1. Introduction

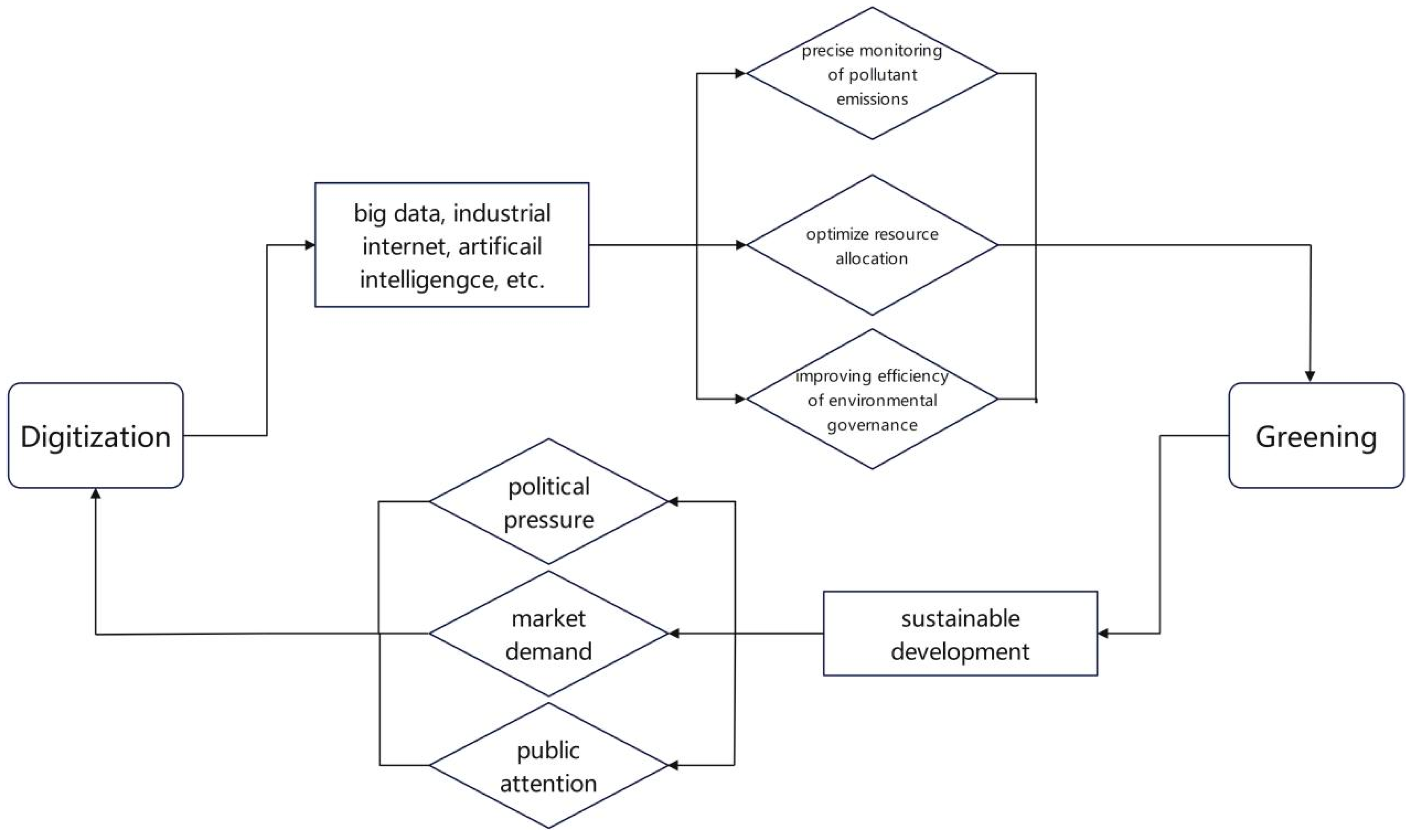

In recent years, green development has emerged as a central topic in the discourse on sustainable development, while digital transformation is increasingly recognized as a vital driver of economic growth [

1,

2]. On the one hand, with the widespread adoption of digital technologies and the continuous advancement of digital transformation across industries, enterprises are increasingly shifting toward digital modes of production and business operation. This transformation enables more precise control over input–output processes, real-time monitoring of energy consumption and pollutant emissions, and efficient information sharing—all of which significantly enhance firms’ capacity for green transformation. On the other hand, the intensifying threat of global warming and the growing frequency of climate-related disasters have drawn broad international attention to the urgency of sustainable development. In response, many countries have proposed ambitious targets, such as carbon peaking and carbon neutrality, alongside increasingly stringent environmental regulations. These shifts exert mounting pressure on enterprises to adopt more advanced and environmentally friendly production technologies. In this context, digital technologies—such as smart manufacturing, big data analytics, and industrial internet—are being widely deployed due to their strengths in dynamic precision management and energy efficiency. The inherent complementarities between digitalization and greening—in terms of development logic, technological pathways, and operational tools—are fostering a mutually reinforcing relationship [

3,

4,

5]. This synergy has increasingly captured the attention of both academic researchers and policy makers, giving rise to the emerging paradigm of coordinated digital–green development. Over the past decades, China’s rapid economic rise was largely driven by an extensive growth model characterized by high input and resource consumption. While this model propelled China into the ranks of the world’s most influential economies, it is now proving unsustainable in the face of a new wave of technological and industrial transformation. As the country transitions toward high-quality development, a fundamental shift in its growth paradigm has become imperative. Against this backdrop, the Chinese government has repeatedly emphasized the importance of “promoting coordinated digital and green development, using digitalization to drive green transformation, and leveraging green goals to deepen digital innovation,” aiming to achieve a more sustainable and innovation-driven growth trajectory [

2,

4].

