Abstract

The manufacturing sector’s pursuit of green transformation amidst the digital revolution presents a critical challenge. Using a comprehensive panel dataset from 2012 to 2022, we analyze how digital technology, through its influence on a firm’s human capital structure, impacts green innovation. Our findings show that digital technology significantly boosts a firm’s green innovation efficiency. We identify two distinct mechanisms: digitalization indirectly enhances efficiency by reconfiguring the workforce to decrease the proportion of production personnel, while it directly drives innovation by increasing the share of sales and technical staff. The analysis also reveals a dual effect of an expanding internal compensation gap, which intensifies the displacement of production workers while weakening the firm’s ability to attract and retain core talent. Further heterogeneity analysis reveals that the impact of digital technology on green innovation efficiency is more significant in high-tech industries, non-capital-intensive industries, and non-heavily polluting industries. These findings provide a deeper understanding of the interdependent mechanisms linking digital transformation to sustainable innovation, offering valuable insights for managers and policymakers aiming to strategically align digital, human, and organizational factors for green development.

1. Introduction

The convergence of a global green economic transition and the digital revolution presents the manufacturing industry with both profound challenges and significant opportunities. As the world’s second-largest economy and a leading manufacturing powerhouse, China’s industrial sector is particularly critical, with its transformation carrying substantial implications for global supply chains and climate governance. This context also offers a valuable research template for other emerging economies. While China has experienced steady growth in manufacturing value-added and continuous optimization of its industrial structure, it still faces persistent issues, including high capital intensity, low output efficiency, and significant emission levels that require urgent attention [1]. For instance, despite the notable 5.8% year-on-year growth in the value-added of industrial enterprises in 2024 and total national R&D expenditure exceeding RMB 3.6 trillion, the country’s formidable environmental challenge is underscored by carbon emissions that account for approximately 32% of the global total. In this demanding environment, China’s manufacturing industry must pivot towards a green, efficient, and sustainable development model, with a particular emphasis on enhancing green innovation efficiency. Compared to general technological innovation, green innovation prioritizes the synergistic unity of economic, social, and ecological benefits. However, its inherent complexity also exposes it to greater uncertainty and risk [2]. For example, while green energy technologies like photovoltaics and wind power offer clear environmental advantages, their output is constrained by natural factors, leading to revenue volatility and grid stability issues. This heightens the risk associated with implementation. Consequently, while the strategic impetus to improve green innovation efficiency is clear, its practical execution remains challenging. To this end, enterprises are increasingly pursuing digital transformation, seeking to harness digital technologies to accelerate their green innovation processes [3]. Yet, the efficacy of these digital tools is not guaranteed, as their application is contingent on the strategic responses of firms, which act as both environmental polluters and agents of innovation. Therefore, a systematic elucidation of how digital technology empowers corporate green innovation is essential for mitigating the resource and environmental constraints faced by manufacturing firms, enabling them to achieve the dual objectives of economic performance and environmental sustainability.

While digital technology offers significant opportunities for enhancing corporate green innovation, its inherent contradictions—often termed the “digital paradox”—cannot be overlooked [4]. On one hand, technologies such as big data, cloud computing, and 5G are fundamentally reshaping how innovation elements are disseminated and combined, disrupting traditional paradigms and fostering open, digitally-driven innovation [5]. Digital technology transformation enables firms to enhance their capabilities, which in turn translates into competitive outcomes [6]. By forging connections across firms, industries, and sectors, digital technology enables organizations to overcome geographical barriers and expand the scope of knowledge spillovers. For instance, 5G and cloud computing allow companies to monitor production facilities in remote areas in real-time, promptly address potential environmental risks, and improve green operational efficiency. On the other hand, the impact of digital technology is not unequivocally positive. First, the substantial capital outlay required for digitalization can strain corporate financial resources, potentially diverting funds from green innovation initiatives [7]. Second, in simultaneously pursuing digital and green transformations, firms may encounter a misalignment between their digital capabilities and their stage of green development, leading to suboptimal outcomes and exacerbating “second- and third-level” digital divides [8]. Furthermore, some firms may treat green innovation as a symbolic gesture, engaging in superficial digital applications without substantive investment, a practice that contributes to the significant heterogeneity observed in its impact [9]. Consequently, the actual effect of digital technology on corporate green innovation remains a “black box,” and its complex underlying mechanisms demand rigorous investigation. Closing this knowledge gap is a critical imperative for both academic research and industry practice.

We argue that the core of this “black box” lies in the reshaping of human capital structure. digital technology does not operate in isolation; rather, it profoundly alters a firm’s organizational form and personnel allocation [10]. For instance, automation technology may reduce the demand for frontline production personnel, while data analytics and algorithm development drastically increase the reliance on technical staff and versatile talents. Furthermore, this adjustment in personnel structure is not frictionless, and its effectiveness is largely influenced by internal incentive mechanisms. The internal compensation gap, as a crucial indicator of a firm’s incentive strategy and resource allocation fairness, may play a pivotal role in this process [11]. A reasonable internal compensation gap can effectively motivate the innovation enthusiasm of technical personnel and foster knowledge sharing and collaboration; conversely, an unreasonable internal compensation gap may trigger internal conflicts, weaken employees’ willingness to collaborate, and consequently hinder the process of digital technology empowering green innovation. Therefore, systematically examining how digital technology influences green innovation efficiency by affecting the proportions of a firm’s production, sales, and technical personnel, and further exploring the moderating role of the internal compensation gap in this transmission path, holds significant theoretical and practical implications.

Despite existing research having deeply explored green innovation efficiency from multiple dimensions, such as financial constraints [12], resource allocation [13], and industrial agglomeration [14], significant theoretical and practical gaps still persist. Firstly, regarding the research perspective, most existing literature primarily focuses on the impact of digital technology on general corporate innovation [15], with a relative scarcity of systematic exploration into green innovation, which possesses both economic and environmental value. Secondly, concerning the mechanisms, although some studies have validated the positive impact of digital technology at the macro-regional level [16], there is a lack of in-depth analysis of the “black box” at the firm’s micro-level. These studies have failed to reveal how digital technology influences internal resource allocation within firms, leaving us unable to understand specific transmission pathways, such as how digital technology alters the proportions of different types of employees (e.g., production, sales, and technical personnel) and subsequently affects green innovation efficiency. Lastly, regarding contextual factors, existing research primarily focuses on renewable contexts [17], neglecting the critical role of internal incentive mechanisms. The complex relationship between digital technology and human capital structure, particularly how core incentive factors like the internal compensation gap play a moderating role, has not been fully verified.

This study aims to fill the aforementioned gaps by thoroughly exploring the intrinsic pathways through which digital technology empowers green innovation efficiency in manufacturing firms, highlighting the following two contributions:

First, theoretical integration and innovation. This research integrates digital technology, human capital structure, and green innovation efficiency into a unified theoretical framework. It innovatively introduces human capital structure as a crucial mediating mechanism through which digital technology influences green innovation efficiency, and further examines the moderating role of the internal compensation gap in this mechanism. This integration achieves a deep fusion of green innovation theory, the smile curve theory, and human resource management theory, providing a comprehensive theoretical framework for subsequent research.

Second, providing practical guidance and policy implications. The findings of this study will offer practical references for firms to continuously advance digital technology transformation, optimize human resource allocation, and design effective compensation incentive strategies to enhance green innovation efficiency. Furthermore, it will provide a scientific basis for government departments to formulate relevant industrial policies, aiming to better achieve the coordinated development of economic growth and environmental protection towards sustainable development.

