Can the Energy Rights Trading System Become the New Engine for Corporate Carbon Reduction? Evidence from China’s Heavy-Polluting Industries

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Literature Review

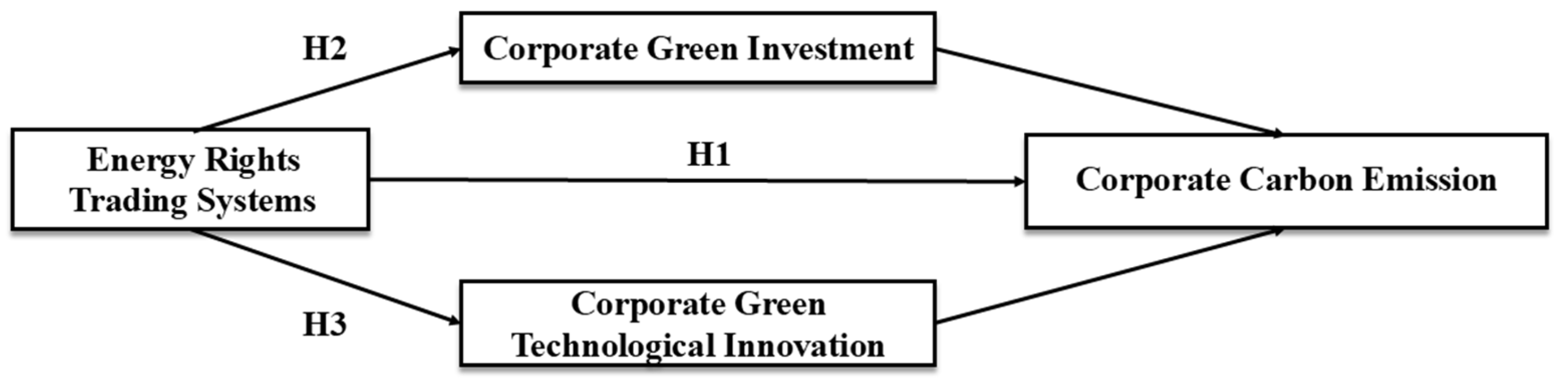

2.2. Research Hypotheses

3. Methodology and Data

3.1. Sample Selection

3.2. Measurement Framework

3.3. Empirical Strategy

4. Results and Findings

4.1. Descriptive Statistics

4.2. Main Effects

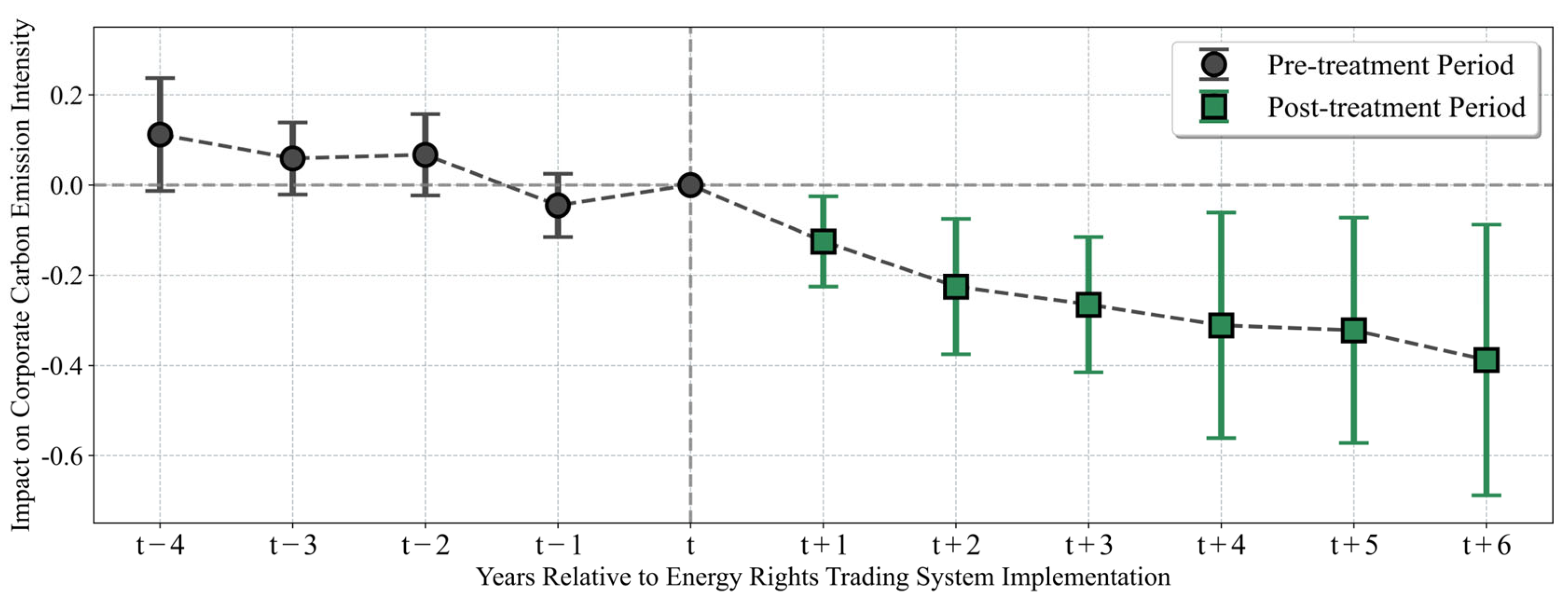

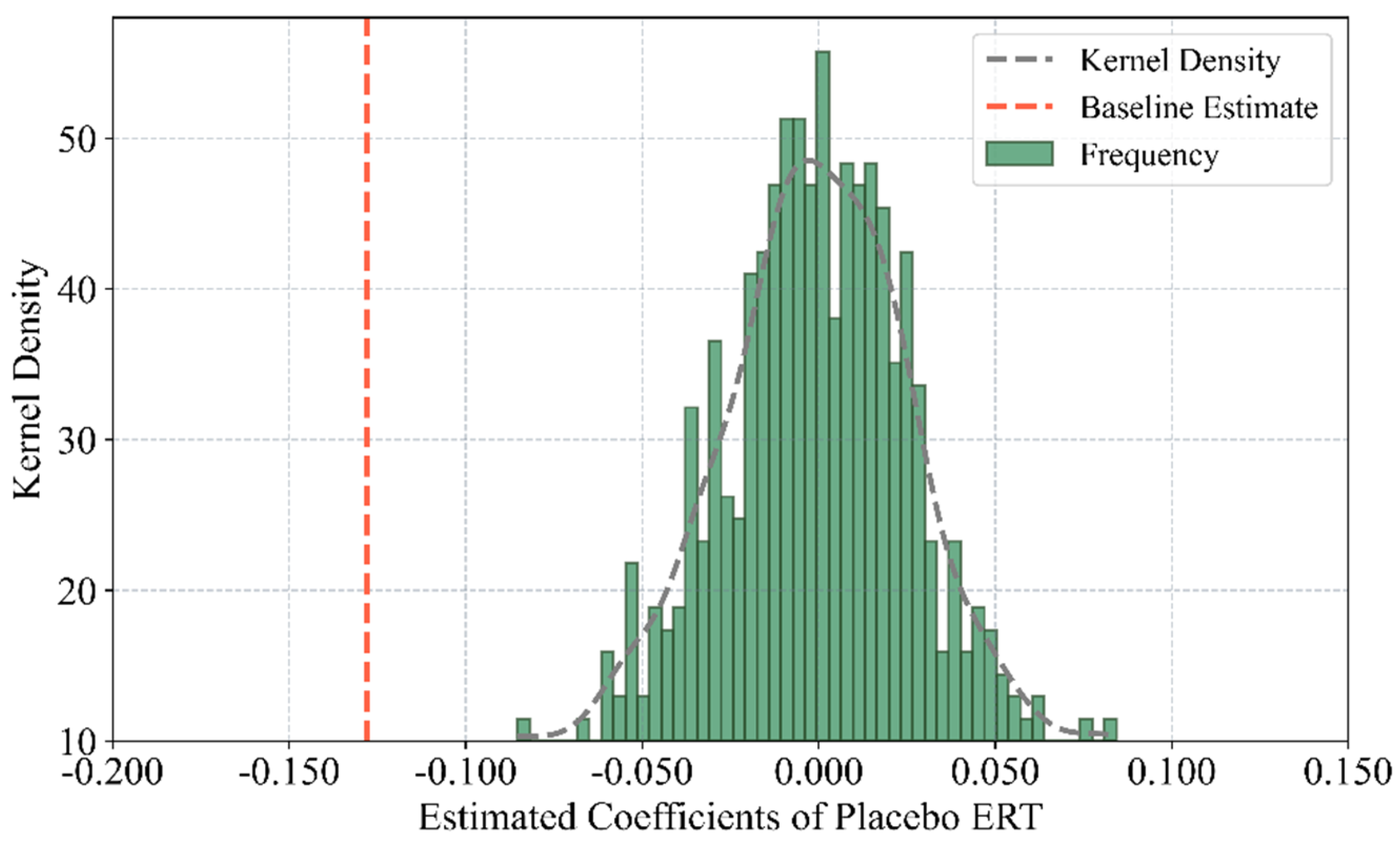

4.3. Sensitivity Analysis

4.4. Cross-Sectional Variations

4.5. Mechanism Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lei, X.; He, S. Climate shocks and innovation persistence: Evidence from extreme precipitation. Humanit. Soc. Sci. Commun. 2025, 12, 881. [Google Scholar] [CrossRef]

