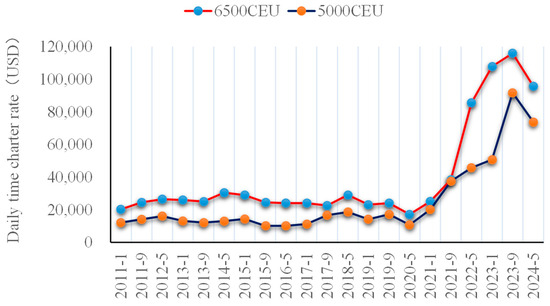

Affected by the imbalance between supply and demand in the Ro-Ro shipping market, the charter rates for Ro-Ro vessels have been rising continuously. Since the fourth quarter of 2021, the charter rates in the international Ro-Ro shipping market have shown a gradual upward trend. As can be seen from Figure 1, between May 2020 and September 2023, the daily time charter rates for Ro-Ro vessels surged dramatically: the rate for a 6500-CEU vessel climbed from less than USD 20,000 to USD 115,000 per day, representing a nearly sixfold increase, while that for a 5000-CEU vessel rose from USD 11,500 to USD 90,000 per day—an approximately 6.87-fold jump. Even though the charter rates saw a seasonal decline in 2024, they still remained as high as USD 70,000 per day. The Ro-Ro shipping market has thus entered its strongest performance in history.

Figure 1.

Daily time charter rate changes over the past four years for 1-year charters of 6500-CEU and 5000-CEU Ro-Ro vessels.

The capacity shortages and the soaring freight rates faced by the international Ro-Ro shipping market exert significant pressure on the automotive manufacturing industry. On one hand, the high maritime transportation costs continue to squeeze the corporate profit margins: the maritime transportation costs for a single finished vehicle account for 30–50% of the vehicle’s total costs, and in extreme cases, even exceed the manufacturing costs. On the other hand, the tight shipping capacity has drastically lengthened order delivery cycles, risking missed opportunities for automakers in fiercely competitive markets and severely challenging supply chain stability.

Against the global backdrop of Ro-Ro shipping capacity shortages and high freight rates, automakers, especially NEV manufacturers, have adopted differentiated transportation strategies based on their scale, market layout, and resource endowments, with varying performance in capacity guarantee, cost control, and supply chain stability. Globally, three mainstream strategies are adopted, i.e., a full outsourcing strategy, hybrid strategy, and self-built fleet strategy. The full outsourcing strategy is generally favored by manufacturers in the early development stage or with small export scales, which entrust all transportation to third-party Ro-Ro operators. For instance, Tesla fully outsourced Ro-Ro transportation for its European market entry to operators like Wallenius Wilhelmsen in its early phase. Leveraging the latter’s mature global route networks, Tesla accessed the European market rapidly with low upfront investment [3]. However, since 2020, the imbalanced global maritime market has led to surging Ro-Ro charter rates, and the third-party operators prioritized long-term contract clients, leaving Tesla facing limited capacity, soaring freight costs, and disrupted delivery efficiency—exposing the drawbacks of full outsourcing in poor market volatility resilience. As automakers expand their export scale and core market demand becomes more stable, the full outsourcing strategy’s limitations in capacity autonomy and cost control gradually emerge, prompting the adoption of a second mainstream approach, i.e., the hybrid strategy. This strategy refers to combining self-owned/joint-venture capacity with partial outsourcing, and is generally adopted by manufacturers with moderate scale. Volkswagen, for example, deployed its self-owned Ro-Ro fleet for the Europe–North America route (its core market with stable demand) to secure capacity and cut long-term costs. Meanwhile, it outsourced transportation to Southeast Asia and South America (markets with scattered, volatile demand) to third-party logistics providers like CEVA Logistics, avoiding fleet idleness. Nevertheless, this strategy requires intensive coordination between self-owned and outsourced resources, and misalignments (e.g., port scheduling conflicts) often cause cargo backlogs and delivery delays. For manufacturers with large-scale, stable export volumes and a focus on long-term supply chain autonomy, even the hybrid strategy’s reliance on external resources may not fully address their need for operational control, thus giving rise to the self-built fleet strategy. The self-built fleet strategy is chosen by such manufacturers to achieve supply chain autonomy. For example, Hyundai Motor Group’s wholly owned subsidiary, Hyundai Glovis, operates the world’s second-largest Ro-Ro fleet and transports roughly 3 million Hyundai vehicles annually, reducing costs by 18% compared to outsourcing during the 2023 freight peak and shortening Europe delivery cycles to 12 days. However, self-built fleets demand high upfront investment and face idle risks, as evidenced by Hyundai’s fleet utilization decline amid weak demand in 2024, which pushed up its idle costs. In recent years, Chinese NEV manufacturers with expanding global market share have increasingly adopted self-built fleets. SAIC’s (Shanghai Automotive Industry Corporation, one of the largest automakers in China) 9500-CEU Ro-Ro vessel Anji Ansheng was delivered in May 2025; BYD (Building Your Dreams, a leading Chinese automaker specializing in NEVs) has four Ro-Ro vessels in operation; Chery (a major Chinese automaker renowned for its diverse range of vehicles, particularly NEVs) launched its first Ro-Ro service to Europe in January 2025; and GAC (Guangzhou Automobile Group Co., Ltd., a leading Chinese automaker with strong NEV export growth) established a Ro-Ro joint venture with China Merchants Shipping to secure export capacity.

Notably, while self-built fleets address capacity and cost issues for both international and Chinese manufacturers, they universally face operational scheduling challenges. Such hurdles directly determine the sustainability of self-built fleet advantages and manufacturers’ global competitiveness, underscoring the urgency and practical value of research on the operational scheduling optimization of automaker’s self-owned Ro-Ro fleet.

As shipowners, automakers differ from traditional shipping companies in their operational philosophy. Traditional shipping firms prioritize maximizing profits, whereas NEV manufacturers primarily aim to meet their export logistics needs, while optimizing for minimal operational costs and complying with carbon emission requirements (aligned with NEV’s green attributes) thereafter. Moreover, automakers’ fleets contrast sharply with those of traditional cargo-owner enterprises (e.g., large energy companies) which focus on bulk commodities like coal and use tramp shipping models centered on bulk cargo characteristics. In contrast, automakers’ fleets serve automobile export needs (mostly their own and similar industries), with shipments featuring small-batch, market-responsive traits. Their shipping demands fluctuate with the consumer market, so vessel scheduling must dynamically adapt (flexibly planning routes, speeds, port calls, and loading/unloading volumes), while also controlling carbon emissions. These decisions are pivotal for enhancing transportation efficiency, controlling costs, reducing environmental impact, and expanding overseas markets.

Against this backdrop, the primary purpose of this study is to address the operational scheduling challenges of automakers’ self-built Ro-Ro fleets in cross-border NEV logistics. It aims to bridge the gap between existing bulk cargo scheduling research and the needs of NEV manufacturers, including fulfilling export demand, minimizing operational costs, and meeting specified carbon emission targets.

To achieve this purpose, the study sets three specific research objectives: first, to systematically examine Ro-Ro fleet scheduling from automakers’ perspective, centering on their core goals of timely export delivery, cost reduction, and carbon emission control; second, to develop a mixed-integer programming model tailored to automakers’ fleet needs, which minimizes total operational costs under deterministic export demands, incorporates flexible scheduling decisions (route selection, port choices, loading/unloading allocation, speed adjustment), and embeds constraints for meeting specified carbon emission requirements; third, to generate specific, actionable operational plans through the model (e.g., optimal port call sequences, per-vessel loading volumes) that balance efficiency, cost, and emissions—for automakers to directly apply in managing their self-owned Ro-Ro fleets.

The remainder of this paper is structured as follows: Section 2 reviews relevant literature and identifies research gaps. Section 3 elaborates on the problem statement of Ro-Ro fleet scheduling and presents the detailed mathematical model formulation. Section 4 introduces the solution algorithm. Section 5 validates the methodology’s effectiveness through a case study based on real-world operations of a Chinese NEV manufacturer. Section 6 summarizes the core findings, discusses the limitations, and outlines future research directions.

2. Literature Review

A key feature of shippers’ owned fleets is that shippers control their own fleets for cargo transportation. Christiansen et al. noted that fleets owned by shippers belong to the scope of industrial shipping. They further defined the fundamental ship routing problem in industrial shipping as a specific type of tramp shipping, where the transportation of all cargoes is mandatory [4].

