1. Introduction

In the Paris Agreement in 2015, the Chinese government announced the carbon peak and neutrality target (hereafter, dual carbon goal). This commitment included a pledge to reduce carbon emissions per unit of GDP by 60% to 65% compared to 2005 levels. Additionally, the share of non-fossil fuels in primary energy consumption is expected to rise to around 20%, with carbon emissions projected to peak around 2030. China is the world’s largest carbon emitter, accounting for over a quarter of the world’s greenhouse gas emissions [

1]. In China, fossil fuels remain the primary component of the energy structure [

2,

3]. In particular, the power industry contributes the largest amount of carbon emissions in China.

In order to lower carbon emissions, the Chinese government implements various policies, including a carbon tax [

4,

5,

6], new energy subsidies [

7,

8], and a carbon emissions trading scheme (ETS) [

1]. Among these, the ETS is a market-based policy instrument designed to achieve emission reduction goals by guiding corporate decision-making through market mechanisms. In October 2011, the NDRC issued the “Notice on Carrying out Pilot Work for Carbon Emission Trading”. The pilot ETS has been officially implemented in several provinces and cities (i.e., Beijing, Tianjin, Shanghai, Chongqing, Hubei, Guangdong, and Shenzhen), covering several high-carbon-emitting industries since 2013. During the pilot period, each pilot city independently conducts carbon trading. These decentralized markets not only differed in the industries covered under the ETS, but also differed in their methods for carbon quota allocation. Nonetheless, all pilot areas included the power industry.

The ETS underwent a major reform when the NDRC issued the “National Carbon Emission Trading Market Establishment Plan in Power Industry” in 2017 (hereafter, the plan). Since the standardized data measurement equipment of the power industry is convenient for data verification and allocation of quotas, and the carbon emission intensity of the power generation industry surpasses other industries, the pilot ETS was promoted nationwide in the power industry. There are 2267 power enterprises included in the national ETS officially, with carbon emissions of about 4.5 billion tons of carbon dioxide (CO

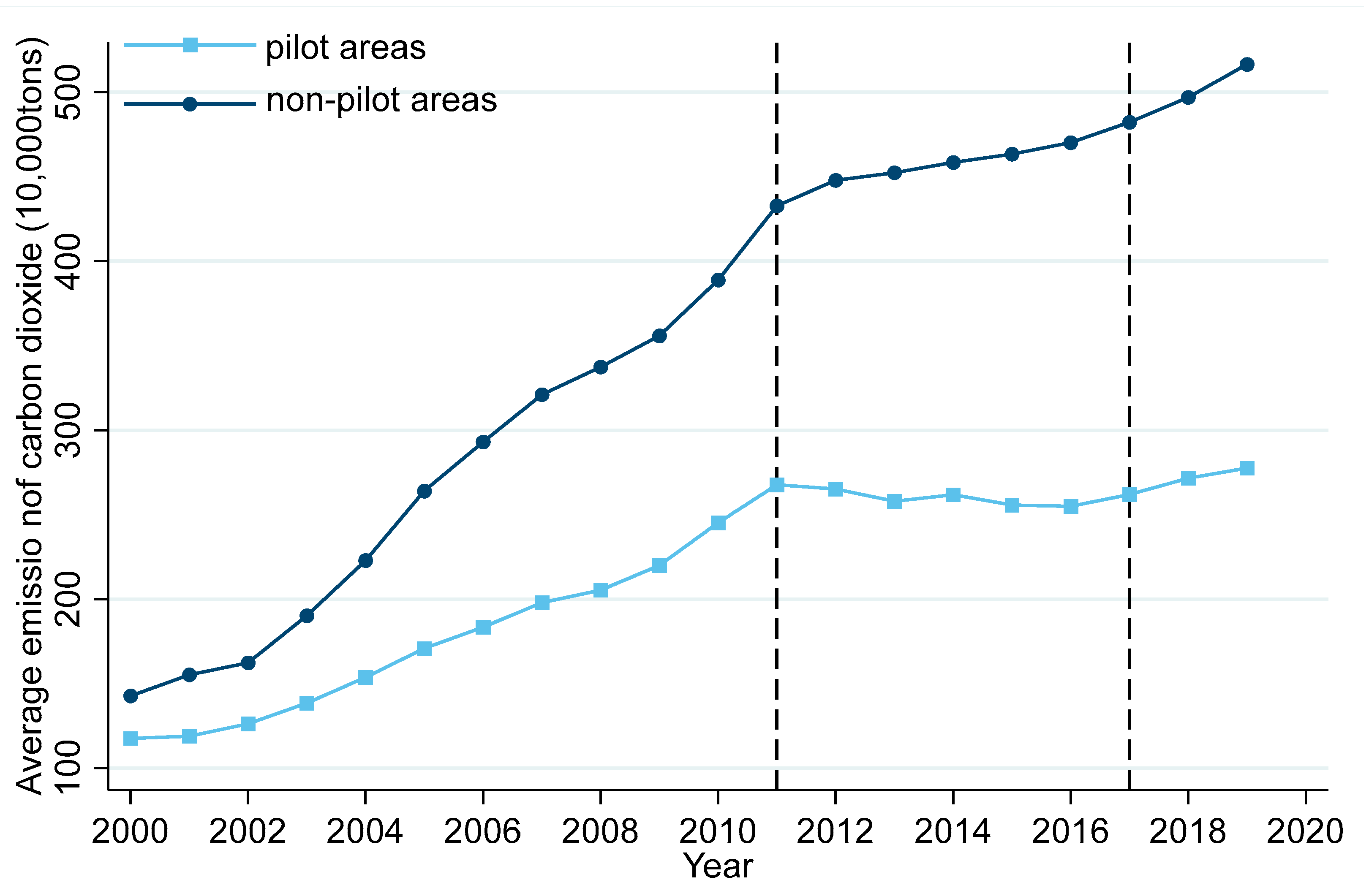

2), accounting for over 40% of the national emission. The consolidation of decentralized pilot markets into a national unified system was a critical reform intended to reduce speculative arbitrage, thereby enhancing market efficiency and stability. As shown in

Figure 1, the objective of this reform was initially achieved, as evidenced by the increase in both the average daily transaction price and total trading volume across pilot regions following the launch of the national ETS in 2017. These trends indicate that market integration was progressing smoothly and that the trading mechanism was beginning to function effectively, attracting more participation and reinforcing price signals.

The ETS regulates power enterprises through the allocation of carbon emission quotas. If an enterprise’s carbon emission exceeds its quota, it must purchase quotas in the market or be punished. In contrast, enterprises with lower unit carbon emissions can accumulate surplus quotas, which may be sold to higher-emitting enterprises in the market, thereby generating additional revenue. When compliance costs become prohibitively high, power companies face several strategic choices to maximize their interests under emission constraints. First, they may reduce fossil fuel consumption at the source by scaling back power output or shifting from thermal power to renewable energy generation, thereby directly reducing the production of CO

2. Second, the power enterprises can choose to improve energy efficiency in the middle end, using less fossil fuels to produce the same amount of electricity, thereby reducing the amount of CO

2 produced when producing the same amount of electricity. The third approach is to further utilize the final generated CO

2 through capture technology at the end of energy. From a long-term perspective, enterprises which make progress in sustainable technology by implementing innovation activities and improve the production efficiency will hold a competitive edge in the market [

9,

10].