To meet the demands of high-quality development, China has increasingly emphasized the implementation of functional industrial policies characterized by a “market-oriented and government-guided” approach as a key component of institutional reform. Functional industrial policy refers to a policy framework whereby the government promotes innovation-driven development, industrial upgrading, and overall competitiveness by improving market institutions, optimizing the business environment, ensuring fair competition, supporting technological innovation and diffusion, providing efficient public services, and enhancing workforce skills to align with evolving industrial demands [

6,

7,

8]. Unlike selective industrial policies—which intervene in the development trajectory of specific industries through preferential tools [

9,

10]—functional industrial policies focus on empowerment rather than intervention. Their core objective is to improve total factor productivity, innovation capabilities, and industrial adaptability. Accordingly, functional policies place greater emphasis on the foundational role of market mechanisms, while positioning government as a provider of favorable institutional environments. They prioritize long-term, systemic development goals, such as the advancement of future industries and the research and development of frontier technologies [

7]. Against this backdrop, China launched the “Made in China 2025” initiative in May 2015, with the aim of upgrading its manufacturing sector and enhancing global competitiveness. The initiative seeks to build a comprehensive innovation ecosystem for manufacturing by strengthening public infrastructure, accelerating the development of producer services, improving fiscal and tax support, and refining market access standards. Subsequently, the Ministry of Industry and Information Technology (MIIT) initiated the construction of 30 MIC2025 pilot cities in 2016 and 2017, urging these cities to pioneer breakthroughs in building new manufacturing systems, promoting regional collaborative innovation, strengthening talent development, and enhancing policy support frameworks. Clearly, the MIC2025 pilot program focuses on institutional supply, infrastructure investment, and the construction of innovation ecosystems. While balancing equity and efficiency, it also avoids the typical pitfalls of selective industrial policies, such as resource misallocation, rent-seeking opportunities, and policy inertia [

9,

10,

11]. Therefore, MIC2025 can be classified as a functional industrial policy. It is clear that MIC2025 contributes to enhancing firms’ innovation capabilities, improving performance, promoting digital transformation, and reducing energy consumption. However, several critical questions remain: Can MIC2025 effectively promote the coordinated advancement of firms’ digitalization and greening processes? Are its effects heterogeneous across different contexts? And what are the underlying mechanisms of its impact? Addressing these questions is crucial for deepening our understanding of the relationship between functional industrial policies and the dual transformation of enterprises. Moreover, it can provide valuable insights for accelerating the integration of digital and green development and fostering high-quality growth among Chinese enterprises.

The remainder of this paper is organized as follows:

Section 2 reviews relevant literature.

Section 3 presents the theoretical framework and research hypotheses.

Section 4 outlines the research design, including data sources, variable construction, and model specification.

Section 5 reports the main empirical results and a series of robustness checks.

Section 6 extends the analysis by exploring heterogeneity across different contexts and examining the underlying mechanisms of policy impact.

Section 7 concludes this study with a summary of key findings and policy implications.

2. Literature Review

This study is closely related to existing literature that focuses on the measurement and influencing factors of enterprise digitalization and greening, as well as the policy effects of MIC2025. The first strand of literature concentrates on the measurement of enterprise digitalization and its influencing factors. Broadly, the methods for measuring enterprise digitalization can be categorized into two types: text analysis and single-indicator methods. The text analysis method involves systematically collecting digital-related keywords, then rigorously searching, matching, extracting, and analyzing the annual reports of listed companies, with the frequency of keyword occurrences serving as a proxy for the level of digitalization [

12,

13,

14,

15,

16,

17,

18,

19]. For instance, Zhu et al. (2024) assess enterprise digitalization by mining the frequencies of keywords such as “blockchain”, “big data”, “cloud computing”, and “artificial intelligence” from annual reports [

18]. Huang and Gao (2023) argue that enterprise digital development consists of two components: digital investment and digital application. The former is measured through the frequencies of terms such as “artificial intelligence technology”, “blockchain technology”, “cloud computing technology”, and “big data technology”, while the latter is gauged through keywords such as “e-commerce”, “mobile payment”, and “industrial internet” [

19]. Yan et al. (2025) further refine the approach by classifying technologies into five major application dimensions—artificial intelligence, big data, cloud computing, blockchain, and digital technologies—and collecting and analyzing keyword frequencies accordingly [

20]. Some studies adopt single indicators to measure digitalization levels, such as digital intangible assets [

18,

21], enterprise ICT investment [

22], or the cumulative customer digital transformation index [

23]. In terms of influencing factors, they are generally categorized into internal and external drivers. Prior research has shown that internal factors such as executive backgrounds [

18,

24,

25], demand for product personalization [

26], venture capital [

24], and dialect diversity [

20] significantly affect enterprise digitalization. External influences include both policy and environmental constraints. The former encompasses supportive or coercive policy effects such as the development of digital or network infrastructure [

27,

28], the layout of computing infrastructure [

29], open government data [

14], tax incentives and subsidies [

30,

31], and labor protection policies [

19,

32]. The latter includes environmental pressures such as carbon emissions [

12,

13,

33], climate risks [

16], and geographic factors [

17], all of which impact the process of digital transformation.

The second body of literature centers on the measurement of corporate greening and its influencing factors. In terms of measurement, four primary approaches are commonly employed in existing studies. The first approach is the use of single indicators, which typically rely on variables such as the number of green patent applications or grants to assess the degree of corporate greening [

34,

35,

36]. The second approach involves constructing composite evaluation systems based on multiple dimensions. For instance, Zhang and Li (2025) developed a framework encompassing economic performance, quality outcomes, management capabilities, and environmental performance, comprising 16 secondary indicators, and applied the entropy method to calculate the greening level [

37]. Similarly, Li et al. (2025) used the entropy method to integrate three dimensions: green management, green production, and external recognition [

38]. Peng et al. (2023) established an evaluation system for green transformation based on eight dimensions, including green culture, green strategy, and environmental information disclosure [

39]. The third approach adopts a production input—output framework to estimate green total factor productivity (GTFP), using efficiency models such as Data Envelopment Analysis (DEA) or Stochastic Frontier Analysis (SFA) [

