The Impact of State-Owned Capital Participation on Carbon Emission Reduction in Private Enterprises: Evidence from China

Abstract

1. Introduction

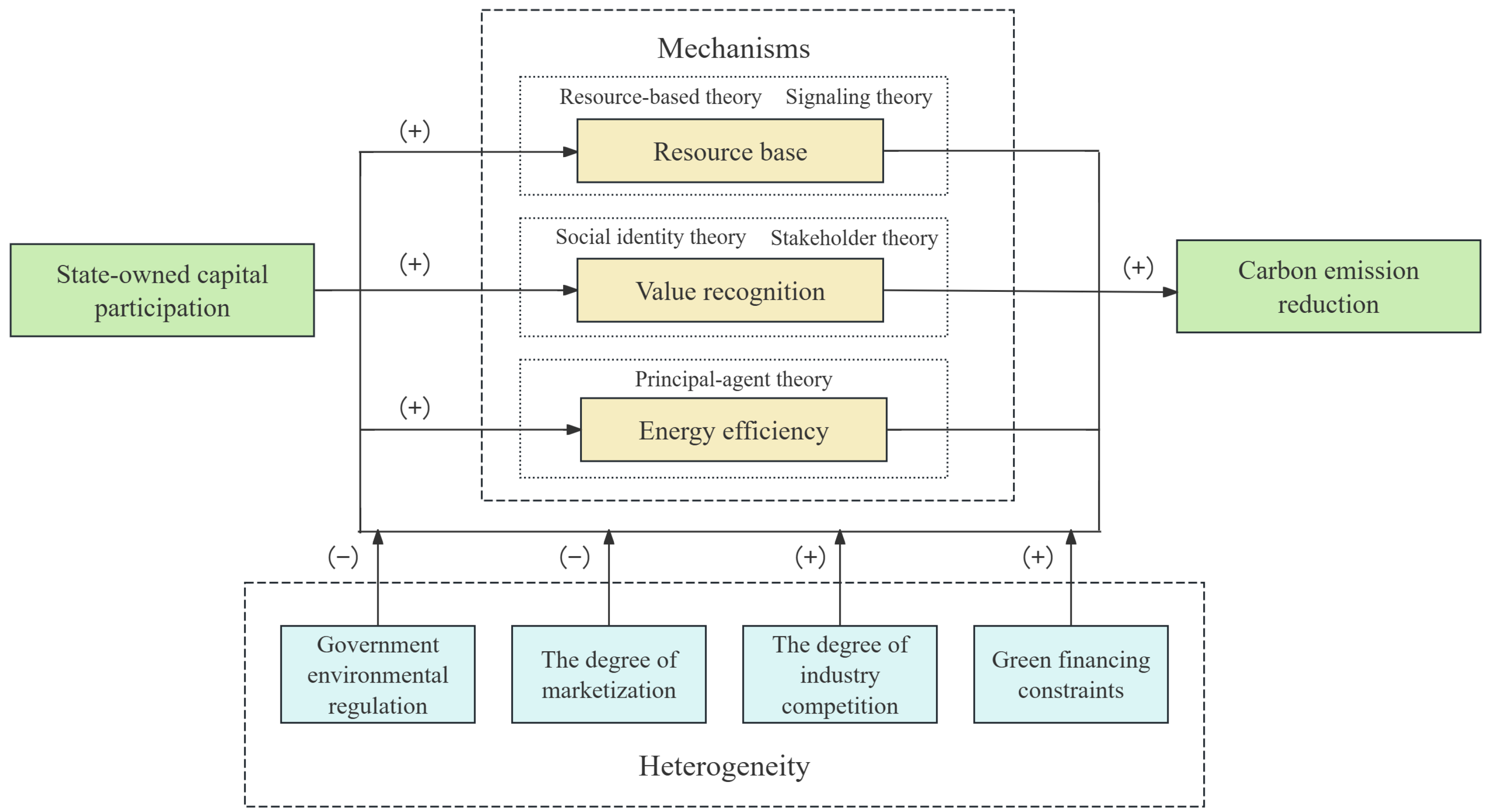

2. Theoretical Analysis and Research Hypotheses

2.1. State-Owned Capital Participation and Carbon Emission Reduction in Private Enterprises

2.2. The Resource-Based Path

2.3. The Value Recognition Path

2.4. The Energy Efficiency Path

3. Research Design

3.1. Sample Selection and Data Sources

3.2. Model Construction

3.3. Definition of Variables

3.3.1. Explained Variable

3.3.2. Explanatory Variable

3.3.3. Control Variables

4. Empirical Results

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Benchmark Regression Results

4.4. Robustness Tests

4.4.1. Treatment Effects Model

4.4.2. Propensity Score Matching

4.4.3. Controlling for Regional Fixed Effects

4.4.4. Alternative Measure of the Explained Variable

4.4.5. Alternative Measures of Explanatory Variables

4.4.6. Altering the Interval Range of Sample Sizes

5. Mechanism Tests

5.1. Resource Base

5.2. Value Recognition

5.3. Energy Efficiency

6. Heterogeneity Analysis

6.1. Government Environmental Regulation

6.2. The Degree of Marketization

6.3. The Degree of Industry Competition

6.4. Green Financing Constraints

7. Conclusions and Discussion

7.1. Managerial Applications

7.2. Conclusions

7.3. Discussion

7.4. Policy Implications

7.5. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Shen, H.T.; Huang, N. Can carbon emissions trading mechanism increase enterprise value. Financ. Trade Econ. 2019, 40, 144–161. [Google Scholar]

- Jiang, W.; Wang, A.X.; Zhou, K.Z.; Zhang, C. Stakeholder Relationship Capability and Firm Innovation: A Contingent Analysis. J. Bus. Ethics 2020, 167, 111–125. [Google Scholar] [CrossRef]

- Zhuang, Z.X.; Ran, Y.; Yin, H.Z. Can “reverse hybridization” promote environmental social responsibility of private enterprises. Macroeconomics 2023, 111–127. [Google Scholar]

- Cadavid-Giraldo, N.; Velez-Gallego, M.C.; Restrepo-Boland, A. Carbon emissions reduction and financial effects of a cap and tax system on an operating supply chain in the cement sector. J. Clean. Prod. 2020, 275, 122583. [Google Scholar] [CrossRef]

- Li, X.S.; Yang, Q.; Zhou, M. Market-based environmental regulation, carbon emission reduction and corporate environmental performance: Evidence from China’s carbon market. China Soft Sci. 2024, 200–210. [Google Scholar]

- Naegele, H.; Zaklan, A. Does the EU ETS cause carbon leakage in European manufacturing? J. Environ. Econ. Manag. 2019, 93, 125–147. [Google Scholar] [CrossRef]

- Xu, Y.Z.; Xu, K.N.; Hu, Y.S. Drivers and decoupling effects of carbon emissions in China’s manufacturing sector. Stat. Res. 2011, 28, 55–61. [Google Scholar]

- Wang, J.; Li, H. The mystery of local fiscal expenditure and carbon emission growth in China. Environ. Sci. Pollut. Res. Int. 2019, 26, 12335–12345. [Google Scholar] [CrossRef]

- Zheng, J.J. Analysis of spatial and temporal changes and influencing factors of carbon emissions in China’s manufacturing industry. J. Nanjing Univ. Financ. Econ. 2019, 48–59. [Google Scholar]

- Li, K.H.; Wu, T.; Zhang, P.; Lian, Y.Q.; Zhou, C.B.; Xiang, Y.Y. Can institutional pressures serve as an efficacious catalyst for mitigating corporate carbon emissions? Environ. Sci. Pollut. Res. 2024, 31, 21380–21398. [Google Scholar] [CrossRef]

