ESG Reporting in the Digital Era: Unveiling Public Sentiment and Engagement on YouTube

Abstract

1. Introduction

2. Literature Review

- It introduces a systematic computational approach for comparing the emotional tone, argumentative stance, and thematic focus of both institutional ESG communications (as expressed in video transcripts) and public responses (as seen in user comments) on YouTube.

- The study utilizes a robust pipeline that combines engagement metrics (such as views, likes, and comments) with AI-powered content analysis, enabling nuanced quantitative and qualitative insight into the structure of ESG discourse within a highly interactive, video-centric social media environment.

- It applies clustering methods to both video- and comment-level data to identify major discourse patterns and outlier groups, thereby providing a scalable template for analyzing online debates around corporate transparency and sustainability.

- The research critically assesses methodological limitations such as keyword selection, representativeness, platform-specific engagement patterns, and the constraints of automated language models in order to inform best practices for future digital research on ESG or similar topics.

- By focusing on YouTube, this study expands the scope of ESG communication research beyond traditional text-based platforms, highlighting the opportunities and challenges inherent to video-based public engagement and AI-driven discourse analysis.

3. Methods

- Sentiment analysis: The sentiment polarity of each text was determined, quantified on a continuous scale from −1 to +1. Here, −1 represents a strongly negative sentiment, +1 represents a strongly positive sentiment, and values around 0 indicate neutral or mixed sentiment. This sentiment score reflects the overall emotional valence of the text, for instance, whether a comment conveys criticism/anger (negative), praise/enthusiasm (positive), or a neutral informational tone. Using a numeric continuum allows fine-grained comparison of sentiment intensity across the dataset. It is important to note that sentiment in this context measures emotional tone and affect [31]. It is distinguished from stance, which is described next.

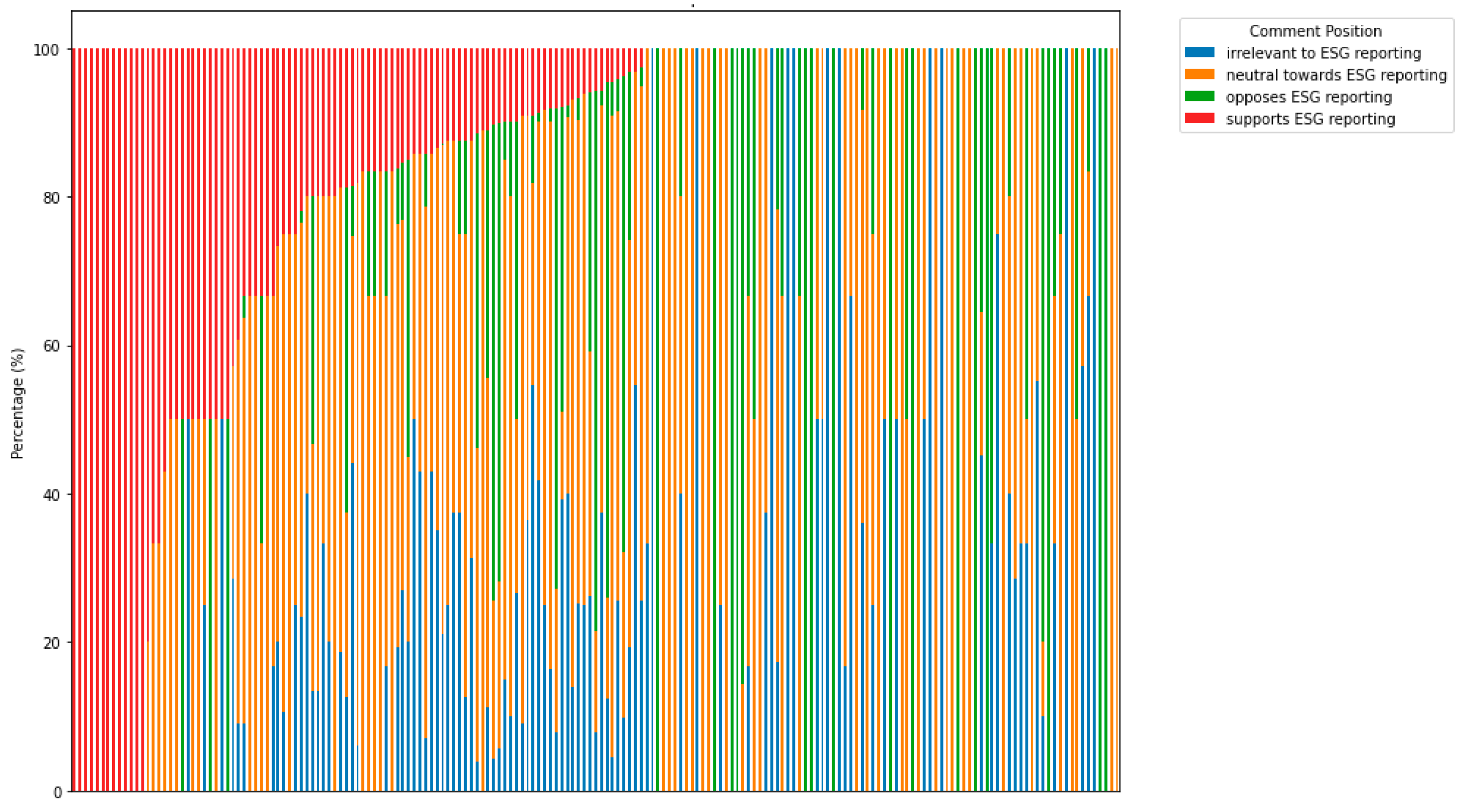

- Stance detection: In addition to sentiment, each text was evaluated for its stance regarding ESG reporting. Stance analysis identifies the author’s position or attitude toward the topic (in this case, ESG reporting practices). Stance was categorized into four classes: supportive (expressing approval of or agreement with ESG reporting), oppositional (expressing disapproval or arguments against ESG reporting), neutral (neither clearly for nor against, possibly just descriptive or ambivalent), or irrelevant (the text does not actually address ESG reporting in a meaningful way). This follows the common approach in stance detection research, which aims to determine if a piece of text is in favor of, against, or neutral toward a given proposition [31]. Stance and sentiment are related but distinct dimensions. A comment might carry negative sentiment (e.g., frustration) but still be supportive of ESG reporting (for instance, “I’m frustrated that more companies aren’t doing ESG reporting”—negative affect, but pro-ESG stance). Conversely, a positive-sounding comment could be sarcastically opposing the topic. By analyzing stance, the alignment or contention in the discourse is captured that pure sentiment analysis might miss. The GPT-4o-mini model was tasked with inferring these stances based on context, phrasing, and keywords in the transcripts and comments.