2. Literature Review

2.1. Related Research on Digital Technology

Under the new wave of the information revolution, digital technology, as an emerging phenomenon accompanying the widespread adoption and deep integration of the internet, is reshaping the economic and social landscape at an unprecedented pace. However, the academic community has yet to form a unified paradigm for the conceptual definition of digital technology. A review of existing research reveals that scholars primarily understand and interpret digital technology from the following three dimensions:

First, from the perspective of digital technology’s constituent elements and functional characteristics, it emphasizes its hardware carriers, software systems, and the basic service capabilities it provides. Scholars define digital technology as products or services that are included in or supported by information and communication technologies [18]. Second, from the perspective of digital technology’s inherent nature and core characteristics, Lv et al.’s [19] research proposes the “specificity” of digital technology, meaning its ability to determine the type of resource input and the specific manner of its output. This category of definitions reveals the generative, pervasive, and disruptive potential of digital technology beyond traditional technologies. Lastly, from the perspective of digital technology’s application scenarios and practical impact, focusing on the specific manifestations of digital technology in corporate operations and value creation [20]. This perspective places greater emphasis on the efficacy produced by digital technology in practical applications and its shaping of organizational behavior.

In sum, despite the multifaceted nature of its definition, digital technology’s integrative and pervasive character, underpinned by its capacity for data processing and connectivity, has established it as a pivotal driver of industrial transformation. This study, therefore, defines digital technology as the suite of data-centric tools and platforms that firms employ to integrate information, computing, communication, and connectivity capabilities within their operational and innovation processes.

2.2. Digital Technology and Corporate Innovation

Given that the core focus of this study is “corporate green innovation efficiency,” and green innovation, as a specific form of corporate innovation, is fundamentally rooted in the broader innovation category, a preliminary review of the general relationship between digital technology and corporate innovation is crucial. This will lay a theoretical foundation for understanding how digital technology empowers green innovation and help identify its unique mechanisms and challenges.

Regarding research on digital technology and corporate innovation, most studies focus on the impact mechanisms of digital technology on corporate innovation, primarily from two perspectives: business processes and intellectual property. In terms of business processes, digital technology provides new pathways for innovation by reshaping internal business processes. Firstly, its impact is heterogeneous, and its effects are not universal [9]. Secondly, the depth of application determines the extent of innovation breakthroughs. Blichfeldt and Faullant’s [21] research indicates that firms with broader and deeper applications of digital technology are better able to achieve fundamental product and service innovations. Finally, technological integration is key. Lokuge et al. [5] emphasize that digital technology must be effectively integrated with a firm’s existing systems and processes to truly unleash its innovative utility, avoiding technological and organizational disjunction. In terms of intellectual property, digital technology significantly enhances firms’ innovation capabilities by accelerating the generation, flow, and absorption of knowledge. Chen et al. [15] point out that digital technology can improve the efficiency of knowledge sharing and utilization both within and outside the firm, thereby effectively promoting innovation.

Although existing literature has extensively discussed the impact of digital technology on general corporate innovation (including product innovation, process innovation, etc.) and revealed its mechanisms from perspectives such as business processes and intellectual property, with increasing global emphasis on sustainable development and environmental protection, green innovation has become a vital direction for corporate innovation. Cheng and Qian [22] contend that the green value of the digital economy, by empowering traditional industrial enterprises, can positively influence the green total factor productivity of industries, becoming a new impetus for building a “dual circulation” development pattern. However, current research still has room for further depth in systematically examining how digital technology empowers corporate green innovation, particularly the association with manufacturing enterprises’ green innovation efficiency. Green innovation not only emphasizes technological innovation itself but also prioritizes the unification of its environmental and economic benefits, exhibiting higher complexity and uncertainty. As a pillar industry of the national economy and a major source of resource consumption and environmental emissions, the green transformation and efficiency improvement of manufacturing are crucial for achieving sustainable development. However, existing research has not fully elucidated how digital technology empowers corporate green innovation efficiency and the complex underlying mechanisms. Therefore, this study aims to fill this gap, hoping to provide more refined theoretical insights and practical guidance for promoting the green and high-quality development of China’s manufacturing industry.

3. Theoretical Analysis and Hypothesis Development

3.1. Digital Technology and Manufacturing Enterprise Green Innovation Efficiency

Green innovation is a strategic behavior where enterprises proactively integrate environmental awareness and responsibility into their production and operations, leveraging innovations such as green technologies and products to reduce pollution and create new market opportunities. Green innovation efficiency refers to the efficiency of utilizing innovation resources in the green innovation process, emphasizing the dual positive externalities of promoting innovation output and improving environmental benefits [23]. According to green innovation theory, enterprises, with green development as their core philosophy, aim to obtain more innovation output with fewer factor inputs. Compared to traditional innovation that overemphasizes economic benefits, green innovation focuses on the development of the entire economy and society, placing greater emphasis on introducing new ideas and technologies to reduce enterprises’ environmental impact while bringing economic value and competitive advantages. As a key force for current corporate transformation, manufacturing enterprises can effectively utilize the proportion of digital elements in their input-output [24], thereby achieving an improvement in manufacturing green innovation efficiency.

The green innovation development of manufacturing possesses prominent characteristics of being green, low-carbon, and sustainable. Digital technology empowering manufacturing technological innovation can foster the application of clean, low-carbon, and environmentally friendly technological means, reduce waste emissions, and promote green development in manufacturing. Specifically, firstly, manufacturing enterprises have a demand to enhance green innovation efficiency through digitalization. By adopting new or improved production processes during green innovation, enterprises can both reduce factor inputs in the production process and achieve intensive development, increasing production capacity and improving the input-output ratio [5]. Simultaneously, in the dual era background of digitalization and greening, manufacturing enterprises, to gain organizational legitimacy, richer resources, and stronger market competitiveness, tend to invest their digital resources into green innovation practices [25]. Secondly, digital technology empowerment in manufacturing possesses inherent advantages such as broad coverage, strong permeability, and information sharing. This accelerates the integration of traditional factors with data elements, enabling the interlinkage of traditional production factors like labor, capital, and technology [13]. This enhances factor allocation efficiency, breaks the constraints of traditional production factor scarcity, and increases pathways for green development in manufacturing enterprises. Thirdly, through its widespread penetration into manufacturing and industrial development, digitalization can optimize product matching transactions and reshape business models, thereby promoting resource recycling. On the one hand, data, as a new quality production factor for enterprise digital technology, possesses powerful resource allocation capabilities and factor efficiency improvement capabilities in the value creation process. This provides favorable conditions for opening up communication channels for resource elements [26]. Through the long-tail economic effect, it breaks the supply constraints of traditional production factors, effectively enhancing enterprise supply capacity, promoting the dynamic and precise matching of market demand and enterprise supply, and facilitating efficient green transformation in manufacturing enterprises [27]. On the other hand, enterprises can leverage digital technology to transform digital resources and environmental opportunities into commercial value, driving the implementation of business model innovation. Since the reliability and validity of data are limited, the diversification of asset reorganization and business operations maximizes the value of data application [28], achieves Pareto optimality of organizational resources, thereby enabling green business model innovation and promoting the efficient output of green innovation in manufacturing enterprises.

Therefore, digital technology empowering manufacturing enterprises’ green innovation and effectively improving green innovation efficiency has become an effective pathway for the current manufacturing transformation and upgrading. Based on the above derivation, digital technology permeates the production processes of manufacturing enterprises, providing practical paths for cultivating new industries and new business forms, and for the green innovation development of manufacturing. Thus, we propose the following hypothesis:

H1.

Digital technology adoption exerts a positive and significant effect on the green innovation efficiency of manufacturing enterprises.

