Pricing Strategy for Sustainable Recycling of Power Batteries Considering Recycling Competition Under the Reward–Penalty Mechanism

Abstract

1. Introduction

- (1)

- We investigated the influence of the government reward–penalty mechanism on power battery recycling;

- (2)

- Under dual-channel recycling scenarios, we proposed and compared pricing schemes for two independent recycling modes and three novel cooperative recycling modes within the CLSC;

- (3)

- We analyzed how the intensity of the reward–penalty mechanism and channel competition affect supply chain profits, recycling rates, and pricing, and provided managerial implications based on these findings.

2. Literature Review

3. Model Description

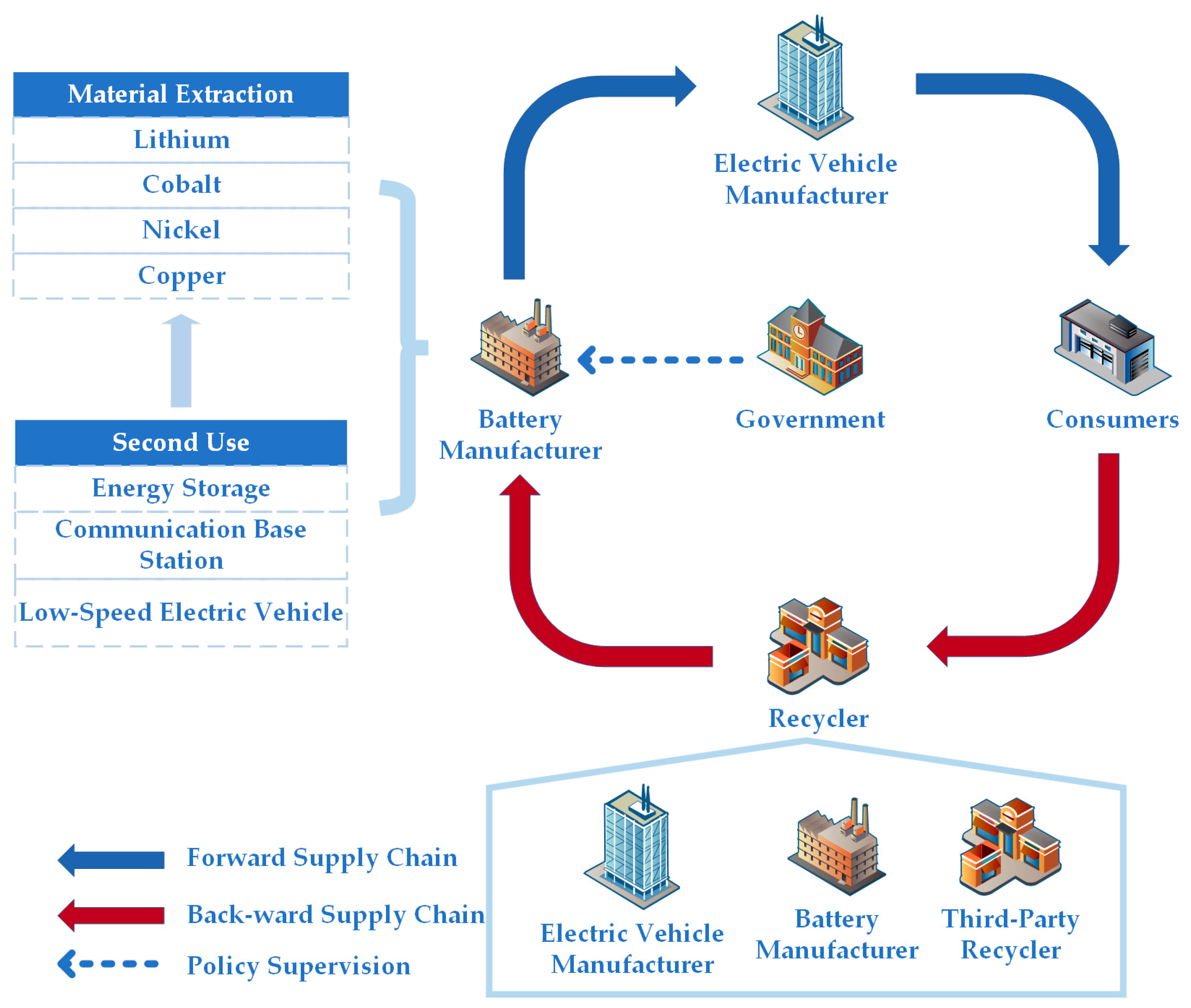

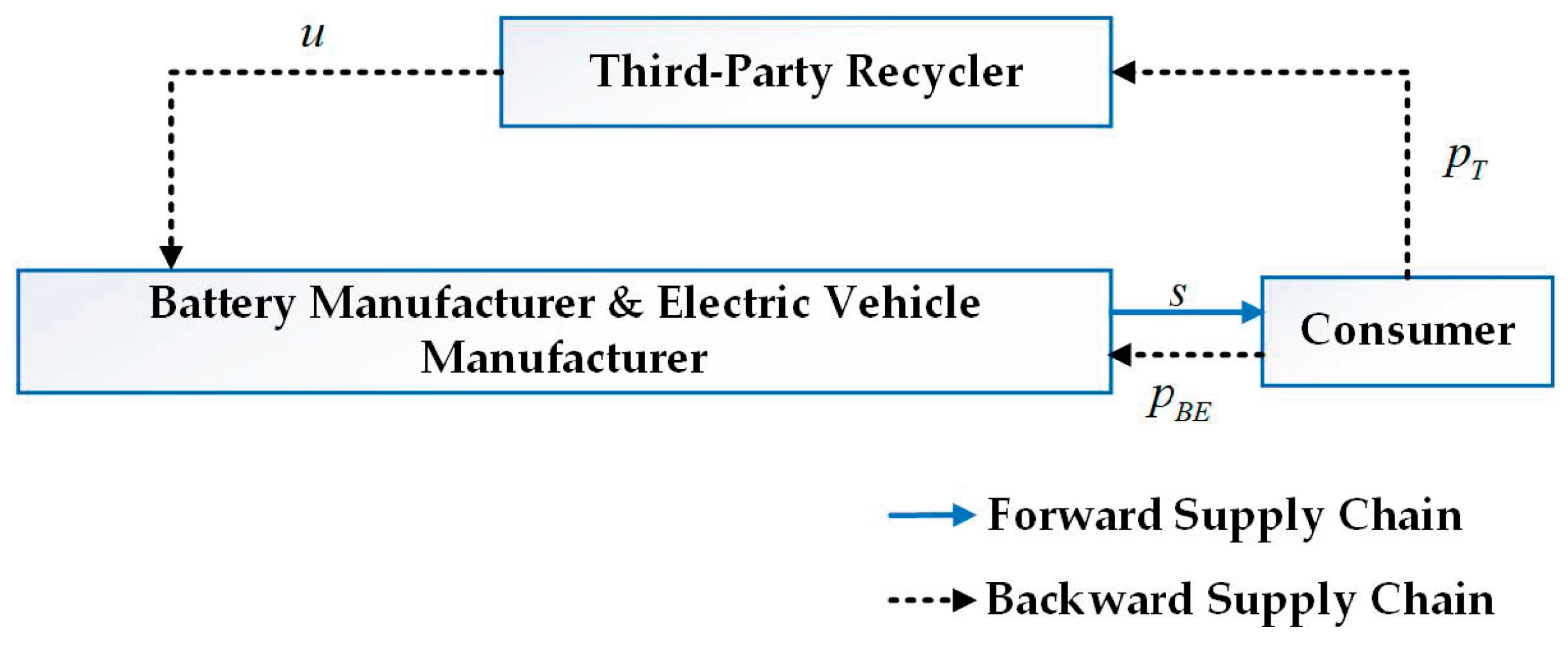

3.1. Problem Description

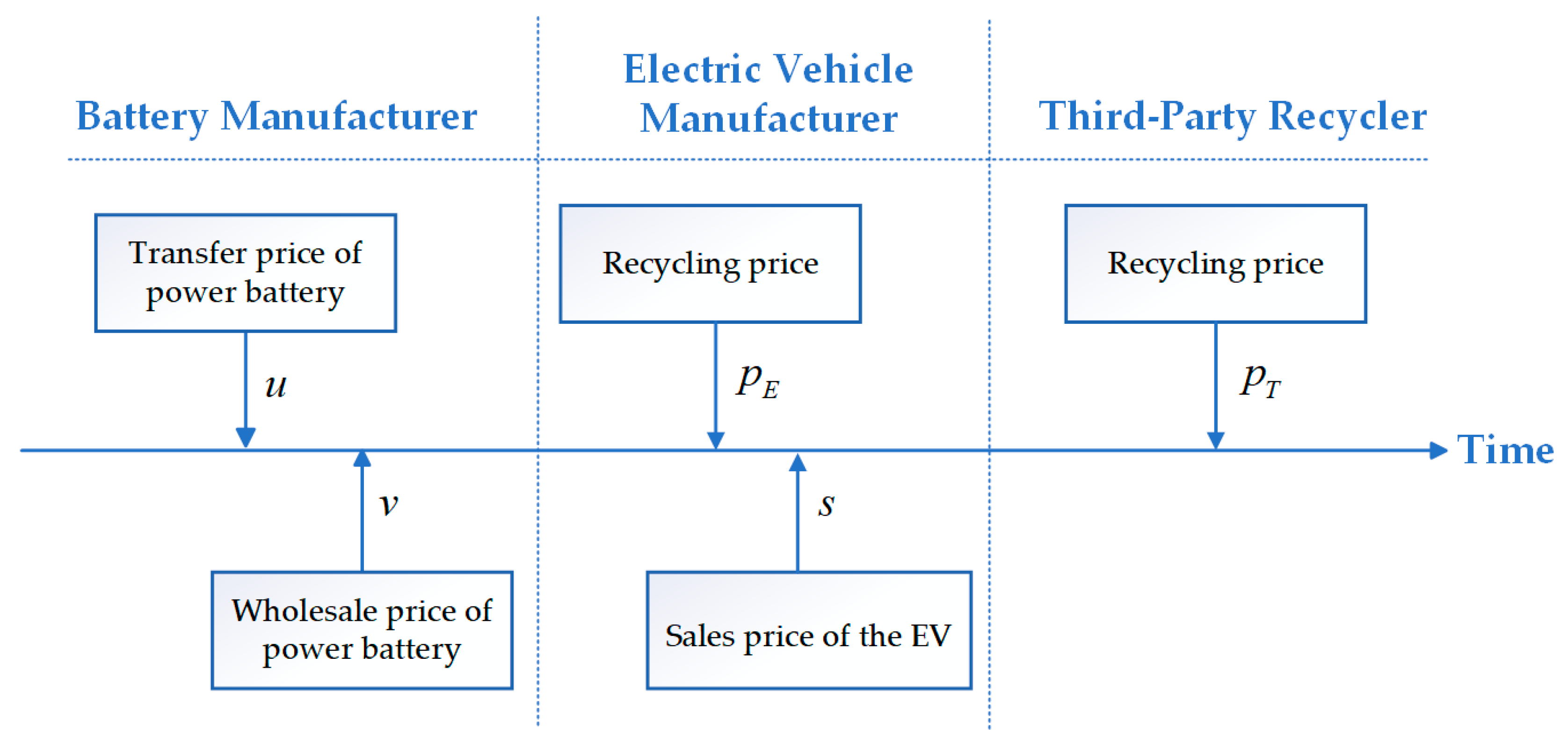

3.2. Description of Notations

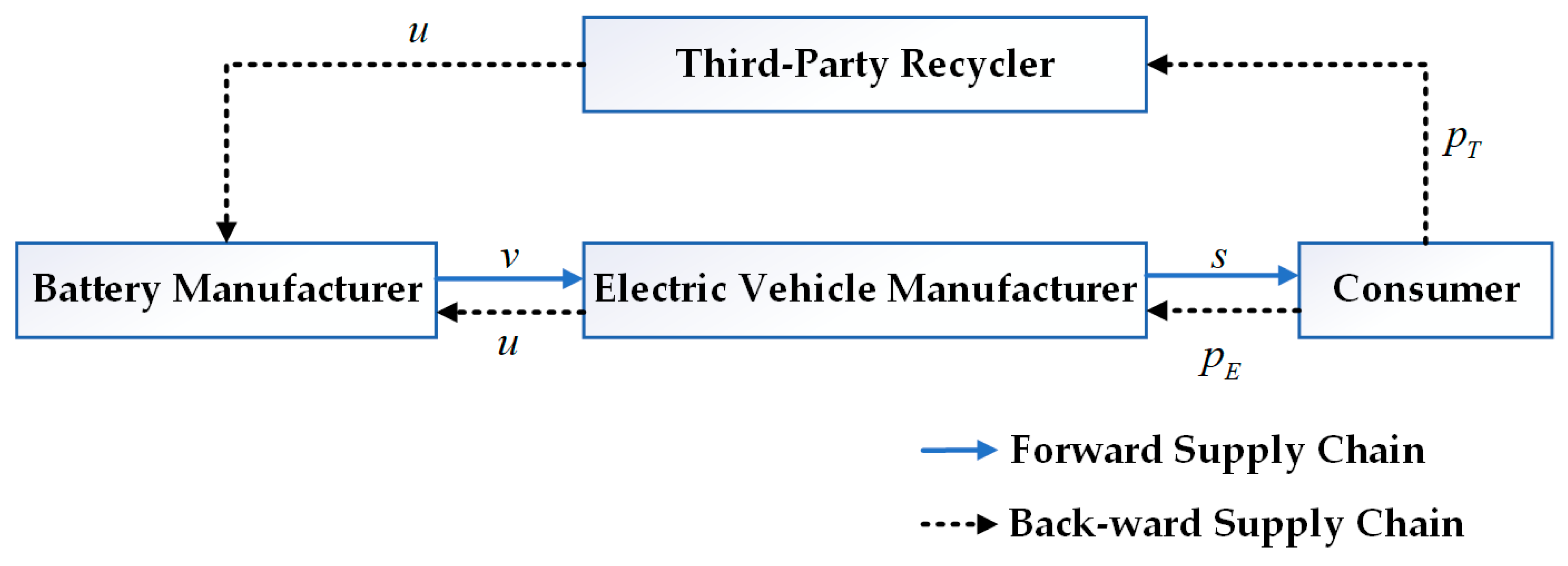

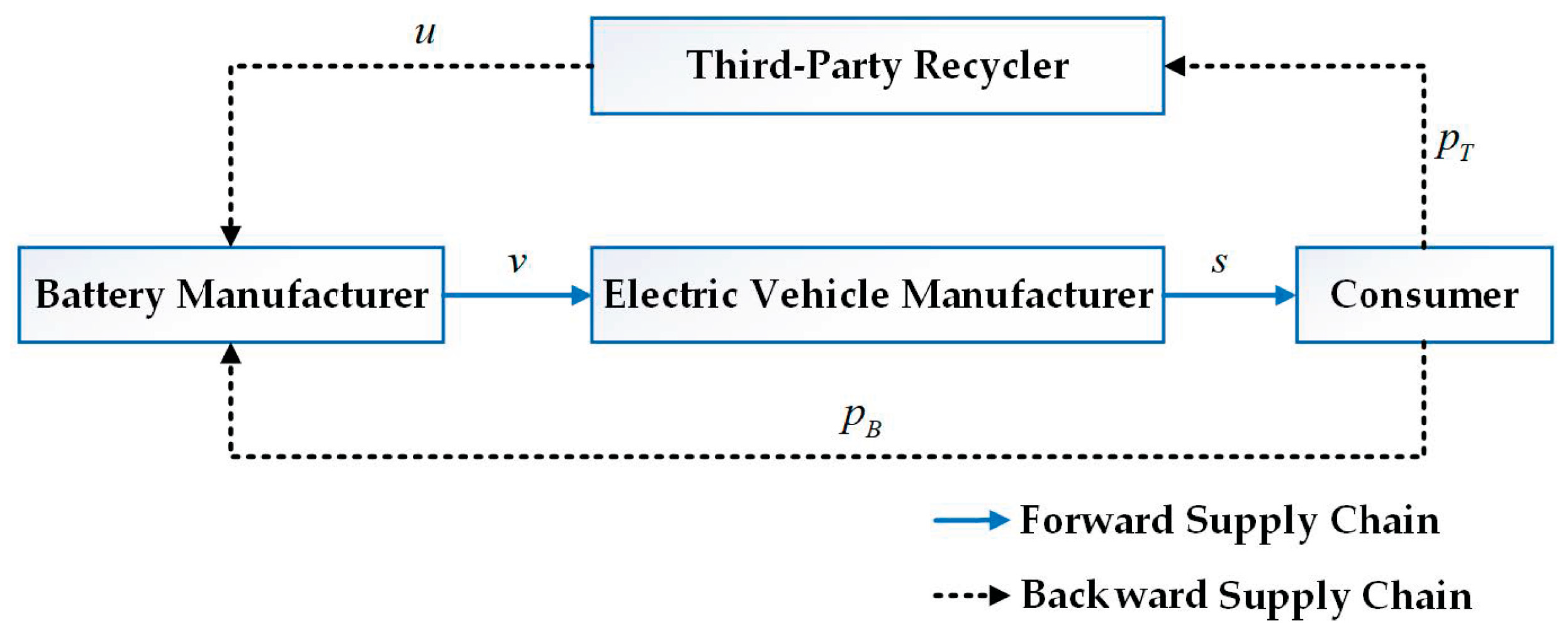

3.3. Basic Assumptions

- (1)

- In the presence of two alternative recycling channels, consumers will choose channels based on the prices offered, leading to competitive relations between channels. According to the assumptions in [23], in the case of dual-channel recycling, the quantity of power batteries voluntarily recycled by consumers is equally allocated between the two recycling channels, with each channel accounting for 1/2. When a recycling channel is operated through cooperation between two enterprises, this channel essentially functions as two separate channels; in other words, the recycling market is equivalent to having three recycling channels, where a is equally divided into three parts, and this cooperative channel accounts for 2/3 [17]. For example, in the E + T mode, the recycling quantity function of the EVM can be expressed as . In the BE+T mode, the recycling quantity function of the BM and EVM cooperative channel can be expressed as . Here, the quantity of power batteries voluntarily recycled by consumers mainly refers to the number of batteries that consumers have to replace when they reach the end of their service life. Moreover, , indicating that the recycling price of the channel has a greater impact on its recycling quantity than the price of other channels.

- (2)

- In the CLSC for power batteries, decision-making among members follows a Stackelberg game [34]. When not collaborating, each stakeholder pursues its own profit maximization; when forming a coalition, they jointly optimize the collective profit of the group. As the “origin” and “terminus” of the power battery lifecycle, the BM is regarded as the leader in this game.

- (3)

- In order to ensure the profitability and motivation of the EVM and TPR to participate in recycling, the transfer price must be higher than their recycling price.

- (4)