- Argument and topic extraction: GPT-4o-mini was also used to extract prominent arguments and themes present in the content. This involved identifying recurrent claims or reasoning in the discourse, for example, common arguments in favor of ESG reporting (such as “improves transparency for investors”) or arguments against it (such as “imposes undue burden on companies”). The model’s advanced comprehension ability makes it well-suited for summarizing and identifying key points from unstructured text. Recent work in computational argumentation has demonstrated that large language models like GPT-4 can feasibly extract argumentative structures from conversational or narrative text [32]. Following this approach, the model was prompted to highlight the main points of contention or agreement in each transcript and comment section. These extracted arguments were then collated to understand which points are most frequently raised or debated across the YouTube discourse on ESG reporting.

- Sampling bias from YouTube’s API: Relying on the YouTube Data API’s search results may introduce algorithmic bias into our sample. The API’s relevance ranking (which factors in metadata, views, engagement, etc.) tends to prioritize content that is already popular or engaging [26]. Consequently, the 553-video dataset likely over-represents highly viewed videos and under-represents niche or dissenting content that did not surface in the top results. Recent research has shown that the YouTube search endpoint can behave inconsistently and may favor shorter, popular videos [26], meaning relevant videos that use different keywords or had lower initial visibility might be missing. Therefore, the generalizability of the findings is limited by the “filter bubble” imposed by YouTube’s search algorithm.

- Keyword and query limitations: The exclusive use of the single keyword “ESG reporting” for data collection means that discussions phrased differently could have been omitted. Videos or comments that address ESG reporting using alternate terminology (e.g., “sustainability disclosure” or “corporate social responsibility reporting”) would not be captured by the search if they did not also tag or mention “ESG reporting”. This narrow query focus helped maintain relevance, but at the risk of missing content that is topically similar but not explicitly labeled with the chosen keywords.

- Incomplete data: Not all videos yielded transcripts or had comment sections, which could skew the analysis. Out of 553 videos, transcripts were missing for 155 videos—likely those where transcripts were not available. Similarly, only 185 videos had user comments to analyze. The rest had either zero comments or disabled comment sections. This indicates a subset of ESG reporting content (potentially those from certain channels or with certain audience settings) is absent from the text analysis. Those missing pieces might represent different viewpoints or styles (for example, perhaps some highly critical videos had comments turned off by cautious creators, or very niche videos simply did not attract engagement).

- Automated analysis accuracy: The use of an AI model (GPT-4o-mini) for sentiment, stance, and argument analysis introduces considerations about accuracy and nuance. Although GPT-4o-mini is a strong performer in general sentiment tasks [30], automated text analysis can sometimes misinterpret context, especially for subtleties like sarcasm, humor, or cultural references. For instance, a sarcastic comment might be labeled as negative sentiment even if the underlying stance is positive (or vice versa), if the model fails to catch the sarcasm. Prior studies highlight that AI still struggles with complex linguistic nuances such as sarcasm and subtle emotional cues [30]. Additionally, the model’s knowledge and biases (trained on data up to a certain point) could influence how it interprets ESG-related content. For example, the model might not fully capture very recent developments in ESG if those post-date its training data.

- Single-platform focus: Finally, the analysis is confined to YouTube, which limits the scope of inference. Online discourse about ESG reporting is not exclusive to YouTube as it also takes place on platforms like X, LinkedIn, news commentaries, blogs, and other social media. User demographics and discourse norms vary by platform. Hence, sentiments and stances on YouTube might differ from those on, e.g., professional networks or forums. Focusing on one platform provides a deep dive into that community’s perspective, but it may not capture the overall public sentiment. Cross-platform research is needed for a more generalizable understanding [33].

- Audience and commenter representativeness: Additionally, the audience engaging with ESG content on YouTube and especially those who choose to leave comments may not be representative of the general population or even of all viewers of these videos. Commenters tend to be more vocal, engaged, or motivated (whether positively or negatively), which could introduce further bias into the analysis of public sentiment and engagement. As such, the findings based on YouTube comments should be interpreted with caution, recognizing that they may reflect the perspectives of a particular subset of users rather than the broader public.

