Greening Through Recognition: Unveiling the Mechanisms of China’s High-Tech Enterprise Identification Policy on Sustainable Innovation

Abstract

1. Introduction

2. Theoretical Analysis and Hypotheses

2.1. The Mediating Role of Alleviating Financing Constraints

2.2. The Mediating Role of Government Subsidy Effect

2.3. The Mediating Role of Talent Agglomeration Effect

2.4. The Mediating Role of R&D Investment

3. Methodology

3.1. Data Source and Sample Selection

3.2. Models

3.3. Variables

- (1)

- Enterprise green innovation (GreenInnovation). Green patents are primarily distinguished into three categories: green invention patents, green utility models, and green design patents, with innovation difficulty progressively decreasing across these three categories [41,42]. Comparatively, green invention patents could better reflect firms’ green innovation capabilities. Therefore, based on data availability and representativeness, this study used the logarithm of one plus the quantity of authorized green invention patents as the measure of eco-innovation behavior.

- (2)

- High-tech enterprise identification policy (Hightechit). The core explanatory variable, Hightechit, is an interaction term of Post and Treat. Post is a time dummy variable indicating the implementation period of the identification policy. It equals 1 for the year when a firm attained high-tech status and for all subsequent years, and 0 otherwise. Treat distinguishes between the control and treatment groups. If a firm obtained high-tech identification during the sample period, it is considered part of the treatment group, with Treat equal to 1; otherwise, it equals 0.

- (3)

- Control variables. Drawing on the studies [43,44,45], a set of controls are included: (1) Basic enterprise characteristics: firm’s age (Age), firm’s size (Size), logarithm of board size (ln_Board), the largest shareholder’s holding ratio (Top1_ratio), liability/asset ratio (Leverage), return on asset (ROA), the proportion of the main business (Mab_ratio), return on equity (ROE), total asset turnover (Turnover), total asset growth rate (Growth).

