1. Introduction

Climate change represents one of the most pressing challenges of our time, with far-reaching consequences that extend across environmental, economic, and social dimensions. The impacts of climate change manifest through rising sea levels, increased frequency and intensity of extreme weather events, shifts in precipitation patterns, ecosystem disruptions, agricultural productivity changes, and threats to human health and food security. Among these diverse consequences, temperature anomalies—deviations from long-term average temperatures—may serve as one of the most broadly perceived and readily accessible indicators of climate change. With approximately 97% of the global population aware of climate change, temperature extremes serve as tangible, immediate signals that tap into public concerns about environmental degradation [

1]. Indeed, empirical literature suggests that public perception of climate risks intensifies significantly during periods of temperature extremes or anomalies, making these events particularly salient in shaping environmental awareness and behavioral responses [

2,

3,

4].

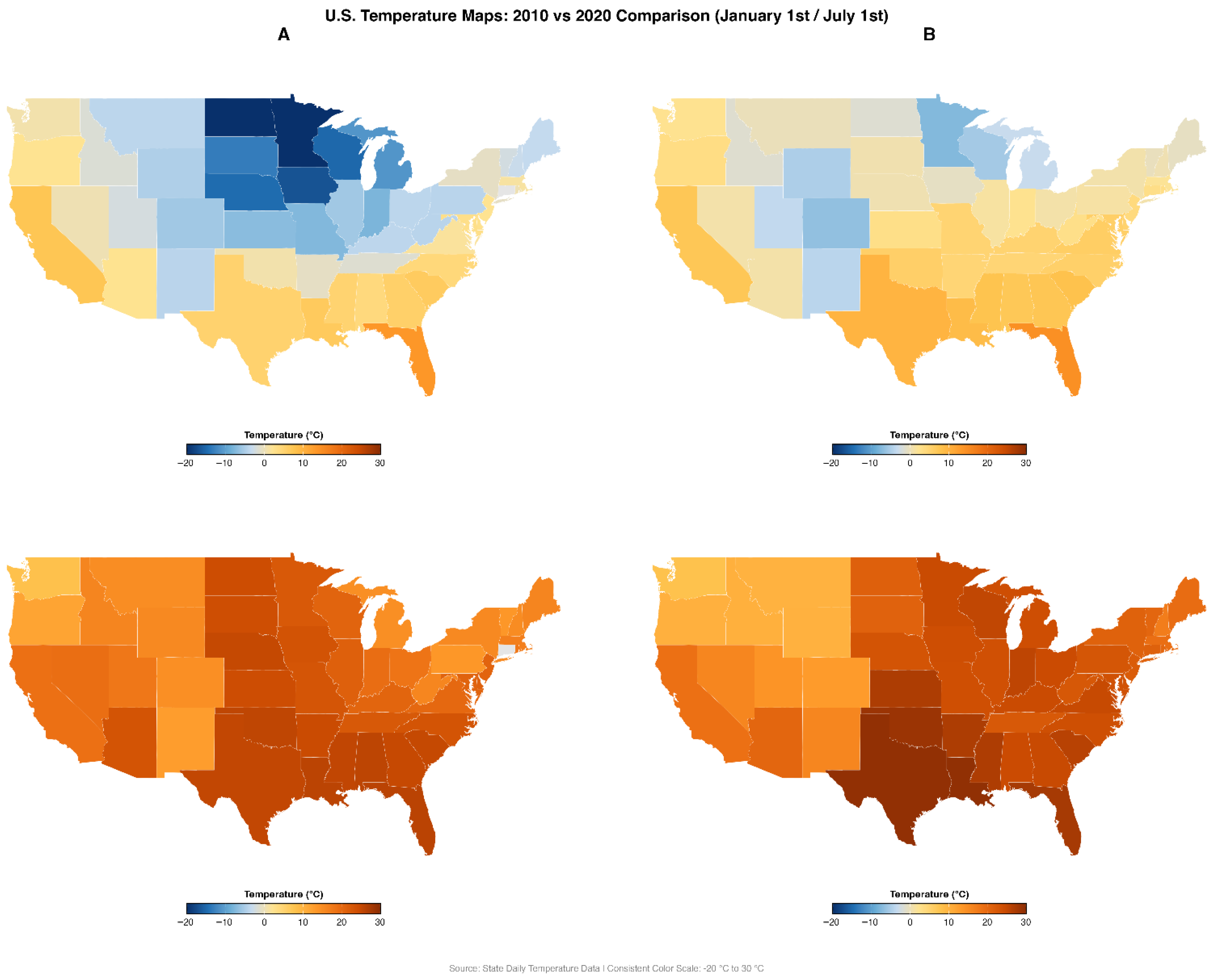

Figure 1 displays the average temperatures across U.S. states on January 1st and July 1st in the years 2010 and 2020. Panel A shows the temperature distributions for January 1st (top) and July 1st (bottom) in 2010, while Panel B presents the corresponding maps for 2020. Between 2010 and 2020, noticeable changes occurred in state-level temperatures. On January 1st, temperatures appear to have warmed in parts of the Midwest and Northeast, where deep blue shading in 2010 shifts toward lighter tones in 2020, indicating milder winter temperatures. On July 1st, nearly all states show increased average temperatures, with warmer colors becoming more dominant in the 2020 map compared to 2010. Although this visual comparison primarily illustrates warming trends—particularly during summer—it is important to note that climate change is not limited to rising temperatures alone. Rather, it encompasses greater variability, including both unusually high and low temperature extremes. Thus, while

Figure 1 emphasizes temperature increases, the broader phenomenon involves a range of anomalous weather patterns, not all of which are captured in this snapshot.

