1. Introduction

To provide a practical foundation for this study, it is essential to acknowledge existing efforts in specific sectors. For instance, the “Green Credit Guidelines” under the China Banking Regulatory Commission and the Indian National Electric Mobility Mission are government-led programs that incentivize clean technology by leveraging financial innovation. Private sector efforts—for instance, through Ant Financial’s “Ant Forest” app— demonstrate how fintech can be leveraged to support green programs through personal carbon-reduction incentives. These illustrations highlight the greater potential of fintech and underscore the crucial role of sound governance in promoting environmental sustainability in Asia, providing reassurance about the effectiveness of these initiatives. Notwithstanding the need for a sustainable economic environment globally to ensure the continuity of the environment and the ecosystem in developing and developed countries, achieving economic prosperity and environmental sustainability has been a massive challenge [

1]. The over-dependence on fossil fuels to drive economic activities and political agendas by countries has threatened the quality of the environment due to the carbon emissions from these sources [

2]. These activities have led to the deterioration of the ecosystem and have significantly threatened human life [

3]. The increasing release of GHG emissions is causing the rise in the earth’s temperature [

4]. Between 2030 and 2050, it is projected that global warming is expected to reach 1.5 degrees Celsius due to the high carbon emissions globally. There is a need to promote the consumption of renewable energies to mitigate the environmental impact of fossil fuels, ensuring a sustainable economy and environment [

5].

Recently, the issue of environmental degradation resulting from global warming has become a serious global concern. Various economies are seeking the most effective ways to mitigate the impact of global warming within their countries. GHG emissions contribute to climate change, primarily resulting from the burning of fossil fuels. The carbon dioxide and methane released into the atmosphere as a result of fossil fuel combustion not only contaminate the environment but also the air and water bodies [

6]. Several efforts by international concern bodies to address the effects of global warming on the environment have faced various ups and downs, making most of these efforts ineffective [

7]. Researchers, as a way of contributing to the solution of this problem, have provided empirical evidence to support a sustainable pathway to reduce the harm caused by carbon emissions. In addition, researchers have recommended the implementation and enforcement of suitable and rigid policies to protect the environment and the ecosystem [

8].

Economic and environmental policies in the fight against global warming cannot be overlooked. Government effectiveness is required to ensure economic prosperity and the effective management of natural resources [

9]. However, issues related to climate change and corruption have made it difficult for most countries to achieve the Sustainable Development Goals. It is believed that a decrease in corruption would significantly lessen the harmful influence of energy use on environmental deterioration. According to the statistics from the Corruption Perceptions Index, it was observed that between 2012 and 2020, China’s corruption perception index increased from 39 to 42, India’s rose from 36 to 40, and Pakistan’s rose from 27 to 31. However, there was a decrease in Sri Lanka’s corruption perceptions index from 40 to 38 [

10]. Considering this, it is important to implement policies that control corruption and are paramount to achieving effective enforcement of energy regulations and consumption. In the view of Li and Tong [

11], empowering transparency and accountability in the governance system is required to combat corruption and its impact on sustainable development. Good governance ensures the effective allocation of resources and the investment in clean technologies that are paramount to achieving environmental sustainability. It is argued that climate policy is required to control carbon emissions [

12], and its impact on the environment. Additionally, laws addressing climate change are important for securing the ecosystem and controlling greenhouse gas emissions (GHG) to protect biodiversity [

6]. Environmental regulators are encouraged to use renewable energy as they have the tendency to control emissions and are considered environmentally friendly [

13]. Environmental regulation plays a crucial role in mitigating carbon emissions.

In the last few decades, financial technology has transformed the financial system. Financial technology (fintech) includes “mobile payments, banking online, blockchain technology, cryptocurrencies, and crowdfunding”. The development of fintech has significantly brought a relevant dimension to the area of financial development [

9]. It has received much attention in the literature due to its ability to democratize fiscal service and promote financial inclusion; however, there are other environmental matters related to it that need to be explored [

14]. However, the theoretical fintech drivers of environmental impacts remain underexplored, particularly when results vary from anticipation. The potential for fintech to create green effects is potentially hindered by policy limitations, constrained infrastructure, or perverse incentives, which require more emphasis. The promotion of green finance through fintech is a way it contributes to environmental quality. As green finance ensures loans for clean energy, fintech ensures the efficacy of clean energy. According to Muganyi et al. [