3.2. Mediating Role of Human Capital Structure

In the digital economy era, the application of digital technology by enterprises inevitably leads to a digital transformation of their production methods and relations, which is centrally reflected in the adaptive adjustment of enterprise human capital structure [10]. According to the “Smile Curve” theory, the two ends of the industrial value chain—R&D (technology) and branding (sales)—possess higher added value, while the intermediate manufacturing segment has relatively lower added value. The digital technology empowerment process will drive the enterprise value chain to extend towards both ends, thereby reshaping the demand for different types of human capital. From an enterprise perspective, human capital, as the most critical resource for a firm, plays a crucial role in enhancing strategic effectiveness, competitiveness, and achieving organizational goals [29]. Therefore, the advancement of human capital structure is an important link in the process of digital technology empowering manufacturing enterprises to enhance green innovation efficiency.

The digital economy era places higher demands on corporate human capital, and enterprises also face the challenge of integrating digital technology with their employees and enabling them to play a critical role in green innovation activities [10]. Digital technology empowerment for manufacturing green innovation efficiency will optimize the human capital structure by “squeezing out” some low-skilled labor. The “Smile Curve” objectively reflects the differential demand for various factors (technology, human resources, etc.) across the industrial value chain segments. Firstly, the smile curve theory posits that higher added value is generated at the two ends of the curve, namely in the technology and sales domains, while the production domain has lower added value. Therefore, digital technology will prompt enterprise employees to concentrate in high-added-value areas, which is a manifestation of human capital structure advancement [30]. The digital technology empowerment process creates new productivity and production methods, while also entailing the “destruction” of old production methods [31]. Thus, enterprise digital technology innovation will replace production work with lower technological content, more repetitive tasks, and higher substitutability; that is, traditional production personnel will be replaced by advanced equipment in the process of enterprise digitalization. Secondly, with intensified market competition, growing consumer demand for personalized and customized products, and the popularization of green product concepts, enterprises require stronger market expansion and customer relationship-management capabilities. The widespread application of digital tools such as digital marketing, e-commerce platforms, and customer relationship-management systems enables enterprises to more accurately identify target customers, conduct personalized marketing, provide efficient after-sales service, and effectively convey the value proposition of green products [32]. This necessitates enterprises to invest more resources in sales and marketing segments, thereby driving an increase in the proportion of sales personnel. Thirdly, due to the high added value characteristics of R&D personnel, there will be an increased demand for specialized technical and R&D personnel [33], thereby accelerating the enterprise’s green R&D process and achieving efficient green output. In short, the enhancement of green innovation efficiency empowered by digital technology in manufacturing enterprises will increase corporate attention and investment in high-skilled labor, promote the transformation and upgrading of human capital structure, and intensify the competition for talent that can boost product added value.

Changes in human capital structure will impact corporate green innovation efficiency. Firstly, a decrease in the proportion of traditional production personnel means that enterprises shift more resources from traditional, labor-intensive production links to high-value-added innovation activities such as R&D, design, brand building, and market promotion. This strategic shift allows enterprises to invest more concentratedly in green innovation projects, for instance, allocating more funds to environmental technology R&D and green product design, thereby accelerating the transformation and application of green technologies [34] and effectively improving green innovation efficiency. By reducing inefficient labor input, enterprises can more flexibly adjust production layouts, adapt to green production standards, and achieve optimized resource allocation. Secondly, an increase in the proportion of sales personnel signifies that enterprises are investing more human resources in green product promotion, market feedback collection, and green brand building. This helps to bring green innovation outcomes to market faster, and through precise marketing and channel expansion, increases the market penetration and consumer acceptance of green products. Sales personnel, in their interactions with customers, can timely acquire market demands and feedback for green products and services, forming a positive market feedback loop [35], which in turn encourages enterprises to conduct iterative innovation based on market demand, further enhancing corporate green innovation efficiency. Lastly, an increase in the proportion of technical personnel directly strengthens the enterprise’s R&D capabilities, technology conversion capabilities, and ability to solve complex green technology problems [36]. Digital technology can improve R&D efficiency and shorten innovation cycles, but its core driving force lies in the talent who can understand and apply these technologies [37]. A high proportion of technical personnel provides a solid human capital foundation for green innovation; they can deeply integrate digital technology with green technology, develop more breakthrough environmental technologies, green products, and cleaner production processes, thereby significantly promoting the improvement of corporate green innovation efficiency.

Therefore, in the process of empowering manufacturing enterprises, digital technology will promote the enhancement of corporate green innovation efficiency through the optimization of the human capital structure. Thus, we propose the following hypotheses:

H2a.

The adoption of digital technology has a significant positive indirect effect on the green innovation efficiency of manufacturing enterprises by reducing the proportion of production personnel.

H2b.

The adoption of digital technology has a significant positive indirect effect on the green innovation efficiency of manufacturing enterprises by increasing the proportion of sales personnel.

H2c.

The adoption of digital technology has a significant positive indirect effect on the green innovation efficiency of manufacturing enterprises by increasing the proportion of technical personnel.

3.3. The Moderating Role of Internal Compensation Disparity

With the advancement of marketization, changes in corporate compensation disparity have become an undeniable fact. Whether from a social or economic perspective, compensation disparity is regarded as a significant factor influencing employee effort. There is a clear correlation between the effort expended by different employees within an enterprise and their perceived compensation disparity, which also affects corporate green innovation behavior [38]. While the enhancing effect of digitalization on green innovation efficiency and economic growth receives considerable attention, from a development perspective, the digital process has clearly weakened the rights and interests of low-skilled workers [39]. Firstly, as digital technology empowers manufacturing and drives enterprise development through changes in human capital structure, the widespread application of information technology, software, and artificial intelligence gradually reduces marginal production costs, with intangible components constituting most of a product’s value. This correspondingly generates higher rent returns. However, the heterogeneity of corporate power distribution places employees in a vulnerable position, leading to employee earnings generally being below the “fair” price of labor [40]. Secondly, as technological iteration promotes the advancement of enterprise human capital structure, it further enhances the substitutability of ordinary employees and exacerbates the significant disparity in bargaining power between ordinary employees and employers in the labor market. Therefore, in the process of digital empowerment, optimizing human capital structure in manufacturing enterprises, it will be influenced by the internal compensation disparity within the enterprise.

Human capital theory suggests that the characteristics of human capital necessitate the management of executives and employees, such as supervision and incentives, otherwise human capital cannot function effectively. Under a market economy, incentives have gradually become the primary management model [41]. Providing different incentives to different types of human capital and acknowledging and affirming their human capital value can mobilize the work enthusiasm of executives and various types of employees. Therefore, the incentive effects of compensation disparity vary for employees at different levels and with different functions. Appropriate compensation disparity contributes to the optimization of enterprise human capital structure, effective integration of corporate human and material resources, and consequently has a positive impact on corporate green innovation efficiency [11]. Specifically, in the digitalization process, manufacturing enterprises, by introducing intelligent equipment and automation programs, reduce their reliance on traditional labor, leading to a large-scale replacement of manual labor by machines in the labor market. This results in a substantial reduction in traditional production and administrative positions [42]. These changes mean that traditional positions primarily involving simple, repetitive tasks face the risk of being replaced, and traditional work models and human resource allocation are challenged [43]. In this process, the bargaining power of low-level employees is further weakened, their opportunities for compensation and promotion within the enterprise are significantly reduced, and some employees even experience actual salary reductions due to digital transformation [44]. Therefore, traditional production staff, being in a weak bargaining position during the digitalization process, can only passively accept the continuously widening internal compensation disparity and the risk of being replaced due to technological progress. Secondly, sales personnel are positioned at the high end of the right side of the smile curve, playing a crucial role in bringing new products to market, which is conducive to increasing product added value and improving enterprise performance during corporate transformation [45]. Due to the frontline operations of sales personnel and their direct interaction with market participants, they can provide specific insights into customer needs and competitive activities, collect unique market information, and further influence corporate strategy [46]. Concurrently, the digital economy promotes the transfer of labor to the service industry, and digital technology significantly increases the proportion of employees in the tertiary industry, promoting the optimization of employment and industrial structures. This further strengthens corporate employment demand, allowing sales personnel to gain higher bargaining power [47]. Therefore, in the process of digital technology empowering manufacturing enterprises, because sales personnel possess advantageous market competitiveness, a high compensation disparity will make it difficult to retain them within the enterprise. Thirdly, R&D personnel, due to the scarcity and irreplaceability of their skills, possess stronger bargaining power compared to other employees, enabling them to obtain higher salaries from policy incentives and corporate development [48]. This is because highly skilled technical personnel, such as engineers and scientists, have an inelastic supply. Hiring such personnel requires enterprises to incur significant time costs and high salaries. Enterprises hope to retain R&D personnel through higher salaries and lower compensation disparity [49]. Simultaneously, paying high salaries to highly skilled R&D personnel can stimulate their innovative motivation, playing a role in optimizing human capital structure and increasing corporate innovation output [50]. It is evident that technical R&D personnel possess specialized skills and scarcity, can provide innovation benefits to enterprises, and demand a smaller compensation disparity, which is a pricing mechanism determined by market forces.