In studies on shippers’ owned fleets, the research focus has mainly centered on issues such as renewal and long-term planning of fleet structure. For example, Jin et al. investigated the best fleet structure (i.e., the ratio of the self-owned fleet to the total fleet) and the corresponding investment scheme under volatile circumstances in the shipping market [5]. Song and Jin focused on industrial shipping scenarios involving one bulk export terminal and multiple bulk import terminals. They examined integrated decision-making processes, which cover three key aspects: determining the appropriate size and composition of the fleet, formulating voyage plans, and optimizing sailing speeds [6]. Sheng et al. studied the industrial shipping services operating within Emission Control Areas (ECAs) and explored the optimal combination of vessel speed and fleet size for such services in line with ECA regulations [7]. Arslan and Papageorgiou optimized the size, mix and deployment of industrial bulk ship fleets under uncertainties in demand and chartering costs [8].

However, research on operational-level scheduling for shipper-owned fleets is relatively scarce, and what little exists mostly focuses on shippers with bulk cargoes. For example, Zhao et al. delved into the problem of planning vessel voyage schedules for maritime ore transportation, drawing on a real-world project in Guinea. A key focus of their study was the incorporation of factors related to the uncertainty of vessel voyages [9]. Wu et al. investigated a ship scheduling problem under stochastic conditions. For an industrial enterprise that manages a fleet of bulk carriers, their research integrated decisions on fleet size and composition with the operational task of canvassing for stochastic backhaul cargo [10].

In contrast, the broader body of literature on vessel scheduling has predominantly centered on the perspectives of shipping companies (including liner and tramp shipping companies) rather than cargo owners. For example, Dulebenets et al. conducted an extensive review of existing studies on vessel scheduling in liner shipping. They categorized these studies into five distinct groups: general vessel scheduling, handling uncertainty in liner shipping operations, collaborative agreements, recovering vessel schedules, and promoting green practices in liner shipping [11]. Zhao et al. studied the combined problem of vessel scheduling and bunker management in liner shipping, particularly when there are collaborative agreements and potential speed deviations. To address this, they established a worst-case scenario analysis centered on the maximum bunker consumption function, with vessel sailing speed treated as an independent variable [12]. Zhou et al. tackled the issue of schedule recovery for liner ships operating under ECA regulations when disruptive events occur. They developed a bi-objective nonlinear programming model, with the objectives being to minimize recovery costs and reduce the severity of delays [13]. Fan et al. explored the tramp ship scheduling problem while incorporating speed optimization. Their research took into account factors such as carbon emissions, the configuration of owned and chartered ships, and the influence of sailing speed on scheduling decisions. The ultimate goal was to minimize the total costs incurred by shipping companies [14]. Liu et al. approached the optimization of vessel scheduling management from the perspective of shipping companies. Considering the opening of the Arctic route, they aimed to minimize the total operational costs of tramp vessels over multiple periods [15]. Gao et al. addressed the collaborative optimization of ship scheduling, routing, and sailing speed, with a specific focus on the needs of dry bulk shipping companies [16].

For automobile exports, Ro-Ro shipping—characterized by specialized vessels equipped with unique ramp systems—enables seamless transfer of vehicles and other rollable cargo between road and maritime transport. This mode minimizes transit links, reduces cargo damage, and significantly shortens logistics cycles, making it the dominant choice for cross-border vehicle transportation. However, the suitability of Ro-Ro shipping and other maritime modes varies notably when distinguishing between NEVs and conventional internal combustion engine vehicles (ICEVs)—a distinction critical for understanding the evolving demands of automaker-led logistics. NEVs, primarily encompassing hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and battery electric vehicles (BEVs), differ from ICEVs in safety requirements and transportation specifications, directly impacting shipping operations. In terms of safety, ICEV transportation focuses on mitigating fuel leaks and collision-induced fire risks, while NEVs face heightened concerns over battery-related failures during transit [17]. These differences shape their suitability with shipping modes. Ro-Ro vessels accommodate both vehicle types efficiently via stern ramps (allowing direct driving into cargo holds) and classify NEVs as general cargo, avoiding lengthy hazardous materials approval procedures. By contrast, container shipping requires specialized teams to secure both ICEVs and NEVs inside containers, and mandates NEVs be declared as dangerous goods (DG). This entails booking dedicated DG holds, adhering to strict handling regulations, and using specialized securing methods (e.g., wheel braces, reverse lashing) to prevent battery damage from cargo shifting, adding substantial complexity and cost to NEV transportation.

Operational optimization of Ro-Ro shipping has attracted growing attention in academic research, with studies focusing on integrating multiple decision-making dimensions to enhance efficiency. Andersson et al. tackled real-world deployment and routing issues in Ro-Ro shipping, highlighting that integrating speed optimization with route planning yields significantly improved solutions [18]. Chandra et al. developed a mixed-integer programming model for the deployment of Ro-Ro fleets. A notable feature of this model is the integration of port inventory management along trade routes, which extends the scope of operational optimization to include factors related to the supply chain [19]. Building on this, Dong et al. tackled the combined challenge of fleet deployment and inventory management in Ro-Ro shipping. They proposed a flexible voyage planning method that permits the skipping of ports with adequate inventory levels, showcasing greater adaptability in operational strategies [20]. More recently, Zhen et al. extended the optimization framework by comparing Ro-Ro shipping with container shipping for automotive transportation, exploring how to optimize distribution plans through decisions on transportation mode selection, shipping volume, and ship routes, reflecting the practical need to balance different maritime transport options in Ro-Ro operational optimization [21].

Heuristic algorithms are commonly utilized to tackle extensive and complex issues within the research domain discussed in this study. Das et al. developed a container vessel scheduling model under uncertainty to address port supply and demand, incorporating speed optimization, simultaneous loading and unloading operations, and load factor considerations to reduce fuel consumption and carbon emission costs, with numerical experiments conducted using an enhanced genetic algorithm [22]. Han et al. developed a cost model that incorporates diverse emission reduction policies and strategies to optimize vessel speeds in Emission Control Areas (ECAs), proposing an enhanced quantum genetic algorithm utilizing “fork genes” and an elite strategy, which was validated through numerical experiments to significantly reduce overall costs [23]. Ma et al. applied the Non-Dominated Sorting Genetic Algorithm III (NSGA-III) to tackle the multi-objective ship weather routing problem, aiming to minimize operational cost, voyage time, and carbon dioxide emissions simultaneously [24]. Zhan et al. addressed the optimization of platform door control parameters for high-speed railways by developing a dynamic multi-population snow goose algorithm, built upon traditional genetic algorithms, which effectively resolved door alignment challenges across diverse train models and parking inaccuracies, with numerical experiments confirming the algorithm’s superior performance in enhancing operational efficiency [25]. Tian et al. identified the limitations of conventional solution algorithms in solving high-dimensional Traveling Salesman Problems and accordingly introduced an innovative two-stage proxy-assisted dovish optimization algorithm (DOSA-PIO), which demonstrated superior performance over traditional genetic algorithms in both solution quality and computational efficiency through extensive experiments on multiple high-dimensional TSP instances [26]. Tian et al. introduced a novel meta-heuristic algorithm known as the Snow Goose Algorithm, inspired by the distinct migratory flight patterns of snow geese, to offer new solutions for complex optimization problems, which was subsequently evaluated in engineering contexts including reinforced concrete bridge design and automotive side-impact collision design [27].

Existing research on Ro-Ro shipping operational optimization—including studies focused on automobile export maritime transport—has predominantly adopted the perspective of shipping companies. These studies emphasize multi-faceted optimization (e.g., routing, speed, inventory, and mode selection) to enhance operational efficiency and resource allocation within shipping companies’ service frameworks. However, they have paid little attention to the needs of cargo owners—specifically, automakers that own and operate their own Ro-Ro fleets. Three key gaps stand out:

First, operational objectives differ markedly between these two groups. Traditional shipping companies prioritize profit maximization, whereas automakers (as fleet owners) prioritize meeting their own export demands first, with cost minimization as a secondary goal. Existing models do not account for this focus on demand fulfillment. Second, research has overlooked the unique traits of automakers’ self-owned fleets. Unlike traditional cargo owners (e.g., energy firms transporting bulk commodities with stable demand), automakers ship finished vehicles—low-volume, high-value goods with demand heavily shaped by market uncertainty. This demands flexible scheduling (e.g., route adjustments, port calls, loading quantities) tied to dynamic demand, a scenario rarely explored in the literature. Third, current research overlooks NEV exporters. The emerging trend of NEV manufacturers building/purchasing Ro-Ro vessels to establish owned fleets has created urgent needs for scheduling optimization in this context, yet this remains unaddressed.

