The Impact of Drug Price Reduction on Healthcare System Sustainability: A CGE Analysis of China’s Centralized Volume-Based Procurement Policy

Abstract

1. Introduction

1.1. Research Background

1.2. Literature Review

1.2.1. CVBP Policy’s Impact on Pharmaceutical Markets and Macroeconomy

1.2.2. CVBP Policy’s Impact on Social Welfare

1.2.3. Research on the Health Policy Based on CGE Model

2. Model Methods and Data

2.1. Model Methods

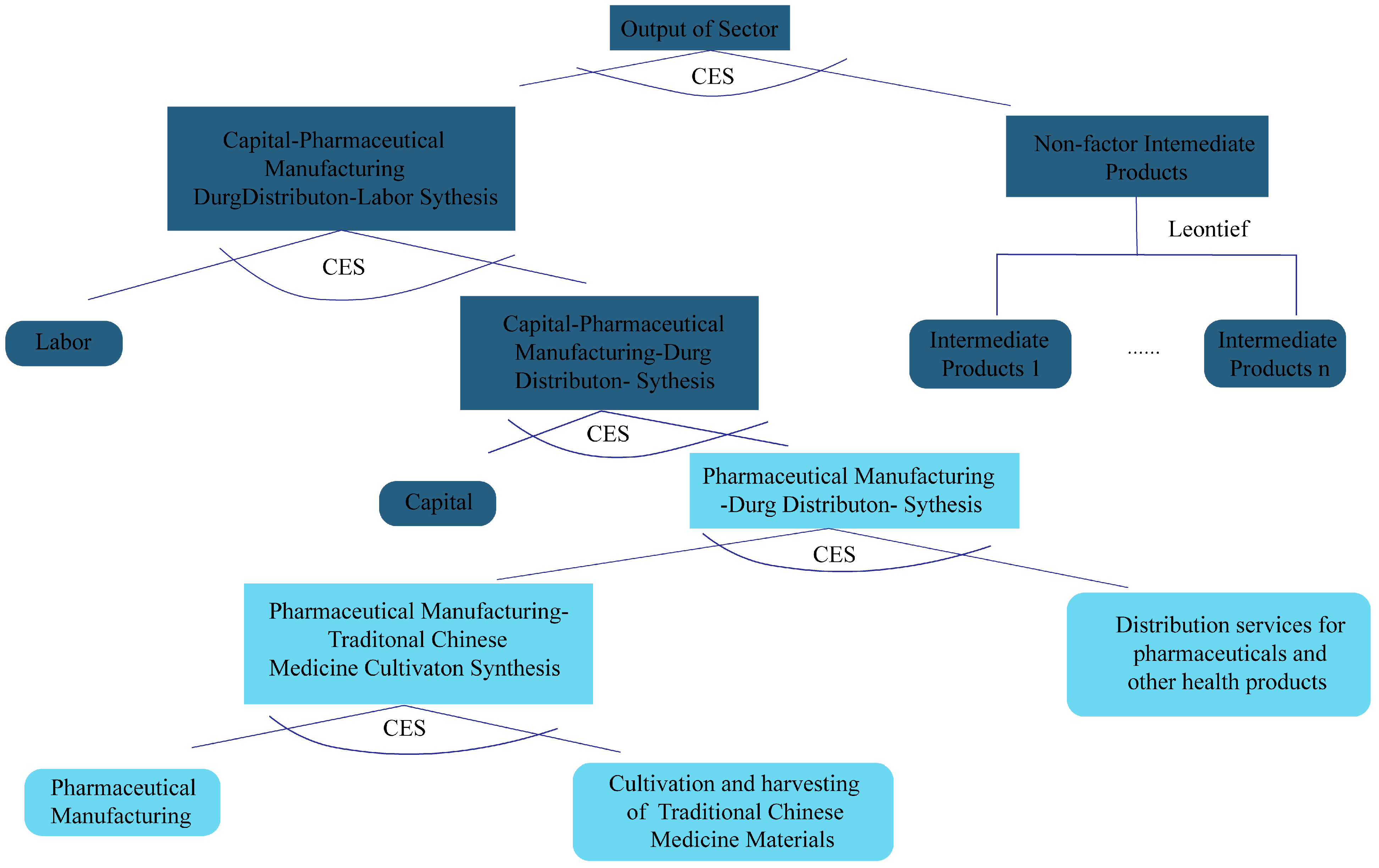

2.1.1. Production Module

2.1.2. Trade Module

2.1.3. Main Institution Module

2.1.4. Equilibrium Closure Module

2.1.5. Social Welfare Module

2.2. Construction of the SAM Table, Parameter, and Scenario Settings

2.2.1. Construction of the SAM Table

2.2.2. Parameter Settings

2.2.3. Scenario Settings

3. Results and Analysis

3.1. The Impact of Drug Prices on the Pharmaceutical Industry

3.2. The Impact of Drug Prices on Macroeconomics

3.3. The Impact of Drug Prices on Social Welfare Levels

4. Conclusions and Prospects

4.1. Conclusions

4.1.1. Sectoral Impacts

- Integrate production costs and reasonable profit margins of active pharmaceutical ingredients (APIs) as essential parameters in winning-bid price negotiations, facilitating transparent price transmission while curbing monopolistic practices.

- Increase weighting coefficients for supply chain stability, quality control metrics, and process innovation indicators within CVBP scoring mechanisms, displacing exclusive reliance on low-price selection.

4.1.2. Macroeconomic Effects

4.1.3. Welfare Consequences

4.1.4. Sustainability Risks

- Establish a cost auditing mechanism for critical APIs to incorporate reasonable profit margins into centralized procurement price negotiations, thereby mitigating price transmission distortions caused by upstream monopolies.

- Create a dedicated R&D innovation fund using savings from centralized procurement to support targeted investments in pharmaceutical R&D, counteracting innovation disincentives arising from profit margin compression.

- Implement workforce reskilling programs for labor-intensive segments, facilitating labor transition towards higher value-added processing or manufacturing sectors.

- Allocate savings from drug expenditure reductions towards expanding reimbursement for chronic disease medications and establishing out-of-pocket caps for low-income patients, directly compensating for social welfare losses.

4.2. Limitations

4.2.1. Data Limitations

4.2.2. Model Limitations

4.2.3. Scenario Specification Constraints

4.2.4. Confidence Level and Policy Implementation

- Adopt phased policy adjustments. Aligning with the study’s qualitative finding that price reductions stimulate consumer demand in the short term but suppress industrial output in the long run, mitigate risks through incremental implementation. Concurrently monitor pharmaceutical industry output and quality metrics to calibrate policy intensity progressively.