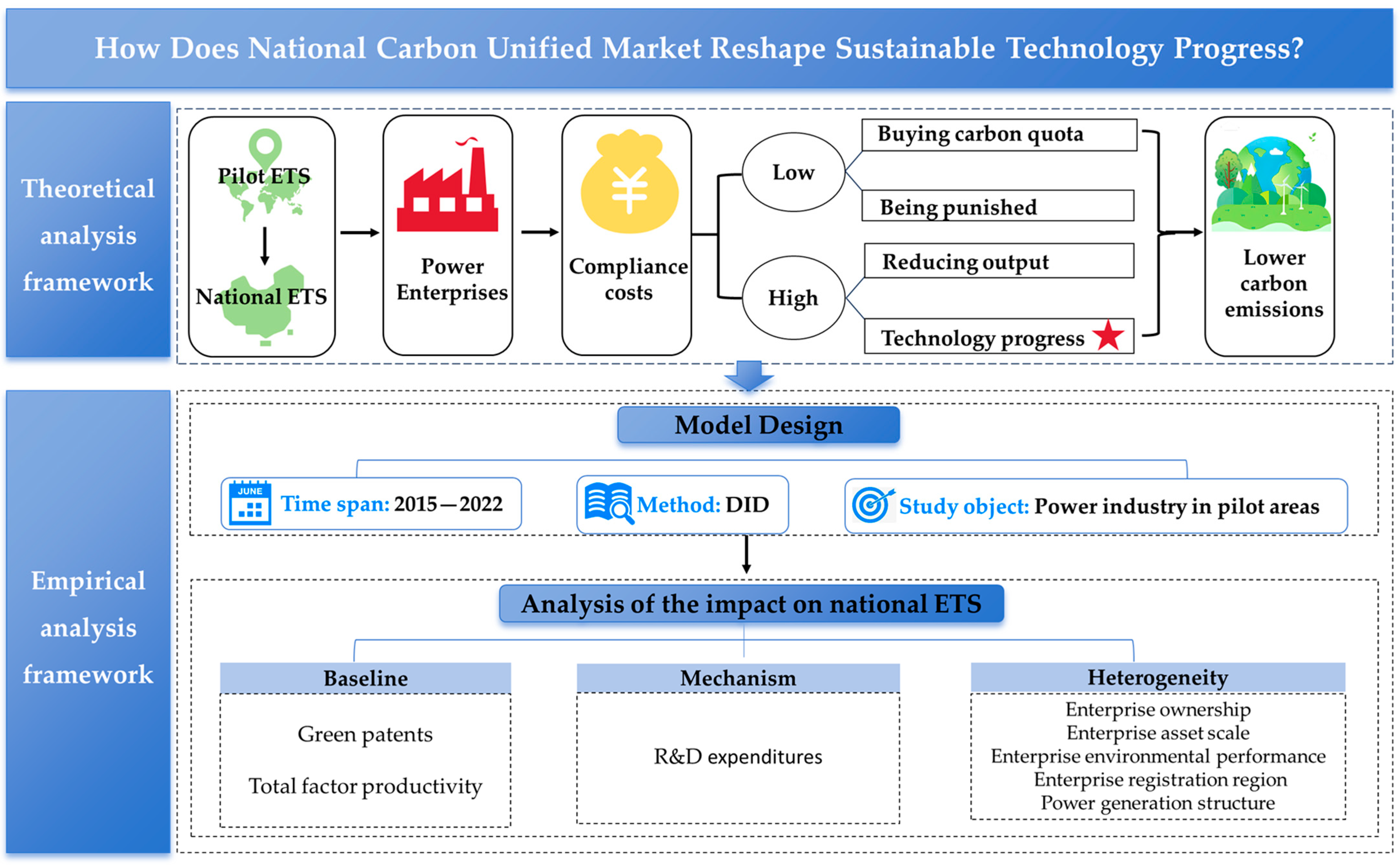

Carbon emissions in pilot areas experience a significant decline following the implementation of the ETS. As shown in

Figure 2, carbon emissions in non-pilot areas continue to rise, while carbon emissions in the pilot areas have remained relatively stable with a slight decrease since 2011. Although both areas show an increase in emissions after 2017, the growth in pilot areas is significantly slower compared to that in non-pilot areas. These turning points coincide with the timing of ETS policy reform. Therefore, it is valuable to explore whether the emission reduction can be attributed to sustainable technological progress and what mechanisms are involved, as this is essential for evaluating the effectiveness of the ETS.

This paper mainly focuses on the green technological progress of power industry after the national ETS. In China, only the pilot policies with long-term viability and strategic importance are scaled up for nationwide implementation [

11]. The national ETS is an essential part of dual carbon goals for the sustainability of economic and only targets for the power industry. Therefore, whether the national ETS promotes green technological innovations in the power industry is an important issue. To address this issue, we measure the technological level of enterprises by green patents and the total factor productivity (TFP) of power enterprises. Using firm-level data from 2015 to 2022, a differences-in-differences (DID) model is constructed to assess the causal impact of the national ETS on technological progress of power generation enterprises.

This study contributes to the existing literature in the following three aspects: (1) This study addresses the research gap concerning the impact of a national carbon unified market on technological innovation in developing countries. While existing studies on such market mainly focuses on developed countries [

12,

13,

14,

15], studies on China’s ETS have so far examined pilot programs’ effects on city-level carbon emissions [

16,

17,

18,

19], production efficiency [

20,

21], corporate investment [

22], technological progress [

3,

12,

16,

23,

24,

25,

26,

27,

28], and other related aspects [

29,

30]. By employing more reliable firm-level microdata and examining the national ETS’s influence on technological progress, this study provides new empirical support to the growing literature on the effects of ETS beyond the pilot period. (2) This study provides new empirical evidence of how ETS promotes technological progress by employing both technological innovation and productivity efficiency. Existing studies focus on either the role in driving technological innovation [

9,

10,

24,

25] or its impact on productivity efficiency [

21,

31,

32], but their conclusions across these studies are inconsistent. Therefore, to address this gap, this study evaluates both aspects within a unified analytical framework. (3) This study expands the literature on corporate social responsibility (CSR) related to environmental regulation. Enterprises with better environmental performance can reduce information asymmetry with investors regarding long-term sustainable investments [

33,

34]. However, some scholars contend that CSR could result in excessive resource allocation and negative environmental spillovers [

35]. Therefore, it is worth discussing how ETS will affect the performance of power generation companies in different environments.

The structure of this paper is as follows.

Section 2 presents a review of the relevant literature and introduces the hypotheses.

Section 3 is the methodologies we employed and the data.

Section 4 provides more detailed results. The heterogeneity analysis is shown in

Section 5.