This study addresses these gaps with three contributions. First, it is among the first to examine Ro-Ro fleet scheduling from the perspective of automakers (particularly NEV manufacturers) as cargo owners, aligning explicitly with their core goals of ensuring export demand fulfillment while minimizing costs. Second, this study develops a mixed-integer programming model to minimize fleet operational costs under deterministic export demands. The model incorporates flexible scheduling decisions (routes, ports, loading/unloading quantities, speed) to reflect automakers’ fleet needs, bridging the gap between bulk cargo scheduling and market-responsive vehicle transport. Third, the model generates specific operational plans—including optimal port calls and loading volumes per vessel—providing actionable guidance for automakers managing their own Ro-Ro fleets in export logistics.

3. Problem Statement and Model Formulation

3.1. Problem Statement

This study examines the maritime transportation planning problem for automakers with their own Ro-Ro fleets, focusing on shipping vehicles from loading ports to unloading ports where overseas dealers are located. The research involves decisions on each Ro-Ro vessel’s port call sequence, loading/unloading quantities at each port, and sailing speed for each voyage leg.

This problem can be described as follows: Suppose an automaker operates several domestic vehicle production bases and owns a fleet of Ro-Ro vessels for undertaking the marine export transportation of automobiles (i.e., all marine export transportation tasks of automobiles are carried out by its own Ro-Ro fleet). Each vessel can load vehicles at multiple domestic coastal ports, then proceeds to unload at a selection of candidate foreign ports before returning in ballast from the final unloading port to its initial port. Given the automaker’s export transportation demands over a specific period (referred to hereafter as the “planning period”), the objective is to optimize each vessel’s route (including port selection, call sequence, and corresponding loading/unloading quantities) and the sailing speeds for each leg during this period. The optimization aims to minimize operational costs while ensuring all export demands are fully met and specific carbon emission requirements are satisfied. The operational cost comprises the fixed operating cost of Ro-Ro vessels, port calling cost, fuel cost, and cargo handling cost (these four cost components generally account for approximately 15%, 25%, 45%, and 15% of the total operational cost, respectively, in line with typical industry cost structures for Ro-Ro shipping).

To facilitate model construction, the following assumptions are proposed:

(1) The automaker’s export plan (export volume, destinations, timetables) and details of its owned Ro-Ro fleet (number, size, type, with all vessels seaworthy) are known. Justification: Export plan is derived from automaker’s long-term strategic planning and historical operational data; fleet details are core logistics asset information tracked in enterprise records, while seaworthiness aligns with industry-standard safety protocols.

(2) Overseas countries’ automobile demand volume is known, with one designated sole unloading port per country. Justification: Demand volume is estimable via automotive industry market reports and economic forecasts. Single unloading port per country reflects real-world practice, because major import markets often rely on 1–2 key ports with superior vehicle-handling infrastructure, simplifying model complexity without losing representativeness.

(3) The candidate ports are known, along with their locations, operational capacities, and cargo delivery time windows. Justification: Port attributes are publicly available via port authority publications, shipping industry databases, and logistics provider reports, which are foundational for route optimization and scheduling.

(4) The vessel acceleration/deceleration time and fuel consumption fluctuations are ignored; vessels sail at constant speed per voyage leg. Justification: In long-haul maritime transportation, sailing at stable speed dominates total voyage time—acceleration/deceleration has minimal impact on overall scheduling accuracy.

(5) Vessels call at ports once without revisiting. Justification: Direct, non-revisiting port calls align with typical large-scale vehicle export logistics, where minimizing transit time and costs avoids redundant port stops.

(6) All vehicles transported are identical, with standard CEU dimensions and 2-ton weight. Justification: Using average standard vehicle specs simplifies cargo capacity calculations and variations in real-world vehicle sizes have negligible impact on fleet-level operational optimization.

(7) The fleet is exclusively for export; vehicles are loaded at domestic ports and unloaded at foreign ports. After completing operations at the final unloading port, vessels return directly to the domestic starting port. Justification: This reflects the common operation mode of automaker’s export-dedicated fleet, separating export logistics from domestic distribution to enhance supply chain efficiency and cost control.

3.2. Notations

The notations of the sets, parameters, and variables related to the model proposed are indicated in Table 1, Table 2 and Table 3.

Table 1.

Notations of the sets in the model.

Table 2.

Notations of the parameters in the model.

Table 3.

Notations of the variables in the model.

3.3. Model Formulation

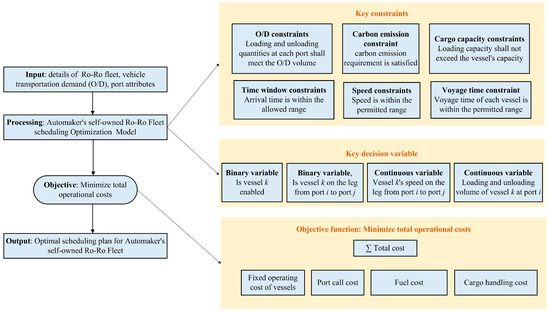

To address the complexity of the proposed Ro-Ro fleet scheduling optimization model and enhance its understandability, a logic diagram (Figure 2) is constructed to systematically illustrate the model’s workflow.

Figure 2.

Logic diagram of the self-owned Ro-Ro fleet scheduling optimization model.

The model formulation is as follows.

Subject to:

The objective function (denoted by Equation (1)) represents the minimization of total operational cost of the whole fleet during the planning period. The total operational cost includes the fixed operating cost of Ro-Ro vessels, the port calling cost, the fuel cost and the cargo handling cost. Constraint 1 (denoted by Equation (2)) represents the total voyage time of any ro-ro ship in the fleet (i.e., the sum of sailing time and loading/unloading time) must not exceed the duration of the planning period. Constraints 2 and 3 (denoted by Equations (3) and (4)) ensure that the number of finished vehicles loaded on each ro-ro vessel is limited by the vessel’s maximum cargo capacity and deadweight tonnage. Constraints 4 and 5 (denoted by Equations (5) and (6)) ensure that the loading and unloading quantities of finished vehicles at each port, respectively, meet the dispatch volume and demand volume of the region where the port is located. Constraints 6 and 7 (denoted by Equations (7) and (8)) ensure that the arrival time of any ro-ro ship in the fleet at any port falls within the specified time window. Constraints 8 and 9 (denoted by Equations (9) and (10)) ensure that each ro-ro vessel has only one sailing route. Constraints 10 (denoted by Equation (11)) requires that vessel navigation be subject to the constraint of continuity. Constraints 11 (denoted by Equation (12)) ensures that no ro-ro vessel can call at the same port consecutively. Constraints 12 and 13 (denoted by Equations (13) and (14)) represents the constraint on the sailing speed of ships. Constraints 14 (denoted by Equation (15)) indicates that each vessel has only one final unloading port. Constraint 15 (denoted by Equation (16)) defines a carbon emission constraint that reflects environmental requirement, where denotes the fuel consumption function of vessel k sailing from port i to j at speed (a ready-made formula expression available based on the rule of thumb in the literature). Constraints 16–20 (denoted by Equations (17)–(21)) are variable constraints.

4. Solution Algorithm

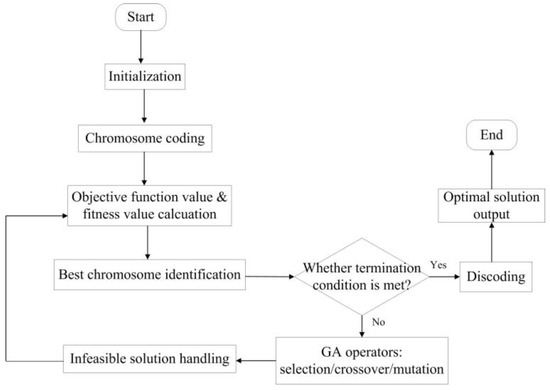

To solve the above-mentioned bi-level model, the specific algorithm based on the genetic algorithm (GA) is designed. The choice of GA is determined by the model’s core characteristics: First, the model involves NP-hard combinatorial optimization, where GA avoids the “curse of dimensionality” of exact algorithms and flexibly handles infeasible solutions via feasibility repair operators and penalty functions. Second, GA maintains solution diversity through population-based evolution, preventing local optima that often occur in single-point search methods. The flowchart of the algorithm is shown in Figure 3. The detailed steps are as follows.