15], fintech helps to maximize energy consumption with less pollution and waste. The growing attention of fintech globally over the years has caused researchers to make claims that the advancement of fintech directly or indirectly affects the adoption of renewable energies, which is the right path towards a clean energy transition. The development of fintech is seen as a sustainable pathway to move away from the over-reliance on natural resources that deteriorate the environment like coal, oil, and gas. According to Tao et al. [

16], the potential of fintech to address global warming and to ensure smooth renewable energy trade alongside facilitating environmental finances contributes significantly to the establishment of the low-economy economic system. In this regard, the development and implementation of fintech will reduce countries’ dependency on fossil fuels for economic activities to sustainable energy. According to the study of Fareed and Pata [

17], the authors stated that financial technology innovation helps to minimize energy consumption and carbon emissions. Similarly, the study by An et al. [

18] established the impact that financial technology innovation has on carbon emissions.

Asia is well known globally because of its population, and most of the countries on the continent are well known. Asia accounts for more than half of the global population, making it a focal region for environmental and energy-related research. Asia is selected for the study due to its large population and high energy consumption levels. Despite the development and growth of most countries on the continent and their commitment to a renewable energy transition, the continent holds the largest use of coal, which accounts for around 53% [

5]. The continent is considered the highest GHG emitter globally. Most countries on the continent emit more emissions because of industrial development on the continent. For example, China is the largest global GHG emitter. Furthermore, over the past three decades, countries such as China, Japan, and India have experienced a significant rise in energy consumption, leading to high emissions [

19]. Therefore, it is necessary to examine whether fintech and government effectiveness can promote renewable energy transition and reduce carbon emissions on the continent. Can the continent’s adoption of fintech significantly reduce its reliance on fossil fuels? Government effectiveness is also important to regulate, implement, and enforce energy policies to ensure a smooth renewable energy transition on the continent and the globe at large. Again, the continent plays a crucial role in the global financial system because of its population and foreign reserves [

20].

To better understand the contributions of Asian countries to the renewable energy transition and carbon emissions mitigation, we have derived data from the World Bank Indicators (WDI) on the ten largest economies in China based on reports from the IMF and IEA 2023. The data covers their emissions levels, renewable energy use percentage, and percentage of their population with access to clean fuels and technologies for cooking. The information presented in

Figure 1 shows the total carbon emissions per capita without Land Use Change Land Use and Forestry. It can be seen from

Figure 1 that Saudi Arabia, Korea, and China emit the most carbon emissions.

Figure 2 shows the percentage of the total population with access to clean fuels and technologies for cooking. This is important as it increases household use of renewable energies. The information presented in

Figure 2 shows that Japan, Saudi Arabia, Israel, and Korea have achieved 100% access to clean fuels and technologies for cooking for their populations from 2000 to 2020.

Figure 3 shows the percentage of total renewable energy use in these countries. The data is from 1990 to 2020, and the percentage has been decreasing for many countries.

The impact of fintech on the environment can come from different directions; however, the impact of fintech on the renewable energy transition in Asia remains to be explored. According to Jie et al. [

21], the investigation of the impact of financial technology innovation on the environment is solely on carbon and GHG emissions. This has limited the scope and the impact of fintech on the environment. For example, the study of Li et al. [

4] focused on fintech and carbon emissions; Zhuang [

22] focused on fintech, economic growth, and environmental sustainability; Zhang et al. [

20] focused on fintech and economic growth; Li et al. [

23] focused on fintech and economic growth; and Aziz et al. [

24] focused on fintech and green growth. With the government effectiveness, most studies have used some government indicators to investigate their effect on energy transition. For example, in Africa, Amoah et al. [

25] have investigated the effect of corruption on energy transition; in the MENA countries Saadaoui [

26] has investigated the effect of political and institutional quality on energy transition; Ullah et al. [

27] investigated the impact of the government on energy transition in belt and road initiative countries; Akhtar et al. [

28] focused on governance indicators and urbanization, but the impact of government effectiveness on renewable energy transition is yet to be explored among Asian countries.