- Since the recycling resources are limited, the quantity of remanufactured power batteries produced from them cannot meet market demand. Therefore, when producing and using remanufactured power batteries, the BM and EVM also produce and use new power batteries to supplement the remaining market demand—i.e., equals the sum of the quantity of remanufactured power batteries and the quantity of new power batteries. The quantity of remanufactured power batteries is equal to the recycling quantity of power batteries.

- (5)

- Remanufactured power batteries are of the same quality as new ones. The production cost of new power batteries is , including raw material procurement costs and subsequent processing and production costs. The production cost of remanufactured power batteries is , including disassembly costs, raw material remanufacturing costs, and subsequent processing and production costs. Compared with new power batteries, remanufactured power batteries have lower production costs [18,35], i.e., . For example, GEM recovers production waste from EVE Energy, and processes it to return battery-grade lithium carbonate, with the cost reduced by 35% compared to direct procurement of spodumene. The unit cost of its remanufactured batteries is 0.6 CNY/Wh, while the cost of new batteries is 0.85 CNY/Wh, showing a significant cost advantage.

- (6)

- This study only considers the single-cycle case, i.e., the price strategy is determined at the beginning of the period, without considering the influence of the previous cycle on the next cycle and the delay effect.

- (7)

- All recovered power batteries are fully utilized for second-life applications and remanufacturing, meaning there is no stockpiling of inventory. Moreover, all batteries can be collected after second-life utilization. For example, GEM’s Wuhan Park classifies and processes recycled batteries by capacity: 60% are used for echelon utilization, 40% are disassembled for recycling, and zero inventory backlog was achieved in 2024. Additionally, by disassembling recycled batteries from retired power batteries to obtain raw materials and using these materials to produce recycled power batteries, the cost of this process is lower than that of directly purchasing raw materials to produce power batteries. Thus, the profit from the reuse of each retired power battery can be divided into two parts: the cost savings from remanufacturing and the profits generated from second-life utilization, i.e., [28,36].

- (8)

- (9)

- Regarding the government’s reward–penalty mechanism [14], letting denote the target recycling rate set by the government for the BM, the target recycling quantity is . Based on this target, the government imposes penalties or rewards on the BM: if the quantity of recycled power batteries by the BM exceeds the target quantity, the BM receives a reward; otherwise, it is penalized.