Figure 3.

Flowchart of the algorithm steps.

Step 0: Set ( denotes the number of iterations), ( denotes the objective value for the best found solution), ( denotes the best solution). Define the convergence criterion and termination condition. In terms of the convergence criterion, set the convergence tolerance , i.e., the minimum allowable relative change in the best objective value. The algorithm is considered to converge if the relative change in between consecutive iterations satisfies for ten consecutive iterations (to avoid misjudgment due to random fluctuations). The algorithm will terminate if either of the following is met: (1) The number of iterations reaches the maximum number of iterations ; (2) The convergence criterion is satisfied.

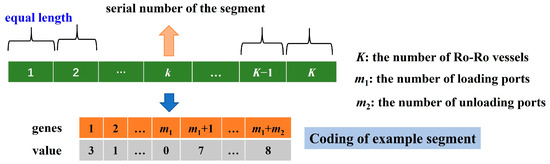

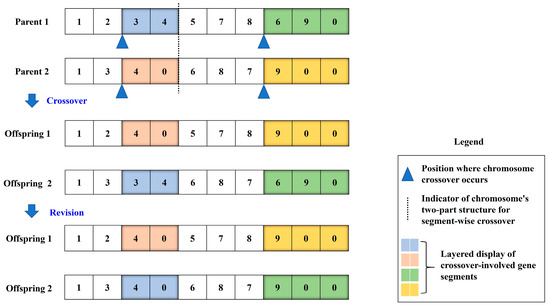

Step 1: Generate an initial population (N denotes the number of chromosomes in the population). For each chromosome, the coding method is shown in Figure 4. Specifically, the chromosome adopts a segmented structure, consisting of K gene segments of equal length, which represent the routes of K vessels. The k-th gene segment has a fixed length of m1 + m2 genes, and the gene coding method is shown in Table 4. The sub-steps for generating a gene segment are as follows.

Figure 4.

Chromosome coding method.

Table 4.

Gene coding method.

Step 1-1: For the first m1 gene loci, perform the following operations: first, randomly determine the number of loading ports to be visited, denoted as (with value range of ). Then, randomly select ports from the loading port set and arrange these ports in a random order—each selected port is removed from the set to avoid duplicate selection. If is less than , the remaining gene loci are filled with 0.

Step 1-2: Similarly, for the last m2 gene loci, perform the following operations: first, randomly determine the number of unloading ports to be visited, denoted as (with a value range of ). Then, randomly select ports from the unloading port set and arrange these ports in a random order—each selected port is removed from the set to avoid duplicate selection. If is less than , the remaining gene loci are filled with 0.

Then repeat Step 1-1 and 1-2 for K times to generate a chromosome.

Step 2: Calculate the objective function value of the solution corresponding to each chromosome, and compute its reciprocal as the fitness value (denoted as ) of each chromosome.

Step 3: Compare the objective function value among the chromosomes in the population, and record the minimum objective function value , and the corresponding chromosome .

Step 4: Compare and . If , then set , ; otherwise, keep and unchanged; output and .

Step 5: Check whether the algorithm converges: calculate the relative change in the best objective ; count the number of consecutive iterations a where (initialize a = 0; if , update a = a + 1; otherwise, reset a = 0). If , the algorithm converges. Then set ; check whether the termination condition is met: if or the algorithm has converged. If yes, terminate the computation; otherwise, go to Step 6.

Step 6: Perform the operations of selection, crossover and mutation to obtain a new population. To avoid getting stuck at locally optimal value, the roulette wheel selection is adopted, and the two-point crossover and the single-point mutation are used. Return to Step 2.

In the crossover operation, offspring chromosomes that violate the constraint of “each port being callable at most once” may be generated. For such infeasible solutions, the following correction method can be adopted: For the first m1 gene loci and the last m2 gene loci of each gene segment, examine them starting from the front of the gene sequence, respectively. If a port has already appeared, all subsequent occurrences of that port gene shall be revised to 0; if there remain subsequent port calls after this revision, these port genes shall be shifted forward sequentially to fill the vacancies. An example of correcting an infeasible solution generated by the crossover operation is shown in Figure 5.

Figure 5.

Schematic diagram of chromosome crossover operation.

The mutation operation is performed as follows: (1) Adding a port: If there exists a gene with a value of zero in the gene segment, a randomly selected unvisited port is used to replace the zero value (specifically, for the first m1 gene loci, an unvisited loading port is selected; for the last m2 gene loci, an unvisited unloading port is selected) (e.g., [2, 0, 0] → [2, 3, 0]). (2) Removing a port: A non-zero gene is randomly selected and set to zero, after which the subsequent genes are shifted forward to fill the position (e.g., [1, 4, 0] → [4, 0, 0]; here, gene 1 (with a value of 1) is set to zero, gene 2 (with a value of 4) is shifted to position 1, and position 3 becomes zero).

5. Case Study

5.1. Case Inputs and Basic Data

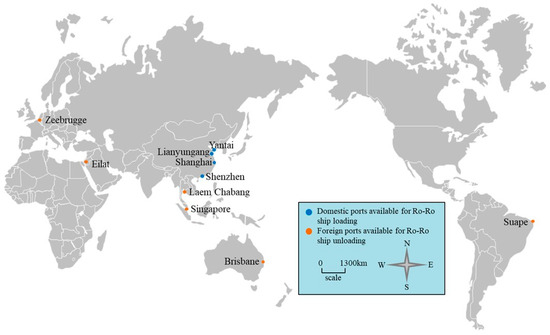

In order to verify the effectiveness of the methodology proposed in Section 3 and Section 4, this study takes the Ro-Ro fleet established by BYD (Build Your Dreams), a leading Chinese NEV manufacturer, as the case study object, and optimizes the operational scheduling scheme of its fleet. BYD has announced an ordered for six Ro-Ro vessels, which will be put into operation sequentially around 2025. BYD has domestic vehicle factories located in Xi’an, Zhengzhou, Jinan, Changzhou, Hefei, Xiangyang, Shanghai, Fuzhou, Changsha and Shenzhen. Prior to initiating maritime transportation, finished vehicles are generally consolidated at coastal ports in eastern and southern China via inland waterway or land transportation for loading. Therefore, this study takes Yantai Port, Lianyungang Port, Shanghai Port and Shenzhen Port as the domestic loading ports. These ports have well-developed Ro-Ro terminal facilities for cargo distribution, while also enabling convenient gather of finished vehicles produced by domestic factories through inland waterway or land transportation. The export destinations for BYD’s finished vehicles primarily encompass Europe, South America, Southeast Asia, the Middle East, and Oceania. Specifically, Zeebrugge Port in Belgium is selected as the unloading port for Europe, Suape Port in Brazil for South America, Laem Chabang Port in Thailand and Singapore Port in Singapore for Southeast Asia, Eilat Port in Israel for the Middle East, and Brisbane Port in Australia for Oceania. Consequently, there are a total of 4 loading ports and 6 unloading ports, as illustrated in Figure 6.

Figure 6.

Distribution of loading and unloading ports.

The relevant information of the Ro-Ro fleet, the manufacturer’s transportation demand for vehicle export is shown in Table 5 and Table 6, respectively. The duration of the planning period is set to 90 days, and the vessel fuel price is set to 950 USD/ton.

Table 5.

Relevant information of the Ro-Ro fleet.

Table 6.

Manufacturer’s transportation demand for vehicle export.

