Does Artificial Intelligence Promote Sustainable Growth of Exporting Firms?

Abstract

1. Introduction

2. Literature Review

2.1. On the Impact of Artificial Intelligence on Exporting Firms

2.2. On the Measurement of Enterprise Growth and Its Influencing Factors

2.3. Relevant Studies on AI and Exporters

2.4. Conclusion

3. Theoretical Mechanisms and Research Hypotheses

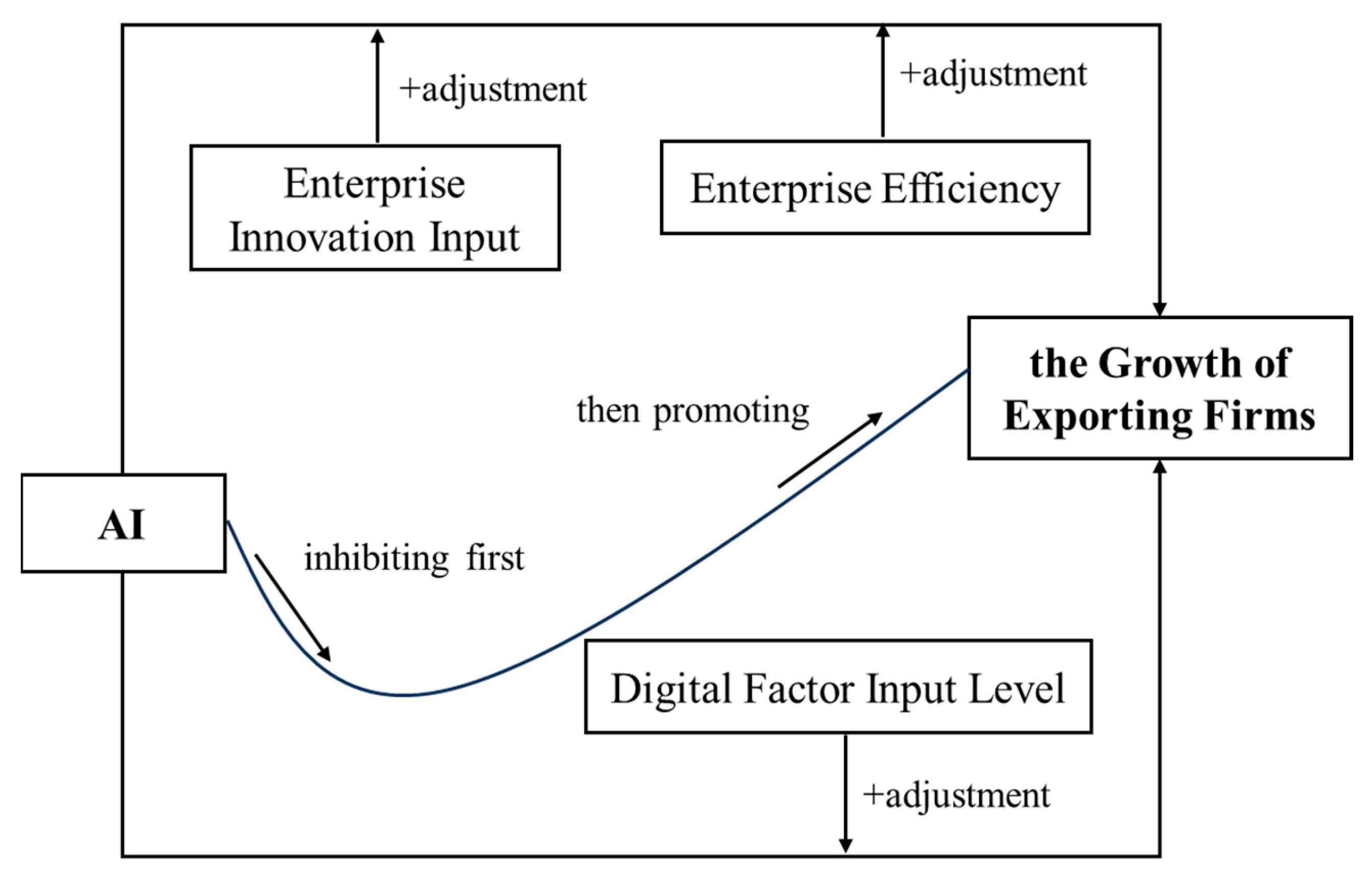

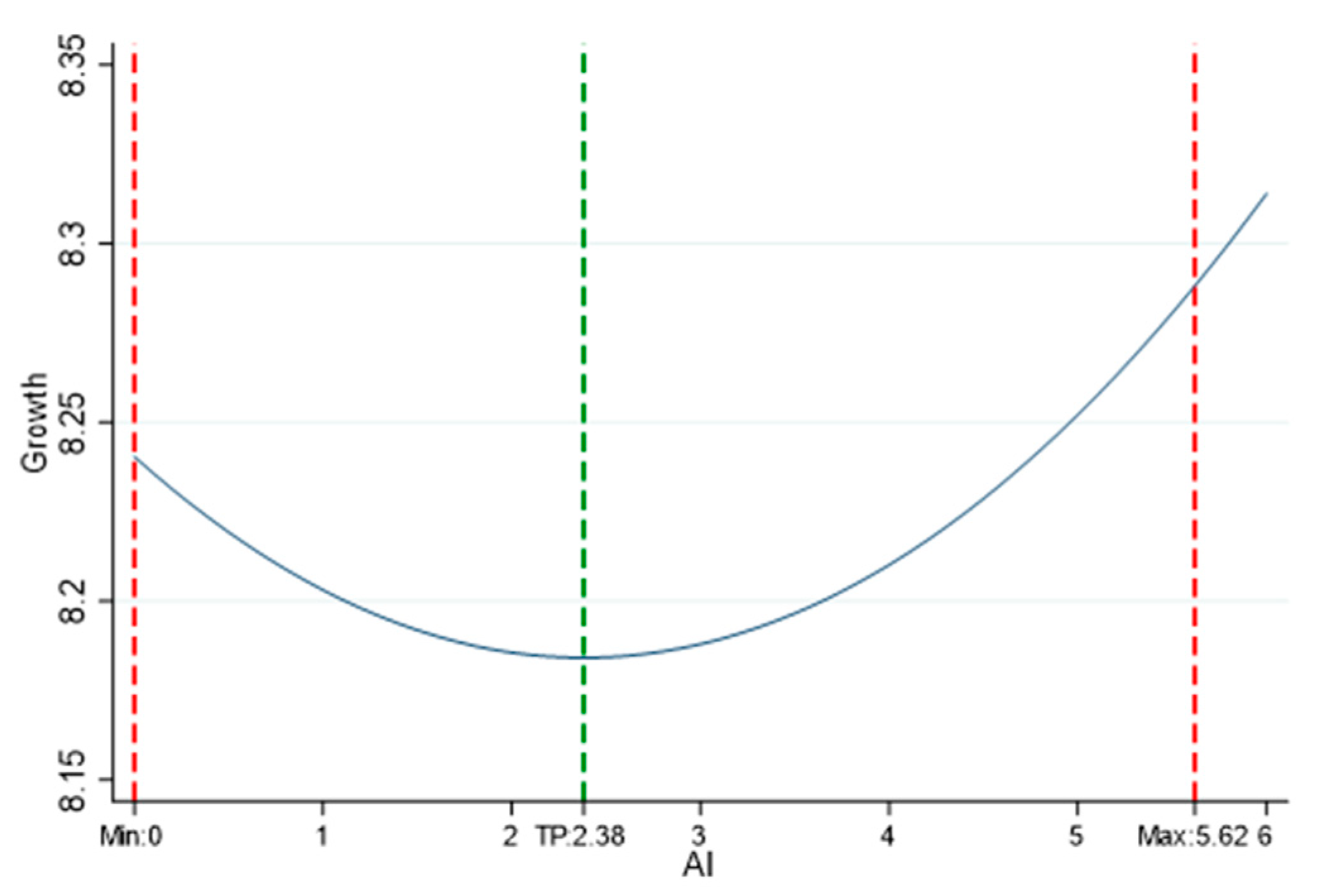

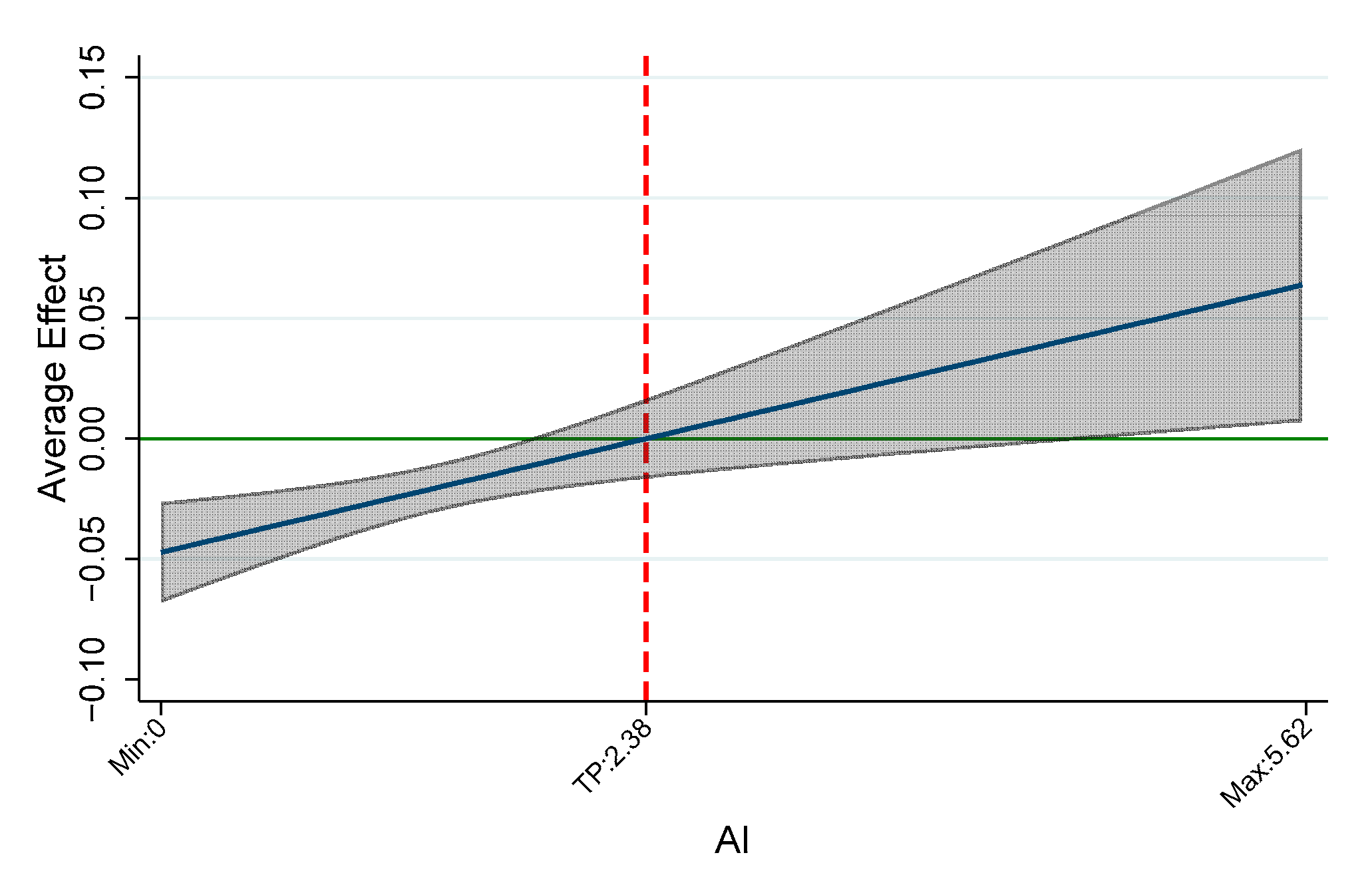

3.1. The Application of Artificial Intelligence Significantly Impacts the Growth of Export Enterprises Through Dynamic Changes

3.2. Enhancing the Mechanistic Effects of Artificial Intelligence Applications on Export Firm Growth

3.2.1. Improving the Efficiency of Enterprises Will Enhance the Positive Impact of AI on the Growth of Export Businesses

3.2.2. Improving the Level of Innovation in Exporting Firms Will Enhance the Positive Impact of AI on Firm Growth

