1. Introduction

Global warming caused by CO

2 has become an urgent issue to address. In response, countries worldwide have established carbon neutrality and carbon reduction targets to mitigate the environmental impacts of climate change. Carbon capture, utilization, and storage (CCUS) projects have significant potential in reducing carbon emissions and achieving carbon neutrality, potentially making substantial contributions to global energy and climate goals in various ways [

1,

2].

Currently, the adoption of clean energy concepts and CCUS technologies is accelerating the transition from fossil fuel-based traditional energy systems toward sustainable, low-carbon alternatives [

3]. For example, microalgae utilize photosynthesis to sequester the CO

2 emitted from the combustion of fossil fuels, offering a low-carbon pathway. The carbon-sequestered microalgae can be reused as organic resources, significantly improving the overall integrated benefits. Modern approaches to microalgae-based carbon sequestration increasingly incorporate intelligent control systems and electrical sensing technologies to optimize carbon fixation. These systems operate across three key stages: (1) capturing and transferring light energy, (2) concentrating inorganic carbon, and (3) converting CO

2 into organic carbon through photosynthetic metabolism, as illustrated in

Figure 1. Moreover, this technology supports the development of a circular economy. It plays a vital role in advancing zero-waste urban initiatives. It has far-reaching implications for urban sustainability, resource efficiency, and integrated waste management strategies [

4].

Until now, numerous studies on microalgae carbon sequestration have been conducted worldwide. For instance, Rahman, F.A. et al. [

5] suggest that microalgae can actively absorb CO

2 from exhaust gases, perform photosynthesis, and self-reproduce. To enhance the carbon sequestration capacity of microalgae cultivated with industrial flue gas, Rao, M. et al. [

6] conducted a comprehensive study on the combined effects of different CO

2 concentrations and light intensities on microalgae growth and carbon fixation. After determining the optimal CO

2 concentration for cultivating microalgae biomass with industrial flue gas, Feng, L. et al. [

7] studied the combination of nitrogen, phosphorus, and CO

2 concentrations to enhance carbon sequestration capacity and biomass yield. To eliminate the influence of sunlight in greenhouses and reduce the construction costs of CO

2 fixation for commercial microalgae cultivation, Cheng, J. et al. [

8] designed a wind-resistant, columnar photobioreactor capable of withstanding typhoons with wind speeds of up to 40 m/s, for outdoor microalgae growth. In addition, Bravo-Fritz, C.P. et al. [

9] conducted a study in Chile on the site selection for industrial-scale microalgae cultivation using flue gas. Although extensive research has been carried out, covering topics such as species selection, enhancing conversion efficiency, and forecasting development trends, most studies have focused only on the technological aspects. Relatively few have addressed the investment decision-making processes associated with microalgae carbon sequestration projects.

Currently, only a limited number of microalgae carbon sequestration projects have been implemented worldwide, and most are still in the early stages of development with a slow commercialization pace. This is likely due to various risks that arise during the construction, operation, and maintenance phases, which investors and project stakeholders must carefully address. However, evaluating risks in microalgae carbon sequestration projects is particularly challenging due to the involvement of multiple complex factors, such as significant capital investments, high technical requirements, market instability, and incomplete or uncertain information. These elements contribute to a high degree of uncertainty and ambiguity.

A robust risk assessment framework not only enhances investor confidence but also facilitates the large-scale commercialization of such projects. By identifying and addressing potential risks early, such assessments can help optimize management practices and ensure the smooth and orderly progression of each project phase [

10]. Recognizing the importance of investment risk analysis in supporting investors and decision-makers, this study aims to carry out a comprehensive risk assessment of microalgae carbon sequestration projects. The goal is to develop a practical and well-structured risk evaluation framework, supported by scientific methods, to guide risk management and provide clear response strategies.

The main contributions of this work include the following: (1) an expert committee that can develop a comprehensive risk indicator system was assembled from prior research findings and practical case studies from both microalgae carbon sequestration and broader CCUS projects; (2) the RANking COMparison (RANCOM) method mitigates subjectivity from expert judgment, enabling a more rational and reliable calculation of indicator weights; and (3) expert evaluations are combined using the Fuzzy Induced Ordered Weighted Harmonic Average (FIOWHA) operator to maximize the utilization of the existing evaluation. The overall risk level is then determined using a fuzzy comprehensive evaluation method along with a similarity measurement. Based on the results, appropriate risk mitigation strategies are proposed.

2. Methodologies and Literature Review

2.1. Fuzzy Set

The multicriteria decision-making (MCDM) process is usually employed for investment decision-making of microalgae carbon sequestration projects. However, the complexity of these scenarios and the inherent uncertainty in human judgment make it challenging to express decision-makers’ preferences using simple numerical values from MCDM.

To address this limitation, Torra, V. [

11] introduced the concept of hesitant fuzzy sets, allowing uncertainty modeling when decision-makers hesitate between several possible values. While effective for handling quantitative ambiguity, these sets are limited in capturing the nuanced linguistic expressions commonly used in real-world decision-making, especially when evaluating diverse indicators, alternatives, and variables.

Rodriguez et al. [

12] proposed the use of hesitant fuzzy linguistic term sets (HFLTS) to overcome the above issues, though expanding the expressive power of decision-making tools by enabling experts to provide evaluations using flexible linguistic terms instead of strict numerical inputs, thereby improving the realism and accuracy of complex decision analyses.

Additionally, fuzzy numbers have been introduced to support the use of linguistic terms in calculations. Unlike a single precise value, a fuzzy number represents a range of possible values, each associated with a degree of certainty expressed by a membership function, which assigns values between 0 and 1. Until now, various types of fuzzy numbers have been developed [

10]. A helpful example is the trapezoidal fuzzy number (TrFNs), introduced by Zadeh [

13], defining four parameters, a, b, c, and d, that form a trapezoidal shape for modeling uncertainty in complex decision-making environments.