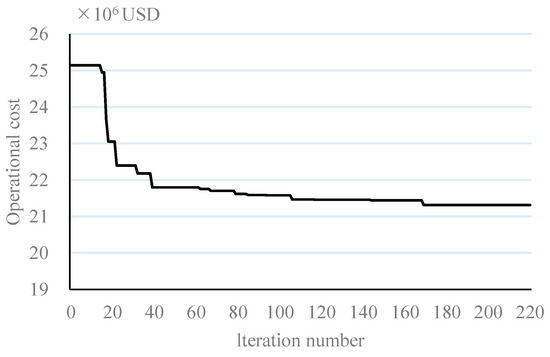

5.2. Optimization Results

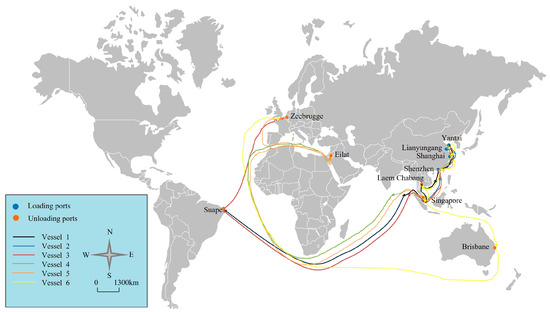

The above case experiment was conducted on a Windows 10 operating system with an Intel(R) Core(TM) i5-8250U processor and 8 GB of memory. The genetic algorithm code for the model was written using Python 3.9, with the following runtime parameters: 220 iterations, a population size of 50, a crossover probability of 0.6, and a mutation probability of 0.05. After multiple runs (the average execution time is 125 s), the case calculation results were obtained, and the iteration curve is shown in Figure 7. Table 7 presents the derived sailing sequence of each vessel, the speed for each voyage leg, and the number of vehicles loaded/unloaded at each port. The schematic diagram of the optimized fleet routes is shown in Figure 8.

Figure 7.

Convergence curve of the solution algorithm.

Table 7.

Optimization result of the operational scheduling scheme of the case fleet.

Figure 8.

Optimized routes of the case fleet.

Based on the model calculation results, taking Vessel 1 as an example, its optimal port call sequence is 1-4-5-9-1. Specifically, it loads 3168 vehicles at Yantai Port (China) and sails to Shenzhen Port at a speed of 12.6 knots for loading an additional 1613 vehicles. Subsequently, it sails to Laem Chabang Port (Thailand) at 12.2 knots to unload 1447 vehicles, and then proceeds to Suape Port (Brazil) at 17.4 knots to unload the remaining 3334 vehicles. After completing the unloading operation, it returns to Yantai Port in ballast at a speed of 12.4 knots to wait for the next task.

5.3. Sensitivity Analysis

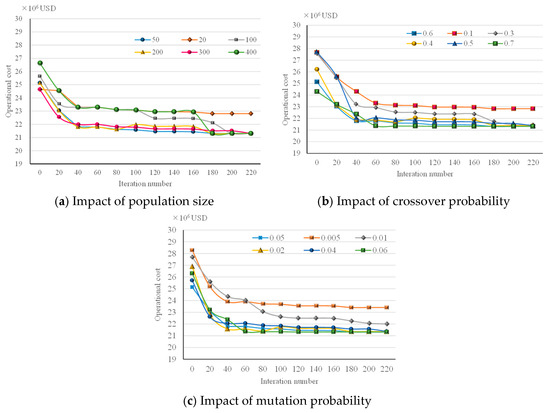

(1) Sensitivity testing of algorithm parameters

To verify the impact of key algorithm parameters on the optimization objective of self-owned Ro-Ro fleet scheduling and justify the rationality of the parameter combination selected in this study (population size = 50, crossover probability = 0.6, mutation probability = 0.05), a sensitivity test was conducted using the “control variable method” in this section. Specifically, only one parameter was adjusted at a time while keeping the other two parameters at their initial values.

The effect of population size is shown in Figure 9a. When only the population size was adjusted (with crossover probability fixed at 0.6 and mutation probability at 0.05), a size of 20 led to insufficient genetic diversity. This limitation restricted the algorithm’s ability to explore the solution space, making it prone to falling into local optima, and thus the converged operational cost was significantly higher than that achieved with the selected population size of 50. When the population size was further increased to 100, 200, 300, or 400, the final converged cost remained essentially the same as that of the 50-size group, with no noticeable improvement in optimization performance being observed. However, the computational burden increased sharply with larger population sizes. The single-solution computation time for a population size of 400, for instance, was 3.2 times that of a size of 50, and the convergence steps also increased by approximately 60% compared to the 50-size group, resulting in a substantial decline in algorithm efficiency. These results confirm that a population size of 50 is optimal, as it uniquely balances solution accuracy (avoiding local optima and achieving the target cost) and computational efficiency (preventing redundant time and resource consumption).

Figure 9.

Impact of algorithm parameters on operational cost optimization result and convergence.

The impact of crossover probability is illustrated in Figure 9b. When only the crossover probability was adjusted, notable differences in algorithm performance emerged. For low crossover probabilities (i.e., 0.1–0.5), insufficient genetic exchange between individuals limited the generation of new, high-quality gene combinations. This not only resulted in delayed convergence, but also led to converged operational costs that were 0.3–7.1% higher than those achieved with the selected probability of 0.6. When the crossover probability was increased to 0.7, the final converged cost was essentially identical to that of the 0.6 group, and the convergence speed also approached the level of the 0.6 probability. However, a closer analysis of the iteration process reveals that the 0.7 probability introduced greater fluctuations in the cost curve during early iterations. This is attributed to the slightly higher genetic exchange frequency, which temporarily disrupted partial stable gene segments before the algorithm converged to the optimal cost. In contrast, the crossover probability of 0.6 maintained a smooth iteration curve throughout the process, ensuring both efficient genetic exchange and stable retention of high-quality gene combinations.

The influence of mutation probability is displayed in Figure 9c. When modifying only the mutation probability, for low mutation probabilities (0.005–0.04), the algorithm failed to introduce sufficient new genetic information to break through the local solution space. This led to the algorithm being trapped in a plateau phase during iterations and the final converged operational costs were 0.3–9.8% higher than those achieved with the mutation probability of 0.05. When the mutation probability was increased to 0.06, the final converged cost was essentially identical to that of the 0.05 group. However, the iteration process of the 0.06 group exhibited more significant fluctuations in the early stage. The cost curve oscillated sharply before stabilizing, which was caused by excessive randomization disrupting the initial stable gene segments. In contrast, the mutation probability of 0.05 maintained population stability to prevent unnecessary cost fluctuations, while introducing enough new genetic information to help the algorithm avoid local optima.

(2) Sensitivity testing of transportation demand

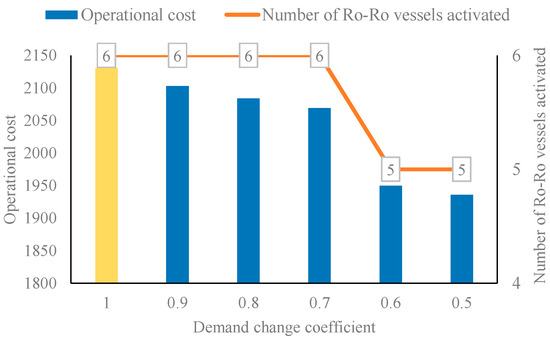

The external environment is characterized by high uncertainty, where the future transportation demand may not only increase but also show a downward trend. With the implementation of the EU’s anti-subsidy policies and tariff escalation measures, the demand for imported automobiles from China in the European market will be directly affected. To this end, the impact of changes in the demand fluctuation coefficient in the European market on the operational costs and the number of activated vessels of manufacturer’s self-operated fleets is investigated, with relevant results presented in Figure 10.

Figure 10.

Impact of demand change coefficient on the case fleet’s operational cost and number of vessels activated.

It reveals that as demand in the European region decreases, the operational costs of the Ro-Ro fleet exhibit a synchronous downward trend. When the demand reduction exceeds 40% (corresponding to the range of demand coefficients from 0.6 to 0.5), the number of Ro-Ro vessels in operation will be reduced from 6 to 5 due to a substantial contraction in transportation demand, leading to a further decline in operational costs. In this situation, for the manufacturer’s self-owned fleet, if it only undertakes transportation tasks for its own products, its operational status will be highly dependent on fluctuations in market orders: insufficient transportation demand will result in idle capacity of some vessels within the fleet. It is therefore proposed that transportation services be extended to manufacturers of other brands to achieve full utilization of the self-established fleet’s capacity.

