1. Introduction

What will happen to the thousands of commercial aircraft expected to retire in the next two decades? As the aviation industry increases its efforts to reduce carbon emissions and resource consumption, the main focus is on operational improvements such as efficiency and sustainable aviation fuels. However, a less visible yet equally important challenge is emerging: the sustainable management of aircraft at the end of their service lives. Between 1980 and 2017, more than 15,000 commercial aircraft were retired worldwide. Projections indicate that an additional 12,000 aircraft could be decommissioned over the next twenty years [

1], a substantial flow of valuable materials. Older narrow-body models such as the Airbus A320 are composed of up to 72% aluminium and aluminium–lithium alloys [

2], which are high-grade materials that can be recycled with low energy use and environmental impact. Despite its growing importance, end-of-life management is governed by unclear and inconsistent regulations. There are currently no binding global requirements dictating what must happen to an aircraft once it is retired. Instead, it is typically treated as a disassembled waste product [

3]. This lack of oversight leads to inconsistent recycling practices and missed opportunities for resource recovery. However, according to the International Air Transport Association’s (IATA’s) 2022 Annual Review, aviation is committed to achieving net-zero carbon emissions by 2050, which will require significant innovation across fleet operations, fuel technology, and end-of-life aircraft management [

4]. This paper explores whether the recycling of aluminium from retired narrow-body commercial aircraft can be both economically viable and environmentally beneficial. By integrating aircraft retirement data, this research aims to assess the role aluminium recycling can play within the aviation circular economy.

While previous studies have examined the economics of aircraft dismantling and the environmental impacts of aviation more broadly, there remains a lack of focused research on the specific role of aluminium recycling in end-of-life aircraft management. Most of the existing literature either generalises aircraft recycling or prioritises composite materials and rare metals, often overlooking the economic and environmental potential of high-grade aluminium recovery, particularly from narrow-body aircraft, which represent a significant portion of the global fleet, currently at 62%, which is expected to rise to 68% by 2035 [

5]. Furthermore, there is limited integration of lifecycle assessment and cost analysis in evaluating aluminium recycling from retired aircraft. This gap leaves uncertainty about the true value of aluminium recovery, both as a business model and as a sustainability strategy. This paper addresses this gap by focusing specifically on the recovery of aluminium from retired commercial narrow-body aircraft through the development of an economic assessment framework for aircraft recycling. The effectiveness of the framework is shown through the economic results shown in this study. Therefore, this paper aims to answer the following research questions:

- RQ1

How much potential volume of aluminium is recoverable from retired narrow-body aircraft?

- RQ2

What is the economic viability of aluminium recycling based on dismantling costs, market prices, and potential revenue streams?

- RQ3

What are the environmental benefits of recycling through a lifecycle emissions model?

- RQ4

What is the role of aluminium recycling in supporting circular economy and decarbonisation objectives in aviation?

In answering these questions, the research provides a more nuanced understanding of how resource recovery can enhance both economic efficiency and environmental performance in the aviation sector.

2. Literature Review

2.1. Literature Review Design

A systematic literature review approach was adopted with the aim to explore and identify the key issues pertaining to aircraft recycling and its contribution to the sustainability and circular economy agenda. The databases utilised were Scopus, MDPI, and Emerald Insight, including specific trade journals relevant to the major aircraft companies (Boeing, Airbus, etc.). An initial search was conducted to identify the relevant journal articles, conference papers, books, and book chapters published in this area. A second search was conducted with a specific time period given between 2010 and 2025 in order to maintain currency and relevance. The filtering criteria used were the combinations of a set of keywords, namely ‘aircraft recycling’, ‘aircraft recycling and Sustainable Development Goals’, ‘aircraft recycling supply chain’, ‘recycling supply chains’, and ‘SDGs’. The initial database searches resulted in a total of 1348 documents being identified from all three databases. An initial review of the documents allowed the team to reduce the total to 154 by removing irrelevant documents, conference articles, and repeat publications. The identified 154 papers were reduced further to 112 following further analyses of the main texts of the papers when analysed for relevance. The key inclusion criteria were based on applications of recycling and the methodologies employed on how the recycling data were developed and analysed within the work. Also, the connections between the aircraft companies, their recycling supply chains, and the SDGs and other sustainability goals were of particular interest and were included in this study.

2.1.1. Initial Findings and Overview

As global air transport expands, a growing cohort of aircraft is reaching the end of life (EoL), intensifying the need for sustainable decommissioning, dismantling, and material recovery. This literature review synthesises evidence from academic studies, industry guidance, and policy documents to (i) map current practices in aircraft recycling, (ii) assess environmental and economic performance, (iii) analyse regulatory and market barriers, and (iv) explicate the contribution of aircraft recycling to the UN Sustainable Development Goals (SDGs).

To start this study, it is useful to consider the broader role of the aviation industry’s contribution to the UN Sustainable Development Goals and sustainability more generally. Our literature review identified the respective SDGs and the evidence demonstrating the industry’s contribution to them.

Table 1 shows the connections.

The broader contributions to the SDGs from the aviation industry (connectivity, trade, jobs) are also documented by the ICAO, underscoring sectoral relevance to 15 of 17 SDGs; EoL circularity strengthens this portfolio by addressing consumption/production and climate dimensions [

6,

13]. The remaining review of the literature will pay particular attention to the recycling aspects of retiring aircraft and the implication this has on the SDGs and the sustainability and circularity agenda more generally.