4. Model Construction and Solution

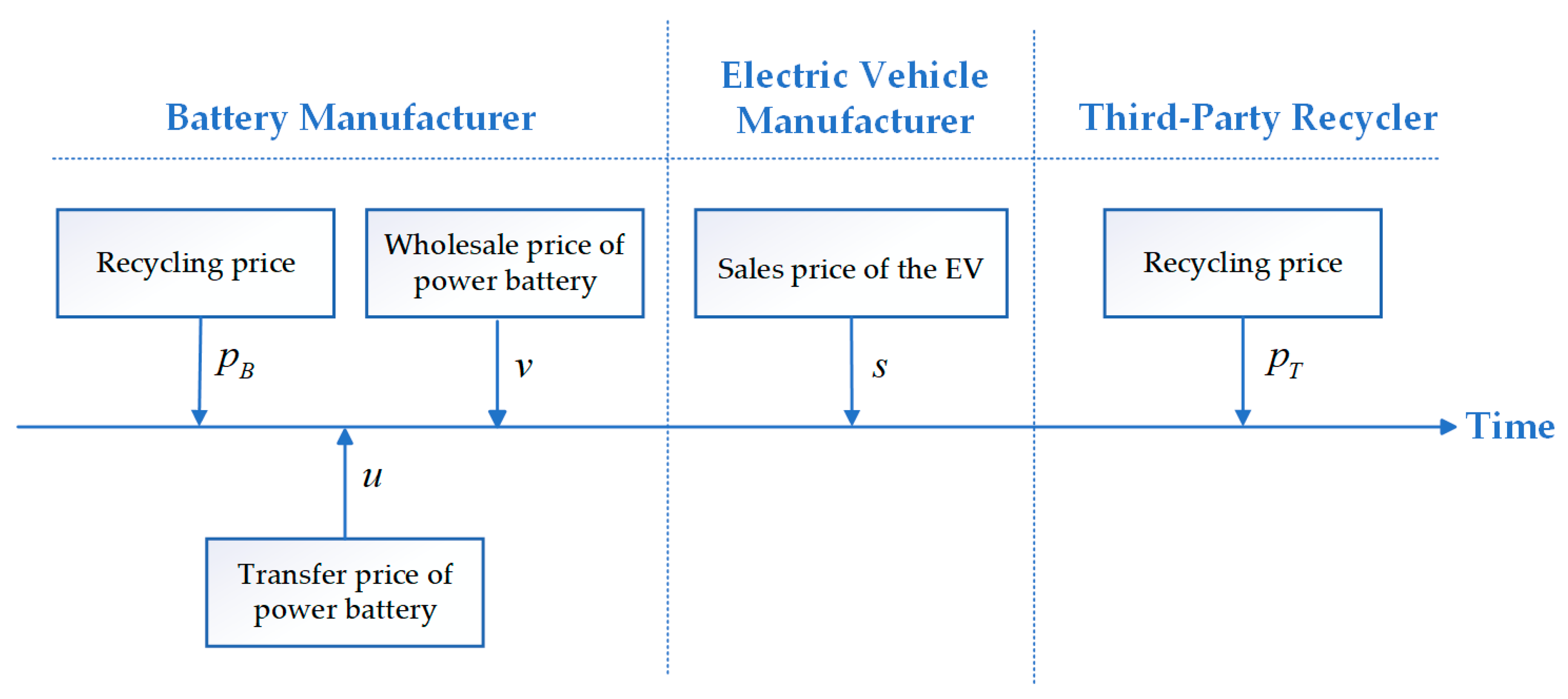

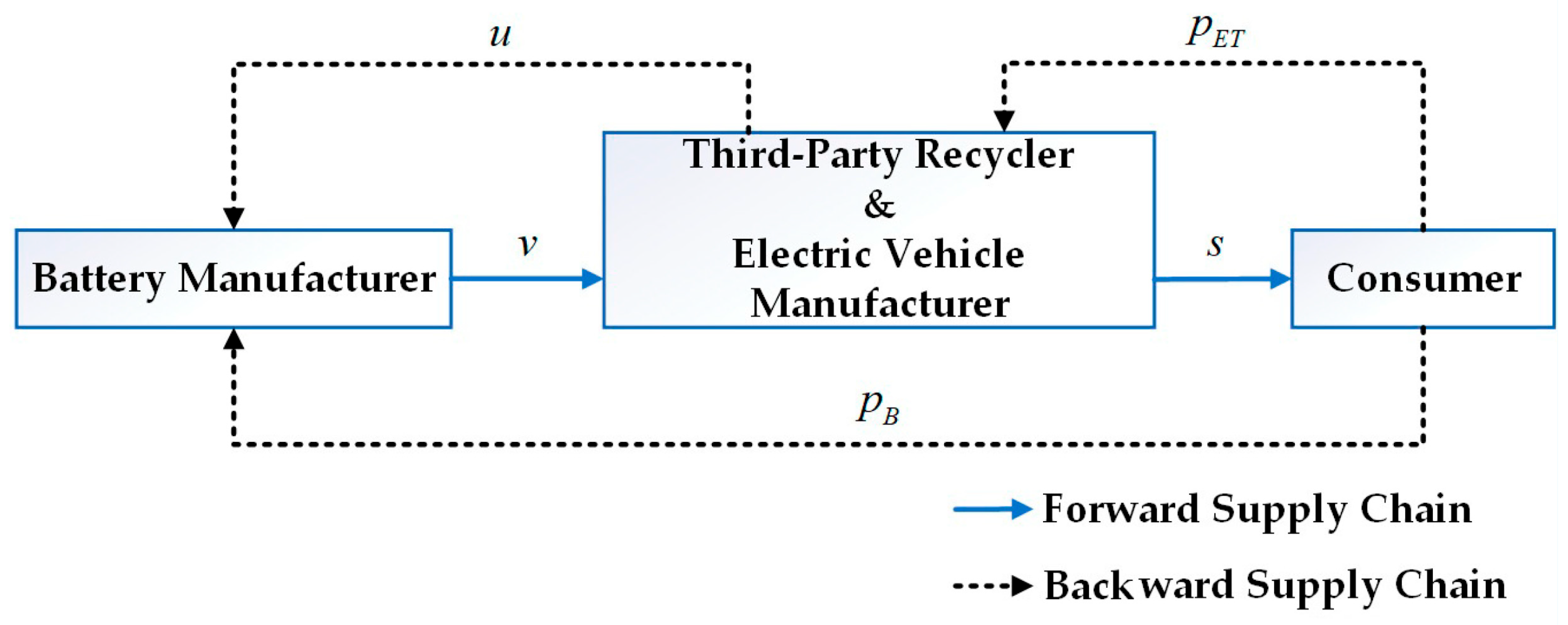

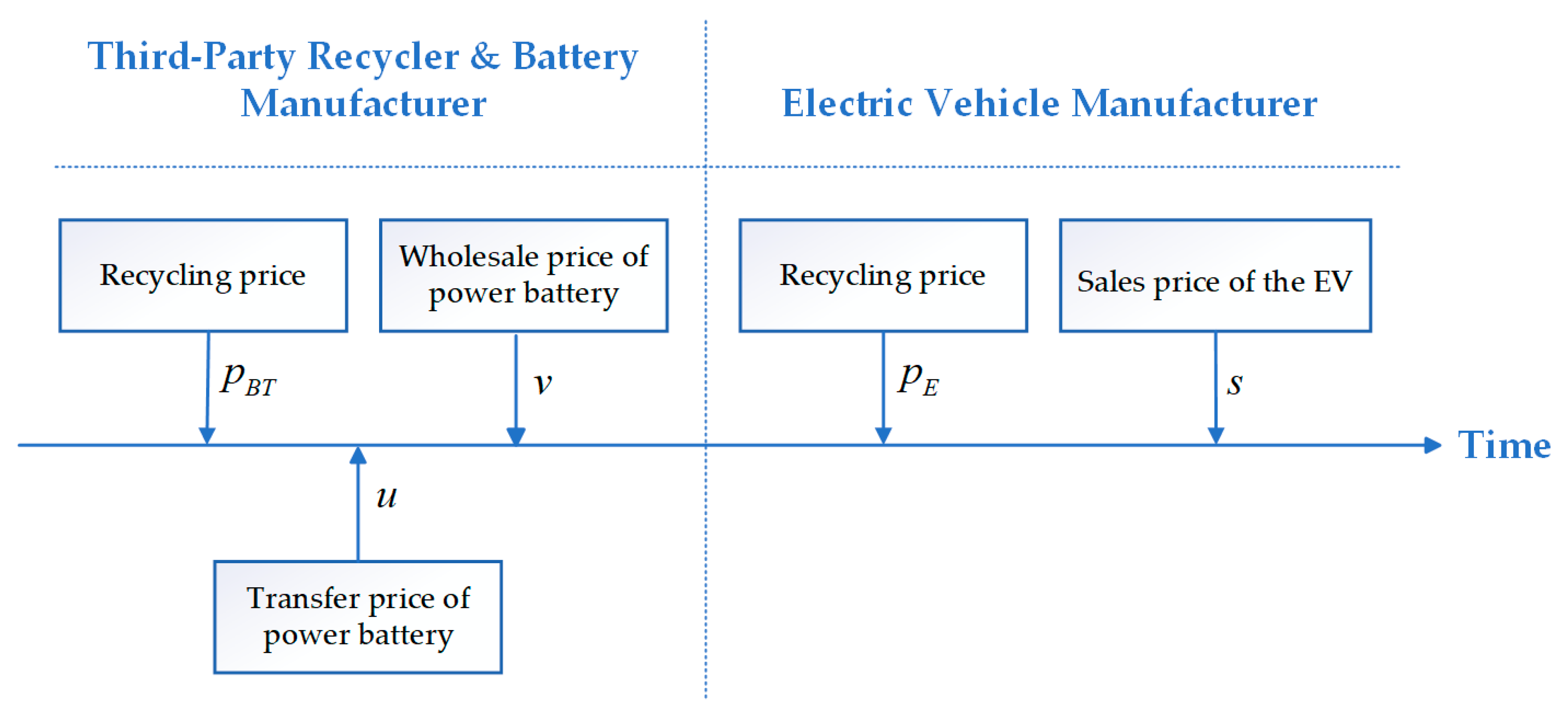

4.1. Competitive Recycling Between the EVM and TPR

4.2. Competitive Recycling Between the BM and TPR

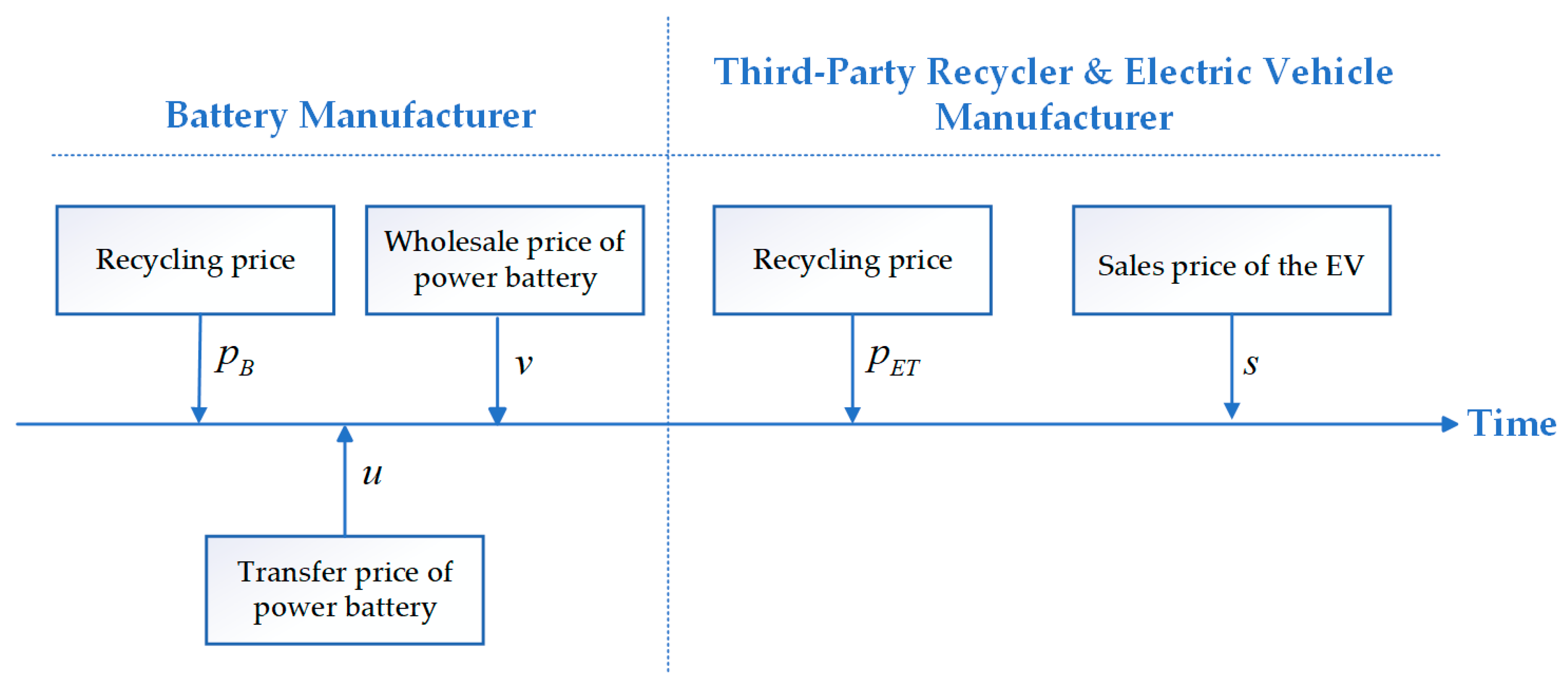

4.3. Cooperative Recycling Between the EVM and TPR

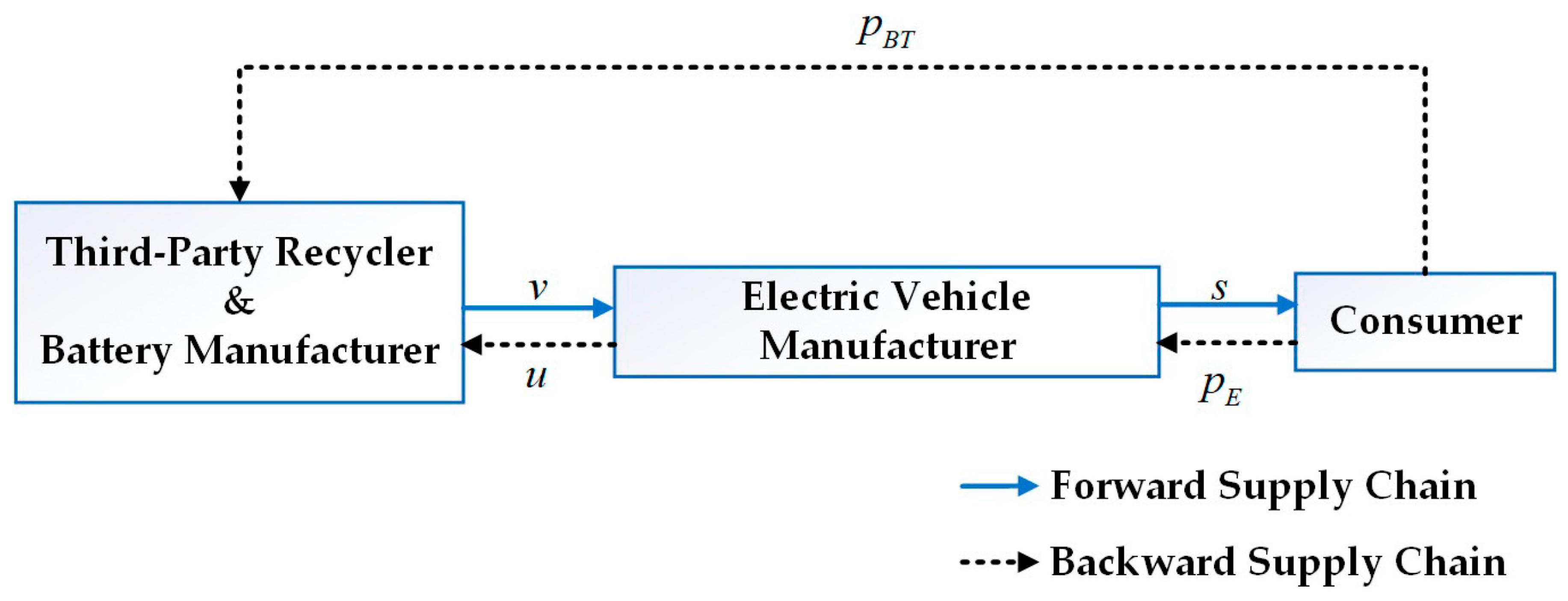

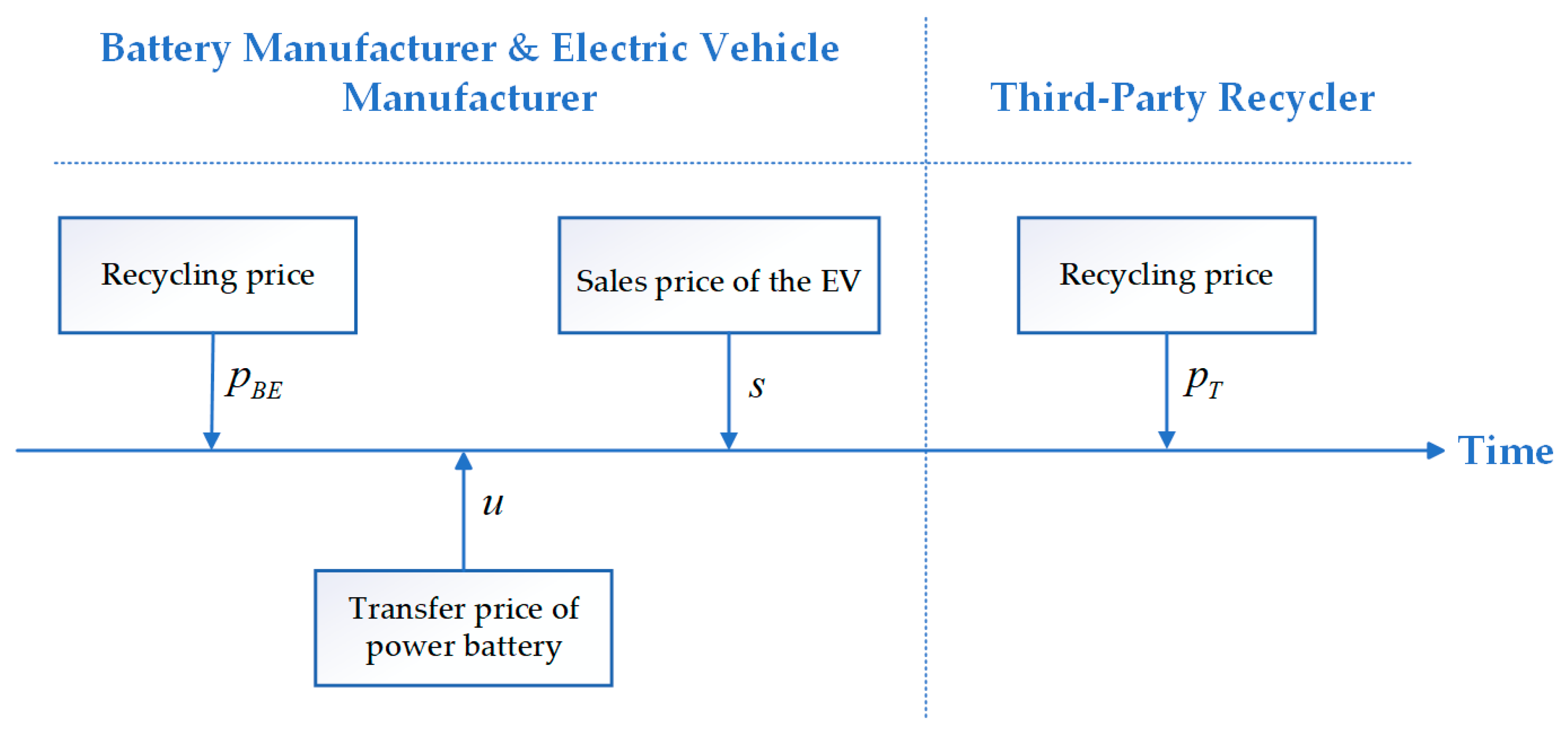

4.4. Cooperative Recycling Between the BM and TPR

4.5. Cooperative Recycling Between the BM and EVM

4.6. Comparison of Equilibrium Solutions

5. Numerical Analysis

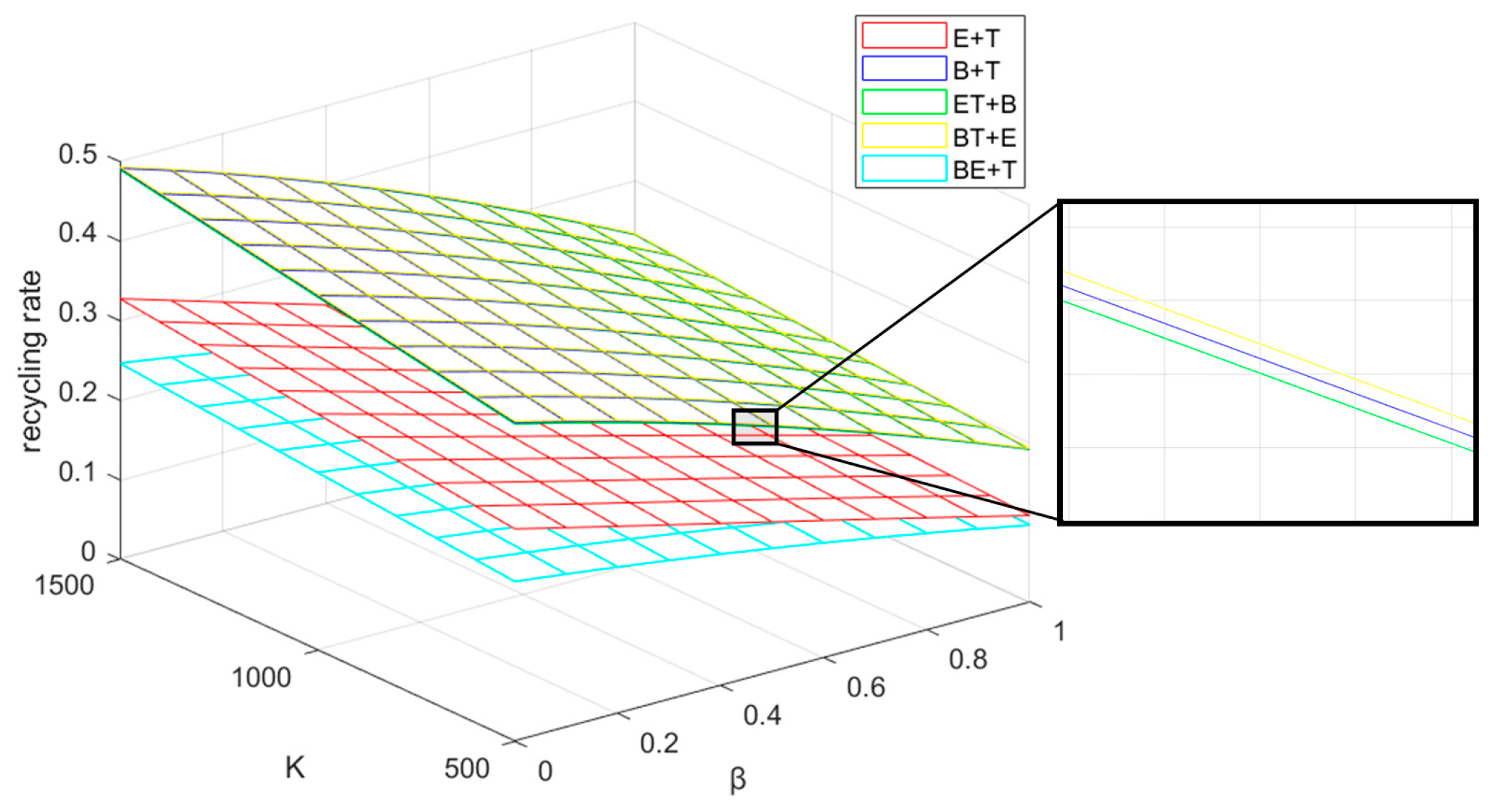

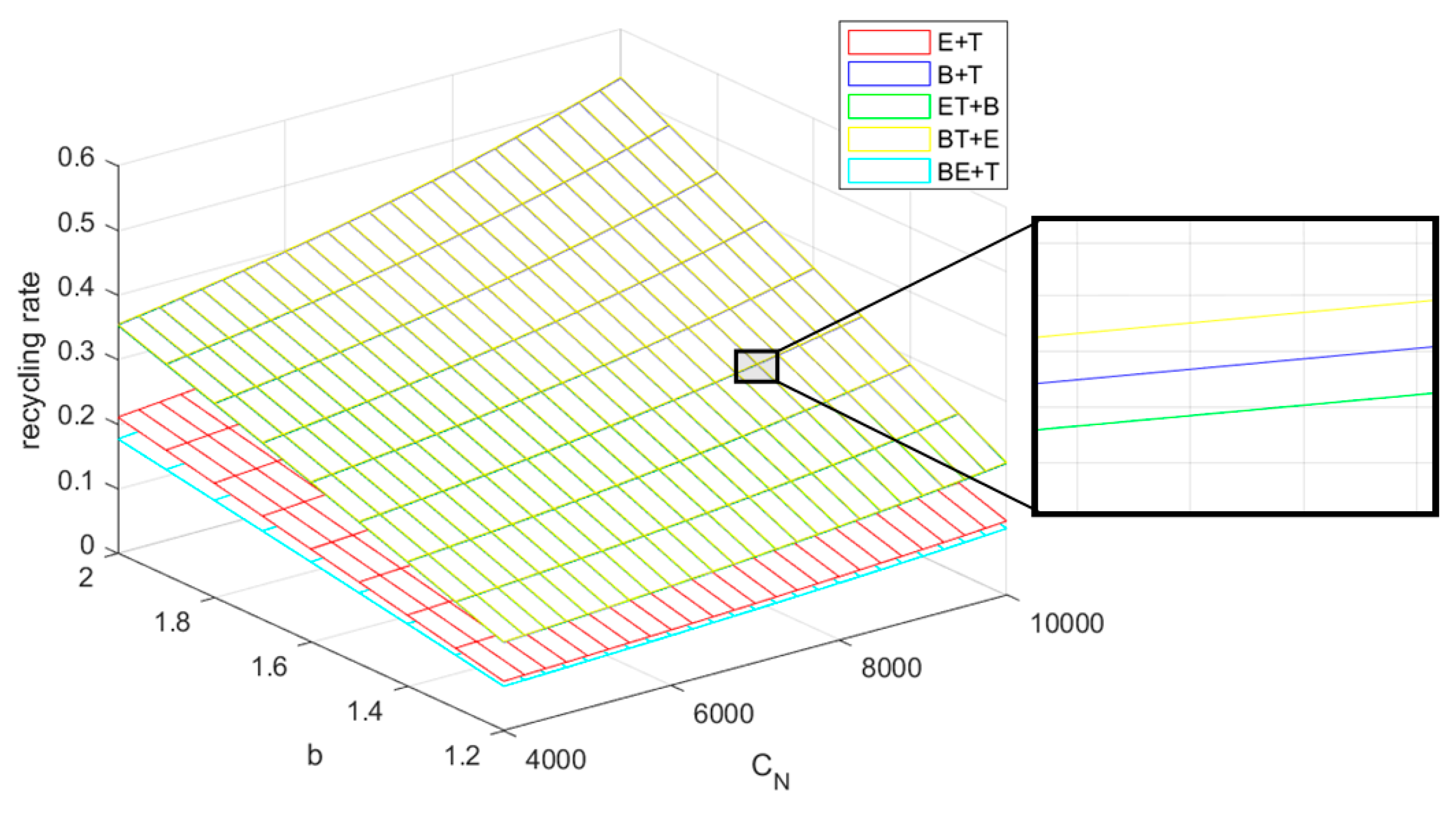

5.1. Recycling Rate Analysis

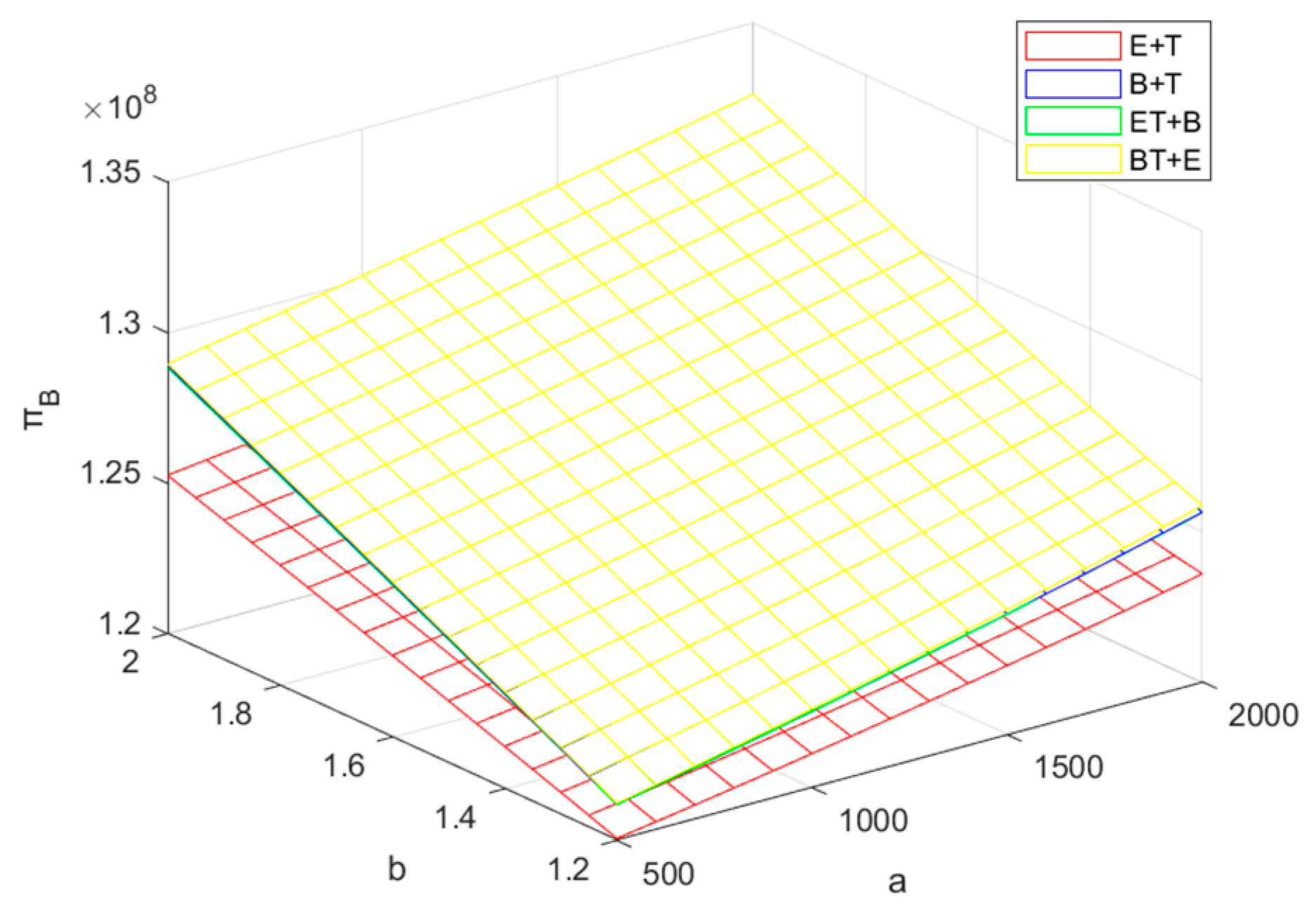

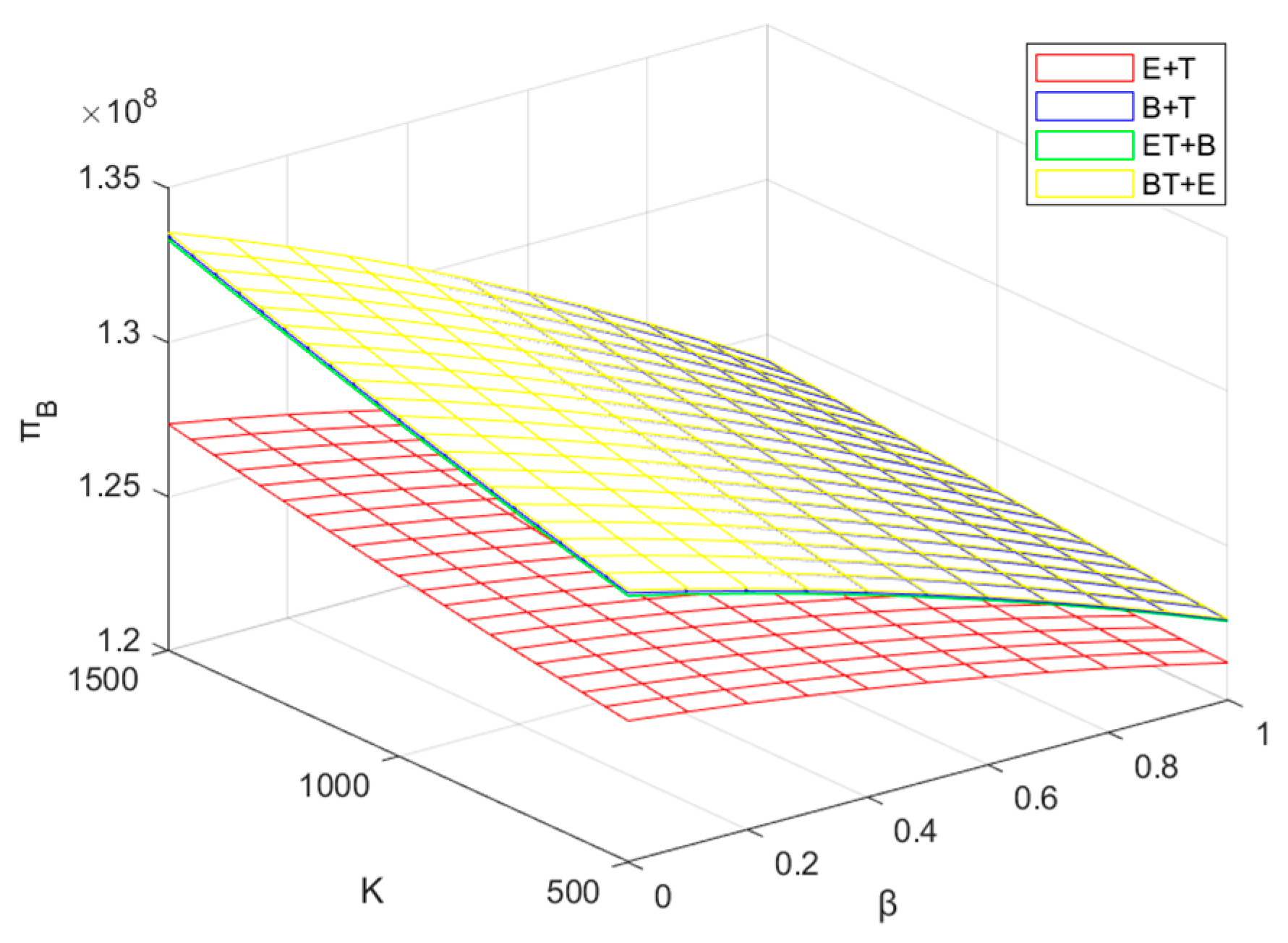

5.2. Profit Analysis of the BM

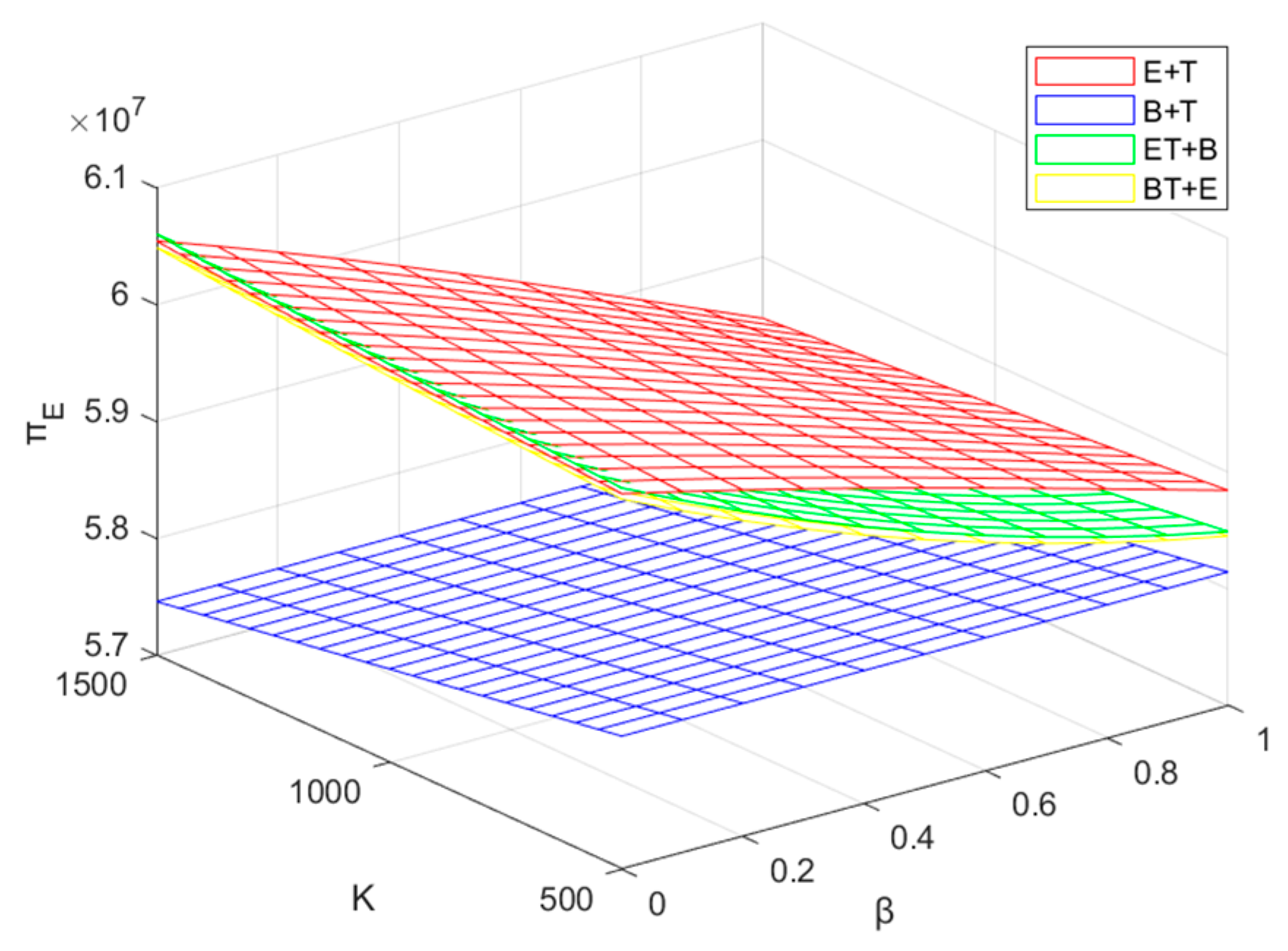

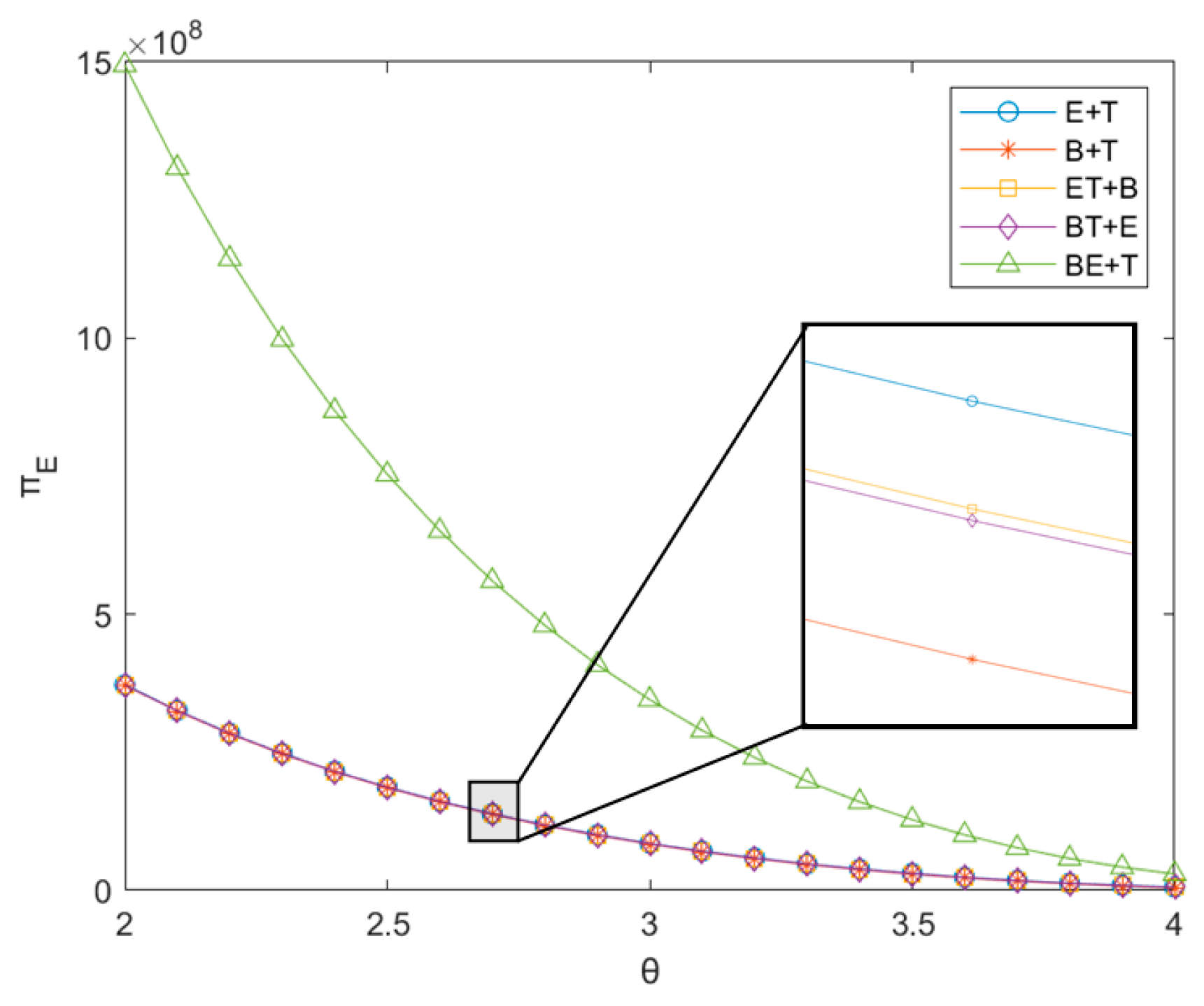

5.3. Profit Analysis of the EVM

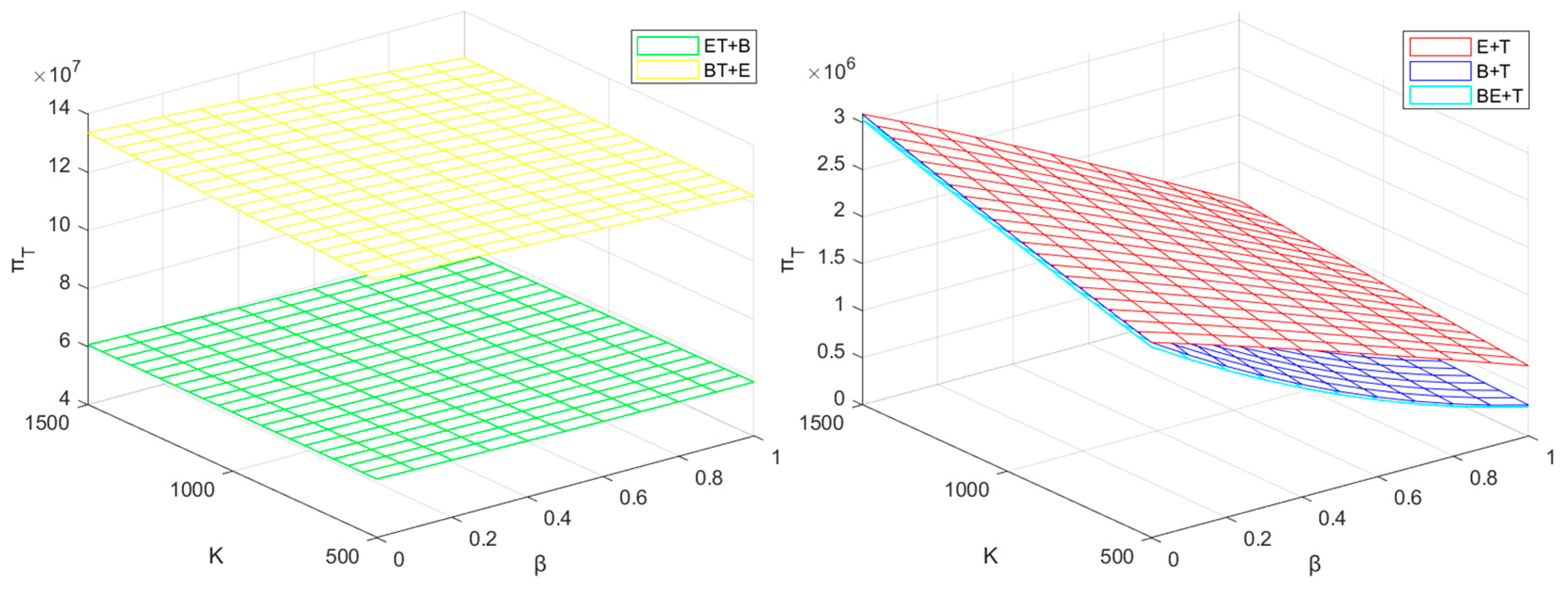

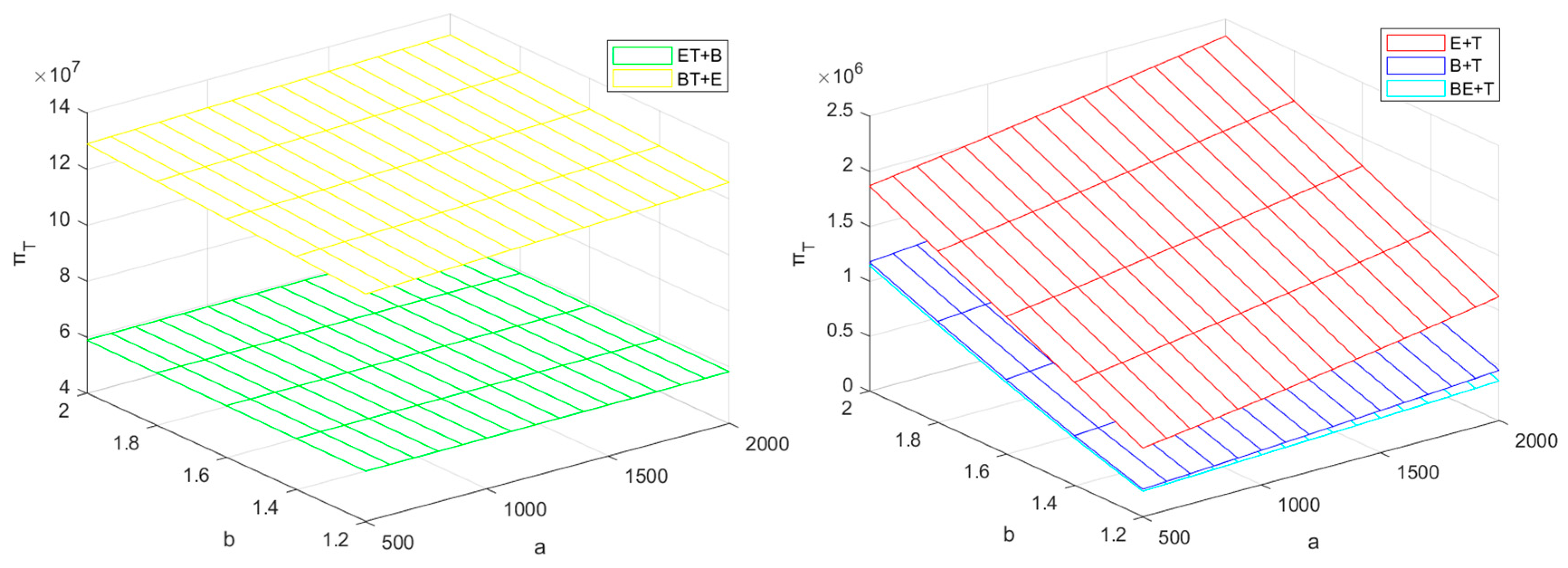

5.4. Profit Analysis of the TPR

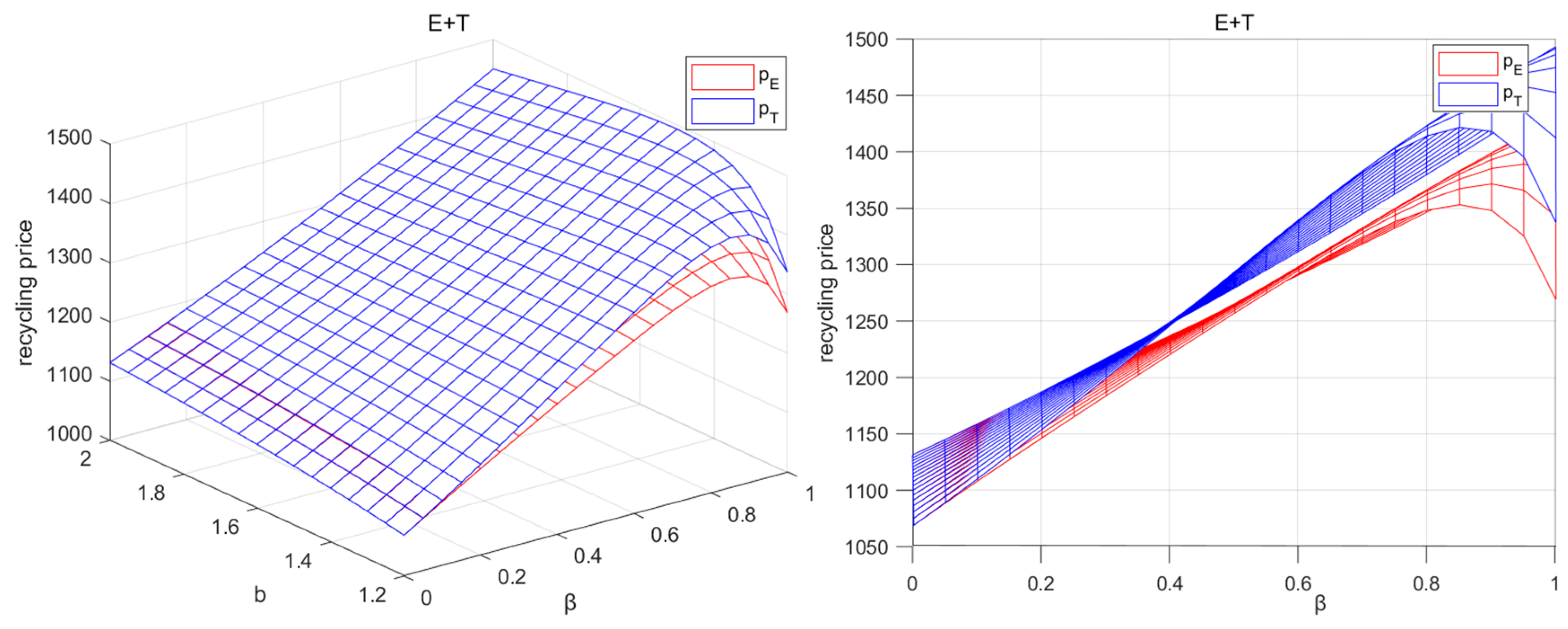

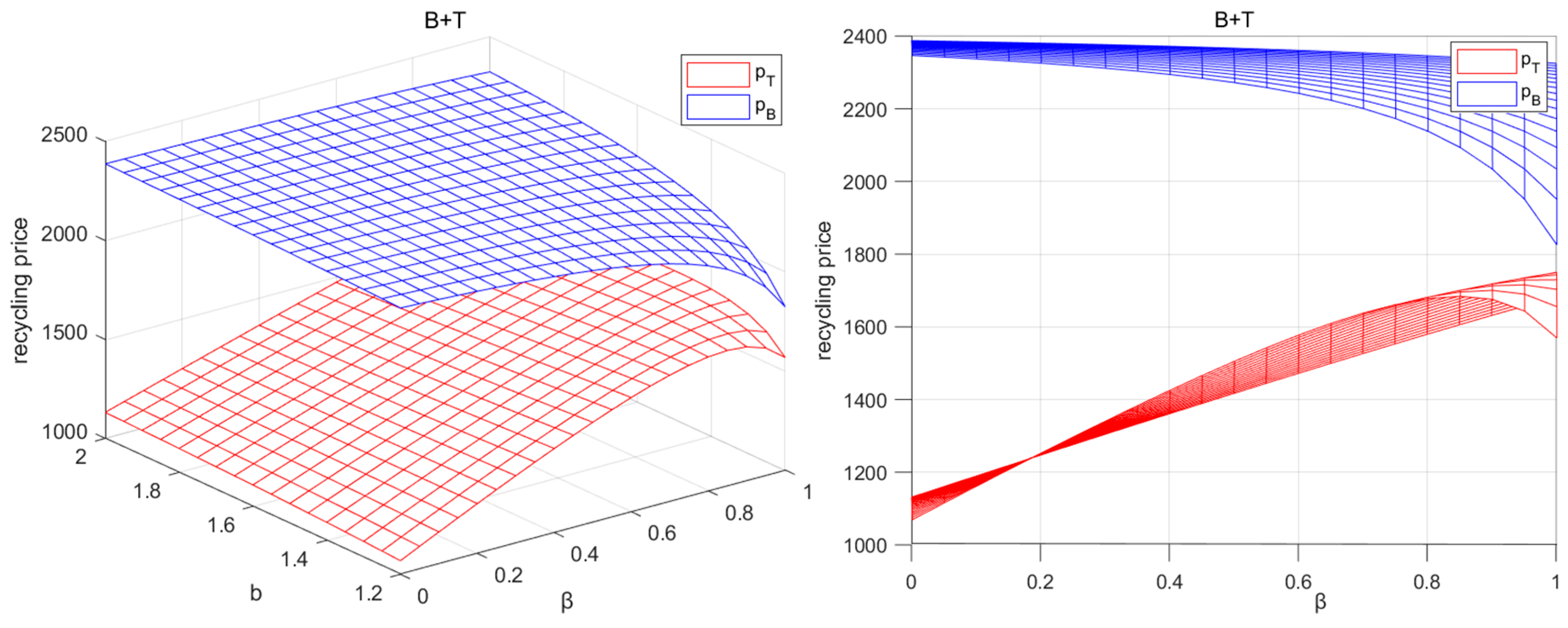

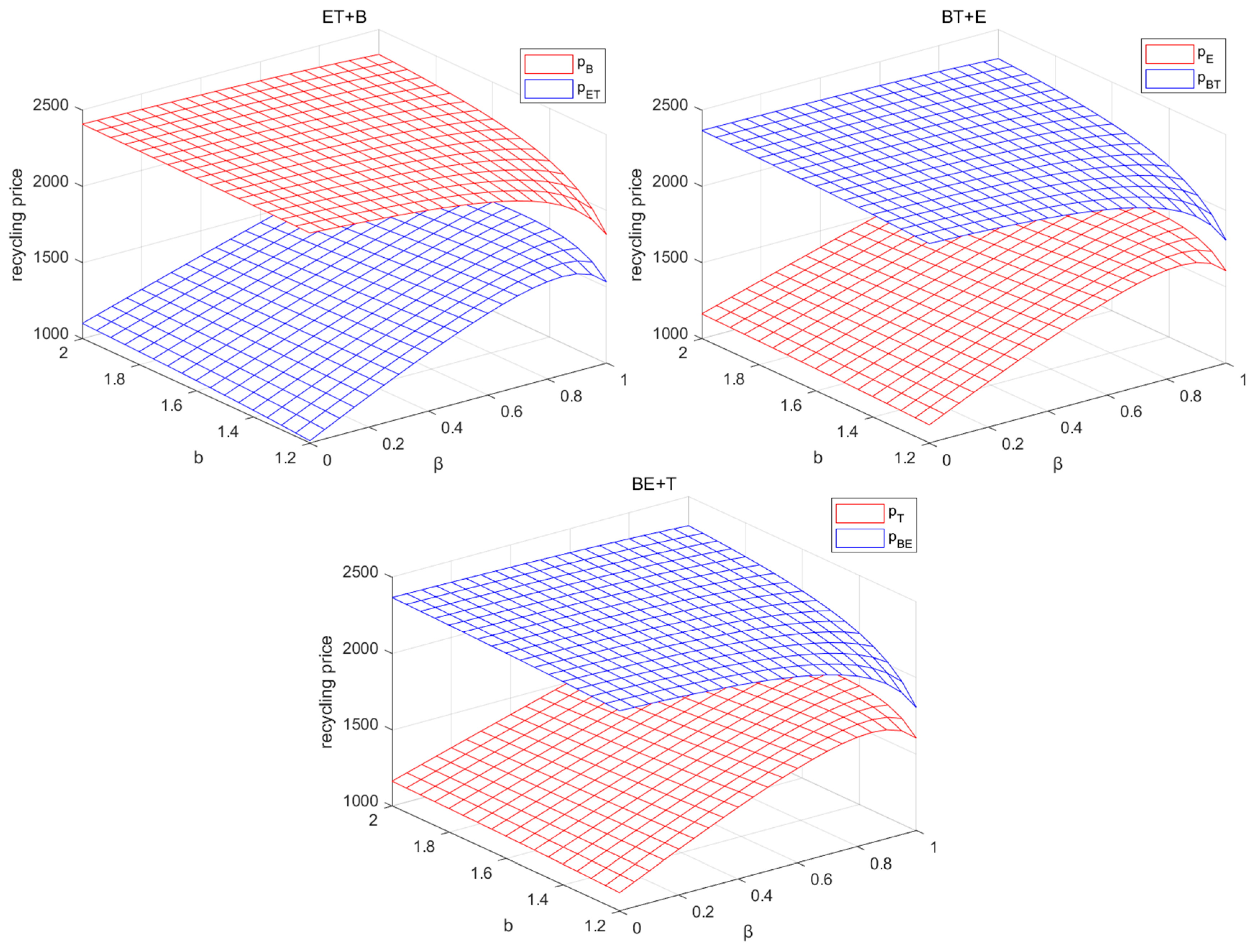

5.5. Recycling Price Analysis

6. Managerial Implications

- (1)

- The reward–penalty mechanism, as an important tool for the government to regulate the market, needs to be reasonably adjusted according to the intensity of competition in the power battery recycling market and the government’s own financial capacity. In order to maintain the long-term incentive effect, the government can dynamically adjust reward–penalty amounts periodically, linking them to market conditions and enterprises’ performance, thereby promoting enterprises to continuously emphasize recycling work. Since increased