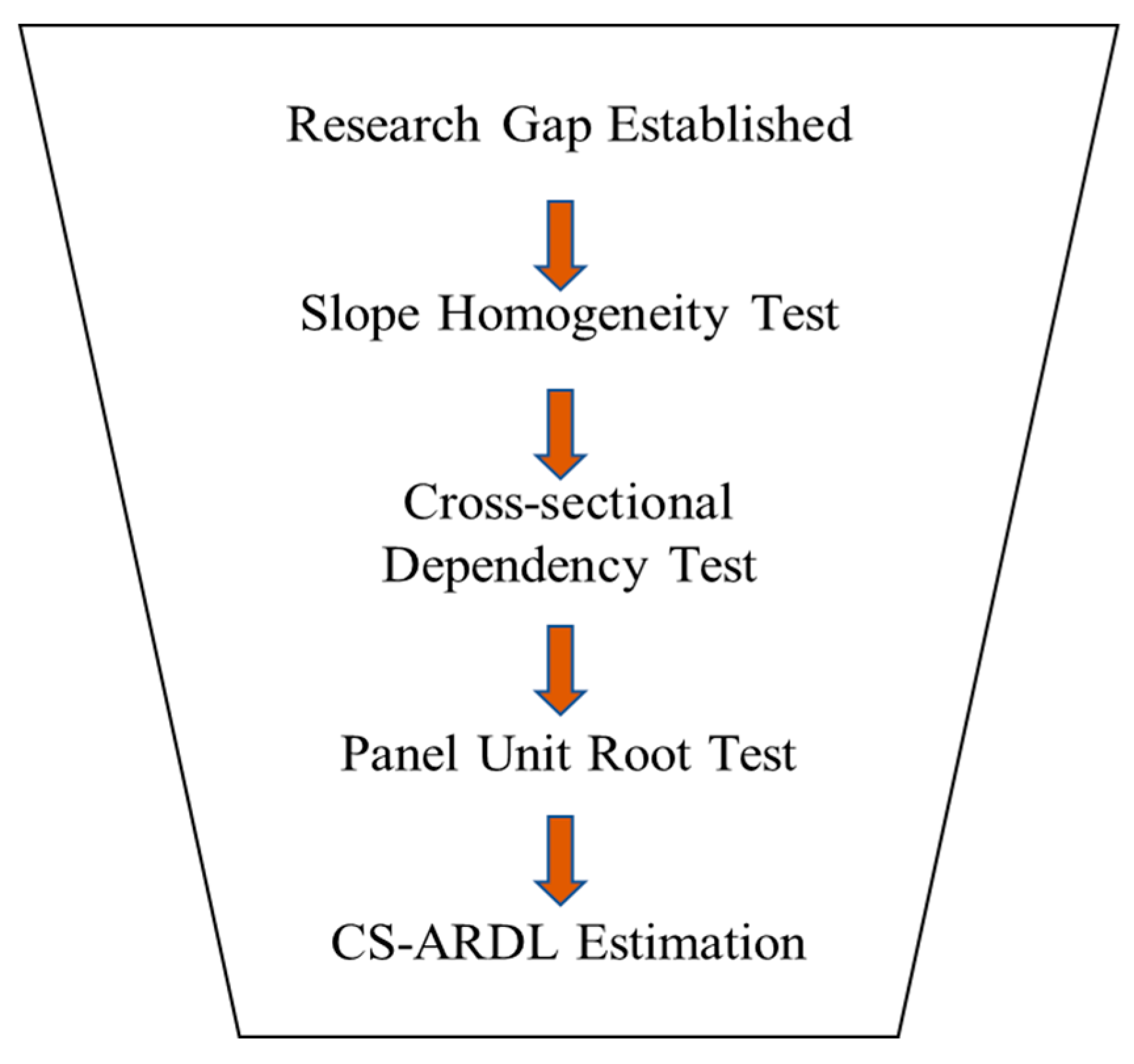

The discussion above has identified a significant gap in the literature that needs to be addressed, and this study addresses this gap and contributes to the existing literature as follows: (1) this current study evaluates the influence fintech has on renewable energy transition in Asia. This will make a significant contribution to the existing literature as it will highlight how the adoption of fintech will shape the energy sector and reduce reliance on fossil fuels. Financial technology innovation plays a crucial role in determining the type of energy a country consumes. In the literature, it has been established that fintech has a significant impact on the environment due to its effect on carbon emissions. Since energy use also has an impact on carbon emissions, it is important to analyze the type of energy that fintech promotes to fully understand its impact on the environment. (2) The study investigates the impact of government effectiveness on renewable energy transition. The study will further highlight the importance of effectively formulating and implementing renewable energy policies and the significant role of government in the transition. Government effectiveness ensures well-established and clear rules and regulations, transparency and accountability, rights and freedoms, checks and balances, all of which are essential qualities needed to champion renewable projects. Although other government indicators have been investigated, the relevance of government effectiveness remains unaddressed and needs to be explored. (3) The study considers Asian countries, which broadens the scope of the literature. The study, moreover, contributes to the existing literature by utilizing panel data that covers one of the world’s most promising continents. This will serve as a case study for both developing and developed countries. Asia is always a continent of interest because of its population and economic might, so considering Asia for the study would make the policies of the study more applicable to other continents. (4) The study further broadens the scope by investigating the impact of government effectiveness and fintech on carbon emissions. To make the study more useful in the field, the impact of the various variables on carbon emissions is assessed to make a comparative analysis. It is equally important to understand how these variables impact the environment from both energy consumption and carbon emissions perspectives.

2. Literature

Global warming’s impact on environmental sustainability is one of the most pressing problems the world is currently facing. The effect of global warming is deteriorating the quality of the ecosystem [

6]. Since the beginning of modernization and industrial development, the global climate has transformed rapidly [

29]. The literature has assessed the impact of several factors on carbon emissions mitigation (environmental quality), and has recorded different empirical evidence based on the methodology used, geographical area, data availability, and other factors. Zhang et al. [

30] investigated some of the factors that affect the environment through carbon emissions and found that green innovation has a direct and significant influence on carbon emissions while economic growth has a negative impact. Similarly, the study of Maulidar et al. [