4. Empirical Results and Discussion

4.1. Benchmark Regression

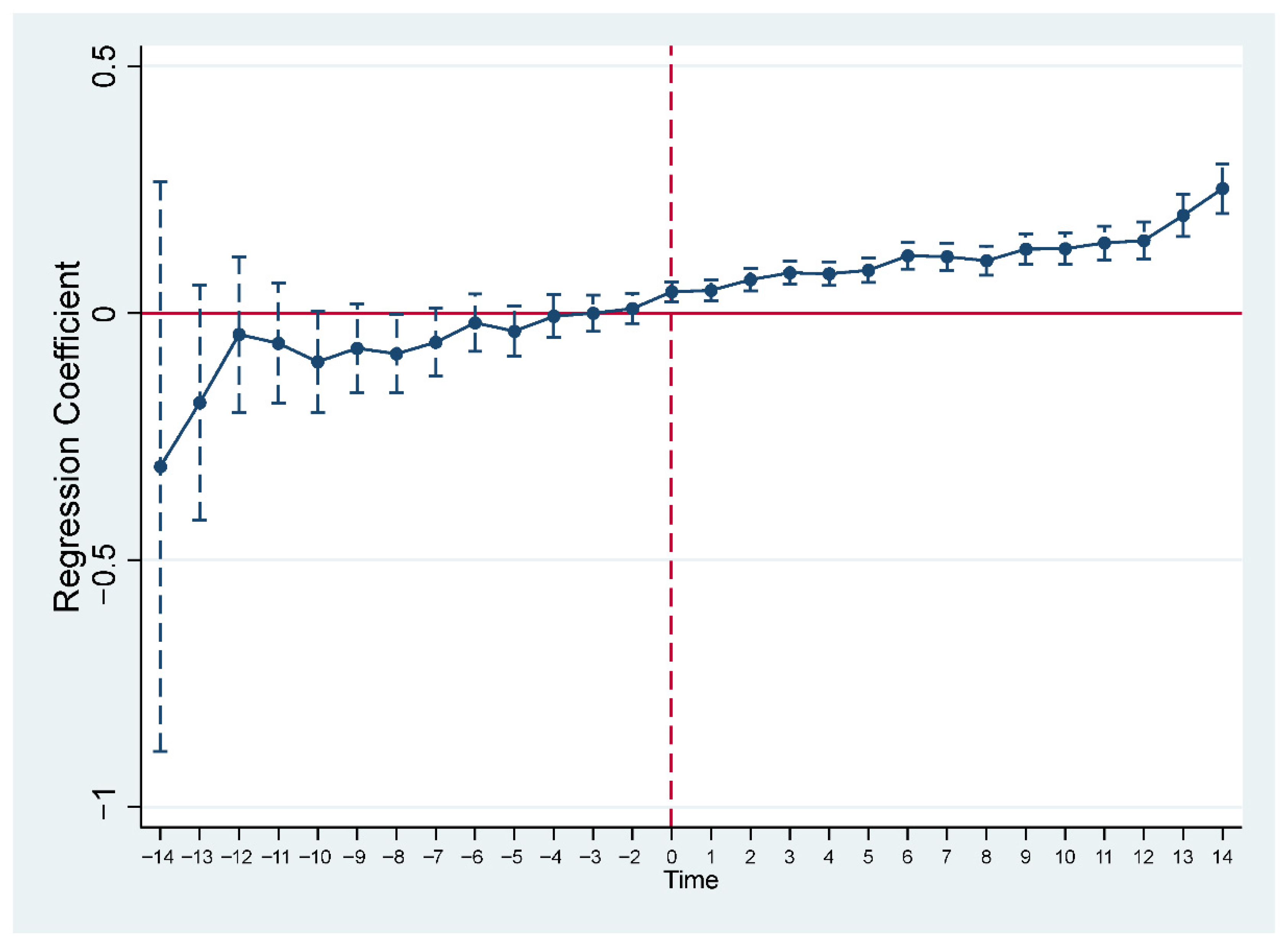

4.2. Parallel Trend Test

4.3. Robustness Checks

4.3.1. Counterfactual Tests

4.3.2. The Interference of Digital Transformation and Other Macro Policies

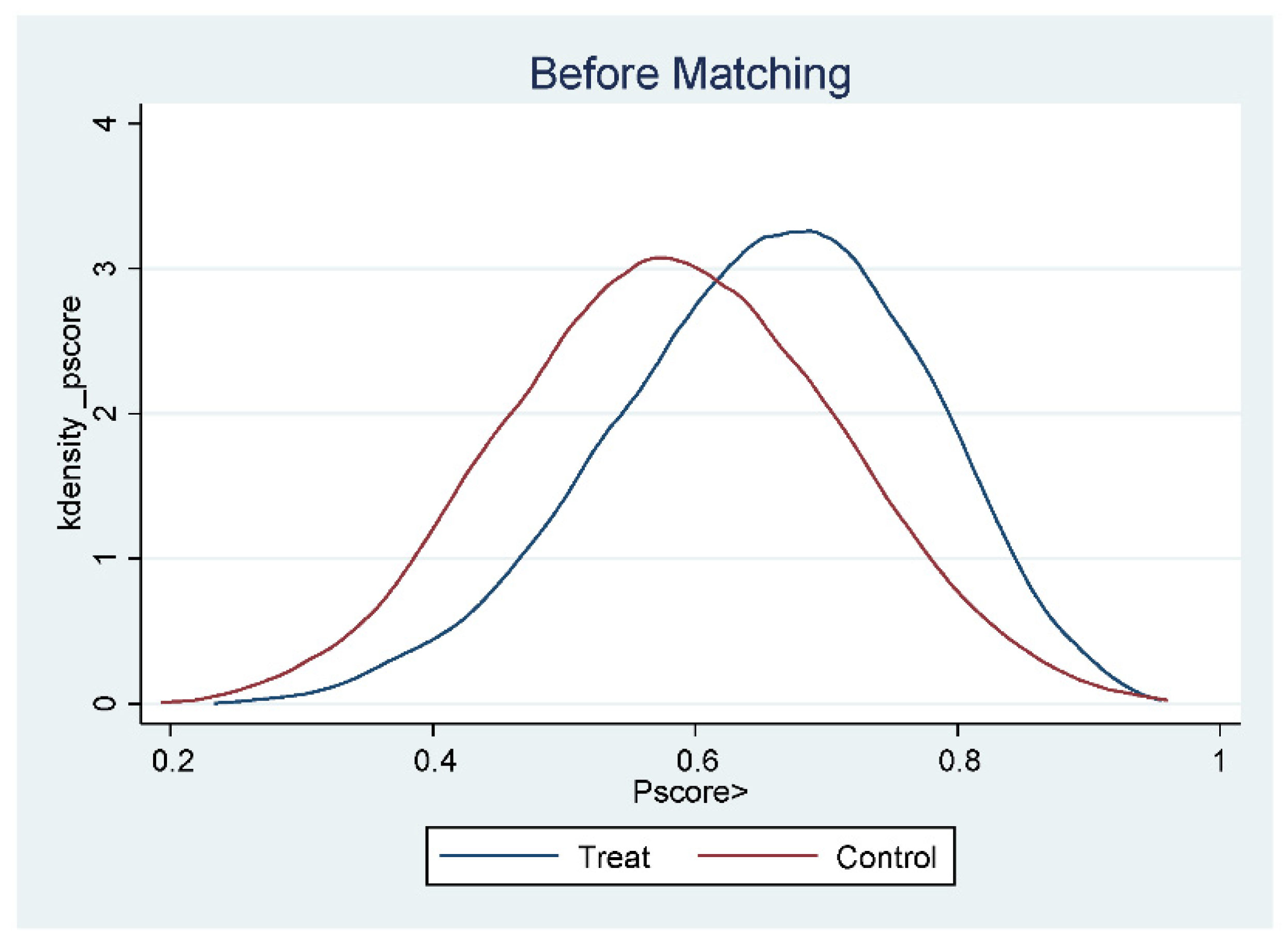

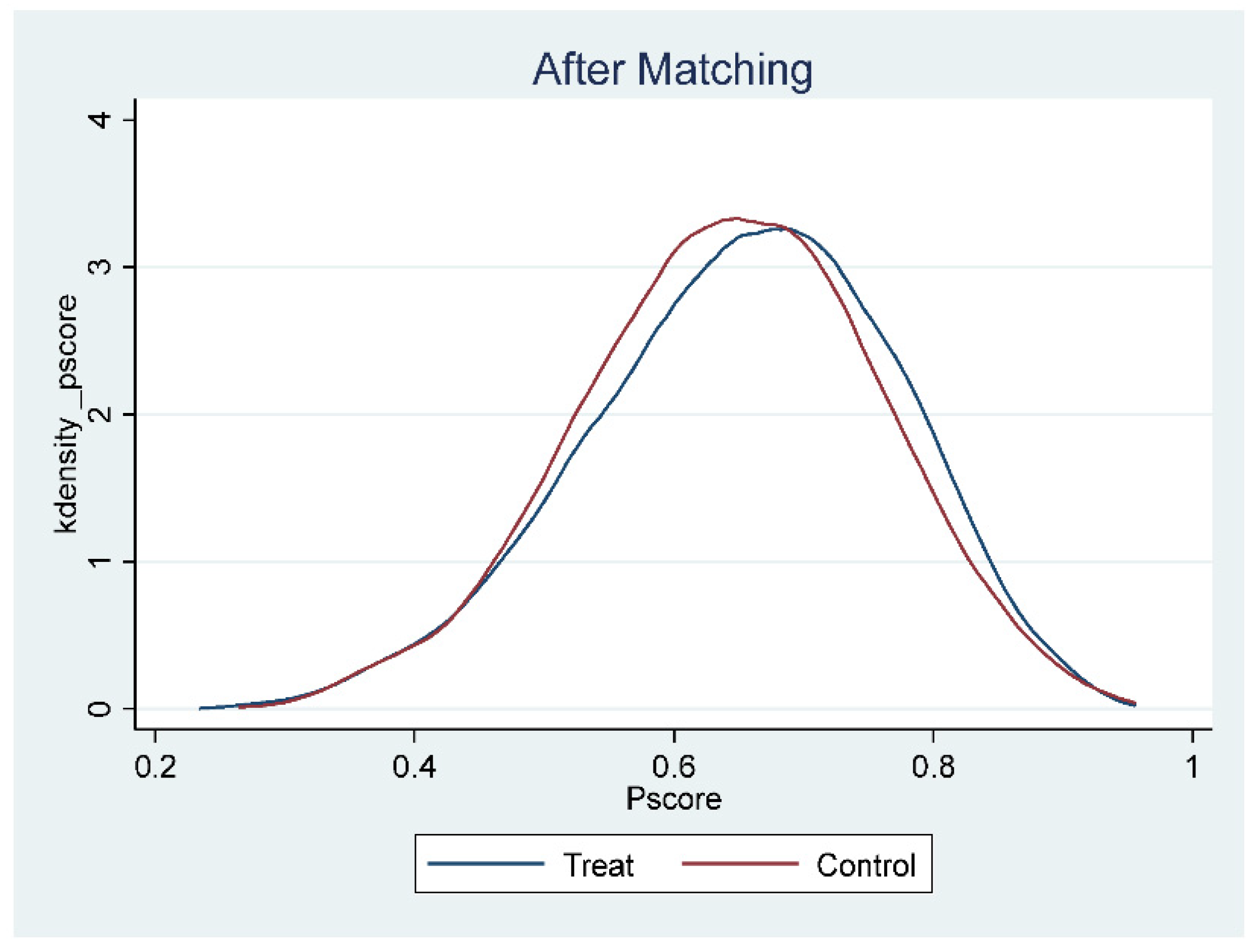

4.3.3. The Sample Selection Bias Issues: PSM-DID Estimation

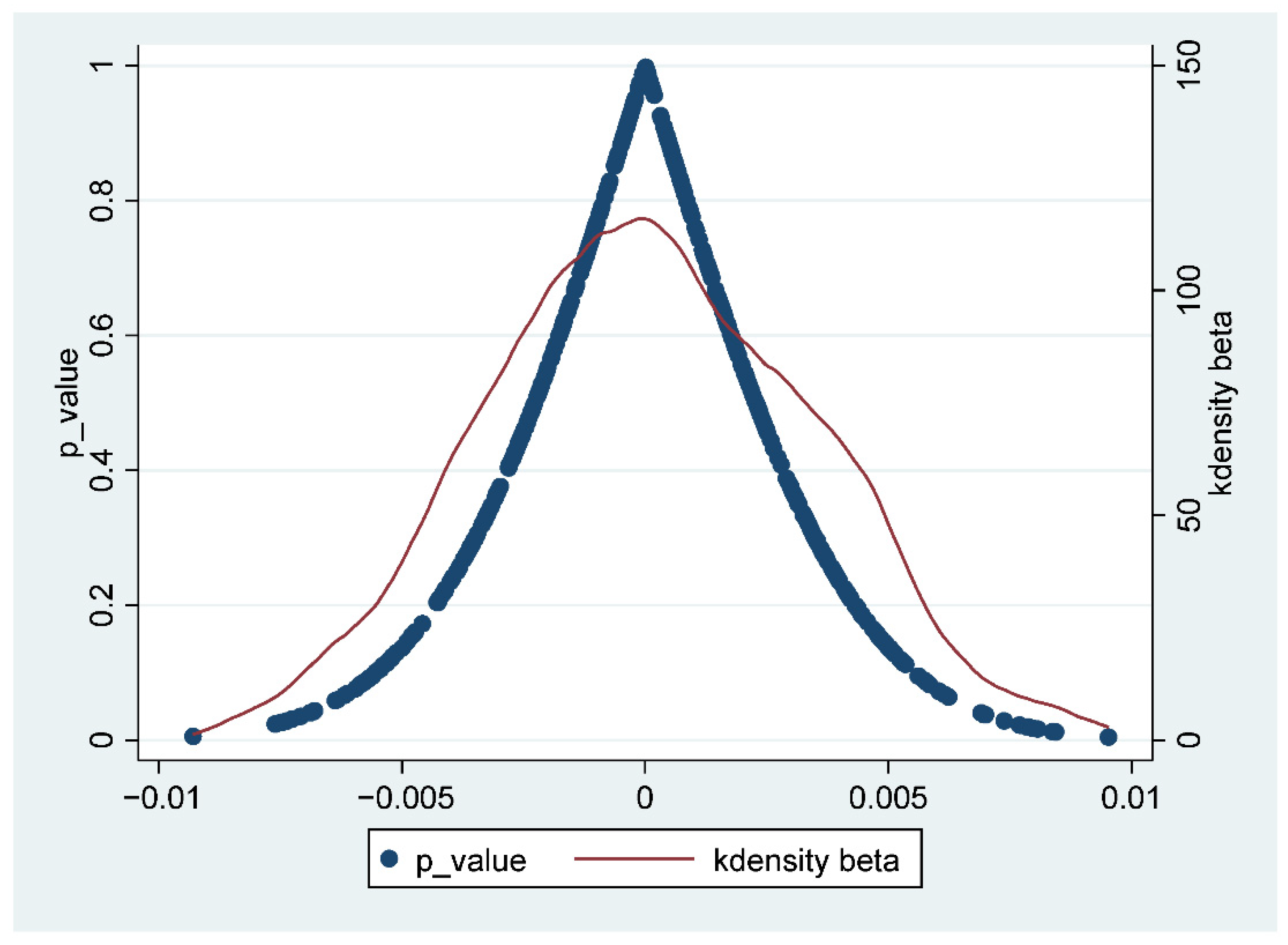

4.3.4. Placebo Text

4.4. Influence Mechanism Tests

4.4.1. Alleviating Financing Constraints

4.4.2. Government Subsidy Effect

4.4.3. Talent Agglomeration Effect

4.4.4. R&D Investment Effect

4.5. Heterogeneity Analysis

4.5.1. Heterogeneity of Enterprise Ownership

4.5.2. Heterogeneity of Enterprise Scale

4.5.3. Heterogeneity of Institutional Quality

4.5.4. Heterogeneity of Enterprise Factor Intensity

4.5.5. Regional Heterogeneity

5. Further Analysis

5.1. Firm Life Circle Analysis

5.2. Green Innovation Efficiency

6. Conclusions and Policy Implications

6.1. Conclusions, Limitations, and Further Research

6.2. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable Name | Description | Source | |

|---|---|---|---|

| Dependent variables | GreenInnovation | The logarithm of one plus the number of green invention patents. | CNRDS |

| Explanatory variables | Hightech | It is a binary dummy variable representing the interaction term of Post and Treat. It equals 1 for the year when a treatment group firm obtained the certification and for all subsequent years, and 0 otherwise. | MAIHTE |

| Control variables | Age | The firm’s age is calculated as the logarithm of the difference between the year of the sample period and the establishment year. | CSMAR |

| Size | The firm’s size (size) is measured as the logarithm of the total number of employees at the end of the year. | ||

| ln_Board | Board size is the natural logarithm of the number of board members. | ||

| Top1_ratio | The largest shareholder’s holding ratio is the percentage of shares held by the company’s largest shareholder. | ||

| Leverage | Liability–asset ratio is expressed as the proportion of total liabilities to total assets at the end of the year. | ||

| ROA | Return on assets is expressed by the ratio of net profit to the total average assets. | ||

| Mab_ratio | The proportion of the main business is the ratio of main business revenue to total business revenue. | ||

| ROE | Return on equity is the ratio of net profit to average net assets. | ||

| Turnover | Total asset turnover is calculated as the ratio of operating revenue to the ending balance of total assets. | ||

| Growth | Total asset growth rate is measured as the proportion of the growth in total assets at the end of the period to that at the beginning of the period. | ||

| Mediating variables | SA | SA index as a proxy for financing constraints, drawing on Hadlock and Pierce [51]. | CSMAR |

| LOAN | The end-of-period loan funds are measured by the funds obtained by an enterprise from financial institutions or other channels through borrowing at the end of the period. | ||

| Gov1 | The logarithm of government subsidies received by enterprises in the current year. | ||

| Gov2 | The logarithm of government subsidies received by enterprises in the previous year. | ||

| RDPerson | The logarithm of the ratio of R&D personnel to total employment. | ||

| Bachelor | The logarithm of the proportion of employees with an undergraduate degree or higher to total employment. | ||

| RDexp | The absolute level of enterprise R&D investment: total R&D expenditure. | ||

| RDexp_r | The relative level of enterprise R&D investment: R&D expenditures as a proportion of operating revenue. |

References

- Xie, X.; Huo, J.; Zou, H. Green process innovation, green product innovation, and corporate financial performance: A content analysis method. J. Bus. Res. 2019, 101, 697–706. [Google Scholar] [CrossRef]

- Cai, W.; Li, G. The drivers of eco-innovation and its impact on performance: Evidence from China. J. Clean. Prod. 2018, 176, 110–118. [Google Scholar] [CrossRef]

- Cai, W.G.; Zhou, X.L. On the drivers of eco-innovation: Empirical evidence from China. J. Clean. Prod. 2014, 79, 239–248. [Google Scholar] [CrossRef]

- Albort-Morant, G.; Leal-Millán, A.; Cepeda-Carrión, G. The antecedents of green innovation performance: A model of learning and capabilities. J. Bus. Res. 2016, 69, 4912–4917. [Google Scholar] [CrossRef]

- Weber, T.A.; Neuhoff, K. Carbon markets and technological innovation. J. Environ. Econ. Manag. 2010, 60, 115–132. [Google Scholar] [CrossRef]

- Wang, J.; Zhang, S. Environmental protection tax, green innovation, and environmental, social, and governance performance. Financ. Res. Lett. 2024, 65, 105592. [Google Scholar] [CrossRef]

- Hu, G.; Wang, X.; Wang, Y. Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 2021, 98, 105134. [Google Scholar] [CrossRef]

- Li, Y.; Yaacob, M.H.; Xie, T. Effects of China’s low carbon pilot city policy on corporate green innovation: Considering the mediating role of public environmental concern. Financ. Res. Lett. 2024, 65, 105641. [Google Scholar] [CrossRef]

- Mao, J.; Tang, S.; Xiao, Z.; Zhi, Q. Industrial policy intensity, technological change, and productivity growth: Evidence from China. Res. Policy 2021, 50, 104287. [Google Scholar] [CrossRef]

- Dai, X.; Wang, F. Does the high- and new-technology enterprise program promote innovative performance? Evidence from Chinese firms. China Econ. Rev. 2019, 57, 101330. [Google Scholar] [CrossRef]

- Fang, H.; Wu, X.; Shen, J.H.; Zhao, L. The impact of technology identification policy on firm innovation: Evidence from China. China Econ. Rev. 2022, 76, 101866. [Google Scholar] [CrossRef]

- Chen, F.; Zeng, X.; Guo, X. Green finance, climate change, and green innovation: Evidence from China. Financ. Res. Lett. 2024, 63, 105283. [Google Scholar] [CrossRef]

- Feng, S.; Zhang, R.; Li, G. Environmental decentralization, digital finance and green technology innovation. Struct. Change Econ. Dyn. 2022, 61, 70–83. [Google Scholar] [CrossRef]

- Wang, Y.; Zhang, W. Green credit policy, market concentration and green innovation: Empirical evidence from local governments’ regulatory practice in China. J. Clean. Prod. 2024, 434, 140228. [Google Scholar] [CrossRef]

- Yuan, B.; Cao, X. Do corporate social responsibility practices contribute to green innovation? The mediating role of green dynamic capability. Technol. Soc. 2022, 68, 101868. [Google Scholar] [CrossRef]

- Mbanyele, W.; Huang, H.; Li, Y.; Muchenje, L.T.; Wang, F. Corporate social responsibility and green innovation: Evidence from mandatory CSR disclosure laws. Econ. Lett. 2022, 212, 110322. [Google Scholar] [CrossRef]

- Quan, X.; Ke, Y.; Qian, Y.; Zhang, Y. CEO foreign experience and green innovation: Evidence from China. J. Bus. Ethics 2021, 182, 535–557. [Google Scholar] [CrossRef]

- Huang, M.; Li, M.; Liao, Z. Do politically connected CEOs promote Chinese listed industrial firms’ green innovation? The mediating role of external governance environments. J. Clean. Prod. 2021, 278, 123634. [Google Scholar] [CrossRef]

- Javed, M.; Wang, F.; Usman, M.; Ali Gull, A.; Uz Zaman, Q. Female CEOs and green innovation. J. Bus. Res. 2023, 157, 113515. [Google Scholar] [CrossRef]

- Abbas, J.; Sağsan, M. Impact of knowledge management practices on green innovation and corporate sustainable development: A structural analysis. J. Clean. Prod. 2019, 229, 611–620. [Google Scholar] [CrossRef]

- Cui, J.; Dai, J.; Wang, Z.; Zhao, X. Does environmental regulation induce green innovation? A panel study of Chinese listed firms. Technol. Forecast. Soc. Change 2022, 176, 121492. [Google Scholar] [CrossRef]

- Du, L.; Lin, W.; Du, J.; Jin, M.; Fan, M. Can vertical environmental regulation induce enterprise green innovation? A new perspective from automatic air quality monitoring station in China. J. Environ. Manag. 2022, 317, 115349. [Google Scholar] [CrossRef]

- Luo, G.; Guo, J.; Yang, F.; Wang, C. Environmental regulation, green innovation and high-quality development of enterprise: Evidence from China. J. Clean. Prod. 2023, 418, 138112. [Google Scholar] [CrossRef]

- Xu, Y.; Yang, L.; Hossain, M.E.; Haseeb, M.; Ran, Q. Unveiling the trajectory of corporate green innovation: The roles of the public attention and government. J. Clean. Prod. 2024, 444, 141119. [Google Scholar] [CrossRef]

- Bai, Y.; Song, S.; Jiao, J.; Yang, R. The impacts of government R&D subsidies on green innovation: Evidence from Chinese energy-intensive firms. J. Clean. Prod. 2019, 233, 819–829. [Google Scholar] [CrossRef]

- Shao, Y.; Chen, Z. Can government subsidies promote the green technology innovation transformation? Evidence from Chinese listed companies. Econ. Anal. Policy 2022, 74, 716–727. [Google Scholar] [CrossRef]

- Dian, J.; Song, T.; Li, S. Facilitating or inhibiting? Spatial effects of the digital economy affecting urban green technology innovation. Energy Econ. 2024, 129, 107223. [Google Scholar] [CrossRef]

- Ge, Y.; Xia, Y.; Wang, T. Digital economy, data resources and enterprise green technology innovation: Evidence from A-listed Chinese firms. Resour. Policy 2024, 92, 105035. [Google Scholar] [CrossRef]

- Wang, A.; Si, L.; Hu, S. Can the penalty mechanism of mandatory environmental regulations promote green innovation? Evidence from China’s enterprise data. Energy Econ. 2023, 125, 106856. [Google Scholar] [CrossRef]

- Zhao, C.; Qu, X.; Luo, S. Impact of the InnoCom program on corporate innovation performance in China: Evidence from Shanghai. Technol. Forecast. Soc. Change 2019, 146, 103–118. [Google Scholar] [CrossRef]

- Chen, Z.; Liu, Z.; Serrato, J.C.S.; Xu, D.Y. Notching R&D investment with corporate income tax cuts in China. Am. Econ. Rev. 2021, 111, 2065–2100. [Google Scholar] [CrossRef]

- Xu, L.; Zhong, H. Identification of high- and new-technology enterprises, supplier relationship and technological innovation: Evidence from China. Int. Rev. Econ. Finance 2024, 94, 103343. [Google Scholar] [CrossRef]

- Jia, J.; Ma, G. Do R&D tax incentives work? Firm-level evidence from China. China Econ. Rev. 2017, 46, 50–66. [Google Scholar] [CrossRef]

- Mukherjee, A.; Singh, M.; Žaldokas, A. Do corporate taxes hinder innovation? J. Financ. Econ. 2017, 124, 195–221. [Google Scholar] [CrossRef]

- Xia, L.; Gao, S.; Wei, J.; Ding, Q. Government subsidy and corporate green innovation—Does board governance play a role? Energy Policy 2022, 161, 112720. [Google Scholar] [CrossRef]

- Liu, S.; Xu, R.; Chen, X. Does green credit affect the green innovation performance of high-polluting and energy-intensive enterprises? Evidence from a quasi-natural experiment. Environ. Sci. Pollut. Res. Int. 2021, 28, 65265–65277. [Google Scholar] [CrossRef]

- Jiang, Y.; Yan, X.; Yang, Z.; Subramanian, U. Returnee employees or independent innovation? The innovation strategy of latecomer countries: Evidence from high-tech enterprises in China. Technol. Forecast. Soc. Change 2023, 192, 122591. [Google Scholar] [CrossRef]

- Dosi, G.; Marengo, L.; Pasquali, C. How much should society fuel the greed of innovators? On the relations between appropriability, opportunities and rates of innovation. Res. Policy 2006, 35, 1110–1121. [Google Scholar] [CrossRef]

- Hall, B.H.; Lerner, J. The financing of R&D and innovation. In Handbook of the Economics of Innovation; North-Holland: Amsterdam, The Netherlands, 2010; Volume 1, pp. 609–639. [Google Scholar]

- Hu, A.G.; Jefferson, G.H. Returns to research and development in Chinese industry: Evidence from state-owned enterprises in Beijing. China Econ. Rev. 2004, 15, 86–107. [Google Scholar] [CrossRef]

- Zhao, Y.; Peng, B.; Elahi, E.; Wan, A. Does the extended producer responsibility system promote the green technological innovation of enterprises? An empirical study based on the difference-in-differences model. J. Clean. Prod. 2021, 319, 128631. [Google Scholar] [CrossRef]

- Yu, C.H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Hong, M.; Li, Z.; Drakeford, B. Do the green credit guidelines affect corporate green technology innovation? Empirical research from China. Int. J. Environ. Res. Public Health 2021, 18, 1682. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Z.; Duan, H.; Shan, S.; Liu, Q.; Geng, W. The impact of green credit on the green innovation level of heavy-polluting enterprises—Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 650. [Google Scholar] [CrossRef]

- Vasileiou, E.; Georgantzis, N.; Attanasi, G.; Llerena, P. The role of innovation portfolio in green innovation decisions: A study of French and Italian firms. Technovation 2024, 130, 102921. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Levkov, A. Big bad banks? The winners and losers from bank deregulation in the United States. J. Finance 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- Liao, F.; Hu, Y.; Chen, M.; Xu, S. Digital transformation and corporate green supply chain efficiency: Evidence from China. Econ. Anal. Policy 2024, 81, 195–207. [Google Scholar] [CrossRef]

- Yan, Z.; Sun, Z.; Shi, R.; Zhao, M. Smart city and green development: Empirical evidence from the perspective of green technological innovation. Technol. Forecast. Soc. Change 2023, 191, 122507. [Google Scholar] [CrossRef]

- Li, P.; Lu, Y.; Wang, J. Does flattening government improve economic performance? Evidence from China. J. Dev. Econ. 2016, 123, 18–37. [Google Scholar] [CrossRef]

- Jiang, T. Mediating effects and moderating effects in causal inference. China Ind. Econ. 2022, 5, 100–120. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, J.R. New evidence on measuring financial constraints: Moving beyond the KZ index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Barbieri, N.; Marzucchi, A.; Rizzo, U. Knowledge sources and impacts on subsequent inventions: Do green technologies differ from non-green ones? Res. Policy 2020, 49, 103901. [Google Scholar] [CrossRef]

- Dai, O.; Liu, X. Returnee entrepreneurs and firm performance in Chinese high-technology industries. Int. Bus. Rev. 2009, 18, 373–386. [Google Scholar] [CrossRef]

- Liu, G.; Zhang, C. Economic policy uncertainty and firms’ investment and financing decisions in China. China Econ. Rev. 2020, 63, 101526. [Google Scholar] [CrossRef]

- Arrow, K.J. Economic welfare and the allocation of resources for invention. In The Rate and Direction of Inventive Activity: Economic and Social Factors; Princeton University Press: Princeton, NJ, USA, 1972; pp. 219–236. [Google Scholar]

- Wang, X.; Fan, G.; Hu, L. Marketization Index of China’s Provinces: NERI Report 2021; Social Sciences Academic Press: Beijing, China, 2021. [Google Scholar]

- Miller, D.; Friesen, P.H. A longitudinal study of the corporate life cycle. Manag. Sci. 1984, 30, 1161–1183. [Google Scholar] [CrossRef]

- Moores, K.; Yuen, S. Management accounting systems and organizational configuration: A life-cycle perspective. Account. Organ. Soc. 2001, 26, 351–389. [Google Scholar] [CrossRef]