40,

41]. For example, Chen and Wang (2024) and Zhang et al. (2025) employed the slack-based measure (SBM) directional distance function and the Malmquist–Luenberger productivity index, which accounts for undesirable outputs, to calculate firm-level GTFP [

42,

43]. Piao et al. (2025) applied SFA methods for the same purpose [

44]. The fourth approach is based on text analysis, wherein keywords related to green transformation are extracted from corporate annual reports, and the frequency of such terms is used to quantify the level of corporate greening [

4,

45]. Regarding the drivers of corporate greening, the literature primarily focuses on the role of digital transformation, intelligent upgrading, and environmental regulations. On one hand, a growing body of research suggests that macro-level investments in digital infrastructure [

46], integration of digital technologies with the real economy [

47], meso-level industrial upgrading through intelligent transformation [

48], as well as micro-level adoption of digital strategies [

36,

38,

49] and artificial intelligence technologies [

45,

50], all facilitate green innovation and enhance corporate greening. On the other hand, various studies have examined the role of environmental regulations—such as environmental taxes [

51,

52], green credit policies [

41,

45,

53,

54], and energy and carbon trading schemes [

37,

55,

56]—in promoting substantial green innovation by exerting external pressure and providing internal incentives [

57,

58]. However, some scholars argue that such regulations may impose additional compliance costs or reduce expected returns, thereby undermining firms’ incentives for green innovation [

59,

60].

The third body of literature focuses on the impact of the MIC2025 industrial policy. Existing empirical studies on the policy’s effects remain limited and primarily examine its influence on enterprise innovation, technological transformation, export performance of related products, asset pricing, and firms’ risk-taking capabilities. For instance, Bai et al. (2025), using MIC2025 as a quasi-natural experiment, find that the government’s industrial prioritization policy significantly enhances the innovation capacity of prioritized firms through three main channels: human capital accumulation, tax incentives, and government subsidies [

61]. Conroy (2024) shows that MIC2025 contributes to technological transformation and economic growth in certain regions [

62]. Xu et al. (2024) demonstrate that the synergy between MIC2025 and trade liberalization helps improve both the quality and price premiums of exported products [

63]. Regarding asset pricing, Liu et al. (2022) find that MIC2025 leads to a significant short-term increase in stock prices, as measured by cumulative abnormal returns (CARs), though this effect tends to reverse in the long run [

64]. Jiang et al. (2025) reveal that MIC2025 substantially enhances firms’ capacity to bear risks, with more pronounced effects observed in firms facing tighter financing constraints, greater information asymmetries, and weaker human capital endowments [

65]. Although relatively few in number, some studies have explored the green development implications of MIC2025. Xu (2022), also adopting a quasi-natural experimental approach, finds that MIC2025 significantly strengthens green innovation capacity among manufacturing firms [

66]. Some scholars have also provided evidence that MIC2025 significantly improves the green economic efficiency of pilot cities, thereby advancing urban green development [

67,

68]. Shen and Lin (2020) find that MIC2025’s R&D preferential policies help increase firms’ R&D capital and reduce their energy intensity [

69].

Existing literature has explored the interactive relationship between digitalization and greening in considerable depth [

3,

4,

5]. On the one hand, firms leverage digital technologies to improve resource allocation efficiency and enhance environmental monitoring precision, thereby advancing green production and governance. On the other hand, digitalization helps alleviate financing constraints associated with green investment by increasing information transparency and strengthening internal controls, thus reducing uncertainties in the green transition process. Regarding the reverse effect, stricter energy efficiency and carbon emission standards drive enterprises to implement energy-saving upgrades in their production systems, which in turn accelerates the adoption of digital technologies. Furthermore, the growing demand for sophisticated information processing in green production, coupled with intensified environmental regulation and rising green consumption preferences, compels firms to adopt digital strategies that emphasize the synergy between economic and environmental performance. However, there remains a notable gap in the literature concerning the role of functional industrial policies—particularly the MIC2025 initiative—in shaping this digital–green interaction. To date, few studies have systematically examined how MIC2025 influences DGSD through specific policy mechanisms, making this a valuable avenue for further research.

Therefore, this study makes contributions from two main perspectives. First, from a research perspective, it is the first to evaluate the impact of MIC2025 on firms’ coordinated digital and green transformation from the standpoint of functional industrial policy. By examining the policy effects of MIC2025, this paper provides new empirical evidence on the relationship between functional industrial policies and firms’ synergistic advancement in digitalization and greening. Second, building on the endogenous growth framework with product variety developed by Romer (1990) and Alfaro et al. (2010) [

70,

71], this study introduces the concept of product diversity to construct a model that integrates MIC2025 with the digital–green transformation of enterprises into a unified theoretical framework. Leveraging panel data from A-share listed firms in China spanning 2011–2022 and applying a multi-period difference-in-differences (DID) approach, we systematically examine the characteristics and mechanisms through which the policy fosters coordinated digital and green transformation at the firm level. This provides valuable insights for policymakers aiming to implement functional industrial policies that promote both digital and green transitions and facilitate high-quality development.