Therefore, we propose the following hypotheses:

H3a.

Compensation gap has a significant positive moderating effect on the relationship between digital technology adoption and the proportion of production personnel.

H3b.

Compensation gap has a significant negative moderating effect on the relationship between digital technology adoption and the proportion of sales personnel.

H3c.

Compensation gap has a significant negative moderating effect on the relationship between digital technology adoption and the proportion of technical personnel.

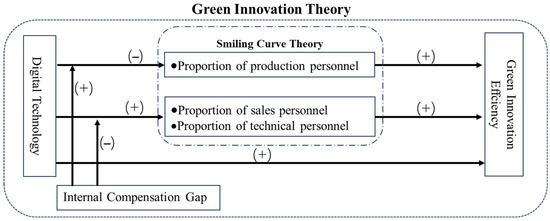

The conceptual model is constructed as follows, as shown in Figure 1, based on the theoretical analysis and hypotheses above:

Figure 1.

Conceptual model diagram.

Figure 1 visually summarizes the core theoretical relationships and hypotheses developed in this study. This model provides a clear framework for our empirical analysis, which we detail in Section 4. It guides our investigation into how digital technology influences green innovation efficiency, both directly and indirectly through human capital structure, while also considering the moderating role of the internal compensation gap.

4. Research Design

4.1. Data Sources and Sample Selection

The year 2012 is considered the starting point for the mature development of China’s digital economy. In this year, China began to systematically promote informatization, subsequently introducing a series of top-level designs such as the “Broadband China” strategy, the “Action Outline for Promoting Big Data Development,” and the “Internet+” action guidelines. These policies laid a solid infrastructure and policy environment for the subsequent popularization and application of digital technology. By 2022, the scale of China’s digital economy had grown from RMB 11 trillion in 2012 to RMB 50.2 trillion, accounting for 41.5% of GDP, signifying that the digital economy has become a crucial component of the national economy. Therefore, this study employs manufacturing firms listed on China’s A-share market from 2012 to 2022 as the research sample for empirical analysis. Digital technology data is sourced from the WIND database, the official websites of the Shanghai Stock Exchange and Shenzhen Stock Exchange, and Juchao Information Network (www.cninfo.com.cn), specifically from listed companies’ annual reports. All other data are obtained from the CSMAR database.

The data underwent the following processing:

- (1)

- Excluding companies designated as ST or *ST: These companies typically receive special treatment or delisting risk warnings due to financial irregularities or significant violations. Their operations are often in distress, financial data is highly volatile, and they may even be involved in abnormal transactions or restructuring activities. Under extreme survival pressure, their innovation decisions might be distorted, failing to reflect the general behavioral patterns of normal enterprises. Including them in the sample would introduce noise and compromise the accuracy of conclusions.

- (2)

- Excluding enterprise samples with severe missing data: Missing data can lead to significant sample selection bias, reduce the power of statistical tests, and make variable construction and statistical analysis difficult to execute accurately. Since data missingness is usually incidental rather than systematic, excluding such samples will not weaken the representativeness of the sample in the manufacturing industry; instead, it ensures the internal and external validity of the research results, providing more reliable empirical evidence for this study.

- (3)

- To mitigate the potential impact of extreme outliers on the regression results, the obtained data will be winsorized at the 1% and 99% levels.

- (4)

- The linear interpolation method was adopted for data supplementation.

In total, this study obtained 14,844 samples. The collected data will then be subjected to regression analysis using Python 3.11 and Stata 17.0 software.

4.2. Model Specification and Variable Definition

To test the hypotheses above, this paper constructs the following regression models:

First, we establish the model examining the impact of digital technology on corporate green innovation efficiency:

GIEi,t = α0 + α1ITi,t + α2∑Controli,t + Year + Ind + εi,t

In Model (1), GIE represents green innovation efficiency, IT denotes digital technology, Control refers to the selected control variables, Year is the year fixed effect, Ind is the industry fixed effect, and εi,t signifies the random error term. By performing OLS regression on Model (1), the primary focus is on the coefficient α1.

Next, we construct the models to verify the mediating role of human capital structure:

PPRi,t = β0 + β1ITi,t + β2∑Controli,t + Year + Ind + εi,t

SPRi,t = β3 + β4ITi,t + β5∑Controli,t + Year + Ind + εi,t

TPRi,t = β6 + β7ITi,t + β8∑Controli,t + Year + Ind + εi,t

GIEi,t = γ0 + γ1ITi,t + γ2PPRi,t + γ3∑Controli,t + Year + Ind + εi,t

GIEi,t = γ4 + γ5 ITi,t + γ6SPRi,t + γ7∑Controli,t + Year + Ind + εi,t

GIEi,t = γ7 + γ8 ITi,t + γ9TPRi,t + γ10∑Controli,t + Year + Ind + εi,t

In these models, PPR is defined as the proportion of production personnel, SPR as the proportion of sales personnel, and TPR as the proportion of technical personnel. All other variables remain consistent with Model (1).

Model (2) primarily focuses on coefficient β1 using OLS regression, while Model (3) centers on coefficient β4, and Model (4) focuses on coefficient β7. For Model (5), we examine coefficients γ1 and γ2. For Model (6), we investigate coefficients γ5 and γ6. Model (7) focuses on coefficients γ8 and γ9.

Models (2) and (5) aim to verify the mediating role of the proportion of production personnel. Models (3) and (6) are designed to verify the mediating effect of the proportion of sales personnel. Models (4) and (7) aim to verify the mediating role of the proportion of technical personnel.

Finally, we construct the models to verify the moderating role of internal compensation disparity:

PPRi,t = δ0 + δ1ITi,t + δ2IWRi,t + δ3ITi,t × IWRi,t+ δ4∑Controli,t + Year + Ind + εi,t

SPRi,t = δ5 +δ6ITi,t + δ7IWRi,t + δ8ITi,t × IWRi,t + δ9∑Controli,t + Year + Ind + εi,t

TPRi,t = δ10 +δ11ITi,t + δ12IWRi,t + δ13ITi,t × IWRi,t + δ14∑Controli,t + Year + Ind + εi,t

In these models, IWR represents internal compensation disparity. All other variables remain consistent with Models (1) through (7).

Model (8) primarily focuses on coefficient δ3 using OLS regression, aiming to verify the moderating role of internal compensation disparity between digital technology and the proportion of production personnel. Model (9) centers on coefficient δ8, used to verify the moderating role of internal compensation disparity between digital technology and the proportion of sales personnel. Model (10) focuses on the coefficient δ13, verifying the moderating role of internal compensation disparity between digital technology and the proportion of technical personnel.