cross-price sensitivity will intensify competition among recycling channels, the government can help recyclers mitigate the impact of increased competition on their own profits by appropriately increasing the reward–penalty intensity. Secondly, the government can also strengthen the standardized regulation of the industry to prevent informal recycling channels from disrupting the market with high prices. At the same time, it can encourage cooperation between enterprises in the field of recycling to achieve resource sharing or regional cooperation, so as to reduce vicious competition, improve the overall efficiency of recycling and corporate earnings, and establish a healthier market environment.

- (2)

- In order to maximize their own interests, enterprises responsible for power battery recycling must change their decision-making in a timely manner according to the changes in reward–penalty intensity of government. An increase in the reward–penalty intensity will cause the optimal recycling price, transfer price, and sales price in the CLSC to increase. Additionally, enterprises need to adjust their pricing in time to maximize their profit. Especially for the EVM, compared with other enterprises, when the reward–penalty intensity increases, the EVM needs to participate in power battery recycling as much as possible in order to avoid the formation of the B + T mode in the recycling market, which will cause its own profit loss.

- (3)

- Under the influence of recycling competition, recyclers participating in power battery recycling must consider the influence of channel competition intensity on themselves. Regardless of the recycling mode, the decrease in recycler profit caused by the increase in cross-price sensitivity is significant. In a competitive recycling market, it