3.2.3. The Dynamic Impact of Artificial Intelligence (AI) on Enterprise Growth Can Be Significantly Enhanced by Improving the Level of Digital Factor Inputs Within the Enterprise

4. Methodology

4.1. Model Construction

4.2. Variables and Data Sources

4.2.1. Explanatory Variables

4.2.2. Explained Variables

4.2.3. Control Variables

- Size: Measured by the logarithm of total assets. Larger firms benefit from economies of scale, enabling cost reduction, efficiency gains, and greater resource availability for technological innovation, which collectively enhance export performance.

- Profit: Represented by net profit, serving as an indicator of overall operational performance. More profitable firms tend to exhibit stronger market competitiveness, which supports firm growth.

- Age: Calculated as the logarithm of the number of years since establishment. Older firms often possess richer market experience and resource accumulation, allowing them to respond more effectively to market dynamics and improve their export capacity.

- Debt: Measured as debt per share, indicating financial leverage. Higher debt levels may impose financial constraints that negatively affect a firm’s ability to compete in international markets.

- Operating Expenses: Higher operating costs may signal business expansion, R&D investment, or efforts to increase market share. While such expenditures raise short-term costs, they may contribute to long-term development.

4.2.4. Data Source

5. Analysis of Regression Results

5.1. Benchmark Regression

5.2. Robustness Test

5.3. Heterogeneity Analysis

5.3.1. Nature of Enterprise Property Rights

5.3.2. Industry Technology Level

5.4. Regulatory Mechanism Analysis

6. Discussion

- AI has a nonlinear dynamic effect on the growth of export enterprises, with ‘inhibition first, then promotion’.