4. Results

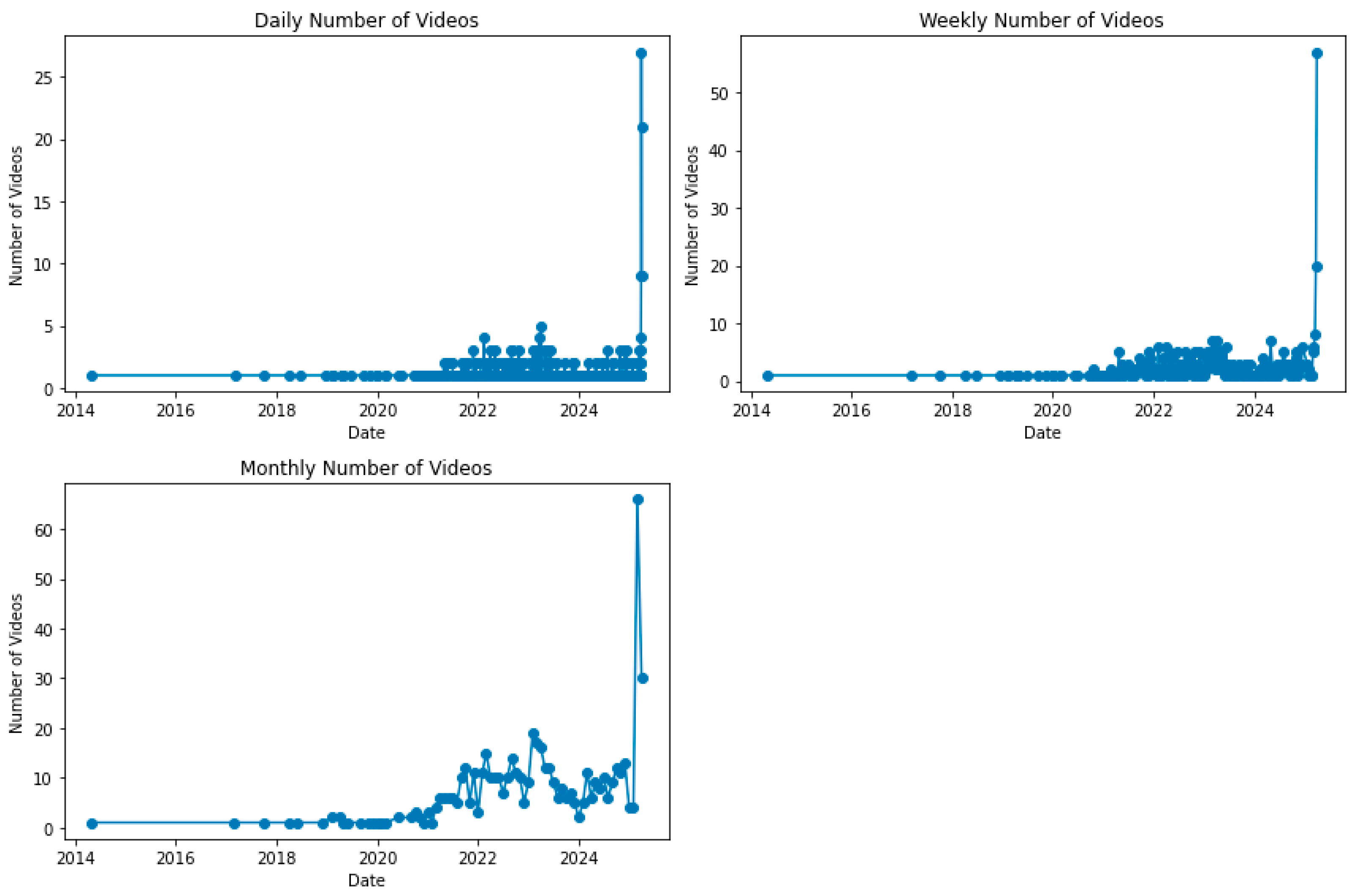

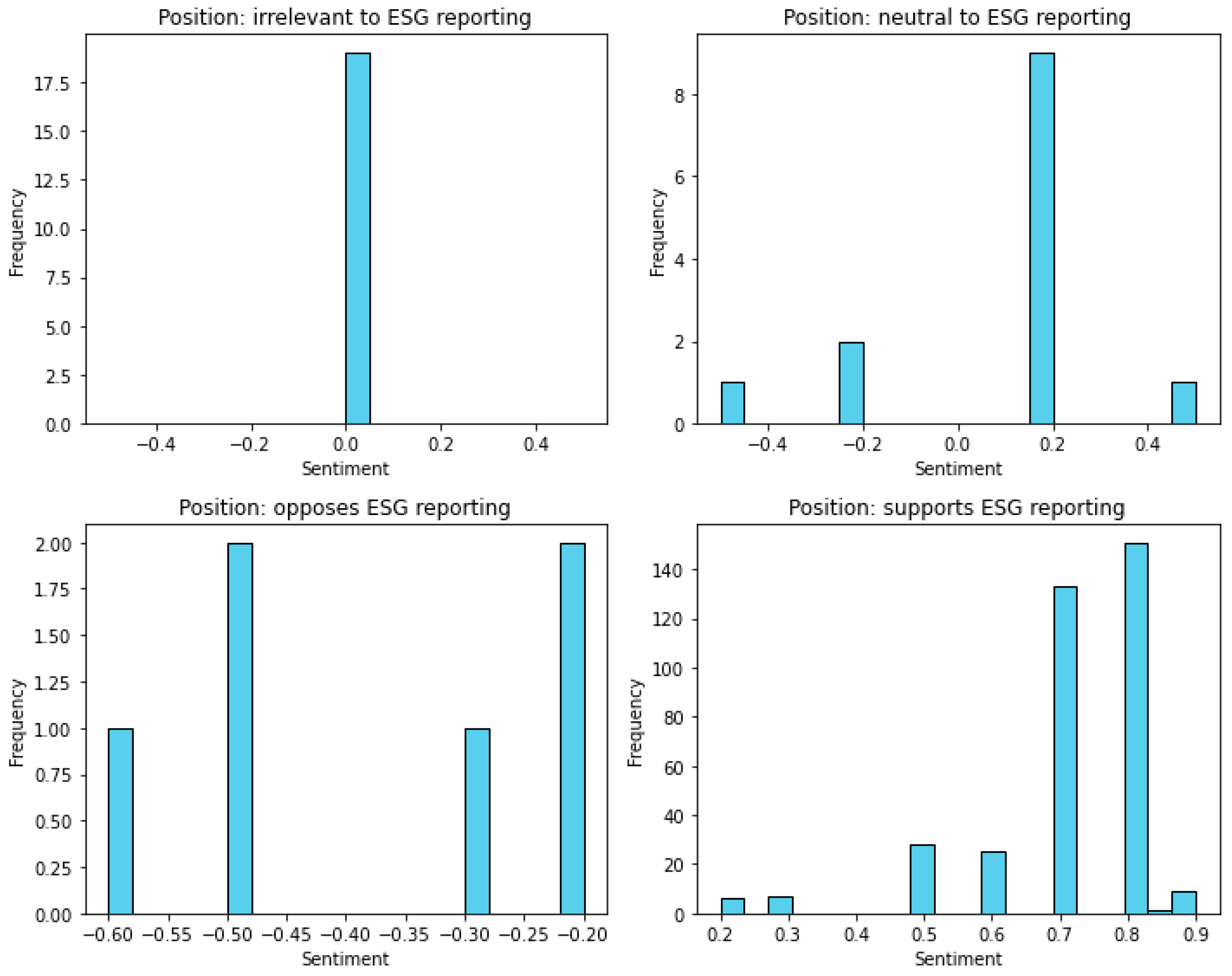

4.1. Video Analysis

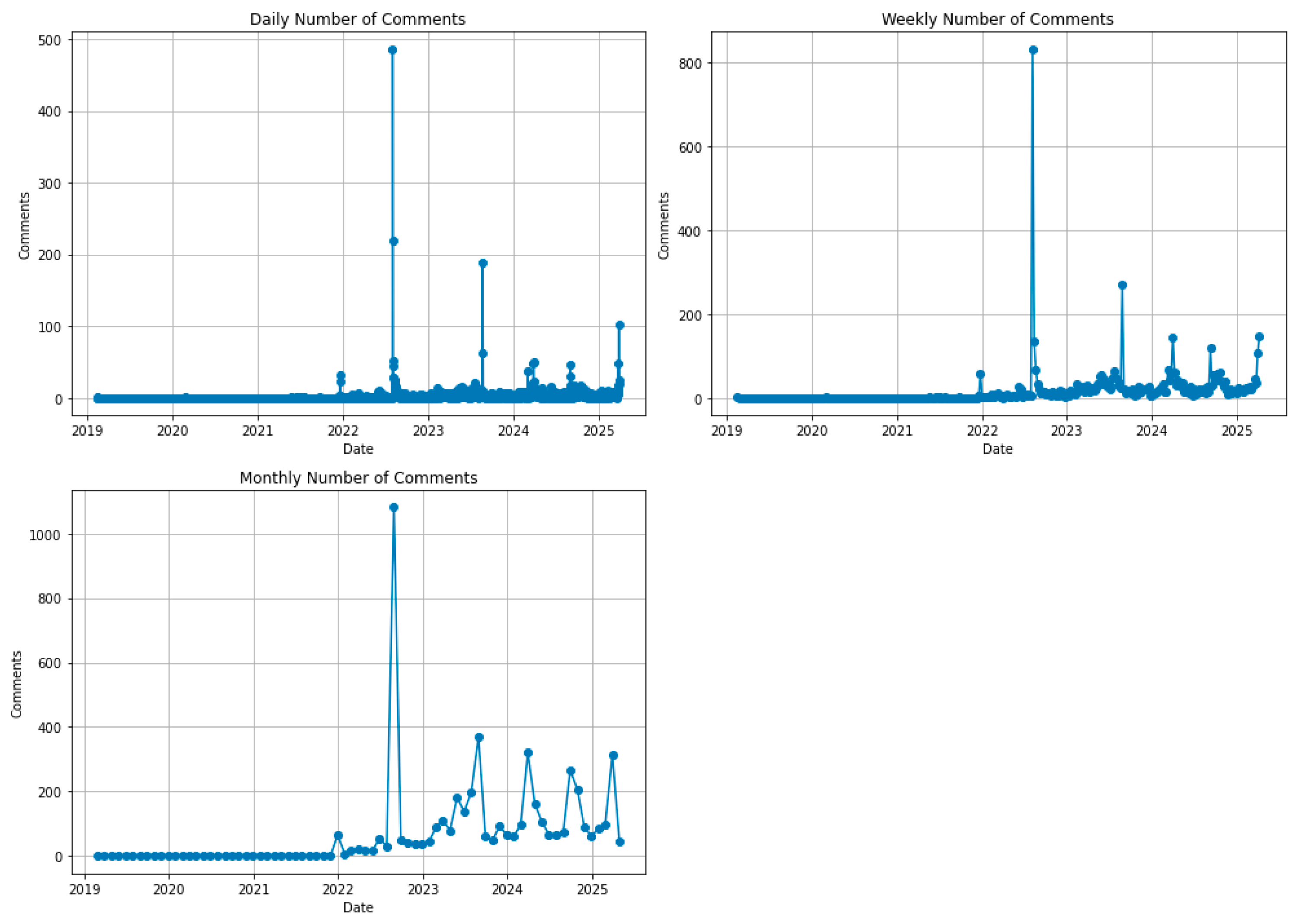

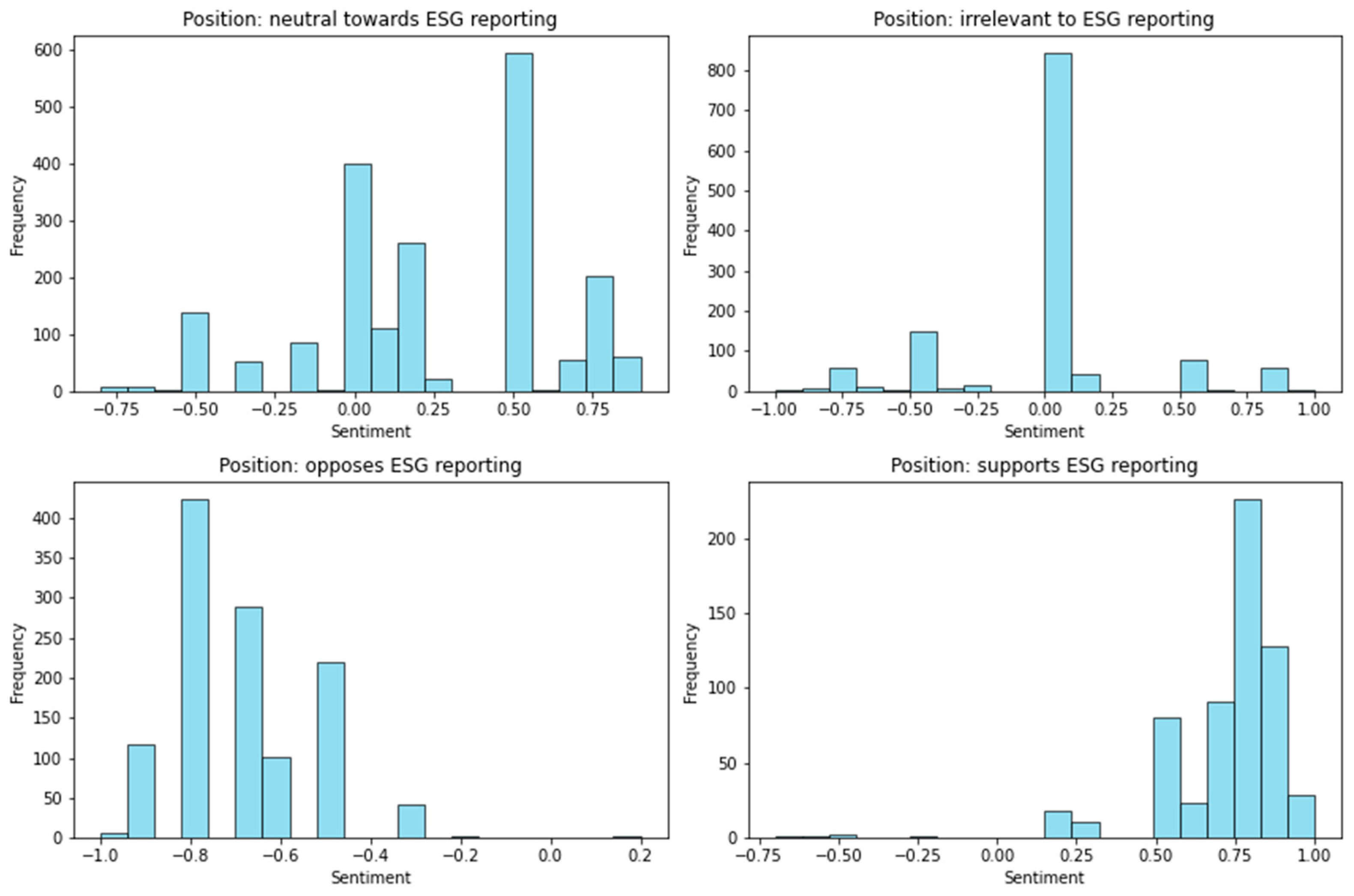

4.2. Comment Analysis

4.3. Videos and Comments Linkage

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Raghavan, K. ESG reporting impact on accounting, finance. J. Glob. Awareness 2022, 3, 9. [Google Scholar] [CrossRef]

- Gupta, R.; Motwani, A. ESG reporting in India: Current scenario. Corp. Gov. Insight 2022, 4, 88–104. [Google Scholar] [CrossRef]

- Huang, J. The environmental, social and governance (ESG) in accounting: A review. J. Glob. Econ. Bus. Financ. 2024, 6, 8. [Google Scholar] [CrossRef] [PubMed]

- Tsang, A.; Frost, T.; Cao, H. Environmental, social, and governance (ESG) disclosure: A literature review. Br. Account. Rev. 2023, 55, 101149. [Google Scholar] [CrossRef]

- Sridharan, V. Bridging the Disclosure Gap: Investor Perspectives on Environmental, Social, & Governance (ESG) Disclosures. Ph.D. Thesis, University of Pennsylvania, Philadelphia, PA, USA, 2018. [Google Scholar] [CrossRef]