is often the best choice for recyclers to seek cooperation with other enterprises. The BM can maximize its profit by cooperating with the EVM in recycling, which on one hand can help the EVM to sell more EVs and thus gain more revenue, and on the other hand, this cooperation mode can help the BM to recycle the largest number of power batteries, which can bring more secondary utilization revenue for the BM in the laddering segment.

- (4)

- As a leader, the BM can recycle the most power batteries by cooperating with other enterprises, but it can choose different partners for different considerations. From the perspective of profit, cooperation with the EVM is the best choice. However, from the perspective of the recycling rate, cooperation with the TPR is the best choice. Although the BM can recycle the same amount of power batteries with both the EVM and TPR, we can see from the recycling rate that the BE+T mode sells more EVs than the BT+E mode, which further leads to a big difference in the additional profit created by cooperative recycling. This highlights the importance of the BM’s participation in cooperation to improve their profitability or recycling rate in the CLSC.

- (5)

- For the TPR, power battery recycling is its core business. The TPR needs to use data such as recycling price and recycling volume to assess the fluctuations in cross-price sensitivity and changes in consumer behavior that create uncertainty in the enterprise’s profitability. In the face of market competition, the TPR can moderately increase the recycling price on the basis of maintaining a reasonable profit to attract more sources of power batteries, and adopt the strategy of “higher volumes through lower margins” to stabilize the market share. At the same time, the TPR should pay close