Abstract

The supply chain is a critical tool for enterprises to withstand risks and ensure sustainable development. Integrating green and environmentally friendly practices into the supply chain has become an increasingly prominent trend. This study examines the impact of green supply chain management (GSCM) on supply chain resilience, using the green supply chain pilot projects implemented in China as a quasi-natural experiment, employing a multi-period difference-in-difference (DID) model. Based on panel data from manufacturing enterprises listed on the A-share market in China from 2014 to 2022, the findings reveal three key insights. First, GSCM significantly improves the resilience of enterprise supply chains. Second, GSCM has both signaling and cost effects, as it can reduce corporate financing costs and enhance market value, lower market transaction costs, and improve productivity. These are potential channels through which GSCM exerts a positive influence. Third, the positive impact of GSCM on supply chain resilience is more pronounced in enterprises with third-party environmental certifications and higher institutional shareholder ratios. Additionally, this study also extends to demonstrate that GSCM directly and positively influences corporate environmental performance. These findings provide policy recommendations for enhancing green supply chain development and offer managerial insights to help enterprises proactively embrace green transformation.

1. Introduction

In today’s globalized economic landscape, supply chains have become the core for enterprises to withstand risks and maintain operations and development. A supply chain not only connects internal operations, such as production and logistics, but also integrates external partners like suppliers, distributors, and retailers. The COVID-19 pandemic exposed vulnerabilities in corporate supply chains, with disruptions in transportation and restrictions on personnel movement underscoring the critical need for resilience.

In this context, the significance of supply chain resilience has become increasingly apparent. Tukamuhabwa et al. (2015) [1] defined supply chain resilience as the ability to resist external shocks or supply chain disruptions, and compared to competitors, it offers superior risk management capacity and the ability to derive advantages from disruptions, ultimately reaching an ideal state. Similarly, Hussain et al. (2022) [2] argued that in a complex and volatile market environment, supply chains with high resilience are able to adapt flexibly to risks, such as fluctuations in raw material prices, natural disasters, and policy changes, ensuring the continuity of business operations and enhancing the competitiveness and sustainability of enterprises.

Parallel to resilience, environmental sustainability has become a key driver of supply chain innovation. Green supply chain management (GSCM) is a management model that integrates environmental protection consciousness into all aspects of the supply chain. Regarding its definition, Sarkis (2003) [3] suggested that GSCM combines enterprise procurement plans with environmental activities to improve the environmental performance of suppliers and customers. Expanding on this, Sarkis et al. (2011) [4] proposed that GSCM not only incorporates green concepts at stages such as product design, use, reuse, dismantling, and disposal, but also ensures green requirements are met in processes like warehousing, transportation, and supplier development. Rabbi et al. (2020) [5] categorized GSCM into two main areas, green design and green operations.

Research on GSCM has yielded substantial results. In terms of measurement methods, Rabbi et al. (2020) [5] used a Bayesian belief network to construct predictive models, while Herrmann et al. (2021) [6] proposed a multidimensional analytical framework. Zhang and Ma (2024) [7] built conceptual models focusing on specific industries. Regarding the factors influencing GSCM and its performance, existing literature mainly covers aspects such as industry practices [8,9], credit strategies [10], network embedding [11,12], and digital capabilities [13,14]. In research on the long-term impacts of GSCM on enterprise development, key areas of focus include green innovation [15] and corporate value [16].

However, existing research still has certain limitations. In terms of research methods, studies primarily rely on questionnaires to collect data and construct indicator systems to measure GSCM. This makes the research results susceptible to biases from sample selection and subjective judgment, leading to higher endogeneity and reducing the reliability and generalizability of the conclusions. Regarding the content of research, the current literature mainly focuses on the impact of GSCM on corporate performance and value, while there is limited exploration of its relationship with supply chain resilience. The positive impact of GSCM on supply chain resilience is obvious. Based on the dynamic capability theory, enterprises can adapt to environmental changes through the supply chain. From practical experience, GSCM integrates various green resources to win support from all parties, thereby enhancing the supply chain’s ability to cope with various risks and challenges.

China places great importance on the development of green supply chains and has introduced related documents. In September 2016, China issued the Notice on the Construction of a Green Manufacturing System, aimed at promoting industrial green development, supporting supply-side structural reforms, and fostering green growth. The green manufacturing system encompasses several aspects, including green factories, green products, green parks, and green supply chains. Among these, green supply chains focus on the coordination and cooperation between enterprises at various nodes of the supply chain, integrating the concept of green manufacturing throughout the entire process from raw material procurement, production, and sales to recycling and disposal, with the goal of reducing resource consumption, minimizing pollution, and enhancing the overall green level of the supply chain. Through the green supply chain pilot program in China, we explore two core issues. The first is whether GSCM can enhance the resilience of the supply chain, and the second is what the potential mechanism is if it can.

In the context of a complex and rapidly changing global environment, as well as the increasing risks in supply chains, researching how GSCM influences supply chain resilience holds significant theoretical and practical implications. The lack of research in this area limits our understanding of the comprehensive role of GSCM. In addition, since 2010, China has become the world’s largest manufacturing country and has made many innovations and reforms in supply chain innovation. Meanwhile, China’s ecological and environmental problems remain severe, and it is the country with the highest carbon dioxide emissions in the world. In this context, we can estimate the role of GSCM for enterprises more clearly, which is our core research motivation.

Based on panel data from manufacturing enterprises listed on China’s A-share market from 2014 to 2022, we treat China’s green supply chain pilot program as a quasi-natural experiment and construct a multi-period difference-in-difference (DID) model to explore the impact of GSCM on supply chain resilience. Our study finds that GSCM can enhance supply chain resilience by reducing corporate financing costs and increasing market value, as well as lowering transaction costs and improving productivity. Furthermore, we also investigate the moderating effects of third-party environmental certifications and institutional investor holdings on GSCM.

This study makes three key contributions. First, we focus on the impact of GSCM on supply chain resilience and provide evidence from a quasi-natural experiment to expand the boundaries of related research. In terms of research directions, the existing literature mainly acquired the data and indicators of GSCM through scales and questionnaires, such as Rabbi et al. (2020) [5] and Herrmann et al. (2021) [6]. These methods may lead to relatively serious endogeneity problems in exploring causal relationships. Based on the pilot construction of green supply chain enterprises in China, we construct a multi-phase DID model to explore its impact, which can effectively alleviate the endogeneity problem in empirical research. In terms of research content, the existing literature mainly explores the impact of GSCM on enterprise value, green innovation, etc., such as Novitasari et al. (2021) [15] and Zhang et al. (2023) [16]. In contrast, our research results expand the existing research boundaries, mainly focusing on the impact of GSCM on supply chain resilience.

Second, we provide a theoretical framework for the impact of GSCM on enterprises, including the dynamic capability theory, the signal theory, and the transaction cost theory. Previous literature on the impact of supply chains mainly provided explanations through the dynamic capability theory. On this basis, we integrate the signal theory and the transaction cost theory to explore the specific mechanism of GSCM for supply chain resilience. Specifically, we deconstruct the black box of GSCM’s influence on supply chain resilience, confirming that it reduces financing costs and increases market value through signaling effects, and that it also has cost effects, including lowering transaction costs and improving productivity. Our research provides both theoretical and empirical support for understanding the impact of GSCM on supply chain resilience, helping to deepen our understanding of policy mechanisms.

Third, based on the empirical research findings, we offer a series of concrete policy recommendations and managerial insights. Our evidence highlights the effectiveness and positive impact of China’s GSCM but also uncovers some issues. Our policy recommendations aim to guide the government in further refining relevant policies and provide useful references for other developing countries. In addition, for enterprises, we propose management suggestions to help them actively respond to the green transformation trend in supply chains, supporting their transformation and upgrade.

The structure of the following text is as follows. In Section 2, we review the previous literature on GSCM, introduce the background of GSCM in China, and put forward research hypotheses. In Section 3, we propose the research methods to define variables and design models and introduce the data sources. In Section 4 and Section 5, we present the results of empirical studies, including benchmark regression, robustness tests, mechanism tests, heterogeneity analysis, and an additional test. In Section 6, we summarize the conclusions of the research and put forward policy recommendations and limitations.

2. Literature Review and Hypotheses

2.1. Literature Review

GSCM has emerged as a strategic framework that systematically integrates environmental sustainability into supply chain operations. Sarkis (2003) [3] defined GSCM as the management practice that integrates corporate procurement plans with environmental activities to enhance the environmental performance of both upstream and downstream supply chain entities. Later, Sarkis et al. (2011) [4] further expanded this concept, stating that GSCM not only includes product lifecycle management, covering design, use, recycling, and disposal, but also involves the greening of operational processes, such as warehousing and transportation, emphasizing the importance of environmental certification systems like ISO 14000. In recent years, scholars have further refined the dimensions of GSCM. For example, Rabbi et al. (2020) [5] proposed a dual framework of “green design” and “green operations,” with the former focusing on controlling environmental impacts during product development and the latter addressing sustainable practices in manufacturing and reverse logistics.

The methodological approaches to measuring GSCM performance have progressed from isolated metrics to sophisticated multidimensional frameworks. Rabbi et al. (2020) [5] innovatively used a Bayesian belief network (BBN) to construct a predictive model, enabling dynamic performance evaluation through the quantification of causal relationships between indicators. Herrmann et al. (2021) [6] conducted a systematic literature review and established a conceptual framework that includes 3 environmental dimensions, 21 categories, and 64 green practices, offering a multi-level analytical perspective for GSCM measurement that spans strategy, innovation, and operations. Zhang and Ma (2024) [7] constructed a dual-measurement model for the livestock product supply chain, focusing on product quality and service quality, and established specific evaluation indicators. These methodological advancements reflect growing scholarly recognition of GSCM’s inherent complexity and multidimensional nature.

The performance of GSCM is influenced by multiple interacting factors, which can be categorized into three main drivers: operational practices, organizational relationships, and digital technologies. In operational contexts, Tippayawong et al. (2016) [8] found that the coordinated implementation of green procurement, manufacturing, and transportation in the Thai automotive industry significantly improved asset turnover, and the combination of reverse logistics and eco-design amplified this effect. Majumdar et al. (2019) [9] revealed the challenges faced by the Southeast Asian textile industry, where the complexity of green processes formed a core barrier, with insufficient consumer awareness, regulatory gaps, and high costs acting as hindrances. Regarding organizational dynamics, Yang et al. (2019) [10] confirmed that credit strategies influence supply chain coordination efficiency through profit distribution mechanisms. Peng et al. (2020) [11] found that relational embedding, structural embedding, and knowledge embedding indirectly enhance performance by integrating green knowledge, with industrial agglomeration reinforcing this mechanism. Jo and Kwon (2021) [12] further proposed that internal and external environmental collaborations foster sustainable innovation (product/process) and achieve performance leaps. Digital transformation has also become a rising research focus. Qiao et al. (2023) [13] demonstrated that digital capabilities promote innovation through green supplier and customer learning, while Li and Donta (2023) [14] developed an SNN-Stacking model that shows the potential of smart algorithms in resource optimization, providing new technological pathways for GSCM.

The long-term organizational impacts of GSCM manifest most prominently in green innovation and market valuation. Novitasari et al. (2021) [15] constructed a chain model, in which GSCM affects green innovation, which in turn impacts corporate performance, revealing the key mediating role of green innovation. Zhang et al. (2023) [16], using data from Chinese listed companies, confirmed that GSCM creates enterprise value by reducing costs and enhancing competitiveness. Yi and Demirel (2023) [17] found that internal GSCM capabilities have a sustained growth effect in U.S. companies, while external collaborations may cause short-term suppression due to coordination costs. Ning et al. (2025) [18] emphasized that supply chain collaboration strengthens the role of GSCM in promoting green innovation and sustainable performance. Gu et al. (2023) [19] found that supply chain finance can further enhance productivity by promoting green innovation.

In addition, Li et al. (2022) [20] held that the financing preferences of manufacturers are closely related to the unit production cost and the cost of green investment. Hu et al. (2025) [21] constructed a tripartite evolutionary game model of the green supply chain and found that blockchain empowerment significantly reduced the financing costs of green small and medium-sized enterprises. Yang and Wang (2021) [22] applied game theory and found that the green innovation model increased the profits of the three sales models of retailers, manufacturers, and middlemen. Furthermore, through these green practices, GSCM can have a positive impact on supply chain resilience [23]. These findings provide a theoretical basis for phased and differentiated implementation of GSCM by enterprises.

2.2. Policy Background

To advance the national strategy of manufacturing power construction and facilitate the transition toward ecological civilization, China issued the Industrial Green Development Plan (2016–2020) in June 2016. In September of the same year, China also released the Notice on the Construction of a Green Manufacturing System, which emphasized the evaluation and demonstration of green factories, green parks, green products, and green supply chains as key components, marking the official launch of the green manufacturing pilot and demonstration projects.

Since its inception, the green supply chain initiative has achieved substantial progress. As of January 2024, the Ministry of Industry and Information Technology has published nine batches of the national green manufacturing list, with each batch including green supply chain management demonstration enterprises. These enterprises are spread across most provinces in China, with Zhejiang, Guangdong, Tianjin, and Jiangsu having a relatively larger share. In terms of industry distribution, demonstration enterprises in the electronics, light industry, machinery, and automotive sectors account for 78.0% of all such enterprises, dominating the green supply chain development landscape.

The green supply chain is the result of combining green manufacturing theory with supply chain management techniques. In the green manufacturing system, it focuses on the coordination and collaboration between supply chain node enterprises. It integrates green concepts throughout the entire product lifecycle, from raw material procurement and production manufacturing to product sales and post-use recycling and disposal. By incentivizing upstream and downstream partners to adopt greener practices, it generates synergistic effects for systemic sustainability. Together with green factories, green products, and green parks, the green supply chain contributes to the construction of the green manufacturing system and promotes the sustainable development of the supply chain.

2.3. Hypothesis Development

2.3.1. GSCM and Supply Chain Resilience

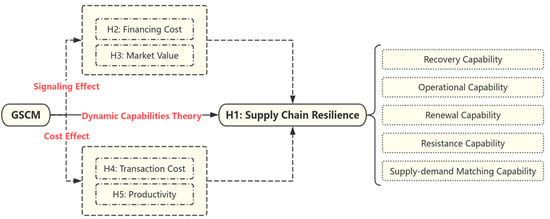

Supply chain resilience is a critical capability for enterprises to respond to internal and external shocks and maintain or quickly restore operations. Based on dynamic capabilities theory [24], enterprises continuously integrate, build, and reconfigure internal and external resources to adapt to environmental changes. GSCM, based on the principles of environmental sustainability, not only helps reduce environmental pollution but also significantly enhances an enterprise’s adaptability and resilience in uncertain environments. Specifically, GSCM strengthens supply chain resilience through five dimensions: recovery capability, operational capability, renewal capability, resistance capability, and supply–demand matching capability.

In terms of recovery capability, dynamic capabilities theory emphasizes that enterprises must possess the ability to rapidly adjust resource allocation to cope with crises. GSCM enhances a firm’s adaptability to disruptions by establishing resource recycling systems and backup supply networks. For example, companies using recyclable materials can more quickly switch supply sources, reducing dependence on single suppliers [25]. Furthermore, closed-loop supply chain management recycles waste products through reverse logistics, improving resource redundancy and accelerating supply chain recovery [26].

In terms of operational capability, GSCM optimizes production and logistics processes to enhance operational efficiency. Green manufacturing technologies can reduce energy consumption and waste emissions, increasing resource utilization, such as lean production and clean production [27]. Green transportation, by optimizing routes and using low-carbon transport options, reduces transportation costs and carbon emissions, such as electric trucks or intermodal transport [28]. These measures not only reduce operational costs but also improve product quality and market competitiveness [29].

In terms of renewal capability, an enterprise’s long-term competitiveness depends on its innovation capacity. GSCM promotes continuous investment in research and development to meet environmental regulations and market demands, fostering product and process innovation. For example, companies using bio-based materials or low-carbon technologies can not only meet environmental requirements but also develop differentiated products [30]. Moreover, GSCM encourages knowledge sharing among supply chain partners, enabling the absorption of external advanced technologies [31].

In terms of resistance capability, dynamic capabilities theory highlights the need for companies to build stable resource networks to withstand external shocks. GSCM mitigates supply risks through rigorous supplier selection, such as adherence to green certification standards [32]. At the same time, environmentally friendly technologies and equipment typically offer higher reliability and stability, reducing the likelihood of production disruptions, such as energy-saving production lines [33].

In terms of supply–demand matching capability, dynamic capabilities theory emphasizes market sensing and responsiveness. GSCM leverages digital technologies like big data and blockchain to accurately predict demand and optimize inventory management [34]. Additionally, close collaboration with suppliers enables information sharing, allowing suppliers to adjust production plans and supply strategies based on market demand. Moreover, green products are more likely to be recognized by consumers due to their sustainability attributes, improving market matching [35].

Drawing on dynamic capabilities theory and prior research [23], GSCM enhances supply chain resilience by improving recovery capability, operational capability, renewal capability, resistance capability, and supply–demand matching capability. Therefore, the following hypothesis is proposed:

H1.

GSCM improves the resilience of enterprise supply chains.

2.3.2. The Signaling Effect of GSCM

Based on signaling theory, the behavior and decisions of enterprises can convey important information about their intrinsic value and future prospects to the market. GSCM, as a strategic initiative in the field of environmental protection and sustainable development, not only demonstrates an enterprise’s commitment to environmental responsibility but also sends positive signals to market participants about the enterprise’s long-term growth potential and risk management capabilities [9].

When financial institutions assess the risk of an enterprise’s debt financing, they take into account the enterprise’s environmental management capabilities and their potential financial impact [20,21]. According to signaling theory, GSCM can transmit positive signals to financial institutions that the enterprise has a lower environmental risk and strong management practices, thereby reducing concerns about the enterprise’s debt repayment ability [36].

Specifically, on one hand, GSCM signals that the enterprise has established a sound environmental management system, which can effectively avoid financial losses, such as fines and lawsuits resulting from environmental violations. This risk control capability significantly improves the financial institutions’ risk assessment of the enterprise. Moreover, GSCM, through optimizing resource utilization efficiency and reducing waste, can lower the enterprise’s long-term operating costs, thereby enhancing its financial stability and debt repayment ability. This financial soundness will further be reflected in more favorable financing terms. Therefore, we propose:

H2.

GSCM significantly reduces corporate financing costs, thereby improving supply chain resilience.

In the context of the increasing popularity of sustainable development concepts, consumers and investors have become more sensitive to an enterprise’s environmental performance. As a visible signal of environmental commitment, green supply chains can enhance an enterprise’s market value [37].

Specifically, GSCM ensures that products meet environmental standards and satisfy consumers’ preference for sustainable products, thus enhancing brand loyalty and expanding market share. For example, empirical research by Zhang et al. (2023) [16] showed that GSCM significantly improves an enterprise’s competitiveness in the consumer goods market. Additionally, investors view GSCM as a reflection of an enterprise’s innovation capability and long-term competitiveness [38]. This forward-looking strategic positioning attracts ESG (environmental, social, governance) focused investors and raises the enterprise’s valuation. Therefore, we propose:

H3.

GSCM significantly increases the enterprise’s market value, thereby improving supply chain resilience.

2.3.3. The Cost Effect of GSCM

According to transaction cost theory, enterprises face various costs during market transactions, including the costs of information search, negotiation, contract signing, monitoring compliance, and resolving disputes. The construction of GSCM can significantly impact these transaction costs through its unique collaboration models and technological characteristics, while also influencing the productivity of enterprises [19,22].

A key characteristic of GSCM is the establishment of long-term stable cooperative relationships. Based on shared green goals, the cooperation between enterprises and suppliers or customers becomes more credible and sustainable, thereby reducing the search and negotiation costs associated with frequently changing partners.

In addition, GSCM mitigates information asymmetry through standardization and regulation, such as unified green product standards and environmental certifications. This transparency in the transaction process reduces monitoring costs and the risk of breaches. The study by Tippayawong et al. (2016) [8] indicated that collaborative cooperation within green supply chains can significantly reduce the uncertainty in the transaction process, thereby lowering overall transaction costs. Therefore, we propose:

H4.

GSCM significantly reduces corporate market transaction costs, thereby enhancing supply chain resilience.

GSCM not only optimizes the transaction process but also improves enterprise productivity through technological integration and process improvements. Specifically, GSCM encourages enterprises to adopt advanced green technologies and processes, such as energy-saving equipment and clean production technologies. These technologies reduce resource waste and optimize production processes, leading to higher output per unit of time.

Additionally, green supply chains emphasize employee skill development, enabling them to efficiently operate green production equipment, further enhancing labor productivity. Peng et al. (2020) [11] highlighted that the knowledge-sharing mechanism within GSCM helps enterprises absorb external advanced green technologies and quickly transform them into productivity gains. Therefore, we propose:

H5.

GSCM significantly improves enterprise productivity, thereby enhancing supply chain resilience.

Figure 1 summarizes the impact relationship among the above variables and concludes the hypotheses.

Figure 1.

Summary.

3. Methods

3.1. Model and Variables

3.1.1. Benchmark Regression Model and Variables

SCR was the dependent variable, representing supply chain resilience. Following Gölgeci and Kuivalainen (2020) [39], we measured supply chain resilience using five dimensions: resistance capability, recovery capability, operational capability, supply–demand matching capability, and renewal capability. The entropy method was used to calculate this indicator.

For the resistance capability, we measured it using the ratio of accounts receivable to main business income and took the natural logarithm. A smaller value indicates a higher proportion of cash sales, meaning less capital occupation by suppliers and thus a more stable supply chain.

For the recovery capability, we used the deviation between actual performance and expected performance to measure the recovery ability. Specifically, we used residuals to capture changes and responses in enterprise performance when affected by external disturbances over time. Larger residuals indicated stronger recovery ability, while smaller residuals suggested weaker recovery ability. The residual is defined as the difference between the actual observed value and the estimated value:

where Profit represents enterprise performance, measured by the ratio of earnings before interest and taxes to the number of employees, and Growth represents the growth rate of operating revenue. Other variable definitions are shown in Table 1.

Table 1.

Variable definitions.

For the operational capability, we used the accounts payable turnover ratio and accounts receivable turnover ratio to measure operational capability.

For the supply–demand matching capability, we measured it using the absolute value of the change in net inventory from the previous period, taken as the natural logarithm. This reflected the degree of inventory adjustment within the enterprise. A larger value indicated a greater mismatch between upstream and downstream enterprises in the supply chain.

For the renewal capability, we measured it using the number of invention patents granted, plus one, and then took the natural logarithm.

GSCM was the independent variable, estimating the average impact of China’s green supply chain pilot program on corporate supply chain resilience. We treated the implementation of green supply chain pilot projects in China as a quasi-natural experiment and used a multi-period DID model to measure its effects. If an enterprise was selected as a green supply chain pilot enterprise in year t, then GSCM was assigned a value of 1 for year t and subsequent years, and 0 for years prior to t. For enterprises not selected by 2022, GSCM was assigned a value of 0.

X represented a set of control variables that may influence corporate supply chain resilience. To control for other characteristics of enterprises and regions that affect supply chain resilience, we introduced the following control variables, including enterprise size (Size), listing duration (Ltime), profitability (ROA), financial leverage (LEV), number of board members (Board), board independence (Ind_r), ownership concentration (Top1), ownership type (SOE), regional economic level (GRP), and regional industrial structure (Industry). The specific definitions are shown in Table 1.

Since China released the first batch of green manufacturing lists in 2017 and had published a total of nine batches by January 2024, our study focused on the period from 2014 to 2023. During this period, we selected the green supply chain pilot enterprises as our experimental group and constructed a multi-period DID model to assess the impact of GSCM on supply chain resilience. The DID model is widely used to evaluate the effects of pilot policies and can effectively mitigate endogeneity issues in empirical research [40]. The benchmark regression model is as follows:

where i represents the enterprise, t represents the year, α is the intercept, β represents the estimated coefficient of GSCM, the key coefficient that we are concerned about, γ represents the coefficients of a series of control variables, δ is the individual fixed effect, μ is the year fixed effect, and ϵ is the random disturbance term.

3.1.2. Mechanism Test Model and Variables

The mechanism variables we studied included financing costs, market value, market transaction costs, and enterprise productivity. For the financing costs, we measured financing costs using the ratio of financial expenses to total liabilities and denoted it by Cod. The lower this value was, the less financial expense the enterprise needed to pay for one unit of financing, that is, the lower the debt cost.

For the market value, we measured it using Tobin’s Q ratio and denoted it by TobinQ. The larger this value was, the higher the market value of the enterprise was, and the more favored it was by investors.

For the market transaction costs, we measured them using the sales expense ratio, which is the ratio of sales expenses to operating income, and denoted this by Sale_fee. The lower this value, the lower the sales expense that the enterprise needed to pay to obtain one unit of operating income, that is, the lower the market transaction cost.

For the enterprise productivity, we measured it using total factor productivity, denoted by TFP. A larger value indicated that the enterprise had a greater ability to increase revenue through technological innovation and optimization of factor allocation, thus reflecting higher productivity.

To explore the mechanisms through which GSCM affects supply chain resilience, we specified the following mechanism testing model:

where Mechanism represents a series of mechanism variables, including financing costs, market value, market transaction costs, and productivity

3.2. Data Sources

We selected manufacturing enterprises listed on the A-share market in China from 2014 to 2022 as the subjects of this study. The reason for focusing on manufacturing enterprises was that they are more significantly impacted by supply chains, their development is relatively more mature, and all the companies in the green supply chain pilot list are manufacturing enterprises. By limiting the sample to manufacturing enterprises, we reduced the issues arising from large differences between the experimental and control groups.

Furthermore, we excluded samples such as ST, ST*, and those with a debt-to-equity ratio greater than 1. The reason for this exclusion was that enterprises with highly unstable financial conditions or insolvent enterprises would severely impact the average estimation results. After removing the samples with missing data, we obtained a total of 2559 sample companies and 17,110 observations.

Based on the Green Manufacturing System Construction Demonstration List released by China’s Ministry of Industry and Information Technology from 2017 to 2022, we manually collected the listed companies from the green supply chain pilot list. We identified a total of 105 listed green supply chain pilot enterprises, accounting for approximately 4.1% of the total sample.

We obtained the raw data for measuring SCR and TFP from the CSMAR database (https://data.csmar.com/, accessed on 20 February 2025). We used the entropy method to calculate SCR and the fixed effects method to measure TFP. Other enterprise-level financial data were also sourced from the CSMAR database. Regional-level data were obtained from the China Statistical Yearbook (https://data.cnki.net/yearBook?type=type&code=A, accessed on 20 February 2025). We processed the data using STATA 17.

4. Empirical Analysis

4.1. Descriptive Statistics

The descriptive statistics of the main variables are shown in Table 2. The mean of the SCR for the sample companies was 16.959, with a standard deviation of 4.218, a minimum value of 7.673, and a maximum value of 36.657. This indicates that there were significant differences in supply chain resilience across the sample, making it a valuable subject for research. Meanwhile, the mean of GSCM was 0.018, which indicates that the observed value for pilot enterprises in green supply chain construction accounted for 1.8% of the sample. Other variables are not discussed further here.

Table 2.

Descriptive statistics.

4.2. Benchmark Regression Analysis

4.2.1. Parallel Trend Test

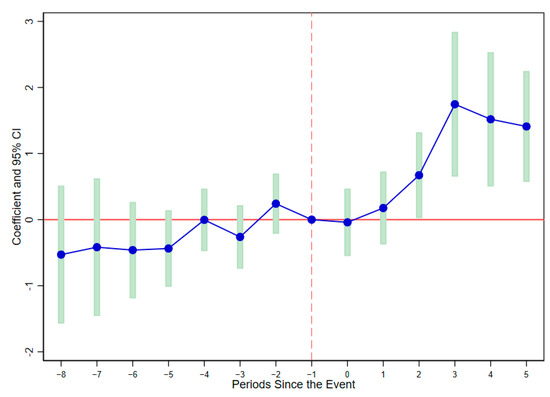

To verify whether the study met the parallel trend assumption, we conducted a dynamic effect test [41]. The model was constructed as follows:

where Treat is a dummy variable that groups enterprises. If an enterprise was selected as a green supply chain pilot enterprise, it was assigned a value of 1, otherwise, it was assigned a value of 0. T is a set of dummy variables based on the difference between the observation year of the pilot enterprise and the year of its pilot construction. In this study, the value range of T was [−8, 5]. Other components of the model remained consistent with model (2).

In Figure 2, we use dots to represent the estimated coefficients of each annual dummy variable, with the dashed lines indicating the 95% confidence intervals. In the pre-policy period, the estimated coefficients of supply chain resilience between the experimental group and the control group were not significant and fluctuated mostly around zero, with confidence intervals including zero. This suggests that there was no significant difference in supply chain resilience between the experimental and control groups, which supports the parallel trend assumption. After the policy implementation, the estimated coefficients became significant and gradually increased, indicating a significant difference between the treatment and control groups post-policy. Additionally, we observed that the effect of GSCM on supply chain resilience was delayed by one year, which may be attributed to the longer cycle of green supply chain construction.

Figure 2.

Dynamic effect test. Note: The blue dots represent the estimated coefficients. The green barm represents the 95% confidence interval. The red solid horizontal line represents the value of 0. The red vertical dotted line indicates the base period.

4.2.2. Regression Results

Table 3 reports the results of the benchmark regression. We found that, after controlling for year fixed effects and individual fixed effects, the coefficient of GSCM was statistically significant at the 5% level and positive, regardless of whether control variables were included. After implementing GSCM, the average supply chain resilience of the enterprise improved by 2.7% (0.467*0.132/16.959), which demonstrates economic significance. This suggests that GSCM can enhance supply chain resilience.

Table 3.

Benchmark regression results.

4.3. Robustness Tests

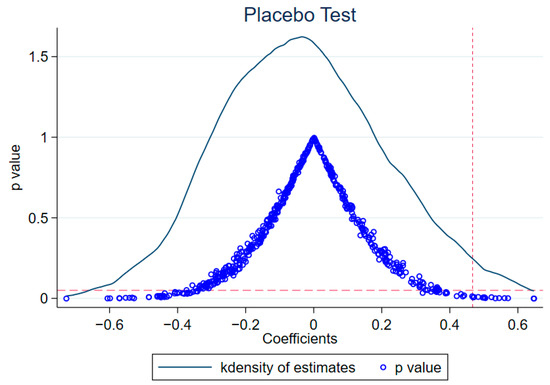

4.3.1. Placebo Test

To avoid the impact of unobservable omitted variables on the effect of GSCM on supply chain resilience, we performed a placebo test [42]. For each batch of green supply chain pilot projects, we randomly selected a placebo treatment group from the total sample, consisting of the same number of companies as those in the corresponding pilot batch. The remaining companies served as the control group. This process was repeated 500 times.

The results are shown in Figure 3. The estimated coefficients of the placebo test were mostly concentrated around zero and were not statistically significant, with the true estimated coefficient being an outlier. This indicates that after conducting the placebo test with the randomly assigned treatment groups, the baseline conclusions could not be reproduced, suggesting that the benchmark regression results are robust.

Figure 3.

Placebo test.

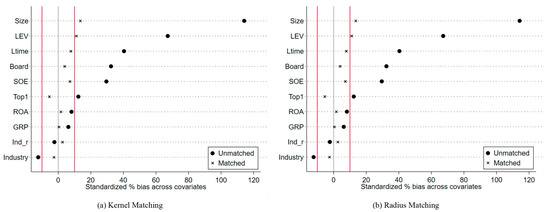

4.3.2. PSM-DID Test

Given the potential biases between the treatment and control groups that could affect the study’s results, we used the propensity score matching (PSM) method to adjust the sample [43]. First, we calculated the propensity score by using all control variables as covariates. Then, we used both kernel matching and radius matching methods to select the samples and re-estimate the effect of GSCM on corporate supply chain resilience.

Figure 4 shows the standard deviations of variables before and after matching. Before matching, most variables had large standard deviations, indicating significant differences between the treatment and control groups. After kernel matching, the standard deviations of most variables fell within a 10% range, except for Size and LEV. After radius matching, the standard deviations of all variables fell within a 10% range. This suggests that PSM provided a good matching effect, and after matching, there were no significant differences in characteristics between the treatment and control groups.

Figure 4.

Balance test.

The results are shown in columns (1) and (2) of Table 4. Under both kernel matching and radius matching, the positive impact of GSCM on supply chain resilience was significant at the 5% level, which is consistent with the estimates from the benchmark regression model. This confirmed the robustness of the research findings.

Table 4.

PSM-DID test results.

4.3.3. Two-Stage DID

Recent studies have shown that when the treatment period for individuals in the treatment group is staggered, and the average treatment effect varies across groups and time, standard DID estimation cannot accurately identify a typical treatment effect or provide a reasonable measure [44,45]. To address this issue, we referred to Gardner (2021) [46] and conducted a two-stage DID analysis. The results, as shown in column (1) of Table 5, indicate that GSCM was significantly positive, suggesting that the issue did not interfere with the results.

Table 5.

Other robustness test results.

4.3.4. Control the Impact of Other Policies

When exploring the impact of pilot policies, we often needed to account for the interference of similar types of policies. As shown in column (2), we generated policy variables for China’s Supply Chain Innovation and Application Pilot Policy (SCIAPE) implemented in 2018, the Digital Financial Innovation Development Pilot Zone (DFIDPZ) established in 2020, and the Modern Logistics Innovation Development Pilot City (MLIDPC) established in 2015 using the DID model, and included them as control variables to account for their effects. The results in column (2) of Table 5 show that GSCM remained significantly positive, indicating that it was not influenced by these policies.

4.4. Mechanism Test

4.4.1. Signaling Effect

Table 6 reports the results of the signaling effect mechanism test. GSCM significantly reduced debt financing costs and increased market value. A smaller Cod value indicated that the enterprise paid less in interest and fees for each unit of debt, meaning that financing costs were lower. A larger TobinQ value indicated that the enterprise was more attractive to investors, and its market value was higher.

Table 6.

Signaling effect mechanism test.

This demonstrated that GSCM could significantly reduce corporate financing costs and enhance market value through the signaling effect mechanism, which, in turn, had a positive impact on supply chain resilience. Therefore, Hypotheses 2 and 3 are validated.

4.4.2. Efficiency Improvement

Table 7 reports the results of the cost effect mechanism test. GSCM significantly reduced market transaction costs and increased productivity. A smaller Sale_fee value indicated that the enterprise paid less in sales expenses to generate each unit of revenue, meaning that market transaction costs were lower. A larger TFP value indicated that the enterprise had a higher ability to increase revenue through technological innovation and optimal allocation of factors, thus reflecting higher productivity.

Table 7.

Cost effect mechanism test.

This demonstrated that GSCM could significantly reduce transaction costs and enhance productivity through the cost effect mechanism, which, in turn, had a positive impact on supply chain resilience. Therefore, Hypotheses 4 and 5 are validated.

5. Extension Analysis

5.1. Heterogeneity Analysis

5.1.1. Third-Party Environmental Certification

We argue that GSCM is more likely to enhance the supply chain resilience of enterprises that are ISO 14001 certified. This is because third-party certification also has a signaling effect, which can amplify the impact of GSCM on market sentiment and attract more high-quality resources. Financial institutions, such as banks and investment enterprises, are more inclined to offer green credit, low-interest loans, and other favorable policies to ISO 14001-certified companies, thereby alleviating the financial pressures of implementing GSCM. Additionally, ISO 14001 certification helps companies establish closer green cooperation relationships with upstream and downstream suppliers and customers.

According to stakeholder theory [47], strict environmental management requirements from an enterprise encourage suppliers to proactively improve their environmental protection standards, creating a green supply chain synergy effect. For customers, the certification label enhances trust in the green attributes of an enterprise’s products, improving brand loyalty. This deep collaboration with stakeholders reduces friction and uncertainty across the supply chain, enhancing overall stability when facing market fluctuations.

We obtained information on whether companies were ISO 14001 certified from the CSMAR database and performed a group regression. As shown in column (1) of Table 8, the estimated coefficient was not significant for the sample without third-party certification. However, as shown in column (2), for the sample with third-party environmental certification (ISO 14001 certification), the estimated coefficient was significantly positive. This indicates that third-party environmental certification creates a positive synergy effect with GSCM.

Table 8.

Third-party environmental certification.

5.1.2. Institutional Investor Ownership

We argue that GSCM is more likely to enhance the supply chain resilience of companies with a higher proportion of institutional investor ownership. This is because companies with a higher institutional investor ownership typically face greater oversight pressure and market attention. These investors are more focused on the long-term sustainable development of the companies they invest in, and GSCM aligns with their investment philosophy.

Additionally, the active investor theory suggests that institutional investors encourage management to focus more on the enterprise’s long-term value and R&D investment [48,49,50]. GSCM helps companies reduce environmental risks and improve resource utilization efficiency, which aligns with institutional investors’ pursuit of long-term value in enterprises. Therefore, institutional investors are more inclined to drive companies to invest in GSCM, which enhances supply chain resilience.

We obtained data on institutional investor ownership from the CSMAR database. Based on the median ownership proportion for each year, we divided the sample into high and low institutional investor ownership groups and performed group regression. As shown in column (1) of Table 9, the estimated coefficient was not significant for samples with low institutional investor ownership. However, as shown in column (2), the sample with higher institutional investor ownership was significantly positive. This suggests that institutional investors had a positive oversight effect on companies’ long-term and green development, and their involvement can drive GSCM to produce positive effects.

Table 9.

Institutional investor ownership.

5.2. Additional Test: Environmental Performance

We further explored whether GSCM had a direct impact on corporate environmental performance. We used environmental scores from Bloomberg’s ESG rating system and from the SynTao Green Finance’s ESG rating system as the measures of corporate environmental performance.

As shown in Table 10, column (1) presents the environmental score from Bloomberg’s ESG rating, and column (2) presents the environmental score from SynTao Green Finance’s ESG rating system. We found that the coefficient for GSCM was significantly positive in both cases, indicating that China’s green supply chain initiative is effective and has a direct positive impact on corporate environmental performance.

Table 10.

Additional test.

6. Conclusions, Recommendations, and Limitations

6.1. Conclusions

In the context of escalating global supply chain risks and the continued advancement of carbon emission targets, the supply chain has become a core strategic tool for enterprises to withstand risks and achieve sustainable development. The transformation toward greener supply chains has become an industry consensus. At the same time, supply chain resilience is crucial for ensuring the continuity of business operations, which in turn enhances competitiveness and long-term sustainability.

This study used China’s green supply chain pilot program as a quasi-natural experiment, based on panel data from A-share listed manufacturing companies between 2014 and 2022. By applying a multi-period DID model, we systematically explored the impact of GSCM on supply chain resilience and its underlying mechanisms and boundary conditions.

Our findings were as follows: First, GSCM significantly enhanced the resilience of corporate supply chains. This conclusion held even after placebo tests, PSM-DID tests, two-stage DID tests, and controlling for other policy effects. Second, the positive impact of GSCM operated through signaling and cost effects, i.e., it reduced corporate financing costs and increased market value, lowered market transaction costs, and enhanced productivity. Third, there was heterogeneity in the positive impact of GSCM, with stronger effects in companies that had third-party environmental certification (ISO 14001) and a higher proportion of institutional investor ownership. Finally, in the extension study, we found that GSCM had a direct positive impact on corporate environmental performance.

6.2. Policy and Managerial Recommendations

6.2.1. Policy Recommendations

We recommend that the government improve the policy incentive system by establishing special financial funds to provide additional subsidies for enterprises that actively implement GSCM and obtain third-party environmental certifications. These subsidies could be used to deepen green technology R&D and equipment upgrades, reducing the cost of corporate green transformation. In terms of tax policy, enterprises implementing GSCM should receive greater income tax reductions and accelerated depreciation incentives for equipment.

Additionally, we encourage financial institutions to develop specialized loan products for green supply chain projects. For enterprises with a higher proportion of institutional investors or those closely followed by institutional investors, the government could relax loan conditions and lower interest rates, such as through the establishment of green supply chain financial loans.

Furthermore, the government should promote the establishment of a robust certification and regulatory mechanism, creating a unified, scientific, and stringent green supply chain certification standard system that covers green indicators across the entire supply chain. This requires enhanced supervision of third-party environmental certification bodies to ensure the authenticity and reliability of certification results. For certified enterprises, the government could collaborate with institutional investors to offer policy rewards and market promotion support.

The government should also establish a dynamic monitoring and evaluation system to regularly assess corporate environmental performance and social responsibility, integrating ESG indicators into the evaluation system, and mandating corrective actions for underperforming enterprises to ensure the quality and effectiveness of green supply chain construction.

We also suggest that the government actively promote industry collaboration policies, set up green supply chain industry collaboration platforms, and organize industry exchanges and industry–academia–research conferences to attract institutional investors. We encourage leading enterprises to play a guiding role in promoting the participation of upstream and downstream SMEs in green supply chain construction. Governments could provide more policy support and financial assistance, such as setting up special industry funds, to industry clusters that have obtained third-party environmental certifications.

Lastly, we recommend that the government strengthen environmental protection publicity and education through official media, public advertisements, etc., widely promoting the concept of green supply chains and environmental knowledge, emphasizing the role of third-party certification and institutional investors in green supply chain development. Targeted training courses for corporate managers and employees should also be conducted to improve corporate green management capabilities.

6.2.2. Managerial Recommendations

We recommend that enterprises include GSCM in their long-term strategic planning, clearly defining construction goals and pathways. Enterprises should establish a leadership team for GSCM, headed by top management, to coordinate and manage departmental efforts. Enterprises should set measurable green performance indicators, such as green procurement ratios and energy consumption reduction rates, and incorporate third-party certification achievement and institutional investors’ focus on ESG indicators into the performance evaluation system, breaking them down into annual and departmental goals to drive performance through evaluations.

Additionally, enterprises should strengthen internal management and process optimization, establishing a robust internal green management system and ensuring full-process green control. In procurement, enterprises should prioritize suppliers with third-party environmental certifications and establish a green supplier evaluation and management mechanism, conducting regular audits. In production, enterprises should increase investment in green technology R&D, adopt energy-efficient and environmentally friendly production processes, optimize production workflows, improve resource utilization, and reduce energy consumption and pollutant emissions. In sales, enterprises should actively promote green products, convey the enterprise’s green supply chain concept to customers, and emphasize third-party certification achievements and institutional investor support to enhance customer trust. In logistics, enterprises should optimize delivery routes, use eco-friendly packaging materials, and promote green transportation methods to reduce carbon emissions.

We also recommend that enterprises enhance their risk management capabilities by establishing a green supply chain risk warning and response mechanism to identify and assess various risks. For policy risks, enterprises should closely monitor government policy trends, particularly related to green policies. For technological risks, enterprises should keep abreast of industry technological developments, increase R&D investment, and anticipate new technologies. Furthermore, enterprises should also strengthen real-time monitoring of the supply chain, promptly identifying risks and taking measures to ensure stable green supply chain operations.

6.3. Limitations

This study still presents academic areas for further exploration in both theoretical extension and empirical analysis. First, the research design was based on a quasi-natural experiment in the Chinese context. Although it provided policy references for emerging market countries, it did not include a comparative analysis with the mature green supply chain systems of developed countries, which limits the generalizability of the findings due to institutional environment heterogeneity. Second, the data observation period ended in 2022, and there was a lack of timely analysis of the dynamic adaptation mechanisms of GSCM in the context of post-pandemic global supply chain restructuring and the deepening of carbon emission goals, failing to capture the potential impacts of policy and technological changes on the research.

Author Contributions

Conceptualization, J.L. and C.Z.; Methodology, J.L. and C.Z.; Software, C.Z.; Formal analysis, C.Z.; Data curation, J.L.; Writing—original draft, J.L. and C.Z.; Writing—review & editing, J.L. and C.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Dataset available on request from the authors.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Tukamuhabwa, B.R.; Stevenson, M.; Busby, J.; Zorzini, M. Supply chain resilience: Definition, review and theoretical foundations for further study. Int. J. Prod. Res. 2015, 53, 5592–5623. [Google Scholar] [CrossRef]

- Hussain, G.; Nazir, M.S.; Rashid, M.A.; Sattar, M.A. From supply chain resilience to supply chain disruption orientation: The moderating role of supply chain complexity. J. Enterp. Inf. Manag. 2022, 36, 70–90. [Google Scholar] [CrossRef]

- Sarkis, J. A strategic decision framework for green supply chain management. J. Clean. Prod. 2003, 11, 397–409. [Google Scholar] [CrossRef]

- Sarkis, J.; Zhu, Q.; Lai, K.H. An organizational theoretic review of green supply chain management literature. Int. J. Prod. Econ. 2011, 130, 1–15. [Google Scholar] [CrossRef]

- Rabbi, M.; Ali, S.M.; Kabir, G.; Mahtab, Z.; Paul, S.K. Green supply chain performance prediction using a Bayesian belief network. Sustainability 2020, 12, 1101. [Google Scholar] [CrossRef]

- Herrmann, F.F.; Barbosa-Povoa, A.P.; Butturi, M.A.; Marinelli, S.; Sellitto, M.A. Green supply chain management: Conceptual framework and models for analysis. Sustainability 2021, 13, 8127. [Google Scholar] [CrossRef]

- Zhang, J.; Ma, W. Research on Construction and Optimization Paths for Quality Concept Model of Green Supply Chain of Livestock Products. Sustainability 2024, 16, 9659. [Google Scholar] [CrossRef]

- Tippayawong, K.Y.; Niyomyat, N.; Sopadang, A.; Ramingwong, S. Factors affecting green supply chain operational performance of the Thai auto parts industry. Sustainability 2016, 8, 1161. [Google Scholar] [CrossRef]

- Majumdar, A.; Sinha, S.K. Analyzing the barriers of green textile supply chain management in Southeast Asia using interpretive structural modeling. Sustain. Prod. Consum. 2019, 17, 176–187. [Google Scholar] [CrossRef]

- Yang, H.; Miao, L.; Zhao, C. The credit strategy of a green supply chain based on capital constraints. J. Clean. Prod. 2019, 224, 930–939. [Google Scholar] [CrossRef]

- Peng, H.; Shen, N.; Liao, H.; Wang, Q. Multiple network embedding, green knowledge integration and green supply chain performance—Investigation based on agglomeration scenario. J. Clean. Prod. 2020, 259, 120821. [Google Scholar] [CrossRef]

- Jo, D.; Kwon, C. Structure of green supply chain management for sustainability of small and medium enterprises. Sustainability 2021, 14, 50. [Google Scholar] [CrossRef]

- Qiao, J.; Li, S.; Xiong, S.; Li, N. How does the digital capability advantage affect green supply chain innovation? An inter-organizational learning perspective. Sustainability 2023, 15, 11583. [Google Scholar] [CrossRef]

- Li, T.; Donta, P.K. Predicting green supply chain impact with snn-stacking model in digital transformation context. J. Organ. End User Comput. (JOEUC) 2023, 35, 1–19. [Google Scholar] [CrossRef]

- Novitasari, M.; Agustia, D. Green supply chain management and firm performance: The mediating effect of green innovation. J. Ind. Eng. Manag. 2021, 14, 391–403. [Google Scholar] [CrossRef]

- Zhang, L.; Dou, Y.; Wang, H. Green supply chain management, risk-taking, and corporate value—Dual regulation effect based on technological innovation capability and supply chain concentration. Front. Environ. Sci. 2023, 11, 1096349. [Google Scholar] [CrossRef]

- Yi, Y.; Demirel, P. The impact of sustainability-oriented dynamic capabilities on firm growth: Investigating the green supply chain management and green political capabilities. Bus. Strategy Environ. 2023, 32, 5873–5888. [Google Scholar] [CrossRef]

- Ning, J.; Liu, B.; Xu, Y.; Yu, L. Does green supply chain management improve corporate sustainability performance? Evidence from China. Environ. Impact Assess. Rev. 2025, 112, 107828. [Google Scholar] [CrossRef]

- Gu, H.; Yang, S.; Xu, Z.; Cheng, C. Supply chain finance, green innovation, and productivity: Evidence from China. Pac.-Basin Financ. J. 2023, 78, 101981. [Google Scholar] [CrossRef]

- Li, B.; Du, Z.; Wang, M. Financing preference and the role of credit insurance in a green supply chain. Manag. Decis. Econ. 2022, 43, 3882–3897. [Google Scholar] [CrossRef]

- Hu, Y.; Feng, B.; Fang, S. Research on the Development of Green Supply Chain Finance Empowered by Blockchain: A Three-party Evolutionary Game Analysis Based on the Cost Perspective. Pol. J. Environ. Stud. 2025, 34, 115–126. [Google Scholar] [CrossRef] [PubMed]

- Yang, M.; Wang, J. Pricing and green innovation decision of green supply chain enterprises. Int. J. Technol. Manag. 2021, 85, 127–141. [Google Scholar] [CrossRef]

- Ji, L.; Yuan, C.; Feng, T.; Wang, C. Achieving the environmental profits of green supplier integration: The roles of supply chain resilience and knowledge combination. Sustain. Dev. 2020, 28, 978–989. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Jabbour, C.J.C.; Fiorini, P.D.C.; Ndubisi, N.O.; Queiroz, M.M.; Piato, É.L. Digitally-enabled sustainable supply chains in the 21st century: A review and a research agenda. Sci. Total Environ. 2020, 725, 138177. [Google Scholar] [CrossRef]

- Van Wassenhove, L.N.; Guide, V.D.R. The Evolution of Closed-Loop Supply Chain Research; INSEAD: Fontainebleau, France, 2008. [Google Scholar]

- Zhu, Q.; Sarkis, J. Relationships between operational practices and performance among early adopters of green supply chain management practices in Chinese manufacturing enterprises. J. Oper. Manag. 2004, 22, 265–289. [Google Scholar] [CrossRef]

- Dekker, R.; Bloemhof, J.; Mallidis, I. Operations Research for green logistics–An overview of aspects, issues, contributions and challenges. Eur. J. Oper. Res. 2012, 219, 671–679. [Google Scholar] [CrossRef]

- Golicic, S.L.; Smith, C.D. A meta-analysis of environmentally sustainable supply chain management practices and firm performance. J. Supply Chain Manag. 2013, 49, 78–95. [Google Scholar] [CrossRef]

- Dangelico, R.M.; Pujari, D. Mainstreaming green product innovation: Why and how companies integrate environmental sustainability. J. Bus. Ethics 2010, 95, 471–486. [Google Scholar] [CrossRef]

- Seuring, S.; Müller, M. From a literature review to a conceptual framework for sustainable supply chain management. J. Clean. Prod. 2008, 16, 1699–1710. [Google Scholar] [CrossRef]

- Sarkis, J. A boundaries and flows perspective of green supply chain management. Supply Chain Manag. Int. J. 2012, 17, 202–216. [Google Scholar] [CrossRef]

- Klassen, R.D.; Vereecke, A. Social issues in supply chains: Capabilities link responsibility, risk (opportunity), and performance. Int. J. Prod. Econ. 2012, 140, 103–115. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A.; Sokolov, B.; Ivanova, M. Literature review on disruption recovery in the supply chain. Int. J. Prod. Res. 2017, 55, 6158–6174. [Google Scholar] [CrossRef]

- Luchs, M.G.; Naylor, R.W.; Irwin, J.R.; Raghunathan, R. The sustainability liability: Potential negative effects of ethicality on product preference. J. Mark. 2010, 74, 18–31. [Google Scholar] [CrossRef]

- Aragón-Correa, J.A. Strategic proactivity and firm approach to the natural environment. Acad. Manag. J. 1998, 41, 556–567. [Google Scholar] [CrossRef]

- Rao, P.; Holt, D. Do green supply chains lead to competitiveness and economic performance? Int. J. Oper. Prod. Manag. 2005, 25, 898–916. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- Gölgeci, I.; Kuivalainen, O. Does social capital matter for supply chain resilience? The role of absorptive capacity and marketing-supply chain management alignment. Ind. Mark. Manag. 2020, 84, 63–74. [Google Scholar] [CrossRef]

- Li, Y.; Zhu, C. Regional digitalization and corporate ESG performance. J. Clean. Prod. 2024, 473, 143503. [Google Scholar] [CrossRef]

- Zhu, C.; Cheng, Z.; Li, J. Is it Possible for Government Intervention to Support Low-Carbon Transition in Agriculture through Agri-Environmental Protection? Evidence from the Waste Agricultural Film Recycling Pilot. Pol. J. Environ. Stud. 2025, 34, 1973–1993. [Google Scholar] [CrossRef]

- Cheng, Z.; Zhu, C. Positive impacts of green finance on environmental protection investment: Evidence from green finance reform and innovations pilot zone. Heliyon 2024, 10, e33714. [Google Scholar] [CrossRef]

- Li, Y.; Zhu, C. Unlocking the Value of Data: The Impact of Market Allocation of Data Elements on Corporate Green Innovation. Pol. J. Environ. Stud. 2024. [Google Scholar] [CrossRef] [PubMed]

- Baker, A.C.; Larcker, D.F.; Wang, C.C. How much should we trust staggered difference-in-differences estimates? J. Financ. Econ. 2022, 144, 370–395. [Google Scholar] [CrossRef]

- De Chaisemartin, C.; d’Haultfoeuille, X. Two-way fixed effects estimators with heterogeneous treatment effects. Am. Econ. Rev. 2020, 110, 2964–2996. [Google Scholar] [CrossRef]

- Gardner, J. Two-stage differences in differences. arXiv 2022, arXiv:2207.05943. [Google Scholar]

- Hatanaka, M.; Bain, C.; Busch, L. Third-party certification in the global agrifood system. Food Policy 2005, 30, 354–369. [Google Scholar] [CrossRef]

- Kochhar, R.; David, P. Institutional investors and firm innovation: A test of competing hypotheses. Strateg. Manag. J. 1996, 17, 73–84. [Google Scholar] [CrossRef]

- Bushee, B.J. The influence of institutional investors on myopic R&D investment behavior. Account. Rev. 1998, 73, 305–333. [Google Scholar]

- Wahal, S.; McConnell, J.J. Do institutional investors exacerbate managerial myopia? J. Corp. Financ. 2000, 6, 307–329. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).