1. Introduction

The global focus on sustainability reinforces the importance of corporate governance as one of the fundamental factors of corporate social responsibility (CSR) [

1,

2,

3,

4,

5]. In the literature, the concept of corporate governance is used interchangeably with the term organizational governance. Therefore, to make the article more transparent, the authors will use the term corporate governance throughout the remainder of this work. The literature emphasizes the importance of corporate governance in shaping company outcomes, particularly in protecting and mitigating negative impacts on the environment and, more broadly, sustainable development [

6,

7]. Corporate governance is an interesting and important topic because of its role in achieving the intended goals and meeting the needs of various stakeholder groups [

8,

9], which can facilitate the successful implementation of numerous projects [

10]. Empirical analysis has shown that active CSR significantly supports sustainable corporate development, with corporate governance factors—such as internal control, managerial capabilities, and the quality of accounting information—playing a moderating role in this relationship [

11].

In the literature, many authors recognize the relationship between corporate governance and the concept of CSR, emphasizing the significant role of good governance in shaping a socially responsible organization [

5,

12,

13]. A high level of responsible organizational governance can help ensure access to necessary services for environmental protection, safety, and an adequate quality of life [

14,

15]. This is of great importance in the water and sewage sector, among others [

16]. Urban water systems play an important role in sustainable development by meeting a fundamental human need: access to safe drinking water and sanitation [

17]. It is extremely important that these services are available to all people around the world [

18]. Given the critical importance of water to society, water management activities require collaboration between organizations from both the public and private sectors [

19,

20]. The disclosure of information about the implementation of social responsibility concepts and their contribution to sustainable development by enterprises, especially those providing essential services to society, is very important and increasingly common. This transparency is important because of the need to gain legitimacy from various stakeholder groups [

17]. High stakeholder legitimacy can be achieved through socially responsible human resource management practices [

17].

Water and wastewater companies are increasingly reporting their commitment to environmental and social projects based on CSR concepts [

14,

17]. Kleinman et al.’s assessment of water reporting by selected U.S. companies in their CSR reports, using formal concept analysis, shows that the main focus of the companies is to set water quality strategies and sustainable water management goals [

17]. Additionally, matters such as partnerships, leadership, and employee engagement are also important [

21,

22]. In the context of meeting the needs of the stakeholders of an enterprise, the concept of corporate governance can be helpful and play an important role. As evident from the analysis of the literature, despite an increasing need to assess the activities carried out by enterprises for social business and sustainable development, there is still a lack of recognized methods for their assessment that take into account the specifics of the industry [

15,

17]. There is limited literature and research focusing on the social responsibility of water utilities [

23,

24]. Even less research is devoted to corporate governance, which is an important area of CSR [

25]. There are significant differences in the literature not only with regard to the theoretical framework and conceptualization of corporate governance, but also in terms of the methods used to measure it by different researchers [

26]. In conclusion, the authors of this article recognize the need to assess one of the main areas of CSR using the case study method, which allows for a deeper understanding of the studied phenomenon. Water and sewage enterprises were chosen as the subject of this study due to their important public role. Therefore, the main objective of this article is to assess the corporate governance structure in the water and sewage sector in the context of CSR, with particular emphasis on internal company practices. In the context of corporate governance assessment, aspects such as transparency of decision-making and communication, compliance with the code of ethics, compliance with legal regulations, focus on stakeholder needs, and employee motivation were analyzed.

The article is structured into six sections. It begins by highlighting issues focusing on the construct of corporate governance as a significant area of CSR.

The second section reviews the literature related to this topic, identifying the lack of literature on the construct of corporate governance and its application to water and wastewater enterprises, revealing a knowledge gap.

The third section presents the research methodology, specifying the objectives and research questions, as well as the research methods and tools. The research was conducted using the case study method in a selected water and wastewater enterprise operating in the Czech Republic. The opinions of managers and employees of the enterprise were studied based on a survey questionnaire for measuring the construct of corporate governance. The research presented in this article is part of an extensive research program undertaken by an interdisciplinary team of researchers from Poland and the Czech Republic in the areas of CSR, environmental awareness, sustainability, and energy management in water and wastewater companies.

The fourth section presents the results of the empirical research. This research contributes to the literature on corporate governance as an important area of the CSR concept. There is limited literature that specifically addresses corporate governance in water and wastewater companies. Previous research has primarily focused on assessing and promoting good practices in this area at the macro level. Part five discusses the research conducted, comparing it with the results of other studies and pointing out the limitations of the research. The article concludes with conclusions, recommendations, and directions for further research.

In the article, we draw attention to the great importance of companies operating in the water and wastewater sector and their impact on the environment and the quality of life of local societies around the world. In this regard, the topic of corporate governance discussed in the context of CSR in water and wastewater companies is of particular importance. We emphasize the need to deepen this topic through future empirical research and literary studies.

2. Literature Review

Upon analyzing the literature, it can be observed that corporate governance is of increasing interest to researchers in management and quality sciences, economics, environmental engineering, and energy, among others.

Recent research on corporate governance and corporate social responsibility (CSR) increasingly emphasizes their interrelationships, pointing out that corporate governance plays a fundamental role as a mechanism driving CSR practices [

27,

28,

29]. The links between these two constructs are highlighted, among others, by Jain, Zicari and Aguilera [

28], who reinterpret the CG–CSR relationship in the context of ESG (Environmental, Social, Governance) integration as a framework linking the two areas, confirming that properly constructed governance promotes the effective implementation of CSR. Corporate governance is a key framework for safeguarding the interests of various stakeholders and supporting the implementation of CSR strategies. From the perspective of stake-holder theory, governance through structures such as independent boards, committees, and stakeholder dialogue policies enables the identification, balancing, and consideration of the expectations of key groups, which directly supports the effective implementation of CSR [

30]. Institutional theory, on the other hand, suggests that organizations adapt governance mechanisms to gain legitimacy in the eyes of regulatory and social actors [

31].

Empirical research confirms that internal governance structures—such as the existence of appropriate committees, policies, and CSR strategies—significantly increase the scope and quality of CSR reporting [

27] and are strongly linked to engagement in ESG activities [

29]. This is particularly true for public utility sectors, such as water and sewage companies. Governance is becoming a key mechanism for integrating CSR strategy, including transparency and environmental responsibility. The water and sewage sector, due to its public mission and environmental sensitivity, is a particular field of analysis of CSR practices and, consequently, corporate governance. As demonstrated, these companies, especially those operating under municipal ownership models, are more likely to implement social responsibility mechanisms in response to stakeholder expectations and regulatory requirements [

32,

33]. These are also important corporate governance mechanisms. Furthermore, the implementation of innovations, including digitalization and artificial intelligence solutions, promotes better implementation of CSR concepts, ESG reporting, and operational efficiency [

34].

As a result, it can be concluded that both stakeholder theory and institutional theory explain that governance not only protects against conflicts, but also plays a strategic role in responding to social and regulatory expectations, leading to more credible and effective CSR practices. The results of a literature review [

35,

36,

37,

38], emphasize that the determinants of effective CSR implementation in the water and sewage sector include: form of ownership, stakeholder pressure, level of institutional development, and adaptation to sustainable development goals, especially SDG 6. In light of the above, the assessment of corporate governance in water and sewage companies as a fundamental element of CSR remains consistent with current research trends focused on integrating governance with environmental, social, and economic responsibility.

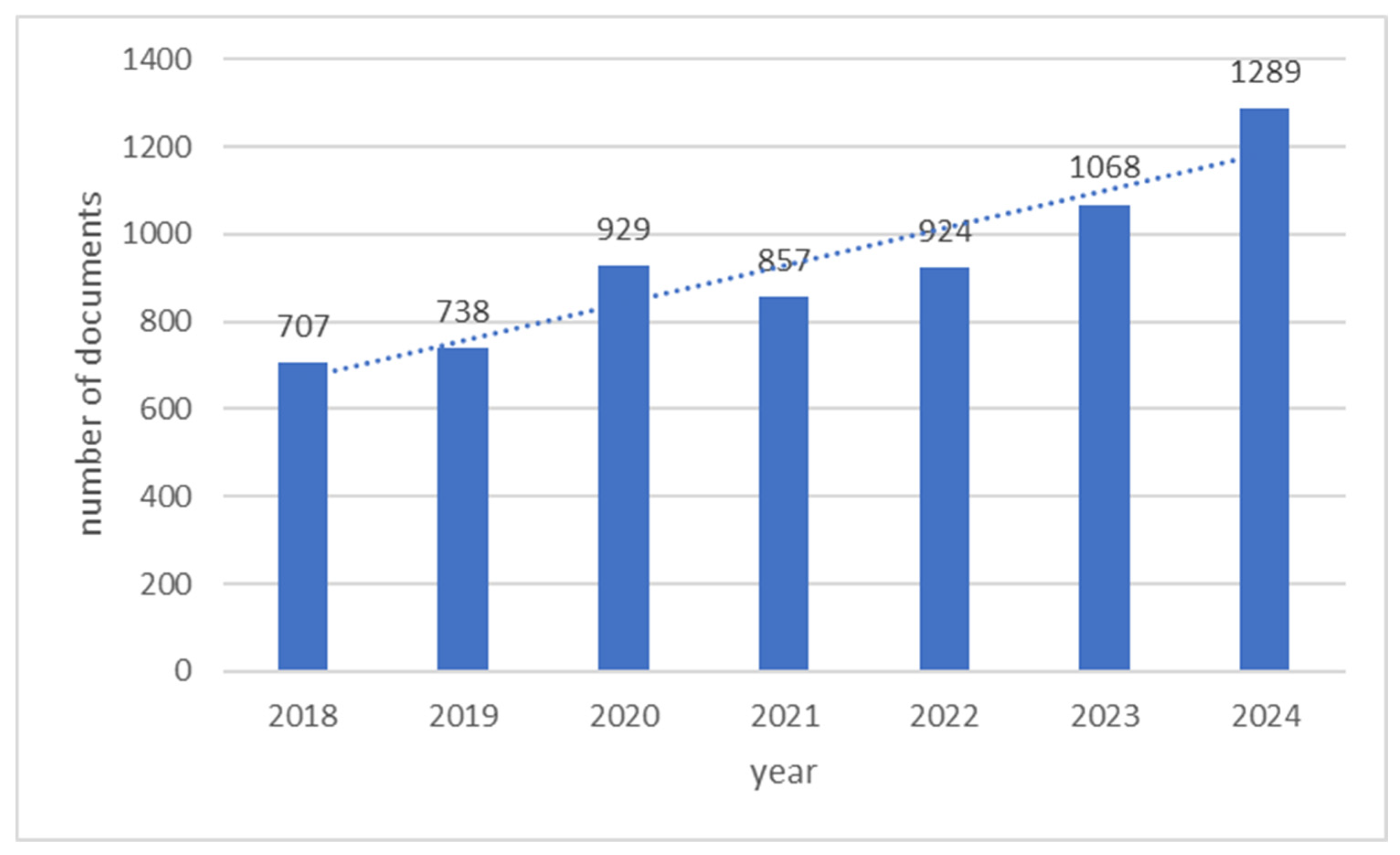

An analysis of articles from the Scopus database using the search term “corporate governance,” focused on journals and papers from the fields of business, management and accounting, social sciences, economics, econometrics and finance, environmental science, engineering, decision sciences, energy, covering the years 2018–2024 (

Figure 1) This analysis revealed a strong research interest in this area with an increasing linear trend.