31] analyzed some of the factors that affect carbon emissions in Indonesia and recorded that capital formation negatively influences carbon emissions while agriculture and economic growth have a distracting influence on carbon emissions. The study specifically focuses on the role of fintech and government effectiveness in promoting renewable energy transition and reducing carbon emissions. Hence, the literature review is structured to critically examine how previous studies have linked these variables to environmental outcomes and where gaps still exist.

2.1. Fintech and Environmental Sustainability

Over the past few decades, the global financial market has undergone a significant transformation, marked by the introduction of numerous products and services. This transformation is mostly influenced by fintech, which has emerged as a key player in financial innovation and inclusion [

9]. This has raised the interest of researchers to investigate the impact of fintech advancements on sustainable economy, global warming, and energy consumption [

32]. Historical evidence has proven fintech to have a significant effect on environmental sustainability, with the recorded results showing either positive or negative effects. According to Li et al. [

33], fintech has made it possible for organizations to obtain compensation for embarking on projects that help in carbon mitigation to ensure a sustainable environment. As a way of contributing to the literature, Croutzet and Dabbous [

34] investigated the relationship between fintech, clean energy investment, saving, and consumption. Their findings revealed that fintech has a potential impact on the variables in OECD economies. Similarly, the study of Ramzan et al. [

35] showed that fintech has a negative and significant impact on environmental quality in 35 selected countries within the OECD. In addition, the results further recorded a significant effect of financial technology innovation on environmental quality and are perceived to facilitate the achievement of Sustainable Development Goals. Again, a study on financial technology innovation and environmental sustainability in Asian economies revealed that financial technology innovation significantly improves environmental sustainability. The study further highlighted that financial technology innovation in Bangladesh has set the country on the road to achieving the SDGs as it promotes environmental sustainability [

36]. The study by Razzaq et al. [

37] also revealed a significant correlation between fintech and renewable energy utilization. However, a study by Teng and Shen [

38] on the Chinese economy revealed that fintech escalates carbon emissions in the country.

Although, overall positive results are achieved, the conceptual mechanisms by which fintech impacts environmental performance are still evolving. The heterogeneous results, varying from positive to negative or statistically nonsignificant, imply that fintech’s impact may depend on institutional quality, policy enforcement, and technological readiness. For example, fintech instruments can trigger green finance, but in the absence of effective regulation, their environmental impacts cannot be fully realized. This leads to additional research on moderating variables, such as governance and infrastructure.