- Li, R.R.; Wang, Q.; Li, X.T. Geopolitical risks and carbon emissions: The mediating effect of industrial structure upgrading. Humanit. Soc. Sci. Commun. 2025, 12, 790. [Google Scholar] [CrossRef]

- Li, W.; Tong, D.; Sun, H. Research on the Impact of Fintech on Carbon Emissions: Empirical Evidence from 286 Prefecture-Level Cities in China. Sustainability 2025, 17, 5331. [Google Scholar] [CrossRef]

- Liu, Q.C.; Kong, L.Q.; An, Z.Y. Analysis of energy-related carbon emission factors in China’s manufacturing industry. China Popul. Resour. Environ. 2014, 24, 14–18. [Google Scholar]

- Fu, H.; Li, G.P.; Zhu, T. Carbon emissions from China’s manufacturing industries: Industry differences and driver decomposition. Reform 2021, 38–52. [Google Scholar]

- Liu, M.L.; Li, Z.H.; Anwar, S.; Zhang, Y. Supply chain carbon emission reductions and coordination when consumers have a strong preference for low-carbon products. Environ. Sci. Pollut. Res. 2021, 28, 152–167. [Google Scholar] [CrossRef]

- Wang, B.; Ji, F.; Zheng, J.; Xie, K.; Feng, Z. Carbon emission reduction of coal-fired power supply chain enterprises under the revenue sharing contract: Perspective of coordination game. Energy Econ. 2021, 32, 179–188. [Google Scholar] [CrossRef]

- Tian, Y.S.; Xiong, S.Q.; Ma, X.M.; Ji, J.P. Structural path decomposition of carbon emission: A study of China’s manufacturing industry. J. Clean. Prod. 2018, 193, 563–574. [Google Scholar] [CrossRef]

- Chen, J.; Guo, Z.; Lei, Z. Research on the mechanisms of the digital transformation of manufacturing enterprises for carbon emissions reduction. J. Clean. Prod. 2024, 449, 141817. [Google Scholar] [CrossRef]

- Yang, B.Y.; Jia, J.; Guo, K.J.; Yin, Y.L. Enterprise digital transformation and carbon emission reduction: Direct impact, mechanism and driving effect. Stat. Decis. Mak. 2024, 40, 173–178. [Google Scholar]

- Yang, Q.; Kong, C.; Jin, S. Digital Transformation and Corporate Carbon Emissions: The Moderating Role of Corporate Governance. Systems 2025, 13, 217. [Google Scholar] [CrossRef]

- Gan, T.; Zhou, Z.; Tu, L.Z. Carbon emission trading, technological progress, synergetic control of environmental pollution and carbon emissions in China. J. Clean. Prod. 2024, 442, 141059. [Google Scholar] [CrossRef]

- Li, W.H.; Li, N. Green Innovation, Digital Transformation and Carbon Emission Reduction Performance of Energy-Consuming Enterprises. J. Manag. Eng. 2023, 37, 66–76. [Google Scholar]

- An, M.T.; Li, X.J. Active Government, Financial Guidance and Carbon Emission Reduction-Empirical Evidence from Green Government Guidance Funds. Financ. Sci. 2024, 1–17. [Google Scholar]

- Song, T.B.; Zhong, X.; Chen, W.H. Will better corporate performance lead to more environmental protection investment?—Empirical evidence from listed companies in China’s manufacturing industry. East China Econ. Manag. 2017, 31, 126–133. [Google Scholar]

- Zhou, K.Z.; Gao, G.Y.; Zhao, H. State Ownership and Product Innovation in China: An Integrated View of Institutional and Efficiency Logics. Adm. Sci. Q. 2017, 62, 375–404. [Google Scholar] [CrossRef]

- Hu, C.; Li, Y.; Ye, P. The Halo Effect of Government: Does State-Owned Capital Promote the Green Innovation of Chinese Private Enterprises? Sustainability 2023, 15, 8587. [Google Scholar] [CrossRef]

- Pedersen, L.H.; Fitzgibbons, S.; Pomorski, L. Responsible investing: The ESG-efficient frontier. J. Financ. Econ. 2021, 142, 572–597. [Google Scholar] [CrossRef]

- Xu, K.; Yuan, P.; Yu, R. The effects of mixed ownership reforms on Chinese firms’ emissions. Econ. Anal. Policy 2025, 86, 191–209. [Google Scholar] [CrossRef]

- Pan, X.; Chen, X.; Sinha, P.; Dong, N. Are firms with state ownership greener? An institutional complexity view. Bus. Strategy Environ. 2020, 29, 197–211. [Google Scholar] [CrossRef]

- Tu, Y.; Wu, W. How does green innovation improve enterprises’ competitive advantage? The role of organizational learning. Sustain. Prod. Consum. 2021, 26, 504–516. [Google Scholar] [CrossRef]

- Yan, H.; Chen, Z.; Yang, Y. State-owned capital and quality of green innovation: Evidence from Chinese listed private firms. Heliyon 2024, 10, e28179. [Google Scholar] [CrossRef]

- Wei, Y.P.; Mao, Z.H.; Wang, H.Y. Research on the impact of state-owned capital participation on ESG performance of private enterprises. Chin. J. Manag. 2023, 20, 984–993. [Google Scholar]

- Huang, L.; Liu, S.; Han, Y.; Peng, K. The nature of state-owned enterprises and collection of pollutant discharge fees: A study based on Chinese industrial enterprises. J. Clean. Prod. 2020, 271, 122420. [Google Scholar] [CrossRef]

- Jiang, G.; Yuan, P.; Yang, F. The effect of state capital injection on firms’ pollution emissions: Evidence from China. J. Environ. Manag. 2023, 331, 117269. [Google Scholar] [CrossRef]

- Qian, A.; Li, J. Effect of Appointed Directors on Corporate Carbon Emission Intensity: Evidence from Mixed-Ownership Reform in Chinese Private Industrial Enterprises. Sustainability 2024, 16, 5662. [Google Scholar] [CrossRef]

- Jiang, F.W.; Ding, H.; Zhang, Z.N.; He, D.X. Mixed Ownership Reform and Private Enterprise Precision Poverty Alleviation—Based on the Perspective of Resource Complementarity and Supervisory Checks and Balances. Econ. Manag. 2024, 46, 91–109. [Google Scholar]

- Wang, C.P.; Jiang, Y.J.; Ren, J.Y.; Li, J. State-owned equity participation and high-quality development of private enterprises: A study based on the perspective of green innovation. Secur. Mark. Her. 2023, 3–15+62. [Google Scholar]

- He, D.X.; Zeng, M.; Zhang, S.N. How Does State Capital Participation Affect Private Enterprises?—A study based on the perspective of debt financing. Manag. World 2022, 38, 189–207. [Google Scholar]

- Tian, X.Y.; Du, Y.Y.; Zhu, L.P. Can state-owned capital participation improve the information content of private enterprise share price. Account. Res. 2023, 83–97. [Google Scholar]

- Zeng, M.; Li, C.Q.; Li, Y.K. Why does state-owned capital participation affect private firms’ cash holdings?—A dual perspective based on cooperative advantages and competitive checks and balances. Econ. Manag. 2022, 44, 134–152. [Google Scholar]

- Zhai, S.P.; Fan, R.; Mu, Q. “Reverse hybridization” and tax avoidance of private enterprises. Foreign Econ. Manag. 2023, 45, 34–50. [Google Scholar]

- Hu, T.T.; You, K.; Lok, C.L. State ownership, political connection and ESG performance. Risk Manag.-Int. J. 2025, 27, 1. [Google Scholar] [CrossRef]

- Chen, Z.; Lu, Z.; Liao, K. Rowing or crowding? The nonlinear effects of State-owned capital participation on ESG performance in private enterprises. Econ. Anal. Policy 2025, 87, 790–810. [Google Scholar] [CrossRef]