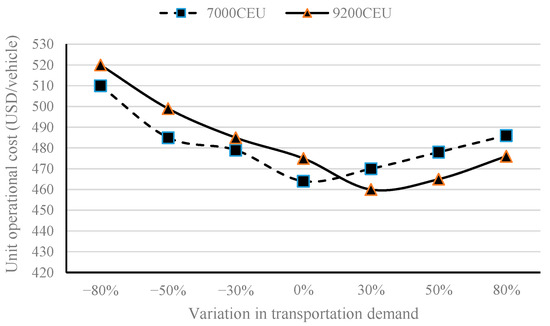

Considering that the vessel type exerts an impact on the operational scheduling and operational cost of the fleet, a sensitivity analysis on vessel type is conducted to assess the impact of different Ro-Ro vessel types on the fleet’s unit operational cost under varying demand levels. The analysis uses projected automotive demand during the planning period as the baseline market demand. Under various demand scenarios, it assumes that the loading capacity of Ro-Ro vessels consistently exceeds market demand. The results are shown in Figure 11, yielding two key insights.

Figure 11.

Impact of demand fluctuation on unit operational cost under different fleet structure.

First, the unit operational cost of both 7000 CEU and 9200 CEU vessels exhibits a “U-shaped” variation trend with the change in market demand. When demand decreases, unit costs rise gradually due to the decline in vessel load factors. This phenomenon arises because fixed costs are amortized across fewer transported vehicles when demand shrinks, leading to higher unit cost burdens. In contrast, when demand increases, unit costs also show a gradual upward trend. As demand continues to grow beyond the optimal load factor, both vessel types require additional voyages or supplementary vessel deployment, thereby pushing unit costs upward. Second, 9200-CEU vessels demonstrate a significant unit cost advantage over 7000-CEU vessels in demand growth scenarios, which aligns with the long-term trend of NEV export expansion. This advantage primarily stems from economies of scale. In contrast, 7000-CEU vessels only show marginal cost advantages in severe demand downturn scenarios.

Based on the above findings, targeted strategic recommendations can be proposed for automakers’ fleet configuration. For enterprises with substantial annual vehicle transport volumes, prioritizing the procurement of large-capacity Ro-Ro vessels is a more cost-effective choice. This approach can leverage economies of scale to reduce unit operational cost in most demand scenarios, especially in the growth scenarios that dominate the long-term NEV export market.

(3) Sensitivity testing of export strategy scenarios

The scheduling of dedicated Ro-Ro fleets owned by automakers is not an isolated operational activity but a core link closely aligned with enterprises’ export strategies. Previous calculation in Section 5.2 assumed equal priority for market demand across all regions; however, in practical operations, variations in export strategies, driven by some factors such as market positioning (e.g., long-term expansion in the European market, leveraging policy dividends in Southeast Asia) and production layout adjustments (e.g., the upgrading of domestic manufacturing bases), lead to divergent scheduling requirements, which in turn impact fleet operational costs and efficiency. Therefore, a sensitivity analysis is conducted to quantify the impact of different export strategy scenarios (Table 8) on the fleet’s total operational cost, providing support for automakers to dynamically adjust scheduling plans.

Table 8.

Export strategy scenarios and sensitivity analysis.

Scenario 1: Prioritizing delivery to the European market

Europe represents the global NEV market with the highest penetration rate and most explicit policy support. The European Union’s New Battery Regulation and 2035 Ban on Internal Combustion Engine Vehicles provide long-term growth momentum for NEVs, yet it remains a competitive battleground for incumbents such as Volkswagen, Stellantis, BMW, and Tesla. Although BYD has initiated construction of a local manufacturing facility in Hungary, the European market will remain dependent on Chinese exports before the local facility is put into operation. Timely or early delivery via optimized fleet scheduling is therefore critical to sustaining dealer network confidence and securing a market window for localized production, justifying “prioritizing European deliveries” as a core strategy.

To simulate this strategy, the delivery time window for European port (Zeebrugge in Belgium) was advanced by 20% relative to the benchmark scenario (i.e., “equal regional priority” scenario). As shown in Table 1, this strategy increased the fleet’s total operational cost by 11.6% compared to the benchmark scenario. Cost increments stemmed primarily from fuel consumption elevated by higher sailing speeds. Despite the 11.6% cost increase, the strategy delivers substantial implicit value. At the market level, early deliveries help BYD maintain a European market share and accumulates a user base for the upcoming Hungarian factory, and mitigates risks of brand trust erosion due to delivery delays.

Scenario 2: Prioritizing delivery to the Southeast Asian market

Southeast Asia is a “neighboring core market” for China’s NEV exports. Following the full entry into force of the Regional Comprehensive Economic Partnership (RCEP) in 2024, tariffs on Chinese NEV exports to Southeast Asia fell, significantly enhancing the price competitiveness of BYD models. Timely delivery remains critical to maximizing RCEP tariff dividends and capturing market share from traditional fuel vehicles. Delays leading to order cancelations would render tariff-driven price advantages obsolete.

To model this strategy, the delivery time window for Southeast Asian ports (Laem Chabang and Singapore) was advanced by 20% relative to the benchmark. As indicated in Table 1, this strategy increased total operational cost by 8.3%, a smaller increment than the Europe-prioritized scenario.

Scenario 3: Adjusting export share of domestic factories

Adjustments to domestic production layouts directly shape port export shares. As BYD’s core maritime gateway in South China, Shenzhen Port is supported by the Shenzhen-Shantou BYD Automotive Industrial Park, the only domestic production base with integrated “factory-port linkage.” This Park adopts a “factory-to-port” model: after rolling off the production line, vehicles are driven by operators into Ro-Ro vessel holds within five minutes. This streamlined, efficient loading process boosts the potential for future growth in Shenzhen Port’s automobile exports.

This strategy was simulated by adjusting export volumes across four major domestic ports: a 20% increase from Shenzhen Port, a 5% decrease from Shanghai Port, and a 7.5% decrease each from Yantai Port and Lianyungang Port. As shown in Table 1, this strategy reduced total operational cost by 5.5% relative to the benchmark.

5.4. Discussion

Before optimizing the operational scheduling of self-owned Ro-Ro fleets, automakers must first address a critical strategic choice: operating self-owned fleets or outsourcing to third-party carriers, as these two strategies differ fundamentally in cost structure, risk exposure, and operational flexibility.

Outsourcing offers distinct advantages, including reduced upfront investment and enhanced flexibility. By avoiding fixed asset risks associated with vessel procurement and maintenance, automakers can dynamically adjust capacity based on export demand fluctuations. For instance, scaling back outsourcing volumes during NEV export off-seasons to cut costs, whereas self-owned fleets would incur idle capacity expenses. Additionally, third-party carriers typically possess mature global port networks and risk management systems, lowering operational complexity for automakers entering unfamiliar markets. However, outsourcing also introduces non-negligible risks that underscore the value of self-owned fleets. First, outsourcing faces significant cost volatility. Ro-Ro shipping rates are highly sensitive to market supply-demand imbalances and geopolitical shocks, which makes outsourcing costs unpredictable, whereas self-owned fleets maintain stable and controllable cost structures. Second, outsourcing has capacity unreliability issues. During peak export seasons, third-party carriers may prioritize higher-paying clients, causing delays to automakers’ cargo; this risk is eliminated by self-owned fleets, as the proposed scheduling model ensures dedicated capacity for deterministic demand. Third, outsourcing leads to strategic dependence. Long-term outsourcing may leave automakers vulnerable to carriers’ service adjustments (e.g., route cancelations), while self-owned fleets support independent overseas market expansion.

Beyond the strategic trade-off between self-owned and outsourced fleets, the operational scheduling of self-owned Ro-Ro fleets also faces uncertainties from external environments, among which geopolitical risks are a major factor. These risks can be quantitatively integrated into the proposed model via dynamic parameter adjustments, enabling the model to generate risk-adapted optimized scheduling schemes. Practically, geopolitical risks primarily manifest in two forms, i.e., route accessibility disruptions and trade policy volatility.

For route accessibility risks (e.g., the Red Sea conflict, heightened tensions in the Strait of Hormuz), conflicts may disrupt specific shipping routes or increase detour costs. For example, closure of the Red Sea-Suez Canal route forces vessels to detour via the Cape of Good Hope, doubling sailing distance and fuel consumption. To address this, risk integration is achieved by adjusting the “voyage leg distance matrix” in the model. If a voyage leg becomes completely impassable due to geopolitical conflicts, the navigation distance of that leg can be set to an extremely large value, enabling the model to automatically avoid the leg when optimizing port call sequences; if a voyage leg only faces the risk of navigation delays, the navigation distance of the leg can be increased in proportion to the expected delay. In the case study’s China-Europe route, incorporating Red Sea conflict risks led the model to prioritize the “China-Indian Ocean-Cape of Good Hope-Europe” route (Figure 8), aligning with real-world operational adjustments and verifying the parameter adjustment method’s effectiveness. For trade policy volatility risks (e.g., tariff barriers, export quotas), policy changes directly alter regional export demand scale and structure. For instance, additional EU tariffs on NEVs reduced European market orders, while Southeast Asian demand grew due to free trade agreement preferences. The model addresses this by dynamically adjusting “regional demand parameters,” as validated by the demand sensitivity analysis in Section 5.3.