A growing body of research explores the relationship between temperature shocks and the market, though the evidence remains limited and mixed. Studies investigating the effects of extreme temperatures—both hot and cold—or temperature anomalies on stock performance report varied results. For example, unusually high temperatures have been associated with declines in trading volume and market returns—such as in the French stock market when daily highs exceed 30 °C—and broader evidence suggests that extreme temperatures can depress conventional stock performance [

6,

7,

8,

9,

10,

11,

12]. Some, find no effect [

13,

14,

15]. These effects are often interpreted through psychological and behavioral mechanisms, where discomfort from extreme weather alters mood, increases aggression, or shifts risk preferences, ultimately influencing investor sentiment and decision-making.

In addition to psychological mechanisms such as mood, aggression, and risk-taking, two complementary theoretical frameworks offer insight into why temperature shocks may generate differential responses across asset types. First, the local warming effect reflects heuristic processing, wherein individuals interpret salient deviations from historical temperature norms—particularly unusually warm or cold local conditions—as signals of broader climate change. This belief updating process can heighten climate risk awareness and strengthen concerns about global warming, thereby increasing investor interest in climate-resilient or environmentally responsible assets [

16,

17,

18,

19,

20,

21,

22].

Second, a valuation-based framework suggests that climate-related risks influence investor expectations. In this view, temperature anomalies may lead investors to revise forecasts of firms’ future cash flows or adjust discount rates, particularly for companies exposed to physical, regulatory, or reputational climate risks [

23]. Together, these frameworks suggest that green and brown assets may respond differently to extreme temperature events, owing to their divergent climate risk profiles and how they are perceived by investors.

Building on these perspectives, recent empirical work has turned to the differential market response of green versus brown (carbon-intensive) assets. Some studies find that temperature anomalies increase investor demand for green investments. For example, heightened climate salience during abnormal warmth can lead socially responsible investors to divest from brown firms [

17] or prompt retail investors to reallocate away from carbon-intensive stocks following extreme heat [

1,

18]. While these studies document the effects of absolute temperature extremes, they leave open key questions about whether temperature anomalies—deviations from expected norms—also drive investor behavior. In particular, anomalies that push already hot or cold conditions into truly extreme territory may be especially salient to investors and could play an important role in shaping market responses. These open questions motivate our analysis of how temperature anomalies, and the extreme conditions they sometimes create, influence the market valuation of climate-aligned firms.

In this paper, we investigate how temperature anomalies—defined as deviations from historical average temperatures—affect investment behavior, focusing on the market valuation of climate-aligned firms. We combine daily temperature data from the Global Historical Climatology Network (GHCN) with financial data for 33 publicly traded U.S. companies engaged in renewable energy, electric vehicles, and related clean technologies (from Yahoo Finance). Our analysis covers the period 2010–2024, a time marked by rising climate awareness and rapid development in sustainability-linked sectors. Using fixed-effects panel regression models and controlling for key macroeconomic variables such as Treasury yield spreads and oil prices (from FRED), we assess both immediate and lagged market responses to anomalous temperature events. To examine heterogeneity in investor reactions, we distinguish between non-extreme and extreme anomaly days—specifically, those in which anomalies push temperatures beyond common comfort thresholds. This design allows us to test whether and how salient climate signals, such as unusually intense heat or cold, systematically influence trading behavior in the green equity market.

This paper contributes to the literature in several important ways. First, it extends existing work on the effects of weather on financial markets by shifting the focus from temperature levels to temperature anomalies or deviations. While previous studies have examined how extreme temperatures affect overall market returns, they have largely concentrated on absolute temperature levels and broad market indices rather than on anomalies and their impact on the valuation of climate-aligned firms [

24,

25]. Second, we focus specifically on the U.S. market for climate-aligned firms, where more than 80 percent of shares are held by domestic investors, providing a setting that enables cleaner identification of how localized temperature anomalies shape investor behavior. Third, we move beyond average effects by exploring the heterogeneity of temperature-anomaly impacts—specifically distinguishing between ordinary deviations and those that push temperatures into salient discomfort zones, whether extremely hot or cold—thus capturing how salience conditions amplify market responses. Fourth, we provide high-frequency evidence using daily firm-level panel data from 2010 to 2024 and link it with real-time macroeconomic controls and meteorological indicators, offering one of the most granular empirical examinations of how climate volatility influences the market valuation of climate-aligned firms over time.

This paper is organized as follows. In

Section 2, we introduce our data sources and empirical methods.

Section 3 presents our main results examining the relationship between temperature anomalies and green stock performance.

Section 4 discusses the implications of our findings and their robustness.

Section 5 concludes.

2. Data and Methods

2.1. Data

We obtain data from multiple sources to construct our comprehensive dataset. Temperature data are sourced from the Global Historical Climatology Network (GHCN), and state-level population, real GSP, and GDP are retrieved from the Federal Reserve Economic Data (FRED) database [

26]. From Yahoo Finance, we collect daily market valuation data for climate-aligned firms as well as index data for the S&P 500, VIX, and Nasdaq Composite [

27]. Macroeconomic control variables—including 10-year Treasury yields, federal funds rates, 3-month Treasury bills, and oil prices—are also sourced from FRED.