- Li, X.; Tian, Z.; Liu, Q.; Chang, B. The Impact and Mechanisms of State-Owned Shareholding on Greenwashing Behaviors in Chinese A-Share Private Enterprises. Sustainability 2025, 17, 741. [Google Scholar] [CrossRef]

- Chang, H.; Ding, Q.; Zhao, W.; Hou, N.; Liu, W. The digital economy, industrial structure upgrading, and carbon emission intensity—Empirical evidence from China’s provinces. Energy Strategy Rev. 2023, 50, 101218. [Google Scholar] [CrossRef]

- Lv, L.J.; Zhang, P.L. How can green industry policy facilitate carbon emissions reduction? Evidence from China’s National Eco-Industrial Demonstration Parks. Clean Technol. Environ. Policy 2024, 26, 4273–4288. [Google Scholar] [CrossRef]

- Wu, Y.Y.; Qi, J.; Xian, Q.; Chen, J.D. Study on the carbon emission reduction effect of China’s carbon market—Based on the synergistic perspective of market mechanism and administrative intervention. China Ind. Econ. 2021, 114–132. [Google Scholar] [CrossRef]

- Wang, F.J.; Sun, J.Q. Research on the impact of government pressure on corporate carbon emission reduction performance. Forecasting 2019, 38, 37–44. [Google Scholar]

- Zhao, Y.Z.; Qiao, Y.J.; Zhou, L. How Emission Reduction Measures Enhance the Financial Performance of Energy-Consuming Enterprises—The Mediating Role of Carbon Performance. Syst. Eng. 2021, 39, 14–24. [Google Scholar]

- Gao, J.; Yu, D.; Lu, D. From “mixing” to “reforming”:The technological innovation effect of state-owned stock participation in private enterprise governance. Financ. Sci. 2022, 122–136. [Google Scholar] [CrossRef]

- Yang, X.; Zhang, K.; Gao, P.; Yang, Z. State-owned shareholders’ participation and environmental, social, and governance performance of private firms: Evidence from China. Appl. Econ. 2025, 57, 3503–3524. [Google Scholar] [CrossRef]

- Ibarra-Sánchez, J.d.J.; Segovia-Hernández, J.G. Reducing energy consumption and CO2 emissions in extractive distillation. Chem. Eng. Res. Des. 2010, 88, 135–145. [Google Scholar] [CrossRef]

- Liao, F.M.; Wan, S.Y.; Ye, S.Q. Does mixed ownership reform affect corporate expense stickiness? Econ. Syst. Reform 2020, 93–98. [Google Scholar]

- Luo, X.R.; Wang, D.; Zhang, J. Whose call to answer: Institutional complexity and Firms’ CSR Reporting. Acad. Manag. J. 2017, 60, 321–344. [Google Scholar] [CrossRef]

- Rosa, J.J.; Pérard, E. When to privatize? When to nationalize? A competition for ownership approach. Kyklos 2010, 63, 110–132. [Google Scholar] [CrossRef]

- Sun, B.W.; Zhang, Z. Carbon emission reduction effect of mixed ownership reform of state-owned enterprises and its mechanism analysis—Micro evidence based on the pollution database of Chinese industrial enterprises. Reform 2021, 75–90. [Google Scholar]

- Wang, A.G.; Liu, Y.; Liu, Y.Y. State-owned equity participation and green governance of private heavy polluters. Financ. Res. 2022, 49–63. [Google Scholar] [CrossRef]

- Huang, M.; Li, M.; Liao, Z. Do politically connected CEOs promote Chinese listed industrial firms’ green innovation? The mediating role of external governance environments. J. Clean. Prod. 2021, 278, 123634. [Google Scholar] [CrossRef]

- Bourgeois Iii, L.J. On the measurement of organizational slack. Acad. Manag. Rev. 1981, 6, 29–39. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Wei, Z.H.; Zeng, A.M.; Li, B. Financial ecosystem and corporate financing constraints—An empirical study based on Chinese listed companies. Account. Res. 2014, 73–80+95. [Google Scholar] [CrossRef]

- Zhang, J.; Marquis, C.; Qiao, K. Do Political Connections Buffer Firms from or Bind Firms to the Government? A Study of Corporate Charitable Donations of Chinese Firms. Organ. Sci. 2016, 27, 1307–1324. [Google Scholar] [CrossRef]

- Bharadwaj, A.S. A Resource-Based Perspective on Information Technology Capability and Firm Performance: An Empirical Investigation. MIS Q. 2000, 24, 169–196. [Google Scholar] [CrossRef]

- Qiang, H.F.; Yan, H.; Zhang, W.C.; Xiao, K.K. State-owned venture capital and corporate finance constraints: As expected or against the grain? Financ. Res. 2021, 47, 154–169. [Google Scholar]

- Zhao, X.Y.; Yi, C.J. Can State Capital Intervention Curb the Derealization of Real Enterprises?—Analyzing the Moderating Role of Pro-Clean Government-Business Relationship. Econ. Manag. 2021, 43, 61–74. [Google Scholar]

- Tajfel, H. Differentiation Between Social Groups: Studies in the Social Psychology of Intergroup Relations; Academic Press: New York, NY, USA, 1978. [Google Scholar]

- Ashforth, B.E.; Mael, F. Social Identity Theory and the Organization. Acad. Manag. Rev. 1989, 14, 20–39. [Google Scholar] [CrossRef]

- Wu, S.N.; Yang, L.L.; Tang, X.D. Enterprise Mixed Ownership Reform and the Chinese Way of Poverty Reduction and Poverty Eradication—Based on the Perspective of State-owned Capital Participation in Private Enterprises. Financ. Res. 2023, 49, 34–48. [Google Scholar]

- Sheng, Q.H.; Xiong, Y. Emotional catharsis, information mining or decision-making participation: Investors’ green interaction “portrait” and corporate green innovation. Financ. Res. 2024, 1–21. [Google Scholar] [CrossRef]

- Hu, J.; Fang, Q.; Long, W.B. Carbon emission regulation, corporate emission reduction incentives and total factor productivity—A natural experiment based on China’s carbon emission trading mechanism. Econ. Res. 2023, 58, 77–94. [Google Scholar]

- Levinthal, C.D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Lane, P.J.; Pathak, K.S. The reification of absorptive capacity: A critical review and rejuvenation of the construct. Acad. Manag. Rev. 2006, 31, 833–863. [Google Scholar] [CrossRef]

- Du, K.; Li, J. Towards a green world: How do green technology innovations affect total-factor carbon productivity. Energy Policy 2019, 131, 240–250. [Google Scholar] [CrossRef]

- Shrouf, F.; Miragliotta, G. Energy management based on Internet of Things: Practices and framework for adoption in production management. J. Clean. Prod. 2015, 100, 235–246. [Google Scholar] [CrossRef]

- Ma, C.W.; Yang, J. Study on the carbon emission reduction effect of enterprise digital transformation—Empirical data from listed companies in manufacturing industry. J. Nanjing Univ. Financ. Econ. 2023, 76–85. [Google Scholar] [CrossRef]

- Ren, S.; Zhang, Y.; Liu, Y.; Sakao, T.; Huisingh, D.; Almeida, C.M.V.B. A comprehensive review of big data analytics throughout product lifecycle to support sustainable smart manufacturing: A framework, challenges and future research directions. J. Clean. Prod. 2019, 210, 1343–1365. [Google Scholar] [CrossRef]

- Cuculiza, C.; Antoniou, C.; Kumar, A.; Maligkris, A. Terrorist Attacks, Analyst Sentiment, and Earnings Forecasts. Manag. Sci. 2020, 67, 2579–2608. [Google Scholar] [CrossRef]