Xu, H. et al. [

14] confirmed the positive role of combining HFLTS and TrFNs in capturing uncertainty and hesitation in expert evaluations, particularly in service quality assessments. HFLTS enables experts to express a variety of possible linguistic terms to accommodate hesitation, while TrFNs models imprecise numerical boundaries. This integration enhances the flexibility, realism, and robustness of risk assessment, making it suitable for complex and uncertain decision-making scenarios, such as microalgae carbon sequestration projects. Therefore, this study adopts the HFLTS-TrFNs framework to more effectively capture and analyze the multifaceted risks and uncertainties inherent in this emerging technology.

2.2. RANking COMparison (RANCOM) and Centroidous Method

Determining the weights of evaluation criteria is critical in microalgae carbon sequestration projects. Traditional MCDM methods, such as the Analytic Hierarchy Process (AHP) [

15] and the Best–Worst Method (BWM) [

16], often fall short in accurately capturing the full scope of subjective expert judgments. Więckowski et al. [

17] found that integrating the RANCOM with TrFNs significantly improves the handling of uncertainty and enhances the accuracy of results. In recent years, RANCOM in combination with other fuzzy techniques has been applied in various contexts, including consumer preference modeling [

18] and offshore wind site selection [

19]. Building on this foundation, the present study adopts RANCOM to calculate the subjective weights of criteria, ensuring a more nuanced and reliable reflection of expert opinions.

While expert opinions are essential, the RANCOM method tends to rely heavily on subjectivity. To address this limitation, the centroidous method, proposed by Vinogradova-Zinkevič et al. [

20], offers a more objective approach by estimating criterion weights based on data distribution. This method evaluates the importance of each criterion based on its position relative to the central point (centroid) of the entire set of criteria. First, experts divide the requirements into subgroups based on their meaning and context. Then, the method groups them into smaller, meaningful clusters by analyzing how the criteria are distributed, such as their proximity to one another or their density of clustering. This spatial analysis helps identify patterns in how criteria relate to each other and provides a more objective basis for assigning weights. As a result, it improves the accuracy and consistency of the final weight distribution.

In addition, to ensure accuracy of attribute weight assessment from experts with varying backgrounds, it is essential to incorporate a strategy that differentiates the trustworthiness of each expert. Fuchao et al. [

21] proposed a method that evaluates the reliability of individual experts and summarizes their judgments by factoring in both their reliability scores and assigned weights. Building on this concept, Zhang Zhigang et al. [

22] further improved the expert credibility model by introducing similarity measures. This modification offers a more balanced and data-driven approach to weight determination.

Therefore, this paper adopts the RANCOM and centroid method integrated with TrFNs, which incorporates the expert credibility model, to determine the criterion weights for the microalgae carbon sequestration project.

2.3. Fuzzy Comprehensive Evaluation Method (FCE)

To overcome the limitations of methods, such as VIKOR [

23], ELECTRE [

24], and TOPSIS [

25], in a single-objective scenario, this study employed the FCE method. FCE is used to assess uncertain risk variables by evaluating their intensity, potential effects, and overall severity [

26].

3. Development of a Risk Evaluation Framework for the Microalgae Carbon Sequestration Project and Its Risk Identification

Identifying and analyzing risk factors is the core component of risk assessment. Due to the limited research specifically focusing on microalgae carbon sequestration projects, this study draws on a broad body of literature from both microalgae technologies and CCUS projects to compile relevant risk factors.