- Chopra, S.S.; Senadheera, S.S.; Dissanayake, P.D.; Withana, P.A.; Chib, R.; Rhee, J.H.; Ok, Y.S. Navigating the challenges of environmental, social, and governance (ESG) reporting: The path to broader sustainable development. Sustainability 2024, 16, 606. [Google Scholar] [CrossRef]

- Jámbor, A.; Zanócz, A. The diversity of environmental, social, and governance aspects in sustainability: A systematic literature review. Sustainability 2023, 15, 13958. [Google Scholar] [CrossRef]

- Hassan, S.M. Greenwashing in ESG: Identifying and addressing false claims of sustainability. J. Bus. Strat. Manag. 2024, 9, 90–105. [Google Scholar] [CrossRef]

- Tian, L.; Niu, J. Mitigating greenwashing in listed companies: A comprehensive study on strengthening integrity in ESG disclosure and governance. Pol. J. Environ. Stud. 2024, 33, 6363–6372. [Google Scholar] [CrossRef]

- Galeano, K.; Galeano, R.; Agarwal, N. An evolving (dis)information environment—How an engaging audience can spread narratives and shape perception: A Trident Juncture 2018 case study. In Disinformation, Misinformation, and Fake News in Social Media: Emerging Research Challenges and Opportunities; Springer: Cham, Switzerland, 2020; pp. 253–265. [Google Scholar] [CrossRef]