- Lei, X.; Xu, X. Storm clouds over innovation: Typhoon shocks and corporate R&D activities. Econ. Lett. 2024, 244, 112014. [Google Scholar] [CrossRef]

- Zhang, S.; Cai, W.; Zheng, X.; Lv, X.; An, K.; Cao, Y.; Cheng, H.S.; Dai, J.; Dong, X.; Fan, S. Global readiness for carbon neutrality: From targets to action. Environ. Sci. Ecotechnology 2025, 25, 100546. [Google Scholar] [CrossRef] [PubMed]

- Lei, X. Assessing the effectiveness of energy transition policies on corporate ESG performance: Insights from China’s NEDC initiative. Int. J. Glob. Warm. 2024, 34, 291–299. [Google Scholar] [CrossRef]

- Haites, E. Experience with linking greenhouse gas emissions trading systems. Wiley Interdiscip. Rev. Energy Environ. 2016, 5, 246–260. [Google Scholar] [CrossRef]

- Song, M.; Zheng, H.; Shen, Z. Whether the carbon emissions trading system improves energy efficiency—Empirical testing based on China’s provincial panel data. Energy 2023, 275, 127465. [Google Scholar] [CrossRef]

- Narassimhan, E.; Gallagher, K.S.; Koester, S.; Alejo, J.R. Carbon pricing in practice: A review of existing emissions trading systems. Clim. Policy 2018, 18, 967–991. [Google Scholar] [CrossRef]

- Pan, Y.; Dong, F. Design of energy use rights trading policy from the perspective of energy vulnerability. Energy Policy 2022, 160, 112668. [Google Scholar] [CrossRef]

- Yang, B.; Cui, Y. Can the energy consumption rights trading system enhance energy resilience?—A synergistic perspective of green finance and financial technology. Energy 2025, 322, 135605. [Google Scholar] [CrossRef]