- Fan, D.C.; Zhang, X.F. Analysis of the effect of green financial reform and innovation on carbon emission reduction of high-emission enterprises. Front. Eng. Manag. Sci. Technol. 2022, 41, 55–61. [Google Scholar]

- Chapple, L.; Clarkson, P.M.; Gold, D.L. The Cost of Carbon: Capital Market Effects of the Proposed Emission Trading Scheme (ETS). Abacus 2013, 49, 1–33. [Google Scholar] [CrossRef]

- Zhong, T.Y.; Ma, F.Q. Carbon Reduction Effect of Enterprise Digital Transformation:Theoretical Mechanism and Empirical Test. Jianghai Acad. J. 2022, 04, 99–105. [Google Scholar]

- Xu, P.; Li, T.G.; Bai, G.Y. How State Capital Participation Affects the Investment and Financing Maturity Mismatch of Private Enterprises? Secur. Mark. Her. 2023, 31–42. [Google Scholar]

- Leaven, L.; Levine, R. Complex Ownership Structures and Corporate Valuations. Rev. Financ. Stud. 2008, 21, 579–604. [Google Scholar] [CrossRef]

- Jiang, F.X.; Cai, X.N.; Zhu, B. Multiple large shareholders and the risk of stock price collapse. Account. Res. 2018, 68–74. [Google Scholar] [CrossRef]

- Song, Z.J.; Feng, L.M.; Tan, X.M. State-owned equity, private entrepreneurs’ political participation and corporate finance facilitation-Empirical evidence from privately held listed companies in China. Financ. Res. 2014, 57, 133–147. [Google Scholar]

- Yao, M.J.; Song, Z.J.; Zhang, Z.Y. Institutional negative externalities and market players’ responses—Empirical evidence from Chinese private firms. Manag. World 2019, 35, 158–173. [Google Scholar]

- Huang, Y.; Chen, P.P.; You, X.L. How does the governance effect of “reverse hybridization” of private enterprises play out?—Evidence based on regulatory inquiries. J. Manag. Eng. 2024, 38, 162–178. [Google Scholar]

- Tang, S.L.; Sun, J.W.; Li, D.M. Can state-owned stock participation in family firms curb the risk of stock price collapse? J. Shanghai Univ. Financ. Econ. 2021, 23, 3–19. [Google Scholar]

- Li, X.; Guo, F.; Zhou, D.; Xu, Q. State-owned capital intervention and strategic risk-taking in private firms—Based on the perspectives of executive incentives and opportunistic behavior. Secur. Mark. Her. 2022, 14–25. [Google Scholar]

- Liu, X.X.; Li, M.H. “Reverse hybridization” and surplus management of private enterprises. Econ. Manag. 2023, 45, 189–208. [Google Scholar]

- Xiao, Z.; Zhai, S.B.; Zhang, J. Can the introduction of state-owned capital resolve the risk of zombification of private enterprises?—Empirical evidence from Chinese listed companies. Econ. Manag. 2022, 42, 36–56. [Google Scholar]

- Sang, L.; Li, F. The impact of participating shareholders’ property rights attributes on private enterprises’ innovation investment. Res. Financ. Issues 2021, 72–82. [Google Scholar] [CrossRef]

- Dou, X.C.; Wang, Y.L.; Liu, Z.Y. Does mixed ownership reform reduce the time lag of audit reports of state-owned enterprises? Audit. Res. 2022, 94–104. [Google Scholar]

- Wen, Z.L.; Ye, B.J. Analyses of Mediating Effects: The Development of Methods and Models. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Yu, Y.; Qi, H.J.; Li, R.L. State-owned shareholders’ participation and audit pricing in private enterprises. Audit. Res. 2022, 105–116. [Google Scholar]

- Li, Q.Y.; Xiao, Z.H. Heterogeneous environmental regulatory tools and corporate green innovation incentives-Evidence from green patents of listed firms. Econ. Res. 2020, 55, 192–208. [Google Scholar]

- Yu, Z.M. Environmental protection interviews, government environmental protection subsidies and corporate green innovation. Foreign Econ. Manag. 2021, 43, 22–37. [Google Scholar]

- Lu, X.D.; Lian, Y.J. Estimation of total factor productivity of Chinese industrial enterprises: 1999–2007. Econ. (Q.) 2012, 11, 541–558. [Google Scholar]

- Chen, Q.; Mao, Y.; Morrison, A.M. Impacts of Environmental Regulations on Tourism Carbon Emissions. Int. J. Environ. Res. Public Health 2021, 18, 12850. [Google Scholar] [CrossRef]

- Tang, Y.C. State Capital Participation Affects Private Firms’ Green Innovation Bias–Promoting Substantial or Strategic Innovation? West. Forum 2023, 33, 96–113. [Google Scholar]

- Li, W.G.; Yu, M.G. Ownership nature, marketization process and corporate risk taking. China Ind. Econ. 2012, 115–127. [Google Scholar] [CrossRef]

- Fang, J.X. Marketization process and the improvement of capital allocation efficiency. Econ. Res. 2006, 50–61. [Google Scholar]

- Yang, M.; Liu, C. Can state-owned equity participation help private small and medium-sized enterprises (SMEs) to “specialize, specialize and innovate”? Audit. Econ. Res. 2023, 38, 65–74. [Google Scholar]

- Wang, X.L.; Hu, L.P.; Fan, G. Report on China’s Marketization Index by Provinces (2021); Social Science Literature Publishing House: Beijing, China, 2021. [Google Scholar]

- Xu, D.; Zhou, K.Z.; Du, F. Deviant versus Aspirational Risk Taking: The Effects of Performance Feedback on Bribery Expenditure and R&D Intensity. Acad. Manag. 2019, 62, 1226–1251. [Google Scholar]

- Zhang, Y.; Yang, X.W. How state-owned equity participation affects the credit rating of private enterprises. Audit. Econ. Res. 2023, 38, 108–118. [Google Scholar]

- Valta, P. Competition and the Cost of Debt. J. Financ. Econ. 2012, 105, 661–682. [Google Scholar] [CrossRef]

- Chy, M.; Franco, G.D.; Su, B. The Effect of Auditor Litigation Risk on Client Access to Bank Debt: Evidence from a Quasi-Experiment. J. Account. Econ. 2020, 71, 101354. [Google Scholar] [CrossRef]

- Liu, H.K.; He, C. Mechanisms and tests of green finance for high-quality development of urban economy-Empirical evidence from 272 prefecture-level cities in China. Investig. Res. 2021, 40, 37–52. [Google Scholar]

- Andersen, E.V.; Wilts, J.W.; Shan, Y.L.; Ruzzenenti, F.; Hubacek, K. Carbon implications of sovereign wealth funds. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 2072–2084. [Google Scholar] [CrossRef]

- Cordeiro, J.J.; Galeazzo, A.; Shaw, T.S.; Veliyath, R.; Nandakumar, M.K. Ownership influences on corporate social responsibility in the Indian context. Asia Pac. J. Manag. 2018, 35, 1107–1136. [Google Scholar] [CrossRef]