- Establish dynamic monitoring with feedback mechanisms. To compensate for static modeling limitations, institute regular tracking of core indicators—including GDP fluctuations, household healthcare expenditure burdens, and pharmaceutical R&D investment. Conduct quarterly policy impact assessments to enable timely optimization and prevent the accumulation of adverse long-term effects.

4.3. Research Contributions

- It develops the first CGE model specifically focused on the pharmaceutical sector. This model addresses constraints inherent in difference-in-differences and regression analyses for capturing cross-sectoral linkages. The framework systematically traces price fluctuation transmission mechanisms throughout industrial chains and the broader macroeconomy, thereby addressing a critical gap in multi-sectoral economic feedback analysis of CVBP policies.

- Extending beyond the existing literature’s emphasis on short-term cost reductions or localized market effects, it provides the first integrated quantification of systemic impacts stemming from pharmaceutical price reductions. These impacts span industrial output, GDP dynamics, and social welfare, revealing potential long-term sustainability risks associated with price-centric regulatory approaches.

- The study simulates graded price reduction scenarios consistent with CVBP’s core ‘volume-for-price’ mechanism. These simulations provide quantitative evidence to inform the optimization of CVBP negotiation design and enhance industrial sustainability.

4.4. Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| CGE | Computable General Equilibrium |

| CVBP | Centralized Volume-Based Procurement |

| SAM | Social Accounting Matrix |

| APIs | Active Pharmaceutical Ingredients |

References

- Wu, W.; Long, S.; Cerda, A.A.; Garcia, L.Y.; Jakovljevic, M. Population Ageing and Sustainability of Healthcare Financing in China. Cost Eff. Resour. Alloc. C/E 2023, 21, 97. [Google Scholar] [CrossRef]

- Wei, M.; Wang, X.; Zhang, D.; Zhang, X. Relationship between the Number of Hospital Pharmacists and Hospital Pharmaceutical Expenditure: A Macro-Level Panel Data Model of Fixed Effects with Individual and Time. BMC Health Serv. Res. 2020, 20, 91. [Google Scholar] [CrossRef] [PubMed]

- Mensa Sorato, M.; Davari, M.; Abdollahi Asl, A.; Soleymani, F.; Kebriaeezadeh, A. Why Healthcare Market Needs Government Intervention to Improve Access to Essential Medicines and Healthcare Efficiency: A Scoping Review from Pharmaceutical Price Regulation Perspective. J. Pharm. Health Serv. Res. 2020, 11, 321–333. [Google Scholar] [CrossRef]

