1. Introduction

Extreme natural disasters have become increasingly frequent due to climate change, drawing heightened attention from governments and scholars worldwide to ecological and environmental challenges [

1]. These conditions continue to threaten the Earth’s ecosystems and human survival, significantly impacting the global economy and the sustainable development of society [

2]. Controlling air pollution emissions has become an urgent priority for humanity to proactively mitigate the impacts of climate change [

3]. However, any initiative to reduce air pollution requires massive capital investment. The role of financial instruments, particularly green finance, in air management is receiving increasing attention [

4].

To channel financial resources toward environmental protection, China has actively begun the exploration of green finance [

5]. At the United Nations Conference on Sustainable Development in 2012, China first put forward the idea of building a green financial system. It elucidated the state’s policy of providing support for the advancement of green finance [

6]. In 2017, the State Council decided to make Zhejiang, Guangdong, Jiangxi, Guizhou, and Xinjiang the first pilot regions for green finance policy [

7]. The principal aim of establishing a pilot green finance zone is to utilize financial instruments to advance the governance of the environment within the designated jurisdiction [

8]. Will the establishment of green finance policy effectively reduce air pollution in designated regions? Through what mechanisms does it influence air pollution? These questions are central to evaluating the policy’s effectiveness and guiding the implementation of pilot programs. For China, clarifying the relationship between green finance policy and air pollution is essential to improving urban air quality and advancing sustainable development.

The extant literature on green finance can be divided into two principal areas of investigation. The first of these concerns green finance’s effects on the macroeconomy. The current literature indicates that the advancement of green finance can facilitate the greening of the economy [

9], superior economic development [

10], and green total factor productivity [

11]. Green credit policy can contribute to the green transformation of the economic structure [

12]. The second area concerns the impact of green finance on microenterprises. Existing studies have shown that the development of green finance can promote corporate green technology innovation [

13]. Green bond issuance can promote corporate green innovation [

14]. Green credit policy has the potential to enhance the environmental and social responsibility of corporations [

15], promote corporate environmental investment [

16], and foster corporate green innovation [

17]. Green funds have been shown to enhance firms’ carbon performance, especially in high-emission sectors, with stronger effects when executives possess green awareness and financial expertise [

18]. Since the inception of green finance policy, its impact has been the subject of considerable scrutiny.

In examining the factors that contribute to air pollution, existing studies have primarily focused on direct sources and indirect factors. In terms of direct sources, transport emissions, coal combustion industrial emissions, open burning [

19], and fossil fuel extraction [

20] are all significant factors that directly contribute to air pollution. In terms of indirect factors, firstly, national policies such as the low-carbon city pilot policy [

21], environmental protection tax [

22], and the “ten articles of the atmosphere” [

23] are able to mitigate air pollution. Second, the development of the Internet improves air quality through promoting industrial upgrading and fostering technological innovation [

24]. A number of studies have previously examined the factors influencing the improvement in air quality from a variety of perspectives. There is a substantial body of literature examining the potential benefits of green finance policy for improving environmental effects. For instance, some literature indicates that green finance policy has the potential to reduce energy consumption intensity [

25] and carbon emissions [

6]. It also can enhance the efficiency of the green economy [

26]. However, one limitation of the existing literature is that it only analyzes the effect of policy implementation from a single pollutant perspective. There is a lack of examination of the synergistic air pollution management effects of green finance policy. Moreover, it is yet unknown how precisely green finance reform measures air quality impact.

This paper makes the following contributions to the existing literature. First, this study conducts a more granular empirical analysis based on prefecture-level city data, offering sharper resolution than that of prior research that has typically focused on national or provincial levels. To enhance the robustness and precision of environmental measurement, this study constructs a composite air pollution index using the entropy weight method, incorporating both industrial SO2 emissions and PM2.5 concentrations. This integrated index allows for a more accurate assessment of policy impacts at the city level. Second, this paper contributes to the mechanism literature by identifying two key transmission pathways through which green finance affects air pollution: resource allocation and green innovation. This channel-based analysis clarifies the internal logic of environmental governance via financial instruments and enriches the theoretical framework. Third, the paper conducts a series of heterogeneity analyses, revealing how the effects of green finance vary across regions with different geographical characteristics, resource endowment, and financial development levels. These findings highlight the spatially differentiated policy impacts and provide valuable implications for targeted environmental governance.