- Lourenço, I.C.; Branco, M.C. Determinants of corporate sustainability performance in emerging markets: The Brazilian case. J. Clean. Prod. 2013, 57, 134–141. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Symbol | Measurement of Variable |

|---|---|---|---|

| Explained variable | Carbon emission reduction effects | CERID | The decrease in carbon emission intensity of enterprises, equal to (carbon emission intensity in year t − 1 − carbon emission intensity in year t)/carbon emission intensity in year t − 1 |

| Explanatory variable | Degree of state-owned capital participation | STATETS | Dummy variable that takes the value of 1 if the proportion of shares held by the state-owned largest shareholder reaches 10%; otherwise, it takes the value of 0 |

| Counterbalance degree of state-owned capital | STATEB | The sum of the shareholding ratios of state-owned shareholders among the top ten shareholders/the sum of the shareholding ratios of non-state-owned shareholders among the top ten shareholders | |

| The degree of state-owned capital director governance | STATE_D | The number of directors appointed by state-owned shareholders among the top ten shareholders/total number of board of directors | |

| The degree of state-owned capital director, executive, and supervisor governance | STATE_DJG | The number of directors, supervisors, and executives appointed by state-owned shareholders among the top ten shareholders/total number of directors, supervisors, and executives | |

| Control variable | Firm size | SIZE | The natural logarithm of the total market value of the listed company |

| Asset–liability ratio | LEV | Total liabilities/total assets | |

| Growth capacity | GROWTH | Percentage change in operating income over the fiscal year | |

| Cash flow ratio | CASH | Net cash flows from operating activities/total assets | |

| Capital intensity | CI | Total assets/operating income | |

| Market value | TQ | Company market capitalization/book value | |

| Firm age | AGE | Number of years the company has been listed | |

| Executive compensation | COMP | The natural logarithm of the total compensation of the top three executives | |

| Political affiliation | PC | If the chairman or general manager has served or is currently serving as a government official, it takes 1; otherwise, it takes 0 | |

| Duality | DUAL | Dummy variable; if the chairman concurrently serves as the general manager, it takes 1; otherwise, it takes 0 | |

| Board size | BOARD | The natural logarithm of the total number of board directors | |

| Proportion of independent directors | INDEP | The number of independent directors/total number of board directors |

| Variable | N | Mean | Sd | Min | P25 | P50 | P75 | Max |

|---|---|---|---|---|---|---|---|---|

| CERID | 14,182 | −0.026 | 0.211 | −2.865 | −0.089 | 0.004 | 0.08 | 0.842 |

| STATETS | 14,182 | 0.038 | 0.191 | 0 | 0 | 0 | 0 | 1 |

| STATEB | 14,182 | 0.038 | 0.096 | 0 | 0 | 0 | 0.027 | 0.897 |

| STATE_D | 14,182 | 0.005 | 0.039 | 0 | 0 | 0 | 0 | 0.500 |

| STATE_DJG | 14,182 | 0.003 | 0.022 | 0 | 0 | 0 | 0 | 0.375 |

| SIZE | 14,182 | 22.44 | 0.910 | 20.53 | 21.78 | 22.30 | 22.94 | 25.94 |

| LEV | 14,182 | 0.366 | 0.179 | 0.028 | 0.221 | 0.357 | 0.494 | 0.925 |

| GROWTH | 14,182 | 0.172 | 0.336 | −0.555 | −0.011 | 0.125 | 0.289 | 2.809 |

| CASH | 14,182 | 0.051 | 0.067 | −0.208 | 0.013 | 0.049 | 0.090 | 0.351 |

| CI | 14,182 | 2.218 | 1.427 | 0.341 | 1.357 | 1.860 | 2.606 | 17.17 |

| TQ | 14,182 | 2.169 | 1.302 | 0.837 | 1.387 | 1.765 | 2.451 | 13.98 |

| AGE | 14,182 | 1.838 | 0.717 | 0.693 | 1.386 | 1.792 | 2.398 | 3.367 |

| COMP | 14,182 | 5.200 | 0.720 | 2.578 | 4.737 | 5.193 | 5.642 | 7.480 |

| PC | 14,182 | 0.319 | 0.466 | 0 | 0 | 0 | 1 | 1 |

| DUAL | 14,182 | 0.399 | 0.490 | 0 | 0 | 0 | 1 | 1 |

| BOARD | 14,182 | 2.082 | 0.183 | 1.609 | 1.946 | 2.197 | 2.197 | 2.565 |

| INDEP | 14,182 | 0.376 | 0.0500 | 0.333 | 0.333 | 0.357 | 0.429 | 0.571 |

| Variable | CERID | STATETS | STATEB | STATE_D | STATE _DJG | SIZE | LEV |

|---|---|---|---|---|---|---|---|

| CERID | 1 | ||||||

| STATETS | 0.008 | 1 | |||||

| STATEB | 0.007 | 0.294 *** | 1 | ||||

| STATE_D | 0.028 *** | 0.340 *** | 0.201 *** | 1 | |||

| STATE_DJG | 0.028 *** | 0.375 *** | 0.220 *** | 0.881 *** | 1 | ||

| SIZE | 0.065 *** | 0.007 | −0.003 | −0.016 * | −0.016 * | 1 | |

| LEV | 0.010 | 0.031 *** | 0.048 *** | −0.008 | −0.001 | 0.116 *** | 1 |

| GROWTH | 0.088 *** | −0.003 | −0.010 | 0.004 | −0.002 | 0.210 *** | 0.077 *** |

| CASH | 0.046 *** | −0.001 | −0.004 | −0.019 ** | −0.014 * | 0.228 *** | −0.156 *** |

| CI | −0.059 *** | 0.026 *** | −0.003 | 0.047 *** | 0.046 *** | −0.036 *** | −0.160 *** |

| TQ1 | 0.035 *** | 0.018 ** | −0.004 | 0.012 | 0.017 ** | 0.239 *** | −0.125 *** |

| AGE | 0.027 *** | 0.059 *** | 0.061 *** | 0.004 | 0.005 | 0.235 *** | 0.302 *** |

| COMP | −0.074 *** | 0.004 | −0.002 | −0.033 *** | −0.034 *** | 0.489 *** | 0.084 *** |

| PC | 0.055 *** | −0.008 | −0.014 | −0.015 * | −0.007 | 0 | 0.011 |

| DUAL | −0.019 ** | −0.027 *** | −0.032 *** | −0.012 | −0.011 | −0.034 *** | −0.051 *** |

| BOARD | 0.033 *** | 0.096 *** | 0.049 *** | 0.043 *** | 0.055 *** | 0.075 *** | 0.052 *** |

| INDEP | −0.012 | −0.058 *** | −0.030 *** | −0.026 *** | −0.042 *** | −0.021 ** | −0.022 *** |

| GROWTH | CASH | CI | TQ | AGE | COMP | PC | |

| GROWTH | 1 | ||||||

| CASH | 0.001 | 1 | |||||

| CI | −0.135 *** | −0.226 *** | 1 | ||||

| TQ | 0.108 *** | 0.073 *** | 0.089 *** | 1 | |||

| AGE | −0.082 *** | 0.011 | 0.032 *** | 0.136 *** | 1 | ||

| COMP | 0.063 *** | 0.217 *** | −0.134 *** | −0.016 * | 0.131 *** | 1 | |

| PC | −0.017 ** | −0.005 | −0.019 ** | −0.044 *** | 0.013 | −0.117 *** | 1 |

| DUAL | 0.031 *** | −0.022 *** | 0.012 | 0.021 ** | −0.148 *** | 0.036 *** | −0.093 *** |

| BOARD | −0.002 | 0.028 *** | −0.036 *** | −0.058 *** | 0.076 *** | 0.022 *** | 0.055 *** |

| INDEP | 0.013 | −0.016 * | 0.042 *** | 0.036 *** | −0.044 *** | 0.006 | −0.021 ** |

| DUAL | BOARD | INDEP | |||||

| DUAL | 1 | ||||||

| BOARD | −0.133 *** | 1 | |||||

| INDEP | 0.125 *** | −0.644 *** | 1 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CERID | CERID | CERID | CERID | |