As shown in the literature on the subject until recently, the term corporate governance was treated as a method that assured capital providers of a return on investment [

39,

40]. Today, however, the term is defined as a means to achieve various goals and expectations of stakeholder groups [

9], extending it to social and environmental issues [

36]. Based on the literature analysis, it can be assumed that a company with a high level of corporate governance will be more effective in addressing contemporary challenges, including those related to sustainable development and achieving intended results [

4,

6]. The goal of corporate governance is to help build an environment of transparency, trust, and accountability necessary to foster long-term investment, business integrity and financial stability, thereby supporting more inclusive societies and stronger growth [

10,

37].

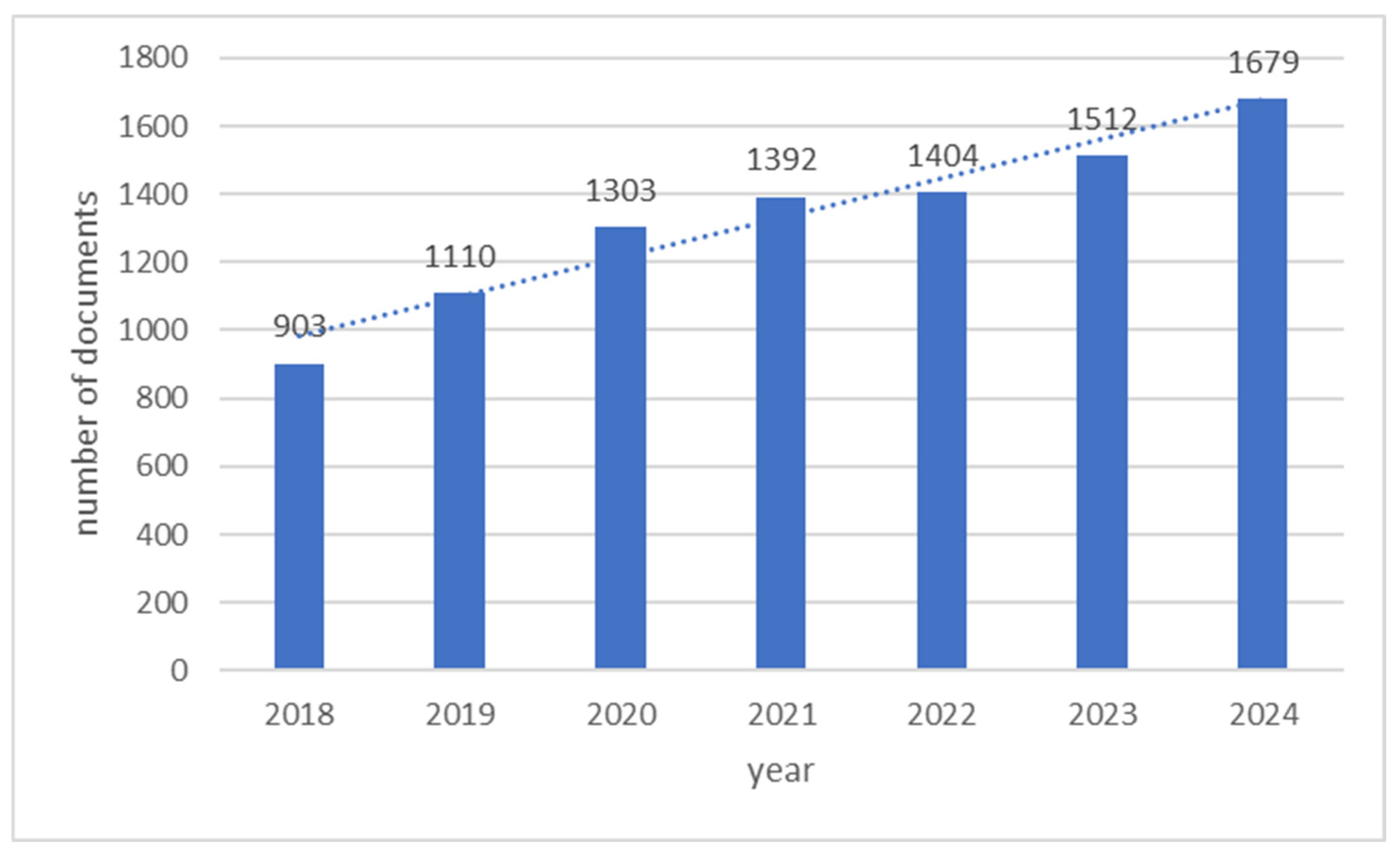

Corporate governance is considered one of the important areas of CSR [

38]. For this reason, a review of the literature on the concept of corporate social responsibility was conducted based on the Scopus database. The results of this analysis are presented in

Figure 2.

An analysis of titles of scientific articles from the Scopus database using the search term “Corporate Social Responsibility,” limited to journals and papers from the fields of business, management and accounting, social sciences, economics, econometrics and finance, environmental science, engineering, decision sciences, energy, covering the years 2018–2024., showed that this area is currently very attractive, as evidenced by the increasing number of publications over the years.

Within the literature, definitions of CSR vary depending on the research context and perspective. Some authors believe that CSR mainly refers to the ethical or ideological theory that companies, as well as individuals, have a responsibility toward society [

39,

40]. Other researchers, in addition to the ethical approach, emphasize the social, environmental, or partnership contexts [

41,

42,

43]. CSR is a concept in which companies voluntarily undertake activities aimed at social, economic, and environmental sustainability, while taking responsibility for their actions and impact on various stakeholder groups. An interesting definition of CSR is presented in the ISO 26000:2010 standard, which states that CSR is a commitment by an organization to integrate social and environmental aspects into its decision-making process. As can be seen from the above definition, corporate governance plays an important role in the context of CSR. It is related to organizations taking responsibility for the impact of these decisions and activities on society and the environment, taking into account the expectations of stakeholders. Such activities should strive for sustainable development while maintaining transparency [

44]. Today, many companies are committed to the CSR concept, as indicated by numerous international studies [

43,

45], as well as Polish [

46,

47,

48,

49] and Czech studies [

50,

51,

52]. This situation shows the continued importance and relevance of the development of the concept of social responsibility. Thus, corporate governance is an important issue to which managers of various organizations should pay attention.

In the context of an organization, corporate governance establishes the framework for its operation and contributes to its effective and efficient management. According to ISO 26000, corporate governance is the most important factor that enables an organization to take responsibility for the impact of its decisions and actions and to integrate social responsibility into the functioning of the entire organization and its relationships [

44]. Corporate governance is based on complex mechanisms and numerous conditions, such as the independence of the supervisory board, the functioning of committees, transparency, and accountability, which work synergistically to ensure effective monitoring and limit conflicts of interest [

53,

54]. A high level of corporate governance can be expressed through a transparent decision-making and communication process, in which the systematic disclosure of the motives and parameters of decisions increases stakeholder confidence and enables effective monitoring and control [

55].

Legal regulations are important in terms of corporate governance. Strict compliance with national law and international compliance standards, including anti-corruption procedures, is the foundation of an organization’s credibility and stability (Corporate governance requires compliance with international and domestic laws and regulations that market participants can rely on to establish legal relationships. The corporate governance framework typically includes elements of regulation, legislation, self-regulation, business practices and voluntary commitments [

37]. Corporate governance, as emphasized by Mohamed Adnan et al., can mitigate harmful cultural influences on CSR reporting [

56]. The role of corporate governance is to create and improve regulations, laws, and contracts for the operation of companies. This ensures that the interests of stakeholders and shareholders are reconciled, value is created for them and a transparent environment is maintained so that the corporation develops in a responsible manner [

57]. Hence, managers play a particularly important role in the context of corporate governance, as they are expected to be competent and able to identify and implement the organization’s priority goals [

58]. A literature analysis by Bolourian, Angus, and Alinaghian showed that two board attributes, namely board structure and board characteristics, interact to shape CSR performance [

26]. Managers are required, above all, to ensure a transparent decision-making process and to communicate their decisions. This means that managers should make decisions in a clear, transparent, and fair manner and make information available about why they were made, the options available, and the consequences. Managers are expected to “define roles and responsibilities, orient management toward a long-term vision of corporate performance, set proper resource allocation plans, contribute know-how, expertise, and external information, perform various watchdog functions, and lead the firm’s executives, managers, and employees in the desired direction” [

59]. This transparency in management contributes to better communication between different employees or departments in the organization [

60]. The motivation of subordinate employees also plays an important role [

61] because an effective motivation system is one of the basic determinants of organizational success [

62]. This includes various interactions with employees aimed at stimulating attitudes and behaviors desirable for achieving the organization’s goals. The active role of management in building a culture of ethical leadership, motivating employees, and supporting the distribution of organizational values promotes the internalization of governance principles and increases engagement [

63]. Finally, strong internal governance mechanisms, such as internal audit, board diversity structures, and appropriately sized management boards, significantly reduce the occurrence of irregularities and confirm the effectiveness of management [

64].