2.2. Governance and Environmental Sustainability

Government effectiveness has to do with governance without corruption, respect for human rights, respect for the rule of law, as well as checks and balance [

39]. It is the reflection of the country’s governance and institutions. Weak governance system promotes corruption [

40]. According to Akalin and Erdogan [

41], through the institutions of a country, the government is able to regulate emissions levels through democratic and equitable restrictions. In the work of Amoah et al. [

25], they investigated how corruption affects energy transition in 36 African countries. The study findings revealed that corruption is irrelevant to renewable energy in these countries. Furthermore, Saadaoui’s [

26] study on MENA countries to investigate how political and institutional quality influence energy transition revealed that these factors encourage energy transition. Edomah [

42] highlighted that government has a significant role to play in the energy transition. In addition. The study of Egbetokun et al. [

43] recorded that government effectiveness has a significant impact on environmental quality. This implies that the presence of government effectiveness promotes environmental sustainability. In the same way, the study of Irfan et al. [

44] showed a significant and negative effect of government effectiveness on carbon emissions.

However, most of these analyses utilize broader governance indicators, such as corruption, institutional quality, or political stability, instead of directly isolating government effectiveness as a distinct variable. The originality of this study lies in its focus on government effectiveness, a more dynamic and active construct that captures the manner in which policies are formulated and implemented. This can provide us with better information on how state capability affects energy and environmental outcomes.

2.3. Policy Implications Across Regions

Asia is the highest emitter continent in the world followed by North America. This high emission is driven by high levels of production and the use of high-emission technologies in the production process. This condition affects low-emit regions like West Africa and Africa as a whole. Due to low technology and production in these regions, the amount of emissions they release is nearly insignificant compared to the high-tech and production regions. To ensure a sustainable environment, various companies across regions should be forced to abide by the carbon pricing and market mechanisms like carbon taxes and periodic reporting of carbon footprint. In support of this, the study of Mehboob et al. [

45] revealed that environmental tax significantly reduces consumption-based carbon emissions. In addition, high emitters like China should improve on consuming more renewable energy like solar and wind forms of electricity to reduce the dependency on coal [

46]. Moreover, these countries can form trade agreements to encourage the trade of renewable energy technologies to reduce the dependency on high-emission technologies in production. Since fintech ensures smooth investment in renewable and energy-efficiency technologies, continents like Asia and North America can develop fintech as one of the measures of controlling carbon footprint through renewable energy development. In support of this, the study of Zhao et al. [

47] indicated that financial structure has a significant role in reducing carbon emissions in high-polluted Asian countries. This measure will further be relevant in countries with low-impact fintech like West Africa, as the study of Nwigwe et al. [

48] revealed that fintech is insignificant in West Africa, and the study of Gyimah and Bonzo [

49] revealed that fintech reduces the consumption of renewable energy in Africa.

Given the regional disparities in emission levels and technological capacity across Asia, tailored strategies are essential for achieving effective carbon mitigation and renewable energy transition. In China and India, the high-emission nations, policies should focus on the strict enforcement of environmental regulations, the phased elimination of coal-based power generation, and the promotion of investment in wind and solar power. These policies, including carbon pricing, emissions trading systems, and renewable energy subsidies, have been effective in such instances [

50,

51]. In addition, they need to improve environmental governance through institutional capacity development, public–private partnerships, and green finance instruments that decrease dependence on fossil fuels [

52].

For advanced and high-tech Asian economies, such as South Korea, Singapore, and Japan, strategic initiatives must focus on leveraging innovative technologies and green digital finance. These countries can drive innovation in clean energy storage, electric vehicles, AI energy efficiency technology, and the application of blockchain in green finance [

53,

54]. Policy-makers in these nations need to give higher priority to cross-sector coordination and exportation of green technology to low-technology developing Asian nations. Development banks, multilateral agencies, and international donors should help facilitate technology transfer and infrastructure enhancement to enable equitable access to clean energy [

55,

56].

Clear and transparent regulatory systems, along with accountability mechanisms and participatory energy policy-making, are pivotal for the rollout of renewable energy and climate resilience [

57]. The rule of law needs to be reinforced by the government through the enforcement of rules, stakeholder engagement, and the use of digital governance, which can streamline regulatory processes and enhance transparency. This regional policy context highlights that a one-size-fits-all approach is insufficient. Instead, differentiated strategies based on technological capability, emission profile, and governance maturity are needed to drive Asia’s clean energy transformation and environmental sustainability.