- Xu, J.; Akhtar, M.; Haris, M.; Muhammad, S.; Abban, O.J.; Taghizadeh-Hesary, F. Energy crisis, firm profitability, and productivity: An emerging economy perspective. Energy Strategy Rev. 2022, 41, 100849. [Google Scholar] [CrossRef]

- Montgomery, W.D. Markets in licenses and efficient pollution control programs. J. Econ. Theory 1972, 5, 395–418. [Google Scholar] [CrossRef]

- Mideksa, T.K.; Weitzman, M.L. Prices versus quantities across jurisdictions. J. Assoc. Environ. Resour. Econ. 2019, 6, 883–891. [Google Scholar] [CrossRef]

- Schmalensee, R.; Stavins, R.N. Lessons learned from three decades of experience with cap and trade. Rev. Environ. Econ. Policy 2017, 11, 59–79. [Google Scholar] [CrossRef]

- Cui, J.; Wang, C.; Zhang, J.; Zheng, Y. The effectiveness of China’s regional carbon market pilots in reducing firm emissions. Proc. Natl. Acad. Sci. USA 2021, 118, e2109912118. [Google Scholar] [CrossRef] [PubMed]

- Zhang, S.; Wang, Y.; Hao, Y.; Liu, Z. Shooting two hawks with one arrow: Could China’s emission trading scheme promote green development efficiency and regional carbon equality? Energy Econ. 2021, 101, 105412. [Google Scholar] [CrossRef]

- Yu, J.; Liu, P.; Shi, X.; Ai, X. China’s emissions trading scheme, firms’ R&D investment and emissions reduction. Econ. Anal. Policy 2023, 80, 1021–1037. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, X.; Chen, F. Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Change 2021, 168, 120744. [Google Scholar] [CrossRef]

- Zhang, Q.; Li, J.; Wang, J. Does energy-consuming right trading have double dividend effect on firm’s economic performance and carbon emission? Environ. Sci. Pollut. Res. 2023, 30, 105595–105613. [Google Scholar] [CrossRef]

- Newell, R.G.; Stavins, R.N. Cost heterogeneity and the potential savings from market-based policies. J. Regul. Econ. 2003, 23, 43–59. [Google Scholar] [CrossRef]

- Betz, R.; Seifert, S.; Cramton, P.; Kerr, S. Auctioning greenhouse gas emissions permits in Australia. Aust. J. Agric. Resour. Econ. 2010, 54, 219–238. [Google Scholar] [CrossRef]

- Cramton, P.; Kerr, S. Tradeable carbon permit auctions: How and why to auction not grandfather. Energy Policy 2002, 30, 333–345. [Google Scholar] [CrossRef]

- Brouwers, R.; Schoubben, F.; Van Hulle, C. The influence of carbon cost pass through on the link between carbon emission and corporate financial performance in the context of the European Union Emission Trading Scheme. Bus. Strategy Environ. 2018, 27, 1422–1436. [Google Scholar] [CrossRef]

- Newell, R.G.; Pizer, W.A.; Raimi, D. Carbon markets: Past, present, and future. Annu. Rev. Resour. Econ. 2014, 6, 191–215. [Google Scholar] [CrossRef]

- Liu, Z.; Sun, H. Assessing the impact of emissions trading scheme on low-carbon technological innovation: Evidence from China. Environ. Impact Assess. Rev. 2021, 89, 106589. [Google Scholar] [CrossRef]

- Chen, J.; Geng, Y.; Liu, R. Carbon emissions trading and corporate green investment: The perspective of external pressure and internal incentive. Bus. Strategy Environ. 2023, 32, 3014–3026. [Google Scholar] [CrossRef]

- Wu, Q.; Wang, Y. How does carbon emission price stimulate enterprises’ total factor productivity? Insights from China’s emission trading scheme pilots. Energy Econ. 2022, 109, 105990. [Google Scholar] [CrossRef]

- Popp, D.C. The effect of new technology on energy consumption. Resour. Energy Econ. 2001, 23, 215–239. [Google Scholar] [CrossRef]