In the context of organizational governance when implementing CSR concepts, it is also important for a company to have a code of ethical conduct [

65]. This is a systematized set of norms and values that guides an organization by integrating employees around the ethical values of the company and shaping their attitudes and behaviors [

66]. A formal and actively implemented code of ethical conduct should be supported by independent committees and violation prevention programs linked to improved reporting quality [

67]. Companies with a well-formulated and implemented code of ethical conduct have lower capital costs and higher investor confidence [

68]. In addition, the institutional governance structure promotes communication policies and internal ethics—independent boards are more likely to update the code of ethics as a tool for internal communication [

69].

As corporate governance is linked to the concept of CSR, it can be concluded that stakeholders play an important role. A focus on stakeholder needs, in line with stakeholder theory, translates into better ethical and operational performance for companies operating in regulatory and social environments that require dialogue [

70]. Campbell [

71] emphasizes that the main tool of corporate governance is the board of directors, which is responsible for protecting the interests of an organization’s stakeholders. An important aspect of CSR is the formation of effective relationships with various stakeholder groups, including local communities and decision-makers [

72,

73]. Corporate governance in the context of CSR has a significant impact on value creation for various stakeholder groups [

74]. This is crucial for sectors such as water and wastewater companies that play a vital role in water supply and wastewater treatment, with a strong focus on environmental aspects [

75].

Based on the literature review, it can be concluded that when a water and sewage company is characterized by a transparent decision-making process, an effectively implemented code of ethics, strict compliance with the law, stakeholder-oriented activities, and strong and ethical leadership, there is a reasonable expectation that its corporate governance level is high. The presence of these mechanisms constitutes the theoretical foundation of high-quality corporate governance. Such a profile of activity corresponds to contemporary governance standards and is confirmed both in management theories and in empirical studies published in recognized scientific sources. In light of the above evidence, taking into account the integrated impact of the discussed factors on the level of corporate governance, it can be concluded that if these conditions are met in a given water and sewage company, there is justification for adopting the following hypothesis:

H1: The corporate governance of the water and sewage company under study is at a high level.

Literature analysis and empirical research indicate that corporate governance is a complex structure that encompasses many dimensions, such as decision-making processes, transparency, legal regulations, motivation, stakeholder relations, and others. The dimensions of organizational governance are therefore not uniform and often vary depending on the organizational context, sector of activity, and the specifics of the market and legal system in which the organization operates [

26,

76,

77]. They also have a varying impact on the functioning of the organization and on the achievement of goals such as efficiency, transparency, and social responsibility [

78,

79]. ISO 26000 also emphasizes that corporate governance cannot be viewed as a uniform mechanism, but as a multi-layered system that requires the coordination of various elements—legal, ethical, and operational—to effectively implement social and environmental responsibility (ISO 26000). Decision-making by management is the foundation of organizational transparency, which is linked to greater stakeholder trust and management effectiveness [

80]. A code of ethical conduct is an organization’s moral compass, shaping its culture and employee behavior, which directly influences value creation within the organization, including in relation to social responsibility [

81]. Compliance with the law ensures the legality of an organization’s operations, providing the basis for its functioning in the market and in international relations. Focusing on the needs of stakeholders indicates the company’s sensitivity to the expectations of various social groups and contributes to the long-term stability and success of the organization [

82]. Finally, the role of management in motivating employees is crucial for the efficient and effective functioning of the organization [

83]. It can be noted that each of these dimensions has a different character: operational, strategic, regulatory or relational, which makes them different from each other. This approach indicates potential differences in the functioning of particular dimensions of corporate governance. Different corporate governance models used in different countries and sectors demonstrate the diversity of its dimensions, which translates into different mechanisms of control, motivation, decision-making, and communication with stakeholders. This diversity suggests that there are differences between the various dimensions of corporate governance. The above arguments justify the adoption of hypothesis which assumes that:

H2: There are statistically significant differences between the various dimensions of corporate governance.

In the literature on the subject, many empirical studies indicate clear differences in the perception of corporate governance between organizational levels, with management generally evaluating it more favorably than other employees [

84,

85]. Analyses show that managers tend to perceive these mechanisms as more effective than assessments by lower-level staff indicate [

84]. The literature also emphasizes that these differences may result from different access to information, differences in its interpretation, and a better understanding of formal structures and mechanisms [

79]. Furthermore, studies focusing on regulated sectors—including the water and sanitation sector—suggest that managers may overestimate performance, while employees assess it more critically based on their daily operational experiences [

86]. This type of cognitive dissonance between groups operating at different levels of the organizational hierarchy forms the basis for testing statistical differences, which allows us to verify the hypothesis of significant differences in assessments between management and employees. In view of the above evidence, it is possible to formulate the following hypothesis:

H3: There are statistically significant differences in the assessment of corporate governance between management and other employees.

In water and sewage companies, where structures are formally implemented, their perception and interpretation may differ between management and other employees.

3. Methodology

The research process consisted of theoretical and cognitive research, identification of the knowledge gap, and research conducted using the case study method for a selected water and wastewater enterprise.

Systematic analysis of the literature allowed the use of clear techniques that facilitate the replication of the procedures used by the researcher [

87]. This research helped to systematize the concepts of CSR and corporate governance. Based on the theoretical and cognitive research, a cognitive gap was identified. This is because the literature broadly addresses corporate governance practices at the macro level, focusing on assessment and promotion, although there is a lack of research reflecting a narrow view of corporate governance at the micro level (i.e., within the company), especially in the area of water supply and sewage systems, that takes into account the integration of CSR with the functioning of the organization as a whole. To address this gap, based on the literature analysis, a study was undertaken to assess the construct of corporate governance in the water and wastewater sector. The concept of corporate governance research is based on the selection of indicators identified on the basis of a literature review, specifically based on the guidelines of ISO 26000, due to its comprehensive and internationally recognized nature in the field of social responsibility and corporate governance. This standard is also a voluntary but widely accepted standard that allows for the systematic and comparable assessment of an organization’s activities. As a result, the questionnaire developed on its basis can reliably and objectively measure various dimensions of corporate governance, ensuring both practical value for the organization and the credibility of the survey results. In addition, ISO 26000 is a standard developed on the basis of international consultations, which means that its recommendations are global in nature and can be applied in organizations from various industries. The choice of ISO 26000 for the development of a corporate governance measurement questionnaire therefore provides a solid theoretical and practical basis, ensuring that the tool adequately reflects the key elements of corporate governance and, at the same time, has universal application in both private and public organizations. Therefore, the choice of ISO 26000 is justified by its comprehensiveness, balanced approach, focus on stakeholder engagement, international recognition of the standard, and its role in raising awareness of social responsibility.

3.1. Population and Sample

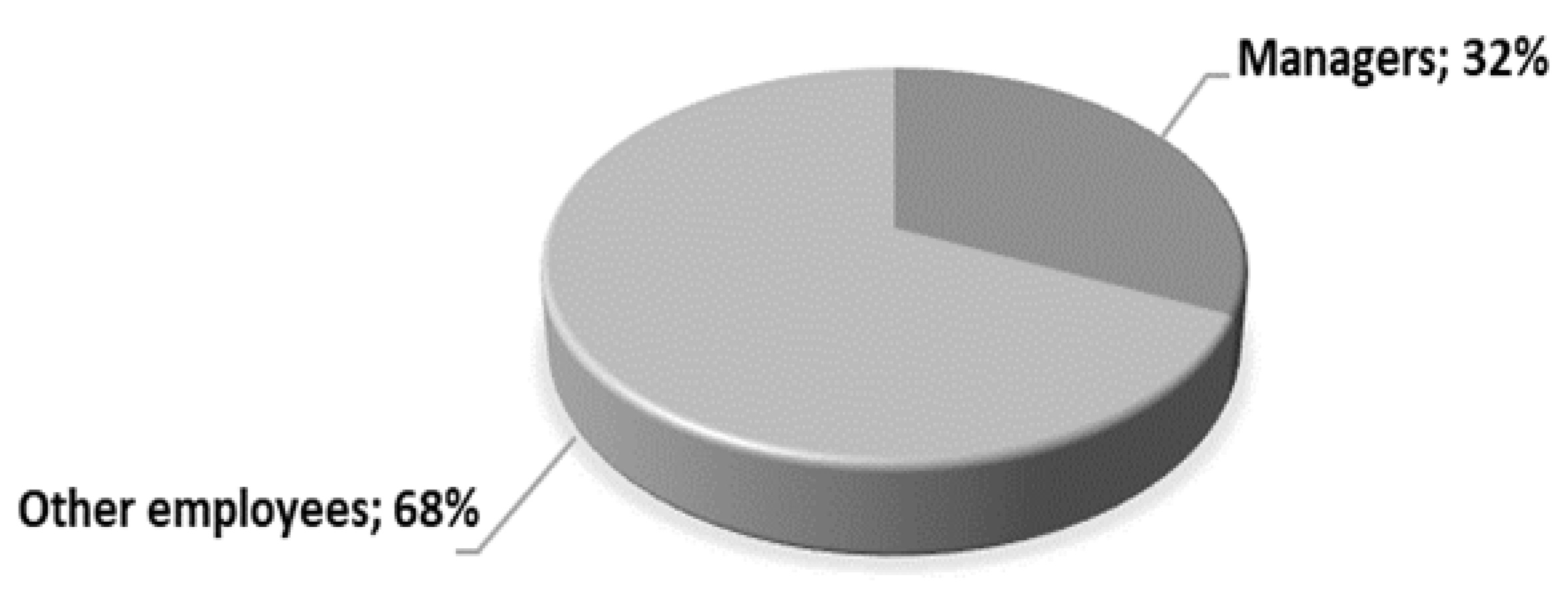

The surveyed group comprised n = 145 individuals, including management (n = 46) and other employees (n = 99). Of the 150 surveys distributed, five were rejected due to missing responses after formal and substantive review, leaving 145 correctly completed questionnaires. The final response rate was 96.7%. The sample size for the entire company’s employee population (approximately 800) was 18.1%. The study group included 46 individuals holding managerial positions (31.7%) and 99 individuals from other organizational levels (68.3%). The distribution of respondents’ answers according to their positions is presented in

Figure 3: 32% of respondents were managers, whereas 68% were other employees of the company.