- Castello, I. Challenges and opportunities in using social media to promote corporate social responsibility. In The Routledge Companion to Corporate Social Responsibility; Routledge: London, UK, 2021; pp. 319–328. [Google Scholar] [CrossRef]

- Muhtar, M.; Amir, A.S.; Karnay, S. Analyzing media impact on public engagement with CSR practices. Int. J. Integr. Sci. 2024, 3, 4. [Google Scholar] [CrossRef]

- Liu, M.; Luo, X.; Lu, W.Z. Public perceptions of environmental, social, and governance (ESG) based on social media data: Evidence from China. J. Clean. Prod. 2023, 387, 135840. [Google Scholar] [CrossRef]

- Park, J.; Choi, W.; Jung, S.U. Exploring trends in environmental, social, and governance themes and their sentimental value over time. Front. Psychol. 2022, 13, 890435. [Google Scholar] [CrossRef] [PubMed]

- Shapiro, M.A.; Park, H.W. Climate change and YouTube: Deliberation potential in post-video discussions. Environ. Commun. 2018, 12, 115–131. [Google Scholar] [CrossRef]

- Arnaboldi, M.; Busco, C.; Cuganesan, S. Accounting, accountability, social media and big data: Revolution or hype? Account. Audit. Account. J. 2017, 30, 762–776. [Google Scholar] [CrossRef]