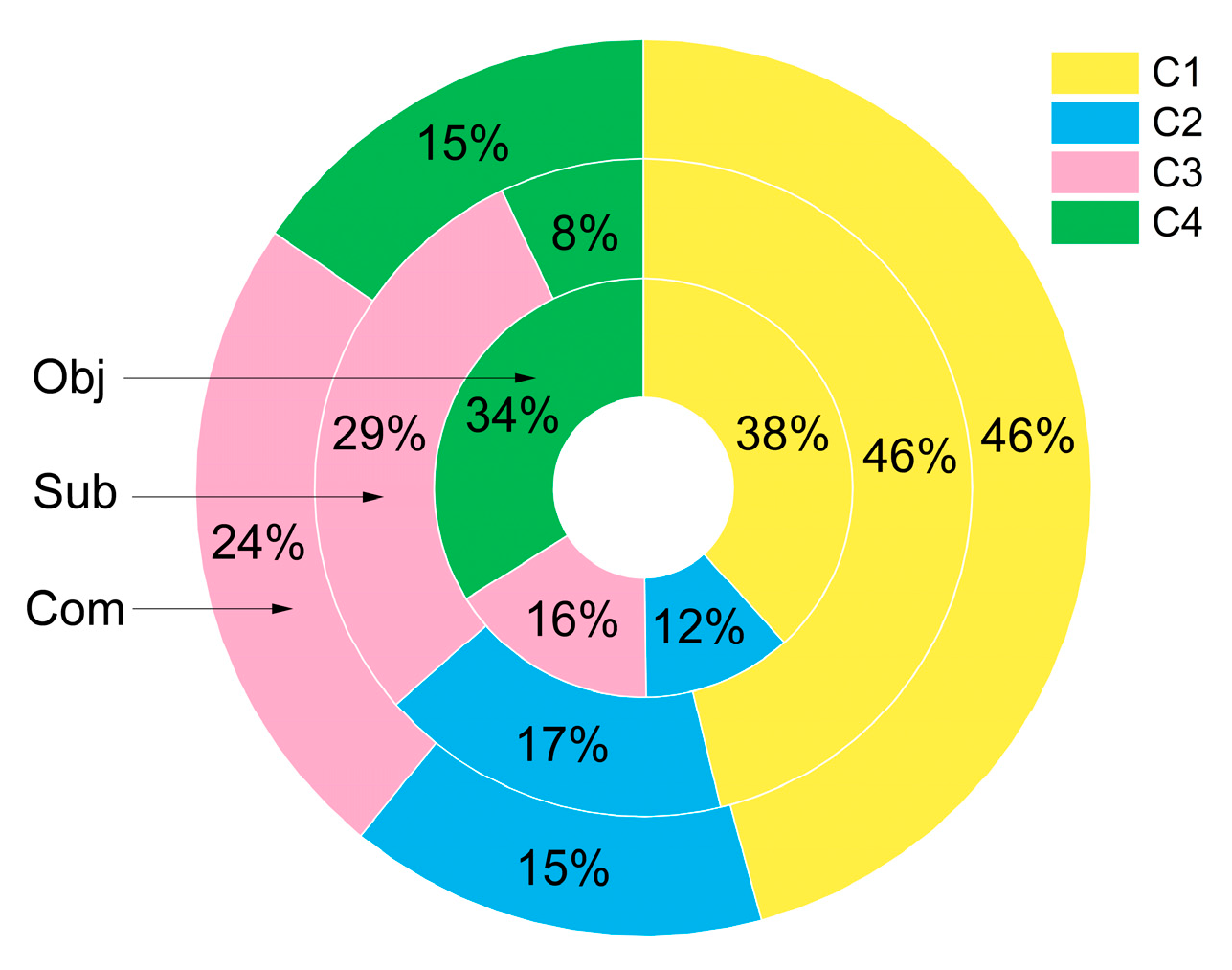

To ensure the validity of the risk identification process, an expert committee was formed, consisting of four professionals with extensive experience in microalgae carbon sequestration and related fields. Each expert has a background in one of the following domains: algae economics, technology, society, or environment, and has over 10 years of experience in the algae sector. Their combined expertise ensures a scientifically grounded and systematic evaluation of the identified risks (see

Table 1). The committee reviewed, screened, and categorized a wide range of risk indicators based on their frequency and weighting in prior studies. Through iterative discussions, the committee finalized a risk criteria system that focuses on microalgae carbon sequestration projects, identifying 15 key risk factors and grouping them into four categories: economic, technical, market, and environmental (

Figure 2).

Following this, the study proceeds to calculate the weights of the 15 risk factors. The weighted results are then used in an FCE to assess the overall risk level of the project and to provide strategic insights for project managers and decision-makers.

3.1. Economic Risk (C1)

Initial Investment (C1) [

27]: The construction of a microalgae cultivation plant requires significant capital expenditures for equipment such as centrifuges and homogenizers (for algae dewatering and collection), water supply pipelines, photobioreactors, meteorological monitoring systems, flow regulation devices, lighting, motors, and flue gas purification units. The need for such specialized infrastructure substantially increases the financial burden of the project’s initial investment.

Operational and Maintenance Costs (C12) [

28]: Algae cultivation systems involve numerous and diverse types of equipment, necessitating substantial financial investment in their operation and upkeep. These costs include energy consumption, routine maintenance, equipment repairs, and technological upgrades, all of which contribute to elevated operational and maintenance expenses.

Economic Issues of Technology Introduction (C13) [

29,

30]: As the project progresses, resolving technical challenges may require the adoption of advanced technologies, which often come with high implementation costs and pose significant financial burdens.

Payback Period (C14) [

31]: The duration required to recover the initial investment in a microalgae carbon sequestration project remains uncertain, making it difficult to predict when financial returns will be realized.

3.2. Technological Risk (C2)

Site Selection and Planning Risk (C21) [

32,

33]: The recommended location for the microalgae cultivation facility, whether near or far from the power plant, may affect local wildlife habitats and pose challenges related to overexpansion and potential land contamination.

Technology Underdeveloped (C22) [

34,

35]: The microalgae production process involves several critical components, such as flue gas treatment, photobioreactor setup, and efficient harvesting. Inadequate or improper operation of these elements can impede optimal production efficiency and maximum yield.

Technical Personnel (C23) [

36]: Refers to the qualifications, technical competence, and commitment of the personnel responsible for managing the microalgae carbon sequestration processes.

3.3. Market Risk (C3)

Market Demand (C31) [

37]: Insufficient market demand or market fluctuations may result in microalgae-derived products failing to meet commercial expectations, thereby hindering the achievement of project goals and increasing investment risk.

Market Price Fluctuations (C32) [

37]: The project relies on various raw materials and consumes resources such as electricity and water during operation. Fluctuations in the prices of these inputs can significantly affect project costs and economic viability.

Policies and Regulations (C33) [

38]: The economic feasibility of the algal bioeconomy largely depends on government support, including subsidies, national strategies, demonstration projects, tax incentives, and regulatory frameworks. Changes in policy can influence the project’s profitability and long-term sustainability.

Public Acceptance (C34) [

37,

39]: Public acceptance of algae-based carbon sequestration is generally high, particularly when the process is transparent and its environmental benefits are well-communicated.

3.4. Environmental Risks (C4)

Ecosystem Risks (C41) [

40,

41]: Incomplete algae harvesting can result in unintended ecological consequences, such as algal overgrowth and the risk of biological invasions.

Pollutant emissions Risks (C42) [

42]: Wastewater generated during the process may contain fertilizers for algae growth, disinfectants for system maintenance, and flocculants used in biomass harvesting. If leaks occur, these substances could pose environmental and health risks.

Water Security Risks (C43) [

42] Microalgal production relies heavily on freshwater resources. Photobioreactors may consume 95–273 L of water per day, raising concerns about excessive water use, potential depletion of local water supplies, and insufficient groundwater recharge.

Disease Transmission Risks (C44) [

36]: Photobioreactor leaks or ruptures—caused by natural disasters, material degradation, or human error—can expose microalgal cultures to the environment. Mosquitoes attracted to surface biomass may act as vectors for diseases like malaria, posing additional public health concerns.

4. Risk Assessment Framework for Microalgae Carbon Sequestration Projects

To assess the risks associated with microalgae carbon sequestration projects, this section establishes a practical, standardized, and targeted risk assessment framework. The risk assessment flowchart is illustrated in

Figure 3.