- Mills, M.; Kanavos, P. Do Pharmaceutical Budgets Deliver Financial Sustainability in Healthcare? Evidence from Europe. Health Policy 2020, 124, 239–251. [Google Scholar] [CrossRef]

- Yuan, J.; Lu, Z.K.; Xiong, X.; Lee, T.-Y.; Huang, H.; Jiang, B. Impact of National Volume-Based Procurement on the Procurement Volumes and Spending for Antiviral Medications of Hepatitis B Virus. Front. Pharmacol. 2022, 13, 842944. [Google Scholar] [CrossRef] [PubMed]

- Carrera, P.; Katik, S.; Schotanus, F. Joint Procurement of Complex Products: Actual Price Savings, Perceived Nonmonetary Advantages, Disadvantages and Impediments. J. Public Procure. 2021, 21, 167–182. [Google Scholar] [CrossRef]

- Fan, Y.; Xu, Q.; Jin, G.; Jiang, L.; Wang, C. The Cost of Total Hip Arthroplasty: Compare the Hospitalization Costs of National Centralized Procurement and National Volume-Based Procurement. Front. Public Health 2024, 12, 1383308. [Google Scholar] [CrossRef] [PubMed]

- Xing, Q.; Tang, W.; Li, M.; Li, S. Has the Volume-Based Drug Purchasing Approach Achieved Equilibrium among Various Stakeholders? Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 4285. [Google Scholar] [CrossRef] [PubMed]

- Chen, L.; Yang, Y.; Luo, M.; Hu, B.; Yin, S.; Mao, Z. The Impacts of National Centralized Drug Procurement Policy on Drug Utilization and Drug Expenditures: The Case of Shenzhen, China. Int. J. Environ. Res. Public Health 2020, 17, 9415. [Google Scholar] [CrossRef]

- Signor, R.; Love, P.E.D.; Marchiori, F.F.; Felisberto, A.D. Underpricing in Social Infrastructure Projects: Combating the Institutionalization of the Winner’s Curse. J. Constr. Eng. Manag. 2020, 146, 5020018. [Google Scholar] [CrossRef]

- Tang, M.; He, J.; Chen, M.; Cong, L.; Xu, Y.; Yang, Y.; Hou, Z.; Song, P.; Jin, C. “4 + 7” City Drug Volume-Based Purchasing and Using Pilot Program in China and Its Impact. Drug Discov. Ther. 2019, 13, 365–369. [Google Scholar] [CrossRef]

- Xuan, Z.; Huihua, N. Public Health Insurance and Pharmaceutical Innovation: Evidence from China. J. Dev. Econ. 2021, 148, 102578. [Google Scholar] [CrossRef]

- Parmaksiz, K.; Pisani, E.; Bal, R.; Kok, M.O. A Systematic Review of Pooled Procurement of Medicines and Vaccines: Identifying Elements of Success. Glob. Health 2022, 18, 59. [Google Scholar] [CrossRef]

- Dubois, P.; Lefouili, Y.; Straub, S. Pooled Procurement of Drugs in Low and Middle Income Countries. Eur. Econ. Rev. 2021, 132, 103655. [Google Scholar] [CrossRef]

- Saha, A.; Roberts, H. Pharmaceutical Industry’s Changing Market Dynamics. Int. J. Econ. Bus. 2020, 27, 159–175. [Google Scholar] [CrossRef]

- Vulto, A.G.; Vanderpuye-Orgle, J.; Van Der Graaff, M.; Simoens, S.R.A.; Dagna, L.; Macaulay, R.; Majeed, B.; Lemay, J.; Hippenmeyer, J.; Gonzalez-McQuire, S. Sustainability of Biosimilars in Europe: A Delphi Panel Consensus with Systematic Literature Review. Pharmaceuticals 2020, 13, 400. [Google Scholar] [CrossRef] [PubMed]

- Rand, L.Z.; Kesselheim, A.S. International Reference Pricing for Prescription Drugs in the United States: Administrative Limitations and Collateral Effects. Value Health 2021, 24, 473–476. [Google Scholar] [CrossRef]

- Mohd Kasim, F.; Hatah, E.; Osman, L.H.; Mhd Ali, A.; Babar, Z.-U.-D. Analyzing Trends and Factors Influencing Price Changes in Public Pooled Drugs Procurement System in Malaysia: Exploring Market Competition. Saudi Pharm. J. 2024, 32, 102214. [Google Scholar] [CrossRef]