attention to the consumers’ response to recycling price in the market survey and dynamically adjust the recycling price to stimulate more consumers to participate in recycling. Especially when consumers’ sensitivity increases, lowering the recycling price or providing incentives will help further expand the recycling volume while effectively controlling costs.

7. Conclusions

- (1)

- The sales price of EVs and the wholesale price of power batteries in the forward supply chain will not change due to the change of recycling mode, but will be affected by the competitive relationship of enterprises in the forward supply chain.

- (2)

- As the reward–penalty intensity increases, the sales price, wholesale price, transfer price, recycling price, and the profit of each recycler in the CLSC will increase. At the same time, the recycling rate of power batteries is also improved. The recycling rate of the BT+E mode is always the highest.

- (3)

- No matter which recycling mode is used, the intensification of recycling competition will not only reduce the profit of each enterprise, but also cause the reduction of the recycling rate. The government can alleviate the loss this brings to the enterprises to a certain extent by appropriately increasing the reward–penalty intensity. When the competition is more intense, cooperation with other enterprises is often the best choice.

- (4)

- Cooperation between enterprises can inhibit the recycling quantities of other enterprises to a certain extent. The cooperation between the EVM and BM can not only increase the recycling quantities, but also increase the sales quantities of EVs, which will result in the reduction of the recycling rate.

- (5)