4.1. Identifying the Set of HFLTS

When experts consider multiple linguistic terms simultaneously, they may struggle to express their knowledge through a single term. HFLTS enables experts to provide more natural evaluations when they are unsure which linguistic term best represents their judgment. The basic operations of HFLTS are as follows [

12]:

Step 1: Determining the semantics of the evaluation linguistic set. Defining

, where

S is a collection of linguistic terms. HFLTS, denoted by

, consists of a finite and ordered subset extracted from the continuous elements of

S.

Table 2 illustrates the mapping between linguistic variables and the categorized linguistic term set, which was organized according to their investment risk levels.

Step 2: To assess the project’s investment risks, specialists with relevant expertise are invited to conduct evaluations, leveraging structured criteria and appropriate data sources.

Step 3: Developing linguistic expressions linked to HFLTS. To express the evaluation results derived from the HFLTS technique, a function is applied, serving as a context-free grammar. The structure

is outlined as follows:

Then, the linguistic expressions

ll produced by

are transformed into HFLTS using the transformation function

. Let

be a function that transforms linguistic expressions

ll obtained by

into HFLTS

, where

S is the linguistic term set used by

:

The linguistic expressions that are generated by using the production rules will be transformed into HFLTS in different ways according to their meaning:

4.2. Transform the HFLTS into the TrFNs

To better represent experts’ incomplete knowledge in decision-making, TrFNs are incorporated into the risk assessment model [

14].

Step 1: Establishing the correlations between HFLTS and TrFNs, listed in

Table 3.

Step 2: A fuzzy number

in the set of real numbers R is given by the following:

where

and

are any two TrFNs.

Step 3: Let

be an HFLTS provided by an expert group towards a risk factor. Suppose that

and

are two different linguistic terms, both belonging to the same set of linguistic terms. Moreover,

I is the total number of levels. Based on this statement, the HFLTS can be transformed into TrFNs as follows [

43]:

4.3. Determining Expert Weights

The consideration of each expert’s level of credibility is crucial to improve the reliability of weight assessments. Fuzzy numbers are incorporated into the conversion from qualitative assessments to quantifiable values. Similarity scores increase when experts reach more consistent opinions, meaning their overall trustworthiness is enhanced. The following sections outline the expert credibility model and explain the calculation process in detail [

22].

Considering as a collection of experts. Each expert, El, assigns a weight corresponding to a criterion . The weight value assigned to the jth criteria, , is calculated through the total sum of all weights, shown as .

Step 1: Expert’s weight evaluation matrix

D is constructed:

Step 2: Constructing a ranking comparison matrix. Considering Y as the matrix of sorted values, where the weights provided by expert

El are organized into

, and

represents the weight for the

jth criteria from expert

El. The matrix for the weights of the criteria can be expressed as follows:

Step 3: The variation in the weight values and the difference in the rankings,

El and

Ek, can be quantified by determining the distance between the attribute values, which is expressed as follows:

The discrepancy in the scores is calculated by summing up the differences between expert

El and all other experts. The corresponding deviation value,

α0l, is defined as follows:

In the same way, the formula for calculating the “sorting deviation”

β0l is as follows:

Step 4: Calculating the final expert credibility. There is an inverse relationship between the degree of discrepancy in scores or rankings and the expert’s credibility—greater inconsistencies result in lower trustworthiness. The parameters

λ0l and

ω0l are positively related to the credibility level:

In light of this relationship, the credibility attributed to expert

El can be defined as follows:

where

p stands for the importance placed by the organizer on the outcome, and

q reflects the weight given to the rankings, where

,

,

. The values of

p and

q are derived from the degree of emphasis the decision-maker places on these two factors. By default, a value of 0.5 is assigned to them, indicating that both factors are considered equally important.

4.4. Aggregation of Expert Evaluation Information Based on the FIOWHA Operator

The risk assessment of the microalgae carbon sequestration project studied in this paper is a group decision-making problem, where a group of experts provides individual evaluation criteria for a specific risk factor. The Fuzzy Induced Ordered Weighted Harmonic Average Operator (FIOWHA) based on TrFNs is employed to aggregate expert opinions. The following sections present the basic concepts and steps.

Let

be a set of TrFN that need to be aggregated. The FIOWHA operator is defined as follows [

44]:

where

, and

represents a weight vector linked to the FIOWHA operator, which fulfills the required conditions.

and

.

represents the second vector

within

of the

ith largest element in

that ranks from the largest to the smallest. The first vector

in

is defined as the order induced vector.

4.5. Determine the Criteria Weights

4.5.1. Determination of the Subjective Criterion Weights Based on RANCOM

RANCOM, which is based on experts’ subjective knowledge and the evaluation of the correlation between criteria, is used to analyze experts’ subjective criterion weights. Compared with AHP, RANCOM better addresses the issue of the expert’s uncertainty. This method requires establishing a standard ranking, and the resulting weight vector must satisfy the condition that its elements sum to 1. The following sections provide the basic concepts and steps.

Step 1: Calculating the metric scores. The following formula was used to calculate the deblurring score for each TrFN:

Step 2: The expert committee evaluated and identified the relative priority among the criteria.

Step 3: Pairwise evaluations were performed to construct the comparison matrix for identifying the ranking of the expert’s score. The Maximum Average Consistency (

MAC) is determined through expert pairwise comparisons, with the results finalized as

. The matrix can be represented as

MAC as follows [

16]:

where

n represents the number of criteria considered in the problem.

Step 4: Based on this, the

matrix can be represented as follows:

where is the

significance function of the criterion

.