Green innovation efficiency (GIE), a key variable in this study, is measured following Yang et al. [51] by taking the natural logarithm of (green patent applications + 1) divided by the previous period’s R&D investment. Digital technology (IT), as another core variable, is quantified using Python-based text mining methods, an approach consistent with Liu [52]. Human Capital Structure is operationalized through the proportions of different types of employees within the firm. Lastly, the internal compensation gap (IWR) is measured according to Kong et al. [53], using the ratio of average management compensation (AMP) to average employee compensation (AEP). This study introduces five control variables: Firm Size (Size), Asset-Liability Ratio (Lev), Proprietary Ratio (Der), Shareholding Proportion of the Largest Shareholder (TOP1), and Cash Flow Ratio (Cashflow).

The main variables and their definitions are presented in Table 1.

Table 1.

Variable definitions.

This section has detailed the research design, including sample selection, data processing, model specification, and variable definition. We used a sample of A-share listed manufacturing firms in China from 2012 to 2022 and ensured the rigor of our study through a series of strict data cleaning and processing steps. Subsequently, we constructed multiple regression models to test the impact of digital technology on firms’ green innovation efficiency, further exploring the mediating role of human capital structure and the moderating effect of the internal compensation gap. The robust establishment of these models and variables lays a solid foundation for the subsequent empirical analysis and result verification.

5. Empirical Results and Analysis

5.1. Descriptive Statistics

Table 2 presents the descriptive statistics. The minimum value for corporate green innovation efficiency (GIE) is 0.000, while the maximum is 31.442, with a mean of 1.660. This wide range and relatively low mean clearly indicate a significant polarization in green innovation efficiency among Chinese manufacturing enterprises, which is a key driver for this study’s in-depth investigation into influencing factors. For digital technology (IT), the minimum value is 0.001 and the maximum is 3.180. From an accounting perspective, this occurs because the minimum net values of fixed assets and intangible assets within digital assets can be zero. Conversely, the total net assets can be influenced by liabilities, resulting in their net value being less than that of digital assets, thereby causing the digital technology ratio to exceed 1. This fully reveals the extensive variation in the adoption and application levels of digital technology across different manufacturing firms, ranging from preliminary involvement to high integration. This aligns perfectly with the current digital transformation process of enterprises in the digital economy. The minimum and maximum proportions of production personnel (PPR) are 0.063 and 0.867, respectively. The minimum and maximum proportions of sales personnel (SPR) are 0.001 and 0.607, respectively. The minimum and maximum proportions of technical personnel (TPR) are 0.026 and 0.632, respectively. The broad range of compensation disparity (IWR) suggests significant differences in compensation incentive mechanisms across firms. The minimum internal compensation disparity is 0.560, indicating relatively flat compensation distribution in some firms, while the maximum of 25.051 suggests that other firms might adopt more incentive-driven, differentiated compensation strategies.

Table 2.

Descriptive statistics.

Additionally, the descriptive statistics for all other variables fall within a reasonable range, indicating good data quality without outliers or extreme deviations. This provides a reliable data foundation for the subsequent regression analysis.

5.2. Baseline Regression

The results of the regression analysis are presented in Table 3. Column (1) of Table 3 shows the regression results without including control variables and without controlling for firm-year fixed effects. Column (2) of Table 3 displays the regression results without including control variables but with firm-year fixed effects. Both consistently indicate a significant positive correlation between digital technology and corporate green innovation efficiency, providing preliminary empirical support for the empowerment of corporate Green Innovation efficiency by digital technology. Further focusing on Model (1) as shown in Column (3) of Table 3, after incorporating all control variables and controlling for firm and year fixed effects, and clustering at the firm level, the regression coefficient for digital technology is 0.434, which is significantly positive at the 5% statistical level. This strongly supports Hypothesis 1 of this study, namely, that digital technology can significantly promote the enhancement of green innovation efficiency in manufacturing firms.

Table 3.

Benchmark regression results.

Benchmark regression analysis provides initial evidence for the direct impact of digital technology on firms’ green innovation efficiency. The study found that even after controlling for various variables and fixed effects, the promotional effect of digital technology on green innovation efficiency remains significant. This finding provides strong support for the core hypothesis of the study.

5.3. Endogeneity and Robustness Tests

5.3.1. Endogeneity Tests

- (1)

- Instrumental Variable Method

To further identify the causal relationship between digital technology and corporate green innovation efficiency, referencing the study by Zheng and Ye [54], we construct an interaction term using the national internet investment from the previous year, which varies over time, and the number of fixed telephones per million people, as instrumental variables for corporate digital technology. The regression results are presented in Column (1) of Table 4. The regression coefficient of IV on IT is significantly positive at the 1% level. The F-statistic for the instrumental variables is 220.469, which is greater than the critical value at the 10% level for the Stock-Yogo weak identification test. The LM statistic is 86.837, and its p-value is 0.000, which significantly rejects the null hypothesis. Therefore, the selected instrumental variables are relatively reasonable. Even after considering endogeneity issues, the results for digital technology and green innovation efficiency remain significantly positive, re-validating the establishment of H1.

- (2)

- Heckman Two-Stage Model

To effectively mitigate potential endogeneity issues arising from sample self-selection in the model, we adopted the Heckman two-stage model for testing. In the first stage, we conducted a Probit regression using all control variables from the baseline regression. This aimed to simulate the enterprise’s decision-making process for adopting digital technology, and based on this, we generated the Inverse Mills Ratio (IMR). This IMR captures unobserved factors in the sample that might simultaneously influence a firm’s choice to adopt digital technology and its performance. In the second stage, we included the calculated IMR as an additional control variable in the baseline Model (1). The analysis results show that the IMR coefficient is significantly negative, strongly indicating the presence of self-selection bias in the sample—enterprises that choose to adopt digital technology might exhibit different outcomes compared to a random sample due to certain unobserved characteristics. More importantly, even after controlling for this self-selection bias, the coefficient for digital technology remains significantly positive and highly consistent with our original conclusions. This fully demonstrates the robustness of our research findings, meaning the positive impact of digital technology on corporate performance is genuine and causal, not merely due to enterprises’ own selection preferences.

- (3)

- Propensity Score Matching (PSM)

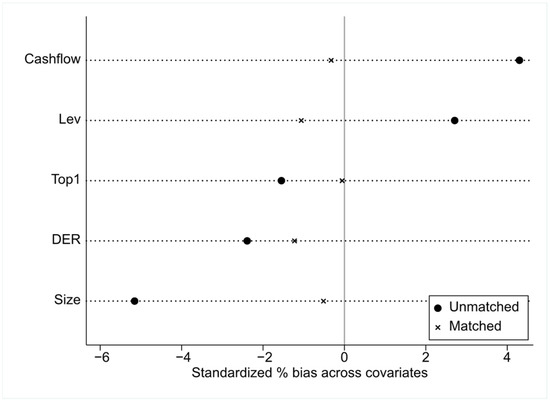

To address potential endogeneity arising from self-selection bias, we employ propensity score matching (PSM). Specifically, we first classify firms into a high-digital-technology (treated) group and a low-digital-technology (control) group using the median of the digital-technology measure. To reduce arbitrariness in the threshold choice, we use the median as a robust cut-off (insensitive to skewness and outliers) and verify overlap on the common support of the estimated treatment probabilities to ensure comparability between groups. We then estimate propensity scores with Size, Lev, DER, TOP1, and Cashflow as covariates and implement kernel matching. As shown in Figure 2, the standardized mean differences of covariates shrink substantially after matching, indicating good balance. Using the matched sample, we re-estimate the regression (Table 4, column (4)); the coefficients on the explanatory variables remain positive and statistically significant, consistent with the main-effect analysis and further confirming the robustness of the positive impact of digital technology on firms’ green innovation efficiency.