- Qiu, F.; Chen, S.; Li, Y.; Wang, X.; Zhu, M. The Impact of the Centralized Volume-Based Procurement Policy on Chinese Pharmaceutical Manufacturing Firms’ R&D Investment: A Difference-in-Differences Approach. PLoS ONE 2025, 20, e0315811. [Google Scholar] [CrossRef]

- He, H.; Zhan, Y.; Huo, B.; Zhang, Y.; Shi, X. The Impact of National Centralized Drug Procurement Policy on Firm Performance: Evidence from Chinese Pharmaceutical Firms. Transp. Res. Part E Logist. Transp. Rev. 2025, 200, 104225. [Google Scholar] [CrossRef]

- Zhao, X.; Li, M.; Wang, H.; Xu, X.; Wu, X.; Sun, Y.; Ning, C.; Wang, B.; Chen, S.; You, H.; et al. Impact of National Centralized Drug Procurement Policy on Antiviral Utilization and Expenditure for Hepatitis B in China. J. Clin. Transl. Hepatol. 2022, 10, 420–428. [Google Scholar] [CrossRef]

- Callejas, J.; Mohapatra, D.P. Welfare Effects of Public Procurement of Medicines: Evidence from Ecuador. Int. J. Ind. Organ. 2021, 75, 102697. [Google Scholar] [CrossRef]

- Jiang, S.; Chen, Z.; Wu, T.; Wang, H. Collective Pharmaceutical Procurement in China May Have Unintended Consequences in Supply and Pricing. J. Glob. Health 2020, 10, 10314. [Google Scholar] [CrossRef]

- Rutten, M. The Economic Impact of Health Care Provision: A CGE Assessment for the UK. Ph.D. Thesis, University of Nottingham, Nottingham, UK, 2004. [Google Scholar]

- Horridge, M.; Wittwer, G. SinoTERM, a Multi-Regional CGE Model of China. China Econ. Rev. 2008, 19, 628–634. [Google Scholar] [CrossRef]

- Pattanayak, S.K.; Ross, M.T.; Depro, B.M.; Bauch, S.C.; Timmins, C.; Wendland, K.J.; Alger, K. Climate Change and Conservation in Brazil: CGE Evaluation of Health and Wealth Impacts. B.E. J. Econ. Anal. Policy 2009, 9, 44. [Google Scholar] [CrossRef]

- Ye, C.-Y.; Lee, J.-M.; Chen, S.-H. Economic Gains and Health Benefits from a New Cigarette Tax Scheme in Taiwan: A Simulation Using the CGE Model. BMC Public Health 2006, 6, 62. [Google Scholar] [CrossRef]

- Lfgren, H.; Harris, R.L.; Robinson, S. A Standard Computable General Equilibrium (CGE) Model in GAMS; International Food Policy Research Institute: Washington, DC, USA, 2002; p. 75. [Google Scholar]

- Liu, J. Development and Application of Input and Output Tables for Health Industry. Master’s Thesis, Fuzhou University, Fuzhou, China, 2020. [Google Scholar]

- Jiang, Z.; Cong, R.; Wu, Y.; Xu, S. Compilation of Input-output Table of Health Industry and the Measurement Method and Empirical Study of Health Industry Added Value. Stat. Decis. 2023, 39, 9–13. [Google Scholar] [CrossRef]

- He, G.; Wang, X. Study on Classification of Ocean-related Industries. Adv. Mar. Sci. 2006, 24, 365–370. [Google Scholar]

- Yao, Y.; Tanaka, M. Price Offers of Pharmaceutical Procurement in China: Evidence from Guangdong Province. Eur. J. Health Econ. 2016, 17, 563–575. [Google Scholar] [CrossRef]

- Pennathur, P.R.; Boksa, V.; Pennathur, A.; Kusiak, A.; Livingston, B.A. The Future of Office and Administrative Support Occupations in the Era of Artificial Intelligence: A State of the Art Review and Future Research Directions. Int. J. Ind. Ergon. 2024, 104, 103665. [Google Scholar] [CrossRef]

- Zhong, Z.; Wang, Q.; Ruan, R.; Chen, S.; Wang, H. Upstream Monopoly and the “Supply Paradox” of MarketOriented Reform: Evidence from the Reform of Massively Deregulating Pharmaceutical Price in China. J. Manag. World 2024, 40, 69–84, 203, 85. [Google Scholar] [CrossRef]