Step 5: Based on the obtained

MAC, the weight of the standard level vector (

SCW) is calculated as follows:

Step 6: Determining subjective weights by comparing the priority values of each criterion:

4.5.2. Calculation Method for the Objective Criterion Weights Based on the Centroidous Method

Step 1: Considering the data array

ij that describes a set of criteria

(

),

j . The data is normalized as follows:

Step 2: Calculating the distance from each criterion to the group center. We calculate the centroid of a set of individual criteria

n from the normalized data array

. The centroid of the set is the vector

of m elements, which is calculated as the average value of the corresponding criterion

i across all

j columns of the matrix

, as shown below:

The following equation is utilized to compute the Euclidean distance between the center of the set and each criterion:

Step 3: Calculating relative distance weight. For risk assessment, the greater the distance to the center of the group, the higher the risk, and thus the greater the criterion weight, as shown below:

Step 4: The weights of the criteria are determined by applying the formula provided below:

4.5.3. Determination of the Comprehensive Weights

The multiplicative normalization method yields the comprehensive criterion weight, which is shown as follows:

4.6. Aggregation of TrFNs Based on the Fuzzy Comprehensive Evaluation Method

In response to the multicriteria uncertainty fuzzy problems involving expert subjective judgment in the risk assessment of the microalgae carbon sequestration project, this paper adopts the fuzzy comprehensive evaluation method to aggregate the trapezoidal fuzzy numbers of each criterion, thereby obtaining the overall risk level of the project. The fuzzy comprehensive evaluation process is divided into three stages.

Step 1: The TrFNs of all secondary criteria under each primary criterion form the evaluation vector for the primary criterion. It is established as follows:

Step 2: The second-level evaluation vector

Rc, containing the TrFNs for each group, is obtained through fuzzy comprehensive operations, as shown below:

where

Wcij represents the assigned weight of each risk element in its respective group.

Step 3: The project’s aggregate risk assessment level, expressed as a trapezoidal fuzzy number, is calculated as follows:

4.7. Defuzzification of TrFNs

Following the steps above, the risk level associated with the microalgae carbon sequestration project is expressed using TrFNs. To improve result interpretability, a similarity measure is incorporated to support the defuzzification process, and the similarity between two trapezoidal fuzzy numbers is calculated using the following formula [

45,

46]:

where

and

are two TrFNs.

is the similarity between

and

, which indicates the degree of resemblance. The evaluation result is determined using the maximum similarity principle, which identifies the risk level that most closely aligns with the outcome data.

5. Empirical Study

To demonstrate the feasibility and effectiveness of the risk evaluation method for microalgae carbon sequestration projects established in this paper, this section presents a case study that includes a problem description, data collection, determination of risk criterion weights, expert weight determination, and risk evaluation result determination.

5.1. Problem Description

With the development of the times, leading green development, establishing energy efficiency benchmarks, and fulfilling the dual-carbon mission have gradually become mainstream trends. Collecting industrial coal combustion exhaust gases containing carbon dioxide as a growth medium for algae farming and subsequently converting them into high-value, high-nutrient algae powder products can reduce greenhouse gas emissions, improve resource utilization efficiency, promote environmental friendliness, and enhance economic value. This approach has broad application prospects and significant economic benefits. In recent years, microalgae carbon sequestration projects have flourished in Guangdong and Shandong provinces. Currently, companies are preparing to invest. The initial stage involves assessing the risk level associated with the project.

5.2. Gathering Information on Risk Factors

An expert group comprising four highly qualified individuals and project-related staff with deep knowledge in associated disciplines and considerable hands-on involvement in microalgae carbon sequestration initiatives was established. First, each expert used HFLTS to evaluate the parameters utilized to assess potential risks within the section “Establishing the Risk Evaluation Criteria System for Microalgae carbon sequestration Projects,” with the results shown in

Table 2. The evaluation results for the secondary criteria, derived from each expert’s assessment, were processed using the TrFNs algorithm outlined in the “HFLTS to TrFNs Conversion” section.

Table 3 provided the basis for calculations, and the final expert evaluation scoring matrix is shown in

Table 4.

5.3. Determination of Expert Weights

By transforming the evaluation scores of each expert into a standard scale, a corresponding matrix is produced that reflects the results. In the matrix, each row represents the expert’s evaluation of the 15 criteria.

The matrix for ranking attributes and the one for evaluating weights are not the same; the former amplifies the differences between criteria, compensating for the limitations of considering only the weight scores (rounded to four decimal places).

To begin with, in order to thoroughly analyze both the commonalities and discrepancies in the experts’ assessments, the values for rating and ranking deviations,

α0l and

β0l, are derived using specific Equations (10)–(12). Then, the expert credibility measures

λ0l and

ω0l can be calculated using Equations (13) and (14). Assuming an equal weight for both the score and ranking deviations (with values of 0.5 for

p and

q), the credibility of the expert can be derived as shown below:

5.4. Determination of Criteria Weights

Determination of Weights Based on the RANCOM Method.

Given that all the criteria are cost-oriented, the overall evaluation scores provided by the experts in

Table 4 require normalization. This is performed using Equations (16) and (17), and the specific values of the expert evaluations are calculated, as shown in

Table 5.

To determine the ranking of the criteria, since the problem involves 15 criteria, the experts need to compare 105 pairs during the evaluation process. In each comparison, the experts define the relationships between the importance of the criteria, as shown in

Table 6.

Based on the experts’ comparisons, the ranking comparison matrix was determined. The dimension of the

M variable is

n ×

n, where

n is the number of criteria considered in the problem. For the microalgae carbon sequestration risk evaluation problem, the

M variable is defined as 15 × 15, and the calculation is performed using Equations (18) and (19):

Using M as the variable, the overall criteria weights are calculated based on Equation (20). The values of the matrix are summed vertically to obtain the .

The final step is to calculate the overall criteria weights using the sum of the criteria sub-weights obtained from Equation (21):

The calculation method for the objective criterion weights is based on the centroid method. Normalize the 15 attributes according to Equations (23) and (24), and calculate the distance di from the criterion to the group center, as shown in

Table 7.

As the criterion moves farther away from the central point of the group, its risk level diminishes. The inverse of the weights for each criterion is derived using Equation (25), as shown in

Table 8, followed by normalization through Equation (26). Once normalized, the sum of all weights is unified to equal 1, as shown in

Table 9.

Finally, the comprehensive weights of each indicator are calculated according to Equation (27), as shown in

Table 9.

As illustrated in

Figure 4, “C1” consistently receives the highest weighting across subjective, objective, and integrated assessments, highlighting the dominant influence of economic factors on project advancement. In contrast, the most significant discrepancy emerges in “C4” environmental risk, where a pronounced divergence exists between subjective and objective weightings. The subjective assessment, derived from expert panel evaluations, reflects the collective attitudes and risk tolerance shaped by their professional backgrounds and experiences, with a stronger focus on the project’s short-term feasibility. On the other hand, the objective weight—resulting from quantitative analysis—places greater emphasis on long-term sustainability, thereby attributing a higher probability to environmental risk occurrence.

This contrast underscores the complementary nature of subjective and objective approaches: the former captures experiential and contextual judgments, while the latter provides data-driven rigor. By integrating both perspectives, the comprehensive weighting method offers a more nuanced and scientifically grounded representation of each criterion’s relative importance, ultimately enhancing the depth and reliability of the risk assessment process.

5.5. Holistic Evaluation of Risks Associated with Investments

Fuzzy Comprehensive Evaluation.

The trapezoidal fuzzy numbers corresponding to each indicator are integrated through a fuzzy comprehensive approach. As an illustration, Equations (28) and (29) can be utilized to compute the fuzzy comprehensive results for the secondary criteria under the primary category of “C1” economic risk.

The fuzzy risk calculations for other criteria are as follows: , , and .

Based on Equations (30) and (31), to evaluate the comprehensive risk of the microalgae carbon sequestration project, the methodology outlined below is applied:

Compared to the evaluation criteria in

Table 3, the overall risk assessment result falls between “

M” and “

MH.” The degree of similarity between the evaluation result and the two criteria is computed using Equation (32). A comprehensive assessment was conducted to establish the overall risk level, with the outcomes detailed as follows:

From the computed results, it is evident that the microalgae carbon sequestration project exhibits its strongest correlation with “MH”, implying that the overall risk assessment for the project is at an upper-medium level. Similarly, to evaluate the alignment, computational methods are applied to measure how hc1, hc2, hc3, and hc4 correlate with various risk categories, the following results are obtained: hc1 has the highest similarity with S5, at 0.947; hc2 has the highest similarity with S3, at 0.979; hc3 has the highest similarity with S4, at 0.902; and hc4 has the highest similarity with S2, at 0.972. In other words, the risk level for C1 is high, C2 is medium, C3 is medium-high, and C4 is medium-low. Therefore, financial risk management should be a top priority, focusing on securing diversified funding sources, reducing costs, and controlling operational and maintenance expenses. This approach will shorten the payback period and enhance liquidity. Next, for market risks, we need to closely monitor regional policies and conduct comprehensive market feasibility studies to meet demand and increase social acceptability, thereby reducing uncertainties in market adoption. Regarding technical risks, it is essential to strengthen oversight and provide staff training to minimize operational errors. Lastly, to mitigate environmental risks, we must implement standardized environmental monitoring procedures and proactively comply with government and project-specific regulations to minimize potential ecological impacts.

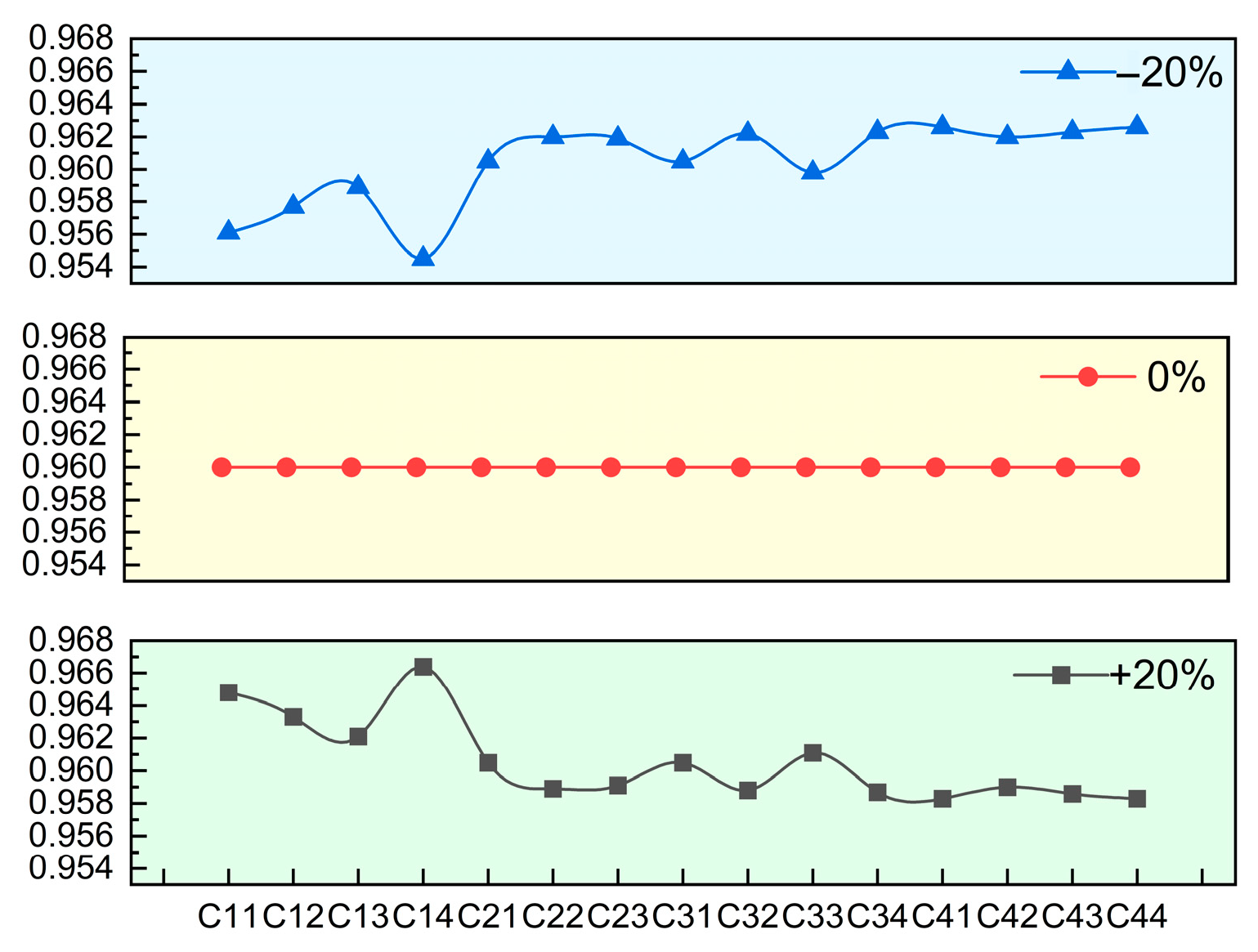

5.6. Sensitivity Analysis

To assess the accuracy and scientific validity of the risk evaluation framework, a sensitivity analysis was conducted using the perturbation method, where the weights of the criteria were increased and decreased.

, the initial weight value, is denoted as

, and

represents the perturbed weight.

,

. Following the normalization of the weights, the values of other criteria weights also change accordingly, denoted as

, and must satisfy the following conditions:

First, the standard weights fluctuate within a range of ±20% compared to the baseline weights. This allows for an intuitive observation of changes in the risk results. The approach focuses on analyzing system robustness and pinpointing the most sensitive criteria. As an example, indicator C11 is highlighted to demonstrate its application. Let

= 0.8, which results in the weight:

. Set

. The corresponding weight assigned to the indicators within the group is defined as

, which results in a risk of

. The overall project risk level is slightly higher, with no significant changes in the risk levels of individual indicator groups. When the weight is increased by 20%, let

= 1.2, and the calculation process follows the same procedure as above. The overall project risk level is shown in

Table 10. Given that trapezoidal fuzzy numbers are used to represent the results, any changes in the outcomes are relatively minor. Consequently, the sensitivity analysis in this paper is based on the similarity measure

Sd (

R,

S4), with a level of

S3, which is slightly higher than medium. The similarity of risk levels in the sensitivity analysis, measured for each attribute with a tolerance of ±20%, is shown in

Table 10; the original similarity measure result is

Sd (

R,

S4) = 0.965. The results consistently exhibit stability, even when changes occur in the weights assigned to the indicators, highlighting the model’s reliability.

While the risk outcomes demonstrate a certain level of stability, decision-makers can enhance their strategies by thoroughly analyzing sensitive indicators and pinpointing critical factors that affect decision results. The aforementioned risks and fluctuations in various weights under indicators are represented in a simplified and structured comparative format, as demonstrated in

Table 11 and

Figure 5.

It can be observed that C11, C12, C14, and C44 exhibit significant fluctuations. The results suggest that specific metrics play pivotal roles in contributing to the dynamic nature of project risks. The reasons for this situation are as follows: The microalgae carbon sequestration project is in its early stages, due to insufficient technological advancements and the absence of a well-established market structure. The initial investment (C11) may hinder project investment, leading to financial difficulties and hindering smooth project progress. Operating and maintenance costs (C12), which are related to the later stages of construction, have long-term and continuous impacts. These costs may lead to project interruption because they are too high. Financial issues arising from the investment recovery period (C14) not only affect the cash flow of the microalgae carbon sequestration project but also its market competitiveness. With the increasing awareness of environmental protection, the construction of new projects will strictly prevent and seriously address disease transmission risks (C44). Therefore, more attention should be given to the risk responses associated with these sensitive criteria.

5.7. Comparative Analysis

Driven by demand, the cloud model has evolved into a complex, large-scale computational system that can be used for risk assessment [

47]. Therefore, this section employs the cloud model to evaluate its effectiveness. Through conducting comparative evaluations, the reliability and precision of the designed risk assessment model were assessed and confirmed.

The cloud quantities associated with the seven linguistic levels in the HFLTS framework are detailed in

Table 12, and the risk assessment results are presented in it. The expert evaluations used as inputs are presented in

Table 4. First, the evaluation clouds and risk levels for the secondary criteria are calculated, followed by fuzzy comprehensive evaluation of the first-level criteria (

Table 13). The risk level for C1 ranges from medium-high to high, for C2 and C3 ranges from medium to medium-high, and for C4 ranges from medium to medium-low (

Table 13). Finally, the project’s risk level, derived through evaluation, is represented by the values (60.651, 8.995, 3.659), positioned in the range of medium to medium-high. The findings correspond to the conclusions generated through the recommended evaluation model for risk analysis, thus validating the effectiveness and accuracy of the framework.

The methods for calculating risk exhibit diverse characteristics. In the computation process, the cloud model makes decisions in uncertain environments using the forward and backward cloud generators. However, the discrete phenomena in the microalgae carbon sequestration project are minimal, as shown in

Figure 6, which increases the ambiguity of the project. Additionally, the challenge of assessing the risk level associated with discrete cloud distributions further increases the complexity that investors need to understand. Therefore, the risk assessment method proposed in this study is both more practical and efficient.

6. Discussion

Section 5 includes an analysis based on a specific case study, where the risk level is represented as

R (0.499, 0.576, 0.653, 0.727), indicating a medium-high project risk level, and the similarity measure

Sd (

R,

S4) = 0.960. The sensitivity and comparative analyses indicate that the risk assessment framework proposed in this study is both scientifically sound and stable. Investors and relevant stakeholders should carefully and rationally consider whether to invest in the microalgae carbon sequestration project. Furthermore, similar microalgae carbon sequestration projects are already underway, and the responsible parties should implement effective risk management measures to ensure the project’s successful implementation. Therefore, based on relevant theories of risk management and the characteristics of microalgae carbon sequestration projects, this study proposes targeted strategies and recommendations, which may provide valuable insights and guidance for policymakers and relevant managers.

Economic Risk:

Initial Investment: Expanding the scale of the microalgae carbon sequestration project can effectively reduce unit costs. Additionally, forming a professional team to conduct thorough reviews and make reasonable adjustments will help eliminate unnecessary project costs. At the same time, domestic and foreign financial institutions are encouraged to provide financing [

48].

High operation and maintenance costs: Using windproof materials to reduce the risk of equipment damage, strengthening supervision to minimize waste, and improving resource utilization. Additionally, implementing measures to mitigate extreme weather events will minimize operation and maintenance costs to the greatest extent.

Economic issues in technology introduction: Establishing partnerships with universities and research institutions to jointly develop new technologies, share technological achievements, and reduce the costs of technology introduction.

Long investment recovery period: Investments can be made in stages according to project progress and market demand, thereby reducing financial pressure. Furthermore, optimizing production processes can accelerate the return on funds.

Technological Risk:

Site selection risk: To mitigate site selection risks, it is essential to establish a scientific and practical decision-making process. By understanding local policies and selecting suitable areas, decision-makers can utilize modern GIS technology in conjunction with MCDM methods to ensure rational site selection [

49].

Risk of technological immaturity: Employee skills can be enhanced through training, effective communication, and ongoing learning, while implementing strict management systems is also crucial. Additionally, supervision at every stage should be strengthened, accountability should be assigned, and employee focus should be improved.

Shortage of technical staff: Talent development should be strengthened by promoting industry–university cooperation, allowing students in relevant fields to participate in internships, bridging the gap between theory and practice, and improving practical skills. Additionally, an incentive mechanism should be implemented to enhance employee benefits, attract top talent, and motivate technical personnel to develop skills continually.

Market Risk:

Market demand risk: Regular market research should be conducted through methods such as surveys or data analysis to understand consumer demand and market trends. Based on these insights, new products should be developed and existing products improved to meet the diverse needs of consumers. At the same time, multi-channel marketing, both online and offline, should be utilized to increase product exposure and expand sales channels.

Market price fluctuation risk: A market monitoring mechanism should be established to adjust product prices flexibly and maintain market share. At the same time, specialized departments should be established to plan budgets and inventories effectively, ensuring that stockpiling occurs when necessary to mitigate the impact of price fluctuations resulting from increases in raw material prices.

Policies and regulations: The microalgae carbon capture initiative is still in the early stages of market development, with policy support playing a crucial role in determining its financial viability. Governments can foster the development of microalgae-based carbon capture technologies through top-level planning, designating microalgae as a key area for strategic support, and promoting their integration with biomanufacturing and carbon neutrality goals. By implementing carbon pricing mechanisms, the economic appeal of microalgae carbon capture projects can be indirectly enhanced. Policy support extends beyond direct financial subsidies to include diverse approaches such as the establishment of R&D platforms and tax incentives that facilitate the industrial incubation of such projects. Meanwhile, due to region-specific policy variations, investors must conduct careful reviews of energy regulations issued by authorities and monitor industrial progress across different regions and countries to make informed decisions.

Public acceptance: Accepting public supervision is also meaningful for public acceptability. The organizers can arrange for the public to visit the site, thereby updating their understanding of the microalgae carbon sequestration project [

50]. Active communication with the government and residents should be conducted to address any concerns raised by the community.

Environmental Risks:

Ecosystem risk: During the recovery phase, a comprehensive ecosystem monitoring network should be established to monitor biodiversity in real-time and prevent algae contamination. After the project is completed, to ensure compliance, an application for quality inspection and validation must be filed with the relevant environmental authority by the designated personnel.

Pollutant emission risk: During the project, environmentally friendly and biodegradable materials should be used to replace high-pollution raw materials. Additionally, timely recovery should be implemented in the later stages of the project to prevent pollutant emissions. Reduce the potential human, health, and environmental hazards caused by construction activities [

51].

Water security risk: A scientific water resource plan should be developed based on regional policies and regulations, with reasonable objectives for the utilization and protection of water resources.

Disease transmission risk: Wind-resistant and corrosion-resistant materials should be selected, and monitoring should be strengthened during the project’s construction phase to prevent leaks during use. Simultaneously, an early warning mechanism should be implemented to prevent the spread of diseases.

7. Conclusions

This paper presents a risk assessment framework for the microalgae carbon sequestration project. Firstly, 15 risk factors are identified and categorized into four groups. Firstly, to mitigate expert bias, a credibility-based model is applied to assign appropriate weights to the experts involved. The RANCOM method is employed to calculate the weights of indicators, taking into account their interdependencies. Furthermore, by transforming TrFNs, the RANCOM method is extended into the HFLTS environment.

Furthermore, the aggregation of expert evaluation information is performed using the aggregation operator (FIOWHA). As a concluding stage, the designed framework for risk analysis is applied to assess the potential uncertainties and challenges within the microalgae carbon sequestration initiative. Using the established methodology, the aggregate risk levels of the project are quantified and represented by R = (0.499, 0.576, 0.653, 0.727), indicating a moderate to high project risk level, and the similarity measurement result Sd (R, S4) = 0.960.

Through these calculated findings, stakeholders, including investors and managers, are equipped with enhanced perspectives to evaluate the project, facilitating informed investment planning thoroughly. Moreover, through the constructed risk assessment model, significant risk factors of the microalgae carbon sequestration project are identified. Utilizing the findings from the risk analysis, specific strategies and actionable recommendations are formulated for distinct risk domains, embedding both academic relevance and real-world feasibility.

However, this paper also has certain limitations and shortcomings. Firstly, due to the limited availability of information, some risk factors may have been overlooked during the collection process. In the future, we will continue to gather information and explore ways to improve the indicator system. Comparative case studies will also be conducted to inform investment decisions related to microalgae-based carbon sequestration initiatives. Furthermore, the fuzzy linguistic evaluation scale applied in this research draws upon prior studies, but its relative sensitivity remains unverified.