Section 6 concludes and presents policy implications. Finally,

Section 7 discusses the limitations of this study and provides future research directions.

3. Materials and Methods

3.1. DID Methods

To identify the causal effects of the national ETS on the electric power industry, we specify the following DID model:

where

represents a series of key variables that are explained within a limited research period in each regression, such as green patents and TFP of enterprises. We use the number of patent applications to measure each enterprise’s technological capability.

represents the treatment group dummy.

is the treatment time dummy.

is a series of control variables of enterprises’ financial condition, including enterprise asset scale, listing years, operating conditions, cash flow situation, etc.

and

represent fixed effects of year and firm, respectively, used to control for unobservable factors affecting enterprise technological innovation, and

is a random error term. We are most interested in the coefficient

. If

is significant, it indicates that the policy has a statistically meaningful effect on promoting green technological innovation among power enterprises.

The core explanatory variable is , representing the impact of the ETS on the technological innovation level of power industry enterprises. Our sample is limited to pilot cities only because only the carbon quota of the power industry can be traded in the national unified market. The treatment group consists of all listed power generation enterprises in the pilot areas, while the control group consists of other industries included in the same areas. The control group mainly includes other high-carbon-emitting industries covered in the pilot market within the trading system, such as electricity, steel, chemical, petroleum and petrochemical, cement, etc. Under policy shocks, when the enterprise is in the production and supply of electricity industry, the 1, otherwise, it equals 0.

Referring to the determination date of the national ETS of Ma et al. [

80], the year 2017 marked the year when the National ETS was announced. In this study, we have set the time node as 2018, and we set the final target time as 2015 to 2022. When the year is 2018 or later,

is 1, otherwise it is 0. We select 2018 as the starting year for the policy shock based on the following considerations. Although the actual national trading began in 2021, its policy framework was announced as early as 2017, providing enterprises with a clear top-level design and expectations. The year 2018 signifies that policies are beginning to be steadily implemented. During the period 2018 to 2020, national and local authorities intensively rolled out detailed implementation rules, such as drafting and soliciting feedback on the “2019–2020 National Carbon Emission Allowance Allocation Implementation Plan for the Power Generation Industry”. Concurrently, foundational work such as historical data reporting, accounting, and verification was launched. These actions indicate that 2018 is when power generation enterprises began substantive preparations for future allowance quota and trading, forming clear market expectations. In this way, enterprises have started establishing carbon management teams and consolidating emission inventories, which directly influenced their innovation decisions. The true impact of a policy begins when firms perceive risks and initiate strategic adjustments, rather than when final transactions occur. The period from 2018 to 2020 constituted a key window during which enterprises comprehended the policy, assessed risks, and allocated R&D resources. Our empirical study is designed to capture this complete dynamic response process.

A potential concern regarding the identification strategy lies in whether the control group could have been affected by other environmental or industrial policies implemented during the same period. However, this concern is mitigated by the nature of these policies and our empirical design. Although other broad policies were indeed implemented during our sample period (2015–2022), such as Supply-Side Structural Reform, the Three-Year Action Plan for Winning the Blue-Sky Defense Campaign, and the Dual Carbon Goals, those policies targeted all high-energy-consumption and high-carbon-emitting industries. It means both our treatment group (power industry) and our control group (e.g., steel industry, chemical industry) were simultaneously regulated by those policies. Therefore, their impacts are largely absorbed by common trends, rather than asymmetric policy shocks specific to any one industry. In contrast, the national ETS only covered the power sector starting in 2017, leading to a distinct asymmetric policy shock. The key identification strategy of our DID model is to isolate the effect of this market-based environmental regulation on the power industry, after accounting for common trends affecting all industries.

3.2. Data Source

The data is collected from several sources. First, the green patents data were launched by the World Intellectual Property Organization (WIPO) in 2010. We use the IPC codes to identify and extract data on green patents. Second, the basic financial data and calculation of the element of enterprise TFP are both coming from the CSMAR database. Third, Huazheng Index Information Service Co., Ltd. (Shanghai, China) offers the corporate ESG ratings data. Fourth, the registered address information of listed enterprises comes from the China Securities Regulatory Commission. Finally, we collect the power generation structure information from the annual financial report of the power enterprises, as published by the National Enterprise Credit Information Publicity System.

This study considers enterprises listed on both the Shanghai and Shenzhen Stock Exchanges. Industry classifications for listed firms are determined according to the National Economic Industry Classification (NEIC) issued by the National Bureau of Statistics of China. According to the NEIC, the two-digit codes of industries in the pilot areas include: coal mining and washing (B06), oil and gas extraction (B07), textile manufacturing (C17), paper and paper products (C22), oil processing and nuclear fuel processing (C25), chemical raw materials and products manufacturing (C26), non-metallic mineral products (C30), ferrous metal smelting and rolling (C32), and electricity and heat production (D44). We mainly focus on the comparison between the power industry (D44) along with other sectors following the establishment of the national ETS. Furthermore, Financial data of listed enterprises from CSMAR is matched with the listed enterprise code to create a corporate financial panel dataset. To avoid outliers, we exclude ST firms, firms in the financial industry, and firms with extensive missing data. In our sample, there are a total of 89 enterprises in the power industry.

3.3. Variables

3.3.1. Independent Variable

Our main dependent variables are as follows:

(1) Green Patents (GP): Given that green patents serve as a significant reflection of an enterprise’s capacity for green technology innovation [

9,

10,

25], this study selects green patents that comply with the Green List published by WIPO from the patent database and uses the number of green patent applications as the indicator. We employ the following dependent variables: (i) Green Patents (GP), measured as the annual number of total green patent applications; (ii) Green Invention Patents (GP_in), representing the annual number of green invention patent applications; (iii) Green Utility Model Patents (GP_um), captured as the number of green utility model applications.