Figure 2.

Covariate balance test.

Table 4.

Endogeneity test results.

Table 4.

Endogeneity test results.

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| First | Second | GIE | GIE | |

| IT | GIE | |||

| IV | 0.259 *** | |||

| (0.017) | ||||

| IT | 14.728 *** | 0.434 ** | 0.238 * | |

| (1.940) | (0.170) | (0.126) | ||

| IMR | −20.58 * | |||

| (12.25) | ||||

| Size | −0.036 *** | 0.309 | 0.604 | −0.224 * |

| (0.014) | (0.284) | (0.492) | (0.124) | |

| Lev | 0.214 *** | −3.925 *** | −12.74 * | −0.575 |

| (0.052) | (1.124) | (7.199) | (0.664) | |

| DER | −0.027 *** | 0.404 ** | 2.135 * | 0.0383 |

| (0.010) | (0.203) | (1.246) | (0.109) | |

| Top1 | −0.000 | 0.001 | 0.00719 | −0.000812 |

| (0.001) | (0.019) | (0.00937) | (0.00789) | |

| Cashflow | −0.024 | 0.449 | −6.795 * | −0.533 |

| (0.045) | (0.916) | (3.882) | (0.621) | |

| _cons | 1.119 *** | - | 7.806 *** | 8.6299 *** |

| (0.304) | - | (2.935) | (7.18) | |

| Year | Yes | Yes | Yes | Yes |

| Stkcd | Yes | Yes | Yes | Yes |

| N | 14,844 | 14,844 | 14,844 | 14,825 |

| adj. R2 | - | - | 0.652 | 0.651 |

Note: Standard errors in parentheses; ***, ** and * denote statistical significance at the 1%, 5% and 10% levels, respectively.

This section conducted various tests to address endogeneity, ensuring the causal relationship of our findings. By using methods such as the instrumental variable approach, the Heckman two-stage model, and Propensity Score Matching (PSM), we effectively controlled for potential omitted variables and sample self-selection bias. All test results consistently re-validated our core conclusion: digital technology has a genuine and significant positive effect on firms’ green innovation efficiency.

5.3.2. Robustness Tests

To ensure the reliability and robustness of our research conclusions, we conducted several robustness tests.

- (1)

- Replacing the Independent Variable

First, recognizing potential measurement error or subjectivity in the primary independent variable, “digital technology (IT),” we replaced it with the more comprehensive and authoritative “Digital Transformation Index (DTA)” from the CSMAR database. We then re-ran Model (1). This index is calculated by assigning specific weights to six primary indicators: strategic leadership (0.3472), technology-driven (0.162), organizational empowerment (0.0969), environmental support (0.0342), digital achievements (0.2713), and digital application (0.0884), and then summing them. This alternative variable offers a broader measure of a firm’s digitalization level, effectively reducing potential measurement bias from a single indicator.

The robustness test results, presented in Column (1) of Table 5, show that the impact of digital technology on corporate green innovation efficiency remains significantly positive at the 1% statistical level. This result is highly consistent with our baseline regression findings, re-validating the conclusion that digital technology significantly promotes the improvement of green innovation efficiency in manufacturing enterprises, thus strongly supporting the robustness of our core hypothesis.

- (2)

- Replacing the Dependent Variable

We acknowledge that the measurement of the explained variable, “green innovation efficiency (GIE),” might involve potential measurement errors. To circumvent this potential issue and enhance the robustness of our study, we refer to the research by Xiao et al. [55] and introduce a substitute variable, Ent. The robustness test results after replacing the explained variable are presented in Column (2) of Table 5. The impact of digital technology on corporate green innovation efficiency remains significantly positive at the 1% statistical level. This finding is highly consistent with the results of the benchmark regression, providing strong support for the core hypothesis of this study.

- (3)

- Controlling for Industry Fixed Effects

Considering that different industries exhibit systematic differences in competitive environments, policy regulations, and other aspects, these factors may influence firms’ green innovation efficiency, potentially leading to omitted variable bias. Therefore, this study, building upon the control for firm and year fixed effects in the main regression, further introduces industry fixed effects for re-estimation. The specific regression results are presented in Column (3) of Table 5. The results indicate that after the inclusion of industry fixed effects, the regression coefficient and significance level of the core explanatory variable (IT) remain largely consistent with the main regression results, showing no substantial change. This suggests that the conclusions of this study are not significantly perturbed by specific industry effects, demonstrating strong robustness.

- (4)

- Controlling for Province Fixed Effects

Different provinces may exhibit significant disparities in economic development levels, industrial policies, environmental regulatory stringency, local government support, and regional innovation climate. These provincial-level heterogeneous factors could simultaneously influence firms’ adoption of digital technology and their green innovation efficiency. Failure to control for these factors might lead to biased regression results. To further rule out potential omitted variable bias, particularly the impact of unobserved provincial-level heterogeneous factors on the study’s findings, this research, building on the original model’s control for year and firm fixed effects, additionally controlled for province fixed effects. By introducing province fixed effects, the model can effectively absorb these unobserved characteristics that vary by province but are constant over time, thereby yielding a more accurate estimation of the impact of digital technology on green innovation efficiency. Even after controlling for year, firm, and province triple fixed effects, the regression results remain statistically significant.

Furthermore, we included an interaction term between province and year for additional examination. As shown in Column (5) of Table 5, the regression results remain robust.

- (5)

- Exclusion of Samples from Specific Years

Given that the COVID-19 pandemic, which erupted at the end of 2019 and continued through 2021, served as a significant external shock, it had an unprecedented impact on the global macroeconomy and corporate operating environments. During this period, firms’ economic indicators might have been distorted; simultaneously, specific industries, such as digital services, experienced explosive growth. To prevent data from this special period from interfering with the purity of our research conclusions, this study conducted a robustness check by excluding samples from this period. Specifically, we re-estimated the model after removing observational samples from 2019 to 2021. The regression results, presented in Column (6) of Table 5, show that the significance of the core explanatory variable remains consistent with the main regression results. This indicates that even after excluding the impact of the COVID-19 pandemic as a special event, the core conclusions of this study still hold, demonstrating the strong robustness of the research findings.

- (6)

- Adding Control Variables

To further mitigate potential omitted variable issues, this study, building upon the benchmark model, additionally incorporated a series of provincial-level and firm-level control variables. The macroeconomic regional environment in which a firm operates (e.g., economic development level, degree of openness to the outside world) and its own life cycle stage (e.g., firm age) can systematically influence innovation activities. Specifically, this paper further controlled for provincial-level economic development (PGDP), foreign direct investment (FDI), fiscal investment intensity (FIS), government intervention (GOV), and firm-level firm age.

Table 5.

Robustness test results.

Table 5.

Robustness test results.