| STATETS | 0.013 ** | |||

| (2.03) | ||||

| STATEB | 0.002 ** | |||

| (2.02) | ||||

| STATE_D | 0.100 *** | |||

| (2.75) | ||||

| STATE_DJG | 0.163 *** | |||

| (2.62) | ||||

| SIZE | 0.001 | 0.001 | 0.001 | 0.001 |

| (0.73) | (0.71) | (0.74) | (0.74) | |

| LEV | −0.003 | −0.003 | −0.003 | −0.003 |

| (−0.31) | (−0.29) | (−0.28) | (−0.30) | |

| GROWTH | 0.041 *** | 0.041 *** | 0.041 *** | 0.041 *** |

| (5.44) | (5.45) | (5.45) | (5.46) | |

| CASH | 0.227 *** | 0.227 *** | 0.227 *** | 0.227 *** |

| (8.49) | (8.48) | (8.50) | (8.50) | |

| CI | −0.006 *** | −0.006 *** | −0.006 *** | −0.006 *** |

| (−4.07) | (−4.04) | (−4.13) | (−4.11) | |

| TQ | 0.0002 | 0.0002 | 0.0002 | 0.0002 |

| (0.13) | (0.16) | (0.15) | (0.13) | |

| AGE | 0.014 *** | 0.014 *** | 0.014 *** | 0.014 *** |

| (6.09) | (6.13) | (6.17) | (6.18) | |

| COMP | −0.003 | −0.003 | −0.003 | −0.003 |

| (−1.24) | (−1.22) | (−1.21) | (−1.21) | |

| PC | 0.005 * | 0.005 * | 0.005 * | 0.005 * |

| (1.70) | (1.68) | (1.73) | (1.71) | |

| DUAL | −0.003 | −0.003 | −0.003 | −0.003 |

| (−1.04) | (−1.04) | (−1.03) | (−1.04) | |

| BOARD | −0.0004 | 0.0004 | −0.0002 | −0.0002 |

| (−0.04) | (0.04) | (−0.02) | (−0.01) | |

| INDEP | 0.001 | 0.001 | 0.001 | 0.002 |

| (0.03) | (0.03) | (0.03) | (0.06) | |

| CONSTANT | −0.072 | −0.074 | −0.074 | −0.074 |

| (−1.48) | (−1.51) | (−1.51) | (−1.52) | |

| YEAR F.E. | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES |

| N | 14,182 | 14,182 | 14,182 | 14,182 |

| R2 | 0.287 | 0.287 | 0.288 | 0.288 |

| adj. R2 | 0.284 | 0.284 | 0.284 | 0.284 |

| (1) | (2) | |

|---|---|---|

| STATETS | CERID | |

| SOERATIO | 1.064 *** | |

| (7.91) | ||

| STATETS | 0.201 ** | |

| (2.29) | ||

| IMR | −0.0840 ** | |

| (−2.17) | ||

| CONSTANT | −0.078 | |

| (−1.60) | ||

| CONTROLS | YES | YES |

| YEAR F.E. | YES | YES |

| IND F.E. | YES | YES |

| N | 14,182 | 14,182 |

| Pseudo. R2/adj. R2 | 0.114 | 0.284 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CERID | CERID | CERID | CERID | |

| STATETS | 0.017 ** | |||

| (2.48) | ||||

| STATEB | 0.004 *** | |||

| (2.91) | ||||

| STATE_D | 0.101 *** | |||

| (3.09) | ||||

| STATE_DJG | 0.188 *** | |||

| (3.24) | ||||

| CONSTANT | 0.027 | 0.026 | 0.024 | 0.024 |

| (0.38) | (0.38) | (0.35) | (0.35) | |

| CONTROLS | YES | YES | YES | YES |

| YEAR F.E. | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES |

| N | 9409 | 9409 | 9409 | 9409 |

| R2 | 0.342 | 0.342 | 0.342 | 0.342 |

| adj. R2 | 0.338 | 0.337 | 0.338 | 0.338 |

| Variable | Treat | Control | Treat | Control | Treat | Control | Standard Deviations Before Matching | Standard Deviations After Matching | |||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Before | After | Variance | Before | After | Skewness | Before | After | |||

| SIZE | 22.577 | 22.412 | 22.577 | 0.941 | 0.795 | 0.941 | 0.681 | 0.834 | 0.680 | 0.170 | 0.000 |

| LEV | 0.394 | 0.360 | 0.394 | 0.034 | 0.031 | 0.034 | 0.193 | 0.308 | 0.193 | 0.183 | 0.000 |

| GROWTH | 0.168 | 0.173 | 0.168 | 0.126 | 0.109 | 0.126 | 2.269 | 2.025 | 2.269 | −0.014 | 0.000 |

| CASH | 0.044 | 0.053 | 0.044 | 0.004 | 0.004 | 0.004 | −0.037 | 0.099 | −0.037 | −0.133 | 0.000 |

| CI | 2.417 | 2.171 | 2.417 | 2.739 | 1.846 | 2.739 | 2.478 | 2.688 | 2.478 | 0.148 | 0.000 |

| TQ | 2.212 | 2.158 | 2.212 | 1.828 | 1.652 | 1.828 | 2.750 | 2.953 | 2.750 | 0.040 | 0.000 |

| AGE | 2.096 | 1.779 | 2.096 | 0.551 | 0.486 | 0.551 | −0.376 | 0.099 | −0.376 | 0.427 | 0.000 |

| COMP | 5.282 | 5.182 | 5.282 | 0.585 | 0.500 | 0.585 | 0.028 | 0.098 | 0.027 | 0.131 | 0.000 |

| PC | 0.336 | 0.315 | 0.336 | 0.223 | 0.216 | 0.223 | 0.693 | 0.797 | 0.693 | 0.045 | 0.000 |

| DUAL | 0.347 | 0.411 | 0.347 | 0.227 | 0.242 | 0.227 | 0.642 | 0.363 | 0.642 | −0.133 | 0.000 |

| BOARD | 2.126 | 2.072 | 2.126 | 0.029 | 0.034 | 0.029 | −0.944 | −0.729 | −0.944 | 0.310 | 0.000 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CERID | CERID | CERID | CERID | |

| STATETS | 0.012 * | |||

| (1.82) | ||||

| STATEB | 0.003 ** | |||

| (2.22) | ||||

| STATE_D | 0.093 ** | |||

| (2.54) | ||||

| STATE_DJG | 0.141 ** | |||

| (2.18) | ||||

| CONSTANT | −0.095 | −0.095 | −0.098 * | −0.099 * |

| (−1.62) | (−1.64) | (−1.68) | (−1.69) | |

| CONTROLS | YES | YES | YES | YES |

| YEAR F.E. | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES |

| N | 14,182 | 14,182 | 14,182 | 14,182 |

| R2 | 0.295 | 0.295 | 0.296 | 0.296 |

| adj. R2 | 0.292 | 0.292 | 0.293 | 0.293 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CERID | CERID | CERID | CERID | |

| STATETS | 0.013 ** | |||

| (1.98) | ||||

| STATEB | 0.002 * | |||

| (1.81) | ||||

| STATE_D | 0.100 *** | |||

| (2.64) | ||||

| STATE_DJG | 0.155 ** | |||

| (2.43) | ||||

| CONSTANT | −0.067 | −0.068 | −0.069 | −0.069 |

| (−1.36) | (−1.38) | (−1.39) | (−1.40) | |

| CONTROLS | YES | YES | YES | YES |

| YEAR F.E. | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES |

| PROVINCE F.E. | YES | YES | YES | YES |

| N | 14,182 | 14,182 | 14,182 | 14,182 |

| R2 | 0.288 | 0.288 | 0.289 | 0.289 |

| adj. R2 | 0.284 | 0.284 | 0.284 | 0.284 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CERQD | CERQD | CERQD | CERQD | |