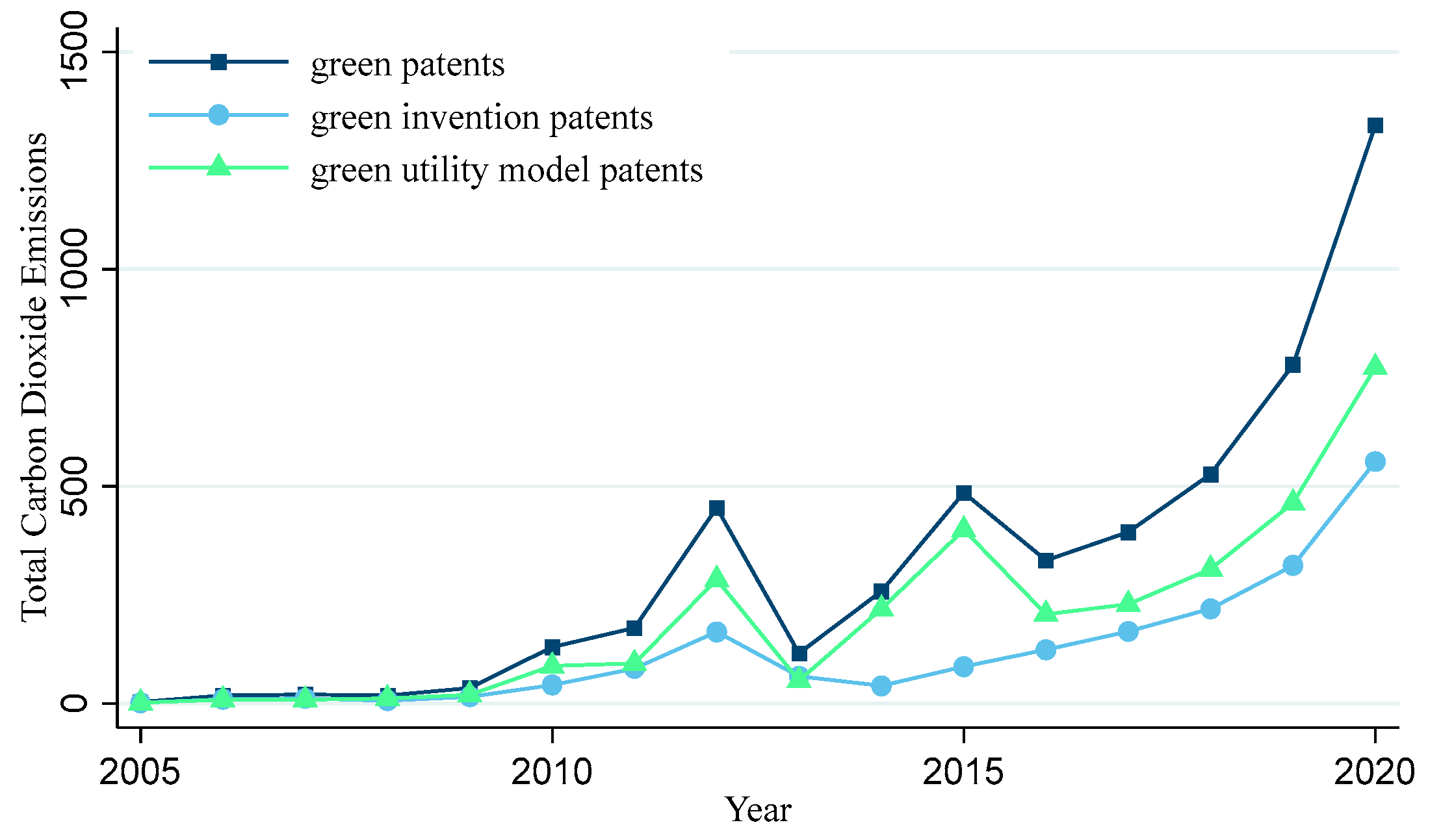

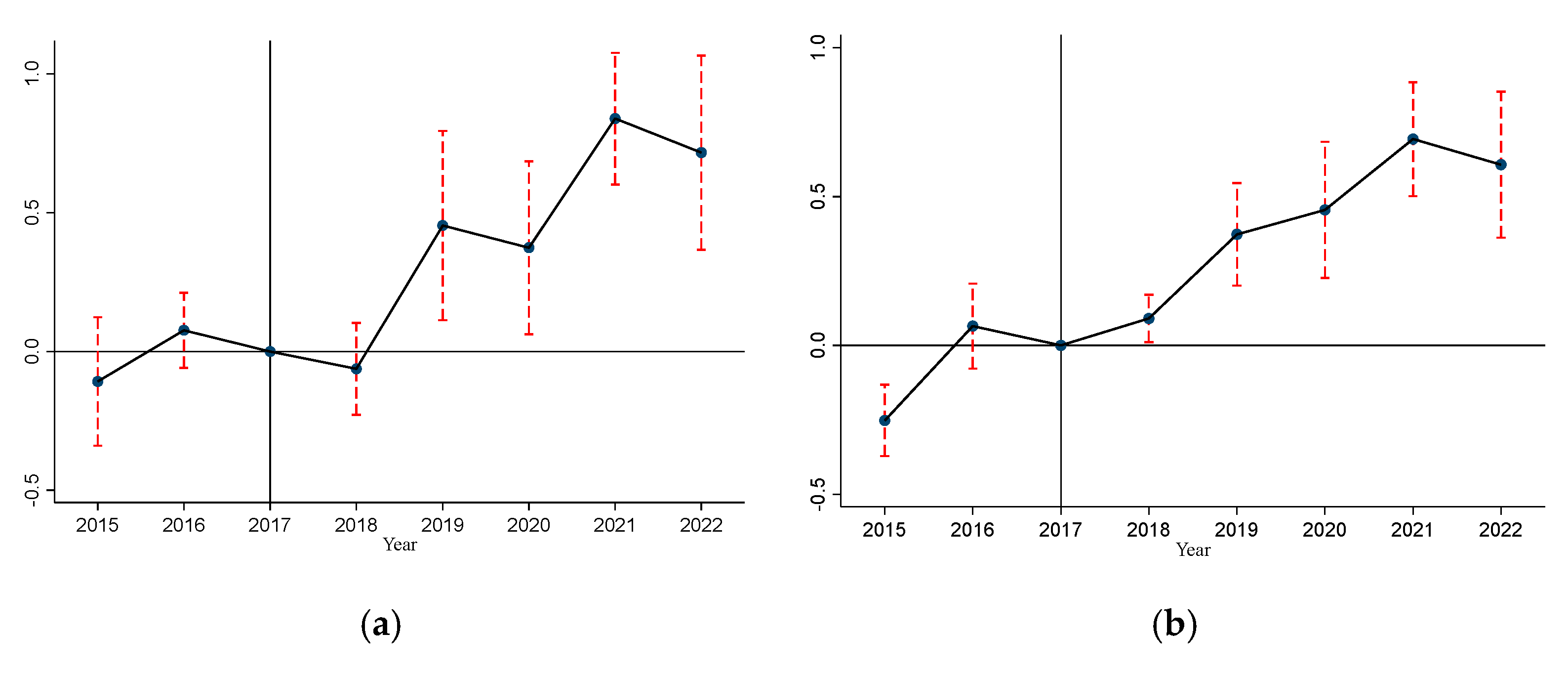

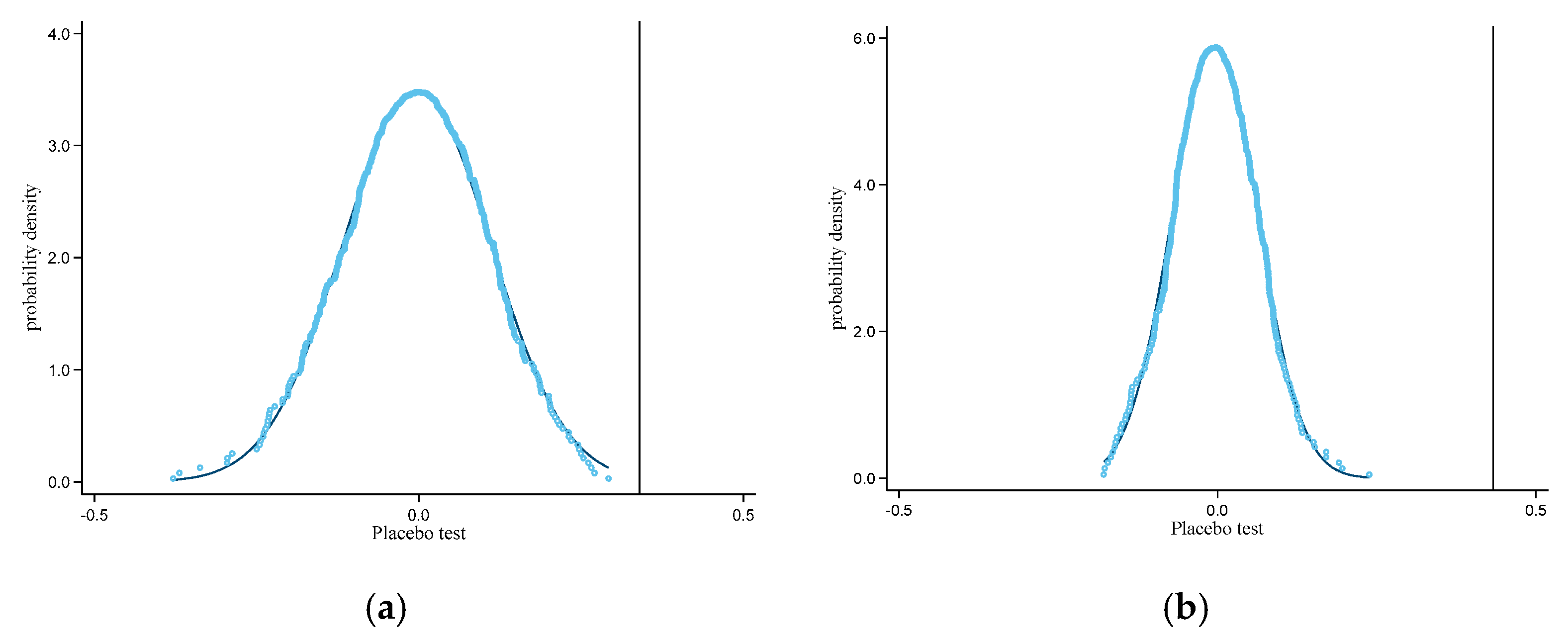

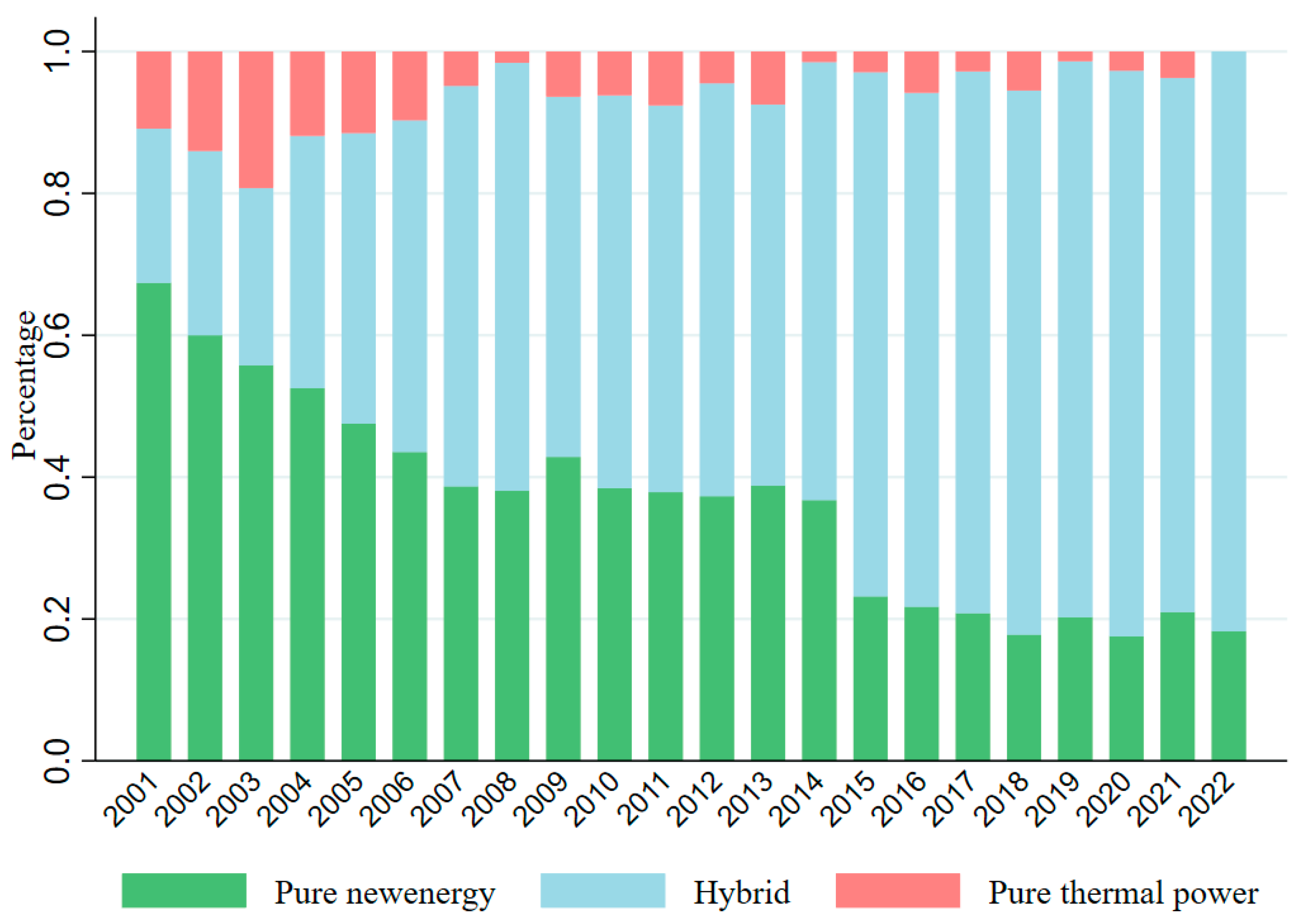

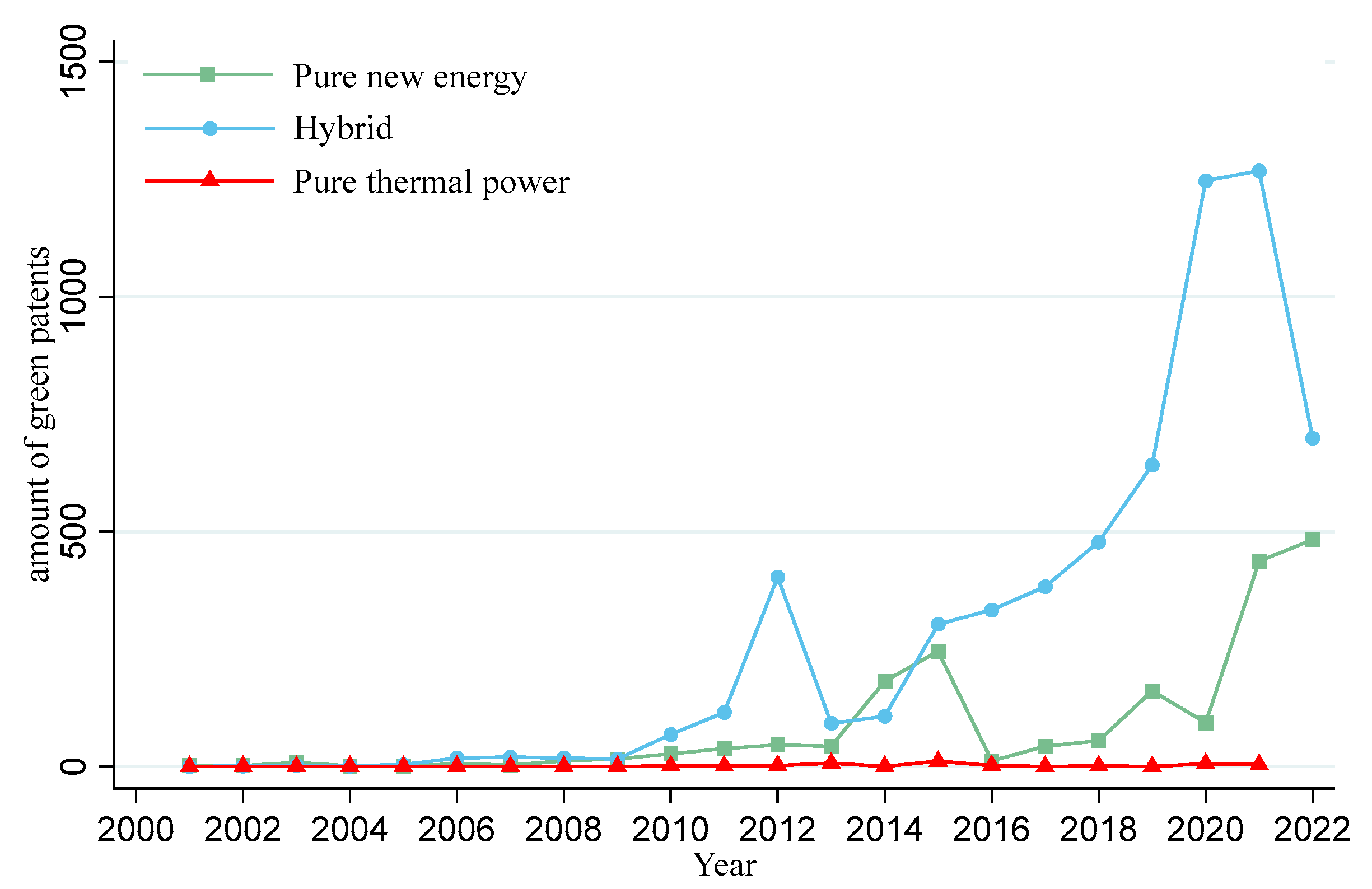

Figure 4 shows the trend of green patent applications in the electric power industry over time. We find that green patents have significantly increased since 2017. It is known that China has started a carbon trading pilot project in seven regions since 2013. There was also a small peak before and after the pilot policy.

(2) TFP of enterprises (TFP_OP): To assess the innovation efficiency of enterprises, we estimate the TFP following the approach of Olley & Pakes [

52]. TFP is an indicator reflecting the average output level in the production process. It is used to measure production efficiency, which represents enterprises’ capability to utilize all factors of production to drive economic growth at a given time [

1,

21,

50,

51]. Then, the GMM method is used to recalculate the TFP of the enterprise for robustness verification.