A key limitation of the proposed scheduling optimization model is its incomplete cost estimation framework, which focuses solely on direct operational costs (e.g., fuel consumption, port loading/unloading fees) and excludes indirect costs. Indirect costs such as warehousing and insurance are closely tied to scheduling decisions but currently unaccounted for. Warehousing costs are linked to port call sequences and loading/unloading quantities. Prioritizing low-cost but warehouse-constrained hub ports may lead to vehicle detention, incurring temporary storage fees and inventory depreciation risks. Insurance costs, meanwhile, depend on scheduling-related factors including route risk and voyage duration. Geopolitically sensitive routes (e.g., the Red Sea) or storm-prone waters (e.g., the North Atlantic in winter) increase hull and cargo insurance premiums, while longer sailing times raise liability insurance costs. In some cases, additional insurance premiums may offset fuel cost savings, rendering the “cost-minimization” objective inaccurate. Future model iterations should focus on integrating indirect costs into the optimization framework.

To further clarify the uniqueness and applicability of our proposed model, a systematic comparison is conducted with two representative categories of similar studies: carrier-focused Ro-Ro scheduling models, and cargo owner-focused bulk fleet scheduling models. The comparison is based on core design logic, key features, and scenario adaptability, as summarized in Table 9.

Table 9.

Comparison with similar studies.

The comparative analysis reveals two fundamental differences between the proposed model and existing works. First, objective function design aligns with automaker needs. Unlike carrier-centric models that prioritize profit maximization, the model places export demand fulfillment as the primary constraint, with operational cost minimization as a secondary objective. This design directly responds to automakers’ pain points (e.g., avoiding delivery delays in competitive markets), whereas carrier models may sacrifice small-batch demand to prioritize high-freight routes. Second, decision variables and constraints match Ro-Ro vehicle transport characteristics. Compared to bulk cargo owner models, which primarily only optimize fleet size and speed for fixed-port bulk shipments, the model integrates three-dimensional dynamic decisions: port call sequence/selection, loading/unloading quantities, and voyage speed. This addresses the “small-batch, multi-destination” trait of vehicle exports—something bulk models (designed for fixed port pairs) cannot achieve. Additionally, Ro-Ro-specific constraints (e.g., CEU capacity, single-port non-revisiting) that bulk models lack are embedded, ensuring scheduling feasibility for vehicle transport.

This comparison reinforces the practical value of the model for automakers. Carrier-focused models, though mature for third-party logistics, fail to guarantee capacity autonomy which is a critical shortcoming amid Ro-Ro market supply shortages. Bulk cargo models, while cargo-owner-centric, are incompatible with vehicle transport’s dynamic port needs. The model, by contrast, balances “demand security” and “cost control” for automaker-owned fleets, as evidenced by the case study’s optimized schedules that reduce costs while fulfilling all regional demand. For logistics practitioners, the comparison highlights the need for scenario-specific scheduling tools. Automakers transitioning from outsourcing to self-owned fleets can directly adopt the model to avoid “one-size-fits-all” solutions from carrier-focused tools.

However, due to the unavailability of detailed parameter settings from existing studies, direct numerical comparisons using identical input data cannot be conducted. Additionally, BYD’s Ro-Ro fleet is not fully operational, so real-world operational data from similar self-owned fleets for benchmarking are lacking. Future research will supplement these comparisons once fleet operation data and peer model parameters are accessible.

6. Conclusions

With the rapid growth in export demand for NEVs, shipping capacity has become increasingly important for automakers. As the primary means of maritime transport for automobile exports, Ro-Ro vessels have attracted significant attention from automakers. Possessing stable and sufficient maritime transport capacity ensures that NEVS can be safely and efficiently delivered to global destinations, thereby meeting international market demand. From a cost control perspective, automakers owning their own fleets can significantly reduce long-term transportation costs.

This study focuses on the operational scheduling of self-owned Ro-Ro fleet established by automakers, aiming to optimize maritime logistics strategies for such fleets. Under the premise of deterministic export transport demand for NEVs, a mixed-integer programming model is constructed with the objective of minimizing fleet operational costs. The decision variables include the selection and sequence of port calls for each vessel in the fleet, the loading/unloading quantities at each port, and the sailing speed for each voyage leg. A genetic algorithm is designed to solve the model. A real-world case study is then conducted using the announced fleet size and export demand of a Chinese large NEV manufacturer. The effectiveness of the proposed methodology is verified by the case study results, which can be summarized as follows. First, the proposed GA-based scheduling optimization model effectively optimizes the operational scheme of BYD’s six-vessel Ro-Ro fleet within a 90-day planning period, generating clear port call sequences, voyage speeds, and loading/unloading quantities for each vessel to balance transportation efficiency and cost control. Second, market demand fluctuations significantly impact fleet operations. Specifically, an over 40% demand reduction cuts activated vessels from six to five, and insufficient overall demand causes fleet idle capacity, indicating that extending transportation services to other brands can improve capacity utilization. Third, vessel type and demand levels jointly affect unit operational cost. Larger vessels leverage economies of scale to outperform smaller vessels in most scenarios (especially long-term NEV export growth scenarios), while smaller vessels only have marginal advantages in severe demand downturns. Lastly, the export strategy adjustments have a direct influence on the fleet operational costs.

This study holds both theoretical and practical implications for Ro-Ro shipping scheduling and related fields. Theoretically, it enriches the theoretical system of Ro-Ro shipping scheduling by constructing a targeted optimization model for automaker’s self-owned fleets, effectively filling the research gap in scheduling optimization for non-third-party Ro-Ro fleets and providing a new theoretical framework for subsequent studies on self-owned maritime logistics assets; meanwhile, the integration of multi-dimensional decision variables (port sequence, load, speed) into the mixed-integer programming model expands the application scope of such models in maritime logistics, offering a valuable reference for optimizing complex scheduling problems with multiple constraints. Practically, for NEV manufacturers, particularly Chinese manufacturers engaged in overseas expansion, the proposed scheduling optimization method can directly support the reduction in operational cost for self-owned Ro-Ro fleets. Specifically, by optimizing port call routes and sailing speeds, enterprises can enhance fleet utilization and alleviate cost pressures arising from high shipping rates of third-party Ro-Ro services; for logistics practitioners in the Ro-Ro shipping industry, the methodology proposed in this study serves as a practical tool for solving complex fleet scheduling problems, which can be adjusted and applied to diverse export demand scenarios to improve the efficiency of real-world fleet operation management.

Beyond operational cost minimization, the proposed Ro-Ro fleet scheduling optimization model also embodies notable contributions to sustainability and social development, aligning with global low-carbon goals and the strategic needs of the NEV industry. From an environmental sustainability perspective, the model’s core optimization mechanisms directly reduce carbon footprints in maritime transportation. Specifically, by optimizing voyage speeds for each leg and rationalizing port call sequences, the model effectively cuts fuel consumption of self-owned Ro-Ro fleets. Additionally, the model’s allocation of loading/unloading quantities based on deterministic demand helps avoid overcapacity or underloading, which reduces idle energy consumption of vessels and port equipment. From a social perspective, the model supports the stable overseas expansion of the NEV industry which promotes low-carbon transportation globally. By ensuring efficient and cost-effective maritime logistics for NEVs, the model indirectly accelerates the replacement of traditional fuel vehicles, contributing to reduced urban air pollution and public health improvements.