- The BM’s leadership in the supply chain is not only reflected in recycling, but also in profit, which is because participation in power battery recycling can bring more profit for the enterprise. Therefore, it is very important for other members of the supply chain to strive for cooperation with the leader in the supply chain if they want to obtain more profits.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Fang, L.; Li, Y.; Govindan, K. Entry mode selection for a new entrant of the electric vehicle automaker. Eur. J. Oper. Res. 2024, 313, 270–280. [Google Scholar] [CrossRef]

- Ahmadi, L.; Yip, A.; Fowler, M.; Young, S.B.; Fraser, R.A. Environmental feasibility of re-use of electric vehicle batteries. Sustain. Energy Technol. Assess. 2014, 6, 64–74. [Google Scholar] [CrossRef]

- Gu, H.; Liu, Z.; Qing, Q. Optimal electric vehicle production strategy under subsidy and battery recycling. Energy Policy 2017, 109, 579–589. [Google Scholar] [CrossRef]

- Wu, W.; Cong, N.; Zhang, X.; Yue, Q.; Zhang, M. Life cycle assessment and carbon reduction potential prediction of electric vehicles batteries. Sci. Total Environ. 2023, 903, 166620. [Google Scholar] [CrossRef]

- Chen, M.; Zheng, Z.; Wang, Q.; Zhang, Y.; Ma, X.; Shen, C.; Xu, D.; Liu, J.; Liu, Y.; Gionet, P.; et al. Closed loop recycling of electric vehicle batteries to enable ultra-high quality cathode powder. Sci. Rep. 2019, 9, 1654. [Google Scholar] [CrossRef] [PubMed]

- Sathre, R.; Scown, C.D.; Kavvada, O.; Hendrickson, T.P. Energy and climate effects of second-life use of electric vehicle batteries in California through 2050. J. Power Sources 2015, 288, 82–91. [Google Scholar] [CrossRef]

- Wang, L.; Wang, X.; Yang, W. Optimal design of electric vehicle battery recycling network–From the perspective of electric vehicle manufacturers. Appl. Energy 2020, 275, 115328. [Google Scholar] [CrossRef]