Our primary independent variable is temperature anomaly, constructed from raw daily temperature data available at the weather station level. We aggregate station-level observations to create daily state-level temperature measures, then calculate temperature anomalies by subtracting each state’s 10-year rolling average temperature from the current daily temperature. Then, to construct a national daily temperature anomaly measure, we weight each state’s anomaly by population, real GSP and GDP. The weighting scheme allows us to identify temperature effects that are proportional to economic significance rather than treating all geographic areas equally, thereby capturing the heterogeneous impact of regional temperature variations on aggregate investment behavior.

Daily data on the market valuation of climate-aligned firms are obtained from Yahoo Finance. While the literature often identifies green investments through environmental ratings or broad sector classifications based on renewable energy activities, we instead select companies whose primary business activities are directly tied to the clean energy transition—such as renewable energy generation, electric vehicles, hydrogen and fuel cells, energy storage, or utilities with significant renewable portfolios. Our final sample consists of 33 U.S. publicly traded firms spanning a wide range of clean energy segments: solar energy companies (FSLR, SPWR, ENPH, SEDG, RUN, NOVAQ, ARRY); electric vehicle and related technology producers (TSLA, LCID, RIVN, NKLA, HYLN, WKHS); hydrogen and fuel cell firms (PLUG, FCEL, BE); biofuels and renewable fuels companies (GPRE, GEVO, CLNE, AMTX); energy storage and battery providers (SLDP, FLNC, STEM); and electric utilities with large renewable portfolios or low-carbon generation (NEE, XEL, AEP, DUK, SO, EXC, AEE, D, EIX, PCG). We also include clean-energy infrastructure and finance companies such as HASI and CWEN. This selection captures the breadth of publicly traded firms positioned to benefit from the transition to sustainable energy systems.

Table 1 presents the list of firms included in the sample.

We include market-level controls such as the daily indices for the S&P 500, the CBOE Volatility Index (VIX), and the Nasdaq Composite, along with macroeconomic variables including the spread between 10-year Treasury yields and the federal funds rate (FFR), the spread between 3-month Treasury bills and the FFR, and daily crude oil prices. These controls allow us to isolate the effect of temperature anomalies from broader market trends and macroeconomic fluctuations.

While regressing the valuation of individual climate-aligned firms on broader indices such as the S&P 500 or Nasdaq Composite could raise concerns of simultaneity or reverse causality, such concerns are mitigated by the fact that these indices comprise hundreds (S&P 500) to thousands (Nasdaq Composite) of firms. Given the small weight of any one firm in these indices—particularly those outside the S&P 500 or modestly represented in the Nasdaq Composite—the possibility that a single climate-aligned firm meaningfully influences index movements is minimal. Therefore, it is reasonable to treat these indices as exogenous market controls, capturing general trends rather than feedback from the sample firms.

The merged dataset forms an unbalanced daily panel of 33 climate-aligned companies from 2010 to 2024, totaling 72,917 firm-day observations. We begin by estimating our models using a more conservative sample of 33 green firms with continuous data coverage over the entire period (a balanced panel). We then verify that the results are consistent when using the full, unbalanced panel that includes firms entering or exiting the market during the sample window. Given the similarity of the findings and to maximize sample size and statistical efficiency, we proceed with the unbalanced panel in the main analysis.

2.2. Statistical Analysis

Prior to estimation, we verify the stationarity properties of our variables to ensure valid statistical inference. We conduct Fisher-type panel unit root tests on the stock returns series, which accommodate the unbalanced nature of our panel data. The test results overwhelmingly reject the null hypothesis of unit roots across all panels (P-statistic = 4494.81, Z-statistic = −64.04, both p < 0.001), confirming that daily log returns are stationary as predicted by standard asset pricing theory. For the temperature anomaly variables, we perform standard augmented Dickey–Fuller tests on the aggregate time series, which confirm stationarity. All three temperature variables—population-weighted anomaly (Z(t) = −14.379), RGSP-weighted anomaly (Z(t) = −14.352), and GDP-weighted anomaly (Z(t) = −14.283)—strongly reject the null hypothesis of a unit root at the 1% significance level (all p-values < 0.001), confirming that these temperature anomaly measures are stationary as expected from their construction as deviations from long-run averages.

Given the time series nature of our data, we test for optimal lag structures to address potential autocorrelation in both dependent and independent variables. We employ information criteria (Akaike and Bayesian) to determine the appropriate lag structure by evaluating multiple combinations of lags for both green stock returns and temperature anomalies [

28,

29]. Akaike Information Criterion (AIC) and Bayesian Information Criterion (BIC) scores used for model selection are reported in

Table 2.

We estimate a fixed effects panel regression model to examine the relationship between temperature anomalies and the market valuation of climate-aligned firms. The empirical model takes the following form:

where

represents the log return of firm

i at time

t, calculated as

,

captures time-invariant firm-specific characteristics, and the control variables include market indices and volatility measures.

corresponds to population, RGSP, and GDP-weighted temperature anomalies.

corresponds to market-level controls, the S&P 500, the VIX, and the NASDAQ Composite Index. Finally,

captures macroeconomic variables including the spread between 10-year Treasury yields and the FFR, the spread between 3-month Treasury bills and the FFR, and daily crude oil prices.

Our primary coefficients of interest are , and , which capture the contemporaneous and lagged effects of temperature anomalies on the financial performance of environmentally oriented firms. The contemporaneous coefficient () identifies the immediate market response to temperature deviations, potentially reflecting investors’ real-time reactions to salient climate signals. The first lag coefficient () captures delayed responses that may occur as information processing and portfolio rebalancing take place over subsequent trading days.