2.1.2. Aircraft Material Composition Overview

The structural design of commercial aircraft is driven by the requirement for lightweight and durable materials, capable of withstanding high loads and fatigue over service lives of up to 60,000 flight hours [

14]. Aluminium alloys have historically been the dominant material in aerospace applications due to their excellent strength-to-weight ratio, corrosion resistance, ease of fabrication, and overall cost-effectiveness [

15]. As an example, the material breakdown of the Airbus A320 shows that approximately 72% of the structure is composed of aluminium or aluminium–lithium alloys, with the remaining materials being composites (10%), steel (9%), and titanium (6%), with miscellaneous materials accounting for approximately 3% [

2].

Similarly, industry data from the Industrial Metal Supply Company indicates that the Boeing 737 is composed of approximately 80% aluminium by weight [

16]. For the purposes of this research, the lower Airbus A320 value of 72% was applied across all calculations to provide a conservative estimate of potential aluminium recovery. The primary aluminium alloys used in aircraft structures belong to the 2xxx and 7xxx series, particularly 2024 and 7075-T6, which are used for their high tensile strength and fatigue resistance [

17,

18]. The 7075-T6 and 7178-T6 are used in upper wing skins and spar caps, where compressive strength is critical [

19]. Alloy 2024 is used in fuselage and wing skins due to its excellent yield strength and fatigue performance. Alloy 2014 has the highest strength and ductility among the common variants but is more susceptible to corrosion, so it is used for internal structures [

20]. Additional alloys include 5052, a non-heat-treatable material known for its strength and corrosion resistance; 6061, often used in light aircraft due to its machinability and weldability; and 7050, which provides high fracture resistance and corrosion protection in thick sections. Alloy 7068 is one of the strongest available; it has a low density and is ideal for military applications. Alloy 7075, with high zinc content, approaches the strength of steel while offering superior machineability and fatigue strength [

20]. Next-generation aircraft, such as the Airbus A350, have shifted toward greater use of advanced composites (up to 54% of the airframe), along with titanium and advanced metallic alloys. This transition aims to reduce the overall weight by as much as 20 tonnes, therefore enhancing fuel efficiency [

21]. However, aluminium remains the predominant material in older aircraft models that continue to form a significant portion of the active fleet. Given the maturity of aluminium recycling infrastructure and the quantifiable economic case, there is a clear opportunity to prioritise aluminium recovery from these legacy aircraft.

2.1.3. Aircraft Retirement Trends and End-of-Life Processing

Aircraft are typically decommissioned due to safety concerns or economic considerations. Once a decision is made to retire an aircraft and the first structural cut is made, the aircraft is classified as waste and will not return to service. The typical retirement age for commercial passenger aircraft ranges between 25 and 30 years, while freighters tend to remain in service longer, with retirement ages between 30 and 40 years [

22]. Although the specific source for this information is not directly referenced, it originates from the European Union Aviation Safety Agency (EASA), a reputable regulatory authority, and is therefore considered reliable. As of March 2023, IATA reported that 6338 aircraft were in storage and 28,093 remained in active service [

22]. This highlights the growing backlog of aircraft nearing or entering end-of-life status, raising questions about how these assets will be managed.

Currently, there are no legal requirements mandating that aircraft be recycled after retirement. Decisions about whether to dismantle, store, or scrap an aircraft are left to the discretion of the owner. If recycling is pursued, it must comply with the International Civil Aviation Organisation (ICAO) Standards and Recommended Practices (SARPs) [

23]. Chapter 8 of ICAO’s 2019 Environmental Protection Report provides essential data on environmental management during aircraft decommission and is considered a credible regulatory source [

13]. Aircraft end-of-life processing generally involves two stages: disassembly and dismantling. Disassembly refers to the systematic removal of usable components for reuse or resale as serviceable parts, while dismantling involves the breakdown of the aircraft into raw materials, with a focus on recycling and final disposal [

24]. During these processes, all fluids, such as hydraulic oils, coolants, and residual fuel, are removed for treatment or recycling. Hazardous components, including batteries, emergency oxygen systems, and fire extinguishers, are also extracted to prevent contamination and safety risks [

25].

Valuable components commonly reclaimed include engines, turbines, landing gear, avionics, and seating. These are often the most financially significant assets, particularly on newer aircraft, as they can be refurbished, sold, or disassembled into high-precision parts. Landing gear systems, which include titanium, steel, and hydraulic assemblies, can also be refurbished for reuse or recycled into raw materials [

25]. After component removal and hazardous material treatment, aluminium is typically sorted into two primary alloy families, namely, the 2000 series and 7000 series alloys. Surface contaminants can be eliminated via thermal or solvent cleaning. The cleaned aluminium is then chipped, remelted, and prepared for reuse [

26]. This process facilitates material recovery while also reducing the environmental burden associated with primary aluminium production.

2.1.4. Environmental and Economic Considerations in Aluminium Recycling

Aluminium is one of the most widely recycled materials globally and retains its properties through multiple recycling cycles without a reduction in quality. Each year, over 30 million tonnes of aluminium scrap are recycled worldwide, highlighting its role in sustainable material management [

27]. Primary aluminium is produced from bauxite ore through the Bayer–Hall–Héroult process, which requires high temperatures and pressures and is therefore energy-intensive [

28]. In contrast, aluminium recycling demands significantly less energy, with the majority of the required input used for melting the material. According to estimates by the University of Cambridge’s DoITPoMS project, producing one kilogram of primary aluminium consumes approximately 260 megajoules of energy. Recycling the same quantity requires only 6 to 10 megajoules, assuming an efficiency of 60 to 80 percent. These values do not include additional processes such as scrap sorting or transportation [

28].