7. Conclusions

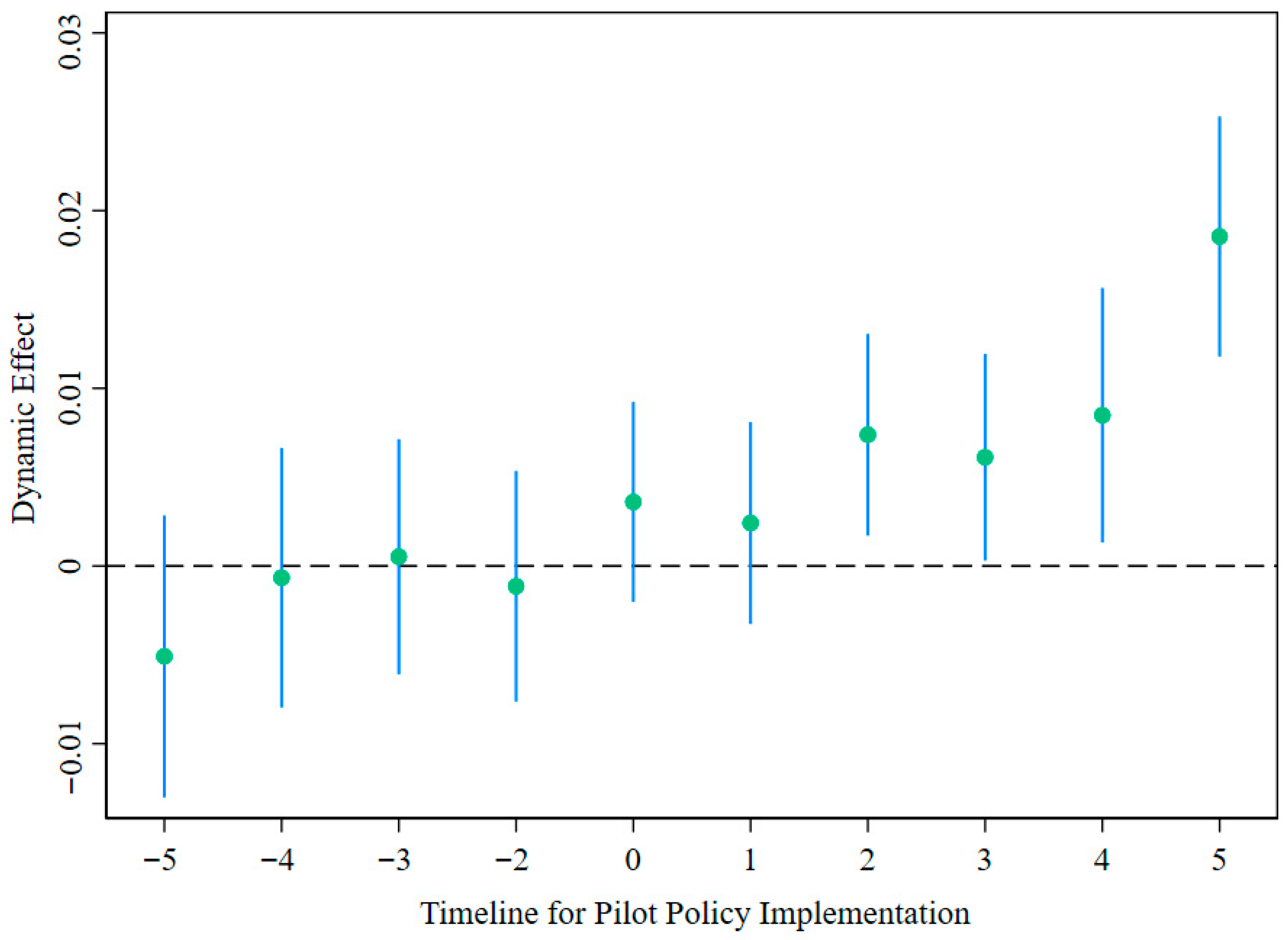

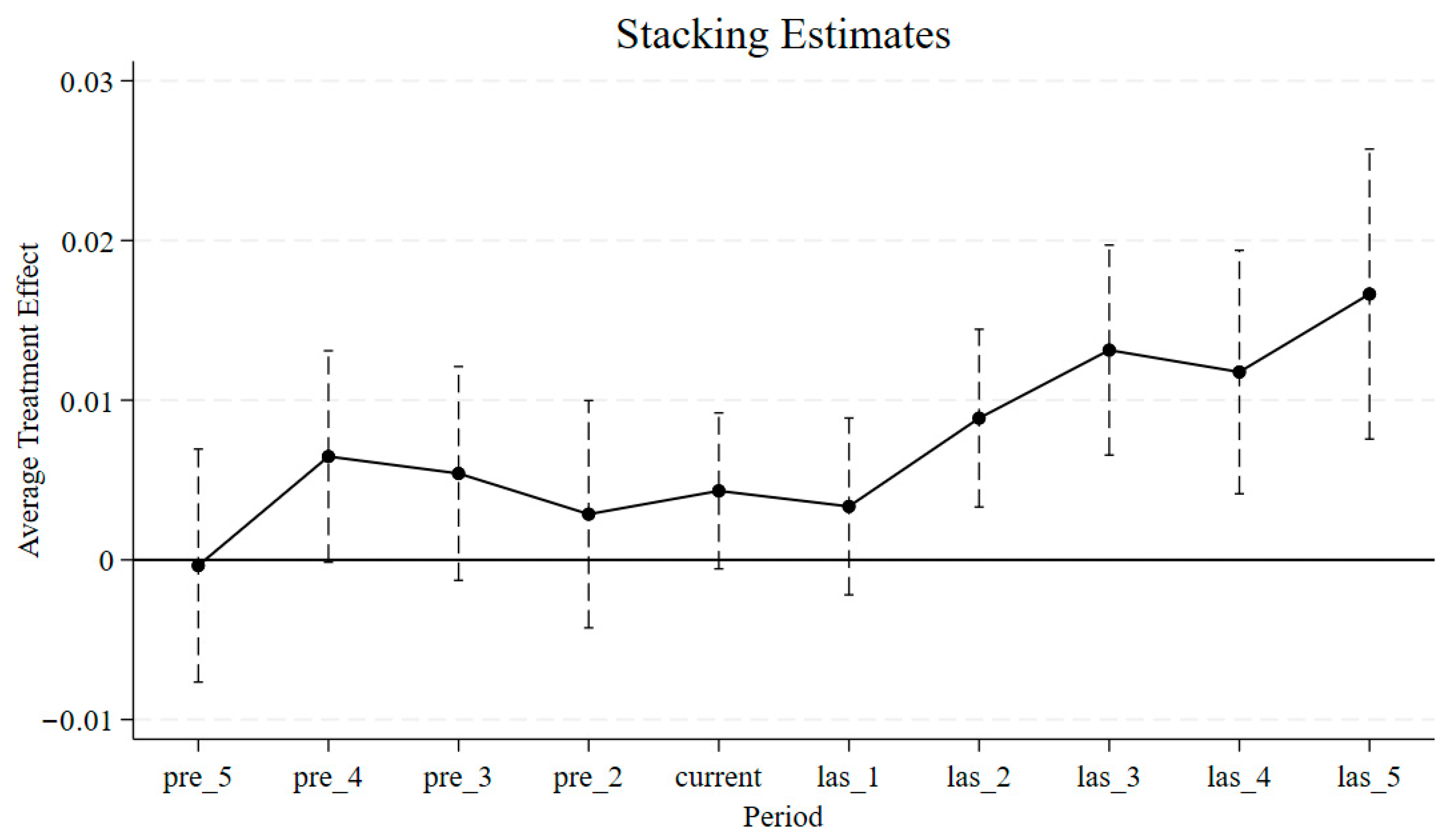

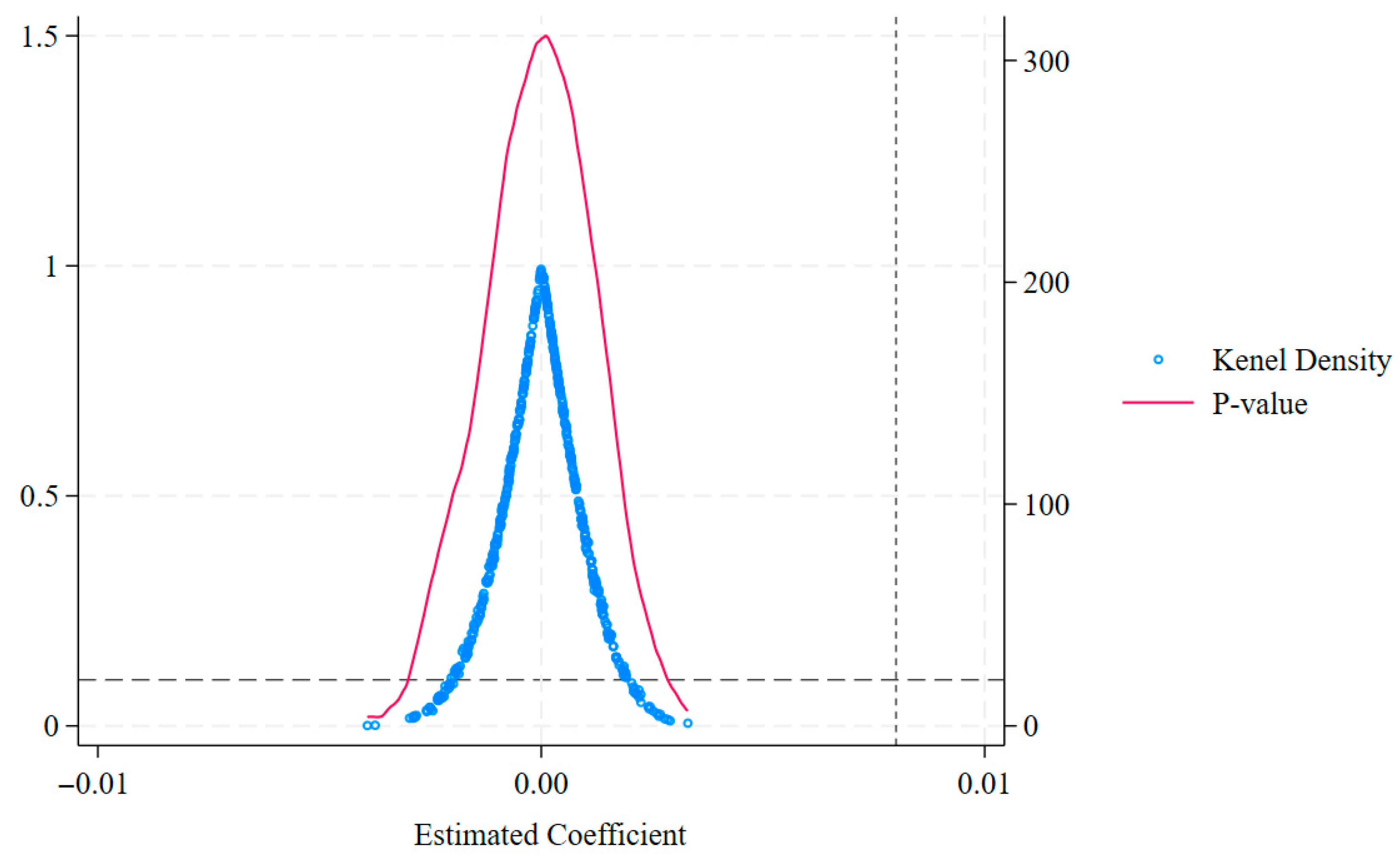

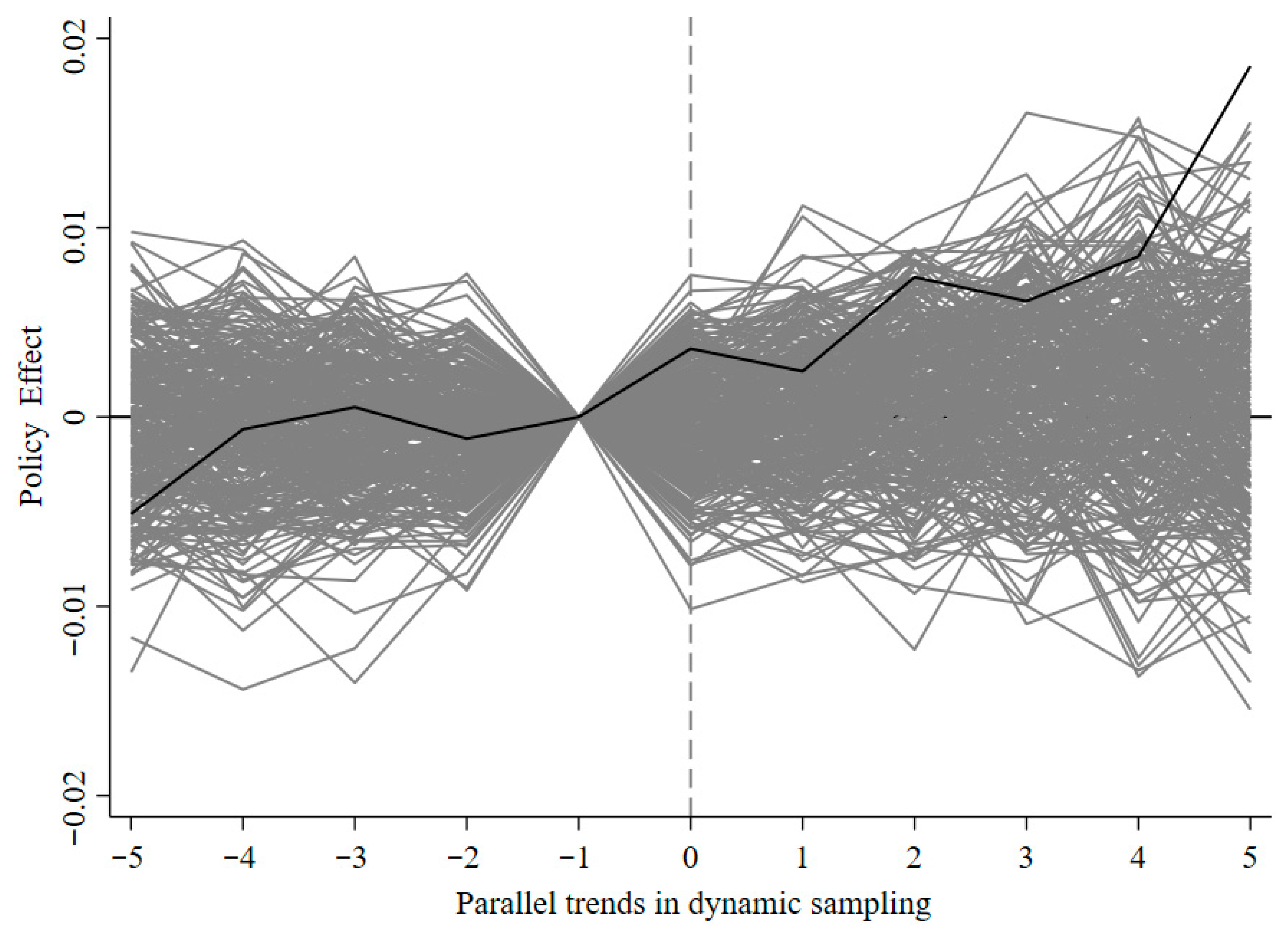

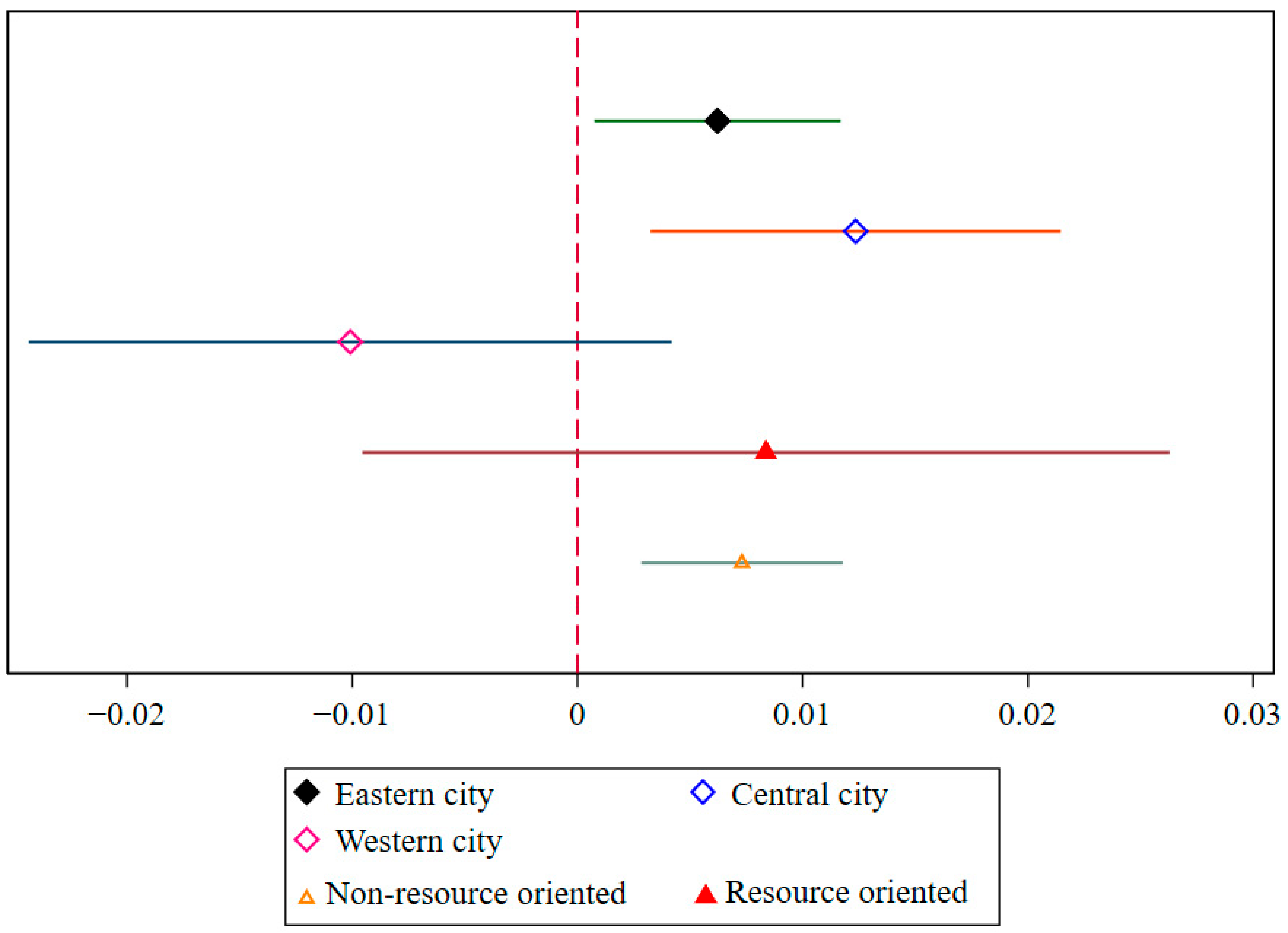

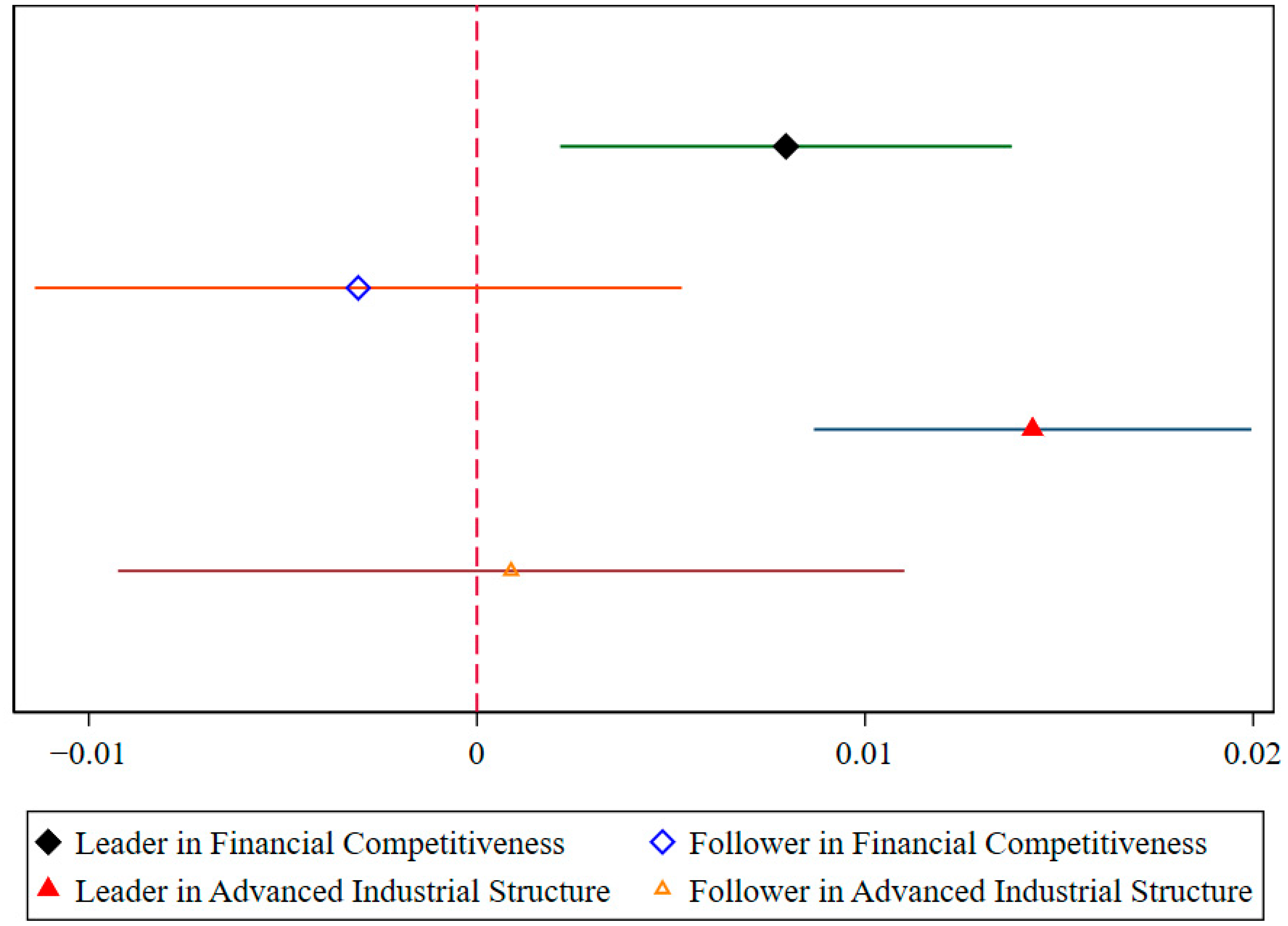

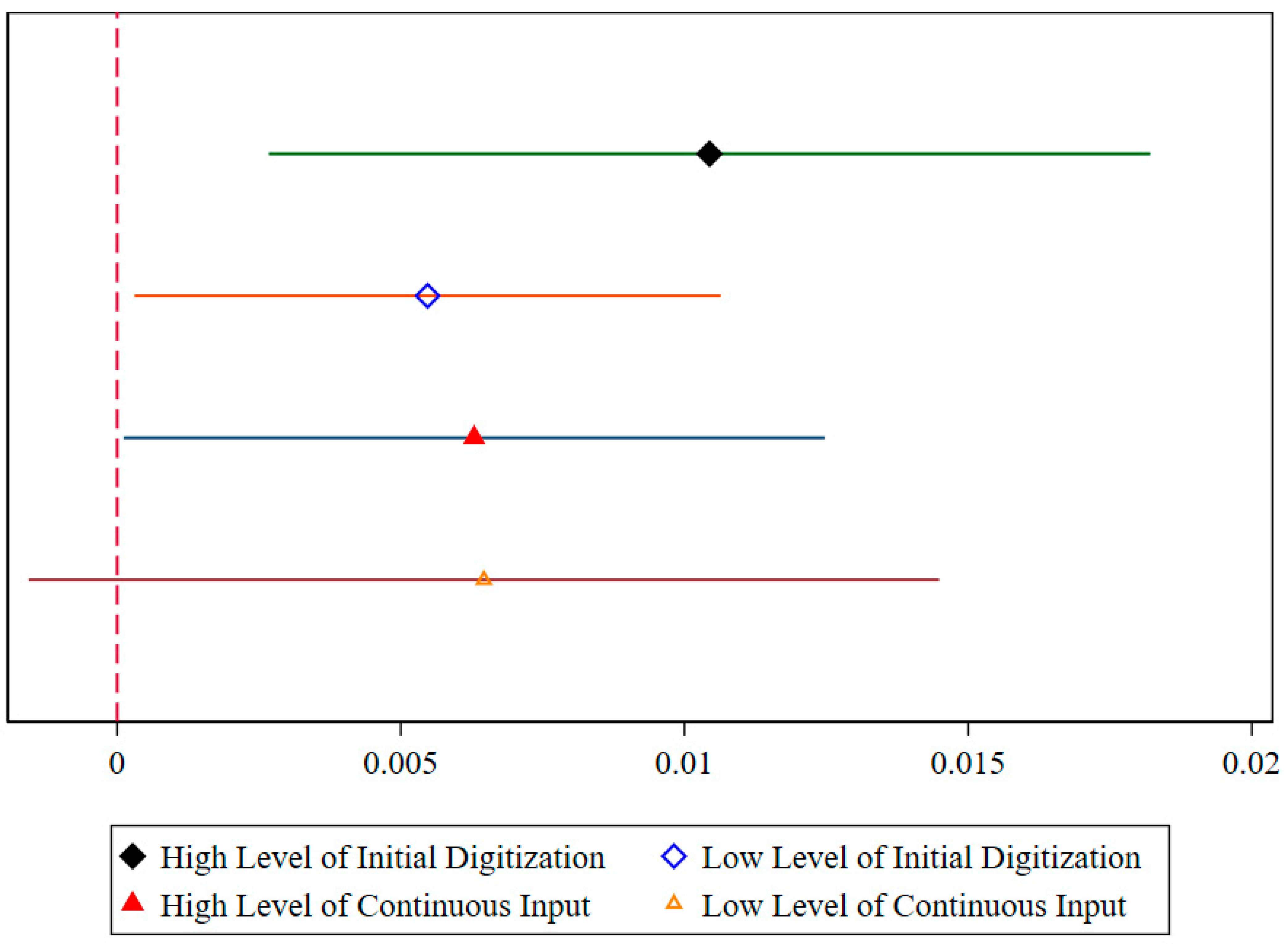

This study incorporates functional industrial policy and enterprise-level DGSD into a unified theoretical framework, analyzing the impact and underlying mechanisms of the MIC2025 policy on DGSD. Based on a multi-period DID model, the empirical findings reveal that the policy exerts a significant positive effect on promoting DGSD. To address potential model specification bias, this study conducts a series of robustness checks, including heterogeneous treatment corrections in the DID model, machine learning methods, and IV estimations. The results remain robust across all specifications. Further, the heterogeneity analysis at the regional level indicates that the policy