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| GIE | Ent | GIE | GIE | GIE | GIE | GIE | |

| DTA | 0.0124 *** | ||||||

| (0.00453) | |||||||

| IT | 0.0895 *** | 0.428 ** | 0.434 ** | 0.443 *** | 0.436 ** | 0.432 ** | |

| (0.0128) | (0.172) | (0.171) | (0.168) | (0.201) | (0.169) | ||

| Size | −0.242** | 0.0479 *** | −0.241 * | −0.211 * | −0.155 | −0.122 | −0.198 |

| (0.124) | (0.0105) | (0.130) | (0.126) | (0.125) | (0.152) | (0.125) | |

| Lev | −0.554 | 0.413 *** | −0.606 | −0.642 | −0.470 | −1.313 | −0.630 |

| (0.614) | (0.0536) | (0.624) | (0.625) | (0.582) | (0.869) | (0.619) | |

| DER | 0.0335 | −0.0274 *** | 0.0488 | 0.0413 | 0.0485 | 0.0589 | 0.0447 |

| (0.0983) | (0.00921) | (0.0981) | (0.100) | (0.0987) | (0.130) | (0.0989) | |

| Top1 | −0.000127 | 0.000928 | −0.00125 | −0.000176 | −0.00216 | 0.00328 | −0.00168 |

| (0.00782) | (0.000604) | (0.00804) | (0.00806) | (0.00788) | (0.00866) | (0.00796) | |

| Cashflow | −0.448 | −0.0556 | −0.460 | −0.476 | −0.154 | −0.957 | −0.408 |

| (0.593) | (0.0544) | (0.594) | (0.595) | (0.608) | (0.888) | (0.596) | |

| PGDP | 1.280 *** | ||||||

| (0.461) | |||||||

| FDI | −83.14 ** | ||||||

| (34.44) | |||||||

| FIS | −0.0269 | ||||||

| (0.0236) | |||||||

| GOV | 7.649 *** | ||||||

| (2.579) | |||||||

| FirmAge | −1.218 | ||||||

| (0.809) | |||||||

| _cons | 7.164 *** | −0.142 | 7.040 ** | 6.353 ** | 5.096 * | 4.511 | −6.226 |

| (2.702) | (0.235) | (2.859) | (2.767) | (2.733) | (3.312) | (6.585) | |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stkcd | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Ind | No | No | Yes | No | No | No | No |

| Province | No | No | No | Yes | Yes | No | No |

| Year × Province | No | No | No | No | Yes | No | No |

| N | 14,844 | 14,844 | 14,844 | 14,844 | 14,844 | 9002 | 14,844 |

| adj. R2 | 0.651 | 0.586 | 0.652 | 0.652 | 0.662 | 0.670 | 0.652 |

Note: Standard errors in parentheses; ***, ** and * denote statistical significance at the 1%, 5% and 10% levels, respectively.

The regression results after adding these control variables are shown in Column (7) of Table 5. The results indicate that, even after considering more potential influencing factors, the coefficient of the core explanatory variable (IT) remains significantly positive and consistent with the main regression results. This further demonstrates that the conclusions of this study remain robust and reliable after controlling for a more comprehensive set of variables.

This section conducted a series of robustness tests to strongly verify the reliability of our core research conclusions. We ensured the robustness of our results by methods such as replacing key variables, controlling for various fixed effects, excluding samples from special years, and adding more control variables. All tests consistently showed that the central finding—that digital technology significantly boosts firms’ green innovation efficiency—is not disturbed by various potential factors, demonstrating the reliability and trustworthiness of our research.

5.4. Mechanism Test

5.4.1. Mediating Effect of Human Capital Structure

Table 6’s regression analysis results verify that digital technology impacts corporate green innovation efficiency through multiple mediating effects of human capital structure.

Table 6.

Mediation effect regression results.

First, Columns (1) and (4) of Table 6 show that digital technology significantly reduces the proportion of production personnel in firms (β1 = −0.00876, p < 0.01), while the proportion of production personnel is significantly negatively correlated with corporate green innovation efficiency (γ2 = −1.272, p < 0.05). This indicates that digital technology indirectly inhibits the improvement of corporate green innovation efficiency by “crowding out” production personnel, thus supporting H2a.

Second, the results from Columns (2) and (5) of Table 6 indicate that digital technology significantly increases the proportion of sales personnel in firms (β4 = 0.00316, p < 0.05), and a higher proportion of sales personnel significantly promotes the improvement of corporate green innovation efficiency (γ6 = 1.727, p < 0.1). This confirms that digital technology enhances corporate green innovation efficiency by driving an increase in the proportion of sales personnel, supporting H2b.

Finally, the results from Columns (3) and (6) of Table 6 reveal that digital technology significantly increases the proportion of technical personnel in firms (β7 = 0.00525, p < 0.01), and a higher proportion of technical personnel also significantly promotes the improvement of corporate green innovation efficiency (γ9 = 1.547, p < 0.01). This suggests that digital technology significantly strengthens corporate green innovation capability by optimizing human capital structure and increasing the reserve of technical talent, thereby supporting H2c.

Notably, in all mediating paths, γ1 = 0.423 in Column (4), γ5 = 0.429 in Column (5), and γ8 = 0.426 in Column (6) are all significant at the 5% level. This indicates that the direct positive effect of digital technology on corporate green innovation efficiency remains significant.

To further enhance the reliability of the mediation effect test results and establish a clear causal time order, we adopted a robustness check method involving lagging both the mediating variable and the outcome variable. We regressed digital technology with the mediating variable lagged by one period to confirm that the independent variable indeed precedes the mediating variable. Subsequently, we regressed the one-period lagged mediating variable on the one-period lagged green innovation efficiency to verify the transmission mechanism of the mediation effect.

The test results, presented in Table 7, show that even after employing the lagging treatment, the mediation effect remains significant, and its action path is consistent with the main test results. This powerfully demonstrates that the mediating transmission mechanism we uncovered is robust and reliable, further strengthening the persuasiveness of our research conclusions.

Table 7.

Robustness test results of mediation effect.

5.4.2. Moderating Effect of Internal Compensation Disparity

Based on the regression analysis results in Table 8, this study confirms the moderating role of internal compensation disparity in the process by which digital technology influences human capital structure. First, Column (1) shows that the regression coefficient of digital technology on the proportion of production personnel is −0.0146, which is significantly negative at the 1% level, indicating that digital technology indeed reduces the proportion of production personnel. More importantly, the estimated coefficient for the interaction term between digital technology and internal compensation disparity (IT × IWR) is 0.00123 and is significant at the 10% level. This suggests that internal compensation disparity positively moderates the impact of digital technology on the proportion of production personnel. Specifically, as compensation disparity widens, the negative impact of digital technology on the proportion of production personnel (i.e., the “crowding-out effect”) weakens, which aligns with Hypothesis H3a. Second, Column (2) shows that the regression coefficient of digital technology on the proportion of sales personnel is 0.00629, which is significantly positive at the 1% level. Concurrently, the estimated coefficient for the interaction term (IT × IWR) is −0.000626 and is significant at the 10% level. This indicates that internal compensation disparity negatively moderates the impact of digital technology on the proportion of sales personnel. This means that a widening compensation disparity weakens the promoting effect of digital technology on the proportion of sales personnel, thereby supporting Hypothesis H3b. Finally, Column (3) shows that the regression coefficient of digital technology on the proportion of technical personnel is 0.00942, which is significantly positive at the 1% level. The estimated coefficient for the interaction term (IT × IWR) is −0.000865 and is significant at the 10% level. This also indicates that internal compensation disparity negatively moderates the impact of digital technology on the proportion of technical personnel. Specifically, a widening compensation disparity inhibits the promoting effect of digital technology on the proportion of technical personnel, thereby supporting Hypothesis H3c.

Table 8.

Moderation effect regression results.

Additionally, recognizing that the measurement of the internal compensation gap might incur measurement error due to the exclusion of equity compensation, we further referred to the study by Liu and Jiang [56] and replaced the measurement method for the internal compensation gap for further examination.

The results are presented in Table 9. The regression outcomes show that even after altering the measurement of the internal compensation gap (GAP), the hypothesis concerning the moderating effect remains valid.

Table 9.

Robustness test results of moderating effect.