The environmental and financial advantages of aluminium recycling are evident in the significant energy savings it offers. The International Aluminium Institute supports these findings, indicating that recycling can achieve energy savings of up to 95.5 percent compared to primary production [

29]. From a carbon emissions perspective, the environmental benefits are equally substantial. Producing one tonne of primary aluminium can result in emissions ranging from 4 to 20 tonnes of carbon dioxide equivalents, depending on the energy mix and production technology. In contrast, recycled aluminium generates only about 0.5 tonnes of carbon dioxide equivalents per tonne [

30]. Economically, the aluminium market is subject to price fluctuations that are influenced by demand in other sectors such as renewable energy and electric vehicles. According to Trading Economics, aluminium prices have ranged between USD 1453 and USD 3848 per tonne in recent years. As of March 2025, the price per tonne stood at approximately USD 2490, with forecasts suggesting an increase to USD 2729 by March 2025 [

30]. A growing demand for metals in low-carbon technologies has contributed to a rise in scrap value, making recycled metals a more cost-effective alternative than virgin materials [

31]. This shows aluminium recycling as both an environmentally and economically beneficial solution, particularly as the global demand for sustainable materials continues to rise.

2.1.5. Circular Economy in Aviation

The circular economy represents a shift in industrial production and consumption, moving away from the traditional linear model of “take, make, dispose” and towards a system focused on material regeneration, reuse, and closed-loop recycling [

32,

33]. In the context of aviation, this means designing aircraft and supply chains to enable the recovery of high-value materials, prolong product life, and reduce environmental burdens throughout the entire lifecycle. Aluminium is well suited to circular aviation systems due to its recyclability without significant degradation in mechanical properties. According to Airbus, recycled aerospace-grade aluminium, when properly sorted and processed, can meet the high structural and performance standards required for reuse in new aircraft components. This supports a closed-loop approach in which recovered aluminium from end-of-life aircraft re-enters the aerospace manufacturing cycle, reducing demand for virgin materials and significantly lowering associated carbon emissions [

34]. Integrating aluminium into circular processes reduces embedded environmental impacts and presents a scalable opportunity, as the infrastructure for aluminium recycling is more mature than for other materials, such as composites or titanium. Airbus reports that such closed-loop systems are already being trialled successfully and shows that recycled aluminium can meet the rigorous specifications of aviation components [

34]. Despite these advancements, the aviation industry continues to trail behind sectors such as automotive and construction in implementing circular design principles. In the automotive industry, design for disassembly is widely adopted; parts are engineered to be easily removed, and vehicles are increasingly designed for full material recovery [

35]. In the European Union (EU), vehicle manufacturers are required to ensure that at least 85% of a vehicle’s weight is reusable or recyclable, rising to 95% when recovery (including energy recovery) is included [

36,

37]. Similarly, the construction sector has developed circular design strategies, such as modular components and material passports, to improve disassembly and reuse [

35,

37]. In contrast, aerospace remains hampered by complex assemblies, composite structures, and stringent certification standards, all of which present significant barriers to circularity.

To conclude, lessons from other industries provide a roadmap for aviation too. The EU’s End-of-Life Vehicles (ELVs) Directive (2000/53/EC) mandates that vehicles must meet a minimum of 95% recovery by weight and at least 85% recycling by 2015 [

36,

37]. This regulatory framework combines clear recovery targets with Extended Producer Responsibility, encouraging manufacturers to design vehicles with an end-of-life process in mind. The directive has been credited with driving innovation in modular design, improved material tracking, and enhanced treatment infrastructure [

36]. If similar regulatory mechanisms were applied to aviation, such as mandated recovery targets or producer take-back schemes, they could start development in areas like material traceability, automated separation technologies, and dismantling infrastructure. In parallel, emerging technologies such as digital product passports, AI-enabled sorting, and blockchain-based traceability systems are beginning to address key challenges in material certification and reuse. These tools can support more precise separation of high-value materials and facilitate the reintegration of recycled content into high-performance aerospace components [

38]. Therefore, aluminium stands out as a key enabler of the circular economy in aviation. The successful development of closed-loop recycling pathways, as demonstrated by Airbus, highlights the material’s potential to support both environmental and economic goals, particularly when coupled with regulatory alignment and technological innovation.

2.1.6. Technological and Logistical Challenges in Aluminium Recovery

Recovering high-quality aluminium from decommissioned aircraft presents several technical and logistical hurdles. One major issue is alloy contamination during melting, particularly when different grades of aluminium or non-aluminium fasteners (such as titanium or steel rivets) enter the recycling stream. Contamination can degrade mechanical properties and limit the material’s future applications. Studies by the Aluminium Association highlight that even trace impurities can change alloy characteristics significantly, limiting usability [

39]. Complex structural elements, such as adhesively bonded panels, composite overlays, and intricate joint assemblies, increase disassembly difficulty. A study by Shroeder et al. found that manual separation processes are not only labour-intensive but also inconsistent, leading to mixed-material waste that complicates recycling [

40]. Although some semi-automated systems are being developed, their effectiveness remains limited, as they are not yet fine-tuned for the material mixes found in many aircraft. Achieving closed-loop recycling within aerospace is also impeded by strict certification standards, requiring high alloy purity and traceability, which is not always achievable in current recycling setups [

41]. Furthermore, efforts to produce ultra-pure recycled aluminium can lead to diminishing environmental returns where the extra refining steps increase energy consumption and carbon emissions, creating a trade-off that must be considered [

42].