has had a strong positive effect in eastern and central cities, whereas its impact in western cities remains limited due to economic and structural constraints. From the urban perspective, cities with stronger fiscal capacity and more advanced industrial structures exhibit more pronounced policy effects. At the firm level, enterprises with higher initial levels of digitalization and continuous R&D investment benefit more from the policy intervention. Moreover, the mechanism analysis reveals that alleviating firms’ financing constraints and enhancing innovation in digital and green technologies are critical channels through which the policy affects DGSD. Notably, the improvement in firms’ DGSD levels exhibits a more pronounced policy effect within strategic industries.

As an effective functional industrial policy, MIC2025 not only supports China’s economic transformation and pursuit of high-quality development through technological and environmental advancement, but also offers valuable insights for developing countries that face technological limitations and ecological stress. (1) Policy design aligned with regional conditions: For countries still in the phase of technological catch-up, it is crucial to avoid directly replicating models of advanced economies. Instead, the institutional logic of MIC2025—featuring differentiated policy design, pilot-based implementation, and regional coordination—can serve as a useful reference. By leveraging national endowments such as resource advantages, industrial base, and sectoral characteristics, developing countries can first build foundational innovation systems and university–industry research mechanisms through early-stage R&D and technology acquisition. Subsequently, by integrating ecological goals with interregional technological diffusion, the synergy between green development and technological upgrading can be progressively achieved, avoiding inefficient uniform approaches. (2) Strengthening