5.5. Heterogeneity Test

5.5.1. Analysis Based on Differences in Industry Technological Environments

Considering that the impact of digital technology on green innovation efficiency is not universal, its effects may vary depending on the technological foundation of the industry in which a firm operates. In high-tech industries, firms generally possess stronger R&D capabilities, deeper technological accumulation, and a more open innovation culture. This allows digital technology to integrate more effectively with existing technological systems, thereby generating greater synergistic effects. In non-high-tech industries, however, due to a relatively weaker technological base, firms may find it difficult to fully utilize the complex functionalities of digital technology, and its empowering role might therefore be limited. To verify this inference, this study divided sample firms into two categories—high-tech industries and non-high-tech industries—based on the China Securities Regulatory Commission’s industry classification, and conducted a grouped regression analysis. The regression results are presented in Columns (1) and (2) of Table 10. In high-tech industries, the promotional effect of digital technology on green innovation efficiency is significantly positive, whereas in non-high-tech industries, the impact of digital technology is not significant. This further confirms the importance of the industry’s technological environment in determining the effectiveness of digital technology’s empowerment.

Table 10.

Heterogeneity test results.

5.5.2. Analysis Based on Differences in Capital Factor Intensity

Manufacturing enterprises with varying capital intensities exhibit significant differences in production models, technological pathways, and resource allocation. Capital-intensive manufacturing firms typically possess substantial fixed assets and heavy equipment, implying potentially more rigid production processes, stronger reliance on existing technologies, and higher transformation costs. Non-capital-intensive manufacturing firms, conversely, might be more flexible and more readily adopt and adapt to new technologies, including digital technologies, to optimize their operations and innovation processes [57]. Thus, the empowerment effect of digital technology on green innovation efficiency might differ between these two types of manufacturing firms. Following the research of Yin et al. [58], this paper divided sample firms into capital-intensive and non-capital-intensive groups for further analysis. The heterogeneity test results are shown in Columns (3) and (4) of Table 10. The study found that in capital-intensive manufacturing enterprises, the impact of digital technology on corporate green innovation efficiency is not significant. In non-capital-intensive manufacturing enterprises, the impact of digital technology on corporate green innovation efficiency is significantly positive at the 1% statistical level.

5.5.3. Analysis Based on Differences in Pollution Attributes

Given that heavily polluting enterprises face stricter environmental regulatory pressures and a greater urgency for green transformation, their demand for and response to digital technology-enabled green innovation might differ from non-heavily polluting enterprises. This study also referred to the research of Guo et al. [59] and conducted group tests based on whether enterprises belong to heavily polluting industries. Digital technology in heavily polluting enterprises might be prioritized for applications in pollution control, energy management, and the circular economy, aiming for greener production processes and efficiency improvements. The heterogeneity test results are shown in Columns (5) and (6) of Table 10. The study found that in heavily polluting manufacturing enterprises, the impact of digital technology on corporate green innovation efficiency is significantly positive at the 10% statistical level, with a regression coefficient of 0.165. In non-heavily polluting manufacturing enterprises, the impact of digital technology on corporate green innovation efficiency is significantly positive at the 1% statistical level, with a regression coefficient of 0.511. This result indicates that the promoting effect of digital technology on green innovation efficiency is more significant, and the impact intensity (regression coefficient) is higher in non-heavily polluting enterprises compared to heavily polluting enterprises.

This chapter, through a rigorous empirical analysis, fully reveals the complex relationship between digital technology, human capital structure, and firms’ green innovation efficiency. The study finds that the application of digital technology significantly enhances the green innovation efficiency of manufacturing firms. This promotional effect is not only direct but also indirectly transmitted by optimizing the human capital structure: digital technology “crowds out” production personnel while “crowding in” sales and technical personnel, thereby reallocating firm resources towards innovation activities. Furthermore, the analysis reveals a complex moderating role of the internal compensation gap, which, to some extent, weakens the positive impact of digital technology on sales and technical personnel while also slowing down the “crowding-out” effect on production staff. The heterogeneity analysis further indicates that the enabling effect of digital technology is more pronounced in high-tech, non-capital-intensive, and non-heavily polluting industries.

6. Discussion and Conclusions

6.1. Research Conclusions and Management Implications

6.1.1. Research Conclusions

Under the dual drivers of global green economic transformation and the digital wave, the manufacturing industry is facing unprecedented opportunities and challenges. As the world’s second-largest economy and a major manufacturing nation, the transformation challenges and green development opportunities confronting China’s manufacturing sector not only profoundly impact global industrial chains and climate governance but also offer crucial experience and universal research value for other emerging economies. In this context, using a sample of China’s A-share manufacturing listed companies from 2012 to 2022, this study deeply explores the intrinsic mechanisms through which digital technology empowers green innovation efficiency in manufacturing enterprises. The main research conclusions are as follows:

Firstly, digital technology significantly promotes the improvement of green innovation efficiency in manufacturing enterprises. This indicates that the widespread application and deep integration of digital technology provide new impetus for corporate green transformation, effectively enhancing green innovation output by optimizing resource allocation, improving information processing capabilities, and fostering collaborative innovation.

Secondly, digital technology plays a mediating role in green innovation efficiency by optimizing human capital structure. Specifically, digital technology significantly reduces the proportion of production personnel, which helps improve green innovation efficiency. This reflects the “crowding-out effect” of automation and intelligence on traditional positions, allowing enterprises to shift more resources from labor-intensive production segments to high-value-added innovation activities, thereby enhancing green innovation efficiency. Simultaneously, digital technology significantly increases the proportion of sales personnel and technical personnel, and the increase in both significantly promotes green innovation efficiency. This, respectively, indicates that digital marketing, e-commerce, and other applications enhance firms’ market expansion and customer relationship-management capabilities, facilitating the market transformation and value realization of green innovation outcomes. Meanwhile, the concentration of highly skilled technical talent is the core driving force for green technology R&D and innovation, with their professional knowledge and innovative abilities directly boosting corporate green innovation efficiency.

Thirdly, internal compensation disparity exerts a complex moderating effect on how digital technology influences human capital structure. The study found that a larger compensation disparity weakens the “crowding-out effect” on production personnel. This may reflect that when compensation disparity is significant, production personnel have relatively lower bargaining power and are more inclined to accept job adjustments brought by digital technology to secure their existing positions, thereby slowing down the rate at which they are “crowded out.” However, a larger compensation disparity weakens the promoting effect of digital technology on the proportion of sales and technical personnel. This reveals the importance of compensation fairness for the stability and attractiveness of core talent. For high-value-added sales and technical talent, excessive internal compensation disparity can lead to psychological imbalance, reduce work enthusiasm, and even result in talent loss, thereby weakening digital technology’s ability to attract and retain these critical talents and optimize human capital structure.

Furthermore, the promotional effect of digital technology on green innovation efficiency exhibits significant differences across various types of manufacturing firms. Specifically, in high-tech industries, the positive effect of digital technology on corporate green innovation efficiency is more pronounced, while it is not significant in non-high-tech industries. In non-capital-intensive firms, the promotional effect of digital technology on green innovation efficiency is significant, whereas it is not significant in capital-intensive firms. This disparity may be related to differences in transformation costs and flexibility among firms with varying capital structures, with non-capital-intensive firms being more adaptable to changes brought by digital technology. Lastly, digital technology has a more significant and stronger promotional effect on the green innovation Efficiency of non-heavily polluting manufacturing firms, and also an active but relatively weaker promotional effect on heavily polluting firms. This suggests that the pollution attributes of the industry in which a firm operates influence the focus and effectiveness of digital technology applications in green innovation.

6.1.2. Management Implications

- (1)

- Theoretical Implications

Based on an empirical analysis of the complex relationships among digital technology adoption, human capital structure, and green innovation efficiency in manufacturing firms, this study offers the following theoretical implications for the existing literature: