1. Introduction

The global financial landscape has been significantly reshaped in recent years by the proliferation of investment strategies focused on environmental, social, and governance (ESG) criteria. The substantial growth in both signatories and assets under management (AUM) for the United Nations Principles for Responsible Investment (PRI), since its 2006 inception, serves as a key indicator of this shift. (The number of signatories nearly doubled between 2010 (734) and 2015 (1384) and more than doubled again by 2020 (3038). Assets under management followed a similar trajectory, rising from USD 21 trillion in 2010 to USD 59 trillion in 2015 and reaching USD 103 trillion in 2020. As of the conclusion of 2021, a total of 4375 investors, collectively managing USD 121 trillion in assets, had become signatories to the Principles for Responsible Investment. See

https://www.unpri.org/pri, accessed on 12 May 2025). Consequently, professional investment managers and institutions with ESG mandates are re-evaluating their asset management frameworks and strategically reallocating capital to align with these evolving objectives. Larry Fink, Blackrock CEO, recently argued (see

https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter, accessed on 12 May 2025) that “The next 1000 unicorns won’t be search engines or social media companies, they’ll be sustainable, scalable innovators—startups that help the world decarbonize and make the energy transition affordable for all consumers.” In the US and global capital markets, we are already encountering a consistent reallocation of capital and growing AUM with an ESG motive. A recent Morgan Stanley report found that individual investor interest in sustainable investment is growing. (The Morgan Stanley report indicates that 77% of global investors express interest in investments integrating positive social and/or environmental impact with financial return. Over half (57%) reported increased interest during the preceding two years, and 54% intended to increase their sustainable investment allocations in the forthcoming year. See

https://www.morganstanley.com/content/dam/msdotcom/en/assets/pdfs/MSInstituteforSustainableInvesting-SustainableSignals-Individuals-2024.pdf, accessed on 12 May 2025). A central question in the recent literature is whether ESG and carbon factors constitute distinct sources of systematic risk or are merely reflections of conventional equity factors [

1,

2,

3,

4]. Despite the widespread incorporation of ESG principles into professional investing, their precise effect on the risk–return profile of investment portfolios remains a subject of continuous academic inquiry [

5]. Although significant attention has been devoted to augmenting asset pricing models with ESG and carbon risk factors, the literature has yet to reach a consensus on the precise role of non-pecuniary risk in shaping expected returns for ESG-focused portfolios. The objective of this study is to determine whether non-pecuniary risks, defined as those that are not purely financial, systematically influence the expected returns of ESG-focused investment portfolios.

Two principal theoretical frameworks address the relationship between ESG investing and return performance: pecuniary (financial) and non-pecuniary (non-financial) considerations. The “pecuniary” view, also known as “doing well by doing good,” suggests that current stock prices do not fully account for the future impact of sustainability-related events. This is essentially an argument based on market inefficiency or mispricing, similar to the concept of short-termism in financial markets [

6]. The non-pecuniary view posits that some investors value both the financial return of an investment and its ESG characteristics, meaning they have preferences beyond purely financial considerations. For example, the findings of [

7] indicate a potential willingness on the part of investors to accept a trade-off between financial performance and the pursuit of investment strategies consistent with their social values. This observation is congruent with the assertion that the intentions of ESG investors encompass considerations beyond the traditional investment objectives of return generation and risk management. For example, in the 2023 presidential address of the American Finance Association, Laura Starks mentions (see

https://afajof.org/2023-annual-meeting-and-panel-sessions/) that the investment motive in ESG firms is non-pecuniary and that motive is a key component of the values surrounding the ESG ecosystem (also see [

8]). The emphasis on non-pecuniary motives related to sustainability and social impact can, however, subject ESG firms to distinct, unobserved risks that pose challenges for empirical measurement.

The existing empirical literature provides a substantial body of research on the comparative returns of environmentally sustainable (“green”) versus environmentally unsustainable (“brown”) assets. One line of inquiry examines returns on an ex ante basis, employing proxies for anticipated future returns. For instance, references [

9,

10,

11] analyze yield differentials between green and brown bonds within the fixed-income market. Chava [

12,

13] compare implied costs of capital, estimated for green versus brown firms in the equity market. Most of these studies report lower ex ante returns for green assets, aligning with theoretical predictions. A second, more extensive body of research examines returns on an ex post basis, measuring realized returns of green versus brown equities. Examples of works that analyze ex post returns include references [

14,

15,

16,

17,

18,

19,

20].

Investors have differing expectations regarding the return difference between high- and low-quality ESG firms. The pecuniary view predicts a positive difference, suggesting ESG stocks perform better. Conversely, the non-pecuniary view predicts a negative difference, implying investors are willing to accept lower returns for investments that align with their ESG preferences. Unlike the traditional risk–return framework, which focuses solely on financial outcomes, the alternative argument incorporates non-pecuniary preferences, where a firm’s ESG performance directly influences investors’ utility (satisfaction or well-being), independent of financial returns. Due to the non-pecuniary motives of ESG investments, the ubiquitousness of traditional common risk factors such as size, value, and momentum for ESG space are not decisive in the risk–return analysis of ESG firms. ESG firms ought to be exposed to risk dimensions that are distinct as well as unobserved, and their empirical proxy is not clearly established. In this paper, we fill this gap in the literature by analyzing a sample of ESG firms and propose latent risk factors using sparse principal component analysis (SPCA). We show that the SPCA-based latent factors capture the inherent risk dimension of the ESG firms and can be used to describe the changes in investment opportunities in ESG investments. This research provides a deeper understanding of the drivers of ESG performance and how risk plays a role.

This paper contributes to the literature by proposing a novel methodology for identifying latent risk factors specific to ESG firms. This methodology, based on SPCA applied to two-dimensional portfolio returns, leverages the risk dimensions inherent within ESG-based portfolio returns, thus avoiding subjective judgment. The SPCA is a statistical technique used to reduce the dimensionality of complex data while highlighting important underlying patterns (latent factors). By using a “sparse” version, the analysis focuses on a smaller subset of variables, making the results more interpretable and potentially more robust. The findings lend themselves to straightforward summarization. Our analysis reveals robust cross-sectional performance for these SPCA-based factors, demonstrating their utility for understanding portfolio diversification within the ESG investment domain. This “risk dimension” likely encompasses various types of risks, such as reputational risk, regulatory risk, operational risk related to environmental or social issues, etc. Changes in these latent factors would signal shifts in the risk profile of ESG investments, thereby affecting their attractiveness to investors.

The structure of this paper is as follows.

Section 2 presents a review of the extant literature on the growth and challenges of sustainable investing and delineates our incremental contribution to the field.

Section 3 details the research design and data employed in this study. Within this section, the empirical methodology and the testing assets utilized throughout the paper are outlined.

Section 4 presents the primary empirical findings. This section provides an overview of the characteristics of the various testing portfolios and presents regression results pertaining to the empirical tests conducted. Finally,

Section 5 offers concluding remarks.

2. Literature Review: Growth and Challenges in Sustainable Investing

As indicated in the introduction, sustainable funds are exhibiting a trend of rapid expansion. According to the UN PRI, the average annual growth rate of AUM allocated to ESG-focused strategies was 22% between 2006 and 2021. Related data reveal a 52% growth rate between 2020 and 2021, and current projections forecast that these funds will reach a value of USD 30 trillion by 2030 (see

https://www.unpri.org/about-us/about-the-pri, accessed on 12 May 2025). Despite the rapid growth of sustainable fund assets, research suggests that these investments do not consistently outperform traditional investments in the long run (see, e.g., [

21,

22,

23]). The current understanding and practice of sustainable finance and ESG investing often differs from the expectation of minimizing negative impacts and maximizing positive ones. The terms “sustainable investing” and “ESG investing” are frequently used interchangeably, but encompass a wide range of strategies, purposes, and approaches, meaning they do not have a single, unified definition. ESG ratings are designed to assess how well companies manage risks related to real-world crises, impacting their potential returns. They do not measure a company’s actual impact on the real world, but rather its risk management practices. Leading providers such as MSCI and Sustainalytics, for example, exhibit several types of biases in their ESG data [

24,

25]. The meaning of a company’s ESG score is often unclear due to a lack of transparency from rating agencies. These agencies typically do not disclose the specific risks they assess or their rating methodologies. Consequently, companies are evaluated on certain aspects but not others, and the assessment focuses on risk management rather than actual impact.

Although ethical investing has existed for a long time, the ESG perspective has gained significant prominence in the last twenty years. Regulatory efforts, such as the EU’s taxonomy of sustainable activities, are also driving the increased focus on ESG. All investments, whether ESG-focused (i.e., green firms) or not (i.e., brown firms), involve different types of risks. Understanding total investment risk, including both systematic and unsystematic risk, is crucial for effective portfolio management. According to modern portfolio theory, investors hold a portfolio of assets to diversify idiosyncratic risk. Although the capital asset pricing model (CAPM) predicts that only systematic risk is priced in equilibrium and idiosyncratic risk is not, various classic works (e.g., [

26,

27]) that incorporate under-diversification of investor’s portfolios predict that presence of idiosyncratic risk. Recent studies are extending traditional asset pricing frameworks, such as the CAPM and multi-factor models, by incorporating specific factors for ESG performance and carbon risk [

2,

3,

13,

14]. Unlike the non-ESG counterparts, the existing empirical literature is inconclusive about the risk dimensions that are specifically associated with ESG investments. The mixed and often contradictory findings from numerous studies call into question whether ESG constitutes a valid, systematic investment factor. In contrast to prior research, we present a method for identifying latent risk factors utilizing two-dimensional portfolio returns derived from a sample of ESG firms. The proposed latent factors are generated through the application of SPCA, thus obviating the need for subjective judgment.

A substantial and expanding body of the academic literature has been devoted to the investigation of the measurement and ranking of ESG factors, as well as their implications for financial performance and risk mitigation [

28]. Empirical studies have consistently demonstrated the potential for portfolios comprising companies with robust ESG profiles to generate compelling financial results. Compared to [

21,

22], which indicate positive returns for high ESG-rated portfolios, the findings in [

23] show no significant differences between returns of high- and low-ESG-rated portfolios. Related work [

29] demonstrates “a negative general ESG premia” in its data. Using firm-level data from 46 developed and emerging markets, the authors of [

30] construct an aggregate world-based ESG index and report that the index contributes to the predictability of economic activity. Recent empirical evidence provided by [

31] suggests that market performance is not reliably correlated with high or low ESG ratings. Avramov et al. [

32] analyzes the asset pricing and portfolio implications of a significant impediment to sustainable investing: uncertainty regarding the corporate ESG profile. Utilizing the standard deviation of ESG ratings from six prominent providers as a proxy for ESG uncertainty, the authors provide empirical support for the model predictions. Their findings contribute to the reconciliation of the mixed evidence concerning the cross-sectional ESG–alpha relationship and suggest that ESG uncertainty influences the risk–return trade-off, social impact, and economic welfare.

Jagannathan et al. [

33] analyze the implications of incorporating ESG criteria into investment processes employed by money managers. Contrary to the perception that ESG integration compromises investment returns, they posit that incorporating ESG criteria into investment strategies can, in fact, reduce exposure to systematic risks, thereby benefiting even those investors primarily concerned with maximizing returns and minimizing risks. Through the integration of ESG factors into their investment approach, portfolio managers can mitigate downside risk by proactively selecting firms positioned to effectively navigate evolving market dynamics. This distinction between rhetoric and reality directly impacts the investment implications of ESG ratings. In related work, the authors of [

34] investigate whether ESG ratings can predict future stock returns. Their findings suggest that while a high ESG rating in itself is not a source of superior risk-adjusted returns, the improvement in a firm’s ESG profile is rewarded by the market. This indicates that investors may value genuine progress over static, and potentially misleading, ESG labels.

Ongoing studies in the literature investigate the complex relationship between corporate governance, environmental externalities, and market outcomes. One line of inquiry focuses on how ownership and governance structures influence corporate behavior. For example, the authors of [

35] find that publicly traded firms pollute significantly more than their private counterparts, suggesting that the nature of public ownership may create incentives that run counter to environmental sustainability. Adding nuance to the role of shareholders, the authors of [

36] provide strong causal evidence that contradicts the common assumption that shareholder-value-focused activism is always detrimental to non-shareholder stakeholders. Beyond governance structures, another stream of research examines the sincerity of corporate communication. Chava et al. [

37] reveal a significant disconnect between corporate rhetoric and action, finding that firms with more positive environmental and social language in their disclosures subsequently exhibit worse real-world performance. While this “greenwashing” may succeed in the short term by positively influencing analysts and the market, the authors find that firms with the largest gap between their “talk” and their “walk” ultimately suffer from worse long-run stock performance.

Several studies used ESG rankings to sort into green and brown stocks (see, e.g., [

2,

13,

32]). This existing research consistently suggests that green or sustainable investments tend to have lower returns compared to conventional investments, after adjusting for risk. This difference in returns is the green return premium, and since the estimates are negative, it indicates a discount rather than a premium. Some researchers use specific aspects of ESG (e.g., [

12]) and find that companies excluded due to environmental concerns (i.e., those with poor environmental performance) face a higher cost of capital and, consequently, have higher expected returns. Aswani et al. [

17] cast doubt on the existence of a direct “carbon risk premium” in stock returns, meaning that investors do not appear to systematically price carbon emissions when valuing stocks. (They in fact find that the correlation between stock returns and carbon emissions disappears when using firm-disclosed emissions data instead of vendor-estimated data. This suggests that previous findings were driven by the correlation between vendor estimates and financial fundamentals). In influential work, the authors of [

18] find a positive relationship between carbon emissions and stock returns. This result is important because it seems to contradict the idea that the market penalizes environmentally unfriendly companies. It suggests that, at least in the period studied, investors were rewarding companies with higher carbon footprints, potentially due to these companies being in industries with higher profitability or facing less regulatory pressure at the time.

There is a large body of research that attempts to substantiate the difference in returns between sustainable or ESG investments and conventional ones. Pástor et al. [

2] argue that if some investors derive utility (satisfaction) from green stocks beyond just financial returns, these stocks can maintain lower returns. However, there is a trade-off: higher expected returns for brown (less sustainable) firms are coupled with higher capital costs. This means brown firms face stricter requirements when financing new investments, incentivizing them to become greener to access cheaper capital. Firms will weigh the costs of ESG improvements against the benefits of lower capital costs. In equilibrium, some firms will be excluded when the cost of improving ESG outweighs the potential gains from cheaper capital. The finding of Hong and Kacperczyk [

38] that “sin stocks” (like tobacco or gambling companies) have significantly positive abnormal returns has implications for the green return premium. The outperformance of “sin stocks” implies that there is a price to pay for ethical investment, and that price is a potential reduction in returns. This is a key point in the debate about whether ESG investing is purely a financial decision or one that involves non-financial considerations.

Prior research on ESG’s cross-sectional return predictability has found weak predictability using overall ESG ratings and mixed evidence based on different ESG proxies. We contribute to this growing literature. The primary objective of this paper is to identify a distinctive risk dimension inherent within the set of ESG-based portfolio returns. In contrast to the existing literature, we highlight the robust cross-sectional performance of SPCA-based factors when applied to portfolios of ESG firms, demonstrating their applicability for addressing portfolio diversification within the ESG investment domain. This research also complements a body of literature that utilizes individual stock data to examine returns and firm-level ESG characteristics.

3. Research Methodology and Data

3.1. Research Design

This subsection outlines the research design and methodology employed in our analysis. The discussion herein is technical; readers primarily interested in the empirical findings may proceed to the next subsection without loss of continuity.

Suppose that

is the (

) response vector,

is the (

) matrix of covariates with

observations and

variables, and

are the predictors. Following [

39], we can formulate the traditional PCA using the conventional least squares problem,

where

is a

principal component loading matrix,

denotes the number of principal components,

is the

identity matrix, and

is the on the L

2-norm (Euclidean distance). In order to easily interpret

in Equation (1), ref. [

40] proposed SPCA for the analysis of multivariate datasets. In essence, SPCA is an extension of PCA and useful for dimensional reduction, especially when the variables have sparsity structures. In simple form, the SPCA maximization problem is given by

where

is a

matrix,

and

are non-negative regularization parameters with positive values, and

is the L

1-norm (Manhattan distance). Due to its construction, SPCA (Equation (2)) simultaneously estimates some parameters as zero and mitigates the issue of parameter identification [

41].

SPCA can additionally serve as a regression model, utilizing a continuous response vector and a reduced set of principal components that contain relevant information concerning the response variable. Let

be an intercept;

is a coefficient vector and

is the standard squared loss function of a linear regression model that utilizes the principal components

as explanatory variables. Following [

40,

41], the sparse principal component regression (SPCR) model is formulated as

where

and

are non-negative regularization parameters,

is a positive tuning parameter, and

is a tuning parameter in [0, 1). A flowchart illustrating the SPCR model implementation is presented in the

Appendix A.

The framework builds upon established machine learning methods, including Ridge, Lasso, and the Elastic Net regression. In Ridge regression [

42], the objective is to minimize the residual sum of squares (RSS) subject to a constraint on the L2-norm of the slope coefficients. In contrast, Lasso regression [

39] minimizes the RSS subject to an L1-penalty imposed on the regression slope coefficients, and Elastic Net regression [

43] minimizes the RSS subject to a combined penalty utilizing both the L1- and L2-norms. In SPCA, each principal component is a linear combination of only a small subset of the original variables. By applying a penalty (similarly to Lasso regression), SPCA forces the loadings of less important variables to be exactly zero. Analogously to existing shrinkage-based methods such as Ridge, Lasso, and Elastic Net regressions, we determine the tuning parameters of SPCR (Equation (3)) through cross-validation. We provide a flowchart for the SPCA models’ implementation in the

Appendix A.

It is noteworthy that PCA presents distinct advantages over penalized regression methods, such as Ridge and Lasso, primarily due to its unsupervised methodology and its efficacy in addressing multicollinearity. In contrast to least squares-based methods, which yield non-zero estimates for all coefficients, shrinkage methods such as LASSO and Elastic Net facilitate automatic variable selection, thereby tending to produce more parsimonious final models. PCA-based regression, on the other hand, achieves dimensionality reduction and provides distinct perspectives on the variance structure within the data. As an unsupervised technique, PCA reduces the dimensionality of a dataset independent of any target or outcome variable. In contrast, penalized regressions are supervised methods wherein the coefficient shrinkage is directly informed by the predictive relationship between the features and a specified outcome. Furthermore, PCA is particularly effective for managing multicollinearity, a condition that occurs when predictor variables are highly correlated. While penalized regression methods address this issue, their approaches differ. For example, ridge regression retains all correlated predictors but shrinks their coefficients, and Lasso regression arbitrarily selects one predictor from a correlated set while eliminating the others by shrinking their coefficients to zero. This process can lead to model instability, as minor variations in the data can alter feature selection. PCA offers a more systematic solution by transforming the original correlated variables into a new set of orthogonal (uncorrelated) principal components. This provides a more stable representation of the feature space and resolves the issue of multicollinearity among the components used in a subsequent model.

The adoption of SPCA (Equation (2)) in lieu of PCA (Equation (1)) within our empirical asset pricing framework is predicated on several considerations. Given our objective of identifying latent risk factors for ESG firms using a dataset of two-dimensional portfolio returns, where each portfolio represents a distinct asset, SPCA offers advantages in terms of interpretability. It is a well-established fact that shrinkage-based estimators exhibit bias and do not lend themselves to causal interpretation. SPCA might explain slightly less variance than PCA for the same number of components, but the trade-off is a gain in clarity. Unlike traditional PCA, which generates principal components by combining all assets, SPCA combines only a subset, facilitating easier interpretation of the resulting risk factors. While standard PCA is effective at reducing dimensionality, its principal components are dense, meaning they are linear combinations of all original variables. This makes it difficult to assign a clear, intuitive meaning to the components. SPCA improves upon this by forcing the loadings of less important variables to be exactly zero. This results in sparse components that are built from only a small subset of the original variables, making them significantly easier to interpret and explain. In practice, the implementation of investment trading strategies based on these factors would incur lower transaction costs due to the reduced number of portfolios (or assets) required for trading. Based on these rationales, we find it reasonable to employ SPCA to derive the latent risk factors.

The SPCA is not free from limitations. The most fundamental assumption of SPCA is that the relationships it seeks to model are linear. It assumes that the underlying structure in the data can be effectively summarized by straight-line relationships [

40,

41]. If the variables are related in a complex, non-linear way (e.g., a U-shaped or cyclical pattern), SPCA will fail to capture the true nature of that structure. For such cases, non-linear dimensionality reduction techniques such as Kernel PCA or t-distributed stochastic neighbor embedding would be more appropriate. Another issue is the assumption of a sparse structure that distinguishes SPCA from PCA. If this assumption is incorrect—and the true structure involves complex interactions among many variables—SPCA might create an overly simplistic model that misses important information. These questions represent fruitful avenues for future investigation.

3.2. Data and Testing Assets

This subsection presents a concise overview of the data and variables employed in this study. As previously indicated, this study examines the non-pecuniary risk associated with expected stock returns of ESG-focused firms. The analysis utilizes monthly firm-level data spanning the period from January 2002 to December 2022. The sample is restricted to US companies with available ESG ratings within the Refinitiv database, obtained from the Asset4 (Refinitiv) data vendor. According to [

44], the ESG score of a company is calculated as the average of the social, environmental and governance scores. Refinitiv’s [

44] ESG scores, expressed in percentile ranks and in letter grades, are based on a company’s relative performance against peers. Although the data include scores as both letter grades (D− to A+) and percentile ranks, this study relies on the numerical representation of the percentile ranks, ranging from 0 (worst) to 100 (best). Specifically, environmental and social scores are benchmarked against industry peers, while governance scores are benchmarked against peers in the same country of incorporation [

44]. Refinitiv’s ESG scores assess a company’s relative performance, commitment, and effectiveness across ten main themes, based on publicly reported data. Scores from these themes are aggregated into three pillar scores: environmental, social, and corporate governance. The environmental and social pillars are calculated using industry-specific weightings, whereas the governance pillar weights are consistent across all industries. Finally, these three pillars are combined to produce the company’s overall ESG score. This methodology results in a data-driven, industry-relative performance measure rather than an absolute definition of “good.” While acknowledging the existence of alternative ESG data providers, such as MSCI KLD, MSCI IVA, Bloomberg, Sustainalytics, and RobecoSAM, the Refinitiv ESG dataset was selected due to its transparency and flexibility. This dataset offers comprehensive global coverage of publicly traded companies and provides a wide range of ESG-related variables and scores (see [

44] for details). Furthermore, this study uses the CRSP-Compustat merged database from WRDS and the Fama–French risk factors from Kenneth French’s data library. The generalizability of our findings is subject to the limitations of the chosen sample and time frame.

It is important to distinguish between the sample construction underlying the Fama–French factors and the Refinitiv ESG scores, as they differ in scope and purpose. The Fama–French portfolios are designed to be comprehensive, constructed from nearly all stocks listed on the NYSE, AMEX, and NASDAQ exchanges (approximately 4000 firms) to represent the entire US market for asset pricing tests. In contrast, the Refinitiv ESG scores aim to rate a broad set of individual companies around the world. At the end of our sample period, the Refinitiv dataset provides firm-level ESG ratings for a more selective sample (around 2300 US companies). While substantial, this coverage is not exhaustive and is weighted towards larger, more prominent firms. While Refinitiv’s global coverage exceeds 15,000 companies, the North American region, which predominantly comprises US companies, constitutes a significant portion of their database. The coverage focuses primarily on publicly listed companies, especially those included in major indices like the S&P 500, Russell 1000, and Russell 3000. This ensures the most impactful US companies are included, but it results in a different sample universe than the one used for the Fama–French factors.

The consistency and reliability of Refinitiv’s ESG ratings have been a point of contention in recent academic studies. One of the key arguments leveled against Refinitiv’s ESG data is the presence of “look-ahead bias.” This issue arises from the company’s practice of retroactively updating and restating historical ESG scores. The extant literature (see, e.g., [

24,

45]) shows that these revisions can be substantial and are not always clearly communicated to users. In response to such critiques, Refinitiv stated that its methodology is designed to be transparent and that changes are made to improve the quality and accuracy of its data as new information becomes available or as its models are refined. Another well-documented phenomenon across the ESG rating landscape related to firm size also appears to affect Refinitiv’s data. Prior research shows that larger companies, with more extensive resources dedicated to sustainability reporting and stakeholder engagement, tend to achieve higher ESG scores than their smaller counterparts. Refinitiv’s [

44] methodology does include some adjustments for company size, particularly in its controversy scoring. However, studies such as [

46] confirm the continued presence of a size bias in Refinitiv’s ESG data, even after the company has claimed to have implemented measures to minimize it. Other common issues regarding Refinitiv’s ESG data include potential geographic and industry-specific biases. Companies operating in regions with more stringent environmental and social regulations and stronger disclosure requirements, such as Europe, may systematically score higher than those in regions with less developed frameworks. Refinitiv attempts to address industry-specific issues by applying different weightings to various ESG factors based on their materiality to a particular sector. Despite the shortcomings, the potential biases within Refinitiv’s ESG data do not underscore the importance of a critical and nuanced approach to its use. This empirical analysis offers new evidence on the generalizability of the distinct risk dimensions within sustainable investing. A key takeaway is that while this data provides a valuable tool for investors integrating sustainability considerations, it should not be viewed as an absolute measure of a company’s performance or virtue.

In

Figure 1, we provide a graphical representation of the sample coverage of ESG firms provided by our data vendor. As the figure demonstrates, the sample includes approximately 500 constituent firms per year during the initial five years of the sample period. Thereafter, the average number of firms stabilizes at approximately 900 between 2009 and 2014, followed by a substantial increase from 2015 onwards. At the beginning of each calendar year (January), all stocks in our sample are ranked according to their ESG ratings, and various portfolios are constructed based on these rankings. Independently, stocks are also categorized into size groups based on market capitalization. Similarly, stocks are also categorized into various groups using the ESG rating. Two sets of double-sorted portfolios are constructed. The first set is formed by intersecting the two size groups (small and big) with the three ESG rating groups (low, medium, and high), yielding a total of six portfolios. The second set is formed by intersecting three size groups (small, medium, and big) with the three ESG rating groups (low, medium, and high), yielding a total of nine portfolios. We also construct five ESG-rating-based quintile portfolios. The time series of returns for each portfolio is subsequently obtained through this annual portfolio construction process. The time series and cross-sectional empirical methodology employed in this study is consistent with established practices in the literature.

Note that traditional analysis of equity returns is grounded in common risk factors such as size, value, and momentum, derived from long-short portfolios. The academic literature, however, acknowledges that these factors may be empirical artifacts rather than systematic risk exposures. The extent to which this conventional factor structure pervades the ESG investment universe remains an open empirical question. A key challenge arises from the motivations of ESG investors, who often pursue non-pecuniary objectives alongside, or in place of, traditional financial goals, thus potentially altering the asset pricing dynamics for sustainable firms. Our proposed methodology, on the other hand, leverages SPCA on two-dimensional portfolio returns to resolve the latent risk structure of ESG-focused investments.

4. Empirical Results

4.1. Characteristics of Size- and ESG-Based Portfolios

We commence this analysis with a succinct delineation of the two-dimensional portfolios.

Table 1 presents the average excess returns of six portfolios constructed through independent sorts based on ESG rating and market capitalization. Panel A reports the value-weighted monthly average returns for all firms, while Panel B presents the corresponding equally weighted average returns. Each portfolio is held for a period of 12 months, with annual rebalancing. The results indicate a tendency for firms with lower ESG ratings to exhibit smaller market capitalizations, while firms with higher ESG ratings tend to possess larger market capitalizations. This is consistent with [

46], which suggests that large firms tend to have higher ESG scores than smaller firms.

The results presented in Panel A suggest a general tendency for value-weighted portfolios composed of smaller firms with lower ESG ratings to exhibit higher average returns, while portfolios comprising larger firms with higher ESG ratings tend to generate lower average returns. A monotonic decline in average excess returns is observed across two size categories as ESG ratings increase from low to high. Specifically, within the small-cap category, the average monthly returns are 0.46%, 0.39%, and 0.33% for low-, medium-, and high-ESG-rated portfolios, respectively. The magnitude of dispersion between high- and low-ESG rating portfolio returns is attenuated for large-cap firms. The average return of a zero-investment portfolio that establishes a long position in low-ESG firms and a short position in high-ESG firms is modest, with 0.13% registered per month for small-cap portfolios and 0.08% registered per month for large-cap portfolios. Furthermore, the average returns of size-based portfolios exhibit a monotonic decrease across all three ESG rating portfolios. The size-based long–short portfolios yield average returns of 0.07% for the lowest and 0.02% for the highest ESG rating portfolios.

Altogether, Panel A reveals two key findings: First, smaller, lower-ESG-rated portfolios tend to have higher value-weighted average returns than larger, higher-ESG-rated portfolios. Second, average returns generally decrease as ESG ratings increase. It can be argued that, although the ESG rating premium exhibits a slightly more pronounced effect for smaller capitalization stocks, the size premium does not appear to be distinctly concentrated within any particular ESG rating group. In Panel B, which presents results for equally weighted portfolios, the overall pattern observed in average returns across six portfolios is broadly consistent with the findings reported in Panel A. Notably, the ESG-rating-based long–short portfolios generate modestly higher average monthly returns in Panel B compared to Panel A. Thus, at least for the period analyzed, portfolios composed of companies with the highest ESG ratings are, on average, generating lower financial returns than portfolios with lower-rated ESG companies. In essence, the finding that higher ESG-rated portfolios are associated with lower average returns suggests that the market may be rewarding investors for taking on the perceived higher risk of lower-rated ESG companies, while the safety and popularity of high-rated ESG companies have driven their prices up to a point where their future returns are more muted.

The rationale underlying this portfolio construction framework is to establish heterogeneity among the test portfolios with respect to both ESG rating and firm size, thereby ensuring a comprehensive range of average returns across the constituent assets. The methodological approach adopted within this research is consistent with the prevailing literature. A distinct advantage of utilizing portfolio-level data, as opposed to firm-level data, is the attenuation of concerns pertaining to infrequent trading and the potential influence of outlier observations. The ensuing subsection details the empirical analysis undertaken on the aforementioned portfolio sets.

4.2. SPCA-Based Factors and the Characteristics of ESG-Rating-Based Portfolios

We now present a detailed examination of the SPCA-derived factors. The three most influential SPCA-based factors are identified through the application of Equation (2) to the size- and ESG-sorted two-dimensional portfolio returns described in the preceding subsection. The principal components are constructed such that each component maximizes the remaining variance while being orthogonal to the preceding components. By construction, the first principal component explains the greatest proportion of variance, with the second principal component explaining the next largest proportion of variance orthogonal to the first, and so on.

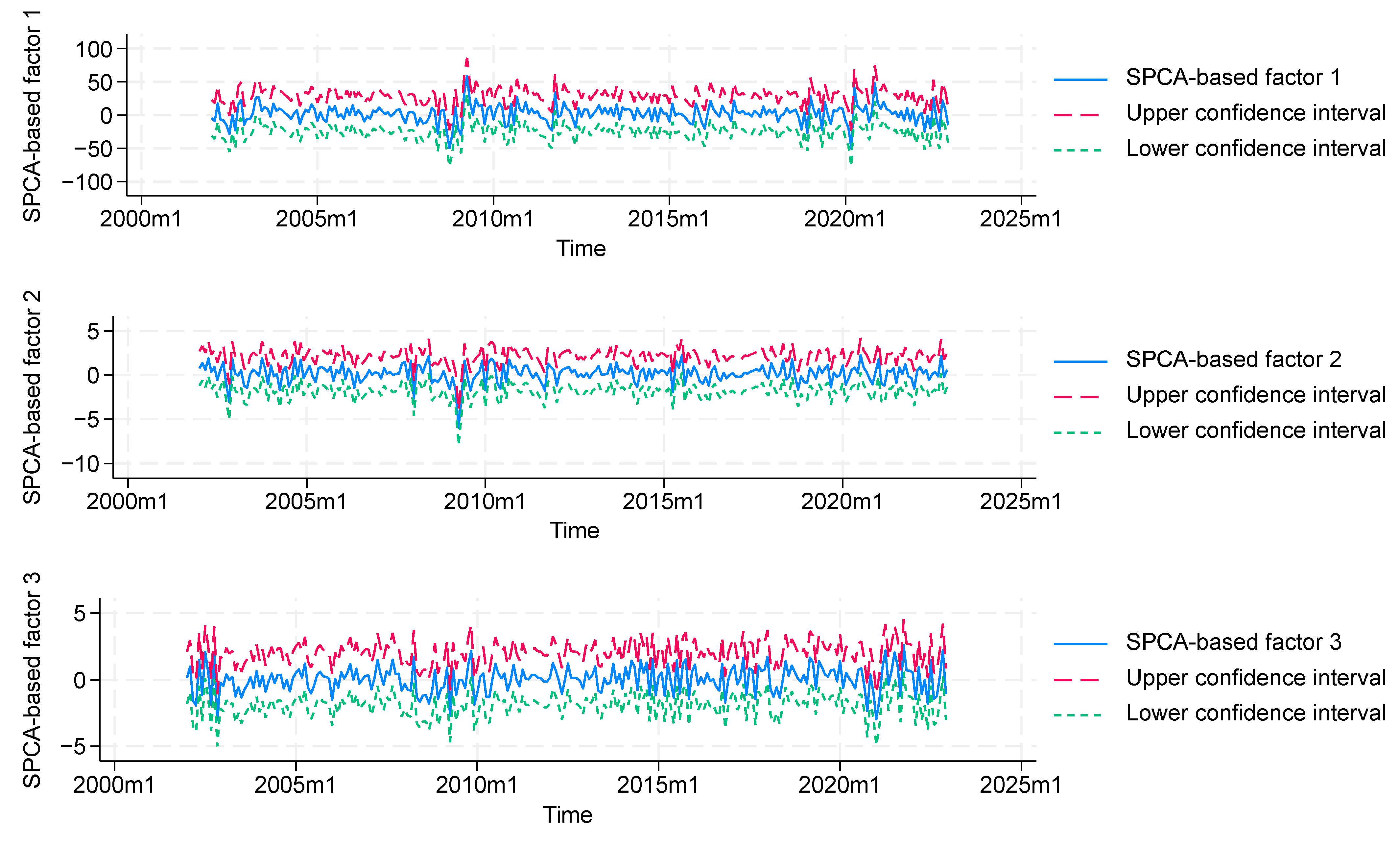

Figure 2 presents a comparative analysis of the three SPCA factors alongside their confidence interval estimates, whereas

Figure 3 provides a comparison of the first SPCA-based factor with the market, size, and value factors of [

47]. Each factor displays distinct characteristics, trends, and patterns of volatility. It is noteworthy that the SPCA-based factors exhibit sensitivity to fluctuations in financial market volatility and economic business cycles.

The preceding information is further complemented by

Table 2, which provides the correlations between the three SPCA-based factors and four established risk factors: market, size, value, and momentum. The correlation between ex post market returns and SPCA1 is approximately 0.74. However, it is important to note that a high degree of ex post market risk does not necessarily translate to a correspondingly high exposure to SPCA1. The standard deviation of SPCA1 is relatively lower than that of the market factor, and its distribution more closely approximates a normal distribution. The average monthly returns for the size and value factors are 0.28% and 0.37%, respectively. All three SPCA-based factors generate economically significant premiums. The first SPCA factor exhibits a correlation of 0.39 with the Fama–French [

47] size factor and a correlation of −0.43 with the momentum factor of [

48]. The correlations between all three SPCA-based factors and the value factor are the lowest among the comparisons. The correlations between the momentum factor and SPCA2 and SPCA3 are 0.27 and 0.06, respectively. These pairwise correlations collectively suggest that the SPCA-based factors capture unique dimensions of risk that are not fully captured by the ex-post market, size, value, and momentum factors.

Complementary to the application of Equation (2), Equation (3) was also employed, utilizing five ESG-rating portfolio excess returns as the response vector and size-ESG-sorted portfolio returns as the matrix of covariates. The resultant sparse principal component factors exhibit a comparable correlation structure to that detailed in

Table 3. The generalizability of our results is constrained by the characteristics of the sample and the temporal scope of the analysis. Note that the first SPCA-based latent factor can be interpreted as the overall, non-diversifiable market risk, as it captures the tendency for all assets to move in the same general direction. A positive value in SPCA1 corresponds to a market rally and a negative value to a market-wide decline. Reinforcing this view,

Figure 3 and

Table 3 show a high correlation between SPCA1 and the CRSP value-weighted excess market return, making a stock’s sensitivity to this factor comparable to its beta.

A pertinent question concerns the financial performance characteristics of portfolios constructed based on ESG ratings. This issue can be investigated by examining the exposures of such portfolios to established risk factors.

Table 3 presents the average exposures of five ESG rating quintile portfolios to a range of risk characteristics and factors. The results indicate a lack of discernible market risk exposure across all ESG-rating-based quintile portfolios. The lower ESG-rated portfolios exhibit greater exposure to SPCA beta and small-cap firms compared to their higher ESG-rated counterparts. A negative correlation is observed between the ESG quintiles and value factors, as measured by book-to-price and dividend yield. Additionally, the ESG-rating portfolios demonstrate moderate exposure to growth, leverage, and liquidity factors.

Reconciling the observed trend in the market beta of ESG portfolios in

Table 3 is an analytical challenge. Market beta measures a firm’s sensitivity to systematic market risk, while ESG scores often reflect business models with varying degrees of exposure to market-wide shocks. A high ESG score is not merely a measure of corporate distinction but a strong indicator of operational resilience and quality. Consequently, the lower market beta associated with high-ESG firms is often a direct reflection of their superior risk management, presence in more stable industries, and ability to generate consistent returns. These firms are less sensitive to market turmoil precisely because they are better managed. Conversely, low-ESG firms tend to operate in more economically sensitive industries, may be less resilient due to weaker governance, and face higher idiosyncratic risks. This combination of factors makes their stock prices more volatile and have a relatively higher correlation with the broader market. A significant portion of the low beta trend can be explained by the fact that ESG investing systematically favors less cyclical sectors.

4.3. Risk-Adjusted Performance for Double Sorted Portfolios

A fundamental implication of a well-specified asset pricing model is that the intercept term in a time series regression of an asset’s excess return (defined as its return in excess of the risk-free rate) on the model’s factor returns should be statistically indistinguishable from zero. The Gibbons, Ross, and Shanken [

49] GRS F test statistic, presented in

Table 4, provides such a test. More specifically, the GRS statistic tests whether the intercept in a time series regression of an asset’s excess return on a model’s factors is zero—a key requirement for a well-specified asset pricing model. This test is applied to several factor models: a single-factor MKTRF model, a single-factor SPCA1 model, the Fama–French [

50,

51] five-factor model (FF5F), and an SPCA1-augmented FF5F model (SPCA1+FF5F). The Fama–French five-factor model represents a refinement of the traditional CAPM by incorporating additional factors beyond market risk to explain asset returns. While the CAPM considers only the market risk premium, the five-factor model includes factors related to size, value, profitability, and investment patterns. (Consistent with [

50,

51], we do not include the momentum factor proposed by [

48] or the liquidity factor proposed by [

52] in our asset pricing tests. These two factors yield only marginal improvements in model performance, and their inclusion does not alter the central findings of this study. Further details are available upon request). The estimation of all regression slopes as constants introduces the potential for misspecification due to time variation in these parameters. To assess the joint statistical significance of the intercept for sets of double- and triple-sorted size–ESG portfolios, we employ the GRS test. The results of this analysis are presented in

Table 4. The first set of results presents performance metrics for six portfolios sorted by size and ESG rating. We apply several factor models to these portfolios and report the average absolute alpha, squared alpha, and the GRS test statistic with its corresponding

p-value. The second set of results replicates this analysis for nine size-ESG-rating-sorted portfolios.

For the set of six size-ESG-sorted portfolios, employing either MKTRF or SPCA as the sole explanatory variable results in a weak rejection of the null hypothesis of jointly zero intercepts. The inclusion of F5F as an explanatory variable has a marginal impact on these results. However, the SPCA1+FF5F model yields a GRS statistic with a

p-value of less than 0.001, indicating a strong rejection of the null hypothesis. When considering the set of nine size-ESG-sorted portfolios, the

p-values associated with the one-factor and FF5F models are near the 0.05 significance level. For these triple-sorted testing portfolios, the GRS statistic associated with the SPCA1+FF5F model unequivocally refutes the hypothesis of jointly zero intercepts (

p-value < 0.005). Notably, while the SPCA1+FF5F model continues to reject the zero-intercept null hypothesis for the nine portfolios, the associated

p-value increases marginally (0.003 in Panel B and 0.001 in Panel A). The results of the tests lead to a strong rejection of all models under consideration, with the associated GRS

p-values rounding to zero, at least to three decimal places. Consequently, it can be concluded that all models represent incomplete characterizations of expected returns of size–ESG-based portfolios. For the six size–ESG-sorted portfolios, the average absolute intercepts are 0.09% per month for the SPCA1 and 0.07% per month for the SPAC+FF5F model. For the nine size–ESG-sorted portfolios, the average absolute intercepts are 0.10% per month for the SPCA1 model and 0.09% per month for the SPAC+FF5F model. Altogether, the asset pricing metrics presented in

Table 4 consistently suggest that the augmented five-factor model incorporating the SPCA factor provide an accurate description of average returns for portfolios sorted based on size and ESG. Therefore, the inclusion of the SPCA-based factor enhances the estimation of expected returns for size–ESG portfolios. The following subsection is dedicated to the continued exploration of the distinctive risk dimension inherent within the context of ESG-based portfolio returns.

4.4. Relative Role of ESG Rating and SPCA Beta

The purpose of this subsection is to ascertain which of the two factors, ESG rating or SPCA beta, exhibits greater salience as a predictor of high and low average returns of individual portfolios. If portfolio returns are solely attributable to diminished (or elevated) ESG ratings, portfolios sorted on ESG rating are expected to exhibit statistically significant differences in average returns, even after accounting for SPCA beta exposures. Conversely, should portfolio returns be attributable to both diminished ESG ratings and diminished SPCA beta (and vice versa), it is expected that SPCA beta will exhibit predictive power with respect to differences in high and low portfolio returns, even after controlling for ESG rating.

Table 5 presents the relevant results in two panels. The analysis employs monthly firm-level data spanning the period from January 2002 to December 2022. We utilize a 60-month observation period for the estimation of the SPCA betas. At the commencement of each calendar year (i.e., starting January 2007), stocks are ranked into quintiles based on their ESG ratings and, separately, into quintiles based on their exposure to SPCA beta. Subsequently, double-sorted portfolios are constructed by intersecting the ESG rating quintiles and SPCA beta quintiles, resulting in a total of twenty-five portfolios. The time series of value-weighted and equally weighted returns for each double-sorted portfolio are then generated through this annual portfolio formation process. Panel A presents the value-weighted returns, while Panel B presents the equally weighted returns, of all double-sorted portfolios.

Each panel of the table details the average returns for portfolios constructed using a double-sorting methodology based on ESG ratings and SPCA beta. This approach allows for a simple analysis of how these two factors jointly influence asset performance. Panel A reveals a distinct and consistent trend. When examining portfolios within the lowest ESG rating quintile—representing firms with the poorest ESG scores—we observe a clear pattern in returns across the different beta quintiles. Specifically, the portfolio with the lowest SPCA beta quintile generated an average value-weighted return of 0.25%. As beta increased, returns diminished, with the median SPCA beta quintile yielding 0.12% and the highest SPCA beta quintile yielding 0.11%. This inverse relationship between beta and returns is not isolated. The data demonstrates a monotonic decrease in average value-weighted returns as one move from the lowest to the highest SPCA beta quintile, a trend that holds consistently across all ESG rating categories.

Furthermore, a strong relationship emerges when analyzing returns across the ESG quintiles themselves. The portfolios composed of firms with the lowest ESG ratings consistently produced the highest average returns at 0.156%. Conversely, the portfolios with the highest ESG ratings yielded the lowest average returns, at just 0.02%. This finding suggests a potential premium for holding assets with lower ESG scores during the period examined. Our investigation of long–short factor strategies shows no evidence of a reliable premium for either SPCA beta or ESG ratings. While a strategy of buying low-SPCA-beta stocks and selling high-SPCA-beta stocks returns between 0.02% and 0.22% per month, these results fail to achieve statistical significance at the 5% confidence level. The findings for the ESG-based long–short portfolio are even weaker, as its returns are both economically minor and statistically indistinguishable from zero. In summary, the results in Panel A indicate two primary findings: first, a “low-beta” effect is present, where lower SPCA beta portfolios outperform higher beta portfolios. Second, a negative relationship exists between ESG ratings and returns, with the lowest-rated ESG firms delivering the highest average returns.

Panel B demonstrates that the double-sorting procedure yields a wide range of average equally weighted returns, spanning from −0.05% to 0.21% per month. Because equally weighted and value-weighted approaches offer distinct and complementary perspectives on ESG risk, opportunity, and impact, we present both side-by-side to provide a more comprehensive analysis. In both panels, the average returns of the ESG rating quintiles do not exhibit statistically significant differences, although the average return differential between the highest and lowest ESG rating portfolios diminishes marginally when progressing from the lowest to the highest SPCA beta quintiles. Altogether, the results suggest that the ESG rating effect, in retrospect, is not independent of SPCA beta exposures, and conversely, the SPCA beta effect is not independent of ESG rating. The principal finding in Panel B—namely, the diminished consistency of average return spreads between low- and high-ESG rated portfolios across the SPCA groups—corroborates the results presented in Panel A. Consequently, even when considering ESG ratings, the firm-specific SPCA beta contributes to the differentiation of the aggregate portfolio return spread. The portfolio that

has is long on low-SPCA-beta stocks and short on high-SPCA-beta stocks generates monthly equally weighted returns ranging from 0.01% to 0.16%; however, these returns lack statistical significance. Likewise, the arbitrage portfolio constructed from ESG ratings produces returns that are both economically negligible and statistically insignificant. As a robustness check, we replicated the analyses for

Table 1,

Table 3 and

Table 5 using two subperiods (2000–2010 and 2000–2014). These additional tests yielded findings consistent with our main results (we thank an anonymous referee for suggesting this analysis). It is therefore reasonable to conclude that risk measures proxied by SPCA beta possess non-negligible predictive power within the cross-section. The following subsection presents the results of the cross-sectional regression analysis.

4.5. Cross-Sectional Regressions

Considering the results presented in preceding subsections, it is necessary to investigate the statistical significance of the SPAC-based risk factor loading and ESG rating characteristic within the cross-section, while controlling for other recognized determinants of expected stock returns. This subsection details these analyses. The influence of ESG ratings on the cross-section of expected returns, and the potential moderating role of firm size, are further examined herein. We follow the traditional implementation of the Fama–MacBeth [

53] two-pass cross-sectional regression (CSR) methodology that comprises two distinct stages. The first stage involves the estimation of risk loading for various factors, including excess market return and SPCA1, via time series regressions. Subsequently, in the second stage, risk premium is estimated via CSR across all assets. The betas estimated in the first stage represent the exposures to the corresponding factors, while their respective slopes in the second stage quantify the compensation for bearing the associated factor risk. In this study, we adhere to the methodology outlined by [

54,

55], employing regressions of monthly individual stock returns on factor loadings and a set of cross-sectional characteristics demonstrated to possess predictive power for future stock returns. Consequently, our cross-sectional regression analyses provide a basis for evaluating rational factor pricing explanations of the ESG premium against the alternative hypothesis of market mispricing.

It is important to recognize that while the individual stock-level analysis exhibits robustness against data mining concerns, the potential for measurement error persists. As documented in the literature, the factor loading of individual stocks estimated in the first stage can be subject to noise, potentially leading to error-in-variable problems in the second stage. To mitigate such errors-in-variables, we adopt the approach of [

43].

Table 6 presents the time series averages of the monthly cross-sectional regression coefficients (multiplied by 100) and their associated t-statistics. The CSR controls for ESG rating, market beta, and SPCA beta for each stock. Within the CSR, we also control for firm characteristics such as ln(size), ln(be/me), six-month momentum, ln(liquidity), gross profitability, and leverage. We construct our variables as follows. Excess return is defined as the individual stock return minus the one-month treasury bill rate. To isolate firm-specific performance, we calculate the CAPM-adjusted return by subtracting the expected return, derived from the stock’s beta and the excess market return (the CRSP value-weighted index minus the T-bill rate), from the stock’s excess return. The set of predictors include the market beta and the SPCA-factor beta. Both the market and the SPCA-factor betas are estimated using a five-year rolling window. We control for several firm characteristics known to influence returns, including 6 month momentum [

56] and gross profitability [

57], as well as the logarithms of market capitalization, the book-to-market ratio [

54], and stock illiquidity [

58]. The parameter of interest is the slope coefficient of SPCA beta. If we predict a negative ESG–performance relationship even when accounting for control variables, we should observe a negative value for the slope of SPCA beta.

The results of our cross-sectional regression analysis are detailed in

Table 6. The study investigates two primary measures of stock performance as dependent variables: excess return, examined in Models 1 through 3, and the CAPM-adjusted return, examined in Models 4 through 6. A principal finding is that environmental, social, and governance (ESG) ratings do not possess predictive power for future stock returns; the coefficient for this variable remains statistically insignificant across all model specifications. Conversely, the SPCA beta emerges as a strong and consistent predictor, demonstrating a statistically significant negative association with subsequent returns. The robustness of this finding is noteworthy, as the relationship holds across all six regression frameworks after controlling for standard firm-level characteristics, including firm size (ln(size)), book-to-market ratio (ln(be/me)), 6-month momentum, gross profitability, and leverage. In line with the prior literature, both ln(be/me) and 6-month momentum are highly significant predictors of returns at the 1% level. Furthermore, firm size and gross profitability also exhibit significant explanatory power (

p < 0.05), while leverage is found to be statistically insignificant throughout the analysis.

In summary, the CSR results confirm the preliminary results derived from the portfolio sort and provides corroborating evidence for the SPAC-augmented Fama–French multifactor model. The empirical findings further suggest that the size and book-to-market characteristics considered herein appear to contain unique information regarding future returns of ESG stocks. This observation is consistent with the findings obtained by the authors of [

59], who assert that the cross-section of expected returns is multidimensional. It is conceivable that certain control variables function as proxies for expected cash flows, thereby identifying discrepancies in expected returns regardless of their provenance in mispricing or risk. From the perspective of the standard valuation equation (e.g., [

60]), controlling for firm-level characteristics, an augmented expected cash flow implies a commensurately elevated expected return. If smaller firms and stocks with low ESG ratings tend to exhibit diminished net cash flow, then the observed negative relationship between average returns of ESG firms and SPCA-beta is reasonably consonant with the valuation equation.

5. Further Discussions: Applied Contexts, Methodological Limitations, and Artificial Intelligence

The core tenet of investment and diversification strategies for professional money managers and retail investors hinges on understanding how different dimensions of risk influence expected returns. The results of this paper indicate that a distinctive understanding of risk–return dynamics emerges from the intersection of ESG criteria and firm-specific attributes. Discerning the extent to which expected return dynamics are influenced by differential exposures to ESG-based risk factors provides crucial inputs for strategic asset allocation and portfolio construction. Consequently, the identification of any unique return patterns presents investment practitioners, including analysts and money managers, with opportunities to construct strategies that may yield superior performance. This paper, therefore, contributes to a more nuanced understanding of the dynamics driving the return premiums for ESG-based investments. Professional money managers with an ESG motive can leverage the distinctive cross-sectional role of ESG-based factor betas to more effectively disentangle the premiums associated with interactions among firm fundamentals, thereby informing their investment and diversification strategies. A better understanding of how expected return dynamics are shaped by varying exposures to ESG-based factor risk can be fundamental to effective asset allocation and portfolio construction. From a practical standpoint, these findings hold significant implications for investment management. The evidence that abnormal returns associated with specific firm characteristics and, notably, our proposed ESG-based factor can be systematically exploited presents a tangible opportunity for strategy development. This is of direct consequence to security analysts seeking to refine their valuation models and to capital allocators, such as portfolio managers, who can leverage these insights to improve investment selection and achieve superior portfolio performance and diversification objectives.

We acknowledge that our study is not without limitations; however, these constraints provide a clear framework for subsequent research and investigation. A primary limitation is the study’s reliance on a single data provider, Refinitiv. The conclusions are therefore contingent upon the specific scoring methodologies and data collection practices of this source. The scope of our analysis did not extend to a cross-validation of results using alternative datasets from providers such as MSCI or Sustainalytics. Note that like those of most ESG rating agencies, Sustainalytics’ data are susceptible to large-cap and disclosure bias that can skew results. MSCI’s ESG ratings are also limited by a bias toward large, well-resourced companies and a lack of algorithmic transparency in how rating grades are calculated. Berg et al. [

24] provides a crucial framework for understanding that the ESG data landscape is not unified. They argue that until there is greater consensus on the scope, measurement, and weighting of ESG attributes, the divergence in ratings will persist, creating challenges for all market participants. Given the recognized and significant divergence in ratings and underlying data among these agencies, it is possible that the significance of ESG-based factors could vary depending on the data source. A comprehensive comparative study analyzing the sources of these discrepancies and their impact on asset pricing would be a valuable contribution to the literature.

Furthermore, our methodological choices involve inherent trade-offs. The use of firm-level data, while allowing for a granular analysis consistent with prior studies, exposes the tests to potential noise from infrequent trading and the disproportionate impact of outliers. While we employ standard statistical controls, future work could confirm these findings using portfolio-level tests, which can mitigate such issues. Similarly, while our application of SPCA offers a robust technique for constructing latent ESG factors, we position it as a rigorous alternative rather than a foundational innovation in factor modeling. Finally, the temporal scope of our analysis is limited to a sample period ending in 2022. The landscape of sustainable finance is evolving rapidly, driven by new regulations, shifting investor sentiment, and enhanced corporate disclosure requirements. Consequently, our results do not reflect the potential influence of these more recent developments. Extending the analysis to include the post-2022 period would be crucial for assessing the continued relevance and stability of the relationships identified herein.

We recognize that the advent of artificial intelligence (AI)—a field that encompasses machine learning—is expected to exert a substantial influence on the paradigm of sustainable investing. This technological shift facilitates the evolution of sustainability assessment from a predominantly qualitative practice to a quantitative, data-centric, and transparent discipline integral to contemporary portfolio management. A new wave of innovation is emerging, catalyzed by two key trends: the availability of low-cost AI services like DeepSeek R1 and the development of highly efficient models for specialized applications, such as corporate disclosure analysis. A salient application of this is reflected in the capacity for AI to mitigate “greenwashing,” in which corporations make misleading claims about their ESG credentials. Specialized AI systems can systematically scrutinize corporate disclosures against a wide array of empirical data to validate the authenticity of their sustainability assertions.