3.2. Variables and Indicators

From the main objective of this study, the following specific objectives were formulated:

Identification of corporate governance dimensions.

Assessment of corporate governance as perceived by employees of the surveyed company.

Formulation of recommendations for management.

Another method used in this study was the case study method, which is a qualitative research approach. The case study design is particularly suitable when there are a large number of variables in a small number of applied units of analysis and when context plays an important role [

88]. This method is based on empirical inference about a phenomenon in its natural context, when the boundary between the case and its context cannot be clearly defined [

89]. The selection of one company and its analysis using the case study methodology resulted from the need for in-depth analysis and the significance of the case studied—and the results obtained can serve as a reference point for further comparative studies.

The study was based on solving the research problem, which was defined in the form of the following question: How is the level of corporate governance shaped in the studied water and sewage enterprise? Specific research questions were also developed:

What are the individual dimensions of corporate governance?

Are there differences between the individual dimensions of corporate governance?

Are there differences of opinion between management and other employees in their perception of the level of individual dimensions of corporate governance?

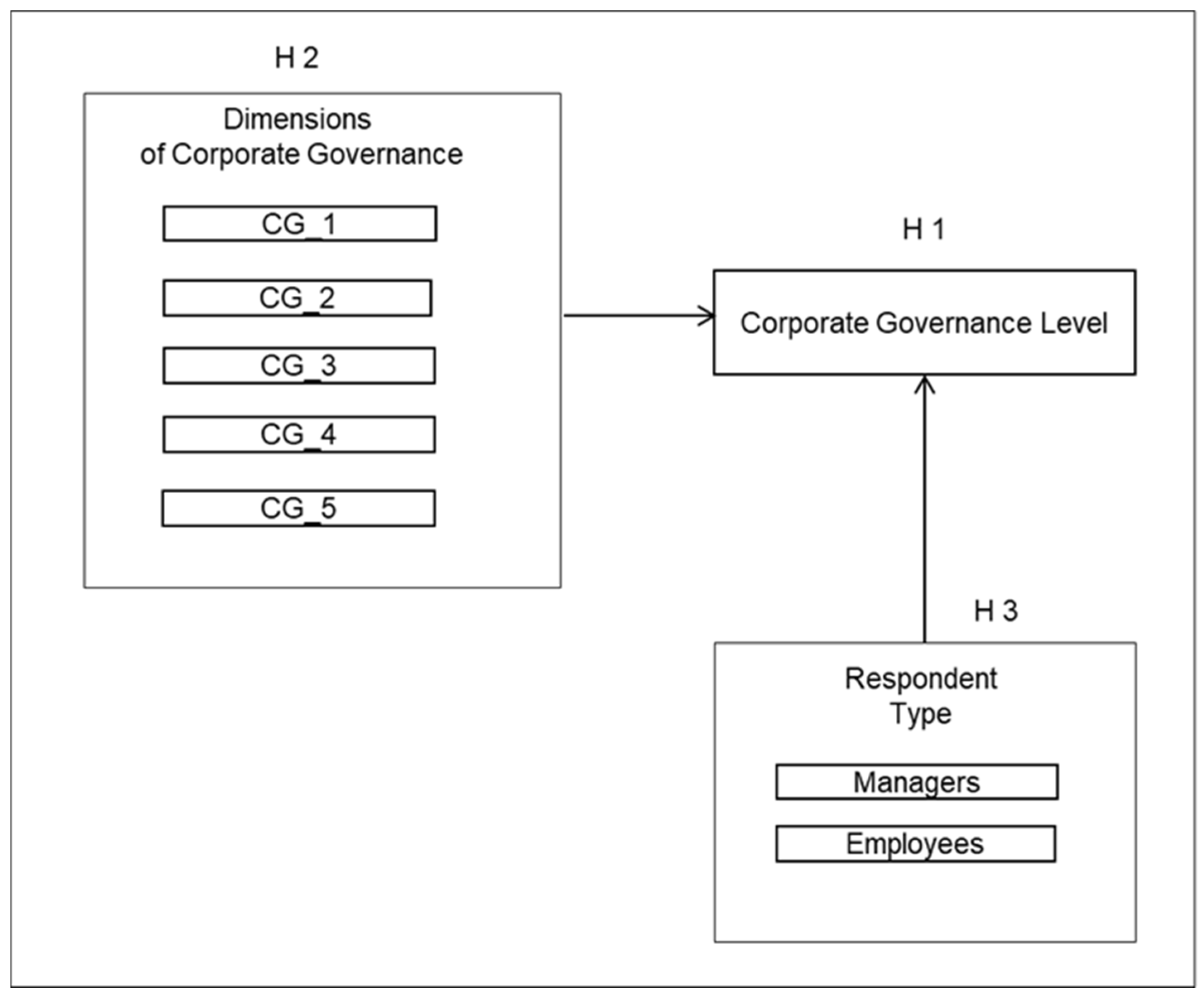

Based on a literature review, the following research hypotheses were formulated and verified in empirical research using a questionnaire:

H1: The corporate governance of the water and sewage company under study is at a high level.

H2: There are statistically significant differences between the various dimensions of corporate governance.

H3: There are statistically significant differences in the assessment of the level of corporate governance between management and other employees.

Figure 4 below presents a diagram illustrating the hypotheses under investigation. This diagram shows the impact of individual dimensions of corporate governance on its overall level and the differences between these dimensions and groups of respondents (managers, employees). The research model is based on an analysis of the perception of the following five dimensions of corporate governance treated as components of one overarching variable:

- –

CG_1—The company has a transparent decision-making and communication process.

- –

CG_2—The company has a code of ethical conduct in place.

- –

CG_3—The company complies with national and international law.

- –

CG_4—The company is oriented towards the needs of its stakeholders.

- –

CG_5—Management plays an important role in motivating employees.

3.3. The Characteristics of the Questionnaire and How It Was Conducted

The research hypotheses were verified in empirical studies. The level of corporate governance is assessed on a five-point Likert scale using a questionnaire. The questionnaire used to measure the construct of corporate governance was developed based on the ISO 26000 standard, due to its comprehensive and internationally recognized nature in the field of social responsibility and corporate governance. This standard is also a voluntary but widely accepted standard that allows for the systematic and comparable assessment of an organization’s activities. As a result, the questionnaire developed on its basis can reliably and objectively measure various dimensions of corporate governance, ensuring both practical value for the organization and the credibility of the survey results. In addition, ISO 26000 is a standard developed on the basis of international consultations, which means that its recommendations are global in nature and can be applied in organizations from various industries. The choice of ISO 26000 for the development of the corporate governance measurement questionnaire therefore provides a solid theoretical and practical basis, ensuring that the tool adequately reflects the key elements of corporate governance and is universally applicable in both private and public organizations.

A 5-point Likert scale was used to rank employees’ perception of the level of corporate governance and its occurrence in the diagnosed enterprise. By evaluating the level of corporate governance using the arithmetic mean, the following interpretation was adopted the individual values:

- 1—

The level of corporate governance is very low.

- 2—

The level of corporate governance is low.

- 3—

The level of corporate governance is average.

- 4—

The level of organizational order is high.

- 5—

The level of organizational order is very high.

The research was conducted using a standardized questionnaire, employing the CAWI (Computer Assisted Web Interview) method, which involves collecting data electronically via the Internet.

The research subject was a purposefully selected Czech water company operating in the Czech Republic. It serves as an example of a company operating in the specific regulatory and market conditions typical of the water and wastewater sector. This selection was justified by the company’s significant market share, its implementation of innovative water and wastewater management solutions, and its typical organizational structure. One large regional water and sewage company with many branches was selected for the research model, as this allows for the examination of five dimensions of corporate governance (CG_1–CG_5) within a uniform system of rules and procedures, thereby eliminating inter-organizational variability (different codes, policies, ownership structures). At the same time, the diversity of local conditions (specificity of markets, infrastructure, regulatory environment), different managers, and diverse branch strategies generate sufficient internal variability to enable comparative testing within a single organization without changing the corporate governance framework. This selection increases internal validity (fixed governance rules, consistent code of ethics, uniform compliance mechanisms), facilitates access to consistent data and documents, and allows for a reliable assessment of the consistency of perceptions CG_1–CG_5 against the backdrop of diverse operational realities. Statistical extrapolation to other companies remains a limitation.

3.4. Description of Statistical Techniques Used

A factor analysis was conducted to verify the accuracy of the selection of variables representing individual dimensions of corporate governance. Prior to the analysis, the adequacy of the data was assessed using the Kaiser–Meyer–Olkin (KMO) measure and Bartlett’s sphericity test. The number of factors identified was determined based on Kaiser’s criterion, which only took into account those components whose eigenvalues exceeded 1. Variables whose factor loadings for all identified factors were lower than 0.6 were excluded from further analysis in the description of the corporate governance dimension. The reliability of the measurement scale for each factor was assessed using Cronbach’s alpha coefficient. To verify hypotheses H1 and H3, descriptive statistics were analyzed and the normality of the distribution of the variable describing corporate governance was assessed using the chi-square test. Hypothesis H2 was verified using a non-parametric, one-way analysis of variance, performed using the Kruskal–Wallis test.

4. Empirical Results and Analysis

Factor analysis was used to validate the selection of variables representing individual elements of corporate governance. This was preceded by calculating the Kaiser–Meyer–Olkin (KMO) measure and conducting Bartlett’s sphericity test. These measures provide information on whether reducing variables makes sense and whether it will have the expected effects. The KMO coefficient compares partial correlations with bivariate correlation coefficients. It may take values in the range of 0 to 1. Lower scores indicate that the potential for a reduction in variables will be small. A KMO score ≥0.5 is assumed to indicate a satisfactory reduction in variables. The higher the score, the stronger the relationship between the variables can be considered to exist. The results obtained in the study (0.746) clearly indicate the validity of the analyses performed and the appropriateness of the choice of variables adopted. Bartlett’s sphericity test examines whether significant correlations exist between variables by testing whether the correlation matrix is a unit matrix. In the case of a significant test result, the hypothesis is rejected, and it is considered that there are correlations between variables, that is, there are hidden factors [

90]. The results of Bartlett’s sphericity test are presented in

Table 1.