- Fleiter, T.; Worrell, E.; Eichhammer, W. Barriers to energy efficiency in industrial bottom-up energy demand models—A review. Renew. Sustain. Energy Rev. 2011, 15, 3099–3111. [Google Scholar] [CrossRef]

- Ambec, S.; Cohen, M.A.; Elgie, S.; Lanoie, P. The Porter hypothesis at 20: Can environmental regulation enhance innovation and competitiveness? Rev. Environ. Econ. Policy 2013, 7, 2–22. [Google Scholar] [CrossRef]

- Zhao, X.; Sun, B. The influence of Chinese environmental regulation on corporation innovation and competitiveness. J. Clean. Prod. 2016, 112, 1528–1536. [Google Scholar] [CrossRef]

- Ramanathan, R.; He, Q.; Black, A.; Ghobadian, A.; Gallear, D. Environmental regulations, innovation and firm performance: A revisit of the Porter hypothesis. J. Clean. Prod. 2017, 155, 79–92. [Google Scholar] [CrossRef]

- Khanna, M. Non-mandatory approaches to environmental protection. J. Econ. Surv. 2001, 15, 291–324. [Google Scholar] [CrossRef]

- Gunningham, N.A.; Thornton, D.; Kagan, R.A. Motivating management: Corporate compliance in environmental protection. Law Policy 2005, 27, 289–316. [Google Scholar] [CrossRef]

- Qi, T.; Chen, L. Heterogeneous environmental regulations and firm financial performance: The moderating effects of marketization. Environ. Dev. Sustain. 2024, 15, 1–37. [Google Scholar] [CrossRef]

- Kenis, A.; Lievens, M. Greening the economy or economizing the green project? When environmental concerns are turned into a means to save the market. Rev. Radic. Political Econ. 2016, 48, 217–234. [Google Scholar] [CrossRef]

- Stefan, A.; Paul, L. Does it pay to be green? A systematic overview. Acad. Manag. Perspect. 2008, 22, 45–62. [Google Scholar] [CrossRef]

- Lei, X.; Xu, X. Innovation in the storm: How typhoons are reshaping the corporate R&D landscape. Technol. Soc. 2025, 81, 102828. [Google Scholar] [CrossRef]

- Xu, X.; Yuan, H.; Lei, X. From Technological Integration to Sustainable Innovation: How Diversified Mergers and Acquisitions Portfolios Catalyze Breakthrough Technologies. Sustainability 2024, 16, 10915. [Google Scholar] [CrossRef]

- Galende, J. Analysis of technological innovation from business economics and management. Technovation 2006, 26, 300–311. [Google Scholar] [CrossRef]

- Lazonick, W. The theory of the market economy and the social foundations of innovative enterprise. Econ. Ind. Democr. 2003, 24, 9–44. [Google Scholar] [CrossRef]

- Song, M.; Tao, J.; Wang, S. FDI, technology spillovers and green innovation in China: Analysis based on Data Envelopment Analysis. Ann. Oper. Res. 2015, 228, 47–64. [Google Scholar] [CrossRef]

- Chen, J.; Guo, Z.; Lei, Z. Research on the mechanisms of the digital transformation of manufacturing enterprises for carbon emissions reduction. J. Clean. Prod. 2024, 449, 141817. [Google Scholar] [CrossRef]

- Zhou, J.; Liu, W. Carbon Reduction Effects of Digital Technology Transformation: Evidence from the Listed Manufacturing Firms in China. Technol. Forecast. Soc. Change 2024, 198, 122999. [Google Scholar] [CrossRef]