- Zhuang, J.; Vandenberg, P.; Huang, Y. Growing Beyond the Low-Cost Advantage: How the People’s Republic of China Can Avoid the Middle-Income Trap; Asian Development Bank: Mandaluyong City, Philippines, 2015. [Google Scholar]

- Wu, C.; Cao, Y.; Xu, H. How Population Aging Drives Labor Productivity: Evidence from China. Sustainability 2025, 17, 5046. [Google Scholar] [CrossRef]

- Lee, J. Economic Insecurity and the Rise of Anti-Immigrant Sentiments: The Role of Labor Market Risks and Welfare Deservingness Perception. Polit. Stud. Rev. 2024, 22, 871–894. [Google Scholar] [CrossRef]

- Liu, J.; Nwagu, E.C.; Liu, R.; Wang, Q.; Debnath, G.C.; Bhowmik, R. Effect of Chinese Outward FDI on Youth Unemployment in Sub-Saharan Africa. PLoS ONE 2024, 19, e0305482. [Google Scholar] [CrossRef] [PubMed]

- Mckayla, M.; Kathryn, L.; Towne, S.D., Jr.; Beleri, V.; Park, C.; Ng, B.P. Lack of Prescription Drug Benefit Knowledge and Problems Paying Medical Bills among Medicare Beneficiaries. J. Eval. Clin. Pract. 2025, 31, e14290. [Google Scholar] [CrossRef]

| Variable or Parameter | Variable Definition |

|---|---|

| Output of sector a | |

| Factor inputs for production activities in sector a | |

| Non-factor intermediate inputs | |

| Intermediate input nec | |

| Output price of sector a | |

| Price of factor inputs | |

| Price of non-factor intermediate inputs | |

| Price of intermediate input nec | |

| Quantity of output supply from sector a domestically | |

| Export amount of output from sector a | |

| Domestic total demand for good c | |

| Import volume of commodity c | |

| Domestic production and domestic sales of commodity c | |

| EXR | Exchange rate |

| Price of commodity c | |

| Domestic price of output supply from sector a | |

| Export price of output from sector a | |

| Import price of commodity c | |

| Price of commodity c produced and sold domestically | |

| YH | Household income |

| QLS | Labor supply |

| Labor price | |

| QKS | Capital supply |

| Capital price | |

| Total consumption of commodity c by residents | |

| Total consumption of commodity c by the government | |

| Corporate income | |

| YG | Government revenue |

| EINV | Corporate investment |

| HSAV | Household savings |

| GSAV | Government savings |

| FSAV | Foreign savings |

| Investment in good c | |

| Pre-shock price of commodity c | |

| Pre-shock total consumption of commodity c by residents | |

| Scale parameter of the first-level nest | |

| Exponent parameter of the first-level nest | |

| Share parameter of the first-level nest | |

| Share parameter of the second-level nest | |

| Share parameter of the third-level nest | |

| Share parameter of the fourth-level nest | |

| Share parameter of the fifth-level nest | |

| Share parameter of the CET function | |

| Share parameter of the Armington aggregation function | |

| Input-output coefficient of the intermediate input module | |

| Production tax rate | |

| Import tariff on good c | |

| Export tariff on output from sector a | |

| Foreign price of output from sector a | |

| Foreign price of imported good c | |

| Government transfer payments to residents | |

| Proportion of capital income held by residents | |

| Proportion of capital income held by residents | |

| Marginal propensity to consume good c by residents | |

| Government’s marginal propensity to consume good c | |

| Personal income tax rate | |

| Corporate income tax rate | |

| Resident savings rate | |

| Government savings rate |

| Sector of SAM Table | Sector of Input–Output Table | Code |

|---|---|---|

| Distribution services for pharmaceuticals and other health products | Wholesale Trade | 51,105 |

| Retail Trade | 52,106 | |

| Leasing Services | 71,130 | |

| Pharmaceutical manufacturing | Pharmaceutical Manufacturing | 27,048 |

| Other Specialized Equipment | 35,074 | |

| Cultivation and harvesting of traditional Chinese medicinal materials | Agricultural Products | 1001 |