2.1.7. Lifecycle Assessment (LCA) Methodology

To evaluate the environmental impacts of aluminium recycling in aviation, this research uses lifecycle assessment (LCA) in accordance with the principles outlined in ISO 14044 (2006) [

43]. LCA provides a comprehensive framework for assessing the resource use and emissions associated with a product throughout its lifecycle. In the context of aircraft aluminium recovery, LCA enables a systematic comparison between recycled and primary aluminium production paths. Cradle-to-gate assessments consider emissions from raw material extraction through the factory gate, while cradle-to-cradle models expand this boundary to include product use, recovery, and reprocessing into new products. For the purpose of this research, both approaches are relevant, with emphasis placed on the post-use phase where aluminium is recovered from end-of-life aircraft. The functional unit in the analysis may be defined either as one tonne of recovered aluminium or as a single narrow-body aircraft, depending on the desired resolution and comparability with industry datasets. Establishing a clear functional unit ensures consistency in emissions reporting and cost comparison. Allocation methods are also critical. Mass-based allocation distributes environmental impacts according to material quantity, whereas economic allocation does so based on the market value of outputs. Aluminium prices are subject to economic cycles; if global demand weakens or production ramps up beyond expectations, prices could stabilise or even decline. As aluminium prices fluctuate significantly over time, economic allocation can distort comparative results. A sensitivity analysis is incorporated into this research to evaluate the robustness of conclusions under different allocation assumptions. By applying a standardised and transparent LCA framework, this research provides a quantifiable assessment of the environmental trade-offs involved in aircraft aluminium recycling, thereby supporting evidence-based strategies for aviation sector decarbonisation.

2.1.8. Regulatory Landscape and Policy Gaps

The aviation industry currently lacks comprehensive regulations mandating end-of-life recovery and instead relies on voluntary sustainability initiatives and fragmented national policies. For example, ICAO’s Circular Economy website highlights that while environmental reporting frameworks exist, they do not impose requirements for material recycling or circular design practices [

40]. In contrast, the automotive industry is governed by the EU End-of-Life Vehicles (ELVs) Directive (2000/53/EC) [

41], which requires manufacturers to achieve 95% recovery and at least 85% recycling rates by weight for motor vehicles sold in the EU. The directive combines Extended Producer Responsibility with concrete recovery targets and has driven innovation in design for disassembly, material tracking, and dismantling infrastructure. A similar policy in aviation could include recovery mandates, producer take-back schemes, or eco-design requirements, effectively encouraging investment in circular infrastructure. The absence of such regulation is widely cited as a barrier to sustainable progress in aerospace, and developing stronger frameworks could help establish circularity as an industry standard rather than an exception.

2.1.9. Alternative Uses for Recycled Aluminium

Aluminium recovered from end-of-life aircraft finds applications across secondary markets such as automotive, construction, and consumer goods; these are industries where material purity standards are less stringent [

42]. However, direct reuse of such aluminium in primary aerospace components remains rare due to challenges around alloy traceability and certification requirements. Consequently, high-grade aluminium is typically downcycled into lower-value products, representing a loss in potential material utility, as shown in

Table 2 [

44]. Achieving closed-loop recycling, where recovered aluminium re-enters aerospace manufacturing, would give the highest environmental impact but remains rare due to technical and policy constraints. Improvements in alloy separation, digital traceability, and disassembly design could increase the proportion of aerospace-grade aluminium that remains within the aviation sector.

2.1.10. Industry Developments in Aircraft End-of-Life Processing

Several organisations are leading the development of aircraft end-of-life processing. These include Airbus’s PAMELA (Process for Advanced Management of End-of-Life Aircraft) trial, conducted on an A300, which demonstrated that up to 85% of an aircraft’s weight can be recovered through disassembly, recycling, or reuse [

45]. An expanded A380 test achieved even higher recovery rates, up to 98% of metallic components, reinforcing the project’s success and information value [

9]. Tarmac Aerosave, in collaboration with Airbus, Safran, and Suez, established a facility capable of recovering more than 92% of aircraft mass [

42]. Working with Constellium, they have now remelted aircraft-grade aluminium into aerospace-approved alloys, marking a breakthrough toward closed-loop recycling [

42]. Furthermore, KPMG-backed studies report that modern dismantling methods currently recover over 90% of structural material and almost 100% of engine parts, though often recycled to lower-grade markets [

9]. Airbus and its partners are testing sorting and certification methods to reintegrate recycled aluminium directly back into aerospace manufacturing; an important step towards closed-loop applications [

42]. These examples demonstrate that while most recovered aluminium is currently downcycled (e.g., for automotive or construction use), the technical capability for aerospace-grade recycling is already being proven. With documented recovery rates of 85–98% and ongoing innovation in alloy remelting, these insights support the research’s argument that closed-loop aircraft aluminium recycling is technically viable and rapidly advancing.

2.2. Economic Incentives or Barriers

The probability of aircraft aluminium recycling depends heavily on scrap metal prices, labour-intensive dismantling, and logistics costs. While aluminium retains a relatively high resale value, especially compared to composite materials, the cost of clean disassembly and transport can offset potential profits. Economic instruments such as government subsidies, carbon pricing, or environmental credit schemes could improve financial feasibility. Extended Producer Responsibility (EPR), where manufacturers are held accountable for end-of-life disposal, has proven effective in other sectors and could be applied to aviation. For example, the Organisation for Economic Co-operation and Development (OECD) outlines how EPR frameworks improve material recovery and incentivise sustainable design across multiple industries.