- Wu, W.; Zhang, M.; Jin, D.; Ma, P.; Wu, W.; Zhang, X. Decision-making analysis of electric vehicle battery recycling under different recycling models and deposit-refund scheme. Comput. Ind. Eng. 2024, 191, 110109. [Google Scholar] [CrossRef]

- Zhang, M.; Wu, W.; Song, Y. Study on the impact of government policies on power battery recycling under different recycling models. J. Clean. Prod. 2023, 413, 137492. [Google Scholar] [CrossRef]

- Zhou, W.; Zheng, Y.; Huang, W. Competitive advantage of qualified WEEE recyclers through EPR legislation. Eur. J. Oper. Res. 2017, 257, 641–655. [Google Scholar] [CrossRef]

- Wang, W.; Zhang, Y.; Zhang, K.; Bai, T.; Shang, J. Reward–penalty mechanism for closed-loop supply chains under responsibility-sharing and different power structures. Int. J. Prod. Econ. 2015, 170, 178–190. [Google Scholar] [CrossRef]

- Lehmann, P. Justifying a policy mix for pollution control: A review of economic literature. J. Econ. Surv. 2012, 26, 71–97. [Google Scholar] [CrossRef]

- Wang, W.; Zhang, Y.; Fan, L.; He, L.; Da, Q. Research on the premium and penalty mechanism of the reverse supply chain considering various goals of government. Chin. J. Manag. Sci. 2015, 23, 68–76. [Google Scholar] [CrossRef]

- Tang, Y.; Zhang, Q.; Li, Y.; Wang, G.; Li, Y. Recycling mechanisms and policy suggestions for spent electric vehicles’ power battery-A case of Beijing. J. Clean. Prod. 2018, 186, 388–406. [Google Scholar] [CrossRef]

- Narang, P.; De, P.K.; Lim, C.P.; Kumari, M. Optimal recycling model selection in a closed-loop supply chain for electric vehicle batteries under carbon cap-trade and reward-penalty policies using the Stackelberg game. Comput. Ind. Eng. 2024, 196, 110512. [Google Scholar] [CrossRef]

- Xiao, M.; Xu, C.; Xie, F. Research on the impact of information sharing and government subsidy on competitive power battery recycling. J. Clean. Prod. 2024, 467, 142989. [Google Scholar] [CrossRef]

- Liu, Q.; Zhu, X. Incentive strategies for retired power battery closed-loop supply chain considering corporate social responsibility. Environ. Dev. Sustain. 2024, 26, 19013–19050. [Google Scholar] [CrossRef]

- Zhang, C.; Tian, Y.X.; Han, M.H. Recycling mode selection and carbon emission reduction decisions for a multi-channel closed-loop supply chain of electric vehicle power battery under cap-and-trade policy. J. Clean. Prod. 2022, 375, 134060. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Bhattacharya, S.; Van Wassenhove, L.N. Closed-loop supply chain models with product remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef]

- Yu, H.; Mi, J.; Xu, N. Recycling, pricing decisions, and coordination in the dual-channel closed-loop supply chain: A dynamic perspective. J. Clean. Prod. 2024, 456, 142297. [Google Scholar] [CrossRef]

- Song, H.; Zhang, J.; Li, J. The impacts of subsidy strategies and recycling modes on the closed-loop supply chain. Manag. Decis. Econ. 2022, 43, 4106–4123. [Google Scholar] [CrossRef]

- Zhao, X.; Peng, B.; Zheng, C.; Wan, A. Closed-loop supply chain pricing strategy for electric vehicle batteries recycling in China. Environ. Dev. Sustain. 2022, 24, 7725–7752. [Google Scholar] [CrossRef]

- Sun, Q.; Chen, H.; Long, R.; Li, Q.; Huang, H. Comparative evaluation for recycling waste power batteries with different collection modes based on Stackelberg game. J. Environ. Manag. 2022, 312, 114892. [Google Scholar] [CrossRef] [PubMed]

- Penkovskii, A.; Stennikov, V.; Mednikova, E.; Postnikov, I. Search for a market equilibrium of Cournot-Nash in the competitive heat market. Energy 2018, 161, 193–201. [Google Scholar] [CrossRef]

- Wang, Z.; Hou, H.; Wei, R.; Li, Z. A Distributed Market-Aided Restoration Approach of Multi-Energy Distribution Systems Considering Comprehensive Uncertainties from Typhoon Disaster. IEEE Trans. Smart Grid 2025. [Google Scholar] [CrossRef]

- Wu, C.; Zhou, D.; Lin, X.; Wei, F.; Chen, C.; Ma, Y.; Huang, Y.; Li, Z.; Dawoud, S.M. A novel energy cooperation framework for community energy storage systems and prosumers. Int. J. Electr. Power Energy Syst. 2022, 134, 107428. [Google Scholar] [CrossRef]

- Chen, J.; Zhang, W.; Gong, B.; Zhang, X.; Li, H. Optimal policy for the recycling of electric vehicle retired power batteries. Technol. Forecast. Soc. Change 2022, 183, 121930. [Google Scholar] [CrossRef]

- Tang, Y.; Zhang, Q.; Li, Y.; Li, H.; Pan, X.; Mclellan, B. The social-economic-environmental impacts of recycling retired EV batteries under reward-penalty mechanism. Appl. Energy 2019, 251, 113313. [Google Scholar] [CrossRef]

- Li, X.; Du, J.; Liu, P.; Wang, C.; Hu, X.; Ghadimi, P. Optimal choice of power battery joint recycling strategy for electric vehicle manufacturers under a deposit-refund system. Int. J. Prod. Res. 2023, 61, 7281–7301. [Google Scholar] [CrossRef]

- Zhang, Q.; Tang, Y.; Bunn, D.; Li, H.; Li, Y. Comparative evaluation and policy analysis for recycling retired EV batteries with different collection modes. Appl. Energy 2021, 303, 117614. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhang, Y.; Wahab, M.I.M.; Goh, M. Channel leadership and performance for a closed-loop supply chain considering competition. Transp. Res. Part E Logist. Transp. Rev. 2023, 175, 103151. [Google Scholar] [CrossRef]

- Garg, A.; Yun, L.; Gao, L.; Putungan, D.B. Development of recycling strategy for large stacked systems: Experimental and machine learning approach to form reuse battery packs for secondary applications. J. Clean. Prod. 2020, 275, 124152. [Google Scholar] [CrossRef]

- Wang, N.; He, Q.; Jiang, B. Hybrid closed-loop supply chains with competition in recycling and product markets. Int. J. Prod. Econ. 2019, 217, 246–258. [Google Scholar] [CrossRef]

- Liu, K.; Wang, C. Production and recycling of new energy vehicle power batteries under channel encroachment and government subsidy. Environ. Dev. Sustain. 2024, 26, 1313–1339. [Google Scholar] [CrossRef]

- Liu, L.; Wang, Z.; Xu, L.; Hong, X.; Govindan, K. Collection effort and reverse channel choices in a closed-loop supply chain. J. Clean. Prod. 2017, 144, 492–500. [Google Scholar] [CrossRef]

- Zhu, L.; Zhang, Q.; Lu, H.; Li, H.; Li, Y.; McLellan, B.; Pan, X. Study on crowdfunding’s promoting effect on the expansion of electric vehicle charging piles based on game theory analysis. Appl. Energy 2017, 196, 238–248. [Google Scholar] [CrossRef]

| Author | Structure Composition | Reward–Penalty Mechanism | Reward–Penalty Object | Recycling Channel | Cooperative Recycling |

|---|---|---|---|---|---|

| Tang et al. (2018) [14] | Power battery manufacturer, retailer, and third-party | √ | Power battery manufacturer | Single or dual | × |

| Zhang et al. (2022) [18] | Manufacturer, retailer, third-party recycler, and echelon utilization enterprise | × | × | Dual or more | √ |

| Wu et al. (2024) [8] | Power battery manufacturer, vehicle manufacturer, and third-party | × | × | Single or dual | √ |

| Zhao et al. (2022) [22] | Power battery manufacturer, EV retailer, and third-party | × | × | Single | √ |

| Xiao et al. (2024) [16] | EVB manufacturer, formal recycler, and informal recycler | × | × | Dual | × |

| Sun et al. (2022) [23] | Manufacture and retailer | × | × | Single or dual | × |

| Li et al. (2023) [29] | Power battery manufacturer, electric vehicle manufacturer, and third-party recycler | × | × | Single or dual | √ |

| Chen et al. (2022) [27] | Power battery manufacturer and electric vehicle manufacturer | × | × | Single | × |

| Zhang et al. (2023) [9] | Power battery manufacturer, vehicle manufacturer, and third-party | √ | Power battery manufacturer | Single or dual | √ |

| Zhang et al. (2021) [30] | Manufacturer, retailer, and third-party | √ | Manufacturer | Single or dual | × |

| Liu et al. (2024) [17] | Battery manufacturer, CSR recycler, and non-CSR recycler | × | × | Dual | √ |

| This paper | Battery manufacturer, electric vehicle manufacturer, and third-party recycler | √ | Battery manufacturer | Dual | √ |

| Notation | Definition |

|---|---|

| Unit recycling price of power batteries | |

| Transfer price of power batteries | |

| Unit wholesale price of power batteries | |

| Unit sales price of EVs | |

| Investment in the recycling activity per unit of power battery, such as the construction of recycling stations, advertising, transportation, etc. | |

| Unit disassembly cost of scrapped power batteries | |

| Unit production cost of power batteries | |

| Unit production cost of EVs | |

| Net profit per unit of remaining capacity of power batteries | |

| Profit of the BM, EVM, or TPR | |

| Quantity of power batteries recycled | |

| Quantity of power batteries voluntarily recycled by consumers | |

| Quantity of vehicles sold by the EVM | |

| Market size of EVs | |

| Sensitivity of consumers to the recycling price | |

| Cross-price sensitivity of one recycling channel to another | |

| Sensitivity of consumers to the price of electric vehicles | |

| Unit remaining capacity of power batteries, which follows a normal distribution | |

| Reward–penalty intensity set by the government | |

| Recycling rate of power batteries |

| E + T Mode | |||

| B + T Mode | |||

| ET+B Mode | |||

| BT+E Mode | |||

| BE+T Mode | / |

| E + T Mode | |

| B + T Mode | |

| ET+B Mode | |

| BT+E Mode | |

| BE+T Mode | |

| Parameter | Value | Parameter | Value |

|---|---|---|---|

| 500 | 1.6 | ||

| 200,000 | 3.2 | ||

| 2000 | 40,000 | ||

| 6400 | 500 | ||

| 10% | 5400 | ||

| 1000 | 0.8 |

| E + T | B + T | ET+B | BT+E | BE+T | |

|---|---|---|---|---|---|

| 5.9013 × 107 | 5.7800 × 107 | 5.85067 × 107 | 5.84524 × 107 | ||

| 1.25107 × 106 | 6.79254 × 105 | 1.25165 × 108 | 6.52377 × 105 | ||

| 1.22684 × 108 | 1.25110 × 108 | 1.25056 × 108 | |||

| 1.81697 × 108 | 1.82910 × 108 | 2.40765 × 108 | |||

| 0.199849 | 0.268290 | 0.267525 | 0.269056 | 0.134528 | |

| 1303.13 | 1063.33 | 1021.67 | |||

| 1414.82 | 1042.50 | 2637.5 | 1021.67 | ||

| 2606.25 | 2575.00 | ||||

| 2637.5 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wei, H.; Qi, Z. Pricing Strategy for Sustainable Recycling of Power Batteries Considering Recycling Competition Under the Reward–Penalty Mechanism. Sustainability 2025, 17, 7224. https://doi.org/10.3390/su17167224

Wei H, Qi Z. Pricing Strategy for Sustainable Recycling of Power Batteries Considering Recycling Competition Under the Reward–Penalty Mechanism. Sustainability. 2025; 17(16):7224. https://doi.org/10.3390/su17167224

Chicago/Turabian StyleWei, Hairui, and Ziming Qi. 2025. "Pricing Strategy for Sustainable Recycling of Power Batteries Considering Recycling Competition Under the Reward–Penalty Mechanism" Sustainability 17, no. 16: 7224. https://doi.org/10.3390/su17167224

APA StyleWei, H., & Qi, Z. (2025). Pricing Strategy for Sustainable Recycling of Power Batteries Considering Recycling Competition Under the Reward–Penalty Mechanism. Sustainability, 17(16), 7224. https://doi.org/10.3390/su17167224