| Variable | Observations | Mean | S.D. | Min | Max |

|---|---|---|---|---|---|

| CI | 4842 | 0.286 | 0.218 | 0.008 | 1.467 |

| ERT | 4842 | 0.247 | 0.431 | 0.000 | 1.000 |

| GIV | 4842 | 0.019 | 0.022 | 0.000 | 0.134 |

| GTI | 4842 | 0.127 | 0.169 | 0.000 | 0.768 |

| Size | 4842 | 22.340 | 1.280 | 20.120 | 25.890 |

| Lev | 4842 | 0.453 | 0.162 | 0.134 | 0.826 |

| ROA | 4842 | 0.042 | 0.051 | −0.187 | 0.234 |

| Growth | 4842 | 0.089 | 0.263 | −0.418 | 1.523 |

| Top1 | 4842 | 0.346 | 0.142 | 0.098 | 0.687 |

| BS | 4842 | 2.178 | 0.183 | 1.792 | 2.639 |

| Variable | (1) | (2) |

|---|---|---|

| CI | CI | |

| ERT | −0.142 ** | −0.128 ** |

| (−2.29) | (−2.08) | |

| Size | −0.076 *** | |

| (−3.42) | ||

| Lev | 0.089 * | |

| (1.84) | ||

| ROA | −0.234 *** | |

| (−4.17) | ||

| Growth | −0.015 | |

| (−0.67) | ||

| Top1 | 0.038 | |

| (1.23) | ||

| BS | 0.024 | |

| (0.91) | ||

| Firm | Yes | Yes |

| Year | Yes | Yes |

| Observations | 4842 | 4842 |

| R2 | 0.736 | 0.748 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| CI | CI | CI | |

| ERT | −0.115 * | −0.122 ** | −0.113 * |

| (−1.89) | (−2.15) | (−1.84) | |

| CETS | −0.102 ** | ||

| (−2.31) | |||

| Controls | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| Observations | 3476 | 4120 | 4842 |

| R2 | 0.752 | 0.745 | 0.741 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Low Financing Constraints | High Financing Constraints | High Supply Chain Concentration | Low Supply Chain Concentration | |

| ERT | −0.167 ** | −0.058 | −0.145 ** | −0.089 |

| (−2.28) | (−0.84) | (−2.19) | (−1.33) | |

| Controls | Yes | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Observations | 2156 | 2686 | 2178 | 2664 |

| R2 | 0.753 | 0.744 | 0.751 | 0.746 |

| Inter-Group Coefficient Difference Test p-Value | 0.084 | 0.092 | ||

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| GIV | CI | GTI | CI | |

| ERT | 0.077 * | −0.116 * | 0.045 * | −0.119 * |

| (1.76) | (−1.89) | (1.68) | (−1.93) | |

| GIV | −0.156 ** | |||

| (−2.34) | ||||

| GTI | −0.198 ** | |||

| (−2.41) | ||||

| Controls | Yes | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Observations | 4842 | 4842 | 4842 | 4842 |

| R2 | 0.623 | 0.752 | 0.587 | 0.754 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lei, X.; Xu, J.; Zhang, Z. Can the Energy Rights Trading System Become the New Engine for Corporate Carbon Reduction? Evidence from China’s Heavy-Polluting Industries. Sustainability 2025, 17, 8226. https://doi.org/10.3390/su17188226

Lei X, Xu J, Zhang Z. Can the Energy Rights Trading System Become the New Engine for Corporate Carbon Reduction? Evidence from China’s Heavy-Polluting Industries. Sustainability. 2025; 17(18):8226. https://doi.org/10.3390/su17188226

Chicago/Turabian StyleLei, Xue, Jian Xu, and Ziyan Zhang. 2025. "Can the Energy Rights Trading System Become the New Engine for Corporate Carbon Reduction? Evidence from China’s Heavy-Polluting Industries" Sustainability 17, no. 18: 8226. https://doi.org/10.3390/su17188226

APA StyleLei, X., Xu, J., & Zhang, Z. (2025). Can the Energy Rights Trading System Become the New Engine for Corporate Carbon Reduction? Evidence from China’s Heavy-Polluting Industries. Sustainability, 17(18), 8226. https://doi.org/10.3390/su17188226