2.3. Research Gap and Research Focus

In summary, the evidence shows that 80–85% of airframe materials (by mass) can be recovered under best-practice processes, while high-value components (e.g., engines, landing gear, avionics) are frequently reused, cutting costs and embodied emissions relative to new production. However, composite-rich next-generation fleets pose recycling challenges, and global EoL governance remains fragmented. Strengthening eco-design, harmonising standards (e.g., AFRA Best Management Practices), and adopting circular economy frameworks can accelerate progress and amplify contributions to SDGs 12 (Responsible Consumption and Production), 13 (Climate Action), 9 (Industry, Innovation and Infrastructure), 8 (Decent Work and Economic Growth), 11 (Sustainable Cities and Communities), and 17 (Partnerships for the Goals). Future research should prioritise scalable composite recycling, digital traceability for parts, robust lifecycle assessment, and policy instruments that enable circularity. While previous studies have highlighted the technical and environmental benefits of recycling aluminium, few have integrated retirement forecasting, material flow analysis, and combined economic–environmental modelling into a single, quantitative framework. Most of the existing literature focuses on general aircraft recycling or multiple streams, with limited attention to aluminium as a standalone circular resource. This paper addresses that gap by focusing specifically on narrow-body commercial aircraft, modelling the financial and lifecycle outcomes of aluminium recovery at end-of-life. By aligning projected retirements with recovery modelling and scenario-based economic analysis, the research offers a structured framework to evaluate the role of aluminium recycling within the aviation sector.

3. Research Methodology

3.1. Introduction and Framework

All emissions are expressed in terms of CO

2e (carbon dioxide equivalent), which standardises the global warming potential of all greenhouse gases (e.g., methane, nitrous oxide) to an equivalent amount of CO

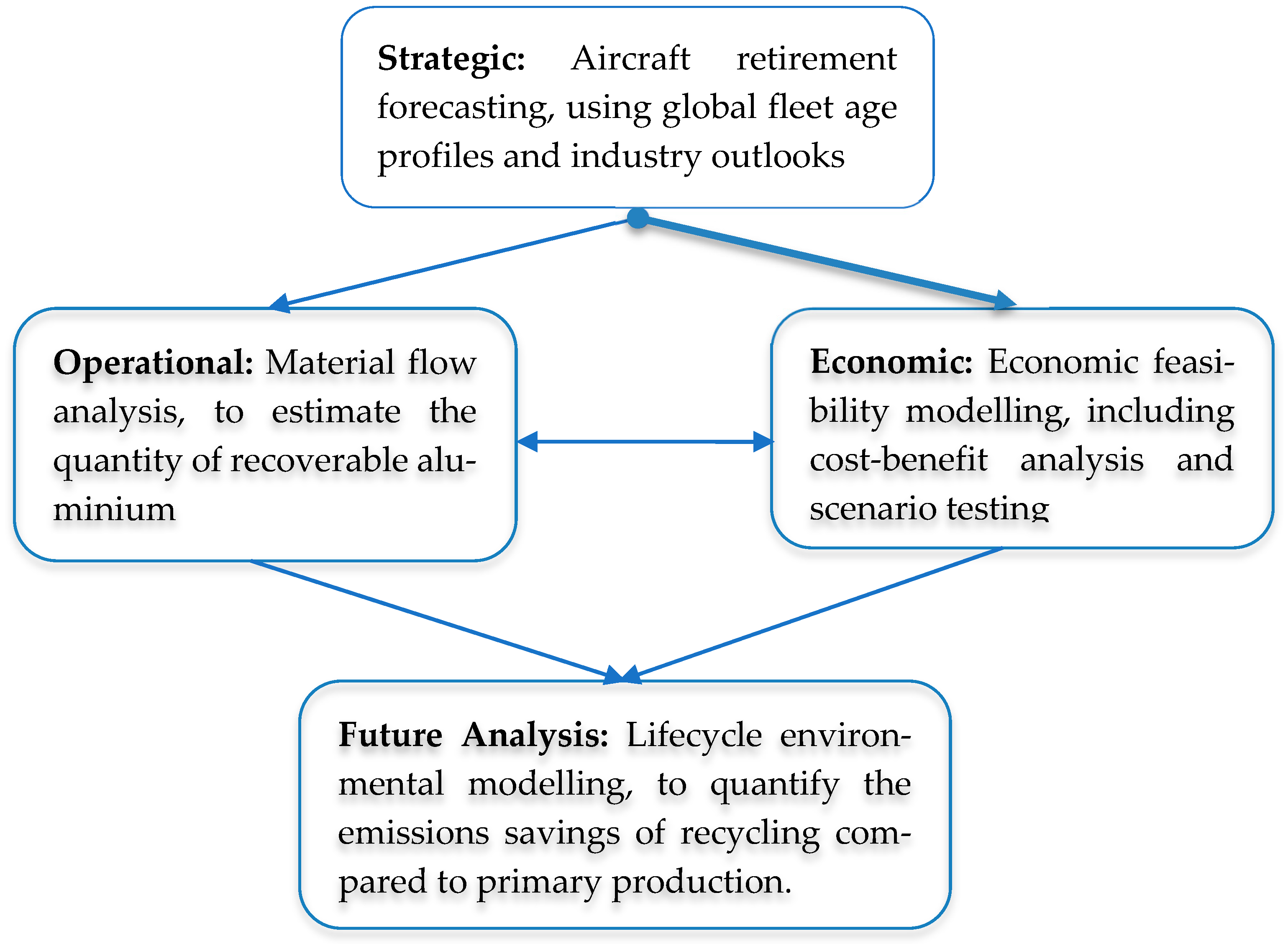

2, enabling consistent comparison and reporting. This paper employs a quantitative, data-driven methodology to evaluate the economic and environmental potential of aluminium recycling from retired narrow-body aircraft, focusing on the Airbus A320 and Boeing 737 families. These aircraft were selected due to their high aluminium content, extensive operational deployment, and broad data availability. They also contribute a significant proportion of projected global retirements and continue to be produced at a large scale, making them ideal subjects for long-term recycling analysis. The methodology approach integrates four key components shown in the following