international technological cooperation and intellectual property systems: For developing countries, utilizing international partnerships to introduce digital and green technologies is a pragmatic starting point. This should be followed by strengthening domestic systems for intellectual property protection and innovation incentives. Given the common challenges of limited technical reserves and weak R&D capacity, building domestic capabilities with external support becomes essential. China’s experience—anchored in the approach of “learning, adapting, and creating” and “bringing in, going out”—illustrates how international cooperation, local adaptation, and institutional development can drive a transition from technology absorption to independent innovation.

However, our research still has such limitations. It is important to recognize that while the experience of MIC2025 offers valuable reference points for developing countries, its applicability is constrained by significant cross-country differences. Variations in political institutions, economic structures, industrial foundations, and governance capacities may limit the direct transferability of China’s policy model. Moreover, the successful implementation of such a complex and coordinated policy framework requires substantial administrative capacity and long-term policy continuity, which may not be readily available in all developing contexts. These factors highlight the contextual limitations of this study and suggest that any policy adaptation must be carefully tailored to local conditions. Due to data availability constraints, this paper focuses solely on listed companies in China. However, the digitalization and greening processes of non-listed enterprises are also of considerable significance and warrant further exploration. Future research could broaden the scope by incorporating firms from different countries and regions, enabling cross-national or contextual policy comparisons.