| STATETS | 0.031 *** | |||

| (3.45) | ||||

| STATEB | 0.004 * | |||

| (1.91) | ||||

| STATE_D | 0.126 ** | |||

| (2.46) | ||||

| STATE_DJG | 0.263 *** | |||

| (3.14) | ||||

| CONSTANT | 0.084 | 0.082 | 0.082 | 0.081 |

| (1.05) | (1.01) | (1.01) | (1.00) | |

| CONTROLS | YES | YES | YES | YES |

| YEAR F.E. | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES |

| N | 14,182 | 14,182 | 14,182 | 14,182 |

| R2 | 0.632 | 0.632 | 0.632 | 0.632 |

| adj. R2 | 0.630 | 0.630 | 0.630 | 0.630 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CERID | CERID | CERID | CERID | |

| STATETS10 | 0.013 ** | |||

| (2.13) | ||||

| STATEB2 | 0.001 * | |||

| (1.77) | ||||

| STATED_DUM | 0.023 *** | |||

| (2.67) | ||||

| STATEDJG_DUM | 0.020 *** | |||

| (2.66) | ||||

| CONSTANT | −0.0730 | −0.0732 | −0.0740 | −0.0744 |

| (−1.49) | (−1.50) | (−1.52) | (−1.52) | |

| CONTROLS | YES | YES | YES | YES |

| YEAR F.E. | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES |

| N | 14,182 | 14,182 | 14,182 | 14,182 |

| R2 | 0.287 | 0.287 | 0.288 | 0.287 |

| adj. R2 | 0.284 | 0.284 | 0.284 | 0.284 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CERID | CERID | CERID | CERID | |

| STATETS | 0.023 *** | |||

| (2.61) | ||||

| STATEB | 0.0033 ** | |||

| (2.19) | ||||

| STATE_D | 0.085 ** | |||

| (2.14) | ||||

| STATE_DJG | 0.133 ** | |||

| (1.97) | ||||

| CONSTANT | −0.023 | −0.025 | −0.025 | −0.025 |

| (−0.32) | (−0.34) | (−0.34) | (−0.34) | |

| CONTROLS | YES | YES | YES | YES |

| YEAR F.E. | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES |

| N | 9169 | 9169 | 9169 | 9169 |

| R2 | 0.326 | 0.325 | 0.326 | 0.326 |

| adj. R2 | 0.321 | 0.321 | 0.321 | 0.321 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CERID | GS | CERID | CERID | GS | CERID | CERID | GS | CERID | CERID | GS | CERID | |

| STATETS | 0.013 ** | 0.040 ** | 0.012 * | |||||||||

| (2.03) | (2.01) | (1.89) | ||||||||||

| STATEB | 0.002 ** | 0.023 ** | 0.002 * | |||||||||

| (2.02) | (2.40) | (1.66) | ||||||||||

| STATE_D | 0.100 *** | 0.312 ** | 0.094 ** | |||||||||

| (2.75) | (2.09) | (2.56) | ||||||||||

| STATE_DJG | 0.163 *** | 0.443 ** | 0.154 ** | |||||||||

| (2.62) | (2.17) | (2.47) | ||||||||||

| GS | 0.020 *** | 0.020 *** | 0.019 *** | 0.020 *** | ||||||||

| (2.75) | (2.80) | (2.65) | (2.70) | |||||||||

| CONSTANT | −0.0723 | 0.211 * | −0.0765 | −0.0735 | 0.205 * | −0.0776 | −0.0737 | 0.206 * | −0.0777 | −0.0740 | 0.206 * | −0.0780 |

| (−1.48) | (1.77) | (−1.56) | (−1.51) | (1.72) | (−1.58) | (−1.51) | (1.73) | (−1.58) | (−1.52) | (1.73) | (−1.59) | |

| YEAR F.E. | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 |

| R2 | 0.287 | 0.021 | 0.288 | 0.287 | 0.022 | 0.288 | 0.288 | 0.022 | 0.288 | 0.288 | 0.022 | 0.288 |

| adj. R2 | 0.284 | 0.017 | 0.285 | 0.284 | 0.017 | 0.285 | 0.284 | 0.018 | 0.285 | 0.284 | 0.017 | 0.285 |

| Sobel Test | 2.471 (p = 0.013) | 2.736 (p = 0.006) | 2.869 (p = 0.004) | 2.706 (p = 0.007) | ||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CERID | ESG | CERID | CERID | ESG | CERID | CERID | ESG | CERID | CERID | ESG | CERID | |

| STATETS | 0.013 ** | 2.211 *** | 0.012 * | |||||||||

| (2.03) | (2.80) | (1.88) | ||||||||||

| STATEB | 0.002 ** | 0.63 *** | 0.002 * | |||||||||

| (2.02) | (2.89) | (1.80) | ||||||||||

| STATE_D | 0.100 *** | 7.185 * | 0.097 *** | |||||||||

| (2.75) | (1.92) | (2.68) | ||||||||||

| STATE_DJG | 0.163 *** | 14.01 ** | 0.157 ** | |||||||||

| (2.62) | (2.05) | (2.50) | ||||||||||

| ESG | 0.0004 ** | 0.0004 ** | 0.0004 ** | 0.0004 ** | ||||||||

| (2.06) | (2.11) | (2.06) | (2.06) | |||||||||

| CONSTANT | −0.072 | 7.049 | −0.075 | −0.074 | 6.810 | −0.076 | −0.074 | 6.865 | −0.077 | −0.074 | 6.832 | −0.077 |

| (−1.48) | (1.64) | (−1.54) | (−1.51) | (1.58) | (−1.57) | (−1.51) | (1.59) | (−1.57) | (−1.52) | (1.59) | (−1.58) | |

| YEAR F.E. | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 | 14,182 |

| R2 | 0.287 | 0.508 | 0.288 | 0.287 | 0.507 | 0.288 | 0.288 | 0.507 | 0.288 | 0.288 | 0.507 | 0.288 |

| adj. R2 | 0.284 | 0.505 | 0.284 | 0.284 | 0.505 | 0.284 | 0.284 | 0.505 | 0.285 | 0.284 | 0.505 | 0.285 |

| Sobel Test | −3.553 (p = 0.000) | −2.701 (p = 0.007) | −2.508 (p = 0.012) | −2.226 (p = 0.026) | ||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CERID | TFP_GMM | CERID | CERID | TFP_GMM | CERID | CERID | TFP_GMM | CERID | CERID | TFP_GMM | CERID | |

| STATETS | 0.013 ** | 0.046 | 0.012 * | |||||||||

| (2.03) | (1.39) | (1.89) | ||||||||||

| STATEB | 0.002 ** | 0.010 | 0.002 ** | |||||||||

| (2.02) | (1.49) | (1.97) | ||||||||||

| STATE_D | 0.100 *** | 0.418 ** | 0.097 *** | |||||||||

| (2.75) | (2.39) | (2.69) | ||||||||||

| STATE_DJG | 0.163 *** | 0.743 ** | 0.156 ** | |||||||||

| (2.62) | (2.36) | (2.56) | ||||||||||

| TFP_GMM | 0.008 ** | 0.008 ** | 0.008 ** | 0.008 ** | ||||||||

| (2.08) | (2.10) | (2.01) | (2.02) | |||||||||

| CONSTANT | −0.072 | −0.787 *** | −0.065 | −0.0735 | −0.791 *** | −0.066 | −0.074 | −0.792 *** | −0.066 | −0.074 | −0.794 *** | −0.067 |

| (−1.48) | (−3.41) | (−1.33) | (−1.51) | (−3.43) | (−1.35) | (−1.51) | (−3.44) | (−1.36) | (−1.52) | (−3.44) | (−1.36) | |

| YEAR F.E. | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 14,182 | 14,147 | 14,147 | 14,182 | 14,147 | 14,147 | 14,182 | 14,147 | 14,147 | 14,182 | 14,147 | 14,147 |