Figure 1:

This combined framework enables a comprehensive assessment of the technical, economic, and environmental implications of aluminium recovery at end of life. All data were sourced ethically from publicly available or openly published reports. No human participants, private company records, or proprietary systems were involved. The research adheres to academic integrity standards and presents assumptions transparently to avoid overstating benefits. Likewise, no physical experiments were conducted; the approach triangulates theoretical modelling, empirical datasets, and policy-relevant economic assumptions; an accepted practice is systems-level sustainability research. The analysis draws on publicly available databases, academic literature, and industry reports, including Fleet and Retirement Data sourced from Airfleets.net, Planspotters.net, and ICAO aircraft movement statistics. Aircraft built before 2005 were prioritised to model near-term retirements, cross-referenced with IATA and Airbus Global Market Forecast data. Aircraft Composition Data, such as structural material breakdowns and empty weight data, were obtained from the aerospace literature and manufacturer specifications. Engine weights were subtracted to isolate recoverable structural mass. Market and cost data included scrap aluminium prices which were obtained from Trading Economics, Fitch Ratings, and London Metal Exchange (LME), averaged over five years to minimise volatility. Dismantling and logistics costs were derived from case studies and adjusted for inflation using U.S CPI data. Environmental lifecycle data, such as emission factors and energy data for primary and secondary aluminium production, were sourced from DoITPoMS, the International Aluminium Institute, and academic lifecycle assessments. Where data were unavailable, conservative estimates were used and tested through sensitivity modelling.

3.2. Developing the Analytical Framework

Aircraft retirement rates between 2025 and 2040 were estimated using a rolling 20–25-year age profile, aligned with historical fleet data. Aircraft delivered between 2000 and 2005 are therefore expected to retire between 2025 and 2030. A conservative retirement probability of 85% was applied to this cohort. Forecasting was based on global fleet age distribution, cross-referenced with commercial projections from Airbus.

3.2.1. Aluminium Recovery per Aircraft

The aluminium recoverable from each aircraft was modelled using the following equation:

where

is the empty structural weight (excluding engines);

is the percentage of aluminium in the airframe (assumed to be 72%);

is the aluminium recovery efficiency (assumed to be 92%).

Operating empty weight was calculated by subtracting the combined engine mass (two V2500 engines at 2480 kg each) from the aircraft’s published operating weight.

This formula was then scaled across the expected number of annual retirements.

3.2.2. Dismantling Cost Estimation

A historical dismantling cost of USD 71,390 (2005) for a Boeing 737–300 was adjusted to 2025 USD using standard inflation indices, in line with best practice in engineering cost estimation [

46]. This figure, which covers labour, equipment, scrap handling, project management, and overheads, was deemed reasonable for modelling, given the lack of publicly available current industry data and its consistency with case study benchmarks. Depending on the size, it takes 2500–3200 person-hours to dismantle an aircraft [

47].

3.2.3. Economic Feasibility Modelling

The following cost–benefit model was used to determine net economic return per aircraft:

Scrap price ranges of USD 2400–2854/tonne were used based on market forecasts between 2025 and 2030. The model incorporates fixed and variable inputs and was designed to allow scenario-based revenue modelling.

3.2.4. Scenario Modelling and Sensitivity Analysis

Four economic scenarios were tested:

Scrap-only revenue;

Scrap + resale value of components (e.g., avionics, engines);

Scrap + carbon credit revenue;

Combined revenue from all sources.

Sensitivity analysis was conducted to identify break-even points and explore the effects of aluminium price volatility, dismantling cost range, and carbon pricing levels (USD 50–100/tonne CO2e).

3.2.5. Lifecycle Emissions Model

The following equation was used to estimate the environmental benefit from aluminium recycling:

where

is the carbon footprint of primary aluminium (based on a global average of 14.5 kg of CO2e/kg);

is that of secondary aluminium (estimated at 0.8 kg of CO2e/kg).

These values were drawn from DoITPoMS and validated against IAI lifecycle databases and were applied across the fleet to assess the potential environmental benefits under projected retirement scenarios.

3.2.6. Economic Model

A cost–benefit model was applied:

Inputs included the following:

Scrap prices: USD 2400–2854/tonne (2025–2030 forecast);

Dismantling cost: USD 116,899.39 (inflation-adjusted from 2005);

Component resale: USD 100,000 assumed average;

Carbon price: USD 50–100/tonne CO2e.

3.2.7. Input Parameter Summary

Table 3 summarises the key numerical inputs used in the economic and environmental models, along with their respective sources. These values underpin the results presented in the following section.

Additional inputs such as contamination loss rate, aluminium price volatility, and regional transport distances were not explicitly modelled but are acknowledged in the sensitivity discussion as potential sources of uncertainty.

5. Discussion

This research set out to evaluate the economic and environmental feasibility of aluminium recycling from retired narrow-body commercial aircraft (RQ 2 and 3). While the analysis does not include experimental validation or structural simulations, the modelling approach triangulates theoretical aircraft data, market-based pricing, and scenario-driven forecasting. This is consistent with systems-level methodologies commonly used in sustainability-focused engineering research. The model integrates fleet-level forecasting (RQ 1), material flow analysis, and economic and environmental assessment to identify the viability of aluminium recovery under current and projected conditions. Labour and equipment account for over 69% of dismantling costs, highlighting that operational logistics, rather than material value, dominate the economics of aircraft disassembly [

51].