The presented results correlate with KMO values, and therefore the Bartlett test confirms the applicability of factor analysis. Factor analysis was then conducted for all corporate governance factors. The analyzed factors were assumed to be single-factor constructs. Factor loadings are presented in

Table 2.

Based on calculations using the data presented in the table, the defined factor for the dimension of corporate governance explains 60.08% of the initial variance of the variables. The Cronbach’s α coefficient for the analyzed scale was 0.825, and removing any variable would not increase this coefficient value. The analyses carried out made it possible to verify the hypotheses, the interpretation and justification of which are discussed in detail later in the article. To verify hypothesis H1, which assumes that the corporate governance of the company under study is at a high level, descriptive statistics were analyzed.

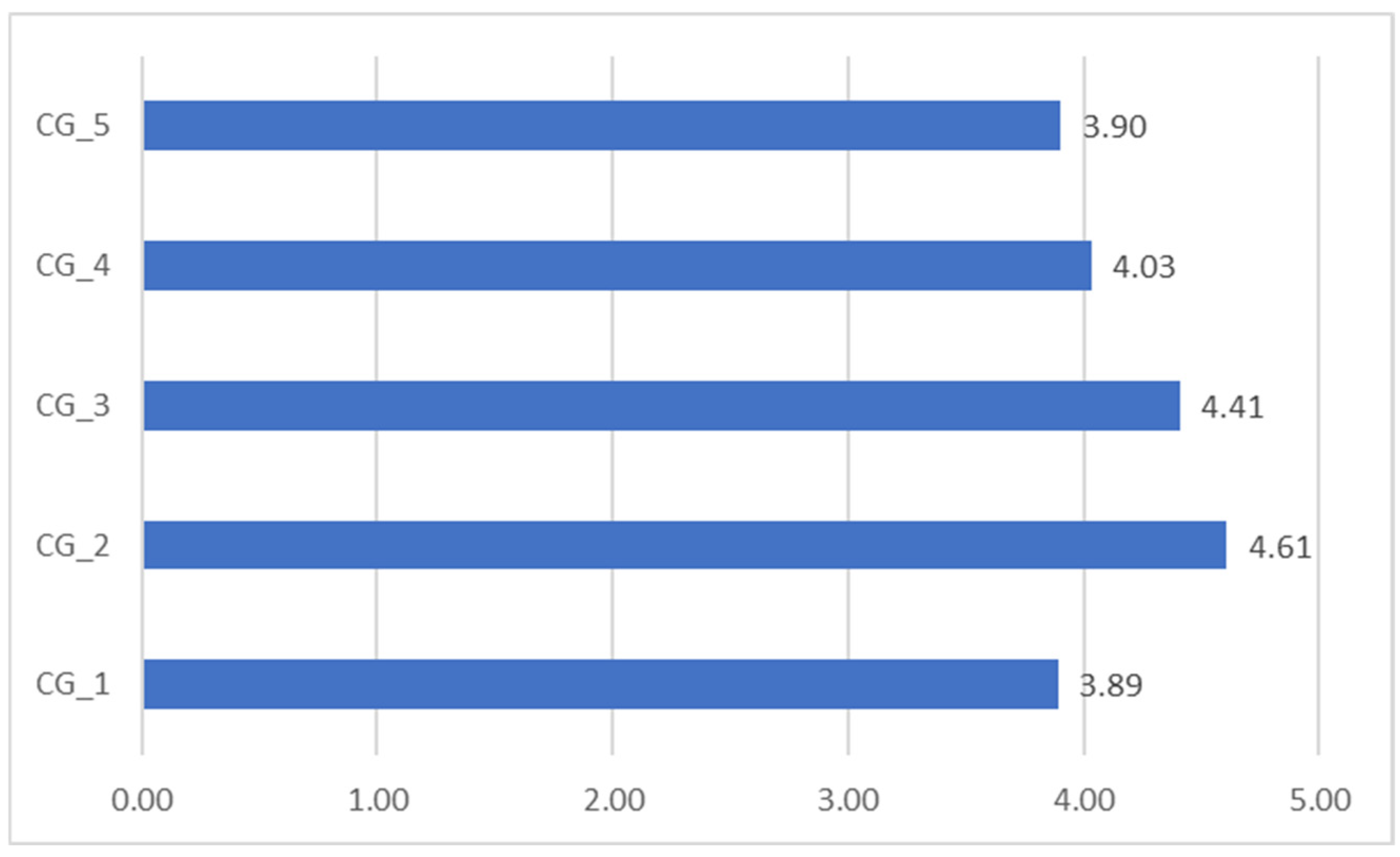

Specific descriptive statistics for the area of corporate governance are presented in

Table 3 and

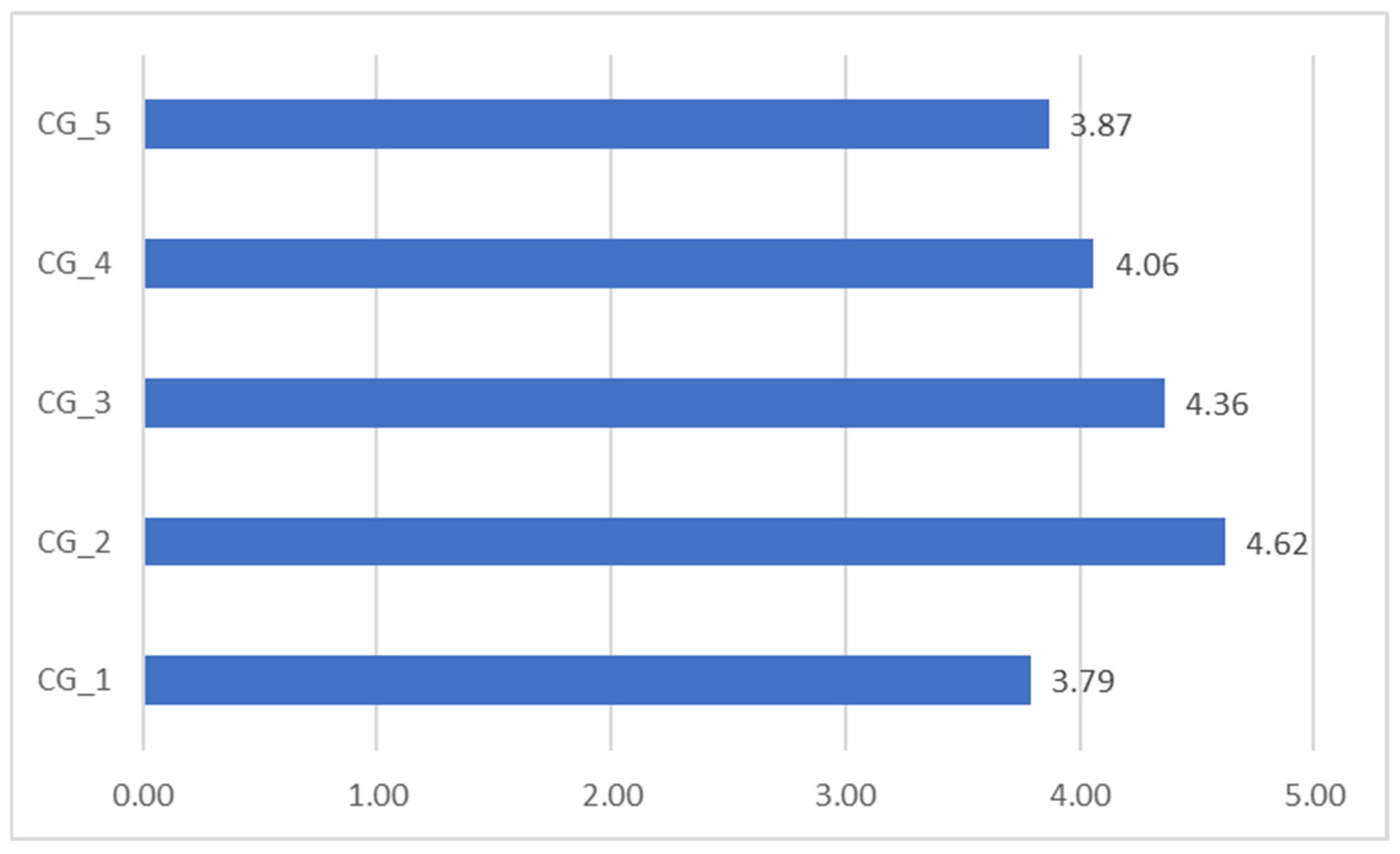

Figure 5.

The results presented in

Table 3 indicate that the highest average values (mean and median) were observed for two variables: ‘CG_2 (median = 5.0, mean = 4.61, and standard deviation S2 = 0.63) and ‘CG_3 (median 5.0, mean = 4.11, and S2 = 0.70). These dimensions are, therefore, considered to be implemented at a very high level from the staff’s and managers’ perspectives.

The lowest mean value, 3.89, was observed for the variable CG_1 (median = 4.0, mean = 4.61, and S2 = 0.83). This dimension, therefore, is perceived to be implemented at a lower level from the staff’s perspective. Transparent communication builds a foundation of trust within organizations. When leaders and team members openly share information about evolving business needs, it creates an environment of honesty and credibility. Regarding the measure of variability in relation to the mean, the coefficient of variation (CV) took values in the range of 13.61 to 22.66 for all dimensions analyzed. Based on the data presented in

Table 3, the arithmetic means for all corporate governance dimensions are shown in

Figure 4. It can be concluded that the overall level of corporate governance was relatively high (4.17).

This situation indicates that the dimensions of corporate governance were at a relatively high level.