- Dickinson, V. Cash flow patterns as a proxy for firm life cycle. Account. Rev. 2011, 86, 1969–1994. [Google Scholar] [CrossRef]

- Agarwal, R.; Gort, M. Firm and product life cycles and firm survival. Am. Econ. Rev. 2002, 92, 184–190. [Google Scholar] [CrossRef]

- DeAngelo, H.; DeAngelo, L.; Stulz, R.M. Dividend policy and the earned/contributed capital mix: A test of the life-cycle theory. J. Financ. Econ. 2006, 81, 227–254. [Google Scholar] [CrossRef]

- Kallunki, J.P.; Silvola, H. The effect of organizational life cycle stage on the use of activity-based costing. Manag. Account. Res. 2008, 19, 62–79. [Google Scholar] [CrossRef]

- Zhou, D.; Lu, Z.; Qiu, Y. Do carbon emission trading schemes enhance enterprise green innovation efficiency? Evidence from China’s listed firms. J. Clean. Prod. 2023, 414, 137668. [Google Scholar] [CrossRef]

| Variable | Observation | Mean | Std.Dev | Max | Min |

|---|---|---|---|---|---|

| GreenInnovation | 35,141 | 0.138 | 0.433 | 2.565 | 0.000 |

| Age | 35,138 | 2.811 | 0.380 | 3.497 | 1.609 |

| Size | 34,069 | 7.655 | 1.236 | 11.190 | 4.970 |

| ln_Board | 35,141 | 2.296 | 0.461 | 2.944 | 0.000 |

| Top1_ratio | 35,141 | 1.379 | 1.630 | 4.615 | 0.000 |

| Leverage | 35,141 | 0.328 | 0.142 | 0.624 | 0.049 |

| ROA | 35,131 | 0.042 | 0.061 | 0.197 | −0.235 |

| Mab_ratio | 35,137 | 0.439 | 0.378 | 1.098 | 0.000 |

| ROE | 35,134 | 0.037 | 0.053 | 0.186 | −0.182 |

| Turnover | 35,141 | 0.378 | 0.269 | 1.197 | 0.000 |

| Growth | 35,141 | 0.156 | 0.242 | 1.174 | −0.298 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Hightech | 0.0681 *** | 0.0192 *** | 0.0188 *** | 0.0186 *** |

| (14.7879) | (2.8358) | (2.7724) | (2.7271) | |

| Age | 0.0753 *** | 0.0748 *** | 0.0604 ** | |

| (2.6647) | (2.6439) | (2.0892) | ||

| Size | 0.0390 *** | 0.0390 *** | 0.0368 *** | |

| (8.2407) | (8.2482) | (7.5359) | ||

| ln_Board | 0.0049 | 0.0033 | ||

| (0.4631) | (0.3141) | |||

| Top1_ratio | 0.0043 *** | 0.0044 *** | ||

| (3.0571) | (3.0932) | |||

| Leverage | 0.0428 * | |||

| (1.7015) | ||||

| ROA | −0.0377 | |||

| (−0.7213) | ||||

| Mab_ratio | 0.0053 | |||

| (0.7286) | ||||

| ROE | −0.0440 | |||

| (−0.6695) | ||||

| Turnover | 0.0010 | |||

| (0.0857) | ||||

| Growth | −0.0167 ** | |||

| (−2.1147) | ||||

| Constant | 0.1055 *** | −0.3766 *** | −0.3928 *** | −0.3425 *** |

| (33.1940) | (−4.5661) | (−4.5449) | (−3.8727) | |

| Firm | No | Yes | Yes | Yes |

| Year | No | Yes | Yes | Yes |

| Observations | 35,141 | 33,573 | 33,573 | 33,561 |

| R-squared | 0.0062 | 0.6271 | 0.6273 | 0.6274 |

| (1) | (2) | (3) | |

|---|---|---|---|

| F1.Hightech | 0.0004 | ||

| (0.0447) | |||

| F2.Hightech | 0.0069 | ||

| (0.7089) | |||

| F3.Hightech | 0.0134 | ||

| (1.2932) | |||

| Constant | −0.2897 *** | −0.2429 ** | −0.3202 *** |

| (−3.0535) | (−2.4029) | (−2.9650) | |

| Controls | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| Observations | 28,477 | 24,276 | 20,999 |

| R-squared | 0.6268 | 0.6293 | 0.6324 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Hightech | 0.0200 *** | 0.0186 *** | 0.0201 *** | 0.0185 *** | 0.0201 *** |

| (2.8523) | (2.7329) | (2.8690) | (2.7167) | (2.8682) | |

| Digital | 3.1984 *** | 3.2034 *** | 3.2056 *** | ||

| (7.8238) | (7.8308) | (7.8361) | |||

| Smart | 0.0041 | 0.0044 | 0.0048 | ||

| (0.9093) | (0.9622) | (1.0285) | |||

| BroadBand | −0.0009 | −0.0018 | |||

| (−0.1990) | (−0.3925) | ||||

| Constant | −0.3452 *** | −0.3449 *** | −0.3477 *** | −0.3425 *** | −0.3471 *** |