The remaining portions of the study are structured as follows:

Section 2 introduces the policy background and research hypothesis.

Section 3 presents the research design.

Section 4 provides the empirical results. Finally, policy recommendations are provided.

2. Policy Background and Research Hypothesis

2.1. Policy Background

According to the OECD (2020) [

27], effective green finance governance requires coordinated action among regulatory institutions, financial markets, and environmental agencies to align investment flows with sustainability goals. Collaborative governance frameworks, such as taxonomies, disclosure mandates, and incentive structures, are critical in directing capital toward green sectors in developing economies.

In 2017, the State Council decided to make Zhejiang, Guangdong, Jiangxi, Guizhou, and Xinjiang the first pilot regions for green finance policy. Among them, Zhejiang is a tertiary-sector-led, urban area; Jiangxi, at mid-industrialization, is an industrial–rural province; Guizhou is a rural–ecological region dominated by primary industry; and Xinjiang is an industrial–rural frontier whose economy is resource-based and secondary-sector-oriented. The pilot districts have carried out a great deal of research in terms of organizational systems, product innovation, and supporting policies.

Regarding the organizational system, each pilot zone has established a Green Finance Leadership Group, which is networked at the provincial, regional, and municipal levels.

In terms of the development of financial products, the pilot zone has promoted the diversification of green financial products, which usually merit more attractive conditions, such as more favorable interest rates, lower handling fees, or higher potential for returns. This diversification strategy mainly encompasses the promotion of green credit, green bonds, green insurance, and green funds. In terms of green credit, the green branch has established a “four priorities” service channel for green credit, providing enterprises with priority approval and more favorable loan interest rates, increasing credit support for green enterprises and at the same time, consolidating credit resources for high-pollution and high-energy-consuming enterprises. In terms of green bonds, the Financial Services Department proactively assists eligible green enterprises by issuing more green corporate bonds, helping them obtain more favorable financing conditions and lower issuance costs. In terms of green insurance, by improving the environmental damage compensation mechanism in the pilot zone, a compulsory environmental pollution liability insurance system will be implemented for highly polluting and energy-consuming enterprises, and premium subsidies may be provided to reduce the insurance costs for enterprises. In terms of the establishment of green funds, each pilot region has set up a guiding fund for the development of green industries, with fiscal resources inclined towards green industries such as energy conservation and environmental protection, aiming to provide investors with opportunities to participate in high-growth green industries with potentially high returns.

In terms of supporting policies, the pilot zone has formulated constraints, incentives, and safeguard mechanisms to ensure the smooth implementation of green finance policy. The government of the pilot zone has introduced special assessment measures for the construction of the pilot zone, covering the administrative districts under it and all relevant departments. Rewards and penalties are implemented according to the fulfilment of tasks in each county and district. The People’s Bank of China incorporates the results of green credit performance evaluation of financial institutions into the comprehensive evaluation system of these institutions. Financial institutions will be incentivized to vigorously develop green financial business and curb the inflow of loans from the “two high” industries. On the financial front, the pilot zone has arranged for financial subsidies and risk compensation for green credit and green bonds with corresponding financial funds. In addition, premiums for green insurance are subsidized to fully mobilize financial institutions to develop green finance.

2.2. Research Hypothesis

Green finance policy is a new type of environmental governance instrument that promotes sustainable economic growth by improving the environmental efficiency of financial resource allocation [

28]. Unlike traditional financial systems, green finance focuses on directing capital flows toward green industries such as energy conservation, environmental protection, and clean energy [

29], thereby reducing overall pollutant emissions and supporting low-carbon development. Green finance supports the implementation and expansion of environmentally friendly projects by offering financial tools such as green credit, green bonds, dedicated funds, insurance services, and fiscal subsidies [

30]. These projects include renewable energy facilities and clean technology applications. The use of these financial instruments reduces the cost of capital for enterprises undertaking green transformation. It also helps alleviate financing constraints and promotes the optimization of industrial structures, leading to improvements in both economic and environmental performance. Furthermore, green finance promotes the concept of green investment and green consumption, which enhances public environmental awareness, encourages low-carbon lifestyles, and helps to reduce dependence on energy-intensive and highly polluting sectors [

31]. At the institutional level, green finance also serves as a policy tool for strengthening environmental regulation. Financial institutions are increasingly required to integrate environmental criteria into financing decisions, and firms are expected to disclose environmental information and improve their ecological responsibility [

32]. In green finance pilot zones, regulatory frameworks are more stringent, credit resources are more carefully evaluated, and capital allocation is guided more strictly in favor of green sectors. At the same time, green financial performance indicators are incorporated into the assessment systems of both financial institutions and local governments, which helps ensure effective policy implementation and enhances accountability for environmental outcomes [

33]. These mechanisms collectively contribute to the formation of a comprehensive governance system. Within this system, green finance directly helps reduce air pollution by promoting green investment, limiting financing for heavily polluting industries, and strengthening environmental supervision through coordinated financial and administrative efforts. In light of this, this paper proposes the following hypothesis.

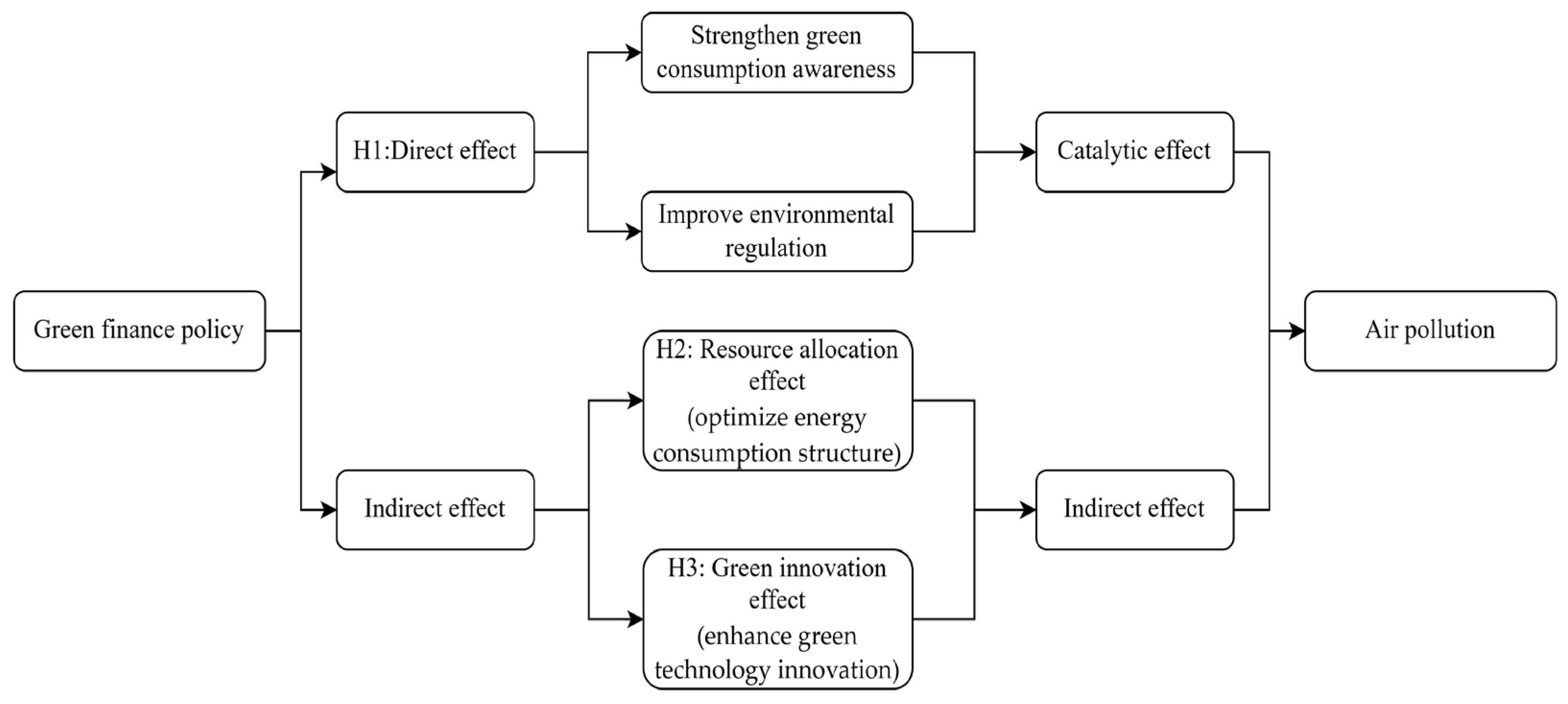

Hypothesis 1. Green finance policy has a catalytic effect on mitigating air pollution in pilot areas.

Green finance can enhance the efficiency of capital utilization by directing financial resources toward high-efficiency and low-pollution sectors, thereby improving green total factor productivity through more targeted investment [

34]. It also reduces the cost of capital for environmentally responsible firms and encourages them to upgrade their production processes and adopt cleaner energy use patterns [

35]. One of the primary mechanisms through which green finance contributes to air pollution reduction is the resource allocation effect. In this study, the resource allocation effect is defined as the capacity of green finance to reallocate capital away from fossil fuel-intensive industries and toward renewable, energy-efficient, and low-carbon sectors. This reallocation process gradually transforms the energy consumption structure by increasing the share of clean energy and reducing dependence on high-carbon energy sources. Such structural adjustment lowers overall energy intensity and helps mitigate pollution in the long run [

36]. Green financial instruments, particularly green credit and green bonds, play a critical role by facilitating access to financing for green industries while restricting capital availability to high-emission sectors [

37]. As green investment expands, the regional energy mix becomes more balanced, sustainable, and environmentally sound [

38]. In contrast to the catalytic effects emphasized in Hypothesis 1, which operate through direct incentives and enhanced regulatory enforcement, the resource allocation effect focuses on long-term structural change in energy use. Therefore, green finance policy mitigates air pollution in pilot areas by optimizing the energy consumption structure through improved capital allocation. In light of this, this paper proposes the following hypothesis.

Hypothesis 2. Green finance policy has a resource allocation effect, mitigating air pollution in pilot areas by optimizing energy consumption structure.

One of the key mechanisms through which green finance policy contributes to air pollution mitigation is the green innovation effect. In this paper, the green innovation effect is defined as the process by which green finance stimulates the research, development, and adoption of environmentally friendly technologies, thereby reducing pollution and improving energy efficiency. The Porter hypothesis suggests that well-designed environmental regulations can stimulate innovation and create win–win situations for the economy and the environment. Green finance policy stimulates green innovation by raising the cost of financing and environmental violations for polluting firms [

39]. When firms face tight financing constraints, their capacity to invest in innovation is often limited. Green finance helps ease these constraints, especially for green technology development, by directing capital toward low-carbon and clean energy solutions [

40]. Moreover, the participation of financial institutions in green finance enhances market information transparency and reduces information asymmetry. This enables investors to make informed decisions based on credible environmental performance metrics [

7]. Technological progress is essential to breaking fossil energy dependence. Green innovation, in particular, plays a vital role in reducing pollution through energy efficiency improvement and the substitution of cleaner alternatives [

41]. In the long term, technological innovation drives companies to use more advanced energy technologies to promote energy conservation and emission reduction [

42]. Therefore, green finance policy can enhance the green innovation capacity of enterprises served in pilot areas. It promotes renewable energy consumption and reduces pollution intensity. In light of this, this paper proposes the following hypothesis.

Hypothesis 3. Green finance policy has a green innovation effect, mitigating air pollution in pilot areas via green technological innovations.

In summary, the mechanism of green finance policy for mitigating air pollution is shown in

Figure 1.

5. Conclusions and Policy Recommendations

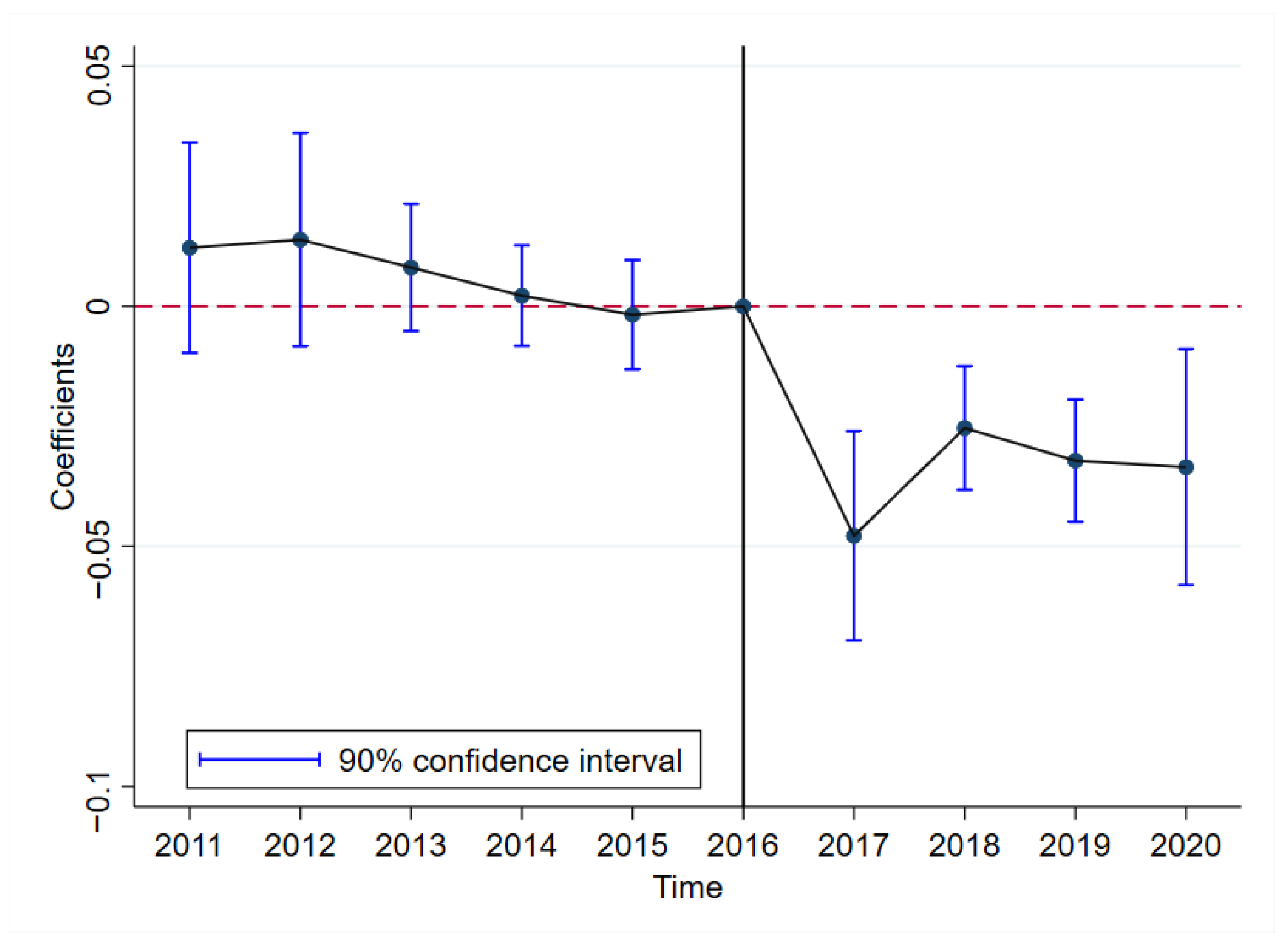

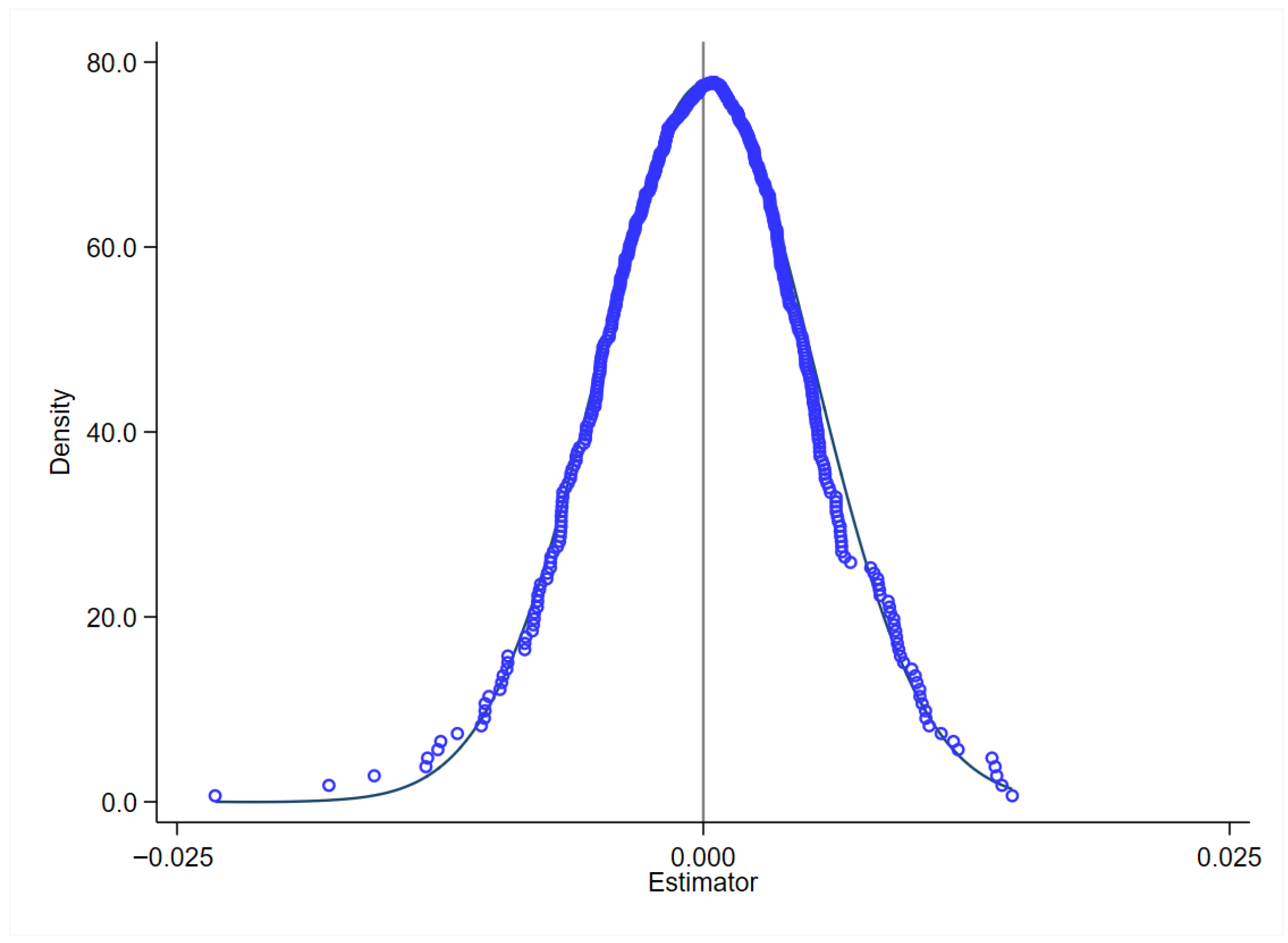

The establishment of green finance reform and innovation pilot zones is a pilot policy proposed in response to China’s guidance to develop green finance for economic transformation and development. This study integrates green finance policy and air pollution into a unified analytical framework and employs a difference-in-differences (DID) model to empirically assess the policy’s impact and mechanisms. Furthermore, it investigates the heterogeneity of policy effects across regions with different geographical characteristics, levels of financial development, and environmental regulatory capacity.

The main findings of this study are as follows: (1) Baseline regression results show that the implementation of green finance policy has significantly reduced air pollution in pilot cities. This conclusion remains robust after parallel trend testing, placebo tests, and multiple robustness checks. (2) Mechanism analysis reveals that green finance policy alleviates air pollution, primarily through improved resource allocation and enhanced green innovation. Specifically, the policy is negatively associated with the proportion of fossil energy consumption and positively correlated with the level of green technological innovation. (3) Heterogeneity analysis confirms that the policy’s effects vary significantly across regions. The air quality improvements are more pronounced in Western regions, resource-based cities, and financially developed cities. These findings suggest that green finance policy can effectively complement local environmental regulatory efforts and enhance environmental governance effectiveness.

The findings of this study yield several important policy implications for promoting sustainable development through green finance. First, policymakers should consider expanding the coverage of green finance reform and innovation pilot zones, particularly in regions with high pollution intensity and strong industrial bases. At the same time, the successful experiences from existing pilot areas should be systematically summarized and promoted nationwide. To enhance the attractiveness of green investment, targeted incentives such as tax exemptions, interest subsidies, and risk compensation mechanisms should be strengthened to include private capital. Moreover, establishing a dynamic evaluation and feedback system for green finance performance will help ensure continuous policy adjustment and effectiveness.

Second, efforts should be made to optimize the resource allocation function of green finance. Financial instruments should be designed to direct funds toward low-carbon industries and environmentally friendly sectors. Governments should enhance both supply-side and demand-side support, e.g., on the one hand, by encouraging financial institutions to develop green credit, bonds, insurance, and funds; on the other hand, by mobilizing private and public sector participation in green investment. In particular, policies should facilitate financing for renewable energy and clean technology deployment. Simultaneously, R&D support for green technologies should be increased. Establishing green innovation funds and offering preferential innovation loans can stimulate enterprise-led technological advancement and reinforce the role of innovation in pollution reduction.

Third, a differentiated policy strategy should be adopted to reflect regional heterogeneity. In Western and resource-based cities, green finance support should be intensified to facilitate industrial restructuring and ecological restoration. In regions with more mature financial systems, policy should focus on enhancing the depth, diversity, and market orientation of green financial products. Cross-departmental and multi-level policy coordination mechanisms should be strengthened to maximize synergy. Finally, local governments should be empowered to play a more active role in implementation through strengthened environmental supervision, adequate fiscal support, and regulatory safeguards. Ensuring local accountability is key to the effective execution of green finance policies and the realization of environmental goals.

In addition to its implications for China, this study offers valuable insights for other developing countries that are actively exploring green finance mechanisms to address environmental challenges. Countries such as India, Brazil, and South Africa have initiated various green finance strategies—ranging from sovereign green bonds and sustainable banking frameworks to tax incentives for clean technology investments. However, common challenges persist, including weak financial infrastructure, insufficient regulatory coordination, and fragmented policy implementation. By unpacking how green finance can alleviate air pollution through resource allocation and green innovation, this study contributes to a broader understanding of how market-based instruments can support sustainable development in emerging economies.

Furthermore, international comparative studies have illustrated that the effectiveness of green finance instruments depends significantly on local institutional and financial contexts. For instance, India’s green bond market has played a vital role in expanding renewable energy capacity under strong central oversight, while Brazil’s national development bank (BNDES) has embedded environmental screening criteria into its credit practices. These cross-country experiences demonstrate the importance of aligning financial reforms with environmental governance structures. Future research can extend this paper’s framework to cross-national empirical studies, which will help evaluate the transferability and contextual adaptability of China’s green finance policies to other parts of the developing world. In conclusion, this study offers valuable insights for both the Chinese government and other developing countries in advancing green finance to achieve sustainable development.

Despite the robustness of the empirical results, this study is subject to several limitations. First, constrained by data availability, the empirical analysis is conducted at the city level, which limits the investigation of firm-level behavioral responses to green finance policy. Second, the air pollution index employed in this study is constructed based on two representative pollutants, which may not fully capture the multidimensional nature of urban air quality. Third, the analysis focuses on the direct treatment effects of the policy, without explicitly considering potential spatial spillover effects across regions. Future research could address these limitations in multiple ways. With the availability of firm-level data, micro-level analyses could be undertaken to better understand how enterprises adjust their investment behavior, innovation activities, and emission control strategies in response to green financial instruments. Additionally, future studies may employ spatial econometric techniques to examine the diffusion mechanisms and spatial externalities of green finance policies. These extensions would help to provide a more comprehensive understanding of the role of green finance in promoting collaborative and regionally coordinated environmental governance.