- Gandía, J.L.; Huguet, D. Textual analysis and sentiment analysis in accounting: Análisis textual y del sentimiento en contabilidad. Rev. Contab. Span. Account. Rev. 2021, 24, 168–183. [Google Scholar] [CrossRef]

- Nerantzidis, M.; Tampakoudis, I.; She, C. Social media in accounting research: A review and future research agenda. J. Int. Account. Audit. Tax. 2024, 54, 100595. [Google Scholar] [CrossRef]

- Lodhia, S.; Kaur, A.; Stone, G. The use of social media as a legitimation tool for sustainability reporting: A study of the top 50 Australian Stock Exchange (ASX) listed companies. Meditari Account. Res. 2020, 28, 613–632. [Google Scholar] [CrossRef]

- Deegan, C. Introduction: The legitimising effect of social and environmental disclosures–a theoretical foundation. Account. Audit. Account. J. 2002, 15, 282–311. [Google Scholar] [CrossRef]

- Russo, S.; Schimperna, F.; Lombardi, R.; Ruggiero, P. Sustainability performance and social media: An explorative analysis. Meditari Account. Res. 2022, 30, 1118–1140. [Google Scholar] [CrossRef]

- Wen, J.T.; Song, B. Corporate ethical branding on YouTube: CSR communication strategies and brand anthropomorphism. J. Interact. Advert. 2017, 17, 28–40. [Google Scholar] [CrossRef]

- Liao, M.Q.; Mak, A.K.Y. “Comments are disabled for this video”: A technological affordances approach to understanding source credibility assessment of CSR information on YouTube. Public Relat. Rev. 2019, 45, 101840. [Google Scholar] [CrossRef]

- Casalegno, C.; Chiaudano, V.; Tamiazzo, M.; Kitchen, P.J. Navigating the challenges of ESG communication on social media. J. Emerg. Perspect. 2024, 1, 33–42. [Google Scholar] [CrossRef]

- Burgess, J.; Green, J. YouTube: Online Video and Participatory Culture; John Wiley & Sons: Chichester, UK, 2018; Available online: https://www.wiley.com/en-us/YouTube%3A+Online+Video+and+Participatory+Culture%2C+2nd+Edition-p-9780745660196 (accessed on 15 July 2025).

- Efstratiou, A. I’m sorry Dave, I’m afraid I can’t return that: On YouTube search API use in research. arXiv 2025, arXiv:2506.04422. [Google Scholar] [CrossRef]

- Stappen, L.; Baird, A.; Cambria, E.; Schuller, B.W. Sentiment analysis and topic recognition in video transcriptions. IEEE Intell. Syst. 2021, 36, 88–95. [Google Scholar] [CrossRef]

- Trinkle, B.S.; Crossler, R.E.; Bélanger, F. Voluntary disclosures via social media and the role of comments. J. Inf. Syst. 2015, 29, 101–121. [Google Scholar] [CrossRef]

- Lutz, S.; Schneider, F.M. Is receiving dislikes in social media still better than being ignored? The effects of ostracism and rejection on need threat and coping responses online. Media Psychol. 2021, 24, 741–765. [Google Scholar] [CrossRef]

- Bojić, L.; Zagovora, O.; Zelenkauskaite, A.; Vuković, V.; Čabarkapa, M.; Veseljević Jerković, S.; Jovančević, A. Comparing large language models and human annotators in latent content analysis of sentiment, political leaning, emotional intensity and sarcasm. Sci. Rep. 2025, 15, 11477. [Google Scholar] [CrossRef]

- Chiusano, F. Two minutes NLP—Quick intro to stance detection on social media. Medium. 17 August 2022. Available online: https://medium.com/nlplanet/two-minutes-nlp-quick-intro-to-stance-detection-on-social-media-5782ce54c701 (accessed on 15 July 2025).

- Pojoni, M.L.; Dumani, L.; Schenkel, R. Argument-mining from podcasts using ChatGPT. In Proceedings of the Workshop on Text Mining and Generation at ICCBR2023, Aberdeen, Scotland, 17–20 July 2023; pp. 129–144. Available online: https://ceur-ws.org/Vol-3438/paper_10.pdf (accessed on 15 July 2025).

- Zhang, B.; Dai, G.; Niu, F.; Yin, N.; Fan, X.; Wang, S.; Cao, X.; Huang, H. A survey of stance detection on social media: New directions and perspectives. arXiv 2024, arXiv:2409.15690. [Google Scholar] [CrossRef]

- Kotsantonis, S.; Serafeim, G. Four things no one will tell you about ESG data. J. Appl. Corp. Finance 2019, 31, 50–58. [Google Scholar] [CrossRef]

- Del Gesso, C.; Lodhi, R.N. Theories underlying environmental, social and governance (ESG) disclosure: A systematic review of accounting studies. J. Account. Lit. 2025, 47, 433–461. [Google Scholar] [CrossRef]

- Torelli, R.; Balluchi, F.; Lazzini, A. Greenwashing and environmental communication: Effects on stakeholders’ perceptions. Bus. Strategy Environ. 2020, 29, 407–421. [Google Scholar] [CrossRef]

- Omran, M.A.; Ramdhony, D. Theoretical perspectives on corporate social responsibility disclosure: A critical review. Int. J. Account. Financ. Rep. 2015, 5, 38–55. [Google Scholar] [CrossRef]

- Fleming, C.S.; Gonyo, S.B.; Freitag, A.; Goedeke, T.L. Engaged minority or quiet majority? Social intentions and actions related to offshore wind energy development in the United States. Energy Res. Soc. Sci. 2022, 84, 102440. [Google Scholar] [CrossRef]

- Bull, R.; Janda, K.B. Beyond feedback: Introducing the ‘engagement gap’ in organizational energy management. Build. Res. Inf. 2018, 46, 300–315. [Google Scholar] [CrossRef]