To account for both cross-sectional and time-series dependence in the residuals, we estimate the fixed-effects panel model using Driscoll–Kraay standard errors. This estimator produces a variance–covariance matrix that is robust to heteroskedasticity, serial correlation, and cross-sectional correlation, thereby providing reliable inference in the presence of spatial and temporal dependence.

While the baseline model estimates the average effect of temperature anomalies on the valuation of climate-aligned firms, the aggregate relationship may obscure important heterogeneity depending on the direction and intensity of the anomaly. Investors may react differently when temperature anomalies exacerbate already uncomfortable conditions—such as making hot days hotter or cold days colder—compared to anomalies that occur under milder baseline temperatures.

To capture this variation, we extend our model to examine heterogeneous effects using two complementary definitions of extreme temperature events. First, we classify a day as extreme when temperature anomalies of more than ±3 °C push mean temperatures beyond commonly perceived comfort thresholds—specifically, positive anomalies greater than 3 °C that raise daily mean temperatures above 22 °C (making already warm days hotter) or negative anomalies less than −3 °C that lower daily mean temperatures below 18 °C (making already cold days colder). Second, we identify extremes when anomalies of more than ±3 °C are large enough to move daily mean temperatures across the 18 °C benchmark used to define positive cooling degree days (CDD) or heating degree days (HDD): positive anomalies exceeding 3 °C that lift mean temperatures above 18 °C generate CDD, while negative anomalies exceeding −3 °C that push mean temperatures below 18 °C generate HDD. For example, a day with a mean temperature of 26 °C—3.5 °C warmer than its historical average of 22.5 °C—meets both criteria for an extreme positive anomaly, while a day at 2 °C that is 3.2 °C colder than its historical norm of 5.2 °C qualifies as an extreme negative anomaly. These thresholds are guided by evidence that temperatures around 18–22 °C represent widely recognized comfort levels, so anomalies that cross these levels by more than 3 °C are likely to be especially salient for investors.

To estimate these heterogeneous effects, we modify the baseline model by interacting the temperature anomaly variables with indicator variables capturing these extreme conditions, allowing us to separately identify the effects of non-extreme versus extreme anomalies on the market valuation of green firms.

where

is a dummy variable equal to 1 if condition (1) (or (2)) from above is met.

3. Results

3.1. Descriptive Statistics

We first present descriptive statistics in

Table 3. In Panel A, the 10-year average temperature rose from 9.48 °C (SD = 9.94) in 2010 to 11.47 °C (SD = 8.03) in 2024. The actual temperature also increased slightly, from 11.21 °C (SD = 8.11) in 2010 to 11.61 °C (SD = 8.08) in 2024. However, the temperature anomaly declined from 0.17 °C (SD = 1.95) in 2010 to −0.872 °C (SD = 2.16) in 2024. Similarly, the population-weighted anomaly decreased from 0.207 °C (SD = 2.15) to −0.909 °C (SD = 2.18), real GSP-weighted anomaly from 0.15 °C (SD = 2.10) to −0.891 °C (SD = 2.12), and the GDP-weighted anomaly from 0.16 °C (SD = 2.14) to −0.892 °C (SD = 2.13).

In Panel B, the market valuation of climate-aligned firms declined markedly from 296.31 (SD = 1614.05) in 2010 to 51.04 (SD = 47.89) in 2024. For broader market measures, the S&P 500 increased from 1139.97 (SD = 56.09) to 5426.43 (SD = 366.98), and the Nasdaq Composite rose from 2349.89 (SD = 147.58) to 17,239.25 (SD = 1362.64). The VIX fell from 22.55 (SD = 5.26) to 15.60 (SD = 3.36).

For macroeconomic indicators, shown in Panel C, the 10-year Treasury–FFR spread decreased from 3.035 (SD = 0.48) to −0.94 (SD = 0.42), while the 3-month Treasury–FFR spread rose from −0.039 (SD = 0.024) to 0.034 (SD = 0.13). The crude oil price declined slightly from 79.48 (SD = 5.24) to 76.65 (SD = 5.42).