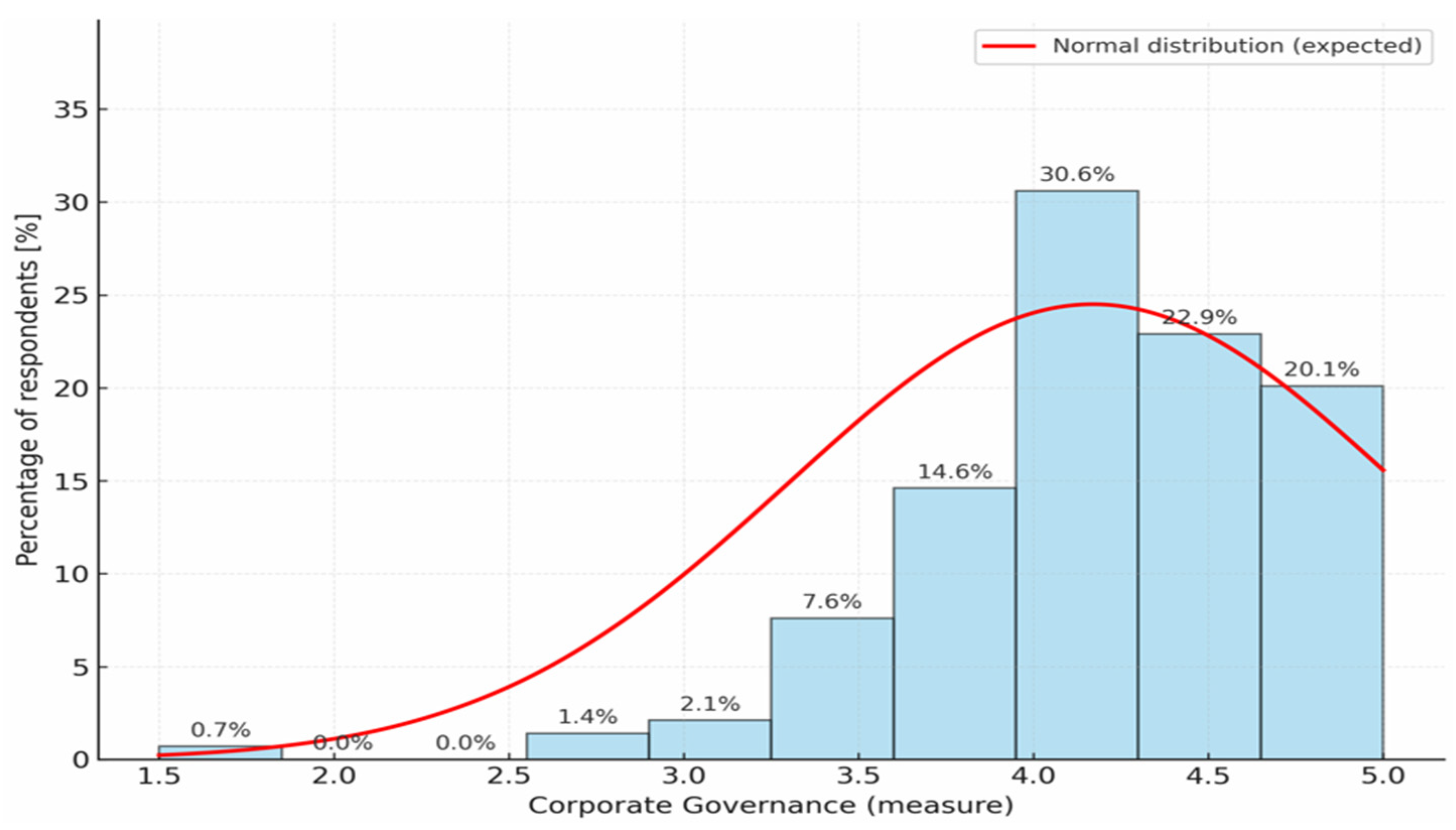

Figure 6 presents the results of testing the hypothesis regarding the normal distribution of the corporate governance construct using the chi-square test. The histogram provides a clear visualization of the distribution of the tested variable. The percentage distribution of responses (blue bars) indicates the percentage of respondents who rated the level of corporate governance within a given range. The red line represents the theoretical normal distribution (expected in the chi-square test). Based on the obtained results, it can be concluded that most ratings are concentrated around values of 4.0–4.5 (over 40% of respondents), while ratings below 3.5 constitute less than 15%. The distribution is asymmetric and creates a right-skewed asymmetry, meaning that most scores are concentrated in the upper range of the scale, with fewer scores occurring at the lower end. This situation indicates that respondents rate the level of corporate governance highly. Based on the obtained results, hypothesis H1 was confirmed.

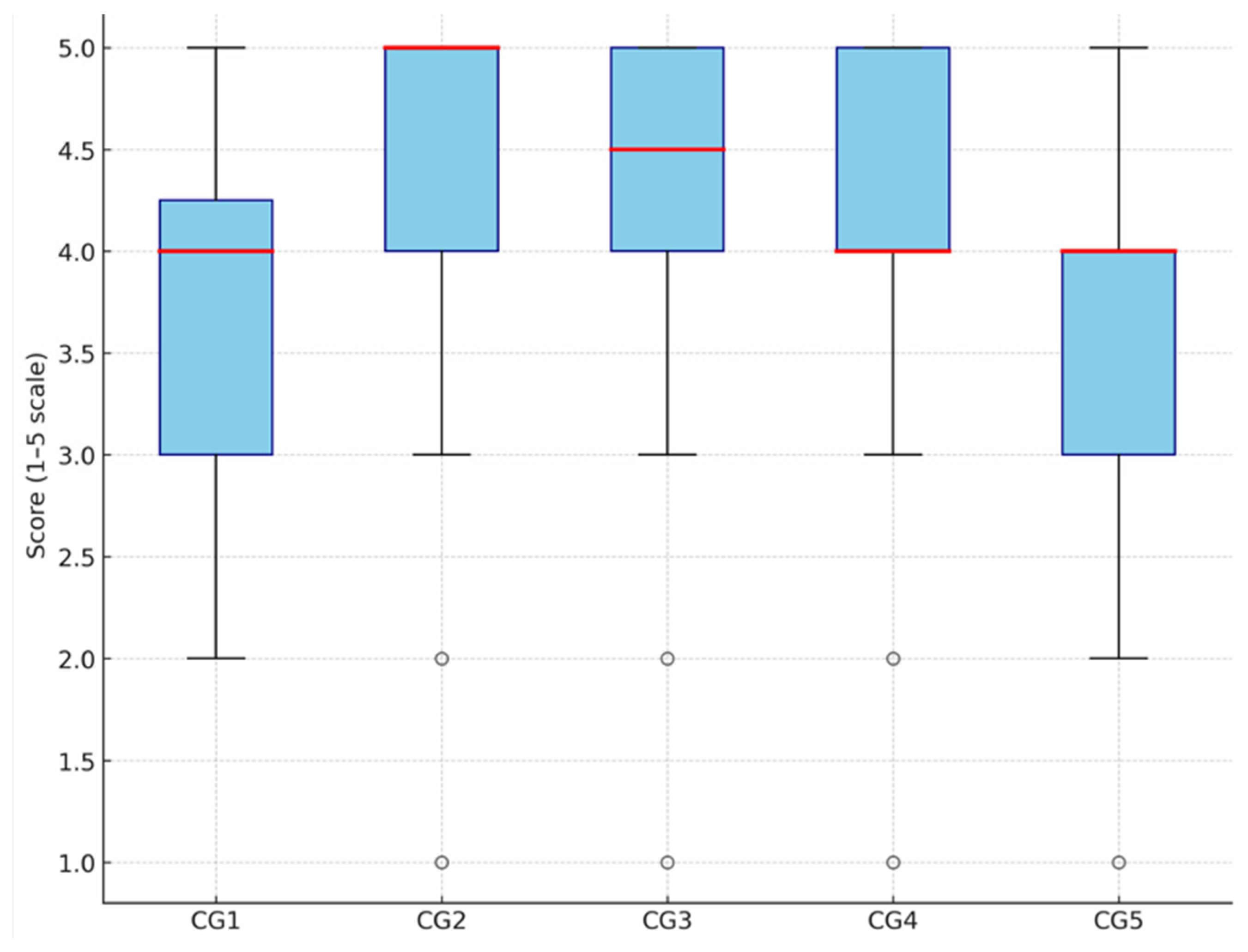

To verify hypothesis H2, which assumed statistically significant differences between the analyzed dimensions of corporate governance, a nonparametric one-way analysis of variance based on the Kruskal–Wallis test was used. This method was justified by the failure to meet key assumptions of traditional ANOVA analysis, particularly regarding normality of the distribution of variables and homogeneity of variance. The Kruskal–Wallis test allowed for a reliable assessment of differences between groups while maintaining the robustness of the analysis to deviations from classical statistical assumptions, which increases the credibility of the obtained results. The test results are presented in

Figure 7.

Testing using the Kruskal–Wallis statistic revealed statistically significant differences between the perceptions of individual dimensions of corporate governance. The results of nonparametric one-way analysis of variance for the obtained data are as follows: H test = 98.87 and p < 0.001. The distribution of ratings for all five dimensions of corporate governance is characterized by the fact that the median for the CG1 dimension is closer to 4, but with a wide range of responses. CG2 shows the highest values, with most responses falling in the 4–5 range. CG3 shows values as high as CG2, with a very small number of lower ratings. CG4, on the other hand, shows a median around 4, with some lower ratings. CG5 is similar to CG1, with a relatively greater range of responses. In summary, dimensions CG2 and CG3 received the highest ratings, while CG1 and CG5 received the most varied ratings and were more often rated lower. Based on this, it can be concluded that within the individual dimensions of corporate governance, there are significant differences in the ratings of the levels of individual dimensions. To determine which dimensions differ from the others, a post hoc test was conducted. The p-values of the probabilities for multiple comparisons allowed the following conclusion to be drawn: the ratings for dimensions such as CG1, CG4, and CG5 were significantly lower than the ratings for dimensions CG2 and CG3. No significant differences were found between dimensions CG1, CG4, and CG5, nor between dimensions CG2 and CG3. In summary, the presented results confirm hypothesis H2, indicating statistically significant differences between the individual dimensions of corporate governance.