- In terms of the use of artificial intelligence on the nature of property rights and industry technology level, and other different types of export enterprise growth, there is significant heterogeneity. In non-state-owned enterprises and enterprises in medium- and low-technology industries, the application of AI demonstrates a significant “inhibit first, promote later” effect on the growth of export enterprises, while, in state-owned enterprises and enterprises in high-tech industries, the effect is not significant.

- The results of the mechanism test show that improving the efficiency of export enterprises, the level of innovation input, and the level of digital factor input are the three paths to enhance the dynamic effect of the application of AI technology on the growth of export enterprises in the “first inhibit, then promote” model so that export enterprises can better control export costs and optimize the allocation of resources and promote the innovation of export products and processes, as well as enhance international competitiveness. It enables export enterprises to better control export costs and optimize resource allocation, to promote export product and process innovation, and to enhance international competitiveness.

7. Implications

7.1. Implications for Theory

7.2. Implications for Practice

8. Recommendations

8.1. Make Full Use of the Opportunities for the Development of Artificial Intelligence: Phased Policy to Promote the Growth of Export Enterprises

8.2. Classification of Policies for the Heterogeneous Characteristics of Enterprises: Narrowing the Gap Between the Growth Level of Different Types of Export Enterprises

8.3. Multi-Dimensional Enhancement of the Independent Innovation Capacity of Enterprises: Improve the Efficiency of Export Enterprises, Increase the Input of Digital Elements, and Enhance the Effect of AI on the Growth of Enterprises to Promote the Role They Play

9. Limitations and Further Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Russell, S.; Norvig, P. Artificial Intelligence: A Modern Approach, 4th ed.; Pearson: London, UK, 2020. [Google Scholar]

- Ke, M.; Yang, S.Z.; Dai, X. Is artificial intelligence driving export upgrading of enterprises. Int. Trade Issues 2023, 49, 125–142. (In Chinese) [Google Scholar] [CrossRef]

- Capriglione, D.; Carissimo, C.; Milano, F.; Sardellitti, A.; Tari, L. Measurement and Applications: Artificial Intelligence in the Field of Measurement Applications. IEEE Instrum. Meas. Mag. 2024, 27, 29–36. [Google Scholar] [CrossRef]

- Dirican, C. The impacts of robotics, artificial intelligence on business and economics. Procedia-Soc. Behav. Sci. 2015, 195, 564–573. [Google Scholar] [CrossRef]

- Cheng, D. Analysis of the current situation and security risk of artificial intelligence application in the financial field. Age Financ. Sci. Technol. 2016, 25, 47–49. Available online: https://kns.cnki.net/kcms2/article/abstract?v=EFYi66xKwqpwsn180eFdBhKrjywgt4G5j42C0wBmIlFF0vUWZWF9xwTSdQQ9-xPyFbK_-VrMqRTfzcAi92hiSHggrHAbriyVT8nf-Gr-ejlPaSHi3QuB8OGxNAQHhCPhFLEi5gYPEo3Hz-hSWYOPrF4pfzITnRLsRgsqwe-tMIghWLqkg9gYkJmd2nDEbFut6sktOgv727E=&uniplatform=NZKPT (accessed on 18 October 2016). (In Chinese).

- Acemoglu, D.; Lelarge, C.; Restrepo, P. in Competing with robots: Firm-level evidence from France. AEA Pap. Proc. 2020, 110, 383–388. [Google Scholar] [CrossRef]

- Kulkov, I. The role of artificial intelligence in business transformation: A case of pharmaceutical companies. Technol. Soc. 2021, 66, 101629. [Google Scholar] [CrossRef]

- Li, J.; Ma, S.; Qu, Y.; Wang, J. The impact of artificial intelligence on firms’ energy and resource efficiency: Empirical evidence from China. Resour. Policy 2023, 82, 103507. [Google Scholar] [CrossRef]

- Chen, K.; Chen, X.; Wang, Z.; Zvarych, R. Does artificial intelligence promote common prosperity within enterprises?—Evidence from Chinese-listed companies in the service industry. Technol. Forecast. Soc. Change 2024, 200, 123180. [Google Scholar] [CrossRef]

- Han, F.; Mao, X. Artificial intelligence empowers enterprise innovation: Evidence from China’s industrial enterprises. Appl. Econ. 2024, 56, 7971–7986. [Google Scholar] [CrossRef]

- Shaik, A.S.; Alshibani, S.M.; Jain, G.; Gupta, B.; Mehrotra, A. Artificial intelligence (AI)-driven strategic business model innovations in small-and medium-sized enterprises. Insights on technological and strategic enablers for carbon neutral businesses. Bus. Strategy Environ. 2024, 33, 2731–2751. [Google Scholar] [CrossRef]