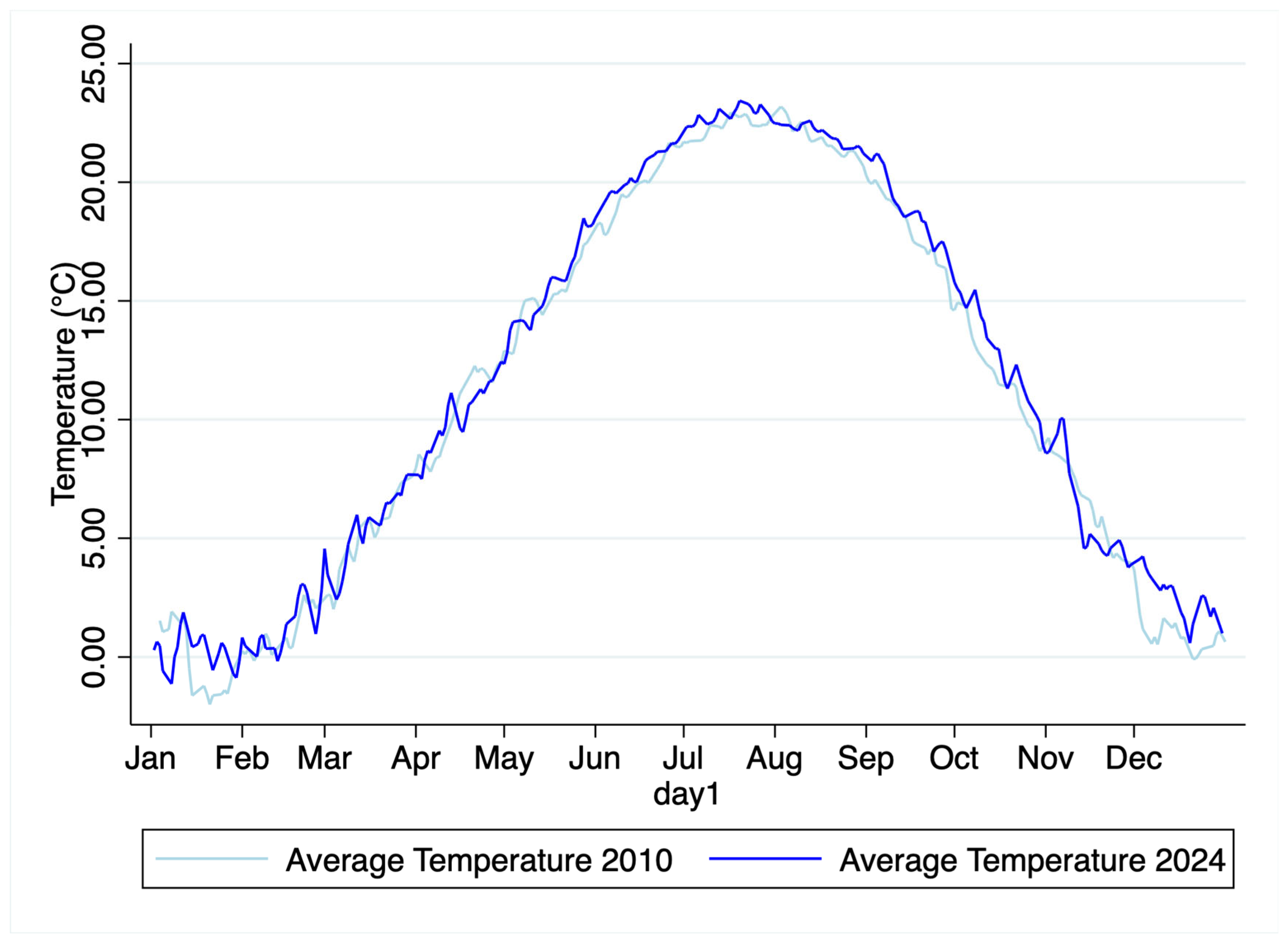

We present daily average temperatures across U.S. states for the years 2010 (light blue line) and 2024 (dark blue line) in

Figure 2. Both lines follow a clear seasonal pattern, with temperatures rising steadily from January through July and peaking during the summer months, before declining toward December. Notably, the 2024 temperatures closely track those of 2010 but remain slightly elevated for much of the year, particularly from late spring through early autumn. This subtle yet consistent upward shift suggests a modest warming trend over the 14 year span, potentially reflecting broader climatic changes.