In order to verify hypothesis H3, which assumes that there are statistically significant differences in the assessment of corporate governance between management and other employees, a descriptive statistical analysis was conducted. The

Table 4 below presents detailed results of responses from managers and other employees based on the arithmetic mean and median.

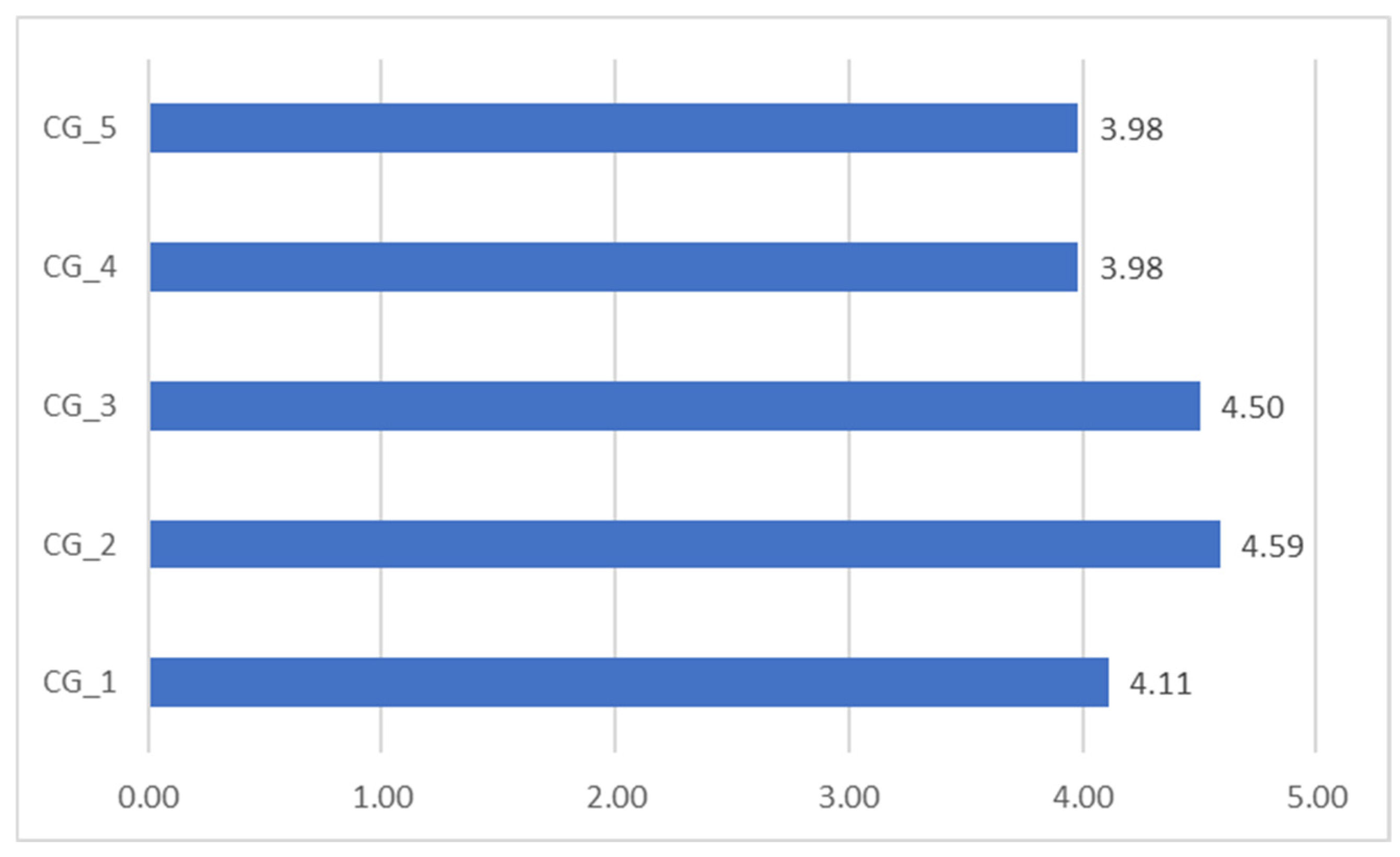

A detailed analysis based on the arithmetic mean showed that managers rated the corporate governance factor CG_2—code of ethics—the highest (4.59), and CG_3—focus on respect for the law (4.50). The factor CG_1—transparent decision-making process—ranked slightly lower (4.11). Two factors received the lowest ratings: CG_5, related to managers’ role in motivating employees (3.98), and CG_4—the company’s orientation toward stakeholder needs (3.98). Managers’ opinions are presented in

Figure 8.

To compare the results of the survey between the two groups (i.e., between managers and other employees), an analysis was conducted of the answers given by other employees in the company. These results are presented in

Figure 9.

Based on the arithmetic mean analysis, it can be concluded that managers and other employees of the enterprise rated the corporate governance factors similarly. The highest rating was given to factor CG_2, of the company having a code of ethics (4.62), and factor CG_3, focusing on compliance with the law (4.36). Slightly lower scores were given to factor CG_4, on stakeholder orientation (4.06), factor CG_5, related to the motivation of employees by management (3.87), and CG_1 on transparent communication and decision-making (3.79). Despite the lack of important outliers, the decision was made to analyze not only the mean value but also the median. Comparing the median values presented in

Table 4 for the individual variables for managers and other employees, one can see discrepancies in the answers given between managers (median = 5.0) and other employees (median = 4.0) regarding ‘The enterprise respects the regulations of national and international law’ and the monitoring of activities related to the social responsibility of the business.

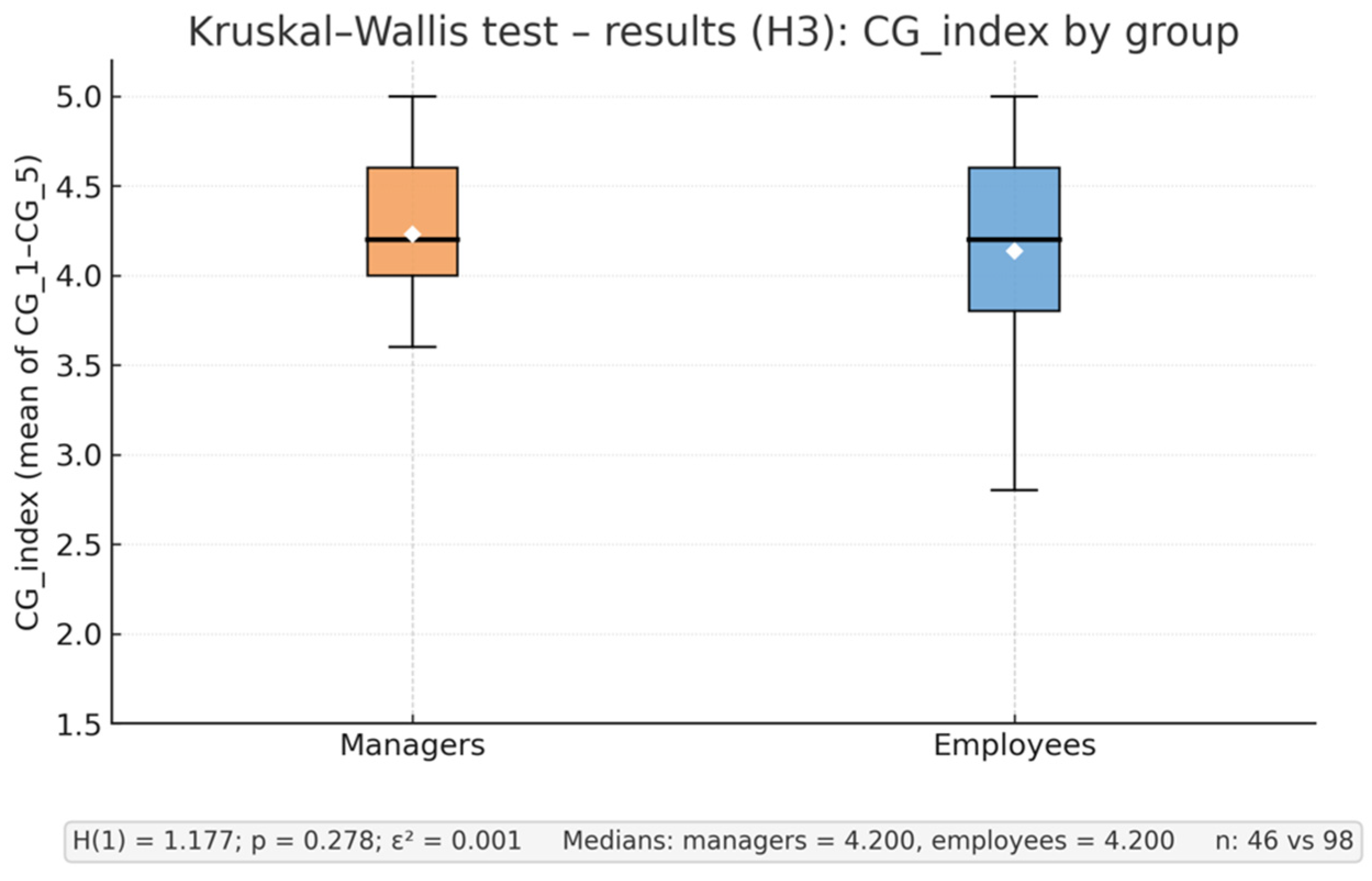

To verify hypothesis H3, which posited statistically significant differences in the level of corporate governance between managers and other employees, we employed a nonparametric one-way analysis of variance based on the Kruskal–Wallis test, owing to violations of key ANOVA assumptions. The outcome variable was CG_index, defined as the mean of the five items CG_1–CG_5 for each respondent. The results are presented in

Figure 10.