(3) R&D expenditure (R&D_expend): This variable incorporates all internal and external expenditures related to R&D activities within the reporting period, covering basic research, applied research, and experimental development [

68,

69]. R&D expenditure activities are essential to technology innovation. It assesses the degree of independent innovation capability that enterprises possess [

73,

77,

78]. Moreover, it offers valuable insights into strategy orientation and future growth potential of enterprises [

71]. We referred to Su et al. [

81], who find that social trust significantly boosts enterprises’ R&D expenditure, and take the natural logarithm of the R&D expenditure after adding a constant to mitigate scaling issues.

3.3.2. Dependent Variables

(1) The cross-term of DID model (): This term serves as the core explanatory variable, representing the overall effect of the national ETS on the green innovation of power industry enterprises.

(2) Enterprise ownership (SOE): This dummy variable indicates ownership type, assigned a value of 1 if the enterprise is state-owned, and 0 otherwise.

(3) Enterprise asset size (Scale): This dummy variable is constructed to reflect enterprise size, taking the value of 1 if the enterprise’s total assets exceed 400 million RMB, and 0 otherwise. Our classification of large-sized enterprises is based on the reference of the Bureau of Statistics in China.

(4) Corporate ESG Rating (ESG): We adopt Huazheng’s corporate ESG rating because their rating of companies in the Chinese stock market is relatively comprehensive and covers the widest range of companies and time. ESG stands for environmental, social, and corporate governance. A high ESG rating represents a company’s outstanding performance in environmental sustainability and social responsibility. Moreover, it is generally believed that companies with high ESG ratings have more transparent disclosure of corporate environmental information, greener corporate strategies, and more sustainable and environmentally friendly business operations [

82,

83]. According to Huazheng’s ESG rating of enterprises, enterprises are classified as either high-rated or low-rated. The Huazheng rating framework comprises a total of 9 levels, ranging from the lowest C ranking to the highest AAA ranking.