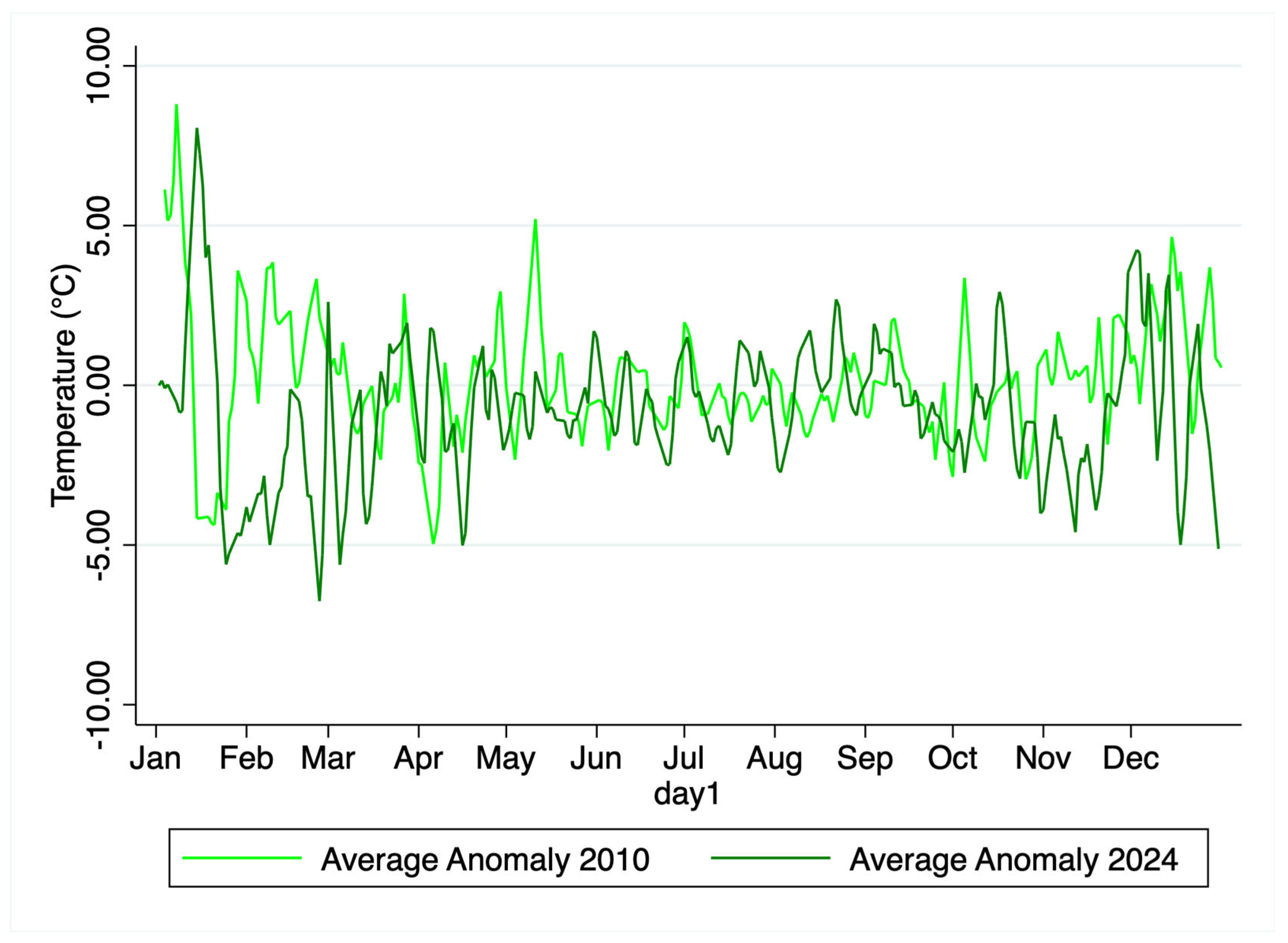

Figure 3 displays daily average temperature anomalies across U.S. states for 2010 (lime green line) and 2024 (dark green line). Anomalies are calculated by subtracting the 10-year historical average temperature for each calendar day from the observed temperature in each state, then computing the daily weighted average across all states. Both years exhibit similar seasonal fluctuation patterns, with anomalies generally centered around zero—indicating typical deviations from long-term norms. However, 2024 exhibits noticeably greater variability, particularly in the early months and late fall. This increased dispersion points to more frequent and intense deviations from historical temperature patterns, consistent with rising climatic volatility. While the overall structure remains comparable, the elevated variance in 2024 may reflect an evolving climate system marked by more pronounced short-term extremes.

3.2. Baseline Results

We present the regression results examining the relationship between weighted average temperature anomalies and the logarithm of daily market valuation of climate-aligned firms in

Table 4 Columns (1), (3), and (5) report estimates without broader macroeconomic controls, while columns (2), (4), and (6) incorporate these controls—specifically, the spread between the FFR and the 10-year Treasury yield, the spread between the 3-month Treasury rate and the FFR, and crude oil prices. We focus on the models with controls in columns (2), (4), and (6). A Hausman specification test (results reported in

Table 5) indicated that the fixed-effects estimator is preferred to the random-effects alternative; accordingly, all models are estimated using a fixed-effects panel specification.

Focusing on Column (2), we find a statistically significant positive association between the population-weighted temperature anomaly and the daily log return of climate-aligned firms: a one-unit increase in the today’s anomaly is associated with a 0.00042 increase in log return (SE = 0.0002). This indicates that deviations from the historical daily average temperature—whether warmer or colder—weighted by population may lead to a short-term uptick in the market valuation of environmentally oriented firms on the same day.

The one-day–lagged anomaly enters with a negative but statistically insignificant coefficient (−0.00038, SE = 0.0002), indicating that the previous day’s positive return is not followed by any systematic reversal. An analogous pattern appears for the real-GSP- and GDP-weighted anomalies in Columns (4) and (6): both exhibit a significant positive effect at the same day (e.g., β = 0.00043, SE = 0.0002 for real GSP) and a small, statistically insignificant negative coefficient at the one-day lag (e.g., β = −0.00038, SE = 0.0002 for real GSP), again showing no consistent reversal.

These findings imply that temperature anomalies may temporarily increase investor interest in climate-aligned firms, potentially reflecting heightened awareness of climate-related risks and opportunities. However, this behavioral response appears short-lived: the one-day lag shows a negative but statistically insignificant coefficient, indicating that the same-day gain in log returns is only partially—and not significantly—offset the following day. In other words, while anomalously warm or cool conditions can trigger immediate inflows into environmentally focused firms, these effects remain transitory, underscoring the fleeting nature of investor sentiment linked to daily temperature fluctuations.

3.3. Heterogeneity Analysis Results

We examine whether the effect of temperature anomalies on the market valuation of climate-aligned firms varies depending on whether the day is classified as extreme. First (

Table 6, Columns (1)–(3)), we define extremes as days when the temperature anomaly exceeds ±3 °C and, as a result, the daily mean temperature crosses common comfort thresholds—that is, a positive anomaly of more than 3 °C that drives the mean temperature above 22 °C, making already warm days uncomfortably hotter, or a negative anomaly of more than −3 °C that drives the mean temperature below 18 °C, making already cool days markedly colder. Second (

Table 6, Columns (4)–(6)), we define extremes as days when anomalies are large enough to generate positive cooling degree days (CDD) or heating degree days (HDD)—that is, positive anomalies exceeding 3 °C that raise daily mean temperatures above 18 °C (producing CDD) or negative anomalies less than −3 °C that lower daily mean temperatures below 18 °C (producing HDD), thereby amplifying heat or cold stress. Thus, Columns (1)–(3) present the estimated effects of anomalies under the first definition—days when anomalies exceed ±3 °C and push mean temperatures beyond the 22 °C or 18 °C comfort thresholds, while Columns (4)–(6) present the estimated effects of anomalies under the second definition—days when anomalies exceed ±3 °C and are large enough to generate positive CDD or HDD.