The Kruskal–Wallis test indicated no statistically significant differences between the groups: H(1) = 1.177; p = 0.278. The medians (IQR) were, respectively, managers 4.20 (0.60) vs. employees 4.20 (0.80). The effect size, estimated as ε2 ≈ 0.001 (η2_H ≈ 0.001), was negligible, corroborating the absence of meaningful differences in the perception of corporate governance between the groups. Since only two groups were compared, no post hoc tests were conducted. Based on the analyses conducted, it can be concluded that the assessments of individual dimensions of corporate governance formulated by managers and employees of the surveyed organization do not differ in a statistically significant manner. Therefore, the hypothesis H3 assuming the existence of such differences has not been confirmed.

5. Discussion

The conducted research indicates the necessity and timeliness of the subject matter undertaken and contributes to the development of the concept of corporate governance as one of the main areas of social responsibility. The results obtained fill the identified gap. Based on this main objective, specific objectives were formulated: to identify the factors of corporate governance, to assess this construct using the opinions of the employees of the company under study, and to formulate recommendations for management. The main objective and specific objectives were achieved through the analysis and theoretical considerations, as well as empirical research. The article addresses a research problem focusing on the assess of the level of corporate governance in the water and sewerage company under study. The specific research questions concerned the individual corporate governance factors level and any differences in opinion between managers and other employees regarding the evaluation of these factors. The empirical analyses conducted made it possible to answer the research questions and verify the research hypotheses.

Corporate governance is a multidimensional concept whose meaning and scope have evolved alongside the development of management theory and economic practices. It encompasses a range of mechanisms and processes for the effective management of companies, with particular emphasis on protecting the interests of various stakeholders—shareholders, management, employees, customers, suppliers, and local communities.

The results obtained confirmed that the level of organizational governance in the company under study is high (H1), which is conducive to the development of the CSR concept. The authors’ research also showed that the level of perception of organizational governance in the opinion of managers and other employees is at a similar level (H3). There was only a slight (statistically insignificant) discrepancy in the responses given by managers and other employees with regard to compliance with national and international law. This situation may be related to the fact that some of the employees surveyed had a lower awareness of legal regulations in the organization. The consistency in the other responses indicates that employees recognize that the way the organization is managed enables the effective implementation and monitoring of corporate social responsibility activities. Analysis of other authors’ research indicates that organizational governance plays a positive role in achieving CSR results. Ainy and Said, conducting research on the 100 largest manufacturing companies, showed that companies with higher standards of governance and better CSR communication achieve better operating results [

91]. Tanjung, in turn, conducted research on the identification of determining factors and the assessment of the level of compliance with corporate governance (CG) principles in Indonesian companies. Research indicates that firms with a high degree of compliance with corporate governance principles display better metrics related to financial stability, effective leadership, and ownership oversight [

92]. The results confirmed a high level of organizational order in the studied company, which supports the development of the concept of CSR. Similarly, a review by Jain and Jamali found a positive role of corporate governance on CSR performance at three levels of a company (whole company, group, and individual) [

93]. In a study on corporate governance in the context of sustainability, Naciti [

4] found that the composition of a board of directors influences corporate performance. Institutional research confirms that high governance quality indicators (CGI—Corporate Governance Index) are closely related to board accountability and the presence of independent committees. The high level of corporate governance of companies, particularly in sectors with social missions such as water and sewage companies, is not commonly observed. Despite the existing research on corporate governance and CSR there are inconsistencies, unresolved issues, and no consensus on measurable impacts [

26]. For example, Arnold surveyed German water supply and distribution companies about their CSR and found that elements of ISO 26000, sustainable management systems, and energy use were only marginally covered [

94]. In another study on accountability in water management, Lambooy [

15] reported difficulties in defining boundaries between public and corporate accountability with regard to the impact of companies on water quality. This was attributed to differences across countries regarding policies and legislation on water and wastewater management [

15]. Goud conducted research on corporate governance in relation to carbon dioxide emission policy, which will be of significant importance for decision-makers and stakeholders in using effective corporate governance mechanisms in the near future [

7]. Research shows that a high level of corporate governance in enterprises promotes effective management, financial stability, and the achievement of CSR goals. At the same time, in sectors with strong social engagement, such as water management, limitations and inconsistencies in the implementation of corporate governance practices are still observed, resulting from, among other things, regulatory differences and difficulties in defining public versus corporate responsibility. Research clearly indicates that corporate governance cannot be treated as a homogeneous phenomenon, as it consists of many factors with different natures, functions, and significance for the organization. Individual governance elements may play different roles in shaping management effectiveness, operational transparency, protecting shareholder interests, and implementing the company’s strategy, including sustainable development strategies. The conducted research demonstrated statistically significant differences between various dimensions of corporate governance (H2). This point is also highlighted by other authors. In their research on corporate governance indices, Tipurić, Dvorsk, and Delić [

95] emphasize that the construction of measurement tools requires consideration of at least three distinct dimensions: compliance, performance, and accountability. Each dimension relates to different aspects of an organization’s functioning—compliance is associated with adherence to regulations and standards, performance with operational effectiveness, and accountability with responsibility to stakeholders [

95]. Other researchers have identified areas of organizational governance such as accountability, transparency, engagement, structure, effectiveness, and power. Accordingly, the understanding of corporate governance is highly contextual and dependent on the industry in which the company operates. Therefore, the authors suggest treating governance as a multifaceted phenomenon [

96]. Rahman and Khatun, who reviewed research on corporate governance, reached similar conclusions, pointing to significant variation in the factors considered when assessing it. These differences are significant because they can lead to a high risk of interpretational bias when comparing organizational governance across countries, economic sectors, and companies [

96]. Individual areas of organizational governance may differ in their importance, implementation methods, and impact on organizational performance. This diversity stems not only from different research methodologies but also from the specificities of the sectors, regulatory systems, and organizational cultures. Corporate governance in the water and sewage sector is characterized by specific characteristics stemming from the sector’s public mission, its complex ownership structures, and strong regulatory and environmental constraints. C. Boada analyzed corporate governance mechanisms and activities in water and sewage companies, including those in Latin America, emphasizing their role in ensuring transparency, responsible management, efficient and sustainable use of water resources, and achieving social development goals [

97]. Similar conclusions were presented by Agovino et al. [

22], who conducted research in water companies in Naples, emphasizing that corporate governance contributes to economic efficiency and also favors the social and environmental aspects of the company’s operations [

22]. The Reports of the Global Commission on the Economics of Water [

98,

99,

100,

101,

102] shows that water utilities often remain state-owned enterprises, where transparency, accountability, and professional management with a focus on the common good are key governance aspects. Furthermore, utilities in this sector are required to simultaneously pursue environmental and social goals, which requires the use of management models that consider efficiency, accessibility, and social justice [

98,

103]. It should also be noted that these utilities are characterized by structural complexity in terms of ownership and oversight. They often operate as independent entities but remain under the supervision of local authorities, which can lead to the so-called multiple-agent problem and hinder clear assignment of responsibility and effective management [

99]. Corporate governance in the water sector must therefore integrate specific requirements: the implementation of a public mission, a corporate structure with limited market share, and regulatory mechanisms that enable a balance between operational efficiency and social values. The authors’ research on the identification and assessment of organizational governance as a key element of corporate social responsibility in water and sewage companies expands knowledge in this area. Previous analyses of this type in the water sector have been sparse and fragmented. Entities in this sector pursuing a social and environmental mission require special attention in assessing corporate governance and management mechanisms. This research therefore expands knowledge on how good corporate governance practices promote not only stability and efficiency but also social responsibility in a sector crucial to quality of life and sustainable development. The study’s findings provide further directions for future research, which largely stem from the limitations of the research conducted. A limitation of the empirical research was its focus on a single, purposefully selected water and sewage company operating in the Czech Republic. The case study method employed limits the generalizability of the results to a broader context. This means that conclusions may be specific to a single organizational structure, local regulatory conditions, or management culture. Corporate governance is associated with certain cultural, social, institutional, and legal conditions, which may be unique to a given country. This may limit the applicability of the research findings to other countries. However, the methodology employed can be applied to other case studies in the water and sewage industry, as well as to companies from other industries. Therefore, future research could be conducted in other companies in the water and sewage industry and in other regions and countries, which would allow for greater generalization of the findings. Another limitation is the risk of errors in the data obtained from the participants. The opinions of managers and employees may have been shaped by subjective perceptions of governance mechanisms, as well as a tendency to present the organization from a more favorable perspective. Therefore, it is recommended that future research triangulate data sources by combining surveys with internal document analysis, audits, or participant observation. This would allow for greater objectivity in the results. Another limitation is the representativeness of the sample. The number of respondents and the structure of the study group may not fully reflect the diversity of opinions among employees, particularly in organizations with high complexity and diverse functions. It should also be emphasized that the specific nature of the water and sewage sector, which is highly regulated and pursues a public mission, means that the observed corporate governance mechanisms may differ from those identified in, for example, private enterprises or other industries. The conducted research prepares the ground for further, broader research on the concept of corporate governance in water utilities, taking into account specific areas such as human rights, fair operating practices, the environment, labor practices, and consumer issues. Initially, it would be worthwhile to focus on identifying the role of management in shaping and implementing organizational governance principles, with particular emphasis on managerial competencies that foster employee motivation and foster an ethical and pro-social culture. Another interesting area of research could be analyzing the impact of organizational governance on the quality of services provided and customer satisfaction. From this perspective, it would be important to determine how responsible management can contribute to improved operational efficiency and increased corporate credibility. Another interesting direction would be to identify and analyze a company’s collaboration with stakeholders, both internal and external, and assess its importance for building social trust. Further research on corporate governance could be interdisciplinary in nature, encompassing various perspectives from management and other disciplines, such as economics (performance analysis), law (regulations regarding accountability and transparency), and social sciences (studying relationships with customers and local communities). However, implementing this research would require multi-level collaboration between universities, water and sewage companies, local governments, industry organizations, and non-governmental organizations. Funding for such research could be obtained from EU funds, such as Horizon Europe, the Cooperative Fund, and others. Such focused research would enable in-depth understanding of the mechanisms underlying organizational governance in enterprises and contribute to the development of practical solutions that enhance the quality of services provided.