- Bryl, L.; Supino, E. Sustainability disclosure in social media—Substitutionary or complementary to traditional reporting? J. Intercult. Manag. 2022, 14, 41–62. [Google Scholar] [CrossRef]

| Topic (% of Videos) | Description |

|---|---|

| Regulatory compliance & mandatory reporting (41.9) | Encompasses the disclosure of a company’s environmental, social, and governance performance, addressing compliance with regulatory requirements and stakeholder expectations, particularly for public companies. It highlights the importance of transparency and accountability in reporting practices, as well as the growing attention from investors and regulators on ESG metrics and frameworks. |

| Environmental sustainability & climate action (26.4) | Encompasses initiatives and practices aimed at reducing carbon emissions, promoting resource efficiency, and ensuring sustainable supply chains, as illustrated by companies focusing on carbon reduction strategies, traceability in agriculture, and compliance with environmental regulations. It emphasizes the importance of transparent reporting and stakeholder engagement to assess and enhance a company’s environmental impact. |

| Transparency, standards & frameworks (12.5) | Encompasses the practices and guidelines that organizations must follow to accurately disclose their sustainability performance, ensuring accountability to stakeholders while adhering to recognized frameworks such as GRI and BRSR. It emphasizes the importance of transparency, stakeholder engagement, and the inclusion of both positive and negative impacts in sustainability reports to enhance credibility and foster trust. |

| Other (7.5) | Encompasses discussions around materiality assessments, the importance of stakeholder engagement, and the integration of ESG factors into corporate strategy and investment decisions, highlighting the need for reliable disclosures and commitments to sustainability standards to enhance accountability and performance. |

| Corporate responsibility & ethical governance (5.6) | Encompasses the assessment of a company’s sustainable and ethical impacts, focusing on environmental factors like resource protection, social factors related to community and employee treatment, and governance factors concerning internal controls and compliance practices. This framework aims to ensure accountability and transparency in corporate operations, ultimately influencing investment decisions. |

| Social impact & community engagement (3.3) | Encompasses a company’s efforts to disclose information related to its social responsibilities, including diversity and inclusion, community involvement, and stakeholder engagement, while navigating various frameworks and standards to ensure transparency and accountability. This category emphasizes the importance of cross-functional collaboration within organizations to accurately report on social metrics and respond to stakeholder expectations. |

| Education & professional development (1.9) | Encompasses the integration of environmental, social, and governance factors into corporate strategies, emphasizing the need for transparency, accountability, and measurable progress through consistent metrics and innovative technologies like AI and geospatial data. This category highlights the importance of educating stakeholders on ESG initiatives and ensuring companies can effectively prove their commitments to sustainability and social responsibility. |

| General support & positive sentiment (0.6) | Encompasses companies’ commitments to sustainability, transparency, and social responsibility, highlighting their efforts to reduce environmental impacts, promote equity, and strengthen governance practices while fostering trust among stakeholders. This includes initiatives like carbon footprint assessments, gender pay equity, and adherence to global sustainability frameworks. |

| Financial performance & investment (0.3) | Encompasses various frameworks and standards, such as GRI, CDP, TCFD, SASB, and CSRD, which guide organizations in disclosing their sustainability impacts and climate-related financial risks to inform investors and enhance transparency in their financial performance. These frameworks help businesses communicate the financial implications of sustainability issues, enabling better investment decisions. |

| Topic (% of Videos) | Description |

|---|---|

| Transparency & subjectivity concerns (50.0) | Highlights skepticism about the validity and objectivity of ESG metrics, suggesting that they are often based on subjective opinions rather than concrete standards, and raises concerns about the potential for unnecessary reporting and compliance burdens that do not enhance business performance. Additionally, it criticizes the influence of external pressures and norms imposed by governments and organizations on corporate decision-making. |

| Regulatory burden & compliance costs (33.3) | Highlights the methodological issues and lack of standardization in ESG data reporting, which undermine investor confidence and decision-making, while also emphasizing the unregulated nature of ESG ratings that can lead to misleading assessments of companies’ environmental and social impacts. Additionally, there are concerns about the potential for increased regulatory scrutiny to complicate compliance for businesses, raising questions about the true effectiveness of ESG investments in driving meaningful change. |

| Effectiveness & sincerity issues (16.7) | Highlights concerns about the limitations of the ESG framework, emphasizing that it often fails to encompass the broader aspects of sustainability, such as economic viability and the qualitative impacts on society, while also pointing out the challenges companies face in implementing effective governance structures and measuring social impacts. |

| Cluster | % of Videos | # of Videos | Avg. Sentiment | Avg. View Count | Avg. Like Count | Avg. Comment Count | Cluster Characteristics |

|---|---|---|---|---|---|---|---|

| 0 | 89.83% | 309 | 0.709 | 6973 | 81 | 6 | Positive sentiment, moderate engagement |

| 1 | 0.29% | 1 | 0.900 | 564,536 | 48,765 | 2271 | Extremely high engagement, highly positive sentiment |

| 2 | 1.74% | 6 | −0.383 | 64,768 | 1604 | 129 | Negative sentiment, moderate engagement |

| 3 | 4.65% | 16 | 0.000 | 4298 | 30 | 1.56 | Neutral sentiment, low engagement |

| 4 | 3.49% | 12 | 0.100 | 5003 | 30.5 | 4.67 | Mildly positive sentiment, low engagement |

| Topic (% of Comment) | Description |

|---|---|

| General support & positive sentiment (37.9) | Encompasses expressions of appreciation for efforts towards social and environmental responsibility, as well as calls for the protection of the planet and future generations. It reflects a supportive attitude towards initiatives that prioritize sustainability and ethical practices over profit. |

| Environmental sustainability & climate action (18) | Reflects a positive reception towards content related to environmental sustainability and climate action within the ESG framework, highlighting appreciation for informative resources and a desire for more educational materials on the topic. |

| Other (16) | Encompasses discussions on the methodologies and regulations surrounding ESG ratings, the importance of industry-specific metrics as outlined by frameworks like IFRS S1 and SASB, and the role of external auditors in ensuring the accuracy of reported data. |