Column (1) of

Table 6 shows the results obtained using population-weighted temperature anomaly as the measure of anomalous temperature. On non-extreme days—that is, days not classified by the indicator as “hot-gets-hotter” (mean temperature > 22 °C with a positive anomaly > 3 °C) or “cold-gets-colder” (mean temperature < 18 °C with a negative anomaly < −3 °C)—a one-degree increase in the population-weighted anomaly is associated with a 0.000528 increase in log daily returns (

p < 0.05). The next-day effect reverses: the coefficient on the one-day lag is −0.000479 (

p < 0.05). On extreme days, the interaction term is negative and marginally significant (β = −0.001476,

p < 0.10), indicating that when a positive (negative) anomaly pushes already warm (cold) days into the “hotter-hot” (“colder-cold”) range, the same-day return is about 0.00148 lower than on non-extreme days. The lagged interaction is positive but insignificant (β = 0.000865).

Column (2) of

Table 6 reports estimates based on real-GSP-weighted temperature anomaly. On non-extreme days, a one-degree anomaly increases log returns by 0.000621 (SE = 0.000,

p < 0.05), while the one-day lag reduces returns by −0.000536 (

p < 0.05). For extreme days the interaction term is significantly negative (β = −0.001947,

p < 0.05), showing a larger same-day decline in returns. This drop is more than offset the following day: the lagged interaction is significantly positive (β = 0.001486, SE = 0.001,

p < 0.05), implying a next-day rebound in returns.

Column (3) of

Table 6 presents results using GDP-weighted temperature anomaly. The pattern closely mirrors that in Column (2): on non-extreme days, a one-degree anomaly raises log returns by 0.000623 (

p < 0.05), followed by decline of −0.000540 (

p < 0.05) the next day. On extreme days the same-day interaction is significantly negative (β = −0.002034,

p < 0.01), and the lagged interaction is significantly positive (β = 0.001527,

p < 0.05), again indicating a temporary dip in returns when anomalies push temperatures beyond the “hot-gets-hotter/cold-gets-colder” thresholds, followed by a rebound the next day.

Columns (4)–(6) of

Table 6 reports estimates using an indicator that flags days when a positive anomaly of more than 3 °C occurs while the daily mean temperature exceeds 18 °C (producing positive cooling degree days), or when a negative anomaly of less than −3 °C occurs while the daily mean temperature is below 18 °C (producing positive heating degree days). The results remain largely consistent with results obtained when the sample was split by more extreme threshold. The non-extreme days temperature anomalies continue to be associated with a contemporaneous increase in log daily returns and a negative reversal the next day, at least when anomalies are weighted by RGSP or GDP. In contrast, on extreme days—when anomalies exceed ±3 °C and generate positive cooling or heating degree days—the same-day effect turns significantly negative and is followed by a positive next-day rebound, indicating a temporary drop in returns when temperature shocks create “hotter-hot” or “colder-cold” conditions.

Taken together, the evidence from Columns (1)–(6) of

Table 6 reveals a consistent pattern in how investors respond to temperature shocks. First, in the specifications that weight anomalies by RGSP or GDP, temperature anomalies on non-extreme days are associated with a contemporaneous increase in log daily returns and a negative reversal the following day, indicating a short-lived boost in market valuation when temperatures deviate modestly from their ten-year norm. Second, when those anomalies occur on extreme days—that is, when positive (negative) anomalies of more than 3 °C push already warm (cold) conditions further beyond the 22 °C (18 °C) comfort thresholds or when they generate positive cooling or heating degree days—the pattern flips: returns show a significant same-day decline followed by a next-day rebound, reflecting a brief, negative market reaction to “hotter-hot” or “colder-cold” conditions. Third, although we considered two alternative ways to define these extremes, the more stringent definition in Columns (1)–(3)—where anomalies of ±3 °C push mean temperatures above 22 °C or below 18 °C relative to the ten-year average—produces the largest magnitudes of effect, underscoring the stronger market response when temperature shocks truly exceed perceptual comfort thresholds. Finally, even under the less stringent split in Columns (4)–(6)—where anomalies of ±3 °C are sufficient to move temperatures across the 18 °C comfort benchmark and create positive cooling or heating degree days—the results remain qualitatively similar: returns rise on non-extreme days and fall on extreme days, with the direction of the effect reversing the following day. Together, these findings show that investor reactions to daily temperature anomalies are real but transitory, and that the initial market response depends critically on whether anomalies merely depart from historical norms or push conditions into genuinely extreme thermal stress.

4. Discussion

This paper examines how daily U.S. temperature anomalies influence the market valuation of climate-aligned firms by linking deviations from ten-year historical norms to the returns of 33 environmentally oriented companies. Across weighting schemes—population, RGSP, and GDP—a consistent pattern emerges. When temperatures depart modestly from their historical norms but do not create genuinely extreme conditions, positive anomalies are associated with a same-day rise in log daily returns and a negative reversal the following day. These short-lived gains suggest that even moderate departures from typical temperatures can temporarily boost the valuation of climate-aligned firms.

The pattern reverses when temperature anomalies are large enough to create truly extreme conditions. We considered two complementary definitions of such extremes. In the first, positive (negative) anomalies greater than 3 °C push mean temperatures above 22 °C (below 18 °C) relative to the ten-year average. In the second, anomalies of more than ±3 °C raise or lower mean temperatures enough to generate positive CDD or HDD. Under both definitions, same-day returns decline when anomalies drive already hot days hotter or already cold days colder, and these losses are followed by a significant rebound in returns the next day. The market thus reacts negatively—but only briefly—when weather shocks create “hotter-hot” or “colder-cold” conditions.