5.1. Interpretation of Key Findings

The main findings indicate that aircraft with high aluminium content, such as the Airbus A320 and Boeing 737, offer substantial recovery potential. Approximately 24.7 tonnes of aluminium can be recovered per aircraft (RQ 1), highlighting the importance of targeting aerospace-grade aluminium. From an environmental perspective, the benefits are compelling. Recycling aluminium instead of producing it from primary sources avoids over 338,000 kg of CO

2e per aircraft (RQ 3), representing a 95% reduction. Across a 2025 forecast of 475 retirements, this translates into emissions reductions exceeding 150,000 tonnes of CO

2e, which is comparable to removing over 34,000 petrol vehicles off the road for a year [

52]. A financial analysis of the break-even scrap price is approximately USD 4297 per tonne (RQ 2), which is significantly higher than current and forecasted market prices. However, this estimate excludes the resale value of high-value components, which can substantially improve financial outcomes. When resale revenue (conservatively estimated at USD 100,000 per aircraft) and carbon pricing incentives are included, the model indicates a potential net gain exceeding USD 59,000 per aircraft.

5.2. Economic Implications

The results confirm that aluminium recycling, even when economic incentives are inconsistent or weak, provides a powerful method for decarbonisation in aviation (RQ 3). However, the financial side is more complex. Scrap value alone is insufficient to sustain profitable dismantling. The base-case scenario at 2025 aluminium prices results in a net loss of over USD 50,000 per aircraft. The inclusion of secondary revenue streams changes this outcome entirely. The resale of high-value components such as engines, avionics, and landing gear can transform recycling into a profitable activity (RQ 2). Assigning a carbon value to avoided emissions adds further economic justification, particularly under future climate policies. A combined approach aligns with strategies seen in the automotive industry, where regulation and diversified revenue streams have driven viable recycling businesses.

5.3. Environmental Trade-Offs and Benefits

Recycling aluminium from aircraft yields major energy savings, approximately 1.71 GWh per aircraft, or over 800 GWh across 2025 retirements (RQ 3). However, environmental trade-offs must be considered, including transport-related emissions from relocating aircraft to dismantling facilities, alloy contamination risks that may force downcycling, and regional variation in recycling infrastructure efficiency. Despite these limitations, the net environmental argument remains strong. Avoiding the production of primary aluminium prevents significant carbon emissions, reduces pressure on bauxite mining, and supports circular economy objectives (RQ 4).

5.4. Broader Industry Context and Barriers

Relative to sectors such as automotive or electronics, aviation lags behind in circular economy adoption (RQ 4). Most aircraft are not designed for easy disassembly, and certification requirements limit the use of recycled aluminium in primary aerospace structures, leading much of it to be downcycled into lower-value applications. In a typical year, around 650 commercial aircraft are retired globally, while only 400–450 (roughly 60–70%) are dismantled and recycled [

3,

47]. The remainder are stored or awaiting dismantling, leaving recovery potential unrealised. During high-retirement periods, such as the COVID-19 downturn, this proportion drops further as storage capacity and dismantling throughput become bottlenecks. With retirement forecast to peak in the 2030s, including many narrow-body aircraft, recycling capacity must expand to maintain or improve current rates. Barriers include a lack of material labelling, minimal modular design, and no industry-wide disassembly standards. Solutions such as blockchain-based material passports, AI-enhanced sorting, and advanced alloy separation, alongside regulatory models like the EU End-of-Life Vehicles Directive, could enable higher-value recovery and close the loop.

5.5. Limitations

While this research provides a comprehensive and original analysis, it is based on several important assumptions. For instance, data sources were primarily secondary and literature-based, not from direct plant records, and aircraft models were generalised to reflect narrow-body configurations, excluding some operational variability. Also, component resale values were estimated on industry ranges, but actual resale may vary significantly with age, condition, and market demand, and reprocessing and transport costs were not modelled in detail but acknowledged in the sensitivity analysis. Finally, costs for post-recovery reprocessing and transportation were not separately modelled but considered in the sensitivity analysis. Despite these limitations, the methodology is robust, with conservative estimates used to avoid overstatement. Sensitivity testing showed that key outcomes are most influenced by aluminium price volatility, resale values, and recovery efficiency, all of which are discussed transparently.

5.6. Strategic and Policy Recommendations

To enable widespread adoption of aluminium recycling in aviation, coordinated action is needed across manufacturers, regulators, and dismantling stakeholders. Strategic priorities include, for instance, mandating design-for-disassembly practices in new aircraft (e.g., modular assemblies and standardised fasteners), incentivising traceability systems to verify material integrity and reuse potential, supporting closed-loop pilot programmes for reintroducing recycled aluminium into non-structural components, expanding infrastructure for certified dismantling and sorting in key aviation markets, and implementing EPR and carbon pricing mechanisms to internalise environmental benefits. Further policy recommendations towards unlocking the full potential of aluminium recycling and advancing circularity in aviation and targeted policy interventions are essential. Drawing lessons from the EU’s End-of-Life Vehicles (ELVs) Directive (2000/53/EC), which mandates 95% recovery and 85% recycling by weight for automobiles, a similar framework could be adapted for aircraft. This would involve the following.

EU-Style Extended Producer Responsibility (EPR) for Aviation: Implementing an EPR scheme specific to aircraft manufacturers and operators would assign financial and operational responsibility for end-of-life management. Producers would be required to fund or facilitate dismantling, sorting, and recycling processes, incentivizing design-for-disassembly and traceable material use. Such a scheme could be structured through Producer Responsibility Organisations (PROs), as seen in the EU packaging and electronics sectors.

Mandatory Recovery Targets: Introduce binding recovery and recycling thresholds for aircraft materials, similar to the ELV Directive. For example, a 90% recovery target for metallic components and a 70% recycling rate for composite materials could drive innovation in dismantling and sorting technologies.