| R2 | 0.287 | 0.618 | 0.288 | 0.287 | 0.617 | 0.288 | 0.288 | 0.618 | 0.288 | 0.288 | 0.618 | 0.288 |

| adj. R2 | 0.284 | 0.616 | 0.285 | 0.284 | 0.616 | 0.285 | 0.284 | 0.616 | 0.285 | 0.284 | 0.616 | 0.285 |

| Sobel Test | −1.176 (p = 0.240) | −0.521 (p = 0.601) | −2.911 (p = 0.004) | −2.805 (p = 0.005) | ||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| Higher | Lower | Higher | Lower | Higher | Lower | Higher | Lower | |

| STATETS | 0.005 | 0.024 ** | ||||||

| (0.53) | (2.30) | |||||||

| STATEB | 0.002 | 0.024 * | ||||||

| (1.05) | (1.67) | |||||||

| STATE_D | 0.047 | 0.156 *** | ||||||

| (0.93) | (3.14) | |||||||

| STATE_DJG | 0.070 | 0.283 *** | ||||||

| (0.75) | (3.06) | |||||||

| CONSTANT | −0.13 | −0.026 | −0.130 | −0.029 | −0.129 | −0.033 | −0.129 | −0.033 |

| (−1.53) | (−0.43) | (−1.53) | (−0.47) | (−1.52) | (−0.54) | (−1.52) | (−0.55) | |

| CONTROLS | YES | YES | YES | YES | YES | YES | YES | YES |

| YEAR F.E. | YES | YES | YES | YES | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 7084 | 7098 | 7084 | 7098 | 7084 | 7098 | 7084 | 7098 |

| R2 | 0.278 | 0.327 | 0.278 | 0.326 | 0.278 | 0.327 | 0.278 | 0.327 |

| adj. R2 | 0.272 | 0.321 | 0.272 | 0.321 | 0.272 | 0.321 | 0.272 | 0.321 |

| Inter-group difference test | 0.019 *** (p = 0.000) | 0.023 *** (p = 0.000) | 0.109 *** (p = 0.000) | 0.213 *** (p = 0.000) | ||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| Higher | Lower | Higher | Lower | Higher | Lower | Higher | Lower | |

| STATETS | −0.012 | 0.027 *** | ||||||

| (−1.02) | (3.37) | |||||||

| STATEB | −0.025 | 0.003 * | ||||||

| (−1.33) | (1.69) | |||||||

| STATE_D | −0.007 | 0.145 *** | ||||||

| (−0.12) | (3.51) | |||||||

| STATE_DJG | −0.033 | 0.249 *** | ||||||

| (−0.33) | (3.55) | |||||||

| CONSTANT | −0.093 | −0.063 | −0.092 | −0.062 | −0.091 | −0.062 | −0.091 | −0.061 |

| (−1.50) | (−0.77) | (−1.49) | (−0.76) | (−1.47) | (−0.76) | (−1.47) | (−0.75) | |

| CONTROLS | YES | YES | YES | YES | YES | YES | YES | YES |

| YEAR F.E. | YES | YES | YES | YES | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 7110 | 7072 | 7110 | 7072 | 7110 | 7072 | 7110 | 7072 |

| R2 | 0.364 | 0.264 | 0.364 | 0.264 | 0.363 | 0.264 | 0.363 | 0.264 |

| adj. R2 | 0.358 | 0.258 | 0.358 | 0.257 | 0.358 | 0.258 | 0.358 | 0.258 |

| Inter-group difference test | 0.038 *** (p = 0.000) | 0.028 *** (p = 0.000) | 0.152 *** (p = 0.000) | 0.282 *** (p = 0.000) | ||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| Higher | Lower | Higher | Lower | Higher | Lower | Higher | Lower | |

| STATETS | 0.025 ** | 0.004 | ||||||

| (2.35) | (0.40) | |||||||

| STATEB | 0.044 ** | 0.001 | ||||||

| (2.43) | (0.87) | |||||||

| STATE_D | 0.125 *** | 0.070 | ||||||

| (2.79) | (1.26) | |||||||

| STATE_DJG | 0.214 ** | 0.098 | ||||||

| (2.54) | (1.16) | |||||||

| CONSTANT | −0.102 | 0.163 * | −0.104 | 0.163 * | −0.107 * | 0.164 * | −0.107 * | 0.163 * |

| (−1.60) | (1.90) | (−1.64) | (1.90) | (−1.68) | (1.91) | (−1.68) | (1.90) | |

| CONTROLS | YES | YES | YES | YES | YES | YES | YES | YES |

| YEAR F.E. | YES | YES | YES | YES | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 7092 | 7089 | 7092 | 7089 | 7092 | 7089 | 7092 | 7089 |

| R2 | 0.332 | 0.262 | 0.332 | 0.262 | 0.332 | 0.262 | 0.332 | 0.262 |

| adj. R2 | 0.326 | 0.256 | 0.326 | 0.256 | 0.326 | 0.256 | 0.326 | 0.256 |

| Inter-group difference test | −0.021 *** (p = 0.000) | −0.043 *** (p = 0.000) | −0.055 ** (p = 0.000) | −0.117 ** (p = 0.000) | ||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| Lower | Higher | Lower | Higher | Lower | Higher | Lower | Higher | |

| STATETS | −0.004 | 0.027 *** | ||||||

| (−0.35) | (3.09) | |||||||

| STATEB | −0.021 | 0.003 * | ||||||

| (−1.27) | (1.83) | |||||||

| STATE_D | 0.042 | 0.137 *** | ||||||

| (0.99) | (2.89) | |||||||

| STATE_DJG | 0.100 | 0.198 ** | ||||||

| (1.41) | (2.31) | |||||||

| CONSTANT | −0.134 ** | −0.014 | −0.135 ** | −0.012 | −0.134 ** | −0.011 | −0.134 ** | −0.012 |

| (−2.36) | (−0.15) | (−2.39) | (−0.14) | (−2.35) | (−0.12) | (−2.35) | (−0.13) | |

| CONTROLS | YES | YES | YES | YES | YES | YES | YES | YES |

| YEAR F.E. | YES | YES | YES | YES | YES | YES | YES | YES |

| IND F.E. | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 7103 | 7078 | 7103 | 7078 | 7103 | 7078 | 7103 | 7078 |

| R2 | 0.362 | 0.245 | 0.362 | 0.245 | 0.362 | 0.245 | 0.362 | 0.245 |

| adj. R2 | 0.356 | 0.238 | 0.356 | 0.238 | 0.356 | 0.238 | 0.356 | 0.238 |

| Inter-group difference test | 0.031 *** (p = 0.000) | 0.024 *** (p = 0.000) | 0.096 *** (p = 0.000) | 0.098 ** (p = 0.000) | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yuan, R.; Li, Y.; Li, C.; Sun, X.; Li, L. The Impact of State-Owned Capital Participation on Carbon Emission Reduction in Private Enterprises: Evidence from China. Sustainability 2025, 17, 7433. https://doi.org/10.3390/su17167433

Yuan R, Li Y, Li C, Sun X, Li L. The Impact of State-Owned Capital Participation on Carbon Emission Reduction in Private Enterprises: Evidence from China. Sustainability. 2025; 17(16):7433. https://doi.org/10.3390/su17167433

Chicago/Turabian StyleYuan, Runsen, Yan Li, Chunling Li, Xiaoran Sun, and Lingyi Li. 2025. "The Impact of State-Owned Capital Participation on Carbon Emission Reduction in Private Enterprises: Evidence from China" Sustainability 17, no. 16: 7433. https://doi.org/10.3390/su17167433

APA StyleYuan, R., Li, Y., Li, C., Sun, X., & Li, L. (2025). The Impact of State-Owned Capital Participation on Carbon Emission Reduction in Private Enterprises: Evidence from China. Sustainability, 17(16), 7433. https://doi.org/10.3390/su17167433