2.4. Gap in the Literature

The existing literature on fintech and the environment primarily focuses on carbon emissions, without considering its impact on renewable energy adoption, energy efficiency, or behavioral change. This has made the scope small as other factors influence the environment. In addition, the government’s effectiveness impact on the environment is also limited mainly to its impact on carbon emissions. Although some researchers have investigated the impact of some of the government indicators, like corruption and institutional quality, on energy transition, the impact of government effectiveness is missing. Despite the relevance of these two variables to the environment, the existing literature has limited their impact on the environment. In this case, we have expanded the literature by investigating the effects of these two variables on the environment through their impact on renewable energy consumption and carbon emissions. Since renewable energy is the most promising substitute for fossil fuels, it is crucial to examine how these variables influence the transition to renewable energy.

5. Discussion

The adoption of renewable energy is perceived as promoting green economy and a sustainable environment, as it is believed that replacing fossil fuels with renewable energy would make the energy cleaner [

64]. Increasing the use of renewable energy resources would ensure a reduction in carbon emissions, as there has been empirical evidence to support the claim that renewable energy has the potential to reduce GHG emissions. In addition, the impact of governance on the type of energy to use and its impact on the environment is worth analyzing. The findings of our study reveal that government effectiveness promotes the transition to renewable energy in the selected Asian countries in both the short and long terms. However, government effectiveness has no significant effect on carbon emissions in both the short and long terms. Song et al. [

65] highlighted in their study that good governance ensures institutional quality and enhances green growth by directly affecting carbon productivity levels. In the view of Qiu et al. [

66], to ensure green growth, there should be a promotion of good governance. In support of our findings, the study of Khan et al. [

67] revealed that government effectiveness significantly reduces carbon emissions. However, the finding of Tarverdi’s [

68] study contradicts our findings as the authors’ findings revealed that governance deteriorates environmental quality as it is associated with an increase in carbon emissions. Similarly, the study of Yang et al. [

69] revealed that good governance system promotes carbon emissions in G7 countries, and it is insignificant in BRICS.

Mitigating climate change to ensure a sustainable environment requires the efforts of financial institutions [

70]. Incorporating financial technology into the already existing financial sector leads to a reduction in carbon emissions [

71]. However, our findings reveal that fintech has no significant influence on the renewable energy transition and carbon emissions in both the short and long terms. Kihombo et al.’s [

72] study revealed that financial development deteriorates the environment. However, Ali and Mujahid’s [

73] study revealed that technological innovation improves environmental sustainability. Similarly, the study of Kakar et al. [

74] revealed that fintech encourages carbon emissions mitigation.

The Environmental Kuznets Curve has been used to explain the relationship between economic growth and environmental impact. Our study revealed that in the presence of government effectiveness and fintech, economic growth has no significant influence on the renewable energy transition and carbon emissions in both the short and long terms. However, Shahbaz et al.’s [

75] study indicated that economic growth increases carbon emissions. The study of Shahbaz and Patel [

76] revealed a significant and positive association between economic growth and carbon emissions. The impact of foreign direct investment on environmental sustainability has been explored and investigated in many regions, countries, and continents. Different findings have been recorded in the literature by Kaushal et al. [

77], either in support of the pollution halo or the pollution haven hypotheses. Pao and Tsai’s [

78] study confirmed the pollution halo hypothesis indicating the positive impact of FDI on the environment. Our findings revealed that in the presence of government effectiveness, FDI has no effect on renewable energy but increases carbon emissions in both short and long terms. However, FDI is insignificant in affecting carbon emissions and renewable energy transition in the presence of fintech. In support of our findings, the study of Abdouli and Hammami [

79] revealed a positive influence of FDI on carbon emissions.

Our findings revealed that in the presence of government effectiveness, population growth in the long and short terms positively affects renewable energy transition, and it has an insignificant effect on carbon emissions. However, in the presence of fintech, population growth is insignificant in affecting renewable energy transition and carbon emissions in both the short and long terms. However, Ehrlich and Holdren’s [

80] study indicated that population growth contributes to environmental deterioration. The findings of our study revealed that trade openness in the presence of fintech and government effectiveness has no effect on renewable energy transition and carbon emissions in both the short and long terms. However, the study of Li and Haneklaus [

81] revealed that trade openness has an adverse impact on carbon emissions.