| Forestry Products | 2002 | |

| Livestock Products | 3003 | |

| Nonferrous Metal Mining and Dressing | 9009 |

| Sector 1 | 0.3 | 0.4 | 0.4 | 0.45 | 0.45 | 0.6 |

| Sector 2 | 0.3 | 0.4 | 0.4 | 0.45 | 0.45 | 0.6 |

| Sector 3 | 0.3 | 0.4 | 0.4 | 0.45 | 0.45 | 0.6 |

| Sector 4 | 0.3 | 0.4 | 0.4 | 0.45 | 0.45 | 0.6 |

| Sector 5 | 0.3 | 0.4 | 0.4 | 0.45 | 0.45 | 0.6 |

| Sector 6 | 0.3 | 0.4 | 0.4 | 0.45 | 0.45 | 0.6 |

| Scenario 1: 10% | Scenario 2: 20% | Scenario 3: 30% | Scenario 4: 40% | Scenario 5: 50% | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Output | Price | Output | Price | Output | Price | Output | Price | Output | Price | |

| Distribution services for pharmaceuticals and other health products | −4.20% | −10.00% | −5.47% | −20.00% | −7.32% | −30.00% | −9.23% | −40.00% | −2.35% | −50.00% |

| Pharmaceutical manufacturing | −1.95% | −0.09% | −1.68% | 0.98% | −3.73% | −1.45% | −1.98% | 3.85% | 1.01% | 0.33% |

| Cultivation and harvesting of traditional Chinese medicinal materials | −0.50% | −0.36% | −0.92% | −1.49% | −2.84% | 3.51% | −4.54% | −7.72% | −3.96% | −0.59% |

| Scenario 1: 10% | Scenario 2: 20% | Scenario 3: 30% | Scenario 4: 40% | Scenario 5: 50% | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Output | Price | Output | Price | Output | Price | Output | Price | Output | Price | |

| Primary industry | 0.14% | 0.00% | −0.22% | 0.02% | 0.06% | 0.00% | −0.33% | 0.07% | 0.23% | −0.01% |

| Secondary industry | −0.01% | 0.00% | 0.03% | 0.00% | −0.04% | 0.01% | 0.03% | −0.01% | −0.01% | 0.00% |

| Tertiary industry | 0.22% | −0.01% | 0.37% | −0.01% | 0.34% | −0.01% | 0.25% | 0.01% | −0.06% | 0.00% |

| Decline | Scenario 1: 10% | Scenario 2: 20% | Scenario 3: 30% | Scenario 4: 40% | Scenario 5: 50% |

|---|---|---|---|---|---|

| GDP | 0.0053% | 0.2082% | −0.1442% | −0.0626% | −0.0514% |

| Decline | Scenario 1: 10% | Scenario 2: 20% | Scenario 3: 30% | Scenario 4: 40% | Scenario 5: 50% |

|---|---|---|---|---|---|

| EV (billion CNY) | −0.42 | −132.43 | 3.48 | −42.76 | −76.582 |

| YH | 0.00% | −0.36% | 0.01% | −0.12% | −0.30% |

| YENT | 0.30% | 0.99% | 1.07% | 0.98% | 0.35% |

| YG | 0.06% | 0.30% | 0.25% | 0.32% | 0.17% |

| EINV | 0.30% | 0.99% | 1.06% | 0.97% | 0.35% |

| HSAV | 0.00% | −0.40% | −0.03% | −0.12% | −0.39% |

| GSAV | 0.06% | 0.39% | 0.26% | 0.25% | 0.62% |

| FSAV | −0.30% | 5.61% | −7.82% | −5.08% | −4.39% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tian, Y.; Sha, F.; Chi, H.; Ji, Z. The Impact of Drug Price Reduction on Healthcare System Sustainability: A CGE Analysis of China’s Centralized Volume-Based Procurement Policy. Sustainability 2025, 17, 7388. https://doi.org/10.3390/su17167388

Tian Y, Sha F, Chi H, Ji Z. The Impact of Drug Price Reduction on Healthcare System Sustainability: A CGE Analysis of China’s Centralized Volume-Based Procurement Policy. Sustainability. 2025; 17(16):7388. https://doi.org/10.3390/su17167388

Chicago/Turabian StyleTian, Yujia, Fei Sha, Haohui Chi, and Zheng Ji. 2025. "The Impact of Drug Price Reduction on Healthcare System Sustainability: A CGE Analysis of China’s Centralized Volume-Based Procurement Policy" Sustainability 17, no. 16: 7388. https://doi.org/10.3390/su17167388

APA StyleTian, Y., Sha, F., Chi, H., & Ji, Z. (2025). The Impact of Drug Price Reduction on Healthcare System Sustainability: A CGE Analysis of China’s Centralized Volume-Based Procurement Policy. Sustainability, 17(16), 7388. https://doi.org/10.3390/su17167388