While this study provides a valid optimization framework for self-owned Ro-Ro fleet scheduling, several avenues for improvement remain to enhance its practicality and extensibility. First, the current deterministic demand assumption can be extended to incorporate uncertainty (e.g., temporary order fluctuations, port handling delays) using stochastic or robust optimization methods, aligning the model with real-world demand volatility in Ro-Ro shipping. Second, the single objective of minimizing operational costs could be expanded to multi-objective optimization—integrating carbon emission reduction, transportation cycle shortening, and ship load factor maximization—with multi-objective evolutionary algorithms (e.g., NSGA-II) employed to balance automaker’s needs for cost, environmental performance, and efficiency. Third, future work may focus on collaborative scheduling of multi-type Ro-Ro vessels across multi-regional export routes, incorporating constraints such as port resource availability and ship navigability to address capacity allocation in global expansion. Fourth, indirect costs (e.g., warehousing detention fees, route-specific insurance premiums) and outsourcing-related parameters (e.g., market spot rates, carrier reliability) could be embedded into the total cost function, supplemented by a risk–benefit matrix, to support automaker’s decisions between self-owned fleets and outsourcing. Finally, geopolitical risk factors could be integrated in the modeling by linking risk probabilities (e.g., Red Sea conflict persistence) to parameter adjustments.

Author Contributions

Conceptualization, S.W. and F.D.; methodology, F.D., Y.R. and S.W.; writing—original draft preparation, F.D. and Y.R.; writing—review and editing, S.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China (grant number 72574111, 71704089), Ningbo Natural Science Foundation (grant number 2023J124).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Acknowledgments

We would like to express our sincere gratitude to the reviewers for their constructive comments and valuable suggestions.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Global EV Outlook 2025. Available online: https://www.iea.org/reports/global-ev-outlook-2025 (accessed on 25 August 2025).

- Electric Motor Vehicles in United States. Available online: https://oec.world/en/profile/bilateral-product/electric-motor-vehicles/reporter/usa (accessed on 25 August 2025).

- 3600 Tesla Model 3 Cars Bound for Zeebrugge with Wallenius Wilhelmsen. Available online: https://www.heavyliftnews.com/3600-tesla-model-3-cars-bound-for-zeebrugge-with-wallenius-wilhelmsen/ (accessed on 25 August 2025).

- Christiansen, M.; Fagerholt, K.; Pisinger, D. Fifty years on maritime transportation. EURO J. Transp. Logist. 2025, 14, 100148. [Google Scholar] [CrossRef]

- Jin, Z.H.; Wang, X.H.; Sun, J.Q.; Xu, Q. Optimization of fleet structure and investment evaluation—The cargo owner’s fleet perspective. Marit. Bus. Rev. 2022, 7, 239–254. [Google Scholar] [CrossRef]

- Song, Z.; Jin, J.G. Bulk ship fleet scheduling in industrial shipping for multiple destinations with time-variant loading constraints. Transp. Res. Part E Logist. Transp. Rev. 2025, 197, 104049. [Google Scholar] [CrossRef]

- Sheng, D.; Meng, Q.; Li, Z.C. Optimal vessel speed and fleet size for industrial shipping services under the emission control area regulation. Transp. Res. Part C 2019, 105, 37–53. [Google Scholar] [CrossRef]

- Arslan, N.A.; Papageorgiou, J.D. Bulk ship fleet renewal and deployment under uncertainty: A multi-stage stochastic programming approach. Transp. Res. Part E 2017, 97, 69–96. [Google Scholar] [CrossRef]

- Zhao, K.; Zhang, D.; Jin, J.G.; Dong, G.; Lee, D.-H. Vessel voyage schedule planning for maritime ore transportation. Ocean Eng. 2024, 291, 116503. [Google Scholar] [CrossRef]

- Wu, L.X.; Pan, K.; Wang, S.A.; Yang, D. Bulk ship scheduling in industrial shipping with stochastic backhaul canvassing demand. Transp. Res. Part B Methodol. 2018, 117, 117–136. [Google Scholar] [CrossRef]

- Dulebenets, M.A.; Pasha, J.; Abioye, O.F.; Kavoosi, M. Vessel scheduling in liner shipping: A critical literature review and future research needs. Flex. Serv. Manuf. J. 2021, 33, 43–106. [Google Scholar] [CrossRef]

- Zhao, S.Q.; Duan, J.R.; Li, D.C.; Yang, H.L. Vessel scheduling and bunker management with speed deviations for liner shipping in the presence of collaborative agreements. IEEE Access 2022, 10, 107669–107684. [Google Scholar] [CrossRef]

- Zhou, J.M.; Zhao, Y.Z.; Yan, X.R.; Wang, M.C. Strategy and impact of liner shipping schedule recovery under eca regulation and disruptive events. J. Mar. Sci. Eng. 2024, 12, 1405. [Google Scholar] [CrossRef]

- Fan, H.M.; Yu, J.Q.; Liu, X.Z. Tramp Ship Routing and Scheduling with Speed Optimization Considering Carbon Emissions. Sustainability 2019, 11, 6367. [Google Scholar] [CrossRef]

- Liu, C.C.; Zhou, Y.J.; Yang, Z.Z.; Li, Y.M.; Li, T. Optimizing the scheduling scheme for NSR/SCR tramp vessel shipping between Asia and Europe. Ocean Eng. 2024, 304, 117747. [Google Scholar] [CrossRef]

- Gao, J.; Wang, J.; Liang, J.P. A unified operation decision model for dry bulk shipping fleet: Ship scheduling, routing, and sailing speed optimization. Optim. Eng. 2024, 25, 301–324. [Google Scholar] [CrossRef]

- Qiao, J.; Wang, Y.F.; Wang, H.Q.; Li, X.; Wang, Y.X.; Wang, Y.R.; Zhang, H.R. Impact of ventilation strategies on the evolution of electric vehicle fire characteristics in ships. Ocean Eng. 2025, 317, 120080. [Google Scholar] [CrossRef]

- Andersson, H.; Fagerholt, K.; Hobbesland, K. Integrated maritime fleet deployment and speed optimization: Case study from Ro-Ro shipping. Comput. Oper. Res. 2015, 55, 233–240. [Google Scholar] [CrossRef]

- Chandra, S.; Christiansen, M.; Fagerholt, K. Combined fleet deployment and inventory management in roll-on/roll-off shipping. Transp. Res. Part E Logist. Transp. Rev. 2016, 92, 43–55. [Google Scholar] [CrossRef]

- Dong, B.; Christiansen, M.; Fagerholt, K.; Bektaş, T. Combined maritime fleet deployment and inventory management with port visit flexibility in roll-on roll-off shipping. Transp. Res. Part E Logist. Transp. Rev. 2020, 140, 101988. [Google Scholar] [CrossRef]

- Zhen, L.; Wu, J.W.; Wang, S.A.; Li, S.Y.; Wang, M.M. Optimizing automotive maritime transportation in Ro-Ro and container shipping. Transp. Res. Part B 2025, 194, 103175. [Google Scholar] [CrossRef]

- Das, M.; Roy, A.; Maity, S.; Kar, S.; Sengupta, S. Solving fuzzy dynamic ship routing and scheduling problem through new genetic algorithm. Decis. Mak. Appl. Manag. Eng. 2022, 5, 329–361. [Google Scholar] [CrossRef]

- Han, Y.Y.; Ma, W.H.; Ma, D.F. Green maritime: An improved quantum genetic algorithm-based ship speed optimization method considering various emission reduction regulations and strategies. J. Clean. Prod. 2023, 385, 135814. [Google Scholar] [CrossRef]

- Ma, D.F.; Zhou, S.Y.; Han, Y.Y.; Ma, W.H.; Huang, H.X. Multi-objective ship weather routing method based on the improved NSGA-III algorithm. J. Ind. Inf. Integr. 2024, 38, 100570. [Google Scholar] [CrossRef]

- Zhan, D.; Tian, A.Q.; Ni, S.Q. Optimizing PID control for multi-model adaptive high-speed rail platform door systems with an improved metaheuristic approach. Int. J. Electr. Power Energy Syst. 2025, 169, 110738. [Google Scholar] [CrossRef]

- Tian, A.Q.; Lv, H.X.; Wang, X.Y.; Pan, J.S.; Snášel, V. Bioinspired Discrete Two-Stage Surrogate-Assisted Algorithm for Large-Scale Traveling Salesman Problem. J. Bionic Eng. 2025, 22, 1926–1939. [Google Scholar] [CrossRef]

- Tian, A.Q.; Liu, F.F.; Lv, H.X. Snow Geese Algorithm: A novel migration-inspired meta-heuristic algorithm for constrained engineering optimization problems. Appl. Math. Model. 2024, 347, 126327. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).