- Gao, Y.; Liu, Y.; Wu, W. How Does Artificial Intelligence Capability Affect Product Innovation in Manufacturing Enterprises? Evidence from China. Systems 2025, 13, 480. [Google Scholar] [CrossRef]

- Liu, J.; Chang, H.; Forrest, J.Y.; Yang, B. Influence of artificial intelligence on technological innovation: Evidence from the panel data of china’s manufacturing sectors. Technol. Forecast. Soc. 2020, 158, 120142. [Google Scholar] [CrossRef]

- Li, C.; Xu, Y.; Zheng, H.; Wang, Z.; Han, H.; Zeng, L. Artificial intelligence, resource reallocation, and corporate innovation efficiency: Evidence from China’s listed companies. Resour. Policy 2023, 81, 103324. [Google Scholar] [CrossRef]

- Turovets, J.; Vishnevskiy, K.; Altynov, A. How To Measure AI: Trends, Challenges and Implications; Higher School of Economics Research Paper No. WP BRP 116/STI/2020; Elsevier: Amsterdam, The Netherlands, 2020. [Google Scholar] [CrossRef]

- Wang, B.; Rau, P.P.; Yuan, T. Measuring user competence in using artificial intelligence: Validity and reliability of artificial intelligence literacy scale. Behav. Inform. Technol. 2023, 42, 1324–1337. [Google Scholar] [CrossRef]

- Giudici, P.; Centurelli, M.; Turchetta, S. Artificial Intelligence risk measurement. Expert Syst. Appl. 2024, 235, 121220. [Google Scholar] [CrossRef]

- Yao, J.Q.; Zhang, K.-P.; Guo, L.-P. How does artificial intelligence improve enterprise productivity? --Based on the perspective of labor skill restructuring. J. Manag. World 2024, 40, 101–116+133+117–122. (In Chinese) [Google Scholar] [CrossRef]

- Penrose, E.T. The Theory of the Growth of the Firm; Oxford University Press: Oxford, UK, 2009. [Google Scholar]

- Heshmati, A. On the growth of micro and small firms: Evidence from Sweden. Small Bus. Econ. 2001, 17, 213–228. [Google Scholar] [CrossRef]

- Morone, P.; Testa, G. Firms growth, size and innovation an investigation into the Italian manufacturing sector. Econ. Innov. New Technol. 2008, 17, 311–329. [Google Scholar] [CrossRef]

- Fang, F.; Cai, W. Banking competition and enterprise growth: Empirical evidence from industrial enterprises. J. Manag. World 2016, 7, 63–75. (In Chinese) [Google Scholar] [CrossRef]

- Snodgrass, D.R.; Winkler, J.P. Enterprise Growth Initiatives: Strategic Directions and Options; Development Alternatives Inc.: New Delhi, India, 2004; Available online: https://citeseerx.ist.psu.edu/document?repid=rep1&type=pdf&doi=14a95caf9852352ac2635e53eac412286e516277 (accessed on 28 February 2024).

- Dung, L.T.; Giang, H.T.T. The effect of international intrapreneurship on firm export performance with driving force of organizational factors. J. Bus. Ind. Mark. 2022, 37, 2185–2204. [Google Scholar] [CrossRef]

- Badghish, S.; Soomro, Y.A. Artificial intelligence adoption by SMEs to achieve sustainable business performance: Application of technology–organization–environment framework. Sustainability 2024, 16, 1864. [Google Scholar] [CrossRef]

- Li, M.; Wei, L. The path of digital transformation driving enterprise growth: The moderating role of financing constraints. Int. Rev. Financ. Anal. 2024, 96, 103536. [Google Scholar] [CrossRef]

- Charoenrat, T.; Amornkitvikai, Y. Factors affecting the export intensity of Chinese manufacturing firms. Glob. Bus. Rev. 2024, 25, 957–980. [Google Scholar] [CrossRef]

- Garcia-Martinez, L.J.; Kraus, S.; Breier, M.; Kallmuenzer, A. Untangling the relationship between small and medium-sized enterprises and growth: A review of extant literature. Int. Entrep. Manag. J. 2023, 19, 455–479. [Google Scholar] [CrossRef]

- Khan, M.A. Barriers constraining the growth of and potential solutions for emerging entrepreneurial SMEs. Asia Pac. J. Innov. Entrep. 2022, 16, 38–50. [Google Scholar] [CrossRef]

- Banerjee, B. Challenges and opportunities for micro, small, and medium enterprises: Navigating the business landscape. Am. J. Interdiscip. Innov. Res. 2023, 5, 13–17. [Google Scholar] [CrossRef]

- Soni, N.; Sharma, E.K.; Singh, N.; Kapoor, A. Impact of artificial intelligence on businesses: From research, innovation, market deployment to future shifts in business models. arXiv 2019, arXiv:1905.02092. [Google Scholar] [CrossRef]

- Gozen, S.; Gunes, P.; Karaca, M.F. Artificial Intelligence, Trade, and Firm Dynamics. Trade, and Firm Dynamics; Elsevier: Amsterdam, The Netherlands, 2024. [Google Scholar] [CrossRef]

- Xu, X.; Tian, C. Does artificial intelligence improve the quality of export products? Evidence from China. Appl. Econ. Lett. 2025, 32, 9–13. [Google Scholar] [CrossRef]

- Cao, Y.; Chen, S.; Tang, H. Robot adoption and firm export: Evidence from China. Technol. Forecast. Soc. 2025, 210, 123878. [Google Scholar] [CrossRef]

- Liu, J.; Qin, C.; Chu, X. Development of corporate artificial intelligence and the quality of export products. Financ. Res. Lett. 2025, 78, 107217. [Google Scholar] [CrossRef]

- Kumar, S.; Vandana; Kumar, V.; Chatterjee, S.; Mariani, M.; De Massis, A. The role of artificial intelligence capabilities in enhancing export performance: A study of ambidexterity and dynamic capabilities. Int. Mark. Rev. 2025. [Google Scholar] [CrossRef]

- Han, J. Schumpeter’s innovation theory from the perspective of modernity and its contemporary significance. J. Shenyang Univ. (Soc. Sci. Ed.) 2021, 23, 161–166. (In Chinese) [Google Scholar] [CrossRef]

- Chu, D.; Zhang, T. Independent R&D, technology introduction and the growth of high-tech industry. Res. Manag. 2013, 34, 53–60+113. (In Chinese) [Google Scholar] [CrossRef]

- Yang, X.; Feng, Z. Artificial Intelligence and GVC Embedding of Chinese Manufacturing Industry: Evidence from the Application of Industrial Robots. Res. Technol. Econ. Manag. 2024, 45, 153–158. Available online: https://kns.cnki.net/kcms2/article/abstract?v=iLvembebNjzChsqovNMK4HnhxAK8-wm95bManyLw0RwlZ4o5YN9Xg6wm0R-3tWV38PAaRqw2FR-U6TYtlGKtFEp854O29tf02-co2c320VqBOv_UTlsKQHS9v-K7ze8l1HbSAldG5OsYHlnyBWBZlxz5ioAtOgzY9s00QXhldX7HtVfjABKaZQ==&uniplatform=NZKPT&language=CHS (accessed on 28 February 2024). (In Chinese).

- Li, J.; Cai, W.; Wang, Y. A Review of Research on Enterprise Growth Theory. J. Xiangtan Univ. (Philos. Soc. Sci. Ed.) 2011, 35, 19–24. (In Chinese) [Google Scholar] [CrossRef]

- Yang, Z.; Chen, J.; Li, J. Global Value Chains in the Era of Digital Economy: Trends, Risks and Countermeasures. Front. Econ. China 2022, 17, 1–23. [Google Scholar] [CrossRef]

- Hausmann, R.; Hwang, J.; Rodrik, D. What You Export Matters. J. Econ. Growth 2007, 12, 1–25. [Google Scholar] [CrossRef]

- Zhang, A.; Yin, M. Technological innovation, demographics and export complexity of China’s manufacturing industry. Soft Sci. 2019, 33, 29–34. (In Chinese) [Google Scholar] [CrossRef]

- Gao, X.; Yuan, K. Cleaner Production Environment Regulation and Technology Complexity of Enterprise Export-Micro Evidence and Influencing Mechanisms. Int. Trade Issues 2020, 46, 93–109. (In Chinese) [Google Scholar] [CrossRef]

- Wang, J. Global value chain embedded position and digital transformation development of Chinese listed companies. Ind. Econ. Res. 2022, 21, 101–113+142. (In Chinese) [Google Scholar] [CrossRef]

- Song, M.; Zhou, P.; Si, H. Financial Technology and Enterprise Total Factor Productivity-Perspective of “Enabling” and Credit Rationing. China Ind. Econ. 2021, 39, 138–155. (In Chinese) [Google Scholar] [CrossRef]

- Aghion, P.; Jones, B.F.; Jones, C. Artificial Intelligence and Economic Growth; National Bureau of Economic Research: Cambridge, MA, USA, 2017; pp. 237–282. [Google Scholar] [CrossRef]

- Tao, F.; Zhu, P.; Qiu, C.; Wang, X. Research on the impact of digital technology innovation on enterprise market value. Res. Quant. Tech. Econ. 2023, 40, 68–91. (In Chinese) [Google Scholar] [CrossRef]

| Variables | Obs | Mean | Std.Dev. | Min | Max |

|---|---|---|---|---|---|

| Growth | 15,023 | 8.223 | 1.262 | 3.140 | 11.528 |

| AI | 15,023 | 0.618 | 1.007 | 0 | 5.620 |

| AI2 | 15,023 | 1.396 | 3.136 | 0 | 31.589 |

| Size | 15,023 | 22.070 | 1.256 | 16.161 | 27.547 |

| Profit | 15,023 | 0.044 | 0.225 | −3.110 | 5.571 |

| lnAge | 15,023 | 2.134 | 0.849 | 0 | 3.526 |

| Debt | 15,023 | 4.422 | 5.919 | −1.011 | 225.993 |

| Operate | 15,023 | 21.155 | 1.515 | 12.280 | 27.370 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Variables | Growth | Growth | Growth | Growth | Growth | Growth | Growth |

| AI | −0.959 *** | −0.041 *** | −0.046 *** | −0.046 *** | −0.046 *** | −0.045 *** | −0.047 *** |

| (0.026) | (0.011) | (0.011) | (0.011) | (0.011) | (0.011) | (0.011) | |

| AI2 | 0.318 *** | 0.012 *** | 0.010 *** | 0.010 *** | 0.010 *** | 0.010 *** | 0.010 *** |

| (0.008) | (0.003) | (0.003) | (0.003) | (0.003) | (0.003) | (0.003) | |

| Size | 0.077 *** | 0.074 *** | 0.067 *** | 0.074 *** | 0.023 ** | ||

| (0.007) | (0.007) | (0.007) | (0.008) | (0.010) | |||

| Profit | 0.047 ** | 0.056 ** | 0.060 *** | 0.050 ** | |||

| (0.023) | (0.023) | (0.023) | (0.023) | ||||

| lnAge | 0.076 *** | 0.075 *** | 0.062 *** | ||||

| (0.014) | (0.014) | (0.014) | |||||

| Debt | −0.002 ** | −0.002 ** | |||||

| (0.001) | (0.001) | ||||||

| Operate | 0.060 *** | ||||||

| (0.008) | |||||||

| Constant | 8.374 *** | 8.234 *** | 6.543 *** | 6.589 *** | 6.573 *** | 6.427 *** | 6.315 *** |

| (0.012) | (0.004) | (0.146) | (0.148) | (0.148) | (0.162) | (0.162) | |

| Observations | 15,081 | 15,024 | 15,023 | 15,023 | 15,023 | 15,023 | 15,023 |

| R-squared | 0.086 | 0.940 | 0.941 | 0.941 | 0.941 | 0.941 | 0.941 |

| IDfix | NO | YES | YES | YES | YES | YES | YES |

| Yearfix | NO | YES | YES | YES | YES | YES | YES |

| Industryfix | NO | YES | YES | YES | YES | YES | YES |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | Growth | Growth | Growth | Growth | Growth |

| L. Growth | 0.635 *** | ||||

| (14.16) | |||||

| AI | −0.047 *** | −0.045 *** | −0.047 *** | −0.004 *** | −0.131 *** |

| (0.011) | (0.010) | (0.012) | (0.001) | (−2.88) | |

| AI2 | 0.010 *** | 0.009 *** | 0.010 *** | 0.001 * | 0.047 *** |

| (0.003) | (0.003) | (0.004) | (0.000) | (3.46) | |

| Size | 0.027 *** | 0.024 ** | 0.015 | 0.003 ** | 0.186 |

| (0.010) | (0.010) | (0.011) | (0.002) | (0.79) | |

| Profit | 0.049 ** | 0.050 ** | 0.159 *** | 0.007 | 0.154 * |

| (0.023) | (0.023) | (0.031) | (0.004) | (1.66) | |

| lnAge | 0.064 *** | 0.063 *** | 0.068 *** | 0.006 *** | 0.001 |

| (0.014) | (0.014) | (0.016) | (0.002) | (0.02) | |

| Debt | −0.002 ** | −0.002 ** | −0.002 | −0.000 * | −0.093 *** |

| (0.001) | (0.001) | (0.001) | (0.000) | (−3.50) | |

| Operate | 0.057 *** | 0.060 *** | 0.061 *** | 0.007 *** | 0.084 |

| (0.008) | (0.008) | (0.009) | (0.001) | (0.58) | |

| Constant | 6.293 *** | 6.309 *** | 6.440 *** | 1.880 *** | −2.941 |

| (0.162) | (0.162) | (0.176) | (0.025) | (−1.22) | |

| Observations | 15,023 | 15,023 | 10,526 | 15,023 | 12,761 |

| R-squared | 0.941 | 0.941 | 0.959 | ||

| IDfix | YES | YES | YES | YES | YES |

| Yearfix | YES | YES | YES | YES | YES |

| Industryfix | YES | YES | YES | YES | YES |

| AR(1) | −6.53 [0.000] | ||||

| AR(2) | 0.80 [0.423] | ||||

| Sargan | 1.29 [0.732] | ||||

| Hansen | 4.12 [0.249] |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| SOEs | NSOEs | High-Tech | Midium-Tech | Low-Tech | |

| Variables | Growth | Growth | Growth | Growth | Growth |

| AI | 0.012 | −0.049 *** | −0.014 | −0.047 *** | −0.079 * |

| (0.061) | (0.011) | (0.014) | (0.014) | (0.043) | |

| AI2 | 0.007 | 0.010 *** | 0.001 | 0.017 *** | 0.052 *** |

| (0.023) | (0.003) | (0.004) | (0.005) | (0.018) | |

| Size | −0.038 | 0.029 *** | −0.019 | 0.074 *** | −0.146 *** |

| (0.055) | (0.011) | (0.016) | (0.012) | (0.032) | |

| Profit | 0.349 *** | 0.041 * | 0.018 | −0.082 *** | 0.213 *** |

| (0.103) | (0.024) | (0.038) | (0.027) | (0.054) | |

| lnAge | 0.299 *** | 0.057 *** | 0.006 | 0.008 | 0.257 *** |

| (0.096) | (0.015) | (0.022) | (0.016) | (0.045) | |

| Debt | −0.001 | −0.002 ** | 0.003 ** | −0.005 *** | −0.001 |

| (0.005) | (0.001) | (0.001) | (0.001) | (0.002) | |

| Operate | 0.143 *** | 0.051 *** | 0.074 *** | 0.056 *** | 0.129 *** |

| (0.041) | (0.009) | (0.013) | (0.010) | (0.025) | |

| Constant | 5.225 *** | 6.395 *** | 6.550 *** | 5.988 *** | 7.856 *** |

| (0.907) | (0.173) | (0.245) | (0.196) | (0.528) | |

| Observations | 1232 | 12,865 | 6321 | 6507 | 2159 |

| R-squared | 0.933 | 0.947 | 0.861 | 0.975 | 0.923 |

| IDfix | YES | YES | YES | YES | YES |

| Yearfix | YES | YES | YES | YES | YES |

| Industryfix | YES | YES | YES | YES | YES |

| (1) | (2) | (3) | |

|---|---|---|---|

| Profitability | RDPersonRatio | Digital | |

| Variables | Growth | Growth | Growth |

| AI | −0.044 *** | −0.020 | −0.058 *** |

| (0.012) | (0.017) | (0.012) | |

| AI2 | 0.008 ** | 0.011 * | 0.013 *** |

| (0.004) | (0.006) | (0.004) | |

| Moderator | 0.005 | 0.004 *** | 0.005 ** |

| (0.003) | (0.001) | (0.003) | |

| AI Moderator | −0.048 ** | −0.003 *** | −0.003 ** |

| (0.024) | (0.001) | (0.002) | |

| AI2 × Moderator | 0.018 ** | 0.001 * | 0.000 * |

| (0.009) | (0.000) | (0.000) | |

| Size | 0.025 ** | 0.025 ** | 0.025 ** |

| (0.011) | (0.011) | (0.011) | |

| Profit | 0.064 ** | 0.046 * | 0.046 |

| (0.026) | (0.025) | (0.029) | |

| lnAge | 0.063 *** | 0.062 *** | 0.054 *** |

| (0.015) | (0.015) | (0.015) | |

| Debt | −0.003 ** | −0.003 ** | −0.003 *** |

| (0.001) | (0.001) | (0.001) | |

| Operate | 0.056 *** | 0.058 *** | 0.064 *** |

| (0.009) | (0.009) | (0.009) | |

| Constant | 6.355 *** | 6.320 *** | 6.218 *** |

| (0.178) | (0.173) | (0.178) | |

| Observations | 13,538 | 13,232 | 13,357 |

| R-squared | 0.943 | 0.943 | 0.943 |

| IDfix | YES | YES | YES |

| Yearfix | YES | YES | YES |

| Industryfix | YES | YES | YES |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, X.; Wu, Y.; Long, Y. Does Artificial Intelligence Promote Sustainable Growth of Exporting Firms? Sustainability 2025, 17, 7273. https://doi.org/10.3390/su17167273

Chen X, Wu Y, Long Y. Does Artificial Intelligence Promote Sustainable Growth of Exporting Firms? Sustainability. 2025; 17(16):7273. https://doi.org/10.3390/su17167273

Chicago/Turabian StyleChen, Xiulian, Yanan Wu, and Yangyang Long. 2025. "Does Artificial Intelligence Promote Sustainable Growth of Exporting Firms?" Sustainability 17, no. 16: 7273. https://doi.org/10.3390/su17167273

APA StyleChen, X., Wu, Y., & Long, Y. (2025). Does Artificial Intelligence Promote Sustainable Growth of Exporting Firms? Sustainability, 17(16), 7273. https://doi.org/10.3390/su17167273