| (−3.8553) | (−3.9032) | (−3.8835) | (−3.8752) | (−3.8762) | |

| Controls | Yes | Yes | Yes | Controls | Yes |

| Firm | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes |

| Observations | 32,629 | 33,570 | 32,617 | 33,570 | 32,617 |

| R-squared | 0.6190 | 0.6274 | 0.6190 | 0.6274 | 0.6190 |

| (1) | (2) | (3) | |

|---|---|---|---|

| 1:2 Nearest Neighbor | 1:3 Nearest Neighbor | Kernel Matching | |

| Hightech | 0.0192 * | 0.0186 ** | 0.0160 ** |

| (1.8677) | (2.1449) | (2.3724) | |

| Constant | −0.2481 ** | −0.3643 *** | −0.2861 *** |

| (−2.1095) | (−3.5409) | (−3.0505) | |

| Controls | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| Observations | 22,570 | 26,887 | 29,489 |

| R-squared | 0.6538 | 0.6460 | 0.6131 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| SA | LOAN | Gov1 | Gov2 | RDPerson | Bachelor | RDexp | RDexp_r | |

| Hightech | −0.0038 *** | 0.4325 *** | 0.0972 ** | 0.1155 *** | 0.0487 *** | 0.0129 ** | 0.0902 *** | 0.0717 *** |

| (−4.1838) | (4.2264) | (2.4833) | (3.0711) | (5.2728) | (2.3600) | (7.3128) | (6.8111) | |

| Constant | −2.6141 *** | −13.3640 *** | 11.6316 *** | 12.6952 *** | 4.1099 *** | −0.1080 | 13.3437 *** | 2.1773 *** |

| (−1.3 × 102) | (−9.2686) | (20.6178) | (23.1127) | (17.2972) | (−1.1552) | (65.2102) | (12.6244) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 33,561 | 33,531 | 21,372 | 22,214 | 22,328 | 28,300 | 28,505 | 27,383 |

| R-squared | 0.8833 | 0.7095 | 0.6730 | 0.6573 | 0.8978 | 0.9292 | 0.9033 | 0.8983 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| SOEs | Non-SOE | Small-Scale | Large-Scale | |

| Hightech | 0.0214 | 0.0147 ** | 0.0222 *** | 0.0206 |

| (1.5055) | (2.0240) | (3.1552) | (1.5265) | |

| Constant | −0.3892 ** | −0.4181 *** | −0.1971 * | −0.4396 ** |

| (−2.4560) | (−3.8688) | (−1.8928) | (−2.4966) | |

| Controls | Yes | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Observations | 12,254 | 20,163 | 15,931 | 17,203 |

| R-squared | 0.6478 | 0.5998 | 0.5461 | 0.6817 |

| Intergroup difference test | −0.059 *** | −0.083 *** | ||

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| High-Quality Institutional | Low-Quality Institutional | Capital Intensive | Labor Intensive | Eastern Region | Western Region | |

| Hightech | 0.0192 * | 0.0135 | 0.0282 *** | 0.0083 | 0.0189 ** | 0.0181 |

| (1.8984) | (1.3431) | (2.8286) | (0.7235) | (2.4252) | (1.3033) | |

| Constant | 0.0067 | −0.2918 ** | −0.2849 ** | −0.4603 *** | −0.3372 *** | −0.3036 * |

| (0.0423) | (−2.2441) | (−2.0939) | (−3.2304) | (−3.2807) | (−1.7336) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 16,186 | 16,644 | 17,028 | 14,816 | 24,211 | 9350 |

| R-squared | 0.7085 | 0.6226 | 0.6664 | 0.6411 | 0.6405 | 0.5876 |

| Intergroup difference test | 0.022 *** | 0.023 *** | 0.022 *** | |||

| (1) | (2) | (3) | |

|---|---|---|---|

| Growth | Maturity | Decline | |

| Hightech | 0.0249 ** | −0.0066 | 0.0334 |

| (2.1834) | (−0.4940) | (1.5350) | |

| Constant | −0.1887 | −0.5024 *** | 0.0252 |

| (−1.2997) | (−2.7499) | (0.1168) | |

| Controls | Yes | Yes | Yes |

| Firm | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| Observations | 14,399 | 11,289 | 4939 |

| R-squared | 0.6344 | 0.6975 | 0.7588 |

| (1) | (2) | |

|---|---|---|

| Hightech | 0.0093 *** | 0.0049 *** |

| (17.0465) | (7.2422) | |

| Constant | 0.0200 *** | −0.0275 *** |

| (49.5686) | (−2.7353) | |

| Controls | NO | Yes |

| Firm | NO | Yes |

| Year | NO | Yes |

| Observations | 29,367 | 28,470 |

| R-squared | 0.0098 | 0.7047 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xin, D.; Liu, W.; Wang, Z.; Wang, K. Greening Through Recognition: Unveiling the Mechanisms of China’s High-Tech Enterprise Identification Policy on Sustainable Innovation. Sustainability 2025, 17, 7896. https://doi.org/10.3390/su17177896

Xin D, Liu W, Wang Z, Wang K. Greening Through Recognition: Unveiling the Mechanisms of China’s High-Tech Enterprise Identification Policy on Sustainable Innovation. Sustainability. 2025; 17(17):7896. https://doi.org/10.3390/su17177896

Chicago/Turabian StyleXin, Daleng, Wenying Liu, Zhonghe Wang, and Kehui Wang. 2025. "Greening Through Recognition: Unveiling the Mechanisms of China’s High-Tech Enterprise Identification Policy on Sustainable Innovation" Sustainability 17, no. 17: 7896. https://doi.org/10.3390/su17177896

APA StyleXin, D., Liu, W., Wang, Z., & Wang, K. (2025). Greening Through Recognition: Unveiling the Mechanisms of China’s High-Tech Enterprise Identification Policy on Sustainable Innovation. Sustainability, 17(17), 7896. https://doi.org/10.3390/su17177896