The magnitude of these effects is most pronounced when anomalies of more than ±3 °C push temperatures above 22 °C or below 18 °C. This stricter definition captures episodes of truly perceptible discomfort, and the larger price reactions suggest that investors respond more strongly when temperature shocks both deviate from the norm and cross familiar comfort thresholds. Even under the broader criterion—where anomalies of more than ±3 °C merely raise or lower temperatures across the 18 °C benchmark and create positive CDD or HDD—the qualitative message remains the same: returns rise on non-extreme days and fall on extreme days, with the direction of the effect reversing the following day.

These heterogeneity results can be placed in the context of prior research on weather and financial markets. Some studies report that stock returns decline when the weather is extremely hot or extremely cold, consistent with our finding of a same-day drop during extreme conditions [

30]. Other work, however, finds no significant relationship between extremely high or low temperature levels and asset valuations [

31]. A related study defines abnormal temperatures as deviations from historical norms and likewise finds no significant association between extreme abnormal heat or cold and stock returns, again differing from our results [

32]. Because these studies differ in research design and, in particular, in how the temperature variable is defined, it is difficult to draw a single conclusive link between temperature and financial outcomes. Nevertheless, the current study adds to this body of work by showing whether and to what extent temperature anomalies can affect investors’ economic decisions and the functioning of financial markets, thereby motivating further research in this area.

These findings are consistent with behavioral explanations of investor decision-making. Exposure to unusually hot or cold weather can affect mood, increase risk aversion, and temporarily dampen trading activity in assets perceived as newer or riskier, such as climate-aligned firms. Temperature-related shifts in investor psychology provide a plausible channel through which daily weather anomalies influence the valuation of these firms. The short-lived nature of the market response suggests that these reactions are driven more by transient changes in sentiment and perceived risk than by any lasting reassessment of fundamentals. Overall, the evidence indicates that daily temperature shocks can shape climate-related investor behavior through psychological and mood effects, producing brief fluctuations in market valuations rather than a sustained reallocation of portfolios.

Several limitations should be considered when interpreting these findings. First, while using data from a single country helps reduce heterogeneity in institutional and macroeconomic conditions, the national-level aggregation of temperature data introduces measurement error. Investors may be responding to local or regional weather conditions that differ from national averages, potentially attenuating the observed effects. Second, the sample of climate-aligned firms is limited to 33 U.S. companies broadly classified as environmentally oriented. These classifications are not based on direct measures of carbon emissions, decarbonization targets, or environmental impact, raising concerns about measurement accuracy and the potential inclusion of firms with varying levels of true “greenness.” Finally, an important design limitation is that the main explanatory variable—the national temperature anomaly—is constant across firms on any given day. This precludes the inclusion of date fixed effects, because they would absorb the very variation used for identification. Although we mitigate concerns about correlated errors across firms and over time by employing Driscoll–Kraay standard errors, the absence of date fixed effects means that unobserved daily shocks correlated with national temperature could still bias the estimates. Moreover, while we verified that month-of-year and day-of-week effects have no significant influence on our results, other factors such as liquidity conditions, policy announcements, or broader macroeconomic shocks that might be correlated with both temperature and market performance could still provide alternative explanations for the observed associations.

5. Conclusions

This study investigates how daily temperature anomalies influence the market valuation of climate-aligned firms in the United States from 2010 to 2024. Using a composite index of 33 environmentally oriented companies and daily temperature anomalies weighted by population, RGSP, and GDP, we find a clear and consistent pattern. For the full sample, temperature anomalies—whether unusually warm or cold—are associated with a short-lived increase in logged daily returns, followed by a reversal the next day.

The heterogeneity analysis shows that this association is concentrated on non-extreme days, when temperatures deviate from historical norms but do not create genuinely hot or cold conditions. On these days, RGSP- and GDP-weighted anomalies generate a same-day rise in returns and a next-day decline. In contrast, when anomalies are large enough to produce extreme conditions—either by pushing already hot days hotter or cold days colder (exceeding ±3 °C and crossing comfort thresholds) or by generating positive cooling or heating degree days—the pattern reverses: returns fall on the day of the anomaly and rebound the following day. Moreover, when extremes are defined by the stricter criterion of pushing mean temperatures above 22 °C or below 18 °C by more than 3 °C relative to the ten-year average, the magnitude of the market response is largest, underscoring that investors react more sharply when both the deviation and the absolute temperature level signal perceptible discomfort.

These findings carry several implications for future research. First, they highlight the need to examine investor behavior under different dimensions of climate salience—linking high-frequency market responses to longer-term climate beliefs and portfolio allocations. Second, they point to the value of exploring heterogeneity across sectors or asset classes to determine whether the short-run effects documented here extend beyond climate-aligned firms and the U.S. market. Third, future work should investigate the behavioral channels—such as mood changes or shifts in risk perception—through which temperature anomalies influence investor decisions, helping to clarify the psychological mechanisms behind the observed market responses. Finally, examining whether similar short-term market effects appear in other countries or under different market structures would provide a broader understanding of the global implications of climate-related financial risks.

The results also have important policy implications. Short-lived swings in the valuation of green firms around temperature shocks suggest that extreme weather events can create temporary volatility in climate-related financial markets, with potential spillovers for capital formation in the clean-energy transition. Policymakers and financial regulators may wish to incorporate such high-frequency climate risk signals into stress-testing frameworks and disclosure requirements, while firms themselves might use these insights to design investor communication strategies that mitigate behavioral over-reactions. By documenting how daily weather shocks shape investor sentiment, this analysis underscores the broader link between climate variability and financial market dynamics and highlights the importance of integrating climate considerations into both investment strategy and financial policy.