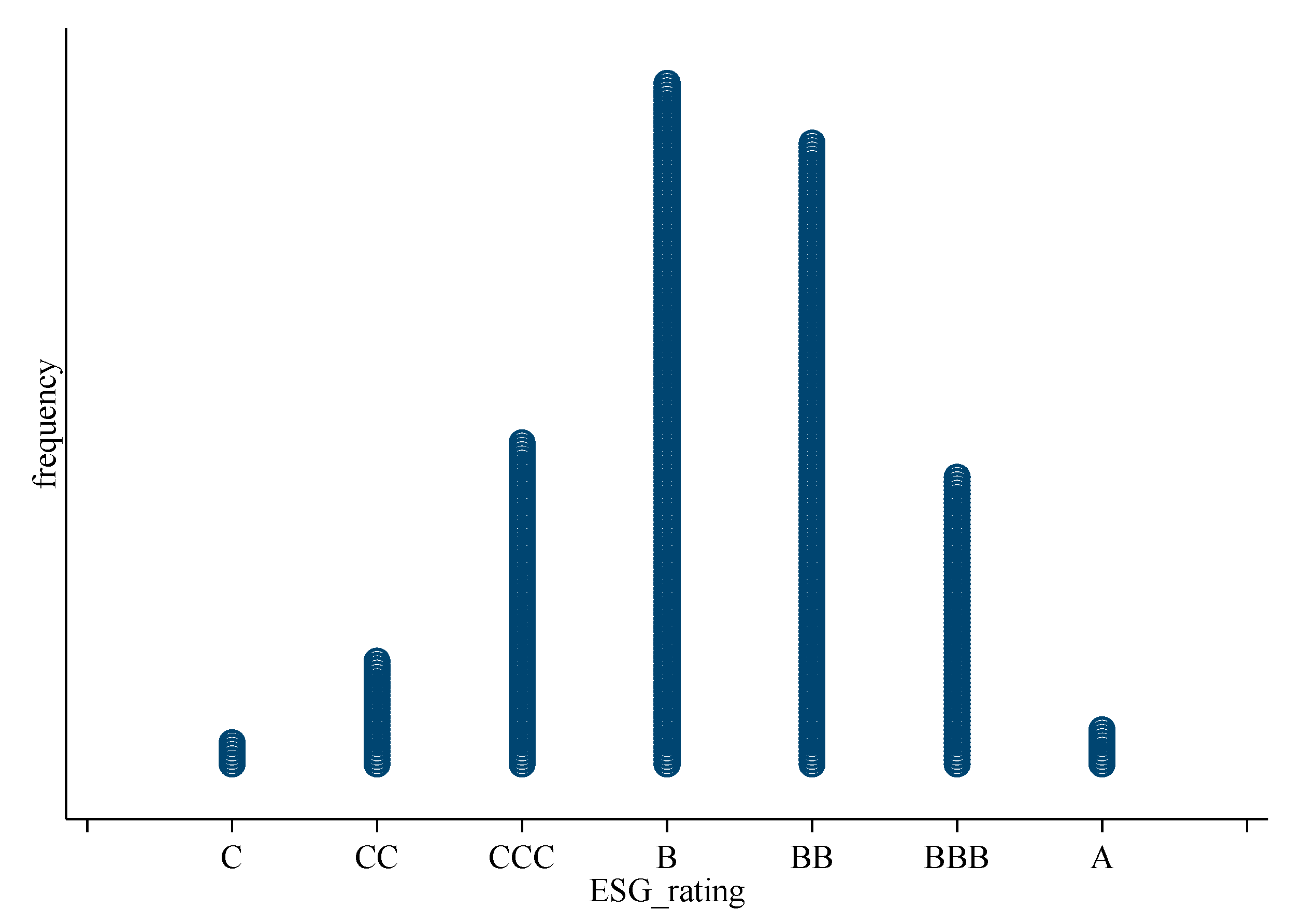

Figure 5 shows the distribution of enterprises’ ESG ratings. The average ESG rating of enterprises is around B, indicating that the majority of companies fall within level B. In this study, enterprises rated B or above are classified as high-rated and assigned a value of ESG = 1, while those rated below level B or lacking rating information are considered low-rated enterprises and assigned ESG = 0.

Figure 5 shows the distribution of power industry enterprises ESG rating.

(5) Registration region of the enterprise (Region): The power generation industry has certain differences between different regions. This dummy variable is assigned a value of 1 if the enterprise is registered in an eastern region of China, and 0 otherwise.

3.3.3. Control Variables

We include several commonly used financial indicators of listed companies as control variables: (i) enterprise size (Size), total assets of the enterprise after logarithm processing; (ii) asset liability ratio (Lev), ratio of total liabilities to total assets at the end of the year; (iii) asset return rate (ROA), net profit of the enterprise divided by the average balance of total assets; (iv) enterprise listing age (ListAge), the duration of a company’s listing, and we did ln processing. The selection of control variables that we mainly refer to Meng & Zhang [

84]. Descriptive statistics of the variables are presented in

Table 1.