| Education & professional development (12.1) | Emphasizes the importance of employee welfare, sustainable growth, and the long-term impact of corporate practices on future generations, highlighting the need for governance, integrity, and investment in sustainability initiatives. It reflects a commitment to balancing profit with social and environmental responsibilities. |

| Social impact & community engagement (5.2) | Reflects a strong consensus among individuals who appreciate informative content that aids in understanding and addressing issues related to energy management, climate change, and sustainability. Comments indicate that viewers find the material valuable for their professional development and practical applications in their fields. |

| Corporate responsibility & ethical governance (4.4) | Encompasses discussions on the importance of sustainable finance, the future of investments in ESG stocks, and the urgent need to address climate change, highlighting both individual investment choices and broader societal implications. It reflects a strong belief in the necessity of transitioning to sustainable practices and the financial opportunities associated with them. |

| Transparency, standards & frameworks (2.8) | Encompasses discussions on the importance of understanding ESG principles, particularly in relation to climate change and corporate impact, as well as the potential for utilizing technology and data to enhance the accuracy and efficiency of measuring and managing emissions, especially Scope 3 emissions. |

| Regulatory compliance & mandatory reporting (2.1) | Encompasses feedback that highlights the clarity and helpfulness of information related to compliance with environmental regulations, as well as positive sentiments towards eco-friendly initiatives. |

| Financial performance & investment (1.5) | Highlights the importance of ethical considerations in evaluating financial performance and investment decisions within the ESG framework, emphasizing that management integrity and public perception can significantly influence investment choices. Additionally, they reflect a recognition of the complexity of measuring ESG metrics and the value of straightforward approaches. |

| Topic (% of comments) | Description |

|---|---|

| Ideological resistance (25.1) | Reflects a backlash against ESG initiatives, characterized by perceptions of them as cult-like or driven by greed, and includes dismissive attitudes towards the motivations behind these movements. Critics often view such initiatives as misguided or a waste of time, emphasizing a resistance to what they see as ideological imposition. |

| Other (15.4) | Encompasses criticisms that label ESG initiatives as politically motivated distractions that detract from a company’s primary focus on profitability, arguing that they serve corporate and financial interests rather than investors and may lead to anti-competitive practices. Critics express concern that resources allocated to ESG and DEI efforts do not contribute to the bottom line, viewing these initiatives as detrimental to the economy. |

| Political influence & agenda (14.1) | Reflects concerns that organizations like BlackRock are perceived as promoting a political agenda that may be seen as exploitative or ineffective, leading to frustration and distrust among critics. |

| Effectiveness & sincerity issues (12.7) | Highlights skepticism about the genuine intentions behind ESG initiatives, questioning their financial motivations and the credibility of leadership within ESG organizations. Critics express frustration over perceived hypocrisy and the inadequacy of human governance in addressing environmental concerns. |

| Corporate greed & profit motives (9.0) | Encompasses criticisms that argue ESG initiatives are often driven by a desire for financial gain rather than genuine social responsibility, suggesting that companies may exploit these programs to enhance their competitive advantage and secure capital while potentially misleading stakeholders about their true motivations. |

| Environmental & climate skepticism (6.0) | Encompasses extreme opposition to environmental initiatives, often framing them as tools of government control or ideologies akin to communism, and expressing distrust towards organizations, suggesting they pose a threat to individual freedoms and national security. |

| ESG as authoritarian/socialist control (5.7) | Encompasses criticisms that portray ESG initiatives as manipulative and oppressive, suggesting they mislead consumers about their responsibilities while promoting a collectivist agenda that undermines individual freedoms. Commenters express strong disdain for what they perceive as a coercive push towards conformity and environmentalism, likening it to Orwellian tactics. |

| Financial & economic concerns (5.7) | Reflects a skepticism towards ESG initiatives, viewing them as intrusive and potentially harmful to individual financial interests, with critics arguing that such measures prioritize ideological agendas over economic stability and personal freedom. |

| Criticism of specific organizations (1.8) | Highlights the financial losses and negative impacts that some companies have faced due to their ESG initiatives, while also expressing broader concerns about the implications of ESG as a mechanism for global control and governance. |

| Transparency & subjectivity concerns (1.6) | Highlights fears that ESG principles are rooted in socialist ideologies, likening them to propaganda and warning that they could lead to societal control and resource scarcity, reminiscent of dystopian scenarios. Critics express distrust in the subjective nature of ESG assessments, suggesting they may undermine individual freedoms and economic stability. |

| Regulatory burden & compliance costs (1.2) | Highlights concerns that ESG demands impose excessive regulatory requirements and compliance costs on companies, potentially harming their brand and shareholder interests, as illustrated by critiques of major corporations prioritizing ESG scores over their core business values. |

| Historical/ideological comparisons (0.9) | Highlights concerns that ESG initiatives are driven by ideological agendas rather than a focus on profitability and shareholder returns, suggesting that such practices should be prohibited. Critics question the relevance and necessity of ESG, arguing that companies should prioritize financial performance over social or environmental considerations. |

| Implementation & practicality issues (0.8) | Encompasses concerns about excessive bureaucracy and regulatory burdens associated with ESG initiatives, skepticism about the validity of climate-related claims, and a belief that such frameworks may lead to negative economic consequences. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Erokhin, D. ESG Reporting in the Digital Era: Unveiling Public Sentiment and Engagement on YouTube. Sustainability 2025, 17, 7039. https://doi.org/10.3390/su17157039

Erokhin D. ESG Reporting in the Digital Era: Unveiling Public Sentiment and Engagement on YouTube. Sustainability. 2025; 17(15):7039. https://doi.org/10.3390/su17157039

Chicago/Turabian StyleErokhin, Dmitry. 2025. "ESG Reporting in the Digital Era: Unveiling Public Sentiment and Engagement on YouTube" Sustainability 17, no. 15: 7039. https://doi.org/10.3390/su17157039

APA StyleErokhin, D. (2025). ESG Reporting in the Digital Era: Unveiling Public Sentiment and Engagement on YouTube. Sustainability, 17(15), 7039. https://doi.org/10.3390/su17157039