Digital Product Passports: Require aircraft components to carry digital identifiers detailing material composition, alloy grade, and lifecycle history. This would support traceability, certification, and reuse—particularly critical for closed-loop recycling of aerospace-grade aluminium.

Carbon Credit Integration into Compliance Markets: Enables verified recycling projects to qualify for regulated carbon markets such as the EU ETS, rather than relying solely on voluntary offsets. This would require standardised methodologies for quantifying avoided emissions and lifecycle benefits, potentially administered through ICAO or EASA.

Public–Private Infrastructure Investment: Co-invest in certified dismantling hubs and alloy separation facilities in strategic aviation regions. These centres could serve as circular economy accelerators, offering economies of scale and consistent quality control.

International Harmonisation of Circular Standards: Collaborate through ICAO to develop global standards for aircraft end-of-life processing, including material recovery protocols, certification pathways, and reporting frameworks. This would reduce fragmentation and support cross-border circular supply chains.

6. Conclusions and Recommendations

This study advances beyond the existing literature by integrating aircraft retirement forecasting, material flow analysis, and scenario-based economic and environmental modelling into a unified framework—offering a more granular and actionable assessment of aluminium recovery from narrow-body aircraft. Unlike prior research that generalises aircraft recycling or focuses on composite materials, this work isolates aluminium as a strategic resource and quantifies its role in circular aviation. However, achieving closed-loop recycling remains constrained by alloy contamination—where mixed grades and residual fasteners degrade material integrity—and by stringent certification standards that demand traceability and purity levels often unattainable in current recycling setups. These barriers limit the reintegration of recovered aluminium into aerospace-grade applications, reinforcing the need for improved separation technologies and regulatory innovation to unlock full circularity.

This research has resulted in the development of a framework for the effective evaluation of the economic and environmental feasibility of aluminium recycled from retired narrow-body aircraft, focusing on A320 and 737 families. It addressed a gap in the literature by combining material flow analysis, cost–benefit modelling, and lifecycle emissions assessment to explore aluminium’s role in circular aviation. The development of such a framework provides the aviation industry with an accurate assessment of the benefits of recycling. Currently, the industry risks losing both environmental and economic value from not employing this economic assessment framework. The opportunity cost per aircraft—over USD 100,000 in potential resale—and avoided emissions is too large to ignore. Recycling must therefore be viewed not as a marginal option, but as a central pillar in aviation’s path toward circularity and net-zero alignment.

The economic assessment framework developed has been able to identify some key outcomes, including the following.

Each aircraft contains approximately 24.7 tonnes of recoverable aluminium; the 2025 forecast yields 11,723 tonnes from 475 retirements, when considering scrap value (RQ 1).

The scrap value alone is insufficient, requiring break-even prices far above forecasts; multi-stream revenue (component resale + carbon credits) can deliver net profits of ~USD 59,000 per aircraft (RQ 2).

Recycling provides a 95% emissions reduction and saves ~1.71 GWh per aircraft. In 2025 alone, potential savings exceed 150,000 tonnes of CO2e and 800 GWh (RQ 3).

Without recycling, over USD 170,000 in potential value is lost per aircraft, along with missed opportunities for emissions reduction and resource security (RQ 4).

Furthermore, failure to recycle not only wastes material and financial value but also undermines industry climate commitments. The opportunity cost is significant: environmentally, strategically, and economically. Without proactive policy measures, downcycling will continue to dominate, preventing closed-loop reuse in aerospace.

Further work is required to fully develop the model further. This would include integrating composite material recovery into lifecycle and economic models, as well as including empirical dismantling cost data from operational facilities and quantifying regional differences in cost, regulation, and infrastructure maturity. Furthermore, comparative studies with other transport sectors, such as automotive and rail, could help identify transferable strategies for improving aircraft recyclability. Aluminium recycling from aircraft is technically feasible, environmentally essential, and economically achievable, but only under the right market and regulatory conditions. If the aviation industry is to meet its 2050 net-zero targets, circularity must become a core part of its sustainable strategy, alongside fuel innovation and operational efficiency. This research contributes to that goal by providing a quantifiable framework for addressing end-of-life aluminium recovery, helping to inform both policy development and engineering practice. As global aircraft retirements accelerate, the opportunity to rethink resource use at end of life has never been more urgent, or more promising. Future research should also explore the evolving impact of automation on dismantling and separation costs in metal recycling, particularly in light of technological advancements. Emphasis should be placed on analysing recent European projects focused on the mechanical separation of aluminium scrap, as well as engaging with industry associations to access granular data that may not be publicly available. This could yield more accurate cost models and inform policy and investment decisions in sustainable recycling systems.

This research considers not only environmental and economic impacts but also social implications. Aircraft dismantling and metals recovery provide opportunities for skilled employment, contribute to regional industrial resilience, and reduce reliance on critical material imports. These align with the Triple Bottom Line of People, Planet, and Profit, a fundamental sustainability framework endorsed by the UN Sustainable Development Goals (SDGs), particularly SDG 12 (Responsible Consumption and Production) and SDG 13 (Climate Action) [

5].

Finally, this study is an example of sustainable engineering by integrating environmental responsibility, economic analysis, and long-term circular design thinking. The approach satisfies sustainability outcomes by embedding recyclability into technical decisions, applying carbon literacy, and evaluating lifecycle impacts of engineering processes. Future engineers must move beyond compliance and develop proactive solutions that regenerate rather than deplete. This research shows aluminium recycling from aircraft as not only a technical process but as a critical element in aviation’s transition towards a more sustainable and circular industry.