6. Conclusions and Policy Implications

6.1. Conclusions

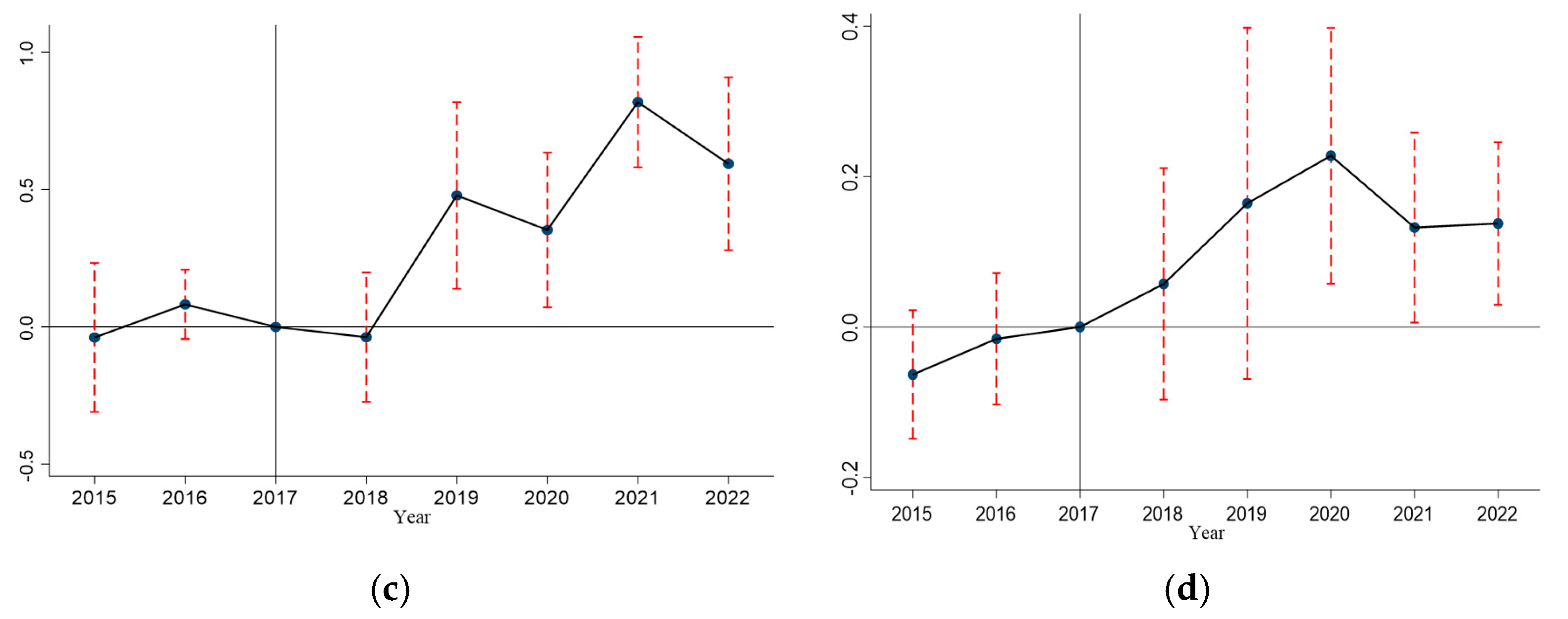

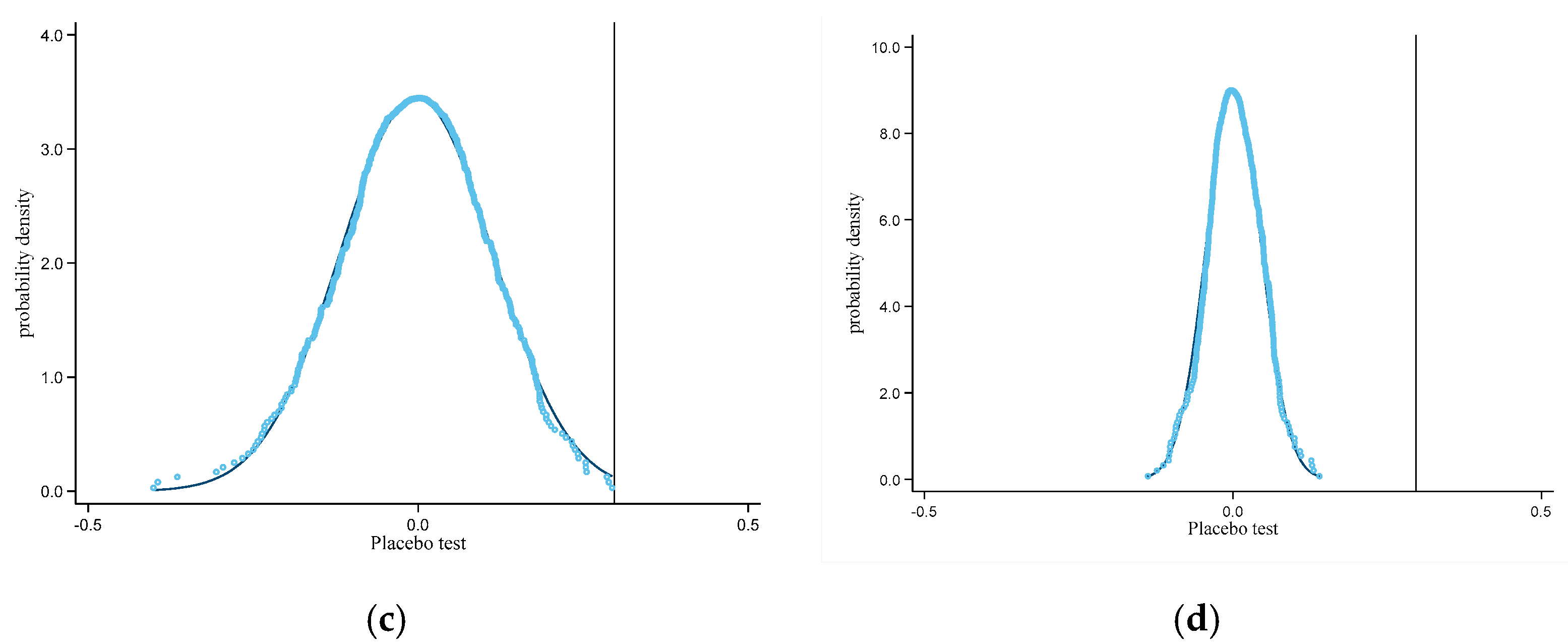

Our study demonstrates an increased causal impact of the national ETS on the sustainable technology progress in power enterprises. We use the firm-level data from 2015 to 2022 through DID to assess the causal impact of the national ETS. This study employs green patents and total factor productivity as measures for sustainable technology progress. Additionally, we explore the mechanism and heterogeneity of the impact. The primary conclusions can be summarized as follows:

Firstly, the growth rate of green patent applications and production efficiency are increased after the national ETS compared to other high-carbon-emitting industries. Moreover, the TFP of these enterprises has also increased, indicating that the production efficiency of power companies has indeed improved. By exploring the mechanism, the positive causal effect is mainly achieved through R&D expenditure.

Secondly, heterogeneity analysis reveals that the national ETS exerts a more significant positive effect on power generation enterprises that are non-state-owned, have smaller asset scale, demonstrate superior environmental performance, and are located in eastern region. However, in the heterogeneity discussion of TFP among different enterprises, there is no significant difference.

Thirdly, we also find that the national ETS has contributed to the green transformation of power industry. The proportion of pure thermal power generation enterprises in the total number of power industry is decreasing, and the main green patent applications are concentrated in pure new energy and hybrid power generation enterprises.

6.2. Policy Implications

First, policymakers should steadily expand the national ETS to other high-carbon-emitting industries. Our findings demonstrate that the national unified market in the power sector has effectively stimulated green innovation and enhanced productivity efficiency. A unified carbon market may reduce corporate speculation, break down regional protectionism and market barriers, optimize resource allocation, stimulate market competition, and promote innovation and technology adoption. Therefore, promoting the monitoring of carbon emissions in other industries and expanding the nationwide unified carbon market to other sectors will promote both emission reduction and sustainable development. In addition, given the important role of environmental performance, policymakers should improve the transparency of environmental information disclosure.

Second, it is essential to increase targeted R&D support for highly responsive enterprises. Our results find that the positive effect of the national ETS on sustainable technology progress is mainly achieved through R&D expenditure. Moreover, the effect of the national ETS is stronger among enterprises that are non-state-owned, have smaller asset scale, demonstrate superior environmental performance, and are located in eastern region. Therefore, offering tailored R&D subsidies, tax benefits, or green credit will strengthen this mechanism.

Third, policymakers should adopt differential compliance mechanisms to address regional and structural disparities. Given that the impacts of the ETS vary significantly across firm types, while TFP responses remain relatively uniform, it is essential to implement more flexible carbon quota allocation methods and promote interregional technical collaboration. Such measures would provide targeted support to economically disadvantaged firms in less-developed regions, enhancing both equity and effectiveness in the transition to a low-carbon economy.

Fourth, policymakers should coordinate energy policy with ETS to accelerate thermal power transition to renewable energy power. With the patents’ applicant shifting from pure thermal power to new energy enterprises, the policymakers should tighten emission caps, complemented by targeted support for renewable integration, energy storage, and carbon capture, utilization, and storage (CCUS) technologies, which can facilitate a structured and gradual phase-out of pure thermal power generation.

7. Limitations and Future Research Directions

This study still has some limitations, which also present opportunities for future research.

First, since the emerging green technologies, such as carbon capture and storage in certain fields and microbial fuel cells are not covered in the Green List published by WIPO, directly using this classification of the green technology may omit some impacts of the national ETS. Future studies can extend beyond the WIPO Green List by incorporating additional sources as CCUS or microbial energy patent databases. In addition, we could also employ text mining and machine learning methods to identify emerging green technologies that are not yet classified in existing frameworks.

Second, due to the limited availability of data, we are only able to obtain the average carbon trading price for each region rather than transaction-level records. Therefore, we may overlook the potential impact of carbon prices on the technology innovation of power enterprises. Therefore, more detailed carbon pricing data should also be collected to better assess its marginal impact on innovation.

Furthermore, given that the CCUS technology may also generate new waste, which can put pressure on the environment and lead to new solid waste problems, the environmental side effects of end-of-pipe treatment are also worth discussing.